PROG Internal PROG Holdings, Inc. Q4 2024 Earnings Supplement February 19, 2025 Exhibit 99.2

2 Statements in this earnings supplement regarding our business that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “continuing”, “believe”, “aim”, "outlook" and similar forward-looking terminology. These risks and uncertainties include factors such as (i) continued volatility and challenges in the macro environment and, in particular, the unfavorable effects on our business of impacts of inflation, a higher cost of living and elevated interest rates, and the impact of those headwinds on: (a) consumer confidence and customer demand for the merchandise that our POS partners sell, in particular consumer durables; (b) our customers’ disposable income and their ability to make the lease and loan payments they owe the Company; (c) the availability of consumer credit; and (d) our overall financial performance and outlook; (ii) our businesses being subject to extensive federal, state and local laws and regulations, including certain laws and regulations unique to the industries in which our businesses operate, that may subject them to government investigations and significant monetary penalties, remediation expenses and compliance-related burdens that may result in them changing the manner in which they operate, which may be materially adverse to several aspects of our performance; (iii) an uncertain macroeconomic environment resulting in our proprietary algorithms and decisioning tools used in approving customers no longer being indicative of their ability to perform, which in turn may limit the ability of our businesses to manage risk, avoid lease and loan charge-offs and may result in insufficient reserves to cover actual losses; (iv) a large percentage of Progressive Leasing's revenue being concentrated with several key POS partners, and the loss of any of these POS partner relationships materially and adversely affecting several aspects of our performance; (v) Progressive Leasing being unable to attract additional POS partners and retain and grow its relationships with its existing POS partners, resulting in several aspects of our performance being materially and adversely affected; (vi) Progressive Leasing being unable to attract new consumers and retain and grow its relationships with its existing customers materially and adversely affecting several aspects of our performance; (vii) Vive and Four’s business models differing significantly from Progressive Leasing's lease-to-own business, which means each of these businesses have different risk profiles; (viii) our efforts to modernize and enhance certain enterprise-wide information management systems and technologies adversely impacting our businesses and operations; (ix) our inability to protect confidential, proprietary, or sensitive information, including the confidential information of our customers, being adversely affected by cyber-attacks or similar disruptions, which may result in significant costs, litigation and reputational damage or otherwise have a material adverse impact on several aspects of our performance; (x) our capital allocation strategy and financial policies, including our current stock repurchase and dividend programs, as well as any potential debt repurchase program not being effective at enhancing shareholder value, or providing other benefits we expect; (xi) the inability of our businesses to successfully operate in highly and increasingly competitive industries materially and adversely affecting several aspects of our performance; (xii) our business, results of operations, financial condition, and prospects being materially and adversely affected due to Progressive Leasing failing to maintain a consistently high level of consumer satisfaction and trust in its brand; (xiii) our performance being materially and adversely affected due to the transactions offered to consumers by our businesses being negatively characterized by federal, state and local government officials, consumer advocacy groups and the media; (xiv) any significant disruption in our vendors’ information technology systems, or disruptions in the information our businesses rely on in their lease and loan decisioning, materially and adversely affecting several aspects of our performance; and (xv) the other risks and uncertainties discussed under "Risk Factors" in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. Statements in this earnings supplement that are "forward-looking" include without limitation statements about: (i) our ability to invest in our businesses to increase customer acquisition and lifetime value, and the results of any such investments; (ii) having the financial flexibility to invest in our future growth and return excess cash to shareholders; (iii) maximizing long-term value creation; and (iv) our full year 2025 outlook and our first quarter 2025 outlook. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this earnings supplement. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this earnings supplement. Use of Forward-Looking Statements

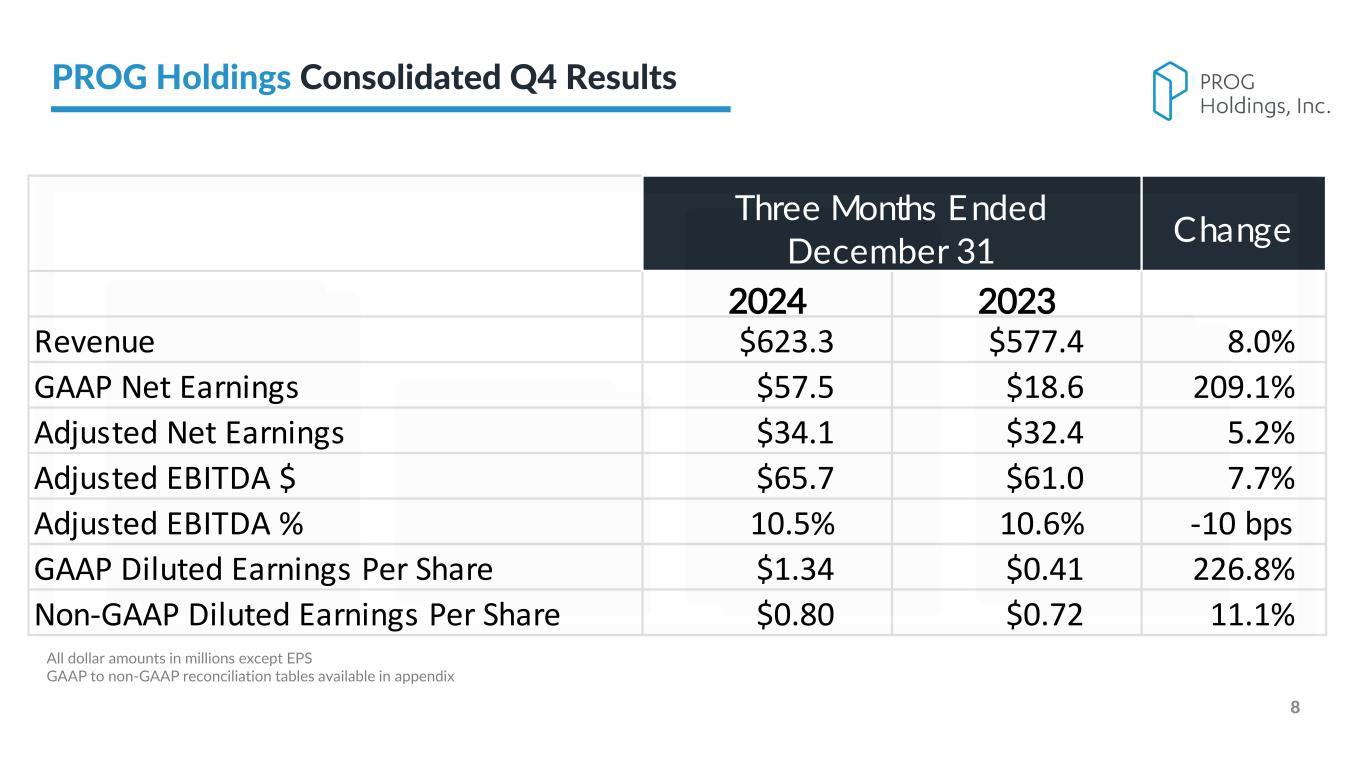

3 PROG Holdings Q4 2024 Headlines • Progressive Leasing GMV of $597.5 million, up 9.1% year- over-year • Consolidated revenues of $623.3 million, up 8.0% • Net earnings of $57.5 million • Adjusted EBITDA of $65.7 million • Diluted EPS of $1.34; Non-GAAP Diluted EPS of $0.80 • Provides full year 2025 consolidated revenue and earnings outlook

4 "We finished 2024 with an excellent fourth quarter, delivering a third consecutive quarter of strong GMV growth and approximating the high end of our outlook ranges for both our revenues and earnings for the period," said PROG Holdings President and CEO Steve Michaels. “2024 was a successful year, driven by better-than-expected GMV growth, disciplined portfolio management, cost efficiencies, and continued execution on multiple strategic fronts. Our teams' execution across sales, marketing, and technology initiatives, combined with tighter credit conditions in the market, played a key role in driving a meaningful increase in new and repeat customers. As we move into 2025, we are excited about continuing to execute our three-pillared strategy to grow, enhance, and expand - investing in our businesses with a focus on increasing customer acquisition and lifetime value. We believe our cash-efficient model gives us the financial flexibility to invest in our future growth and return excess cash to shareholders, as we aim to maximize long-term value creation," concluded Michaels Steve Michaels President and CEO, PROG Holdings, Inc. PROG Holdings Executive Commentary

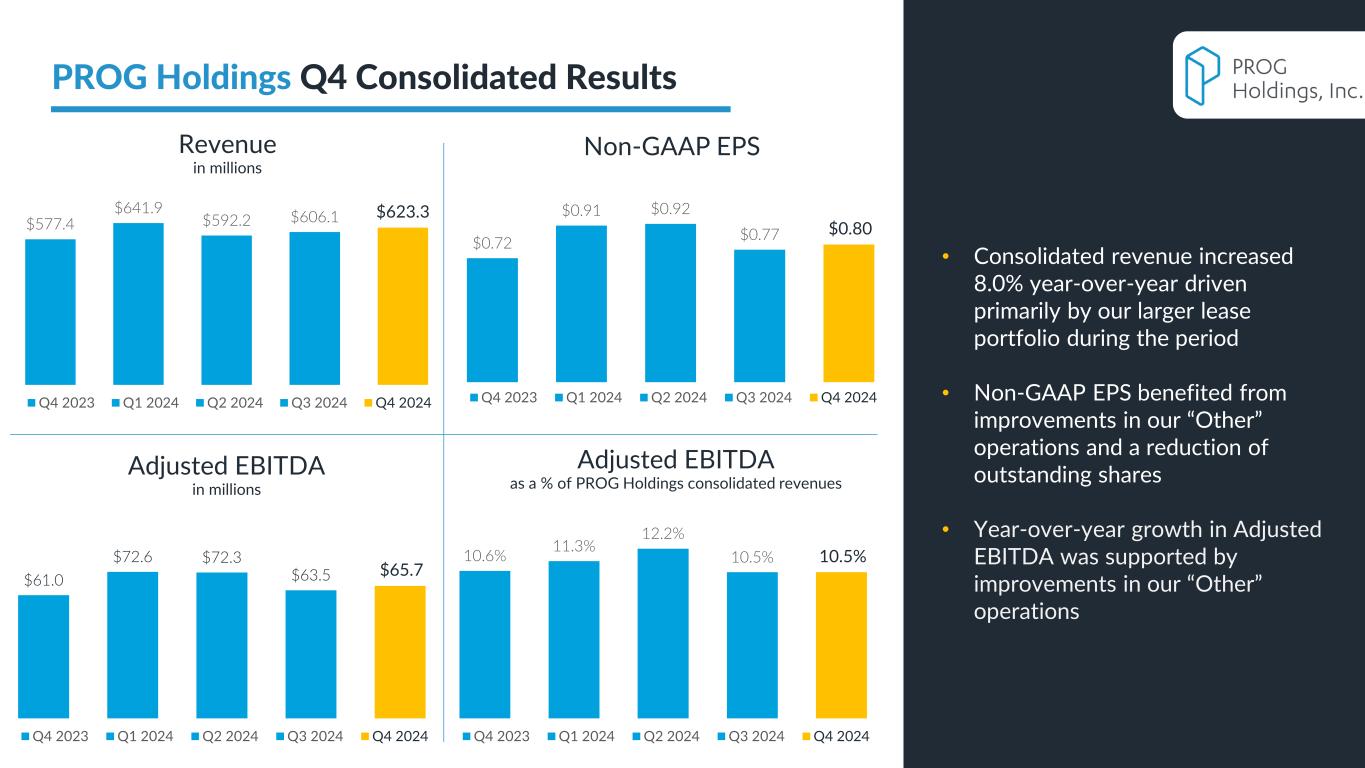

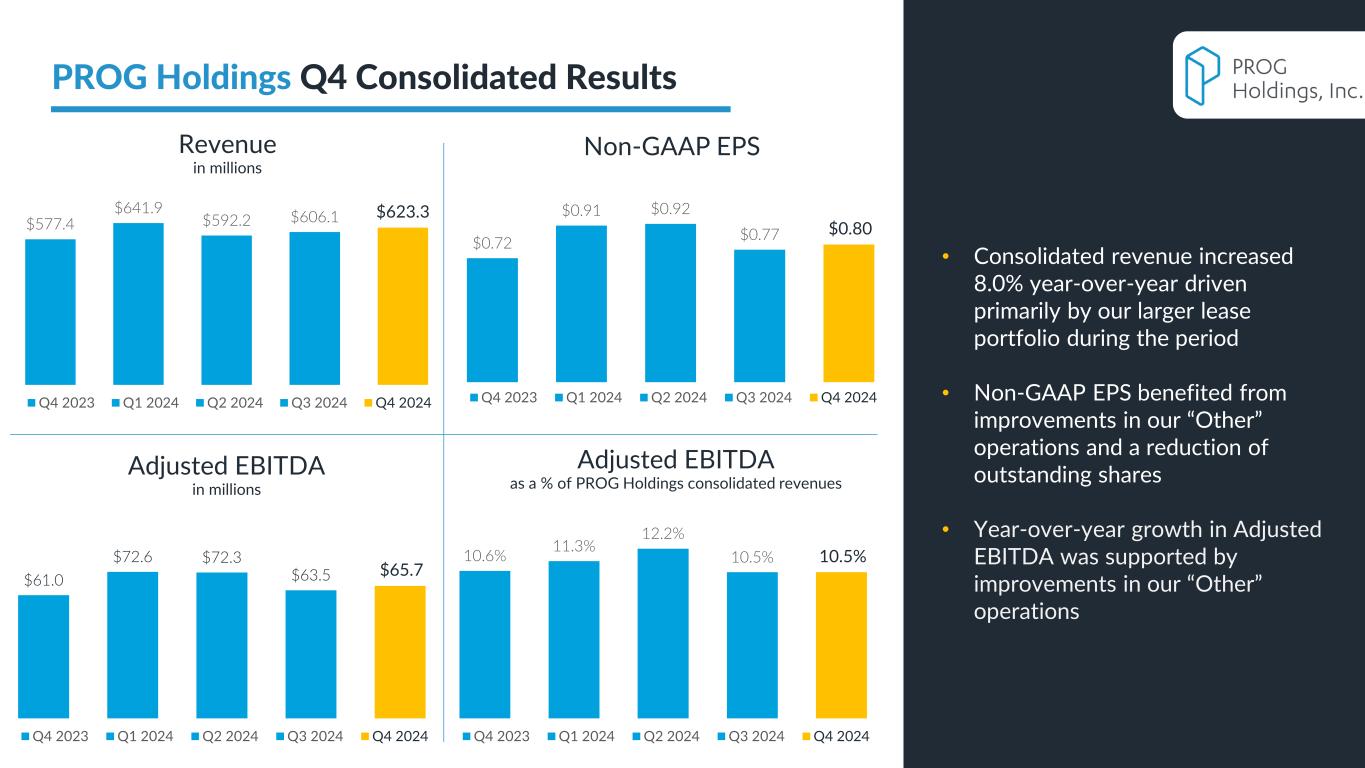

PROG Internal Adjusted EBITDA in millions 5 $577.4 $641.9 $592.2 $606.1 $623.3 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Non-GAAP EPSRevenue in millions 10.6% 11.3% 12.2% 10.5% 10.5% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Adjusted EBITDA as a % of PROG Holdings consolidated revenues PROG Holdings Q4 Consolidated Results $61.0 $72.6 $72.3 $63.5 $65.7 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 $0.72 $0.91 $0.92 $0.77 $0.80 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 • Consolidated revenue increased 8.0% year-over-year driven primarily by our larger lease portfolio during the period • Non-GAAP EPS benefited from improvements in our “Other” operations and a reduction of outstanding shares • Year-over-year growth in Adjusted EBITDA was supported by improvements in our “Other” operations

