UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

(Exact name of registrant as specified in charter)

100 Pearl Street, New York, New York 10004

Registrant's telephone number, including area code:

Date of reporting period:

Item 1. Report to Stockholders.

(a) The registrant’s semi-annual report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940 is as follows:

Alger 35 ETF

ATFV / NYSEArca

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day.This ETF will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the ETF's shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF's portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared to other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF confidential, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF's performance. If other traders are able to copy or predict the ETF's investment strategy, however, this may hurt the ETF's performance.

For additional information regarding the unique attributes and risks of this ETF, please refer to the Non-Transparent ETF Risks section of the ETF's prospectus.

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger 35 ETF (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 223-3810.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Alger 35 ETF | $31 | 0.55% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger 35 ETF generated a 23.53% return for the fiscal six-month period ended June 30, 2024, compared to the 15.29% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Information Technology and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corporation; Spotify Technology SA; Amazon.com, Inc.; Natera, Inc.; and Microsoft Corporation were the top five contributors to absolute performance.

Detractors from Performance

The Financials and Consumer Staples sectors were the largest detractors from relative performance. Regarding individual positions, Cabaletta Bio, Inc.; 908 Devices Inc.; Autolus Therapeutics; Snap, Inc.; and Joby Aviation, Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter of 2023 grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

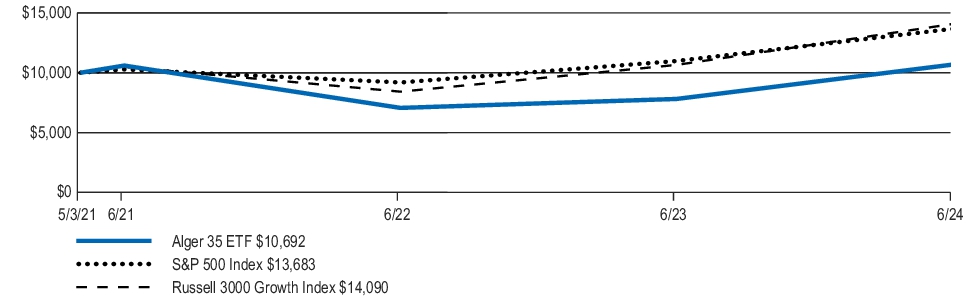

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of the Fund since its inception. The graph assumes a $10,000 initial investment at Net Asset Value at the inception date of the Fund in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

10691.90 10870.15 10656.5355 14090.07124 9448.19 10517.60 10000 10000 10000 10277 10600.00 6730.01 10000.00 10000.00 10000 10000.00 13682.96362 10985.03823 7809.34 9185.5826 10000 10000 8499.67 6798.68 10493 11873.74 8417.4846 7060.00 10330.00 7673.35 10895.00

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | Since Inception

(5/3/21) |

| Alger 35 ETF | 36.91% | 2.14% |

| S&P 500 Index | 24.56% | 10.44% |

| Russell 3000 Growth Index | 32.22% | 11.47% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $19,498,948% |

| Total number of portfolio holdings1 | $31% |

| Portfolio turnover rate as of the end of the reporting period | $152.51% |

| 1 | Excludes Money Market Funds. |

| Communication Services | 16.4% |

| Consumer Discretionary | 14.0% |

| Energy | 1.9% |

| Healthcare | 9.0% |

| Industrials | 4.9% |

| Information Technology | 47.0% |

| Materials | 2.0% |

| Utilities | 2.0% |

| Short-Term Investments and Other Net Assets | 2.8% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

In January 2024, George Ortega was added as a portfolio manager of the Fund.

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, administrator, and transfer agent from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective April 30, 2024, Alger Management contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through December 31, 2025 to the extent necessary to limit other expenses of the Fund to 0.10% of the Fund’s average daily net assets.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 223-3810.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 223-3810.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 223-3810 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary.

The Fund utilizes the ActiveShares® methodology licensed from Precidian Investments, LLC ("Precidian"). Precidian’s products and services are protected by domestic and international intellectual property protections, including, without limitation, the following issued patents and pending patent applications: 7813987, 8285624, 7925562, 13011746, 14528658, 14208966, 16196560.

Alger Mid Cap 40 ETF

FRTY / NYSEArca

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day.This ETF will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the ETF's shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF's portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared to other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF confidential, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF's performance. If other traders are able to copy or predict the ETF's investment strategy, however, this may hurt the ETF's performance.

For additional information regarding the unique attributes and risks of this ETF, please refer to the Non-Transparent ETF Risks section of the ETF's prospectus.

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Mid Cap 40 ETF (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 223-3810.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Alger Mid Cap 40 ETF | $33 | 0.60% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Mid Cap 40 ETF generated a 18.31% return for the fiscal six-month period ended June 30, 2024, compared to the 5.98% return of Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Information Technology and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, Super Micro Computer, Inc.; Vertiv Holdings Co.; Natera, Inc.; Micron Technology, Inc.; and AppFolio Inc were the top five contributors to absolute performance.

Detractors from Performance

The Energy and Financials sectors were the largest detractors from relative performance. Regarding individual positions, Exact Sciences Corporation; Cabaletta Bio, Inc.; Akero Therapeutics, Inc.; Snowflake, Inc.; and indie Semiconductor, Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth of 2023 quarter grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

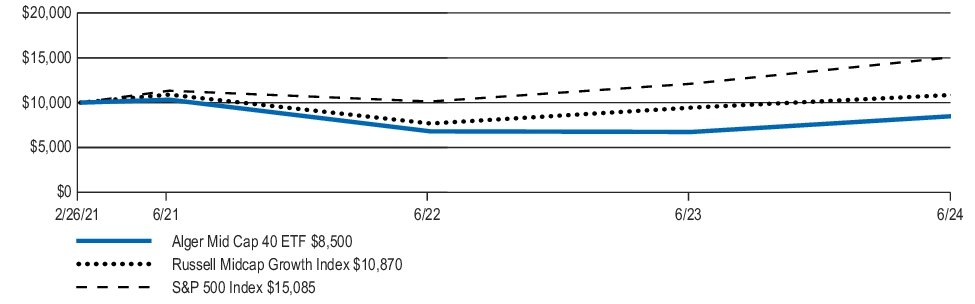

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of the Fund since its inception. The graph assumes a $10,000 initial investment at Net Asset Value at the inception date of the Fund in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | Since Inception

