Issuer Free Writing Prospectus dated December 27, 2021

Filed Pursuant To Rule 433

Registration No. 333-255424

[Transcript of Liquidity and Opportunity Zone Investing, Publicly Traded Opportunity Zone Fund CPA Academy Webinar from December 22, 2021]

Jasmine: Hello everyone and welcome to another webinar from CPA Academy. My name is Jasmine, and I’ll be your moderator for today’s event, Liquidity and Opportunity Zone Investing, Publicly Traded Opportunity Zone Fund. Our presenters for today are Brandon Lacoff and Cody Laidlaw. Before we get started though, I just want to do a quick check to make sure everything is working out on your end in the audience. Please head over to the questions box on your Go-To Webinar side panel and type me a quick message to let me know that you can hear my voice and see the title slide. Also, feel free to let me know what city you’re listening in from, I always enjoy seeing that coming in from all over the world. Now, while we’re collecting those responses, please note that this questions box is your main communication vehicle for the presentation. This is where you’ll let me know if you have any technical trouble during the broadcast, or if you have any comments or questions for our presenters today. We’ll do our best to get around to you all as quickly as possible.

Alright, I see you guys chiming in from, Memphis, Tennessee, Sarasota Florida, Tampa, El Paso Texas, nice. Thanks so much for confirming. Now that we know everything is working, let’s go through some housekeeping. This is a one CPE or one CE webinar. The way that you earn that credit is fairly straightforward. Just stay logged in for fifty minutes, that’s five O minutes and answer the poll questions. We’ll have four polls today, and to earn full credit, you’ll need to answer at least three of them. As always though we encourage you to answer as many polls and as quickly as possible. It’ll be so interesting to see all the results from across the audience. Now finally, an archive recording of today’s webinar, along with your CPE credit will be available in your CPA Academy accounts within 24 hours. We also recommend that you download today’s presentation materials, which can be found in the control panels handouts tab. Now that we’re all set, let’s welcome our first speaker Cody, our attendees are ready and the floor is all yours.

Cody Laidlaw: Perfect. Thank you very much Jasmine, and good afternoon everybody. So before we get started, I have to read this disclaimer, so bear with me. So today’s presentation may include statements that are forward-looking statements within the meaning of the federal securities laws. Any forward-looking statements expressed in this webinar are made in good faith, and we believe there is a reasonable basis for them. However, there are a number of risks, uncertainties and other important factors, many of which are difficult or impossible to predict, that could cause actual results to vary materially from the forward-looking statements expressed in this webinar. Except as otherwise required by law, we will not update or revise any forward-looking statements to reflect subsequent events. Belpointe PREP has filed a registration statement with the SEC for the offer and sale of up to $750 million dollars’ worth of its Class A units. Investing in Belpointe PREP’s Class A units involves a high degree of risk, including a complete loss of your investment. You should read Belpointe PREP’s most recent prospectus and the other documents that it has filed with the SEC for more complete information about Belpointe PREP and its offering. Prior to making an investment decision, you should carefully consider Belpointe PREP’s investment objectives and strategy, risk factors, fees, expenses, and any tax consequences that may result permanent investment in Belpointe PREP’s Class A units. You can obtain a copy of Belpointe PREP’s prospectus and other filings on the SEC’s website, on our website at belpointeoz.com, or by contacting me via phone at 203-883-1944 or by email at claidlaw@belpointe.com, which will also be included at the end of today’s presentation. With that, I’ll pass it off to our CEO, Brandon Lacoff.

Brandon Lacoff: Thank you, Cody. I appreciate you reading all that, its a lot of disclosure, but necessary for being a publicly traded company. So today, I want to spend the first 10 minutes or so just giving people a high-level background on opportunity zone, what the regulations are. I don’t want to spend too much time there, because there’s a lot to go over regarding our stock, and then we’ll go over some assets that we’ve invested in, and then also at least maybe 10, 15 minutes at the end for questions. If people do have questions throughout the webinar, please put them in the question box or email Cody, and we’re going to try to get to as many questions as we can.

If we don’t get to all the questions, we will email you the answers after the webinar within 24 hours, so again, if you have any questions throughout the webinar, please put those questions in the question box or email Cody at claidlaw@belpointe.com. So, let’s start. So a little background on us before we talk about the OZ program. Like Cody said in this offering we’re raising an additional $750 million in this offering. We’ve already raised about $120 million in the previous offering, and we plan to continue to raise capital as there’s tax benefits of OZ, but also as we keep on making quality investments throughout the country. Our company, we’re a private equity real estate funds out of Greenwich, Connecticut. We have offices around the country from California to Florida, and we don’t just do real estate, we are invested in other things like stocks and bonds, and our financial services side of the business. That business, we manage over $3 billion dollars in public securities, and we’ve invested over a billion dollars in real estate developments through our AvalonBay team and our team for the last 11 plus years.

Since 2012, we’ve raised approximately $236 million, we’ve done over $400 million dollars of investments. Believe it or not, our last funds, we actually had 91% of our investments actually in opportunity zones and that was before opportunity zones were even designated. So we’ve been investing in opportunity zones for many years as they’re high growth markets and we’re excited about the opportunity zones and the tax benefits that come along with opportunity zones. We’re going to get into that right now, so high level, without getting too much into the weeds, there’s over 8,700 census tracts that are opportunity zones, those were designated in 2018 using states’ governors and then verified by the federal government.

These opportunity zones are all over the country. Every state has at least 25 opportunity zones or some states like California that over 800 opportunity zones. To receive the tax benefits of an opportunity zone, the fund itself, like ourselves, we are required to invest 90% of the capital that we raise into opportunity zones and these zones, when we invest in these zones, you have to meet a couple of tests. You either have to, when it comes to real estate, you have to either have ground-up construction in these zones or you have to meet the substantial improvement test. Which means if you have, if you buy a building that’s in the opportunity zone and let’s say you bought that building for $30 million dollars, you’d have to put another $30 million or greater into that property to qualify as a qualified opportunity zone investment. And we’re going to get into that detail, there is actually a third which is unique to us, which is buying stabilized opportunity zone deals, which we’re going to get into later in the presentation, but everybody else is either ground-up construction or meeting the substantial improvement test on renovation.

