Corporate Presentation June 2022 Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Exhibit 99.2

Forward-Looking Statements and Legal Disclaimers This presentation contains express or implied forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements that are based on our management's belief and assumptions and on information currently available to our management. Although we believe that the expectations reflected in these forward-looking statements are reasonable, these statements relate to future events or our future operational or financial performance, and involve known and unknown risks, uncertainties and other factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by these forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as "may," "should," "expects," "intends," "plans," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties, and other facts, which are, in some cases, beyond our control and which could materially affect results. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. These risks and uncertainties include, but are not limited to, uncertainties inherent in the drug development process, including Fusions’ programs’ early stage of development, the process of designing and conducting preclinical and clinical trials, the regulatory approval processes, the timing of regulatory filings, the challenges associated with manufacturing drug products, Fusion’s ability to successfully establish, protect and defend its intellectual property, risks relating to business interruptions resulting from the coronavirus (COVID-19) disease outbreak or similar public health crises and other matters that could affect the sufficiency of existing cash to fund operations. For a discussion of other risks and uncertainties, and other important factors, see the section entitled “Risk Factors” in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2022, as well as other risks detailed in the Company’s subsequent filings with the Securities and Exchange Commission. You should read this presentation and the documents that we reference in this presentation completely and with the understanding that our actual future results may be materially different from any future results expressed or implied by these forward-looking statements. The forward-looking statements in this presentation represent our views as of the date of this presentation. We anticipate that subsequent events and developments will cause our views to change. However, while we may elect to update these forward-looking statements at some point in the future, we have no current intention of doing so except to the extent required by applicable law. You should therefore not rely on these forward-looking statements as representing our views as of any date subsequent to the date of this presentation. This presentation also contains estimates, projections and other information concerning our industry, our business and the markets for our product candidates. Information that is based on estimates, forecasts, projections, market research or similar methodologies is inherently subject to uncertainties and actual events or circumstances may differ materially from events and circumstances that are assumed in this information. Unless otherwise expressly stated, we obtained this industry, business, market, and other data from our own internal estimates and research as well as from reports, research, surveys, studies, and similar data prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources. While we are not aware of any misstatements regarding any third-party information presented in this presentation, their estimates, in particular, as they relate to projections, involve numerous assumptions, are subject to risks and uncertainties and are subject to change based on various factors. Market data and industry information used throughout this presentation are based on management’s knowledge of the industry and the good faith estimates of management. We also relied, to the extent available, upon management’s review of independent industry surveys and publications and other publicly available information prepared by a number of third party sources. All of the market data and industry information used in this presentation involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, we cannot guarantee the accuracy or completeness of this information, and we have not independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. No representations or warranties are made by the Company or any of its affiliates as to the accuracy of any such statements or projections. Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

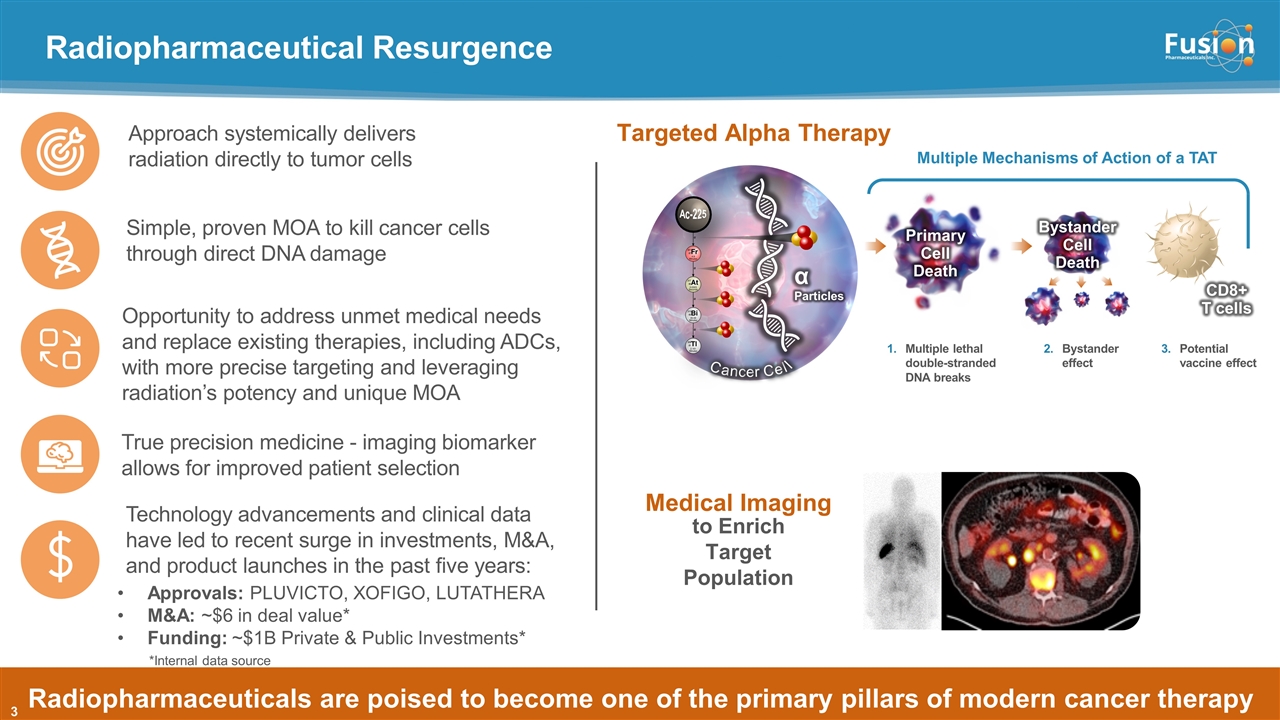

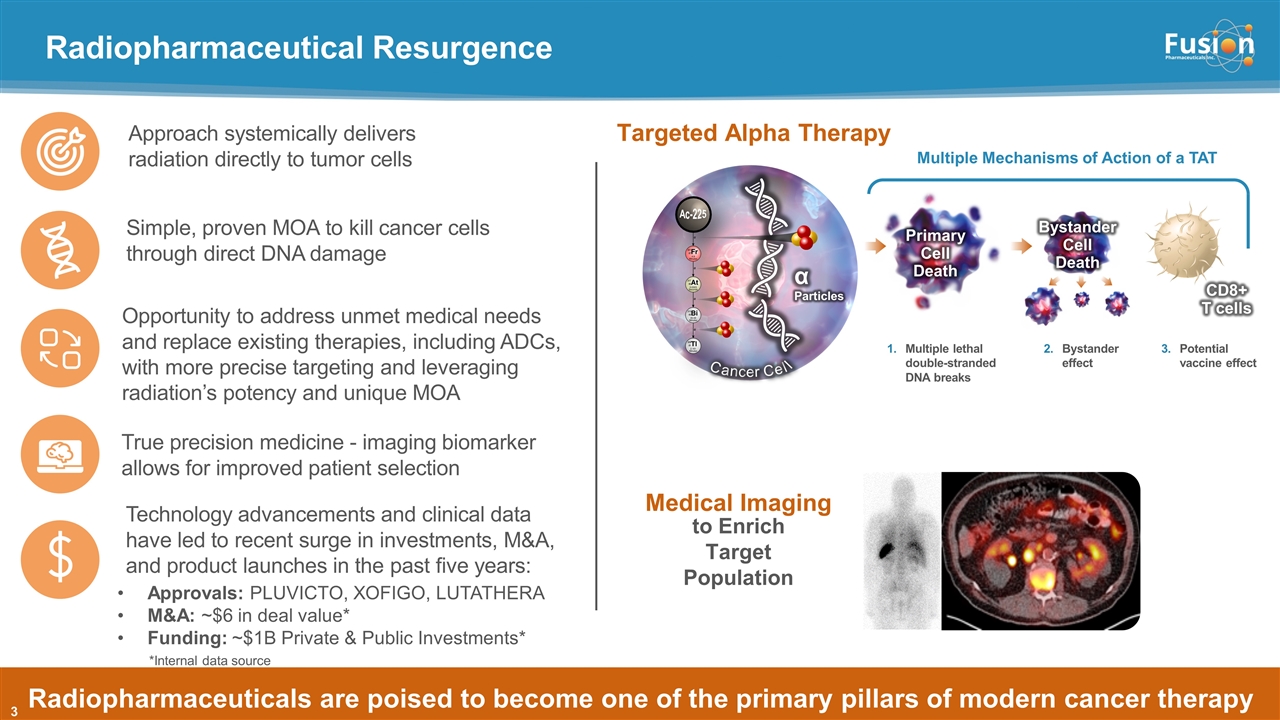

Radiopharmaceutical Resurgence Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Radiopharmaceuticals are poised to become one of the primary pillars of modern cancer therapy Simple, proven MOA to kill cancer cells through direct DNA damage Technology advancements and clinical data have led to recent surge in investments, M&A, and product launches in the past five years: Approach systemically delivers radiation directly to tumor cells True precision medicine - imaging biomarker allows for improved patient selection Opportunity to address unmet medical needs and replace existing therapies, including ADCs, with more precise targeting and leveraging radiation’s potency and unique MOA Approvals: PLUVICTO, XOFIGO, LUTATHERA M&A: ~$6 in deal value* Funding: ~$1B Private & Public Investments* α Particles Primary Cell Death Cancer Cell CD8+ T cells Ac-225 Multiple lethal double-stranded DNA breaks Bystander effect Potential vaccine effect Bystander Cell Death Multiple Mechanisms of Action of a TAT Medical Imaging to Enrich Target Population Targeted Alpha Therapy *Internal data source

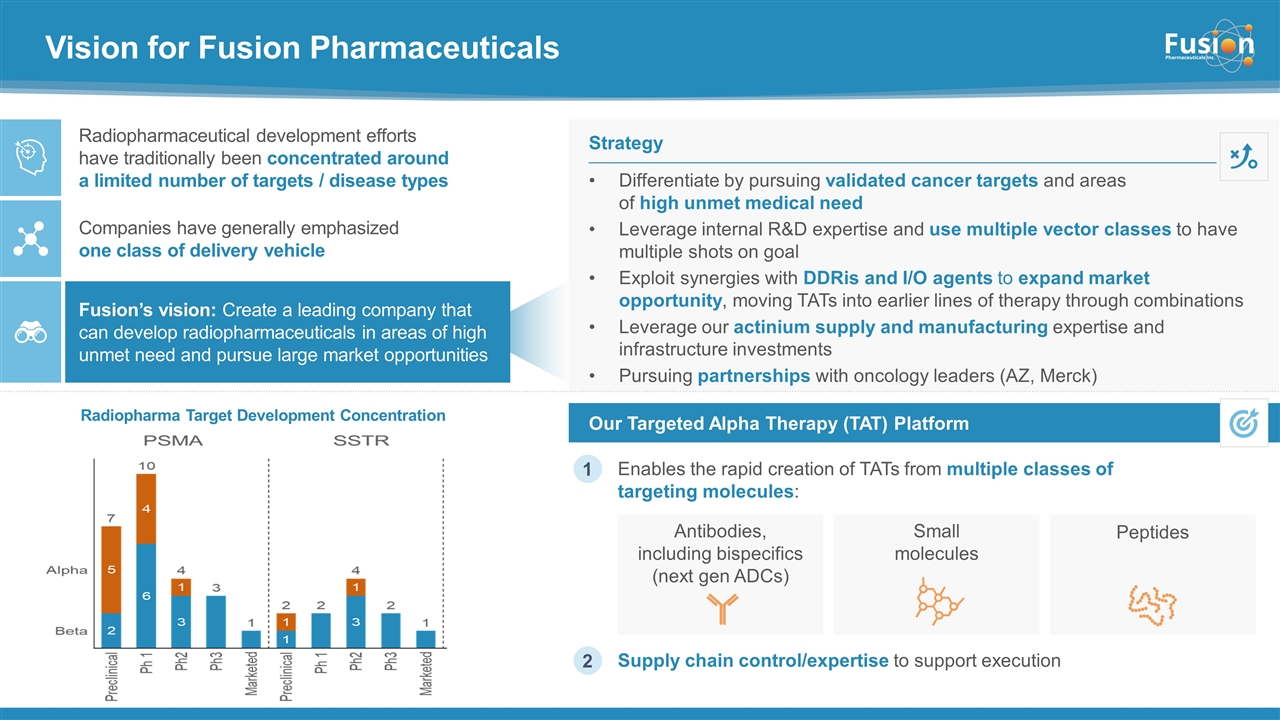

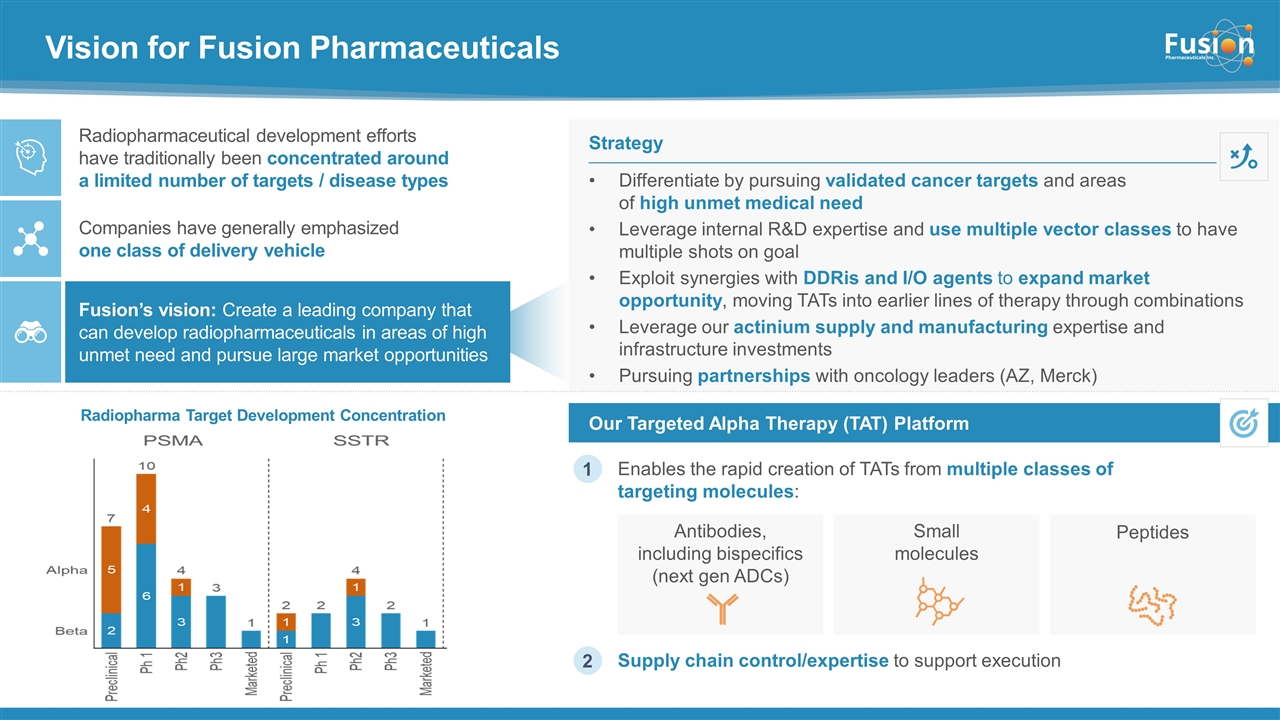

Vision for Fusion Pharmaceuticals Enables the rapid creation of TATs from multiple classes of targeting molecules: Our Targeted Alpha Therapy (TAT) Platform Differentiate by pursuing validated cancer targets and areas of high unmet medical need Leverage internal R&D expertise and use multiple vector classes to have multiple shots on goal Exploit synergies with DDRis and I/O agents to expand market opportunity, moving TATs into earlier lines of therapy through combinations Leverage our actinium supply and manufacturing expertise and infrastructure investments Pursuing partnerships with oncology leaders (AZ, Merck) Strategy Radiopharmaceutical development efforts have traditionally been concentrated around a limited number of targets / disease types Fusion’s vision: Create a leading company that can develop radiopharmaceuticals in areas of high unmet need and pursue large market opportunities Companies have generally emphasized one class of delivery vehicle 1 Supply chain control/expertise to support execution Antibodies, including bispecifics (next gen ADCs) Small molecules Peptides 2 Radiopharma Target Development Concentration

