UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number (811-23563)

Zell Capital

(Exact name of registrant as specified in charter)

175 S. Third

Suite 200

Columbus, OH 43215

(Address of principal executive offices) (Zip code)

William L. Zell

175 S. Third

Suite 200

Columbus, OH 43215

(Name and address of agent for service)

888-484-1944

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: September 30, 2022

Item 1. Reports to Stockholders.

| (a) | Semi-Annual Report for the period ended September 30, 2022 is filed herewith pursuant to Rule 30e-1 under the Investment Company Act of 1940. |

ZELL CAPITAL

Semi-Annual Report

For the Period Ended September 30, 2022

(Unaudited)

Contents

Audited Financial Statements (Unaudited)

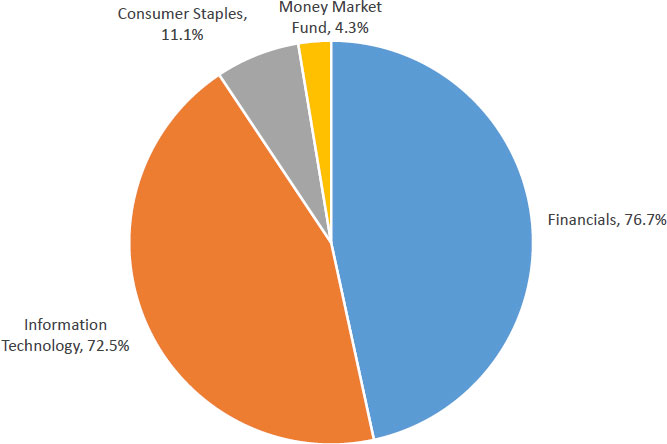

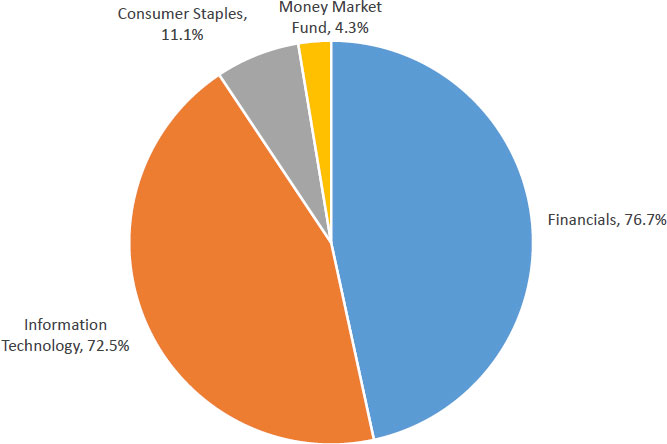

Zell Capital

Graphical Representation of Holdings

September 30, 2022 (Unaudited)

The Fund’s holdings by Sector as of September 30, 2022, as a percentage of net assets:

Please refer to the Schedule of Investments in this Semi-Annual Report for a detailed listing of the Fund’s holdings.

See accompany notes to the financial statements.

Zell Capital

Schedule of Investments

September 30, 2022 (Unaudited)

| Security Description | | Cost | | | Fair Value | |

| | | | | | | |

| SAFE Notes - 149.2% | | | | | | | | |

| Financials - 76.7% | | | | | | | | |

| Noether Rudin, Inc. DBA DOLR(1)(2)(3)(4) | | $ | 130,000 | | | $ | 130,000 | |

| OptioLend, Inc.(2)(4) | | | 50,000 | | | | 50,000 | |

| | | | | | | | | |

| Information Technology - 72.5% | | | | | | | | |

| Studium Inc.(2)(3)(4) | | | 160,000 | | | | 160,000 | |

| GRID(2)(4)(5) | | | 10,000 | | | | 10,000 | |

| | | | | | | | 170,000 | |

| Total SAFE Notes (Cost $350,000) | | | | | | | 350,000 | |

| | | | | | | | | |

| Private Equity - 11.1% | | | | | | | | |

| Consumer Staples - 11.1% | | | | | | | | |

| Veritus Capital TK SPV, LLC(2)(4)(6) | | | 26,120 | | | | 26,120 | |

| Total Private Equity (Cost $26,120) | | | | | | | 26,120 | |

| | | | | | | | | |

| Money Market Fund - 4.3% | | | | | | | | |

| First American Government Obligations Fund, Class X - 0.19%(7) | | | 10,077 | | | | 10,077 | |

| Total Money Market Fund (Cost $10,077) | | | | | | | 10,077 | |

| | | | | | | | | |

| Total Investments (Cost $386,197) - 164.6% | | | | | | $ | 386,197 | |

| Other Assets in Excess of Liabilities - (64.6)% | | | | | | | (151,606 | ) |

| Net Assets - 100.0% | | | | | | $ | 234,591 | |

SAFE - Simple Agreement for Future Equity

| (1) | DOLR is a client of mpMurcia, LLC, dba Book+Street. An officer of the Fund is the majority shareholder of Book + Street. |

| (3) | If there is an equity financing, this SAFE will convert into preferred shares at the greater of (1) the Fund’s cost of investment divided by the lowest price per share of the preferred stock or (2) the Fund’s invested amount divided by the SAFE price. |

| (4) | Security is restricted for sale. |

| (5) | If there is an equity financing, this SAFE will convert into preferred shares equal to the Fund’s cost of investment divided by the lower of the cap price or the discount price. GRID has a discount rate of 80.0%. |

| (6) | Veritus Capital TK SPV, LLC invests solely in Terra Kaffe. |

| (7) | Rate represents the Money Market Fund’s average 7-day % yield as of September 30, 2022. |

