QuickLinks -- Click here to rapidly navigate through this document

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

| Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

| o | Preliminary Proxy Statement | |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ý | Definitive Proxy Statement | |

| o | Definitive Additional Materials | |

| o | Soliciting Material Pursuant to §240.14a-12 | |

CASCADE CORPORATION | ||

| (Name of Registrant as Specified In Its Charter) | ||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||

Payment of Filing Fee (Check the appropriate box):

| ý | No fee required. | |||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

NOTICE OF ANNUAL MEETING

To the Shareholders:

Cascade Corporation's 2002 Annual Meeting will take place on Thursday, May 23, 2002, at 10:00 a.m., Pacific Daylight Time, at Corporate Headquarters, 2201 N.E. 201st Avenue, Fairview, Oregon. Shareholders will be asked to consider the following items of business:

- 1.

- Electing three directors to serve three-year terms.

- 2.

- Amendment of the 1995 Senior Managers' Incentive Stock Option Plan.

- 3.

- Such other business as may properly come before the meeting.

Shareholders of record at the close of business on March 29, 2002 will be entitled to vote at the meeting.

IF YOU DO NOT EXPECT TO ATTEND THE MEETING IN PERSON, PLEASE DATE, SIGN AND RETURN THE ENCLOSED PROXY IN THE ACCOMPANYING ENVELOPE SO THAT YOUR SHARES WILL BE VOTED. THE ENVELOPE REQUIRES NO POSTAGE IF MAILED IN THE UNITED STATES.

Greg H. Kubicek

Chairman

Portland, Oregon

April 12, 2002

PROXY STATEMENT

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors currently consists of nine directors, which our Bylaws divide into three groups. The term of office of one group expires at each Annual Meeting. This year the terms of Mr. Warren, Mr. Kubicek, Mr. Schwartz and Mr. Wessinger expire. Messrs. Warren, Schwartz and Wessinger are nominated for reelection and, if elected, will serve terms ending in 2005. Mr. Kubicek has advised the Board he does not wish to be nominated for reelection, and the Board will consist of eight directors following the Annual Meeting.

Unless directed otherwise, the accompanying proxy will be voted in favor of Mr. Warren, Mr. Schwartz and Mr. Wessinger, or, if any of them is unable to serve, for another nominee designated by the Board of Directors. Election of directors will be determined by a plurality of the votes cast. Abstentions or broker non-votes will not affect the determination of a plurality. Each nominee was elected to the Board at the 1999 Annual Meeting.

NOMINEES

| ROBERT C. WARREN, JR. | Director since 1982 | Age 53 | ||

Mr. Warren has served as President and Chief Executive Officer of the Corporation since May, 1996. He was President and Chief Operating Officer until May, 1996, and was formerly Vice President—Marketing. He is a Director of ESCO Corporation, a manufacturer of high alloy steel products. | ||||

JACK B. SCHWARTZ | Director since 1995 | Age 65 | ||

Mr. Schwartz is a partner in the law firm of Newcomb, Sabin, Schwartz & Landsverk, LLP and Assistant Secretary of the Corporation. | ||||

HENRY W. WESSINGER II | Director since 1998 | Age 49 | ||

Mr. Wessinger is Senior Vice President, Ragen MacKenzie, a Division of Wells Fargo Investments, LLC. He serves as President of the Catlin Gabel School Foundation and Treasurer of Wessinger Foundation. | ||||

(Term Expires 2003)

| C. CALVERT KNUDSEN | Director since 1974 | Age 78 | ||

Mr. Knudsen is a director of West Fraser Timber Co., Ltd., Vice Chairman of the Washington Research Foundation, retired Chairman and Chief Executive Officer of MacMillan Bloedel, Ltd., a Director and Treasurer of The Ostrom Company, and Chairman of Argyle Winery. | ||||

ERNEST C. MERCIER | Director since 1997 | Age 69 | ||

Mr. Mercier is a Director of Golden Star Resources, Ltd., a gold mining and exploration company, and of Toreador Resources Corporation, an oil and gas production and exploration company. | ||||

(Term Expires 2004)

| NICHOLAS R. LARDY, Ph.D. | Director since 1993 | Age 56 | ||

Dr. Lardy is a Senior Fellow at The Brookings Institution, a policy research institution in Washington, D.C. | ||||

1

JAMES S. OSTERMAN | Director since 1994 | Age 64 | ||

Mr. Osterman is President of Outdoor Products Group, Oregon Cutting Systems Division of Blount, Inc., a diversified international manufacturing company. | ||||

NANCY A. WILGENBUSCH, Ph.D. | Director since 1997 | Age 54 | ||

Dr. Wilgenbusch is President of Marylhurst University. She currently Chairs the Oregon Regional Advisory Board for Pacificorp, and serves on the Pacificorp Advisory Board for Scottish Power, an international energy company. She is Chairman of the Portland Branch of the Federal Reserve Bank of San Francisco. | ||||

Board Committees and Meetings

The Board of Directors currently has standing Audit, Nominating and Governance and Compensation Committees. Each director attended at least 75% in aggregate of the meetings of the Board and committees on which he or she served, except for Mr. Osterman who attended 13 of the 19 meetings. The members of the committees and the number of meetings held in the year ended January 31, 2002 are identified in the following table.

