Issuer Free Writing Prospectus Dated December 31, 2020 Filed Pursuant to Rule 433 Relating to Preliminary Prospectus Dated December 28, 2020 Registration Statement No. 333 - 250889 JOWELL GLOBAL LTD. A China’s Leading Cosmetics, Health and Nutritional Supplements and Household Products E - Commerce Platform

This presentation includes statements that are, or may be deemed, “forward - looking statements“ . In some cases, these forward - looking statements can be identified by the use of forward - looking terminology, including the terms ”believes,” “estimates,” “anticipates,” “expects”,“ ”plans,“ intends,” “may,” “could,” “might,” “will,” “should,” “approximately,” “potential,” or in each case, their negative or other variations thereon or comparable terminology, although not all forward - looking statements contain these words . They appear in a number of places throughout this presentation and include statements regarding our intentions, beliefs, projections, outlook, analyses or current expectations concerning, among other things, the cosmetics, health and nutritional supplements and household products, e - commerce market in China, the prospects of the cosmetics, health and nutritional supplements and household products and businesses as stated herein . By their nature, forward - looking statements involve risks and uncertainties because they relate to events, competitive dynamics, and regulatory developments and depend on the economic circumstances that may or may not occur in the future or may occur on longer or shorter timelines than anticipated . Although we believe that we have a reasonable basis for each forward - looking statement contained in this presentation, we caution you that forward - looking statements are not guarantees of future performance and that our actual results of operation, financial condition and liquidity, and the development of the industries in which we operate may differ materially from the forward - looking statements contained in this presentation as a result of, among other factors, the factors referenced in the “Risk Factors” section of the preliminary prospectus contained in the registration statement on Form F - 1 (File No . 333 - 250889 ) initially filed with the Securities and Exchange Commission (the “SEC”) on November 23 , 2020 as amended thereafter, for our proposed initial public offering (the "Registration Statement") . In addition, even if our results of operations, financial conditions and liquidity, and the development of the industries in which we operate are consistent with the forward - looking statements contained in this presentation, they may not be predictive of results or developments in future periods . Any forward - looking statement that we make in this presentation speaks only as of the date of such statement, and we undertake no obligation to update or revise publicly any of the forward - looking statements after the date hereof to conform the statements to actual results or changed expectations except as required by applicable law . You should read carefully the factors described in the "Risk Factors" section of the prospectus contained in the Registration Statement to better understand the risks and uncertainties inherent in our businesses and any forward - looking statements . The trademarks and its symbols used herein are the properties of their respective owners . Industry and Market Data In this presentation, we rely on and refer to information and statistics regarding the sectors in which we compete and other industry data . We obtained this information and statistics from third - party sources, including reports by market survey companies and other sources . We have supplemented this information where necessary with our own internal estimates, taking into account publicly available information about other industry participants and our management’s best view as to information that is not publicly available . Forward - Looking Statements

This free writing prospectus relates to the proposed public offering of ordinary shares of Jowell Global Ltd (the “Company”) and should be read together with the Registration Statement filed by the Company with the SEC for the offering to which this presentation relates and may be accessed through the following web link : www.sec.gov/Archives/edgar/data/1805594/000121390020044870/ea132259 - f1a1_jowellglobal.htm The Registration Statement has not yet become effective . Before you invest, you should read the prospectus in the Registration Statement (including the risk factors described therein) and other documents we have filed with the SEC in their entirety for more complete information about us and the offering . You may get these documents for free by visiting EDGAR on the SEC Web site at http : //www . sec . gov . Alternatively, we or our underwriter will arrange to send you the prospectus if you contact Network 1 Financial Securities, Inc . , 2 Bridge Ave, Suite # 241 , Red Bank, NJ 07701 , or by calling + 1 ( 800 ) - 886 - 7007 . , or contact Jowell Global Ltd . , via email : IR@ 1 juhao . com . Free Writing Prospectus Statement

1. Company Overview Contents JOWELL GLOBAL LTD Operates an online platform and LHH Mall through Shanghai Juhao Information Technology Co., Ltd. Health & Nutritional Supplements Household Products Co s me ti cs 1 3. Investment Highlights

2 Preliminary Offering Summary Issuer • Jowell Global, Ltd. Listing / Ticker • NasdaqCM: JWEL (Subject to NASDAQ Approval) Securities • Ordinary Shares Offering Type • Initial Public Offering Base Offering • 3,714,286 Ordinary Shares* Over - Allotment Option • 557,143 Ordinary Shares (15% of base offering)* Price Per Share • $7.00 per Ordinary Share* Post - Offering Shares Outstanding • 24,863,711 (exclusive exercise of underwriters’ over - allotment option )* Net Proceeds • $24.18 million (net of underwriting discounts but before expenses)* Expected Pricing Date • Q1 2021* Use of Proceeds • Approximately $5 million to upgrade online platform and infrastructure with new technologies such as AI, big data and cloud - based solutions* • Approximately $8 million to expand sales channel, network, and number of LHH Stores and to increase product categories* • Approximately $5 million to make potential acquisition of emerging technology platforms* • Approximately $6.18 million for general corporate purposes, including working capital requirements* Underwriter(s) Network 1 Financial Securities, Inc. Issuer and UW Counsels FisherBroyles, LLP; Hunter Taubman Fischer & Li LLC * All terms stated herein are proposed terms See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