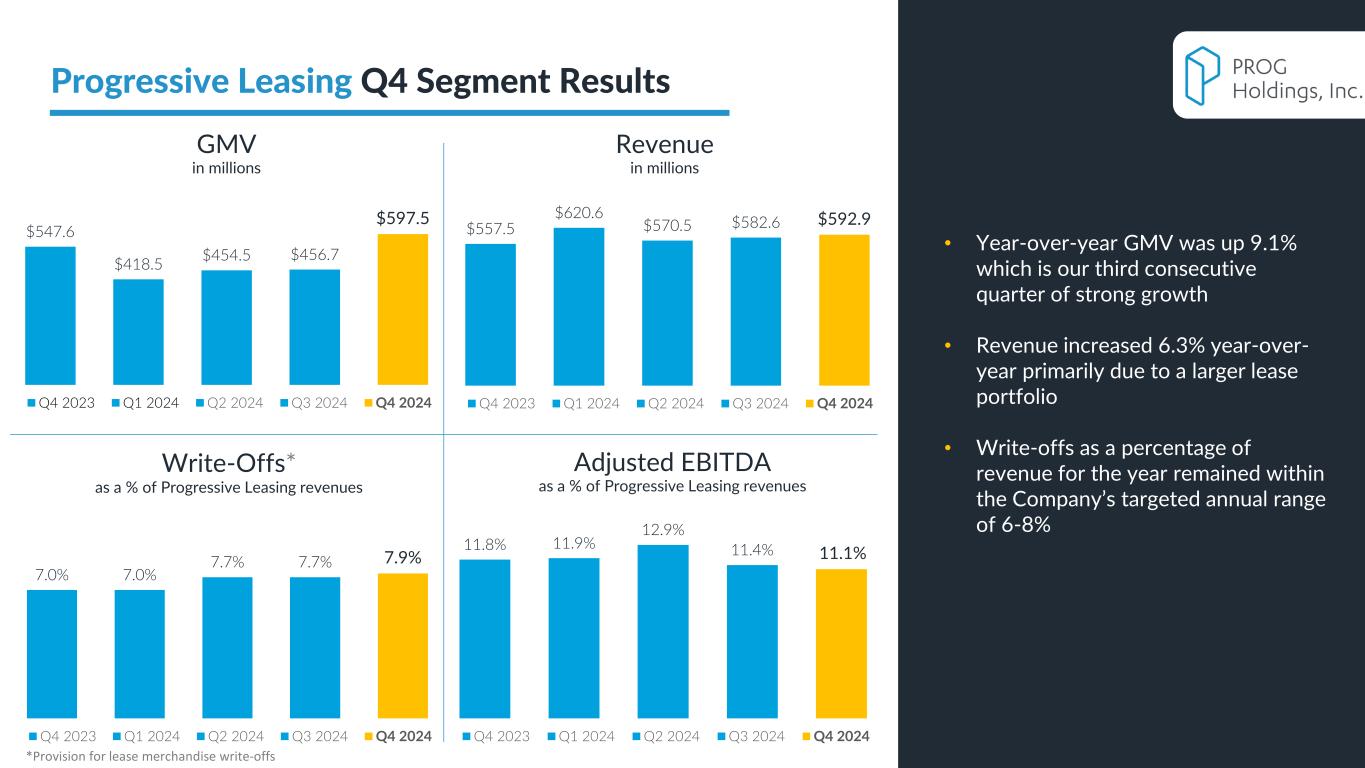

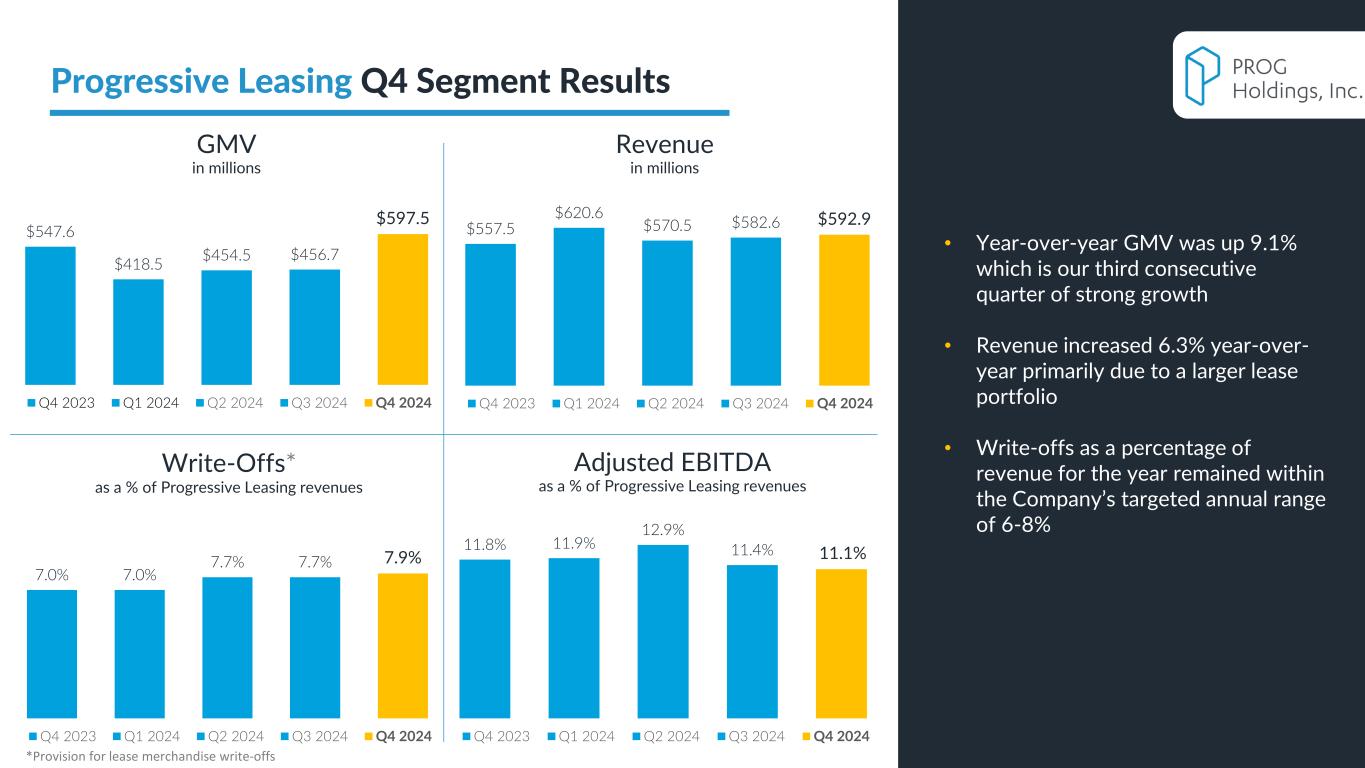

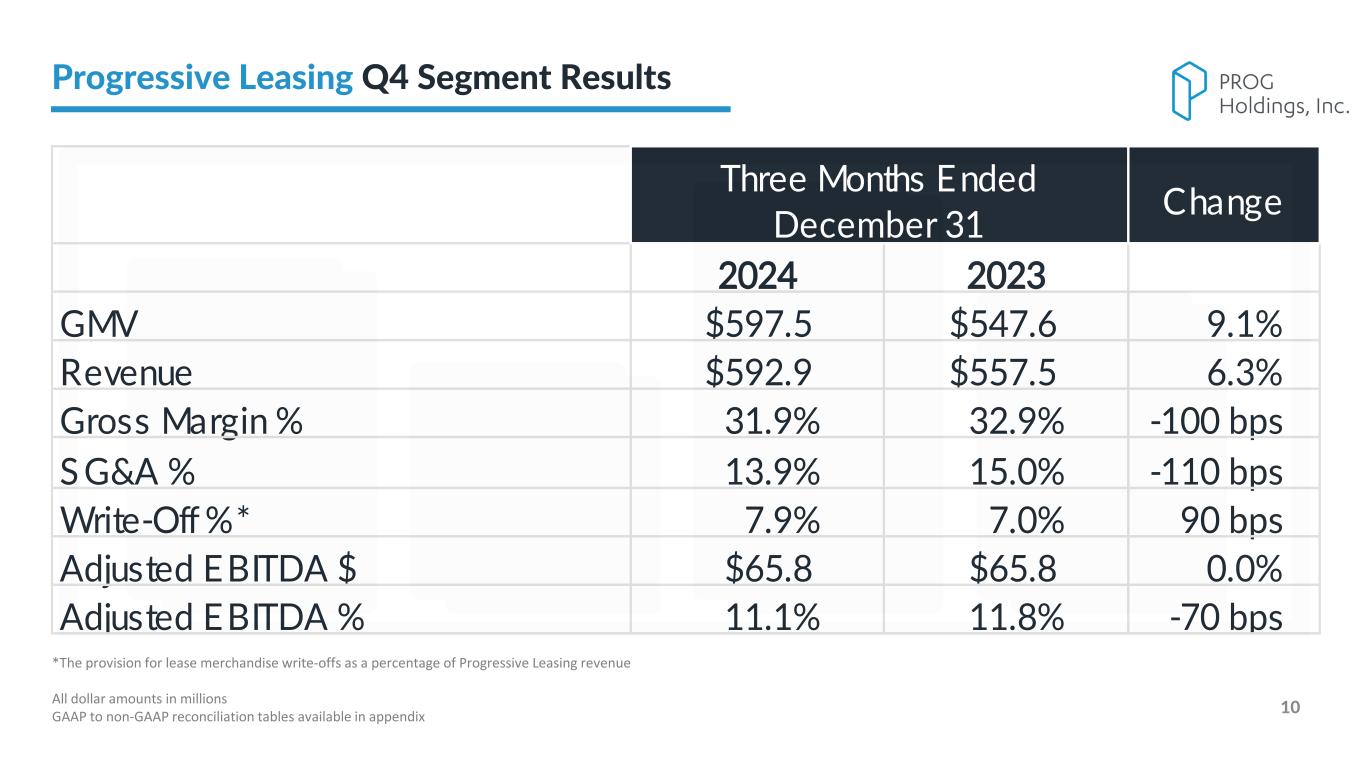

PROG Internal $557.5 $620.6 $570.5 $582.6 $592.9 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Write-Offs* as a % of Progressive Leasing revenues 6 $547.6 $418.5 $454.5 $456.7 $597.5 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 GMV in millions 7.0% 7.0% 7.7% 7.7% 7.9% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Adjusted EBITDA as a % of Progressive Leasing revenues Progressive Leasing Q4 Segment Results Revenue in millions *Provision for lease merchandise write-offs 11.8% 11.9% 12.9% 11.4% 11.1% Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 • Year-over-year GMV was up 9.1% which is our third consecutive quarter of strong growth • Revenue increased 6.3% year-over- year primarily due to a larger lease portfolio • Write-offs as a percentage of revenue for the year remained within the Company’s targeted annual range of 6-8%

PROG Internal Results

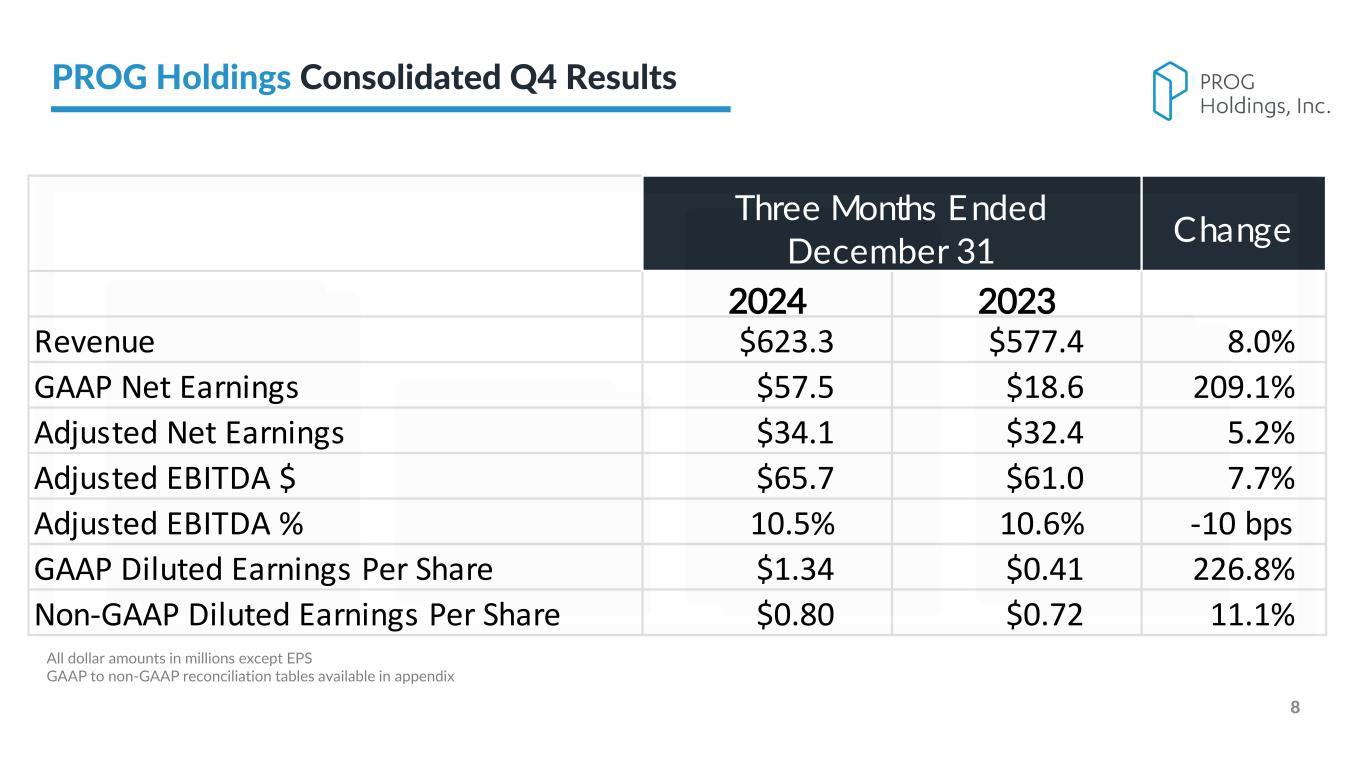

PROG Internal 8 2024 2023 Revenue $623.3 $577.4 8.0% GAAP Net Earnings $57.5 $18.6 209.1% Adjusted Net Earnings $34.1 $32.4 5.2% Adjusted EBITDA $ $65.7 $61.0 7.7% Adjusted EBITDA % 10.5% 10.6% -10 bps GAAP Diluted Earnings Per Share $1.34 $0.41 226.8% Non-GAAP Diluted Earnings Per Share $0.80 $0.72 11.1% Three Months Ended December 31 Change All dollar amounts in millions except EPS GAAP to non-GAAP reconciliation tables available in appendix PROG Holdings Consolidated Q4 Results

