The information in this preliminary Offering Circular is not complete and may be changed. These securities may not be sold until the offering statement filed with the Securities and Exchange Commission is qualified. This preliminary Offering Circular is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JANUARY 14, 2021

PRELIMINARY OFFERING CIRCULAR

GROUNDFLOOR YIELD LLC

Groundfloor Yield Notes

MAXIMUM OFFERING: $50,000,000

MINIMUM OFFERING: $0

Groundfloor Yield LLC, a Georgia limited liability company, (the “Company” or “we”) intends to offer and sell on a continuous basis, its Groundfloor Yield Notes described in this offering circular (the “Offering Circular”). Such Groundfloor Yield Notes shall be made available for investment on an online investment platform (the “Groundfloor Yield Platform” or the “Platform”) available through a smartphone application (the “Mobile App”) owned and operated by the Company, a facsimile of which also exists on the Groundfloor Platform owned and operated by Groundfloor Finance Inc., a Georgia corporation (“Groundfloor Finance”), the Company’s sole member and manager. The proceeds of this offering will be used primarily to purchase commercial real estate loans from Groundfloor Holdings, LLC (“GFH”), a Georgia limited liability company and wholly owned subsidiary of Groundfloor Finance and for general corporate purposes of the Company, including the cost of this offering.

The Company will offer and sell on a continuous basis the Groundfloor Yield Notes described in this Offering Circular. This Offering Circular describes some of the general terms that may apply to the Groundfloor Yield Notes and the general manner in which they may be offered and follows the disclosure format of Part II of Form 1-A pursuant to the general instructions of Part II(a)(1)(i) of Form 1-A.

The Groundfloor Yield Notes will:

| | · | Be priced at $0.01 each; |

| | · | Represent a full and unconditional obligation of the Company; |

| | · | Bear interest at 4.0% per annum as set forth in the applicable Groundfloor Yield Note, as such interest rate may be modified from time to time, but not more frequently than twice per month, by the Company in its sole discretion as described in this Offering Circular; such modifications to reflect an interest rate per annum of 2.0%-6.0% in 0.25% increments; |

| | · | Have a three (3) year term and will (i) contain a redemption feature that is exercisable by the holder every five (5) business days from the date of issuance; and (ii) be callable, redeemable, and prepayable at any time by the Company; |

| | · | Be secured by a first priority security interest in the assets (and related property and rights) of the Company, which assets will principally consist of commercial real estate loans held by the Company; and |

| | · | Not be payment dependent on any individual underlying real estate loan or loans held by the Company, including without limitation, any loans issued on Groundfloor Finance’s online lending platform. |

The Company reserves the right to modify the applicable interest rate on the Groundfloor Yield Notes from time to time, but not more frequently than twice per month, in its sole discretion. All updates to the applicable interest rate will be communicated to Investors through the Mobile App no less than seven (7) calendar days prior to the effective date of such updated interest rate, and will also be reflected in an offering circular supplement to be filed with the Securities and Exchange Commission no later than five (5) business days after the effective date of such updated interest rate. All updates to the applicable interest rate shall apply to all outstanding

Groundfloor Yield Notes held by such Investor as of the effective date of the interest rate change. For the avoidance of doubt, no terms of the Groundfloor Yield Notes (including the term, price, or other non-interest rate features of the Groundfloor Yield Notes) other than the applicable interest rate may be modified in the sole discretion of the Company.

For more information on the Groundfloor Yield Notes being offered, please see the section entitled “Groundfloor Yield Notes” beginning on page 9 of this Offering Circular. The aggregate initial offering price of the Groundfloor Yield Notes will not exceed $50,000,000 in any 12-month period, and there will be no minimum offering.

We intend to offer the Groundfloor Yield Notes in $0.01 increments on a continuous basis directly through the Mobile App. At the present time, we do not anticipate using any underwriters to offer our securities.

This Offering Circular does not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sales of the Groundfloor Yield Notes in any states where such offer, solicitation would be unlawful, prior to registration or qualification under the laws of any such state.

We were formed in Georgia in April 2020 by our sole member and manager, Groundfloor Finance Inc. and our principal address is 600 Peachtree Street, Suite 810, Atlanta, GA 30308. Our phone number is (404) 850-9225. Our website is located at https://www.groundfloor.us/.