| Director | Board | Audit | Nominating and Governance | Compensation | Special | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| C. Calvert Knudsen | X | X | X | |||||||

| Greg H. Kubicek | X (Chair) | X | X | X | ||||||

| Nicholas R. Lardy | X | X | X | X | ||||||

| Ernest C. Mercier | X | X (Chair) | X | |||||||

| James S. Osterman | X | X | X (Chair) | X (Chair) | ||||||

| Jack B. Schwartz | X | |||||||||

| Robert C. Warren, Jr. | X | X (Chair) | ||||||||

| Henry W. Wessinger II | X | X | X | |||||||

| Nancy A. Wilgenbusch | X | X | X | |||||||

| Number of meetings | 12 | 4 | — | 2 | 1 |

The Nominating and Governance Committee makes recommendations to the Board with respect to nominations or elections of directors and officers. The Committee will consider prospective nominees to the Board of Directors which are submitted in writing prior to January 31, 2003. Shareholders should address recommendations to the Committee at the Company's Executive Offices. Separate reports from the Compensation and Audit Committees are presented below.

A Special Committee of Directors to consider options to increase shareholder value functioned through March 2, 2001. The Committee, consisting of Mr. Osterman, Chair, Dr. Wilgenbusch, Dr. Lardy, and Messrs. Mercier and Wessinger, was first appointed during the prior year.

Remuneration of Directors

Directors who are not employees of the Corporation received a $15,000 annual retainer, attendance fees of $1,000 for each Board and Special Committee meeting and $700 for each standing committee meeting attended during the year ended January 31, 2002. Mr. Kubicek received an additional $75,000 retainer as Chairman of the Corporation for the year ended January 31, 2002. Mr. Osterman received an additional $25,000 retainer for service as Chairman of the Compensation Committee.

2

PROPOSAL 2: AMENDMENT OF THE 1995 SENIOR MANAGERS' INCENTIVE STOCK OPTION PLAN TO INCREASE THE SHARES AVAILABLE UNDER THE PLAN BY 600,000 SHARES

On November 29, 2001, the Board of Directors approved an amendment to the Cascade Corporation 1995 Senior Managers Stock Incentive Plan (Plan) to increase the number of common shares available under the Plan by 600,000, bringing the total shares reserved for issuance under the Plan to 1,400,000. As of January 31, 2002, options for the purchase of 799,995 shares were outstanding and the market price of an underlying share as quoted by the New York Stock Exchange was $12.09. The exercise prices of outstanding options granted under the Plan range from $9.55 to $18.02 per share. No options granted under the Plan have been exercised. The amendment would become effective upon shareholder approval. The Board of Directors believes approval of the amendment is necessary for the following reasons:

- •

- The Plan is the only long-term incentive plan Cascade provides;

- •

- The availability of shares for the grant of options and other incentives under the Plan is critical to Cascade's efforts to retain key officers, managers and employees;

- •

- There is an insufficient number of shares available for grants under the Plan in 2002 and future years.

If the amendment is approved, there will be a total of 600,005 shares available under the Plan, in addition to shares reserved for issuance under outstanding option grants. Approval requires the affirmative vote of a majority of shares represented in person or by proxy at the Annual Meeting. Unless otherwise indicated, the accompanying proxy will be voted for the proposal. Abstentions and broker non-votes will be treated as if the shares were not voted.The Directors recommend that shareholders vote FOR the approval of the amendment to the 1995 Cascade Corporation Senior Managers' Stock Option Plan.

Material Features of the Plan

In 1999, the shareholders approved an amendment and restatement of the Plan, including the following material features:

Plan Administration. The Plan is administered by a Stock Option Committee consisting of non-employee directors, presently the members of the Compensation Committee. The Committee determines eligible management employees, options and other rights to be granted each, and other option terms not fixed by the Plan.

Eligible Participants. Awards may be granted to Cascade and subsidiary employees, officers and directors. Directors who are not employees are ineligible to receive awards other than the automatic, one-time option grants discussed below.

Term. The Plan will continue until all shares available for awards have been issued. However, no options or other rights under the Plan may be granted after May 8, 2005.

Types of Awards. The Plan permits the following:

(1) Stock option grants, including incentive stock options under Section 422 of the Internal Revenue Code (the Code) or nonstatutory stock options: The Committee determines the number of shares subject to the option, the period of the option and the terms of exercise. The Code provides that the exercise price for incentive stock options must equal 100% of fair market value on the date of grant (110% for optionees directly or indirectly owning more than 10% of common shares). The exercise price for nonstatutory stock options must be no less than 85% of fair market value.

3

(2) Stock bonus grants: The Committee may issue common shares as bonuses on such terms, and subject to such restrictions, as it may determine. No shares have been issued as bonuses under the Plan.

(3) Share sales: The Committee may sell common shares to employees on such terms, and subject to such restrictions as it may determine, provided that the sale price must be no less than 85% of fair market value. No such sales have taken place.

(4) Grants of other share awards or awards based on shares: These awards may include common shares or other property. The Committee may determine the recipients of such awards and the award terms, subject to the condition that any right to purchase shares be for no less than fair market value on the date of grant. This provision permits the Committee to take into account changes in tax or other legal requirements. There have been no such grants or awards.

