STARTUP ACCESS FUND Filed Pursuant to Rule 433 Issuer Free Writing Prospectus dated August 3, 2020 Relating to Registration Statement No. 333 - 237742 and 811 - 23563

Investors are advised to carefully consider the investment objectives, risks, charges and expenses of Zell Capital before investing. The prospectus contains this and other information about Zell Capital and should be read carefully before investing. The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov . Alternatively, the Zell Capital will arrange to send you the prospectus if you request it from Zell Capital by email at wzell@zellcapital.com. 2 | ZELL CAPITAL

Use our innovative ACCESS FUND model to invest in world - class startups across the United States. MISSION

ACCESS FUND : INNOVATION IN PRIVATE MARKETS 240 million people in the US cannot invest in venture capital funds • Securities laws restrict private startup fund investing to accredited investors • Most accredited investors still lack access to quality private fund strategies • Attempted solutions to open access - like the JOBS Act - do not provide opportunity for fund investing …but the masses can revolutionize startup investing • Startups need customers, resources, market feedback and promoters • Investors need market input, technical expertise and customer insight for due diligence • A large active network of investors can create unique value not found in traditional venture capital funds 4 | ZELL CAPITAL

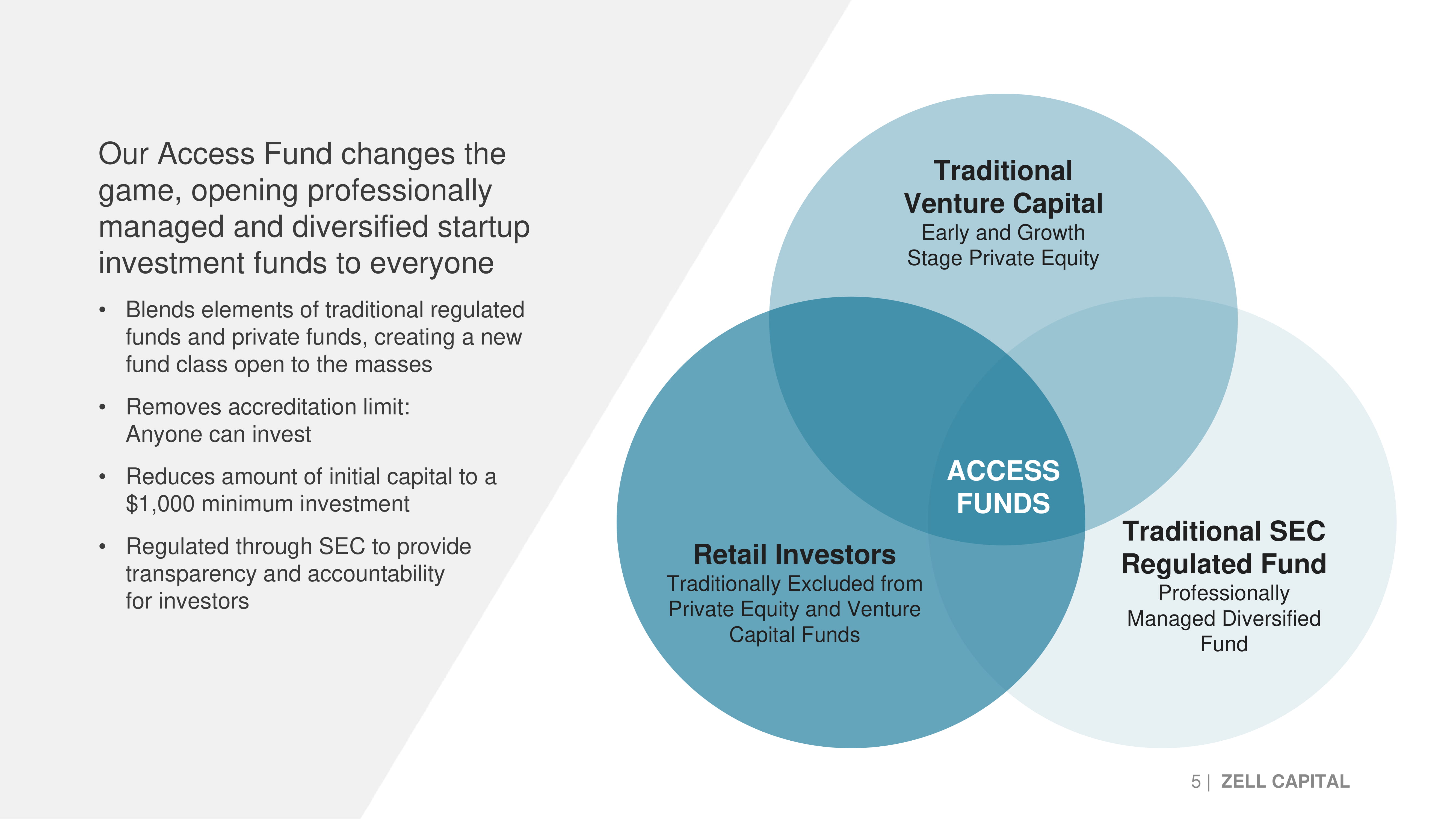

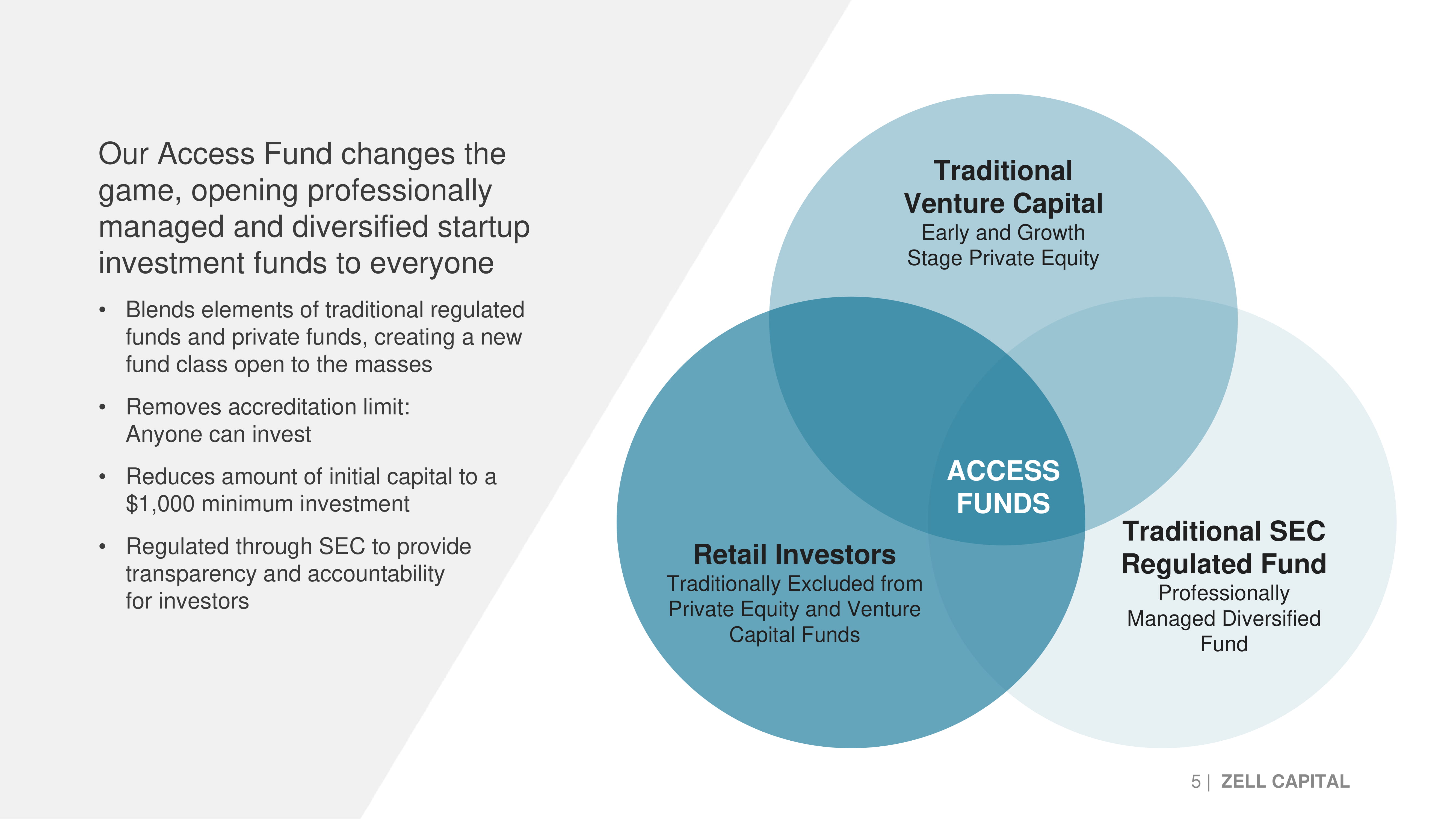

Traditional Venture Capital Early and Growth Stage Private Equity Traditional SEC Regulated Fund Professionally Managed Diversified Fund Retail Investors Traditionally Excluded from Private Equity and Venture Capital Funds ACCESS FUNDS Our Access Fund changes the game, opening professionally managed and diversified startup investment funds to everyone • Blends elements of traditional regulated funds and private funds, creating a new fund class open to the masses • Removes accreditation limit: Anyone can invest • Reduces amount of initial capital to a $1,000 minimum investment • Regulated through SEC to provide transparency and accountability for investors 5 | ZELL CAPITAL

