System1, Inc./S1 Holdco LLC Unaudited Statements of Operations System1, Inc. System1, Inc. S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC Successor + Predecessor Total S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC (in thousands) Sucessor Period Sucessor Period Predecessor Period QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD YTD 30-Jun-22 1.27.22 - 3.31.22 1.1.22 - 1.26.22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 30-Jun-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Revenue 219,797 166,108 52,712 199,803 171,446 169,579 147,561 135,755 117,268 100,019 122,935 438,617 688,389 488,586 317,140 475,977 340,222 222,954 0 0 Operating cost and expenses: Cost of revenues 152,558 120,131 41,760 155,276 128,885 126,167 110,785 96,635 83,892 73,937 86,532 314,449 521,113 365,837 236,952 340,996 244,361 160,469 Salaries, commissions, and benefits 45,555 43,459 35,175 18,715 15,139 17,698 15,195 15,915 13,120 13,183 13,330 124,189 66,747 48,032 32,893 55,548 39,633 26,513 Selling, general, and administrative 16,167 14,981 14,817 14,650 7,936 6,277 6,950 5,863 7,095 4,879 5,142 45,965 35,813 21,163 13,227 22,979 17,116 10,021 Depreciation and amortization 33,397 23,311 1,000 3,625 3,459 3,112 3,689 3,082 3,331 3,889 3,530 57,708 13,885 10,260 6,801 13,832 10,750 7,419 Total operating costs and expenses 247,677 201,882 92,752 192,266 155,419 153,254 136,619 121,495 107,438 95,888 108,534 542,311 637,558 445,292 289,873 433,355 311,860 204,422 0 0 Operating income (27,880) (35,774) (40,040) 7,537 16,027 16,325 10,942 14,260 9,830 4,131 14,401 (103,694) 50,831 43,294 27,267 42,622 28,362 18,532 0 0 Loss (gain) on Fait Value of Warrants (4,139) 13,761 - - - - - - - - - 9,622 - - - - - - Interest expense 7,324 4,776 1,049 4,162 4,184 4,476 4,048 5,781 5,741 6,332 6,497 13,149 16,870 12,708 8,524 24,351 18,570 12,829 Income (loss) from continuing operations before income tax (31,065) (54,311) (41,089) 3,375 11,843 11,849 6,894 8,479 4,089 (2,201) 7,904 (126,465) 33,961 30,586 18,743 18,271 9,792 5,703 0 0 Income tax expense 3,000 (16,252) (629) 262 475 77 151 1,527 198 (173) 355 (13,881) 965 703 228 1,907 380 182 Net income (loss) from continuing operations (34,065) (38,059) (40,460) 3,113 11,368 11,772 6,743 6,952 3,891 (2,028) 7,549 (112,584) 32,996 29,883 18,515 16,364 9,412 5,521 0 0 Net Income (Loss) Attributable To Noncontrolling Interest (4,867) (8,068) - - - - - - - - - (12,935) - - - - - - Gain (loss) from discontinued operations, net of taxes - - - - - - - 55,315 99 (4,460) (3,557) - - - - 47,397 (7,918) (8,017) 0 0 Net income (29,198) (29,991) (40,460) 3,113 11,368 11,772 6,743 62,267 3,990 (6,488) 3,992 (99,649) 32,996 29,883 18,515 63,761 1,494 (2,496)

System1, Inc./S1 Holdco LLC Unaudited Condensed Balance Sheet (in thousands) System1, Inc. System1, Inc. S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC 30-Jun-22 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 ASSETS Current Assets: Cash and cash equivalents 37,442$ 42,178$ 47,896$ 36,209$ 34,567$ 30,853$ 29,013$ 37,657$ 33,985$ 55,763$ Accounts receivable, net of allowance for doubtful accounts 93,397 99,976 90,203 85,588 79,446 75,610 71,140 58,404 53,662 66,331 Restricted cash 5,757 4,895 - - - - - - - - Prepaid expenses and other current assets 9,671 14,468 7,689 7,236 4,870 3,996 3,016 4,012 4,825 5,739 Assets of discontinued operations - - - - - - - 20,602 13,936 13,229 Total current assets 146,267 161,517 145,788 129,033 118,883 110,459 103,169 120,675 106,408 141,062 Restricted Cash 1,532$ 3,034$ 743$ -$ -$ -$ -$ -$ -$ -$ Property and equipment, net 4,330 2,855 830 836 916 976 1,057 1,137 1,139 1,243 Internal-use software development costs, net 11,647 10,704 11,213 11,012 10,578 9,764 9,660 10,079 9,414 9,045 Intangible assets, net 537,913 568,675 50,368 52,534 54,698 56,740 59,009 60,829 52,638 54,764 Goodwill 907,248 907,009 44,820 44,820 44,820 44,820 44,820 44,820 54,566 54,898 Due from related party - - 2,469 2,469 2,453 1,222 969 969 - - Operating lease right-of-use assets 7,533 6,388 - - - - - - - - Other assets 779 808 680 529 - - - - - - Assets of discontinued operations - - - - - - - 67,714 69,138 70,101 Total Assets 1,617,249$ 1,660,990$ 256,911$ 241,233$ 232,348$ 223,981$ 218,684$ 306,223$ 293,304$ 331,114$ LIABILITIES AND MEMBERS’ DEFICIT Current Liabilities: Accounts payable 17,286$ 76,004$ 72,846$ 64,625$ 60,659$ 57,410$ 52,104$ 40,690$ 34,058$ 42,476$ Accrued expenses and other current liabilities 97,752 67,635 31,284 20,319 18,814 9,988 17,150 15,987 14,312 17,806 Deferred Revenue 68,368 64,810 1,971 2,100 2,383 2,053 1,889 2,727 2,453 2,242 Operating lease liabilities, current 2,065 1,895 - - - - - - - - Due to related party - 80 - - - - - - - - Notes payable, current 14,888 14,822 170,453 171,780 4,739 9,374 9,374 19,347 24,347 44,237 Liabilities of discontinued operations - - - - - - - 62,523 56,303 47,141 Total current liabilities 200,359 225,246 276,554 258,824 86,595 78,825 80,517 141,274 131,473 153,902 Operating lease liabilities, non current 7,073$ 5,645$ -$ -$ -$ -$ -$ -$ -$ -$ Notes payable, non-current 406,026 409,777 - - 168,226 169,411 170,595 226,417 228,469 229,432 Warrant liability 13,669 40,773 - - - - - - - - Deferred tax liability 137,354 144,027 - - - - - - - - Protected incentive plan liability 18,163 - - - - - - - - - Other long-term liabilities 7,482 5,804 8,758 9,368 9,051 16,497 15,801 12,935 11,821 13,208 Liabilities of discontinued operations - - - - - - - - - Total liabilities 790,126$ 831,272$ 285,312$ 268,192$ 263,872$ 264,733$ 266,913$ 380,626$ 371,763$ 396,543$ Commitments and contingencies (Note 8) Members’ deficit: Class A common stock 9$ 9$ -$ -$ -$ -$ -$ -$ -$ -$ Class C common stock 2 2 - - - - - - - - Additional paid-in capital 761,002 728,540 - - - - - - - - Accumulated deficit (118,373) (89,175) - - - - - - - - Members’ deficit in S1 Holdco - - (28,829) (27,182) (31,646) (40,850) (47,886) (74,078) (78,017) (64,753) Noncontrolling interest 184,304 190,370 - - - - - - - - Accumulated other comprehensive income 179 (28) 428 223 122 98 (343) (325) (443) (675) Total members’ deficit 827,123 829,718 (28,401) (26,959) (31,524) (40,752) (48,229) (74,403) (78,460) (65,428) Total Liabilities And Members’ Deficit 1,617,249$ 1,660,990$ 256,911$ 241,233$ 232,348$ 223,981$ 218,684$ 306,223$ 293,303$ 331,115$