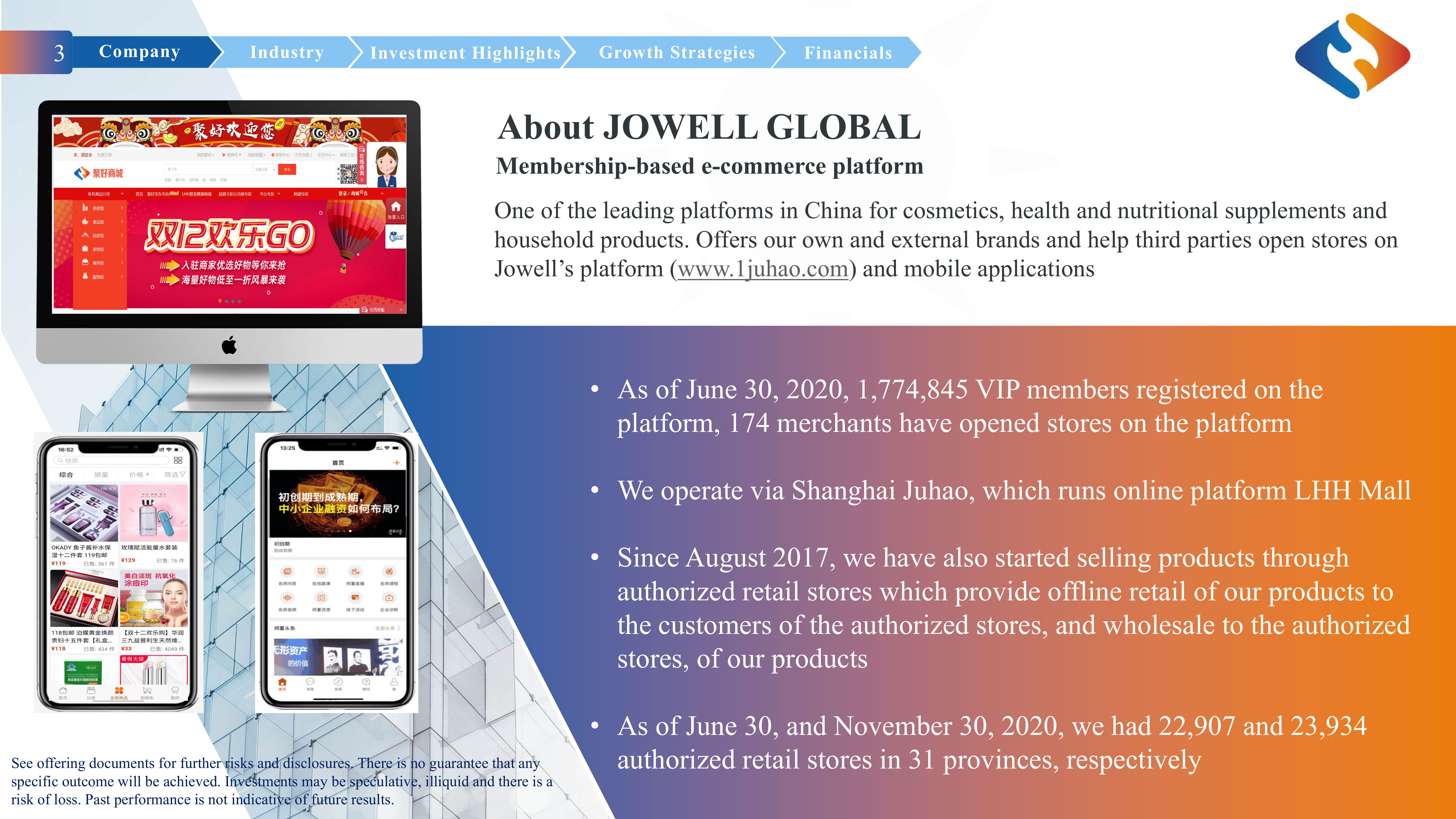

• As of June 30, 2020, 1,774,845 VIP members registered on the platform, 174 merchants have opened stores on the platform • We operate via Shanghai Juhao, which runs online platform LHH Mall • Since August 2017, we have also started selling products through authorized retail stores which provide offline retail of our products to the customers of the authorized stores, and wholesale to the authorized stores, of our products • As of June 30, and November 30, 2020, we had 22,907 and 23,934 authorized retail stores in 31 provinces, respectively About JOWELL GLOBAL Membership - based e - commerce platform One of the leading platforms in China for cosmetics, health and nutritional supplements and household products. Offers our own and external brands and help third parties open stores on Jowell’s platform ( www.1juhao.com ) and mobile applications 3 Financials C I o n m d u p s a t r n y y I P n o d s u it s io tr n y Investment Highlights Growth Strategies See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Sales Channel Online direct sales, authorized retail store distribution, third - party merchants and live streaming marketing 4 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Live Streaming Marketing We train our authorized retail store owners to participate in our live online ma r ket b r oadc a sti ng to a n d se l l their p r o d uc t s. W e wo r k with Key Opinion Leaders (KOLs) to promote our products name St o r e” of “L ove or “LHH Home St o r e”, au t ho ri zed either r e tail e r s a re i ndependen tl y operated or run as store - in - shops (i n t eg r a t ed stores) Third - Party Merchants We hold an EDI certificate approved by the Shanghai Bureau of Communication Management which allows our online shopping mall to a c c e pt thi rd - pa rt y platforms and companies to open their stores on our platform Authorized Retail Store Operating under the brand Online Direct Sales We offer an online platform LHH Mall through Shanghai Juhao, selling our own branded products, as well as domestic and i n t e r na ti onal b r anded products See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