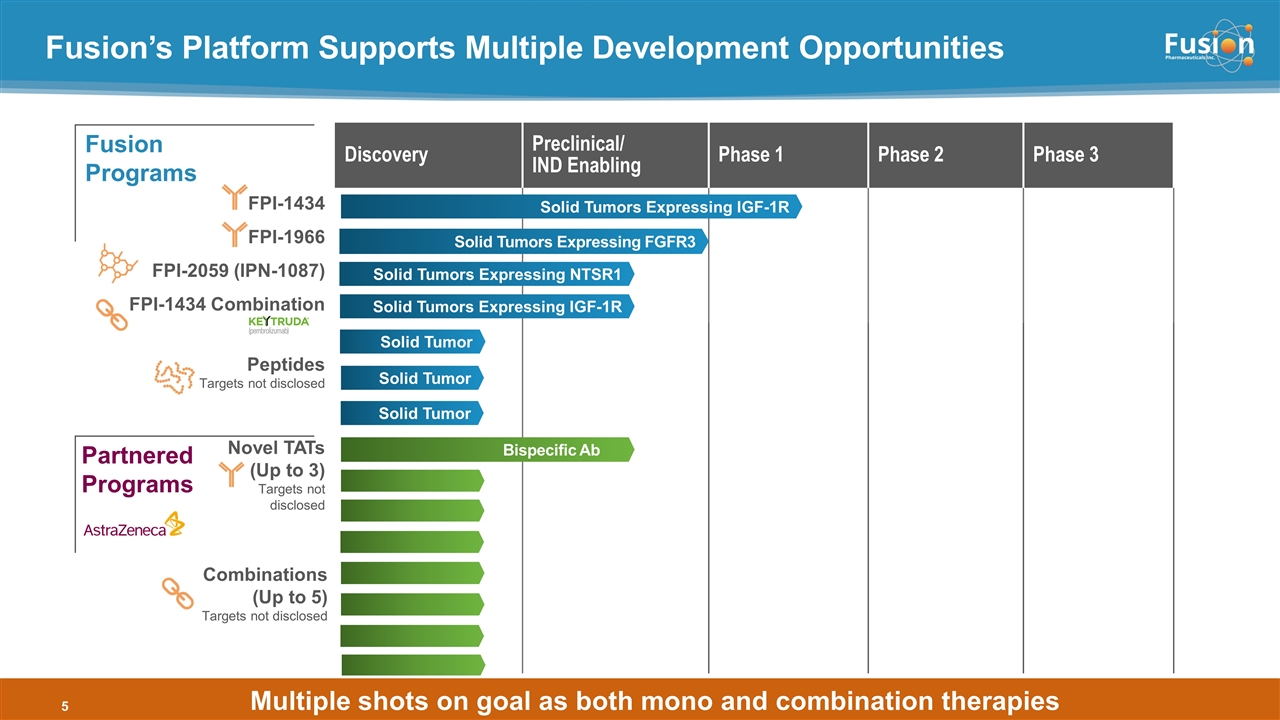

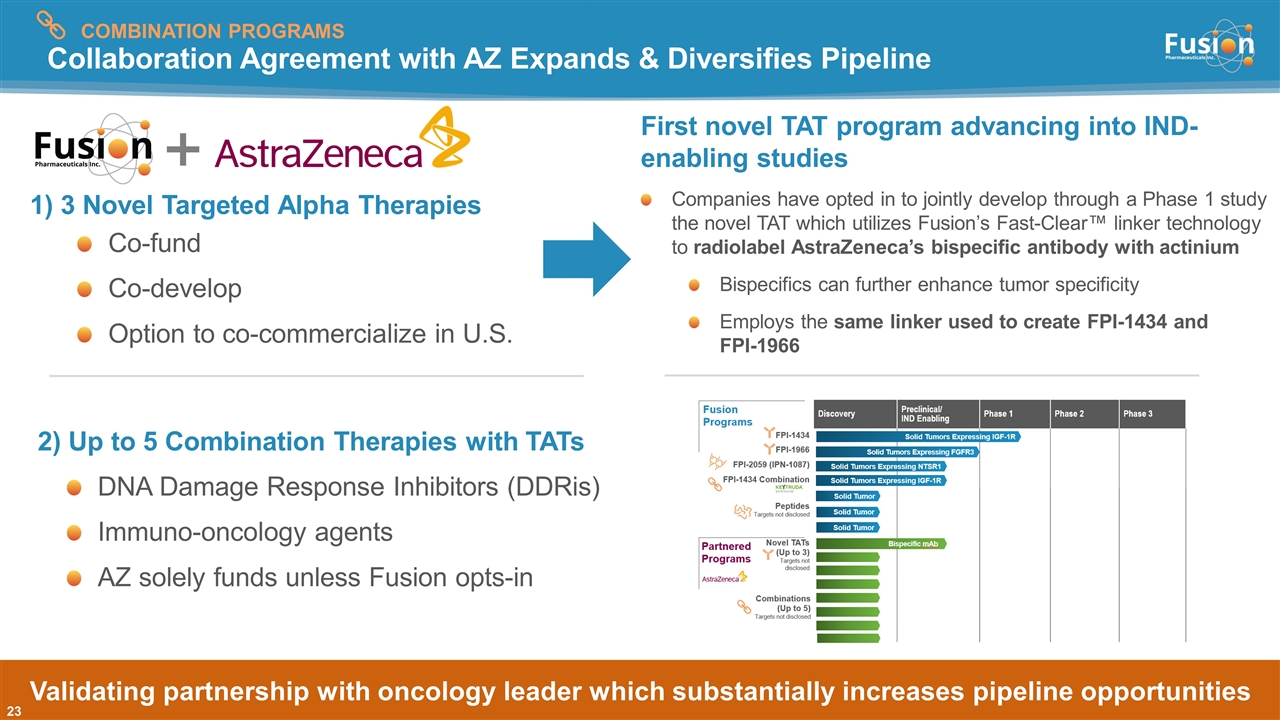

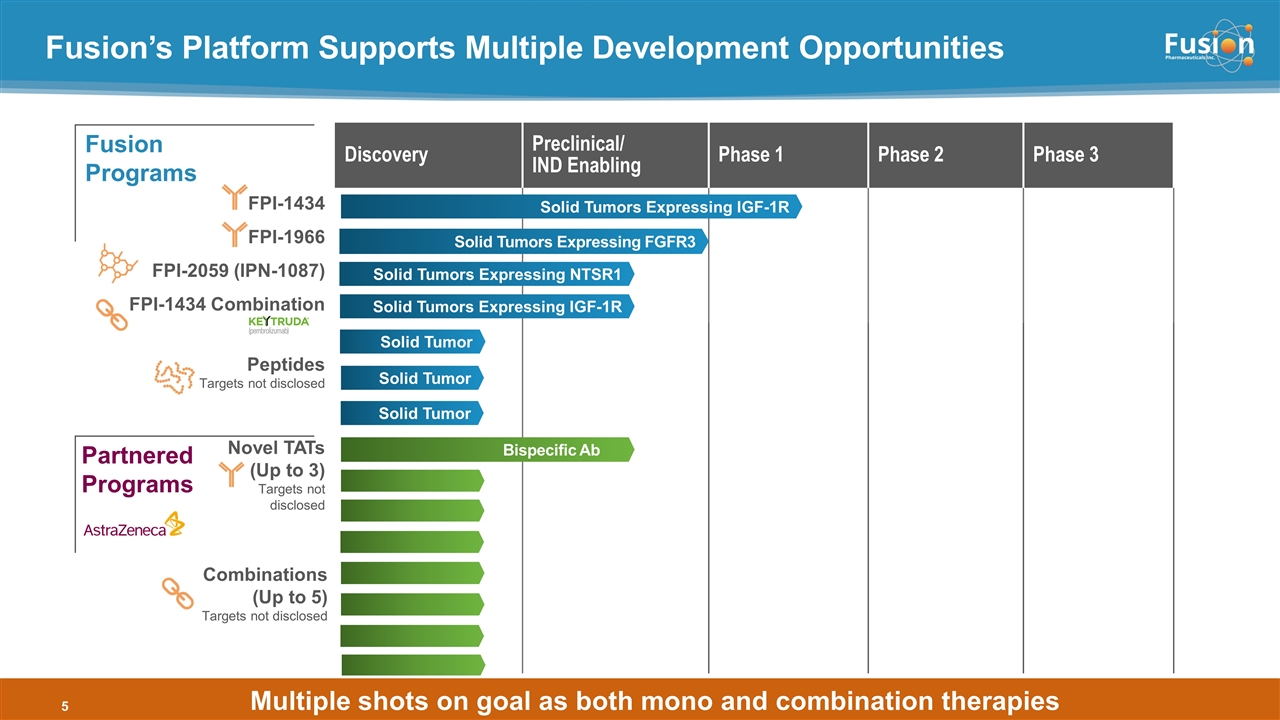

Fusion’s Platform Supports Multiple Development Opportunities Discovery Preclinical/ IND Enabling Phase 1 Phase 2 Phase 3 FPI-1434 FPI-1966 FPI-2059 (IPN-1087) FPI-1434 Combination Peptides Targets not disclosed Novel TATs (Up to 3) Targets not disclosed Solid Tumors Expressing IGF-1R Solid Tumors Expressing IGF-1R Solid Tumors Expressing NTSR1 Solid Tumor Bispecific Ab Partnered Programs Fusion Programs Solid Tumors Expressing FGFR3 Multiple shots on goal as both mono and combination therapies Solid Tumor Solid Tumor Combinations (Up to 5) Targets not disclosed

Fusion’s Radiopharmaceutical & Oncology Drug Development Expertise Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved CTO Eric Burak, PhD CFO John Crowley, CPA CHIEF OF STAFF Cara Ferreira, PhD CEO John Valliant, PhD CMO James O’Leary, MD PRESIDENT & CBO Mohit Rawat CLO Maria Stahl, JD CSO Chris Leamon, PhD Fusion’s team has deep radiopharmaceutical & oncology expertise: Creation and operation of a global radiopharmaceutical manufacturer INDs/CTAs and development of multiple radiopharmaceuticals including TATs Development of PSMA-targeted radiopharmaceutical acquired by Novartis R&D leadership at Nordion, a global leader in medical isotope and radiopharmaceutical production Commercial leadership within Novartis Oncology Head of regulatory at Advanced Accelerator Applications (now a Novartis company), developer of Lutathera

Programs Fusion’s growing and diverse portfolio Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Antibodies: FPI-1434, FPI-1966, Bispecific antibody via AZ collaboration Small Molecules: FPI-2059 Peptides: Discovery partnerships Combinations: Pharma collaborations

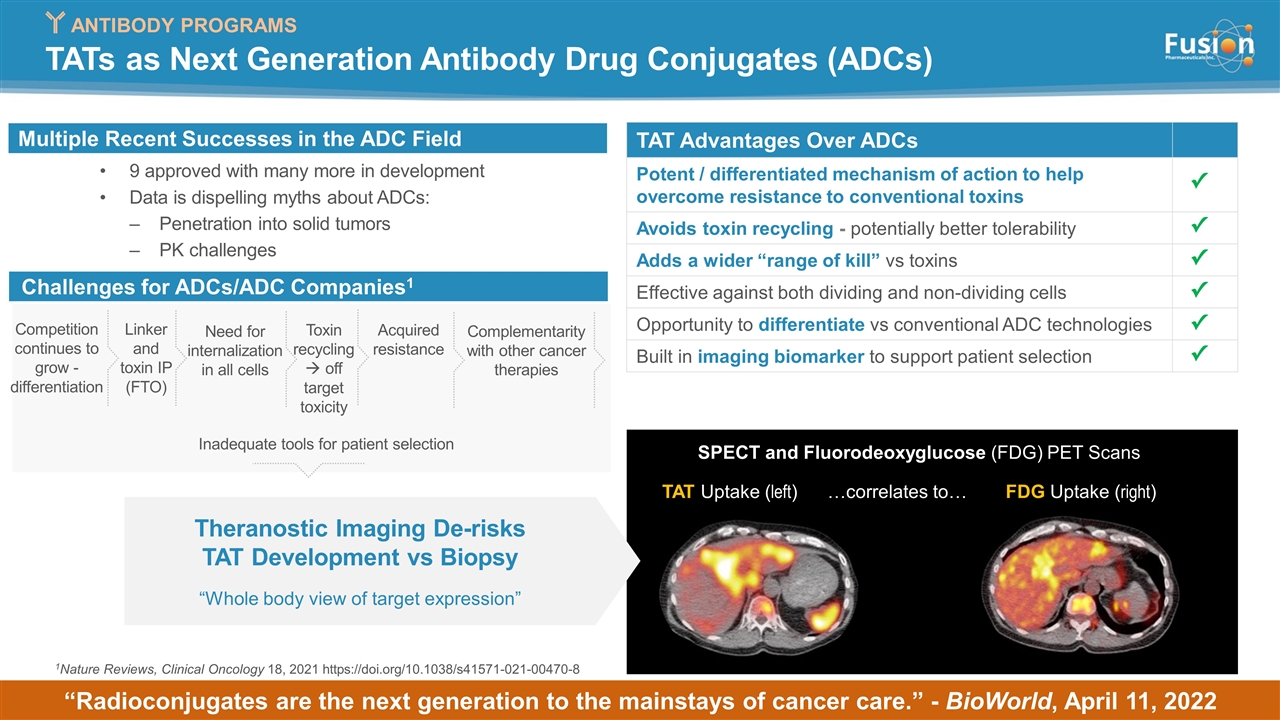

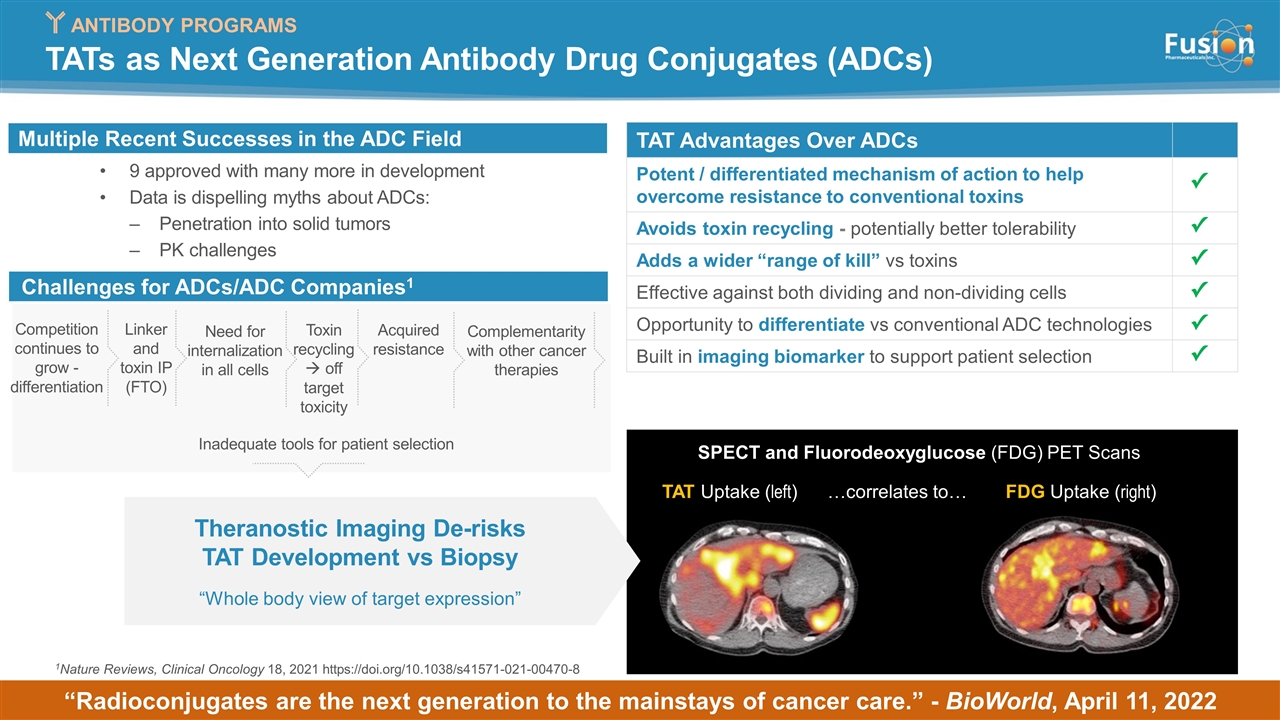

TATs as Next Generation Antibody Drug Conjugates (ADCs) SPECT and Fluorodeoxyglucose (FDG) PET Scans TAT Uptake (left) FDG Uptake (right) …correlates to… Theranostic Imaging De-risks TAT Development vs Biopsy “Whole body view of target expression” 1Nature Reviews, Clinical Oncology 18, 2021 https://doi.org/10.1038/s41571-021-00470-8 TAT Advantages Over ADCs Potent / differentiated mechanism of action to help overcome resistance to conventional toxins Avoids toxin recycling - potentially better tolerability Adds a wider “range of kill” vs toxins Effective against both dividing and non-dividing cells Opportunity to differentiate vs conventional ADC technologies Built in imaging biomarker to support patient selection 9 approved with many more in development Data is dispelling myths about ADCs: Penetration into solid tumors PK challenges “Radioconjugates are the next generation to the mainstays of cancer care.” - BioWorld, April 11, 2022 ANTIBODY PROGRAMS Challenges for ADCs/ADC Companies1 Competition continues to grow - differentiation Linker and toxin IP (FTO) Need for internalization in all cells Toxin recycling à off target toxicity Acquired resistance Complementarity with other cancer therapies Multiple Recent Successes in the ADC Field Inadequate tools for patient selection

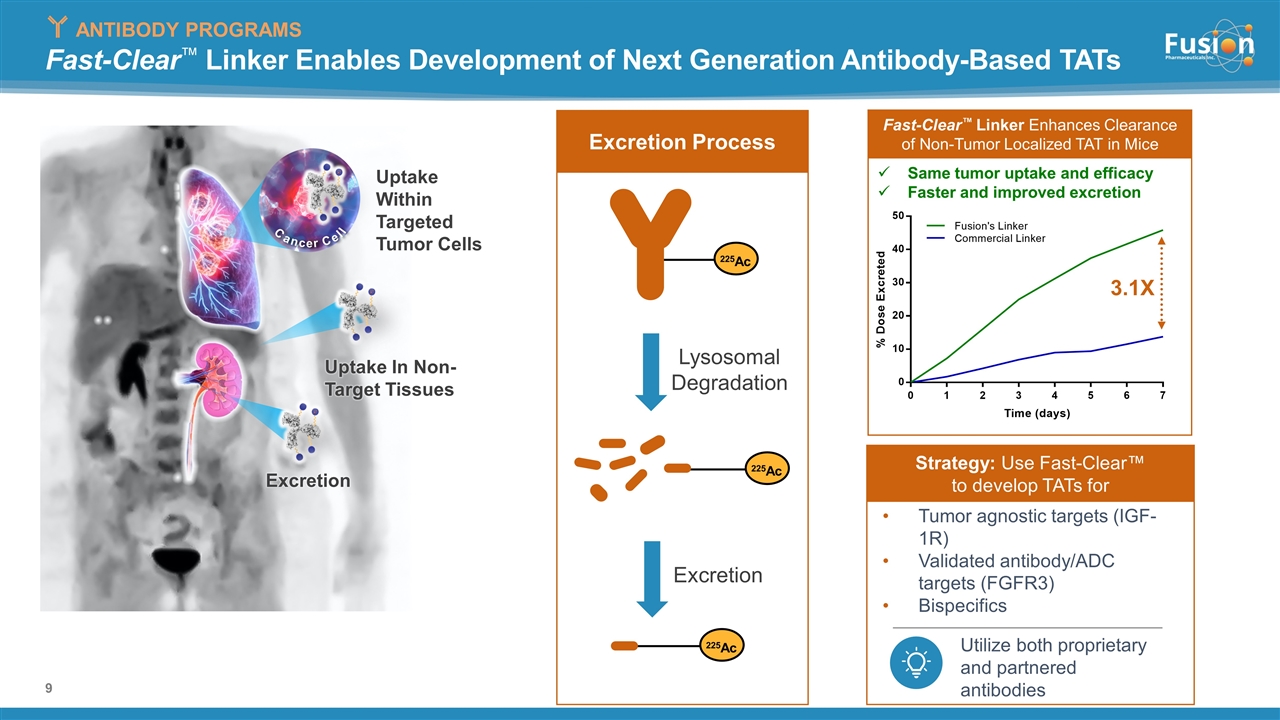

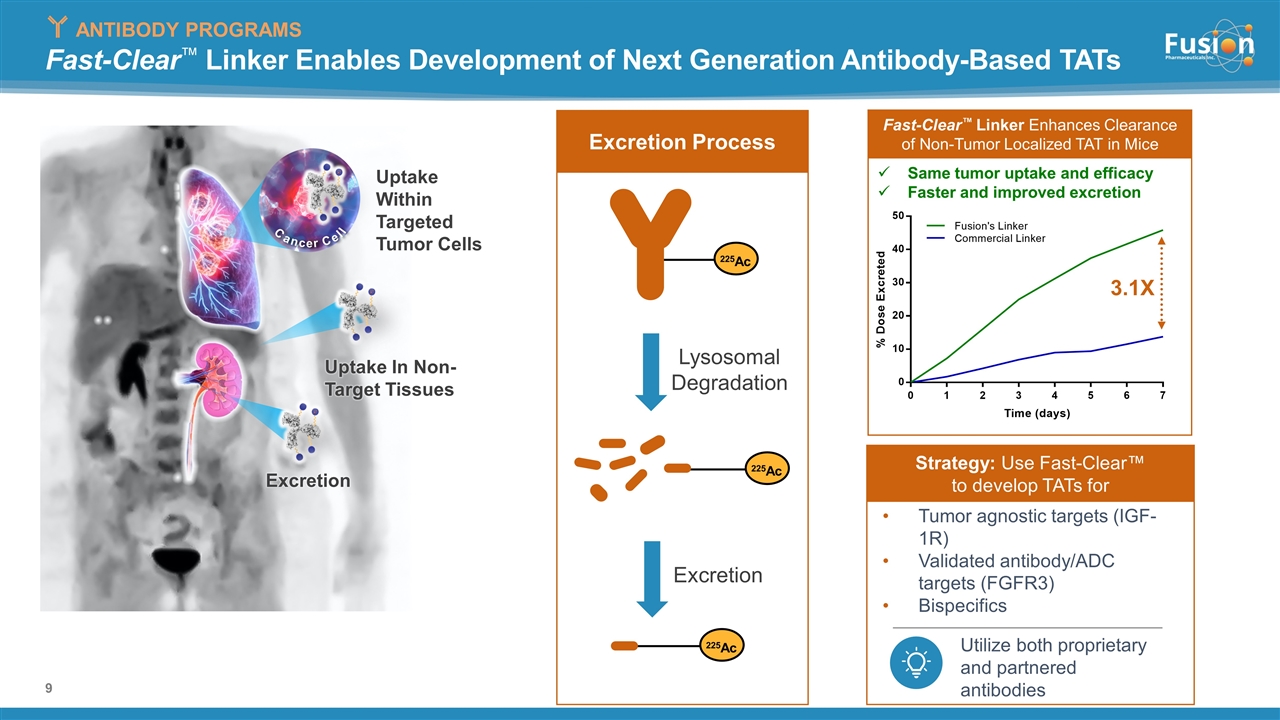

Fast-Clear™ Linker Enables Development of Next Generation Antibody-Based TATs Cancer Cell Uptake Within Targeted Tumor Cells Excretion Uptake In Non- Target Tissues Rapid Reduction 225Ac Lysosomal Degradation 225Ac 225Ac Excretion Excretion Process ANTIBODY PROGRAMS Tumor agnostic targets (IGF-1R) Validated antibody/ADC targets (FGFR3) Bispecifics Utilize both proprietary and partnered antibodies Strategy: Use Fast-Clear™ to develop TATs for Fast-Clear™ Linker Enhances Clearance of Non-Tumor Localized TAT in Mice Same tumor uptake and efficacy Faster and improved excretion 3.1X

