not that some or all of the deferred tax asset will not be realized. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability, the duration of statutory carry forward periods and the associated risk that operating loss carry-forwards may expire unused. The Company records interest and penalties to interest expense as incurred.

The Company is also required to determine whether a tax position taken or expected to be taken is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. For tax positions meeting the more likely than not threshold, the tax amount recognized in the financial statements is reduced by the largest benefit that has a greater than fifty percent likelihood of being realized upon ultimate settlement with the relevant taxing authority. The Company recognizes interest related to these positions in interest expense.

Recent Accounting Pronouncements

As of September 30, 2021, there were no recent accounting pronouncements which have not been adopted that would have a significant impact on the Company’s financial reporting.

| 3. | Noncontrolling Interest |

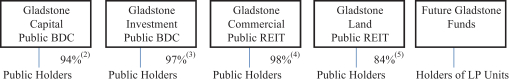

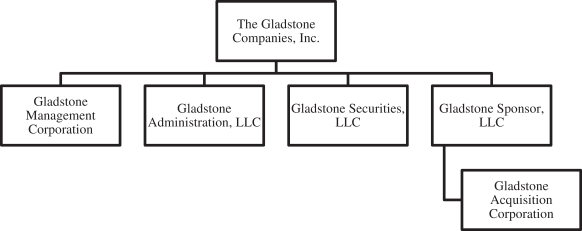

On August 9, 2021, Gladstone Acquisition consummated its initial public offering (the “IPO”) of 10,000,000 units (the “Units”). Each Unit consists of one share of Class A common stock, $0.0001 par value per share (the “Common Stock”), and one-half of one redeemable warrant (the “Public Warrants”), each whole Public Warrant entitling the holder thereof to purchase one share of Common Stock at an exercise price of $11.50 per share, subject to adjustment. The Units were sold at an offering price of $10.00 per Unit, generating gross proceeds of $100,000,000.

Simultaneous with the consummation of the IPO and the issuance and sale of the Units, (i) Gladstone Acquisition consummated the private placement of 4,200,000 private placement warrants (the “Private Placement Warrants”) to Sponsor, each exercisable to purchase one share of Common Stock at $11.50 per share, subject to adjustment, at a price of $1.00 per Private Placement Warrant, generating total proceeds of $4,200,000 and (ii) the Company consummated the private placement of 200,000 shares of Common Stock (the “Representative Shares”) to EF Hutton, division of Benchmark Investments, LLC, for nominal consideration. The private placement warrants issued to the Sponsor have been eliminated in consolidation.

Of the proceeds the Company received from the Gladstone Acquisition IPO, $102.0 million, or $10.20 per Unit issued in the IPO, was deposited into a trust account with Continental Stock Transfer & Trust Company acting as trustee (the “Trust Account”).

Subsequently, on August 10, 2021, the Underwriter exercised the over-allotment option in part, and the closing of the issuance and sale of the additional Units (the “Over-Allotment Units”), additional Private Placement Warrants (the “Over-Allotment Private Placement Warrants”) and additional Representative Shares (the “Over-Allotment Representative Shares”) occurred on August 18, 2021. The total aggregate issuance by the Company of 492,480 Over-Allotment Units, 98,496 Over-Allotment Private Placement Warrants at a purchase price of $1.00 per Private Placement Warrant and 9,850 Over-Allotment Representative Shares for nominal consideration resulted in total gross proceeds of $5,023,296 (the “Over- Allotment Proceeds”).

The Over-Allotment Proceeds were deposited to the Trust Account and added to the net proceeds from the IPO; upon closing of the over-allotment in part, there was an aggregate of approximately

$107,023,296, or $10.20 per issued and outstanding Unit, in the Trust Account.

The Trust Account proceeds are in U.S. treasury securities. In connection with the trust account, the Company reported “Cash held in trust account” of $107,023,929 on the Condensed Consolidated Balance Sheet at September 30, 2021 and “Investment of Gladstone Acquisition initial public offering proceeds into trust account” on the Condensed Consolidated Statement of Cash Flows for the three months ended September 30, 2021.

F-32