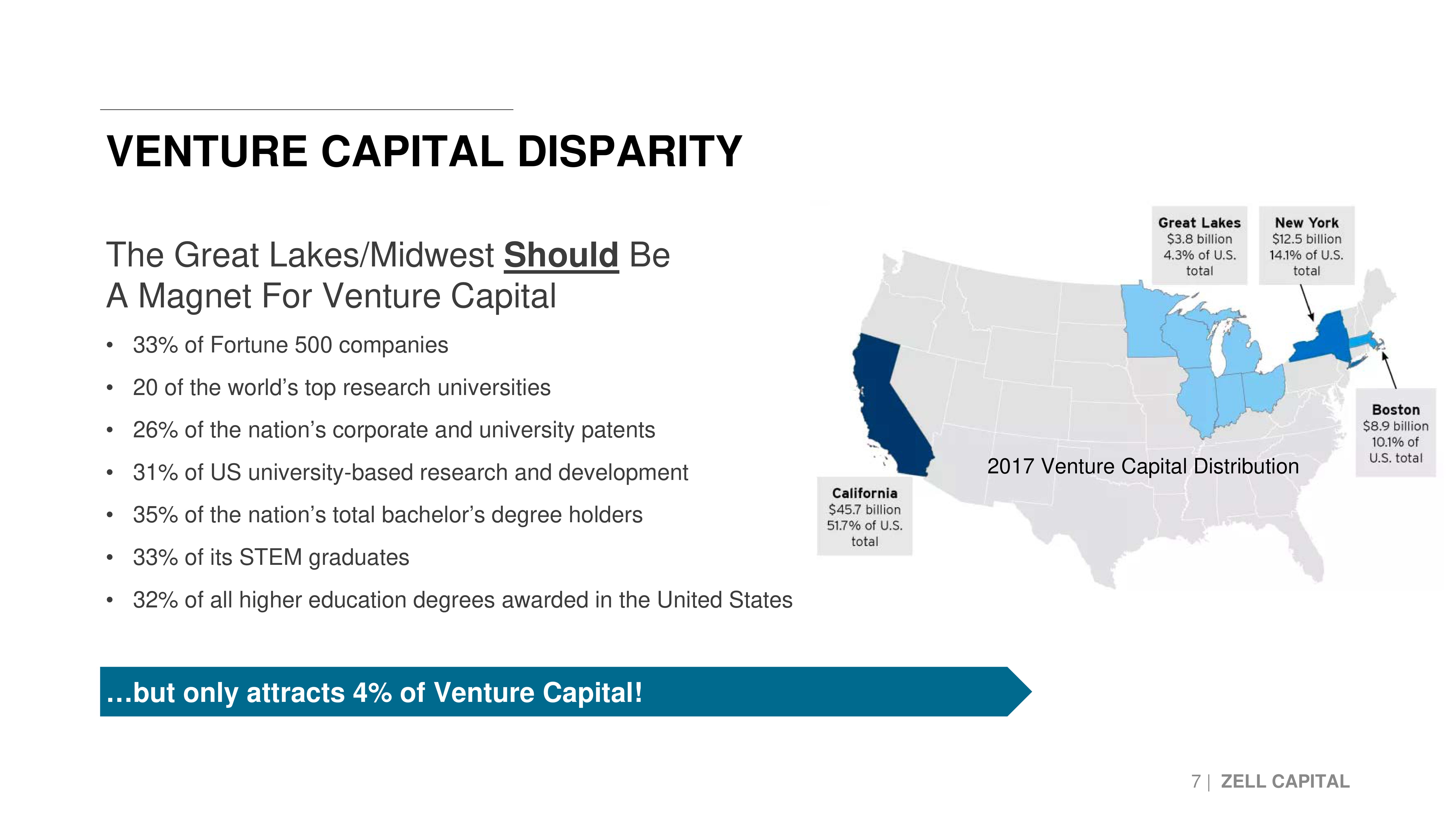

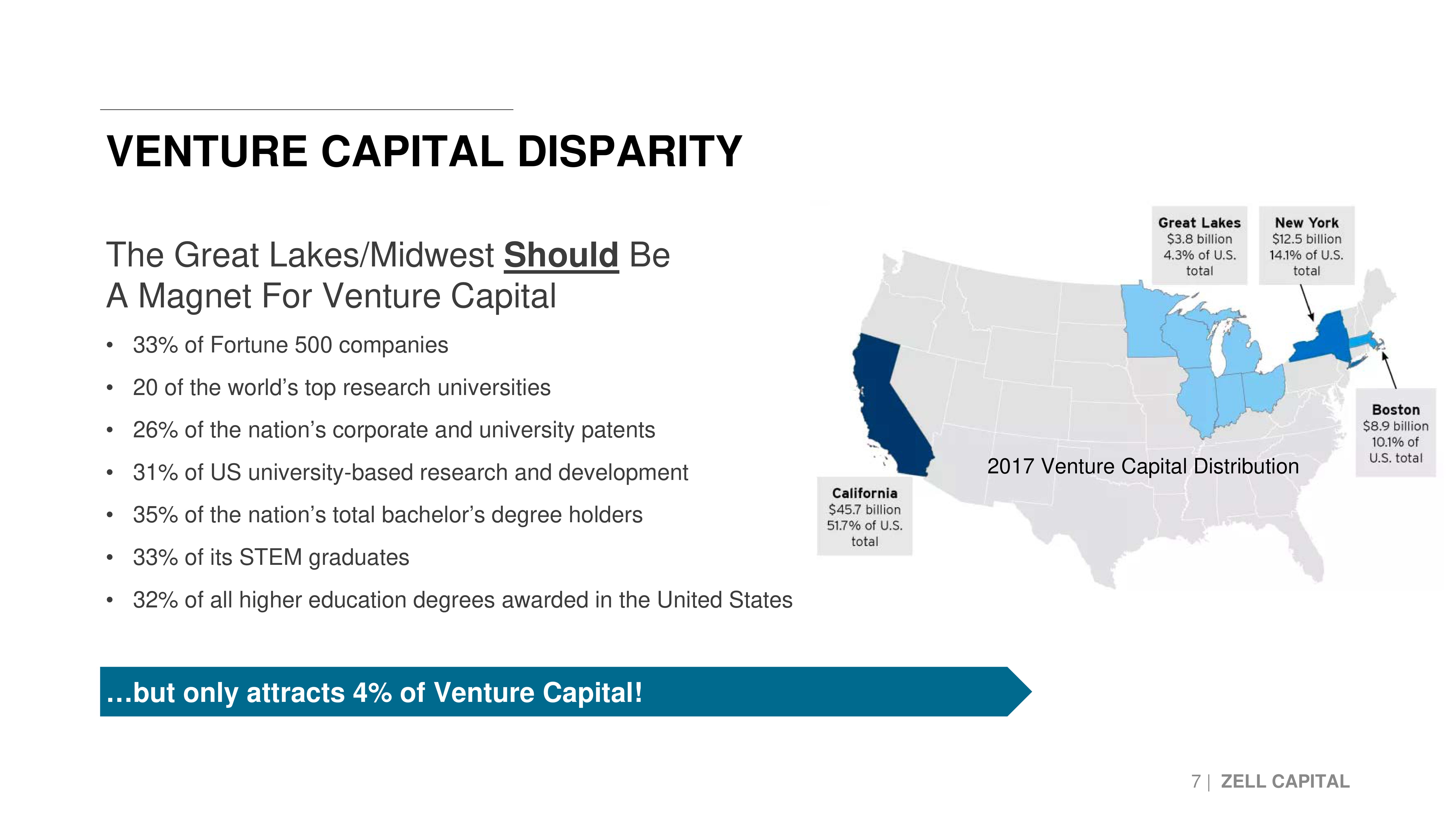

Zell Capital’s first access fund is an early - stage venture capital strategy. The fund will seek to make investments into high - growth startup companies in non - traditional geographic markets. Data in this presentation focuses on venture capital disparity comparing traditional markets (Silicon Valley, New York City, Boston) and the Great Lakes/Midwest region. We believe that this region serves as a proxy for all other non - traditional markets in the United States that Zell Capital will source deals from. Zell Capital

…but only attracts 4% of Venture Capital! VENTURE CAPITAL DISPARITY The Great Lakes/Midwest Should Be A Magnet For Venture Capital • 33% of Fortune 500 companies • 20 of the world’s top research universities • 26% of the nation’s corporate and university patents • 31% of US university - based research and development • 35% of the nation’s total bachelor’s degree holders • 33% of its STEM graduates • 32% of all higher education degrees awarded in the United States 7 | ZELL CAPITAL 2017 Venture Capital Distribution

