UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| OR |

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | |

| For the fiscal year ended December 31, 2022 |

| |

| OR |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report:

For the transition period from to

Commission file number: 001-40004

| Cloopen Group Holding Limited |

| (Exact Name of Registrant as Specified in Its Charter) |

| N/A |

| (Translation of Registrant’s Name into English) |

| Cayman Islands |

| (Jurisdiction of Incorporation or Organization) |

16/F, Tower A, Fairmont Tower

33 Guangshun North Main Street

Chaoyang District, Beijing

| People’s Republic of China |

| (Address of Principal Executive Offices) |

Yipeng Li, Chief Financial Officer

Telephone: (86) 10-6477-5680

E-mail: liyipeng@yuntongxun.com

16/F, Tower A, Fairmont Tower

33 Guangshun North Main Street

Chaoyang District, Beijing

| People’s Republic of China |

| (Name, Telephone, E-mail and/or Facsimile Number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Securities registered or to be registered pursuant to Section 12(g) of the Act.

| Title of Each Class | | Trading Symbol |

| American depositary shares, each representing six Class A ordinary shares, par value US$0.0001 per share | | RAASY |

| Class A ordinary shares, par value US$0.0001 per share* | | |

| * | Not for trading, but only in connection with the quotation of the American depositary shares on the over-the-counter market. |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report:

As of December 31, 2022, there were 308,308,147 Class A ordinary shares (excluding treasury shares) and 25,649,839 Class B ordinary shares outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports) and (2) has been subject to such filing requirements for the past 90 days.

Yes ☐ No ☒

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☐ No ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☒ | Non-accelerated filer ☐ |

| | | Emerging growth company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act.

†The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| U.S. GAAP ☒ | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☐ | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

Yes ☐ No ☐

TABLE OF CONTENTS

INTRODUCTION

Unless we indicate otherwise and for the purpose of this annual report only:

| | ● | “active customers” at the end of any period refers to customers which had over RMB50 in annual spending in the preceding 12 months; |

| | | |

| | ● | “ADRs” refers to the American depositary receipts, which, if issued, evidence the ADSs; |

| | | |

| | ● | “ADSs” refers to our American depositary shares, each of which represents six Class A ordinary shares; |

| | | |

| | ● | “AI” or “artificial intelligence” refers to intelligence demonstrated by machines, in contrast to the natural intelligence displayed by humans and other animals; |

| | | |

| | ● | “API” or “application programming interface” refers to an application-specific computing interface that allows third parties to utilize and extend the features and functions of the application; |

| | | |

| | ● | “A2P SMS” or “application-to-person short message service” refers to a one-way process of sending messages from an application to mobile users; |

| | | |

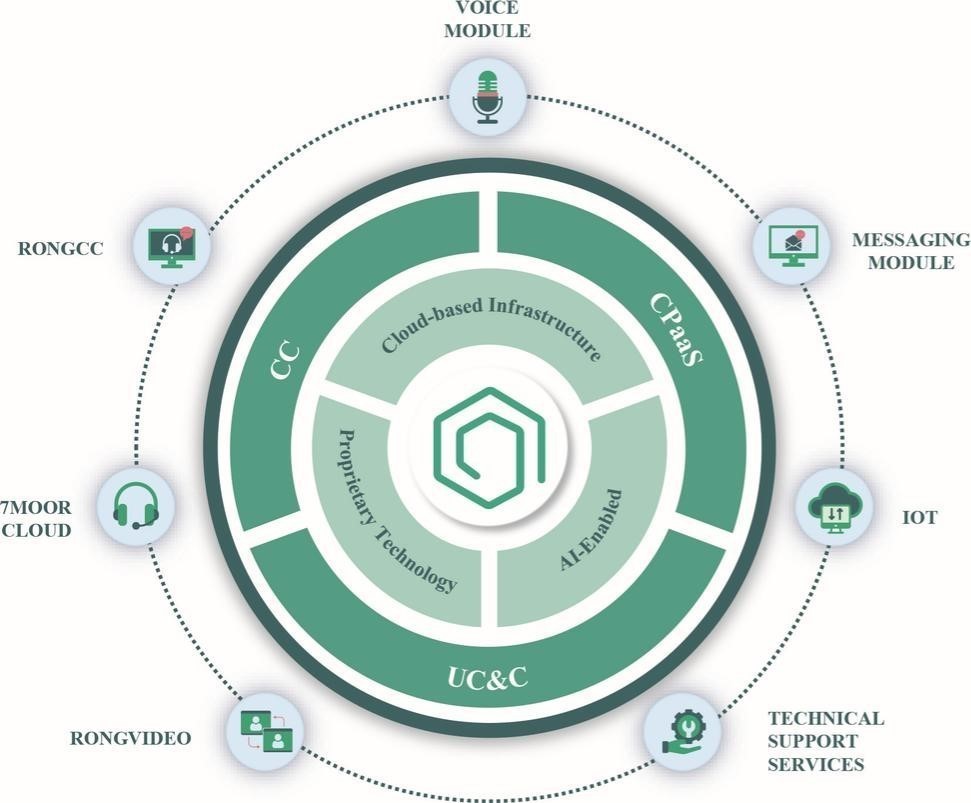

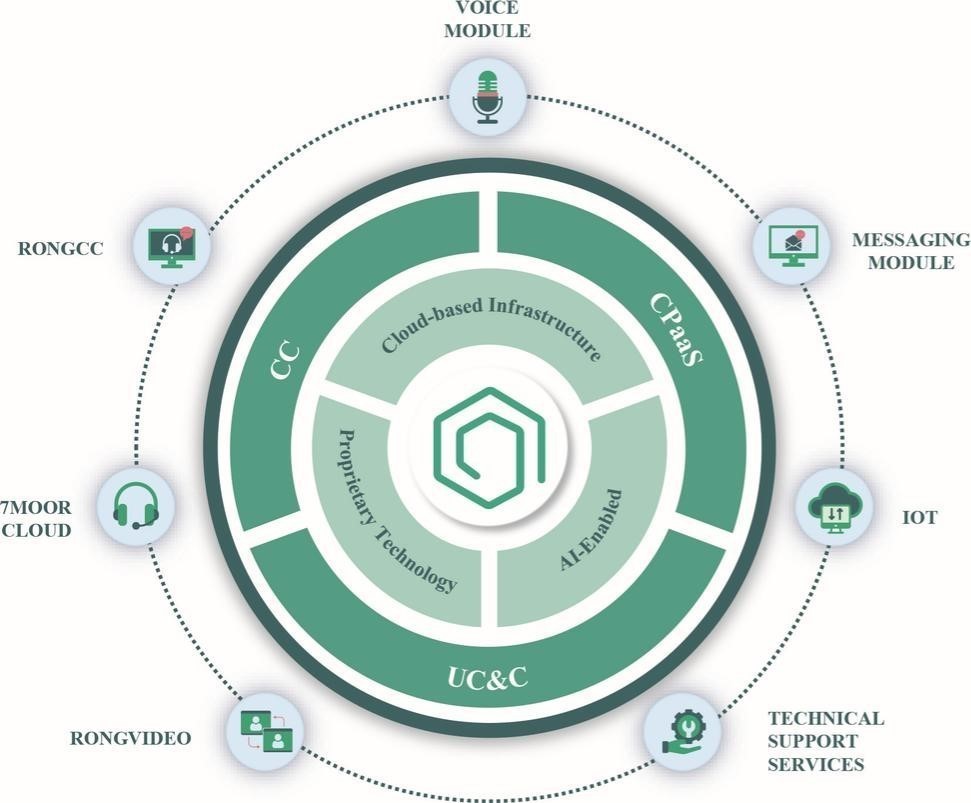

| | ● | “CC” or “contact center” refers to a business’s central point for managing all communications with customers, including customer service and acquisition, through all channels; |