We offer high - quality and affordable products on our platform 5 Product Categories Health and nutritional supplements and foods Cosmetics Skincare Body care Baby and Children Washing items Fragrances Food Electronics Apparel Household products Financials C I o n m d u p s a t r n y y I P n o d s u it s i t o r n y Investment Highlights G C ro o w nt t e h nt Strategies See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Industry Overview The E - commerce market continues to expand China is the world’s No.1 E - commerce market since 2015 • Online sales volume in China rose by more than 30 % , approaching $ 2 trillion or more than half of global online retail sales in 2019 tril l ion yu a n in • Consumer goods retail China sales with reached onl i ne 41.16 sa l e s accounting for 25.83% of the total sales in 2019 6 Financials C I o n m d u p s a t r n y y I P n o d s u it s io tr n y Investment Highlights Growth Strategies 20.5 22.8 28.8 30.7 32.8 0 1 1.20% 26.30% 6.60% 6.80% 0.0% 5.0% 1 0 . 0% 1 5 . 0% 2 0 . 0% 2 5 . 0% 3 0 . 0% 0 5 10 15 20 25 30 35 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 19 Changes in total e - commerce transactions in China 2015 - 2019 E - commerce transactions (billion yuan) Year over year growth Data sourced from industry report produced by CEVSN Information Consulting Co., Ltd. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

