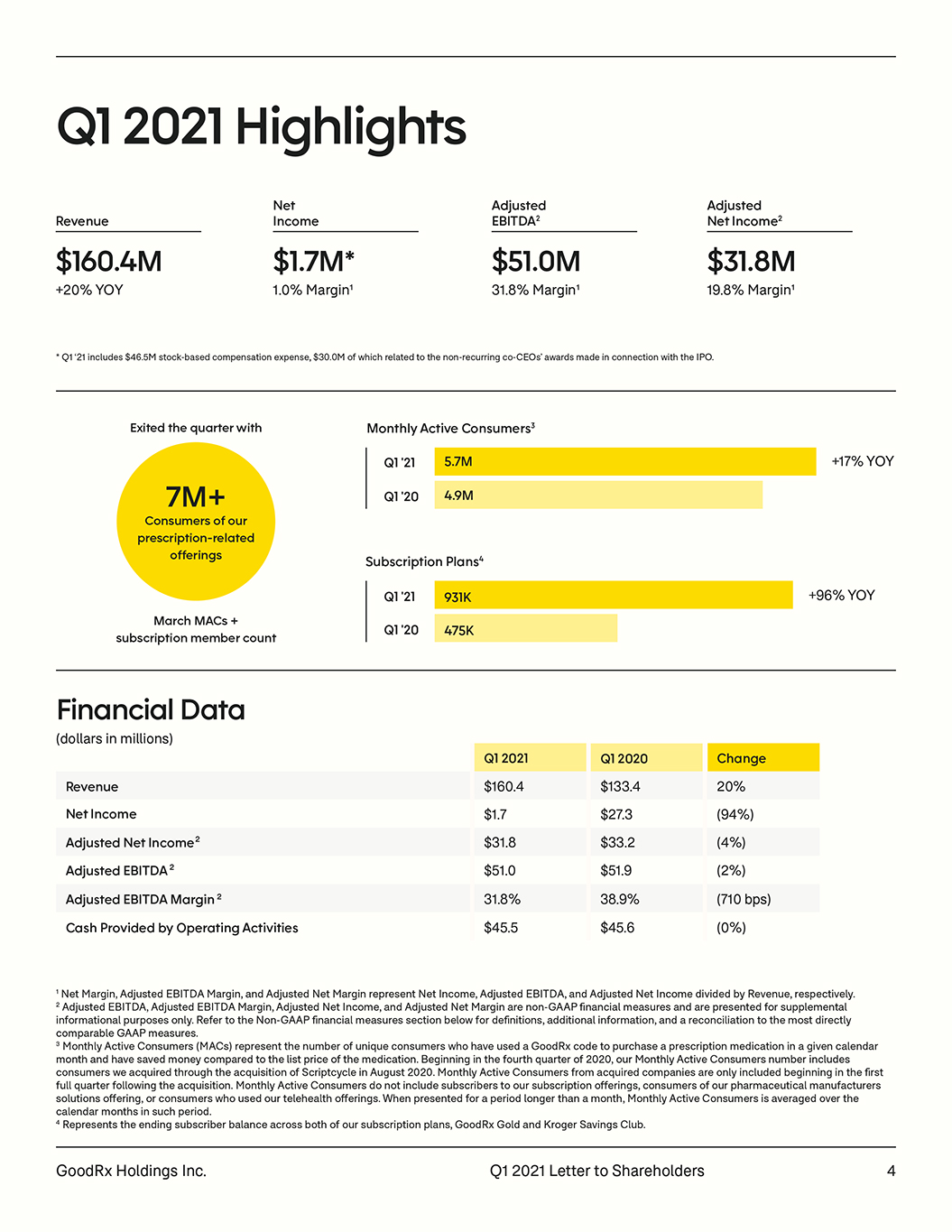

Non-GAAP Financial Measures Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income, Adjusted Net Margin and Adjusted Earnings Per Share are supplemental measures of our performance that are not required by, or presented in accordance with, U.S. GAAP. We also present each cost and operating expense on our condensed consolidated statements of operations on an adjusted basis. Collectively, we refer to these non-GAAP financial measures as our “Non-GAAP Measures”. We define Adjusted EBITDA for a particular period as net income or loss before interest, taxes, depreciation and amortization, and as further adjusted for acquisition related expenses, cash bonuses to vested option holders, stock-based compensation expense, payroll tax expense related to stock-based compensation, loss on extinguishment of debt, financing related expenses, loss on abandonment and impairment of operating lease assets, charitable stock donation and other income or expense, net, as applicable for the periods presented. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of revenue. We define Adjusted Net Income for a particular period as net income or loss adjusted for, as applicable for the periods presented, amortization of intangibles related to acquisitions, acquisition related expenses, stock-based compensation expense, payroll tax expense related to stock-based compensation, loss on extinguishment of debt, financing related expenses, loss on abandonment and impairment of operating lease assets, charitable stock donation, and as further adjusted for estimated income tax on such adjusted items. We calculate income taxes in interim periods by applying an estimated annual effective tax rate to (loss) income before income taxes and by calculating the tax effect of discrete items recognized during the period. As such, we adjusted our estimated annual effective tax rate in order to account for the Adjusted Net Income adjustments. Adjusted income tax benefit (expense) was determined by applying the adjusted estimated annual effective tax rate to non-GAAP Adjusted Income before income taxes and including the tax effect of discrete items recognized during the period. Adjusted income tax benefit (expense) excludes excess tax benefits/deficiencies recognized discretely in connection with stock-based compensation. Adjusted Net Margin is Adjusted Net Income divided by revenue. Adjusted Earnings Per Share is Adjusted Net Income attributable to common stockholders divided by weighted average number of shares. The weighted average shares we use in computing Adjusted Earnings Per Share – basic is equal to our GAAP weighted average shares – basic and the weighted average shares we use in computing Adjusted Earnings Per Share – diluted is equal to either GAAP weighted average shares – basic or GAAP weighted average shares – diluted, depending on whether the Company has adjusted net loss or adjusted net income, respectively. We also assess our performance by evaluating each cost and operating expense on our condensed consolidated statements of operations on a non-GAAP, or adjusted, basis. The adjustments to these cost and operating expense items include acquisition related expenses, amortization of intangible assets related to acquisitions, stock-based compensation expense, payroll tax expense related to stock-based compensation, financing related expenses, loss on abandonment and impairment of operating lease assets, and charitable stock donation, as applicable. We believe our Non-GAAP Measures are helpful to investors, analysts and other interested parties because they assist in providing a more consistent and comparable overview of our operations across our historical financial periods. Adjusted EBITDA is also a key measure we use to assess our financial performance and is also used for internal planning and forecasting purposes. In addition, Adjusted EBITDA, Adjusted Net Income and Adjusted Earnings Per Share are frequently used by analysts, investors and other interested parties to evaluate and assess performance. The Non-GAAP Measures are presented for supplemental informational purposes only and should not be considered as alternatives or substitutes to financial information presented in accordance with GAAP. These measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our condensed consolidated statements of operations that are necessary to run our business. Other companies, including other companies in our industry, may not use these measures or may calculate these measures differently than as presented herein, limiting their usefulness as comparative measures. GoodRx Holdings Inc. Q1 2021 Letter to Shareholders 16