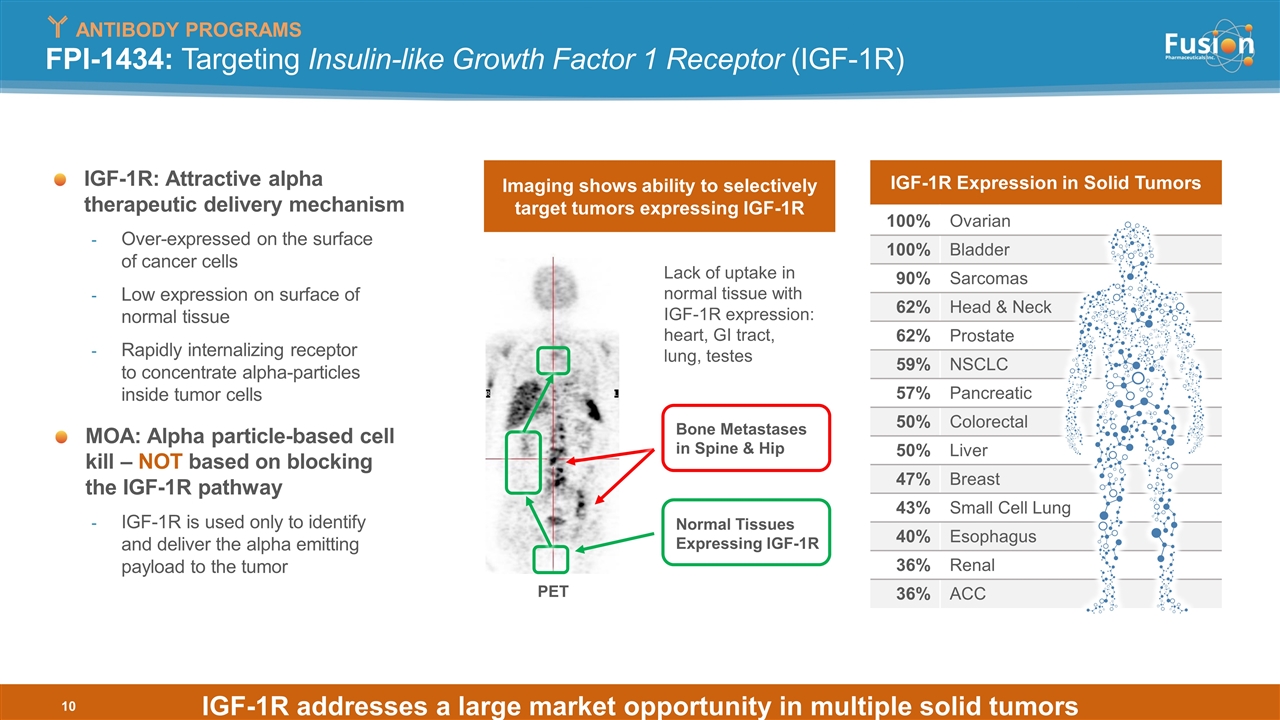

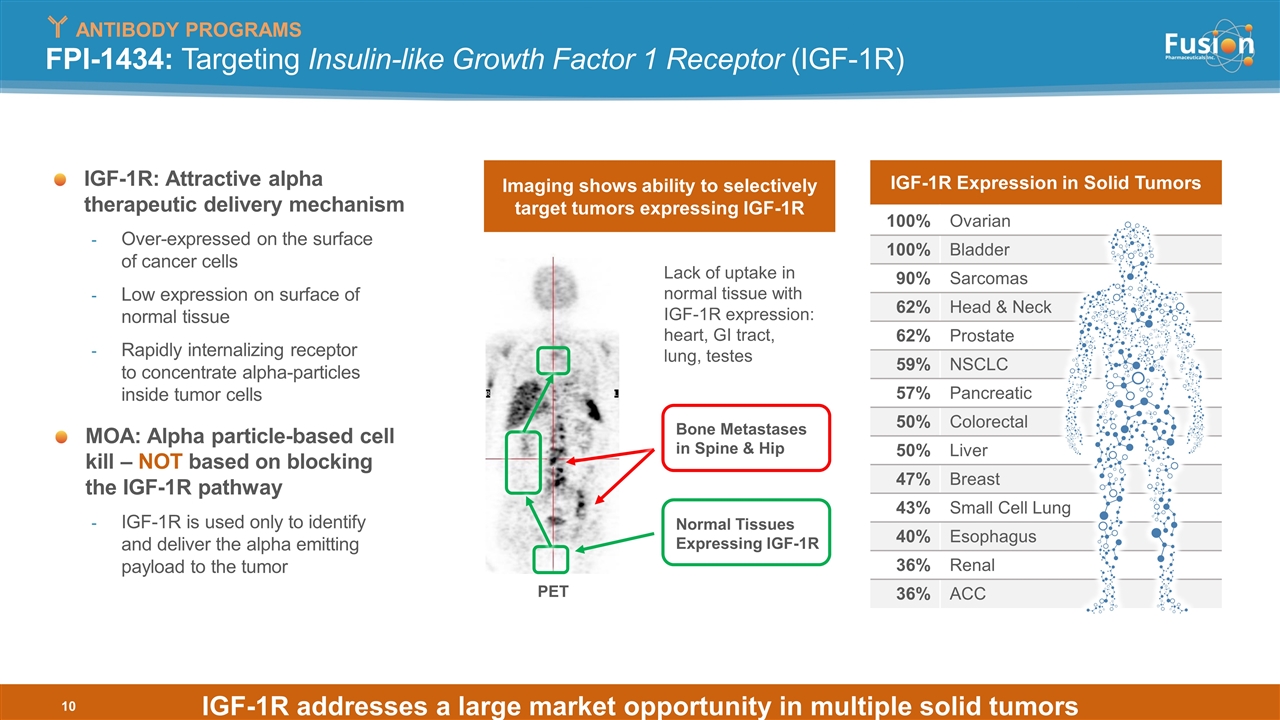

FPI-1434: Targeting Insulin-like Growth Factor 1 Receptor (IGF-1R) IGF-1R Expression in Solid Tumors 100% Ovarian 100% Bladder 90% Sarcomas 62% Head & Neck 62% Prostate 59% NSCLC 57% Pancreatic 50% Colorectal 50% Liver 47% Breast 43% Small Cell Lung 40% Esophagus 36% Renal 36% ACC IGF-1R: Attractive alpha therapeutic delivery mechanism Over-expressed on the surface of cancer cells Low expression on surface of normal tissue Rapidly internalizing receptor to concentrate alpha-particles inside tumor cells MOA: Alpha particle-based cell kill – NOT based on blocking the IGF-1R pathway IGF-1R is used only to identify and deliver the alpha emitting payload to the tumor PET Lack of uptake in normal tissue with IGF-1R expression: heart, GI tract, lung, testes Normal Tissues Expressing IGF-1R Bone Metastases in Spine & Hip Imaging shows ability to selectively target tumors expressing IGF-1R ANTIBODY PROGRAMS IGF-1R addresses a large market opportunity in multiple solid tumors

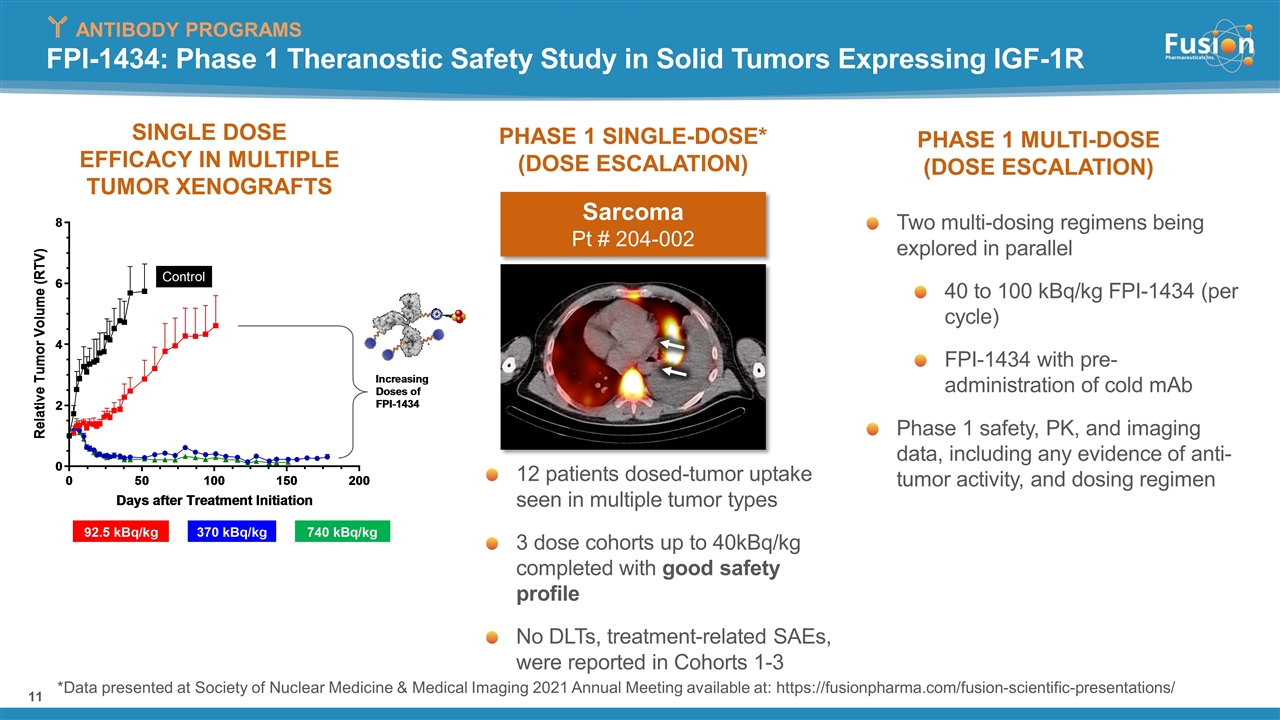

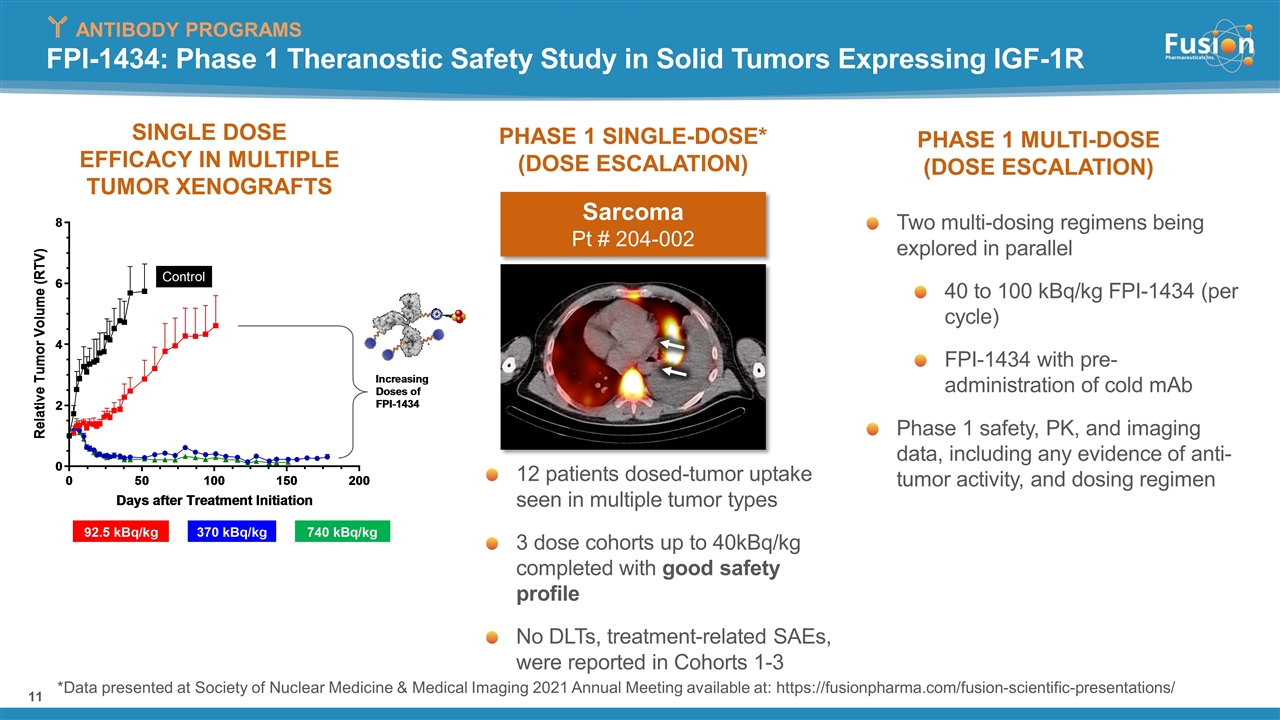

FPI-1434: Phase 1 Theranostic Safety Study in Solid Tumors Expressing IGF-1R PHASE 1 MULTI-DOSE (DOSE ESCALATION) PHASE 1 SINGLE-DOSE* (DOSE ESCALATION) 12 patients dosed-tumor uptake seen in multiple tumor types 3 dose cohorts up to 40kBq/kg completed with good safety profile No DLTs, treatment-related SAEs, were reported in Cohorts 1-3 Two multi-dosing regimens being explored in parallel 40 to 100 kBq/kg FPI-1434 (per cycle) FPI-1434 with pre-administration of cold mAb Phase 1 safety, PK, and imaging data, including any evidence of anti-tumor activity, and dosing regimen ANTIBODY PROGRAMS SINGLE DOSE EFFICACY IN MULTIPLE TUMOR XENOGRAFTS *Data presented at Society of Nuclear Medicine & Medical Imaging 2021 Annual Meeting available at: https://fusionpharma.com/fusion-scientific-presentations/ Sarcoma Pt # 204-002

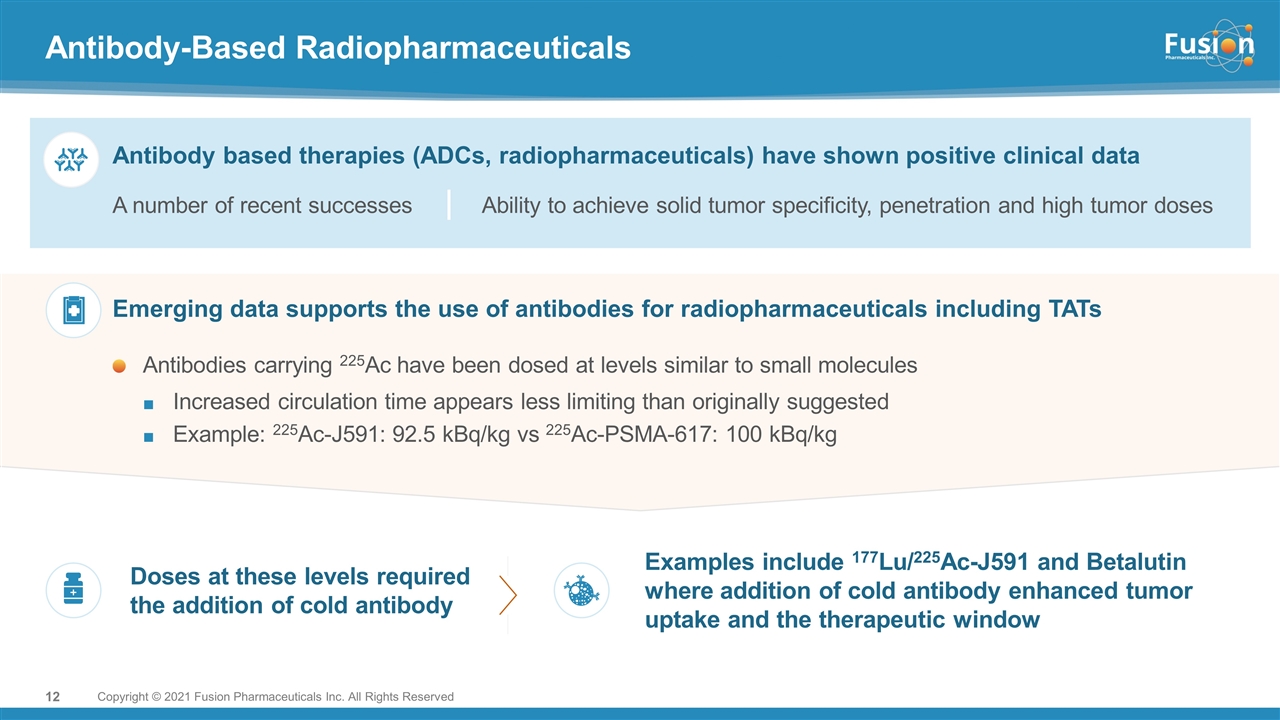

Antibody-Based Radiopharmaceuticals Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Antibody based therapies (ADCs, radiopharmaceuticals) have shown positive clinical data A number of recent successes Emerging data supports the use of antibodies for radiopharmaceuticals including TATs Antibodies carrying 225Ac have been dosed at levels similar to small molecules Increased circulation time appears less limiting than originally suggested Example: 225Ac-J591: 92.5 kBq/kg vs 225Ac-PSMA-617: 100 kBq/kg Ability to achieve solid tumor specificity, penetration and high tumor doses Doses at these levels required the addition of cold antibody Examples include 177Lu/225Ac-J591 and Betalutin where addition of cold antibody enhanced tumor uptake and the therapeutic window

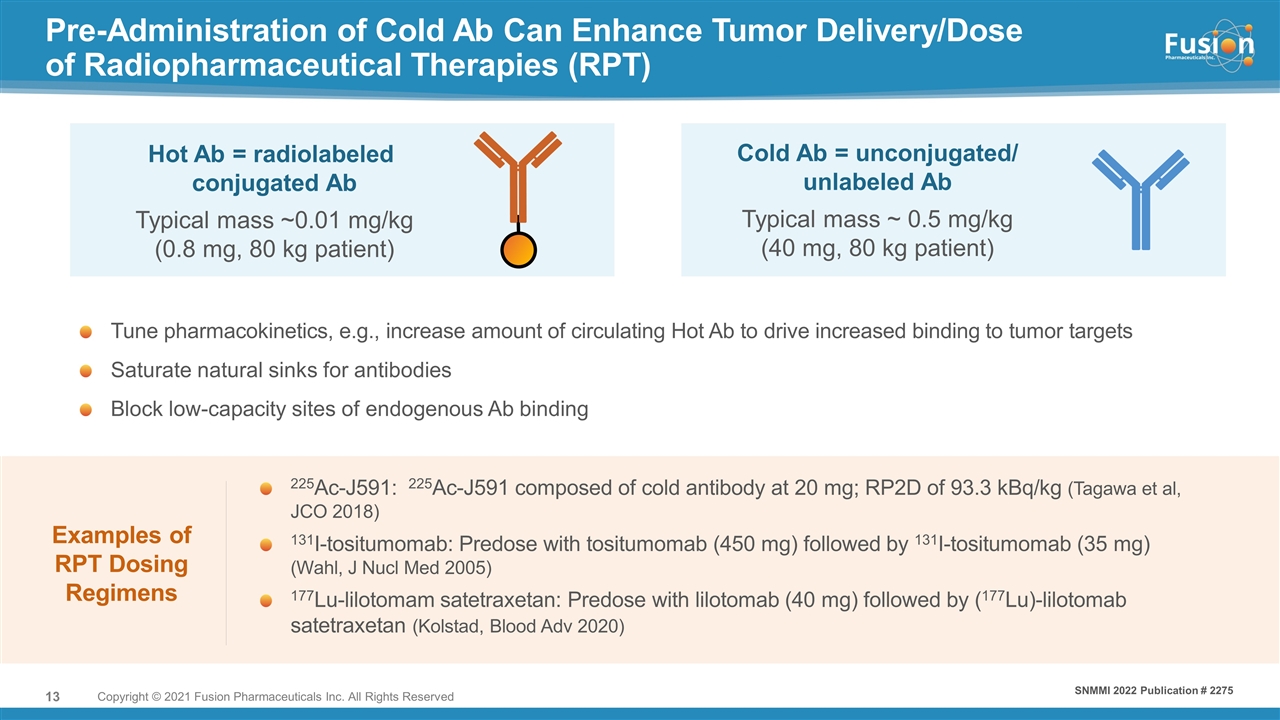

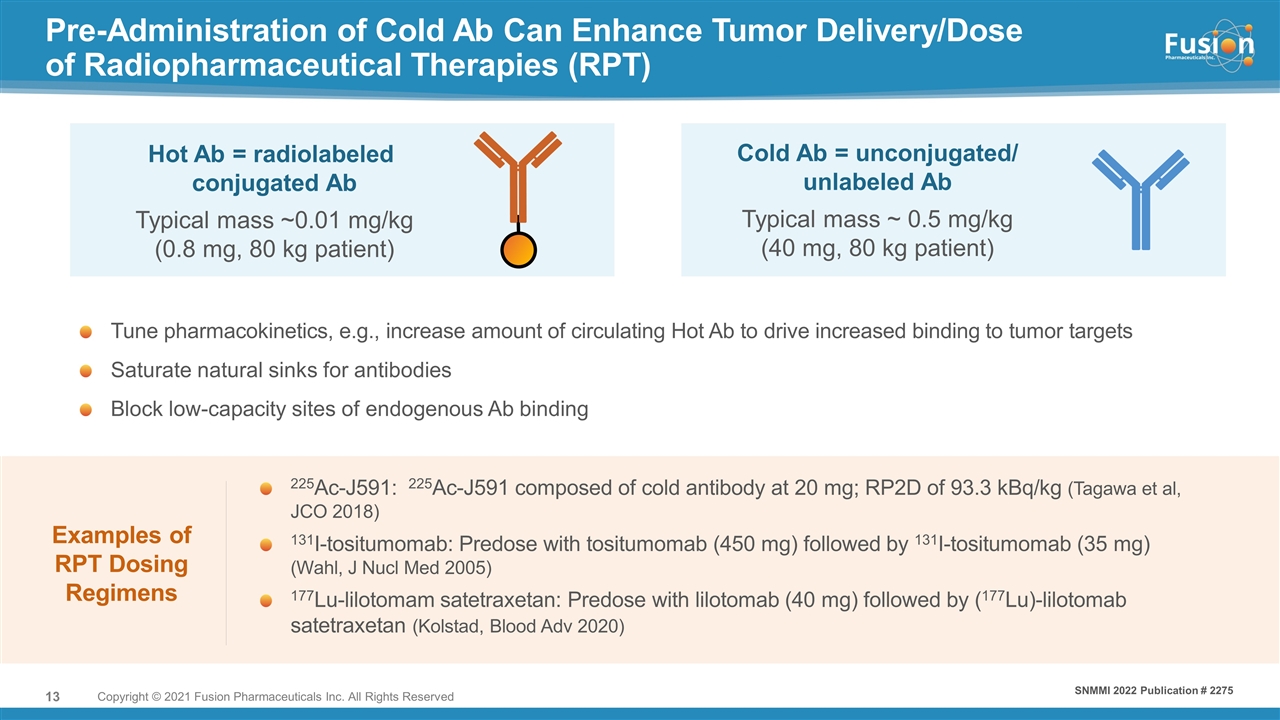

Pre-Administration of Cold Ab Can Enhance Tumor Delivery/Dose of Radiopharmaceutical Therapies (RPT) Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Examples of RPT Dosing Regimens 225Ac-J591: 225Ac-J591 composed of cold antibody at 20 mg; RP2D of 93.3 kBq/kg (Tagawa et al, JCO 2018) 131I-tositumomab: Predose with tositumomab (450 mg) followed by 131I-tositumomab (35 mg) (Wahl, J Nucl Med 2005) 177Lu-lilotomam satetraxetan: Predose with lilotomab (40 mg) followed by (177Lu)-lilotomab satetraxetan (Kolstad, Blood Adv 2020) Cold Ab = unconjugated/ unlabeled Ab Typical mass ~ 0.5 mg/kg (40 mg, 80 kg patient) Typical mass ~0.01 mg/kg (0.8 mg, 80 kg patient) Hot Ab = radiolabeled conjugated Ab Tune pharmacokinetics, e.g., increase amount of circulating Hot Ab to drive increased binding to tumor targets Saturate natural sinks for antibodies Block low-capacity sites of endogenous Ab binding SNMMI 2022 Publication # 2275