Percentages are stated as a percent of net assets.

See accompany notes to the financial statements.

Zell Capital

Statement of Assets and Liabilities

September 30, 2022 (Unaudited)

| Assets | | | |

| Investments, at fair value (cost $376,120) | | $ | 376,120 | |

| Investment in money market fund (cost $10,077) | | | 10,077 | |

| Cash | | | 45,115 | |

| Dividends and interest receivable | | | 19 | |

| Prepaid assets | | | 94,463 | |

| Total assets | | | 525,794 | |

| | | | | |

| Liabilities | | | | |

| Due to affiliates | | | 69,873 | |

| Accrued professional fees | | | 18,750 | |

| Accrued accounting, custody, and transfer agent fees | | | 40,982 | |

| Short term debt | | | 125,000 | |

| Accrued Directors Expense | | | 6,000 | |

| Accrued expenses and other liabilities | | | 30,598 | |

| Total liabilities | | | 291,203 | |

| Net assets | | $ | 234,591 | |

| | | | | |

| Net assets consist of: | | | | |

| Paid in capital | | $ | 713,725 | |

| Accumulated loss | | | (479,134 | ) |

| Net assets | | $ | 234,591 | |

| | | | | |

| Net asset value per share: | | | | |

| 32,561.25 shares issued and outstanding, no par value, | | | | |

| 2,500,000 registered shares | | $ | 6.57 | |

See accompany notes to the financial statements.

Zell Capital

Statement of Operations

For the Period Ended September 30, 2022 (Unaudited)

| Income | | | |

| Dividend income | | $ | 55 | |

| Other income | | | 12,083 | |

| Total income | | | 12,138 | |

| | | | | |

| Expenses | | | | |

| Professional fees | | | 111,500 | |

| Accounting, custody, and transfer agent fees | | | 82,200 | |

| Payroll expense | | | 67,520 | |

| Marketing fees | | | 18,750 | |

| Compliance fees | | | 31,667 | |

| Insurance expense | | | 14,582 | |

| Directors Expense | | | 6,000 | |

| Other expenses | | | 21,880 | |

| Total expenses | | | 354,099 | |

| Expenses reimbursed | | | (121,783 | ) |

| Net expenses | | | 232,316 | |

| Net investment loss | | | (220,178 | ) |

| | | | | |

| Net decrease in net assets resulting from operations | | $ | (220,178 | ) |

See accompany notes to the financial statements.

Zell Capital

Statement of Changes in Net Assets

| | | For the Period

Ended

September 30, 2022

(Unaudited) | | | For the Period

Ended

March 31, 2022(a) | |

| Net decrease in net assets resulting from operations: | | | | | | | | |

| Net investment loss | | $ | (220,178 | ) | | $ | (60,431 | ) |

| Net decrease in net assets resulting from operations | | | (220,178 | ) | | | (60,431 | ) |

| | | | | | | | | |

| Shareholder transactions: | | | | | | | | |

| Subscriptions (representing 17,635.00 shares) | | | 62,500 | | | | 352,700 | |

| Net increase in net assets from shareholder transactions | | | 62,500 | | | | 352,700 | |

| Total increase in net assets | | | (157,678 | ) | | | 292,269 | |

| | | | | | | | | |

| Net assets, beginning of period (representing 14,926.25 shares) | | | 392,269 | | | | 100,000 | |

| Net assets, end of period (representing 32,561.25 shares) | | $ | 234,591 | | | $ | 392,269 | |

(a) The Fund commenced operations on June 8, 2021.

See accompany notes to the financial statements.