(2/26/21) |

| Alger Mid Cap 40 ETF | 26.30% | (4.75)% |

| Russell Midcap Growth Index | 15.05% | 2.53)% |

| S&P 500 Index | 24.56% | 13.10)% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $37,002,601% |

| Total number of portfolio holdings1 | $40% |

| Portfolio turnover rate as of the end of the reporting period | $91.35% |

| 1 | Excludes Money Market Funds. |

| Communication Services | 8.1% |

| Consumer Discretionary | 10.4% |

| Consumer Staples | 1.6% |

| Energy | 2.5% |

| Financials | 2.1% |

| Healthcare | 12.2% |

| Industrials | 23.8% |

| Information Technology | 26.2% |

| Utilities | 2.8% |

| Short-Term Investments and Other Net Assets | 10.3% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, administrator, and transfer agent from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective April 30, 2024, Alger Management contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through December 31, 2025 to the extent necessary to limit other expenses of the Fund to 0.10% of the Fund’s average daily net assets.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 223-3810.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 223-3810.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 223-3810 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary.

The Fund utilizes the ActiveShares® methodology licensed from Precidian Investments, LLC ("Precidian"). Precidian’s products and services are protected by domestic and international intellectual property protections, including, without limitation, the following issued patents and pending patent applications: 7813987, 8285624, 7925562, 13011746, 14528658, 14208966, 16196560.

Alger Weatherbie Enduring Growth ETF

AWEG / NYSEArca

This ETF is different from traditional ETFs. Traditional ETFs tell the public what assets they hold each day.This ETF will not. This may create additional risks for your investment. For example:

You may have to pay more money to trade the ETF's shares. This ETF will provide less information to traders, who tend to charge more for trades when they have less information.

The price you pay to buy ETF shares on an exchange may not match the value of the ETF's portfolio. The same is true when you sell shares. These price differences may be greater for this ETF compared to other ETFs because it provides less information to traders.

These additional risks may be even greater in bad or uncertain market conditions.

The differences between this ETF and other ETFs may also have advantages. By keeping certain information about the ETF confidential, this ETF may face less risk that other traders can predict or copy its investment strategy. This may improve the ETF's performance. If other traders are able to copy or predict the ETF's investment strategy, however, this may hurt the ETF's performance.

For additional information regarding the unique attributes and risks of this ETF, please refer to the Non-Transparent ETF Risks section of the ETF's prospectus.

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Weatherbie Enduring Growth ETF (“Fund”) for the period of January 1, 2024 to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 223-3810.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs for the last six months?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Alger Weatherbie Enduring Growth ETF | $34 | 0.65% |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Weatherbie Enduring Growth ETF returned 6.80% during the fiscal six-month period ended June 30, 2024, compared to the 5.98% return of the Russell Midcap Growth Index. During the reporting period, the largest sector weightings were Information Technology and Industrials. The largest sector overweight was Consumer Staples and the largest sector underweight was Communication Services.

Contributors to Performance

The Industrials and Information Technology sectors provided the largest contributions to relative performance. Regarding individual positions, TransDigm Group Incorporated; Glaukos Corp; Impinj, Inc.; StepStone Group, Inc.; and Vertex, Inc. were the top five contributors to absolute performance.

Detractors from Performance

The Health Care and Real Estate sectors were the largest detractors from relative performance. Regarding individual positions, Nevro Corp.; ACADIA Pharmaceuticals Inc.; Paylocity Holding Corp.; SiteOne Landscape Supply, Inc.; and Progyny, Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| Soft-landing Narrative | Positive | During the period, the soft-landing scenario—an economic slowdown without a recession—drove equity markets higher as U.S. GDP for the fourth quarter grew 3.4%, exceeding the initial 2.0% consensus, driven by robust consumer spending. |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Elevated Inflation | Negative | Inflation concerns resurfaced during the first quarter of 2024, with Consumer Price Index (CPI) and Personal Consumption Expenditure Price Index (PCE) readings coming in higher-than-expected. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

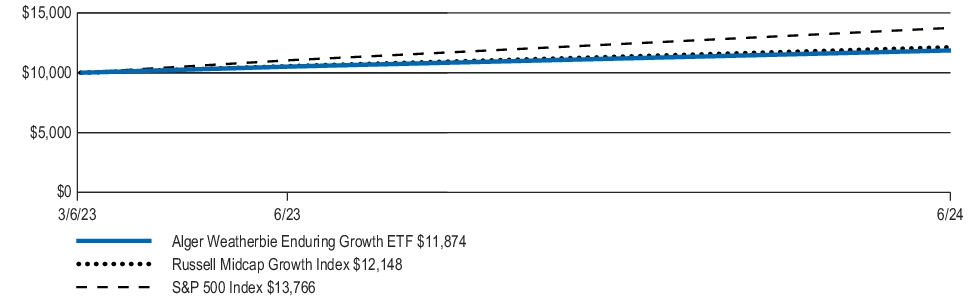

Fund Performance

The following graph and chart compares the initial and subsequent account values at the end of each of the most recently completed semi-annual periods of the Fund since its inception. The graph assumes a $10,000 initial investment at Net Asset Value at the inception date of the Fund in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

INITIAL INVESTMENT OF $10,000

| Average Annual Total Returns (As of June 30, 2024) | 1 Year | Since Inception

(3/6/23) |

| Alger Weatherbie Enduring Growth ETF | 12.89% | 13.92% |

| Russell Midcap Growth Index | 15.05% | 15.92% |

| S&P 500 Index | 24.56% | 27.45% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $4,714,365% |

| Total number of portfolio holdings1 | $25% |

| Portfolio turnover rate as of the end of the reporting period | $22.44% |

| 1 | Excludes Money Market Funds. |

| Communication Services | 1.4% |

| Consumer Discretionary | 3.3% |

| Financials | 4.8% |

| Healthcare | 16.6% |

| Industrials | 44.4% |

| Information Technology | 16.3% |

| Real Estate | 6.7% |

| Short-Term Investments and Other Net Assets | 6.5% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On May 23, 2023, the Board of Trustees of the Fund (the “Board”) approved the transition of the Fund’s custodian, administrator, and transfer agent from Brown Brothers Harriman & Company to The Bank of New York. This change was implemented on March 18, 2024.

