- BFLY Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Butterfly Network (BFLY) DEF 14ADefinitive proxy

Filed: 26 Apr 24, 4:07pm

| Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

| ☐ | | | Preliminary Proxy Statement |

| ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

| ☐ | | | Definitive Additional Materials |

| ☐ | | | Soliciting Material under §240.14a-12 |

| ☒ | | | No fee required |

| ☐ | | | Fee paid previously with preliminary materials |

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| 2024 Proxy Statement | | | 2 |

| TIME: | | | 11:00 a.m. Eastern Time |

| DATE: | | | Friday, June 7, 2024 |

| ACCESS: | | | This year’s annual meeting will be held virtually via live audio webcast on the internet. You will be able to attend the annual meeting, vote and submit your questions during the meeting by visiting www.virtualshareholdermeeting.com/BFLY2024 and entering the 16-digit control number included in the Notice of Internet Availability or proxy card that you receive. |

| 1. | To elect seven directors to serve one-year terms expiring in 2025; |

| 2. | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024; |

| 3. | To approve by a non-binding advisory vote the compensation of our NEOs, as disclosed in this proxy statement; |

| 4. | To approve the 2024 Employee Stock Purchase Plan; |

| 5. | To approve a proposed A&R Charter, which will amend and restate our current Second Amended and Restated Certificate of Incorporation (the “Charter”), to: |

| a) | add a provision with respect to the automatic conversion of our Class B common stock effective February 12, 2028, which is seven years from the date of the closing of our business combination by and among Longview Acquisition Corp., Clay Merger Sub Inc., and BFLY Operations, Inc. (formerly Butterfly Network, Inc.) (the “Class B Conversion Amendment”); |

| b) | add a provision to provide for the exculpation of officers as permitted by recent amendments to Delaware law (the “Officer Exculpation Amendment”); and |

| c) | amend the exclusive forum provision (the “Exclusive Forum Amendment”); and |

| 6. | To transact such other business that is properly presented at the annual meeting and any adjournments or postponements thereof. |

| 2024 Proxy Statement | | | 3 |

| | | BY ORDER OF OUR BOARD OF DIRECTORS | |

| | |  | |

| | | Heather C. Getz | |

| | | Chief Financial and Operations Officer and Corporate Secretary |

| 2024 Proxy Statement | | | 4 |

| 2024 Proxy Statement | | | 5 |

| 2024 Proxy Statement | | | 7 |

| 2024 Proxy Statement | | | 8 |

| • | By internet or by telephone. Follow the instructions included in the Notice or, if you received printed materials, in the proxy card to vote over the internet or by telephone. |

| • | By mail. If you received a proxy card by mail, you can vote by mail by completing, signing, dating and returning the proxy card as instructed on the card. If you sign the proxy card but do not specify how you want your shares voted, they will be voted in accordance with our board of directors’ recommendations as noted below. |

| • | “FOR” the election of the nominees for director; |

| • | “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2024; |

| • | “FOR” the compensation of our NEOs, as disclosed in this proxy statement; |

| 2024 Proxy Statement | | | 9 |

| • | “FOR” the approval of the Employee Stock Purchase Plan; and |

| • | “FOR” the proposed A&R Charter, including each of the Class B Conversion Amendment, the Officer Exculpation Amendment and the Exclusive Forum Amendment (collectively, the “Charter Amendments”). |

| • | if you received a proxy card, by signing a new proxy card with a date later than your previously delivered proxy and submitting it as instructed above; |

| • | by re-voting by internet or by telephone as instructed above; |

| • | by notifying Butterfly Network, Inc.’s Corporate Secretary in writing before the annual meeting that you have revoked your proxy; or |

| • | by attending the annual meeting and voting at the meeting. Attending the annual meeting will not in and of itself revoke a previously submitted proxy. You must specifically request at the annual meeting that it be revoked. |

| Proposal 1: Elect Directors | | | The nominees for director will be elected by the affirmative vote of a majority of the votes cast for the election of a nominee. For each nominee, you may vote either FOR or AGAINST such nominee. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| Proposal 2: Ratify Appointment of Independent Registered Public Accounting Firm | | | The affirmative vote of a majority of the votes cast for this proposal is required to ratify the appointment of our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to select our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, our audit committee of our board of directors will reconsider its selection. |

| 2024 Proxy Statement | | | 10 |

| Proposal 3: Approve a Non-Binding Advisory Vote on the Compensation of our Named Executive Officers, as Disclosed in this Proxy Statement | | | The affirmative vote of a majority of the votes cast for this proposal is required to approve, on a non-binding advisory basis, the compensation of our NEOs, as disclosed in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the compensation committee and our board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

| Proposal 4: Approve the 2024 Employee Stock Purchase Plan | | | The affirmative vote of a majority of the votes cast for this proposal is required to approve, the 2024 Employee Stock Purchase Plan, as disclosed in this proxy statement. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

Proposal 5: Approval of the A&R Charter, which incorporates: (a) the Class B Conversion Amendment; (b) the Officer Exculpation Amendment; and (c) the Exclusive Forum Amendment | | | For Proposal 5(a) only, the affirmative vote of the holders of at least two-thirds (66 2/3%) of the outstanding shares of Class B Common Stock, voting as a single class is required to approve the Class B Conversion Amendment. Abstentions and broker non-votes will have the same effect as votes against for each vote required for this proposal. For Proposals 5(b) and 5(c) only, the affirmative vote of the holders of a majority of the total voting power of all the then-outstanding shares of stock of the Company entitled to vote for this proposal is required to approve the Officer Exculpation Amendment and the Exclusive Forum Amendment. Abstentions will have no effect on the results of this vote. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on these proposals. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

| 2024 Proxy Statement | | | 11 |

| 2024 Proxy Statement | | | 12 |

| • | each person known to the Company to be the beneficial owner of more than 5% of outstanding Company common stock; |

| • | each of the Company’s NEOs and directors; and |

| • | all current executive officers and directors of the Company as a group. |

Name and Address of Beneficial Owner(1) | | | Number of shares of Class A Common Stock | | | % | | | Number of shares of Class B Common Stock | | | % | | | % of Total Voting Power** |

| Directors and Executive Officers: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(2) | | | 10,479,298 | | | 5.7 | | | 26,426,937 | | | 100 | | | 75.6 |

Larry Robbins(3) | | | 17,409,154 | | | 9.5 | | | — | | | — | | | 2.4 |

Dawn Carfora(4) | | | 95,042 | | | * | | | — | | | — | | | — |

Elazer Edelman, M.D., Ph.D.(5) | | | 84,974 | | | * | | | — | | | — | | | — |

S. Louise Phanstiel(6) | | | 143,082 | | | * | | | — | | | — | | | — |

Erica Schwartz, M.D., J.D., M.P.H.(7) | | | 64,167 | | | * | | | — | | | — | | | — |

