an amount of $517,500,000 ($10.00 per Unit) from the net proceeds of the sale of the Units in the Initial Public Offering and the sale of the Private Placement Warrants was placed in a trust account (the “Trust Account”) located in the United States and invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act, with a maturity of 185 days or less, or in any open-ended investment company that holds itself out as a money market fund meeting certain conditions of Rule 2a-7 of the Investment Company Act of 1940, as amended (the “Investment Company Act”), as determined by the Company, until the earlier of: (i) the completion of a Business Combination and (ii) the distribution of the funds in the Trust Account to the Company’s shareholders, as described below.

The Company’s management had broad discretion with respect to the specific application of the net proceeds of the Initial Public Offering and the sale of the Private Placement Warrants, although substantially all of the net proceeds applied generally toward completing a Business Combination.

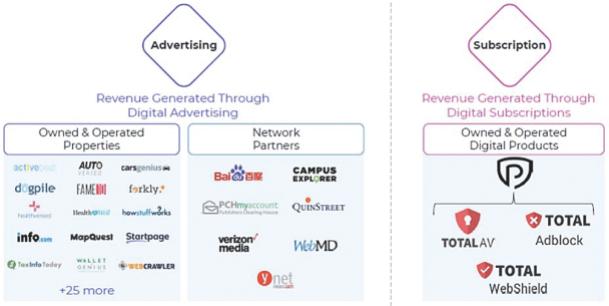

On June 28, 2021, we entered into a business combination agreement by and among Trebia, S1 Holdco, Trebia Merger Sub I, Trebia Merger Sub II, Protected and the other parties thereto. On January 27, 2022, the Company consummated the Business Combination.

Results of Operations

We neither engaged in any operations nor generated any operating revenues prior to the Business Combination. Our only activities from inception through December 31, 2021 were organizational activities, those necessary to prepare for the Initial Public Offering, described below, and, subsequent to the Initial Public Offering, identifying a target company for a Business Combination. We do not expect to generate any operating revenues until after the completion of our initial Business Combination. We incurred expenses as a result of being a public company (for legal, financial reporting, accounting and auditing compliance), as well as for due diligence expenses in connection with searching for, and completing, a Business Combination. Additionally, we recognized non-cash gains and losses with other income (expense) related to changes in recurring fair value measurement of our warrant and FPA liabilities at each reporting period.

For the year ended December 31, 2021, we had net income of $21,026,763, consisting of $23,699,501 of gain on change in fair value of warrant liability, $7,494,372 of gain on change in fair value of FPA liability and $3,160,168 of gain on termination of the FPA offset by formation and operating costs of $13,327,278.

For the period from February 11, 2020 (inception) through December 31, 2020, we had a net loss of $29,914,748, which consisted of formation and operating costs of $806,028, transaction costs allocated to warrant and FPA liabilities of $1,381,051, loss on change in fair value of warrant liability of $17,328,667, and loss on change in fair value of FPA liability of 10,399,002.

Liquidity and Capital Resources

Until the consummation of the Initial Public Offering, our only source of liquidity was an initial purchase of common stock by the Sponsors and loans from our Sponsors.

On June 19, 2020, we consummated the Initial Public Offering of 51,750,000 Units, inclusive of the underwriters’ election to fully exercise their option to purchase an additional 6,750,000 Units, at a price of $10.00 per Unit, generating gross proceeds of $517,500,000. Simultaneously with the closing of the Initial Public Offering, we consummated the sale of 8,233,334 Private Placement Warrants to the Sponsor at a price of $1.50 per Private Placement Warrant generating gross proceeds of $12,350,000.

Following the Initial Public Offering, the exercise of the over-allotment option in full and the sale of the Private Placement Warrants, a total of $517,500,000 was placed in the Trust Account, and we had $1,994,558 of cash held outside of the Trust Account, after payment of costs related to the Initial Public Offering, and available for working capital purposes. We incurred $29,241,089 in transaction costs, including $10,350,000 of underwriting fees, $18,112,500 of deferred underwriting fees and $778,589 of other costs.

For the year ended December 31, 2021, cash used in operating activities was $1,240,496. Net income of $21,026,763 was affected by the change in the fair value of warrants of $23,699,501, change in the value of FPA liability of $7,494,372 and gain on termination of the FPA of $3,160,168. Changes in operating assets and liabilities which provided $12,086,782 of cash from operating activities.