| | | |

| | ● | “CPaaS” or “communications platform as a service” refers to a cloud-based solution that allows enterprises to add real-time communications capabilities such as voice and messaging to their applications and systems by deploying APIs and SDKs; |

| | | |

| | ● | “China” or “PRC” refers to the People’s Republic of China, excluding, for the purposes of this annual report only, Taiwan, the Hong Kong Special Administrative Region and the Macau Special Administrative Region; |

| | | |

| | ● | “Class A ordinary shares” refers to our Class A ordinary shares, par value US$0.0001 per share, each of which entitles the holder thereof to one vote; |

| | | |

| | ● | “Class B ordinary shares” refers to our Class B ordinary shares, par value US$0.0001 per share, each of which entitles the holder thereof to ten votes; |

| | | |

| | ● | “dollar-based net customer retention rate” illustrates our ability to increase revenue generated from our existing customer base. To calculate dollar-based net customer retention rate for a given period, we first identify all customers for solutions that we offer on a recurring basis, unless otherwise specified, with over RMB1,000 in monthly spending in the preceding period, then calculate the quotient from dividing the revenue generated from such customers in the given period by the revenue generated from the same group of customers in the preceding period. Solutions that we offer on a recurring basis include our CPaaS solutions and cloud-based CC solutions deployed primarily on public cloud, for which we change a combination of seat subscription fees and related resource usage fees; |

| | | |

| | ● | “dollar-based net customer retention rate for active customers” represents the dollar-based net customer retention rate for all active customers for solutions that we offer on a recurring basis, unless otherwise specified; |

| | | |

| | ● | “IM” or “instant messaging” refers to the exchange or real-time messages over the internet; |

| | ● | “IoT” or “Internet of Things” refers to a network of interrelated computing devices that enables data transmissions without human-to-human or human-to-computer interactions; |

| | | |

| | ● | “IVR” or “interactive voice response” refers to an automated telephony system that interacts with human callers through voice and keypad selections; |

| | | |

| | ● | “large-enterprise customers” at the end of any period refers to customers which had over RMB700,000 (equivalent to approximately US$100,000) in annual spending in the preceding 12 months; |

| | | |

| | ● | “multi-capability vendors” refers to vendors which offer a wide range of cloud-based communications services; |

| | | |

| | ● | “RMB” and “Renminbi” refers to the legal currency of China; |

| | | |

| | ● | “shares” or “ordinary shares” refers to our Class A ordinary shares and our Class B ordinary shares; |

| | | |

| | ● | “single-capability vendors” refers to vendors which focus on only one specific type of cloud-based communications services, with such service contributing over 75% of total revenues; |

| | | |

| | ● | “SDK” or “software development kit” refers to an installable software package that contains the tools one needs to build a platform; |

| | | |

| | ● | “UC&C” or “unified communications and collaboration” refers to the integration of enterprise communications and collaboration through a unified user interface, which allows consistent user experience across multiple devices, channels and communications formats; |

| | | |

| | ● | “US$” and “U.S. dollars” refers to the legal currency of the United States; |

| | | |

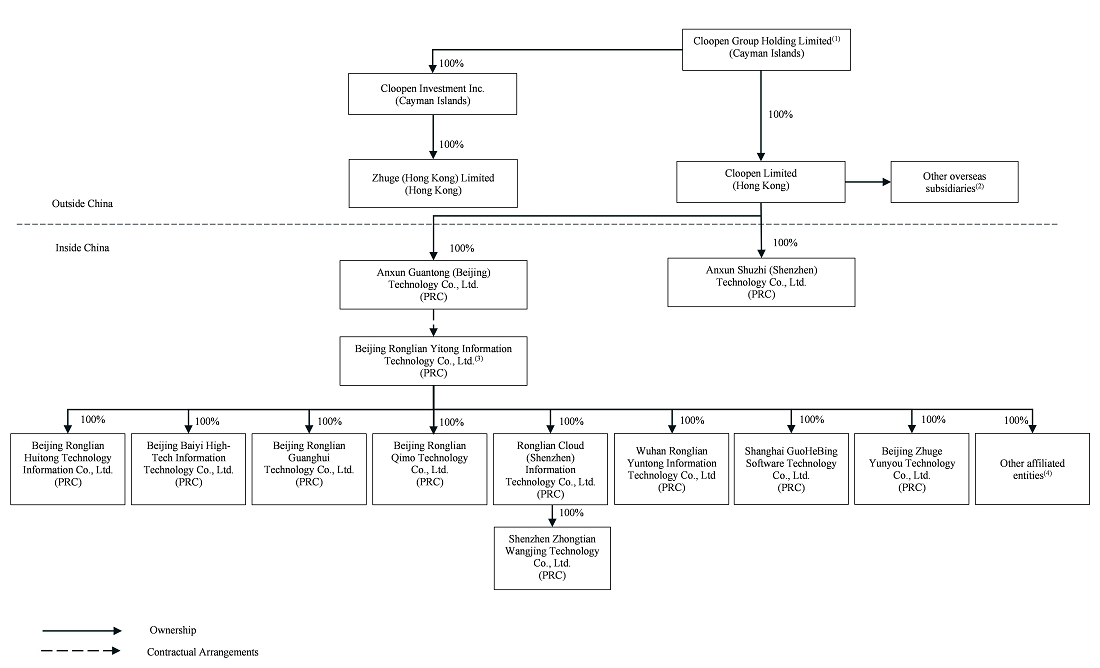

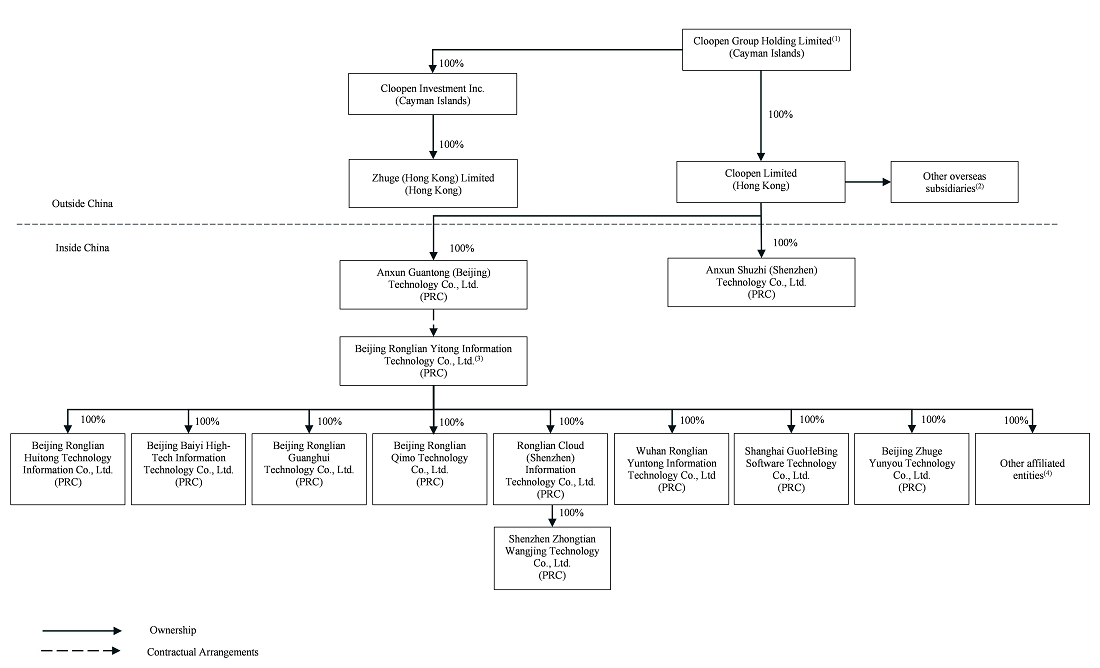

| | ● | “VIE” or “Ronglian Yitong” refers to Beijing Ronglian Yitong Information Technology Co. Ltd., and “affiliated entities” refers to, collectively, the VIE and its subsidiaries; |

| | | |

| | ● | “we,” “us,” “our company,” “our,” “our group” or “Ronglian” refers to Cloopen Group Holding Limited, our Cayman Islands holding company, its predecessor entity, its subsidiaries and its affiliated entities, as the context requires; and |

| | | |

| | ● | “WFOE” or “Anxun Guantong” refers to Anxun Guantong (Beijing) Technology Co., Ltd. |

Effective on March 15, 2023, we changed the ratio of the ADSs to Class A ordinary shares from the then ADS ratio of one ADS representing two Class A ordinary shares to a new ADS ratio of one ADS representing six Class A ordinary shares. Unless otherwise indicated, ADSs and per ADS amount in this annual report have been retroactively adjusted to reflect the change in ratio for all periods presented.