System1, Inc./S1 Holdco LLC Unaudited Condensed Statements of Cash Flow System1, Inc. System1, Inc. S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC Successor + Predecessor Total S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC (in thousands) Sucessor Period Sucessor Period Predecessor Period QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD YTD 30-Jun-22 1.27.22 - 3.31.22 1.1.22 - 1.26.22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 30-Jun-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Cash Flows From Operating Activities: Net cash provided by operating activities of continuing operations 20,007 (26,216) (10,490) 21,336 12,056 17,185 10,128 15,714 12,971 9,122 14,600 (16,699) 60,705 39,369 27,313 52,407 36,693 23,722 Net cash used for operating activities of discontinued operations - - - - - - - (1,917) 1,979 (390) (5,532) - - - - (5,860) (3,943) (5,922) Net cash provided by operating activities 20,007 (26,216) (10,490) 21,336 12,056 17,185 10,128 13,797 14,950 8,732 9,068 (16,699) 60,705 39,369 27,313 46,547 32,750 17,800 Cash Flows From Investing Activities: Purchases of property and equipment (912) (1,373) - (49) - - - (11) (8) - - (2,285) (49) - - (19) (8) - Proceeds from sale of Protected - - - - - - 74,544 - - - - - - - 74,544 - Purchase of business, net of cash acquired (19,338) (426,555) - - - - - - - - - (445,893) Expenditures for internal-use software development costs (1,979) (922) (441) (1,585) (1,668) (1,793) (1,440) (617) (1,632) (1,970) (1,893) (3,342) (6,486) (4,901) (3,233) (6,112) (5,495) (3,863) Net cash provided by (used in) investing activities of continuing operations (22,229) (428,850) (441) (1,634) (1,668) (1,793) (1,440) 73,916 (1,640) (1,970) (1,893) (451,520) (6,535) (4,901) (3,233) 68,413 (5,503) (3,863) Net cash provided by (used in) investing activities of discontinued operations - - - - - - - (142) (79) 144 (170) - - - - (247) (105) (26) Net cash provided by (used in) investing activities (22,229) (428,850) (441) (1,634) (1,668) (1,793) (1,440) 73,774 (1,719) (1,826) (2,063) (451,520) (6,535) (4,901) (3,233) 68,166 (5,608) (3,889) Cash Flows From Financing Activities: Proceeds from term loan and line of credit - 449,000 - - - - - - - - 20,000 449,000 - - - 20,000 20,000 20,000 Repayment of line of credit - - - - - (34,862) - - - - - (34,862) - - Repayment of term loan (5,000) (172,488) - (1,750) (1,750) (6,386) (1,750) (32,231) (7,715) (21,727) (1,750) (177,488) (11,636) (9,886) (8,136) (63,423) (31,192) (23,477) Payments for deferred financing cost (422) (24,423) - (382) - - - - - - - (24,845) (382) - - - - - Cash received from backstop - 246,484 - - - - - - - - - 246,484 - - - - - - Member capital contributions - - - (32) 109 3 147 206 551 747 751 - 227 259 150 2,255 2,049 1,498 Payments on contingent consideration - - - - - (1,715) (5,000) - - (5,038) (462) - (6,715) (6,715) (6,715) (5,500) (5,500) (5,500) Related party loan - - - - - (1,500) - - - - - - (1,500) (1,500) (1,500) - - - Redemptions of Class A common stock - (510,469) - - - - - - - - - (510,469) - - - - - - Distributions to members from sale of Protected - - - - - (28,765) - - - - - (28,765) - - Payments for earnouts (1,715) - - - - - - - - - - (1,715) - - - - - - Proceeds from Warrant Exercises 5,029 - - - - - - - - - - 5,029 - - - - - - Distributions to members (1,254) (247) - (4,786) (7,102) (2,691) - (12,575) (1,146) (3,558) (501) (1,501) (14,579) (9,793) (2,691) (17,780) (5,205) (4,059) Net cash provided by financing activities (3,362) (12,143) - (6,950) (8,743) (12,289) (6,603) (108,227) (8,310) (29,576) 18,038 (15,505) (34,585) (27,635) (18,892) (128,075) (19,848) (11,538) Effect of exchange rate changes in cash, cash equivalents and restricted cash 208 (237) (132) (322) (3) 611 (245) 120 35 130 (735) (161) 41 363 366 (450) (570) (605) Net Increase In Cash (5,376) (467,446) (11,063) 12,430 1,642 3,714 1,840 (20,536) 4,956 (22,540) 24,308 (483,885) 19,626 7,196 5,554 (13,812) 6,724 1,768 Cash and restricted cash: Beginning of period 50,107 517,553 48,639 36,209 34,567 30,853 29,013 49,549 44,593 67,133 42,825 48,639 29,013 29,013 29,013 42,825 42,825 42,825 End of period 44,731$ 50,107$ 37,576$ 48,639$ 36,209$ 34,567$ 30,853$ 29,013$ 49,549$ 44,593$ 67,133$ 44,730$ 48,639$ 36,209$ 34,567$ 29,013$ 49,549$ 44,593$