Heather C. Getz(8) | | | 679,000 | | | * | | | — | | | — | | | * |

Andrei G. Stoica, Ph.D.(9) | | | 477,715 | | | * | | | — | | | — | | | * |

Joseph DeVivo(10) | | | 1,610,000 | | | * | | | — | | | — | | | * |

| | | | | | | | | | | | |||||

All Current Directors and Executive Officers of the Company as a Group (10 Individuals)(11) | | | 31,042,432 | | | 16.9 | | | 26,426,937 | | | 100 | | | 78.5 |

| Five Percent Holders: | | | | | | | | | | | |||||

Jonathan M. Rothberg, Ph.D.(2) | | | 10,479,298 | | | 5.7 | | | 26,426,937 | | | 100 | | | 75.6 |

Entities Affiliated with Glenview Capital Management(3) | | | 17,409,154 | | | 9.5 | | | — | | | — | | | 2.4 |

Blackrock, Inc.(12) | | | 10,330,167 | | | 5.6 | | | — | | | — | | | 1.4 |

ARK Investment Management LLC(13) | | | 13,688,534 | | | 7.4 | | | — | | | — | | | 1.9 |

Fosun Industrial Co., Limited(14) | | | 10,716,630 | | | 5.8 | | | — | | | — | | | 1.5 |

* | Indicates beneficial ownership of less than 1%. |

** | Percentage of total voting power represents voting power with respect to all outstanding shares of our Class A common stock and our Class B common stock as a single class. Each share of our Class B common stock is entitled to 20 votes per share and each share of our Class A common stock is entitled to one vote per share. |

(1) | Unless otherwise indicated, the business address of each of these individuals is c/o Butterfly Network, Inc., 1600 District Avenue, Burlington, MA 01803. |

(2) | Consists of (i) 2,576,135 shares of Class A common stock held by Dr. Rothberg, (ii) 21,645 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024, held by Dr. Rothberg, (iii) 6,202,545 shares of Class A common stock distributed from 2012 JMR Trust |

| 2024 Proxy Statement | | | 13 |

(3) | Consists of (i) 4,546,687 shares of Class A common stock held by Longview Investors LLC, (ii) 8,033,501 shares of Class A common stock held by Glenview Capital Partners, L.P., Glenview Institutional Partners, L.P., Glenview Capital Master Fund, LTD., Glenview Capital Opportunity Fund, L.P., Glenview Healthcare Master Fund, L.P. and Glenview Offshore Opportunity Master Fund, LTD. (the “Glenview Investment Funds”), (iii) 3,032,600 shares underlying private placement warrants held by Longview Investors LLC that are exercisable within 60 days of April 1, 2024, (iv) 1,713,333 shares underlying private placement warrants held by the Glenview Investment Funds that are exercisable within 60 days of April 1, 2024, (v) 61,388 shares of Class A common stock held by Mr. Robbins, and (vi) 21,645 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024 held by Mr. Robbins. Mr. Robbins is the managing member of Longview Investors LLC; the founder, portfolio manager and chief executive officer of Glenview Capital Management, LLC; and a member of our board of directors. Glenview Capital Management, LLC serves as investment manager to each of the Glenview Funds. Mr. Robbins shares voting and dispositive power over the shares held by Longview Investors LLC, Glenview Capital Management, LLC and the Glenview Investment Funds and may be deemed to beneficially own such shares. The address of the principal business office for Mr. Robbins, Longview Investors LLC and the Glenview Investment Funds is 767 Fifth Avenue, 44th Floor, New York, NY 10153. |

(4) | Consists of (i) 73,397 shares of Class A common stock and (ii) 21,645 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. |

(5) | Consists of (i) 63,329 shares of Class A common stock and (ii) 21,645 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. |

(6) | Consists of (i) 60,049 shares of Class A common stock held by H.G. Phanstiel LP (ii) 61,388 shares of Class A common stock held by Ms. Phanstiel, and (iii) 21,645 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. Ms. Phanstiel is the Managing Member of H.G. Phanstiel LP, and therefore has voting and investment control over the shares. |

(7) | Consists of (i) 64,167 shares of Class A common stock. |

(8) | Consists of (i) 364,420 shares of Class A common stock, (ii) 157,123 shares of Class A common stock issuable upon the vesting of restricted stock units within 60 days of April 1, 2024, and (ii) 157,457 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. |

(9) | Consists of (i) 396,535 shares of Class A common stock and (ii) 81,180 shares of Class A common stock issuable upon the exercise of options exercisable within 60 days of April 1, 2024. |

(10) | Consists of (i) 810,000 shares of Class A common stock and (ii) 800,000 shares of Class A common stock issuable upon the vesting of restricted stock units within 60 days of April 1, 2024. |

(11) | See footnotes 2 through 10. |

(12) | Information is based on the Schedule 13G/A filed by BlackRock, Inc. on January 29, 2024, consists of shares of Class A common stock beneficially owned, or that may be deemed to be beneficially owned, by BlackRock, Inc. and certain of its subsidiaries as of December 31, 2023. The principal business address of BlackRock, Inc. is 50 Hudson Yards, New York, NY 10001. |

(13) | Information is based on the Schedule 13G/A filed by ARK Investment Management LLC on January 29, 2024, consists of shares of Class A common stock beneficially owned, or that may be deemed to be beneficially owned, by ARK Investment Management LLC as of December 31, 2023. The principal business address of ARK Investment Management LLC is 200 Central Avenue, St. Petersburg, FL 33701. |

(14) | Information is based on the Schedule 13G/A filed by Fosun Industrial Co., Limited (“Fosun Industrial”) and Shanghai Fosun Pharmaceutical (Group) Co., Ltd. (“Fosun Pharma”) on February 14, 2023, Consists of shares of Class A common stock held by Fosun Industrial. Fosun Industrial is a wholly-owned subsidiary of Fosun Pharma. Fosun Pharma is a subsidiary of, and is beneficially held approximately 35.82% by, Shanghai Fosun High Technology (Group) Co. Ltd. (“Fosun High Technology”) and 0.22% by Fosun International Limited (“Fosun International”). Fosun High Technology is a wholly-owned subsidiary of Fosun International, which is a subsidiary of, and is beneficially held approximately 73.53% by, Fosun Holdings Limited (“Fosun Holdings”). Fosun Holdings is a wholly-owned subsidiary of Fosun International Holdings Ltd. (“Fosun International Holdings”). Fosun International Holdings is beneficially held approximately 85.29% by Guo Guangchang and 14.71% by Wang Qunbin. Guo Guangchang controls Fosun International Holdings and could therefore be deemed the beneficial owner of the securities held by Fosun Industrial. The address of the principal business office for Fosun Pharma is No. 1289 Yishan Road (Building A, Fosun Technology Park), Shanghai 200233, People’s Republic of China. The address of the principal business office for Fosun Industrial is 5/F, Manulife Place, 348 Kwun Tong Road, Kowloon, Hong Kong. |

