- FFIE Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Faraday Future Intelligent Electric (FFIE) PRE 14APreliminary proxy

Filed: 31 Jan 25, 6:48am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________

SCHEDULE 14A

________________

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant | ☒ | |

| Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

| ☒ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

FARADAY FUTURE INTELLIGENT ELECTRIC INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

PRELIMINARY PROXY STATEMENT DATED JANUARY 30, 2025

SUBJECT TO COMPLETION

FARADAY FUTURE INTELLIGENT ELECTRIC INC.

18455 S. Figueroa Street

Gardena, California 90248

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON MARCH 7, 2025

Dear Stockholder:

You are cordially invited to attend a Special Meeting of Stockholders (including any adjournment, postponement or rescheduling thereof, the “Special Meeting”) of Faraday Future Intelligent Electric Inc., a Delaware corporation (“FF” or the “Company”), which will be held on March 7, 2025 at 9:00 a.m. Pacific Time. The Special Meeting will be held in a virtual meeting format only, via live audio webcast. Stockholders will not be able to attend the Special Meeting in person. To attend the Special Meeting, please visit www.virtualshareholdermeeting.com/FFIE2025SM. The live audio webcast will begin promptly at 9:00 a.m. Pacific Time, with online access beginning at 8:45 a.m. Pacific Time. If you plan to attend the Special Meeting, please refer to the attendance and registration information in the accompanying proxy statement (the “Proxy Statement”).

The Special Meeting will be held for the purpose of voting upon the following proposals (each of which is a “Proposal” and, together, the “Proposals”):

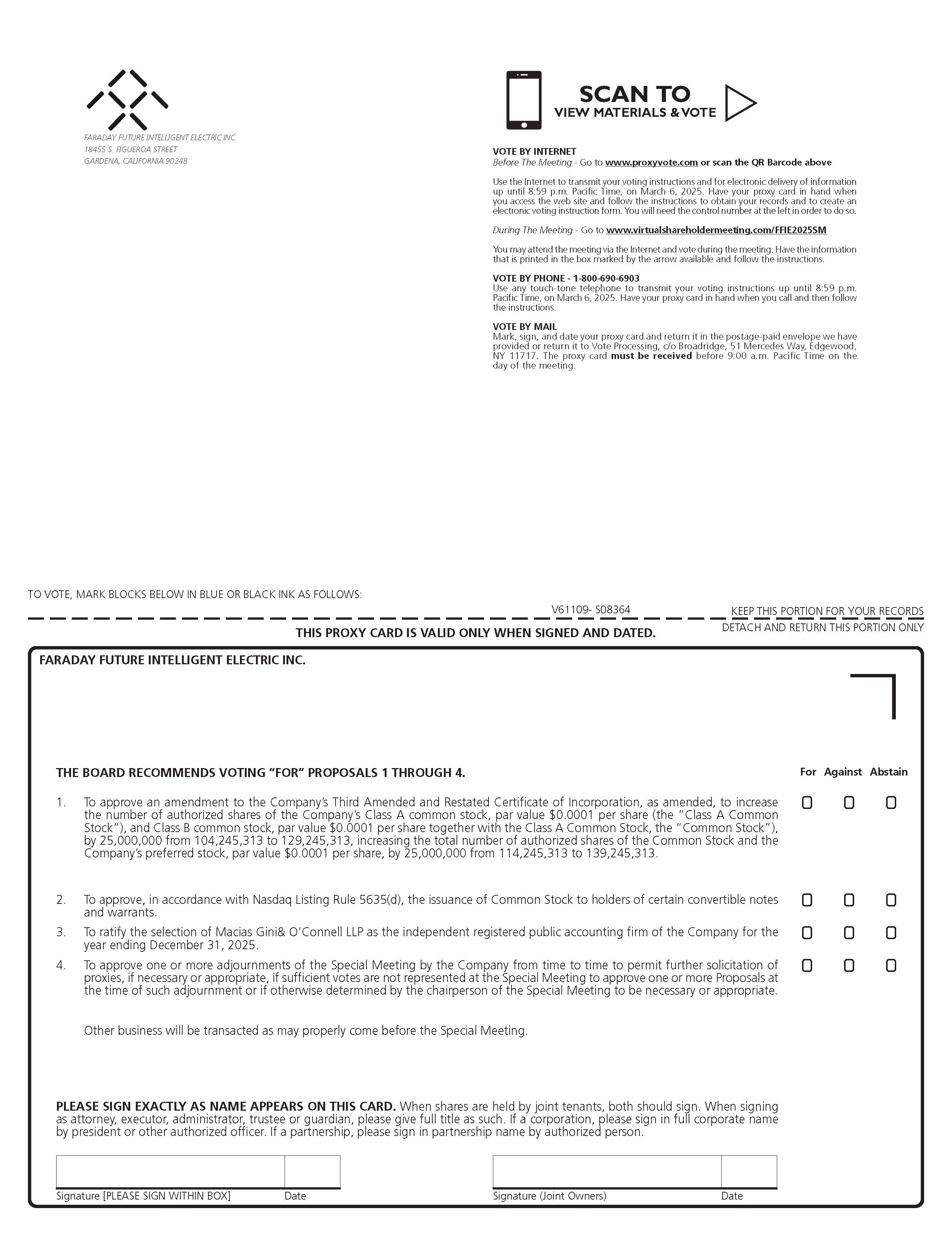

| 1. | To approve an amendment to the Company’s Third Amended and Restated Certificate of Incorporation, as amended (the “Charter”), to increase the number of authorized shares of the Company’s Class A common stock, par value $0.0001 per share (the “Class A Common Stock”), and Class B common stock, par value $0.0001 per share (the “Class B Common Stock,” and, together with the Class A Common Stock, the “Common Stock”), by 25,000,000, from 104,245,313 to 129,245,313, increasing the total number of authorized shares of the Common Stock and the Company’s preferred stock, par value $0.0001 per share, by 25,000,000, from 114,245,313 to 139,245,313 (the “Share Authorization Proposal”). |

| 2. | To approve, in accordance with Nasdaq Listing Rule 5635(d), the issuance of Common Stock to holders of certain convertible notes and warrants (the “Private Placements Proposal”). |

| 3. | To ratify the selection of Macias Gini & O’Connell LLP as the independent registered public accounting firm of the Company for the year ending December 31, 2025. |

| 4. | To approve one or more adjournments of the Special Meeting by the Company from time to time to permit further solicitation of proxies, if necessary or appropriate, if sufficient votes are not represented at the Special Meeting to approve one or more Proposals at the time of such adjournment or if otherwise determined by the chairperson of the Special Meeting to be necessary or appropriate (the “Adjournment Proposal”). |

Other business will be transacted as may properly come before the Special Meeting.

Each Proposal is more fully described in the Proxy Statement accompanying this notice. THE BOARD RECOMMENDS VOTING “FOR” EACH OF PROPOSALS 1 THROUGH 4.

This Notice of Special Meeting, the accompanying Proxy Statement and the form of proxy are first being mailed on or about February 10, 2025 to stockholders of record as of January 28, 2025 (the “Record Date”). Only stockholders of record at the close of business on the Record Date may vote at the Special Meeting.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING. WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND SUBMIT YOUR PROXY OR VOTE INSTRUCTIONS AS SOON AS POSSIBLE SO THAT YOUR SHARES MAY BE VOTED IN ACCORDANCE WITH YOUR WISHES AND SO THAT THE PRESENCE OF A QUORUM MAY BE ASSURED.

You may cast your vote over the Internet, by telephone or by completing and mailing the enclosed proxy card by following the instructions on the proxy card. Signing and returning the proxy card or submitting your proxy by Internet or telephone in advance of the Special Meeting will not prevent you from voting at the Special Meeting if you attend virtually, but will assure that your vote is counted if you are unable to attend the Special Meeting. Proxies forwarded by or for banks, brokers or other nominees should be returned as requested by them. We encourage you to vote promptly to ensure your vote is represented at the Special Meeting, regardless of whether you plan to attend the Special Meeting.

If you have any questions or need assistance voting, please contact our proxy solicitor:

Georgeson LLC

51 West 52nd Street, 6th Floor

New York, NY 10019

Phone: 1-866-295-8105 (toll-free within the United States) or 1-781-575-2137 (outside of the United States)

Email: Faraday@georgeson.com

This 30th day of January, 2025.

| By Order of the Board of Directors | |

| /s/ Matthias Aydt | |

| Matthias Aydt | |

| Global Chief Executive Officer | |

| Gardena, California |

FARADAY FUTURE INTELLIGENT ELECTRIC INC.