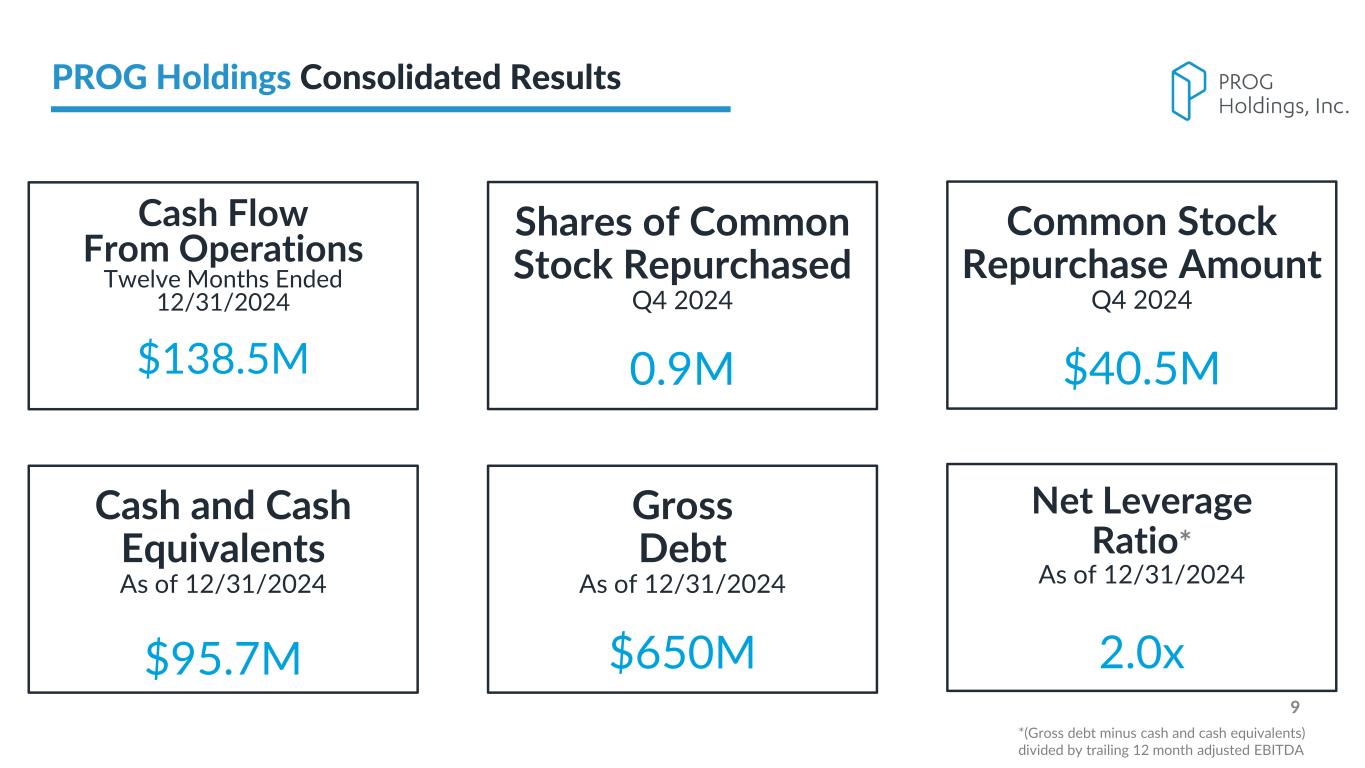

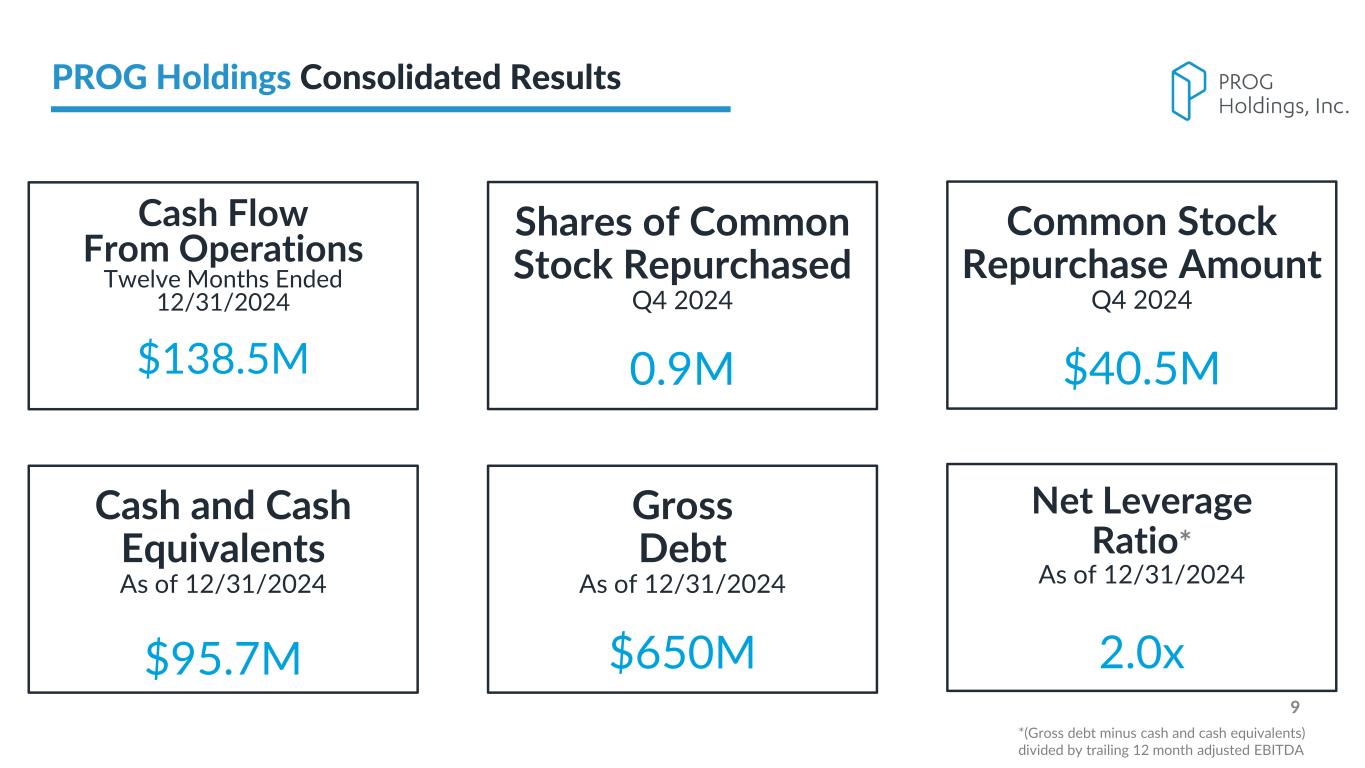

PROG Internal 9 *(Gross debt minus cash and cash equivalents) divided by trailing 12 month adjusted EBITDA PROG Holdings Consolidated Results Shares of Common Stock Repurchased Q4 2024 0.9M Cash and Cash Equivalents As of 12/31/2024 $95.7M Gross Debt As of 12/31/2024 $650M Net Leverage Ratio* As of 12/31/2024 2.0x Cash Flow From Operations Twelve Months Ended 12/31/2024 $138.5M Common Stock Repurchase Amount Q4 2024 $40.5M

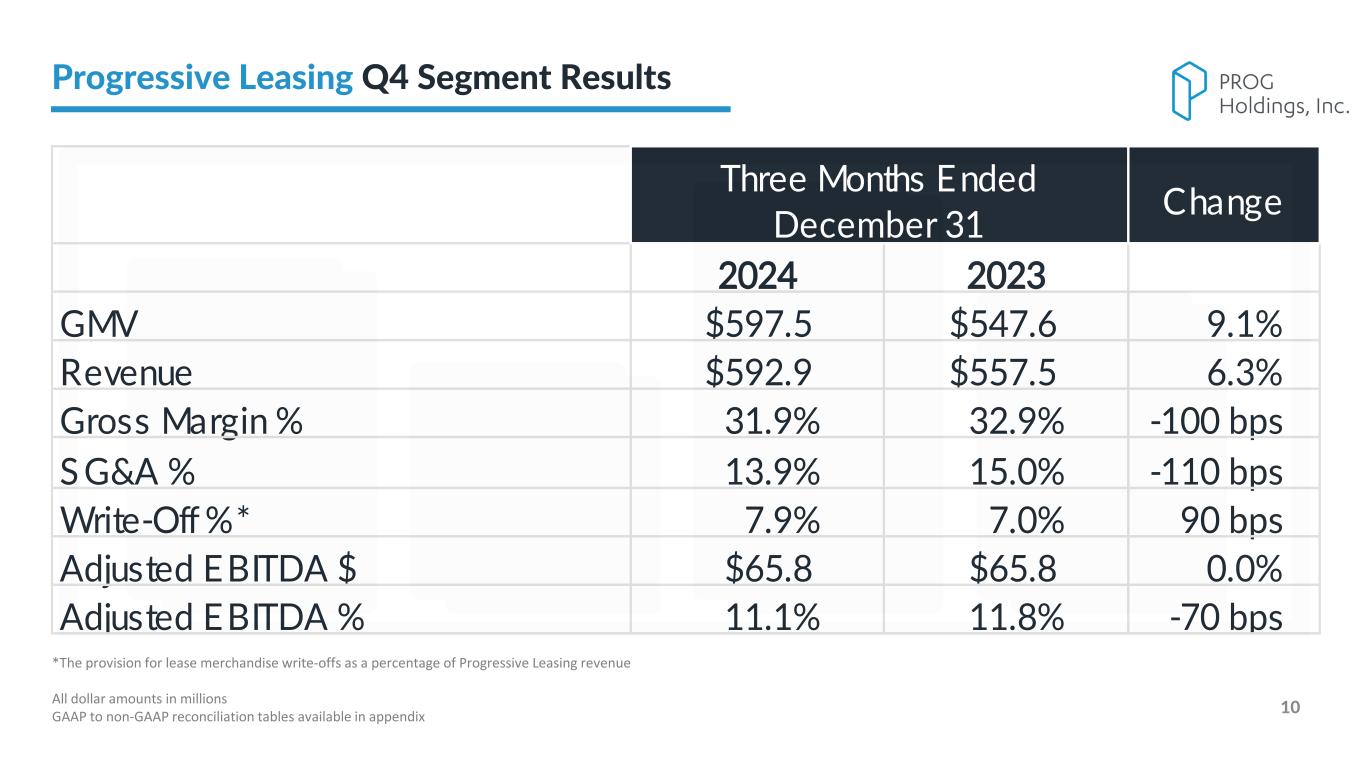

PROG Internal 10 2024 2023 GMV $597.5 $547.6 9.1% Revenue $592.9 $557.5 6.3% Gross Margin % 31.9% 32.9% -100 bps S G&A % 13.9% 15.0% -110 bps Write-Off %* 7.9% 7.0% 90 bps Adjusted EBITDA $ $65.8 $65.8 0.0% Adjusted EBITDA % 11.1% 11.8% -70 bps Three Months Ended December 31 Change *The provision for lease merchandise write-offs as a percentage of Progressive Leasing revenue All dollar amounts in millions GAAP to non-GAAP reconciliation tables available in appendix Progressive Leasing Q4 Segment Results

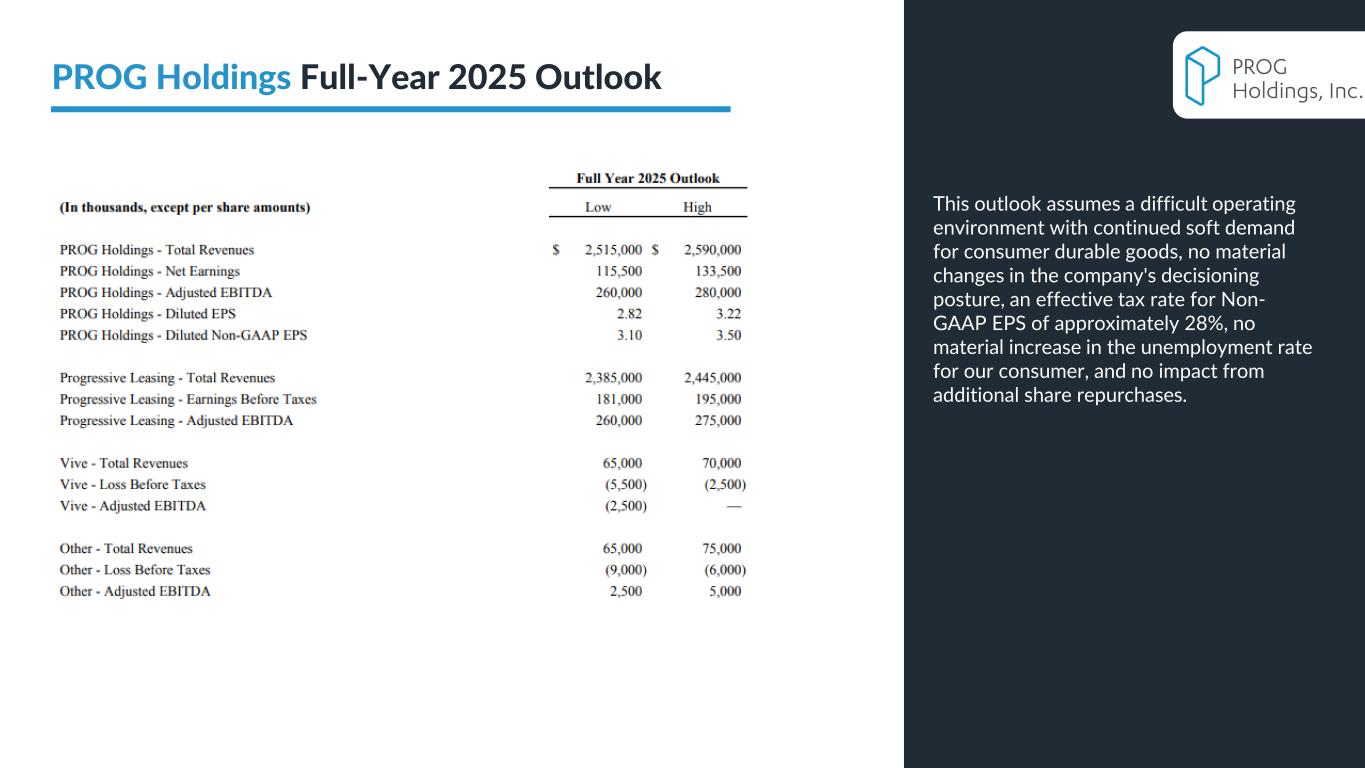

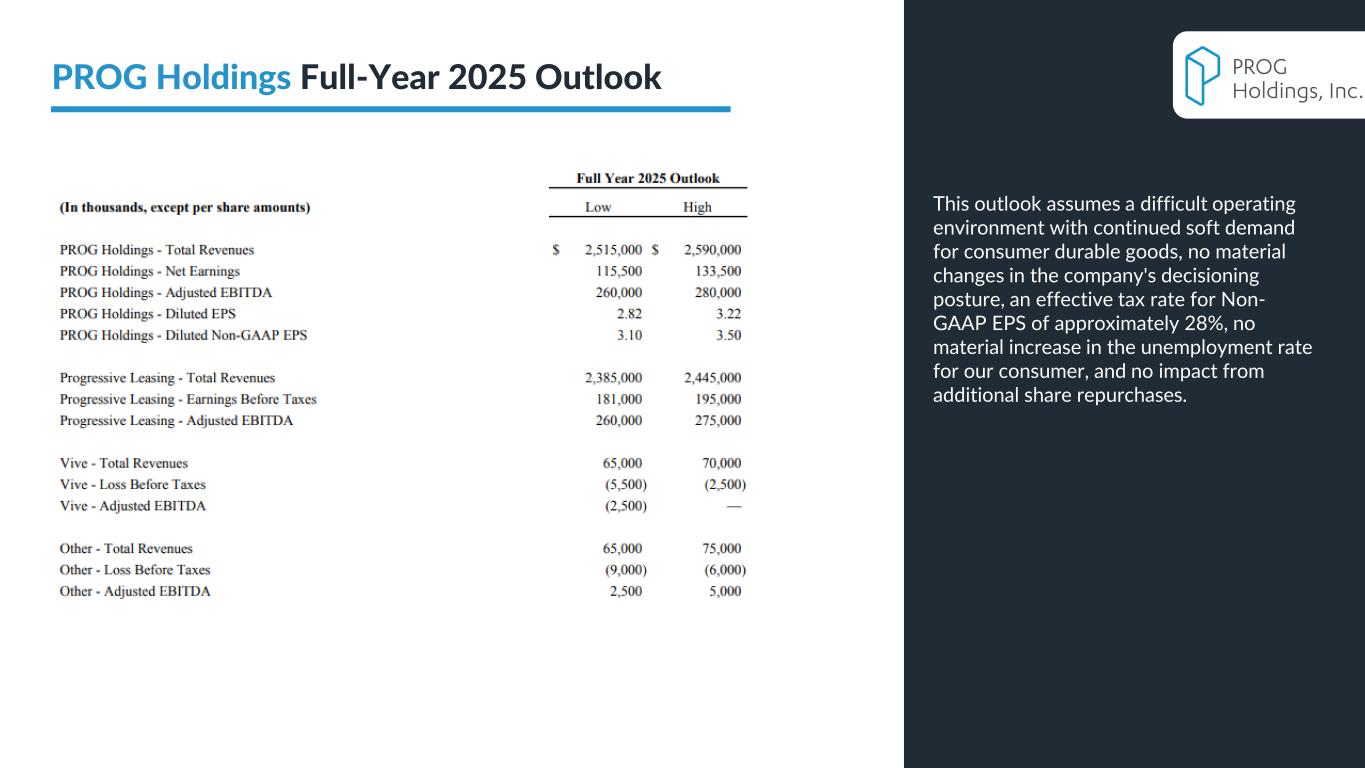

PROG Internal 11 PROG Holdings Full-Year 2025 Outlook This outlook assumes a difficult operating environment with continued soft demand for consumer durable goods, no material changes in the company's decisioning posture, an effective tax rate for Non- GAAP EPS of approximately 28%, no material increase in the unemployment rate for our consumer, and no impact from additional share repurchases.