(5) Grants of stock appreciation rights (SAR): A SAR represents the right to payment from Cascade of an amount equal to the fair market value on the date of exercise of the number of common shares covered by the portion of the grant which is exercised over the fair market value of such shares on the date of grant. Employees pay no consideration for the grant or exercise of SARs; amounts received on exercise are subject to tax withholding. Cascade can pay amounts owed on exercise in the form of cash or common shares. No SAR have been granted under the Plan.

Value of Plan Benefits. The Plan is discretionary regarding entitlement to and amount of employee grants, and it is not possible to state or estimate Plan benefits employees will receive in the future. Certain information as to outstanding option grants to senior executives under the Plan is presented at page 10 of this Proxy Statement.

Automatic Grants. Directors initially elected by the shareholders are entitled to a one-time, 5,000 share, automatic option grant upon election. Options granted to Directors vest and become exercisable 25% upon grant and 25% per year thereafter. No present Director is eligible for further option awards under the Plan.

Tax Treatment. Tax consequences of the award or exercise of rights under the Plan to Cascade and to grant recipients will depend upon specific provisions of federal, state or foreign tax laws. A summary of basic United States federal income tax effects of awards under the Plan follows:

(1) Incentive Stock Options: Optionees normally recognize no income on the grant or exercise of options, and are taxed at capital gains rates on the difference between the exercise and sale prices upon sale of shares acquired through the exercise of options. In the event of a "disqualifying disposition" (sale within two years of grant or one year of exercise), an optionee will recognize ordinary income, and Cascade will receive a corresponding deduction, equal to the difference between the option price of shares covered by the option and the fair market value of those shares at the date the option is exercised. Any balance realized on sale would be taxed to the employee at capital gains rates.

(2) Nonstatutory stock options: Recipients of nonstatutory stock options recognize no income until an option is exercised. On exercise the optionee will recognize ordinary income, and Cascade will receive a corresponding deduction, equal to the difference between the option price and the fair market value of those shares as to which the option is exercised. When shares are sold, any increase in value will be taxable at ordinary or capital gains rates, depending upon the length of time the shares are held.

(3) Stock bonus grants, share sales, and other share awards: Grants of shares or other property which are not subject to a substantial risk of forfeiture and may be transferred will be taxable as ordinary income to the extent fair market value exceeds the amount paid. Cascade will be entitled to a corresponding tax deduction for compensation. To the extent such grants may not be transferred or are subject to a substantial risk of forfeiture, a recipient, and Cascade, normally will not realize these

4

income tax consequences until the risk of forfeiture lapses or the shares become transferable; however, the recipient may elect to recognize income for tax purposes upon grant as if there were no restrictions on transfer or risks of forfeiture, in which case Cascade would generally receive a corresponding deduction at that time.

(4) SAR Awards: Recipients of SARs realize no income until the SAR is exercised. On exercise, the recipient will recognize ordinary income, and Cascade will be entitled to a compensation deduction in an amount equal to cash, and the fair market value of any shares, received.

COMPENSATION COMMITTEE'S REPORT ON EXECUTIVE COMPENSATION

The Compensation Committee recommends executive salary levels and compensation programs to the Board of Directors for approval. Compensation for key Cascade executives consists of three major elements: base salary, annual incentive, and long term incentive. The Committee, with advice from the consulting firm of William M. Mercer Co., had previously reviewed executive compensation and developed an approach to salary and incentive compensation which was fully implemented during the year ended January 31, 2002.

The Committee recommended base salary levels for the year ended January 31, 2002, after considering both compensation ranges for executives with like responsibilities in comparable companies and industries, and their view that executive compensation should reflect performance incentives to a substantial degree.

The incentive plan groups executive officers according to responsibility levels and establishes target annual incentive levels for each group. Incentive payments are triggered only if Cascade's net income reaches 75% of budgeted net income. Executive incentive awards, except for the Chief Executive Officer, are based on three criteria: Cascade's net income relative to the budget (40%), return on assets (40%), and the individual executive's achievement against agreed objectives (20%). Once net income of 75% of budgeted net income is reached, executive officers will be eligible for bonuses equal to a minimum of 40%, and a maximum of 200%, of their target incentive depending upon the degree to which the three qualifying criteria are met. For the year ended January 31, 2002, no regular incentive payments were made to officers, including the Chief Executive Officer, since Cascade's net income did not reach 75% of budgeted net income.

The Committee and the Board will provide long-term incentives through option grants under Cascade's Senior Managers' Incentive Stock Option Plan upon approval by shareholders of Proposal 2 in this Proxy Statement.

The Committee and the Board establish the Chief Executive Officer's compensation according to the criteria outlined above. Mr. Warren's incentive level target for the current year will equal 75% of base salary, and his incentive payment will be based 50% on net income relative to budget and 50% on return on assets, thus tying his incentive eligibility entirely to overall corporate performance.

| COMPENSATION COMMITTEE | ||

| James S. Osterman, Chair C. Calvert Knudsen Greg H. Kubicek Nicholas Lardy |

5

The Company's Audit Committee consists of five non-employee directors, who are independent, as that term is defined in Sections 303.01(B)(2)(a) and (3) of the New York Stock Exchange Listing Standards. The Board has adopted a charter that governs the Audit Committee. The Charter is attached to this Proxy Statement as Appendix A. The members of the Committee are Ernest C. Mercier, Chair, C. Calvert Knudsen, Greg H. Kubicek, James S. Osterman, and Nancy A. Wilgenbusch.