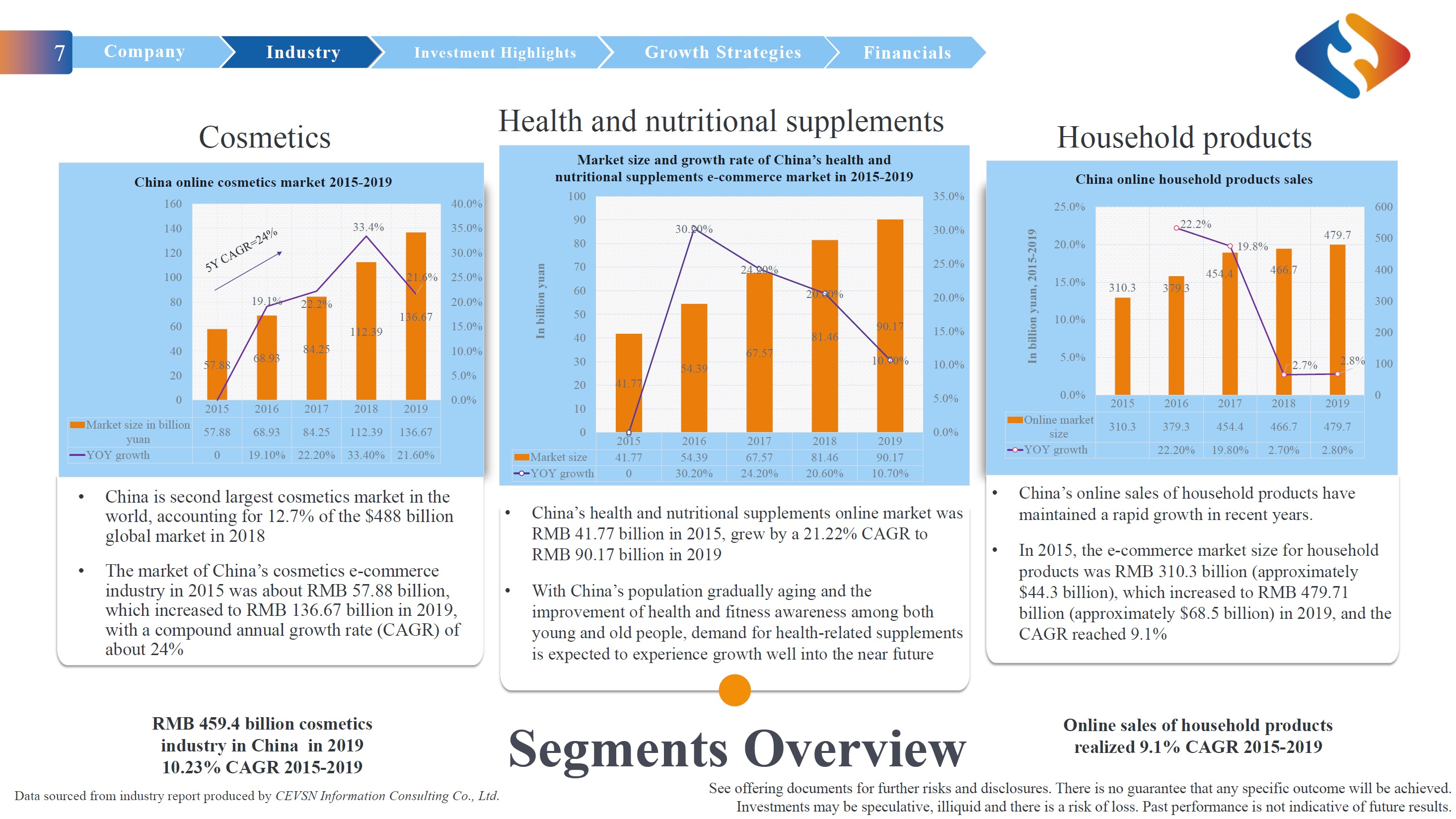

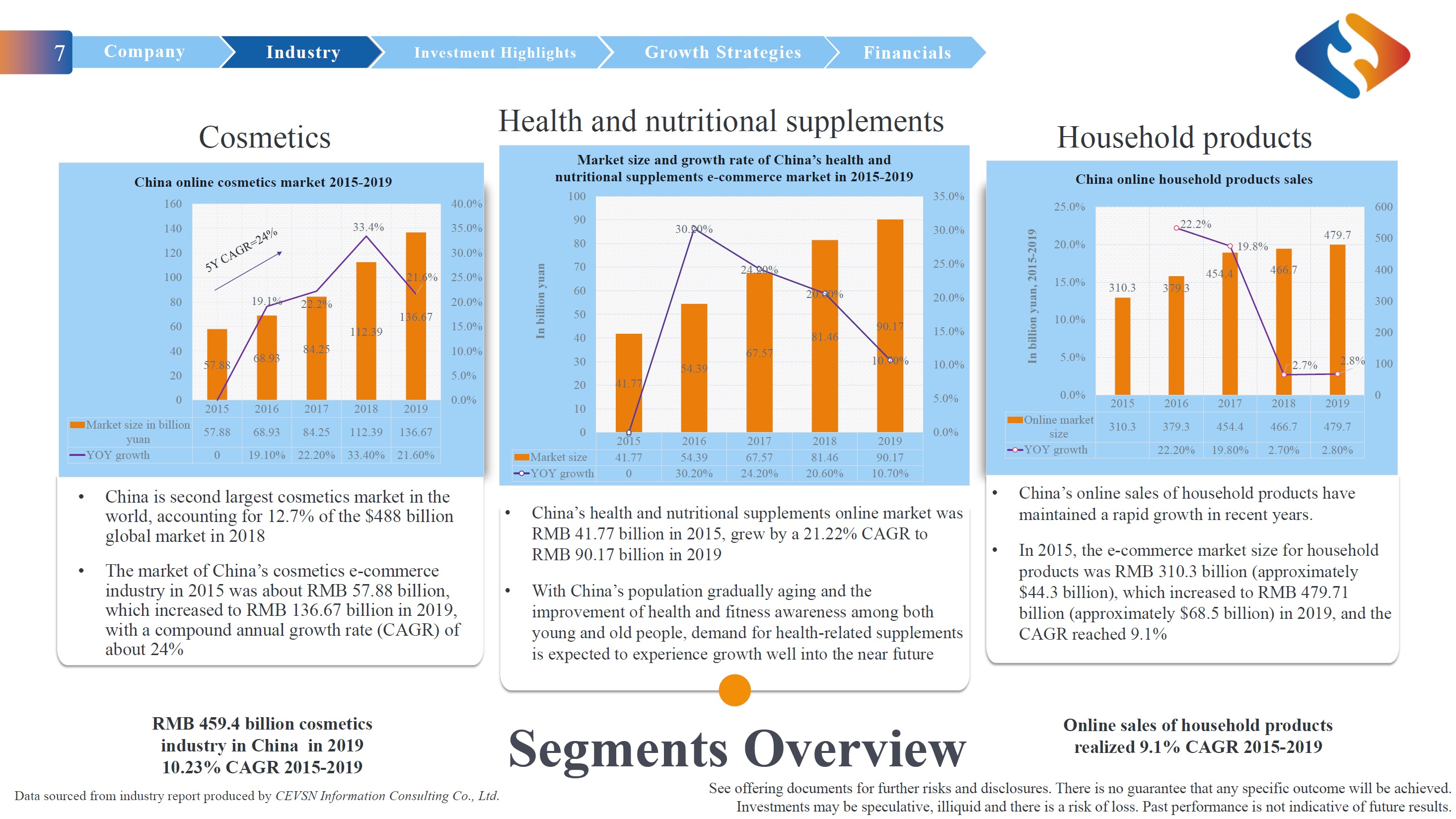

+Cosme ti cs • China is second largest cosmetics market in the world, accounting for 12 . 7 % of the $ 488 billion global market in 2018 • The market of China’s cosmetics e - commerce industry in 2015 was about RMB 57.88 billion, which increased to RMB 136.67 billion in 2019, with a compound annual growth rate (CAGR) of about 24% +Health and nutritional supplements +Household products • With China’s population gradually aging and the improvement of health and fitness awareness among both young and old people, demand for health - related supplements is expected to experience growth well into the near future • China’s online sales of household products have maintained a rapid growth in recent years. • In 2015, the e - commerce market size for household products was RMB 310.3 billion (approximately $44.3 billion), which increased to RMB 479.71 billion (approximately $68.5 billion) in 2019, and the CAGR reached 9.1% Segments Overview RMB 459.4 billion cosmetics industry in China in 2019 10.23% CAGR 2015 - 2019 Data sourced from industry report produced by CEVSN Information Consulting Co., Ltd. Online sales realized 9.1% CAGR 2015 - 2019 7 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Market size in billion yuan YOY growth 2 0 1 5 2 0 1 6 2 0 1 7 2 0 1 8 2 0 19 5 7 . 88 6 8 . 93 8 4 . 25 1 1 2.3 9 1 3 6.67 0 1 9 . 1 0 % 2 2 . 2 0 % 3 3 . 4 0 % 2 1 . 6 0% 57.88 68.93 84.25 1 12.39 136.67 19.1% 22.2% 33.4% 21.6% 3 0 . 0% 2 5 . 0% 2 0 . 0% 1 5 . 0% 1 0 . 0% 5.0% 0.0% 4 0 . 0% 3 5 . 0% 1 20 1 00 80 60 40 20 0 1 40 China online cosmetics market 2015 - 2019 160 310.3 379.3 454.4 466.7 479.7 22.2% 19.8% 2.7% 2.8% 0 1 00 2 00 3 00 4 00 5 00 6 00 0.0% 2015 2016 2017 2018 2 0 19 Online market 310.3 size 379.3 454.4 466.7 4 7 9 .7 YOY growth 22.20% 19.80% 2.70% 2 . 8 0% 5.0% 1 0 . 0% 1 5 . 0% 2 0 . 0% 2 5 . 0% In billion yuan, 2015 - 2019 China online household products sales 2 0 15 2 0 16 2 0 17 2 0 18 2 0 19 Market size 4 1 . 77 5 4 . 39 6 7 . 57 8 1 . 46 9 0 . 17 YOY growth 0 30.20% 24.20% 20.60% 10.70% • China’s health and nutritional supplements online market was RMB 41.77 billion in 2015, grew by a 21.22% CAGR to RMB 90.17 billion in 2019 41.77 54.39 67.57 81.46 90.17 0 30.20% 24.20% 20.60% 10.70% 0.0% 5.0% 1 0 . 0% 1 5 . 0% 2 0 . 0% 2 5 . 0% 3 0 . 0% 3 5 . 0% 90 80 70 60 50 40 30 20 10 0 1 00 In billion yuan Market size and growth rate of China’s health and nutritional supplements e - commerce market in 2015 - 2019 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

INVESTMENT HIGHLIGHTS 8 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Competitive Advantages 01 02 03 04 Top - Quality Services and Technology Investment Customers, Marketing and Integration Strong Dedicated Management Team with Extensive Industry Experience See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Competitive Advantages Personalization, instantaneity, convenience, interaction, accuracy and fragmentation Our competitors • Re t a i l m arke t s i n C h in a a r e frag m en t ed and highly competitive. • Competition from