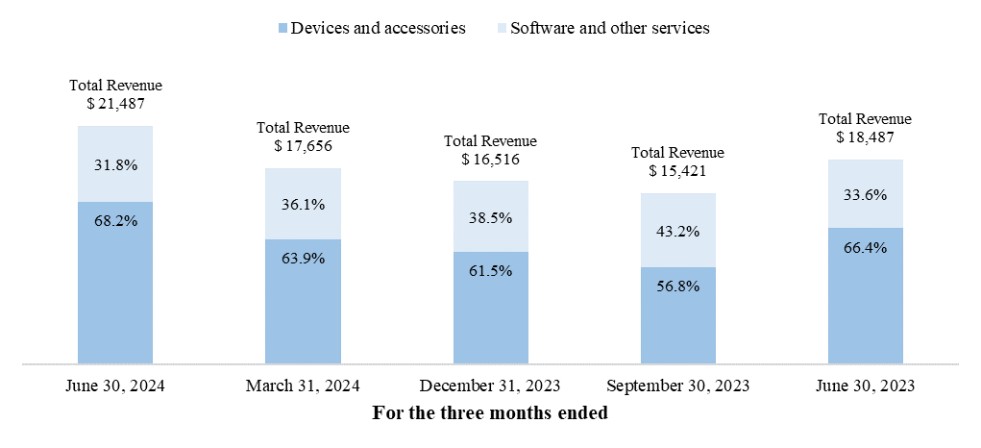

current year, our software and other services mix decreased due to the even larger increase in product revenue realized in the current year.

Description of Certain Components of Financial Data

Revenue

Revenue consists of revenue from the sale of products, such as medical devices and accessories, and the sale of software and related services, classified as software and other services revenue on our condensed consolidated statements of operations and comprehensive loss, which are SaaS subscriptions and product support and maintenance (“Support”). SaaS subscriptions include licenses for teams and individuals as well as enterprise-level subscriptions. For sales of products, revenue is recognized at a point in time upon transfer of control to the customer. SaaS subscriptions and Support are generally related to stand-ready obligations and are recognized ratably over time.

Over time, as adoption of our devices increases through further market penetration and as practitioners in the Butterfly network continue to use our devices, we expect our annual revenue mix to shift more toward software and other services. The quarterly revenue mix may be impacted by the timing of device sales. In 2024, due to the launch of our next generation iQ3 device, we are expecting our software and other services as a percentage of total revenue to remain flat or decrease.

To date, we have invested heavily in building out our direct salesforce, with the ultimate goal of growing adoption at large-scale healthcare systems. As we expand our healthcare system software offerings and develop relationships with larger healthcare systems, we continue to expect a higher proportion of our sales in healthcare systems compared to eCommerce.

Cost of revenue

Cost of product revenue consists of product costs including manufacturing costs, personnel costs and benefits, inbound freight, packaging, warranty replacement costs, payment processing fees, and inventory obsolescence and write-offs. We expect our cost of product revenue to fluctuate over time due to the level of units fulfilled in any given period and fluctuate as a percentage of product revenue over time as our focus on operational efficiencies in our supply chain may be offset by increased prices of certain inventory components.

Cost of software and other services revenue consists of personnel costs, cloud hosting costs, and payment processing fees. Because the costs and associated expenses to deliver our SaaS offerings are less than the costs and associated expenses of manufacturing and selling our device, we anticipate an improvement in profitability and margin expansion over time as our revenue mix shifts increasingly towards software and other services. We plan to continue to invest additional resources to expand and further develop our SaaS and other service offerings.

Research and development

Research and development expenses primarily consist of personnel costs and benefits, facilities-related expenses and depreciation, fabrication services, and software costs. Most of our research and development expenses are related to developing new products and services that have not reached the point of commercialization and improving our products and services that have been commercialized. Fabrication services include certain third-party engineering costs, product testing, and test boards. Research and development expenses are expensed as incurred. We expect to continue to make substantial investments in our product and software development, clinical, and regulatory capabilities.

Sales and marketing

Sales and marketing expenses primarily consist of personnel costs and benefits, advertising, conferences and events, facilities-related expenses, and software costs. We expect to continue to make substantial investments in our sales capabilities.

General and administrative

General and administrative expenses primarily consist of personnel costs and benefits, insurance, patent fees, software costs, facilities-related expenses, and outside services. Outside services consist of professional services, legal fees, and other professional fees.