| 2024 Proxy Statement | | | 14 |

| Names | | | Ages | | | Positions |

| Executive Officers: | | | | | ||

| Joseph DeVivo | | | 57 | | | President, Chief Executive Officer and Chairperson of the Board of Directors |

| Heather C. Getz | | | 49 | | | Chief Financial & Operations Officer and Corporate Secretary |

| Andrei G. Stoica | | | 51 | | | Chief Technology Officer |

| Non-Employee Directors: | | | | | ||

| Dawn Carfora | | | 52 | | | Director |

| Elazer Edelman, M.D., Ph.D. | | | 67 | | | Director |

| S. Louise Phanstiel | | | 65 | | | Director |

| Larry Robbins | | | 54 | | | Director |

| Erica Schwartz, M.D., J.D., M.P.H. | | | 52 | | | Director |

| Jonathan M. Rothberg, Ph.D. | | | 60 | | | Founder and Director |

| 2024 Proxy Statement | | | 15 |

| 2024 Proxy Statement | | | 16 |

| 2024 Proxy Statement | | | 17 |

| 2024 Proxy Statement | | | 18 |

| • | the achievement of corporate goals and individual performance; |

| • | the level of contributions made to the general management and leadership of the Company; |

| • | the appropriateness of salary increases; |

| • | the amount of bonuses to be paid, if any; and |

| • | whether or not stock option, restricted stock unit and/or other equity awards should be made. |

| 2024 Proxy Statement | | | 19 |

| • | all information relating to such person that would be required to be disclosed in a proxy statement; |

| 2024 Proxy Statement | | | 20 |

| • | certain biographical and share ownership information about the stockholder and any other proponent, including a description of any derivative transactions in the Company’s securities; |

| • | a description of certain arrangements and understandings between the proposing stockholder and any beneficial owner and any other person in connection with such stockholder nomination; and |

| • | a statement whether or not either such stockholder or beneficial owner intends to deliver a proxy statement and form of proxy to holders of voting shares sufficient to carry the proposal. |

| • | certain biographical information concerning the proposed nominee; |

| • | all information concerning the proposed nominee required to be disclosed in solicitations of proxies for election of directors; |

| • | certain information about any other security holder of the Company who supports the proposed nominee; |

| • | a description of all relationships between the proposed nominee and the recommending stockholder or any beneficial owner, including any agreements or understandings regarding the nomination; and |

| • | additional disclosures relating to stockholder nominees for directors, including completed questionnaires and disclosures required by our bylaws. |

| 2024 Proxy Statement | | | 21 |

| 2024 Proxy Statement | | | 22 |

| 2024 Proxy Statement | | | 23 |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($)(1) | | | Stock Awards ($)(2) | | | Option Awards ($)(3) | | | All Other Compensation ($) | | | Total ($) |

Joseph DeVivo, Chief Executive Officer(4) | | | 2023 | | | 588,942 | | | 1,101,712 | | | 9,117,333 | | | — | | | 630(5) | | | 10,808,618 |

Jonathan M. Rothberg, Former Interim Chief Executive Officer(6) | | | 2023 | | | — | | | — | | | — | | | — | | | 217,351(7) | | | 217,351 |

| | 2022 | | | — | | | — | | | — | | | — | | | 217,498 | | | 217,498 | ||

Heather Getz Chief Financial Officer | | | 2023 | | | 535,500 | | | 374,710(8) | | | 2,390,400 | | | — | | | 7,510(9) | | | 3,308,120 |

| | 2022 | | | 316,667 | | | 255,464 | | | 2,249,998 | | | 749,458 | | | 401,897 | | | 3,973,484 | ||

Andrei Stoica, Chief Technology Officer | | | 2023 | | | 484,500 | | | 197,600 | | | 1,545,600 | | | — | | | 23,116(10) | | | 2,250,816 |

| | 2022 | | | 475,000 | | | 199,500 | | | 1,714,139 | | | — | | | 319,131 | | | 2,707,770 |

(1) | The amounts in this column for 2023 reflect cash bonuses earned in 2023 and paid in 2024 as well as a $500,000 sign-on bonus paid to Mr. DeVivo when he commenced employment with us. |

(2) | The amounts in this column reflect the aggregate grant date fair value of stock awards granted during 2023 and 2022, respectively, computed in accordance with Accounting Standards Codification, or ASC, Topic 718, Compensation-Stock Compensation, or Topic 718. Such grant date fair values do not take into account any estimated forfeitures. Details as to the assumptions used to calculate the fair value of the option awards are included in Note 11 “Equity Incentive Plan” to our consolidated audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The grant date fair value of each time-based RSU award is measured based on the closing price of our Class A common stock on the grant date. For performance-based RSU awards granted on April 24, 2023 and July 13, 2023 to Mr. DeVivo and Ms. Getz, respectively, the vesting conditions relating to each such awards are considered market conditions and not financial performance conditions. Accordingly, there is no grant date fair value below or in excess of the amount reflected in the table above for Mr. DeVivo and Ms. Getz that could be calculated and disclosed based on achievement of the underlying market condition. The grant date fair value of such performance-based awards with a market condition, measured utilizing a Monte Carlo simulation as of the date of grant, was $3,333,333 and $408,000 for each award, respectively. The amounts reported in this column do not necessarily correspond to the actual value recognized or that may be recognized by the NEOs. |

(3) | The amounts in this column reflect the aggregate grant date fair value of the option awards granted during 2022, computed in accordance with Topic 718, using the Black-Scholes option-pricing model. Such grant date fair values do not take into account any estimated forfeitures. Details as to the assumptions used to calculate the fair value of the option awards are included in Note 11 “Equity Incentive Plan” to our consolidated audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These amounts do not necessarily correspond to the actual value recognized or that may be recognized by the NEOs. |

(4) | Mr. DeVivo commenced employment with us on April 24, 2023. |

(5) | Amounts reported in this column represent $630 of cell phone reimbursements. |

(6) | Dr. Rothberg served as our Interim Chief Executive Officer from December 31, 2022 to April 24, 2023 and received no additional compensation for this role. In connection with Mr. DeVivo’s appointment as our President and Chief Executive Officer, effective as of the April 24, 2023, Mr. Rothberg stepped down as Interim President and Chief Executive Officer as of that same date and continued to serve as a director of our Board. Dr. Rothberg received no additional compensation in connection with his role as Interim President and Chief Executive Officer. Following April 24, 2023, Dr. Rothberg continued to serve as a director of our Board. |