Zell Capital

Statement of Cash Flows

For the Period Ended September 30, 2022 (Unaudited)

| Cash flows from operating activities | | | |

| Net decrease in net assets resulting from operations | | $ | (220,178 | ) |

| Adjustments to reconcile net decrease in net assets resulting from operations to net cash used in operating activities: | | | | |

| Purchase of investments | | | (95,000 | ) |

| Purchase of money markets | | | 34,325 | |

| Increase in prepaid assets | | | (72,772 | ) |

| Increase in due from affiliates | | | 65,589 | |

| Increase in due to affiliates | | | (80,127 | ) |

| Increase in accrued directors expense | | | 6,000 | |

| Decrease in offerings costs payable | | | — | |

| Decrease in payable to Providence Holdings | | | — | |

| Increase in accrued professional fees | | | 1,097 | |

| Increase in accrued accounting, custody, and transfer agent fees | | | 30,063 | |

| Increase in accrued expenses and other liabilities | | | 22,048 | |

| Net cash used in operating activities | | | (308,955 | ) |

| | | | | |

| Cash flows from financing activities | | | | |

| Subscriptions, net of subscriptions received in advance | | | 200,000 | |

| Net cash provided by financing activities | | | 200,000 | |

| | | | | |

| Net change in cash and cash equivalents | | | (108,955 | ) |

| Cash and cash equivalents at beginning of period | | | 154,070 | |

| Cash and cash equivalents at end of period | | $ | 45,115 | |

See accompany notes to the financial statements.

Zell Capital

Financial Highlights

| | | For the Period

Ended

September 30, 2022

(Unaudited) | | | For the Period

Ended

March 31, 2022(a) | |

| For a Share outstanding throughout the period: | | | | | | | | |

| Net asset value, beginning of period | | $ | 12.05 | | | $ | 20.00 | |

| Net investment loss(a) | | | (6.30 | ) | | | (2.50 | ) |

| Net decrease resulting from operations | | | (6.30 | ) | | | (2.50 | ) |

| Impact of issuance of capital transactions at initial offering price as compared to net asset value | | | 0.82 | | | | (5.45 | ) |

| Net decrease in net asset value | | | (5.48 | ) | | | (7.95 | ) |

| Net asset value, end of period | | $ | 6.57 | | | $ | 12.05 | |

| Total return(b)(d) | | | (45.48 | )% | | | (39.75 | )% |

| | | | | | | | | |

| Ratio of total expenses before expense reimbursements(c) | | | 203.27 | % | | | 374.27 | % |

| Ratio of total expenses after expense reimbursements(c) | | | 133.36 | % | | | 32.41 | % |

| Ratio of net investment loss after expense reimbursements(c) | | | (126.39 | )% | | | (32.39 | )% |

| Portfolio turnover (d) | | | 0.00 | % | | | 0.00 | % |

| Net assets, end of period | | $ | 234,591 | | | $ | 392,269 | |

| (a) | Calculated based on the average shares outstanding methodology. |

| (b) | Total return assumes a subscription of a share to the Fund at the beginning of the period indicated and a repurchase of a share on the last day of the period, assumes reinvestment of all distributions for the period. |

| (e) | The Fund commenced operations on June 8, 2021. |

See accompany notes to the financial statements.

Zell Capital

Notes to Financial Statements

September 30, 2022 (Unaudited)

1. Organization

Zell Capital (the “Fund”) was organized on October 16, 2019 as a statutory trust under the laws of the state of Delaware. The Fund commenced operations on June 8, 2021. The Fund is an internally managed registered closed-end management investment company. The Fund offers a new, alternative approach to traditional venture capital fund investing to allow individual investors who do not meet the net worth or income thresholds necessary to qualify as an “accredited investor” access to investments in a fund that invests in venture capital. Because an investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”) qualifies as an accredited investor under the Securities Act, the Fund is eligible to make investments in venture stage companies. However, individuals are not required to qualify as accredited investors or QIBs to invest in the Fund. Therefore, the Fund provides retail investors access to investments in venture stage companies by pooling their investments in the Fund and using this capital to invest in venture capital, an opportunity and asset class to which these individuals typically would not have access to. This business structure is referred to as an “Access Fund” model. As an internally managed company, the Fund is managed by its executive officers under the supervision of the Board of Trustees (“Board”) and the Fund does not utilize an external investment adviser. The Fund seeks to maximize long-term total return principally by seeking capital gains in its equity investments and secondarily through ordinary income from debt and debt-like investments.

The Fund invests principally in equity securities, including common equity and preferred equity, and to a lesser extent in alternative financing strategies such as convertible debt and preferred shares in connection with revenue sharing agreements. Because most of the companies in which the Fund invests are private, early stage start-up companies that are highly speculative and whose securities are illiquid, an investment in the shares of the Fund involves substantial risk. The Fund is non-diversified for purposes of the 1940 Act.

The Board has overall responsibility for monitoring and overseeing the Fund’s operations and investment program. A majority of the Trustees are not “interested persons” (as defined by the 1940 Act) of the Fund.

2. Significant Accounting Policies

The following significant accounting policies are in conformity with U.S. generally accepted accounting principles (“US GAAP”). Such policies are consistently followed by the Fund in preparation of its financial statements. The Fund is an investment company in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946, “Financial Services – Investment Companies,” for the purpose of financial reporting. The preparation of the financial statements in conformity with US GAAP requires estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases or decreases in net assets from operations during the reporting period. Actual results could differ from those estimates. The Fund’s financial statements are stated in United States dollars.

