- ALIT Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Alight (ALIT) DEF 14ADefinitive proxy

Filed: 5 Apr 23, 6:16am

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required | |

| ☐ | Fee paid previously with preliminary materials | |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and0-11 |

2023 proxy statement

ALIGHT, INC. 4 Overlook Point Lincolnshire, IL 60069

Notice of Annual Meeting of Stockholders

|  |

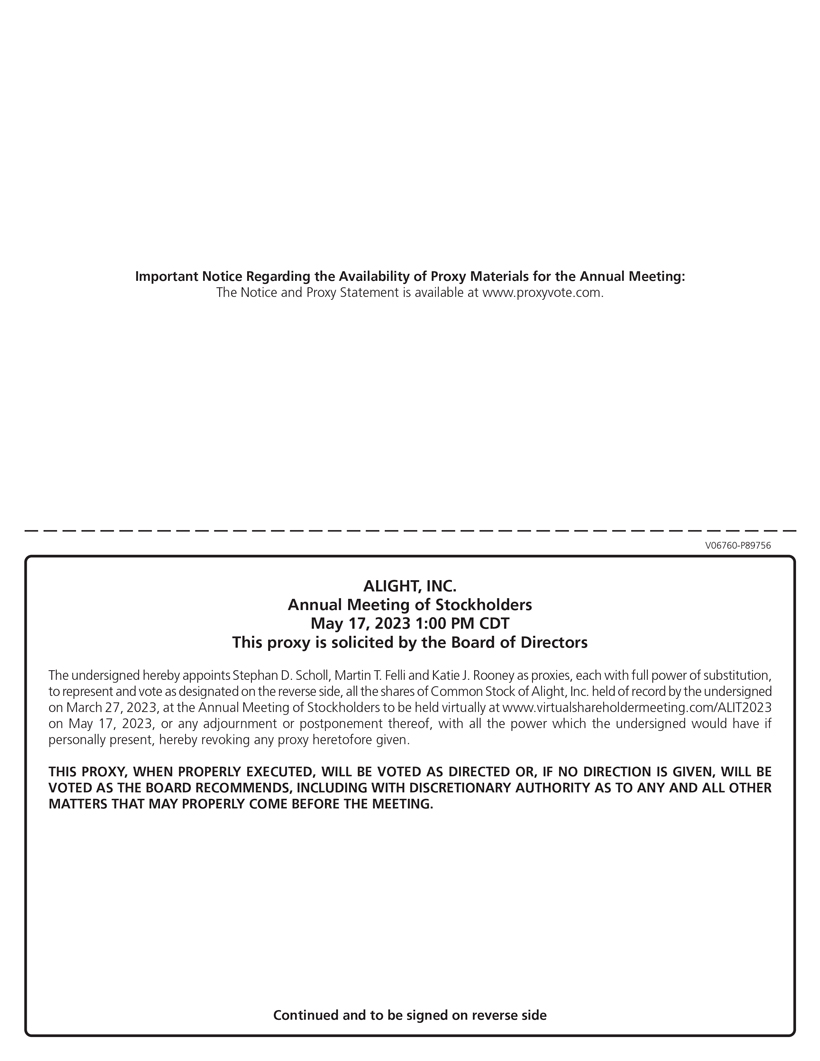

| DATE AND TIME Wednesday, May 17, 2023 1:00 pm Central Time |  | VIRTUAL LOCATION You can attend the Annual Meeting online, vote your shares electronically and submit your questions during the Annual Meeting by visiting www.virtualshareholdermeeting.com/ALIT2023.

You will need to have your 16-Digit Control Number included on your proxy card or the instructions that accompanied your proxy materials in order to join the Annual Meeting. | |||

Items of Business

1. To elect the director nominees listed in the Proxy Statement. | ||

2. To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2023. | ||

3. To approve, on an advisory (non-binding) basis, the 2022 compensation paid to our named executive officers. | ||

4. To consider such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. | ||

Record Date

| You may vote at the Annual Meeting if you were a stockholder of record at the close of business on March 27, 2023. A list of the stockholders of record at the close of business on March 27, 2023 will be available electronically during the Annual Meeting at www.virtualshareholdermeeting.com/ALIT2023 when you enter your 16-Digit Control Number. | ||

Voting By Proxy

| To ensure your shares are voted, you may vote your shares by proxy over the Internet, by telephone or by mail. Voting procedures are described on the following page and on the proxy card. | ||

By Order of the Board of Directors,

Martin T. Felli

Chief Legal Officer and Corporate Secretary

April 5, 2023

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on Wednesday, May 17, 2023: The Notice of Internet Availability, this Proxy Statement and our Annual Report are available free of charge at www.proxyvote.com. As permitted by the rules of the Securities and Exchange Commission (the “SEC”), we are furnishing our proxy materials to stockholders over the Internet. We sent a Notice of Internet Availability of Proxy Materials on or about April 5, 2023 to our stockholders of record at the close of business on March 27, 2023. The notice contains instructions on how to access our Proxy Statement and Annual Report and vote online. A list of the stockholders of record at the close of business on March 27, 2023 will also be available electronically during the Annual Meeting at www.virtualshareholdermeeting.com/ALIT2023.

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

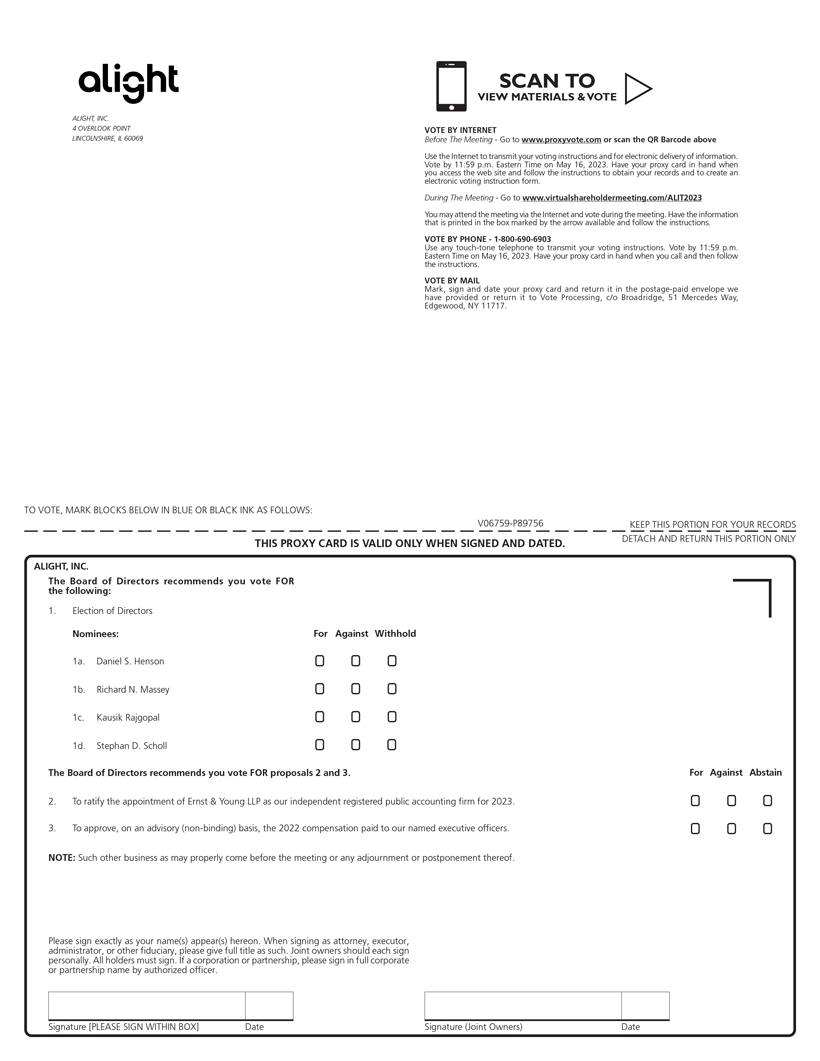

Proxy Voting Methods

If you were a stockholder of record at the close of business on March 27, 2023, you may vote your shares (i) in advance of the Annual Meeting, over the internet, by telephone or by mail, or (ii) at the Annual Meeting, by proxy or over the internet. You may also revoke your proxies at the times and in the manners described in the “Questions and Answers About our Annual Meeting” section of this Proxy Statement. For shares held through a broker, bank or other nominee, you may submit voting instructions to your broker, bank or other nominee. Please refer to information from your broker, bank or other nominee on how to submit voting instructions.

If you are a stockholder of record planning to vote before the Annual Meeting, your internet, telephone or mail vote must be received by 11:59 p.m., Eastern Time, on May 16, 2023 to be counted.

To vote by proxy if you are a stockholder of record:

| BY INTERNET

• Go to the website www.proxyvote.com and follow the instructions, 24 hours a day, seven days a week.

• You will need the 16-digit number included on your proxy card to obtain your records and to create an electronic voting instruction form.

| |

| BY TELEPHONE

• From a touch-tone telephone, dial 1-800-690-6903 and follow the recorded instructions, 24 hours a day, seven days a week.

• You will need the 16-digit number included on your proxy card in order to vote by telephone.

| |

| BY MAIL

• Mark your selections on the proxy card if you have received a paper copy of the proxy.