System1, Inc./S1 Holdco LLC Non-GAAP Financials System1, Inc. System1, Inc. S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC Successor + Predecessor Total S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC S1 Holdco LLC (in thousands) Sucessor Period Sucessor Period Predecessor Period QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD YTD 30-Jun-22 1.27.22 - 3.31.22 1.1.22 - 1.26.22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 30-Jun-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Net income (loss) from continuing operations (34,065)$ (38,059)$ (40,460)$ 3,113$ 11,368$ 11,772$ 6,743$ 6,952$ 3,891$ (2,029)$ 7,549$ (112,584)$ 32,996$ 29,883$ 18,515$ 16,364$ 9,412$ 5,520$ Income tax expense 3,000 -16,252 -629 262 475 77 151 1,527 198 (173) 355 (13,881) 965 703 228 1,907 380 183 Interest expense 7,324 4,776 1,049 4,162 4,185 4,476 4,048 5,781 5,741 6,332 6,497 13,149 16,871 12,709 8,524 24,351 18,570 12,829 Depreciation & amortization 33,397 23,311 1,000 3,625 3,458 3,113 3,689 3,082 3,331 3,889 3,530 57,708 13,884 10,259 6,801 13,832 10,750 7,419 Other income/expense (1) 2,122 1,800 -61 70 (25) 18 84 196 294 138 (229) 3,861 147 76 102 399 202 (91) Stock-based compensation and distributions to Members (2) 22,411 27,208 27,355 3,458 673 3,342 2,118 3,362 1,817 2,288 2,008 76,974 9,591 6,133 5,460 9,474 6,113 4,295 Revaluation of non-cash warrant liability -4,139 13,761 0 - - - - - - - - 9,622 - - - - - - Terminated product lines (3) 0 0 0 - - - - - - (2) 559 - - - - 556 556 556 Costs related to acquisitions/business combinations 4,227 6,390 15,676 7,970 2,755 623 1,484 1,033 222 71 1,032 26,292 12,833 4,862 2,108 2,358 1,325 1,103 One-time Ad Credit Impact 6,334 0 0 0 0 0 0 0 0 0 0 6,334 - - - - - - Acquisition earnout 72 274 9 32 31 32 63 62 2,278 373 - 356 158 126 95 2,713 2,651 373 Severance costs 153 206 0 3 118 164 330 121 393 545 21 359 615 612 494 1,080 960 567 Other costs, including restructuring 200 26 0 0 8 98 99 101 11 185 98 226 206 205 197 396 294 283 Adjusted EBITDA 41,037$ 23,442$ 3,938$ 22,696$ 23,046$ 23,715$ 18,809$ 22,217$ 18,177$ 11,616$ 21,420$ 68,416$ 88,265$ 65,570$ 42,524$ 73,430$ 51,214$ 33,036$ (1) Non-cash adjustments related to foreign exchange and asset disposals (2) Comprised of distributions to equity holders and non-cash stock-based compensation (3) In 2020, S1 Holdco terminated its Social Publishing product line, where it created quiz content primarily for the purpose of display advertising monetization. S1 Holdco has excluded revenue and direct costs associated with this product line for all presented periods