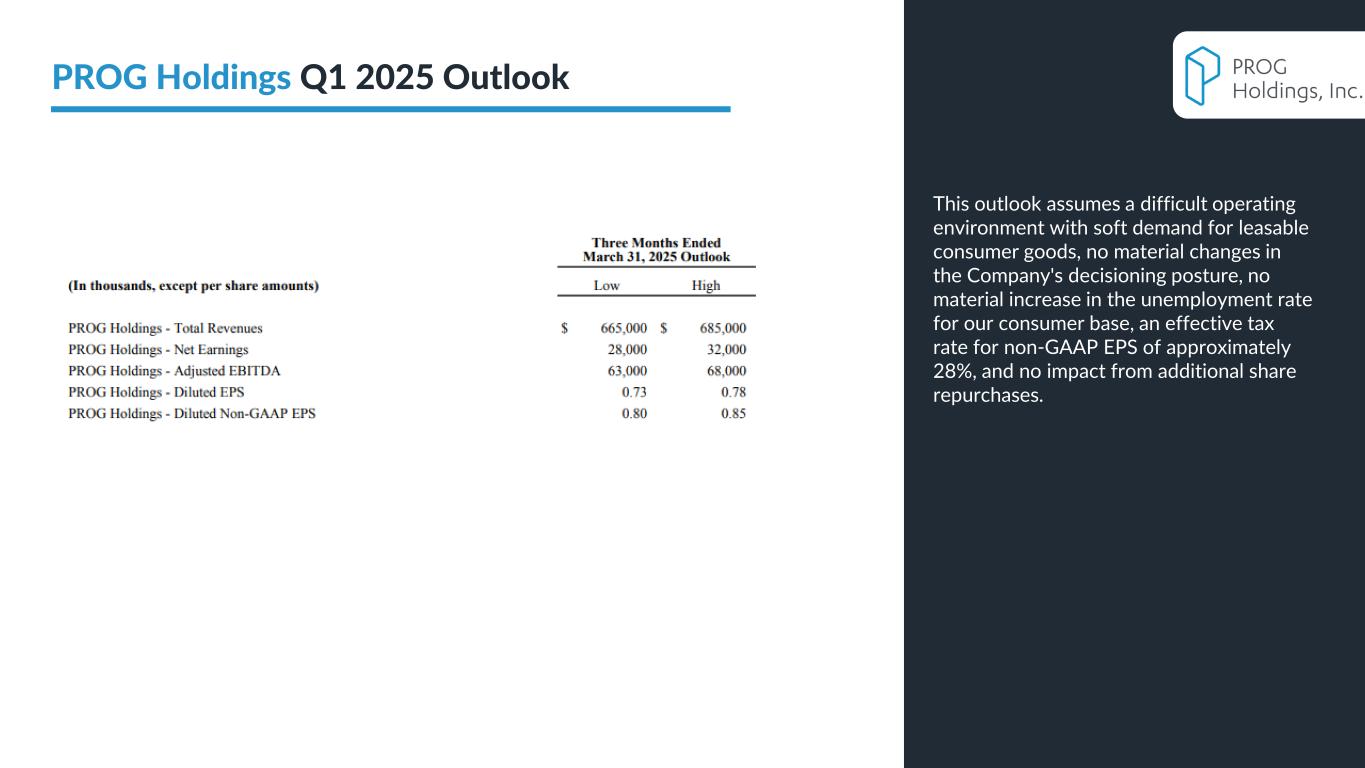

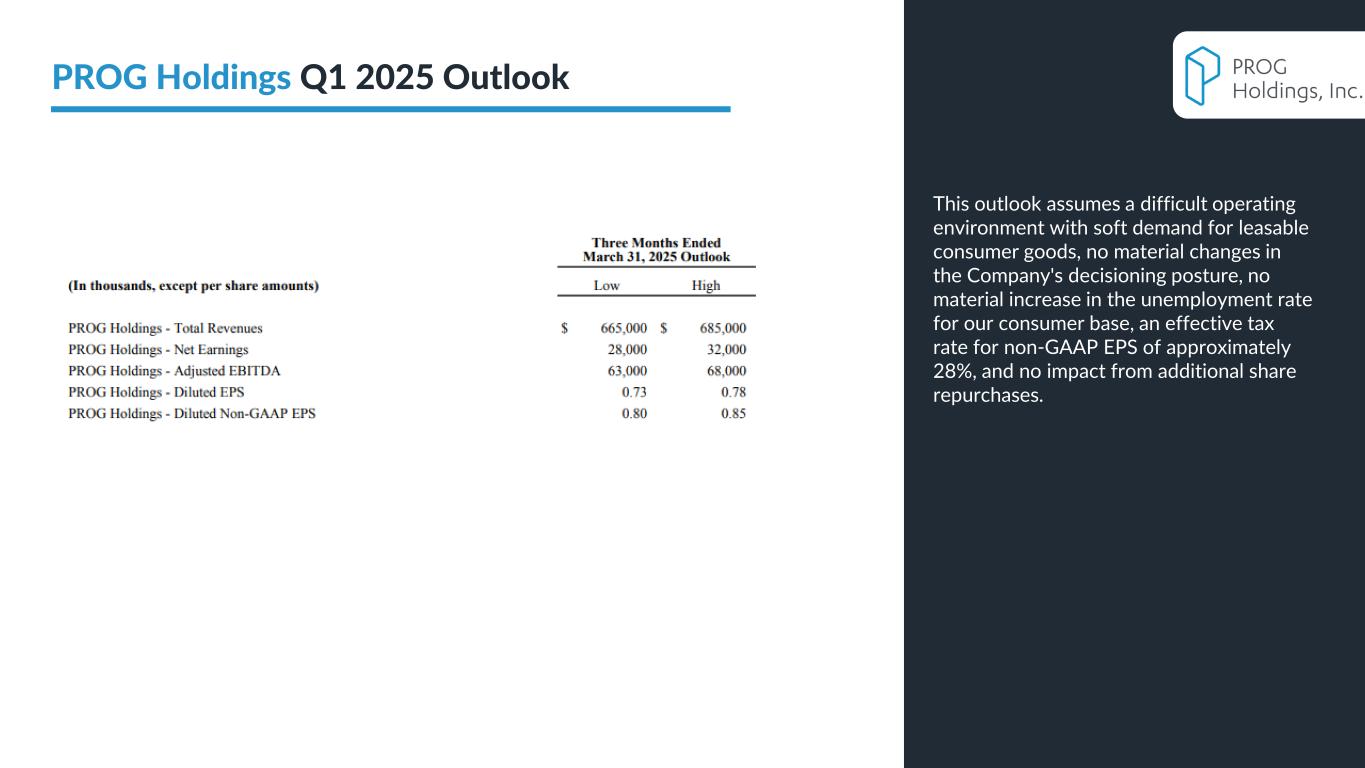

PROG Internal 12 PROG Holdings Q1 2025 Outlook This outlook assumes a difficult operating environment with soft demand for leasable consumer goods, no material changes in the Company's decisioning posture, no material increase in the unemployment rate for our consumer base, an effective tax rate for non-GAAP EPS of approximately 28%, and no impact from additional share repurchases.

