| | Goodwin Procter LLP The New York Times Building

620 Eighth Avenue

New York, NY 10018 goodwinlaw.com +1 212 813 8800 |

May 13, 2020

VIA EDGAR

Mr. Jonathan Burr

U.S. Securities and Exchange Commission

Division of Corporation Finance – Office of Real Estate & Commodities

100 F Street, N.E.

Washington, D.C. 20549-3010

| Re: | Fundrise Balanced eREIT II, LLC

Amendment No. 1 to |

Offering Statement on Form 1-A

Filed May 1, 2020

File No. 024-11163

Dear Mr. Burr:

This letter is submitted on behalf of Fundrise Balanced eREIT II, LLC (the “Company”) in response to a comment letter from the staff of the Division of Corporation Finance (the “Staff”) of the Securities and Exchange Commission (the “Commission”) dated May 8, 2020 with respect to Amendment No. 1 to the Company’s Offering Statements on Form 1-A filed with the Commission on May 1, 2020, relating to the offering of up to $50,000,000 in common shares (the “Offering Statement”). The responses provided are based upon information provided to Goodwin Procter LLP by the Company.

For your convenience, the Staff’s comments have been reproduced in italics herein with responses immediately following the comments. Defined terms used herein but not otherwise defined have the meanings given to them in the Offering Statement.

Amendment No. 1 to Offering Statement on Form 1-A filed May 1, 2020

General

| 1. | We note your response to verbal comment 1 in your April 17, 2020 response letter. Please provide more detail about your decision to pause accepting new investments in your more mature eREITs and eFunds. Specifically, please identity the eREITs and eFunds that have paused accepting new investments, tell us in detail the reason why you decided to pause new subscriptions and for how long new subscriptions have been paused. In this regard, please also tell us whether there is anything preventing you from accepting new subscriptions. We may have further comment. |

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 2 | |

Response to Comment No. 1

RESPONSE: In response to the Staff's comment, we respectfully note that Rise Companies Corp. (“Fundrise”), the sponsor of each of the eREITs and eFunds (“Fundrise Programs”), including the Company, has advised us that beginning on May 13, 2020, each Fundrise Program that had offering capacity available to it under Regulation A began processing subscriptions, if any, in connection with their ongoing continuous offerings pursuant to Regulation A. For the Fundrise Programs that do not have remaining capacity from what has been previously qualified, post qualification amendments will be filed and qualified with the Staff in order to increase offering capacity before accepting further subscriptions. Fundrise has always continued to treat those offerings that had reached their Regulation A offering limit as continuous offerings, including filing appropriate offering circular supplements to update disclosure on assets or other items, even when such programs could not accept new subscriptions under the exemption because of such offering limits.

The time period in which the various Fundrise Programs were not processing subscriptions1 was 42 days, which is in accordance with each Fundrise Program’s stated ability to accept or reject subscriptions for up to 45 days (the following disclosure is contained in offering circular of each of the Fundrise Programs):

Subscriptions will be binding upon investors and will be accepted or rejected within 45 days of receipt by us.

