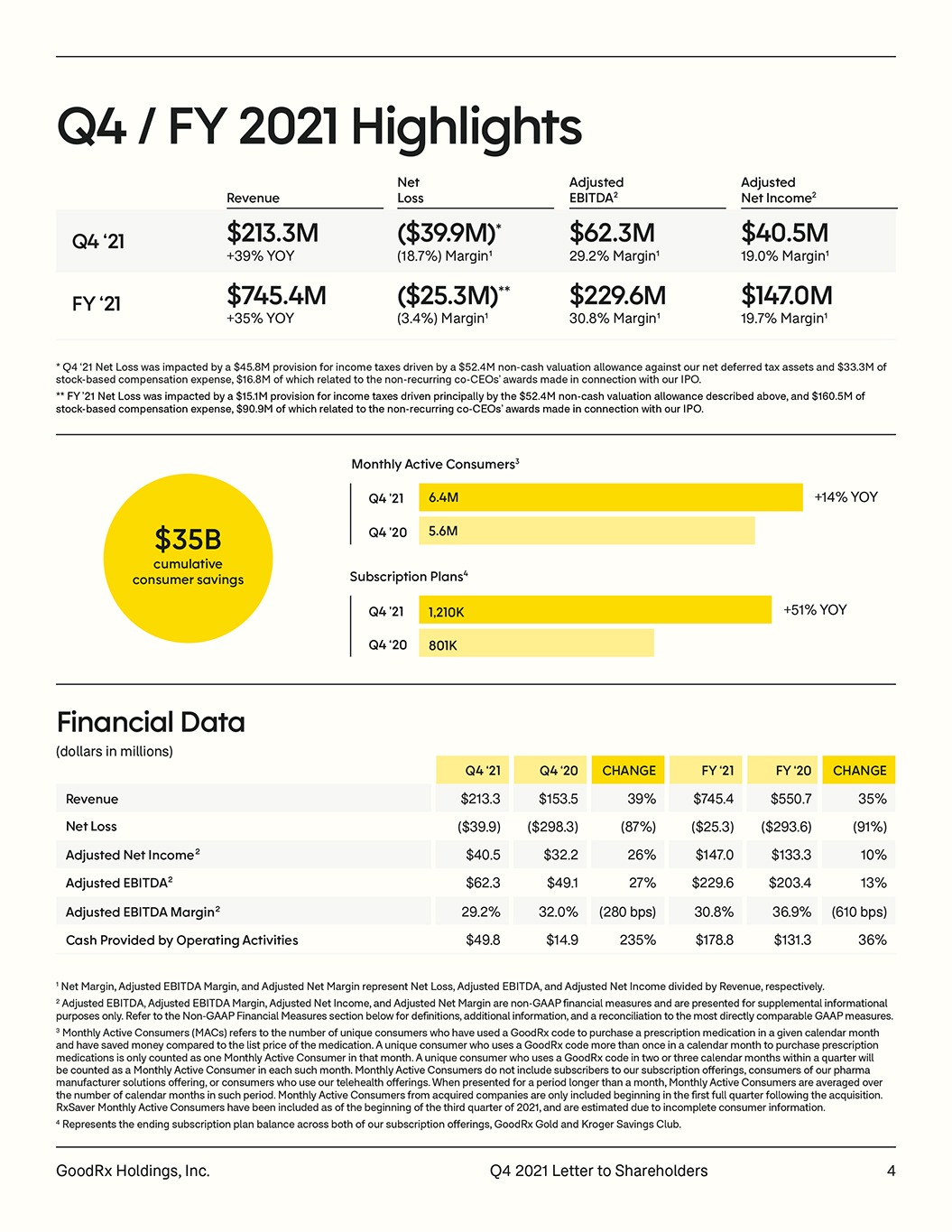

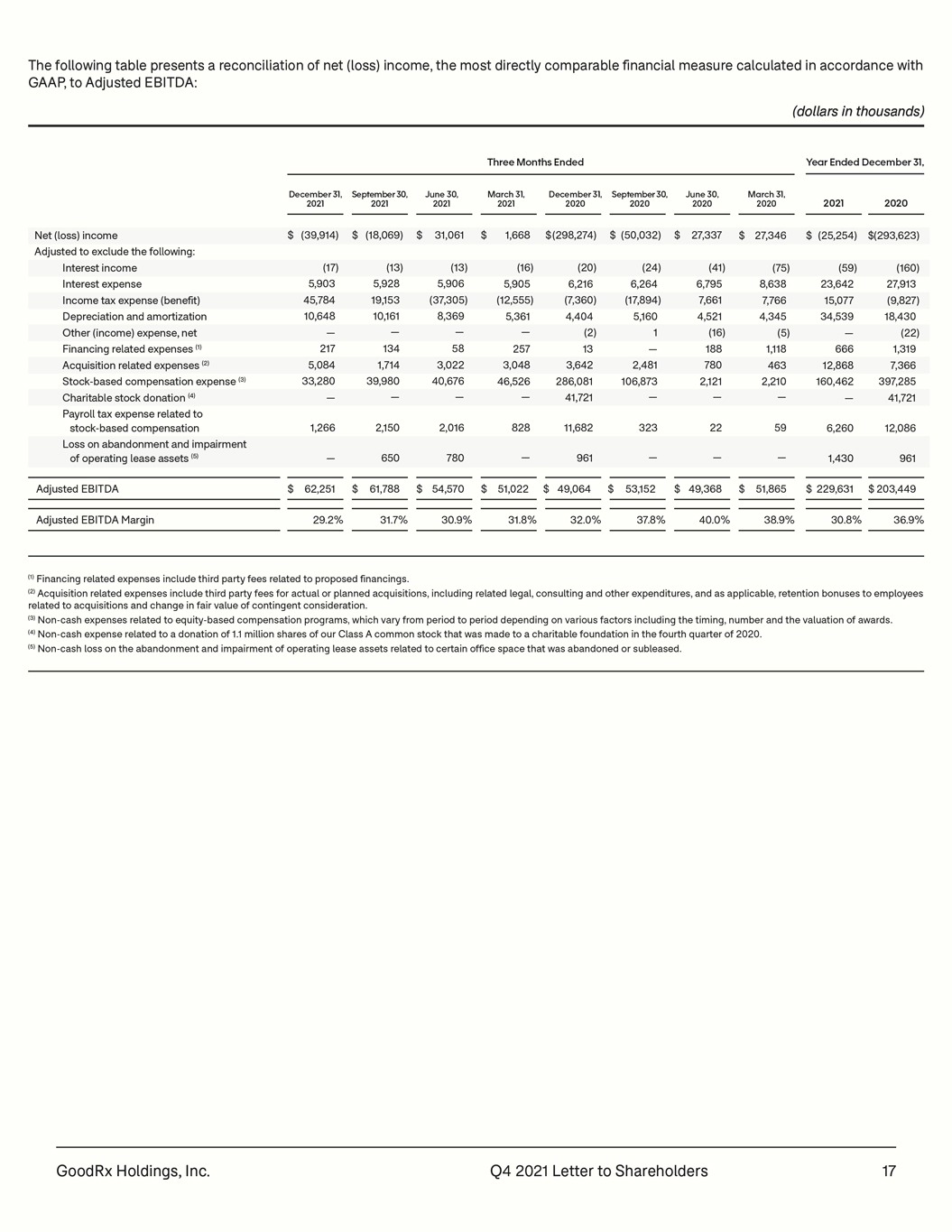

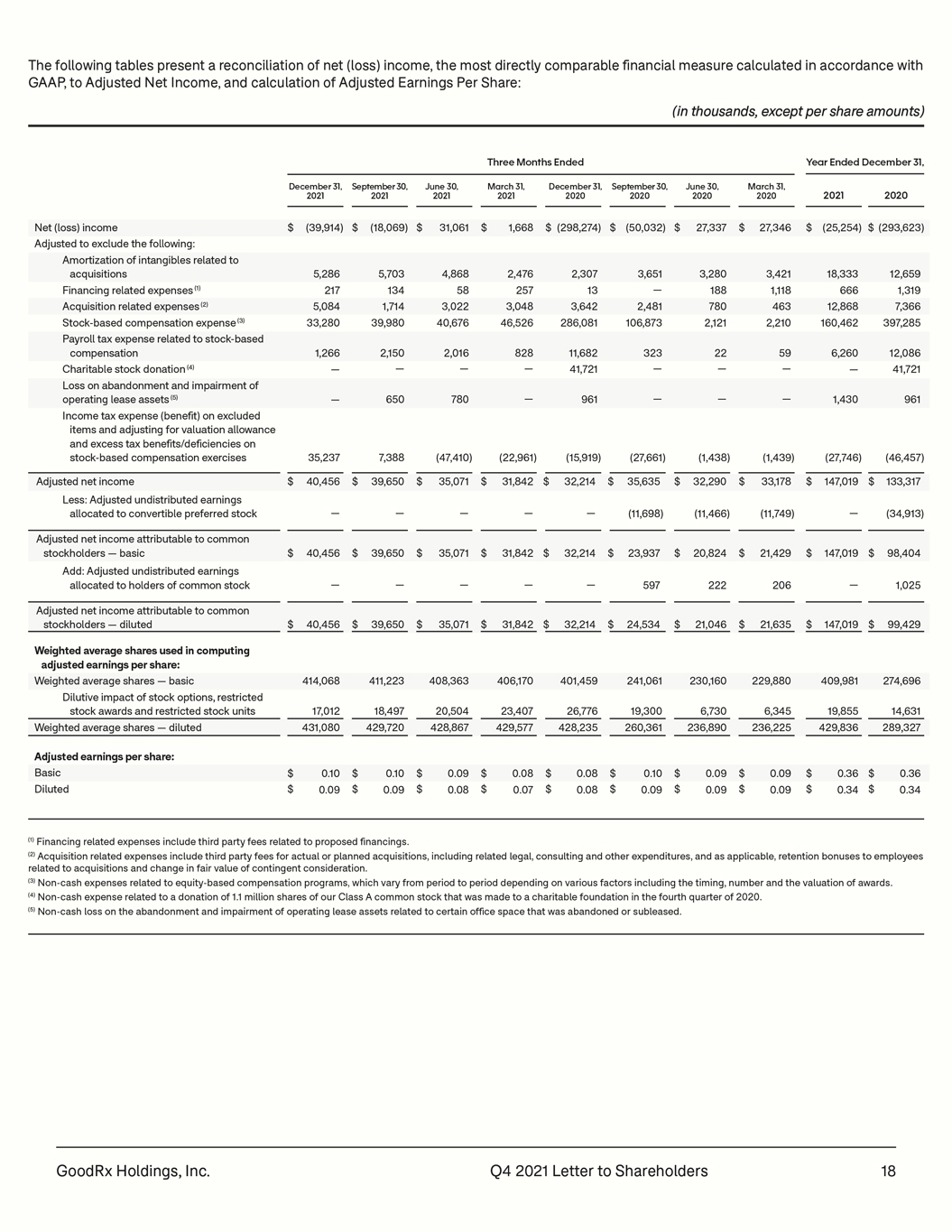

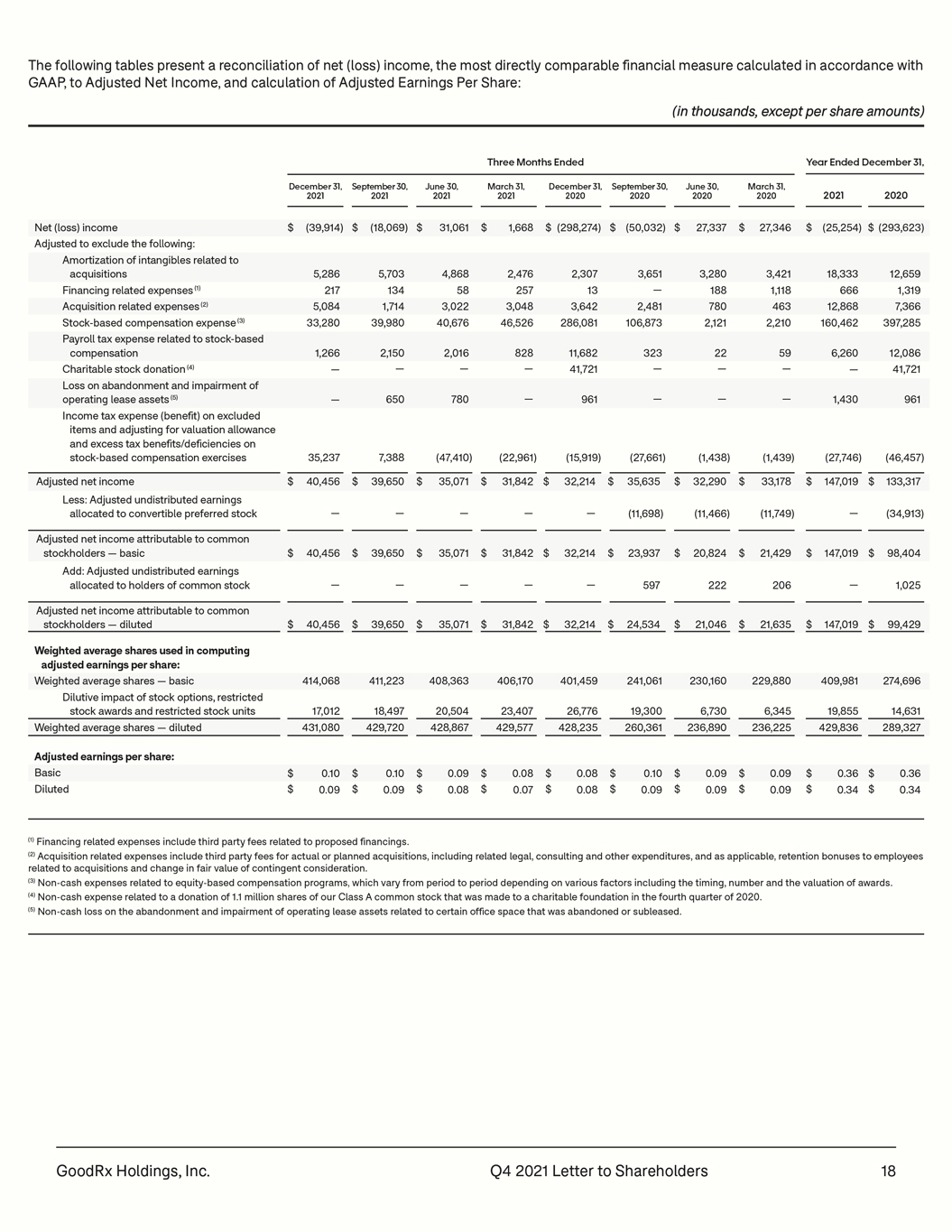

THEFOLLOWINGTABLESPRESENTARECONCILIATIONOFNET (LOSS)INCOME,THEMOSTDIRECTLYCOMPARABLEFINANCIALMEASURECALCULATEDINACCORDANCEWITH GAAP,TO ADJUSTED NET INCOME,ANDCALCULATIONOF ADJUSTED EARNINGS PER SHARE: (INTHOUSANDS,EXCEPTPERSHAREAMOUNTS) THREE MONTHS ENDED YEAR ENDED DECEMBER 31, DECEMBER 31, SEPTEMBER 30, JUNE 30, MARCH 31, DECEMBER 31, SEPTEMBER 30, JUNE 30, MARCH 31, 2021 2021 2021 2021 2020 2020 2020 2020 2021 2020 NET (LOSS)INCOME $ (39,914) $ (18,069) $ 31,061 $ 1,668 $ (298,274) $ (50,032) $ 27,337 $ 27,346 $ (25,254) $ (293,623) ADJUSTEDTOEXCLUDETHEFOLLOWING: AMORTIZATIONOFINTANGIBLESRELATEDTO ACQUISITIONS 5,286 5,703 4,868 2,476 2,307 3,651 3,280 3,421 18,333 12,659 FINANCINGRELATEDEXPENSES (1) 217 134 58 257 13 — 188 1,118 666 1,319 ACQUISITIONRELATEDEXPENSES (2) 5,084 1,714 3,022 3,048 3,642 2,481 780 463 12,868 7,366 STOCK-BASEDCOMPENSATIONEXPENSE (3) 33,280 39,980 40,676 46,526 286,081 106,873 2,121 2,210 160,462 397,285 PAYROLLTAXEXPENSERELATEDTOSTOCK-BASED COMPENSATION 1,266 2,150 2,016 828 11,682 323 22 59 6,260 12,086 CHARITABLESTOCKDONATION (4) — — — — 41,721 — — — — 41,721 LOSSONABANDONMENTANDIMPAIRMENTOF OPERATINGLEASEASSETS (5) — 650 780 — 961 — — — 1,430 961 INCOMETAXEXPENSE (BENEFIT)ONEXCLUDED ITEMSANDADJUSTINGFORVALUATIONALLOWANCE ANDEXCESSTAXBENEFITS/DEFICIENCIESON STOCK-BASEDCOMPENSATIONEXERCISES 35,237 7,388 (47,410) (22,961) (15,919) (27,661) (1,438) (1,439) (27,746) (46,457) ADJUSTEDNETINCOME $ 40,456 $ 39,650 $ 35,071 $ 31,842 $ 32,214 $ 35,635 $ 32,290 $ 33,178 $ 147,019 $ 133,317 LESS: ADJUSTEDUNDISTRIBUTEDEARNINGS ALLOCATEDTOCONVERTIBLEPREFERREDSTOCK — — — — — (11,698) (11,466) (11,749) — (34,913) ADJUSTEDNETINCOMEATTRIBUTABLETOCOMMON STOCKHOLDERS —BASIC $ 40,456 $ 39,650 $ 35,071 $ 31,842 $ 32,214 $ 23,937 $ 20,824 $ 21,429 $ 147,019 $ 98,404 ADD: ADJUSTEDUNDISTRIBUTEDEARNINGS ALLOCATEDTOHOLDERSOFCOMMONSTOCK — — — — — 597 222 206 — 1,025 ADJUSTEDNETINCOMEATTRIBUTABLETOCOMMON STOCKHOLDERS —DILUTED $ 40,456 $ 39,650 $ 35,071 $ 31,842 $ 32,214 $ 