The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY PROSPECTUS (Subject to Completion)

Dated January 7, 2022

16,000,000 American Depositary Shares

AMTD Digital Inc.

Representing 6,400,000 Class A Ordinary Shares

This is the initial public offering of 16,000,000 American depositary shares, or ADSs, of AMTD Digital Inc. Every five ADSs represent two of our Class A ordinary shares, par value US$0.0001 per share. We anticipate that the initial public offering price per ADS will be between US$6.80 and US$8.20.

Prior to this offering, there has been no public market for the ADSs or our Class A ordinary shares. We have applied for listing the ADSs on the New York Stock Exchange under the ticker symbol “HKD.”

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements.

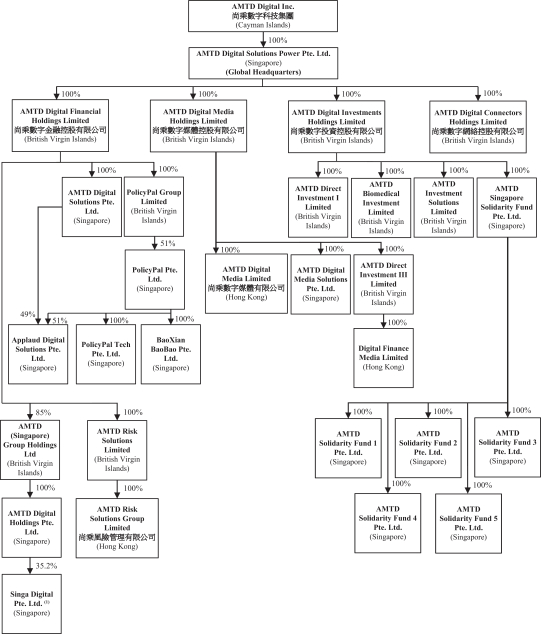

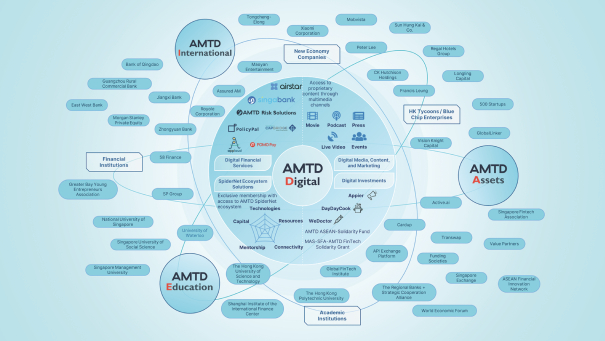

AMTD Digital Inc. was incorporated in September 2019 by our Controlling Shareholder as a holding company of our businesses. Upon the completion of the Offering, we will be a “controlled company” as defined under the NYSE Listed Company Manual because our Controlling Shareholder will hold more than 50% of the voting power for the election of directors.

As of the date of this prospectus, our outstanding share capital consists of Class A ordinary shares and Class B ordinary shares, and our Controlling Shareholder and certain other affiliates beneficially own all of our issued and outstanding Class B ordinary shares. These Class B ordinary shares will constitute approximately 32.7% of our total issued and outstanding ordinary shares and 90.7% of the aggregate voting power of our total issued and outstanding ordinary shares immediately after the completion of this offering, assuming that the underwriters do not exercise their option to purchase additional ADSs. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote, and is not convertible into Class B ordinary shares under any circumstances. Each Class B ordinary share is entitled to twenty votes, and is convertible into one Class A ordinary share at any time by the holder thereof.

Investing in the ADSs involves risks. See “Risk Factors” beginning on page 18.