Investment in the Fund

Effective July 5, 2022, the Fund suspended its offering of up to $50,000,000 worth of shares of common stock (the “Shares”). Shares of the Fund are no longer available for purchase.

As of September 30, 2022, William Zell, Chief Executive Officer and Chairman of the Board, is an investor and owns 5.74% of the outstanding Shares of the Fund; Michelle Murcia, Chief Financial Officer of the Fund, is an investor and owns 0.28% of the outstanding Shares of the Fund; and Zell Access Innovation, LLC, an affiliate of the Fund, is an investor and owns 1.75% of the outstanding Shares of the Fund. William Zell is the sole owner of Zell Access Innovation, LLC. Gravity Investments is a shareholder and owns 21.02% of the outstanding Shares of the Fund.

Portfolio Valuation

The net asset value of the Fund is determined as of the close of business at the end of each month. In connection with each monthly closing, the Board or its delegates determines the then current net asset value of the Fund’s common stock as of a time within 48 hours of the sale of the Shares, pursuant to Section 23(b) of the 1940 Act.

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

2. Significant Accounting Policies (continued)

Portfolio Valuation (continued)

The Fund’s portfolio investments will typically not be in publicly traded securities. As a result, although some of the equity investments may trade on private secondary marketplaces, a market value for any direct investments in portfolio companies will typically not be readily determinable. Under the 1940 Act, for investments for which there are no readily available market quotations, including securities that while listed on a private securities exchange, have not actively traded, will be valued at fair value monthly as determined in good faith by the Board based upon the recommendation of the Board’s Audit Committee in accordance with the Fund’s written valuation policy. In connection with that determination, members of the portfolio management team will prepare portfolio company valuations using, where available, the most recent portfolio company financial statements and forecasts. The Audit Committee utilizes the services of an independent valuation firm, at least annually, which prepares valuations for each of the portfolio investments that are not publicly traded or for which the Fund does not have readily available market quotations, including securities that while listed on a private securities exchange, have not actively traded. However, the Board retains ultimate authority as to the appropriate valuation of each such investment. The types of factors that the Audit Committee takes into account in providing its fair value recommendation to the Board with respect to such non-traded investments include, as relevant and, to the extent available, the valuation of the investment as of the portfolio company’s latest funding round, the portfolio company’s earnings, the markets in which the portfolio company does business, comparison to valuations of publicly traded companies, comparisons to recent sales of comparable companies, the discounted value of the cash flows of the portfolio company and other relevant factors. This information may not be available because it is difficult to obtain financial and other information with respect to private companies, and even where we are able to obtain such information, there can be no assurance that it is complete or accurate. Because such valuations are inherently uncertain and may be based on estimates, determinations of fair value may differ materially from the values that would be assessed if a readily available market for these securities existed.

Cash and Cash Equivalents

Cash and cash equivalents consist of cash held on deposit and short-term highly liquid investments that are readily convertible to known amounts of cash and have maturities of three months or less. Investments in money markets are recorded at fair value and are categorized as Level 1 securities as described in Note 3. As of September 30, 2022, cash equivalents consisted of investments in money market funds valued at $10,077. Investments in money market funds are valued at net asset value.

Income Recognition and Expenses

The Fund recognizes income and records expenses on an accrual basis. Income, expenses, and realized and unrealized gains and losses are recorded monthly.

During the six-month period ended September 30, 2022, a portion of expenses totaling $121,783, were reimbursed by Zell Access Innovation, LLC, an affiliate of the Fund. The Fund will not repay Zell Access Innovation, LLC in the future.

Income Taxes

The Fund intends to qualify as a “regulated investment company” under Sub-chapter M of the Internal Revenue Code of 1986, as amended, and in conformity with the Regulated Investment Company Modernization Act of 2010. The Fund will not be subject to federal income tax to the extent the Fund satisfies the requirements under Section 851 of the Internal Revenue Code, including distributing substantially all of its investment company taxable income and any net realized capital gains to its shareholders based on the Fund’s fiscal year end of March 31.

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

2. Significant Accounting Policies (continued)

Income Taxes (continued)

In order to avoid imposition of the excise tax on undistributed income applicable to regulated investment companies, the Fund intends to declare each year as dividends in each calendar year at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

The Fund evaluates tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether it is “more-likely-than-not” (i.e., greater than 50-percent) that each tax position will be sustained upon examination by a taxing authority based on the technical merits of the position. Tax positions not deemed to meet the more-likely-than- not threshold are recorded as a tax benefit or expense in the current year. The Fund did not record any tax provision in the current period. However, management’s conclusions regarding tax positions taken may be subject to review and adjustment at a later date based on factors including, but not limited to, examination by tax authorities, on-going analysis of and changes to tax laws, and regulations and interpretations thereof. If applicable, the Fund recognizes interest accrued related to unrecognized tax benefits in interest expense and penalties in other expenses in the Statement of Operations.