The Company's management is responsible for Cascade Corporation's internal controls and financial reporting. PricewaterhouseCoopers, LLP, Cascade's independent auditors, are responsible for auditing Cascade's annual consolidated financial statements in accordance with generally accepted auditing standards and for issuing a report on those financial statements. The Audit Committee monitors and oversees these processes, recommends to the Board the filing of Cascade's annual and quarterly reports with the Securities and Exchange Commission, and recommends to the Board for its approval a firm of certified independent accountants to be Cascade's independent auditors.

To fulfill our responsibilities, we did the following:

- •

- We reviewed the independent auditors audit plan for the year ended January 31, 2002.

- •

- We reviewed and discussed with Cascade's management and the independent auditors Cascade's consolidated financial statements for the fiscal year ended January 31, 2002.

- •

- We reviewed management's representations to us that those consolidated financial statements were prepared in accordance with generally accepted accounting principles.

- •

- We discussed with the independent auditors the matters that Statement on Auditing Standards No. 61 (communications with Audit Committees) requires them to discuss with us, including matters related to the conduct of the audit of Cascade's consolidated financial statements.

- •

- We received written disclosures and the letter from the independent auditors required by Independence Standards Board Standard No. 1 relating to their independence from Cascade, and we have discussed with PricewaterhouseCoopers LLP their independence from the Company.

- •

- We considered whether PricewaterhouseCoopers LLP's nonaudit services to Cascade were compatible with maintaining their independence from Cascade.

- •

- Based on the discussions we had with management and the independent auditors, the independent auditors' disclosures and letter to us, the representations of management to us and the report of the independent auditors, we recommended to the Board that Cascade's audited annual consolidated financial statements for the fiscal year 2002 be included in Cascade's Form 10-K for the fiscal year ended January 31, 2002 for filing with the Securities and Exchange Commission.

- •

- Based on the discussions we had with management and the independent auditors, the representations of management to us and the representations of the independent auditors, we recommended to the Board that Cascade's interim consolidated financial statements at April 30, 2001, July 31, 2001 and October 31, 2001 be included in Cascade's Form 10-Q for the quarters then ended for filing with the Securities and Exchange Commission.

- •

- We recommended that the Board select PricewaterhouseCoopers LLP as Cascade's independent auditors to audit and report on any consolidated financial statements of Cascade filed with the Securities and Exchange Commission in fiscal year 2003.

| Audit Committee | ||

Ernest C. Mercier, Chair C. Calvert Knudsen Greg H. Kubicek James S. Osterman Nancy A. Wilgenbusch |

6

VOTING SECURITIES—STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

As of March 20, 2002, Cascade had 11,291,990 common shares and one special voting share outstanding. The special voting share is entitled to cast 800,000 votes on matters presented to shareholders, bringing the total number of votes which may be cast on any matter presented to the shareholders to 12,091,990. TD Trust Company holds the special voting share as trustee for the owner of 800,000 exchangeable shares of a Cascade subsidiary which may be converted into a like number of Cascade common shares. TD Trust Company is required to vote as the owner of the shares may instruct.

The percentage calculations below assume conversion of the 800,000 exchangeable shares into common shares, and include 391,021 shares issuable, based on stock options vesting within 60 days of March 20, 2002:

| Person or Entity | Amount and Nature of Beneficial Ownership(1) | Percent of Class(2) | ||

|---|---|---|---|---|

| Cannell Capital LLC The total shown reflects a Schedule 13D filed with the Securities and Exchange Commission on or about December 13, 2001. 150 California Street, 5th Floor San Francisco, California 94111 | 832,300 | 6.7% | ||

| The Robert C. and Nani S. Warren Revocable Trust, of which Nani S. Warren, Robert C. Warren, Jr., C. Calvert Knudsen, and Jack B. Schwartz are Trustees and share investment powers. Mr. Warren has sole voting power. Messrs. Knudsen and Schwartz disclaim beneficial ownership in Trust shares. c/o P.O. Box 20187 Portland, Oregon 97294-0187 | 827,896 | 6.7% | ||

| William J. Harrison The total shown includes 10,000 common shares as to which Mr. Harrison holds sole voting power and 800,000 exchangeable shares owned by W.J. Harrison Holdings, Ltd., each of which may be exchanged for one common share. Mr. Harrison owns 100% of the outstanding shares of W.J. Harrison Holdings, Ltd. Information is based upon a Schedule 13D filed with the Securities and Exchange Commission on or about February 9, 1999. 27 Fox Run Drive, RR#3 Guelph, Ontario, Canada N1H 6N9 | 810,000 | 6.5% | ||

| Nani S. Warren Revocable Trust, of which Nani S. Warren is Trustee and has sole investment power c/o P.O. Box 20187 Portland, Oregon 97294-0187 | 800,096 | 6.5% | ||

| Dimensional Fund Advisors I The total shown reflects a Schedule 13G filed with the Securities and Exchange Commission on or about February 2, 2001. Dimensional Fund Advisors Inc. has sole voting power with respect to such shares which are owned by certain of its advisory clients and disclaims beneficial ownership of all such securities. 1299 Ocean Avenue, 11th Floor Santa Monica, California 90401 | 755,950 | 6.1% |