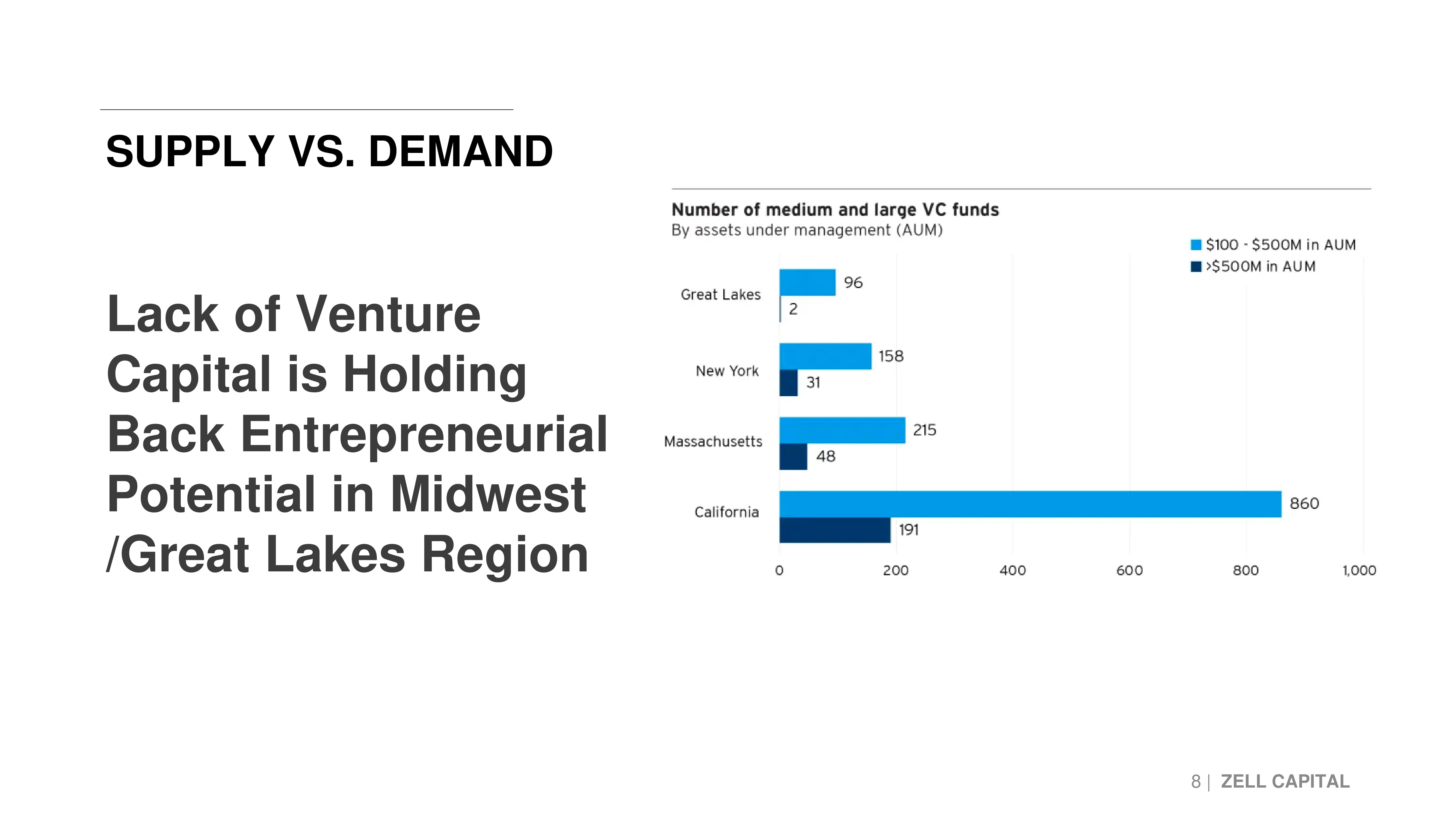

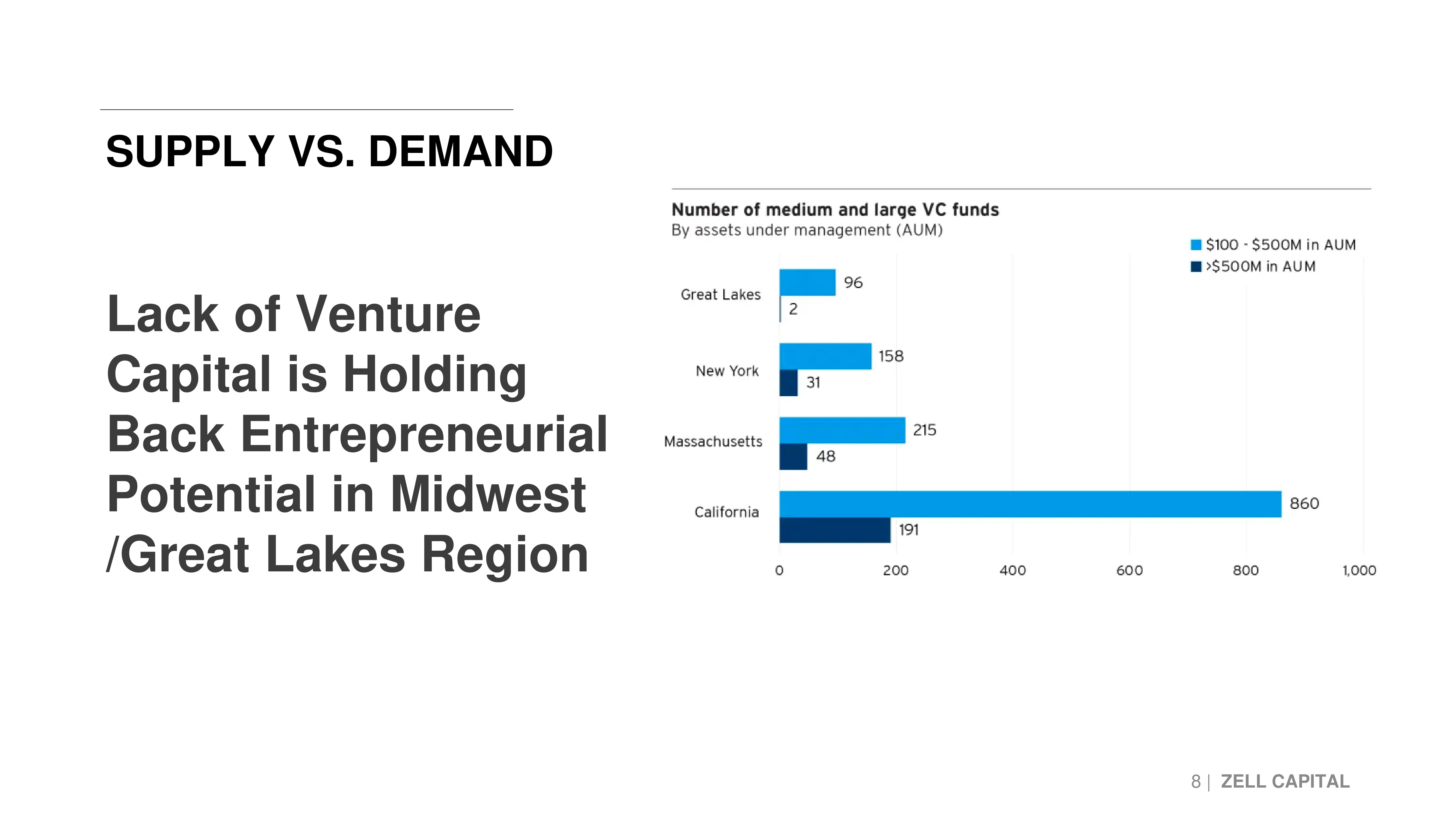

SUPPLY VS. DEMAND 8 | ZELL CAPITAL Lack of Venture Capital is Holding Back Entrepreneurial Potential in Midwest /Great Lakes Region