The Fund files tax returns with the U.S. Internal Revenue Service and the state of Delaware. The Fund may be subject to taxes imposed by countries in which it invests. Such taxes are generally based on income earned or gains realized or repatriated. Taxes are accrued and applied to net investment income, net realized capital gains and net realized appreciation, as applicable, as the income is earned or capital gains are recorded. Generally, open tax years under potential examination vary by jurisdiction, but at least each of the tax years in the period from June 8, 2021 (commencement of operations) to December 31, 2021 remain subject to examination by major taxing authorities.

As of September 30, 2022, the cost and related gross unrealized appreciation and depreciation for tax purposes were as follows:

| Cost of investments for tax purposes | | $ | 376,119 | |

| Gross tax unrealized appreciation | | | — | |

| Gross tax unrealized depreciation | | | — | |

| Net tax unrealized appreciation/depreciation on investments | | $ | — | |

Distribution of Income and Gains

The timing and amount of distributions, if any, will be determined by the Board. Any distributions to shareholders will be declared out of assets legally available for distribution. As the strategy is to maximize long-term total return principally by seeking capital gains, it is not anticipated that the Fund will pay distributions on a quarterly basis or become a predictable distributor of distributions. The Fund intends to distribute substantially all of its capital gains and net income on an annual basis. The specific tax characteristics of any distributions will be reported to shareholders after the end of each calendar year.

The Fund has adopted a dividend reinvestment plan established by the Fund (the “DRIP”), pursuant to which each Shareholder whose Shares are registered in its own name will automatically be a participant under the DRIP and have all income, dividends, and capital gains distributions automatically reinvested in additional Shares unless such Shareholder specifically elected to receive all income, dividends, and capital gain distributions in cash. No action is required on the part of a shareholder to reinvest dividends and/or capital gain distributions in shares of the Fund. A shareholder may elect to receive dividends and/or capital gain distributions in cash by notifying the transfer agent in writing or by calling so that such notice is received no later than 10 days prior to the record date for distributions to investors. The transfer agent will, instead of crediting shares to the shareholder’s account, pay the amount of the distribution via ACH (Automatic Clearing House) to the shareholder’s bank account of record or via check mailed directly to the shareholder.

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

2. Significant Accounting Policies (continued)

Indemnifications

Under the Fund’s Amended and Restated Agreement and Declaration of Trust, the Fund has agreed to indemnify, to the fullest extent authorized by the relevant portions of Delaware law, any person who was or is involved in any actual or threatened action, suit, or proceeding (whether civil, criminal, administrative or investigative) by reason of the fact that such person is or was one of our trustees or officers or is or was serving at our request as a trustee or officer of another corporation, partnership, limited liability company, joint venture, trust or other enterprise, including service with respect to an employee benefit plan, against expenses (including attorney’s fees), judgments, fines and amounts paid or to be paid in settlement actually and reasonably incurred by such person in connection with such action, suit, or proceeding, except in cases in which the indemnitee did not act in good faith with the reasonable belief that his or her conduct was in, or not opposed to, the best interest of the Fund or the indemnitee’s conduct constituted gross negligence, bad faith, reckless disregard, or willful misconduct.

In the normal course of business, the Fund enters into contracts that contain a variety of representations and that provide general indemnifications. The Fund’s maximum liability exposure under these arrangements is unknown, as future claims that have not yet occurred may be made against the Fund. However, management expects the risk of loss to be remote.

3. Fair Value of Investments

Investments are carried at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. The Board will determine the fair value of investments on at least a monthly basis and at such other times when it feels it would be appropriate to do so given the circumstances. A determination of fair value involves subjective judgments and estimates and depends on the facts and circumstances present at each valuation date. Due to the inherent uncertainty of determining fair value of portfolio investments that do not have a readily available market value, fair value of investments may differ significantly from the values that would have been used had a readily available market value existed for such investments, and the differences could be material.

The Fund values investments in accordance with U.S. GAAP and fair values its investment portfolio in accordance with the provisions of the FASB ASC Topic 820 Fair Value Measurements and Disclosures, which defines fair value, establishes a framework for measuring fair value and requires enhanced disclosures about fair value measurements. The Fund uses a three-tier hierarchy to distinguish between (a) inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the reporting entity (observable inputs) and (b) inputs that reflect the reporting entity’s own assumptions about the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances (unobservable inputs) and to establish classification of fair value measurements for disclosure purposes. Various inputs are used in determining the fair value of the Fund’s investments.