Now, for the investor to qualify, they have to invest their capital gain, and just the capital gain portion, within 180 days of receiving a capital gain. So once they recognize or realize a capital gain, they have 180 days to reinvest that into an opportunity zone structure. However, there are extensions on 180 days, depending if you receive that capital gain through an entity, a pass-through entity, like an LLC or a partnership or S Corp, then you get an extension on the 180 days and it’s two extensions, you actually get 180 days from the last day of the year or you can have 180 day extension from when their tax return would be due, which typically would be March 15th. So there are extensions for clients who receive the capital gain through an entity, they would have two extra opportunities to reinvest that capital gain.

Now, the capital gain for opportunity zone, different than a 1031, is for any type of capital gain, it could be from stocks, bonds, commodities, cryptocurrencies, artwork, classic cars, jewelry, real estate, so any type of capital gain, as long as you make it within 180 day, one of the 180 day windows, you will receive the tax benefits of opportunity zones. Now, just to be clear, the capital gain that we’re talking about, could be, like I said, can be any capital gain, including short-term capital gains and long-term capital gains. So that’s an important factor that people ask all the time, “can it be a short-term capital gain?” And the answer is yes.

In addition to capital gains, people ask us all the time, “can we invest cash that wasn’t derived from a capital gain?” You can invest in our structure, you just won’t get the tax benefits of opportunity zones. So you only get the benefit of opportunity zones if you’re re-investing capital gain, so that’s an important factor I wanted to spell out.

Here’s a map of that 8,700 plus census tracts that are designated capital gains throughout the country.

So real quick, without spending too much time, want to go over the tax benefits, hopefully everybody understands the tax benefits, if not, we’re going to explain it real quick right now. So if you invest within 180 days of receiving your capital gain, the investor gets to defer their capital gain until the end of 2026. So the capital gain that they’ve received will be non-taxable until 2027, which means there’s no capital gains, it’s deferred for at least five years if you invest by the end of this year. You can invest after this year, you just won’t get a full five years. Your deferral ends at the end of 2026, so it doesn’t matter when you invest before 2027, your capital gain will just end December 31st of 2026. So you got the deferral.

The second benefit is reduction of capital gain and this is why we’re having this webinar now and why it’s so important why we have over 550 attendees today is because this tax benefit is going away if you do not invest by the end of this year. This tax benefit is a reduction of your old capital gain and that reduction is a 10% reduction, but you have to invest by the end of this year and you have to hold it for at least five years to receive this benefit. After this year, this one benefit is eliminated and is no longer available to investors. The third benefit is the elimination of capital gains. The elimination is on the appreciation of the investment, so you make an investment in my stock, my stock rises over the next 10 years, if you sell any time after 10 years, the appreciation of my stock that you invested in is tax-free, you have no tax, no capital gain tax on the appreciation of our stock, as long as you hold our stock for at least 10 years.

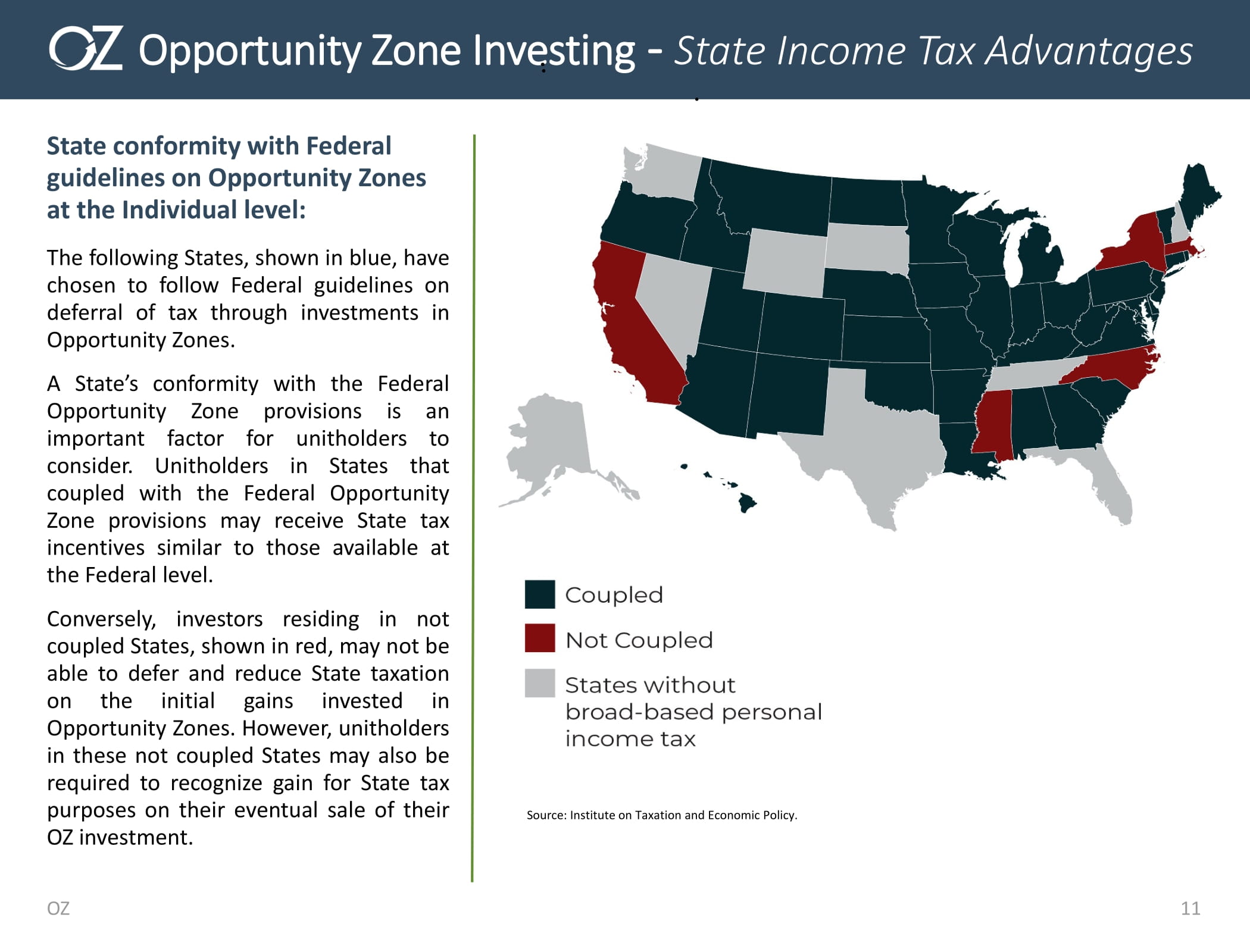

The fourth benefit, which is a benefit that people don’t usually talk about, is receiving that same benefits that we talked about in number one, number two, number three, which is the deferral, the reduction and the elimination of capital gains, also at the state level. So here’s a map real quick that shows the states that you receive that tax benefit, both of the federal level and at the state level. However, the five states in red, you do not receive the tax benefit of opportunity zone in those five states. Those states are California, Mississippi, North Carolina, New York and Massachusetts. If a client resides in one of those five states, you only receive the federal tax benefit, you do not receive the state tax benefit for opportunity zone. So that’s an important factor, but if you live in one of the other states, obviously you don’t have to pay capital gains taxes, or you get to benefit of opportunity zone, and you get the elimination of capital gains if you hold 10 years.