traditional retailers • Competition from online retailers, such as Jumei, Lefeng, as well as general e - commerce platforms, such as Suning . com, Taobao . com, Tmall . com, Amazon . cn, JD . com, VIP . com, and Dangdang . com . Our advantages – online and offline new retail model B i g d a t a and art i f i c i al i n t e lli g en c e t ec h no l og i es to co ll ect an d a na l yze c o ns u mer s ’ a c ti vi ti es o n our platform and their shopping patterns • Ecosystem – integrated services to improve consumer experience and increased user retention • Multiplatform – online platform and offline stores to enhance interaction with our consumers via different platforms • Int e lli gen t b usi n e ss model – we p lan to d e ve l op the app li ca t ion of 5G t e l ec o m m un i ca ti on, intelligent v irt ual clothes fitting room, 3 D remote touch sensing, photo search, voice shopping, VR shopping, unmanned logistics, self - service payment and virtual assistant • Shopping experience – price based to value based shopping, quality of shopping experience will increasingly become the key factor for consumers 9 Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Financials See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

• Large, engaged and loyal customer base • 29,393 or 52.01% repeat customers of total customers in 2019 • A customer is considered repeat customer if he or she returns to our platform and purchase from us within 30 days from his or her last purchase • Creative and cost - efficient marketing campaigns • Live streaming marketing and self - media platform marketing (WeChat) to communicate with our customers and issue promotions and products information • Constant communication with suppliers and third - party merchants to keep them informed of any changes to the inventory levels • Our website interface is fully integrated with our warehouse management system, enabling us to track order and delivery status on a real - time basis. Customers 01 Marketing 02 03 10 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Integration See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Customer service, Technology and Mobile App 24/7 customer service Peer Review Photography Multimedia Live Streaming 11 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies * Gross Merchandise Volume See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. Customer Service Sales and after - sales service hotlines available 24 hours a day, 7 days a week Customer service representatives highly educated to answer inquiries and proactively educate potential customers about our products Customer - friendly return policies Technology Copyright protected APP software Service - oriented architecture supported by data processing technologies Analysis of int e rn a lly - g e n e r a t ed customer behavior and transaction data Mobile Application Our mobile App provides excellent shopping experience About 35.84% of GMV* from online shopping was generated from our mobile app in 2018. In 2019, the figure was 41.49% During the first half of 2020, 39.68% (unaudited) of our GMV was from our mobile App