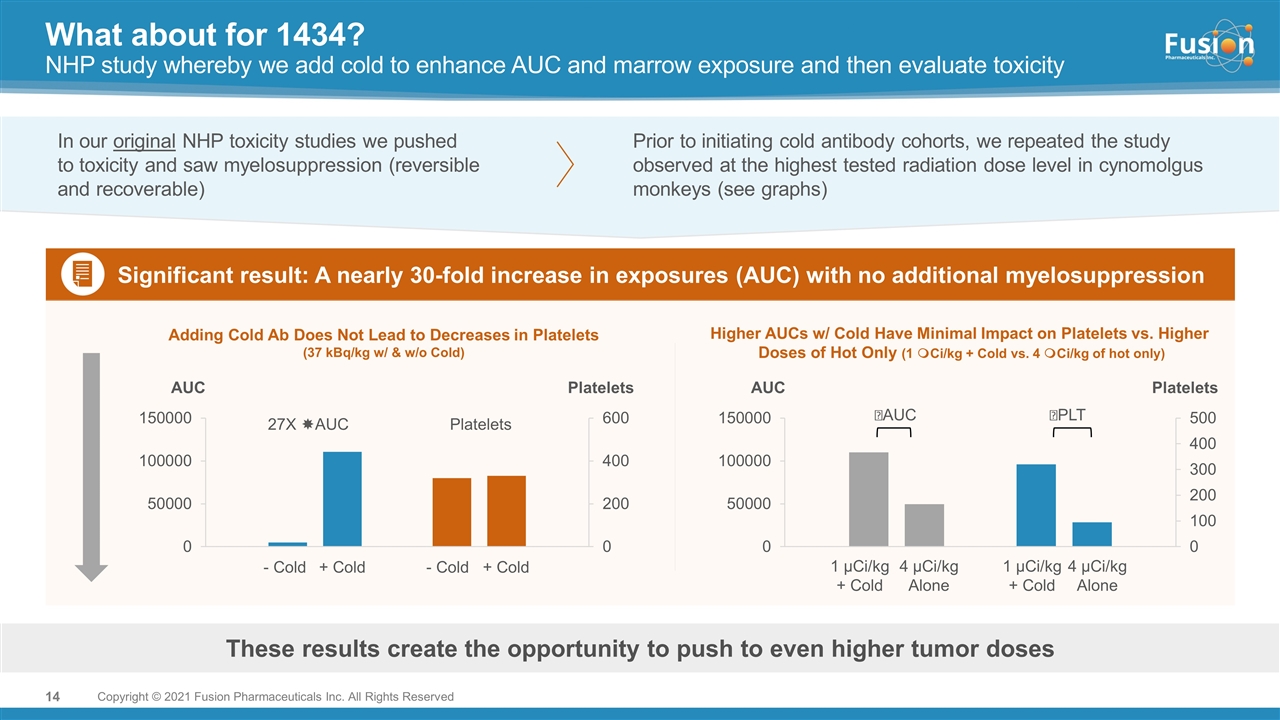

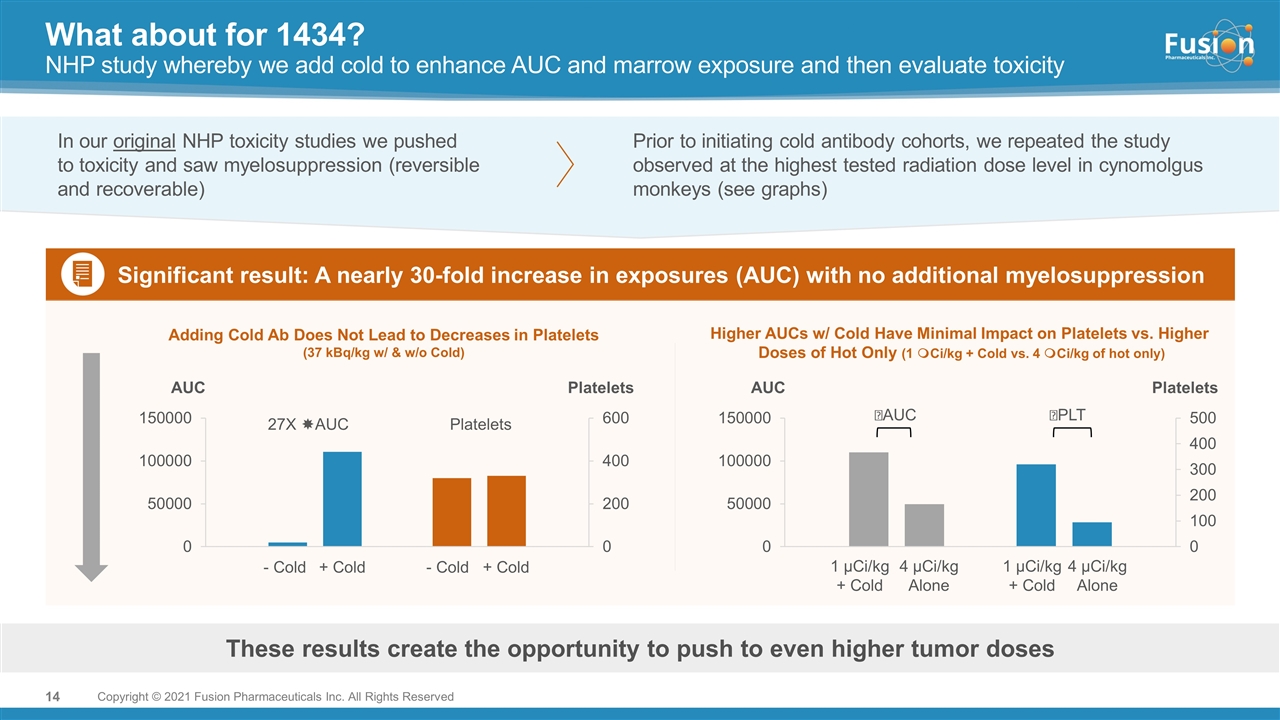

What about for 1434? NHP study whereby we add cold to enhance AUC and marrow exposure and then evaluate toxicity Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved In our original NHP toxicity studies we pushed to toxicity and saw myelosuppression (reversible and recoverable) These results create the opportunity to push to even higher tumor doses Prior to initiating cold antibody cohorts, we repeated the study observed at the highest tested radiation dose level in cynomolgus monkeys (see graphs) Significant result: A nearly 30-fold increase in exposures (AUC) with no additional myelosuppression Adding Cold Ab Does Not Lead to Decreases in Platelets (37 kBq/kg w/ & w/o Cold) Higher AUCs w/ Cold Have Minimal Impact on Platelets vs. Higher Doses of Hot Only (1 mCi/kg + Cold vs. 4 mCi/kg of hot only) AUC Platelets - Cold + Cold + Cold - Cold 27X AUC Platelets AUC Platelets AUC PLT 1 µCi/kg + Cold 4 µCi/kg Alone 1 µCi/kg + Cold 4 µCi/kg Alone

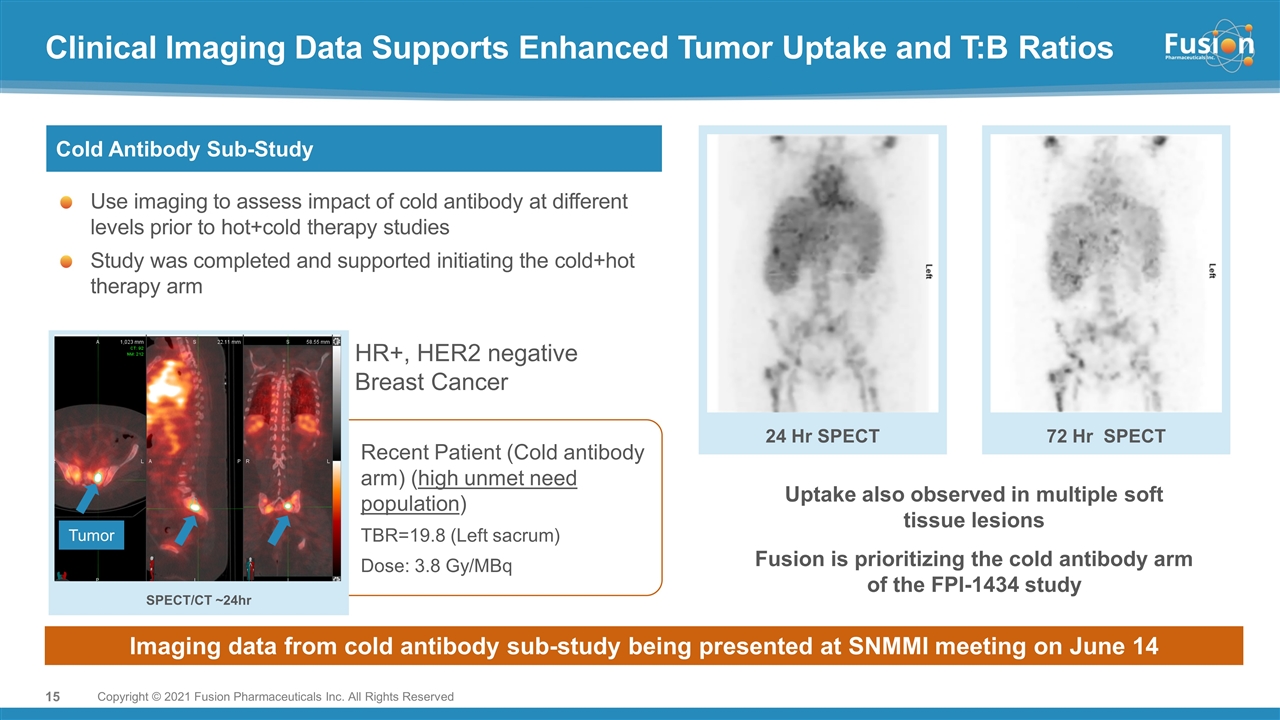

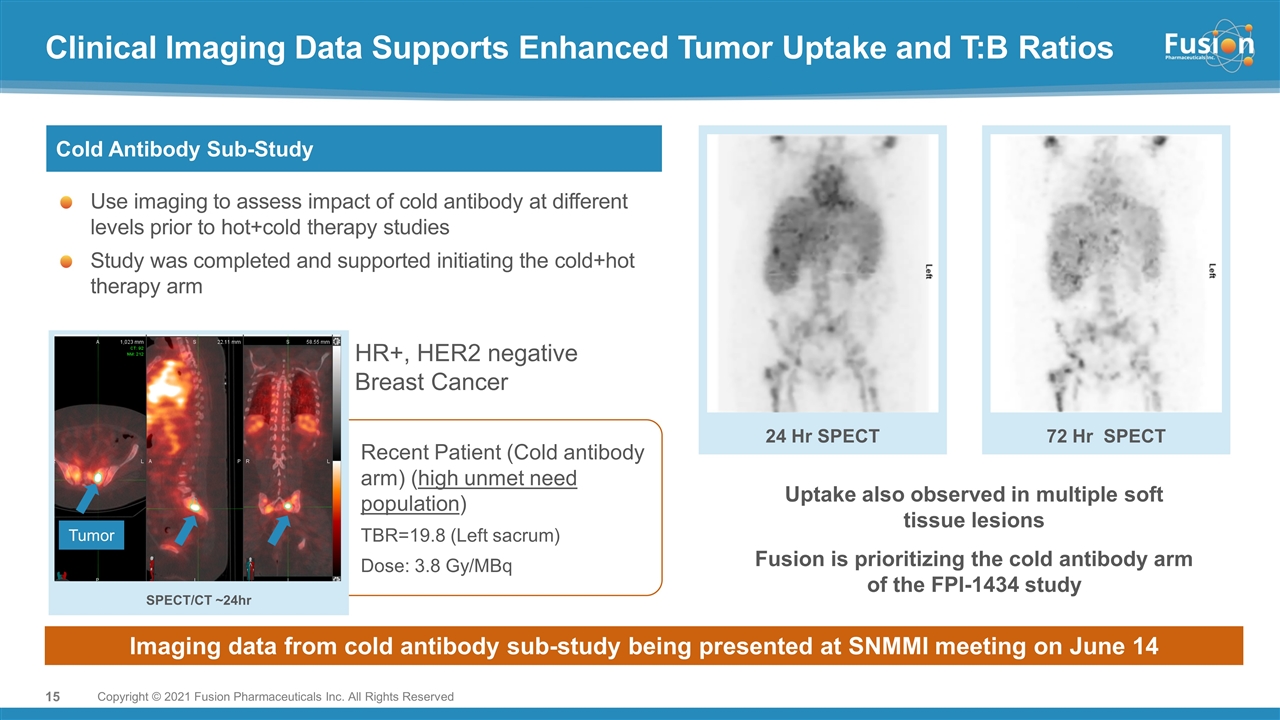

Clinical Imaging Data Supports Enhanced Tumor Uptake and T:B Ratios Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Cold Antibody Sub-Study Use imaging to assess impact of cold antibody at different levels prior to hot+cold therapy studies Study was completed and supported initiating the cold+hot therapy arm SPECT/CT ~24hr Recent Patient (Cold antibody arm) (high unmet need population) TBR=19.8 (Left sacrum) Dose: 3.8 Gy/MBq 24 Hr SPECT 72 Hr SPECT Uptake also observed in multiple soft tissue lesions Fusion is prioritizing the cold antibody arm of the FPI-1434 study Imaging data from cold antibody sub-study being presented at SNMMI meeting on June 14 Tumor HR+, HER2 negative Breast Cancer

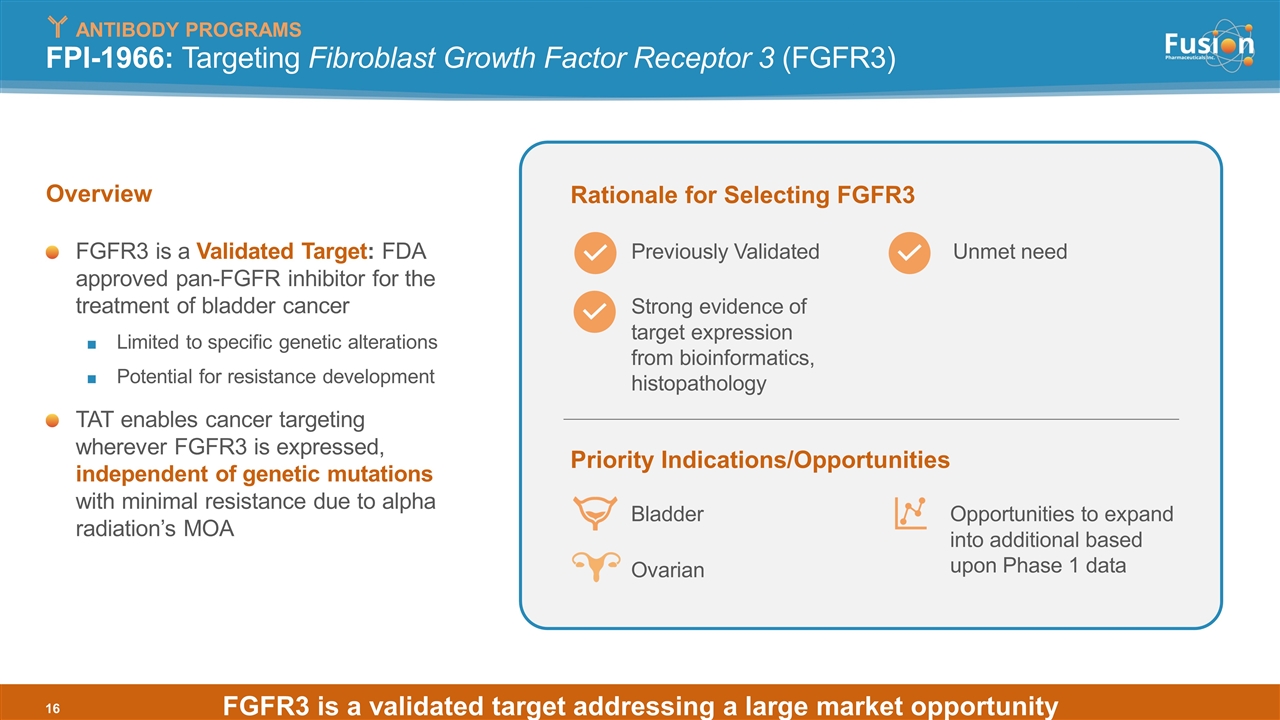

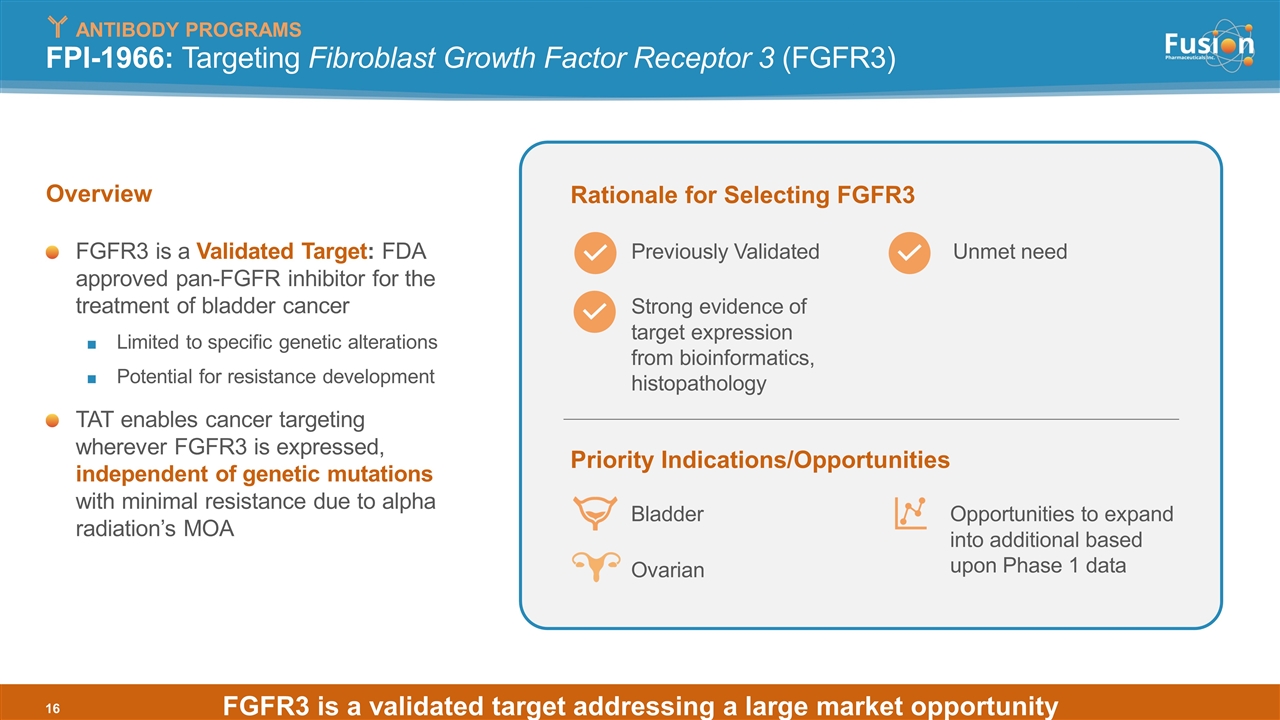

FGFR3 is a validated target addressing a large market opportunity FPI-1966: Targeting Fibroblast Growth Factor Receptor 3 (FGFR3) FGFR3 is a Validated Target: FDA approved pan-FGFR inhibitor for the treatment of bladder cancer Limited to specific genetic alterations Potential for resistance development TAT enables cancer targeting wherever FGFR3 is expressed, independent of genetic mutations with minimal resistance due to alpha radiation’s MOA ANTIBODY PROGRAMS Previously Validated Strong evidence of target expression from bioinformatics, histopathology Bladder Unmet need Rationale for Selecting FGFR3 Priority Indications/Opportunities Opportunities to expand into additional based upon Phase 1 data Ovarian Overview