• Date and sign your name exactly as it appears on your proxy card.

• Mail the proxy card in the enclosed postage-paid envelope provided to you. |

YOUR VOTE IS IMPORTANT TO US. THANK YOU FOR VOTING.

2023 PROXY STATEMENT |

CONTENTS

| 1 | ||||

| 1 | ||||

| 2 | ||||

| 2 | ||||

| 2 | ||||

| 3 | ||||

| 4 | ||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| 7 | ||||

| 14 | ||||

| 16 | ||||

| 19 | ||||

| 25 | Security Ownership of Certain Beneficial Owners and Management | |||

| 27 | ||||

| 33 | ||||

| 53 | Proposal 2: Appointment of Independent Registered Public Accounting Firm | |||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| A-1 | ||||

| 1 |

Forward-Looking Statements

This Proxy Statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements may include, but are not limited to, statements that relate to expectations regarding future financial performance, and business strategies or expectations for our business. Forward-looking statements can often be identified by the use of words such as “anticipate,” “appear,” “approximate,” “believe,” “continue,” “could,” “estimate,” “expect,” “foresee,” “intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “would” or similar expressions or the negative thereof. These forward-looking statements are based on information available as of the date of this report and the Company’s management’s current expectations, forecasts and assumptions, and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside the control of the Company and its directors, officers and affiliates. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date. The Company does not undertake any obligation to update, add or otherwise correct any forward-looking statements contained herein to reflect events or circumstances after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date hereof or otherwise, except as may be required by law. As a result of a number of known and unknown risks and uncertainties, our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Factors that could affect future results, include, but are not limited to, those discussed under “Risk Factors” in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the year ended December 31, 2022.

This Proxy Statement contains statements regarding individual and Company performance objectives and targets. These objectives and targets are disclosed in the limited context of our compensation plans and programs and should not be understood to be statements of management’s future expectations or estimates of future results or other guidance. We specifically caution investors not to apply these statements to other contexts.

Website and Social Media Disclosure

We use our website (www.alight.com) and our corporate Facebook (http://www.facebook.com/AlightGlobal), Instagram (@alight_solutions), LinkedIn (www.linkedin.com/company/alightsolutions), Twitter (@alightsolutions), and YouTube (www.youtube.com/c/AlightSolutions) accounts as channels of distribution of Company information. The information we post through these channels may be deemed material. Accordingly, investors should monitor these channels, in addition to following our press releases, SEC filings and public conference calls and webcasts. The contents of our website and social media channels are not, however, a part of this Proxy Statement.

| 2 | 2023 PROXY STATEMENT |

2023 Proxy Statement Summary

|  |

This summary highlights certain information contained in the Proxy Statement. This summary does not contain all the information that you should consider, and you should read the entire Proxy Statement before voting. For more complete information regarding the Company’s performance in the fiscal year ended December 31, 2022 (“Fiscal 2022”), please review the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 (the “Form 10-K”) that accompanied this Proxy Statement.

Background

| DATE AND TIME |

| PLACE – VIRTUALLY VIA WEBCAST | |||

| May 17, 2023 | Participate in the Annual Meeting by | |||||

| 1:00 pm Central Time | visiting our Annual Meeting Website at | |||||

| www.virtualshareholdermeeting.com/ALIT2023 |

RECORD DATE — March 27, 2023

| VOTING Stockholders of record as of the close of business on the record date are entitled to vote for each director nominee and for each of the other proposals to be voted on at the Annual Meeting. Each share of Alight Class A common stock (the “Company Class A common stock”) and Alight Class V common stock (the “Company Class V common stock” and, collectively with the Company Class A common stock “Common Stock”) is entitled to one vote. | |

| VIRTUAL SHAREHOLDER MEETING Our 2023 Annual Meeting will be conducted exclusively online via live webcast, allowing all of our stockholders the option to participate in the live, online meeting from any location convenient to them, providing stockholder access to our Board of Directors (the “Board”) and management, and enhancing participation. Stockholders at the close of business on the record date will be allowed to communicate with us and ask questions in our virtual stockholder meeting forum before and during the meeting. Certain of our executive officers, as well as our independent registered public accounting firm, are expected to be available to answer questions. For further information on the virtual meeting, please see the “Notice of Annual Meeting of Stockholders” and “Proxy Voting Methods” sections of this Proxy Statement. | |

| 1 |

2023 PROXY STATEMENT SUMMARY

Proposals

Proposal |

| Board Recommendation | More Information | |||

| i. | To elect the director nominees listed in the Proxy Statement. | FOR each Nominee | on page 6 | |||

| ii. | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2023. | FOR | on page 53 | |||

| iii. | To approve, on an advisory (non-binding) basis, the 2022 compensation paid to our named executive officers. | FOR | on page 56 | |||

Board Characteristics

Experience and Skills

Skill | William P. Foley, II | Daniel S. Henson | David N. Kestnbaum | Richard N. Massey | Erika Meinhardt | Regina M. Paolillo | Kausik Rajgopal | Stephan D. Scholl | Peter F. Wallace | Denise Williams | ||||||||||||||||||||||||||||||

Strategic planning | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||

Organizational Design / Governance | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||

Technology / Product Dev | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||

Cybersecurity | ● | ● | ● | |||||||||||||||||||||||||||||||||||||

Financial control / Audit | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||

Marketing / Social Media | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||

People / Comp / Benefits | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||

Leadership | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||

International Operations | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||

Diversity, Equity & Inclusion | ● | ● | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||

Prior CEO Experience | ● | ● | ● | ● | ● | |||||||||||||||||||||||||||||||||||

Industry Knowledge Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||||||||||||||||||||||||||||||

Public/Gov’t Affairs External & Crisis Communications | ● | ● | ● | ● | ||||||||||||||||||||||||||||||||||||

| 2 | 2023 PROXY STATEMENT |

2023 PROXY STATEMENT SUMMARY

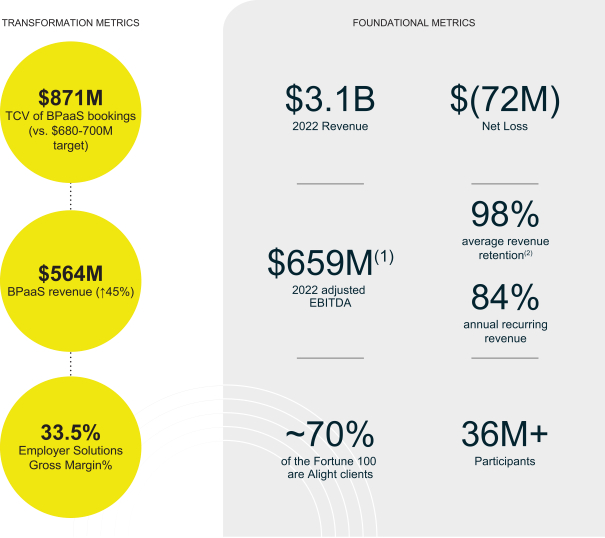

Company Performance Highlights

Solid foundation supports ongoing

transformation into 2022 and beyond.

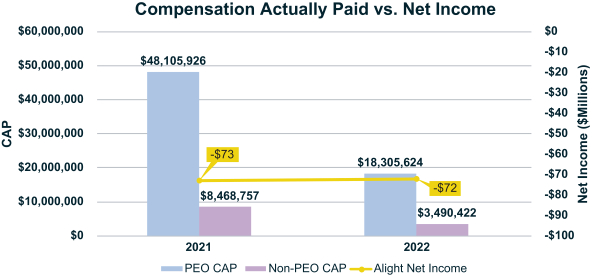

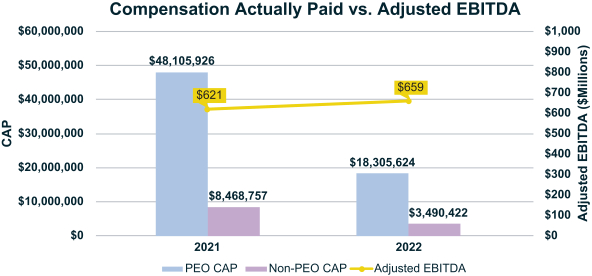

| • | Grew full year revenue 7.4% to $3,132 million and Adjusted EBITDA 6.1% to $659 million(1) |

| • | BPaaS full year revenue growth of 44.6% to $564 million |

| • | BPaaS full year bookings on a total contract value basis increased from $602 million in 2021 to $871 million in 2022, well above the $680-$700 million target |

| • | $2.9 billion of revenue for FY 23 under contract as of January 1, 2023 |

1 Please see Appendix A for a reconciliation of Adjusted EBITDA and Net Income (Loss) and other supplemental financial information.