We have made rounding adjustments to reach some of the figures included in this annual report. Consequently, numerical figures shown as totals in some tables may not be arithmetic aggregations of the figures that precede them.

Our reporting currency is Renminbi. This annual report contains translations of certain foreign currency amounts into U.S. dollars for the convenience of the reader. Unless otherwise stated, all translations of Renminbi into U.S. dollars were made at RMB6.8972 to US$1.00, the noon buying rate on December 30, 2022 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board. We make no representation that the Renminbi or U.S. dollar amounts referred to in this annual report could have been or could be converted into U.S. dollars or Renminbi at any particular rate or at all. On August 23, 2024, the noon buying rate was RMB7.1244 to US$1.00 as set forth in the H.10 statistical release of the U.S. Federal Reserve Board.

FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements, including our current expectations and views of future events. These forward-looking statements are made under the “safe-harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements relate to events that involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements to be materially different from those expressed or implied by these statements.

You can identify some of these forward-looking statements by words or phrases such as “may,” “will,” “could,” “expect,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “is/are likely to,” “propose,” “potential,” “continue” or other similar expressions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our results of operations, financial condition, business strategy and financial needs. The forward-looking statements included in this annual report relate to, among other things:

| | ● | our mission, goals and strategies; |

| | | |

| | ● | our ability to retain and grow customer base; |

| | | |

| | ● | our future business development, results of operations and financial condition; |

| | | |

| | ● | expected changes in our revenue, costs or expenditures; |

| | | |

| | ● | competition in our industry; |

| | | |

| | ● | relevant government policies and regulations relating to our industry; |

| | | |

| | ● | general economic and business conditions globally and in China; and |

| | | |

| | ● | assumptions underlying or related to any of the foregoing. |

You should read this annual report and the documents that we refer to in this annual report completely and with the understanding that our actual future results may be materially different from and worse than what we expect. Moreover, new risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. We qualify all of our forward-looking statements by these cautionary statements.

You should not place undue reliance on these forward-looking statements. The forward-looking statements made in this annual report relate only to events or information as of the date on which the statements are made in this annual report. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Comparisons of results for current and any prior periods are not intended to express any future trends or indications of future performance, unless specifically expressed as such, and should only be viewed as historical data.

PART I

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Our Holding Company Structure and Contractual Arrangements with the VIE and Its Shareholders

The VIE structure and its associated risks

Cloopen Group Holding Limited, our ultimate Cayman Islands holding company, does not have any substantive operations other than (1) directly controlling Anxun Guantong, our wholly-owned PRC subsidiary and a foreign-invested enterprise under PRC laws that controls the VIE and its subsidiaries through certain contractual arrangements instead of direct equity ownership, and (2) directly controlling our overseas subsidiaries that conduct our overseas business operations. Investors in the ADSs are purchasing equity securities of our ultimate Cayman Islands holding company rather than purchasing equity securities of the affiliated entities.

We, together with our WFOE and the affiliated entities, are subject to PRC laws relating to, among others, restrictions over foreign investment in companies that engage in value-added telecommunications services as set out in the Negative List (2021 Version) promulgated by the Ministry of Commerce, or the MOFCOM, and the National Development and Reform Commission, or the NDRC. As a result, we operate value-added telecommunications business in China through the affiliated entities, and rely on a series of contractual arrangements by and among WFOE, the VIE and its shareholders to control and receive the economic benefits of the business operations of the affiliated entities. Our VIE structure is used to replicate foreign investment in China-based companies where the PRC law prohibits direct foreign investment in the operating companies. The contractual agreements enable us to (1) exercise effective control over the affiliated entities; (2) receive substantially all of the economic benefits of the affiliated entities; and (3) have an exclusive option to purchase all or part of the equity interests in the affiliated entities when and to the extent permitted by PRC law. See “Item 4. Information on the Company—C. Organizational Structure—Contractual Arrangements.” As a result of our direct ownership in WFOE and the contractual agreements with the VIE, we are regarded as the primary beneficiary of the VIE, and the VIE and its subsidiaries are treated as our consolidated affiliated entities under U.S. GAAP. However, our contractual arrangements with the VIE are not equivalent of an investment in the VIE, and the PRC regulatory authorities could disallow our corporate structure at any time.

The VIE structure involves unique risks to investors in the ADSs. It may be less effective than direct ownership in providing us with operational control over the VIE or its subsidiaries and we may incur substantial costs to enforce the terms of the arrangements. For example, the VIE and its shareholders could breach their contractual arrangements with us by, among other things, failing to conduct the operations of the VIE in an acceptable manner or taking other actions that are detrimental to our interests. If we had direct ownership of the VIE in China, we would be able to exercise our rights as a shareholder to effect changes in the board of directors of the VIE, which in turn could implement changes, subject to any applicable fiduciary obligations, at the management and operational level. However, under the current contractual arrangements, we rely on the performance by the VIE and its shareholders of their obligations under the contracts to direct the VIE’s activities. The shareholders of the VIE may not act in the best interests of our company or may not perform its obligations under these contracts. If any dispute relating to these contracts remains unresolved, we will have to enforce our rights under these contracts through the operations of PRC law and arbitration, litigation and other legal proceedings and therefore will be subject to uncertainties in the PRC legal system.

We may face challenges in enforcing the contractual arrangements due to jurisdictional and legal limitations. There are and will continue to be substantial uncertainties regarding the interpretation and application of current and future PRC laws, rules and regulations regarding the status of the rights of our Cayman Islands holding company with respect to its contractual arrangements with the VIE and its shareholders through our WFOE. As of the date of this annual report, the agreements under the contractual arrangements among our WFOE, the VIE and its shareholders have not been tested in a court of law. It is uncertain whether any new PRC laws or regulations relating to VIE structures will be adopted or, if adopted, what they would provide. If we or the VIE is found to be in violation of any existing or future PRC laws or regulations or fail to obtain or maintain any of the required licenses, permits, filings or approvals, the relevant PRC regulatory authorities would have broad discretion to take action in dealing with such violations or failures. The PRC regulatory authorities could disallow the VIE structure at any time in the future. If the PRC government deems that our contractual arrangements with the VIE do not comply with PRC regulatory restrictions on foreign investment in the relevant industries, or if these regulations or the interpretation of existing regulations change or are interpreted differently in the future, we could be subject to severe penalties and may incur substantial costs to enforce the terms of the arrangements, or be forced to relinquish our interests in those operations. Our Cayman Islands holding company, our subsidiaries, the affiliated entities, and investors in our securities (including the ADS) face uncertainty with respect to potential future actions by the PRC government that could affect the enforceability of the contractual arrangements with the VIE and, consequently, significantly affect the financial performance of our company and the affiliated entities as a whole. For details, see “Risk Factors—Risks Related to Our Corporate Structure.”