Proxy Statement

TABLE OF CONTENTS

i

FARADAY FUTURE INTELLIGENT ELECTRIC INC.

18455 S. Figueroa Street

Gardena, California 90248

SPECIAL MEETING OF STOCKHOLDERS TO BE HELD ON MARCH 7, 2025

PROXY STATEMENT

This proxy statement (this “Proxy Statement”) and the accompanying proxy card are being furnished to stockholders of Faraday Future Intelligent Electric Inc., a Delaware corporation (“FF,” the “Company,” “our,” “us,” or “we”), in connection with the solicitation of proxies by our board of directors (the “Board”) for use at a Special Meeting of Stockholders to be held March 7 , 2025 (including any adjournment, postponement or rescheduling thereof, the “Special Meeting”). The Special Meeting will be held at 9:00 a.m. Pacific Time. The Special Meeting will be held in a virtual meeting format only, via live audio webcast. Stockholders will not be able to attend the Special Meeting in person. To attend the Special Meeting, please visit www.virtualshareholdermeeting.com/FFIE2025SM. The live audio webcast will begin promptly at 9:00 a.m. Pacific Time, with online access beginning at 8:45 a.m. Pacific Time. You will be able to vote and submit questions online through the virtual meeting platform during the Special Meeting.

Only stockholders of record as of the close of business on January 28, 2025, the record date for determination of the stockholders entitled to vote at the Special Meeting (the “Record Date”), will be entitled to vote at the Special Meeting.

INFORMATION ABOUT THE SPECIAL MEETING

THE INFORMATION PROVIDED IN THE “QUESTIONS AND ANSWERS” FORMAT BELOW IS FOR YOUR CONVENIENCE AND INCLUDES ONLY A SUMMARY OF CERTAIN INFORMATION CONTAINED IN THIS PROXY STATEMENT. YOU SHOULD READ THIS ENTIRE PROXY STATEMENT CAREFULLY.

Why am I receiving these materials?

You are receiving this Proxy Statement and the enclosed proxy card because the Board is soliciting your vote at the Special Meeting. This Proxy Statement summarizes material information with respect to the Special Meeting and the proposals being voted upon thereat. You may cast your vote over the Internet, by telephone or by completing and mailing the enclosed proxy card by following the instructions on the proxy card. You do not need to attend the Special Meeting to vote your shares.

1

What proposals will be voted on at the Special Meeting? What are the Board’s voting recommendations?

| Proposals | Board’s Recommendation | More Information | ||||

| Proposal 1 | Approval of an amendment to the Charter, to increase the number of authorized shares of the Company’s Common Stock by 25,000,000, from 104,245,313 to 129,245,313, increasing the total number of authorized shares of the Common Stock and the Company’s preferred stock, par value $0.0001 per share (the “Preferred Stock”), by 25,000,000, from 114,245,313 to 139,245,313 (the “Share Authorization Proposal”) | FOR | Page 11 | |||

| Proposal 2 | Approval of the issuance of Common Stock to holders of certain convertible notes and warrants, in accordance with Nasdaq Listing Rule 5635(d) (the “Private Placements Proposal”) | FOR | Page 12 | |||

| Proposal 3 | Ratification of appointment of Macias Gini & O’Connell LLP (“MGO”) as the Company’s independent registered public accounting firm for the year ending December 31, 2025 (the “Auditor Ratification Proposal”) | FOR | Page 19 | |||

| Proposal 4 | Approval of one or more adjournments of the Special Meeting by the Company from time to time to permit further solicitation of proxies, if necessary or appropriate, if sufficient votes are not represented at the Special Meeting to approve one or more Proposals at the time of such adjournment or if otherwise determined by the chairperson of the Special Meeting to be necessary or appropriate (the “Adjournment Proposal”) | FOR | Page 21 |

WE ENCOURAGE YOU TO RETURN YOUR PROXIES OR VOTING INSTRUCTIONS FOR THE SPECIAL MEETING TO ENSURE THAT YOUR VOTES ARE COUNTED ON EACH MATTER THAT IS BROUGHT TO A VOTE OF THE COMPANY’S STOCKHOLDERS.

What happens if other business not discussed in this Proxy Statement comes before the Special Meeting?

The Board knows of no other matters to be brought before the Special Meeting. If any other business should properly come before the Special Meeting, the persons named in the proxy will vote on such matters according to their best judgment.

When and where will the Special Meeting be held?

The Special Meeting will be held on March 7, 2025 at 9:00 a.m. Pacific Time at www.virtualshareholdermeeting.com/FFIE2025SM.

How can I attend the Special Meeting?

Stockholders as of the Record Date (or their authorized representatives) may attend, vote and submit questions virtually at the Special Meeting by logging in at www.virtualshareholdermeeting.com/FFIE2025SM. To log in, stockholders (or their authorized representatives) will need the control number provided on their proxy card or voting instruction form. If you are not a stockholder or do not have a control number, you may still access the Special Meeting as a guest, but you will not be able to submit questions or vote at the Special Meeting.

The Special Meeting will begin promptly at 9:00 a.m. Pacific Time, on March 7, 2025. We encourage you to access the Special Meeting prior to the start time. Online access will open at 8:45 a.m. Pacific Time, and you should allow ample time to log in to the meeting webcast and test your computer audio system. We recommend that you carefully review the procedures needed to gain admission in advance.

2

What if I have technical difficulties or trouble accessing the virtual Special Meeting?

We will have technicians ready to assist you with any technical difficulties you may have accessing the virtual Special Meeting. If you encounter any difficulties accessing the virtual meeting during check-in or during the meeting, please call the technical support number that will be posted on the virtual stockholder meeting login page at www.virtualshareholdermeeting.com/FFIE2025SM.

What is the quorum requirement?

A quorum of stockholders is necessary to hold the Special Meeting and vote upon the proposals and consider such other business as may properly come before the Special Meeting. One-third of the voting power of the outstanding shares of Common Stock, and Series A Preferred Stock issued and outstanding on the Record Date and entitled to vote at any meeting of stockholders shall constitute a quorum for the transaction of business at the Special Meeting. On the Record Date, there were 72,943,568 shares of Common Stock outstanding and entitled to vote and one share of Series A Preferred Stock outstanding and entitled to vote on the Share Authorization Proposal (subject to the requirements set forth in the Certificate of Designation for the Series A Preferred Stock being satisfied). Thus, in addition to the presence of the Series A Preferred Stock at the meeting, the holders of 24,314,523 shares must be present by virtual attendance or represented by proxy at the Special Meeting to have a quorum.

In addition, unless at least one-third of the shares of Common Stock outstanding on the Record Date are present by virtual attendance at the Special Meeting or represented by proxy, the holder of Series A Preferred Stock will not cast any votes on the Share Authorization Proposal.

Your shares will be counted towards the quorum only if you submit a valid proxy (or one is submitted on your behalf by your broker, bank or other nominee) or if you vote online at the Special Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement.

If there is no quorum, the Special Meeting may be adjourned to another date by the holders of a majority of shares present by virtual attendance at the meeting or represented by proxy or by the chairperson of the meeting without any action by the stockholders to permit further solicitation of proxies.

Who is entitled to vote?

The Record Date for the Special Meeting is the close of business on January 28, 2025. As of the Record Date, 72,943,568 shares were outstanding, consisting of 72,936,901 shares of Class A Common Stock, 6,667 shares of Class B Common Stock and one share of Series A Preferred Stock. Only holders of record of Common Stock as of the Record Date will be entitled to notice of, and to vote at, the Special Meeting. Each stockholder is entitled to one vote for each share of Class A Common Stock and/or Class B Common Stock and 3,000,000,000 votes for each share of Series A Preferred Stock held by such stockholder on the Record Date.

The share of Series A Preferred Stock may only vote on the Share Authorization Proposal as described below.

On January 28, 2025, the holder of all of the issued and outstanding shares of Class B Common Stock, pursuant to and in accordance with Article VI, Section 6.1 of the Charter and Section 229 of the Delaware General Corporation Law, approved on behalf of the Class B Common Stock (among other things) the issuance of the share of Series A Preferred Stock and terms of the Series A Preferred Stock.