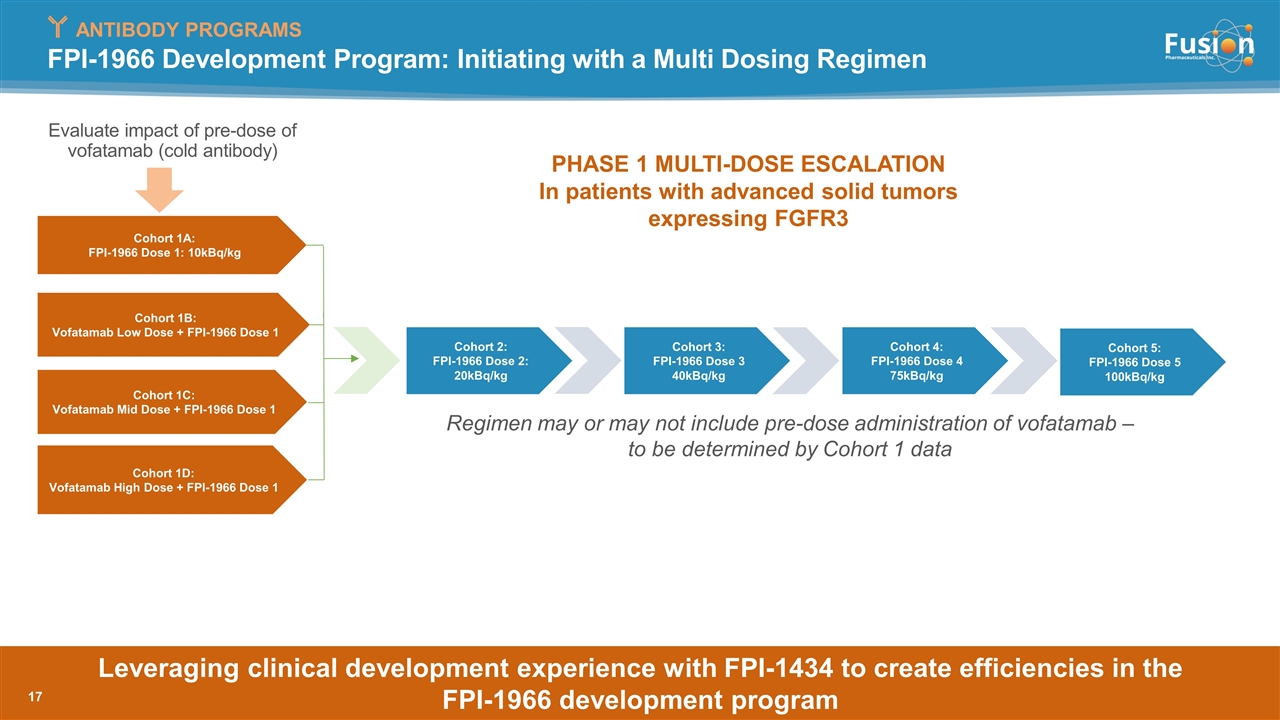

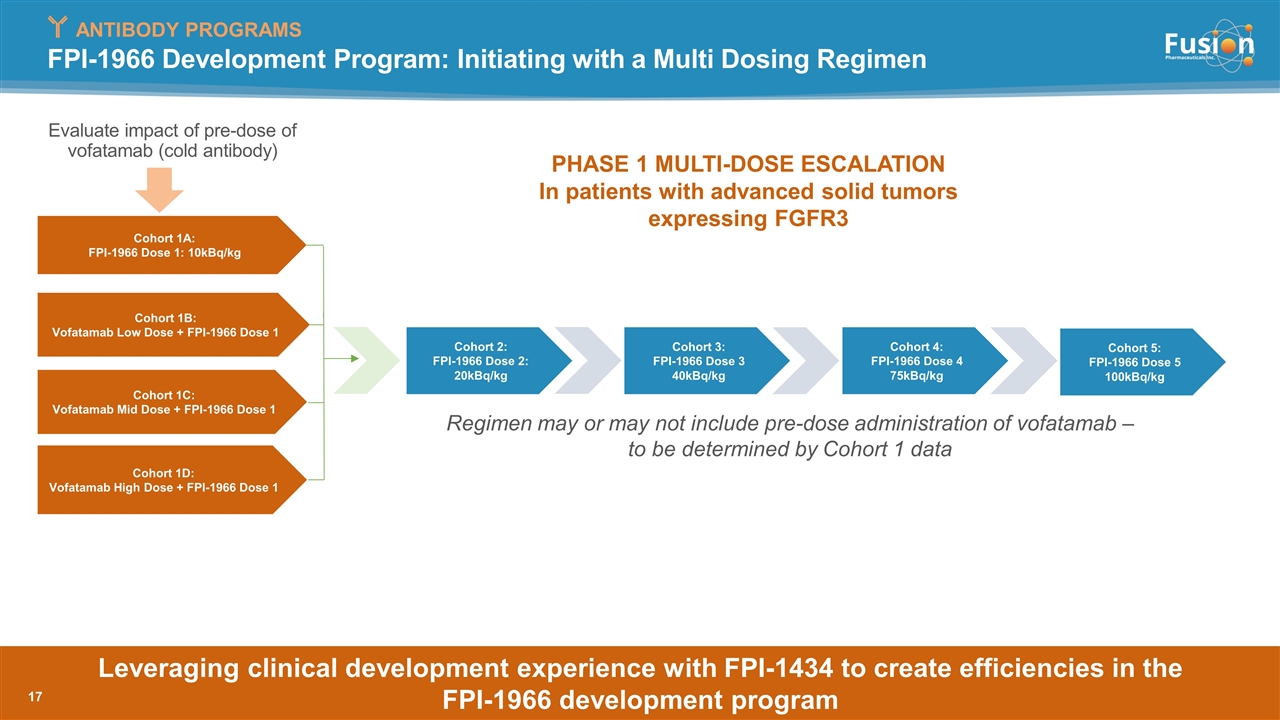

PHASE 1 MULTI-DOSE ESCALATION In patients with advanced solid tumors expressing FGFR3 FPI-1966 Development Program: Initiating with a Multi Dosing Regimen ANTIBODY PROGRAMS Cohort 1A: FPI-1966 Dose 1: 10kBq/kg Cohort 1B: Vofatamab Low Dose + FPI-1966 Dose 1 Cohort 1C: Vofatamab Mid Dose + FPI-1966 Dose 1 Cohort 1D: Vofatamab High Dose + FPI-1966 Dose 1 Cohort 2: FPI-1966 Dose 2: 20kBq/kg Cohort 3: FPI-1966 Dose 3 40kBq/kg Cohort 4: FPI-1966 Dose 4 75kBq/kg Cohort 5: FPI-1966 Dose 5 100kBq/kg Regimen may or may not include pre-dose administration of vofatamab – to be determined by Cohort 1 data Leveraging clinical development experience with FPI-1434 to create efficiencies in the FPI-1966 development program Evaluate impact of pre-dose of vofatamab (cold antibody)

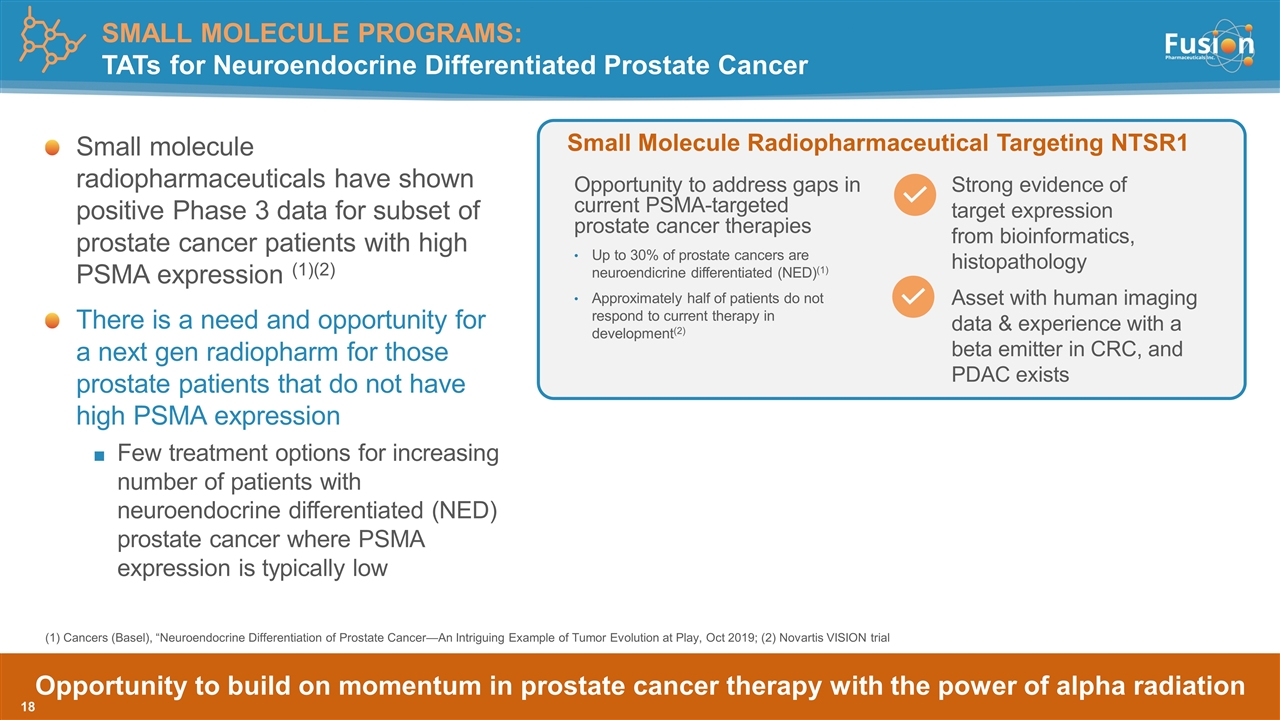

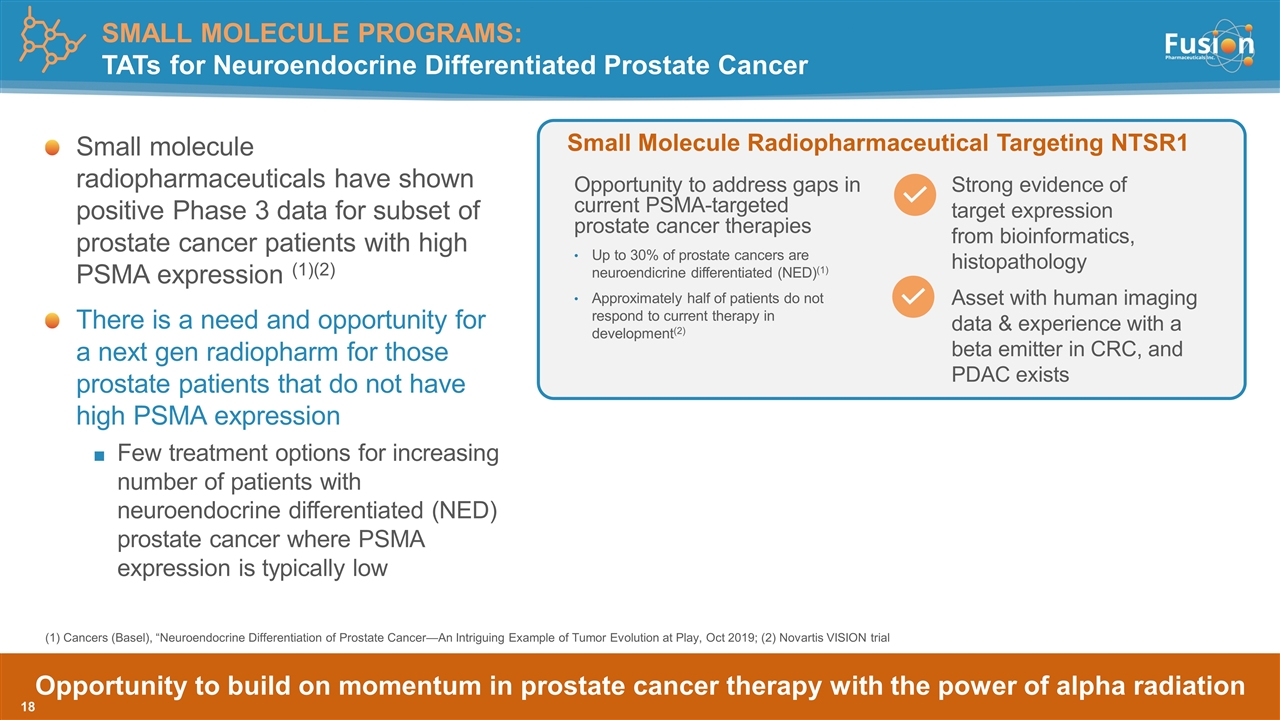

Opportunity to build on momentum in prostate cancer therapy with the power of alpha radiation Small molecule radiopharmaceuticals have shown positive Phase 3 data for subset of prostate cancer patients with high PSMA expression (1)(2) There is a need and opportunity for a next gen radiopharm for those prostate patients that do not have high PSMA expression Few treatment options for increasing number of patients with neuroendocrine differentiated (NED) prostate cancer where PSMA expression is typically low Strong evidence of target expression from bioinformatics, histopathology Small Molecule Radiopharmaceutical Targeting NTSR1 Asset with human imaging data & experience with a beta emitter in CRC, and PDAC exists Opportunity to address gaps in current PSMA-targeted prostate cancer therapies Up to 30% of prostate cancers are neuroendicrine differentiated (NED)(1) Approximately half of patients do not respond to current therapy in development(2) (1) Cancers (Basel), “Neuroendocrine Differentiation of Prostate Cancer—An Intriguing Example of Tumor Evolution at Play, Oct 2019; (2) Novartis VISION trial SMALL MOLECULE PROGRAMS: TATs for Neuroendocrine Differentiated Prostate Cancer

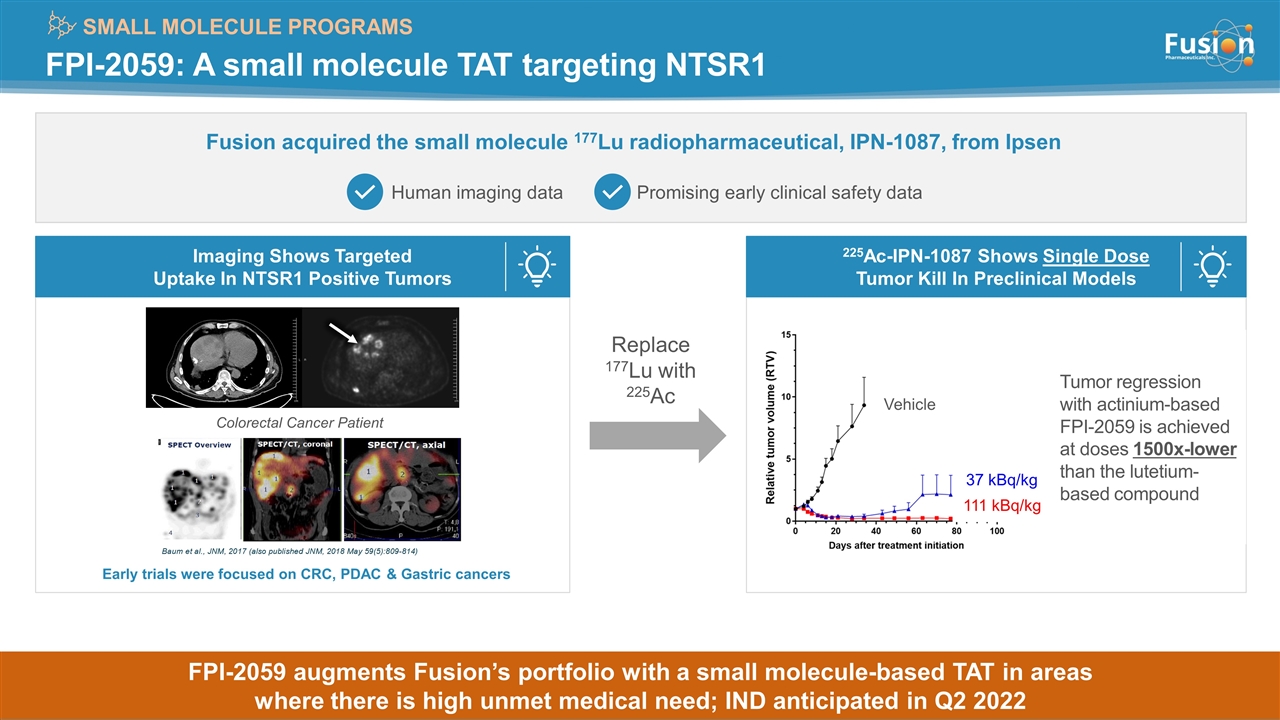

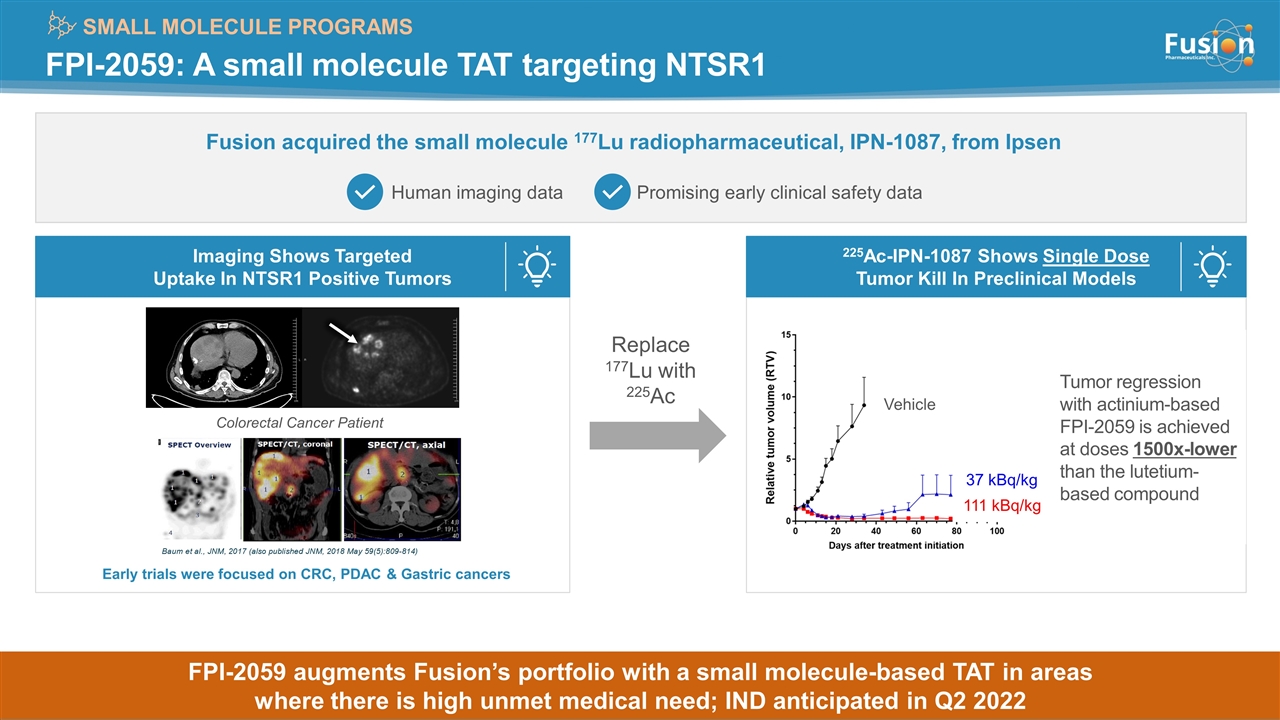

FPI-2059: A small molecule TAT targeting NTSR1 SMALL MOLECULE PROGRAMS Fusion acquired the small molecule 177Lu radiopharmaceutical, IPN-1087, from Ipsen Human imaging data Promising early clinical safety data 225Ac-IPN-1087 Shows Single Dose Tumor Kill In Preclinical Models Imaging Shows Targeted Uptake In NTSR1 Positive Tumors Replace 177Lu with 225Ac Colorectal Cancer Patient Early trials were focused on CRC, PDAC & Gastric cancers Vehicle 37 kBq/kg 111 kBq/kg Tumor regression with actinium-based FPI-2059 is achieved at doses 1500x-lower than the lutetium-based compound Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved FPI-2059 augments Fusion’s portfolio with a small molecule-based TAT in areas where there is high unmet medical need; IND anticipated in Q2 2022