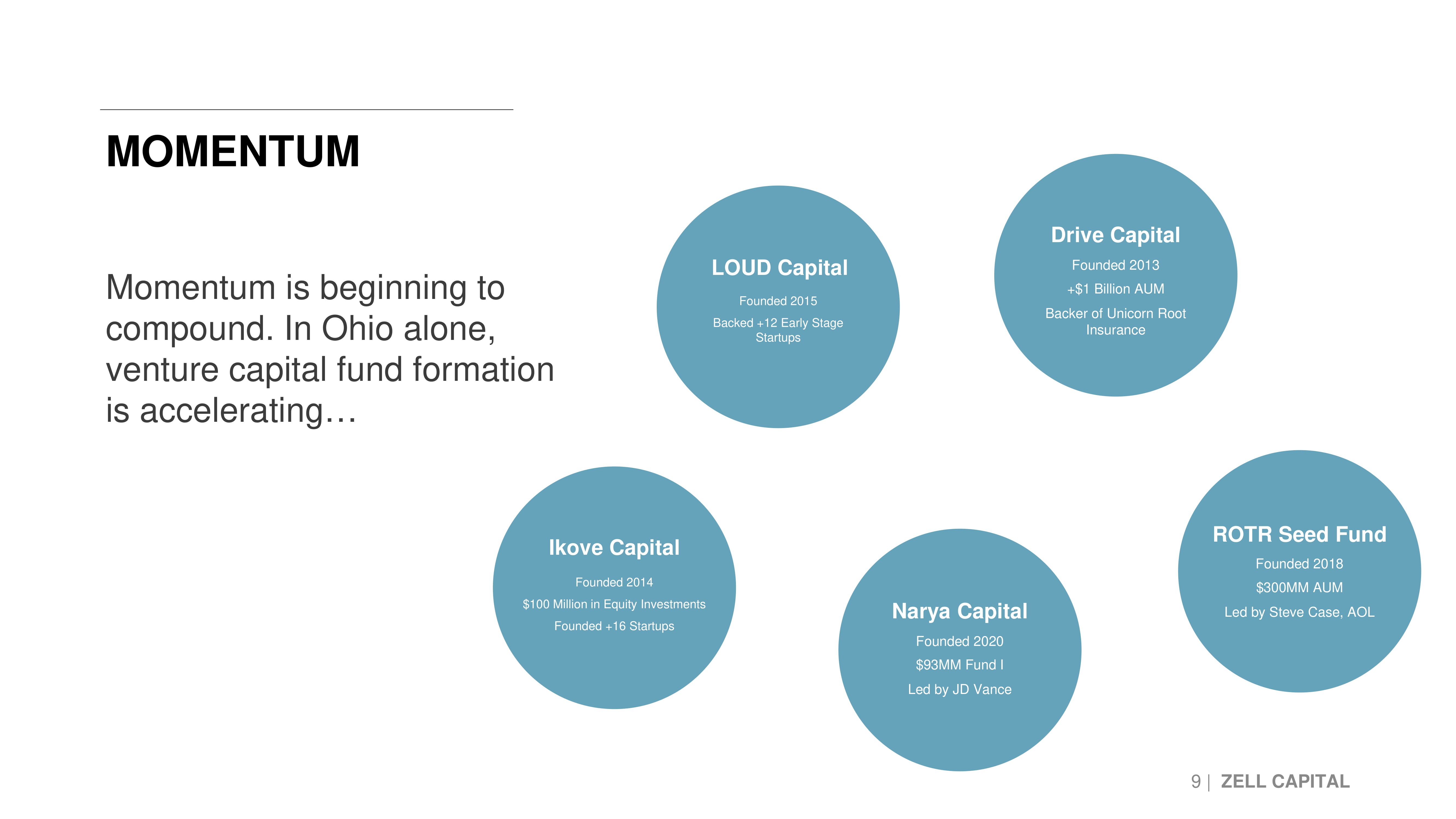

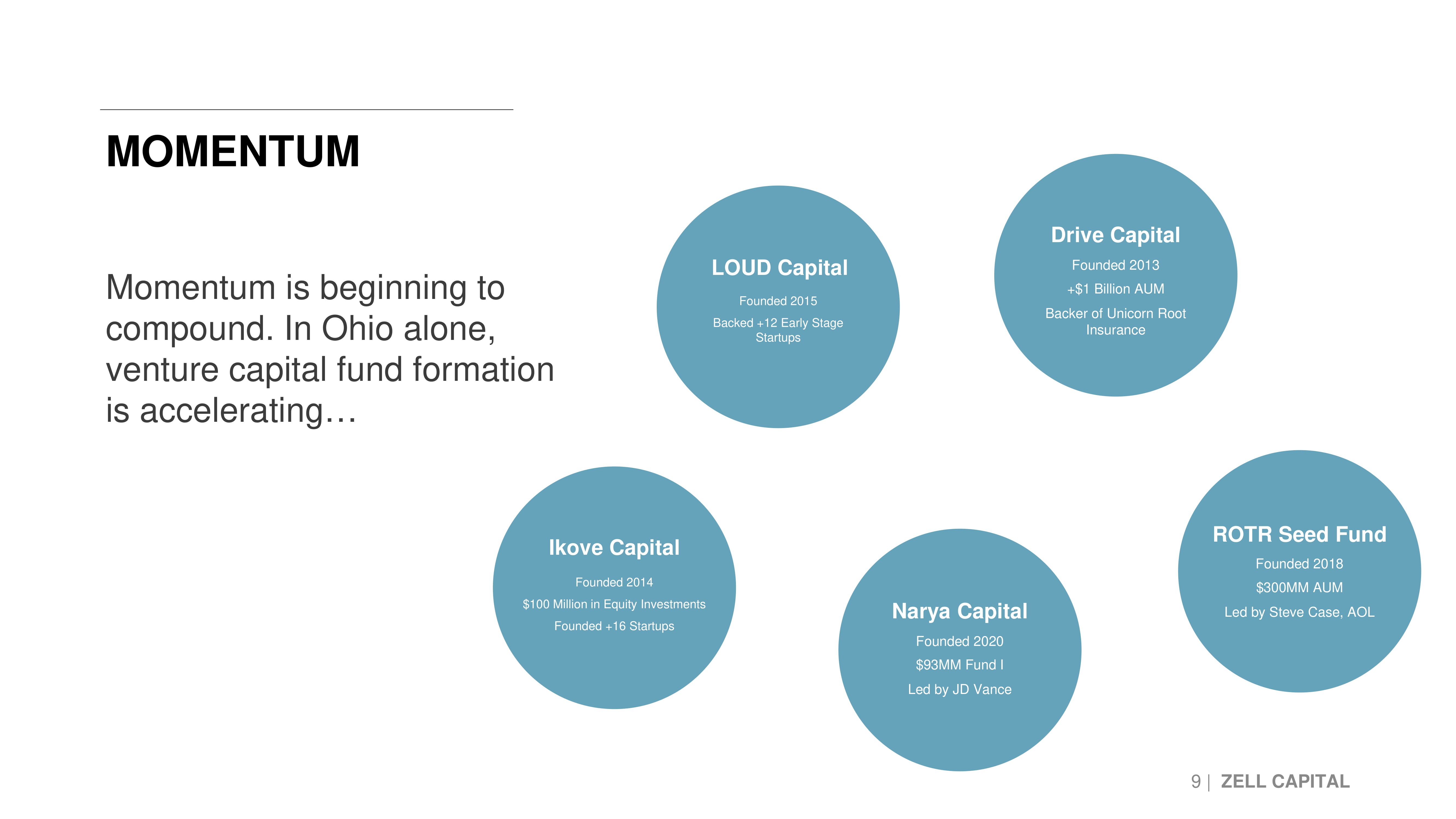

MOMENTUM Momentum is beginning to compound. In Ohio alone, venture capital fund formation is accelerating… 9 | ZELL CAPITAL Drive Capital Founded 2013 +$1 Billion AUM Backer of Unicorn Root Insurance Ikove Capital Founded 2014 $100 Million in Equity Investments Founded +16 Startups Narya Capital Founded 2020 $93MM Fund I Led by JD Vance LOUD Capital Founded 2015 Backed +12 Early Stage Startups ROTR Seed Fund Founded 2018 $300MM AUM Led by Steve Case, AOL