7

| Robert J. Davis Family The total shown reflects a Schedule 13D filed with the Securities Exchange Commission on or about September 12, 2000. Shares are voted as directed by Mr. Robert J. Davis. 17530 Little River Dr. Bend, Oregon 97707 | 682,100 | 5.5% | ||

| Michael W. Cook, Asset Management, Inc. The total shown reflects a Schedule 13d-1(b) filed with the Securities and Exchange Commission on or about February 14, 2001. Michael W. Cook Asset Management, Inc., has sole voting power with respect to such shares which are owned by certain of its advisory clients. 5170 Sanderlin Avenue Suite 200 Memphis, TN 38117 | 659,900 | 5.3% | ||

| Robert C. Warren, Jr. | 161,171 | (3)(4) | 1.3% | |

| Jack B. Schwartz | 139,181 | (5) | 1.1% | |

| C. Calvert Knudsen | 13,187 | * | ||

| James S. Osterman | 10,787 | * | ||

| Nicholas R. Lardy | 9,087 | * | ||

| Greg H. Kubicek | 8,365 | * | ||

| Henry W. Wessinger II | 8,000 | * | ||

| Ernest C. Mercier | 6,187 | * | ||

| Nancy A. Wilgenbusch | 5,187 | * | ||

| Richard S. Anderson | 34,169 | (3) | * | |

| Gregory S. Anderson | 29,418 | (3) | * | |

| Terry H. Cathey | 34,528 | * | ||

| 12 Officers and Directors as a Group | 1,287,163 | (6) | 10.3% |

- (1)

- Includes shares issuable upon exercise of currently vested stock options or options that will vest within 60 days of March 20, 2002, as follows: R.C. Warren, Jr., 67,713, T.H. Cathey, 28,028, R.S. Anderson, 24,861, G.S. Anderson, 23,402, C.C. Knudsen, N.R. Lardy, E.C. Mercier, J.S. Osterman, J.B. Schwartz, G.H. Kubicek, H.W. Wessinger and N.A. Wilgenbusch, 5,000 each, and all executive officers and directors, 184,004.

- (2)

- No officer or director owns more than 1% of Cascade's outstanding shares, except for the following who may be considered to own beneficially the percentages indicated: R.C. Warren, Jr., 7.9%; C.C. Knudsen, 6.7%; and J.B. Schwartz, 7.7%. These percentages in each case include shares held as trustee for The Robert C. and Nani S. Warren Revocable Trust and should not be combined to determine the total percentage voting power of the persons listed.

- (3)

- Includes shares held for the benefit of these officers by a 401(k) plan as follows: R.C. Warren, Jr., 29,954; R.S. Anderson, 3,034; and G.S. Anderson, 5,016.

- (4)

- Includes shared voting and investment powers as to 22,000 shares and sole voting and investment powers as to 9,600 shares, all held as fiduciary for the benefit of various family members, and 1,200 shares owned by Mr. Warren's spouse, as to all which Mr. Warren disclaims beneficial interest.

- (5)

- Includes shared voting and investment powers as to 128,394 shares, or 1.0% of those outstanding, held by a charitable foundation, as to which Mr. Schwartz disclaims beneficial interest.

- (6)

- Includes an aggregate of 989,090 shares held by officers and directors in fiduciary capacities.

8

CERTAIN TRANSACTIONS INVOLVING DIRECTORS AND MANAGEMENT

Newcomb, Sabin, Schwartz & Landsverk, LLP, a firm in which a director, Jack B. Schwartz, is a partner, provides legal services to Cascade in the ordinary course of business. During the year ended January 31, 2002, Cascade paid the firm fees of approximately $409,000.

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Securities Exchange Act of 1934 requires directors, executive officers and holders of more than 10% of any class of our shares to file reports regarding their stock ownership and any changes in that ownership with the Securities and Exchange Commission. Cascade believes its officers, directors and 10% shareholders complied with all Section 16(a) filing requirements during the year ended January 31, 2002.

Item 13. Certain Relationships and Related Transactions

EXECUTIVE OFFICER COMPENSATION

Summary Compensation Table

The following table provides information concerning compensation of Cascade's Chief Executive Officer and each of its four other most highly compensated officers for the year ended January 31, 2002, and for each of the prior two fiscal years.

| | | Annual Compensation | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position | Year ended January 31, | Salary | Incentive Payment | All Other Compensation(1) | |||||||

| Robert C. Warren, Jr. President and Chief Executive Officer | 2002 2001 2000 | $ | 325,000 325,000 325,000 | $ | — 487,500 175,000 | $ | 12,050 12,050 11,400 | ||||

| Terry H. Cathey Sr. Vice President and Chief Operating Officer | 2002 2001 2000 | 170,000 170,000 160,000 | — 221,000 95,455 | 12,050 12,017 11,400 | |||||||

| Richard S. Anderson Sr. Vice President and Chief Financial Officer | 2002 2001 2000 | 168,000 150,000 140,000 | — 182,000 82,727 | 11,983 11,217 10,600 | |||||||

| Kurt G. Wollenberg (2) Sr. Vice President—Finance | 2002 2001 2000 | 202,308 150,000 150,000 | — 170,625 95,455 | 5,319 11,250 11,000 | |||||||

| Gregory S. Anderson Sr. Vice President—Human Resources | 2002 2001 2000 | 140,000 140,000 140,000 | — 140,000 82,727 | 10,850 10,850 10,600 | |||||||

| Art Otsuka Vice President—Asian Operations (3) | 2002 2001 2000 | 150,000 125,000 — | — — — | 6,668 — — | |||||||

- (1)

- The amounts shown primarily relate to Cascade contributions to a 401(k) plan for the benefit of the named executives.