2 Retention defined as prior year’s active client revenue compared to the following year.

| 3 |

2023 PROXY STATEMENT SUMMARY

Corporate Governance Highlights

| BOARD PRACTICES |

| ● | Non-executive chair |

| ● | 9 out of 10 Directors are independent |

| ● | Fully independent standing Board committees |

| ● | Annual Board and committee self-evaluations |

| ● | Structured process for Board’s risk oversight |

| ● | Related party transaction approval by Audit Committee |

| STOCKHOLDER MATTERS |

| ● | Recommended annual “Say-on-Pay” advisory vote |

| OTHER BEST PRACTICES |

| ● | Robust share ownership guidelines for Officers and Directors |

| ● | Executive compensation clawback policy |

| ● | Board and committee oversight of environmental, social & governance matters |

| ● | Code of Conduct |

Executive Compensation Highlights

| 4 | 2023 PROXY STATEMENT |

2023 PROXY STATEMENT SUMMARY

Investor Engagement

We engage with investors and analysts through conference calls, broker conferences, one-on-one meetings, and non-deal roadshows throughout the year. We typically discuss our financial position, strategic priorities, business outlook, and other topics of importance to investors. As we continue to grow as a public company, we will continue to engage with our stockholders regarding our ESG efforts and corporate governance practices, among other topics. We are committed to maintaining an active dialogue with investors to better understand their perspectives and consider their ideas as we continue to evolve our corporate governance and business practices, and public disclosures.

As described in our Corporate Governance Guidelines, stockholders and other interested parties who wish to communicate with a member or members of our Board, including each of the committees of the Board, or with the non-management or independent directors as a group, may do so by addressing such communications or concerns to the Company’s Corporate Secretary by email at Corporate.Secretary@alight.com or by mail at 4 Overlook Point, Lincolnshire, Illinois 60069, who will forward such communication to the appropriate party.

Awards and Recent Recognition

| • | Great Place to Work® for the fifth consecutive year |

| • | Recognized in Seramount’s Inclusion Index for inclusive workplace environment |

| • | Best Place to Work by Parents@Work |

| • | Top 100 companies for remote workers by Flexjobs for the sixth consecutive year |

| • | 2023 Stevie® Awards Gold Winner for Sales & Customer Service |

| • | Recognized by Seramount as a Top Companies for Executive Women, a Best Company for Dads, and a Top 100 Best Company for 2022 |

| • | Top 100 Best Companies for 2022 by Seramount |

| • | Top 100 Hybrid Role Employer by Flexjobs in 2022 |

| • | Stephan Scholl recognized by Crain’s Chicago Business 2022 Notable Executive in HR and Diversity, Equity and Inclusion (DE&I) |

| • | In 2021, Alight earned a perfect score on the Human Rights Campaign Foundation’s Corporate Equality Index for the third consecutive year and was also designated a Best Place to Work for LGBTQ+ Equality |

| • | Alight has also received recognition from the Black EOE Journal, Hispanic Network Magazine, US Veterans Magazine and Professional Woman’s Magazine |

|  |  | ||

|

| |||

|  |  | ||

| 5 |

PROPOSAL 1

Election of Directors

|  |

Our Board is currently comprised of ten directors. As described in our Amended and Restated Certificate of Incorporation (the “Certificate of Incorporation”), our Board is currently divided into three classes. The term of our Class II directors expires at this Annual Meeting, the term of our Class III directors expires at the annual meeting of stockholders in 2024 and the term of our Class I directors expires at the annual meeting of stockholders in 2025. Upon the recommendation of the Nominating and Corporate Governance Committee, the Board has considered and nominated Daniel S. Henson, Richard N. Massey, Kausik Rajgopal and Stephan D. Scholl to serve as Class II directors, with a three-year term expiring in 2026, for election at the Annual Meeting. Action will be taken at the Annual Meeting for the election of these four Class II Director nominees.

The following table describes the schedule for the election of our directors over the next three annual meetings and the terms our directors will serve if elected.

MEETING | CLASS OF DIRECTORS STANDING FOR ELECTION | TERM IF ELECTED | ||

2023 Annual Meeting | Class II | Three-year term expiring at 2026 Annual Meeting | ||

2024 Annual Meeting | Class III | Three-year term expiring at 2027 Annual Meeting | ||

2025 Annual Meeting | Class I | Three-year term expiring at 2028 Annual Meeting | ||

If you return a duly executed proxy card without specifying how your shares are to be voted, the persons named in the proxy card will vote to elect Daniel S. Henson, Richard N. Massey, Kausik Rajgopal and Stephan D. Scholl as Class II directors. Daniel S. Henson, Richard N. Massey, Kausik Rajgopal and Stephan D. Scholl currently serve on our Board and have indicated their willingness to continue to serve if elected. However, if any director nominee should be unable to serve, or for good cause will not serve, the Common Stock represented by proxies may be voted for a substitute nominee designated by our Board, or our Board may reduce its size. Our Board has no reason to believe that any of the nominees will be unable to serve if elected.

Board Recommendation

The Board unanimously recommends that you vote “FOR” the election of each of the four Class II Director nominees named above.

| 6 | 2023 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS

Our Board of Directors

The biographies of each of our current directors, including our Class II director nominees, are included below. Each of the biographies highlights specific experience, qualifications, attributes and skills that led us to conclude that such person should serve as a director. We believe that, as a whole, our Board exemplifies the highest standards of personal and professional integrity and the requisite skills and characteristics, leadership traits, work ethic and independence to provide effective oversight. No director or executive officer is related by blood, marriage or adoption to any other director or executive officer. Other than as provided by our Investor Rights Agreement, no arrangements or understandings exist between any director and any other person pursuant to which such person was selected as a director or nominee. Eight of our current directors, Mr. Foley, Mr. Henson, Mr. Kestnbaum, Mr. Massey, Ms. Meinhardt, Ms. Paolillo, Mr. Wallace, and Ms. Williams, were designated pursuant to our Investor Rights Agreement. See “Certain Relationships and Related Person Transactions – Investor Rights Agreement – Designation Rights.”

NAME | AGE | POSITION | ||

William P. Foley, II | 78 | Chairman | ||

Daniel S. Henson | 62 | Director | ||

David N. Kestnbaum | 41 | Director | ||

Richard N. Massey | 67 | Director | ||

Erika Meinhardt | 64 | Director | ||

Regina M. Paolillo | 64 | Director | ||

Kausik Rajgopal | 49 | Director | ||

Stephan D. Scholl | 52 | Chief Executive Officer and Director | ||

Peter F. Wallace | 48 | Director | ||

Denise Williams | 62 | Director | ||

Class II Directors

| Daniel S. Henson, Director |

DIRECTOR SINCE 2021

AGE 62

COMMITTEES

Audit Compensation

Nominating and Corporate Governance (Chair) | Previously, Mr. Henson served as the non-executive chairman of Alight Holding Company, LLC, (f/k/a Tempo Holding Company, LLC) (“Alight Holdings”) our predecessor entity, from May 2017 to July 2021. Mr. Henson serves as the non-executive chairman of Paysafe Ltd. (NYSE: PSFE) (“Paysafe”), a payments platform that connects businesses and consumers across payment types. Mr. Henson also serves as non-executive chairman of IntraFi Network (formerly Promontory Intrafinancial Network), a leading provider of deposit placement services operating in the Washington D.C. area. Prior to serving in these roles, Mr. Henson had served as a non-executive chairman of Exeter Finance, a director of Healthcare Trust of America and the lead director of OnDeck Capital. Mr. Henson worked with the General Electric Company (“GE”) for 29 years and held a variety of senior positions at GE and GE Capital, including Chief Marketing Officer of GE and Six Sigma Quality Leader at GE Capital. He also served as the Chief Executive Officer of a number of GE Capital’s financial services businesses in the U.S. and internationally. Starting in 2008, Mr. Henson was responsible for all GE Capital commercial leasing and lending businesses in North America. From 2009 to 2015, Mr. Henson also oversaw capital markets activities at GE Capital and GE Capital’s industrial loan company bank in Utah. Mr. Henson holds a B.B.A. in Marketing from George Washington University. Mr. Henson’s qualifications to serve on the Board include his extensive experience with GE and GE Capital and his other directorships, including on a public company board.

| |||

| 7 |

PROPOSAL 1: ELECTION OF DIRECTORS

| Richard N. Massey, Director |

DIRECTOR SINCE 2021

AGE 67

COMMITTEES

Compensation (Chair) | Mr. Massey served as Chairman of Foley Trasimene Acquisition Corp. (“FTAC”) from April 2021 to July 2021. He also has served as Chief Executive Officer of FTAC from March 2020 to July 2021 and served as a member of the FTAC board of directors from May 2020 to July 2021. In addition, he serves as a Senior Managing Director of Trasimene Capital Management LLC and has served as Chief Executive Officer of Cannae Holdings, Inc. (NYSE: CNNE) (“Cannae”) since November 2019. Mr. Massey has also served as the Chief Executive Officer of Austerlitz Acquisition Corp. I (NYSE: AUS) and Austerlitz Acquisition Corp. II (NYSE: ASZ) from January 2021 through December 2022 and served as a director of each company from February 2021 until April 2022. Mr. Massey also served as Chief Executive Officer of Foley Trasimene Acquisition Corp. II from July 2020 until March 2021 and as a director from August 2020 until March 2021. Mr. Massey served as the Chairman and principal shareholder of Bear State Financial, Inc., a publicly traded financial institution from 2011 until April 2018. Mr. Massey has served on the boards of directors of Cannae since June 2018 and of Dun & Bradstreet (NYSE: DNB) (“DNB”) since February 2019. Mr. Massey previously served on Black Knight Inc.’s board of directors from December 2014 until July 2020 and on Fidelity National Financial (NYSE: FNF)’s (“FNF”) board of directors from February 2006 until January 2021. Mr. Massey has been a partner in Westrock Capital, LLC, a private investment partnership, since January 2009. Prior to that, Mr. Massey was Chief Strategy Officer and General Counsel of Alltel Corporation and served as a Managing Director of Stephens Inc., a private investment bank, during which time his financial advisory practice focused on software and information technology companies. Mr. Massey also formerly served as a director of Fidelity National Information Services Inc. (“FIS”), Bear State Financial, Inc. and FGL Holdings. Mr. Massey is also a director of the Oxford American Literary Project and of the Arkansas Razorback Foundation. Mr. Massey has a long track record in corporate finance and investment banking, as a financial, strategic and legal advisor to public and private businesses, and in identifying, negotiating and consummating mergers and acquisitions. Mr. Massey’s qualifications to serve on the board of directors of the Company include his significant financial expertise and experience on the boards of a number of public companies.