How many votes do I have?

For each proposal on the agenda for the Special Meeting, you have one vote for each share of Common Stock you owned as of the Record Date. The holder of the one outstanding share of our Series A Preferred Stock has 3,000,000,000 votes but has the right to vote only on the Share Authorization Proposal and the Series A Preferred Stock votes must be voted in the same proportion as the votes cast by shares of Common Stock on such Proposal. For example, if 60% of the votes cast by holders of common stock for the Share Authorization Proposal vote “For” the proposal and 40% vote “Against” the proposal, the holder of the share of Series A Preferred Stock will cast 1,800,000,000 votes “For” the Share Authorization Proposal and 1,200,000,000 votes “Against” the Share Authorization Proposal. The Series A Preferred Stock will vote on the Share Authorization Proposal as a single class with the Common Stock. The share of Series A Preferred Stock will be automatically redeemed by us effective upon the approval of the Share Authorization Proposal (or at an earlier time as the Board may determine in its sole discretion).

3

How do I vote?

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote electronically during the Special Meeting, vote by proxy using the enclosed proxy card, vote by proxy over the telephone, or vote by proxy over the Internet by following the instructions on the enclosed proxy card. We urge you to vote by proxy, regardless of whether you plan to attend the Special Meeting, to ensure your vote is counted. You may still attend the Special Meeting and vote electronically during the meeting even if you have already voted by proxy.

| ● | To vote your shares electronically during the Special Meeting, follow the instructions above for participating in the Special Meeting. Join the Special Meeting as a “Stockholder” with your control number, and click on the “Cast Your Vote” link on the meeting center website. |

| ● | To vote using the proxy card, simply complete, sign and date the enclosed proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us before the Special Meeting, your shares will be voted as you direct. |

| ● | To vote over the telephone, dial toll-free 1-800-690-6903 using a touch-tone phone and follow the recorded instructions. You will be asked to provide the control number from the enclosed proxy card. Your vote must be received by 8:59 p.m. Pacific Time, on March 7, 2025 to be counted. |

| ● | To vote over the Internet, go to www.proxyvote.com and follow the steps outlined to complete an electronic proxy card. You will be asked to provide the Company number and control number from the enclosed proxy card. Your vote must be received by 8:59 p.m. Pacific Time, on March 7, 2025 to be counted. |

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a proxy card and voting instructions with these proxy materials from that organization. Simply complete and mail the proxy card to ensure that your vote is counted. Alternatively, you may vote by telephone or over the Internet as instructed by your broker or bank. To vote your shares electronically during the Special Meeting, you must obtain a valid legal proxy from your broker, bank or other agent and register in advance by following the instructions above, join the Special Meeting as a “Stockholder” with your control number, and click on the “Cast Your Vote” link on the meeting center website. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How do I change my vote or revoke my proxy?

You may change your vote or revoke your proxy at any time before it is voted at the Special Meeting. If you are a stockholder of record, you may change your vote or revoke your proxy by:

| ● | delivering, to the attention of the Corporate Secretary at the address on the first page of this Proxy Statement, a written notice of revocation of your proxy; |

| ● | delivering to us an authorized proxy bearing a later date (including a proxy over the Internet or by telephone); or |

| ● | attending the Special Meeting and voting electronically, as indicated above under “How do I vote?” Attendance at the Special Meeting will not, by itself, revoke a proxy. |

If your shares are held in the name of a bank, broker or other nominee, you may change your vote by submitting new voting instructions to your bank, broker or other nominee. Please note that if your shares are held of record by a bank, broker or other nominee, and you decide to attend and vote at the Special Meeting, your vote at the Special Meeting will not be effective unless you present a legal proxy, issued in your name from the record holder (your bank, broker or other nominee).

4

If I vote in advance, can I still attend the Special Meeting?

Yes. You are encouraged to vote promptly by returning your signed proxy card by mail or, if applicable, by appointing a proxy to vote electronically via the Internet or by telephone so that your shares will be represented at the Special Meeting. However, returning your proxy card does not affect your right to attend the Special Meeting.

How many votes are required for the approval of each of the Proposals, and how will abstentions and broker non-votes be treated?

Vote Required

Proposal 1. The affirmative vote of the holders of a majority of the voting power of the outstanding shares of Common Stock and Series A Preferred Stock, voting together as a single class, is required for the approval of Proposal 1, the Share Authorization Proposal.

Proposal 2. The affirmative vote of the holders of a majority of the voting power of the shares present by virtual attendance or represented by proxy at the Special Meeting and entitled to vote is required for the approval of Proposal 2, the Private Placements Proposal. The Series A Preferred Stock is not entitled to vote on this proposal.

Proposal 3. The affirmative vote of the holders of a majority of the voting power of the shares present by virtual attendance or represented by proxy at the Special Meeting and entitled to vote is required for the approval of Proposal 3, the Auditor Ratification Proposal. The Series A Preferred Stock is not entitled to vote on this proposal.

Proposal 4. The affirmative vote of the holders of a majority of the voting power of the shares present by virtual attendance or represented by proxy at the Special Meeting and entitled to vote is required for the approval of Proposal 4, the Adjournment Proposal. The Series A Preferred Stock is not entitled to vote on this proposal.

Abstentions

A stockholder may abstain from voting with respect to each item submitted for stockholder approval. Abstentions will be counted as present for purposes of determining the existence of a quorum. Abstentions will have the same effect as a vote against.

Broker Non-Votes

If you are a beneficial owner of shares held in street name and you do not instruct your broker how to vote your shares, the question of whether your broker will still be able to vote your shares depends on whether the New York Stock Exchange (the “NYSE”) deems the particular proposal to be a “routine” matter. Although our shares are listed with the Nasdaq Stock Market, LLC (“Nasdaq”), the NYSE regulates broker-dealers and their discretion to vote on stockholder proposals. Under the NYSE rules applicable to brokers and other similar organizations that are subject to NYSE rules, such organizations may use their discretion to vote your “uninstructed shares” with respect to matters considered to be “routine” under NYSE rules, but not with respect to “non-routine” matters. Under such rules and interpretations, non-routine matters are matters that may substantially affect the rights or privileges of stockholders, such as mergers, stockholder proposals, elections of directors (even if not contested), executive compensation (including any advisory stockholder votes on executive compensation and on the frequency of stockholder votes on executive compensation), and certain corporate governance proposals, even if management-supported. In this regard, the Share Authorization Proposal, and the Private Placements Proposal should be considered to be “non-routine” under NYSE rules and, accordingly, we believe that your broker may NOT vote your shares on such proposals without your instructions. The Auditor Ratification Proposal and the Adjournment Proposal should be considered to be “routine” under NYSE rules and, accordingly, we believe that your broker may vote your shares on such Proposals without instructions from you. Nevertheless, whether a proposal is “routine” or “non-routine” remains subject to the final determination of the NYSE. If your shares are held by a bank, we believe your shares cannot be voted without your specific instructions. Accordingly, if you hold your shares in street name and do not provide voting instructions to your broker that holds your shares, we believe your broker should not have discretionary authority under NYSE rules to vote your shares on the Share Authorization Proposal absent additional instructions from you. Given such discretionary authority, we do not anticipate broker non-votes for this Proposal.

5

Broker non-votes will be counted as present for purposes of determining the existence of a quorum. For the Share Authorization Proposal and Private Placements Proposal, broker non-votes will have no effect on the outcome of such Proposals. Although abstentions, if any, will technically have the same effect as “Against” votes with respect to the Share Authorization Proposal, because the share of Series A Preferred Stock has 3,000,000,000 votes and will vote in a manner that mirrors votes actually cast (which does not include abstentions), abstention, if any, will have virtually no effect on the outcome of the Share Authorization Proposal. Therefore, if you do not wish for the Share Authorization Proposal to pass, you should vote “Against” each such Proposal.

What are the consequences if the Share Authorization Proposal is not approved?

If the Share Authorization Proposal is not approved at the Special Meeting, the Charter will not be amended to increase the number of authorized shares of Common Stock, by 25,000,000, from 104,245,313 to 129,245,313, increasing the total number of authorized shares of the Common Stock and Preferred Stock, by 25,000,000, from 114,245,313 to 139,245,313. The failure to obtain approval of the Share Authorization Proposal may hinder the Company from meeting its existing obligations to issue shares of Common Stock as and if they become due, from obtaining future financing and from meeting the goals of its compensation strategy.