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board.

Effective April 30, 2024, Alger Management contractually agreed to waive and/or reimburse Fund expenses (excluding acquired fund fees and expenses, dividend expense on short sales, net borrowing costs, interest, taxes, brokerage and extraordinary expenses, to the extent applicable) through December 31, 2025 to the extent necessary to limit other expenses of the Fund to 0.10% of the Fund’s average daily net assets.

This is a summary of certain changes to the Fund since January 1, 2024. For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 223-3810.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 223-3810.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 223-3810 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary.

The Fund utilizes the ActiveShares® methodology licensed from Precidian Investments, LLC ("Precidian"). Precidian’s products and services are protected by domestic and international intellectual property protections, including, without limitation, the following issued patents and pending patent applications: 7813987, 8285624, 7925562, 13011746, 14528658, 14208966, 16196560.

Alger Concentrated Equity ETF

CNEQ / NYSEArca

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger Concentrated Equity ETF (“Fund”) for the period of April 4, 2024 (commencement of operations) to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 223-3810.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs since inception?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Alger Concentrated Equity ETF | $141 | 0.55% |

1 | The Fund commenced investment operations on April 4, 2024. Had the Fund been in operation for a complete fiscal year, the cost of a $10,000 investment would have been higher. |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger Concentrated Equity ETF generated a 11.65% return from its April 4, 2024, inception date to June 30, 2024, compared to the 10.63% return of the Russell 1000 Growth Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Industrials and the largest sector underweight was Consumer Staples.

Contributors to Performance

The Information Technology and Industrials sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corporation; Apple Inc.; Microsoft Corporation; Taiwan Semiconductor Manufacturing Co., Ltd.; and Amazon.com, Inc. were the top five contributors to absolute performance.

Detractors from Performance

The Communication Services and Consumer Discretionary sectors were the largest detractors from relative performance. Regarding individual positions, Mobileye Global, Inc.; Meta Platforms Inc; Advanced Micro Devices, Inc.; Visa Inc.; and Broadcom Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

Fund Performance

The following chart reflects the Fund's average annual total returns at Net Asset Value at the end of the most recently completed semi-annual period since the Fund's inception. It also reflects average annual total returns in an appropriate, broad-based securities market index and a more narrowly based index that reflects the market sector in which the Fund invests for the same period.

| Average Annual Total Returns (As of June 30, 2024) | Since Inception

(4/4/24) |

| Alger Concentrated Equity ETF | 11.65% |

| Russell 1000 Growth Index | 10.63% |

| S&P 500 Index | 6.43% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $5,235,743% |

| Total number of portfolio holdings1 | $30% |

| Portfolio turnover rate as of the end of the reporting period | $17.31% |

| 1 | Excludes Money Market Funds. |

| Communication Services | 13.0% |

| Consumer Discretionary | 11.1% |

| Energy | 1.0% |

| Financials | 4.1% |

| Healthcare | 8.0% |

| Industrials | 9.1% |

| Information Technology | 49.2% |

| Utilities | 1.4% |

| Short-Term Investments and Other Net Assets | 3.1% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board of the Fund.

This is a summary of certain changes to the Fund since April 4, 2024 (commencement of operations). For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 223-3810.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 223-3810.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 223-3810 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary.

Alger AI Enablers & Adopters ETF

ALAI / NYSEArca

Semi-Annual SHAREHOLDER REPORT | June 30, 2024

This semi-annual shareholder report contains important information about the Alger AI Enablers & Adopters ETF (“Fund”) for the period of April 4, 2024 (commencement of operations) to June 30, 2024. You can find additional information about the Fund at https://connect.rightprospectus.com/Alger. You can also request a copy of the semi-annual report by contacting us at (800) 223-3810.

This report describes changes to the Fund that occurred during the reporting period.

What were the Fund costs since inception?

(Based on a hypothetical $10,000 investment)

| Fund | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| Alger AI Enablers & Adopters ETF | $141 | 0.55% |

1 | The Fund commenced investment operations on April 4, 2024. Had the Fund been in operation for a complete fiscal year, the cost of a $10,000 investment would have been higher. |

Management's Discussion of Fund Performance

What impacted Fund performance over the reporting period?

The Alger AI Enablers & Adopters ETF generated a 11.76% return from its April 4, 2024, inception date to June 30, 2024, compared to the 6.43% return of the S&P 500 Index. During the reporting period, the largest sector weightings were Information Technology and Communication Services. The largest sector overweight was Information Technology and the largest sector underweight was Financials.

Contributors to Performance

The Information Technology and Communication Services sectors provided the largest contributions to relative performance. Regarding individual positions, NVIDIA Corporation; Apple Inc.; Microsoft Corporation; Alphabet Inc.; and Broadcom Inc. were the top five contributors to absolute performance.

Detractors from Performance

The Real Estate and Consumer Staples sectors were the largest detractors from relative performance. Regarding individual positions, Meta Platforms Inc; DraftKings, Inc.; Mobileye Global, Inc.; International Business Machines Corporation; and Salesforce, Inc. were the top five detractors from absolute performance.

| U.S. FACTOR | IMPACT | SUMMARY |

| AI Enthusiasm | Positive | Continued anticipation about artificial intelligence drove strong gains for related companies, supported by robust operating results and upward earnings revisions. |

| Revised Federal Reserve Rate Cut Expectations | Negative | Elevated inflation readings during the first quarter of 2024 led to the Federal Reserve postponing an anticipated March rate cut. The revision of the market’s rate cut expectations, initially from a projected six cuts at the beginning of the period down to just one for the year, led to some market volatility in April. |

Fund Performance

The following chart reflects the Fund's average annual total returns at Net Asset Value at the end of the most recently completed semi-annual period since the Fund's inception. It also reflects average annual total returns in an appropriate, broad-based securities market index for the same period.

| Average Annual Total Returns (As of June 30, 2024) | Since Inception

(4/4/24) |

| Alger AI Enablers & Adopters ETF | 11.76% |

| S&P 500 Index | 6.43% |

Keep in mind that the Fund’s past performance is not a good predictor of how the Fund will perform in the future.

Visit https://www.alger.com/Pages/StrategyFinder.aspx?vehicle=mf for the most recent performance information. The table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. All performance figures assume reinvestment of distributions.