| |||

| 8 | 2023 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS

| Kausik Rajgopal, Director |

DIRECTOR SINCE 2023

AGE 49

COMMITTEES

None | Mr. Rajgopal has served as Executive Vice President of People & Sourcing at PayPal Holdings, Inc. since June 2021, where he leads the company’s global human resources, procurement, real estate and the payments markets and partnership teams. Before joining PayPal, from 2006 to 2021, Mr. Rajgopal played several leadership roles at McKinsey & Company, including serving as the global lead for the payments practice and as managing partner for the San Francisco and Silicon Valley offices and for the Western U.S. Region. Most recently from July 2012 to June 2021, Mr. Rajgopal was the firm’s co-managing partner for the United States, where he was responsible for client services across all industry sectors as well as people initiatives. Mr. Rajgopal serves as chair of the board and executive committee of the Bay Area Council, and as vice chair of the Stanford Graduate School of Business Advisory Council. He holds undergraduate degrees in industry engineering and political science, as well as an MBA from Stanford University. Mr. Rajgopal’s qualifications to serve on the Board include his unique blend of senior leadership expertise in human resources, technology, payments and financial services.

| |||

| Stephan D. Scholl, Director and Chief Executive Officer |

DIRECTOR SINCE 2021

AGE 52

COMMITTEES

None

| Mr. Scholl has more than 25 years of experience in the industry. Prior to joining Alight in April 2020, Mr. Scholl served as President of Infor Global Solutions from April 2012 to July 2018. Prior to that, from 2011 until 2012, Mr. Scholl served as President and Chief Executive Officer of Lawson Software from 2011 until 2012. In addition, Mr. Scholl served in various senior roles at both Oracle and Peoplesoft for more than a decade, including leading Oracle’s North America Consulting Group and leading its Tax and Utilities Global Business unit. Since September 2018, Mr. Scholl has served on the boards of Avaya Holdings Corp. (NYSE: AVYA) and 1010 Data, a leader in analytical intelligence and alternative data. Mr. Scholl holds a bachelor’s degree from McGill University in Montreal.

| |||

| 9 |

PROPOSAL 1: ELECTION OF DIRECTORS

Class III Directors (Terms to Expire in 2024)

| William P. Foley, II, Chairman |

DIRECTOR SINCE 2021

AGE 78

COMMITTEES

Nominating and Corporate Governance | Mr. Foley has served as the non-executive Chairman of the board of directors of Alight since April 2021 and served on the board of its predecessor, FTAC from May 2020 through April 2021 and as the Executive Chairman of FTAC from March 2020 until May 2020. Mr. Foley has served as the Chairman of Cannae since July 2017 (including as non-executive Chairman since May 2018). Mr. Foley has served as the Managing Member and a Senior Managing Director of Trasimene Capital Management, LLC, a private company that provides certain management services to Cannae, since November 2019. Mr. Foley is a founder of FNF and has served as Chairman of the board of directors of FNF since 1984. He served as Chief Executive Officer of FNF until May 2007 and as President of FNF until December 1994. Mr. Foley has also served as Chairman of DNB since February 2019 and as Executive Chairman since February 2022. Mr. Foley served as director of System 1, Inc. (NYSE: SST) from January 2022 through March 2023. Mr. Foley formerly served as Chairman of Black Knight, Inc. (NYSE: BKI), Chairman of Paysafe (NYSE: PSFE), Co-Chairman of FGL Holdings (NYSE: FG), as Vice Chairman of FIS, and as a director of Ceridian HCM Holdings, Inc. (NYSE: CDAY) and special purpose acquisition companies Foley Trasimene Acquisition Corp., Foley Trasimene Acquisition Corp. II, Austerlitz Acquisition Corporation I (NYSE: ASZ), Austerlitz Acquisition Corporation II (NYSE: ASZ), and Trebia Acquistion Corp.

Mr. Foley is Executive Chairman and Chief Executive Officer of Black Knight Sports and Entertainment LLC, which is the private company that owns the Vegas Golden Knights, a National Hockey League team. He is also the founder and owner of Foley Family Wines Inc., a private company, and Chairman of Foley Wines Ltd., a New Zealand company. Mr. Foley serves on the boards of numerous foundations, including The Foley Family Charitable Foundation and the Cummer Museum of Art and Gardens. He is a founder, trustee and director of The Folded Flag Foundation, a charitable foundation that supports our nation’s Gold Star families.

After receiving his B.S. degree in engineering from the United States Military Academy at West Point, Mr. Foley served in the U.S. Air Force, where he attained the rank of captain. Mr. Foley received his M.B.A. from Seattle University and his J.D. from the University of Washington.

Mr. Foley’s qualifications to serve on the Board include more than 30 years as a director and executive officer of FNF, his strategic vision, his experience as a board member and executive officer of public and private companies in a wide variety of industries, and his strong track record of building and maintaining shareholder value and successfully negotiating mergers and acquisitions.

| |||

| 10 | 2023 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS

| David N. Kestnbaum, Director |

DIRECTOR SINCE 2021

AGE 41

COMMITTEES

None

| Mr. Kestnbaum served as a member of the board of directors of Alight Holdings from May 2017 to July 2021. Mr. Kestnbaum is a Senior Managing Director in the Private Equity Group at Blackstone Inc. (“Blackstone”). Since joining Blackstone in 2013, Mr. Kestnbaum has been involved in the execution of Blackstone’s investments in Alight, Ancestry, Candle Media, Merlin, Encore, Packers Sanitations Services Inc., Cloverleaf Cold Storage, SESAC, SERVPRO, Tradesmen, Outerstuff, Allied Barton Security Services, DJO Global and AVINTIV, and in evaluating investment opportunities across multiple sectors, including Business Services, Transportation & Logistics, Travel & Leisure, Apparel, and various other industries. Before joining Blackstone, Mr. Kestnbaum was a Vice President of Vestar Capital Partners, where he analyzed and executed private equity investments in multiple different sectors. Prior to Vestar, Mr. Kestnbaum worked in investment banking as a member of JPMorgan’s Financial Sponsor Group, where he executed a variety of private equity-related M&A and financing transactions. He currently serves as a Director of Ancestry, Candle Media, Encore, SERVPRO, SESAC and Tradesmen, and was previously a Director of AlliedBarton Security Services, DJO Global, Outersuff, and Packers Sanitation Services, Inc. Mr. Kestnbaum holds a B.A. in Political Science from The University of North Carolina at Chapel Hill. Mr. Kestnbaum’s qualifications to serve on the board of directors of the Company include his extensive experience with Blackstone’s portfolio investments and his other directorships.

| |||

| Peter F. Wallace, Director |

DIRECTOR SINCE 2021

AGE 48

COMMITTEES

Compensation

| Mr. Wallace served as a member of the board of directors of Alight Holdings from May 2017 to July 2021. Mr. Wallace is a Senior Managing Director and serves as co-head of U.S. Acquisitions for Blackstone’s Private Equity Group. Since joining Blackstone in 1997, Mr. Wallace has led or been involved in Blackstone’s investments in Alight, AlliedBarton Security Services, Allied Waste, American Axle & Manufacturing, Centennial Communications, Centerplate (formerly Volume Services America), CommNet Cellular, GCA Services, LocusPoint Networks, Michaels Stores, New Skies Satellites, Outerstuff, Ltd., Packers Sanitation Services Inc., Pinnacle Foods/Birds Eye Foods, PSAV, SeaWorld Parks & Entertainment (formerly Busch Entertainment Corporation), Service King, Sirius Satellite Radio, Tradesmen International, Universal Orlando, Vivint, Vivint Solar, and The Weather Channel Companies. Mr. Wallace serves on the board of directors of Outerstuff, Ltd., Service King, Tradesmen International, Vivint (NYSE: VVNT) and Vivint Solar. Mr. Wallace received a B.A. from Harvard College, where he graduated magna cum laude. Mr. Wallace’s qualifications to serve on the board of directors of the Company include his extensive experience with Blackstone’s portfolio investments and his other directorships, including of a public company board.