How will my shares be voted if I return a blank proxy card or voting instruction form?

If your shares are registered in your name, you must sign and return a proxy card in order for your shares to be voted, unless you vote via the Internet or by telephone, or vote at the Special Meeting. If you provide specific voting instructions, your shares will be voted as you have instructed. If you execute the proxy card and do not provide voting instructions on any given matter, your shares will be voted in accordance with our Board’s recommendations on that matter. We urge you to sign, date and return the enclosed proxy card in the postage-paid envelope provided, or vote via the Internet or by telephone as instructed on the proxy card, whether or not you plan to vote at the Special Meeting.

If your shares are held in “street name” (that is, held for your account by a broker, bank or other nominee), you will receive a voting instruction form from your broker, bank or other nominee. You must follow these instructions in order for your shares to be voted. Your broker is required to vote those shares in accordance with your instructions. If you do not instruct your broker, bank or other nominee how to vote your shares, then your shares:

| ● | will be counted as present for purposes of establishing a quorum; |

| ● | may be voted by your broker, bank or other nominee in their discretion with regards to Proposal 3 (Auditor Ratification Proposal) and Proposal 4 (Adjournment Proposal); and |

| ● | may not be voted by your broker, bank or other nominee with regards to Proposal 1 (Share Authorization Proposal) and Proposal 2 (Private Placements Proposal). For these proposals, your shares will be treated as “broker non-votes.” |

If your broker, bank or other nominee executes the proxy card and does not provide voting instructions on any given matter, your shares will be voted in accordance with our Board’s recommendations on that matter. We urge you to instruct your broker, bank or other nominee to vote your shares in accordance with our Board’s recommendations on the voting instruction form, whether or not you plan to vote at the Special Meeting.

Our Board knows of no matter to be presented at the Special Meeting other than Proposals 1 through 4. If any other matters properly come before the Special Meeting upon which a vote properly may be taken, shares represented by all proxies received by us will be voted with respect thereto as permitted and in accordance with the judgment of the proxy holders.

What is the deadline for submitting a proxy?

To ensure that proxies are received in time to be counted prior to the Special Meeting, proxies submitted by Internet or by telephone should be received by 8:59 p.m. Pacific Time on the day prior to the date of the Special Meeting, and proxies submitted by mail should be received by the close of business on the day prior to the date of the Special Meeting.

6

What does it mean if I receive more than one proxy card from the Company?

If you hold your shares in more than one account, you will receive a proxy card for each account. To ensure that all of your shares are voted, please complete, sign, date and return a proxy card for each account or use the proxy card for each account to vote by Internet or by telephone. To ensure that all of your shares are represented at the Special Meeting, we recommend that you vote every proxy card that you receive.

Can I ask questions at the virtual Special Meeting?

Stockholders as of the Record Date who attend and participate in our virtual Special Meeting will have an opportunity to submit questions live via the Internet during a designated portion of the Special Meeting. To ensure the orderly conduct of the Special Meeting, we encourage you to submit questions in advance of the Special Meeting until 8:59 p.m. Pacific Time the day before the Special Meeting by going to www.virtualshareholdermeeting.com/FFIE2025SM and logging in with your control number.

During the Special Meeting, we will spend up to 15 minutes answering stockholder questions that comply with the meeting rules of conduct. The rules of conduct, including the topics and types of questions that will be accepted, will be posted on the Special Meeting website during the Special Meeting. If we receive substantially similar questions, we will group such questions together and provide a single response to avoid repetition. Stockholders must have available their control number provided on their proxy card to ask questions during the Special Meeting.

Only questions pertinent to meeting matters will be answered during the meeting, subject to time constraints, and in accordance with our rules of conduct for the Special Meeting, which will be posted on the meeting center website.

How do I ask questions during the Special Meeting?

If you are a stockholder of record, or a beneficial owner who registered in advance by following the instructions above, you can join the Special Meeting as a “Stockholder” with your control number and may submit questions during the Special Meeting at www.virtualshareholdermeeting.com/FFIE2025SM. We also encourage you to submit questions in advance of the meeting until 8:59 p.m. Pacific Time the day before the Special Meeting by going to www.virtualshareholdermeeting.com/FFIE2025SM and logging in with your control number.

Who is paying for this proxy solicitation?

The Company will bear the expenses of calling and holding the Special Meeting and the solicitation of proxies with respect to the Special Meeting. These costs will include, among other items, the expense of preparing, assembling, printing, and mailing the proxy materials to stockholders of record and street name stockholders, and reimbursements paid to brokers, banks, and other nominees for their reasonable out-of-pocket expenses for forwarding proxy materials to stockholders and obtaining voting instructions from street name stockholders. In addition to soliciting proxies by mail, our directors, officers, and certain employees, investors and their representatives may solicit proxies on behalf of our Board, without additional compensation, personally or by telephone.

Certain representatives of FF Global Partners Investment LLC, formerly FF Top Holding LLC (“FF Top”), and its indirect parent entity FF Global Partners, LLC (“FF Global”), including, without limitation, Weiwei Zhao (collectively, the “FF Top Representatives”), are additional participants in the solicitation of proxies in connection with the Special Meeting. Information regarding the direct and indirect interests in the Company, by security holdings or otherwise, of FF Global, FF Top and the FF Top Representatives is included in the Company’s Definitive Proxy Statement on Schedule 14A, filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 31, 2024, and the Annual Report on Forms 10-K for the year ended December 31, 2023, filed with the SEC on May 28, 2024, as amended by the Form 10-K/A filed with the SEC on May 30, 2024 and June 24, 2024. Changes to the direct or indirect ownership of FF Top and FF Global are set forth in SEC filings on Schedule 13D/A.

The Company has retained Georgeson LLC (“Georgeson”) to solicit proxies. Under our agreement with Georgeson, they will receive a fee of up to approximately $100,000 plus the reimbursement of reasonable expenses. The Company also agreed to indemnify Georgeson against certain liabilities relating to, or arising out of, its retention. Georgeson will solicit proxies by mail, telephone, facsimile and email.

7

Will a stockholder list be available for inspection?

A list of stockholders entitled to vote at the Special Meeting will be available for inspection by stockholders for any purpose germane to the Special Meeting for 10 business days prior to the Special Meeting at Faraday Future Intelligent Electric Inc., 18455 S. Figueroa Street, Gardena, California 90248, between the hours of 9:00 a.m. and 5:00 p.m. Pacific Time. The stockholder list will also be available to stockholders of record for examination during the Special Meeting at www.virtualshareholdermeeting.com/FFIE2025SM. You will need the control number included on your proxy card or otherwise provided by your bank, broker or other nominee.

What is “householding” and how does it affect me?

We have adopted a procedure approved by the SEC, called “householding.” Under this procedure, we send only one Proxy Statement to eligible stockholders who share a single address, unless we have received instructions to the contrary from any stockholder at that address. This practice is designed to eliminate duplicate mailings, conserve natural resources, and reduce our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards.

If you share an address with another stockholder and receive only one set of proxy materials but would like to request a separate copy of these materials, please contact our mailing agent, Broadridge Financial Solutions, either by calling (866) 540-7095, or by writing to Broadridge Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and an additional copy of proxy materials will be promptly delivered to you. Similarly, if you receive multiple copies of the proxy materials and would prefer to receive a single copy in the future, you may also contact Broadridge at the above telephone number or address. If you own shares through a bank, broker, or other nominee, you should contact the nominee concerning householding procedures.

How can I find out the results of the voting at the Special Meeting?

Preliminary voting results will be announced during the Special Meeting. We will report the final voting results of the Special Meeting in a Current Report on Form 8-K filed with the SEC within four business days following the Special Meeting, a copy of which will also be available on our website at https://investors.ff.com.

Whom can I contact for further information?