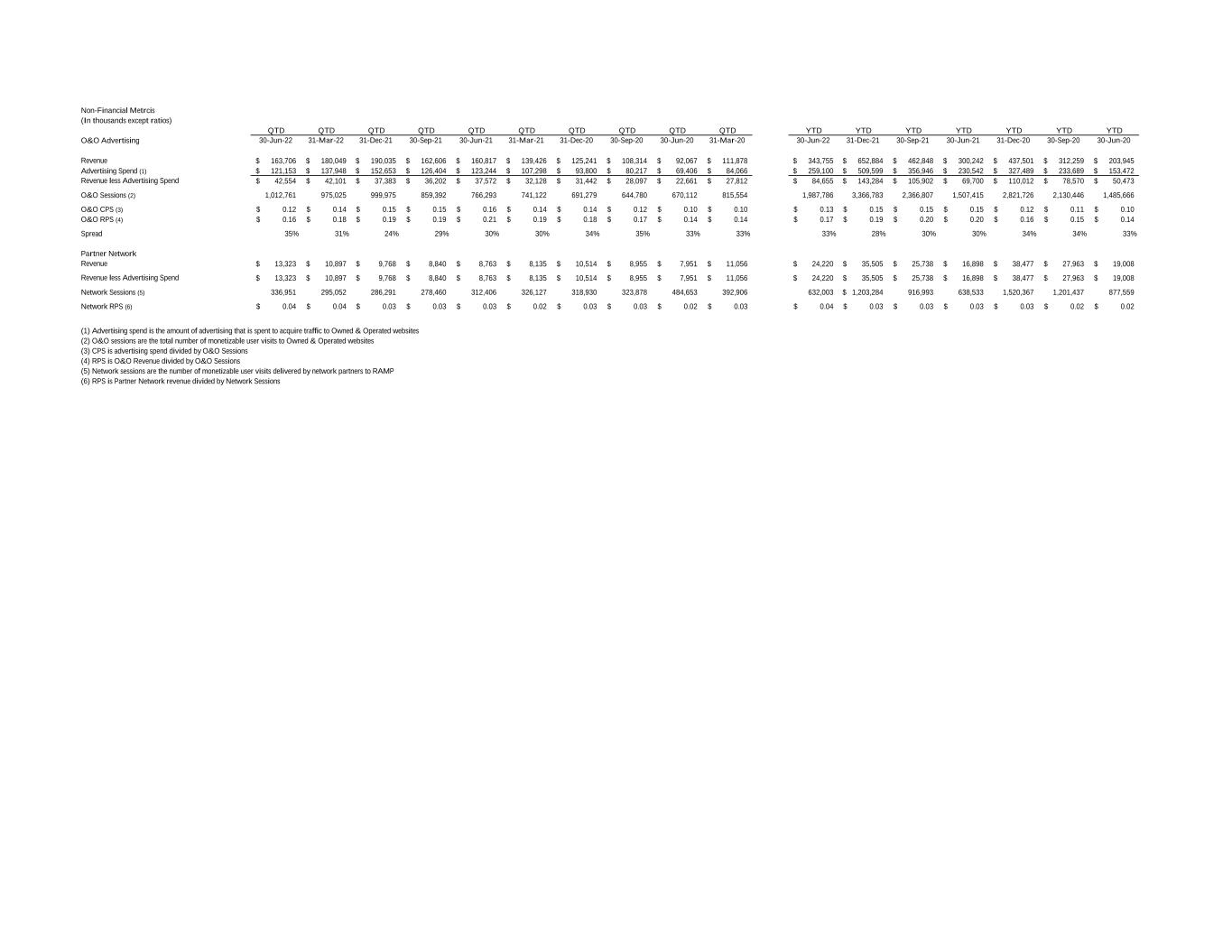

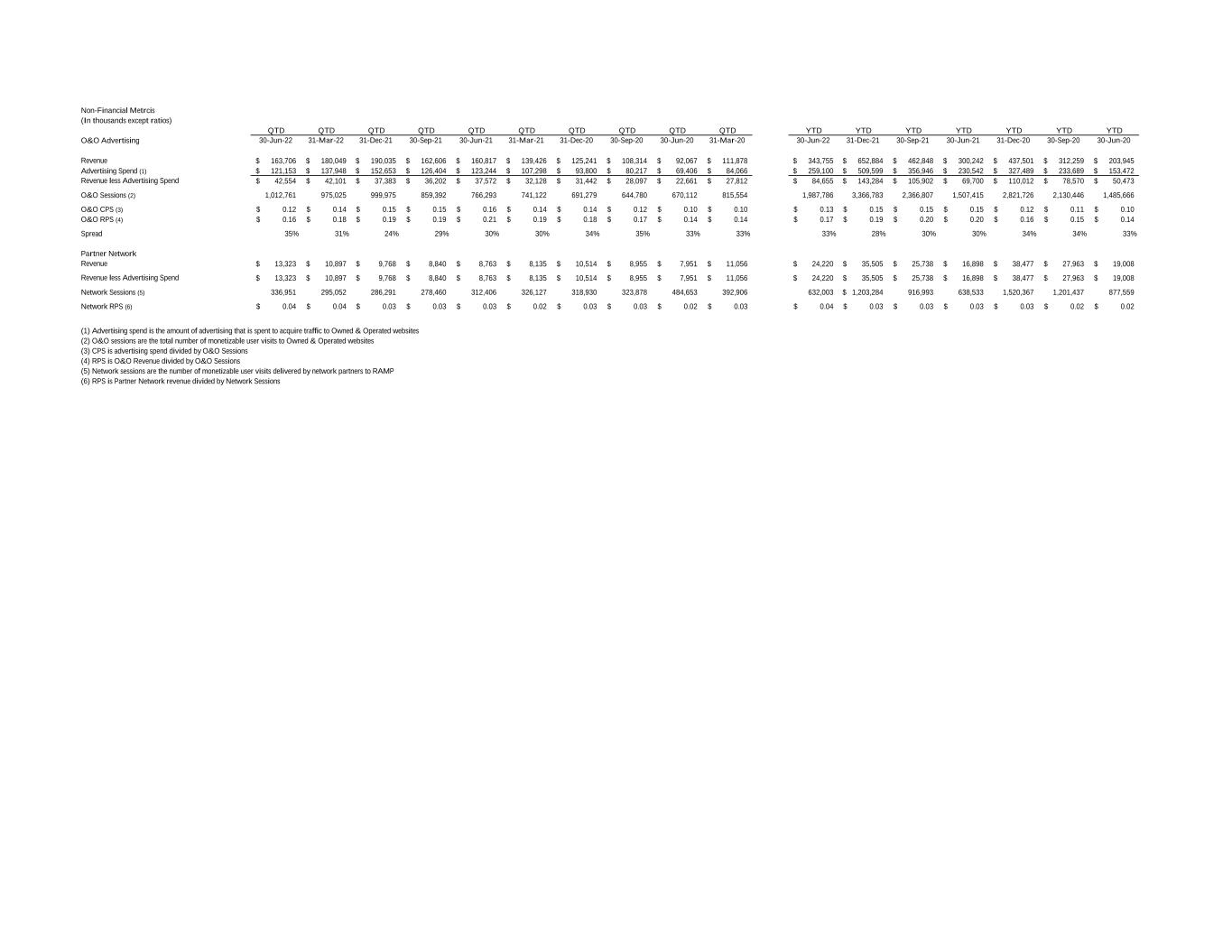

Non-Financial Metrcis (In thousands except ratios) QTD QTD QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD YTD O&O Advertising 30-Jun-22 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 30-Jun-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Revenue 163,706$ 180,049$ 190,035$ 162,606$ 160,817$ 139,426$ 125,241$ 108,314$ 92,067$ 111,878$ 343,755$ 652,884$ 462,848$ 300,242$ 437,501$ 312,259$ 203,945$ Advertising Spend (1) 121,153$ 137,948$ 152,653$ 126,404$ 123,244$ 107,298$ 93,800$ 80,217$ 69,406$ 84,066$ 259,100$ 509,599$ 356,946$ 230,542$ 327,489$ 233,689$ 153,472$ Revenue less Advertising Spend 42,554$ 42,101$ 37,383$ 36,202$ 37,572$ 32,128$ 31,442$ 28,097$ 22,661$ 27,812$ 84,655$ 143,284$ 105,902$ 69,700$ 110,012$ 78,570$ 50,473$ O&O Sessions (2) 1,012,761 975,025 999,975 859,392 766,293 741,122 691,279 644,780 670,112 815,554 1,987,786 3,366,783 2,366,807 1,507,415 2,821,726 2,130,446 1,485,666 O&O CPS (3) 0.12$ 0.14$ 0.15$ 0.15$ 0.16$ 0.14$ 0.14$ 0.12$ 0.10$ 0.10$ 0.13$ 0.15$ 0.15$ 0.15$ 0.12$ 0.11$ 0.10$ O&O RPS (4) 0.16$ 0.18$ 0.19$ 0.19$ 0.21$ 0.19$ 0.18$ 0.17$ 0.14$ 0.14$ 0.17$ 0.19$ 0.20$ 0.20$ 0.16$ 0.15$ 0.14$ Spread 35% 31% 24% 29% 30% 30% 34% 35% 33% 33% 33% 28% 30% 30% 34% 34% 33% Partner Network Revenue 13,323$ 10,897$ 9,768$ 8,840$ 8,763$ 8,135$ 10,514$ 8,955$ 7,951$ 11,056$ 24,220$ 35,505$ 25,738$ 16,898$ 38,477$ 27,963$ 19,008$ Revenue less Advertising Spend 13,323$ 10,897$ 9,768$ 8,840$ 8,763$ 8,135$ 10,514$ 8,955$ 7,951$ 11,056$ 24,220$ 35,505$ 25,738$ 16,898$ 38,477$ 27,963$ 19,008$ Network Sessions (5) 336,951 295,052 286,291 278,460 312,406 326,127 318,930 323,878 484,653 392,906 632,003 1,203,284$ 916,993 638,533 1,520,367 1,201,437 877,559 Network RPS (6) 0.04$ 0.04$ 0.03$ 0.03$ 0.03$ 0.02$ 0.03$ 0.03$ 0.02$ 0.03$ 0.04$ 0.03$ 0.03$ 0.03$ 0.03$ 0.02$ 0.02$ (1) Advertising spend is the amount of advertising that is spent to acquire traffic to Owned & Operated websites (2) O&O sessions are the total number of monetizable user visits to Owned & Operated websites (3) CPS is advertising spend divided by O&O Sessions (4) RPS is O&O Revenue divided by O&O Sessions (5) Network sessions are the number of monetizable user visits delivered by network partners to RAMP (6) RPS is Partner Network revenue divided by Network Sessions