| |||

| 11 |

PROPOSAL 1: ELECTION OF DIRECTORS

Class I Director Nominees (Terms to Expire in 2025)

| Erika Meinhardt, Director |

DIRECTOR SINCE 2021

AGE 64

COMMITTEES

Audit | Ms. Meinhardt has served as a member of the board of directors of Cannae since July 2018. Since January 2018, Ms. Meinhardt has served as Executive Vice President of FNF. She previously served as President of National Agency Operations for FNF’s Fidelity National Title Group from February 2005 until January 2018. Prior to assuming that role, she served as Division Manager and National Agency Operations Manager for FNF from 2001 to 2005. Ms. Meinhardt previously served as a director of Foley Trasimene Acquisition Corp. II from August 2020 to March 2021 and as a director of Austerlitz Acquisition Corp. I (NYSE: AUS) and Austerlitz Acquisition Corp. II (NYSE: ASZ) from February 2021 to December 2022. Ms. Meinhardt’s qualifications to serve on the Board include her experience as an executive of FNF and in managing and growing complex business organizations as President of FNF’s National Agency Operations.

| |||

| Regina M. Paolillo, Director |

DIRECTOR SINCE 2021

AGE 64

COMMITTEES

Audit (Chair)

Nominating and Corporate Governance | Ms. Paolillo served as the Executive Vice President, Chief Financial & Administrative Officer of TTEC Holdings, Inc. (Nasdaq: TTEC) (“TTEC”) from 2011 to 2022. Between 2009 and 2011, Ms. Paolillo was an Executive Vice President for enterprise services and Chief Financial Officer at Trizetto Group, Inc., a privately held professional services company serving the healthcare industry. Between 2007 and 2008, Ms. Paolillo served as a Senior Vice President, operations group for General Atlantic, a leading global growth equity firm. Between 2005 and 2007, Ms. Paolillo served as an Executive Vice President for revenue cycle and mortgage services at Creditek, a Genpact subsidiary. Prior to Creditek’s acquisition by Genpact, between 2003 and 2005 and during 2002 and 2003, Ms. Paolillo was Creditek’s Chief Executive Officer and Chief Financial Officer, respectively. Ms. Paolillo also served as the Chief Financial Officer and Executive Vice President for corporate services at Gartner, Inc., an information technology research and advisory company. Ms. Paolillo is a member of the board of directors of Unisys Corporation (NYSE: UIS). Ms. Paolillo holds a B.S. in accounting from University of New Haven. Ms. Paolillo’s qualifications to serve on the Board include her experience as an executive of TTEC, her experience as a Chief Financial Officer of three organizations and her experience on a public company board.

| |||

| 12 | 2023 PROXY STATEMENT |

PROPOSAL 1: ELECTION OF DIRECTORS

| Denise Williams, Director |

DIRECTOR SINCE 2023

AGE 62

COMMITTEES

None | Ms. Williams has served as Chief People Officer at FIS, a global leader in financial services technology since April 2016. Between 2001 and 2016, Ms. Williams served in several capacities for IBM. Most recently, from May 2011 to April 2016, Ms. Williams served as Vice President, Human Resources North America, from May 2007 to May 2011 she was the Director Human Resources – Global Hardware Sales, from May 2004 to May 2007, she was the Director Human Resources – Websphere, and from June 2001 to May 2004 she was the Program Manager of Executive Compensation & Succession Planning. Ms. Williams previously held human resources roles at Alliance Bernstein, First Data, Avis and Coopers & Lybrand. Ms. Williams earned her bachelor’s degree from SUNY Albany and is a current member of organizations including the Human Resources Policy Association and the Center on Executive Compensation. Ms. Williams’ qualifications to serve on the Board include her more than 25 years of experience in human resources and her leadership experience across numerous market-leading organizations.

| |||

| 13 |

Director Compensation

|  |

William P. Foley, II, Daniel S. Henson, Richard N. Massey, Erika Meinhardt, and Regina M. Paolillo received compensation for serving on our Board during the year ended December 31, 2022. Employee directors and directors employed by Blackstone currently receive no compensation for serving on the Board. However, all directors are reimbursed for their reasonable out-of-pocket expenses related to their service as a member of the Board.

Description of Director Compensation.

With respect to Fiscal 2022, the compensation program for non-employee directors (other than directors affiliated with Blackstone) consisted of the following:

COMPENSATION TYPE | ANNUAL AMOUNT | |

Chairperson of the Board annual cash retainer | $500,000 | |

Board member annual equity grant | $150,000 | |

Board member annual cash retainer(1) | $70,000 | |

Committee chair annual cash retainer | $30,000 Audit Committee $20,000 other committees | |

Committee member annual cash retainer | $15,000 Audit Committee $10,000 other committees | |

(1) For the purpose of clarification, the Board member annual cash retainer is not paid to the Chairperson.

Cash retainers are paid on a quarterly basis. Non-employee directors can elect to receive fully vested shares of the Company Class A common stock in lieu of cash payment or split such quarterly payments into designated percentages of cash and shares of the Company Class A common stock.

Equity Ownership Guidelines

The Compensation Committee maintains equity ownership guidelines to promote substantial equity ownership by the Board and align their interests with the interests of our long-term stockholders. Each non-employee Director who receives compensation for their service on the Board is required to own equity equal to a multiple of their retainer, reflecting such Director’s role and level of responsibility. Directors who have not yet met their equity ownership requirements are required to retain 100% of their after-tax shares until the share ownership requirement is met. Directors have five years to meet their ownership requirements after becoming a Director.

TITLE/POSITION | STOCK OWNERSHIP REQUIREMENT | |||

Chairperson of the Board | 10x Retainer | |||

All Other Non-Employee Directors | 5x Retainer | |||

| 14 | 2023 PROXY STATEMENT |

DIRECTOR COMPENSATION

Director Compensation for 2022

The following table provides summary information concerning the compensation of our directors, other than our employee directors and those affiliated with Blackstone, for the year ended December 31, 2022.

NAME | FEES EARNED OR PAID IN CASH(1) | STOCK AWARDS(2) | ALL OTHER COMPENSATION | TOTAL | ||||||||||||

William P. Foley, II | $ | 509,992 | $ | 148,799 | — | $ | 658,791 | |||||||||

Daniel S. Henson | $ | 112,208 | $ | 148,799 | — | $ | 261,007 | |||||||||

Richard N. Massey | $ | 89,995 | $ | 148,799 | — | $ | 238,793 | |||||||||

Erika Meinhardt | $ | 85,003 | $ | 148,799 | — | $ | 233,802 | |||||||||

Regina M. Paolillo | $ | 109,997 | $ | 148,799 | — | $ | 258,796 | |||||||||

(1) Amounts reported represent annual cash retainers and Committee fees paid to our non-employee directors for Fiscal 2022. Mr. Massey and Ms. Meinhardt elected to receive 100% of their pro-rated annual cash retainers in the form of unrestricted shares of the Company Class A common stock paid quarterly. Ms. Paolillo elected to receive 100% of her pro-rated annual cash retainer in the form of unrestricted shares of the Company Class A common stock for Q1 and Q2 and elected to receive 50% of her pro-rated annual cash retainer in the form of unrestricted shares of the Company Class A common stock and 50% in cash for Q3 and Q4. Mr. Foley elected to receive 60% of his pro-rated annual cash retainer in the form of unrestricted shares of the Company Class A common stock and 40% in cash for Q1 and Q2 and elected to receive 75% of his pro-rated annual cash retainer in the form of unrestricted shares of the Company Class A common stock and 25% in cash for Q3 and Q4. Mr. Henson elected to receive 100% of his pro-rated annual cash retainer in the form of cash paid quarterly.

(2) Amounts reported represent the aggregate Grant Date (as defined below) fair value of time-vested RSU awards granted to our non-employee directors in Fiscal 2022, calculated in accordance with FASB ASC Topic 718. The Grant Date fair value with respect to the time-vested RSUs is calculated by multiplying the number of shares subject to the RSUs by $6.825, the average opening and closing of the Company Class A common stock on July 1, 2022 (the “Grant Date”). The time-vested RSUs vest on July 1, 2023 subject to the director’s continued active service with Alight through the vesting date, except in the case of death, disability, termination within six months prior to a change-in-control or within eighteen months following a change-in-control, and certain involuntary terminations. As of December 31, 2022, the number of outstanding RSUs held by our non-employee directors was as follows: 21,802 time-vested RSUs held by each of Mr. Henson, Mr. Massey, Ms. Meinhardt and Ms. Paolillo. As of December 31, 2022, Mr. Foley held 105,136 time-vested RSUs and, assuming achievement of the performance metrics at target performance levels 250,000 performance-vested RSUs.

| 15 |

Executive Officers

|  |

NAME | AGE | POSITION | ||

Stephan D. Scholl | 52 | Chief Executive Officer and Director | ||

Katie J. Rooney | 44 | Chief Financial Officer | ||

Gregory R. Goff | 51 | Chief Technology and Delivery Officer | ||

Cesar Jelvez | 49 | Chief Professional Services and Global Payroll Officer | ||

Dinesh V. Tulsiani | 49 | Chief Strategy Officer | ||

Martin T. Felli | 55 | Chief Legal Officer & Corporate Secretary | ||

Michael J. Rogers | 41 | Chief Human Resources Officer | ||

As Mr. Scholl also serves as a director of the Company, his information is presented above in this Proxy Statement under the heading “Proposal 1 – Election of Directors - Directors, Executive Officers and Corporate Governance – Class II Directors.”