(7) | Amounts reported in this column represent $67,352 of director fees and $149,999 relating to a RSU award granted to Dr. Rothberg in connection with his services as a director in 2023. Dr. Rothberg's fees are partially prorated as a result of his stepping down as Chairperson of the Nominating and Corporate Governance Committee in December 2023. The amount in this column relating to Dr. Rothberg’s RSU award reflects the aggregate grant date fair value of the stock award granted during 2023 computed in accordance with Topic 718. Such grant date fair value does not take into account any estimated forfeitures. The amount reported with respect to Dr. Rothberg’s RSU award does not necessarily correspond to the actual value recognized or that may be recognized by him. |

(8) | Excludes an amount of $21,290, which represents a prorated portion attributable to 2022 of an additional discretionary bonus paid to Ms. Getz in 2023 in connection with her services to the Office of the Chief Executive Officer. |

(9) | Amounts reported in this column represent $910 of cell phone reimbursements and $6,600 of 401(k) plan employer match contributions. |

(10) | Amounts reported in this column represent $910 of cell phone reimbursements, $15,606 of tax gross-ups and reimbursements, and $6,600 of 401(k) plan employer match contributions. |

| 2024 Proxy Statement | | | 24 |

| Name | | | 2023 Base Salary |

Joseph DeVivo(1) | | | $875,000 |

| Heather Getz | | | $600,000 |

| Andrei Stoica, Ph.D. | | | $494,000 |

Jonathan M. Rothberg, Ph.D.(2) | | | — |

| (1) | Mr. DeVivo commenced employment with us on April 24, 2023. This amount reflects his annual base salary assuming employment for the full year. His actual base salary received was prorated according to his hire date. |

| (2) | Dr. Rothberg served as our Interim Chief Executive Officer effective December 31, 2022 to April 24, 2023 and received no additional compensation for this role. |

| Name | | | 2023 Target Bonus (% of Base Salary) | | | 2023 Target Bonus ($) |

| Joseph DeVivo | | | 125% | | | $1,093,750 |

| Heather Getz | | | 70% | | | $420,000 |

| Andrei Stoica, Ph.D. | | | 50% | | | $247,000 |

Jonathan M. Rothberg, Ph.D.(1) | | | — | | | — |

| (1) | Dr. Rothberg was not bonus eligible for 2022 or 2023 and did not receive any bonus for his services as Interim Chief Executive Officer. |

| 2024 Proxy Statement | | | 25 |

| Name | | | Target Bonus Opportunity | | | Annual Cash Incentive Earned | | | % of Target |

| Joseph DeVivo | | | 125% | | | $601,712 | | | 80% |

| Heather Getz | | | 70% | | | $336,000 | | | 80% |

| Andrei Stoica, Ph.D. | | | 50% | | | $197,600 | | | 80% |

Jonathan M. Rothberg, Ph.D.(1) | | | — | | | — | | | — |

| (1) | Dr. Rothberg served as our Interim Chief Executive Officer from December 31, 2022 to April 24, 2023 and received no additional compensation for this role. |

| Award Type | | | Description / Objective |

| RSUs | | | • Vest over a two to three-year period from the grant date |

| | | • Realized value linked to share price while maintaining retentive glue during times of volatility | |

| Performance Stock Units | | | • Awarded to certain executives to further incentivize performance |

| 2024 Proxy Statement | | | 26 |

| 2024 Proxy Statement | | | 27 |

| Name | | | Grant Date | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($) | | | Option Expiration Date(1) | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(2) | | | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights That Have Not Vested (#) | | | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or Other Rights That Have Not Vested ($)(2) |

Joseph DeVivo, Chief Executive Officer | | | 4/24/2023(3) | | | — | | | — | | | — | | | — | | | 1,600,000 | | | 1,728,000 | | | — | | | — |

| | 4/24/2023(4) | | | — | | | — | | | — | | | — | | | — | | | — | | | 1,600,000 | | | 1,728,000 | ||

Jonathan M. Rothberg, Former Interim Chief Executive Officer | | | 2/16/2021(5) | | | — | | | — | | | — | | | — | | | 4,387 | | | 4,738 | | | — | | | — |

| | 7/1/2021 | | | 21,645 | | | — | | | 14.25 | | | 6/30/2031 | | | — | | | — | | | — | | | — | ||

| | 6/20/2023(6) | | | — | | | — | | | — | | | — | | | 65,789 | | | 71,052 | | | — | | | — | ||

Heather Getz, Chief Financial Officer | | | 5/2/2022(7) | | | 124,653 | | | 190,262 | | | 3.58 | | | 5/1/2032 | | | — | | | — | | | — | | | — |

| | 5/2/2022(8) | | | — | | | — | | | — | | | — | | | 471,368 | | | 509,077 | | | — | | | — | ||

| | 3/1/2023(9) | | | — | | | — | | | — | | | — | | | 142,500 | | | 153,900 | | | — | | | — | ||

| | 3/1/2023(10) | | | — | | | — | | | — | | | — | | | 600,000 | | | 648,000 | | | — | | | — | ||

| | 7/13/2023(11) | | | — | | | — | | | — | | | — | | | — | | | — | | | 200,000 | | | 216,000 | ||

Andrei Stoica, Chief Technology Officer | | | 7/19/2021(12) | | | 68,496 | | | 53,275 | | | 10.68 | | | 7/18/2031 | | | — | | | — | | | — | | | — |

| | 7/19/2021(13) | | | — | | | — | | | — | | | — | | | 27,037 | | | 29,200 | | | — | | | — | ||

| | 3/4/2022(14) | | | — | | | — | | | — | | | — | | | 129,310 | | | 139,655 | | | — | | | — | ||

| | 3/22/2022(15) | | | — | | | — | | | — | | | — | | | 37,357 | | | 40,346 | | | — | | | — | ||

| | 3/1/2023(16) | | | — | | | — | | | — | | | — | | | 95,000 | | | 102,600 | | | — | | | — | ||

| | 3/1/2023(17) | | | — | | | — | | | — | | | — | | | 500,000 | | | 540,000 | | | — | | | — |

(1) | All option awards generally have a ten-year term from the grant date. Pursuant to our current equity plan, upon separation from the Company, unexercised options expire 3 months after the departure date. |

(2) | The market value of the stock awards is based on the closing price of our Class A common stock of $1.08 per share on December 31, 2023. |

(3) | The shares underlying this RSU vested as to 33% of the award on April 24, 2023, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Mr. DeVivo’s continued service through the applicable vesting dates. |

(4) | The RSU awards reported in this column vest based on market conditions and a service condition. 33% shall vest upon the achievement of a price for the Class A common stock equal to or exceeding $3.00 per share, 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or exceeding $4.50 per share, and 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or |

| 2024 Proxy Statement | | | 28 |

(5) | The shares underlying this RSU vested as to 33% of the award on February 16, 2022, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Dr. Rothberg’s continued service through the applicable vesting dates. |