PROG Internal

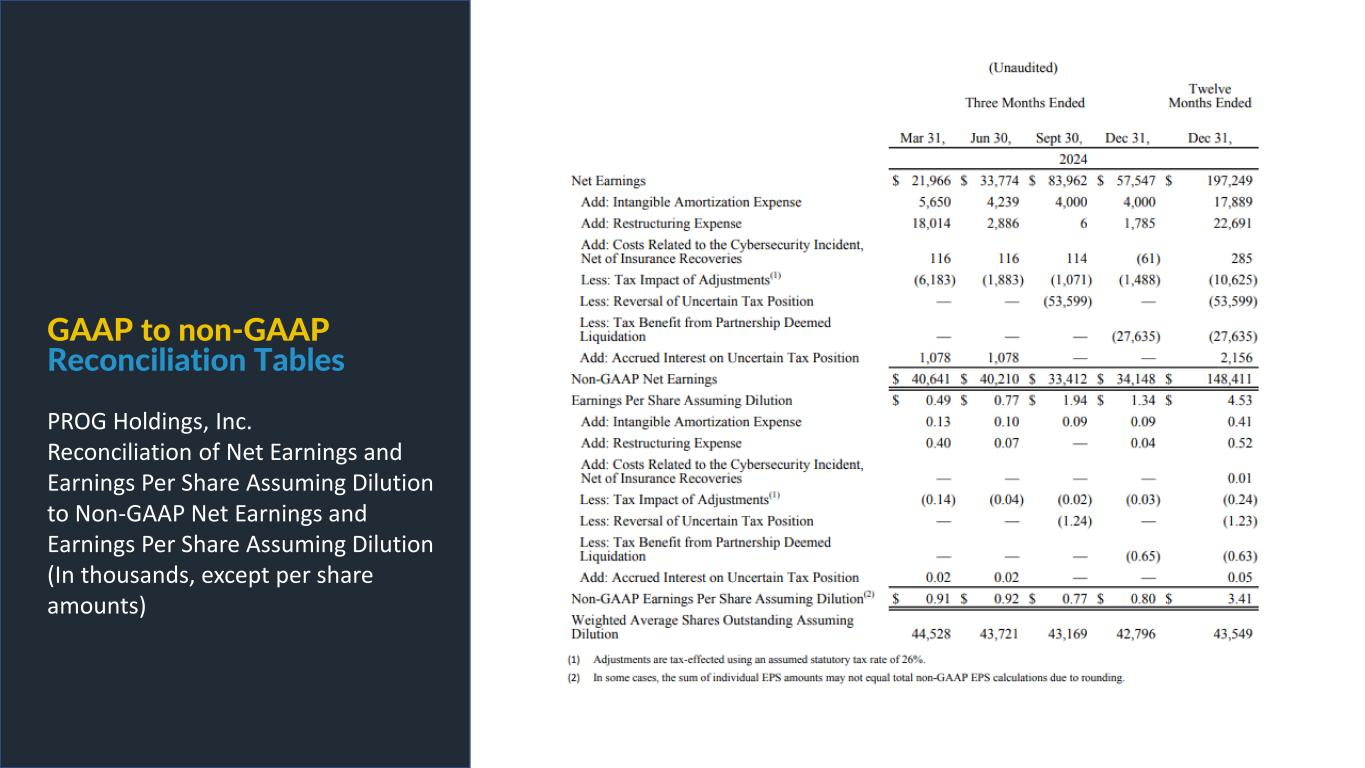

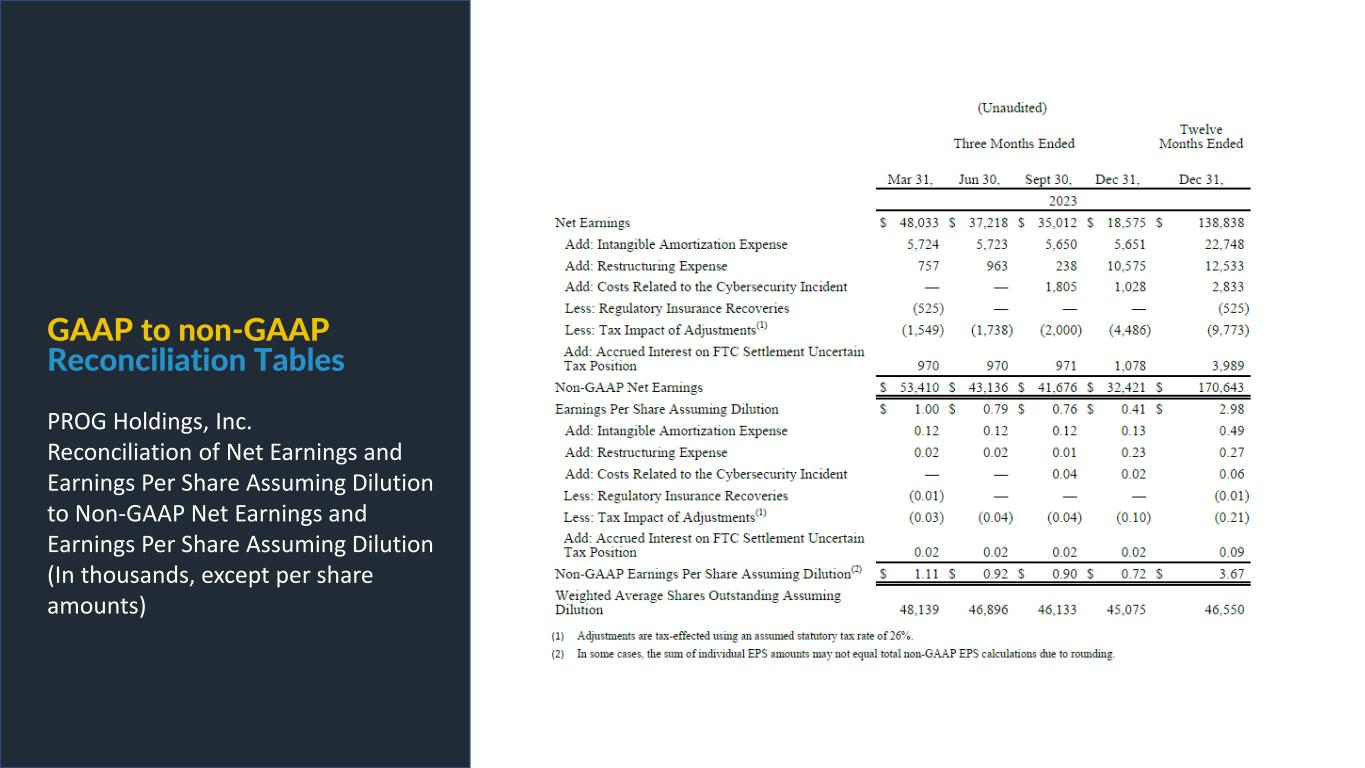

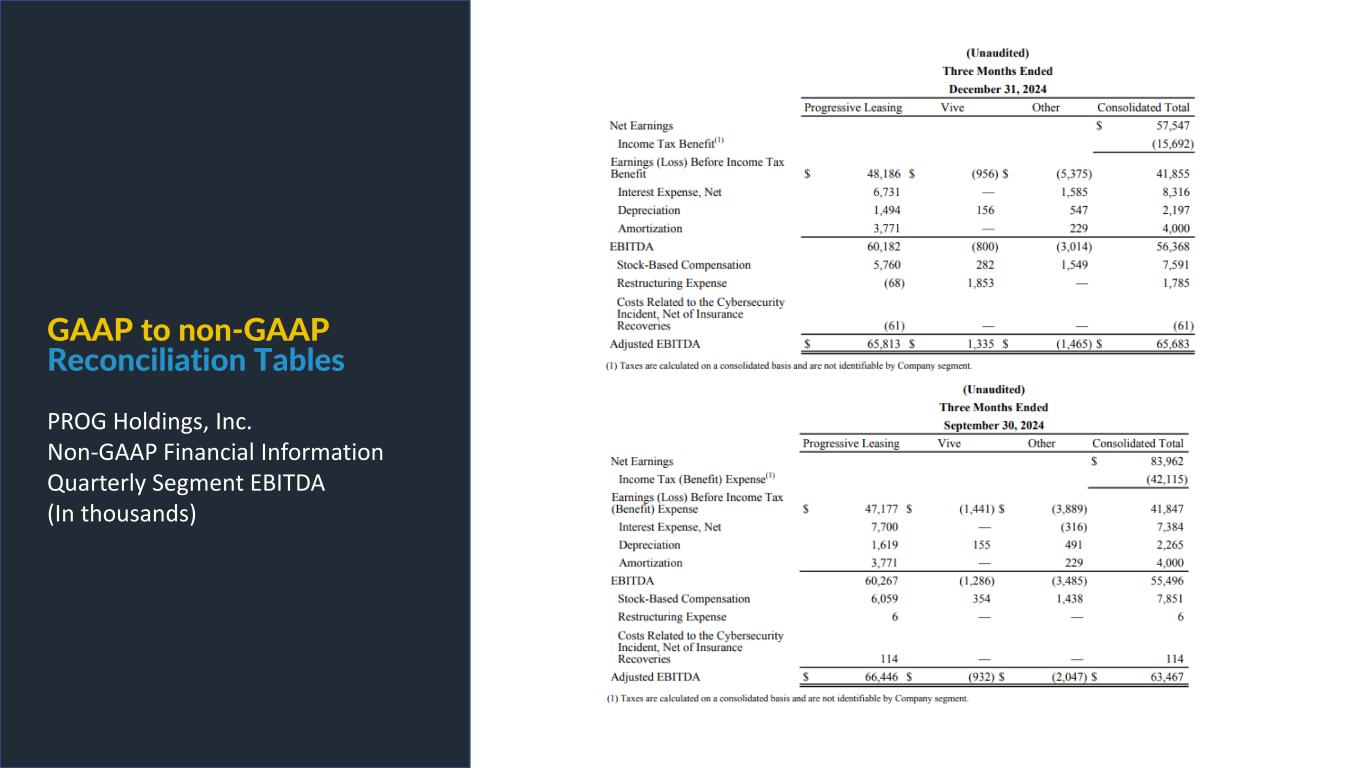

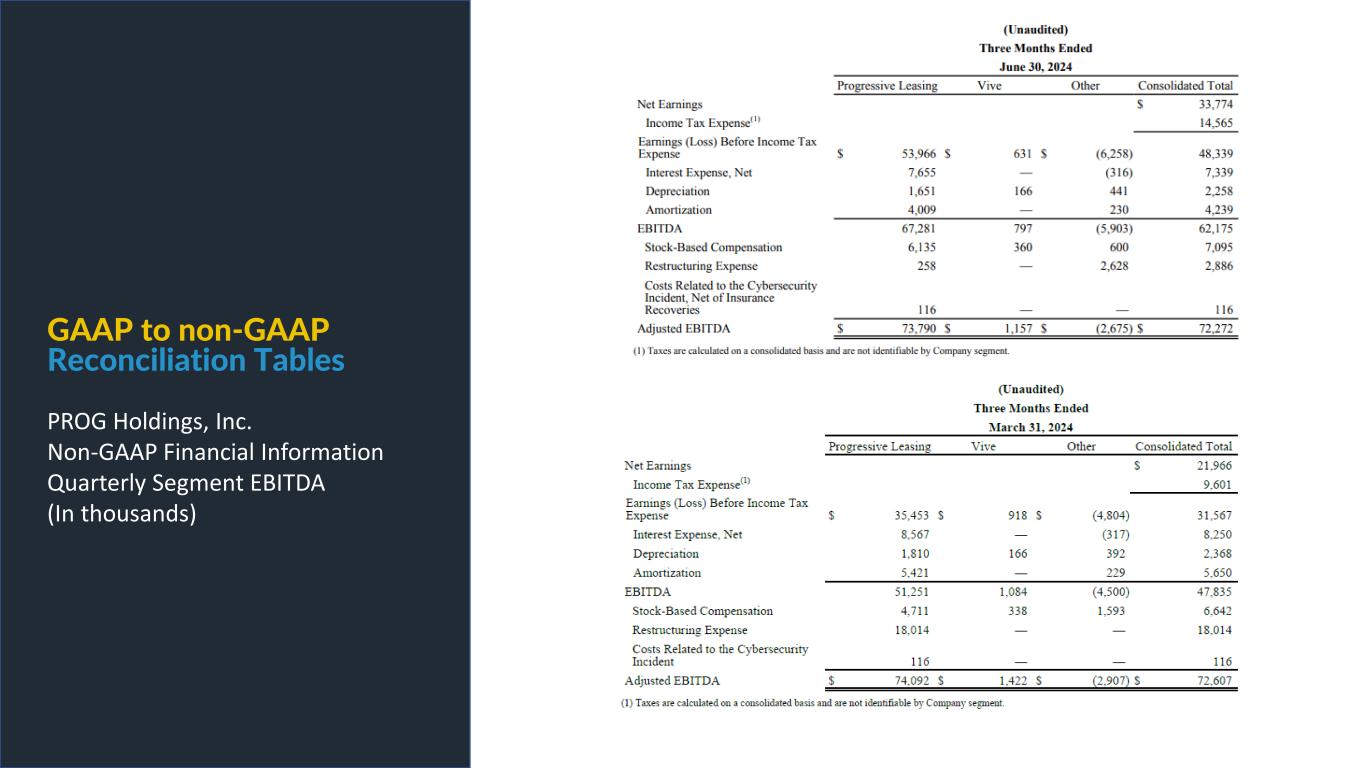

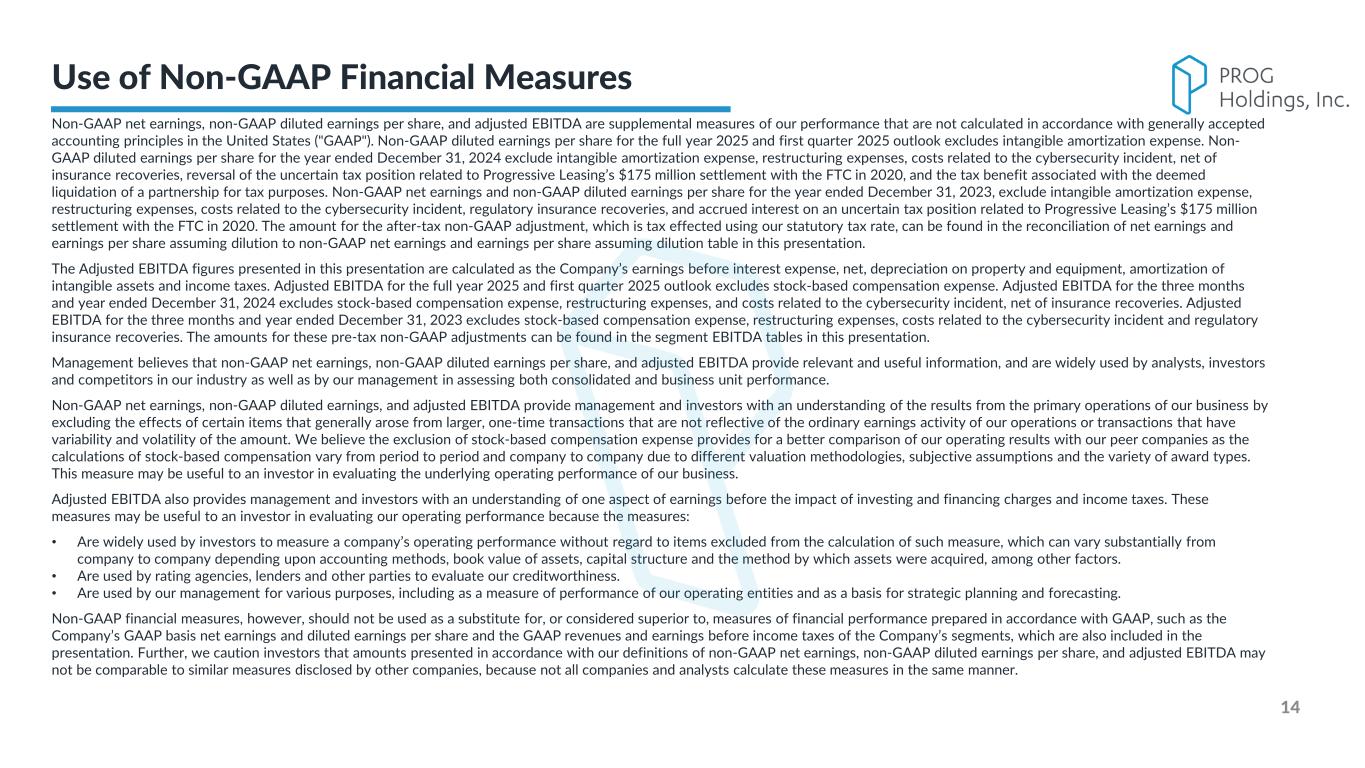

PROG Internal Non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA are supplemental measures of our performance that are not calculated in accordance with generally accepted accounting principles in the United States ("GAAP"). Non-GAAP diluted earnings per share for the full year 2025 and first quarter 2025 outlook excludes intangible amortization expense. Non- GAAP diluted earnings per share for the year ended December 31, 2024 exclude intangible amortization expense, restructuring expenses, costs related to the cybersecurity incident, net of insurance recoveries, reversal of the uncertain tax position related to Progressive Leasing’s $175 million settlement with the FTC in 2020, and the tax benefit associated with the deemed liquidation of a partnership for tax purposes. Non-GAAP net earnings and non-GAAP diluted earnings per share for the year ended December 31, 2023, exclude intangible amortization expense, restructuring expenses, costs related to the cybersecurity incident, regulatory insurance recoveries, and accrued interest on an uncertain tax position related to Progressive Leasing’s $175 million settlement with the FTC in 2020. The amount for the after-tax non-GAAP adjustment, which is tax effected using our statutory tax rate, can be found in the reconciliation of net earnings and earnings per share assuming dilution to non-GAAP net earnings and earnings per share assuming dilution table in this presentation. The Adjusted EBITDA figures presented in this presentation are calculated as the Company’s earnings before interest expense, net, depreciation on property and equipment, amortization of intangible assets and income taxes. Adjusted EBITDA for the full year 2025 and first quarter 2025 outlook excludes stock-based compensation expense. Adjusted EBITDA for the three months and year ended December 31, 2024 excludes stock-based compensation expense, restructuring expenses, and costs related to the cybersecurity incident, net of insurance recoveries. Adjusted EBITDA for the three months and year ended December 31, 2023 excludes stock-based compensation expense, restructuring expenses, costs related to the cybersecurity incident and regulatory insurance recoveries. The amounts for these pre-tax non-GAAP adjustments can be found in the segment EBITDA tables in this presentation. Management believes that non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry as well as by our management in assessing both consolidated and business unit performance. Non-GAAP net earnings, non-GAAP diluted earnings, and adjusted EBITDA provide management and investors with an understanding of the results from the primary operations of our business by excluding the effects of certain items that generally arose from larger, one-time transactions that are not reflective of the ordinary earnings activity of our operations or transactions that have variability and volatility of the amount. We believe the exclusion of stock-based compensation expense provides for a better comparison of our operating results with our peer companies as the calculations of stock-based compensation vary from period to period and company to company due to different valuation methodologies, subjective assumptions and the variety of award types. This measure may be useful to an investor in evaluating the underlying operating performance of our business. Adjusted EBITDA also provides management and investors with an understanding of one aspect of earnings before the impact of investing and financing charges and income taxes. These measures may be useful to an investor in evaluating our operating performance because the measures: • Are widely used by investors to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary substantially from company to company depending upon accounting methods, book value of assets, capital structure and the method by which assets were acquired, among other factors. • Are used by rating agencies, lenders and other parties to evaluate our creditworthiness. • Are used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for strategic planning and forecasting. Non-GAAP financial measures, however, should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings and diluted earnings per share and the GAAP revenues and earnings before income taxes of the Company’s segments, which are also included in the presentation. Further, we caution investors that amounts presented in accordance with our definitions of non-GAAP net earnings, non-GAAP diluted earnings per share, and adjusted EBITDA may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate these measures in the same manner. 14 Use of Non-GAAP Financial Measures

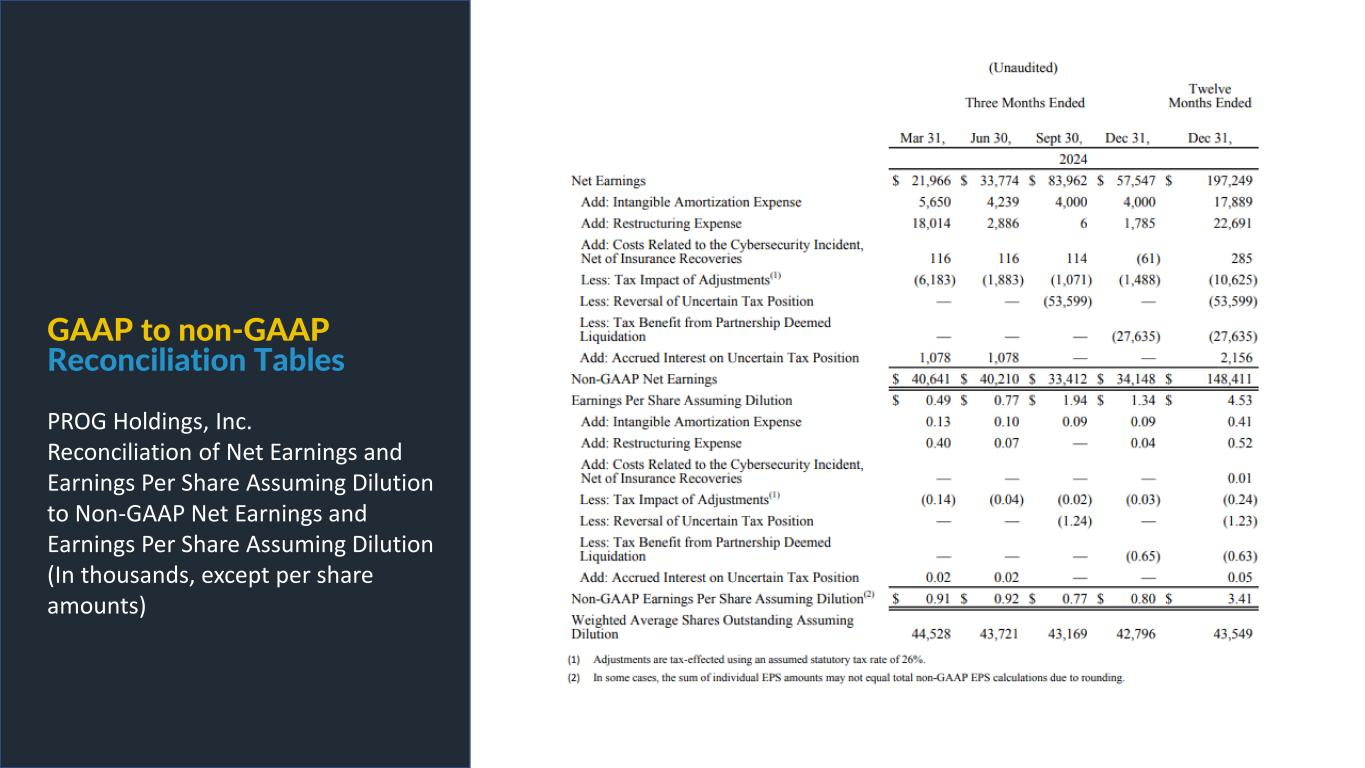

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to Non-GAAP Net Earnings and Earnings Per Share Assuming Dilution (In thousands, except per share amounts)

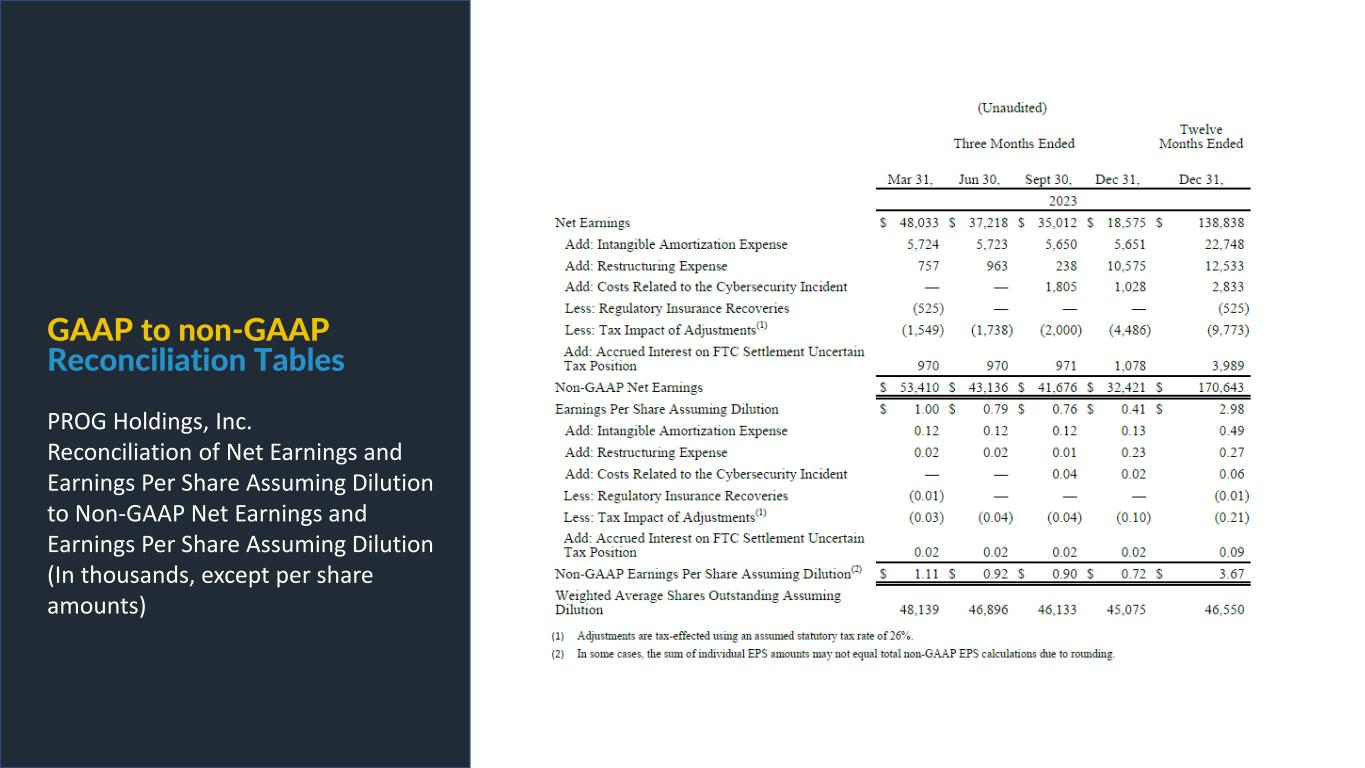

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Reconciliation of Net Earnings and Earnings Per Share Assuming Dilution to Non-GAAP Net Earnings and Earnings Per Share Assuming Dilution (In thousands, except per share amounts)