| Katie J. Rooney, Chief Financial Officer |

OFFICER SINCE 2017

AGE 44 | Ms. Rooney has more than 20 years of experience in the industry. Prior to joining Alight in May 2017, Ms. Rooney served as the Chief Financial Officer for Aon Hewitt from January 2016 to May 2017. Prior to that, she served across various financial roles within Aon Hewitt and Aon from January 2009 to December 2015, including Chief Financial Officer of the Outsourcing business, the Finance Chief Operating Officer and Assistant Treasurer for Aon. Before joining Aon, Ms. Rooney worked in Investment Banking at Morgan Stanley. Ms. Rooney serves on the Board of Trustees for Window to the World Communications, Inc., owner of WTTW and WFMT. Ms. Rooney holds a B.B.A. in Finance from the University of Michigan.

| |||

| 16 | 2023 PROXY STATEMENT |

EXECUTIVE OFFICERS

| Gregory R. Goff, Chief Technology and Delivery Officer |

OFFICER SINCE 2020

AGE 51 | Mr. Goff has more than 15 years of experience in the industry. Prior to joining Alight in May 2020, Mr. Goff served as Chief Product Officer of Uptake since 2015. Mr. Goff served as Chief Technology Officer of Morningstar from 2011 through 2015. Prior to that, Mr. Goff served in a number of technology roles at Nielsen and Accenture. Mr. Goff serves on the board of directors of InMoment, a consumer experience provider. Mr. Goff holds a B.S. degree in electrical engineering from the University of Illinois at Urbana-Champaign. | |||

| Cesar Jelvez, Chief Professional Services and Global Payroll Officer |

OFFICER SINCE 2020

AGE 49 | Mr. Jelvez has more than 20 years of experience in the industry. Prior to joining Alight in May 2020, Mr. Jelvez was a partner at Elixirr from November 2019 to May 2020. From August 2017 through November 2019, Mr. Jelvez was Global Leader of Strategic Programs and Global Delivery Services at Infor. From September 2014 through August 2017, Mr. Jelvez was Vice President of Digital Enterprise Application Services at DXC Technology. Prior to that, Mr. Jelvez served in a number of roles at Cognizant Technology Solutions, Infosys, IBM Global Business Services and Accenture. Mr. Jelvez holds a M.S. degree in finance and investment from the University of York in the United Kingdom. | |||

| Dinesh V. Tulsiani, Chief Strategy Officer |

OFFICER SINCE 2017

AGE 49 | Mr. Tulsiani previously served as Alight’s Head of Strategy and Corporate Development. Prior to joining Alight in September 2017, from 2013 to 2017, Mr. Tulsiani led corporate development for Aon’s HR solutions segment and served in various other key strategic roles with Aon, including Senior Vice President, Corporate Strategy and Vice President, Corporate Development and Strategy at Hewitt Associates. Prior to that, he worked at IHS Markit from 2007 to 2010 and Ernst & Young LLP from 1999 to 2005. Mr. Tulsiani holds a B.B.A. in Finance and Economics from Delhi University and an M.B.A. from Wake Forest University. Mr. Tulsiani is also a Chartered Financial Analyst. | |||

| 17 |

EXECUTIVE OFFICERS

| Martin T. Felli, Chief Legal Officer & Corporate Secretary |

OFFICER SINCE 2023

AGE 55 | Mr. Felli has more than 27 years of legal experience. Prior to joining Alight, Mr. Felli served as Executive Vice President, Chief Legal and Chief Administrative Officer at Blue Yonder Holding, Inc., a Blackstone and New Mountain Capital sponsored company, from 2018 to April 2022. Prior to that, Mr. Felli held other key legal leadership roles at Blue Yonder from 2013 to 2018, was General Counsel and Corporate Counsel at Ecotality, Inc., from 2011 to 2013, and held additional senior legal positions across a broad range of organizations including Clear Channel Outdoor, Inc., from 2006 to 2011, and HBO, from 2000 to 2004. In 2014, Mr. Felli voluntarily filed for personal bankruptcy under Chapter 7 in connection with certain real estate investments made from 2006-2008, and the bankruptcy was discharged on December 30, 2014. Mr. Felli holds a juris doctor degree from the University of Pennsylvania Law School and a B.A. magna cum laude from Baruch College. Mr. Felli serves on the board of trustees of the Phoenix Country Day School in Phoenix, Arizona. | |||

| Michael J. Rogers, Chief Human Resources Officer |

OFFICER SINCE 2020

AGE 41 | Mr. Rogers has more than 15 years of experience in the industry. Prior to joining Alight in June 2020, Mr. Rogers served as Chief People Officer of NGA Human Resources from March 2017 to June 2020. Prior to that, Mr. Rogers held key human resources roles across a variety of companies, including Vistaprint, where he played a key role in driving its rapid growth across Europe, and Travelocity (lastminute.com). Mr. Rogers holds a degree in Business with first- class honors from the University of Brighton, Brighton, England. | |||

| 18 | 2023 PROXY STATEMENT |

Corporate Governance

|  |

Board Leadership Structure

Our Board understands that there is no single approach to providing board leadership. Given the very competitive and rapidly developing business environment in which we operate, the right Board leadership structure may vary as circumstances change. Our Amended and Restated Bylaws (“Bylaws”) provide that the Board appoints our corporate officers, including our Chief Executive Officer (“CEO”). Our Nominating and Corporate Governance Committee periodically reviews the Company’s governance structure and practices, including applicable provisions of our Certificate of Incorporation and Bylaws.

We do not have a fixed rule about separation of the Chairperson and CEO positions, or whether our Chairperson should be an employee or elected from among non-employee directors. We believe it is in the best interests of the Company to have flexibility to evaluate our leadership structure over time as part of our ongoing succession planning processes. Our Corporate Governance Guidelines, which are available on our investor website at investor.alight.com under the heading “Governance—Governance documents”, provide that an independent “Lead Director” may be elected from among the independent directors when the Chairperson of the Board is not an independent director or when the Chairperson of the Board is the CEO. We do not currently have a Lead Director.

Our Board Leadership structure currently separates the positions of CEO and Chairperson of the Board. The Board believes that this separation is appropriate for the Company at this time because it allows for a division of responsibilities and a sharing of ideas between individuals having different perspectives. Our CEO, who is also a member of our Board, is primarily responsible for our operations and strategic direction, while our Chairperson, who is an independent member of the Board, is primarily focused on matters pertaining to corporate governance, including management oversight and strategic guidance. The Board believes that this is the most appropriate structure at this time but will make future determinations regarding whether or not to separate the roles of Chairperson and CEO based on then-current circumstances.

Our Board believes that the structure of the Board and its committees will provide strong overall management of the Company.

Code of Conduct

The Company has adopted a Code of Conduct, which was refreshed in 2022 and is available on the Company’s website at investor.alight.com. Our Code of Conduct has been developed to help directors and employees around the world efficiently resolve ethical issues in our complex global business environment. The Code of Conduct applies to all directors and employees without limitation. The Code of Conduct covers a variety of topics, including those required to be addressed by the SEC. Topics covered include, among other things, conflicts of interest, confidentiality of information, and compliance with applicable laws and regulations. Directors and employees receive periodic updates regarding corporate governance policies and are informed when material changes are made to the Code of Conduct. The Audit Committee oversees, reviews and periodically updates the Code of Conduct, reviews any significant violations of the Code of Conduct, reviews requests of waivers of the Code of Conduct by executive officers and directors and reviews the Company’s systems to monitor compliance with and enforcement of the Code of Conduct.

| 19 |

CORPORATE GOVERNANCE

The Company will make any legally required disclosures regarding amendments to, or waivers of, certain provisions of its Code of Conduct and Ethics on its website. There were no amendments or waivers of the provisions of the Code of Conduct with respect to any of our officers or directors in 2022. The information contained on, or accessible from, the Company’s website is not part of this proxy statement, by reference or otherwise.

Compensation Committee Interlocks and Insider Participation

None of the Company’s executive officers currently serves, or in the past year has served, (i) as a member of the compensation committee or of the board of directors of another entity, one or more of whose executive officers served on the Compensation Committee, or (ii) as a member of the compensation committee of another entity, one of whose executive officers served on the Board. We are party to certain transactions with the Sponsor Investors (as defined below) and their affiliates as described in “Certain Relationships and Related Person Transactions.”

Management Succession Planning

The Nominating and Corporate Governance Committee may periodically review a succession plan relating to the CEO and other executives that report to the CEO that is developed by management. The succession plan will include, among other things, an assessment of the experience, performance and skills for possible successors to the CEO. The Nominating and Corporate Governance Committee will from time to time make recommendations to the Board with respect to the selection of individuals to occupy these positions.

Board and Committee Self-Evaluations

Our Board conducts an annual self-evaluation of itself and its committees to assess its effectiveness and identify opportunities for improvement. Our Board believes that this process supports continuous improvement and provides opportunities to strengthen Board and committee effectiveness.

Director Nomination Process

The Nominating and Corporate Governance Committee is responsible for reviewing the qualifications of potential director candidates and selecting or recommending for the Board’s selection those candidates to be nominated for election to the Board, subject to any obligations and procedures governing the nomination of directors to the Board set forth in our Investor Rights Agreement. The Nominating and Corporate Governance Committee considers various factors including: strength of character, mature judgment, familiarity with the Company’s business and industry, independence of thought, an ability to work collegially with the other members of the Board, diversity of age, gender, nationality, race, ethnicity, and sexual orientation, existing commitments to other businesses, potential conflicts of interest with other pursuits, legal considerations, corporate governance background, career experience, relevant technical skills or business acumen, and the size, composition and combined expertise of the existing Board. The Board monitors the mix of specific experience, qualifications and skills of its directors so that the Board, as a whole, has the necessary tools to perform its oversight function effectively in light of the Company’s business and structure. Stockholders may also nominate directors for election at the Company’s annual stockholders meeting by following the provisions set forth in the Company’s bylaws, whose qualifications the Nominating and Corporate Governance Committee will consider.