Revenues contributed by the affiliated entities accounted for substantially all of our total revenues in 2020, 2021 and 2022. For a consolidation schedule depicting the results of operations, financial position and cash flows for us and the affiliated entities, see “Item 5. Operating and Financial Review and Prospects—B. Liquidity and Capital Resources—Financial Information Related to the VIE.”

Cash and asset flows through our organization

In light of our holding company structure and the VIE structure, our ability to pay dividends to the shareholders, including the investors in the ADSs, and to service any debt we may incur may highly depend upon dividends paid by our WFOE to us and service fees paid by the affiliated entities to our WFOE, despite that we may obtain financing at the holding company level through other methods. For example, if any of our WFOE or the VIE incurs debt on its own behalf in the future, the instruments governing such debt may restrict its ability to pay dividends to us and the investors in the ADS as well as the ability to settle amounts owed under the contractual arrangements. As of the date of this annual report, none of Cloopen Group Holding Limited, our WFOE and the VIE has paid any dividends or made any distributions to their respective shareholders, including any U.S. investors. In 2020, 2021 and 2022, the VIE did not pay any service fees to our WFOE under the contractual arrangements. We expect to distribute earnings and settle the service fees owed under the contractual arrangements at the request of our WFOE and based on our business needs, and do not expect to declare dividend in the foreseeable future. We currently have not maintained any cash management policies that specifically dictate how funds shall be transferred among Cloopen Group Holding Limited, the subsidiaries of Cloopen Group Holding Limited (including our WFOE), the affiliated entities and investors. We will determine the payment of dividends and fund transfer based on our specific business needs in accordance with the applicable laws and regulations.

Under PRC laws and regulations, our WFOE is permitted to pay dividends only out of its retained earnings, if any, as determined in accordance with PRC accounting standards and regulations. Furthermore, our WFOE and the affiliated entities are required to make appropriations to certain statutory reserve funds or may make appropriations to certain discretionary funds, which are not distributable as cash dividends except in the event of a solvent liquidation of the companies. Remittance of dividends by our WFOE out of China is also subject to certain procedures with the banks designated by the State Administration of Foreign Exchange, or SAFE. These restrictions are benchmarked against the paid-up capital and the statutory reserve funds of our WFOE and the net assets of the VIE in which we have no legal ownership. In addition, while there are currently no such restrictions on foreign exchange and our ability to transfer cash or assets between Cloopen Group Holding Limited and our Hong Kong subsidiary, if certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future were to become applicable to our Hong Kong subsidiary in the future, and to the extent our cash or assets are in Hong Kong or a Hong Kong entity, such funds or assets may not be available due to interventions in or the imposition of restrictions and limitations on our ability to transfer funds or assets by the PRC government. Furthermore, we cannot assure you that the PRC government will not intervene or impose restrictions on Cloopen Group Holding Limited, its subsidiaries and the affiliated entities to transfer or distribute cash within the organization, which could result in our inability of or prohibition on making transfers or distributions to entities outside of mainland China and Hong Kong.

Under PRC laws and regulations, we, the Cayman Islands holding company, may fund our WFOE only through capital contributions or loans, and fund the affiliated entities only through loans, subject to satisfaction of applicable government registration and approval requirements. See “—D. Risk Factors—Risks Related to Our Corporate Structure—We may rely on dividends paid by our PRC subsidiaries to fund cash and financing requirements. Any limitation on the ability of our PRC subsidiaries to pay dividends to us could have a material adverse effect on our ability to conduct our business and to pay dividends to holders of our ordinary shares, including those represented by the ADSs,” and “—D. Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues effectively and affect the value of your investment.”

Our Operations in China and Permissions Required from the PRC Authorities for Our Operations

We, through our WFOE and the affiliated entities, conduct our operations in China. We also control Anxun Shuzhi (Shenzhen) Technology Co., Ltd., our wholly-owned PRC subsidiary and a foreign-invested enterprise under PRC laws, which has no material business operations as of the date of this annual report. Our operations in China are governed by PRC laws and regulations. We and the affiliated entities are required to obtain certain licenses, permits, filings or approvals from relevant governmental authorities in China in order to operate our business. As of the date of this annual report, as advised by our PRC counsel, CM Law Firm, our PRC subsidiaries and the affiliated entities in China have obtained the material licenses, permits, filings and approvals from the PRC government authorities necessary for our business operations in China, including, among others, Value-Added Telecommunications Business Operating Licenses. Given the uncertainties of interpretation and implementation of relevant laws and regulations and the enforcement practice by relevant government authorities, and the promulgation of new laws and regulations and amendment to the existing ones, we may be required to obtain additional licenses, permits, filings or approvals for our business operations in the future. We cannot assure you that we or the affiliated entities will be able to obtain, in a timely manner or at all, or maintain such licenses, permits, filings or approvals, and we or the affiliated entities may also inadvertently conclude that such permissions or approvals are not required. Any lack of or failure to maintain requisite licenses, permits, filings or approvals applicable to us or the affiliated entities may have a material adverse effect on our business, results of operations, financial condition and prospects and cause the value of any securities we offer to significantly decline or become worthless. For details, see “—D. Risk Factors—Risks Related to Regulatory Compliance—Our business is subject to extensive regulation, and if we fail to obtain and maintain required licenses and permits, we could face government enforcement actions, fines and possibly restrictions on our ability to operate or offer certain of our solutions.”

On December 28, 2021, the Cyberspace Administration of China, or the CAC, and other 12 PRC regulatory authorities jointly issued an amendment to the Measures for Cybersecurity Review, or the Cybersecurity Review Measures, which took effect on February 15, 2022. The Cybersecurity Review Measures stipulates that (1) critical information infrastructure operators purchasing network products and services and network platform operators carrying out data processing activities, which affect or may affect national security, are subject to the cybersecurity review by the Cybersecurity Review Office, and (2) network platform operators holding personal information of more than one million users seeking for listing in a foreign country must apply for the cybersecurity review. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations relating to cybersecurity and privacy protection—Cybersecurity.” As of the date of this annual report, we have not been informed by any PRC governmental authority of any requirement that we file for a cybersecurity review. However, if we are not able to comply with the cybersecurity and data privacy requirements in a timely manner, or at all, we may be subject to government enforcement actions and investigations, fines, penalties, or suspension of our non-compliant operations, among other sanctions, which could materially and adversely affect our business and results of operations. See “—D. Risk Factors—Risks Related to Our Business and Industry—If we fail to comply with laws and contractual obligations related to data privacy and protection and cybersecurity, our business, results of operations and financial condition could be materially and adversely affected.”

On February 17, 2023, Chinese Securities Regulatory Commission, or the CSRC, promulgated the Trial Measures of the Overseas Securities Offering and Listing by Domestic Companies, or the Overseas Listing Trial Measures, and the related guidelines, which became effective on March 31, 2023. The Overseas Listing Trial Measures has comprehensively improved and reformed the existing regulatory regime for overseas offering and listing of securities by PRC domestic companies and regulates both direct and indirect overseas offering and listing of securities by PRC domestic companies by adopting a filing-based regulatory regime. According to the Overseas Listing Trial Measures, PRC domestic companies that seek to offer and list securities in overseas markets, either in direct or indirect means, are required to fulfill the filing procedure with the CSRC and report relevant information. The CSRC provided further notice related to the Overseas Listing Trial Measures that companies that have already been listed on overseas stock exchanges prior to March 31, 2023 are not required to make immediate filings for its listing, but are required to make filings for subsequent offerings in accordance with the Overseas Listing Trial Measures, i.e., to file with the CSRC within three business days after the closing of such subsequent offerings. As we had been listed on an overseas stock exchange prior to March 31, 2023, we are not required to make such immediate filing with the CSRC in connection with such previous listing. However, we could be subject to the filing requirements with the CSRC if we conduct subsequent offerings or seek to list our securities on a stock exchange. See “Item 4. Information on the Company—B. Business Overview—Regulations—Regulations relating to M&A Rule and overseas listing in the PRC.”