Key Fund Statistics

The following table outlines key fund statistics as of the reporting date.

| Fund net assets | $7,166,844% |

| Total number of portfolio holdings1 | $46% |

| Portfolio turnover rate as of the end of the reporting period | $28.28% |

| 1 | Excludes Money Market Funds. |

| Communication Services | 15.9% |

| Consumer Discretionary | 13.5% |

| Consumer Staples | 0.5% |

| Financials | 3.6% |

| Healthcare | 4.3% |

| Industrials | 2.1% |

| Information Technology | 52.3% |

| Real Estate | 1.9% |

| Utilities | 2.8% |

| Short-Term Investments and Other Net Assets | 3.1% |

| 100.0% |

† | Based on net assets of the Fund. |

Material and Other Fund Changes

On August 16, 2024, at a joint special meeting of shareholders, shareholders of the Fund elected three new trustees and one current trustee to the Board of the Fund.

This is a summary of certain changes to the Fund since April 4, 2024 (commencement of operations). For more complete information, you may review the Fund's next prospectus, which we expect to be available by May 1, 2025 at https://connect.rightprospectus.com/Alger or upon request at (800) 223-3810.

Availability of Additional Information

You can find additional information about the Fund such as the prospectus, financial information and fund holdings at https://connect.rightprospectus.com/Alger. Fund proxy voting information is available at https://www.alger.com/ProxyVoting. You can also request this information by contacting us at (800) 223-3810.

For additional information, please scan the QR code at left to navigate to additional hosted material at www.alger.com.

Householding

To reduce expenses, only one copy of the most recent financial reports and prospectus may be mailed to households, even if more than one person in a household holds shares of a Fund. Call an Alger Funds Representative at (800) 223-3810 if you need additional copies of financial reports or prospectuses, or download them at https://connect.rightprospectus.com/Alger. If you do not want the mailing of these documents to be combined with those for other members of your household, contact your broker-dealer or other financial intermediary.

| (b) | Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not applicable.

ITEM 2. CODE OF ETHICS.

Not applicable to this semi-annual report.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

Not applicable to this semi-annual report.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

Not applicable to this semi-annual report.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

Not applicable to this semi-annual report.

ITEM 6. INVESTMENTS.

(a) A Schedule of Investments in securities of unaffiliated issuers as of the close of the Reporting Period is included as part of the report to shareholders filed under Item 7 of this Form N-CSR.

(b) Not applicable.

ITEM 7. FINANCIAL STATEMENTS AND FINANCIAL HIGHLIGHTS FOR OPEN_END MANAGEMENT INVESTMENT COMPANIES.

|

|

Alger Weatherbie Enduring Growth ETF |

Alger Concentrated Equity ETF |

Alger AI Enablers & Adopters ETF |

SEMI-ANNUAL FINANCIAL STATEMENTS AND OTHER INFORMATION

June 30, 2024 (UNAUDITED)

Each of Alger 35 ETF, Alger Mid Cap 40 ETF and Alger Weatherbie Enduring Growth ETF utilizes the ActiveShares® methodology licensed from Precidian Investments, LLC ("Precidian"). Precidian's products and services are protected by domestic and international intellectual property protections, including, without limitation, the following issued patents and pending patent applications: 7813987, 8285624, 7925562, 13011746, 14528658, 14208966, 16196560.

THE ALGER ETF TRUST | ALGER 35 ETFSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

| | |

APPLICATION SOFTWARE—3.4% |

| | |

| | |

|

|

| | |

|

| | |

|

| | |

| | |

|

|

| | |

COAL & CONSUMABLE FUELS—1.9% |

| | |

|

Constellation Energy Corp. | | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.3% |

Vertiv Holdings Co., Cl. A | | |

ELECTRONIC EQUIPMENT & INSTRUMENTS—1.5% |

| | |

|

| | |

| | |

|

|

| | |

HEALTHCARE EQUIPMENT—2.5% |

Intuitive Surgical, Inc.* | | |

HOTELS RESORTS & CRUISE LINES—1.4% |

| | |

INTERACTIVE MEDIA & SERVICES—8.9% |

| | |

Meta Platforms, Inc., Cl. A | | |

| | |

|

|

| | |

MOVIES & ENTERTAINMENT—7.5% |

| | |

| | |

|

|

| | |

PASSENGER GROUND TRANSPORTATION—1.4% |

| | |

|

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER 35 ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—97.2% (CONT.) |

SEMICONDUCTOR MATERIALS & EQUIPMENT—2.8% |

| | |

|

| | |

| | |

| | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | |

|

|

| | |

|

| | |

|

Crowdstrike Holdings, Inc., Cl. A* | | |

| | |

|

|

| | |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—8.5% |

| | |

TOTAL COMMON STOCKS

(Cost $14,413,687) | | |

SHORT-TERM SECURITIES—2.8% |

|

Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, | | |

| | |

|

|

Total Investments

(Cost $14,954,491) | | |

Unaffiliated Securities (Cost $14,954,491) | | |

Liabilities in Excess of Other Assets | | |

| | |

| American Depositary Receipts |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER MID CAP 40 ETFSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

| | |

| | |

|

|

| | |

|

| | |

APPLICATION SOFTWARE—15.6% |

| | |

| | |

| | |

| | |

Manhattan Associates, Inc.* | | |

| | |

Palantir Technologies, Inc., Cl. A* | | |

| | |

|

|

| | |

|

| | |

Sarepta Therapeutics, Inc.* | | |

| | |

|

|

| | |

|

| | |

|

The AZEK Co., Inc., Cl. A* | | |

CARGO GROUND TRANSPORTATION—1.5% |

| | |

|

| | |

CONSTRUCTION & ENGINEERING—1.8% |

Comfort Systems USA, Inc. | | |

DIVERSIFIED FINANCIAL SERVICES—2.1% |

Apollo Global Management, Inc. | | |

|

Constellation Energy Corp. | | |

ELECTRICAL COMPONENTS & EQUIPMENT—6.6% |

| | |

Vertiv Holdings Co., Cl. A | | |

|

|

| | |

ENVIRONMENTAL & FACILITIES SERVICES—1.6% |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER MID CAP 40 ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—89.7% (CONT.) |

|

| | |

HEALTHCARE EQUIPMENT—1.8% |

| | |

HEAVY ELECTRICAL EQUIPMENT—1.2% |

| | |

INDUSTRIAL MACHINERY & SUPPLIES & COMPONENTS—2.4% |

Gates Industrial Corp. PLC* | | |

INTERACTIVE HOME ENTERTAINMENT—1.1% |

| | |

LIFE SCIENCES TOOLS & SERVICES—1.5% |

| | |

MOVIES & ENTERTAINMENT—7.0% |

Liberty Media Corp. Series C Liberty Formula | | |

| | |

|

|

| | |

OIL & GAS EXPLORATION & PRODUCTION—2.5% |

| | |

PERSONAL CARE PRODUCTS—1.6% |

| | |

|

Shake Shack, Inc., Cl. A* | | |

|

| | |

Monolithic Power Systems, Inc. | | |

|

|

| | |

|

Crowdstrike Holdings, Inc., Cl. A* | | |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—3.6% |