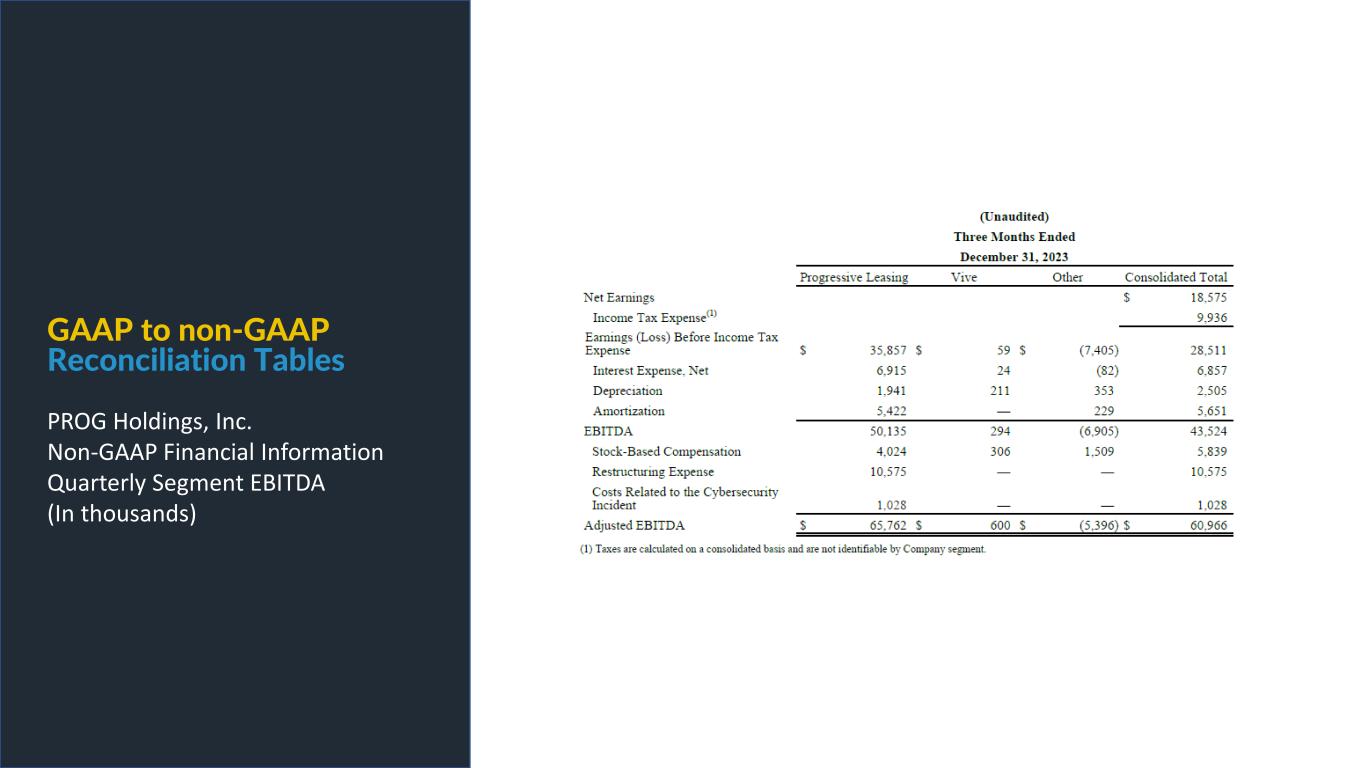

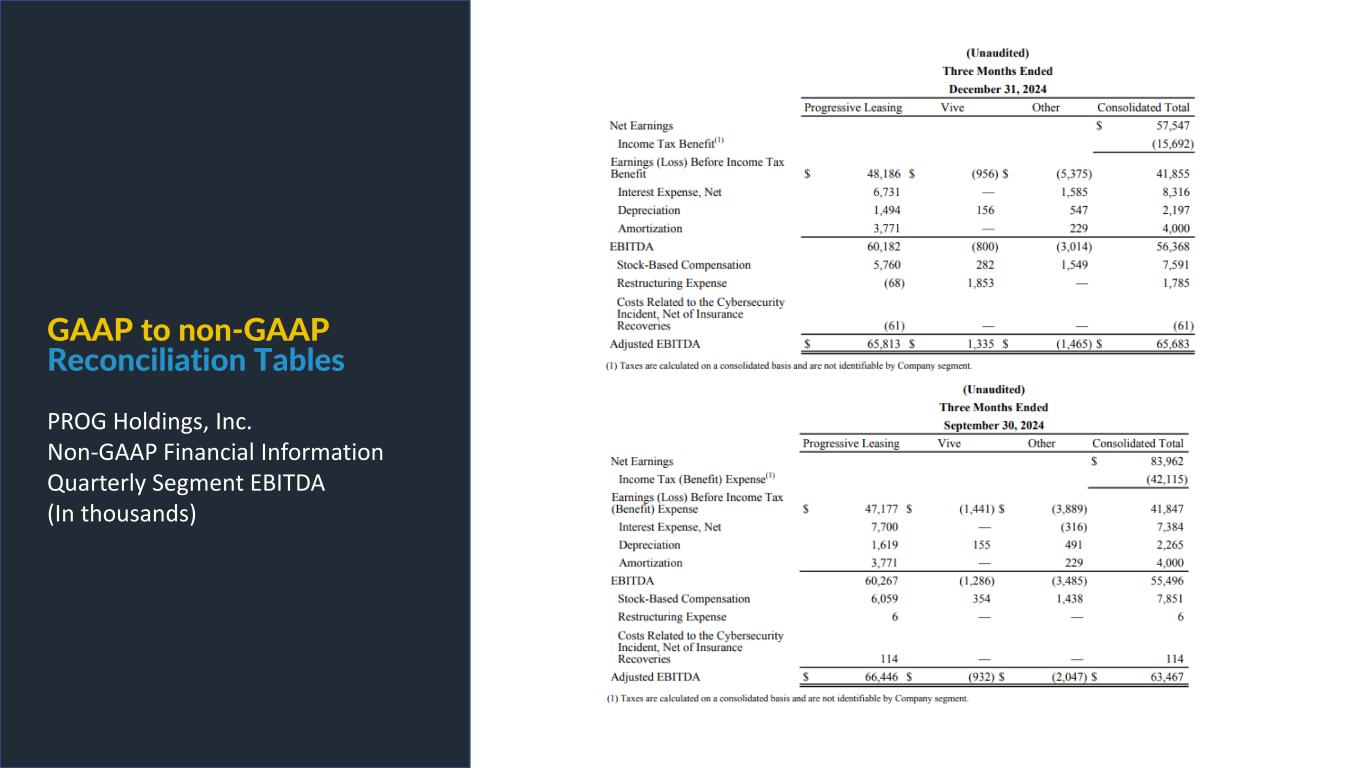

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

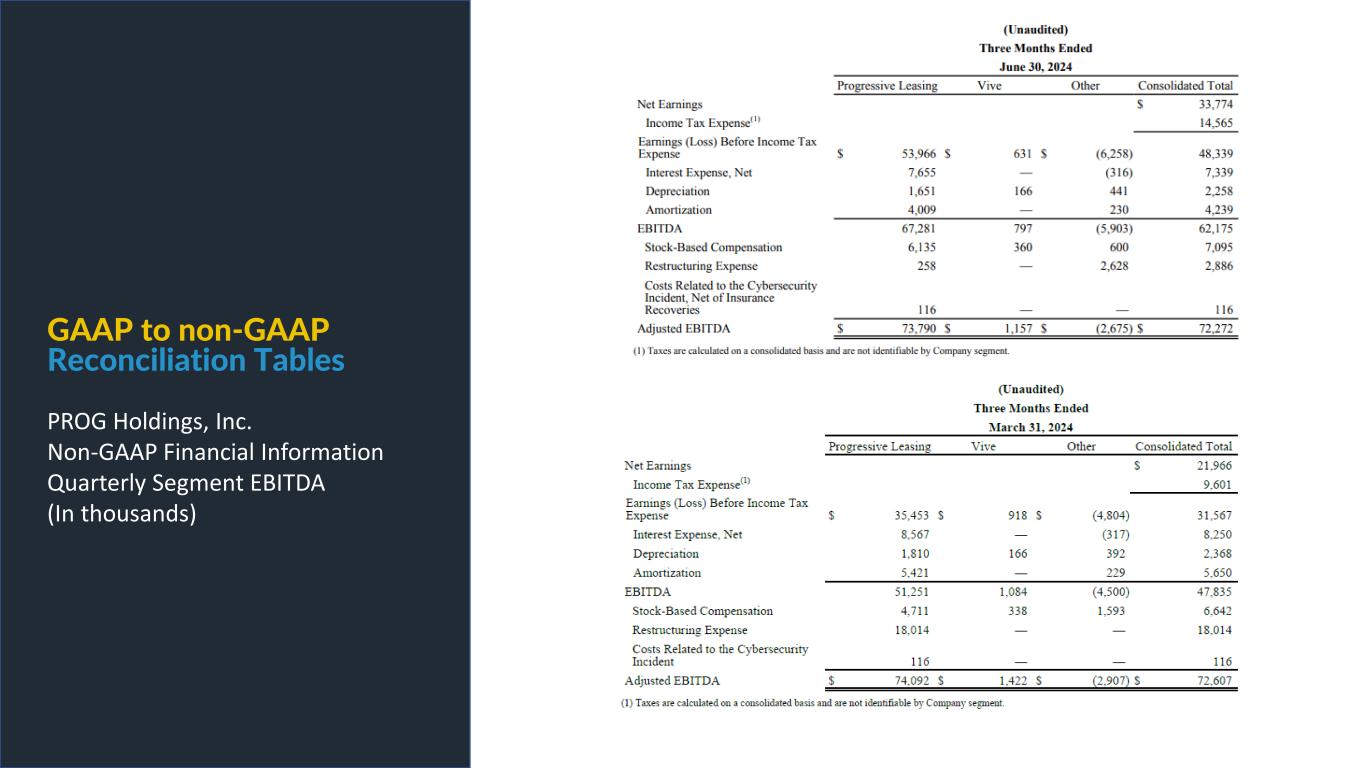

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

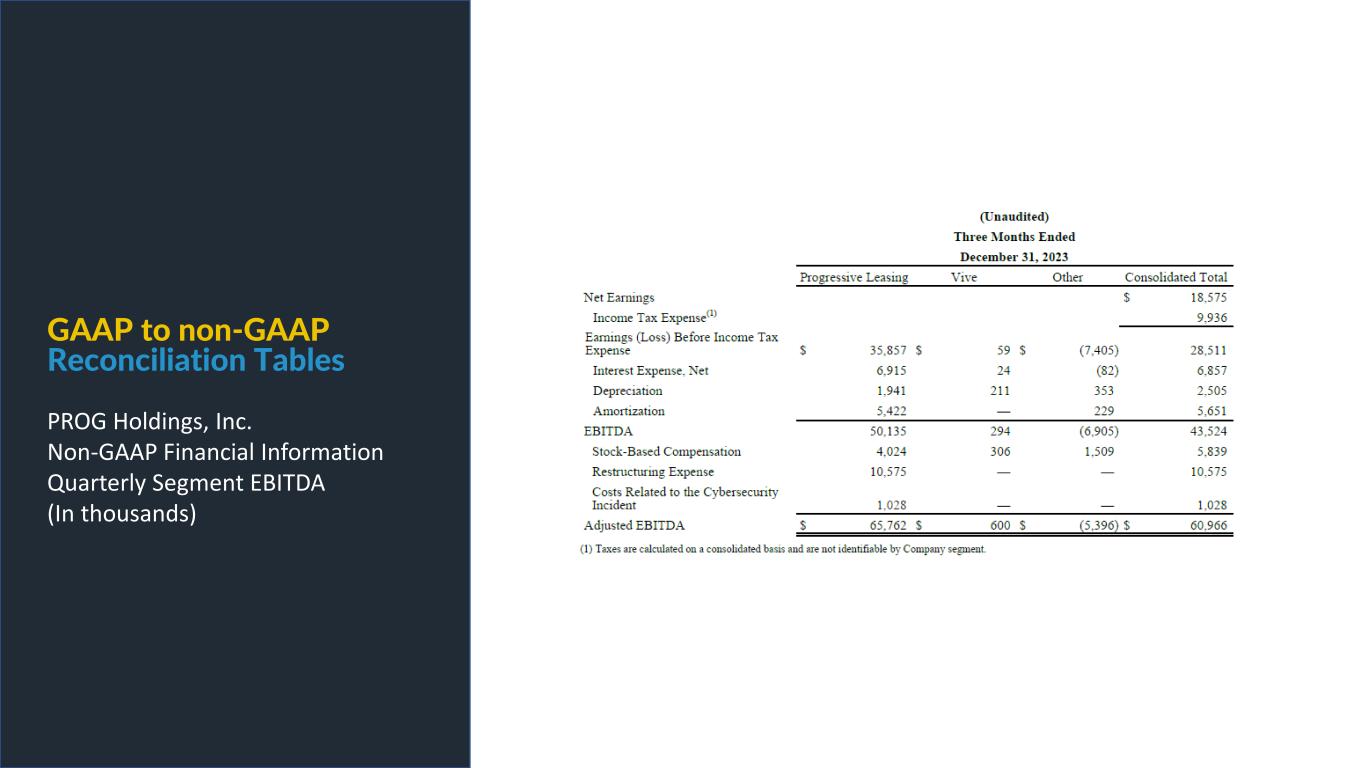

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Quarterly Segment EBITDA (In thousands)