During the early stages of a venture stage company’s existence, traditional valuation methods (e.g., discounted cash flow) are often a less reliable tool for valuing investments. As such, until the Fund’s portfolio companies grow to a point where traditional valuation methods apply, the Fund will value its investments based on how they progress through capital raising cycles. The valuation of the Fund’s portfolio companies will typically be adjusted when a new valuation is set by the lead investor in the next funding round. As such, the Fund also intends to adjust the valuation of its portfolio companies with each new funding round, which is the generally accepted methodology for the valuation of venture stage companies like the ones the Fund intends to invest in. However, while the valuation as of the latest funding round is a prominent factor in the Fund’s valuation process, it is not the only factor that the Fund will consider when valuing its portfolio investments. At the outset of each investment in a portfolio company, the Fund will also establish upper bound and lower bound thresholds that could trigger a re-valuation of the portfolio company. Such upper and lower bound thresholds typically represent fundamental changes in the value of the portfolio company that would affect the anticipated return on the Fund’s investment. An upper bound threshold could include an unexpected business or technology breakthrough or faster than anticipated revenue growth. Alternatively, a lower bound threshold could include a fundamental failure of the technology, the loss of a key customer or the success of a competitor in the same industry. If a portfolio company breaches one of these upper or lower bound thresholds, the Fund will re-value the underlying investment and adjust the Fund’s net asset value and, if necessary, the Fund’s initial offering price of $20.00 per share (if such re- valuation occurs during the initial offering period).

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

3. Fair Value of Investments (continued)

For companies that are past the venture stage, valuation methods utilized include, but are not limited to the following: comparisons to prices from secondary market transactions; public offerings; and purchase or sales transactions; as well as analysis of financial ratios and valuation metrics of the portfolio companies that issued such private equity securities to peer companies that are public, analysis of the portfolio companies’ most recent financial statements and forecasts, and the markets in which the portfolio company does business, and other relevant factors. The Fund assigns a weighting based upon the relevance of each method to determine the fair value of each investment.

At least annually, a nationally recognized independent third-party valuation firm will conduct independent appraisals and review management’s preliminary valuations and make its own independent assessment, for each investment for which there is no readily available market quotation.

The inputs are summarized in the three broad levels listed below:

| ● | Level 1 – quoted prices in active markets for identical investments |

| ● | Level 2 – quoted prices for similar investments in active markets; quoted prices for identical or similar investments in markets that are not considered active; observable inputs other than observable quoted prices for the asset or liability; or inputs derived principally from or corroborated by observable market data |

| ● | Level 3 – significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments) that reflect the assumptions that market participants would use in pricing the asset or liability, including assumptions about risk, developed based on the best information available in the circumstances |

The inputs or methodology used for valuing investments are not necessarily an indication of the risk associated with investing in those investments.

The following is a summary of the inputs used as of September 30, 2022 in valuing the Fund’s investments carried at fair value:

| Valuation Inputs |

| Investments at Value | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| SAFE Notes | | $ | — | | | $ | — | | | $ | 350,000 | | | $ | 350,000 | |

| Private Equity | | | | | | | | | | | 26,120 | | | | 26,120 | |

| Money Markets | | | 10,077 | | | | — | | | | — | | | | 10,077 | |

| Total | | $ | 10,077 | | | $ | — | | | $ | 376,120 | | | $ | 386,197 | |

The following is a reconciliation of Level 3 investments for the six-month period ended September 30, 2022:

| | | Private Notes | |

| Beginning Balance – March 31, 2022 | | $ | 281,120 | |

| Purchases | | | 95,000 | |

| Sales | | | — | |

| Transfers in/(out) of Level 3 | | | — | |

| Realized gains (losses), net | | | — | |

| Change in unrealized appreciation/depreciation | | | — | |

| Ending Balance –September 30, 2022 | | $ | 376,120 | |

| Change in unrealized appreciation/depreciation on investments still held as of September 30, 2022 | | $ | — | |

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

3. Fair Value of Investments (continued)

The following is a summary of quantitative information about significant unobservable valuation inputs for Level 3 investments held as of September 30, 2022:

| Type of Investment | | Fair Value as of

September 30, 2022 | | | Valuation Technique | | Unobservable Inputs | | Range of Inputs

(Weighted Average) | |

| Noether Rudin, Inc. DBA DOLR | | | $130,000 | | | Market Approach(a) | | Discount Rate | | 15.5% | |

| OptioLend, Inc. | | | 50,000 | | | Market Approach | | Transaction Price | | $50,000 | |

| Studium | | | 160,000 | | | Market Approach(a) | | Discount Rate | | 14.0% | |

| GRID | | | 10,000 | | | Market Approach | | Transaction Price | | $10,000 | |

| Veritus Capital TK SPV, LLC | | | 26,120 | | | Market Approach | | Transaction Price | | $26,120 | |

| Total | | | $376,120 | | | | | | | | |

| (a) | Valued using the Probability-Weighted Expected Return Method (PWERM). |

The significant unobservable input used in the fair value measurements above is the transaction price, and the assumption that performance of the investments has not caused additional adjustment to that transaction price. A change in assumption used in any of the unobservable inputs in isolation may significantly impact the fair value measurement. Due to the inherent uncertainty of determining the fair value of investments that do not have observable inputs, the fair value of the Fund’s investments may fluctuate from period to period.