So Jasmine, can we get to the first polling question?

Jasmine: Yes, we can, absolutely. I went ahead and launched poll number one, that should be live on every one’s screen now. Poll number one asks, “Have you recommended opportunity zones to your clients?” Please choose one of the four options available and go ahead and cast share a vote in the next 45 seconds. Right, poll number one still live on your screen. Like to leave these polls open for a full minute allow everyone to cast their votes and get their credits. I’ll be closing down poll number one in five, four, three, two, one.

Brandon Lacoff: Great, thank you very much.

Jasmine: Sure, back to you.

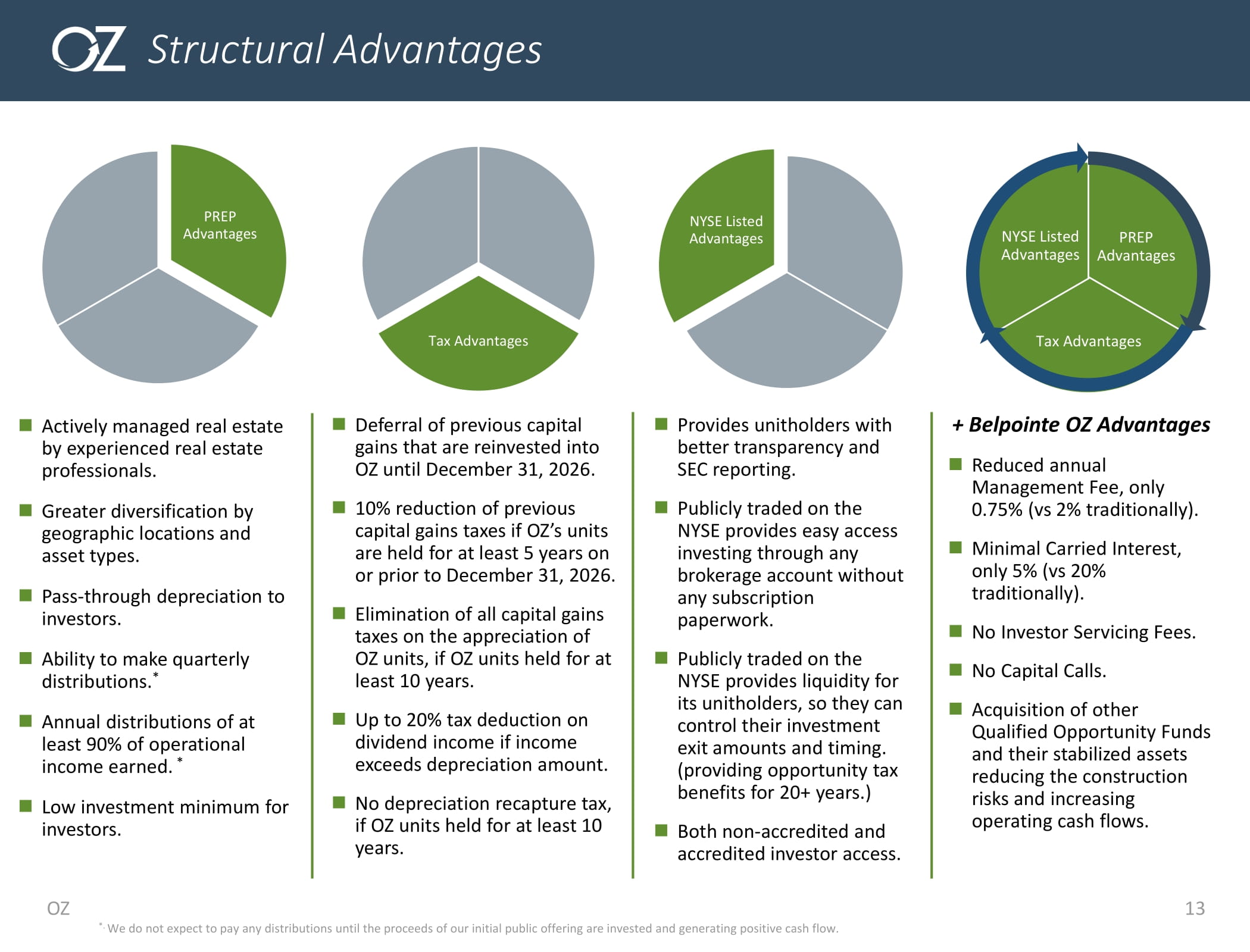

Brandon Lacoff: Thank you. Alright, so misspoke, we have over 600 people on this not 550. So on this webinar it’s at 600. So, let’s talk about our structural advantages. So, this slide is one of the most important slides, I think this. and the one following this slide, are probably the most important slides because it really talks about how this structure is different than every other structure. Yeah, we are the first and the only publicly traded structure, but it’s more than just being publicly traded, and what does that mean? And so, first I’m talking about being a PREP, which stands for “public real estate partnership,” and so having actively managed real estate is important, especially by professionals and professionals that we have internally, which are former AvalonBay professionals, which Avalon, if people don’t know, is the largest multi-family development company on the New York Stock Exchange. They are a $30-something billion, I think they’re $33-billion-dollar company.

They started out in Connecticut, two towns over from where we’re headquartered, and they started with I think four or $500 million when they rolled up in 1993, merged with Bay in 1998 and now is a $30-plus billion dollar company. So having that actively managed is important, because like I said earlier in the conversation, is opportunity zones either has to be new construction or meet the substantial improvement test, which means heavy construction. And so, that’s an important factor in opportunity zone investing is make sure you’re mitigating that risk. We’re going to talk more about that later today.