If you have any questions, please contact our proxy solicitor:

Georgeson LLC

51 West 52nd Street, 6th Floor

New York, NY 10019

Phone: 1-866-295-8105 (toll-free within the United States) or 1-781-575-2137 (outside of the United States)

Email: Faraday@georgeson.com

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table and accompanying footnotes set forth information with respect to the beneficial ownership of Common Stock, as of January 28, 2025, for (1) each person known by us to be the beneficial owner of more than 5% of the outstanding shares of Common Stock, (2) each member of the Board, (3) each of our named executive officers (as disclosed below) and (4) all of the members of the Board and our executive officers, as a group. As of January 28, 2025, there were outstanding 72,936,901 shares of Class A Common Stock, 6,667 shares of Class B Common Stock, one Series A Preferred Stock, and 33,114,928 outstanding warrants to purchase shares of Class A Common Stock.

The beneficial ownership percentages set forth in the table below are based on 72,943,568 shares of Class A Common Stock issued and outstanding as of January 28, 2025, (including for this purpose, 6,667 shares of Class A Common Stock issuable upon conversion of 6,667 shares of Class B Common Stock held by FF Top, all as issued and outstanding shares as of January 28, 2025) and do not take into account the issuance of any shares of Class A Common Stock upon the exercise of warrants to purchase up to 33,114,928 shares of Class A Common Stock that remain outstanding, the exercise of any of the 2,765 outstanding options and vesting of unvested 9,537 RSUs (both within 60 days of January 28, 2025), or the conversion of any of the outstanding convertible notes. In computing the number of shares of Common Stock beneficially owned by a person, we deemed to be outstanding all shares of Common Stock subject to warrants and stock options held by the person that are currently exercisable or may be exercised within 60 days of January 28, 2025. We did not deem such shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

Beneficial ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. A person is a “beneficial owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the voting of the security, or “investment power,” which includes the power to dispose of or to direct the disposition of the security or has the right to acquire such powers within 60 days.

Unless otherwise noted in the footnotes to the following table, and subject to applicable community property laws, the persons and entities named in the table have sole voting and investment power with respect to their beneficially owned Common Stock. Unless otherwise indicated, the business address of each person listed in the table below is c/o Faraday Future Intelligent Electric Inc., 18455 S. Figueroa Street, Gardena, California 90248.

9

| Title of Class | Name and Address of Beneficial Owner | Number of Shares of Common Stock Beneficially Owned | Percentage of Class | |||||||

| Holder of Over 5%: | ||||||||||

| Class A Common Stock | None | |||||||||

| Director and Named Executive Officers | ||||||||||

| Class A Common Stock | Matthias Aydt(1) | 47,659 | * | |||||||

| Class A Common Stock | Chad Chen | 7,943 | * | |||||||

| Class A Common Stock | Xuefeng Chen(2) | 4 | * | |||||||

| Class A Common Stock | Scott Graziano | 0 | * | |||||||

| Class A Common Stock | Yun Han(3) | 0 | * | |||||||

| Class A Common Stock | Li Han(4) | 22,926 | * | |||||||

| Class A Common Stock | Chui Tin Mok (5) | 18,481 | * | |||||||

| Class A Common Stock | Jia Sheng | 22,937 | * | |||||||

| Class A Common Stock | Lev Peker | 22,811 | * | |||||||

| Class A Common Stock | Jonathan Maroko(6) | 8,247 | * | |||||||

| Class A Common Stock | Koti Meka(7) | 5,849 | * | |||||||

| Class A Common Stock | Yueting Jia(8) | 268,538 | * | |||||||

| All executive officers and directors as a group (12 individuals) | 425,395 | * | ||||||||

| * | Less than 1% |

| (1) | Includes options to acquire 69 shares of Class A Common Stock that have vested or will vest within 60 days of January 22, 2025. To the Company’s knowledge, Mr. Aydt has not sold any shares since the Company became a public company. |

| (2) | Based solely on the Form 4 filed on November 30, 2023 by Mr. Xuefeng Chen. Mr. Xuefeng Chen served as the Company’s Global CEO and as a member of the Board until his resignation effective on September 29, 2023. |

| (3) | Based solely on the Form 4s filed on March 31, 2023 by Ms. Han. Ms. Han served as the Company’s Interim Chief Financial Officer until July 5, 2023 and as the Company’s Chief Accounting Officer until February 2, 2024. |

| (4) | Based solely on the Form 4 filed on May 28, 2024 by Li Han. |

| (5) | Includes options to acquire 117 shares of Class A Common Stock that have vested or will vest within 60 days of January 22, 2025. To the Company’s knowledge, Mr. Mok has not sold any shares since the Company became a public company. |

| (6) | Based solely on the Form 4 filed on July 17, 2024 by Mr. Jonathan Maroko. Mr. Jonathan Maroko was appointed Interim Chief Financial Officer of the Company effective as of July 24, 2023, and resigned from the position on September 15, 2024. |

| (7) | Includes options to acquire 10 shares of Class A Common that have vested or will vest within 60 days January 22, 2025. To the Company’s knowledge, Mr. Meka has not sold any shares since the Company became a public company. Mr. Koti Meka was appointed Chief Financial Officer of the Company on September 17, 2024. |

| (8) | Includes options to acquire 75 shares of Class A Common Stock that have vested or will vest within 60 days of January 22, 2025. To the Company’s knowledge, Mr. Jia has not sold any shares since the Company became a public company. |

10

PROPOSAL 1: APPROVAL OF THE SHARE AUTHORIZATION PROPOSAL

The Board recommends that the stockholders adopt an amendment to the Charter to increase the number of authorized shares (the “Authorized Shares Increase”) of Common Stock, by 25,000,000, from 104,245,313 to 129,245,313 shares, increasing the number of authorized shares of Common Stock and Preferred Stock, by 25,000,000, from 114,245,313 to 139,245,313 shares. Pursuant to the Charter, the Company currently has 10,000,000 shares of its Preferred Stock and 104,245,313 shares of Common Stock authorized, including (i) 99,815,625 shares of Class A Common Stock and (ii) 4,429,688 shares of Class B Common Stock. As of January 28, 2025, there were 72,936,901 shares of Class A Common Stock, 6,667 shares of Class B Common Stock and one Series A Preferred Stock issued and outstanding.

The Board believes it is desirable for the Company to have a sufficient number of shares of Class A Common Stock available for the satisfaction of its existing obligations to issue shares of Class A Common Stock as and if they become due, for conversion of the promissory notes and exercise of the outstanding warrants, possible future financings or acquisition transactions, stock dividends or splits, stock issuances pursuant to employee benefit plans and other proper corporate purposes. In particular, in order to fund its ongoing operations and business plan, including to continue production of the FF 91 2.0 Futurist Alliance and to fund the execution of the FX strategy, the Company is seeking to raise additional capital from various fundraising efforts currently underway to bolster its cash on hand. FF expects that it may be able to raise additional capital to support the ramp-up of production of the FF 91 to potentially generate sufficient revenues to put the Company on a path to cash flow break-even. It is possible that some of these additional shares could be used for various other purposes without further stockholder approval, except as such approval may be required in particular cases by the Charter, applicable law or the rules of any stock exchange or other quotation system on which the Company’s securities may then be listed. The Board believes that approval of the Share Authorization Proposal is crucial predominantly to ensure that the Company has sufficient authorized shares to meet its existing obligations to issue shares of Class A Common Stock as and if they become due, and to secure needed financing without incurring the delay and expense of holding additional stockholders’ meetings.

If the Share Authorization Proposal is approved, up to an additional 25,000,000 shares of Class A Common Stock, would be issued and outstanding or available for future issuance. The additional shares of Class A Common Stock will have the same rights as the presently authorized shares of Class A Common Stock, including the right to cast one vote per share of Class A Common Stock. Although the authorization of additional shares will not, in itself, have any effect on the rights of any holder of our Class A Common Stock, the future issuance of additional shares of Class A Common Stock (other than by way of a stock split or dividend) would have the effect of diluting the voting rights and could have the effect of diluting earnings per share and book value per share of existing stockholders.

The Charter amendment will become effective upon the filing of the amendment with the Secretary of State of the State of Delaware. The Company currently plans to file such amendment promptly after the Special Meeting if the Share Authorization Proposal is approved. The text of the form of the Charter amendment is set forth in Annex A to this Proxy Statement. Such text is subject to amendment to include such changes as may be required by the office of the Secretary of State of the State of Delaware or as the Board deems necessary or advisable to effect the Authorized Shares Increase, if any.