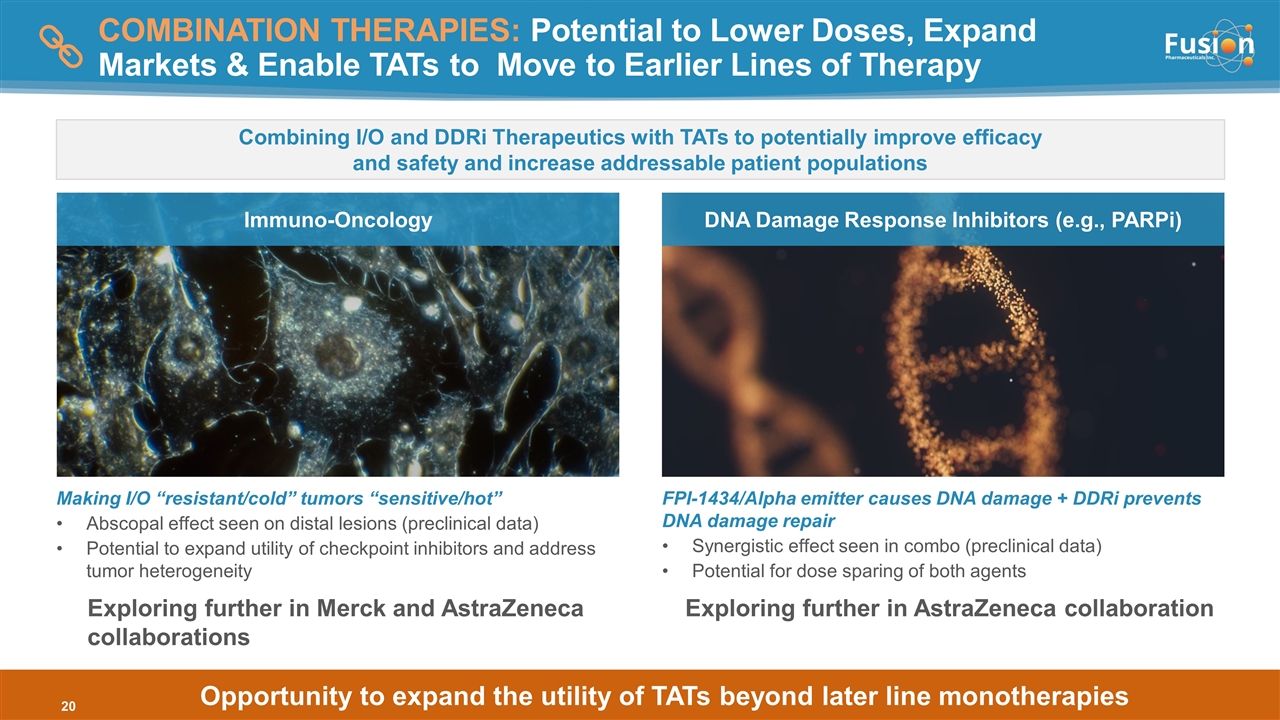

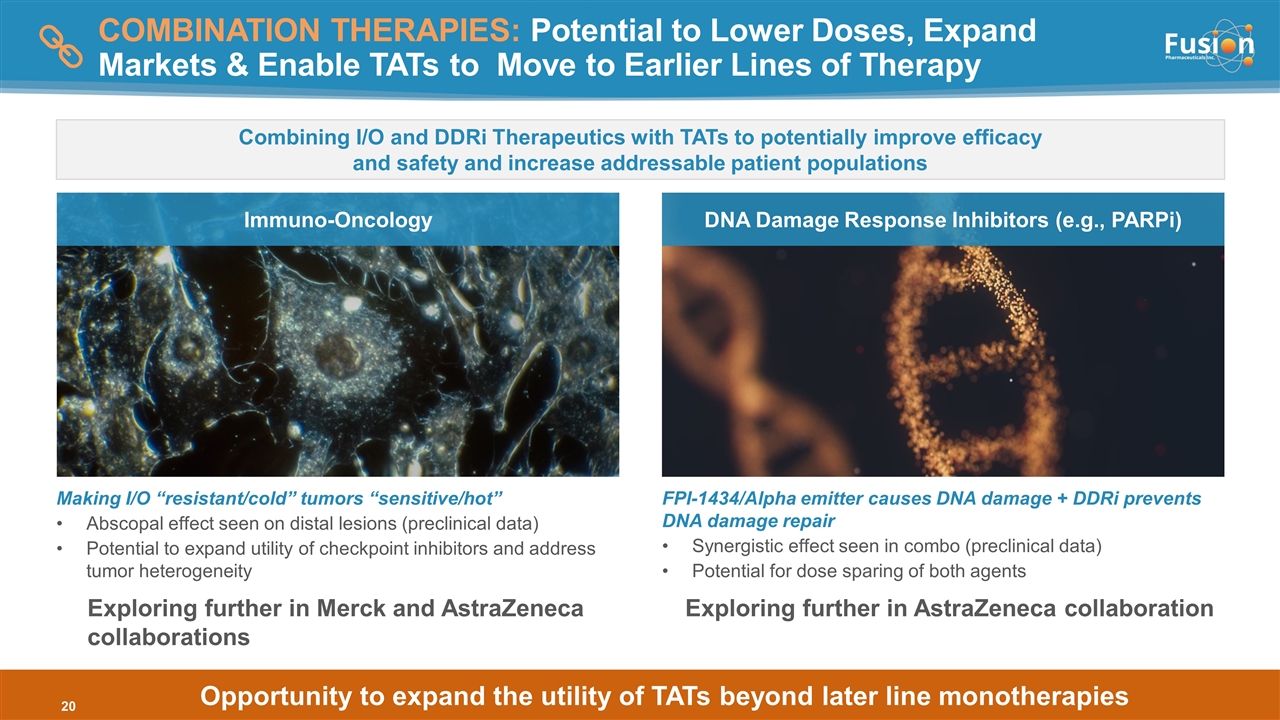

COMBINATION THERAPIES: Potential to Lower Doses, Expand Markets & Enable TATs to Move to Earlier Lines of Therapy Making I/O “resistant/cold” tumors “sensitive/hot” Abscopal effect seen on distal lesions (preclinical data) Potential to expand utility of checkpoint inhibitors and address tumor heterogeneity FPI-1434/Alpha emitter causes DNA damage + DDRi prevents DNA damage repair Synergistic effect seen in combo (preclinical data) Potential for dose sparing of both agents Immuno-Oncology DNA Damage Response Inhibitors (e.g., PARPi) Combining I/O and DDRi Therapeutics with TATs to potentially improve efficacy and safety and increase addressable patient populations Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Opportunity to expand the utility of TATs beyond later line monotherapies Exploring further in AstraZeneca collaboration Exploring further in Merck and AstraZeneca collaborations

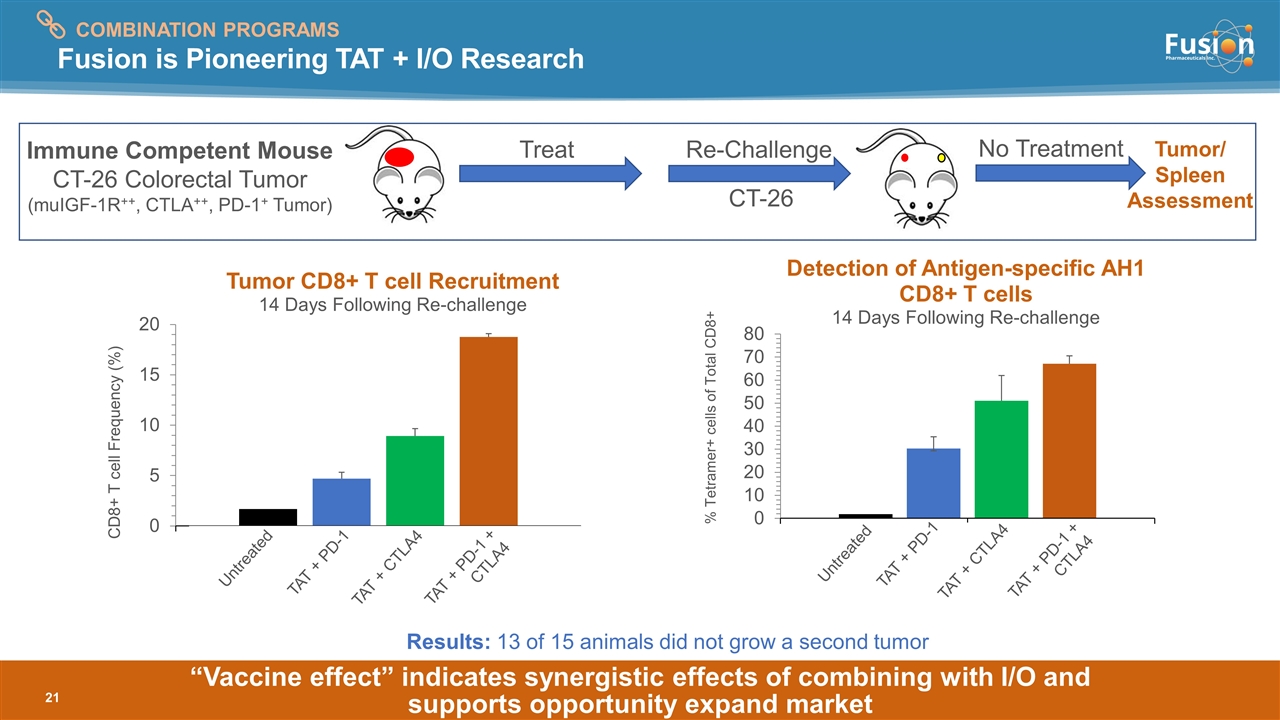

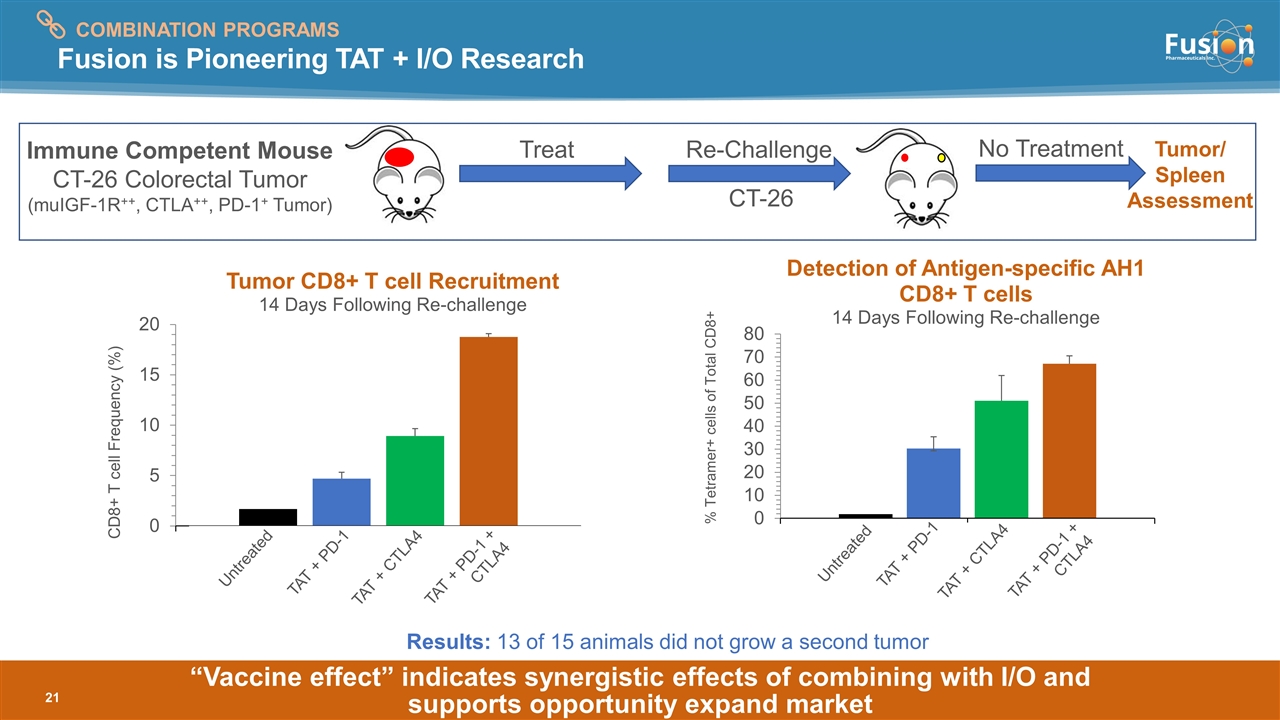

“Vaccine effect” indicates synergistic effects of combining with I/O and supports opportunity expand market Fusion is Pioneering TAT + I/O Research Treat Re-Challenge CT-26 No Treatment Tumor/ Spleen Assessment Immune Competent Mouse CT-26 Colorectal Tumor (muIGF-1R++, CTLA++, PD-1+ Tumor) Untreated TAT + PD-1 TAT + CTLA4 Untreated TAT + PD-1 TAT + CTLA4 TAT + PD-1 + CTLA4 TAT + PD-1 + CTLA4 COMBINATION PROGRAMS Results: 13 of 15 animals did not grow a second tumor

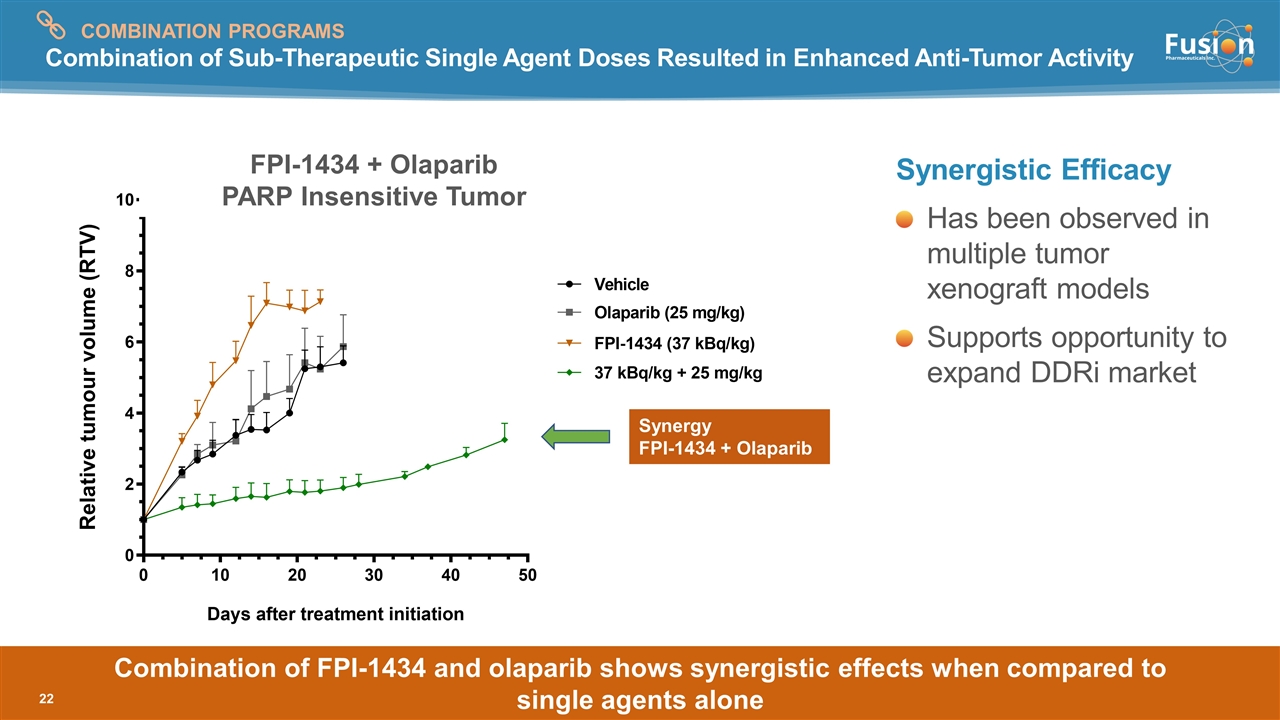

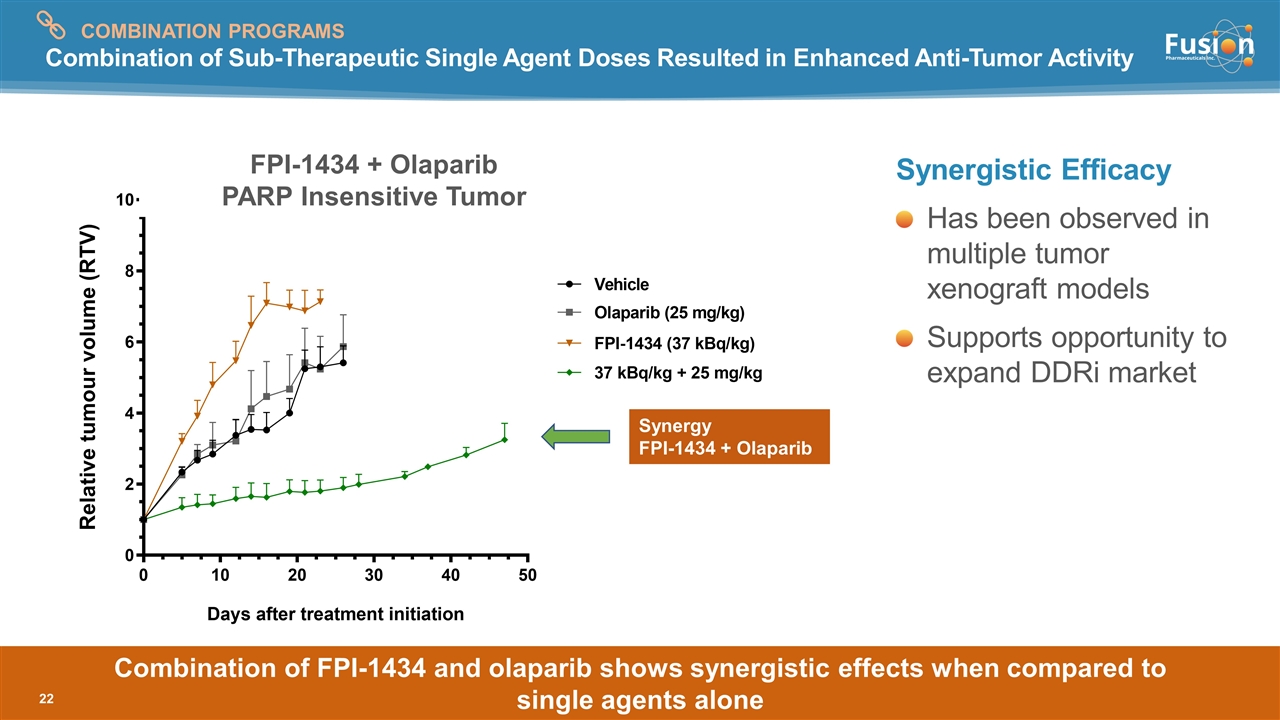

Combination of Sub-Therapeutic Single Agent Doses Resulted in Enhanced Anti-Tumor Activity Synergistic Efficacy Has been observed in multiple tumor xenograft models Supports opportunity to expand DDRi market Synergy FPI-1434 + Olaparib FPI-1434 + Olaparib PARP Insensitive Tumor Combination of FPI-1434 and olaparib shows synergistic effects when compared to single agents alone COMBINATION PROGRAMS

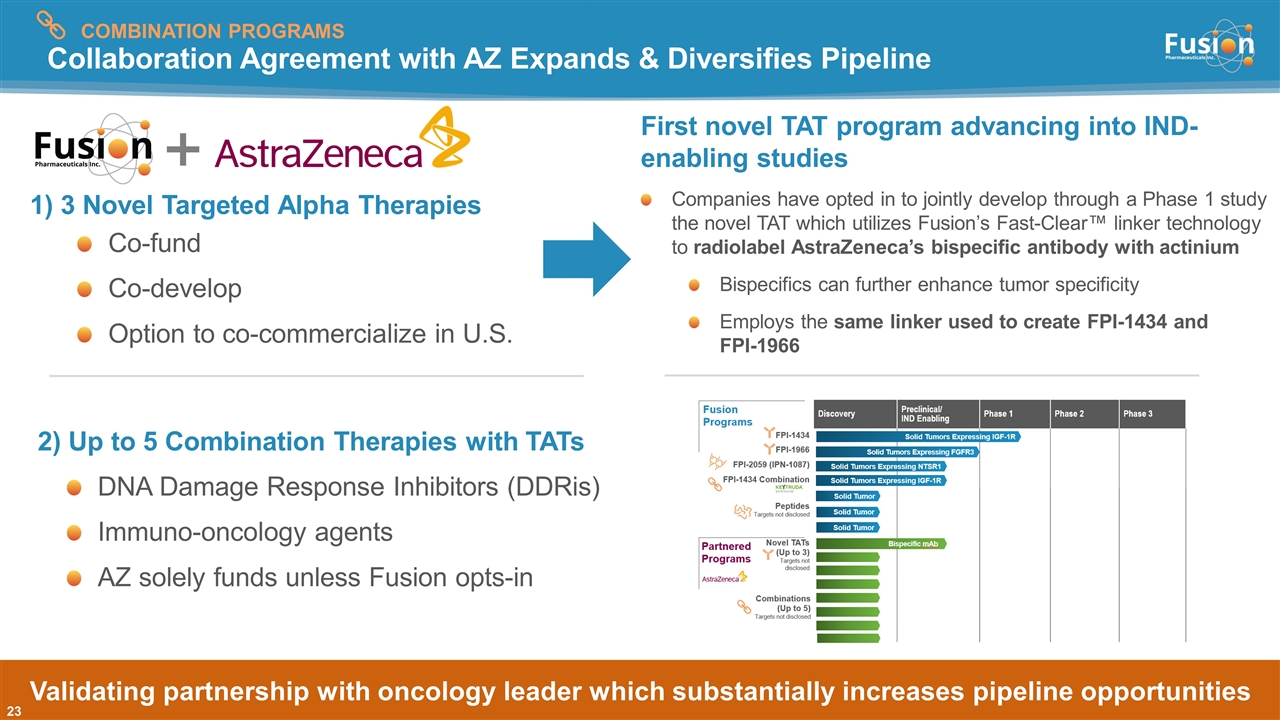

Collaboration Agreement with AZ Expands & Diversifies Pipeline 2) Up to 5 Combination Therapies with TATs DNA Damage Response Inhibitors (DDRis) Immuno-oncology agents AZ solely funds unless Fusion opts-in 1) 3 Novel Targeted Alpha Therapies Co-fund Co-develop Option to co-commercialize in U.S. Validating partnership with oncology leader which substantially increases pipeline opportunities COMBINATION PROGRAMS First novel TAT program advancing into IND-enabling studies Companies have opted in to jointly develop through a Phase 1 study the novel TAT which utilizes Fusion’s Fast-Clear™ linker technology to radiolabel AstraZeneca’s bispecific antibody with actinium Bispecifics can further enhance tumor specificity Employs the same linker used to create FPI-1434 and FPI-1966

Fusion has created TATs from antibodies and small molecules that bind to validated cancer targets New partnership agreements provide access to discovery tools needed to create de novo TATs leveraging Fusion’s platform and internal expertise Adding the capability to develop peptide-based TATs gives Fusion’s the ability to select the best targeting molecule (antibodies, small molecules, peptides) for the target and cancer type – “using the right tool for the job” Copyright © 2020 Fusion Pharmaceuticals Inc. All Rights Reserved Fusion has a comprehensive set of tools to create novel TATs leading to multiple shots on goal PEPTIDE PROGRAMS