24,534 $ 21,046 $ 21,635 $ 147,019 $ 99,429 WEIGHTEDAVERAGESHARESUSEDINCOMPUTING ADJUSTEDEARNINGSPERSHARE: WEIGHTEDAVERAGESHARES —BASIC 414,068 411,223 408,363 406,170 401,459 241,061 230,160 229,880 409,981 274,696 DILUTIVEIMPACTOFSTOCKOPTIONS,RESTRICTED STOCKAWARDSANDRESTRICTEDSTOCKUNITS 17,012 18,497 20,504 23,407 26,776 19,300 6,730 6,345 19,855 14,631 WEIGHTEDAVERAGESHARES —DILUTED 431,080 429,720 428,867 429,577 428,235 260,361 236,890 236,225 429,836 289,327 ADJUSTEDEARNINGSPERSHARE: BASIC $ 0.10 $ 0.10 $ 0.09 $ 0.08 $ 0.08 $ 0.10 $ 0.09 $ 0.09 $ 0.36 $ 0.36 DILUTED $ 0.09 $ 0.09 $ 0.08 $ 0.07 $ 0.08 $ 0.09 $ 0.09 $ 0.09 $ 0.34 $ 0.34 (1) FINANCINGRELATEDEXPENSESINCLUDETHIRDPARTYFEESRELATEDTOPROPOSEDFINANCINGS. (2) ACQUISITIONRELATEDEXPENSESINCLUDETHIRDPARTYFEESFORACTUALORPLANNEDACQUISITIONS,INCLUDINGRELATEDLEGAL,CONSULTINGANDOTHEREXPENDITURES,ANDASAPPLICABLE,RETENTIONBONUSESTOEMPLOYEESRELATEDTOACQUISITIONSANDCHANGEINFAIRVALUEOFCONTINGENTCONSIDERATION. (3) NON-CASHEXPENSESRELATEDTOEQUITY-BASEDCOMPENSATIONPROGRAMS,WHICHVARYFROMPERIODTOPERIODDEPENDINGONVARIOUSFACTORSINCLUDINGTHETIMING,NUMBERANDTHEVALUATIONOFAWARDS. (4) NON-CASHEXPENSERELATEDTOADONATIONOF 1.1 MILLIONSHARESOFOUR CLASS ACOMMONSTOCKTHATWASMADETOACHARITABLEFOUNDATIONINTHEFOURTHQUARTEROF 2020. (5) NON-CASHLOSSONTHEABANDONMENTANDIMPAIRMENTOFOPERATINGLEASEASSETSRELATEDTOCERTAINOFFICESPACETHATWASABANDONEDORSUBLEASED. GOODRX HOLDINGS INC. Q4 2021 LETTERTO SHAREHOLDERS 18