Non-Financial Metrcis (In thousands except ratios) QTD QTD QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD YTD 30-Jun-22 31-Mar-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 30-Jun-22 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Billings (1) 46,283$ 45,405$ 38,443$ 37,632$ 40,473$ 37,992$ 31,126$ 27,758$ 26,458$ 22,529$ 91,688$ 154,541$ 116,097$ 78,465$ 107,871$ 76,745$ 48,987$ Change in Deferred Revenue During Period 3,515$ 5,512$ (671)$ (567)$ 4,445$ 6,792$ 6,287$ 2,591$ 4,796$ 4,409$ 9,027$ 9,999$ 10,671$ 11,238$ 18,084$ 11,796$ 9,205$ Advertising Spend (2) 19,878$ 22,296$ 17,986$ 16,966$ 17,884$ 23,626$ 17,562$ 18,059$ 22,467$ 18,575$ 42,174$ 76,462$ 58,477$ 41,510$ 76,664$ 59,101$ 41,042$ Beginning Subscribers 2,284 2,208 2,208 2,187 2,128 1,905 1,770 1,586 1,357 1,234 2,208 1,905 1,905 1,905 1,234 1,234 1,234 Ending Subscribers (3) 2,305 2,284 2,208 2,208 2,187 2,128 1,905 1,770 1,586 1,357 2,305 2,208 2,208 2,187 1,905 1,770 1,586 New Subscribers (4) 319 388 312 298 331 462 324 341 398 275 706 1,403 1,091 793 1,338 1,014 673 CTA (5) 62.40$ 57.49$ 57.73$ 56.91$ 54.10$ 51.10$ 54.23$ 52.95$ 56.42$ 67.53$ 59.71$ 54.51$ 53.60$ 52.35$ 57.29$ 58.27$ 60.96$ ARPU (6) 20.17$ 20.22$ 17.41$ 17.13$ 18.76$ 18.84$ 16.94$ 16.54$ 17.98$ 17.39$ 40.63$ 75.15$ 56.45$ 38.35$ 68.72$ 51.09$ 34.74$ (1) Billings is the total amount billed to customers during a period (2) Advertising spend is the total amount spent on advertising to acquire new subscribers during a period (3) Ending subscribers are the number of paying subscribers for its products, at the end of a period (4) New subscribers are the number of new subscribers acquired for its products, during a period (5) CTA is advertising spend divided by new subscribers in a period (6) ARPU is the billings in a period divided by average of the beginning and ending subscribers during that period *Deferred revenue from billings is amortized on a straight line basis over the subscription period and recognized as revenue in the financial statements **Excludes metrics for terminated product lines