• director of CN Energy Group Inc. since August 2019 • Chief Financial Officer of China Eco - Materials Group Co., Limited from July 23, 2019 to November 11, 2020 • Audit manager at Friedman, LLP and Patrizio & Zhao LLC from December 2006 to September 2017 • Graduated from Jiangsu Radio & TV University with a major in Economic Management in December 2003 Mei Cai, CFO Ms. Cai was appointed as the Chief Financial Officer of the Company on November 15, 2020. Dan (Jessie) Zhao, Board member Ms. Zhao was appointed as a member of the Board on December 15, 2019 and Vice President of Finance of the Company on September 17, 2020. • Secretary of the board of directors of Shanghai Juhao Information Technology Co., Ltd., since May 2019 • Served in various positions at Jiangsu Longrich Group Co., Ltd. including head of investment department, general manager of its subsidiary company, director of customer service department and director of planning and information department from April 1996 to May 2019 • Holds a Bachelor degree in Economics from Nanjing Audit University in June 2007 Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies 12 OUR LEADERSHIP Zhiwei Xu, CEO & Chairman Haitao Wang, Independent Director Mr. Wang was appointed as a member of the Board on December 15, 2019 • Served as the vice president of Qichen (Shenzhen) Fund Management Co. Ltd. and supervisor of Shanghai Xiandai Industrial Co., Ltd since 2016 • Graduated from Heilongjiang Finance School in 1990 with a major in planning and statistics • Independent Director of Oriental Culture Holding LTD (NASDAQ: OCG) • Served as CFO of Aerkomm Inc . (EuroNext - Paris : AKOM, OTCQX : AKOM) since April 2017 and served as CFOs for multiple public and private companies from 2008 to 2014 • Received Master of Arts in Accounting from the Ohio State University in February 1982 and his Bachelor of Arts in Economics from Soochow University in Taiwan in May 1977 Y. Tristan Kuo, Independent Director Mr. Kuo was appointed as a member of the Board on December 23, 2020 William Morris, Independent Director Mr. Morris was appointed as a member of the Board on July 1, 2020. • Served as the trading advisor for WJM Trading Strategies, LLC. since December 2018 • Received his Bachelor of art degree in Psychology from the University of Dayton in April 1975 Mr. Xu was appointed as a member of the Board of Directors on August 16, 2019, and as Chairman of the Board and the Chief Executive Officer of the Company on July 1, 2020 • Served as the Chairman of the board of directors of Shanghai Juhao Information Technology Co., Ltd., since 2012 • Served as the Chairman of the board of directors of Jiangsu Longrich Group Co., Ltd since 1992 • Graduated from EMBA program of Fudan Qiushi Continuing Education College in August 2002

Authorized stores Develop additional community, franchise, direct and joint venture stores Suppliers Expand high - quality suppliers base Services Provide additional services such as physical demonstration stores and shipping centers Technology Continue to develop AI, blockchain, cloud - based solutions, IoT and intelligent supply chain Big data Provide better and more relevant products, services, and experiences to our customers International Global business expansion via new stores outside of China in 2021 and plans to introduce 1,000 domestic and foreign SKUs Ecosystem Create value for participants in our health supplements and cosmetics ecosystem Partnership Leverage internal expertise and seek highly strategic and value - adding acquisitions OUR STRATEGIES Enhance our competitive position 13 Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Financials See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

A B I C We will continue to develop our AI capacity to enhance functions of our smart procurement services and automatic re - ordering system. We are also developing an artificial intelligence product recommendation system to provide better choices to our consumers. Blockchain We intend to use blockchain technology to improve the security and efficiency of our system in various areas, including product anti - counterfeiting, product tracking, logistics tracking, supplier credibility and credit granting, cross - border payment, and to use blockchain technology to store business activities and shopping and spending patterns. Cloud - based solutions We provide our authorized stores and consumers with a series of cloud - based solutions, including authorized store inventory management, cloud stores and big data analysis services. We will continue to develop new solutions and applications in this area. Internet of Things & Intelligent supply chain We will work with our business partners to incorporate various types of wearable devices to enhance our data collection capabilities and provide health management service. We will also increase our intelligent supply chain capabilities, reduce distribution costs, improve precision marketing, improve consumer feedback data quality, and optimize the experience for LHH store users. TECHNOLOGIES Small programs, APPs, online tools Artificial intelligence 14 Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Financials See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