For the six-month period ended September 30, 2022, aggregated purchases and proceeds from the sales of long term investments were $95,000 and $0, respectively.

4. Related Party Transactions and Agreements

Administrator

U.S. Bancorp Fund Services, LLC, d/b/a US Bank Global Fund Services (the “Administrator”), serves as administrator to the Fund. Under the Administration Agreement by and among the Fund and the Administrator, the Administrator maintains the Fund’s general ledger and is responsible for calculating the net asset value of the Shares, and generally managing the administrative affairs of the Fund. Under an administrative services agreement, USBFS is paid an administrative fee, computed and payable monthly at an annual rate based on the aggregate monthly total assets of the Fund.

Custodian, Dividend Paying Agent, Transfer Agent and Registrar

U.S. Bancorp Fund Services, LLC, d/b/a US Bank Global Fund Services serves as the Fund’s dividend paying agent, transfer agent and registrar. Under a transfer agency services agreement, USBFS is paid an administrative fee, computed and payable monthly at an annual rate based on the transactions processed.

U.S. Bank National Association (“USB N.A.”) serves as the custodian to the Fund. Under a custody services agreement, USB N.A. is paid a custody fee monthly based on the average daily market value of any securities and cash held in the portfolio.

Related Party Transactions

During the six-month period ended September 30, 2022, a portion of the Fund’s expenses totaling $121,783, were reimbursed by Zell Access Innovation, LLC, an affiliate of the Fund. The Fund will not repay any of these expenses.

Zell Capital

Notes to Financial Statements (continued)

September 30, 2022 (Unaudited)

4. Related Party Transactions and Agreements (continued)

During the six-month period ended September 30, 2022, Zell Access Innovation, LLC, an affiliate of the Fund, paid expenses totaling $69,873 on behalf of the Fund. As of September 30, 2022, $69,873 was due to the affiliate, as presented on the Statement of Assets and Liabilities.

5. Short Term Debt

Short term debt represents convertible notes issued by the Fund, that will convert to equity interests in the Fund if and when the Fund deregisters under the 1940 Act and converts to a private fund. As of September 30, 2022, the Fund issued one convertible note for $125,000.

6. Commitments

The Fund has future non-binding commitments to fund additional capital into underlying companies. The remaining commitment at September 30, 2022 is $160,000.

7. Risk Factors

An outbreak of an infectious respiratory illness, COVID-19, caused by a novel coronavirus has resulted in travel restrictions, disruption of healthcare systems, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, layoffs, ratings downgrades, defaults and other significant economic impacts. Certain markets have experienced temporary closures, extreme volatility, severe losses, reduced liquidity and increased trading costs. The duration of COVID-19 related economic disruption and its ultimate impact on the Fund, and on the global economy, cannot be determined with certainty.

The Fund is subject to concentration of investment risk to the extent that the portfolio is heavily invested, at any particular time, in specific asset types, classes, industries, sectors or collateral types, among other defining features. Developments and the market’s perception thereof in any of these concentrations may exacerbate the negative effects on the Fund’s investment portfolio compared to other companies.

The Fund has invested and may continue to invest the net proceeds from its continuous offering in Simple Agreements for Future Equity (SAFEs). Although SAFEs convert into equity in the event of a future equity financing or liquidity event, there is a chance they will never convert to equity, and the Fund may lose all or a part of its investment. Additionally, SAFEs often lack additional protections for investors, such as accruing interest on the principal initially invested, a maturity date upon which the note becomes due and repayable (in cash or conversion), and an ability to have the investment secured and registered against assets of the company. SAFEs are also not freely transferable and there is not now, and likely will not be, a public market for the SAFEs. Because the SAFEs have not been registered under the 1933 Act or under the securities laws of any state or non-United States jurisdiction, the SAFEs have transfer restrictions under Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act of 1933 or other securities laws will be affected. As such, the Fund will have limited liquidity with respect to its investments in SAFEs. Limitations on the transfer of the SAFE may also adversely affect the price that the Fund might be able to obtain for the SAFE in a private sale. The Fund’s investments in SAFEs are highly speculative, and the Fund may lose all or part of its investment in such SAFEs. As of September 30, 2022, the Fund had invested 149% of its net assets in SAFE Notes.

8. Subsequent Events

Unless otherwise stated throughout the Notes to the Financial Statements, the Fund noted no additional subsequent events that require disclosure in or adjustment to the Financial Statements.

Zell Capital

Additional Information (Unaudited)

September 30, 2022

Proxy Voting Policies and Procedures and Proxy Voting Record

If applicable, a copy of (1) the Fund’s policies and procedures with respect to the voting of proxies relating to the Fund’s investments; and (2) how the Fund voted proxies relating to Fund investments during the most recent period ended June 30, is available without charge, on the Securities and Exchange Commission’s website at http://www.sec.gov.