Investing in our securities involves a high degree of risk, including the risk that you could lose all of your investment. Please read the section entitled “Risk Factors” beginning on page 10 of this Offering Circular about the risks you should consider before investing.

| | | Price to the Public | | | Underwriting

discount and

commissions | | | Proceeds to

issuer | | | Proceeds to

other persons | |

| Groundfloor Yield Notes | | $ | 0.01 | | | $ | 0 | | | $ | 50,000,000 | | | $ | 0 | |

| Total Minimum | | | - | | | | - | | | | - | | | | - | |

| Total Maximum | | $ | 0.01 | | | $ | 0 | | | $ | 50,000,000 | | | $ | 0 | |

The approximate date of the proposed sale to the public is as soon as practicable after the offering is qualified.

IMPORTANT NOTICES TO INVESTORS

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SELLING LITERATURE. THESE SECURITIES ARE BEING OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED HEREUNDER ARE EXEMPT FROM REGISTRATION.

Generally, no sale may be made to you in this offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

The date of this preliminary Offering Circular is January 14, 2021.

Table of Contents

OFFERING CIRCULAR SUMMARY

This summary highlights information contained in this Offering Circular and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire Offering Circular, including our consolidated financial statements and the related notes thereto and the information in “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

Unless the context otherwise requires, we use the terms “Company,” “we,” “us” and “our” in this Offering Circular to refer to Groundfloor Yield LLC.

Business Overview

We are a wholly-owned subsidiary of Groundfloor Finance Inc. (“Groundfloor Finance”), an early-stage company making secured real estate loans that range from $15,000 to $500,000 through an online platform (the “Groundfloor Platform”). Through the Groundfloor Platform, Groundfloor Finance offers a marketplace for developers of residential and small commercial real estate (“Developers” or “Borrowers”) who wish to obtain funding in order to acquire or renovate residential and small commercial real estate projects or refinance existing indebtedness in connection with such projects (each, a “Project” and collectively, the “Projects”). Groundfloor Finance currently offers term loans with terms that range between six months to five years (the “Loans”). These terms are subject to change as market needs dictate, and it anticipates offering additional products in the future. Groundfloor Finance uses technology, data analytics, and its proprietary credit scoring model to assess the creditworthiness of each prospective borrower. If the applicant meets the Groundfloor Finance criteria, Groundfloor Finance sets the initial interest rate according to its credit and financial models.

Groundfloor Platform and Mobile App

Groundfloor Finance currently operates a web-based platform (the “Groundfloor Platform”), which is described in further detail below. The Groundfloor Yield Notes will be offered on the Platform through the Mobile App, which is owned and operated by the Company, a facsimile of which also exists on the Groundfloor Platform. Prospective investors in the Groundfloor Yield Notes will create a username and password, and indicate agreement to our terms and conditions and privacy policy on the Mobile App.

The following features are available to participants in the Groundfloor Yield Notes program through the Mobile App:

| | · | Available Online Directly from us. You can purchase Groundfloor Yield Notes directly from us through the Mobile App. |

| | · | No Purchase Fees Charged. We will not charge you any commission or fees to purchase Groundfloor Yield Notes through our platform. However, other financial intermediaries, if engaged, may charge you commissions or fees. |

| | · | Invest as Little as $0.01. You will be able to purchase Groundfloor Yield Notes in amounts as low as $0.01. |

| | · | Flexible, Secure Payment Options. You may purchase Groundfloor Yield Notes with funds electronically withdrawn from your checking account or by wire transfer. |

| | · | Manage Your Portfolio Online. You can view your investments, returns and transaction history online, as well as receive tax information and other portfolio reports. |

Proceeds from the Groundfloor Yield Notes contemplated in this offering will be used by the Company to purchase loans originated by Groundfloor Holdings, LLC (“GFH”), and for general corporate purposes of the Company, including the cost of this offering, but Groundfloor Yield Notes are not dependent upon any particular loan originated by GFH and remain at all times the general obligations of the Company. Final decisions on use of proceeds allocations will be made by Groundfloor Finance, as manager of the Company. Please refer to “About the Groundfloor Platform” starting on page 17 for more information relating to Groundfloor Finance and its subsidiaries.