We cannot assure you that we can complete the filing procedures, obtain the approvals or complete other compliance procedures in a timely manner, or at all, or that any completion of filings or approvals or other compliance procedures would not be rescinded. Any such failure would subject us to sanctions by the CSRC or other PRC regulatory authorities. These regulatory authorities may impose restrictions and penalties on the operations in China, significantly limit or completely hinder our ability to launch any new offering of our securities, limit our ability to pay dividends outside of China, delay or restrict the repatriation of the proceeds from future capital raising activities into China, or take other actions that could materially and adversely affect our business, results of operations, financial condition and prospects, as well as the trading price of the ADSs. Furthermore, the PRC government authorities may further strengthen oversight and control over listings and offerings that are conducted overseas. Any such action may adversely affect our operations and significantly limit or completely hinder our ability to offer ADSs and/or other securities to investors, and cause the value of such securities to significantly decline or be worthless. See “—D. Risk Factors—Risks Related to Doing Business in China—The approval of and the filing with the CSRC or other PRC government authorities may be required in connection with our future offshore offerings under PRC law, and, if required, we cannot predict whether or for how long we will be able to obtain such approval or complete such filing.”

The Holding Foreign Companies Accountable Act

The Holding Foreign Companies Accountable Act, or the HFCAA, was enacted on December 18, 2020. Pursuant to the HFCAA and related regulations, if we have filed an audit report issued by a registered public accounting firm that the PCAOB has determined that it is unable to inspect and investigate completely, the SEC will identify us as a “Commission-Identified Issuer,” and the trading of our securities on any U.S. national securities exchanges, as well as any over-the-counter, or OTC, trading in the United States, will be prohibited if we are identified as a Commission-Identified Issuer for two consecutive years. On August 26, 2022, the PCAOB, the CSRC and the Ministry of Finance of the PRC signed the Statement of Protocol, which establishes a specific and accountable framework for the PCAOB to conduct inspections and investigations of PCAOB-governed accounting firms in mainland China and Hong Kong. On December 15, 2022, the PCAOB announced that it was able to secure complete access to inspect and investigate PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong in 2022. The PCAOB Board vacated its previous 2021 determinations that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong. However, whether the PCAOB will continue to be able to satisfactorily conduct inspections of PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong is subject to uncertainties and depends on a number of factors out of our and our auditor’s control. The PCAOB continues to demand complete access in mainland China and Hong Kong moving forward and is making plans to resume regular inspections, as well as to continue pursuing ongoing investigations and initiate new investigations as needed. The PCAOB has also indicated that it will act immediately to consider the need to issue new determinations with the HFCAA if needed. If the PCAOB is unable to inspect and investigate completely registered public accounting firms located in mainland China and Hong Kong, or if we fail to, among others, meet the PCAOB’s requirements, including retaining a registered public accounting firm that the PCAOB determines it is able to inspect and investigate completely, and upon two consecutive years of non-inspection under the HFCAA, our shares and the ADSs will not be permitted for trading on a national securities exchange or the OTC trading market in the United States under the HFCAA and related regulations. The related risks and uncertainties could cause the value of the ADSs to decline significantly or become worthless. For details, see “—D. Risk Factors—Risks Related to Doing Business in China—The ADSs may be prohibited from being traded over the counter in the United States under the HFCAA if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely. The prohibition from trading of the ADSs, or the threat of their being prohibited from being traded, may materially and adversely affect the value of your investment.”

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Summary Risk Factors

Our business is subject to a number of risks, including risks that may prevent us from achieving our business objectives or may adversely affect our business, results of operations, financial condition, cash flows, and prospects. These risks are discussed more fully below and include, but are not limited to, risks related to:

Risks related to the Independent Investigation and restatement of consolidated financial statements

| | ● | legal proceedings, investigations and inquiries in connection with or arising from the previously disclosed employee misconduct and transaction irregularities, and other associated adverse effects; |

| | | |

| | ● | adverse publicity and potential concerns from our customers and other business partners relating to or arising from the Independent Investigation and restatement of consolidated financial statements; |

| | | |

| | ● | our ability to implement and maintain an effective system of internal control over financial reporting to accurately report our results of operations, meet our reporting obligations and prevent fraud; and |

| | | |

| | ● | our failure to timely comply with our SEC reporting obligations. |

Risks related to our business and industry

| | ● | our ability to attract new customers or retain existing ones; |

| | | |

| | ● | continued development of our solutions and the markets our solutions target; |

| | | |

| | ● | our limited operating history; |

| | | |

| | ● | our ability to generate profits and positive cash flows; |

| | | |

| | ● | our reliance on collaborations with China’s major mobile network operators; |

| | | |

| | ● | our ability to enhance or upgrade our existing solutions and introduce new ones; |

| | ● | compatibility of our solutions across devices, business systems and applications and physical infrastructure; |

| | | |

| | ● | our ability to compete effectively in China’s cloud-based communications industry and internationally; |

| | | |

| | ● | our ability to collect accounts receivable from our customers in a timely manner; |

| | | |

| | ● | our ability to maintain and enhance our brand image and generate positive publicity; |

| | | |

| | ● | our ability to optimize the prices for our solutions; |

| | | |

| | ● | our ability to manage our sales cycle to large enterprises; |

| | | |

| | ● | our ability to comply with related laws and regulations associated with conducting business with state-owned enterprises; |

| | | |

| | ● | real or perceived errors, defects, failures, vulnerabilities, or bugs in our solutions; |

| | | |

| | ● | our ability to integrate acquired businesses and technologies successfully or achieve the expected benefits of such acquisitions; |

| | | |

| | ● | our ability to support and resolve intellectual property rights claims and other litigation matters; |

| | | |

| | ● | our ability to protect or defend our intellectual property rights; and |

| | | |

| | ● | our ability to comply with laws and contractual obligations related to data privacy and protection and cybersecurity. |

Risks related to regulatory compliance

| | ● | compliance with extensive and evolving laws and regulations in the PRC; |

| | | |

| | ● | third-party misconduct and misuse of our solutions in violation of relevant laws and regulations; and |

| | | |

| | ● | our limited insurance coverage, which could expose us to significant costs and business disruption. |

Risks related to doing business in China

| | ● | changes in China’s economic, political or social conditions or government policies; |

| | | |

| | ● | evolving legal development, non-compliance with which, or changes in which, may adversely affect our business and prospects; |

| | | |

| | ● | Chinese government’s significant authority to intervene or influence our operations and to exert control over offerings conducted overseas and/or foreign investment in China-based issuers; |

| | | |

| | ● | the approval of and the filing with the CSRC or other PRC government authorities in connection with our future offshore offerings; and |

| | ● | the threat of the ADSs being prohibited from being traded over the counter in the United States under the HFCAA if the SEC subsequently determines our audit work is performed by auditors that the PCAOB is unable to inspect or investigate completely. |

Risks related to our corporate structure

| | ● | compliance of the contractual arrangements that establish our corporate structure for operating our business; |

| | | |

| | ● | failure by the VIE or its shareholders to perform their obligations under our contractual arrangements with them; and |

| | | |

| | ● | actual or potential conflicts of interest of shareholders of the VIE with us. |

Risks related to corporate governance

| | ● | our status as a foreign private issuer; |

| | | |

| | ● | our status as an emerging growth company; and |

| | | |

| | ● | our dual-class voting structure and the concentration of ownership which provide Class B ordinary shareholder considerable influence over corporate matters, including the election of board of directors. |

Risks related to the ADS

| | ● | delisting of the ADSs from the New York Stock Exchange, which may continue to have a material adverse effect on the trading and price of the ADSs; |

| | | |

| | ● | volatility of the trading price of the ADSs; and |

| | | |

| | ● | the sale or availability for sale of substantial amounts of the ADSs. |

Risks Related to the Independent Investigation and Restatement of Consolidated Financial Statements

The previously disclosed employee misconduct and transaction irregularities have exposed us to a number of legal proceedings, investigations and inquiries, resulted in significant legal and other expenses, required significant time and attention from our senior management, among other adverse effects.