Proposal

The Company is seeking stockholder approval to adopt an amendment to the Charter to increase the number of authorized shares of Common Stock, by 25,000,000 from 104,245,313 to 129,245,313, increasing the total number of authorized shares of the Common Stock and Preferred Stock, by 25,000,000, from 114,245,313 to 139,245,313.

Voting Requirements

Approval of the Share Authorization Proposal requires the affirmative vote of the holders of a majority of the voting power of the outstanding shares of our Common Stock and Series A Preferred Stock, voting together as a single class. Each share of Common Stock has one vote. The share of Series A Preferred Stock has 3,000,000,000 votes, but those votes must be voted in the same proportion as the votes cast by shares of Common Stock on this Proposal. Abstentions will be counted towards the vote total and will have the same effect as “Against” votes for this Proposal. However, because the share of Series A Preferred Stock has 3,000,000,000 votes and will vote in a manner that mirrors votes actually cast (which does not include abstentions or broker non-votes), abstentions and broker non-votes, if any, will have no effect on the manner in which the Series A Preferred Stock votes are cast. We believe that broker non-votes will be counted towards the presence of a quorum but will have no effect and will not be counted towards the vote total for this Proposal because we have been advised by NYSE that this Proposal should be considered “non-routine” under NYSE rules, and accordingly, we believe that your broker may not vote your shares on such Proposal without instructions from you. Nevertheless, whether a proposal is “routine” or “non-routine” remains subject to the final determination of NYSE. If your shares are held by a bank, we believe your shares cannot be voted without your specific instructions. Further, because the share of Series A Preferred Stock has 3,000,000,000 votes and will vote in a manner that mirrors votes actually cast (which does not include abstentions or broker non-votes), abstentions and broker non-votes, if any, will have no effect on the manner in which the Series A Preferred Stock votes are cast. Therefore, if you do not wish for this Proposal to pass, you should vote “Against” this Proposal.

Recommendation

THE BOARD RECOMMENDS VOTING “FOR” THE SHARE AUTHORIZATION PROPOSAL.

11

PROPOSAL 2: APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK TO HOLDERS OF CERTAIN OF OUR CONVERTIBLE NOTES AND WARRANTS

We are seeking stockholder approval, for purposes of complying with Listing Rule 5635(d), for the issuance of (i) 10,855,757 shares of Common Stock issuable upon conversion of the Exchange Notes (as defined below) issued by the Company pursuant to the Exchange Agreement (defined below) (such issuance, the “Exchange Financing”); (ii)(A) 57,288,691 shares of Common Stock issuable upon conversion of the Secured Notes (defined below) and certain incremental secured convertible promissory notes issuable upon exercise of the September Incremental Warrants (defined below) and (B) 5,931,538 shares of Common Stock issuable upon exercise of the September Warrants (defined below) and PA Warrants (defined below) issued pursuant to the September Purchase Agreement (defined below) (such financing, the “September Financing”); and (iii)(A) 57,280,430 shares of Common Stock issuable upon conversion of the Unsecured Notes (defined below) and certain incremental unsecured convertible promissory notes issuable upon exercise of the December Incremental Warrants (defined below) and (B) 25,874,953 shares of Common Stock issuable upon exercise of the December Warrants (defined below) issued pursuant to the December Purchase Agreement (defined below) (such financing, the “December Financing” and, collectively with the September Financing and the Exchange Financing, the “Financings”).

The information set forth herein in connection with the September Financing is qualified in its entirety by reference to the full text of the form of the September Purchase Agreement, September Warrants, September Incremental Warrants, PA Warrants (defined below) and Secured Notes attached as exhibits 10.1, 4.1, 4.2, 4.3, 4.4, respectively, to the Company’s Current Report on Form 8-K, filed with the SEC on September 6, 2024. Stockholders are urged to carefully read these documents.

The information set forth herein in connection with the December Financing is qualified in its entirety by reference to the full text of the form of the December Purchase Agreement, December Warrants, December Incremental Warrants, and Unsecured Notes attached as exhibits 10.1, 4.1, 4.2, and 4.3, respectively, to the Company’s Current Report on Form 8-K, filed with the SEC on December 23, 2024. Stockholders are urged to carefully read these documents.

Background

On August 29, 2024, the Company entered into an Exchange Agreement (the “Exchange Agreement”) with certain noteholders (the “Holders”) who beneficially owned and held certain notes (the “Streeterville Notes”) of the Company which were initially issued on August 4, 2023 (the “Initial Issuance Date”) and acquired by the Holders on May 17, 2024. Pursuant to the Exchange Agreement, the Company agreed to issue certain senior convertible notes (the “Exchange Notes”), in exchange for the surrender of the outstanding Streeterville Notes held by the Holders.

On September 5, 2024, the Company entered into a Securities Purchase Agreement (the “September Purchase Agreement”) with certain institutional investors as purchasers (the “September Purchasers”). Pursuant to the September Purchase Agreement, the Company sold, and the September Purchasers purchased, approximately $30 million, consisting of approximately $22.5 million in cash and approximately $7.5 million converted from previous loans to the Company, of secured convertible promissory notes (the “Secured Notes”), common stock purchase warrants (the “September Warrants”) and incremental note purchase warrants (the “September Incremental Warrants” and, together with the Secured Notes and the September Warrants, the “September Financing Documents”) in two closings. The initial closing occurred on September 12, 2024 and the subsequent closing occurred on September 30, 2024.

On December 21, 2024, the Company entered into a Securities Purchase Agreement (the “December Purchase Agreement”) with certain institutional investors as purchasers (the “December Purchasers” and, together with the September Purchasers and the Holders, the “Noteholders”). Pursuant to the December Purchase Agreement, the Company sold, and the December Purchasers purchased, approximately $30 million, consisting of approximately $22.5 million in cash and approximately $7.5 million converted from previous loans to the Company, of unsecured convertible promissory notes (the “Unsecured Notes”), common stock purchase warrants (the “December Warrants”) and incremental note purchase warrants (the “December Incremental Warrants”) in multiple closings. The initial closing occurred on December 31, 2024, the second closing occurred on January 17, 2025 and the final closing occurred on January 22, 2025. V W Investment Holding Limited, one of the December Purchasers involved in the December Financing only, is an independent investment fund with investors including FF Global Partners (“FFGP”).

12

The Exchange Notes, Secured Notes, September Warrants, PA Warrants, Unsecured Notes, and December Warrants are each referred to herein as a “Financing Document”, and collectively, the “Financing Documents”.

Exchange Financing

For the purpose of descriptions of the terms under this Exchange Financing section only, capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Exchange Notes.

Exchange Notes

Maturity Date; Interest.

Pursuant to the Exchange Notes, interest shall accrue at a rate of 10% per annum if paid in cash or 15% if paid in shares of Common Stock (the “Interest Rate”) and shall be computed on the basis of a 360-day year and twelve 30-day months and shall be payable on a Conversion Date with respect to the Conversion Amount being converted on such Conversion Date, with any remaining accrued and unpaid Interest payable on the sixth anniversary of the Initial Issuance Date (the “Maturity Date”) (each, an “Interest Date”).

Interest shall be payable on each Interest Date, to the Holders on the applicable Interest Date, in shares of Common Stock so long as there has been no equity conditions failure; provided however, that the Company may, at its option following notice to the noteholders, pay Interest on any Interest Date in cash or in a combination of cash and shares. Prior to the payment of Interest on an Interest Date, interest on the Exchange Notes shall accrue at the Interest Rate and be payable by way of inclusion of the Interest in the Conversion Amount on each Conversion Date, or upon any redemption, unless in the event of an event of default, in which case the interest rate of the Exchange Notes shall automatically be increased to 18% per annum (“Interest Adjustments”). In the event such default has been cured, such Interest Adjustments shall cease to be effective as of the calendar day immediately following the date of such cure; provided that the interest as calculated and unpaid at such increased rate during the continuance of that certain default shall continue to apply to the extent relating to the days after the occurrence of such default through and including the date of such cure of such default.

The Maturity Date may be extended by the noteholders under circumstances specified therein. On the Maturity Date, the Company shall pay to the Holders an amount in cash representing all outstanding principal, accrued and unpaid interest on such principal and interest and accrued and unpaid Late Charges. Other than as specifically permitted by the Exchange Notes, the Company may not prepay any portion of the outstanding principal and accrued, unpaid interest or accrued and unpaid Late Charges on principal and interest, if any.