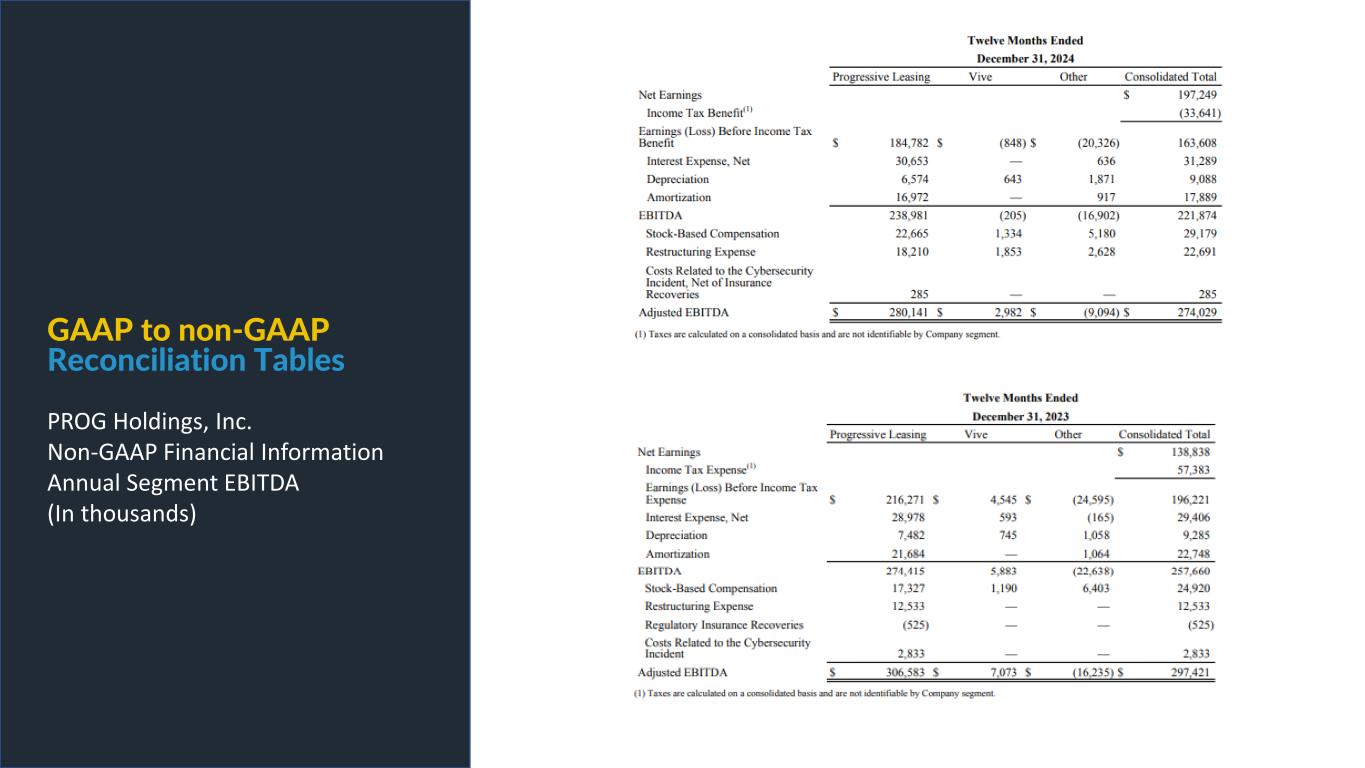

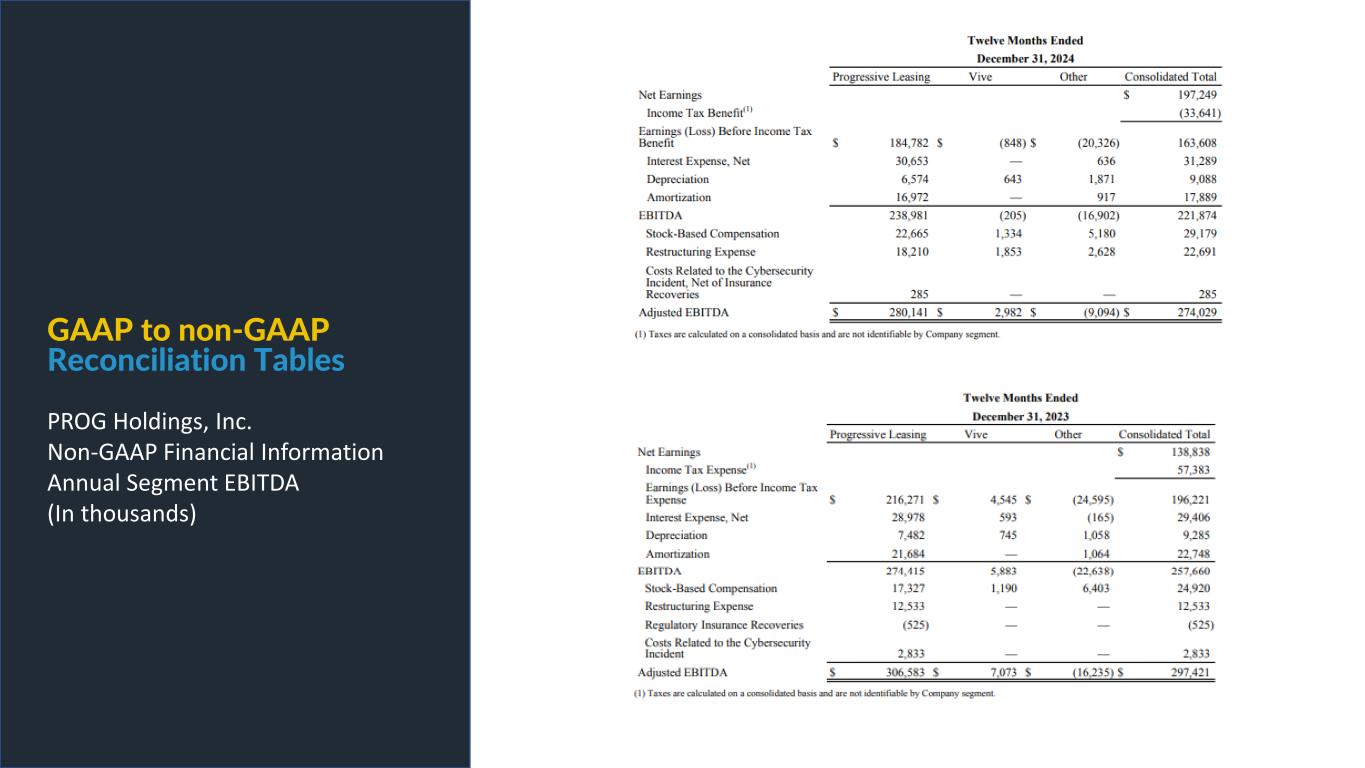

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Annual Segment EBITDA (In thousands)

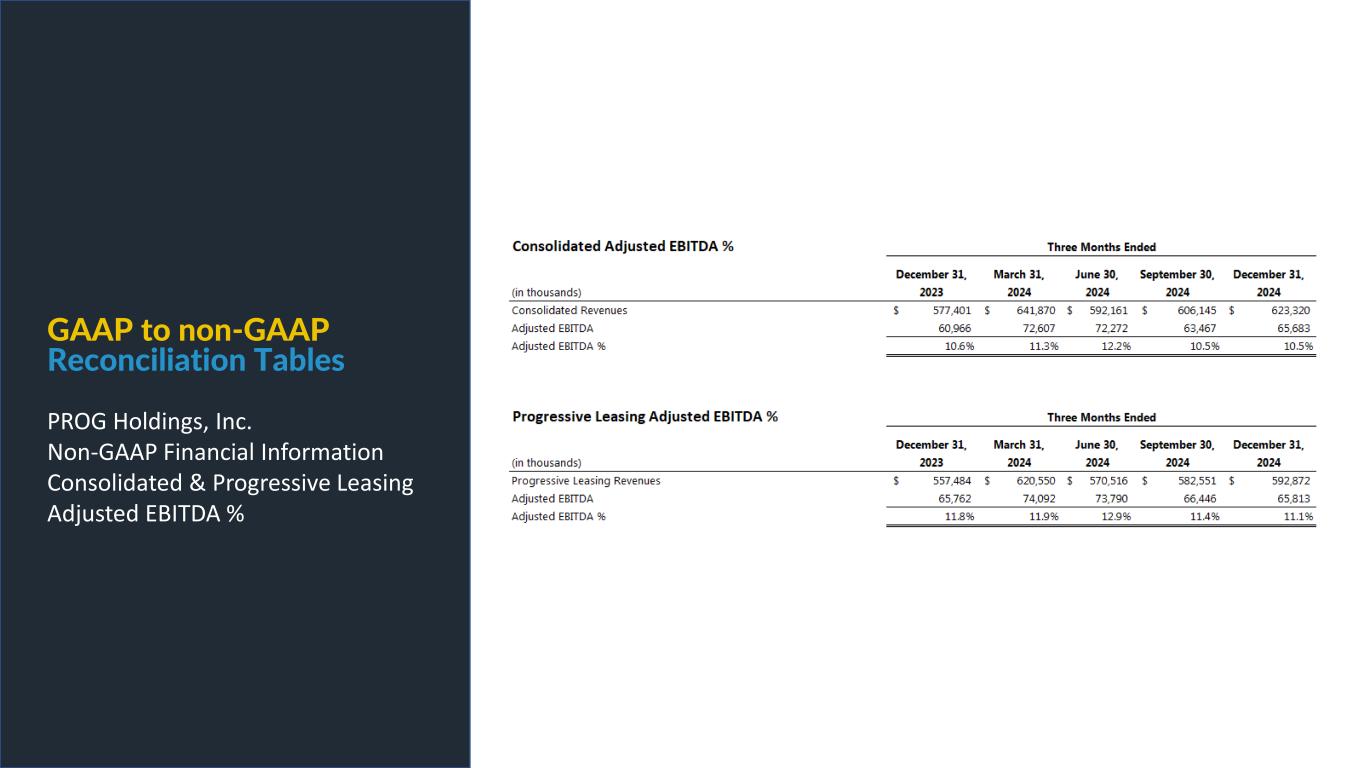

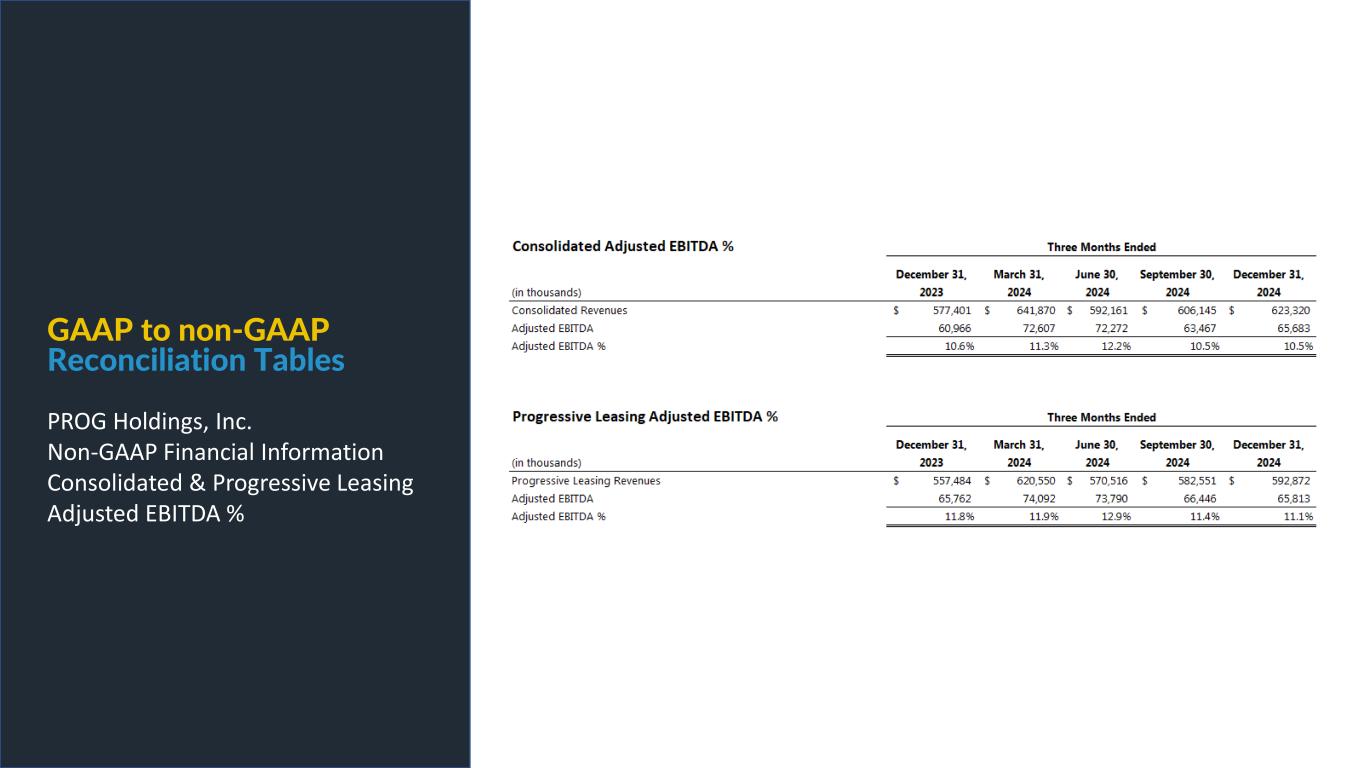

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Consolidated & Progressive Leasing Adjusted EBITDA %

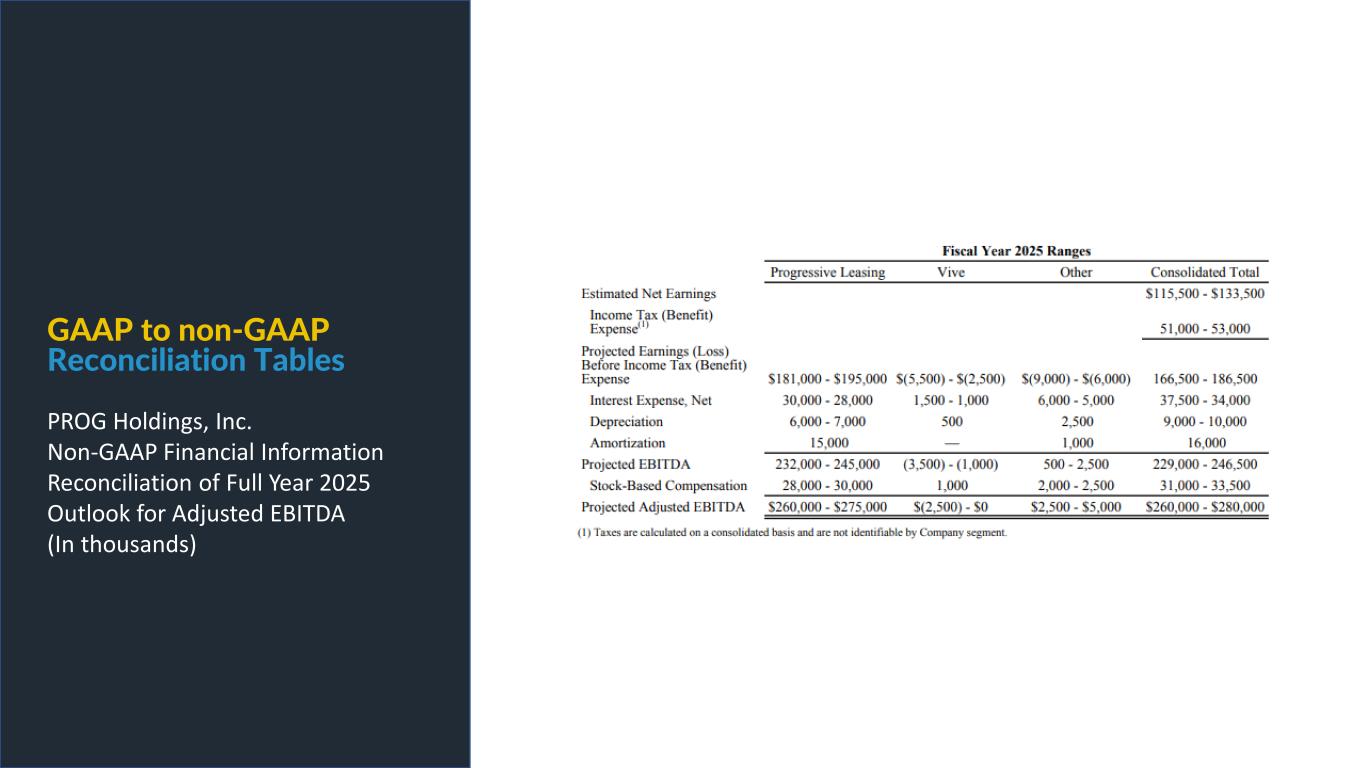

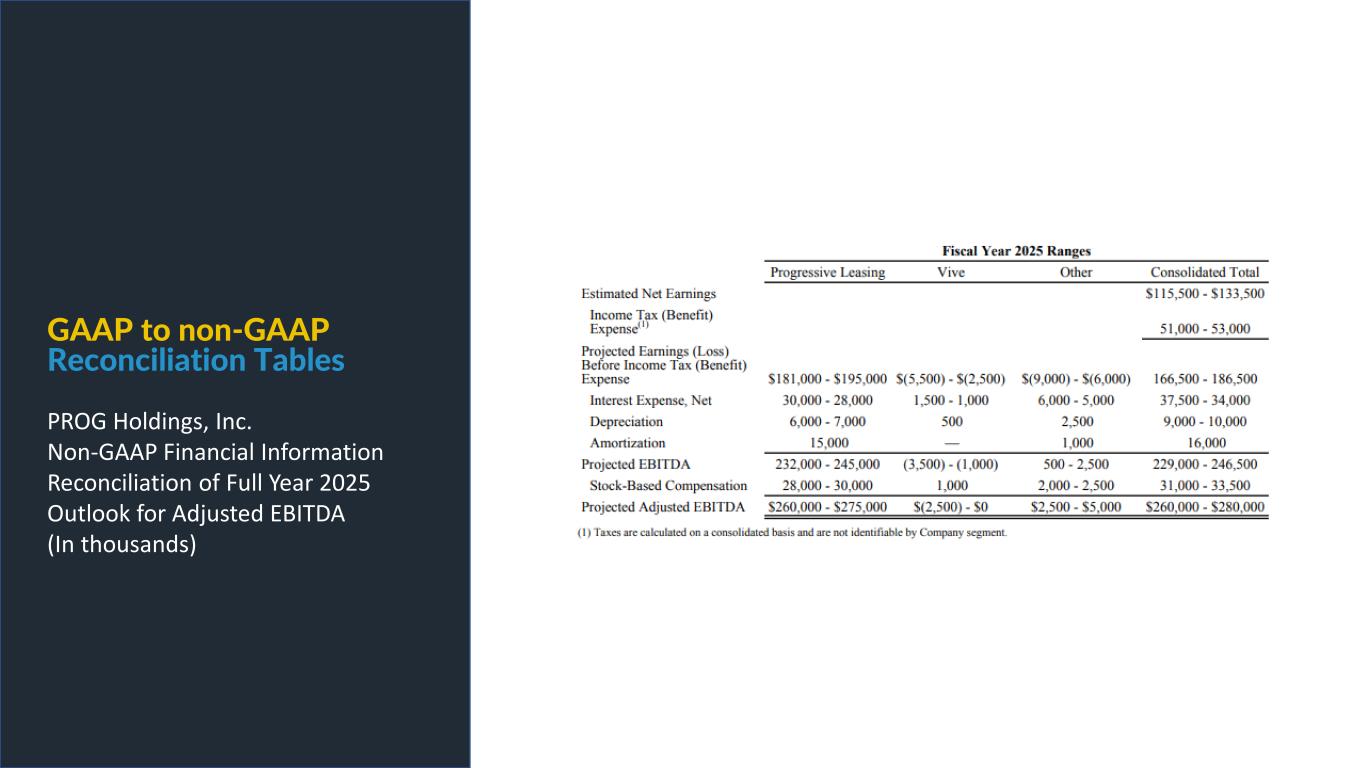

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Full Year 2025 Outlook for Adjusted EBITDA (In thousands)