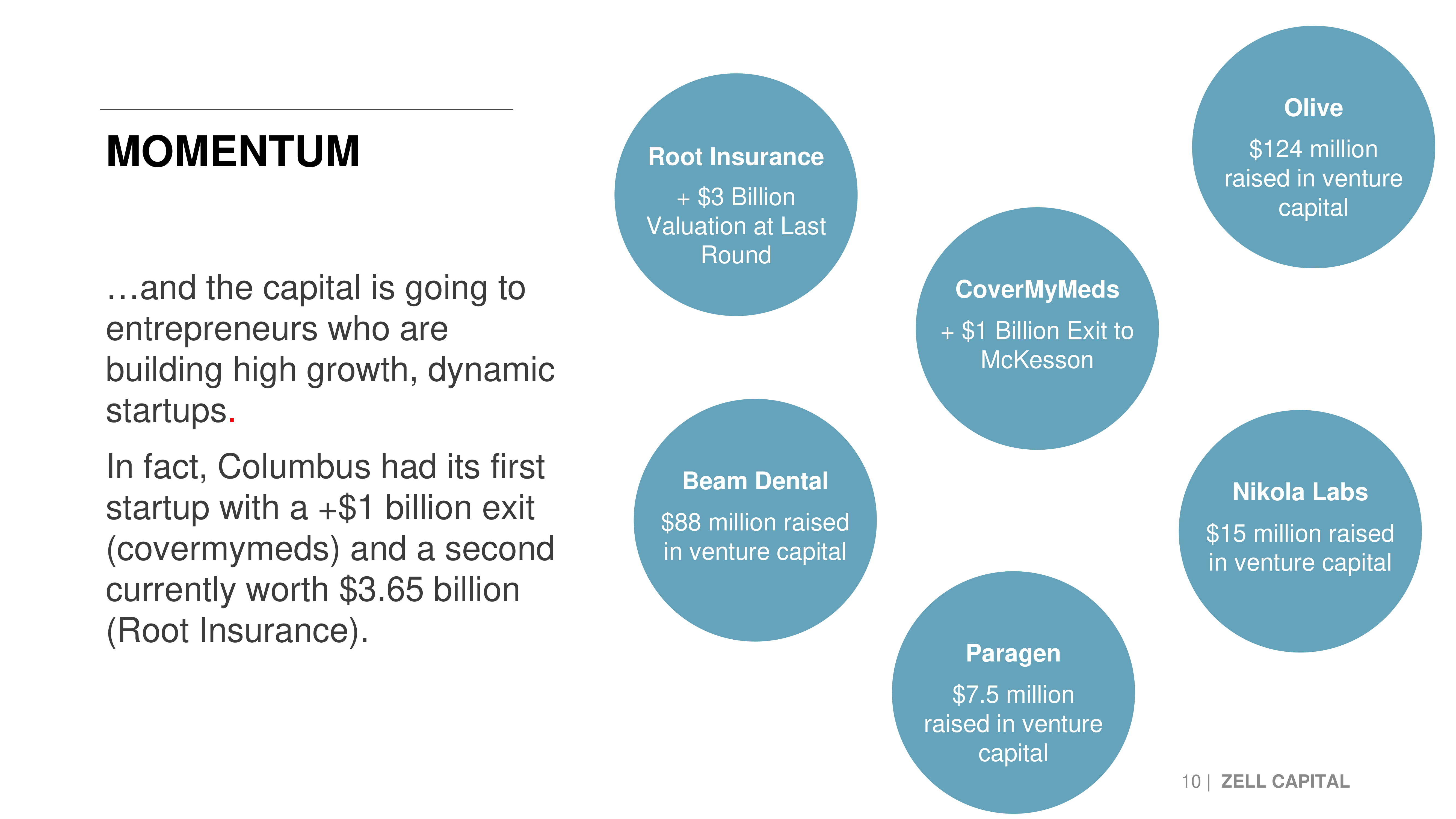

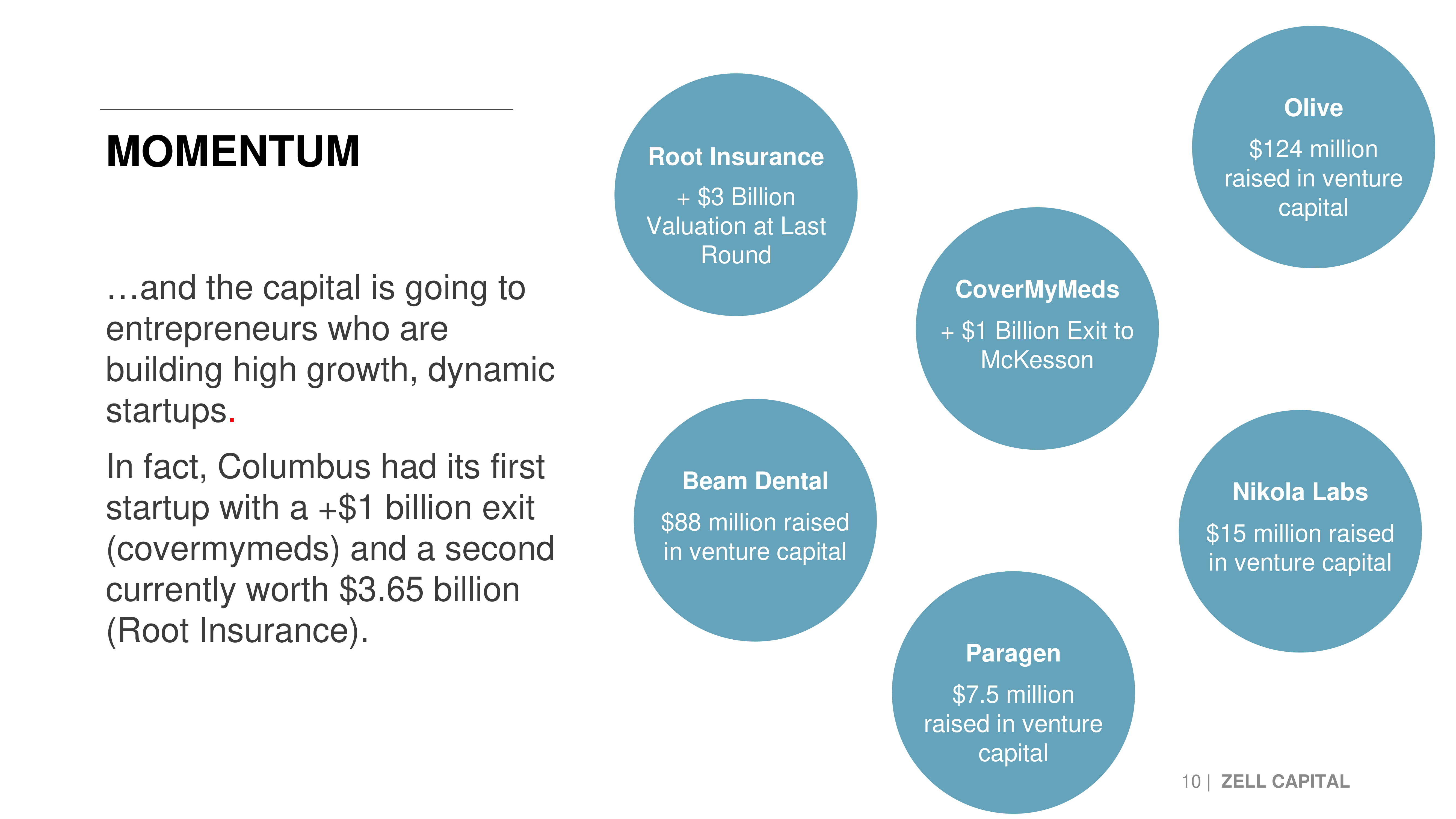

MOMENTUM …and the capital is going to entrepreneurs who are building high growth, dynamic startups . In fact, Columbus had its first startup with a +$1 billion exit (covermymeds) and a second currently worth $3.65 billion (Root Insurance). 10 | ZELL CAPITAL CoverMyMeds + $1 Billion Exit to McKesson Root Insurance + $3 Billion Valuation at Last Round Nikola Labs $15 million raised in venture capital Beam Dental $88 million raised in venture capital Paragen $7.5 million raised in venture capital Olive $124 million raised in venture capital

BUT THE MIDWEST IS STILL DRASTICALLY BEHIND 11 | ZELL CAPITAL “Investors agree that, even though there are some shoots of progress in other regions like the Midwest, it will take four or five successful exits and more local institutional investors to kickstart the investment engines.” - AXIOS “…but the data suggests we have a long way to go. Indeed, one of my predictions last year — that we’d see an increase of VC going to “rising” states, proved to be wrong. It actually went up, from 75% of VC going to just three states (California, New York and Massachusetts) in 2018, to 78% in 2019” - Steve Case, Rise of the Rest

Early Stage Investment Strategy Although more capital is needed in the Midwest at every stage of the startup lifecycle, Zell Capital will focus on Seed through Series A investments, where we believe is the greatest need for venture capital. 12 | ZELL CAPITAL Zell Capital Investment Focus Leo Polovets, General Partner at Susa Ventures in Silicon Valley