(6) | The shares underlying this RSU vest as to 100% of the award on the date of the 2024 annual meeting of Company’s stockholders, subject to Dr. Rothberg’s continued service through the applicable vesting date. |

(7) | The shares underlying this option vestvested as to 25% of the award on May 2, 2023, with the remainder of the award vesting in 36 equal monthly installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(8) | The shares underlying this RSU vested as to 25% of the award on May 2, 2023, with the remainder of the award vesting in 3 equal annual installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(9) | The shares underlying this RSU vested as to 50% of the award on July 1, 2023, with the remainder of the award vesting on January 1, 2024, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(10) | The shares underlying this RSU vest as to 33% of the award on March 1, 2024, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Ms. Getz’s continued service through the applicable vesting dates. |

(11) | This award vests based on market conditions and a service condition. 33% shall vest upon the achievement of a price for the Class A common stock equal to or exceeding $3.00 per share, 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or exceeding $4.50 per share, and 33% shall vest upon the achievement of a price for the Company’s Class A common stock equal to or exceeding $6.00 per share. In each case, the closing stock price for 20 consecutive trading days must equal or exceed the share price targets, and provided such share price is achieved prior to the fifth anniversary following the grant date. Ms. Getz must continue to have a service relationship with the Company on the applicable vesting dates to vest in any portion of her RSU award. |

(12) | The shares underlying this option vested as to 25% of the award on September 30, 2022, with the remainder of the award vesting in 36 equal monthly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(13) | The shares underlying this RSU vested as to 25% of the award on September 30, 2022, with the remainder of the award vesting in 12 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(14) | The shares underlying this RSU vested as to 33% of the award on March 4, 2023, with the remainder of the award vesting in 8 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(15) | The shares underlying this RSU vested as to 33% of the award on March 22, 2023, with the remainder of the award vesting in 8 equal quarterly installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(16) | The shares underlying this RSU vested as to 50% of the award on July 1, 2023, with the remainder of the award vesting on January 1, 2024, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

(17) | The shares underlying this RSU vested as to 33% of the award on March 1, 2024, with the remainder of the award vesting in 2 equal annual installments thereafter, subject to Mr. Stoica’s continued service through the applicable vesting dates. |

| 2024 Proxy Statement | | | 29 |

| • | Severance payable in the form of salary continuation. The severance amount is equal to participant’s then-current base salary times a multiplier determined based on the participant’s title or role with us. The multiplier for Ms. Getz (executive vice president) is 1.0 and for Dr. Stoica (senior vice president) is .75. |

| • | We will pay for company contribution for continuation coverage under the Consolidated Omnibus Budget Reconciliation Act of 1985, as amended, or COBRA, during the severance period. |

| • | Severance payable in a single lump sum. The severance amount is equal to participant’s then-current base salary and then-current target annual bonus opportunity, times a change in control multiplier determined based on the participant’s title or role with us. The multiplier for Ms. Getz and Dr. Stoica is 1.0. |

| • | We will pay for company contribution for continuation coverage under COBRA during the severance period. |

| • | Any outstanding unvested equity awards held by the participant under our then-current outstanding equity incentive plan(s) will become fully vested on the date the termination of such participant’s employment becomes effective. |

| (i) | any person or group of persons (other than us or our affiliates) becomes the owner, directly or indirectly, of our securities representing more than 50% of the combined voting power of our then outstanding voting securities (the “Outstanding Company Voting Securities”) (but excluding any bona fide financing event in which securities are acquired directly from us); or |

| (ii) | the consummation of a merger or consolidation of us with any other corporation, other than a merger or consolidation (i) that results in the Outstanding Company Voting Securities immediately prior thereto continuing to represent (either by remaining outstanding or by being converted into voting securities of the surviving entity) at least 50% of the combined voting power of the Outstanding Company Voting Securities (or such surviving entity or, if we or the entity surviving such merger is then a subsidiary, the ultimate parent thereof) outstanding immediately after such merger or consolidation, or (ii) immediately following which the individuals who comprise the board of directors immediately prior thereto constitute at least a majority of the board of directors of the entity surviving such merger or consolidation or, if we or the entity surviving such merger is then a subsidiary, the ultimate parent thereof; or |

| (iii) | the sale or disposition by us of all or substantially all of our assets, other than (i) a sale or disposition by us of all or substantially all of our assets to an entity, at least 50% of the combined voting power of the voting securities of which are owned directly or indirectly by our stockholders following the completion of such transaction in substantially the same proportions as their ownership of us immediately prior to such sale or (ii) a sale or disposition of all or substantially all of our assets immediately following which the individuals who comprise the board of directors immediately prior thereto constitute at least a majority of the board of directors of the entity to which such assets are sold or disposed or, if such entity is a subsidiary, the ultimate parent thereof; |

| 2024 Proxy Statement | | | 30 |

| (iv) | provided that with respect to Sections (i), (ii) and (iii) above, a transaction or series of integrated transactions will not be deemed a Change in Control (A) unless the transaction qualifies as a change in control within the meaning of Section 409A of the Code, or (B) if following the conclusion of the transaction or series of integrated transactions, the holders of our Class B Common Stock immediately prior to such transaction or series of transactions continue to have substantially the same proportionate voting power in an entity which owns all or substantially all of our assets immediately following such transaction or series of transactions. |