Obviously, having diversification is important. And that’s why having a single pooled structure has multiple assets in locations around the country is important, we’re going to talk about our assets later today. Having the PREP structure, allows us to pass through depreciation to our shareholders, which offsets income, which obviously is another great feature of our structure, and we’re going to get into that in more detail. Our ability to make distributions on equality basis, which obviously everybody likes distributions and making it four times a year is great. Because we’re a publicly traded partnership structure, similar to our REIT, we’re required to distribute 90% of our income that’s operated from operations of our real estate. So that’s an important factor to educate our shareholders to make sure that they know they will be receiving at least 90%, if not 100% of income that is earned through our investments. And then, question we get all the time is “What is our minimum for investors?” Typical minimum for OZ structures is anywhere from $100,000 all the way up to half a million dollars. Our structure, is simply buying one share. You simply can buy just one share, which is approximately $100 dollars a share, so our minimum is around a $100 a share whatever it costs per share.

So currently, our stock is, let’s see here, our stock is trading at $100.06 right now, actually it’s seven cents, so just changed. So again, you just have to buy one share to meet the minimum. Next column, which we talked a little bit about, which is the opportunity zone benefits, which is obviously the deferral, the reduction, the 10% reduction, if you hold for at least five years as long as you invest by the end of this year, hence the elimination of all capital gains on the growth on the appreciation of our stock as long as you hold for 10 years. So those are the things that we already talked about. The next two are pretty unique and I think are very important.

One is, if there is any income, if we do a really great job and there’s income above the depreciation, only 80% of that income would be taxable under 199A, which is a pretty unique benefit under the opportunity zone, which is separate from opportunity zone regulations, but is unique because all the limitations that this 199A has in the statute is actually waived for REITs and publicly traded partnerships. So again, those limitations are waived under our structure.

The other big benefit, which I think is probably the number two benefit in my eyes, is on the depreciation. Depreciation is very common in real estate, but what normally happens in real estate is when you sell the real estate, all the benefit you took under the depreciation, you have to pay it all back after you sell the real estate. In our structure, as long as you hold our stock for at least 10 years, which most of our investors will hold for 10 years, if not longer, there’s no depreciation recapture. Which means you’re getting the benefit of depreciation every year, and you don’t have to pay it back like in a normal structure, you don’t have to pay it back as long as you hold our stock for at least 10 years. So that is a huge, huge tax benefit that people don’t talk about in the OZ structure. Not every OZ structure has this benefit, but because of the way we’re structured, you receive that tax benefit. So you get the benefit of a yearly depreciation and you don’t have to pay it back as long as you hold the stock for at least 10 years, so that’s a big benefit.

I’m moving on to being publicly traded. Again, we are the only publicly traded opportunity zone structure. Because we’re publicly traded, the benefits of that, which some of it you can imagine, but off the bat, you get better transparency and SEC reporting. So you’re getting 10-Qs, 10-Ks, 8-Ks, so you’re getting, whenever something significant is happening in the company, we’re making an acquisition or we have quarterly numbers that is reported like any other publicly traded company. So getting that transparency, I think is important to advisors and to clients. Being publicly traded on the New York Stock Exchange, makes it much easier to invest. We call it one-click investing, which is simply logging on to your brokerage account. If it’s Schwab, TD, Fidelity, wherever you trade, wherever you buy your securities, you simply have to just buy the stock, like you’d buy any other publicly traded company. Our stock symbol is “OZ,” so you would log in and just buy as many shares as you need, and you simply, and that’s all you need to do to make you a qualified opportunity zone investment, it’s just buy the stock. There’s no wiring money, there’s no paperwork you know with subscription agreements like a typical fund would have. It’s simply just going on and buying the security.

The next benefit is because we’re publicly traded, we put the control of the exit in the shareholders hands. What that means is if you invest in a private fund, a private opportunity zone fund or any fund, the manager gets to decide when they’re going to sell the real estate and when they’re going to make distributions to their shareholders. In our structure, we put that power into our shareholders hands. They’re able to sell the stock whenever they want. They can forego some or all the tax benefits of opportunity zone by selling it before 10 years or five years, or even within days or the same day. So they have full control of their exit, but because of they have full control of their exit, we don’t have an end life like a closed-end private equity fund has, which means they can hold the stock for a longer period of time than the 10 years.

So they can get out faster if they want, or they can stay in longer. So if we’re doing our job and we’re distributing tax-free distributions, and the stock is growing tax free, why would any investor want to sell in year 10? You’re going to want to hold it as long as you can. So not having an end life that allows our shareholders to receive the tax benefits of opportunity zones for as long as they want to hold it, and that could be longer than 20 years if they choose. So something that is unique is putting that power of the exit in our shareholders hands and then they choosing when they want to sell their security, if it’s early, at the 10-year anniversary or sometime later than the 10 years. We think that’s, we know, that’s a huge tax benefit for our shareholders to continue to receive the opportunity zone benefit for longer than the 10-year period.

Again, because we’re publicly traded, accredited and non-accredited investors can invest in our structure while in a typical opportunity zone structure, it’s only accredited investors, so that’s another nice feature for our shareholders, it’s open to everybody. The last column is really talking about structural changes that we’ve made in our structure to provide benefit through our shareholders. One of them is reduced management fee. Our management fee is only 75 basis points. So it’s three-quarters of 1%, which is much less than the typical 1.5%-2.5% that you’ll see elsewhere. So having a reduced management fee allows for a lower drag on the security, on the investment, which results into higher returns. So that is the number one benefit under this category. The second benefit under this that are our advantages is having a lower carried interest. And a carried interest is really a profit sharing for the managers of the investment, the sponsor. So us being the sponsor or any sponsor would typically take anywhere from 15-25% of the profit of the real estate. Our structure, we’re only taking 5%, so it’s on average about 75% less than our competitors.

We don’t charge any investor a servicing fee which is typical when a security is sold through a broker-dealer or a broker, that’s an additional management fee, we do not charge that at all. We also do not have any capital calls and that is a huge, huge benefit because most investors expect or should expect in a closed-end funds that they may have to put additional capital in if the company needs more capital. In our structure, there’ll never be a capital call, which is something that’s unique as well compared to a closed-end private equity opportunity zone structure.

The last benefit under Belpointe advantages which is probably one of the biggest and most important advantages, we hit upon this and we’re going to get into a little bit more detail, is the ability for our structure to acquire qualified opportunity zone deals. By acquiring their parent company, it allows us to buy assets that are already built by another opportunity zone structure. So let me explain that in a little bit more detail. So before we talked about opportunity zone structures, we had to either build brand new construction in opportunity zones or meet the substantial improvement test if they’re renovating a project. There’s now a third category which is, and it’s solely for us, because of being a publicly traded partnership structure, that we can acquire cash flowing already built opportunity zone deals through the acquisition of competitor opportunity zone funds. So we are buying in addition to building and renovating other projects that we have in the pipeline, for which we’ll talk about later in the webinar, we will also be able to acquire stabilized opportunity zone deals that were built by another opportunity zone funds, which will allow for quicker increased speed on dividends and distributions to our shareholders. So, I’m going to go into that in the next slide, but before I do, let me get, let me have Jasmine come back, give us the next polling question so I got to make sure I spread this out every 15 minutes or so, so Jasmine.

