(24) The section entitled “Capitalization” on page 59 is amended in its entirety to read as set forth on Exhibit B below.

(25) The section entitled “Dilution” starting on page 60 is amended in its entirety to read as set forth on Exhibit C below.

(26) Amend the fifth paragraph under the heading of “Digital Financial Services” on page 68 to read as follows:

Also in June 2020, we entered into a binding term sheet pursuant to which we expect to acquire 55% of CapBridge Financial Pte. Ltd.’s equity interest. We expect to complete the proposed acquisition in the early part of 2022. The completion of our proposed acquisition of CapBridge is subject to a number of conditions, including negotiation of terms of the transaction, MAS approval, and satisfaction of our closing obligations.

(27) Amend the first paragraph under the heading of on page 69 to read as follows:

The following table sets forth the name change history and licenses held by our company and subsidiaries (the proposed acquisition of CapBridge is subject to negotiation of terms of the transactions, MAS approval, and satisfaction of our closing conditions).

(28) Amend the first paragraph under the heading of “Our Relationship with the Controlling Shareholder and Other Group Companies” on page 73 to read as follows:

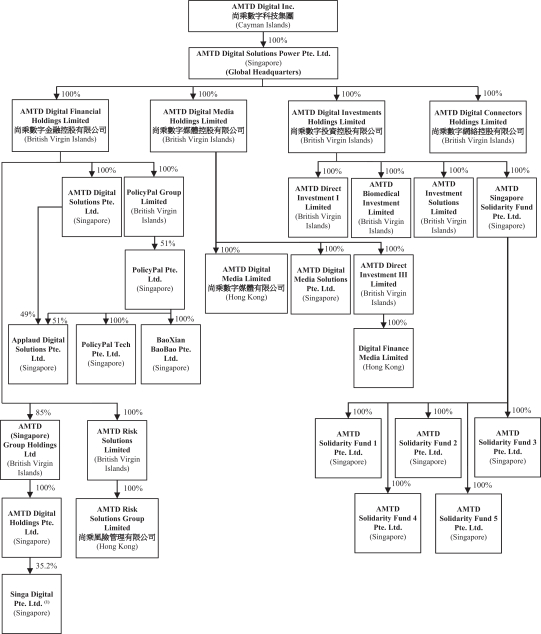

AMTD Digital is the core of the AMTD SpiderNet, and hence, we have created a shareholding structure where the interest of all AMTD Group companies’ interests are aligned with those of AMTD Digital, ensuring seamless cooperation between the group companies and that maximum synergies will be achieved. As of the date of this prospectus, AMTD Digital Inc. is effectively 72.2%-owned by our Controlling Shareholder and its subsidiaries in aggregate, with our Controlling Shareholder owning 29.4%, AMTD International owning 10.4%, AMTD Education Group, or AMTD Education, owning 16.2%, and AMTD Assets owning 16.2% of our equity interests.

(29) Amend the first paragraph under the heading of “Our ability to expand into new markets and offer new products and services” on page 80 to read as follows:

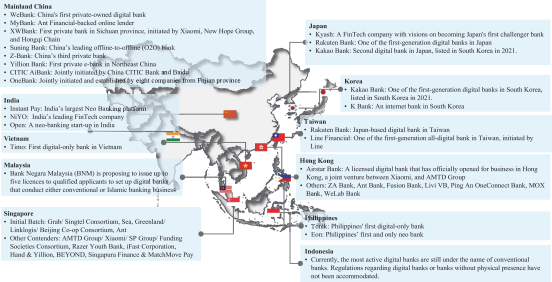

Digital financial services business is a highly regulated industry, and digital financial licenses are generally regulated separately across different product types and different regions. In order to provide one-stop crossregional digital financial services that meet the evolving needs of clients, it is important for us to obtain licenses from multiple regulatory regimes. We expanded our digital financial services operations in 2020 with the acquisition of PolicyPal, and plan to continue to expand through the proposed acquisition of CapBridge (currently subject to negotiation of terms of the transaction, as well as MAS approval), and the proposed establishment of Singa Bank and Applaud (currently subject to MAS approval). In the future, we may consider to apply for banking licenses in other ASEAN countries such as Malaysia, Vietnam, and Indonesia, as regulations allow, and may also consider to obtain financial licenses in other areas, such as digital insurance, digital assets exchange, and digital payment. If we are unable to expand into new markets, our future results of operations could be affected.

(30) Amend the last sentence under the heading of “Our future capabilities to provide insightful information to support our clients’ strategic decisions” on page 80 to read as follows:

Our SpiderNet ecosystem solutions income increased from HK$5.9 million for the fiscal year ended April 30, 2019 to HK$157.7 million for the fiscal year ended April 30, 2020, and to HK$184.1 million (US$23.7 million) for the fiscal year ended April 30, 2021.

(31) Amend the disclosures under the heading of “Our ability to attract, retain, and motivate talents” on page 81 to read as follows:

It is essential for us to attract, retain, and motivate talent because our businesses are human capital intensive. We believe that it is necessary and customary to invest in talents, arguably our most important assets, with attractive compensation packages, as we compete to attract, retain, and motivate qualified employees. Key members of our management are also shareholders of our company, ensuring that interests and incentives are aligned with our performance. Our staff costs for the fiscal years ended April 30, 2019, 2020, and 2021 were HK$9.2 million, HK$15.2 million, and HK$48.0 million (US$6.2 million), respectively, representing 63.0%, 9.1%, and 24.5% of our total revenue for the corresponding periods. Our staff costs have historically been comprised of cash-based and share-based compensation and benefits. Nevertheless, highly incentivized professionals and other talents could potentially enable us to achieve great business prospects and results of operations.

12