- (2)

- Mr. Wollenberg resigned from the Company, effective May 4, 2001. Salary amounts for the year ended January 31, 2002 include $150,000 in severance payments.

- (3)

- Mr. Otsuka joined the Company in April 2000.

9

Compensation Pursuant to Stock Options

| | | % of Total Options Granted in Fiscal 2002 | | | Potential Realizable Value at Assumed Rates for Option Term(3) | | | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | Value of Unexercised in-the-money options at 1/31/02 | |||||||||||||||

| Name | Options Granted in Fiscal 2002 | Exercise Price Per Share(1) | Expiration Date(2) | Options Outstanding at 1/31/02 | ||||||||||||||||

| 5% | 10% | |||||||||||||||||||

| Robert C. Warren, Jr. | 67,513 | 21.4 | % | $ | 11.06 | (4 | ) | $ | 1,000,617 | $ | 1,936,684 | 191,873 | $ | 135,677 | ||||||

| Terry H. Cathey | 17,955 | 5.7 | 10.05 | (4 | ) | 241,896 | 468,188 | 62,363 | 68,820 | |||||||||||

| Richard S. Anderson | 17,955 | 5.7 | 10.05 | (4 | ) | 241,896 | 468,188 | 59,042 | 68,820 | |||||||||||

| Gregory S. Anderson | 17,955 | 5.7 | 10.05 | (4 | ) | 241,896 | 468,188 | 56,608 | 68,820 | |||||||||||

- (1)

- Represents weighted average exercise price per share.

- (2)

- Under the terms of the Stock Option Plan, options are granted at fair market value (110% of fair market value in Mr. Warren's case). Vesting for options granted in fiscal 1999, 2000, 2001 and 2002 occurs over a four year period, while options granted in previous years generally may not be exercised until the employee has completed three years of continuous employment with the Company or its subsidiaries from the grant date. Options have a term of ten years and generally terminate on the date of the optionee's termination of employment with the corporation, or in the event of death or disability, on the first anniversary of the optionee's termination of employment.

- (3)

- Potential Realizable Value calculation assumes appreciation at the rate shown beginning on the date of grant through the option expiration date.

- (4)

- Options granted in fiscal 2002 expire in June 2011 and September 2011.

Severance Agreements

Cascade has entered into severance agreements with Messrs. R.C. Warren, Jr., R.S. Anderson, and T.H. Cathey. Under the agreements each would be entitled to certain benefits if his employment is involuntarily terminated (other than for cause) within 12 months following a change in control of the Company. In addition to discharge, involuntary termination includes resignation following a change which materially reduces an individual's level of responsibility, a 20% reduction in level of compensation, or a relocation of place of employment by more than 50 miles.

The agreements define a change in control of the Company as (a) a change in the composition of the Board of Directors over a period of 24 months or less as a result of contested elections which results in a majority of Board members who were not Board members at the beginning of the period or were not subsequently nominated or elected by the Board; (b) sale, transfer or other disposition of substantially all of Cascade's assets; (c) a merger or consolidation in which securities with more than 50% of the voting power of all outstanding Cascade securities are transferred to persons different from the holding of such securities prior to the transaction; or (d) the successful acquisition of securities possessing more than 35% of the voting power of all outstanding Cascade securities pursuant to a transaction or series of related transactions that the Board does not recommend for shareholder acceptance or approval.

An officer whose employment is involuntarily terminated following a change in control would receive the following severance benefits: (a) a lump sum payment equal to 2.99 times the officer's average annual compensation of the prior three years as reported on Form W-2; (b) accelerated vesting of all outstanding stock options; and (c) continued health coverage for the officer and eligible dependents for a period of 24 months or until the officer is covered by another health plan which provides a substantially similar level of benefits. In order to avoid becoming an excess parachute payment under federal tax laws, the total benefit package is limited to 2.99 times the officer's average compensation as reported on Form W-2 for the prior five years, subject to certain exceptions, provided under the Internal Revenue Code.

Each agreement provides that the officer will not compete with Cascade for a period of 24 months following termination of employment for any reason.