Jasmine: Yeah, it sounds good. I went ahead and launched poll number two, that should be live on everyone’s screen now. Go ahead and select one of the two options available. This question asks, would you like someone from Belpointe to reach out after the webinar? Again, this is poll number 2 of 4. I definitely want to thank you all for voting so quickly, go ahead and cast your votes now. This is our attendance check for CPE, we want to make sure that everybody gets their credit. And we’ll go ahead and close down poll number two in five, four, three, two, one. Back to you, Brandon.

Brandon Lacoff: Thank you very much. So I want to get into that a little bit more because that’s an important factor for reducing risk and having high returns and reducing risk, which is unique for our structure. So we talked about that. So we talked about being able to acquire stabilized assets through acquisitions of other opportunity zone funds and acquiring their real estate. So people ask me all the time, how is this even possible? Why can you do it and nobody else can? And that’s because we are a publicly traded partnership structure. Being a publicly traded REIT doesn’t work and just being a partnership doesn’t work. It has to be the combination of the two and how we have our open structure. So, how does this work and why does this work? And the reason why is because everybody wins. Number one, the sponsors of these other funds, they win because they typically have a two-year construction period when they’re building their projects, which means they’re required to hold their assets an additional eight more years to meet the minimum 10-year hold period for opportunity zones to get the full tax benefits. Well, that being said, if we can provide a liquidity event for those sponsors, that’s going to be eight plus years quicker than they normally expected, they’re going to love that, because if they can get, if their carried interest profit is, let’s say it’s $5 million or $10 million or $20 million, whatever the number is, if we can get them that cash eight years or more quicker, faster than they expected, it’s a no-brainer for them. So they’re just getting their cash, they’re getting it eight years quicker and they’re happy, so that’s a no-brainer for the sponsor. However, they have investors. Their investors are opportunity zone investors and for those investors, they still continue to keep the tax benefits of opportunity zones. They don’t lose a day in their investment schedule. So if it’s two years in, they’re not going to lose that two years. So they don’t lose any part of their schedule and they receive the benefits of our structure, they get the greater diversification, they get to realize or really recognize their gains from whatever they sold to us. They get obviously instant liquidity, they’re able to borrow against a stock to get cash out right away, they have obviously lower fees because our structure has that benefit. So they get all the benefits of our being a publicly traded stock and they get our benefits of getting some in cash and some of our stock, so it’s a no-brainer for their investors that we’re acquiring. The third win is really for our shareholders and why is that good for us? That’s good for us because we’re getting immediate cash flow, so we’re getting distributions from those assets that we acquired because they’re already fully built and fully stabilized and fully rented. Obviously, it’s reducing our risk because we’re acquiring these assets with no construction or development risk and no lease-up risk and we’re getting improved investment diversification because we’re getting more assets under our umbrella, which is going to give us cash flow and diversification all at once so, it’s a no-brainer for us to be able to acquire these assets and obviously it’s a no-brainer for the companies that we’re acquiring, the sponsors and their investors. Everybody wins, everybody benefits from this and it’s a net net positive for everybody, so there’s no negative for any of the three categories. So, to me this is one of the most important slides in here.

Real quick, and I don’t want to spend too much time because we’re about halfway through, I want to talk a little bit about our uniqueness on our investment strategy. Obviously, we’re investing and we’re looking at data analytics of other projects that are being built, of the supply coming on to the market, we typically are building within 75 miles of a metropolitan area. We’re looking at 2010 to 2020 data, seeing where the growth is, seeing where the population growth is, seeing where the job growth is. So looking at all that data and really digesting it and making sure we’re making good investments.

Again, the second investment strategy which we talked about is the stabilized acquisitions, buying other opportunity zone deals that are already built, already stabilized, so reducing that risk. We’re mostly focused on multifamily because of our AvalonBay expertise and multifamily being the lowest risk with the highest return, so that’s something that we’re very focused on. But something really, really important is our investment platforms. We have a franchise platform and a programmatic platform. I’m going to spend time on both. So the franchise is we buy the market that we really like, we’ll open up a franchise location and hire a developer to run that location, that branch for us. So that’s a franchise platform.

We also have programmatic platform, which is a much bigger thing for us, where we find a local developer who’s strong in a certain market, for example Nashville, Tennessee is a, we have a strong programmatic partner there, where we sign a joint venture with that partner and any deal that they find, especially off-market deals that they find, they’re obligated to bring it to the partnership, to us first, and if we like the deal, we’ll invest in that deal, if we do not like the deal then we can pass them that deal, but it gives us a first right of refusal to look at all the deals that that local partner comes across in the opportunity zone in their market.

Obviously, strategic locations, we’re building mostly in-fill ground-up construction type of projects, and obviously we spend a lot of time making sure underwriting is tight, anywhere from the demographics, the employment, like we talked about, having the right underwriting when it comes to income growth and making sure that we underwrite the expenses correctly. So we’re triangulating between the different projects that have already built in the market and underwriting as if the building was built today and the expenses were as of today, that’s how we underwrite our deals. We don’t trend based on what we think the future is going to look like, we underwrite it based on today’s economics. Real quick on the risk mitigation, again, really, really important. We are in-house development and construction, so unique to many funds and opportunity zones do not always have that ability to have a full construction and development team in-house. It’s something that we have and it’s been around, it’s been with us for 11 years. Having that AvalonBay developers and construction expertise is a game changer for us. Because like I said, a lot of the deals that we’re investing in and all the deals that our competitors are investing in, it’s all heavy construction, either ground-up or renovation. You need to have that expertise in-house, which is that development and construction expertise.

Obviously, we talked about before, geographic diversification, we’re invested around the country, we don’t just invest in one location. It’s not like some of our competitors are very regional or maybe in one city, we are invested throughout the country to make sure we diversify our risk.

Asset class, like I said before, 85% of our investments will be multifamily because we feel, especially when in downturn, people need somewhere to live and on bad times, which we will go through cycles, multifamily has always done the best in the long term, and again, it’s our expertise because of the AvalonBay experience.