Retirement Policy

The Board does not believe that there should be a fixed term or retirement age for directors but will consider each director’s tenure and the average tenure of the Board when determining who to nominate for election at an upcoming stockholder meeting.

| 20 | 2023 PROXY STATEMENT |

CORPORATE GOVERNANCE

Director Independence

Under the rules of the New York Stock Exchange (“NYSE”), independent directors must comprise a majority of a listed company’s board of directors. In addition, the rules of NYSE require that, subject to specified exceptions, each member of a listed company’s audit, compensation and nominating and corporate governance committees be independent. Under the rules of NYSE, a director will only qualify as an “independent director” if, in the opinion of that company’s board of directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Audit committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the rules of NYSE. Compensation Committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and the rules of NYSE.

In order to be considered independent for purposes of Rule 10A-3 under the Exchange Act and under the rules of NYSE, a member of an audit committee of a listed company may not, other than in his or her capacity as a member of the committee, the board of directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

To be considered independent for purposes of Rule 10C-1 under the Exchange Act and under the rules of NYSE, the board of directors must affirmatively determine that the members of the Compensation Committee are independent, including a consideration of all factors specifically relevant to determining whether the director has a relationship to the company which is material to that director’s ability to be independent from management in connection with the duties of a Compensation Committee member, including, but not limited to: (1) the source of compensation of such director, including any consulting, advisory or other compensatory fee paid by the company to such director; and (2) whether such director is affiliated with the company, a subsidiary of the company or an affiliate of a subsidiary of the company.

Our Board has determined that all of our non-employee directors meet the applicable criteria for independence established by NYSE. Stephan Scholl does not qualify as independent under the NYSE Rules due to his employment as our CEO. In arriving at the foregoing independence determinations, the Board reviewed and discussed information provided by the directors with regard to each director’s business and personal activities and any relationships they have with us and our management.

Committees of the Board; Committee Appointments

The Board has an Audit Committee, a Compensation Committee, and a Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of the Board is described below.

| AUDIT COMMITTEE | COMPENSATION COMMITTEE | NOMINATING AND CORPORATE GOVERNANCE COMMITTEE | |||||||||||||

William P. Foley, II |

|

|

|

|

|

|  | ||||||||

Daniel S. Henson |  |  |  | ||||||||||||

David N. Kestnbaum |

|

|

|

|

|

|

|

|

| ||||||

Richard N. Massey |

|

|

|  |

|

|

| ||||||||

Erika Meinhardt |  |

|

|

|

|

|

| ||||||||

Regina M. Paolillo |  |

|

|

|  | ||||||||||

Kausik Rajgopal |

|

|

|

|

|

|

|

|

| ||||||

Peter F. Wallace |

|

|

|  |

|

|

| ||||||||

Denise Williams |

|

|

|

|

|

|

|

|

| ||||||

Chairperson of the Board

Chairperson of the Board  Committee Chair

Committee Chair  Committee Member

Committee Member

| 21 |

CORPORATE GOVERNANCE

The Audit Committee’s members are Regina M. Paolillo (Chair), Daniel S. Henson and Erika Meinhardt. The Compensation Committee’s members are Richard N. Massey (Chair), Daniel S. Henson and Peter F. Wallace. The Nominating and Corporate Governance Committee’s members are Daniel S. Henson (Chair), William P. Foley, II and Regina M. Paolillo. Members will serve on these committees until their resignation or until as otherwise determined by the Board.

Audit Committee

All members of the Audit Committee have been determined to be “independent” under SEC rules and NYSE listing standards applicable to boards of directors in general and audit committees in particular, and each member is also financially literate under NYSE listing standards. Additionally, Regina M. Paolillo qualifies as an “audit committee financial expert” as defined in applicable SEC rules. The Company’s Audit Committee is responsible for, among other things:

| • | selecting a qualified firm to serve as the independent registered public accounting firm to audit the Company’s financial statements; |

| • | helping to ensure the independence and performance of the independent registered public accounting firm; |

| • | discussing the scope and results of the audit with the independent registered public accounting firm and reviewing, with management and the independent registered public accounting firm, the Company’s interim and year-end financial statements; |

| • | developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| • | reviewing and overseeing the Company’s policies on risk assessment and risk management, including enterprise risk management; |

| • | reviewing the adequacy and effectiveness of internal control policies and procedures and the Company’s disclosure controls and procedures; |

| • | reviewing the Company’s cybersecurity program and controls; and |

| • | approving or, as required, pre-approving, all audit and all permissible non-audit services, other than de minimis non-audit services, to be performed by the independent registered public accounting firm. |

The Board has adopted a written charter for the Audit Committee, which is available on the Company’s website at investor.alight.com.

Compensation Committee

All members of the Compensation Committee have been determined to be “independent” under SEC rules and NYSE listing standards applicable to boards of directors in general and compensation committees in particular. The Company’s Compensation Committee is responsible for, among other things:

| • | reviewing, approving and determining the compensation of the Company’s officers and key employees; |

| • | reviewing, approving and determining compensation and benefits, including equity awards, to directors for service on the Board or any committee thereof; |

| • | administering the Company’s equity compensation plans; |

| • | reviewing, approving and making recommendations to the Board regarding incentive compensation and equity compensation plans; |

| • | considering the risks arising from the Company’s compensation policies and practices; and |

| 22 | 2023 PROXY STATEMENT |

CORPORATE GOVERNANCE

| • | establishing and reviewing general policies relating to compensation and benefits of the Company’s employees. |

The Board has adopted a written charter for the Compensation Committee, which is available on the Company’s website at investor.alight.com.

Nominating and Corporate Governance Committee

All members of the Nominating and Corporate Committee have been determined to be “independent” under NYSE listing standards applicable to board of directors in general. The Nominating and Corporate Governance Committee is responsible for, among other things:

| • | identifying, evaluating and selecting, or making recommendations to the Board regarding, nominees for election to the Board and its committees; |

| • | evaluating the performance of the Board and of individual directors; |

| • | considering, and making recommendations to the Board regarding the composition of the Board and its committees; |

| • | overseeing succession planning for management; |

| • | reviewing developments in corporate governance practices, including related to environmental, social and governance matters; |

| • | evaluating the adequacy of the corporate governance practices and reporting; and |

| • | developing, and making recommendations to the Board regarding, corporate governance guidelines and matters. |

The Board has adopted a written charter for the Nominating and Corporate Governance Committee, which is available on the Company’s website at investor.alight.com.

Board and Committee Meetings; Attendance

Directors are encouraged to attend our annual meetings of stockholders and, at our inaugural 2022 annual meeting of stockholders, seven of our eight directors at the time attended the meeting. During the year ended December 31, 2022, the Board held five meetings, the Audit Committee held seven meetings, the Compensation Committee met four times and the Nominating and Corporate Governance Committee met seven times. In 2022, all of our directors attended at least 75% of the meetings of the Board and committees during the time in which he or she served as a member of the Board or such committee.

The Board’s Role in Risk Oversight

The Board directs and oversees the management of the business and affairs of the Company in a manner consistent with the best interests of the Company and its stockholders, with a view to enhancing long-term stockholder value. The Board’s responsibility is one of oversight, and in performing its oversight role, the Board serves as the ultimate decision-making body of the Company, except for those matters reserved for or shared with the Company’s stockholders, including any applicable terms of the Investor Rights Agreement. The Board selects and oversees the members of senior management, who are charged by the Board with conducting the business of the Company. The Board exercises direct oversight of strategic risks to the Company in regular coordination with the Company’s management. The Audit Committee reviews guidelines and policies governing the process by which senior management assesses and manages the Company’s exposure to risk, including the Company’s major financial and operational risk exposures and the steps management takes to monitor and control such exposures. The Compensation Committee oversees risks relating to the Company’s compensation policies and practices. The Nominating and Corporate Governance Committee assists the Board by overseeing and evaluating programs and risks associated with Board organization, membership and structure and corporate governance. Each committee is charged with risk oversight and reports to the Board on those matters.

| 23 |

CORPORATE GOVERNANCE

Environmental, Social, and Governance (ESG)

ESG Governance

Our Board, as a whole and through its standing committees, works closely with our executive team to govern and manage ESG initiatives. While the full Board has ultimate responsibility for ESG matters that impact our business, the Nominating and Corporate Governance Committee exercises primary Board oversight of ESG risk management, strategy, initiatives, and policies. Alight also maintains an ESG Management Committee, which is comprised of cross-functional leaders across the Alight management team and drives our ESG strategy development and implementation. It is led by our Chief Legal Officer and Corporate Secretary, who has primary responsibility for corporate governance, the legal and compliance function, and risk management and by our Chief Human Resources Officer.

