Exhibit 99.1

AMTD IDEA Group to Inject US$500 Million Worth of Global Portfolio of Premium Real Estate Assets Located in Major Cities into AMTD Digital Inc.

August 16, 2022 06:37 AM Eastern Daylight Time

NEW YORK & SINGAPORE & HONG KONG—(BUSINESS WIRE)— AMTD IDEA Group (“AMTD IDEA Group”) (NYSE: AMTD; SGX: HKB), a subsidiary of AMTD Group Company Limited (“AMTD Group”) and a leading platform for comprehensive financial services and digital solutions, and AMTD Digital Inc. (“AMTD Digital”) (NYSE: HKD), a controlled and consolidated subsidiary of AMTD IDEA Group and a comprehensive one-stop digital solutions platforms in Asia, jointly announced that AMTD IDEA Group had entered into certain agreements (the “AMTD Assets Agreements”) with AMTD Group and AMTD Digital. Pursuant to the terms of the AMTD Assets Agreements:

| | 1. | AMTD Group will inject into AMTD IDEA Group 100% of the equity interest in AMTD Assets Group (“AMTD Assets”), which represents the letter “A” of AMTD Group’s “IDEA” strategy, and holds a global portfolio of premium whole building properties, with a fair market value of approximately US$500 million. After deducting the outstanding liabilities associated with the properties, the net purchase consideration amounted to US$268 million, which will be settled by the issuance of 30,875,576 newly issued Class B ordinary shares of AMTD IDEA Group at US$8.68 per share (equivalent to a value of US$8.68 per American depositary share of AMTD IDEA Group at a conversion ratio of each American depositary share of AMTD IDEA Group representing one ordinary share of AMTD IDEA Group), and |

| | 2. | Following the completion of the above transaction, AMTD IDEA Group will inject AMTD Assets into AMTD Digital at the same valuation in return for 515,385 newly issued Class B ordinary shares of AMTD Digital at US$520 per share (equivalent to a value of US$208 per American depositary share of AMTD Digital at a conversion ratio of every five American depositary shares of AMTD Digital representing two ordinary shares of AMTD Digital). |

The transactions contemplated under each of the AMTD Assets Agreements are subject to certain closing conditions and are expected to close in September 2022. Upon the completion of the foregoing transactions, AMTD Digital will own 100% of the equity interest in AMTD Assets, and AMTD IDEA Group will further increase its ownership interest in AMTD Digital to 87.64% of and continue to consolidate AMTD Digital.

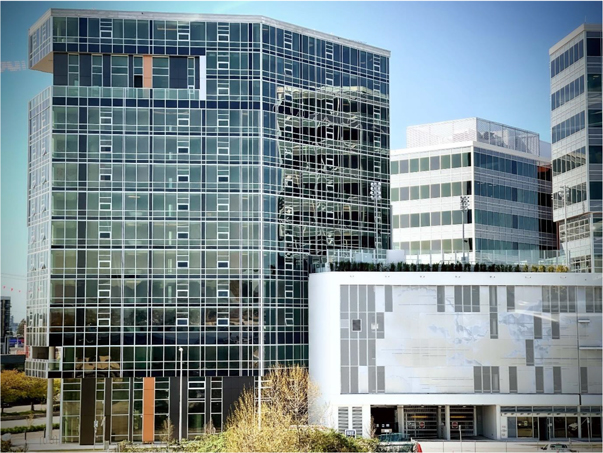

AMTD Assets is the real estate arm of AMTD Group, focusing on and specialising in hospitality and lifestyle concepts globally. AMTD Assets offers a customer-centric VIP members approach for its business portfolio in the key areas comprising stylish hotels and serviced apartments, property rental, food and beverage, and club membership services across major cities.

The Board of Directors and Audit Committees of each of AMTD IDEA Group and AMTD Digital have unanimously approved the AMTD Assets Agreements to which it is a party, and the transactions contemplated thereunder.

In addition, AMTD IDEA Group and AMTD Digital understand that in the next two years, (i) AMTD Group, Dr. Calvin Choi, the founder and chairman of AMTD Group (together with his holding company Infinity Power Investments Limited), and the executive officers of AMTD IDEA Group have undertaken that they will not sell any shares they own in AMTD IDEA Group in the open market, and (ii) AMTD Group, Dr. Calvin Choi (together with his holding company Infinity Power Investments Limited), AMTD IDEA Group and the executive officers of AMTD Digital have also undertaken that they will not sell any shares they own in AMTD Digital in the open market.