our hub partners; our ability to collect tuition fees; the availability of qualified personnel and the ability to retain such personnel; changes in government regulations applicable to the education industry in Brazil; government interventions in education industry programs, which affect the economic or tax regime, the collection of tuition fees or the regulatory framework applicable to educational institutions; a decline in the number of students enrolled in our programs or the amount of tuition we can charge; our ability to compete and conduct our business in the future; the success of operating initiatives, including advertising and promotional efforts and new product, service and concept development by us and our competitors; changes in consumer demands and preferences and technological advances, and our ability to innovate to respond to such changes; changes in labor, distribution and other operating costs; our compliance with, and changes to, government laws, regulations and tax matters that currently apply to us; general market, political, economic, and business conditions; and our financial targets. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the potential effects of the COVID-19 pandemic on our business operations, financial results and financial position and on the Brazilian economy.

The forward-looking statements can be identified, in certain cases, through the use of words such as “believe,” “may,” “might,” “can,” “could,” “is designed to,” “will,” “aim,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “forecast”, “plan”, “predict”, “potential”, “aspiration,” “should,” “purpose,” “belief,” and similar, or variations of, or the negative of, such words and expressions. Forward-looking statements speak only as of the date they are made, and the Company does not undertake any obligation to update them in light of new information or future developments or to release publicly any revisions to these statements in order to reflect later events or circumstances or to reflect the occurrence of unanticipated events. The achievement or success of the matters covered by such forward-looking statements involves known and unknown risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, our results could differ materially from the results expressed or implied by the forward-looking statements we make. Readers should not rely upon forward-looking statements as predictions of future events. Forward-looking statements represent management’s beliefs and assumptions only as of the date such statements are made. Further information on these and other factors that could affect the Company’s financial results is included in filings made with the U.S. Securities and Exchange Commission (“SEC”) from time to time, including the section titled, “Item 3. Key Information—D. Risk Factors” in the most recent Annual Report on Form 20-F of the Company. These documents are available on the SEC Filings section of the investor relations section of our website at investors.vitru.com.br.

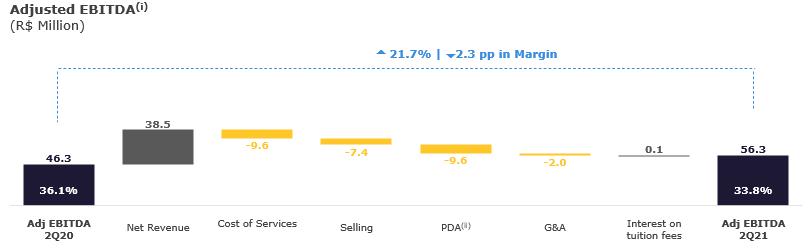

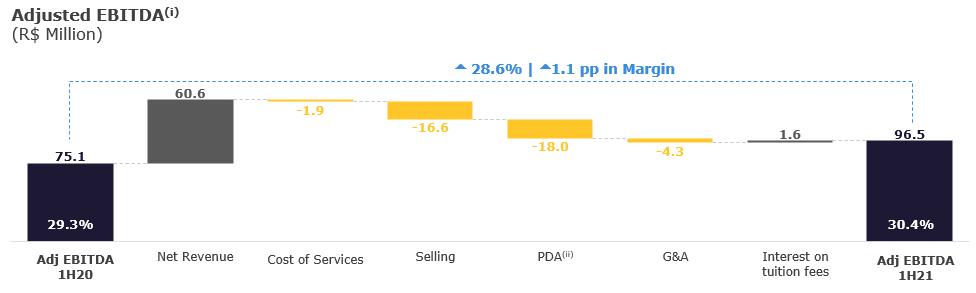

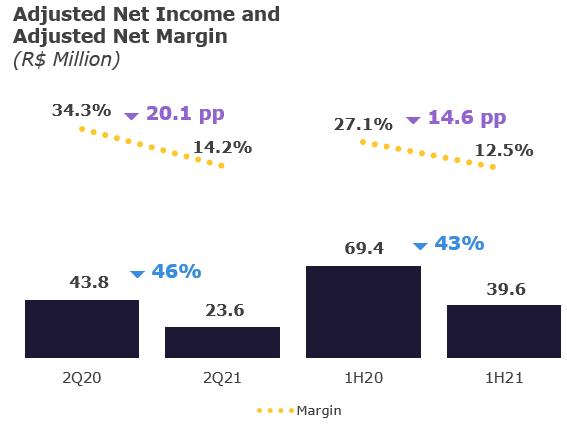

NON-GAAP FINANCIAL MEASURES

To supplement the Company’s consolidated financial statements, which are prepared and presented in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board—IASB, VITRU uses Adjusted EBITDA, Adjusted Net Income and Adjusted Cash Flow Conversion from Operations information for the convenience of the investment community, which are non-GAAP financial measures. A non-GAAP financial measure is generally defined as one that purports to measure financial performance but excludes or includes amounts that would not be so adjusted in the most comparable GAAP measure.

VITRU calculates Adjusted EBITDA as the net income (loss) for the period plus:

| ◾ | deferred and current income tax, which is calculated based on income, adjusted based on certain additions and exclusions provided for in applicable legislation. The income taxes in Brazil consist of corporate income tax (Imposto de Renda Pessoa Jurídica), or IRPJ, CSLL, which are social contribution taxes; |

| ◾ | financial results, which consists of interest expenses less interest income; |

| ◾ | depreciation and amortization; |