Dell Technologies, Inc., Cl. C | | |

Pure Storage, Inc., Cl. A* | | |

|

|

| | |

TOTAL COMMON STOCKS

(Cost $25,687,497) | | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER MID CAP 40 ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

SHORT-TERM SECURITIES—10.3% |

|

Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, | | |

| | |

|

|

Total Investments

(Cost $29,489,044) | | |

Unaffiliated Securities (Cost $29,489,044) | | |

Other Assets in Excess of Liabilities | | |

| | |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER WEATHERBIE ENDURING GROWTH ETFSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

The Trade Desk, Inc., Cl. A* | | |

AEROSPACE & DEFENSE—16.6% |

| | |

| | |

| | |

|

|

| | |

APPLICATION SOFTWARE—15.3% |

| | |

| | |

| | |

| | |

| | |

|

|

| | |

ASSET MANAGEMENT & CUSTODY BANKS—4.8% |

StepStone Group, Inc., Cl. A | | |

|

ACADIA Pharmaceuticals, Inc.* | | |

|

Ollie's Bargain Outlet Holdings, Inc.* | | |

CARGO GROUND TRANSPORTATION—6.1% |

| | |

| | |

|

|

| | |

ENVIRONMENTAL & FACILITIES SERVICES—15.8% |

Casella Waste Systems, Inc., Cl. A* | | |

Montrose Environmental Group, Inc.* | | |

| | |

|

|

| | |

HEALTHCARE EQUIPMENT—9.0% |

| | |

Tandem Diabetes Care, Inc.* | | |

|

|

| | |

|

| | |

HUMAN RESOURCE & EMPLOYMENT SERVICES—3.4% |

| | |

|

| | |

REAL ESTATE SERVICES—6.7% |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER WEATHERBIE ENDURING GROWTH ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—93.5% (CONT.) |

|

| | |

TRADING COMPANIES & DISTRIBUTORS—2.4% |

SiteOne Landscape Supply, Inc.* | | |

TOTAL COMMON STOCKS

(Cost $3,435,988) | | |

SHORT-TERM SECURITIES—7.3% |

|

Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, | | |

| | |

|

|

Total Investments

(Cost $3,777,603) | | |

Unaffiliated Securities (Cost $3,777,603) | | |

Liabilities in Excess of Other Assets | | |

| | |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER CONCENTRATED EQUITY ETFSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

| | |

APPLICATION SOFTWARE—5.3% |

| | |

Cadence Design Systems, Inc.* | | |

| | |

|

|

| | |

AUTOMOBILE MANUFACTURERS—1.0% |

| | |

|

| | |

|

| | |

| | |

|

|

| | |

COAL & CONSUMABLE FUELS—1.0% |

| | |

CONSTRUCTION & ENGINEERING—1.5% |

| | |

|

Constellation Energy Corp. | | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.6% |

Vertiv Holdings Co., Cl. A | | |

ENVIRONMENTAL & FACILITIES SERVICES—2.6% |

| | |

FINANCIAL EXCHANGES & DATA—2.0% |

| | |

HEALTHCARE EQUIPMENT—2.0% |

Intuitive Surgical, Inc.* | | |

INTERACTIVE MEDIA & SERVICES—9.3% |

| | |

Meta Platforms, Inc., Cl. A | | |

| | |

|

|

| | |

LIFE SCIENCES TOOLS & SERVICES—2.1% |

| | |

MOVIES & ENTERTAINMENT—3.7% |

Liberty Media Corp. Series C Liberty Formula One * | | |

| | |

|

|

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER CONCENTRATED EQUITY ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—96.9% (CONT.) |

|

| | |

SEMICONDUCTOR MATERIALS & EQUIPMENT—1.5% |

| | |

|

| | |

| | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | |

|

|

| | |

|

| | |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—7.3% |

| | |

TRANSACTION & PAYMENT PROCESSING SERVICES—2.1% |

| | |

TOTAL COMMON STOCKS

(Cost $4,553,207) | | |

SHORT-TERM SECURITIES—2.2% |

|

Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, 5.18%(a) | | |

| | |

|

|

Total Investments

(Cost $4,667,923) | | |

Unaffiliated Securities (Cost $4,667,923) | | |

Other Assets in Excess of Liabilities | | |

| | |

| American Depositary Receipts |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER AI ENABLERS & ADOPTERS ETFSchedule of Investments June 30, 2024 (Unaudited)

| | |

|

|

The Trade Desk, Inc., Cl. A* | | |

APPLICATION SOFTWARE—7.0% |

| | |

| | |

Cadence Design Systems, Inc.* | | |

| | |

|

|

| | |

AUTOMOBILE MANUFACTURERS—0.4% |

| | |

AUTOMOTIVE PARTS & EQUIPMENT—0.1% |

Mobileye Global, Inc., Cl. A* | | |

|

| | |

|

| | |

| | |

|

|

| | |

|

| | |

COMPUTER & ELECTRONICS RETAIL—0.4% |

| | |

CONSTRUCTION & ENGINEERING—0.3% |

| | |

CONSUMER STAPLES MERCHANDISE RETAIL—0.5% |

| | |

|

Digital Realty Trust, Inc. | | |

|

| | |

| | |

|

|

| | |

|

Constellation Energy Corp. | | |

| | |

| | |

|

|

| | |

ELECTRICAL COMPONENTS & EQUIPMENT—1.4% |

Vertiv Holdings Co., Cl. A | | |

FINANCIAL EXCHANGES & DATA—2.4% |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER AI ENABLERS & ADOPTERS ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—95.9% (CONT.) |