Having the right amount of leverage also mitigates risk. We typically have somewhere around 65% leverage when we start construction and then once we stabilize that asset, that because the value going up and the debts staying the same, we typically we will be somewhere around that 50% or less loan-to-value at that point once we stabilize that asset.

Again, lower management fees which we talked about, obviously reduces risk because we are taking less cost and less fee over the next 10 years or greater compared to our competitors who charge anywhere between 1.5-2% or greater. We’re charging only 75 basis points, which is 3/4 of 1%, which again has a lower drag on the structure.

Again, one more time, I know it’s in here but I’m not going to spend too much time but acquiring stabilized assets again eliminates construction risk and lease-up risk, which obviously is a huge benefit in our structure because on the projects that we’re buying that are stabilized, we don’t have any construction risk, which is the number one risk of opportunity zone investing is the construction risk, and if we can eliminate that on the investments that we’re making, that are stabilized assets, that’s a game changer and eliminates that risk.

Obviously, asset diversification like I said before, is having the right asset diversification throughout the country greatly reduces it, reduces risk, because you’re investing in multiple locations and different assets. So before we get to some of the assets that we’ve already currently own and markets that we’re investing in, Jasmine, can you give us the third polling question?

Jasmine: Yes, I can and yes, I have. So poll number three is live on your screen now. Want to know what’s the most valuable part of today’s webinar so far, go ahead and cast your vote now. In the next 45-50 seconds or so, go ahead and cast your vote for poll number three. Definitely want to thank you all for your questions as well, we’ve seen those pop up in the questions box, and want to make sure you guys continue to ask those if they come up. Give it another 20 seconds or so. Alright, I will be closing down poll number three in five, four, three, two, one.

Brandon Lacoff: Thank you. So opportunity zones are great, you get the deferral, you get the reduction, and then you get the elimination of capital gains, plus your dividends will be tax-free, or at least most of them will be tax-free as we grow the assets, and we grow the income. You might have some exposure to some tax but again, you get 199A that offsets 20% of that exposure. So opportunity zones are great, but you still have to make good investments. And so, I want to go over some of the investments that we’ve made already to date, because I think it’s important to really talk about the business. We can talk about being publicly traded, we can talk about the tax benefits but in the end it comes down to making good investments. So let’s talk about some, the first investment, which is 1991 Main in Sarasota, Florida. I think I heard Jasmine say one of our investors or one of the people, I shouldn’t say investors, one of the people on this webinar is actually from Sarasota, Florida and probably knows this site very, very well.

This is right on Main Street in downtown Sarasota, which is where all the night life is, the restaurants, the entertainment, really the focal point of downtown Sarasota is on this Main Street. We actually have two projects, I guess technically we have four projects, but two main ones we’re going to talk about. Actually, three we’ll talk about today. So 1991 Main is 400 plus units, actually 418 units. We actually have some hotel units as well, so it actually greater than 418. It’s with over 55,000 square foot of retail, which we’ll have restaurants and grocer. So we’re extremely excited about this project’s phenomenal location. I think we’re about eight or nine blocks away from Ritz Carlton, which is on the waterfront in Sarasota, and it’s just a great, great location. It’s two towers, great amenities in the building and all Class A. Our penthouses will have private roof decks, so it’s a home-run project. We’re very excited about it, and if anybody has more questions, we’re happy to answer these questions after the webinar.

About two blocks away across the street, we have another project, which is 1700 Main Street, very similar project, Class A apartment, a little bit more boutique, 160 units. This project has, you can kind of see, has a little retail building, it’s actually a bank building with two levels of office above. So we’re excited about this overall development.

And then, right behind this project is a building, an office building, which we typically don’t buy, but this is a perfect example of buying something that’s outside multi-family that benefits the multi-family. So, we bought this building, because we needed the development rights for our property across the street, and so what we did was we bought 1700 and this building at the same time from two different sellers. This is actually bought from Frontier, which was Frontier Communications, which is a company that was in bankruptcy, came out of bankruptcy. We did a sale-leaseback with them during bankruptcy, and we were able to take the development rights, which were somewhere around $2.5 to $3 million, leaving the building purchase price around $4 million for this building. The land alone is worth the $4 million, so we pretty much got this building at a zero cost when it comes to the structure itself. We’ll put a couple of million dollars of renovations to this building, lease up the remaining 40,000 square feet that’s vacant. Obviously, we have Frontier leasing the other 40,000 square feet. Frontier is actually paying 100% of the expenses of this building, and when we lease out the remaining space, we’ll actually receive 150% of the expenses and have a 100%, or whatever we can lease up the building, it’s 90% or 100% of the building, we’ll have leased up and have a fully leased up office building and create all this value even though we paid very little for the building and still get the multi-family that I showed that you see on your screen now. So these two buildings, even though they’re two separate operations, the office building is benefiting the development rights on this building. So I think a nice benefit for both projects to lower the cost for the office building, have 100% of the operating costs covered by the cable company, and then be able to lease out the rest of the space and create more value.

St. Pete, Florida, again another phenomenal market. This is an EDGE district, this is right on the edge of the opportunity zone, plus a beautiful building, 260 plus units, with some restaurants and some retail on the first floor, and again, this is right half a block away from the EDGE, from the Central Avenue, which is the main retail strip with restaurants and other entertainment as well. So there’s phenomenal location, walkability score is extremely high on both the Sarasota projects and this project, so we’re excited about these multifamily projects.

Nashville, Tennessee, same story, it’s right on the edge of the Gulch and Music Row in downtown, uptown Nashville. Again, we have a great operating partner here, you know phenomenal location in where you want to be in downtown Nashville, so we’re excited about this project. This is going to be over 265 apartments and a great location with some retail on the first floor as well. Also, we call it Nashville Number Two, right next, this is on the east side of Nashville on the river front overlooking Nashville, Tennessee, again, same local partner, same programmatic partner and plan on building over 400 apartments here as well with a little bit of retail on the first floor, so we’re excited about this location as well. A couple of miles away from the new Oracle campus who are spending hundreds of millions of dollars on their new headquarters in Nashville.

Real quick, if we are running out of time, this is our Mansfield Project, which is University of Connecticut, again, super excited about it. University of Connecticut has about 82% of their students live on campus, where in a typical university 60% live on campus, and that’s because there’s not enough quality residence for off-campus housing. And again, this is just north of the campus, phenomenal location, huge pent-up demand in this market. Very, very difficult to get projects approved at University of Connecticut. University of Connecticut has the second lowest off-campus student housing ratio to any public university, so again, very, very excited about this project. We think this project is a home run because of the pent-up demand and students are driving 25 minutes or longer to get a quality off-campus housing, so the rents are super, super high here because of that demand.