Protected.net Group Limited Unaudited Statements of Operations (in thousands) Predecessor Period QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD 1.1.22 - 1.26.22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Revenue 12,016 39,115 38,199 36,028 31,199 25,149 25,415 21,965 18,379 144,541 105,426 67,227 90,908 65,759 40,345 Cost of Revenue 8,434 23,186 22,570 23,460 29,731 23,122 23,827 27,892 23,139 98,946 75,760 53,191 97,980 74,858 51,030 Gross profit (Loss) 3,582 15,929 15,629 12,568 1,469 2,027 1,587 (5,926) (4,759) 45,595 29,666 14,037 (7,072) (9,099) (10,686) - - General and administrative 1,431 4,231 3,910 5,074 2,697 2,365 1,730 1,978 637 15,912 11,681 7,771 6,711 4,346 2,616 Related party rent expense 62 208 133 180 144 111 159 116 150 665 457 324 536 425 266 Total Operating Expenses 1,493 4,440 4,042 5,254 2,841 2,476 1,889 2,094 788 16,577 12,138 8,095 7,247 4,771 2,882 - - Gain on sale of intangible assets - - - - - - (1,580) - - - - - (1,580) (1,580) - Foreign currency transaction (gains)/losses 97 225 583 209 322 (170) 37 60 207 1,341 1,115 532 135 304 267 Other operating income - - (0) (222) (121) (18) (3) (27) (0) (343) (343) (343) (48) (30) (27) Other operating expense (income) 97 225 583 (13) 201 (188) (1,546) 33 207 997 772 189 (1,494) (1,306) 240 - - Operating income (loss) 1,992 11,264 11,004 7,326 (1,574) (262) 1,244 (8,054) (5,754) 28,020 16,757 5,753 (12,826) (12,564) (13,808) - - Related party interest expense - - - - - 105 136 130 35 - - - 406 301 165 Related party interest income (83) (303) (153) (328) (157) - - - - (941) (638) (485) - - - Interest expense 230 53 144 235 151 29 - - - 583 530 386 29 - - Other non-operating expenses/(income) - - - (70) 70 (2) - - - - - - (2) - - Total non-operating expenses/(income), net 147 (250) (9) (163) 64 132 136 130 35 (358) (108) (99) 433 301 165 - - Net income (loss) before income taxes 1,844 11,514 11,013 7,489 (1,638) (394) 1,108 (8,184) (5,789) 28,378 16,865 5,852 (13,258) (12,865) (13,973) - - Income Tax Expense (Benefit) (1,688) (16,139) 966 - - - - - - (15,173) 966 - - - - - - Net income (loss) 3,532 27,653 10,047 7,489 (1,638) (394) 1,108 (8,184) (5,789) 43,551 15,899 5,852 (13,258) (12,865) (13,973)

Protected.net Group Limited Unaudited Condensed Balance Sheet (in thousands) 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 ASSETS Current assets: Cash 35,067$ 21,112$ 14,227$ 11,296$ 6,253$ 7,060$ 5,356$ 7,020$ Restricted cash 1,333 2,148 2,458 5,757 5,604 4,943 4,874 7,321 Prepaid expenses and other current assets 546 548 691 791 359 317 404 327 Deposits 15 3,000 3,000 3,000 3,000 3,000 3,000 - Total current assets 36,963 26,807 20,376 20,844 15,216 15,320 13,634 14,667 Due from related parties 33,082 33,115 26,249 15,719 10,230 - 244 139 Property, plant and equipment 616 398 373 370 270 195 184 196 Intangible Assets 369 386 415 62 53 54 90 108 Deferred tax assets 17,237 - - - - - - - Goodwill 284 284 284 - - - - - Total assets 88,550$ 60,991$ 47,696$ 36,995$ 25,769$ 15,568$ 14,153$ 15,112$ Liabilities and Shareholders’ Deficit: Accounts payable 216$ 3,029$ 732$ 2,876$ 3,005$ 2,698$ 3,739$ 436$ Accrued expenses 10,162 7,537 6,199 7,686 6,704 5,896 5,907 8,441 VAT tax liability 11,404 9,696 9,351 6,965 6,366 8,939 8,446 6,211 Deferred revenue 57,405 58,186 58,731 54,139 47,431 41,855 39,044 34,156 Related party deferred revenue 166 187 208 229 168 - - - Current portion of note payable 2,813 2,250 2,813 2,250 1,500 - - - Due to related party 23 - - - 4 3,501 5,599 6,243 Refund liability 537 429 449 597 512 558 405 428 Total current liabilities 82,725 81,313 78,482 74,741 65,690 63,447 63,140 55,915 Note payable, net of current portion and deferred financing costs 10,546 11,086 11,636 12,164 8,352 - - - Deferred tax liability - 966 - - - - - - Total liabilities 93,271$ 93,365$ 90,118$ 86,905$ 74,042$ 63,447$ 63,140$ 55,915$ Commitments and Contingencies Shareholders’ Deficit: Class A Preferred shares 11 11 11 11 11 11 11 11 Class B Common shares 11 11 11 11 11 11 11 11 Additional paid-in capital 40,953 40,953 40,953 40,953 40,953 40,953 40,953 40,953 Accumulated deficit (45,696) (73,349) (83,396) (90,885) (89,247) (88,854) (89,962) (81,778) Total Shareholders’ deficit (4,721) (32,374) (42,421) (49,911) (48,273) (47,879) (48,987) (40,803) Total Liabilities and Shareholders’ Deficit 88,550$ 60,991$ 47,696$ 36,995$ 25,769$ 15,568$ 14,153$ 15,112$ *Class A Preferred shares, par value £0.0001 per share, 7,992,009 shares authorized, issued, and outstanding on September 30, 2021 and December 31, 2020, respectively **Class B Common shares, par value £0.0001 per share, 7,960,105 shares authorized, issued, and outstanding on September 30, 2021 and December 31, 2020, respectively