Quarterly Portfolio Schedule

The Fund also files a complete schedule of portfolio holdings with the Securities and Exchange Commission for the Fund’s first and third fiscal quarters on Form N-PORT. The Fund’s Form N-PORT are available on the Securities and Exchange Commission’s website at http://www.sec.gov.

Zell Capital

Privacy Policy (Unaudited)

September 30, 2022

We appreciate your business and the trust you have placed in us. Our privacy philosophy reflects the value of your trust. We are committed to protecting the personal data we obtain about you. On behalf of Zell Capital, we make the following assurance of your privacy.

Not Using Your Personal Data for our Financial Gain

Zell Capital has never sold shareholder information to any other party, nor have we disclosed such data to any other organization, except as permitted by law. We have no plans to do so in the future. We will notify you prior to making any change in this policy.

How We Do Use Your Personal and Financial Data

We use your information primarily to complete your investment transactions. We may also use it to communicate with you about other financial products that we offer.

The Information We Collect About You

You typically provide personal information when you complete a Zell Capital account application or when you request a transaction that involves Zell Capital, either directly or through a brokerage firm. This information may include your:

| ● | Name, address and phone numbers |

| ● | Social security or taxpayer identification number |

| ● | Birth date and beneficiary information (for IRA applications) |

| ● | Basic trust document information (for trusts only) |

How We Protect Your Personal Information

As emphasized above, we do not sell information about current or former shareholders or their accounts to third parties. We occasionally share such information to the extent permitted by law to complete transactions at your request, or to make you aware of related financial products that we offer. Here are the details:

| ● | To complete certain transactions or account changes that you direct, it may be necessary to provide identifying information to companies, individuals, or groups that are not affiliated with Zell Capital. For example, if you ask to transfer assets from another financial institution to Zell Capital, we will need to provide certain information about you to that company to complete the transaction. |

| ● | In certain instances, we may contract with non-affiliated companies to perform services for us, such as processing orders for share purchases and repurchases and distribution of shareholder letters. Where necessary, we will disclose information about you to these third parties. In all such cases, we provide the third party with only the information necessary to carry out its assigned responsibilities (in the case of shareholder letters, only your name and address) and only for that purpose. We require these third parties to treat your private information with the same high degree of confidentiality that we do. |

| ● | Finally, we will release information about you if you direct us to do so, if we are compelled by law to do so, or in other legally limited circumstances (for example, to protect your account from fraud). |

How We Safeguard Your Personal Information

We restrict access to your information to those Zell Capital representatives who need to know the information to provide products or services to you. We maintain physical, electronic, and procedural safeguards to protect your personal information.

Zell Capital

Privacy Policy (Unaudited) (continued)

September 30, 2022

Purchasing Shares of the Fund through Brokerage Firms

Zell Capital shareholders may purchase their shares through brokerage firms. Please contact those firms for their own policies with respect to privacy issues.

What You Can Do

For your protection, we recommend that you do not provide your account information, user name, or password to anyone except a Zell Capital representative as appropriate for a transaction or to set up an account. If you become aware of any suspicious activity relating to your account, please contact us immediately.

We’ll Keep You Informed

If we change our privacy policy with regard to disclosing your confidential information, we are required by law to notify you and provide you with a revised notice. You can access our privacy policy from our website.

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual report.

Item 6. Investments.

(a) Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form.

(b) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual report.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable for semi-annual report.

Item 9. Purchases of Equity Securities by Closed‑End Management Investment Company and Affiliated Purchasers.

No purchases were made during the reporting period by or on behalf of the registrant or any “affiliated purchaser,” as defined in Rule 10b-18(a)(3) under the Exchange Act (17 CFR 240.10b-18(a)(3)), of shares or other units of any class of the registrant’s equity securities that is registered by the registrant pursuant to Section 12 of the Exchange Act (15 U.S.C. 781).

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees since the registrant last provided disclosure in response to this item.

Item 11. Controls and Procedures.

(a) The registrant’s principal executive officer and principal financial officer have concluded, based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(d) under the 1940 Act) as of a date within 90 days of the filing date of this report on Form N-CSR, that the design and operation of such procedures are effective to provide reasonable assurance that information required to be disclosed by the investment company on Form N-CSR is recorded, processed, summarized and reported within the time periods specified in the Commission’s rules and forms.

(b) There have been no changes in the registrant's internal control over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) during the six months ended September 30, 2022 that materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

The registrant did not engage in securities lending activities during the period reported on this Form N-CSR.

Item 13. Exhibits.

(a)(1) Not applicable.

(a)(3) Not applicable.

(a)(4) Not applicable.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Zell Capital

By /s/ William L. Zell

William L. Zell, Chief Executive Officer

Date December 9, 2022

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By /s/ William L. Zell

William L. Zell, Chief Executive Officer

Date December 9, 2022

By /s/ Michelle Murcia

Michelle Murcia, Chief Financial Officer

Date December 9, 2022