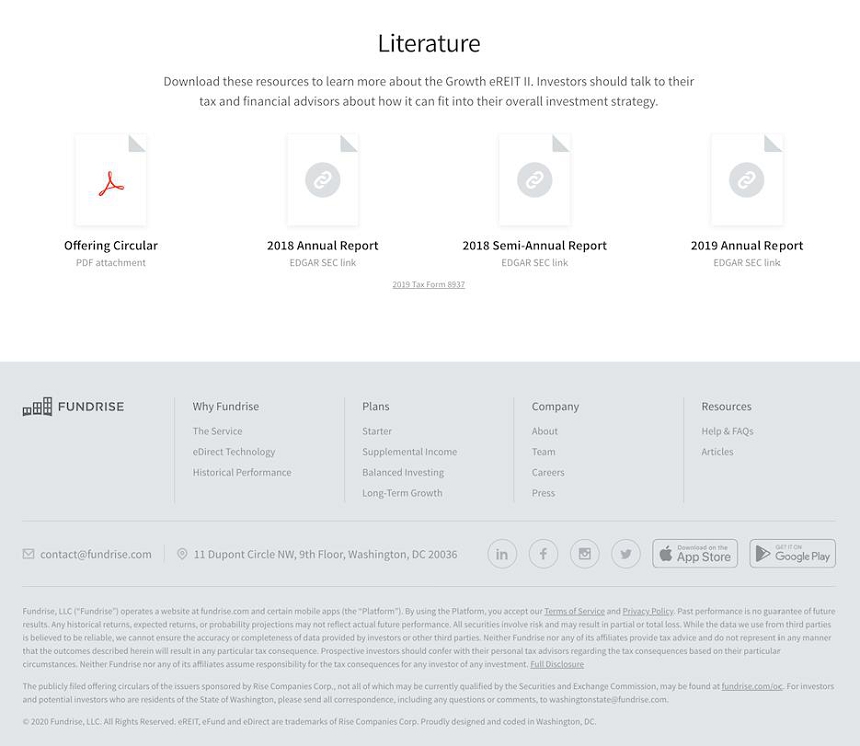

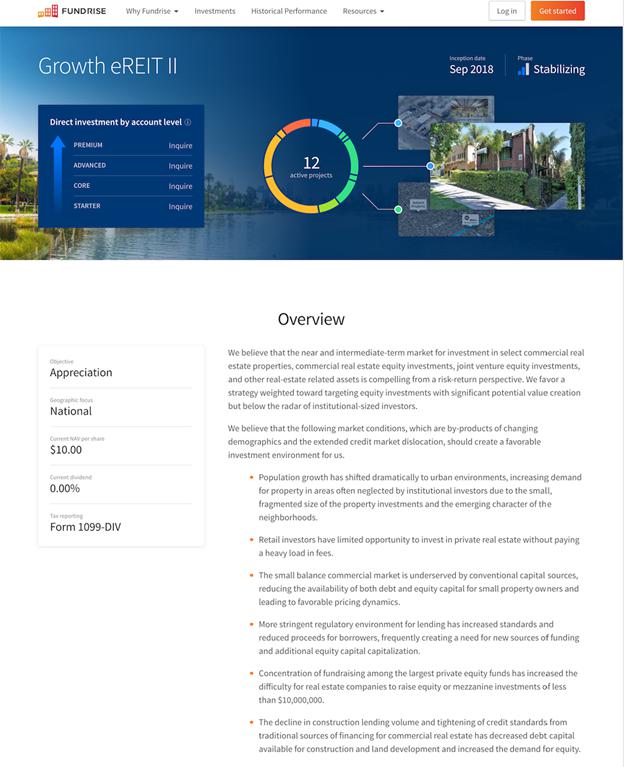

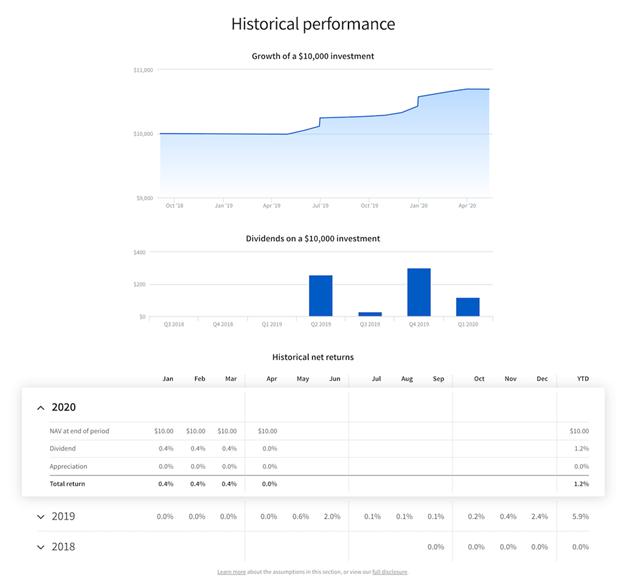

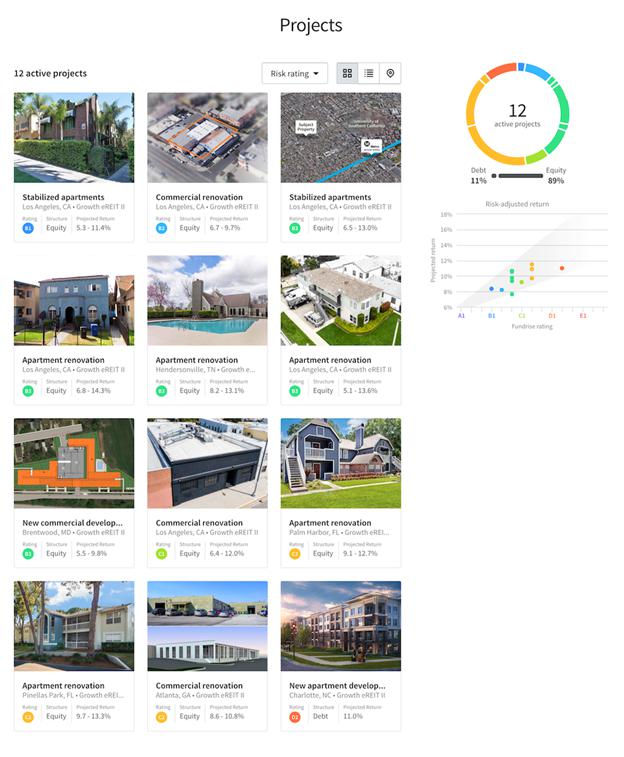

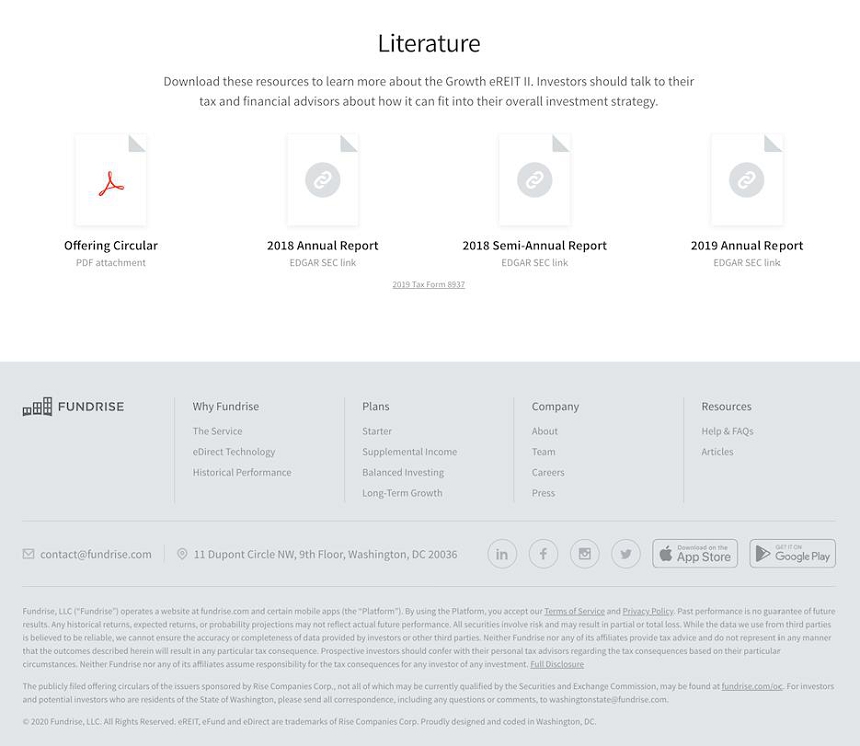

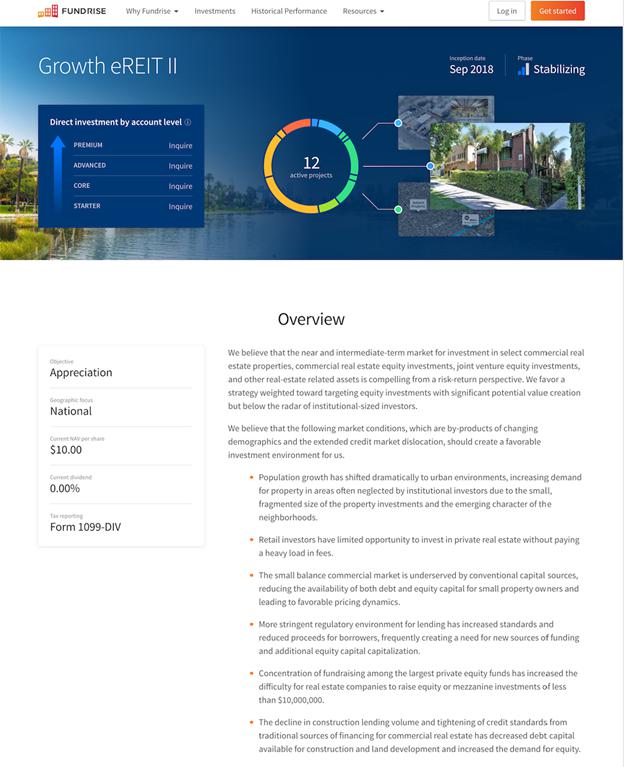

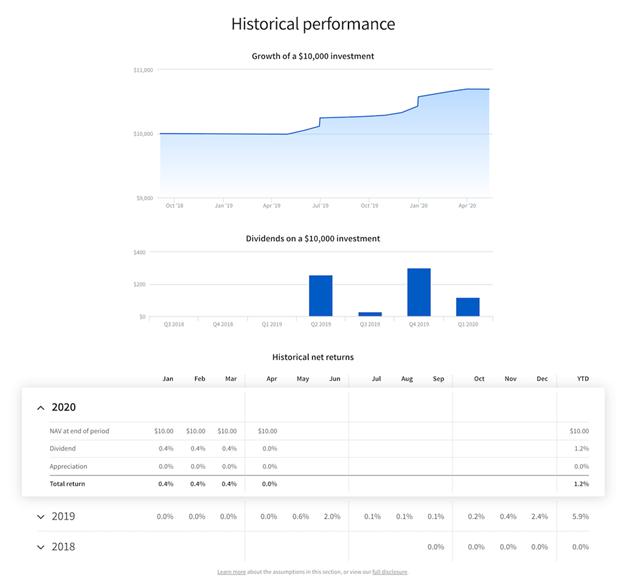

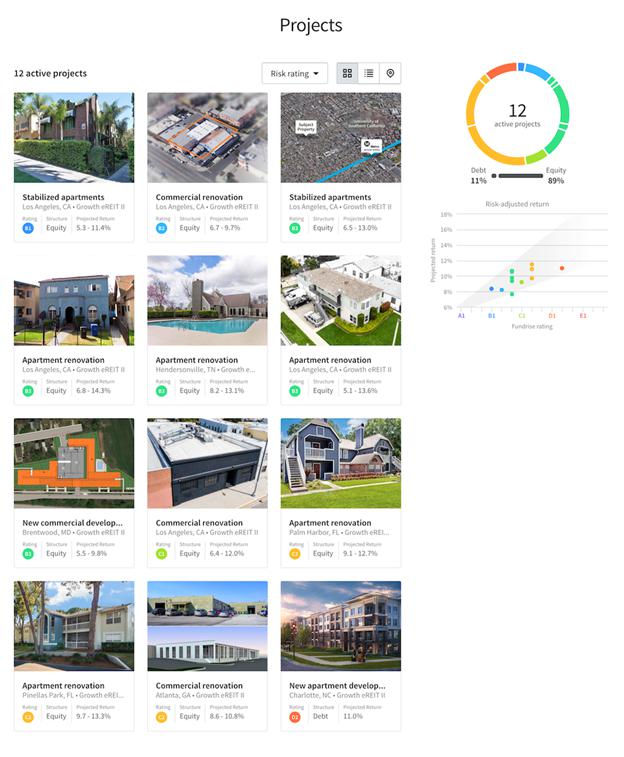

In addition, during this 42-day time period, all of the individual Fundrise Program offering pages remained live and publicly reviewable by the public (an example is included as Exhibit A). As can be plainly seen, such offering pages include numerous informational items regarding the offering that the Staff has previously concluded would be deemed an “offer” of securities, including, but not limited to, (a) offering documents (including subscription agreement), (b) share price, (c) current dividend yield, (d) assets held by the fund, etc. To determine that the attached website does not constitute an ongoing "offer of securities" under the Securities Act would seem contrary to all prior SEC precedent.