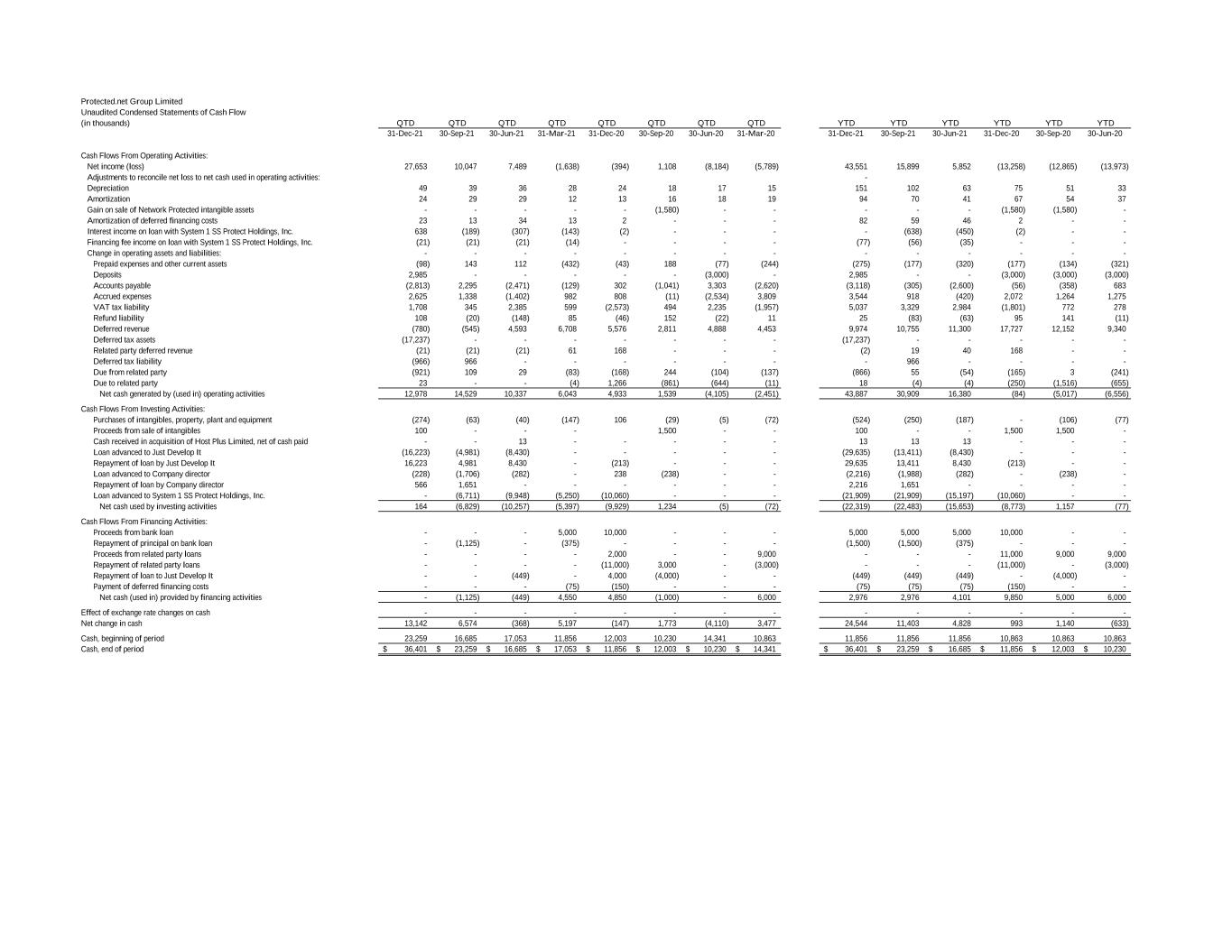

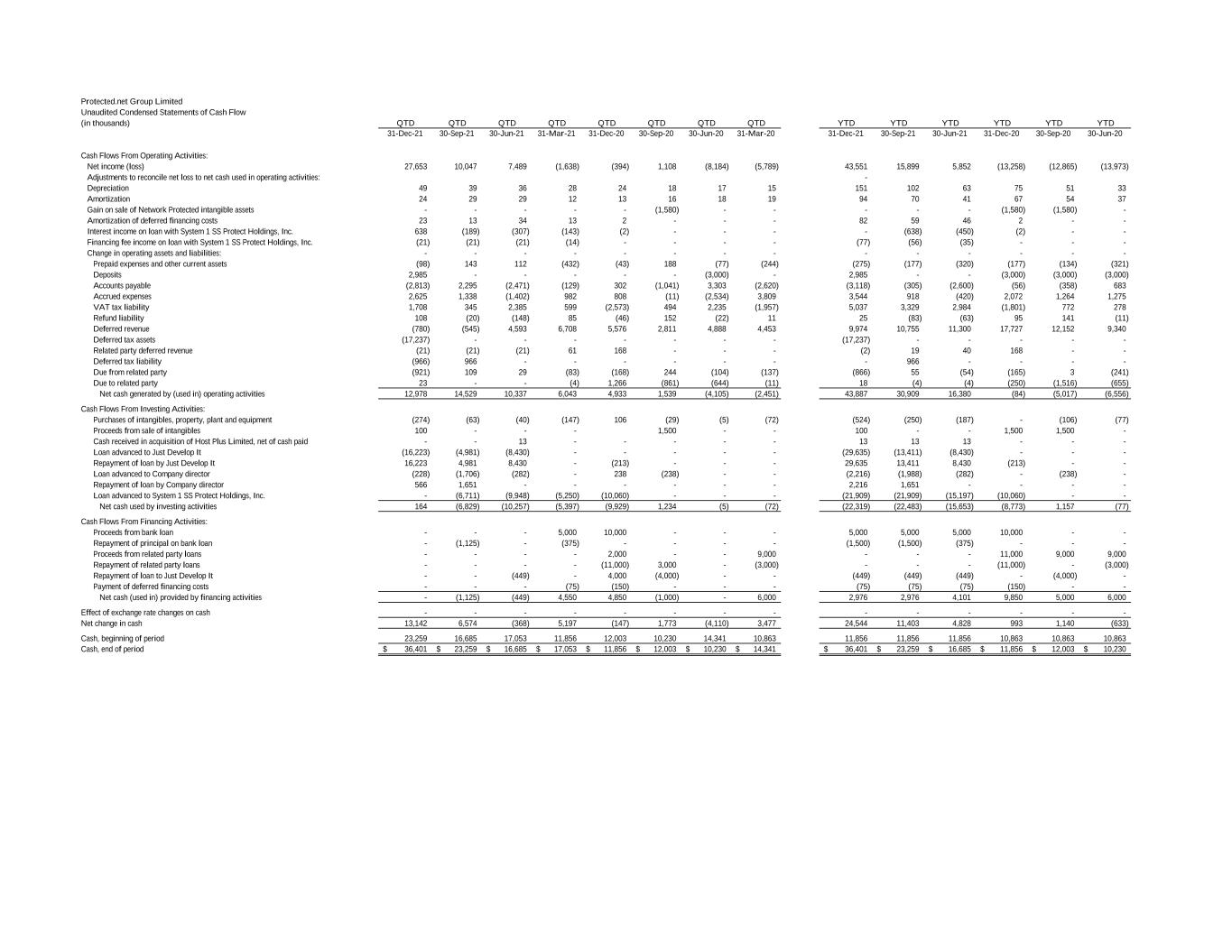

Protected.net Group Limited Unaudited Condensed Statements of Cash Flow (in thousands) QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Cash Flows From Operating Activities: Net income (loss) 27,653 10,047 7,489 (1,638) (394) 1,108 (8,184) (5,789) 43,551 15,899 5,852 (13,258) (12,865) (13,973) Adjustments to reconcile net loss to net cash used in operating activities: - Depreciation 49 39 36 28 24 18 17 15 151 102 63 75 51 33 Amortization 24 29 29 12 13 16 18 19 94 70 41 67 54 37 Gain on sale of Network Protected intangible assets - - - - - (1,580) - - - - - (1,580) (1,580) - Amortization of deferred financing costs 23 13 34 13 2 - - - 82 59 46 2 - - Interest income on loan with System 1 SS Protect Holdings, Inc. 638 (189) (307) (143) (2) - - - - (638) (450) (2) - - Financing fee income on loan with System 1 SS Protect Holdings, Inc. (21) (21) (21) (14) - - - - (77) (56) (35) - - - Change in operating assets and liabilities: - - - - - - - - - - - - - - Prepaid expenses and other current assets (98) 143 112 (432) (43) 188 (77) (244) (275) (177) (320) (177) (134) (321) Deposits 2,985 - - - - - (3,000) - 2,985 - - (3,000) (3,000) (3,000) Accounts payable (2,813) 2,295 (2,471) (129) 302 (1,041) 3,303 (2,620) (3,118) (305) (2,600) (56) (358) 683 Accrued expenses 2,625 1,338 (1,402) 982 808 (11) (2,534) 3,809 3,544 918 (420) 2,072 1,264 1,275 VAT tax liability 1,708 345 2,385 599 (2,573) 494 2,235 (1,957) 5,037 3,329 2,984 (1,801) 772 278 Refund liability 108 (20) (148) 85 (46) 152 (22) 11 25 (83) (63) 95 141 (11) Deferred revenue (780) (545) 4,593 6,708 5,576 2,811 4,888 4,453 9,974 10,755 11,300 17,727 12,152 9,340 Deferred tax assets (17,237) - - - - - - - (17,237) - - - - - Related party deferred revenue (21) (21) (21) 61 168 - - - (2) 19 40 168 - - Deferred tax liability (966) 966 - - - - - - - 966 - - - - Due from related party (921) 109 29 (83) (168) 244 (104) (137) (866) 55 (54) (165) 3 (241) Due to related party 23 - - (4) 1,266 (861) (644) (11) 18 (4) (4) (250) (1,516) (655) Net cash generated by (used in) operating activities 12,978 14,529 10,337 6,043 4,933 1,539 (4,105) (2,451) 43,887 30,909 16,380 (84) (5,017) (6,556) Cash Flows From Investing Activities: Purchases of intangibles, property, plant and equipment (274) (63) (40) (147) 106 (29) (5) (72) (524) (250) (187) - (106) (77) Proceeds from sale of intangibles 100 - - - 1,500 - - 100 - - 1,500 1,500 - Cash received in acquisition of Host Plus Limited, net of cash paid - - 13 - - - - - 13 13 13 - - - Loan advanced to Just Develop It (16,223) (4,981) (8,430) - - - - - (29,635) (13,411) (8,430) - - - Repayment of loan by Just Develop It 16,223 4,981 8,430 - (213) - - - 29,635 13,411 8,430 (213) - - Loan advanced to Company director (228) (1,706) (282) - 238 (238) - - (2,216) (1,988) (282) - (238) - Repayment of loan by Company director 566 1,651 - - - - - - 2,216 1,651 - - - - Loan advanced to System 1 SS Protect Holdings, Inc. - (6,711) (9,948) (5,250) (10,060) - - - (21,909) (21,909) (15,197) (10,060) - - Net cash used by investing activities 164 (6,829) (10,257) (5,397) (9,929) 1,234 (5) (72) (22,319) (22,483) (15,653) (8,773) 1,157 (77) Cash Flows From Financing Activities: Proceeds from bank loan - - - 5,000 10,000 - - - 5,000 5,000 5,000 10,000 - - Repayment of principal on bank loan - (1,125) - (375) - - - - (1,500) (1,500) (375) - - - Proceeds from related party loans - - - - 2,000 - - 9,000 - - - 11,000 9,000 9,000 Repayment of related party loans - - - - (11,000) 3,000 - (3,000) - - - (11,000) - (3,000) Repayment of loan to Just Develop It - - (449) - 4,000 (4,000) - - (449) (449) (449) - (4,000) - Payment of deferred financing costs - - - (75) (150) - - - (75) (75) (75) (150) - - Net cash (used in) provided by financing activities - (1,125) (449) 4,550 4,850 (1,000) - 6,000 2,976 2,976 4,101 9,850 5,000 6,000 Effect of exchange rate changes on cash - - - - - - - - - - - - - - Net change in cash 13,142 6,574 (368) 5,197 (147) 1,773 (4,110) 3,477 24,544 11,403 4,828 993 1,140 (633) Cash, beginning of period 23,259 16,685 17,053 11,856 12,003 10,230 14,341 10,863 11,856 11,856 11,856 10,863 10,863 10,863 Cash, end of period 36,401$ 23,259$ 16,685$ 17,053$ 11,856$ 12,003$ 10,230$ 14,341$ 36,401$ 23,259$ 16,685$ 11,856$ 12,003$ 10,230$