As previously disclosed in press releases dated May 3, 2022 and September 6, 2022, the Special Committee undertook the Independent Investigation regarding certain employee misconduct and transaction irregularities with the assistance of independent advisors during 2022.

The employee misconduct and transaction irregularities had and could continue to have material adverse effects on us. On February 6, 2024, we reached a settlement with the SEC regarding the employee misconduct and transaction irregularities, under which we shall cease and desist from committing or causing any violations and any future violations of certain federal securities laws. Entering into the settlement with the SEC also results in the loss of certain exemptions or protections that were available to us under federal securities laws. See “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal and Other Proceedings.” We incurred significant costs, including legal expenses and cost associated with the restatement and adjustment of our financial statements. We may also incur material costs associated with our indemnification arrangements with our current and former directors and certain of our officers, as well as other indemnitees. Moreover, an unfavorable outcome in any of these matters could result in significant damages, additional penalties or other remedies imposed against us, and/or our current or former directors or officers, which could harm our reputation, business, results of operations, financial condition, or liquidity. In addition, an unfavorable outcome in any of these matters could exceed coverage provided, if any, under potentially applicable insurance policies, which is limited. Following disclosure of the employee misconduct and transaction irregularities, we have had difficulties in obtaining desirable insurance coverage, or any insurance coverage, regarding legal proceedings, investigations and inquiries, and we cannot assure you with any certainty that we will be able to obtain such coverage in the future. The employee misconduct and transaction irregularities also led to material adverse effects on our operations, our reputation and our relationships with business partners, as well as material adverse effects on our financial position, including incurred costs and expenses and our ability to raise new capital in the future. Furthermore, our senior management team devoted significant time to facilitate the Independent Investigation and is expected to continue to devote significant time and efforts to address the impacts associated with or arising from the employee misconduct and transaction irregularities.

We cannot predict all impacts on us in connection with or arising from the employee misconduct and transaction irregularities. Any unknown or new risks might result in a material adverse effect on us.

We were named as a defendant in a number of lawsuits filed by purchasers of our securities, including class action lawsuits that could have a material adverse effect on our business, results of operation, financial condition and cash flows, and our reputation. We may continue to be, the subject of a number of legal proceedings, investigations and inquiries by governmental agencies with respect to the employee misconduct and transaction irregularities.

We were named as a defendant in a number of lawsuits filed by purchasers of our securities, including class action lawsuits described in “Item 8. Financial Information—A. Consolidated Statements and Other Financial Information—Legal and Other Proceedings.” We may continue to be, the subject of a number of legal proceedings, investigations and inquiries by governmental agencies with respect to the employee misconduct and transaction irregularities.

The matters that led to the Independent Investigation and restatement of consolidated financial statements have exposed us to increased risks of litigation, regulatory proceedings and government enforcement actions. We and our current and former directors and officers may, in the future, be subject to additional proceedings relating to such matters. Regardless of the outcome, any lawsuits or other proceedings that may be brought against us or our current or former directors and officers, could be time-consuming, result in significant expense and divert the attention and resources of our management and other key employees. An unfavorable outcome in any of these matters could result in significant damages, fines, additional penalties, administrative sanctions or other remedies imposed against us, our current or former directors or officers, which could harm our reputation, business, results of operations, financial condition or cash flows. Subject to certain limitations, we are obligated to indemnify, among others, our current and former directors and officers in connection with such lawsuits and any related proceedings or settlements amounts. In addition, an unfavorable outcome in any of these matters could exceed coverage provided, if any, under potentially applicable insurance policies, which is limited.

Matters relating to or arising from the Independent Investigation and restatement of consolidated financial statements, including adverse publicity and potential concerns from our customers and other business partners, have had and could continue to have a material adverse effect on our business and financial condition.

We have been and could continue to be the subject of negative publicity focusing on the Independent Investigation and restatement of our financial statements, and we may be materially and adversely affected by negative reactions from our customers, suppliers or others with whom we do business. Concerns include the perception of the efforts required to address our accounting and control environment, and the ability for us to be a long-term provider to our customers. Continued adverse publicity and potential concerns from our customers and business partners could harm our business and have an adverse effect on our financial condition.

If we fail to implement and maintain an effective system of internal control over financial reporting, we could be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud, and investor confidence and the market price of the ADSs may be materially and adversely affected.

In the course of preparing our consolidated financial statements as of and for the year ended December 31, 2022, we and our independent registered public accounting firm identified certain material weaknesses in our internal control over financial reporting as of December 31, 2022. As defined in the standards established by the PCAOB, a “material weakness” is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of our annual or interim consolidated financial statements will not be prevented or detected on a timely basis.

The material weaknesses identified relate to: (1) insufficient accounting personnel with appropriate U.S. GAAP knowledge for accounting of complex transactions, presentation and disclosure of financial statements in accordance with U.S. GAAP and SEC reporting requirements, (2) lack of rigorous implementation of controls on financial closing policies and procedures, (3) lack of sufficient procedures on recognizing revenue on a gross basis or a net basis, (4) insufficient controls and reporting procedures on monitoring the past due status of customer to assess the revenue recognition and provision of accounts receivable, (5) insufficient authorization, monitoring or review controls in the revenue and the purchase processes, (6) lack of systematic process controls over the filing and registration of the sales and purchase agreements, (7) improper approval and timely review on certain system user’s authorization relating to general information technology control, and (8) insufficient acceptance control of systems (or subsystems) developed by external subcontractors. See “Item 15. Controls and Procedures—Management’s Annual Report on Internal Control over Financial Reporting” for details of our remedial measures.

The implementation of remedial measures, however, may not fully address the material weaknesses identified in our internal control over financial reporting, and we cannot conclude that they have been fully remedied. Our failure to correct the material weaknesses or our failure to discover and address any other material weaknesses or deficiencies could result in inaccuracies or material misstatements in our financial statements and impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis.

We are subject to reporting obligations under the U.S. securities laws. As a public company, we are also subject to the Sarbanes-Oxley Act of 2002. Commencing with our fiscal year ended December 31, 2021, we must perform system and process evaluation and testing of our internal control over financial reporting to allow management to report on the effectiveness of our internal control over financial reporting in our annual report on Form 20-F for such year, as required by Section 404 of the Sarbanes-Oxley Act, or Section 404. Our management has concluded that our internal control over financial reporting was ineffective as of December 31, 2022. See “Item 15. Controls and Procedures.” In addition, once we cease to be an “emerging growth company” as such term is defined in the JOBS Act, our independent registered public accounting firm must attest to and report on the effectiveness of our internal control over financial reporting. Our management may conclude that our internal control over financial reporting is not effective. Moreover, even if our management concludes that our internal control over financial reporting is effective, our independent registered public accounting firm, after conducting its own independent testing, may issue a report that is qualified if it is not satisfied with our internal controls or the level at which our controls are documented, designed, operated or reviewed, or if it interprets the relevant requirements differently from us. As a public company, our reporting obligations may also place a significant strain on our management, operational and financial resources and systems for the foreseeable future. We may be unable to timely complete our evaluation testing and any required remediation.