We face various legal and operational risks and uncertainties relating to our operations. Although we do not have any material operation or maintain any office or personnel in Mainland China nor do we have any variable interest entities structure in place, we face risks and uncertainties associated with the complex and evolving PRC laws and regulations and as to whether and how the recent PRC government statements and regulatory developments, such as those relating to variable interest entities, data and cyberspace security, and anti-monopoly concerns, would apply to us. Should these statements or regulatory actions apply to us, including our Hong Kong operations, in the future, or if we expand our business operations into Mainland China leveraging our fusion-in program, through AMTD SpiderNet ecosystem or in some other ways such that we become subject to them to a greater extent, our ability to conduct our business, invest into Mainland China as foreign investments or accept foreign investments, or list on a U.S. or other overseas exchange may be restricted. For example, if the recent PRC regulatory actions on data security or other data-related laws and regulations were to apply to us, we could become subject to certain cybersecurity and data privacy obligations, including the potential requirement to conduct a cybersecurity review for our public offerings at a foreign stock exchange, and the failure to meet such obligations could result in penalties and other regulatory actions against us and may materially and adversely affect our business and results of operations. We also may face risks relating to the lack of PCAOB inspection on our auditor, which may cause our securities to be delisted from a U.S. stock exchange or prohibited from being traded over-the-counter in the future under the Holding Foreign Companies Accountable Act, if the SEC determines that we have filed annual report containing an audit report issued by a registered public accounting firm that the PCAOB has determined it is unable to invest or investigate completely for three consecutive years beginning in 2021. The delisting or the cessation of trading of our ADS, or the threat of their being delisted or prohibited from being traded, may materially and adversely affect the value of your investment. On December 16, 2021, the PCAOB issued a report to notify the SEC its determinations that it is unable to inspect or investigate completely registered public accounting firms headquartered in Mainland China and Hong Kong, respectively, and identifies the registered public accounting firms in Mainland China and Hong Kong that are subject to such determinations. Our auditor is identified by the PCAOB and is subject to the determination. Furthermore, the PRC government has significant authority to intervene or influence the China or Hong Kong operations of an offshore holding company, such as ours, at any time. These risks, together with uncertainties in the PRC legal system and the interpretation and enforcement of PRC laws, regulations, and policies, could hinder our ability to offer or continue to offer the ADSs, result in a material adverse change to our business operations, and damage our reputation, which could cause the ADSs to significantly decline in value or become worthless. For a detailed description of risks relating to doing business in China, see “Risk Factors—Risks Relating to Doing Business in Mainland China and Hong Kong.”

AMTD Digital Inc. is not an operating company but a Cayman Islands holding company with operations primarily conducted by its subsidiaries. Investors in our ADSs thus are purchasing equity interest in a Cayman Islands holding company. As used in this prospectus, “we,” “us,” “our company,” or “our” refers to AMTD Digital Inc. and its subsidiaries. This structure involves unique risks to investors. As a holding company, we may rely on dividends from our subsidiaries for our cash requirements, including any payment of dividends to our shareholders. The ability of our subsidiaries to pay dividends to us may be restricted by the debt they incur on their own behalf or laws and regulations applicable to them. For a detailed description, see “Summary Consolidated Financial Data—Cash Transfers and Dividend Distribution.”

As of the date of this prospectus, no transfer of cash or other types of assets has been made between our Cayman Islands holding company and subsidiaries. Our Cayman Islands holding company has not declared or paid dividends in the past given the early development stage of our businesses, nor any dividends or distributions were made by a subsidiary to the Cayman Islands holding company. We intend to have our holding company distribute dividends in the future, but we do not have a fixed dividend policy. Our board of directors has complete discretion on whether to distribute dividends, subject to applicable laws. See “Risk Factors—Risks Relating to Our ADSs and This Offering—Because the amount, timing, and whether or not we distribute dividends at all is entirely at the discretion of our board of directors, you must rely on price appreciation of the ADSs for return on your investment.” If needed, cash can be transferred between our holding company and subsidiaries through intercompany fund advances, and there are currently no restrictions of transferring funds between our Cayman Islands holding company and subsidiaries in Hong Kong and Singapore. Two of our subsidiaries are subject to paid-up capital requirements, and we must consider their financial conditions in any distribution of the earnings to their respective holding companies. There are no significant restrictions on foreign exchange or our ability to transfer cash between entities within our group, across borders, or to U.S. investors. See “Summary Consolidated Financial Data—Cash Transfers and Dividend Distribution.”

PRICE US$ PER ADS

| | | | | | | | |

| | | Per ADS | | | Total | |

Initial public offering price | | US$ | | | | US$ | | |

Underwriting discounts and commissions(1) | | US$ | | | | US$ | | |

Proceeds, before expenses, to us | | US$ | | | | US$ | | |

| (1) | See “Underwriting” for additional disclosure regarding underwriting compensation payable by us. |

We have granted the underwriters an option to purchase up to an additional 2,400,000 ADSs.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the ADSs against payment in U.S. dollars to purchasers on or about , 2022.

AMTD

| | | | |

| Loop Capital Markets | | Maxim Group LLC | | Livermore Holdings Limited |

Prospectus dated , 2021