10

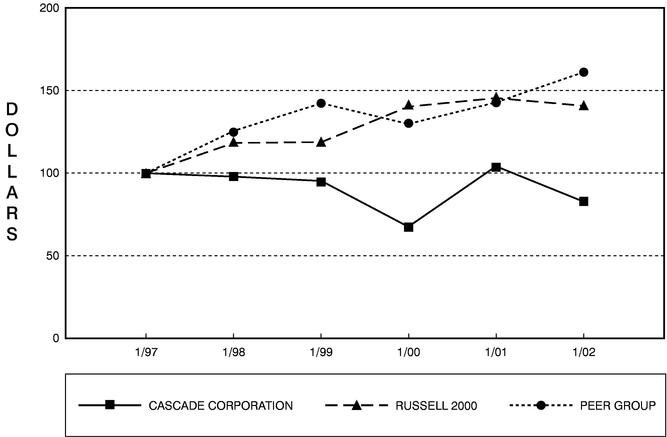

The following graph compares the annual percentage change in the cumulative shareholder return on Cascade common stock with the cumulative total return of the Russell 2000 Index and an industry group of peer companies, in each case assuming investment of $100 on January 31, 1997, and reinvestment of dividends.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

AMONG CASCADE CORPORATION, THE RUSSELL 2000 INDEX

AND A PEER GROUP

* $100 INVESTED ON 1/31/97 IN STOCK OR INDEX—

INCLUDING REINVESTMENT OF DIVIDENDS

FISCAL YEAR ENDING JANUARY 31.

The peer group comprises the following companies: Actuant Corporation., Alamo Group Inc., Ampco-Pittsburgh Corporation, Astec Industries, Inc., Columbia-McKinnon Corporation, Gehl Company, Gulf Island Fabrication, Inc., IDEX Corporation, Lindsay Manufacturing Company, Nordson Corporation.

11

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

The Company's Audit Committee has recommended to the Board of Directors that PricewaterhouseCoopers LLP (PricewaterhouseCoopers) serve as the Company's independent auditor for the fiscal year ending January 31, 2003. Cascade expects representatives of PricewaterhouseCoopers LLP to be present at the meeting. They will have the opportunity to make a statement if they desire to do so, and will be available to respond to appropriate questions from shareholders.

Fees billed for professional services performed by PricewaterhouseCoopers for the year ended January 31, 2002 are as follows:

Audit Fees

Aggregate fees for professional services rendered by PricewaterhouseCoopers in connection with its audit of the Company's consolidated financial statements as of and for the year ended January 31, 2002 and its limited reviews of the Company's unaudited condensed consolidated interim financial statements were $440,200.

Financial Information Systems Design and Implementation Fees

During the year ended January 31, 2002, PricewaterhouseCoopers rendered no professional services to the Company in connection with the design and implementation of financial information systems.

Other Fees

In addition to the fees described above, aggregate fees of $305,000 were billed by PricewaterhouseCoopers during the year ended January 31, 2002, primarily for the following professional services:

| Audit-related services(a) | $ | 92,100 | |

| Income tax compliance and related tax services | 171,300 | ||

| Other(b) | 41,600 |

- (a)

- Audit related fees include fees for audits of the Company's employee benefit plans, statutory audits and consultation regarding new accounting pronouncements.

- (b)

- Miscellaneous services, primarily consultation regarding the sale of the Company's hydraulic cylinder division and review of information system controls.

Cascade may make arrangements with brokerage houses and other custodians to send proxies and proxy-soliciting materials to their principals, and may reimburse them for their expenses.

Shareholder proposals intended to be presented at the next Annual Meeting must be received by Cascade no later than January 31, 2003, to be included in the proxy materials for the meeting. A shareholder making a proposal must have been a registered or beneficial owner of at least one percent of the outstanding common shares or common shares with a market value of at least $2,000 for at least one year prior to submitting the proposal and must continue to own the stock through the date the meeting is held.

12

Cascade is mailing its Annual Report on Form 10-K to shareholders with this Notice of Annual Meeting and Proxy Statement. The Annual Report is not incorporated in the Proxy Statement by reference, nor is it a part of the proxy-soliciting material.

A copy of Cascade's Annual Report on Form 10-K filed with the Securities and Exchange Commission is available without charge to record or beneficial shareholders as of the record date. Requests for the form should be addressed to the Secretary, Cascade Corporation, at its Executive Offices, P.O. Box 20187, Portland, Oregon 97294-0180.

13

APPENDIX A

AUDIT COMMITTEE CHARTER

- A.

- The Audit Committee shall have at least three members and consist solely of independent directors qualified under the rules of the New York Stock Exchange. The Chair shall be appointed by the Board and shall be responsible for scheduling meetings.

- B.

- The Audit Committee and Board are responsible for the selection, evaluation and replacement of the independent auditors, and such auditors ultimately are accountable to the Board and the Audit Committee.

- C.

- The Audit Committee is responsible for ensuring that the outside auditor submits on a periodic basis a formal written statement delineating all relationships between the outside auditors and the Company.

- D.

- The Audit Committee is responsible for actively engaging in dialogue with the outside auditor with respect to any disclosed relationships or services that may impact the auditor's objectivity and independence, and for recommending that the Board take appropriate action in response to the outside auditor's report to satisfy itself of the outside auditor's independence.

- E.

- The Audit Committee shall meet at least twice annually, or more frequently, as determined by the Chair, and shall meet at least annually with Management and the outside auditors separately to discuss any matters that the Committee believes should be discussed privately. In addition, at least the Chair should meet with the outside auditors and Management quarterly to review the Company's financial statements. The Committee shall also have such additional responsibilities as prescribed by rules of the New York Stock Exchange or the SEC and the Corporate Bylaws.