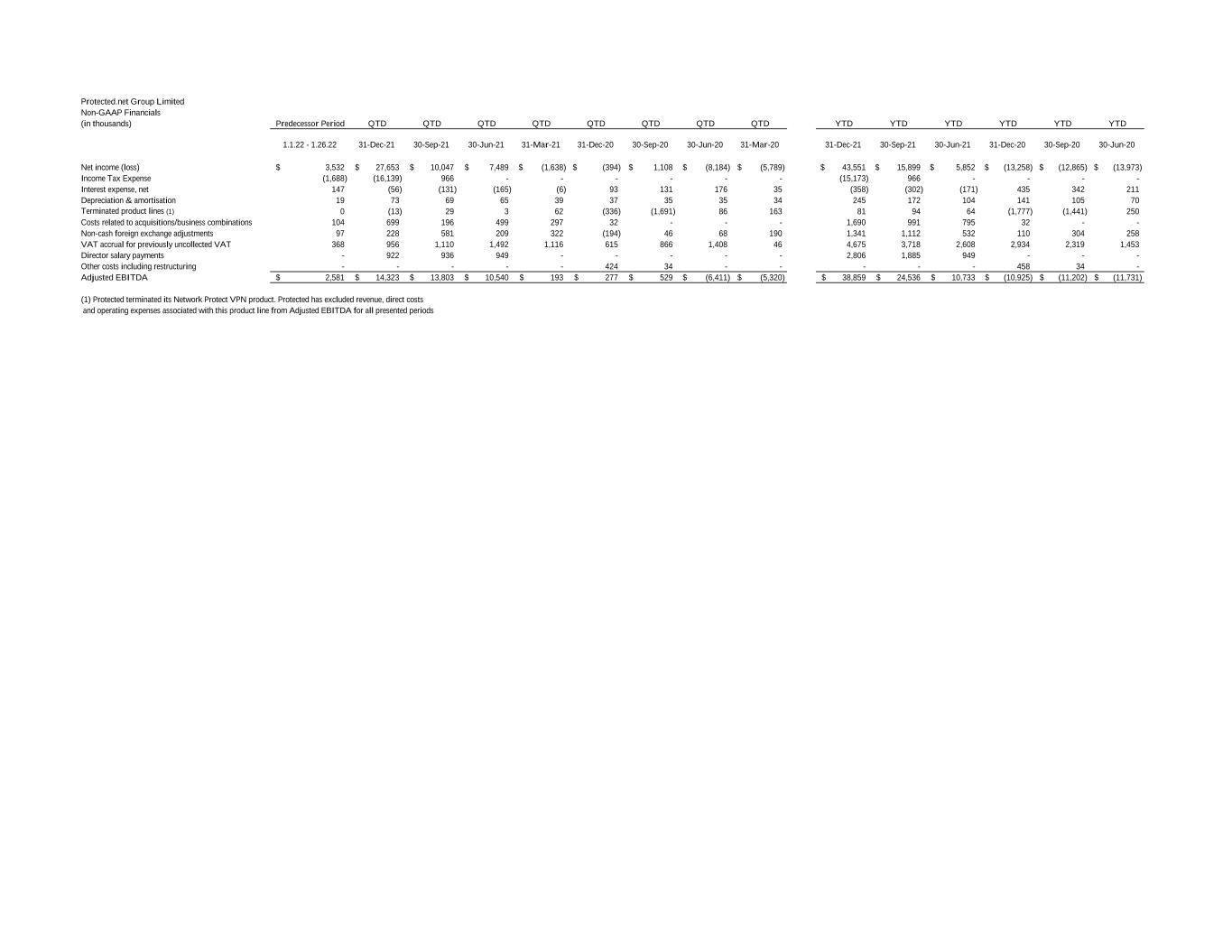

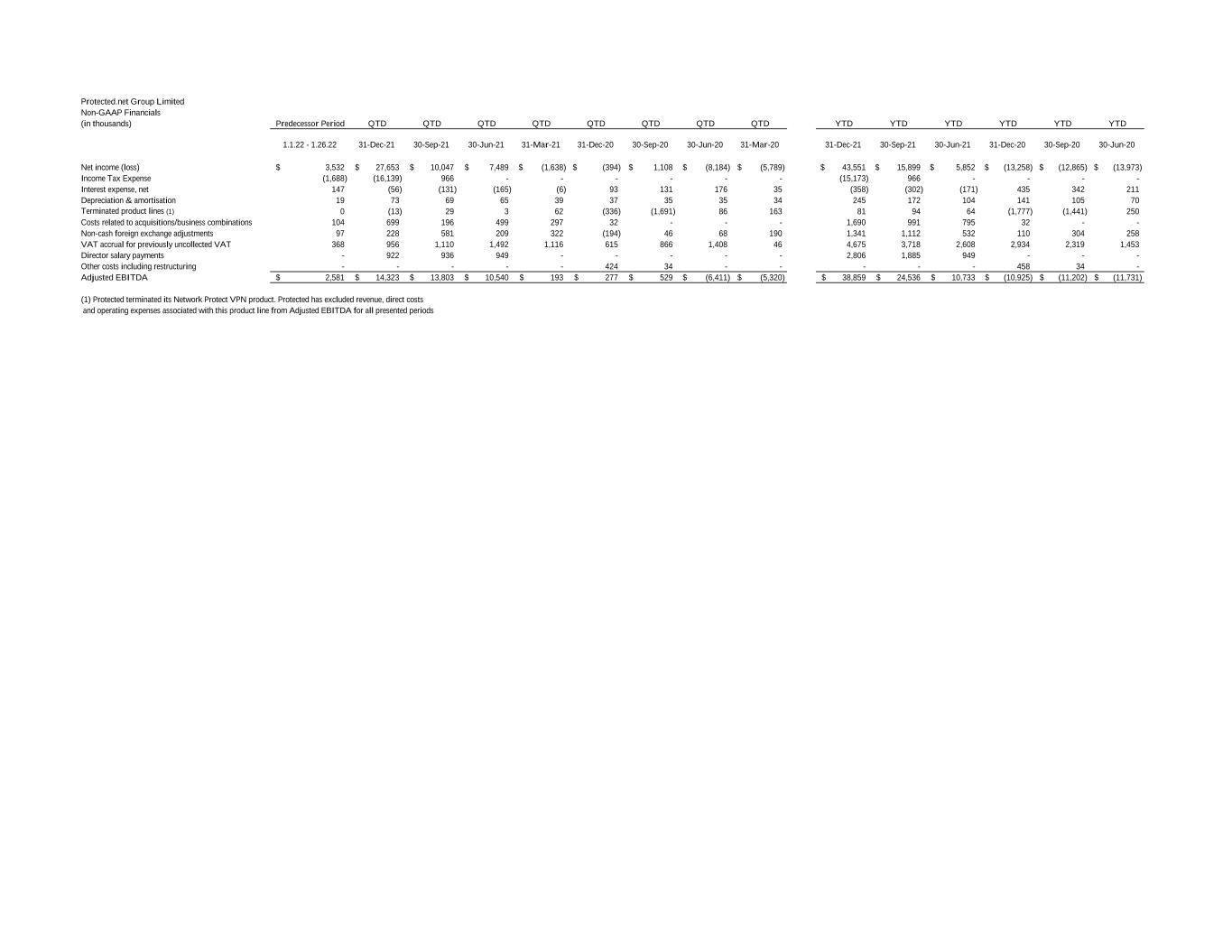

Protected.net Group Limited Non-GAAP Financials (in thousands) Predecessor Period QTD QTD QTD QTD QTD QTD QTD QTD YTD YTD YTD YTD YTD YTD 1.1.22 - 1.26.22 31-Dec-21 30-Sep-21 30-Jun-21 31-Mar-21 31-Dec-20 30-Sep-20 30-Jun-20 31-Mar-20 31-Dec-21 30-Sep-21 30-Jun-21 31-Dec-20 30-Sep-20 30-Jun-20 Net income (loss) 3,532$ 27,653$ 10,047$ 7,489$ (1,638)$ (394)$ 1,108$ (8,184)$ (5,789)$ 43,551$ 15,899$ 5,852$ (13,258)$ (12,865)$ (13,973)$ Income Tax Expense (1,688) (16,139) 966 - - - - - - (15,173) 966 - - - - Interest expense, net 147 (56) (131) (165) (6) 93 131 176 35 (358) (302) (171) 435 342 211 Depreciation & amortisation 19 73 69 65 39 37 35 35 34 245 172 104 141 105 70 Terminated product lines (1) 0 (13) 29 3 62 (336) (1,691) 86 163 81 94 64 (1,777) (1,441) 250 Costs related to acquisitions/business combinations 104 699 196 499 297 32 - - - 1,690 991 795 32 - - Non-cash foreign exchange adjustments 97 228 581 209 322 (194) 46 68 190 1,341 1,112 532 110 304 258 VAT accrual for previously uncollected VAT 368 956 1,110 1,492 1,116 615 866 1,408 46 4,675 3,718 2,608 2,934 2,319 1,453 Director salary payments - 922 936 949 - - - - - 2,806 1,885 949 - - - Other costs including restructuring - - - - - 424 34 - - - - - 458 34 - Adjusted EBITDA 2,581$ 14,323$ 13,803$ 10,540$ 193$ 277$ 529$ (6,411)$ (5,320)$ 38,859$ 24,536$ 10,733$ (10,925)$ (11,202)$ (11,731)$ (1) Protected terminated its Network Protect VPN product. Protected has excluded revenue, direct costs and operating expenses associated with this product line from Adjusted EBITDA for all presented periods