| 2024 Proxy Statement | | | 31 |

| 2024 Proxy Statement | | | 32 |

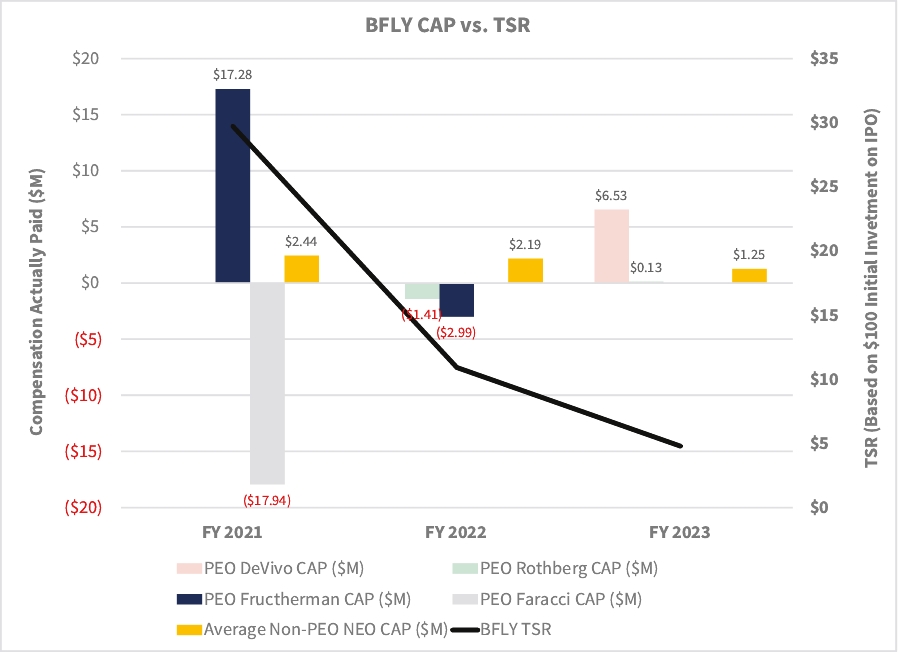

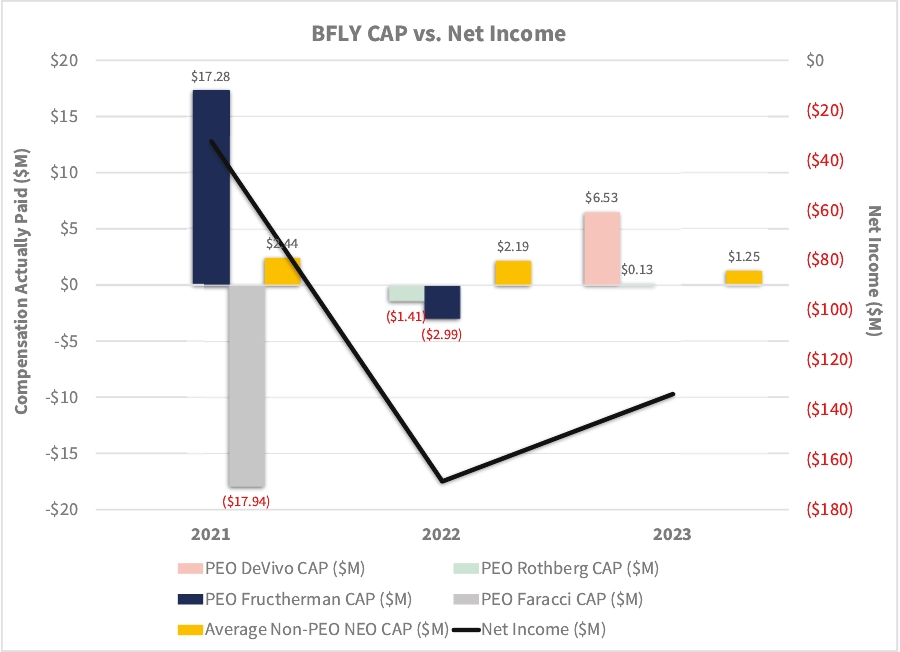

Fiscal Year (a)(1) | | | SCT For PEO1 (b)(2) | | | CAP For PEO1 (c)(3) | | | SCT For PEO2 (b)(2) | | | CAP For PEO2 (c)(3) | | | SCT For PEO3 (b)(2) | | | CAP For PEO3 (c)(3) | | | SCT For PEO4 (b)(2) | | | CAP For PEO4 (c)(3) | | | Average SCT for Other NEOs (d)(4) | | | Average CAP For Other NEOs (e)(3) | | | TSR (f)(5) | | | Net Income ($M) (h)(6) |

| 2023 | | | $10,808,618 | | | $6,531,285 | | | $217,351 | | | $127,089 | | | — | | | — | | | — | | | — | | | $2,779,468 | | | $1,254,662 | | | $4.80 | | | ($133.7) |

| 2022 | | | — | | | — | | | $217,498 | | | ($1,412,374) | | | $6,640,611 | | | ($2,988,104) | | | — | | | — | | | $3,340,627 | | | $2,187,065 | | | $10.93 | | | ($168.7) |

| 2021 | | | — | | | — | | | — | | | — | | | $34,816,164 | | | $17,275,459 | | | $3,541,800 | | | ($17,942,453) | | | $2,875,233 | | | $2,441,247 | | | $29.73 | | | ($32.4) |

(1) | For 2023, Mr. DeVivo (“PEO1”) and Dr. Rothberg (“PEO2”) each served as our PEO during part of the year, and Ms. Getz and Mr. Stoica as our Other Non-PEO NEOs. For 2022, Dr. Rothberg and Dr. Fruchterman (“PEO3”) each served as our PEO during part of the year, and Ms. Getz and Mr. Stoica as our Other Non-PEO NEOs. For 2021, Dr. Fruchterman and Mr. Faracci (“PEO4”) each served as our PEO during part of the year, and Ms. Fielding, Ms. Pugh, Mr. Shahida, and Mr. Stoica served as our Other Non-PEO NEOs. |

(2) | The dollar amounts reported in column (b) are the amounts of total compensation reported for our PEOs for each corresponding year in the “Total” column of the Summary Compensation Table. |

(3) | The dollar amounts reported in columns (c) and (e) represent the amount of CAP as computed in accordance with SEC rules. CAP does not necessarily represent cash and/or equity value transferred to the applicable NEO without restriction, but rather is a value calculated under applicable SEC rules. We do not have a defined benefit plan so no adjustment for pension benefits is included in the table below. Similarly, no adjustment is made for dividends as dividends are factored into the fair value of the award. The following table details these adjustments: |

| Fiscal Year | | | | | SCT (a) | | | Grant Date Value of New Awards (b) | | | Year End Value of New Awards (i) | | | Change in Value of Prior Awards (ii) | | | Change in Value of Prior Awards Vested (iii) | | | Value of New Awards Vested (iv) | | | Change in Value of Canceled Awards (v) | | | TOTAL Equity CAP (c)=(i)+(ii) +(iii)+ (iv)+(v) | | | CAP (d) =(a)- (b)+(c) | |

| 2023 | | | PEO1 | | | $10,808,618 | | | $9,117,333 | | | $2,912,000 | | | — | | | — | | | $1,928,000 | | | — | | | $4,840,000 | | | $6,531,285 |

| | | PEO2 | | | $217,351 | | | $149,999 | | | $71,052 | | | ($6,054) | | | ($5,262) | | | — | | | — | | | $59,737 | | | $127,089 | |

| | | PEO3 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | PEO4 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | Non-PEO NEOs | | | $2,779,468 | | | $1,968,000 | | | $797,917 | | | ($523,556) | | | ($104,291) | | | $273,125 | | | — | | | $443,194 | | | $1,254,662 | |

| 2022 | | | PEO1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | PEO2 | | | $217,498 | | | ($149,998) | | | $118,648 | | | ($37,106) | | | ($1,561,416) | | | — | | | — | | | ($1,479,874) | | | ($1,412,374) | |

| | | PEO3 | | | $6,640,611 | | | ($3,645,155) | | | — | | | — | | | ($4,873,998) | | | — | | | ($1,109,562) | | | ($5,983,560) | | | ($2,988,104) | |

| | | PEO4 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | Non-PEO NEOs | | | $3,340,627 | | | ($2,356,798) | | | $1,446,322 | | | ($189,039) | | | ($54,046) | | | — | | | — | | | $1,203,236 | | | $2,187,065 | |

| 2021 | | | PEO1 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — |

| | | PEO2 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| | | PEO3 | | | $34,816,164 | | | ($29,611,907) | | | $12,071,202 | | | — | | | — | | | — | | | — | | | $12,071,202 | | | $17,275,459 | |

| | | PEO4 | | | $3,541,800 | | | — | | | — | | | — | | | $6,021,275 | | | — | | | ($27,505,528) | | | ($21,484,253) | | | ($17,942,453) | |

| | | Non-PEO NEOs | | | $2,875,233 | | | ($1,762,952) | | | $692,140 | | | $145,508 | | | $491,318 | | | — | | | — | | | $1,328,966 | | | $2,441,247 |