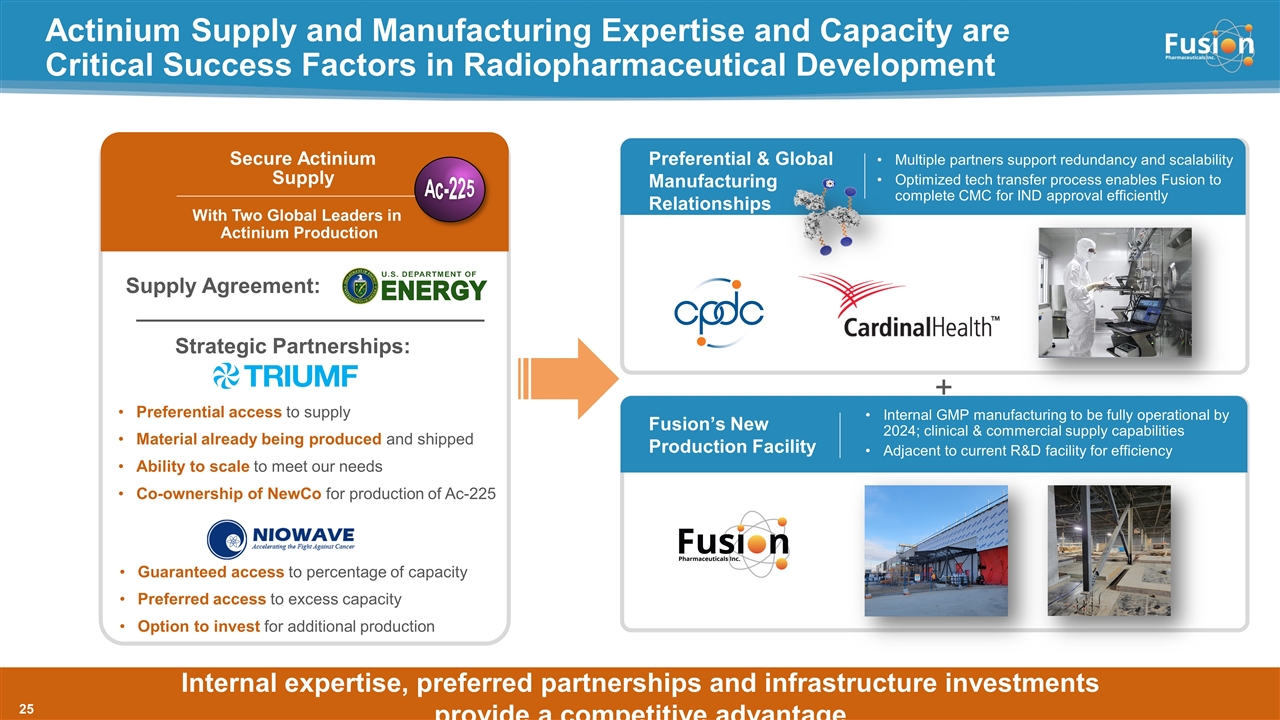

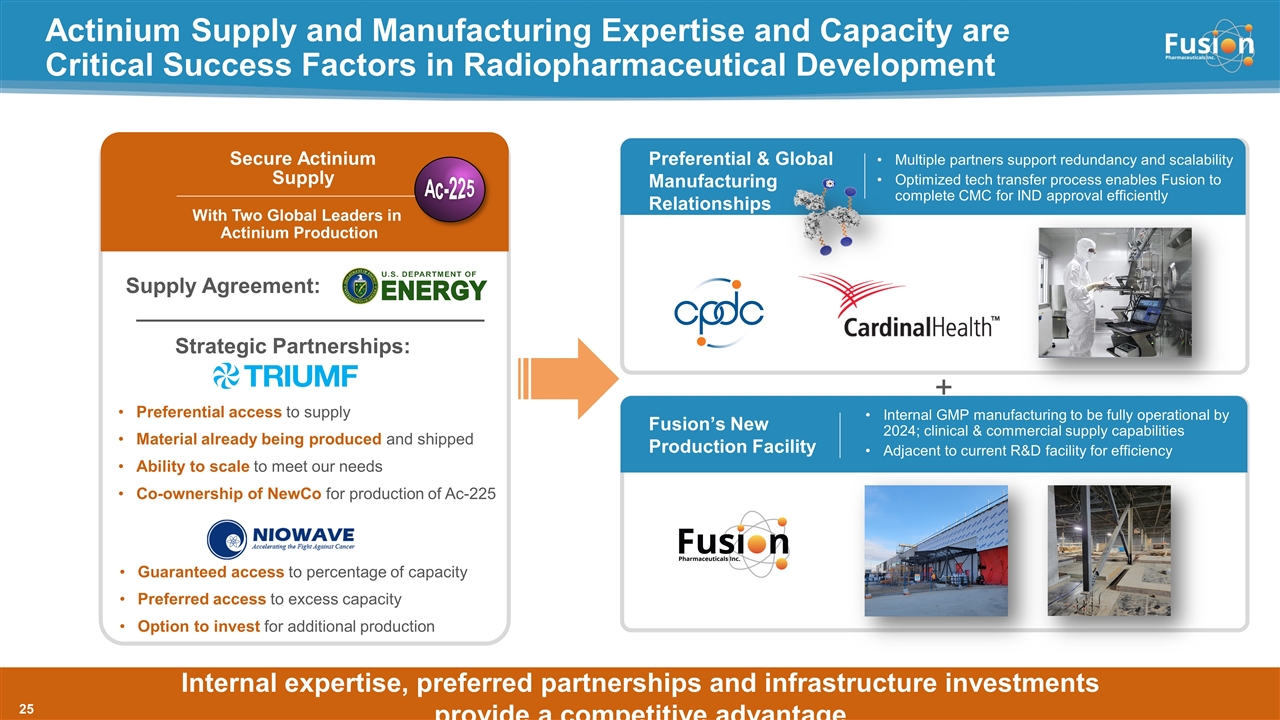

Preferential & Global Manufacturing Relationships Actinium Supply and Manufacturing Expertise and Capacity are Critical Success Factors in Radiopharmaceutical Development Multiple partners support redundancy and scalability Optimized tech transfer process enables Fusion to complete CMC for IND approval efficiently Internal expertise, preferred partnerships and infrastructure investments provide a competitive advantage Fusion’s New Production Facility Internal GMP manufacturing to be fully operational by 2024; clinical & commercial supply capabilities Adjacent to current R&D facility for efficiency Secure Actinium Supply With Two Global Leaders in Actinium Production Supply Agreement: Strategic Partnerships: Preferential access to supply Material already being produced and shipped Ability to scale to meet our needs Co-ownership of NewCo for production of Ac-225 + Ac-225 Guaranteed access to percentage of capacity Preferred access to excess capacity Option to invest for additional production

Financials and Key Milestones

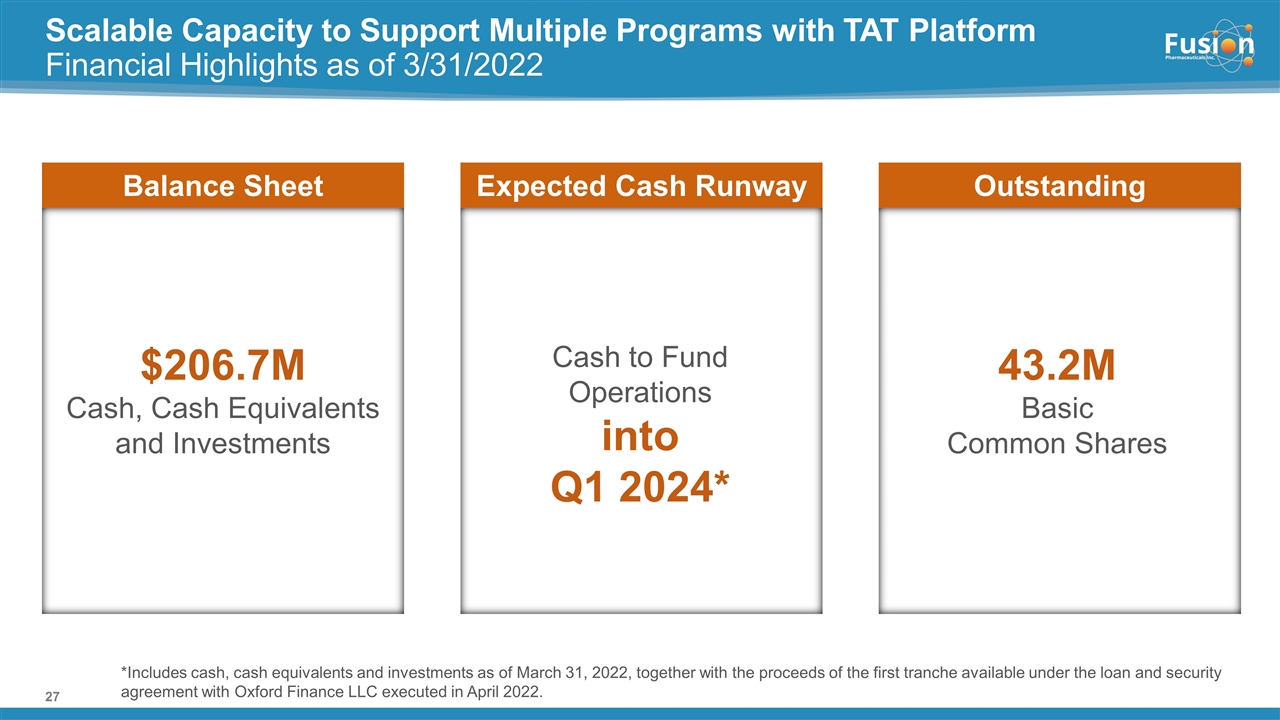

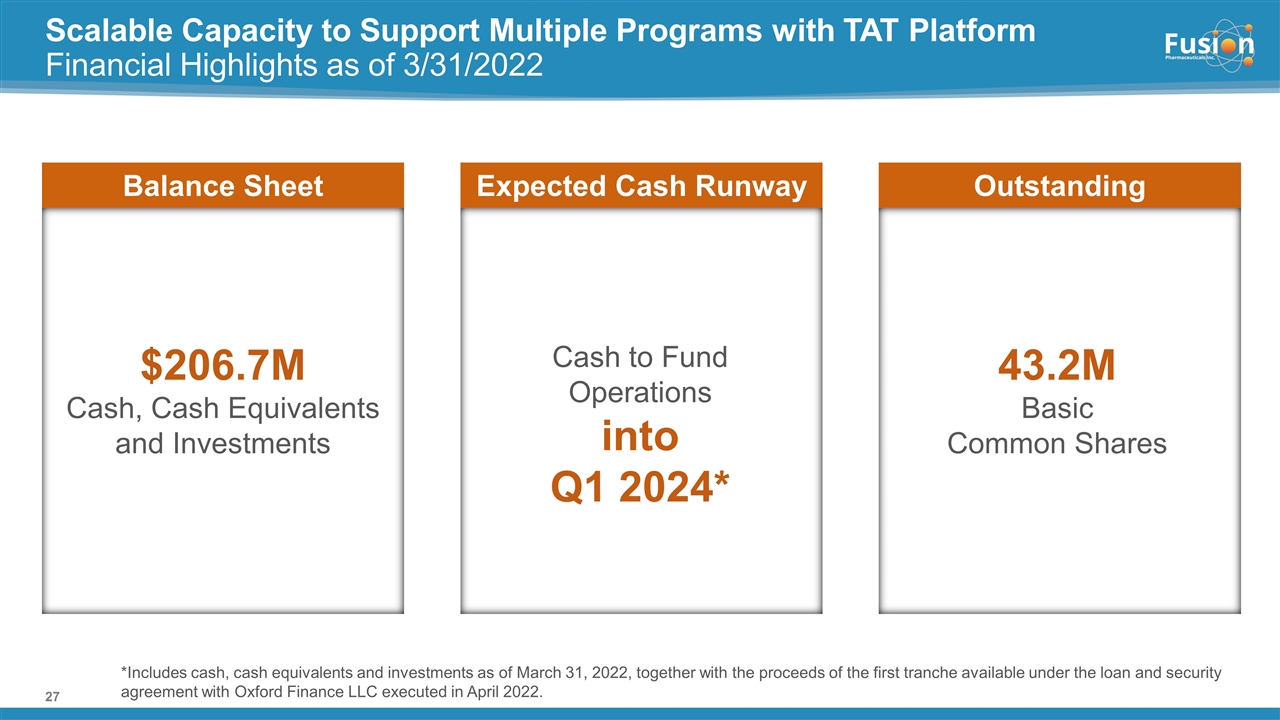

Scalable Capacity to Support Multiple Programs with TAT Platform Financial Highlights as of 3/31/2022 $206.7M Cash, Cash Equivalents and Investments Balance Sheet Cash to Fund Operations into Q1 2024* Expected Cash Runway Outstanding 43.2M Basic Common Shares *Includes cash, cash equivalents and investments as of March 31, 2022, together with the proceeds of the first tranche available under the loan and security agreement with Oxford Finance LLC executed in April 2022.

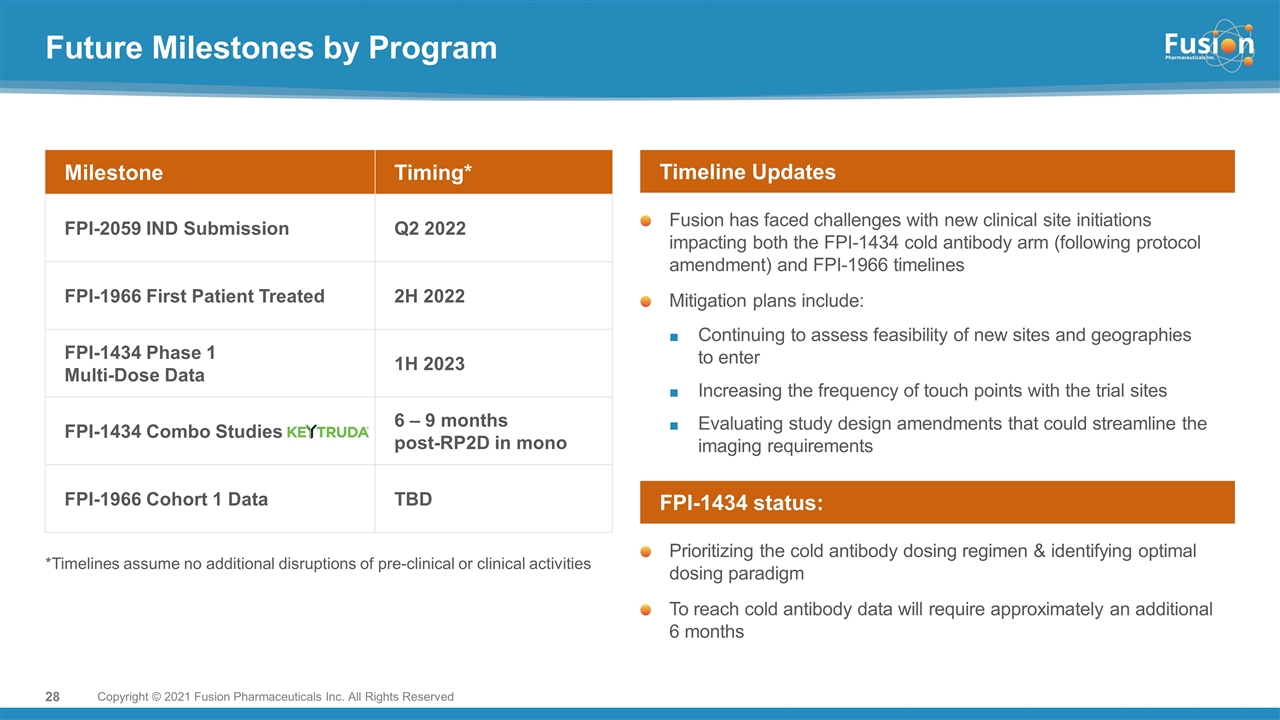

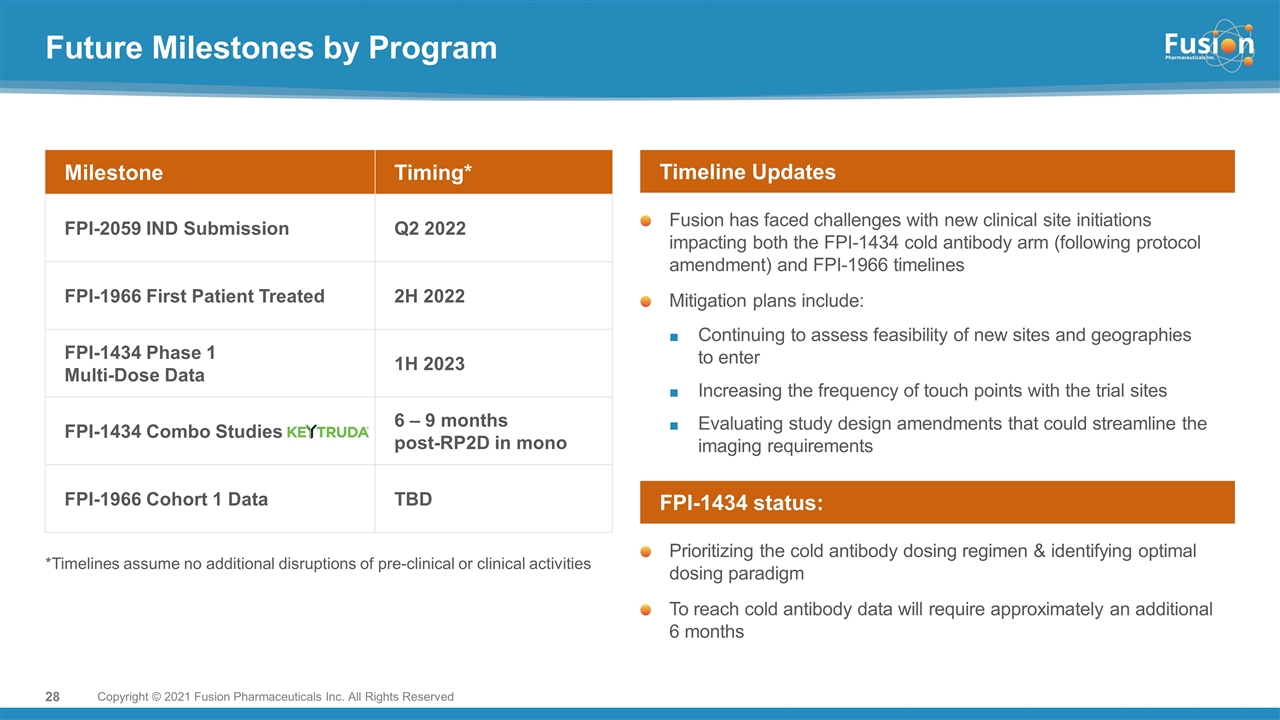

Future Milestones by Program Milestone Timing* FPI-2059 IND Submission Q2 2022 FPI-1966 First Patient Treated 2H 2022 FPI-1434 Phase 1 Multi-Dose Data 1H 2023 FPI-1434 Combo Studies 6 – 9 months post-RP2D in mono FPI-1966 Cohort 1 Data TBD *Timelines assume no additional disruptions of pre-clinical or clinical activities Fusion has faced challenges with new clinical site initiations impacting both the FPI-1434 cold antibody arm (following protocol amendment) and FPI-1966 timelines Mitigation plans include: Continuing to assess feasibility of new sites and geographies to enter Increasing the frequency of touch points with the trial sites Evaluating study design amendments that could streamline the imaging requirements Timeline Updates Prioritizing the cold antibody dosing regimen & identifying optimal dosing paradigm To reach cold antibody data will require approximately an additional 6 months FPI-1434 status: Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved

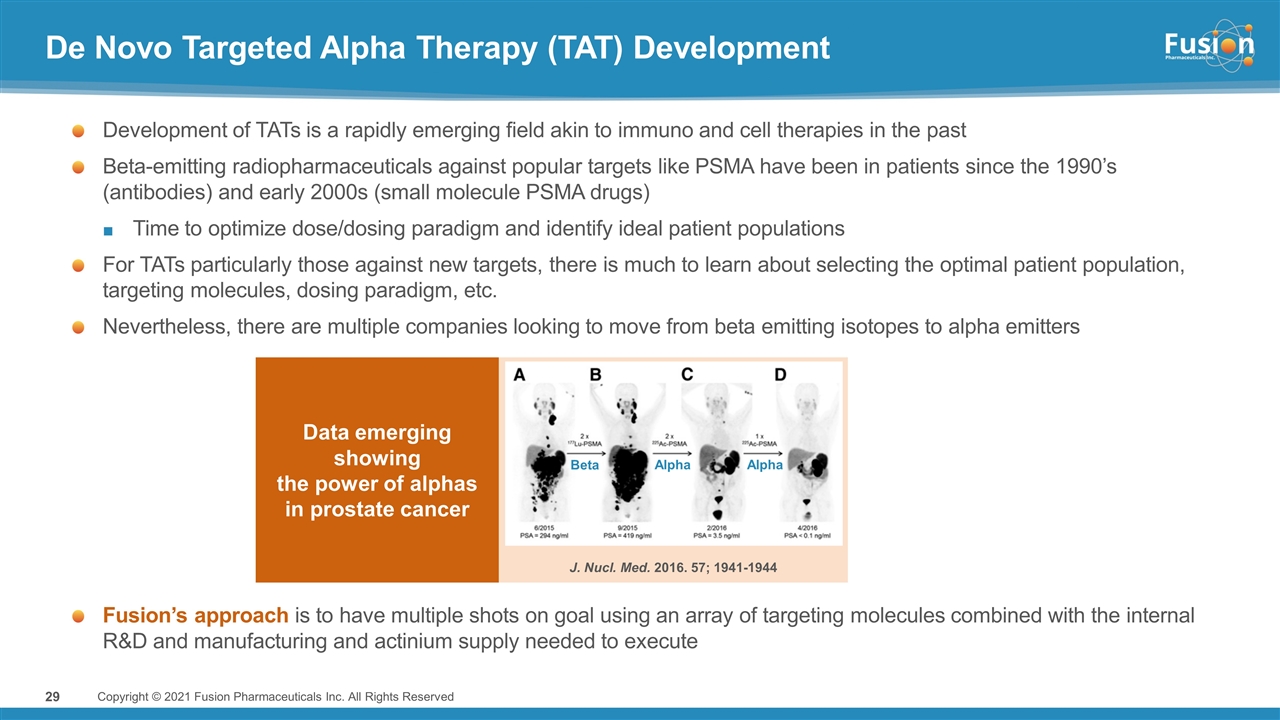

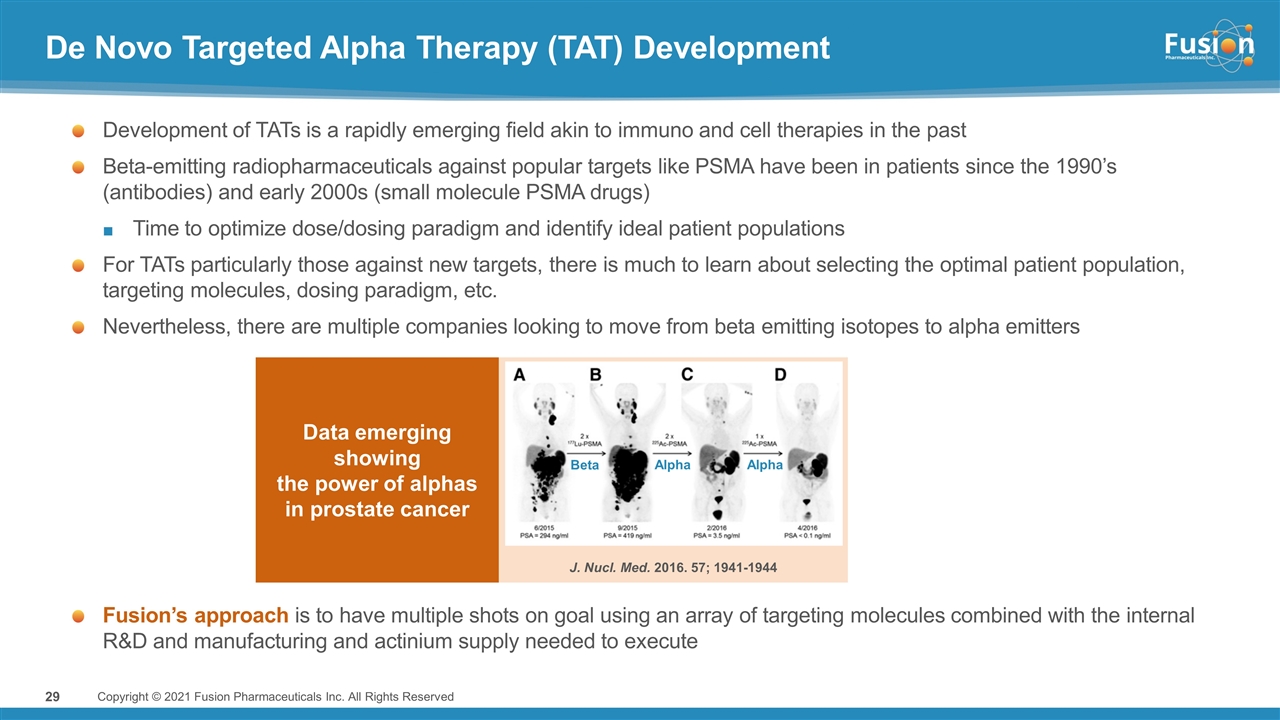

De Novo Targeted Alpha Therapy (TAT) Development Development of TATs is a rapidly emerging field akin to immuno and cell therapies in the past Beta-emitting radiopharmaceuticals against popular targets like PSMA have been in patients since the 1990’s (antibodies) and early 2000s (small molecule PSMA drugs) Time to optimize dose/dosing paradigm and identify ideal patient populations For TATs particularly those against new targets, there is much to learn about selecting the optimal patient population, targeting molecules, dosing paradigm, etc. Nevertheless, there are multiple companies looking to move from beta emitting isotopes to alpha emitters J. Nucl. Med. 2016. 57; 1941-1944 Beta Alpha Alpha Fusion’s approach is to have multiple shots on goal using an array of targeting molecules combined with the internal R&D and manufacturing and actinium supply needed to execute Data emerging showing the power of alphas in prostate cancer Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved

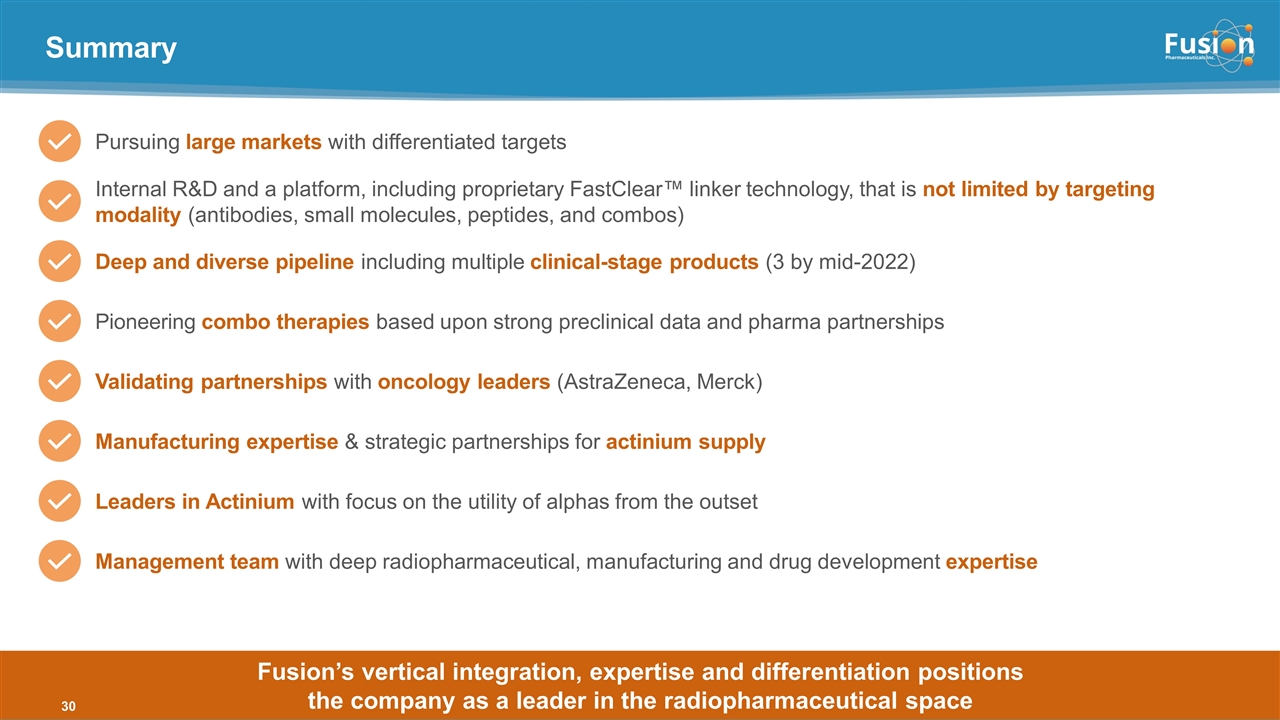

Summary Pursuing large markets with differentiated targets Internal R&D and a platform, including proprietary FastClear™ linker technology, that is not limited by targeting modality (antibodies, small molecules, peptides, and combos) Deep and diverse pipeline including multiple clinical-stage products (3 by mid-2022) Validating partnerships with oncology leaders (AstraZeneca, Merck) Pioneering combo therapies based upon strong preclinical data and pharma partnerships Manufacturing expertise & strategic partnerships for actinium supply Leaders in Actinium with focus on the utility of alphas from the outset Management team with deep radiopharmaceutical, manufacturing and drug development expertise Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved Fusion’s vertical integration, expertise and differentiation positions the company as a leader in the radiopharmaceutical space

Appendix www.FusionPharma.com Copyright © 2021 Fusion Pharmaceuticals Inc. All Rights Reserved

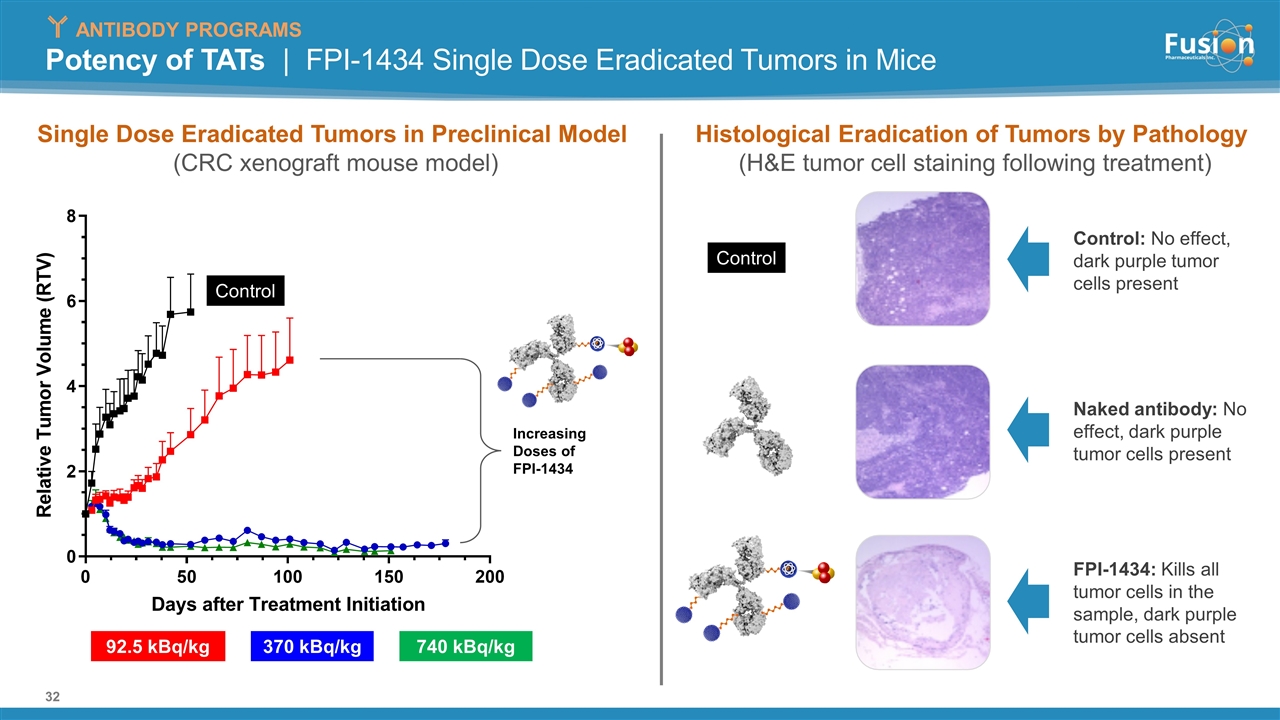

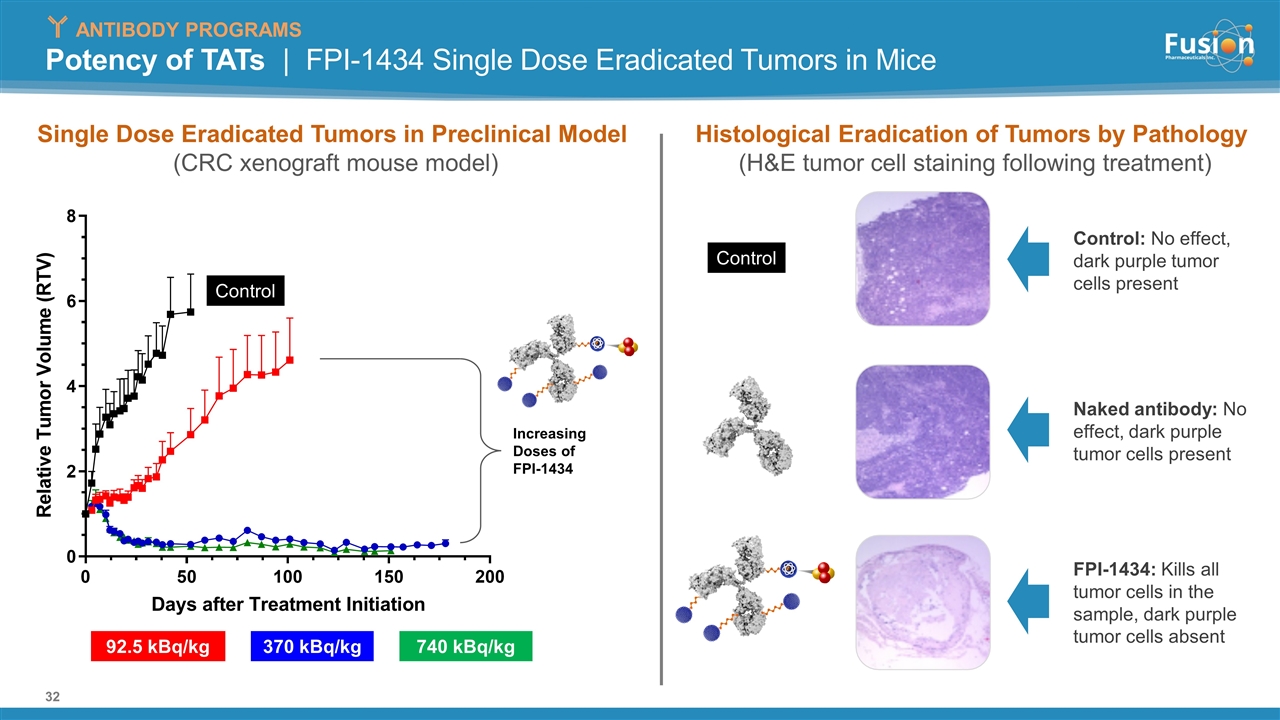

Potency of TATs | FPI-1434 Single Dose Eradicated Tumors in Mice Single Dose Eradicated Tumors in Preclinical Model (CRC xenograft mouse model) Histological Eradication of Tumors by Pathology (H&E tumor cell staining following treatment) Control: No effect, dark purple tumor cells present Naked antibody: No effect, dark purple tumor cells present FPI-1434: Kills all tumor cells in the sample, dark purple tumor cells absent Control Control 92.5 kBq/kg 370 kBq/kg Increasing Doses of FPI-1434 740 kBq/kg ANTIBODY PROGRAMS

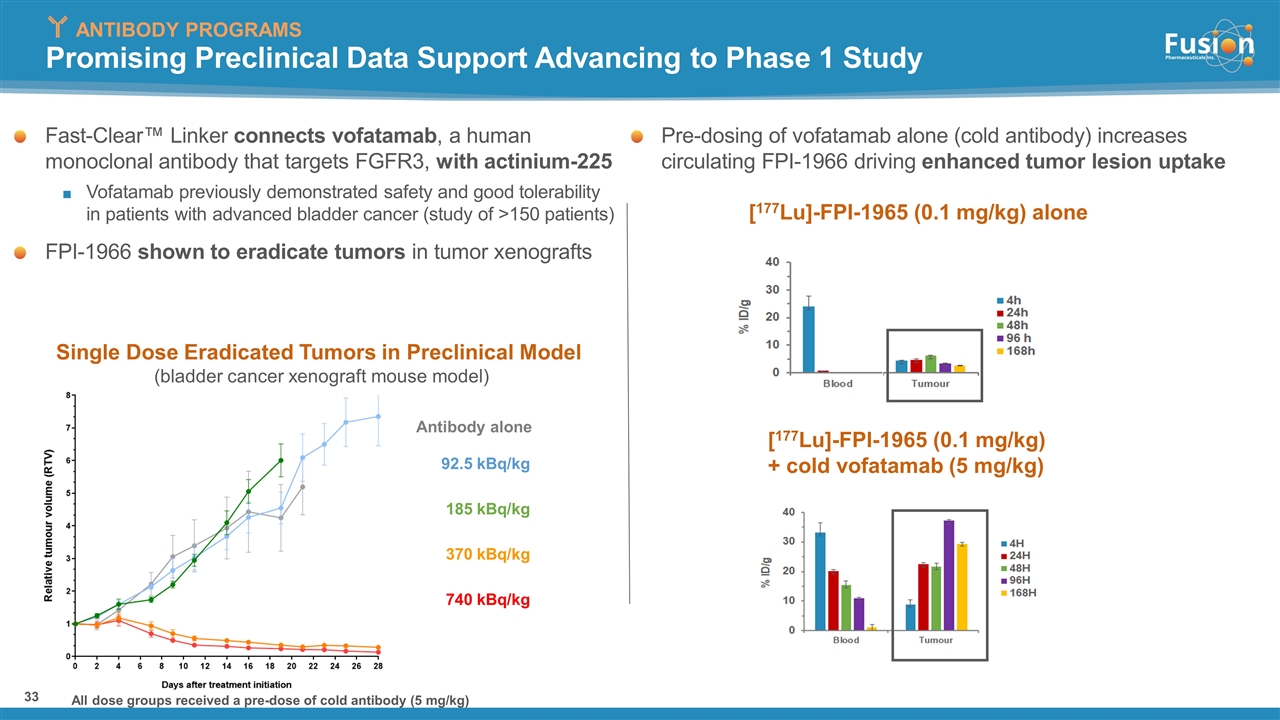

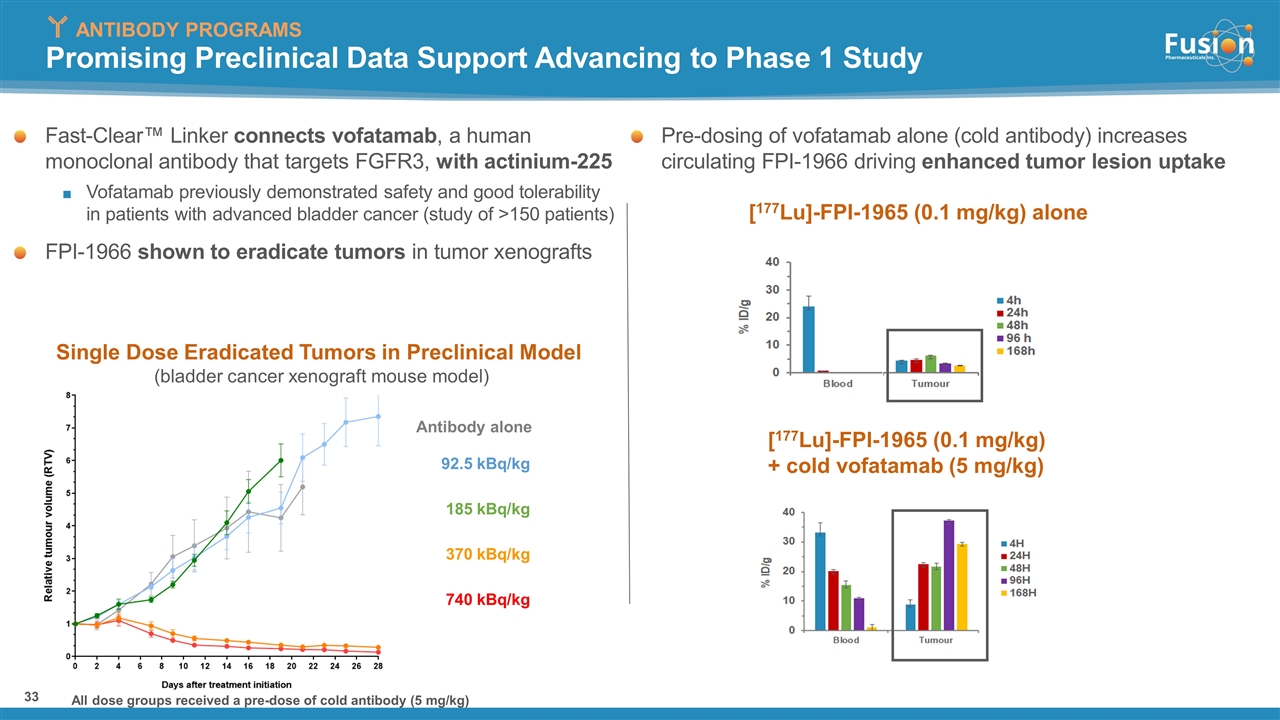

Promising Preclinical Data Support Advancing to Phase 1 Study Fast-Clear™ Linker connects vofatamab, a human monoclonal antibody that targets FGFR3, with actinium-225 Vofatamab previously demonstrated safety and good tolerability in patients with advanced bladder cancer (study of >150 patients) FPI-1966 shown to eradicate tumors in tumor xenografts Antibody alone 92.5 kBq/kg 370 kBq/kg 185 kBq/kg 740 kBq/kg All dose groups received a pre-dose of cold antibody (5 mg/kg) Pre-dosing of vofatamab alone (cold antibody) increases circulating FPI-1966 driving enhanced tumor lesion uptake [177Lu]-FPI-1965 (0.1 mg/kg) alone [177Lu]-FPI-1965 (0.1 mg/kg) + cold vofatamab (5 mg/kg) Single Dose Eradicated Tumors in Preclinical Model (bladder cancer xenograft mouse model) ANTIBODY PROGRAMS