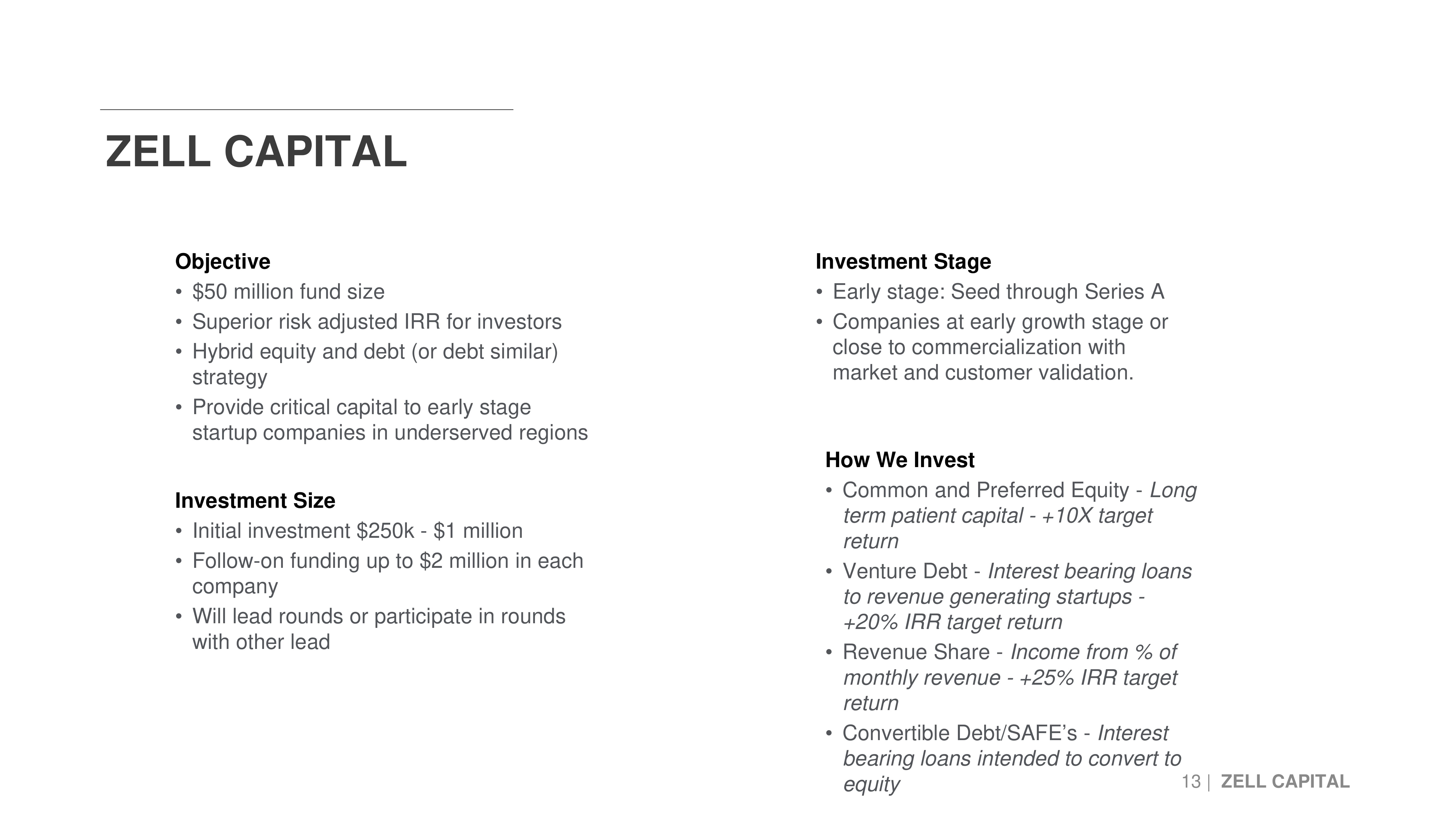

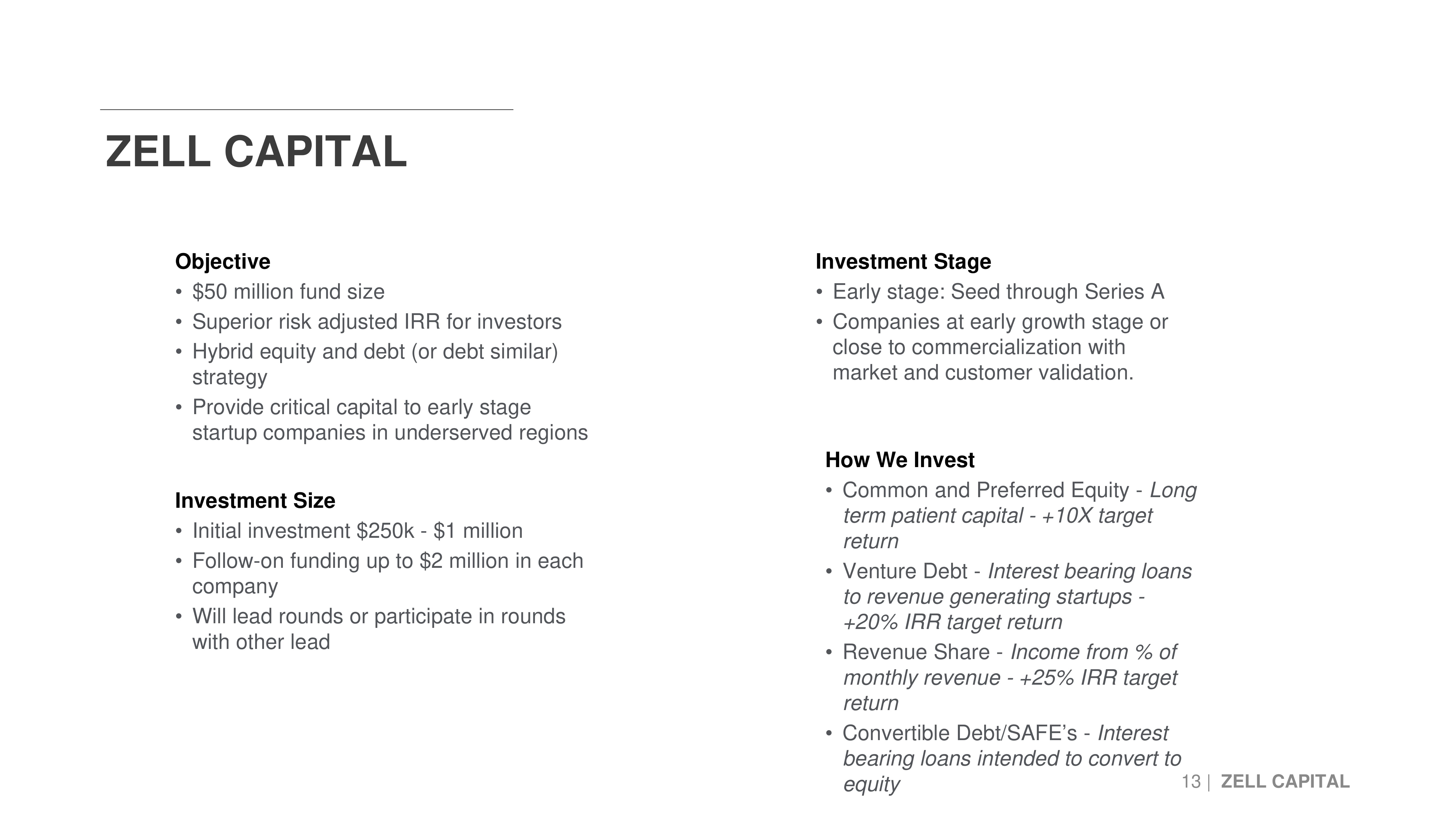

How We Invest • Common and Preferred Equity - Long term patient capital - +10X target return • Venture Debt - Interest bearing loans to revenue generating startups - +20% IRR target return • Revenue Share - Income from % of monthly revenue - +25% IRR target return • Convertible Debt/SAFE’s - Interest bearing loans intended to convert to equity Investment Stage • Early stage: Seed through Series A • Companies at early growth stage or close to commercialization with market and customer validation. ZELL CAPITAL 13 | ZELL CAPITAL Objective • $50 million fund size • Superior risk adjusted IRR for investors • Hybrid equity and debt (or debt similar) strategy • Provide critical capital to early stage startup companies in underserved regions Investment Size • Initial investment $250k - $1 million • Follow - on funding up to $2 million in each company • Will lead rounds or participate in rounds with other lead

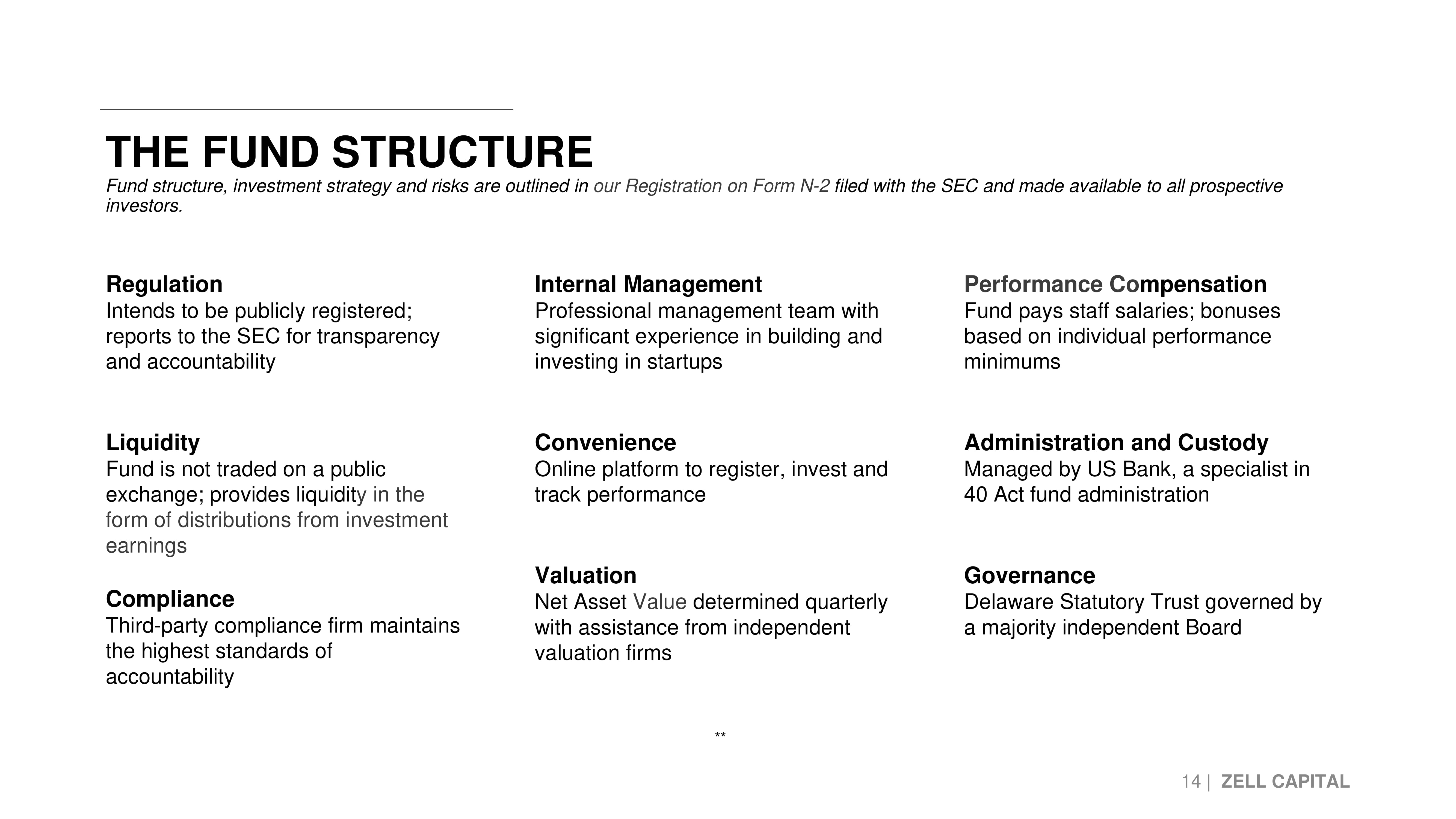

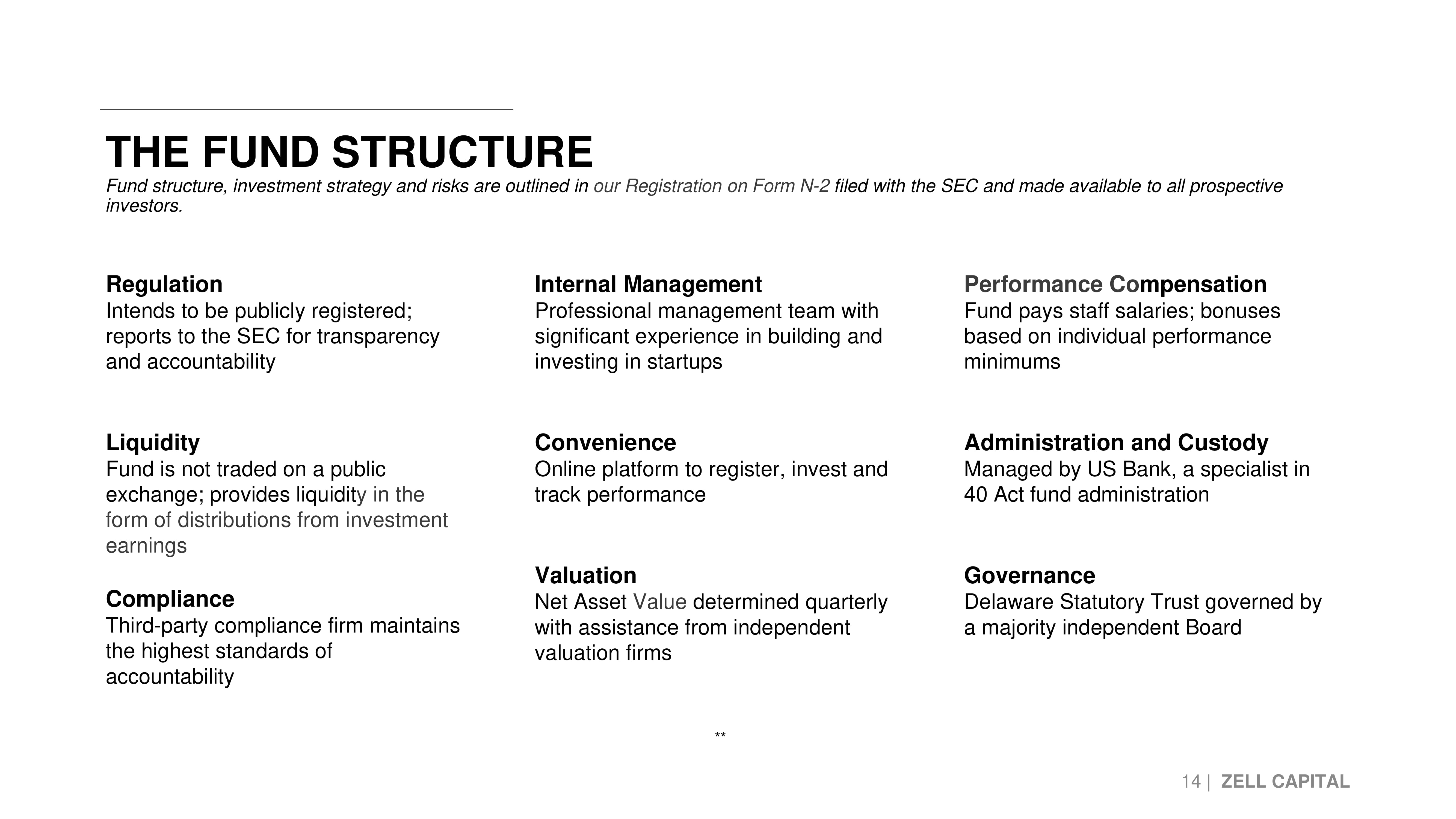

THE FUND STRUCTURE Fund structure, investment strategy and risks are outlined in our Registration on Form N - 2 filed with the SEC and made available to all prospective investors. ** Internal Management Professional management team with significant experience in building and investing in startups Convenience Online platform to register, invest and track performance Valuation Net Asset Value determined quarterly with assistance from independent valuation firms Performance Co mpensation Fund pays staff salaries; bonuses based on individual performance minimums Administration and Custody Managed by US Bank, a specialist in 40 Act fund administration Governance Delaware Statutory Trust governed by a majority independent Board Regulation Intends to be publicly registered; reports to the SEC for transparency and accountability Liquidity Fund is not traded on a public exchange; provides liquidit y in the form of distributions from investment earnings Compliance Third - party compliance firm maintains the highest standards of accountability 14 | ZELL CAPITAL