(a) | The dollar amounts reported in the Summary Compensation Table for the applicable year. |

(b) | The grant date fair value of equity awards represents the total of the amounts reported in the “Stock Awards” column in the Summary Compensation Table for the applicable year. |

| 2024 Proxy Statement | | | 33 |

(c) | The recalculated value of equity awards for each applicable year includes the addition (or subtraction, as applicable) of the following: |

| (i) | the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; |

| (ii) | the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any awards granted in prior years that are outstanding and unvested as of the end of the applicable year; |

| (iii) | for awards granted in prior years that vest in the applicable year, the change in the fair value as of the vesting date from the beginning of the applicable year. |

| (iv) | for awards granted in the applicable year that vest in the applicable year, the fair value as of the vesting date. |

| (v) | for awards that are cancelled in the applicable year, the fair value of awards from the beginning of the applicable year. |

(4) | The dollar amounts reported in column (d) are the average amounts of total compensation reported for the other Non-PEO NEOs for each corresponding year in the “Total” column of the Summary Compensation Table. |

(5) | TSR determined in column (f) is based on the value of an initial fixed investment of $100 as of IPO on February 16, 2021. |

(6) | The amounts in this column reflect net income as reported in the company’s Consolidated Statements of Operations and Comprehensive Loss in the Annual Report on Form 10-K for the fiscal year ended December 31, 2023. |

| 2024 Proxy Statement | | | 34 |

|

|

| 2024 Proxy Statement | | | 35 |

| Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1)(2) ($) | | | Option Awards(2) ($) | | | All Other Compensation ($) | | | Total ($) |

| Dawn Carfora | | | 58,017(3) | | | 149,999 | | | — | | | — | | | 208,016 |

| Elazer Edelman, M.D., Ph.D. | | | 65,000 | | | 149,999 | | | — | | | — | | | 214,999 |

| John Hammergren | | | 4,452(4) | | | — | | | — | | | — | | | 4,452 |

| Gianluca Pettiti | | | 72,782(5) | | | 149,999 | | | — | | | — | | | 222,781 |

| S. Louise Phanstiel | | | 77,500 | | | 149,999 | | | — | | | — | | | 227,499 |

| Larry Robbins | | | 71,855(6) | | | 149,999 | | | — | | | — | | | 221,854 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | 62,648(7) | | | 149,999 | | | — | | | — | | | 212,647 |

(1) | These amounts represent the aggregate grant date fair value of stock awards granted to each director in 2023 computed in accordance with Topic 718. Such grant date fair values do not take into account any estimated forfeitures. Details as to the assumptions used to calculate the fair value of the stock awards are included in Note 11 “Equity Incentive Plan” to our consolidated audited financial statements included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. These amounts do not necessarily correspond to the actual value recognized or that may be recognized by the directors. |

(2) | The following table shows outstanding and unexercised options and unvested RSUs for each non-employee director as of December 31, 2023, other than for Dr. Rothberg, whose outstanding equity is reported in the Outstanding Equity Awards at 2023 Fiscal Year-End. |

| Name | | | Total Options Outstanding | | | Vested Options | | | Unvested RSUs |

| Dawn Carfora | | | 21,645 | | | 21,645 | | | 70,176 |

| Elazer Edelman, M.D., Ph.D. | | | 21,645 | | | 21,645 | | | 70,823 |

| John Hammergren | | | — | | | — | | | — |

| Gianluca Pettiti | | | 21,645 | | | 21,645 | | | — |

| S. Louise Phanstiel | | | 21,645 | | | 21,645 | | | 70,176 |

| Larry Robbins | | | 21,645 | | | 21,645 | | | 70,176 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | — | | | — | | | 73,757 |

(3) | Ms. Carfora’s fees are partially prorated as a result of her addition to the Audit Committee and appointment as Chairperson of the Compensation Committee in December 2023. |

(4) | Mr. Hammergren’s fees are partially prorated as a result of his resignation from the board of directors in January 2023. |

(5) | Mr Pettit's fees are partially prorated as a result of his resignation from the board of directors in December 2023. |

(6) | Mr. Robbin’s fees are partially prorated as a result of his addition to the Audit Committee in January 2023. |

(7) | Ms. Schwartz’s fees are partially prorated as a result of her appointment as Chairperson of the Nominating and Corporate Governance Committee in December 2023. |

| 2024 Proxy Statement | | | 36 |

| Name | | | RSUs Granted (#) | | | Options Granted (#) | | | Grant Date | | | Grant Date Fair Value ($) |

| Dawn Carfora | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Elazer Edelman, M.D., Ph.D. | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| John Hammergren | | | — | | | — | | | — | | | — |

| Gianluca Pettiti | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| S. Louise Phanstiel | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Larry Robbins | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Erica Schwartz, M.D., J.D., M.P.H. | | | 65,789 | | | — | | | 6/20/2023 | | | 149,999 |

| Position | | | Retainer |

| Audit committee chairperson | | | $20,000 |

| Audit committee member | | | $10,000 |

| Compensation committee chairperson | | | $15,000 |

| Compensation committee member | | | $7,500 |

| Nominating and corporate governance committee chairperson | | | $10,000 |

| Nominating and corporate governance committee member | | | $5,000 |

| Technology committee chairperson | | | $15,000 |

| Technology committee member | | | $7,500 |

| 2024 Proxy Statement | | | 37 |

| | | (a) | | | (b) | | | (c) | |

| Plan category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

Equity compensation plans approved by security holders(1) | | | 23,009,170(2) | | | $6.17(3) | | | 27,248,959(4) |

Equity compensation plans not approved by security holders(5) | | | — | | | — | | | — |

| Total | | | 23,009,170 | | | $6.17 | | | 27,248,959(6) |

(1) | These plans consist of our 2012 Employee, Director and Consultant Equity Incentive Plan, or 2012 Plan, and our Amended and Restated 2020 Equity Incentive Plan, as amended, or 2020 Plan. |

(2) | Consists of (i) 5,205,281 shares to be issued upon exercise of outstanding options and RSUs under the 2012 Plan and (ii) 17,803,889 shares to be issued upon exercise of outstanding options and RSUs under the 2020 Plan. |