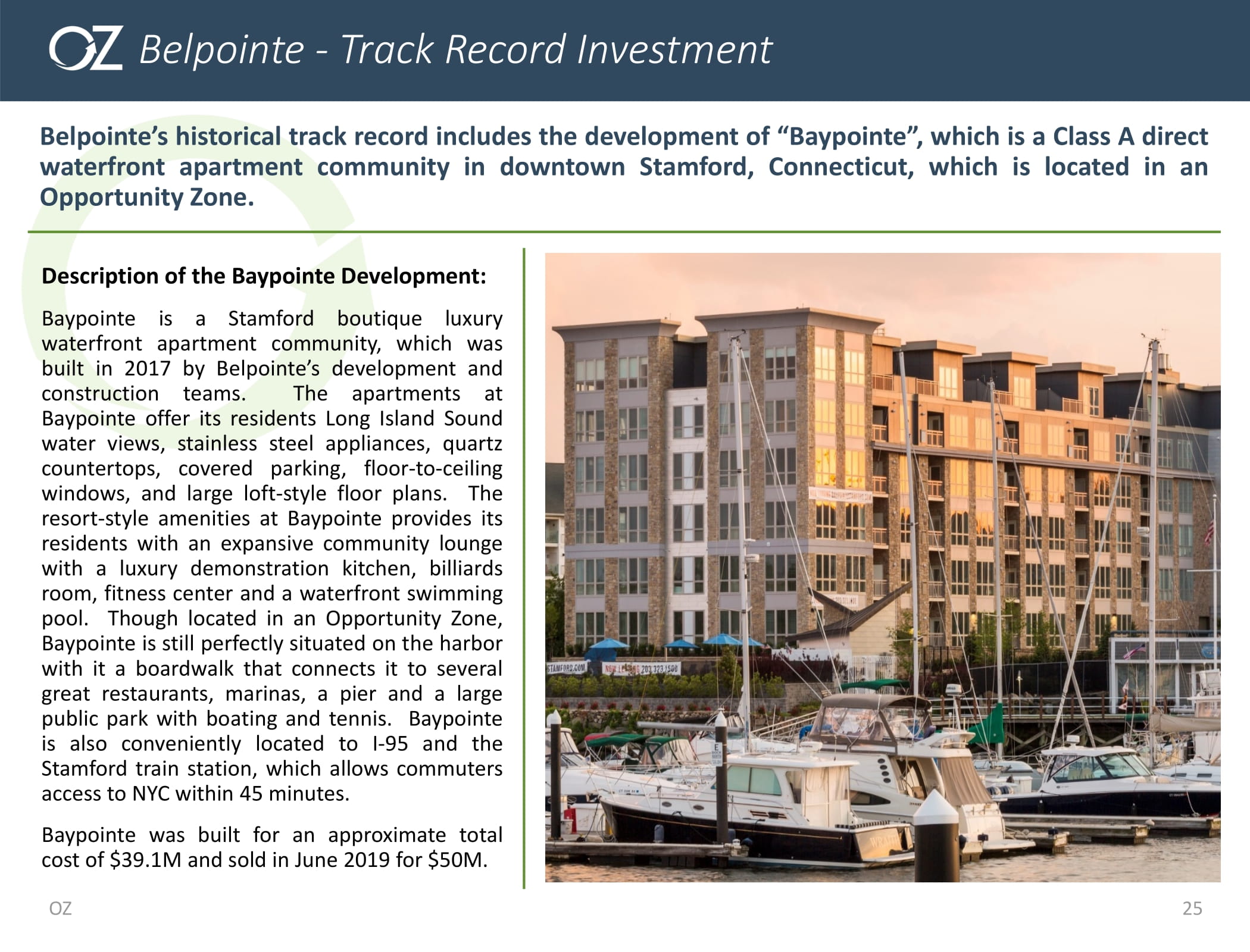

Last thing before we get to questions and answers, this is a project that we built in our old fund. This was built, we started building in 2015, we completed in 2017. So, because it was built before 2018, we did not get the tax benefits of opportunity zone, but this is in an opportunity zone, it’s something that we built, that we would have built anyway that way, because we did build it anyway without the opportunity zone tax benefits. A home run deal, we built it for $39 million, we sold it for over $50 million and it’s on the waterfront in Stanford, it’s called Baypointe. If you guys want to Google it, check it out. Phenomenal location, phenomenal deal. We did very, very well on that project. Again, that’s an opportunity zone deal. We did not receive tax benefit because of when we built it, but it was a, it would have been an opportunity zone deal if we built it today. Jasmine, could you just go to the last question then I’ll leave 10 minutes for questions.

Jasmine: Sounds good, I’ll go ahead and launch poll number 4 of 4, should be live on your screen now. This is our fourth and final poll of the day, go ahead and cast your vote now in the next 45-50 seconds, I want to make sure everyone gets a chance to get their CPE credit for today. I will give this another 15 seconds or so, go ahead and cast your vote now with a final chance to get your CPE credit. Thanks so much everyone, I’ll go ahead and close on this final poll in five, four, three, two, one. Alright, back to you.

Brandon Lacoff: Alright. Cody. Thank you, Jasmine. So Cody, we got nine minutes, so let’s try to get through as many questions as we can. Did I lose you, Cody? I can’t hear Cody, hold on one second. I think I’ll...

Cody Laidlaw: Can you hear me now?

Brandon Lacoff: We can hear you now, yes.

Cody Laidlaw: Perfect, my apologies. Alright, so a lot of these questions are recaps but I think they’re great to go over. Can you explain again what’s the benefit of investing on or prior to year end, so December 31st of this year?

Brandon Lacoff: Yeah, so if, real quick, if you do not invest before the end of this year, you lose the ability to get the 10% step up basis, which means you’re reducing your old capital gain by 10%. You have to invest in 2021 by December 31st 2021 to have the ability to get that reduction in your capital gain.

Cody Laidlaw: Perfect. And then further on that question, this just popped up, is it possible to still invest prior to year-end, into our structure?

Brandon Lacoff: Yeah, the answer is yes. You have until December 31st to simply buy our stock. You can do it through subscription, but 99.9% of our shareholders buy through just purchasing the stock, which is just OZ. So you log on to your brokers account, buy the stock before the end of the year and you made a valid opportunity zone investment and you will still get that 10% reduction.

