“Service Provider” means any officer, director, employee (whether temporary, full- or part-time) or individual independent contractor of the Company or any of its Subsidiaries.

“Shareholder Loan Notes” means, collectively, (i) those certain loan notes due 2026 issued to certain of the Sellers by Mirion Technologies (HoldingSub1), Ltd. pursuant to that certain Second Amended and Restated Loan Note Instrument dated September 10, 2018; and (ii) those certain loan notes due 2026 issued to certain of the Sellers by Mirion Technologies (HoldingSub1), Ltd. pursuant to that certain Loan Note Instrument dated December 16, 2020.

“Software” means all: (i) computer programs, including all software implementations of algorithms, models and methodologies, whether in source code or object code; (ii) databases and compilations, including all data and collections of data, whether machine readable or otherwise; (iii) descriptions, flow-charts and other work product used to design, plan, organize and develop any of the foregoing, screens, user interfaces, report formats, firmware, development tools, templates, menus, buttons, images, videos, models and icons; and (iv) documentation, including user manuals and other training documentation, related to any of the foregoing.

“SPAC Material Adverse Effect” means, with respect to the SPAC, any state of facts, development, effect, change, circumstance, event or occurrence that, individually or in the aggregate, has prevented, materially delayed or materially impaired, or would reasonably be expected to prevent, materially delay or materially impair, the ability of the SPAC to consummate the Transactions.

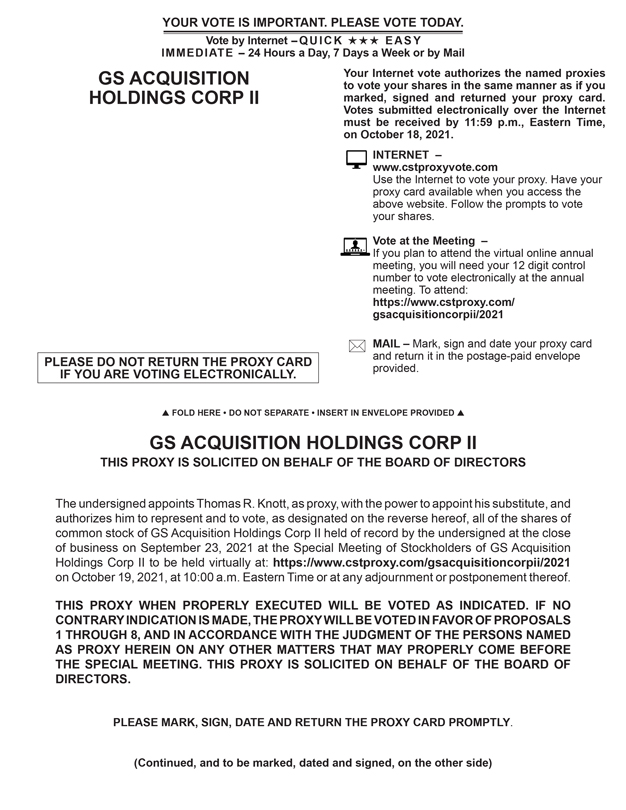

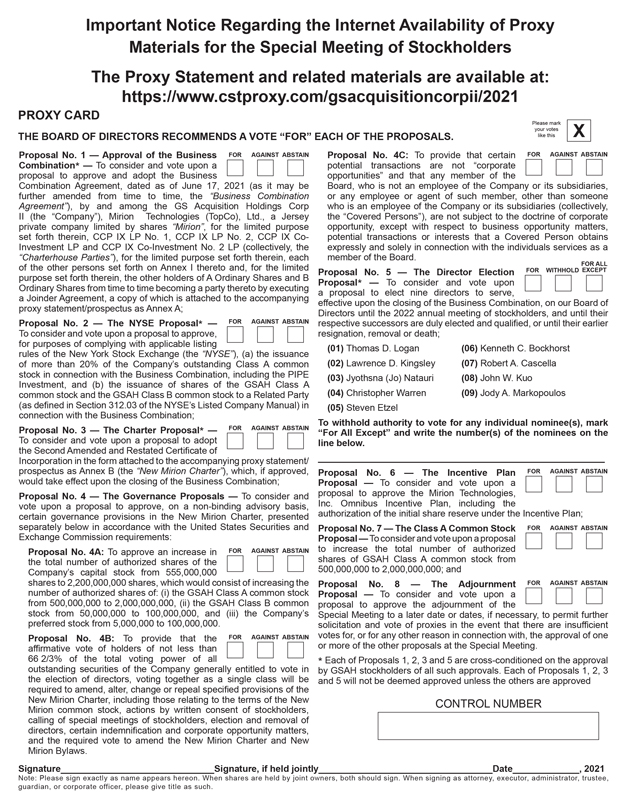

“SPAC Special Meeting” means the meeting of the Existing SPAC Stockholders, for the purpose of obtaining the approval of the Transaction Proposals and other matters reasonably related to the Transaction Proposals.

“SPAC Stock Election Proportion” means the number of SPAC Stock Electing Shares, divided by the aggregate number of SPAC Stock Electing Shares and Unit Electing Shares.

“Sponsor” means GS Sponsor II LLC, a Delaware limited liability company.

“Straddle Period” means any taxable period that includes (but does not end on) the Closing Date.

“Subsidiary” means, with respect to any Person, any partnership, limited liability company, corporation or other business entity of which: (i) if a corporation, a majority of the total voting power of shares of capital stock entitled (without regard to the occurrence of any contingency) to vote in the election of directors, managers, or trustees thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more of the other Subsidiaries of that Person or a combination thereof; (ii) if a partnership, limited liability company or other business entity, a majority of the partnership or other similar ownership interests thereof is at the time owned or controlled, directly or indirectly, by that Person or one or more Subsidiaries of that Person or a combination thereof; or (iii) in any case, such Person controls the management thereof.

“Tax” means (i) any federal, state, provincial, territorial, local, non-U.S. and other net income, alternative or add-on minimum, franchise, gross income, adjusted gross income or gross receipts, employment-related (including employee withholding or employer payroll, ad valorem, transfer, franchise, license, excise, severance, stamp, occupation, premium, personal property, real property, capital stock, profits, disability, occupation, windfall profit, registration, value added, social security, estimated, customs, duties, sales or use tax, or any other tax or like assessment or charge, in each case, in the nature of a tax, together with any interest, penalty, addition to tax or additional amount imposed with respect thereto by a Governmental Authority and (ii) any liability in respect of any items described in clause (i) payable as a result of being a member of a combined, consolidated, unitary or affiliated group (including pursuant to Treasury Regulations Section 1.1502-6 or any comparable provision of Applicable Law), or as a transferee or successor.

A-17