(3) | Consists of the weighted-average exercise price of the 7,439,187 stock options outstanding on December 31, 2023 and does not include RSUs, which do not have an exercise price. |

(4) | Consists of shares that remained available for future issuance under the 2020 Plan as of December 31, 2023. No shares remained available for future issuance under the 2012 Plan as of December 31, 2023. |

(5) | We do not have any compensation plans that were not approved by shareholders nor have we granted any inducement awards. |

(6) | The 2020 Plan has an evergreen provision that allows for an annual increase in the number of shares available for issuance under the 2020 Plan to be added on the first day of each fiscal year, beginning in fiscal year 2021 and ending on the second day of fiscal year 2030. The evergreen provides for an automatic increase in the number of shares available for issuance equal to the lesser of (i) 4% of the number of outstanding shares of common stock on such date and (ii) an amount determined by the plan administrator. |

| 2024 Proxy Statement | | | 38 |

| • | Reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2023 with management and Deloitte & Touche LLP, our independent registered public accounting firm; |

| • | Discussed with Deloitte & Touche LLP the matters required to be discussed in accordance with Auditing Standard No. 1301 - Communications with audit committees; and |

| • | Received written disclosures and the letter from Deloitte & Touche LLP regarding its independence as required by applicable requirements of the Public Company Accounting Oversight Board regarding Deloitte & Touche LLP’s communications with the audit committee and the audit committee further discussed with Deloitte & Touche LLP their independence. The audit committee also considered the status of pending litigation, taxation matters and other areas of oversight relating to the financial reporting and audit process that the committee determined appropriate. |

| 2024 Proxy Statement | | | 39 |

| 2024 Proxy Statement | | | 40 |

| 2024 Proxy Statement | | | 41 |

| • | any person who is or was an executive officer, director, or director nominee of the Company at any time since the beginning of the Company’s last fiscal year; |

| • | a person who is or was an Immediate Family Member (as defined below) of an executive officer, director, director nominee at any time since the beginning of the Company’s last fiscal year; |

| • | any person who, at the time of the occurrence or existence of the transaction, is the beneficial owner of more than 5% of any class of the Company’s voting securities (a “Significant Stockholder”); or |

| • | any person who, at the time of the occurrence or existence of the transaction, is an Immediate Family Member of a Significant Stockholder of the Company. |

| • | the related person’s interest in the transaction; |

| • | the approximate dollar value of the amount involved in the transaction; |

| • | the approximate dollar value of the amount of the related person’s interest in the transaction without regard to the amount of any profit or loss; |

| • | whether the transaction was undertaken in the ordinary course of business of the Company; |

| • | whether the transaction with the related person is proposed to be, or was, entered into on terms no less favorable to the Company than terms that could have been reached with an unrelated third party; |

| • | the purpose of, and the potential benefits to the Company of, the transaction; and |

| • | any other information regarding the transaction or the related person in the context of the proposed transaction that would be material to investors in light of the circumstances of the particular transaction. |

| 2024 Proxy Statement | | | 42 |

| 2024 Proxy Statement | | | 43 |

| Fees | | | 2023 | | | 2022 |

Audit Fees(1) | | | $1,072,167 | | | $1,662,341 |

Audit-Related Fees(2) | | | — | | | — |

Tax Fees(3) | | | | | | 215,625 |

All Other Fees(4) | | | — | | | — |

| Total Fees | | | $1,072,167 | | | $1,877,966 |

| (1) | Audit Fees. Audit fees consisted of audit work performed in the preparation of consolidated financial statements, as well as work generally only the independent registered public accounting firm can reasonably be expected to provide, such as quarterly review procedures and the provision of consents in connection with the filing of registration statements and related amendments, as well as other filings. |

| (2) | Audit-Related Fees. This category consists of assurance and related services by the independent registered public accounting firm that are reasonably related to the performance of the audit or review of our financial statements and are not reported above under “Audit Fees.” |

| (3) | Tax Fees. Tax fees consisted principally of tax consulting services. |

| (4) | All Other Fees. Our independent registered public accountants did not provide any products and services not disclosed in the table above during the fiscal years ended December 31, 2023 and 2022. As a result, there were no other fees billed or paid during those fiscal years. |

| 2024 Proxy Statement | | | 44 |

| 2024 Proxy Statement | | | 45 |

| 2024 Proxy Statement | | | 46 |

| 2024 Proxy Statement | | | 47 |

| 2024 Proxy Statement | | | 48 |

| 2024 Proxy Statement | | | 49 |

| a) | add a provision with respect to the automatic conversion of our Class B common stock effective February 12, 2028, which is seven years from the date of the closing of the Business Combination (the “Class B Conversion Amendment”); |

| b) | add a provision to provide for the exculpation of officers (the “Officer Exculpation Amendment” and collectively with the “Class B Conversion Amendment”, the “Charter Amendments”); and |

| c) | amend the exclusive forum provision (the “Exclusive Forum Amendment” |

| 2024 Proxy Statement | | | 50 |

| 2024 Proxy Statement | | | 51 |

| 2024 Proxy Statement | | | 52 |

| 2024 Proxy Statement | | | 53 |

| 2024 Proxy Statement | | | 54 |

| 2024 Proxy Statement | | | 55 |

| 2024 Proxy Statement | | | 56 |

| 2024 Proxy Statement | | | 57 |

| 2024 Proxy Statement | | | A-1 |

| 2024 Proxy Statement | | | A-2 |

| 2024 Proxy Statement | | | A-3 |

| 2024 Proxy Statement | | | A-4 |

| 2024 Proxy Statement | | | A-5 |

| 2024 Proxy Statement | | | A-6 |

| 2024 Proxy Statement | | | B-1 |

| 2024 Proxy Statement | | | B-2 |

| 2024 Proxy Statement | | | B-3 |

| 2024 Proxy Statement | | | B-4 |

| 2024 Proxy Statement | | | B-5 |

| 2024 Proxy Statement | | | B-6 |

| 2024 Proxy Statement | | | B-7 |

| 2024 Proxy Statement | | | B-8 |

| 2024 Proxy Statement | | | B-9 |

| 2024 Proxy Statement | | | B-10 |

| 2024 Proxy Statement | | | B-11 |

| 2024 Proxy Statement | | | B-12 |

| 2024 Proxy Statement | | | B-13 |

| 2024 Proxy Statement | | | B-14 |

| 2024 Proxy Statement | | | B-15 |

| | | LONGVIEW ACQUISITION CORPBUTTERFLY NETWORK, INC. | ||||

| | | By: | | | /s/ Mark Horowitz | |

| | | Name: Mark HorowitzJoseph DeVivo | ||||

| | | Title: Chief FinancialExecutive Officer | ||||

| 2024 Proxy Statement | | | B-16 |