Cody Laidlaw: Perfect, so again, the stock symbol is OZ and obviously that stands for opportunity zone. Does purchasing your stock from somebody that is reselling it versus buying directly from you qualify for the opportunity zone program?

Brandon Lacoff: It does, it’s clear in the statute and we have an opinion letter from our council, it doesn’t matter if you buy it from us directly, if you buy it from the exchange, and if you buy it from the exchange you’re buying from another shareholder, it does not matter.

Cody Laidlaw: Perfect. Go over again our unique investment strategy regarding acquiring already stabilized assets versus doing ground-up development.

Brandon Lacoff: Oh, we’re going to do both. We estimate about 20% of our projects will be ground-up development multifamily, but at the same time 80% will be acquiring stabilized opportunity zone deals. And again, it’s unique to us because of our structure, and so really simple, we’re buying already completed cash-flowing opportunity zone deals that have no construction risk, that have no lease-up risk, they’re already built, they’re stabilized. Yes, it’s unique, it might be confusing to investors and we’re happy to get into more detail if people want to reach out to Cody or myself, we’re happy to get into that detail. But yes, we can acquire stabilized opportunity zone deals using our structure.

Cody Laidlaw: Great. Why would a private fund manager want to be acquired by us?

Brandon Lacoff: A private fund manager would want to be acquired by us very simply because they’re able to exit and get their profit as a sponsor of their funds, they’re able to get their profit eight to 10 years faster than they normally would. So right now, they only have one choice, they have to build the project and hold it for 10 years. With us coming around, they have, they now, they now have the ability, which they didn’t have prior, to now be able to sell that asset to us and still keep the tax benefits for their shareholders, and then those shareholders will also receive the same benefits of our shareholders which is all the benefits of opportunity zone, because we’re going to be making these acquisitions mostly using our shares at whatever fair market value of those assets, so it’s really a no-brainer for the sponsor because it’s either they build the project and hold it for many years or they build it and sell it to us and still keep the tax benefits for their shareholders.

Cody Laidlaw: Perfect. Simple question, how does an investor actually, excuse me, report the deferral to the IRS?

Brandon Lacoff: Yeah, real simple, it’s the capital gains form which is the 8949, so you’re making you’re disclosing your capital gain and then you’re disclosing that you’re making an opportunity zone election. And then there’s the 8997 which is what describes what you invested in and when you invested, so it’s just the 8949 which you need to do anyway with capital gains and the additional form is the 8997 which describes the, when and what investment you made to make a qualified opportunity zone investment.

Cody Laidlaw: Perfect. Next question, at the 10-year mark, how do investors in your publicly traded structure get their money out?

Brandon Lacoff: Simply logging on to your brokers account and selling the stock. Now, I don’t think people, I think most investors are not going to sell in year 10. If I’m doing a good job and I’m, I don’t even have to do a great job, even just an average job, by giving tax-free distributions to our shareholders on a quarterly basis plus the stock growing tax-free, our shareholders are not going to want to sell in year 10. If they choose to sell, they simply go, log on to their brokerage account and just sell the security just like any other publicly traded company.

Cody Laidlaw: Perfect. Important question, this was asked about three times, so the process for investing into your structure is that we have to form a qualified opportunity fund and then invest into your fund?

Brandon Lacoff: Oh, that’s incorrect. A qualified opportunity zone fund can’t invest into another qualified opportunity zone fund, so that would be a violation. You simply have to just buy our stock; we are a qualified opportunity zone fund and you’re investing in our qualified opportunity zone fund by purchasing the stock.

Cody Laidlaw: Perfect, nice and simple. Let’s see, trying to see good questions popping up. Here’s one, how are the actual opportunity zones selected? Are these really markets for Class A apartments?

Brandon Lacoff: So yeah, they were selected by each governor of each state at the time, so that was in 2018, and some of them, there’s, many of them are not great locations but there’s definitely a handful, more than handful, there’s over 8,700 census tract is probably 10% of them, maybe over 800 census tracts that are really good or quality opportunity zones, and really, they were based on 2010 census tracts. So for example Sarasota 20 years ago is not what it is today, so they’ve been going through a revitalization over the last 20 years. If you look at the last 10 years, you’ll see when they designated it, it was different than what it is today, so these are large census tracts and not, the census tract could have a good area and it can have a bad area and so that’s part of it, and also the data was based on 2010, and areas like Stamford, Connecticut have gone from major renovations or major revitalization over the last 20 years. So that’s why certain tracts that are definitely better than others.

Cody Laidlaw: Perfect. So a little over two minutes left, what is the minimum investment?

Brandon Lacoff: Simply buying one share which is about $100 a share.

Cody Laidlaw: And last question I believe we have time for, is there a lock-up period in your structures and what are the penalties, if so?

Brandon Lacoff: There’s no lock-up structure in our structure at all. You can buy the stock today and sell it tomorrow, there’s no lock-up at all. However, if you sell before the five-year tax benefit or the 10-year hold period, you lose some of your opportunity zone benefits, so the only penalty you would have would be you’d be in the same situation if you bought any other stock. You would just lose some or all of the opportunity zone tax benefits, so that’s why most shareholders will hold for at least 10 years or greater. We expect most of our shareholders to hold at least 15-20 years.

Cody Laidlaw: Got it. So, we’ll end on this note, last question. This genuinely seems too easy, is there something that I’m missing?

Brandon Lacoff: There’s nothing you’re missing. It’s coming up with the right structure and using publicly traded structure for illiquid assets is changing, it’s really a game changer, and this is something that we’re doing for opportunity zones and plan on doing it for other non-opportunity zone investing. So, even though this is the first, I don’t think this is going to be the last.

Jasmine: Alright.

Cody Laidlaw: Perfect. So that’s it for the questions. Jasmine, go ahead.

Jasmine: Yeah, yeah. I definitely want to thank you so much Brandon and Cody for these valuable insights, and thanks to all of our attendees for all their great questions as mentioned. If we didn’t get to yours, no worries. All questions are shared with our presenters in a full report. Now with that, we’ve come to the conclusion of today’s webinar. We here at CPA Academy will go ahead and process your credit later today. A copy of this webinar, handouts and CPE credit will be available in your CPA Academy accounts within 24 hours. Please also keep an eye on your email inbox, you’ll find in the evaluation link for this webinar and we’d love to hear your thoughts about today’s presentation. Thanks again gentlemen for this great content and to our members for your participation. Please check the schedule on our website for additional information and we hope to see you all very soon on a future webinar. Have a great day everyone.