A-1

PROXY

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

CASCADE CORPORATION

The undersigned hereby appoints R.C. Warren, Jr. and R.S. Anderson, and each of them, with power to act without the other and with power of substitution, as proxies and attorneys-in-fact and hereby authorizes them to represent and vote, as provided on the other side, all the shares of Cascade Corporation Common Stock which the undersigned is entitled to vote, and, in their discretion, to vote upon such other business as may properly come before the Annual Meeting of Stockholders of the Company to be held May 23, 2002 or any adjournment thereof, with all powers which the undersigned would possess if present at the Meeting.

(Continued, and to be marked, dated and signed, on the other side)

^ Detach here from proxy voting card. ^ |

You can now access your Cascade account online.

Access your Cascade Corporation shareholder/stockholder account online via Investor ServiceDirectSM (ISD).

Mellon Investor Services LLC agent for Cascade Corporation Investor Services, now makes it easy and convenient to get current information on your shareholder account. After a simple, and secure process of establishing a Personal Identification Number (PIN), you are ready to log in and access your account to:

| • | View account status | • | View payment history for dividends | |||

| • | View certificate history | • | Make address changes | |||

| • | Establish/change your PIN |

Visit us on the web at http://www.melloninvestor.com

and follow the instructions shown on this page.

| Step 1: FIRST TIME USERS – Establish a PIN You must first establish a Personal Identification Number (PIN) online by following the directions provided in the upper right portion of the web screen as follows. You will also need your Social Security Number (SSN) available to establish a PIN. Investor ServiceDirectSM is currently only available for domestic individual and joint acounts. • SSN • PIN • Then click on theEstablish PIN button Please be sure to remember your PIN, or maintain it in a secure place for future reference. | Step 2: Log in for Account Access You are now ready to log in. To access your account please enter your: • SSN • PIN • Then click on theSubmit button If you have more than one account, you will now be asked to select the appropriate account. | Step 3: Account Status Screen You are now ready to access your account information. Click on the appropriate button to view or initiate transactions. • Certificate History • Issue Certificate • Payment History • Address Change |

For Technical Assistance Call 1-877-978-7778 between

9am-7pm Monday-Friday Eastern Time

| THIS PROXY WILL BE VOTED AS DIRECTED, OR IF NO DIRECTION IS INDICATED, WILL BE VOTED "FOR" THE PROPOSALS THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS. | Please mark your votes as indicated in this example | ý |

| The Board of Directors recommend a vote FOR Item 2. | FOR, EXCEPT NOMINEES WITHHELD BELOW | WITHHELD FOR ALL | FOR | AGAINST | ABSTAIN | ||||||||||||

| 1. Election of Directors Nominees: 01 Robert C. Warren, Jr. 02 Henry W. Wessinger II 03 Jack B. Schwartz | o | o | ITEM 2- | APPROVAL OF AN AMENDMENT TO THE 1995 SENIOR MANAGERS' INCENTIVE STOCK OPTION PLAN | o | o | o | Please disregard if you have previously provided your consent decision. | |||||||||

| Withheld for the nominees you list below. (Write that nominee's name in the space provided below.) ________________________________ | If you plan to attend the Annual Meeting, please mark the WILL ATTEND box | WILL ATTEND o | By checking the box to the right, I consent to the future delivery of annual reports, proxy statements, prospectuses and other materials and shareholder communications electronically via the Internet at a webpage which will be disclosed to me. I understand that the Company may no longer distribute printed materials to me from any future shareholder meeting until such consent is revoked. I understand I may revoke my consent at anytime by contacting the Company's transfer agent, Mellon Investor Services LLC, Ridgefield Park, NJ and that costs normally associated with electronic delivery, such as usage and telephone charges as well as any costs I may incur in printing documents, will be my responsibility. | o | |||||||||||||

Signature | Signature | Date | ||||||||

| NOTE: Please sign as name appears hereon. Joint owners should each sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. | ||||||||||

^ Detach here from proxy voting card. ^ | ||||||||||

Vote by Internet or Telephone or Mail

24 Hours a Day, 7 Days a Week

Internet and telephone voting is available through 4PM Eastern Time

the business day prior to annual meeting day.

Your telephone or Internet vote authorizes the named proxies to vote your shares in the same manner

as if you marked, signed and returned your proxy card.

Internet http://www.eproxy.com/cae | Telephone 1-800-435-6710 |

| Use the Internet to vote your proxy. Have your proxy card in hand when you access the web site. You will be prompted to enter your control number, located in the box below, to create and submit an electronic ballot. | OR | Use any touch-tone telephone to vote your proxy. Have your proxy card in hand when you call. You will be prompted to enter your control number, located in the box below, and then follow the directions given. | OR | Mark sign and date your proxy card and return it in the enclosed postage-paid envelope. |

If you vote your proxy by Internet or by telephone,

you do NOT need to mail back your proxy card.

You can view the Annual Report and Proxy Statement

on the internet at: http://www.cascorp.com

COMPENSATION COMMITTEE'S REPORT ON EXECUTIVE COMPENSATION

AUDIT COMMITTEE REPORT

VOTING SECURITIES—STOCK OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

CERTAIN TRANSACTIONS INVOLVING DIRECTORS AND MANAGEMENT

SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

EXECUTIVE OFFICER COMPENSATION

PERFORMANCE GRAPH

INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

PROXY SOLICITATION

SHAREHOLDER PROPOSALS

ANNUAL REPORT

APPENDIX A AUDIT COMMITTEE CHARTER