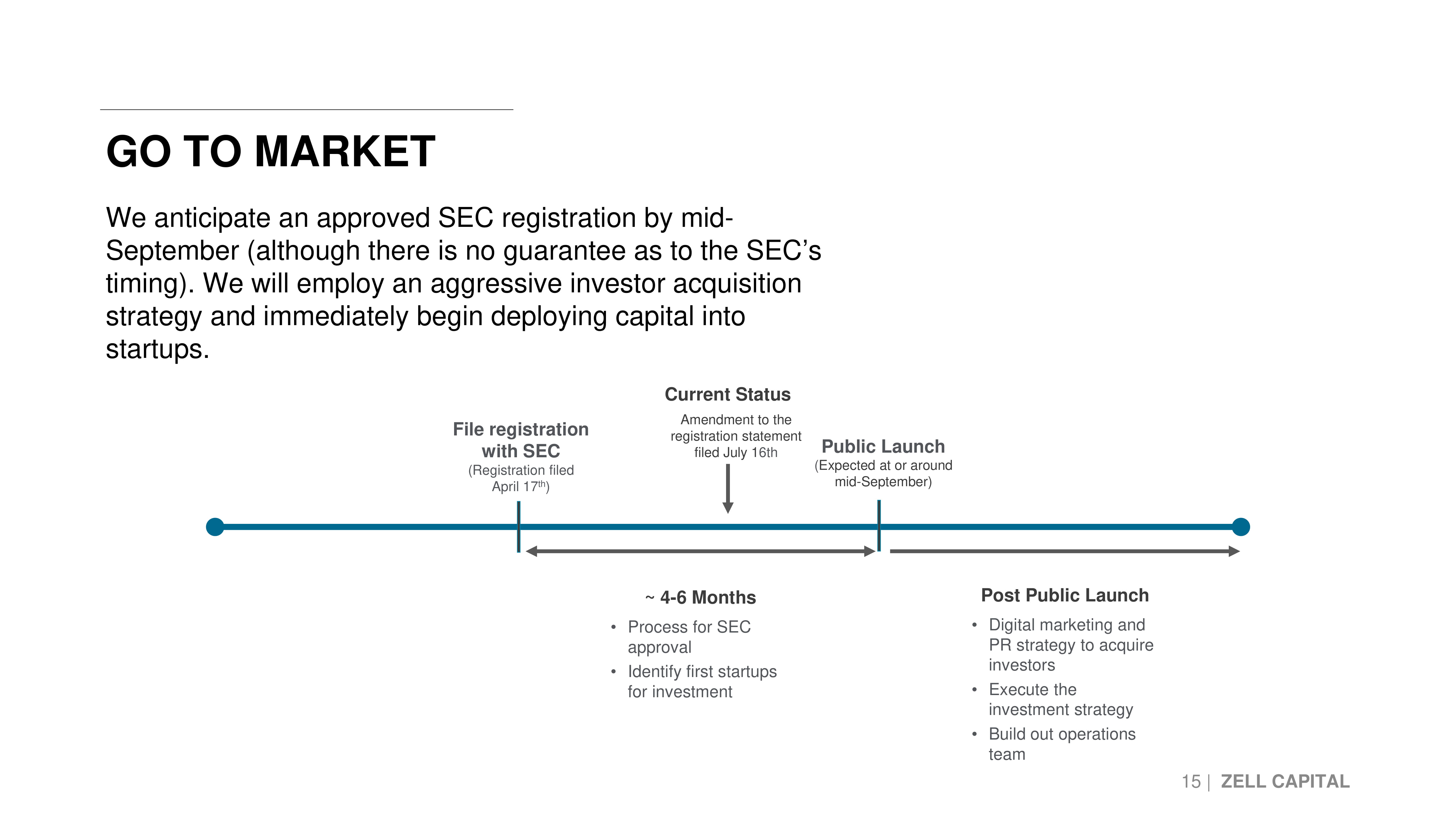

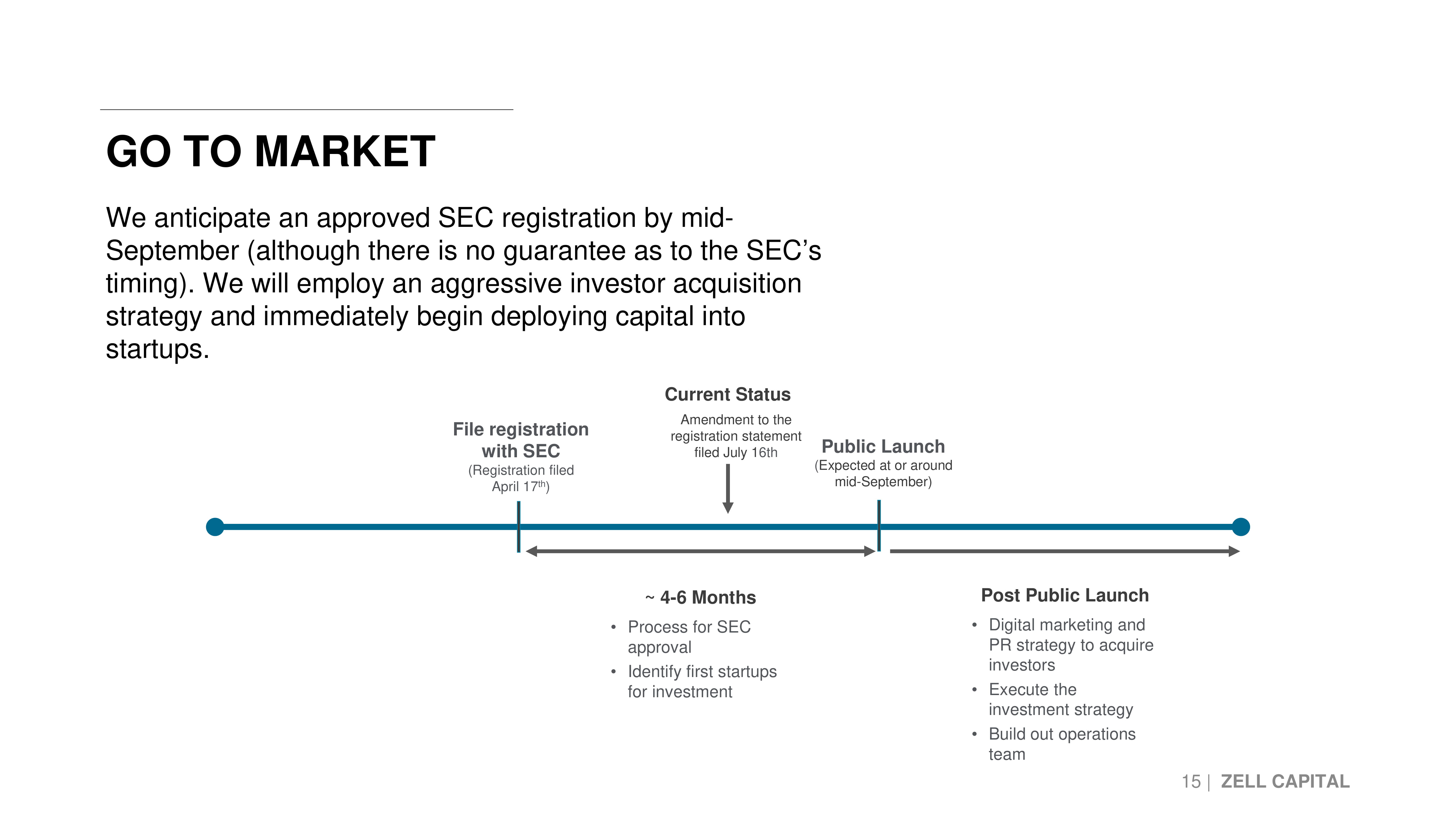

Current Status ~ 4 - 6 Months Amendment to the registration statement filed July 1 6th GO TO MARKET 15 | ZELL CAPITAL File registration with SEC (Registration filed April 17 th ) Public Launch ( Expected at or around mid - September) • Process for SEC approval • Identify first startups for investment Post Public Launch • Digital marketing and PR strategy to acquire investors • Execute the investment strategy • Build out operations team We anticipate an approved SEC registration by mid - September (although there is no guarantee as to the SEC’s timing). We will employ an aggressive investor acquisition strategy and immediately begin deploying capital into startups.