HEALTHCARE EQUIPMENT—1.9% |

Edwards Lifesciences Corp.* | | |

GE HealthCare Technologies, Inc. | | |

Intuitive Surgical, Inc.* | | |

|

|

| | |

INTERACTIVE MEDIA & SERVICES—11.8% |

| | |

Meta Platforms, Inc., Cl. A | | |

| | |

|

|

| | |

INTERNET SERVICES & INFRASTRUCTURE—0.5% |

| | |

|

| | |

MOVIES & ENTERTAINMENT—3.2% |

| | |

| | |

|

|

| | |

PASSENGER GROUND TRANSPORTATION—0.4% |

| | |

SEMICONDUCTOR MATERIALS & EQUIPMENT—1.3% |

| | |

| | |

|

|

| | |

|

Advanced Micro Devices, Inc.* | | |

| | |

| | |

| | |

| | |

Taiwan Semiconductor Manufacturing Co., Ltd. ADR | | |

|

|

| | |

|

| | |

| | |

|

|

| | |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—7.8% |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUST | ALGER AI ENABLERS & ADOPTERS ETFSchedule of Investments June 30, 2024 (Unaudited) (Continued)

| | |

COMMON STOCKS—95.9% (CONT.) |

TECHNOLOGY HARDWARE STORAGE & PERIPHERALS—7.8% (CONT.) |

Dell Technologies, Inc., Cl. C | | |

|

|

| | |

TOTAL COMMON STOCKS

(Cost $6,337,301) | | |

REAL ESTATE INVESTMENT TRUST—1.0% |

|

| | |

| | |

SHORT-TERM SECURITIES—4.4% |

|

Dreyfus Treasury Obligations Cash Management Fund, Institutional Shares, | | |

| | |

|

|

Total Investments

(Cost $6,730,723) | | |

Unaffiliated Securities (Cost $6,730,723) | | |

Liabilities in Excess of Other Assets | | |

| | |

| American Depositary Receipts |

| Rate shown reflects 7-day effective yield as of June 30, 2024. |

| Non-income producing security. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited)

| | |

|

Investments in unaffiliated securities, at value (Identified cost below)* see accompanying schedules of investments | | |

Cash and cash equivalents | | |

Receivable for investment securities sold | | |

Dividends and interest receivable | | |

Receivable from Investment Manager | | |

| | |

| | |

|

Accrued fund accounting fees | | |

Accrued professional fees | | |

Accrued transfer agent fees | | |

Accrued investment advisory fees | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Paid in capital (par value of $.001 per share) | | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| | |

SHARES OF BENEFICIAL INTEREST OUTSTANDING

— Note 6: | | |

NET ASSET VALUE PER SHARE: | | |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $15,047,634, amounted to $4,458,589, which consisted of aggregate gross unrealized appreciation of $4,663,971, and aggregate gross unrealized depreciation of $205,382. |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $29,489,044, amounted to $7,507,535, which consisted of aggregate gross unrealized appreciation of $7,905,112, and aggregate gross unrealized depreciation of $397,577. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| Alger Weatherbie Enduring Growth ETF | Alger Concentrated Equity ETF |

|

Investments in unaffiliated securities, at value (Identified cost below)* see accompanying schedules of investments | | |

Cash and cash equivalents | | |

Receivable for investment securities sold | | |

Dividends and interest receivable | | |

Receivable from Investment Manager | | |

| | |

| | |

|

Accrued fund accounting fees | | |

Accrued professional fees | | |

Accrued transfer agent fees | | |

Accrued investment advisory fees | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

|

Paid in capital (par value of $.001 per share) | | |

| | |

| | |

| | |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| Alger Weatherbie Enduring Growth ETF | Alger Concentrated Equity ETF |

SHARES OF BENEFICIAL INTEREST OUTSTANDING

— Note 6: | | |

NET ASSET VALUE PER SHARE: | | |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $3,777,641, amounted to $972,733, which consisted of aggregate gross unrealized appreciation of $1,134,434, and aggregate gross unrealized depreciation of $161,701. |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $4,667,923, amounted to $521,401, which consisted of aggregate gross unrealized appreciation of $535,328, and aggregate gross unrealized depreciation of $13,927. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| Alger AI Enablers & Adopters ETF |

|

Investments in unaffiliated securities, at value (Identified cost below)* see accompanying schedules of investments | |

Receivable for investment securities sold | |

Dividends and interest receivable | |

Receivable from Investment Manager | |

| |

| |

|

Accrued fund accounting fees | |

Accrued professional fees | |

Accrued transfer agent fees | |

Accrued investment advisory fees | |

| |

| |

| |

| |

Payable for investment securities purchased | |

| |

| |

|

Paid in capital (par value of $.001 per share) | |

| |

| |

| |

| |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Assets and Liabilities June 30, 2024 (Unaudited) (Continued)

| Alger AI Enablers & Adopters ETF |

SHARES OF BENEFICIAL INTEREST OUTSTANDING

— Note 6: | |

NET ASSET VALUE PER SHARE: | |

| At June 30, 2024, the net unrealized appreciation on investments, based on cost for federal income tax purposes of $6,730,723, amounted to $532,188, which consisted of aggregate gross unrealized appreciation of $545,482, and aggregate gross unrealized depreciation of $13,294. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Operations for the six months ended June 30, 2024 (Unaudited)

| | |

|

Dividends (net of foreign withholding taxes*) | | |

| | |

| | |

|

Investment management fees — Note 3 | | |

| | |

| | |

| | |

Transfer agent fees — Note 3 | | |

| | |

| | |

| | |

| | |

| | |

| | |

Less, expense reimbursements/waivers — Note 3 | | |

| | |

| | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

Net realized gain on unaffiliated investments | | |

Net realized gain on redemptions in-kind | | |

| | |

Net change in unrealized appreciation on unaffiliated investments | | |

Total change in unrealized appreciation | | |

Net realized and unrealized gain on investments and foreign currency | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Operations for the six months ended June 30, 2024 (Unaudited) (Continued)

| Alger Weatherbie Enduring Growth ETF | Alger Concentrated Equity ETF

From April 4, 2024

(commencement of

operations) to

June 30, 2024 |

|

Dividends (net of foreign withholding taxes*) | | |

| | |

| | |

|

Investment management fees — Note 3 | | |

| | |

| | |

| | |

Transfer agent fees — Note 3 | | |

| | |

| | |

| | |

| | |

| | |

| | |

Less, expense reimbursements/waivers — Note 3 | | |

| | |

| | |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

Net realized gain (loss) on unaffiliated investments | | |

| | |

Net change in unrealized appreciation on unaffiliated investments | | |

Total change in unrealized appreciation | | |

Net realized and unrealized gain on investments and foreign currency | | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | |

* Foreign withholding taxes | | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Operations for the six months ended June 30, 2024 (Unaudited) (Continued)

| Alger AI Enablers & Adopters ETF

From April 4, 2024

(commencement of

operations) to

June 30, 2024 |

|

Dividends (net of foreign withholding taxes*) | |

| |

| |

|

Investment management fees — Note 3 | |

| |

| |

Transfer agent fees — Note 3 | |

| |

| |

| |

| |

| |

Less, expense reimbursements/waivers — Note 3 | |

| |

| |

REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS AND FOREIGN CURRENCY: |

Net realized (loss) on unaffiliated investments | |

| |

Net change in unrealized appreciation on unaffiliated investments | |

Total change in unrealized appreciation | |

Net realized and unrealized gain on investments and foreign currency | |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

* Foreign withholding taxes | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Changes in Net Assets (Unaudited)

| |

| For the

Six Months Ended

June 30, 2024 | For the

Year Ended

December 31, 2023 |

| | |

| | |

Net change in unrealized appreciation | | |

Net increase in net assets resulting from operations | | |

Dividends and distributions to shareholders: |

Total dividends and distributions to shareholders | | |

Net increase from shares of beneficial interest transactions — Note 6 | | |

| | |

|

| | |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Changes in Net Assets (Unaudited) (Continued)

| |

| For the

Six Months Ended

June 30, 2024 | For the

Year Ended

December 31, 2023 |

Net investment income (loss) | | |

| | |

Net change in unrealized appreciation | | |

Net increase in net assets resulting from operations | | |

Dividends and distributions to shareholders: |

Net increase (decrease) from shares of beneficial interest transactions — Note 6 | | |

Total increase (decrease) | | |

|

| | |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Changes in Net Assets (Unaudited) (Continued)

| Alger Weatherbie Enduring Growth ETF |

| For the

Six Months Ended

June 30, 2024 | From March 6, 2023

(commencement of

operations) to

December 31, 2023 |

Net investment income (loss) | | |

| | |

Net change in unrealized appreciation | | |

Net increase in net assets resulting from operations | | |

Dividends and distributions to shareholders: |

Total dividends and distributions to shareholders | | |

Net increase from shares of beneficial interest transactions — Note 6 | | |

| | |

|

| | |

| | |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Changes in Net Assets (Unaudited) (Continued)

| Alger Concentrated Equity ETF |

| From April 4, 2024

(commencement of

operations) to

June 30, 2024 |

| |

| |

Net change in unrealized appreciation | |

Net increase in net assets resulting from operations | |

Dividends and distributions to shareholders: |

Net increase from shares of beneficial interest transactions — Note 6 | |

| |

|

| |

| |

See Notes to Financial Statements.

THE ALGER ETF TRUSTStatements of Changes in Net Assets (Unaudited) (Continued)

| Alger AI Enablers & Adopters ETF |

| From April 4, 2024

(commencement of

operations) to

June 30, 2024 |

| |

| |

Net change in unrealized appreciation | |

Net increase in net assets resulting from operations | |

Dividends and distributions to shareholders: |

Net increase from shares of beneficial interest transactions — Note 6 | |

| |

|

| |

| |

See Notes to Financial Statements.

THE ALGER ETF TRUSTFinancial Highlights for a share outstanding throughout the period (Unaudited)

| | | | |

| | | | From 5/3/2021

(commencement of

operations) to

|

Net asset value, beginning of period | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

Net investment income (loss)(b) | | | | |

Net realized and unrealized gain (loss) on investments | | | | |

Total from investment operations | | | | |

Dividends from net investment income | | | | |

Net asset value, end of period | | | | |

| | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | |

Ratio of gross expenses to average net assets | | | | |

Ratio of expense reimbursements to average net assets | | | | |

Ratio of net expenses to average net assets | | | | |

Ratio of net investment income (loss) to average net assets | | | | |

Portfolio turnover rate(d) | | | | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

| Amount was less than $0.005 per share. |

| Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTFinancial Highlights for a share outstanding throughout the period (Unaudited)

| | | | |

| | | | From 2/26/2021

(commencement of

operations) to

|

Net asset value, beginning of period | | | | |

INCOME FROM INVESTMENT OPERATIONS: |

Net investment income (loss)(b) | | | | |

Net realized and unrealized gain (loss) on investments | | | | |

Total from investment operations | | | | |

Distributions from net realized gains | | | | |

Net asset value, end of period | | | | |

| | | | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | | | |

Ratio of gross expenses to average net assets | | | | |

Ratio of expense reimbursements to average net assets | | | | |

Ratio of net expenses to average net assets | | | | |

Ratio of net investment income (loss) to average net assets | | | | |

Portfolio turnover rate(d) | | | | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

| Amount was less than $0.005 per share. |

| Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTFinancial Highlights for a share outstanding throughout the period (Unaudited)

Alger Weatherbie Enduring Growth ETF | | |

| | From 3/6/2023

(commencement of

operations) to

|

Net asset value, beginning of period | | |

INCOME FROM INVESTMENT OPERATIONS: |

Net investment income (loss)(b) | | |

Net realized and unrealized gain on investments | | |

Total from investment operations | | |

Dividends from net investment income | | |

Net asset value, end of period | | |

| | |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | | |

Ratio of gross expenses to average net assets | | |

Ratio of expense reimbursements to average net assets | | |

Ratio of net expenses to average net assets | | |

Ratio of net investment income (loss) to average net assets | | |

Portfolio turnover rate(c) | | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

| Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTFinancial Highlights for a share outstanding throughout the period (Unaudited)