Conversion

Each Holder of Exchange Notes may convert all, or any part, of the outstanding principal of the Exchange Notes, at any time at such holder’s option, into shares of Common Stock, at a conversion price per share of $5.49 (the “Conversion Price”), subject to adjustment under certain circumstances described in the Exchange Notes. Each Holder may alternatively elect to convert the Exchange Notes, at any time at such holder’s option, into shares of Common Stock at the “Alternate Conversion Price” equal to the lesser of: (i) the Conversion Price then in effect and (ii) the greater of (a) the floor price of $1.10 per share and (b) 90% of the volume weighted average price per share of our common stock as of the Trading Day immediately preceding the delivery or deemed delivery of the applicable Conversion Notice.

Redemption

Company Optional Redemption. The Company has the option to redeem the Exchange Notes at the greater of (i) 10% redemption premium to the Conversion Amount being redeemed as of the Company Optional Redemption Date, and (ii) the equity value of Common Stock underlying the Exchange Notes. The equity value of Common Stock underlying the Exchange Notes is calculated using the greatest closing sale price of Common Stock during the period commencing on the date immediately preceding notice of such redemption and ending on the Trading Day immediately prior to the date the Company makes the entire payment required to be made for such redemption.

13

Bankruptcy Event of Default Mandatory Redemption. Upon any bankruptcy event of default, the Company shall immediately redeem in cash all amounts due under the Exchange Notes at 25% premium unless the holder waives such right to receive such payment.

Casualty Event Redemption. Upon receipt of certain casualty proceeds, each holder of Exchange Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Exchange Notes and (y) all of the proceeds of such casualty event.

Asset Sale Redemption. Upon the occurrence of certain asset sales, each holder of Exchange Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Exchange Notes and (y) all of the proceeds of such asset sale.

Extraordinary Receipt Redemption. Upon the receipt of an Extraordinary Receipt, each holder of Exchange Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Exchange Notes and (y) all of the net cash proceeds of such Extraordinary Receipt.

September Financing

For the purpose of descriptions of the terms under this September Financing section only, capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Secured Notes.

Secured Notes

Maturity Date; Interest.

Pursuant to the Secured Notes, interest shall accrue at a rate of 10% per annum (the “Interest Rate”) and shall be computed on the basis of a 360-day year and twelve 30-day months and shall be payable on a Conversion Date with respect to the Conversion Amount being converted on such Conversion Date, with any remaining accrued and unpaid Interest payable on the fifth anniversary of the issuance date thereof (the “Maturity Date”) (each, an “Interest Date”).

Interest shall be payable on each Interest Date, to the noteholders on the applicable Interest Date, in shares of Common Stock so long as there has been no Equity Conditions Failure; provided however, that the Company may, at its option following notice to the noteholders, pay Interest on any Interest Date in cash or in a combination of cash and shares. Prior to the payment of Interest on an Interest Date, interest on this Note shall accrue at the Interest Rate and be payable by way of inclusion of the Interest in the Conversion Amount on each Conversion Date, or upon any redemption, unless in the event of an event of default, in which case the interest rate of the Secured Notes shall automatically be increased to 18% per annum (“Interest Adjustments”). In the event such default has been cured, such Interest Adjustments shall cease to be effective as of the calendar day immediately following the date of such cure; provided that the interest as calculated and unpaid at such increased rate during the continuance of that certain default shall continue to apply to the extent relating to the days after the occurrence of such default through and including the date of such cure of such default.

The Maturity Date may be extended by the noteholders under circumstances specified therein. On the Maturity Date, the Company shall pay to the noteholder an amount in cash representing all outstanding principal, accrued and unpaid interest on such principal and interest and accrued and unpaid Late Charges. Other than as specifically permitted by the Secured Note, the Company may not prepay any portion of the outstanding principal and accrued, unpaid interest or accrued and unpaid Late Charges on principal and interest, if any.

14

Conversion

Each holder of Secured Notes may convert all, or any part, of the outstanding principal of the Secured Notes, at any time at such holder’s option, into shares of Common Stock, at a conversion price per share of $5.24 (the “Conversion Price”), subject to adjustment under certain circumstances described in the Secured Notes. Each holder may alternatively elect to convert the Secured Notes, at any time at such holder’s option, into shares of Common Stock at the “Alternate Conversion Price” equal to the lesser of: (i) the Conversion Price then in effect and (ii) the greater of (a) the floor price of $1.048 per share and (b) the volume weighted average price per share of our common stock during the five Trading Days ending and including the Trading Day immediately preceding the delivery or deemed delivery of the applicable conversion notice.

Redemption

Company Optional Redemption. The Company has the option to redeem the Secured Notes at a 10% redemption premium to the greater of (i) the shares of Common Stock then outstanding under the Secured Notes and (ii) the equity value of Common Stock underlying the Secured Notes. The equity value of Common Stock underlying the Secured Notes is calculated using the greatest closing sale price of Common Stock during the period commencing on the date immediately preceding notice of such redemption and ending on the Trading Day immediately prior to the date the Company makes the entire payment required to be made for such redemption.

Bankruptcy Event of Default Mandatory Redemption. Upon any bankruptcy event of default, the Company shall immediately redeem in cash all amounts due under the Secured Notes at 25% premium unless the holder waives such right to receive such payment.

Casualty Event Redemption. Upon receipt of certain casualty proceeds, each holder of Secured Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Secured Notes and (y) all of the proceeds of such casualty event.

Asset Sale Redemption. Upon the occurrence of certain asset sales, each holder of Secured Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Secured Notes and (y) all of the proceeds of such asset sale.

Extraordinary Receipt Redemption. Upon the receipt of an Extraordinary Receipt, each holder of Secured Notes may require the Company to redeem in cash with the net proceeds therefrom, the lesser of (x) a 10% redemption premium (or 25% if an event of default has then occurred and is continuing) to the shares of Common Stock then outstanding under the Secured Notes and (y) all of the net cash proceeds of such Extraordinary Receipt.

Ranking; Security Interest.

The Secured Notes are junior secured obligations of the Company and are secured by a security interest in substantially all of the assets of the Company, pursuant to a security agreement. In addition, certain subsidiaries of the Company in the September Purchase Agreement secured the Company’s obligations under the September Financing Documents by granting a perfected lien upon substantially all of the personal property of each such subsidiary, for the benefit of the Investors.

September Letter Agreement

On January 28, 2025, the Company entered into a letter agreement (the “September Letter Agreement”), pursuant to which, the September Purchasers agreed to not to convert any portion of the Secured Notes at a conversion price less than $5.24 per share prior to Company’s receipt of stockholder approval. In consideration therefor, the Company agreed to issue to the September Purchasers who so convert any Secured Notes at the initial conversion price of $5.24 prior to the Company’s receipt of stockholder approval, certain True-Up Shares (as defined in the September Letter Agreement) underlying the True-Up Conversion Amount (as defined in the September Letter Agreement). The applicable conversion price for purposes of calculating the number of True-Up Shares to which any such Purchaser is entitled is the lower of (i) the applicable Conversion Price as in effect on the applicable True-Up Date (as defined in the September Letter Agreement), and (ii) the greater of (x) the Floor Price and (y) the lowest of the five (5) VWAPs of the Common Stock during the five (5) consecutive Trading Day period ending and including the Trading Day immediately preceding the True-Up Date.

September Warrants

The September Warrants are exercisable for a term of five (5) years to purchase an aggregate of 5,728,770 shares of Common Stock at an exercise price of $6.29 per share, subject to adjustment under certain circumstances described in the September Warrants. Pursuant to the September Letter Agreement, the September Purchasers agreed to not to exercise any such September Warrants before the Company’s receipt of stockholder approval.

15

The September Incremental Warrants are exercisable for a term of one (1) year to purchase the Secured Notes at an exercise price of equal to the principal amount of the Secured Notes issued to such September Purchaser, subject to adjustment under certain circumstances described in the September Incremental Warrants.

The Company also issued certain placement agent warrants (“PA Warrants”) to Univest Securities LLC, the sole placement agent of the transaction. The PA Warrants are exercisable for a term of five (5) years to purchase an aggregate of 202,768 shares of Common Stock at an exercise price of $6.29 per share, subject to adjustment under certain circumstances described in the PA Warrants.