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of the Three Months Ended March 31, 2025 Outlook for Adjusted EBITDA (In thousands)

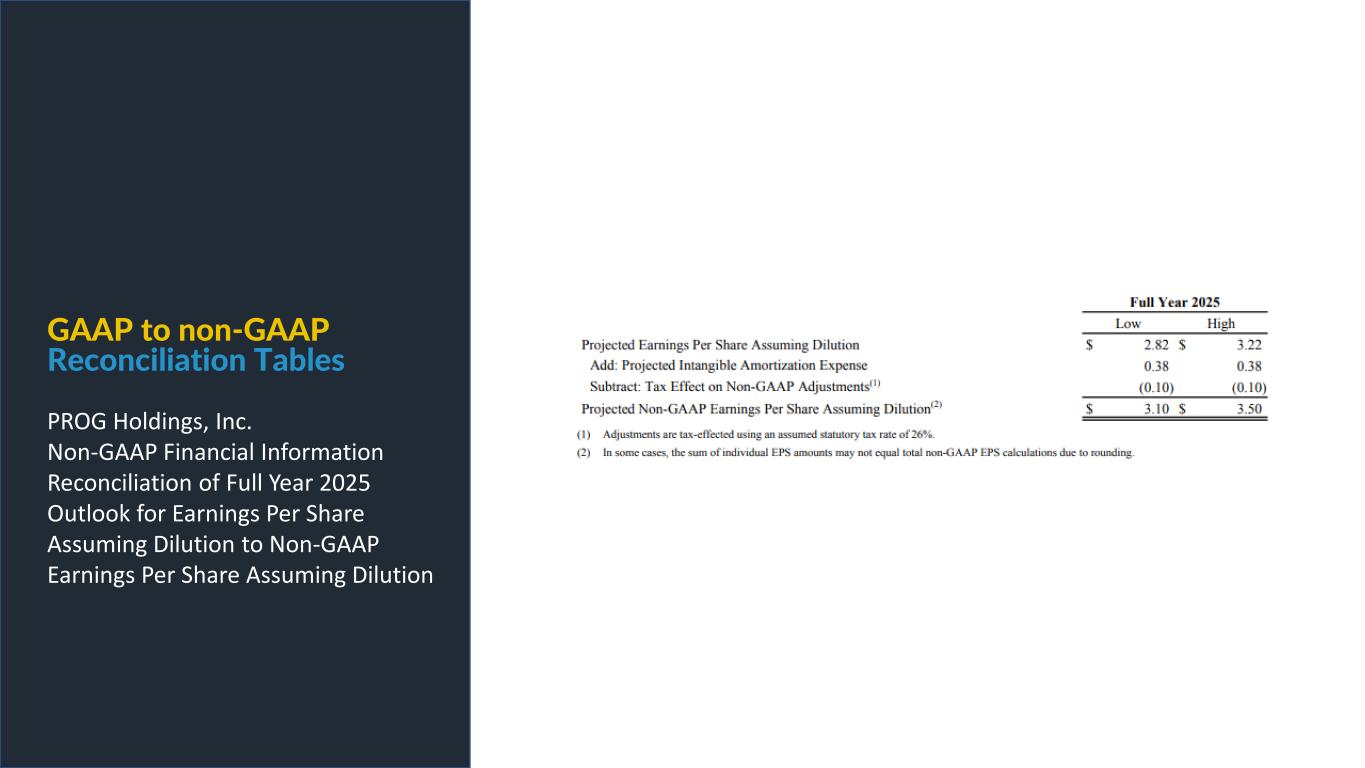

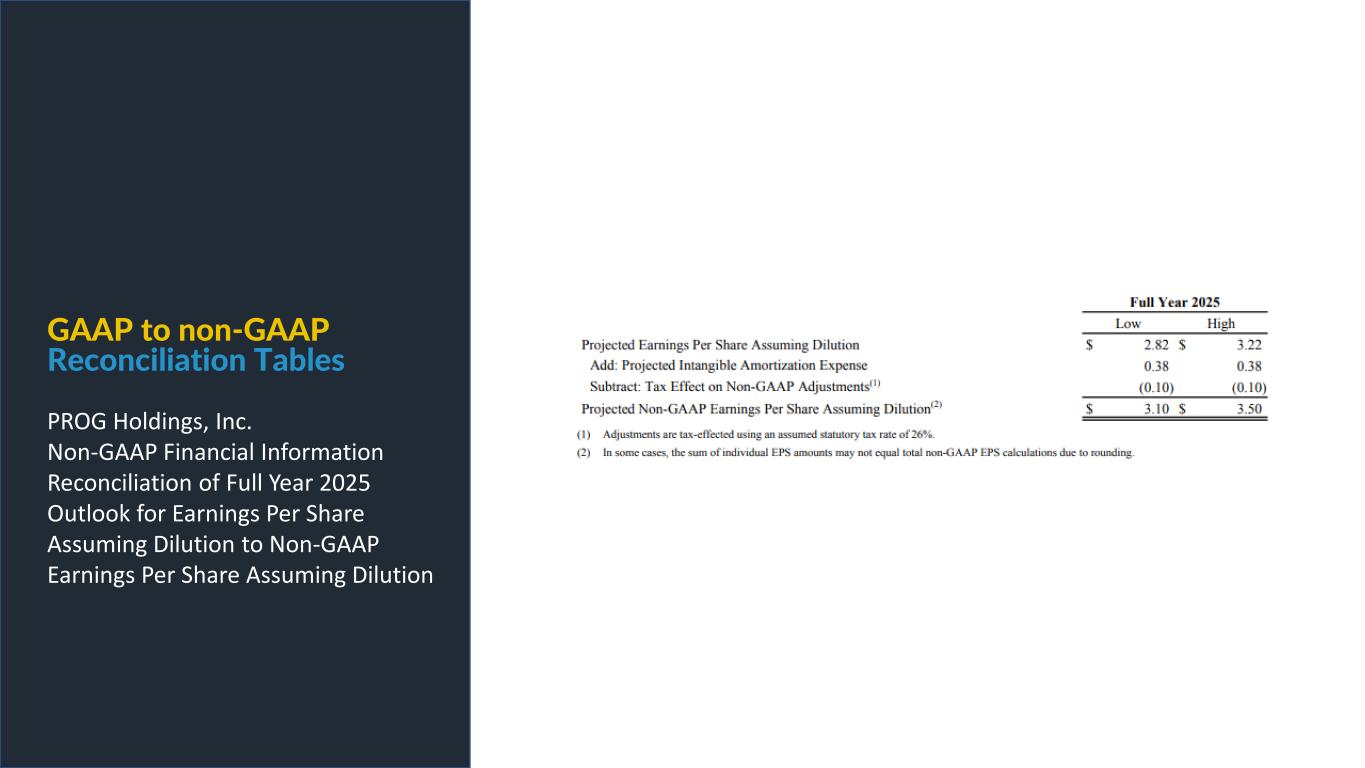

PROG Internal GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of Full Year 2025 Outlook for Earnings Per Share Assuming Dilution to Non-GAAP Earnings Per Share Assuming Dilution

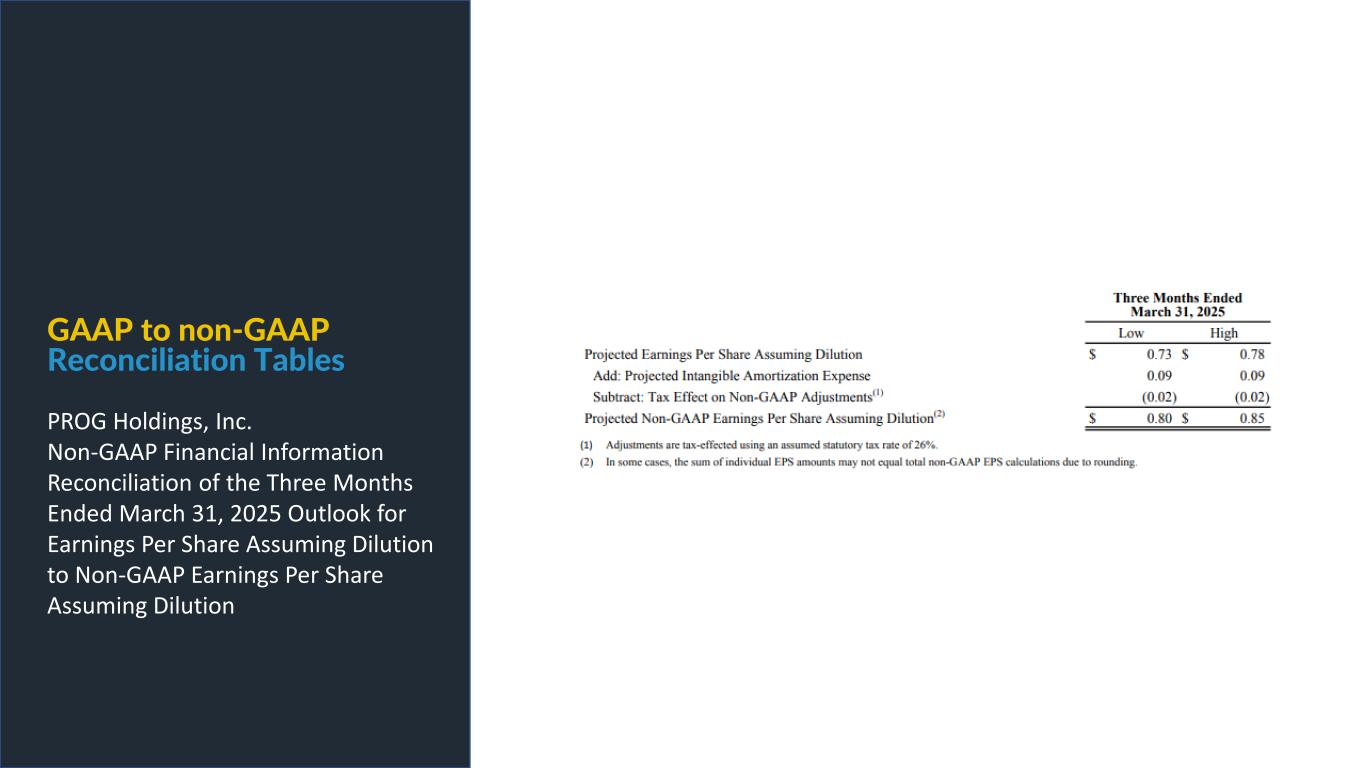

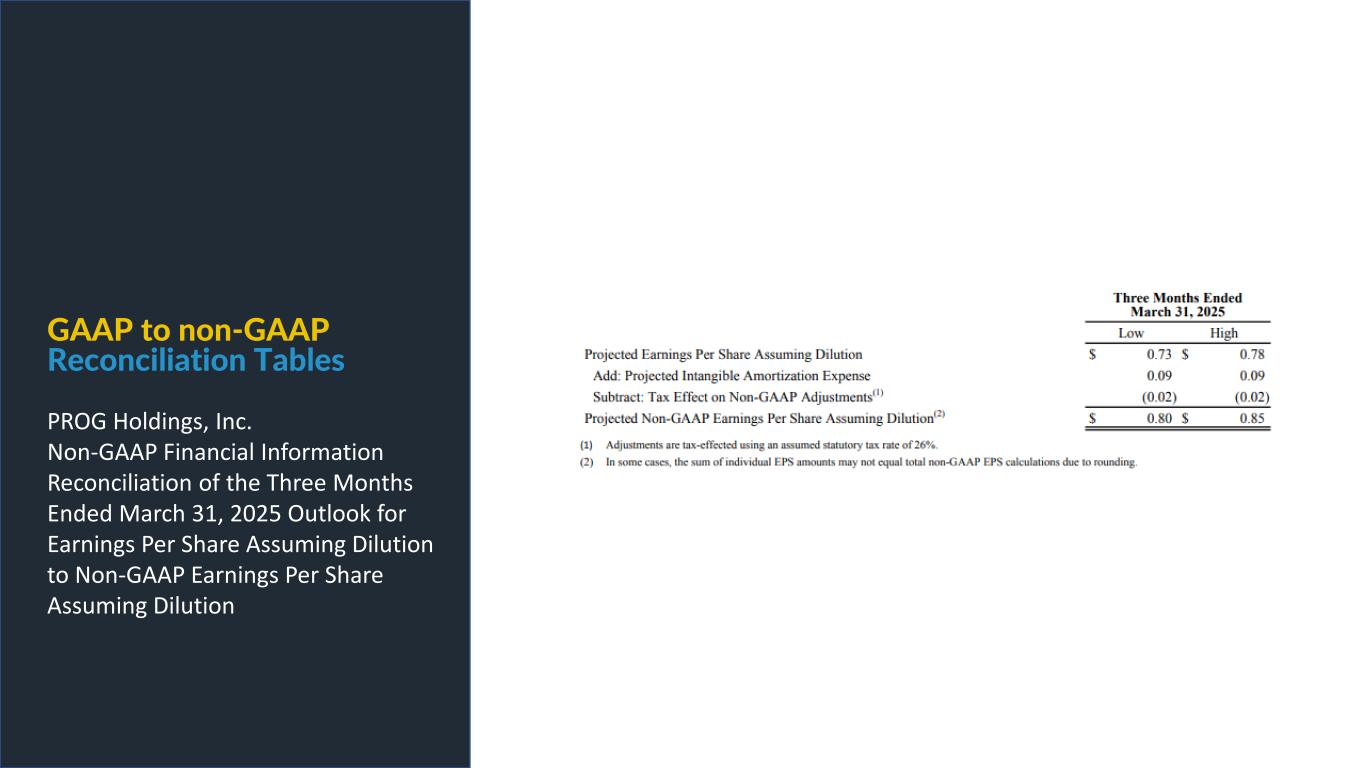

GAAP to non-GAAP Reconciliation Tables PROG Holdings, Inc. Non-GAAP Financial Information Reconciliation of the Three Months Ended March 31, 2025 Outlook for Earnings Per Share Assuming Dilution to Non-GAAP Earnings Per Share Assuming Dilution

PROG Internal