ESG Accomplishments

Alight’s ESG strategy is based on ongoing assessments and prioritization of the non-financial topics designated as critical to our long-term success and positive impact. These priority areas are informed by insights gleaned from our assessment of various ESG factors and our ongoing engagement with stakeholders inside and outside Alight. In 2022, we published our inaugural Global Impact Report and launched an ESG page on Alight’s corporate website. Both can be found on our website at alight.com/about/esg. The Alight Global Impact Report details the work we do every day to advance our ESG initiatives and highlights the progress we made over the past year. We believe that our commitment in these strategic areas will support long-term value creation for our stockholders, help achieve sustainable business success, and ultimately help improve the health and wellbeing of the communities, employees, and their families that Alight influences.

The Board’s Role in Human Capital Management and Talent Development

Our Board plays an integral role in human capital management by ensuring that Alight has a strong, performance-driven senior management team in place. In connection with this responsibility, our Board oversees the development and retention of senior management talent as part of the succession planning process for our CEO as well as the members of the Company’s executive leadership team that directly report to our CEO.

Through regular reviews, the Board is actively engaged and involved in executive talent management and provides input on important decisions in this area. High potential leaders are considered for additional leadership roles and developmental opportunities needed to prepare them for greater responsibilities. We are focused on building a diverse and inclusive workforce to support a culture of openness and innovation at Alight, so we periodically assess with the Board the talent pool of candidates just below the executive leadership team level to help maintain a robust and diverse talent pipeline.

While our Nominating and Corporate Governance Committee has the primary responsibility to develop succession plans for the CEO position, it regularly reports to the Board and decisions are made at the Board level. In connection with this responsibility for developing succession plans, our Board reviews, at least annually, the short, medium and long-term succession plans for the Company’s senior management, including the CEO. This annual review also includes a review of the Company’s broader human capital management practices around culture, engagement, and diversity and inclusion.

| 24 | 2023 PROXY STATEMENT |

Security Ownership of Certain Beneficial Owners and Management

|  |

The following table sets forth information regarding the beneficial ownership of shares of Alight’s Class A common stock and Class V common stock as of March 27, 2023 by:

| • | each of Alight’s named executive officers and directors; |

| • | all executive officers and directors of Alight as a group; and |

| • | each person known by Alight to be the beneficial owner of more than 5% of the shares of any class of Alight’s Common Stock. |

Beneficial ownership is determined according to the rules of the SEC, which generally provide that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power over that security, including options and warrants that are currently exercisable or exercisable within 60 days.

The percentage of beneficial ownership of shares of Alight’s Common Stock is calculated based on the following outstanding shares as of March 27, 2023: (i) an aggregate of 497,280,331 shares of Class A common stock and (ii) an aggregate of 44,135,874 shares of Class V common stock.

Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all shares beneficially owned by them. Unless otherwise noted, the business address of each of the following entities or individuals is 4 Overlook Point, Lincolnshire, Illinois 60069.

BENEFICIAL OWNERSHIP AS OF MARCH 27, 2023 | ||||||||||||||||||||

NAME |

SHARES OF | % OF CLASS A COMMON STOCK | SHARES OF CLASS V COMMON STOCK | % OF CLASS V COMMON STOCK | % OF TOTAL VOTING POWER | |||||||||||||||

Directors and Named Executive Officers |

| |||||||||||||||||||

William P. Foley, II(1) | 11,878,236 | 2.4 | % | — | — | 2.2 | % | |||||||||||||

Daniel S. Henson | 635,983 | * | 42,121 | * | * | |||||||||||||||

David N. Kestnbaum | — | — | — | — | — | |||||||||||||||

Richard N. Massey | 1,274,084 | * | — | — | * | |||||||||||||||

Erika Meinhardt(2) | 54,522 | * | — | — | * | |||||||||||||||

Regina M. Paolillo | 42,536 | * | — | — | * | |||||||||||||||

Kausik Rajgopal | — | — | — | — | — | |||||||||||||||

Peter F. Wallace | — | — | — | — | — | |||||||||||||||

Denise Williams | — | — | — | — | — | |||||||||||||||

Stephan D. Scholl | 4,384,576 | * | — | — | * | |||||||||||||||

Katie J. Rooney | 758,004 | * | 69,620 | * | * | |||||||||||||||

Gregory R. Goff | 182,343 | * | — | — | * | |||||||||||||||

Cesar Jelvez | 184,134 | * | — | — | * | |||||||||||||||

Dinesh V. Tulsiani | 166,793 | * | 82,945 | * | * | |||||||||||||||

All Directors and Executive Officers as a Group (16 persons) | 19,604,037 | 3.9 | % | 194,686 | * | 3.7 | % | |||||||||||||

| 25 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

BENEFICIAL OWNERSHIP AS OF MARCH 27, 2023 | ||||||||||||||||||||

NAME |

SHARES OF | % OF CLASS A COMMON STOCK | SHARES OF CLASS V COMMON STOCK | % OF CLASS V COMMON STOCK | % OF TOTAL VOTING POWER | |||||||||||||||

5% Holders |

| |||||||||||||||||||

Blackstone Inc.(3) | 31,271,617 | 6.3 | % | 31,184,461 | 70.7 | % | 11.5 | % | ||||||||||||

Cannae Holdings, Inc.(4) | 52,477,062 | 10.6 | % | — | — | 9.7 | % | |||||||||||||

FPR Partners, LLC(5) | 32,243,960 | 6.5 | % | — | — | 6.0 | % | |||||||||||||

The Vanguard Group(6) | 27,125,829 | 5.5 | % | — | — | 5.0 | % | |||||||||||||

ArrowMark Colorado Holdings, LLC(7) | 26,255,426 | 5.3 | % | — | — | 4.8 | % | |||||||||||||

* Percentage owned is less than 1.0%

(1) Consists of 5,044,932 shares of Class A common stock held directly by William P. Foley, II; 171,878 shares of Class A common stock held directly by Trasimene Capital FT, LLC (“Trasimene GP”), and 6,661,426 shares of Class A common stock held directly by Bilcar FT, LP (“Bilcar”). William P. Foley, II is the sole member of Bilcar FT, LLC (“Bilcar FT”), which, in turn, is the sole general partner of Bilcar. William P. Foley, II is also the sole member of Trasimene GP. Because of the relationships between William P. Foley, II and Bilcar, Bilcar FT, LLC, and Trasimene GP, William P. Foley, II may be deemed to beneficially own the securities reported herein to the extent of his pecuniary interests. William P. Foley, II disclaims beneficial ownership of the securities reported herein, except to the extent of his pecuniary interest therein, if any. Mr. Foley and the entities referred to in this footnote are sometimes referred to collectively herein as “Foley.”

(2) Consists of 44,522 shares of Class A common stock held by Erika Meinhardt and 10,000 shares of Class A common stock held by a trust of which Erika Meinhardt is the trustee.

(3) Reflects 31,214,589 shares of Class A common stock held by BX Tempo ML Holdco 1 L.P. and 57,028 shares of Class A common stock and 31,184,461 shares of Class V common stock directly held by BX Tempo ML Holdco 2 L.P (together, the “Blackstone Funds”).

The general partner of BX Tempo ML Holdco 1 L.P. is BX Tempo MP Holdco GP L.L.C. Blackstone Capital Partners VII (IPO) NQ L.P. and Blackstone Capital Partners VII.2 (IPO) NQ L.P. are the members of BX Tempo ML Holdco 1 GP L.L.C.

The general partner of BX Tempo ML Holdco 2 L.P. is BX Tempo ML Holdco 2 GP L.L.C. Blackstone Capital Partners VII NQ L.P., BCP VII SBS Holdings L.L.C., Blackstone Family Investment Partnership VII-ESC NQ L.P. and BTAS NA Holdings L.L.C. are the members of BX Tempo ML Holdco 2 GP L.L.C.

The general partner of each of Blackstone Capital Partners VII NQ L.P., Blackstone Capital Partners VII (IPO) NQ L.P. and Blackstone Capital Partners VII.2 (IPO) NQ L.P. is Blackstone Management Associates VII NQ L.L.C., the sole member of which is BMA VII NQ L.L.C., the managing member of which is Blackstone Holdings II L.P.

The sole member of BCP VII SBS Holdings L.L.C. is Blackstone Side-by-Side Umbrella Partnership L.P., the general partner of which is Blackstone Side-by-Side Umbrella GP L.L.C., the sole member of which is Blackstone Holdings III L.P., the general partner of which is Blackstone Holdings III GP L.P., the general partner of which is Blackstone Holdings III GP Management L.L.C.

The general partner of Blackstone Family Investment Partnership VII – ESC NQ L.P. is BCP VII Side-by-Side GP NQ L.L.C., the sole member of which is Blackstone Holdings II L.P. The managing member of BTAS NQ Holdings L.L.C. is BTAS Associates-NQ L.L.C., the managing member of which is Blackstone Holdings II L.P.

The general partner of Blackstone Holdings II L.P. is Blackstone Holdings I/II GP L.L.C. Blackstone Inc. is the sole member of each of Blackstone Holdings I/II GP L.L.C. and Blackstone Holdings III GP Management L.L.C. Blackstone Group Management L.L.C. is the sole holder of the Series II Preferred Stock of Blackstone Inc. Blackstone Group Management L.L.C. is wholly-owned by Blackstone’s senior managing directors and controlled by its founder, Stephen A. Schwarzman.