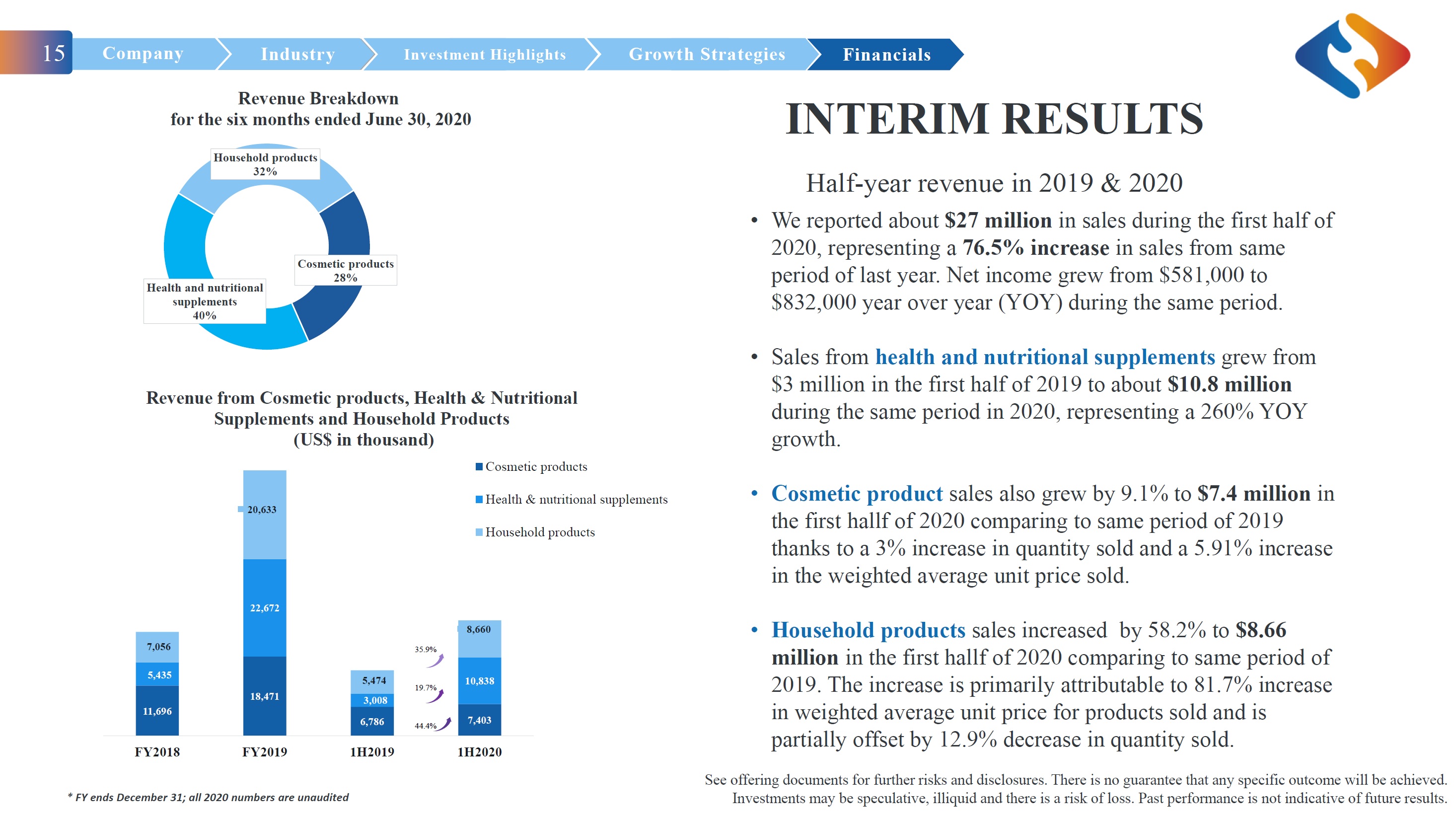

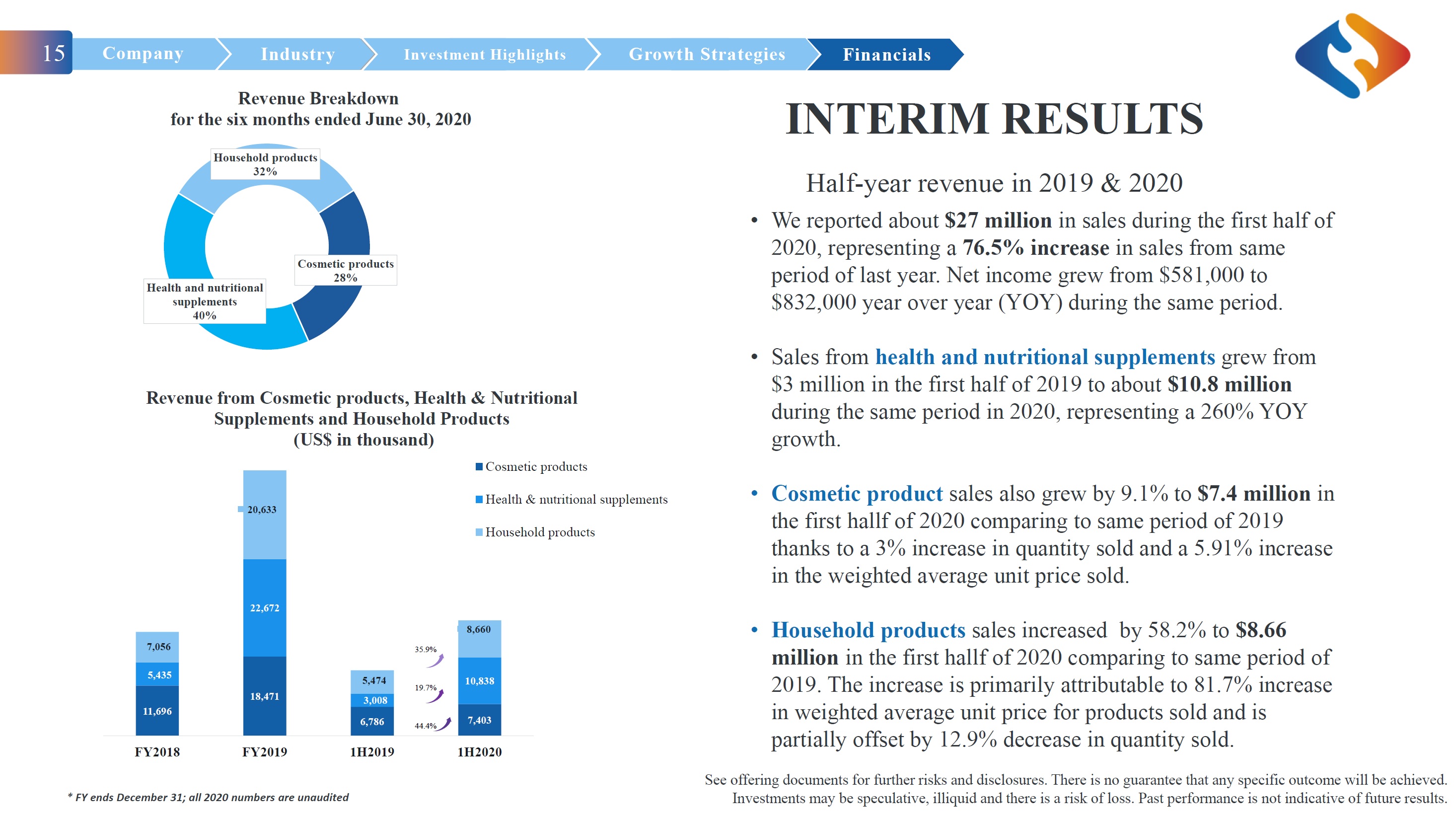

Cosmetic products 28% Health and nutritional supplements 40% Household products 32% Revenue Breakdown for the six months ended June 30, 2020 • Sales from health and nutritional supplements grew from $3 million in the first half of 2019 to about $10.8 million during the same period in 2020, representing a 260% YOY growth. • Cosmetic product sales also grew by 9.1% to $7.4 million in the first hallf of 2020 comparing to same period of 2019 thanks to a 3% increase in quantity sold and a 5.91% increase in the weighted average unit price sold. • Household products sales increased by 58.2% to $8.66 million in the first hallf of 2020 comparing to same period of 2019. The increase is primarily attributable to 81.7% increase in weighted average unit price for products sold and is partially offset by 12.9% decrease in quantity sold. See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results. 15 Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies Financials INTERIM RESULTS Half - year revenue in 2019 & 2020 • We reported $27 million in sales during the six months ended June 30, 2020, representing a 76.5% increase in sales from same period of last year. Net income grew from $581,000 to $832,000 year over year (YOY) during the same period. * FY ends December 31; all 2020 numbers are unaudited 11,696 18,471 6,786 7,403 5,435 22,672 3,008 10,838 7,056 20,633 5,474 8,660 FY2018 FY2019 1 H 2019 1 H 2020 Revenue from Cosmetic products, Health & Nutritional Supplements and Household Products (US$ in thousand) Cosmetic products Health & nutritional supplements Household products 35.9% 19.7% 44.4%

FOR FISCAL YEAR 2018 & 2019 (US$ in thousand) Income from operation 2018 2019 - 14.2 1,985 % 1,704 - 13.5% Financials Company I P n o d s u it s io tr n y Investment Highlights Growth Strategies 16 * FY ends December 31 24,188 61,776 Net revenue 2018 2019 155.4% 1,478 1,278 Net income 2018 2019 See offering documents for further risks and disclosures. There is no guarantee that any specific outcome will be achieved. Investments may be speculative, illiquid and there is a risk of loss. Past performance is not indicative of future results.

Thank You! Adam Pasholk apasholk@ne tw1. com Karen (Huiyun) Mu kmu@netw1.com Network 1 Financial Securities, Inc. Phone: +1 732 - 758 - 9001 Fax: +1 732 - 758 - 6671 Investor Relations EverGreen Consulting Inc. IR@changqingconsulting.com +1 - 908 - 510 - 2351 +86 13811768559 At Company Jessie Zhao, Director and VP of Finance Jessie.zhao@1juhao.com +86 - 21 - 55210174 Underwriter