Furthermore, our internal control over financial reporting will not prevent or detect all errors and all fraud. A control system, no matter how well designed and operated, can provide only reasonable, not absolute, assurance that the control system’s objectives will be met. In light of the inherent limitations in all control systems, no evaluation of controls can provide absolute assurance that misstatements due to error or fraud will not occur or that all control issues and instances of fraud will be detected.

During the course of documenting and testing our internal control procedures, in order to satisfy the requirements of Section 404, we may identify other weaknesses and deficiencies in our internal control over financial reporting. If we fail to maintain the adequacy of our internal control over financial reporting, as these standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404. Generally, if we fail to achieve and maintain an effective internal control environment, it could result in material misstatements in our financial statements and could also impair our ability to comply with applicable financial reporting requirements and related regulatory filings on a timely basis. As a result, our businesses, results of operations, financial condition and prospects, as well as the trading price of the ADSs, may be materially and adversely affected. Additionally, ineffective internal control over financial reporting could expose us to increased risk of fraud or misuse of corporate assets and subject us to regulatory investigations and civil or criminal sanctions. We may also be required to restate our financial statements from prior periods.

The circumstances that led to the failure to file our annual report on time, and our efforts to investigate, assess and remediate those matters have caused and may continue to cause substantial delays in our SEC filings.

Our ability to resume a timely filing schedule with respect to our SEC reporting is subject to a number of contingencies, including whether and how quickly we are able to effectively remediate the identified material weaknesses in our internal control over financial reporting. Our filing of this annual report has been delayed and we cannot assure you we will be able to timely make our future filings.

In case we delay our filings, investors may need to evaluate certain decisions with respect to the ADSs in light of our lack of current financial information. Furthermore, in June 2022, we were informed by the depositary bank that due to our failure to timely comply with our SEC reporting obligations, the depositary bank decided to close its books to conversions of our ordinary shares into the ADSs. We cannot assure you when or if our ADR facility will be reopened for conversions. The closing of the depositary’s books does not affect the trading of the previously issued ADSs. Accordingly, any investment in our shares and/or the ADSs involves a greater degree of risk. Our lack of current public information may have an adverse effect on investor confidence, which could lead to a reduction in our stock price or restrictions on our abilities to obtain financing in the public market, among others.

Risks Related to Our Business and Industry

If we fail to attract new customers or retain existing ones, our business, results of operations and financial condition could be materially and adversely affected.

In order to increase our revenues and maintain future growth, we must attract new customers and encourage existing customers to continue their subscriptions, increase their usage, and purchase additional features and solutions from us.

For customer demand and the adoption of our solutions to grow, the quality, cost and features of these solutions must compare favorably to those of competing products and services. To that end, we must continue to offer high-quality solutions and features at competitive prices. As our target markets mature, or as competitors introduce more differentiated products or services at lower costs that compete or are perceived to compete with ours, we may be unable to attract new customers or retain existing ones on favorable terms or at all, which could have an adverse effect on our revenues and future growth. The rate at which our existing customers purchase any new or enhanced feature and solution we may offer also depends on a number of factors, including the importance of these additional features and solutions to our customers, their quality and performance, the prices at which we offer them, and the general economic condition and specific industry landscape in relation to our customers. If our customers react negatively to our new and enhanced features and solutions, or our efforts to cross-sell and up-sell are otherwise not as successful as we anticipate, we may fail to maintain or grow our revenues and our customer base.

Our sales and marketing strategies must also continue to evolve and adapt, including through various online and offline channels and direct and indirect sales efforts. In addition, marketing and selling new and enhanced features and solutions may require increasingly sophisticated and costly marketing campaigns. If we fail to do so cost-effectively, we may be unable to attract new customers or sell additional features and solutions to existing customers in a cost-effective manner.

We must also continue to offer high-quality training, implementation and other customer support services in order to attract new customers and retain existing ones. These services require customer support personnel with industry-specific technical knowledge and expertise which may be difficult and costly to locate and hire. We also need to provide our customer support personnel with extensive training on our solutions and their features, which could make it difficult to scale up our operations rapidly or effectively, especially when we expand our business across different geographical markets or industries. If we fail to provide effective ongoing support and help our customers promptly resolve product issues, our ability to attract new customers and retain existing ones could be negatively affected, which, in turn, could materially and adversely affect our business, results of operations and financial condition.

Our future business growth and expansion is dependent on the continued development of our solutions and the markets our solutions target.

We offer a comprehensive portfolio of cloud-based communications solutions to enterprises of all sizes, from which we generate most of our revenues. The markets we target are rapidly evolving and subject to a number of risks and uncertainties. Our success will depend to a substantial extent on the growth of these markets, especially the widespread adoption of cloud-based communications solutions as a replacement for legacy on-premises systems and other traditional forms of communications.

The growth of these addressable markets also depends on a number of other factors, including the refresh rate for legacy on-premises systems, the cost, performance and perceived value associated with cloud-based communications solutions, as well as their ability to address security, stability, and privacy concerns. In order to grow our business and extend our market position, we intend to educate our existing and prospective customers about the benefits of our solutions and continuously enhance and innovate our solutions and features to increase market acceptance. However, if ever the cloud-based communications technologies fail to develop in a way that satisfies the growing demands of customers, or develop more slowly than we anticipate, it could significantly harm our business. In addition, the cloud-based communications industry may fail to grow significantly or at all, or there could be a reduction in demand as a result of a lack of public acceptance, technological challenges, competing products and services, decreases in IT spending by current and prospective customers, weakening economic conditions and other causes. The occurrence of any of the foregoing could materially and adversely affect our business, results of operations and financial condition.

We have a limited operating history, which could make it difficult to forecast our revenues and evaluate our business and prospects.

We began offering cloud-based communications solutions in 2014. As a result of our limited operating history, however, our ability to forecast our future results of operations is limited and subject to a number of uncertainties. We have encountered, and expect to continue to encounter, risks and uncertainties frequently experienced by growing companies in rapidly evolving industries, such as the risks and uncertainties related to technological development and regulatory environment. We derive a significant portion of our revenues from project-based solutions focusing primarily on large enterprises, and the continued availability of such projects and customers is uncertain, which could materially affect the accuracy of our forecasts and our financial performance. For solutions that we offer on a recurring basis, our short operating history also limits our ability to predict our future pricing capabilities and sales volumes. If we do not successfully address these risks and uncertainties, our results of operations and financial condition could differ materially from our estimates and forecasts, which could materially and adversely impact our business and the trading price of the ADSs.

We have incurred significant net losses and negative operating cash flows since inception, and we may therefore not be able to achieve or sustain profitability in the future.

We have incurred substantial net losses since our inception. In 2020, 2021 and 2022, our net loss was RMB425.2 million, RMB904.5 million and RMB975.9 million (US$141.5 million), respectively, our operating cash outflow was RMB216.5 million, RMB238.1 million and RMB567.3 million (US$82.2 million), respectively. Over the past few years, we have spent considerable amounts of time and financial resources to develop new cloud-based communications solutions and enhance or upgrade our existing ones in order to position us favorably for future growth. In addition, we have expended significant resources upfront to market, promote and sell our solutions through various direct and indirect channels, and expect to continue to do so in the future. Our aggressive investments continue to drive our negative cash flows and we expect to continue to invest in business operations, technological improvements, marketing campaigns and international expansion. Our status as a public company could also incur significant additional accounting, legal and other expenses.

Achieving profitability will require us to increase revenues, manage our cost structure, and avoid significant liabilities. We cannot guarantee, however, that we can achieve any of these goals as we continue to aggressively invest in the aspiration of continued revenue growth. Our failure to generate increased revenues to cover the expected increase in these various expenditures could prevent us from ever achieving profitability or positive cash flows from operating activities.

Our business relies on the communications infrastructure and telecommunications resources provided by China’s major mobile network operators. If we fail to maintain our collaborations with these mobile network operators, our ability to serve our customers could be materially and adversely affected.