| 1 | Of the Fundrise Programs, only Fundrise Income eREIT V, LLC, Fundrise Growth eREIT VI, LLC and Fundrise Balanced eREIT, LLC were processing subscriptions prior to May 13, 2020. |

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 3 | |

We respectfully submit that, for a “continuous offering” under Rule 251 and Rule 415 of the Securities Act, the term “continuous” only applies to the offer of the securities, not the sales of the securities, which are two different and distinct actions. Nowhere in Rule 251 or Rule 415 does it condition a continuous offering with the constant processing of such subscriptions. Indeed, most “continuous offerings” have the actual sales conducted sporadically or at set-time intervals (e.g., weekly, monthly or quarterly).

As to the specific reason why many of the various Fundrise Programs paused processing subscriptions, we respectfully advise the Staff that, as a result of the COVID-19 pandemic, the entirety of the Fundrise workforce (approximately 125 people) moved from working on a single floor in an office in Dupont Circle in Washington, DC to conducting business 100% remotely in mid-March 2020. As conditions continued to deteriorate across the country, Fundrise worked diligently to keep the investors in the various Fundrise Programs up to date on the status of Fundrise and the Fundrise Programs, culminating in Fundrise’s investor letter and asset-level stress test originally cited by the Staff. Accordingly, as explained in detail in our previous correspondence, in an abundance of caution and prudence, Fundrise Advisors, LLC, the manager of each of the Fundrise Programs suspended the processing and payment of redemptions under each of the applicable Fundrise Program’s redemption plans and the processing of subscriptions for such Fundrise Programs while it waited to see if the most dire consequences of the COVID-19 global pandemic came to be, while simultaneously being completely transparent about this decision in the correspondence previously cited by the Staff.

Fundrise is extremely fortunate that it has been able to navigate having its entire workforce working remotely, and that after this successful transition, the global pandemic has had little day-to-day effect on its ability to manage the almost 20 Fundrise Programs. As a result, as stated at the outset of this response, we are happy to inform the Staff that Fundrise has advised us that all of the Fundrise Programs that have offering capacity have begun processing subscriptions again and those that do not have capacity (or otherwise need to file for a new offering due to the 3-year sunset provision in Rule 251) will be filing post-qualification amendments (or Form 1-As) with the SEC in order to gain more offering capacity (or refresh its offering).

Accordingly, as a result of the foregoing, we respectfully submit that a pause in processing of subscriptions for a period of less than 45 days, while continuing to market and provide offering information to prospective investors, is neither contrary to SEC precedent of a “continuous offering” nor contrary to the plain language of the offering documents of the various eREITs and eFunds.

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 4 | |

Appendix A, page A-1

| 2. | Please update your prior performance tables to include information as of December 31, 2019. |

Response to Comment No. 2

RESPONSE: In response to the Staff’s comment, the Company will update its prior performance tables to include information as of December 31, 2019 when it files Amendment No. 2 to the Offering Statement.

* * * * *

If you have any questions or would like further information concerning the Company’s responses to the Comment Letter, please do not hesitate to contact me at (212) 813-8842 or Bjorn J. Hall at (202) 584-0550.

Sincerely,

/s/ Mark Schonberger

Mark Schonberger

Benjamin S. Miller, Chief Executive Officer

Bjorn J. Hall, General Counsel and Secretary

Michelle A. Mirabal, Associate General Counsel

Rise Companies Corp.

Matthew Schoenfeld, Esq.

Goodwin Procter LLP

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 5 | |

EXHIBIT A

Representative Example of the Fundrise Programs’ Offering Pages

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 6 | |

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 7 | |

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 8 | |

Mr. Jonathan Burr Division of Corporation Finance May 13, 2020 Page 9 | |