Registration Rights

The Company filed a registration statement with the SEC on November 1, 2024 providing for the resale by the Investors of certain shares issuable pursuant to the September Financing Documents and such registration statement was declared effective on November 29, 2024. The Company also agreed to keep such registration statement effective at all times until no Investors owns any September Warrants or shares of Common Stock issuable upon exercise thereof.

December Financing

For the purpose of descriptions of the terms under this December Financing section only, capitalized terms used herein and not otherwise defined shall have the respective meanings set forth in the Unsecured Notes.

Unsecured Notes

Maturity Date; Interest.

Pursuant to the Unsecured Notes, interest shall commence accruing on the date thereof at the interest rate of 10% per annum and shall be computed on the basis of a 360-day year and twelve 30-day months and shall be payable on a Conversion Date with respect to the Conversion Amount being converted on such Conversion Date, with any remaining accrued and unpaid Interest payable on the fifth anniversary of the issuance date thereof (the “Maturity Date”) (each, Conversion Date and the Maturity Date being an “Interest Date”).

Interest shall be payable to noteholders on each Interest Date in shares of Class A Common Stock of the Company, par value $0.0001 per share; provided, however, that the Company may, at its option following notice to the noteholders, pay Interest on any Interest Date in cash or in a combination of cash and Common Stock. Prior to the payment of Interest on an Interest Date, interest on the Unsecured Notes shall accrue at the Interest Rate and be payable by way of inclusion of the Interest in the Conversion Amount on each Conversion Date, or upon any redemption, unless in the event of an event of default, in which case the interest rate of the Unsecured Notes shall automatically be increased to 18% per annum (“Interest Adjustments”). In the event such default has been cured, such Interest Adjustments shall cease to be effective as of the calendar day immediately following the date of such cure; provided that the interest as calculated and unpaid at such increased rate during the continuance of that certain default shall continue to apply to the extent relating to the days after the occurrence of such default through and including the date of such cure of such default.

The Maturity Date may be extended by the noteholders under circumstances specified therein. On the Maturity Date, the Company shall pay noteholders an amount in cash representing all outstanding principal, accrued and unpaid interest on such principal and interest and accrued and unpaid Late Charges. Other than as specifically permitted by the Unsecured Notes, the Company may not prepay any portion of the outstanding principal and accrued, unpaid interest or accrued and unpaid Late Charges on principal and interest, if any.

16

Conversion

Each holder of Secured Notes may convert all, or any part, of the outstanding principal of the Unsecured Notes, at any time at such holder’s option, into shares of Common Stock, at a conversion price per share of $1.16 (the “Initial Conversion Price”), subject to adjustment under certain circumstances described in the Unsecured Notes. Each holder may alternatively elect to convert the Unsecured Notes, at any time at such holder’s option, into shares of Common Stock at the “Alternate Conversion Price” equal to the lesser of: (i) the Initial Conversion Price then in effect and (ii) the greater of (a) the floor price of $1.048 per share and (b) the lowest volume weighted average price per share of the Common Stock during the five consecutive Trading Days ending and including the Trading Day immediately preceding the delivery or deemed delivery of the applicable conversion notice.

Adjustments

If on the day(s) on which (i) a registration statement registering for resale by the Investors the Common Stock issuable upon exercise of the December Warrants and conversion of the Unsecured Notes and Incremental Notes (the “Resale Registration Statement”) becomes effective and the prospectus contained therein is available for use (the “Registration Adjustment Event”) and (ii) the Company files with the Secretary of State of the State of Delaware an amendment to its Third Amended and Restated Certificate of Incorporation such that the Company has enough authorized and unissued Common Stock available for conversion in full of the Unsecured Notes and Incremental Notes at the Initial Conversion Price and the exercise in full of the December Warrants at the Initial Exercise Price (the “Authorized Share Adjustment Event” and, together with the Registration Adjustment Event, each an “Adjustment Event”, and the day on which each Adjustment Event occurs, an “Adjustment Date”), the Conversion Price then in effect is greater than the Closing Bid Price of the Common Stock on the Trading Day ended immediately prior to such Adjustment Date (each, an “Adjustment Price” and, collectively, the “Adjustment Prices”), on any such Adjustment Date, the Conversion Price shall automatically lower to the Adjustment Price.

Redemption Rights

Company Optional Redemption. The Company has the option to redeem the Unsecured Notes at a 10% redemption premium to the greater of (i) the shares of Common Stock then outstanding under the Unsecured Notes and (ii) the equity value of Common Stock underlying the Unsecured Notes. The equity value of Common Stock underlying the Unsecured Notes is calculated using the greatest closing sale price of the Common Stock during the period commencing on the date immediately preceding notice of such redemption and ending on the Trading Day immediately prior to the date the Company makes the entire payment required to be made for such redemption.

Bankruptcy Event of Default Mandatory Redemption. Upon any bankruptcy event of default, the Company shall immediately redeem in cash all amounts due under the Unsecured Notes at 25% premium unless the noteholder waives such right to receive such payment.

December Letter Agreement

On January 28, 2025, the Company entered into a letter agreement (the “December Letter Agreement”), pursuant to which, the December Purchasers agreed to not to convert any portion of the Unsecured Notes at a conversion price less than $1.16 per share prior to Company’s receipt of stockholder approval. In consideration therefor, the Company agreed to issue to the December Purchasers who so convert any Unsecured Notes at the initial conversion price of $1.16 prior to the Company’s receipt of stockholder approval, certain True-Up Shares (as defined in the December Letter Agreement) underlying the True-Up Conversion Amount (as defined in the December Letter Agreement). The applicable conversion price for purposes of calculating the number of True-Up Shares to which any such Purchaser is entitled is the lower of (i) the applicable Conversion Price as in effect on the applicable True-Up Date (as defined in the December Letter Agreement), and the Alternate Conversion Price (as defined in the Unsecured Notes). The Company also agrees in the December Letter Agreement that, if on the day(s) after the receipt of the stockholder approval, on which a Registration Statement (as defined in the Unsecured Notes) becomes effective and the prospectus contained therein is available for use (such date, an “Adjustment Date”), the Conversion Price (as defined in the Unsecured Notes) then in effect is greater than the Closing Bid Price (as defined in the Unsecured Notes) of the Common Stock on the Trading Day (as defined in the Unsecured Notes) ended immediately prior to such Adjustment Date (the “Adjustment Price”), the Conversion Price shall automatically lower to the Adjustment Price.

December Warrants

The December Warrants are exercisable immediately on the date thereof with a term of five years to purchase an aggregate of 25,874,953 shares of Common Stock at an exercise price of $1.392 per share (the “Initial Exercise Price”), subject to adjustment under certain circumstances described in the December Warrants. Pursuant to the December Letter Agreement, the December Purchasers agreed to not to exercise any such December Warrants before the Company’s receipt of stockholder approval.

17

The December Incremental Warrants are exercisable immediately on the date thereof with a term of one year to purchase the Unsecured Notes at an exercise price of equal to the principal amount of the Unsecured Notes issued to such December Purchaser, subject to adjustment under certain circumstances described in the December Incremental Warrants.

Registration Rights

The Company has agreed to file a Resale Registration Statement with the Securities and Exchange Commission, or SEC, (i) with respect to the initial closing, within 45 calendar days of December 31, 2024 (the “Initial Closing Date”) or as soon as practicable thereafter and (ii) with respect to any subsequent closings, within 45 calendar days after the later of (A) the date on which the most recently filed Resale Registration Statement becomes effective and the prospectus contained therein is available for use and (B) the applicable closing date (each such date, a ”Registration Trigger Date”), and, in each case, seek effectiveness within 90 days following the initial closing date or the applicable Registration Trigger Date, and keep such Resale Registration Statements effective at all times until no Investors owns any Unsecured Notes, December Warrants or December Incremental Warrants or shares of Common Stock issuable upon exercise thereof.

Limitations on Conversion

A Noteholder shall not have the right to convert any portion of a Financing Document to the extent that, after giving effect to such conversion, the Noteholder (together with certain related parties) would beneficially own in excess of 4.99%, or the “Maximum Percentage”, of shares of Common Stock outstanding immediately after giving effect to such conversion. The Maximum Percentage may be raised or lowered to any other percentage not in excess of 9.99%, at the option of the Noteholder, except that any increase will only be effective upon 61 days’ prior notice to the Company.

Nasdaq Stockholder Approval Requirement