We interconnect with mobile network operators in China and other countries to enable the use of our solutions by our customers. Specifically, we obtain telecommunications resources from mobile network operators and offer our CPaaS and other solutions to allow our customers to access and utilize these resources in a way that suits their specific communication needs. We currently collaborate with all three major mobile network operators in China. As all telecommunications resources in China are distributed among and managed by theses mobile network operators and their provincial branches, we expect that we will continue to rely heavily on our collaborations with them to offer our solutions. Any termination of our collaborations with any major mobile network operator in China would negatively impact our business.

Our reliance on mobile network operators has reduced our operating flexibility as well as our ability to control quality and make rectifications. If our customers encounter errors or defective performance, whether or not caused by a mobile network operator or otherwise, we could find it difficult to identify the source of the problems and fail to make timely or effective rectifications, which could have a negative impact on customer satisfaction and lead to a loss of our existing customers or delay the adoption of our solutions by prospective customers.

In addition, the fees charged by mobile network operators may fluctuate more frequently than we could charge our customers to pass on the increased cost, which may adversely affect our margins and business. Mobile network operators have also, at times, instituted additional fees due to regulatory, competitive or other reasons. We have historically responded to such fee increases by negotiating an agreed-upon fee arrangement with mobile network operators, passing on the increased cost to our customers, or accepting lower profit margins. Our ability to respond to any increased fees charged by mobile network operators may be constrained if all mobile network operators in a particular market implement similar fee increases, if the magnitude of the fees is disproportionately large when compared to the underlying prices we charge our customers, or if the market conditions and competitive landscape limit our ability to increase the price we charge our customers. If we are unable to respond to such fee increases in a way that preserves the competitiveness or profitability of our solutions, our business, results of operations and financial condition could be materially and adversely affected.

Furthermore, although we have historically collaborated closely with a number of China’s mobile network operators and their local branches, our contracts with them generally have fixed terms ranging from one to five years, and they may terminate our collaboration upon expiration. In the past, we were generally able to renew our contracts with mobile network operators and their local branches. However, if a significant portion of such mobile network operators and their local branches cease to provide us with access to their telecommunications resources or fail to provide services to us on favorable terms, it could be costly and time-consuming to switch to other qualified mobile network operators in the affected regions on commercially reasonable terms or at all, which could materially and adversely affect our business, results of operations and financial condition.

If we fail to enhance or upgrade our existing solutions and introduce new ones that are broadly accepted by the market and meet our customers’ evolving demands in a timely and cost-effective manner, our business, results of operations and financial condition could be materially and adversely affected.

Our ability to attract new customers and increase revenues from existing customers depends in part on our ability to enhance and improve our existing solutions and introduce new ones. The success of any enhancement or new solution depends on a number of factors, including timely completion, adequate quality testing, consistently high actual performance, market-accepted pricing levels and overall market acceptance. Enhancements and new solutions that we develop may not be introduced in a timely or cost-effective manner, may contain errors or defects, may have interoperability difficulties or may not achieve the broad market acceptance necessary to generate significant revenues. We also have invested, and may continue to invest, in the acquisition of complementary businesses, technologies, services, products and other assets that benefit our innovation and overall business operations. Our investments may not result in enhancements or new solutions that will be accepted by existing or prospective customers. If we are unable to enhance or upgrade our existing solutions to meet the evolving customer requirements or develop new ones in a timely or cost-effective manner, we may not be able to maintain or increase our revenues or recoup our investments, and our business, results of operations and financial condition would be materially and adversely affected.

If we fail to maintain the compatibility of our solutions across devices, business systems and applications and physical infrastructure that we do not control, it could lead to increased integration costs and lowered customer satisfaction.

One of the most important value propositions of our solutions is the compatibility with a wide range of devices, business systems and applications and physical infrastructure. The experience of our customers depends, in part, on our ability to integrate with their existing business systems and applications, many of which may have been developed by third-party providers. In addition, the functionality of our solutions depends on the seamless integration with our customers’ legacy on-premises hardware and communications infrastructure, such as third-party video-conferencing systems. Third-party services and products are constantly evolving, and we may not be able to modify our solutions to assure the compatibility with that of other third parties following development changes. Furthermore, third-party providers or manufacturers may, without prior notice, change the configuration or features of their services and products, restrict our access, or adversely alter the terms and conditions of use. Any of these changes could functionally limit or terminate our ability to use these third-party products and services in conjunction with ours, which could have a material negative impact on our business. If we fail to properly integrate our solutions with our customers’ existing business systems and applications and physical infrastructure, whether developed in-house or by third parties, we may be unable to offer the functionality that is expected by our customers and is essential to our solutions, which would materially and adversely affect our business, results of operations and financial condition.

Our customers are also able to use and manage our solutions on multiple terminals, including PCs and mobile devices such as smartphones and tablets. As new smart devices and operating systems are released, we may encounter difficulties supporting these devices and operating systems, and we may need to devote significant resources to the creation, support, and upgrade of our solutions. If we experience difficulties integrating our solutions into PCs, smartphones, tablets or other devices, our reputation, results of operations and future growth could be materially and adversely affected.

We operate in a highly competitive market. If we fail to compete effectively, our business, results of operations and financial condition could be materially and adversely affected.

The cloud-based communications industry in China is rapidly evolving and highly competitive. With the introduction of new technologies and market entrants, we expect competition to continue to intensify in the future. The principal competitive factors in our market include comprehensiveness of business portfolio, innovation capabilities, brand awareness and reputation, strength of sales and marketing efforts as well as customer reach.

Some of our competitors have greater financial, technological and other resources, greater brand recognitions, larger sales and marketing budgets and larger intellectual property portfolios. As a result, certain of our competitors may be able to respond more quickly and effectively than we can to new or evolving opportunities, technologies, standards or customer requirements. In addition, some competitors may offer products or services that address one or a limited number of functions at lower prices, with greater depth than our solutions or in geographies or industry verticals where we do not operate or are less established. Our current and potential competitors may develop and market new products or services with functionality comparable to ours, which could lead to increased pricing pressures. In addition, some of our competitors have lower prices, which may be attractive to certain customers even if those products or services have different or lesser functionality. Moreover, as we expand the scope of our business, we may face additional competition. If one or more of our competitors were to merge or partner with another of our competitors, the change in the competitive landscape could also adversely affect our ability to compete effectively.

If we are unable to compete effectively or maintain favorable pricing, it could lead to reduced revenues, reduced margins, increased losses or the failure of our solutions to achieve or maintain widespread market acceptance, any of which could materially and adversely affect our business, results of operations and financial condition.

If we fail to collect contract assets and accounts receivable from our customers in a timely manner, our business, results of operations and financial condition may be materially and adversely affected.

Our contract assets represented our right to consideration for work performed but not invoiced. When our right to consideration becomes unconditional, we reclassify the contract assets to accounts receivable. We had contract assets of RMB18.3 million, RMB21.1 million and RMB50.8 million (US$7.4 million) as of December 31, 2020, 2021 and 2022, respectively. We recorded allowance for contract assets of RMB6.7 million, RMB10.6 million and RMB12.3 million (US$1.8 million), respectively, as of December 31, 2020, 2021 and 2022. We typically extend to our customers payments terms ranging from 60 to 180 days after our customers have been billed, resulting in accounts receivable. We had accounts receivable, net, including those due from third parties and related parties, of RMB214.6 million, RMB159.0 million and RMB133.7 million (US$19.4 million) as of December 31, 2020, 2021 and 2022, respectively. We recorded allowance for doubtful accounts in relation to accounts receivable of RMB44.4 million, RMB57.4 million and RMB81.2 million (US$11.8 million), respectively, as of December 31, 2020, 2021 and 2022.