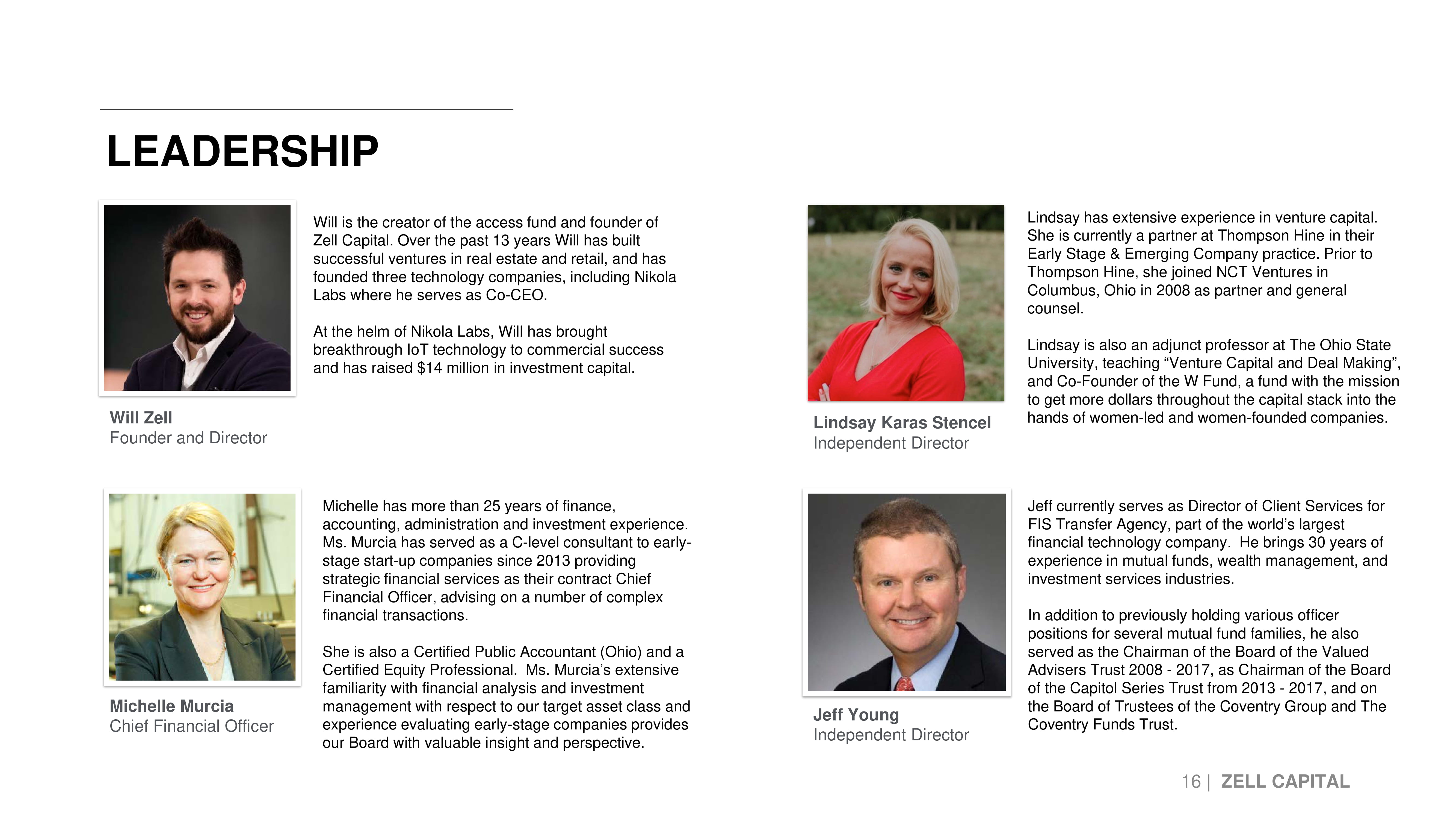

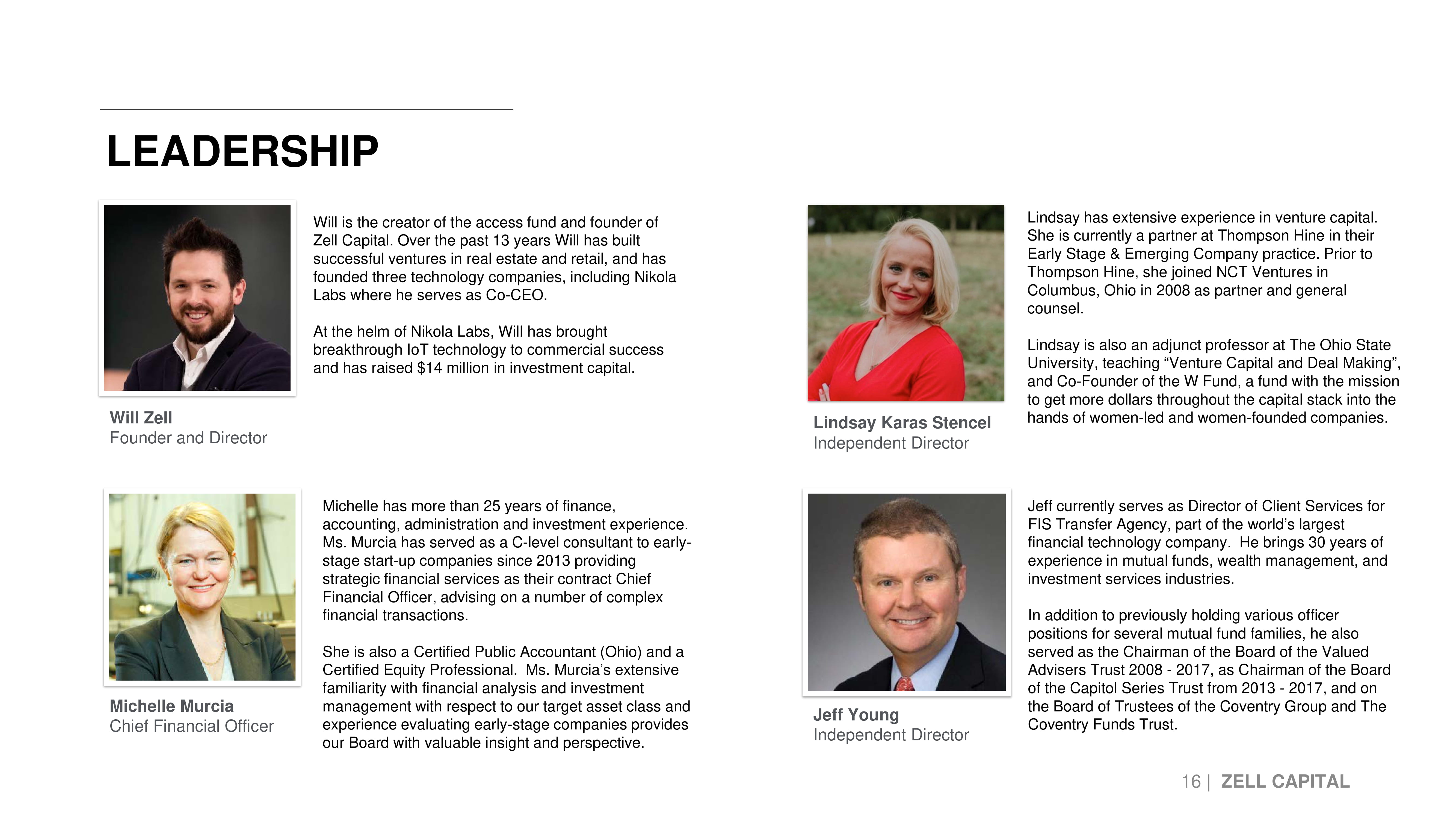

LEADERSHIP 16 | ZELL CAPITAL Will Zell Founder and Director Will is the creator of the access fund and founder of Zell Capital. Over the past 13 years Will has built successful ventures in real estate and retail, and has founded three technology companies, including Nikola Labs where he serves as Co - CEO. At the helm of Nikola Labs, Will has brought breakthrough IoT technology to commercial success and has raised $14 million in investment capital. Jeff Young Independent Director Jeff currently serves as Director of Client Services for FIS Transfer Agency, part of the world’s largest financial technology company. He brings 30 years of experience in mutual funds, wealth management, and investment services industries. In addition to previously holding various officer positions for several mutual fund families, he also served as the Chairman of the Board of the Valued Advisers Trust 2008 - 2017, as Chairman of the Board of the Capitol Series Trust from 2013 - 2017, and on the Board of Trustees of the Coventry Group and The Coventry Funds Trust. Michelle Murcia Chief Financial Officer Michelle has more than 25 years of finance, accounting, administration and investment experience. Ms. Murcia has served as a C - level consultant to early - stage start - up companies since 2013 providing strategic financial services as their contract Chief Financial Officer, advising on a number of complex financial transactions. She is also a Certified Public Accountant (Ohio) and a Certified Equity Professional. Ms. Murcia’s extensive familiarity with financial analysis and investment management with respect to our target asset class and experience evaluating early - stage companies provides our Board with valuable insight and perspective. Lindsay Karas Stencel Independent Director Lindsay has extensive experience in venture capital. She is currently a partner at Thompson Hine in their Early Stage & Emerging Company practice. Prior to Thompson Hine, she joined NCT Ventures in Columbus, Ohio in 2008 as partner and general counsel. Lindsay is also an adjunct professor at The Ohio State University, teaching “Venture Capital and Deal Making”, and Co - Founder of the W Fund, a fund with the mission to get more dollars throughout the capital stack into the hands of women - led and women - founded companies.

LEGAL DISCLOSURE This presentation is for informational purposes only and is not intended to recommend any investment discussed in this presen tat ion. All information with respect to Zell Capital and industry data have been obtained from sources believed to be reliable and cu rre nt, but accuracy cannot be guaranteed. Statements in this presentation are made as of the date specified herein and Zell Capital has no obligation to up dat e the information in this presentation. The forward looking statements contained in this presentation are only estimates of future results that are based on assumpti ons made at the time such projections were developed. There can be no assurance that the results predicted or targeted will be attained, and actual res ult s may be significantly different from the statements in this presentation. Also, general economic factors, which are not predictable, can have a material impa ct on the reliability of our targeted results. For more information, including a detailed discussion of the risks of investing in Zell Capital, please see ou r most recent Registration Statement on Form N - 2, available online at www.sec.gov , or by clicking the following hyperlink: https://www.sec.gov/Archives/edgar/data/1809051/000121390020017665/ea124178 - n2a1_zellcapital.htm In considering any performance information contained in this presentation, you should bear in mind that past performance is n o g uarantee of future results, and there can be no assurance that future investments will achieve satisfactory results.

Zell Capital Columbus, Ohio