Alger Concentrated Equity ETF | |

| From 4/4/2024

(commencement of

operations) to

|

Net asset value, beginning of period | |

INCOME FROM INVESTMENT OPERATIONS: |

| |

Net realized and unrealized gain on investments | |

Total from investment operations | |

Net asset value, end of period | |

| |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | |

Ratio of gross expenses to average net assets | |

Ratio of expense reimbursements to average net assets | |

Ratio of net expenses to average net assets | |

Ratio of net investment loss to average net assets | |

Portfolio turnover rate(d) | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

| Amount was less than $0.005 per share. |

| Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTFinancial Highlights for a share outstanding throughout the period (Unaudited)

Alger AI Enablers & Adopters ETF | |

| From 4/4/2024

(commencement of

operations) to

|

Net asset value, beginning of period | |

INCOME FROM INVESTMENT OPERATIONS: |

| |

Net realized and unrealized gain on investments | |

Total from investment operations | |

Net asset value, end of period | |

| |

RATIOS/SUPPLEMENTAL DATA: |

Net assets, end of period (000's omitted) | |

Ratio of gross expenses to average net assets | |

Ratio of expense reimbursements to average net assets | |

Ratio of net expenses to average net assets | |

Ratio of net investment income to average net assets | |

Portfolio turnover rate(c) | |

| Ratios have been annualized; total return and portfolio turnover rate have not been annualized. |

| Amount was computed based on average shares outstanding during the period. |

| Portfolio turnover excludes the value of portfolio securities received or delivered as a result of in-kind fund share transactions. |

See Notes to Financial Statements.

THE ALGER ETF TRUSTNOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1 — General:

The Alger ETF Trust (the “Trust”) is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”), and organized as a business trust under the laws of the Commonwealth of Massachusetts on March 24, 2020. The Alger Mid Cap 40 ETF is a separate diversified series of the Trust, and the Alger 35 ETF, the Alger Weatherbie Enduring Growth ETF, the Alger Concentrated Equity ETF and the Alger AI Enablers & Adopters ETF are each separate non-diversified series of the Trust (each, a “Fund” and together, the “Funds”). The Trust qualifies as an investment company as defined in Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 946-Financial Services – Investment Companies. Each Fund’s investment objective is to seek long-term capital appreciation. Under normal circumstances, each Fund invests primarily in equity securities. Shares of each Fund are listed for trading on the NYSE Arca, Inc.

The Alger Concentrated Equity ETF and the Alger AI Enablers & Adopters ETF commenced operations on April 4, 2024.

On May 23, 2023, the Board of Trustees of the Trust (the “Board”) approved the transition of the custodian, administrator, and transfer agent from Brown Brothers Harriman & Company to The Bank of New York (collectively, the "Custodian") for the Alger 35 ETF, the Alger Mid Cap 40 ETF, and the Alger Weatherbie Enduring Growth ETF. This change became effective on March 18, 2024.

NOTE 2 — Significant Accounting Policies:

(a) Investment Valuation: The Funds value their financial instruments at fair value using independent dealers or pricing services under policies approved by the Board. Investments held by the Funds are valued on each day the New York Stock Exchange (the “NYSE”) is open, as of the close of the NYSE (normally 4:00 p.m. Eastern Time).

The Board has designated, pursuant to Rule 2a-5 under the 1940 Act, the Funds' investment adviser, Fred Alger Management, LLC (“Alger Management” or the “Investment Manager”) as its valuation designee (the “Valuation Designee”) to make fair value determinations subject to the Board’s review and oversight. The Valuation Designee has established a Valuation Committee (“Committee”) comprised of representatives of the Investment Manager and officers of the Funds to assist in performing the duties and responsibilities of the Valuation Designee.

The Valuation Designee has established valuation processes including but not limited to: (i) making fair value determinations when market quotations for financial instruments are not readily available in accordance with valuation policies and procedures adopted by the Board; (ii) assessing and managing

THE ALGER ETF TRUSTNOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

material risks associated with fair valuation determinations; (iii) selecting, applying and testing fair valuation methodologies; and (iv) overseeing and evaluating pricing services used by the Funds. The Valuation Designee regularly reports its fair valuation determinations and related valuation information to the Board. The Committee generally meets quarterly and on an as-needed basis to review and evaluate the effectiveness of the valuation policies and procedures in accordance with the requirements of Rule 2a-5.

Investments in short-term securities held by the Funds having a remaining maturity of sixty days or less are valued at amortized cost which approximates market value. Investments in other open-end investment companies registered under the 1940 Act are valued at such investment companies' net asset value per share.

Equity securities, including traded rights, warrants and option contracts for which valuation information is readily available, are valued at the last quoted sales price or official closing price on the primary market or exchange on which they are traded as reported by an independent pricing service. In the absence of quoted sales, such securities are generally valued at the bid price or, in the absence of a recent bid price, the equivalent as obtained from one or more of the major market makers for the securities to be valued.

FASB Accounting Standards Codification 820 – Fair Value Measurements and Disclosures (“ASC 820”) defines fair value as the price that the Funds would receive upon selling an investment in a timely transaction to an independent buyer in the principal or most advantageous market of the investment. ASC 820 established a three-tier hierarchy to maximize the use of observable market data and minimize the use of unobservable inputs and to establish classification of fair value measurements for disclosure purposes. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability and may be observable or unobservable. Observable inputs are based on market data obtained from sources independent of the Funds. Unobservable inputs are inputs that reflect the Funds' own assumptions based on the best information available in the circumstances. The three-tier hierarchy of inputs is summarized in the three broad Levels listed below.

• Level 1 – quoted prices in active markets for identical investments

• Level 2 – significant other observable inputs (including quoted prices for similar investments, amortized cost, interest rates, prepayment speeds, credit risk, etc.)

• Level 3 – significant unobservable inputs (including the Funds' own assumptions in determining the fair value of investments)

The Funds' valuation techniques are generally consistent with either the market or the income approach to fair value. The market approach considers prices and

THE ALGER ETF TRUSTNOTES TO FINANCIAL STATEMENTS (Unaudited) (Continued)

other relevant information generated by market transactions involving identical or comparable assets to measure fair value. The income approach converts future amounts to a current, or discounted, single amount. These fair value measurements are determined on the basis of the value indicated by current market expectations about such future events. Inputs for Level 1 include exchange-listed prices and broker quotes in an active market. The Funds cannot invest in Level 2 and Level 3 securities.

(b) Cash and Cash Equivalents: Cash and cash equivalents include U.S. dollars.

(c) Securities Transactions and Investment Income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Dividend income is recognized on the ex-dividend date and interest income is recognized on the accrual basis.