Competitive Strengths

We believe we benefit from the following competitive strengths compared to traditional lenders:

| | · | Reduced product origination and financing request costs; |

| | · | Lower interest rates for financing of real estate projects; |

| | · | Attractive returns for investors |

| | · | The opportunity to promote community redevelopment by investing in local real estate projects; and |

| | · | Growing acceptance of the Internet, including the use of mobile applications as an efficient and convenient forum for investment transactions. |

Groundfloor Platform

Groundfloor Finance is the sole member of both the Company and GFH. Each of the Company and GFH is managed by Groundfloor Finance and Nick Bhargava, who is also the Co-Founder, Acting Chief Financial Officer, Secretary, and Executive Vice President (Legal and Regulatory) of Groundfloor Finance. The business operations of Groundfloor Finance are managed by a team of executive officers which includes (i) Brian Dally, President and CEO, (ii) Nick Bhargava, in the capacities mentioned above, (iii) Rhonda Hills, Senior Vice President (Marketing and Sales), (iv) Richard Pulido, Senior Vice President (Head of Lending and Risk Management) and (v) Chris Schmitt, Vice President (Software), and by its board of directors, which includes two independent directors.

Groundfloor Finance operates an online investment platform (the “Groundfloor Platform”) designed to source financing for real estate development projects. Through the Groundfloor Platform, investors can choose between multiple real estate development investment opportunities (each, a “Project”) and developers of the Projects (each, a “Developer”) can obtain financing. The Platform focuses on the commercial lending market for developers of residential and small commercial real estate projects that are not owned and occupied by the Developer. Proceeds from the loans are generally applied toward the Project’s acquisition and/or renovation or construction costs. In connection with the issuance of Groundfloor Yield Notes by the Company, the Company owns and operates the Mobile App. The Groundfloor Platform operated by Groundfloor Finance facilitates due diligence and underwriting reviews, coordinates payment to and from investors and developers, manages loan advances, and administers, services and collects on the loans originated by GFH which are subsequently acquired by the Company. All intellectual property relating to the Groundfloor Platform and the GFY Mobile App is owned by each of Groundfloor Finance and the Company, respectively.

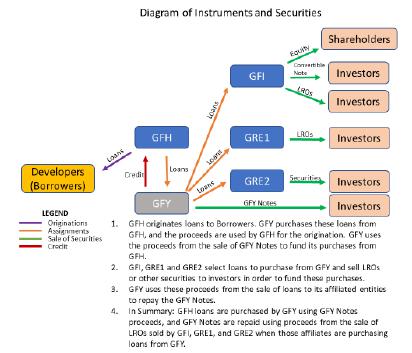

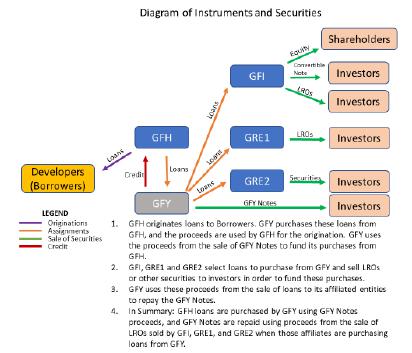

In connection with the Groundfloor Platform, Groundfloor Finance operates several subsidiaries with distinct functions. Subsidiaries help us isolate credit risks, legal risks, and other operational risks. This protects our investors, customers, and employees. Below is a list of our primary operating entities, including management structure, and function.

| | · | Groundfloor Finance Inc. (“Groundfloor Finance”). Groundfloor Finance is a Georgia corporation and is our main operating entity. It is managed by an executive team and governed by a board of directors (see "Management" section starting on page 24. Groundfloor Finance develops, owns, and operates the Groundfloor Platform, and associated technology IP. Groundfloor Finance may also identify and select Loans for acquisition from GFY, and once such Loans have been identified and selected, Groundfloor Finance will sell securities to investors which correspond to the identified Loan. Groundfloor Finance will use the proceeds from the sales of such securities to acquire and service the Loan for the duration of the Loan. As of the date of this Offering Circular, GFY has not commenced full operations, and Groundfloor Finance has been acquiring Loans directly from GFH. |

| | · | Groundfloor Holdings, LLC (“GFH”). GFH is a single member Georgia limited liability company. It is managed by Groundfloor Finance. Its sole purpose is to originate loans identified by Groundfloor Finance. It will use the proceeds of the sale of loans to Groundfloor Yield, LLC (“GFY”) to fund the loans that it originates. GFH intends to use the proceeds of the sale of loans to GFY to fund the origination of Loans in lieu of, and as a replacement for its existing credit facility with ACM Alamosa DA LLC. Loans typically stay on its balance sheet for up to 30 days before being sold to GFY. |

| | · | Groundfloor Yield, LLC (“GFY”). GFY is a single member Georgia limited liability company. It is managed by Groundfloor Finance and Nick Bhargava, Executive Vice President, Secretary, and Acting Chief Financial Officer of Groundfloor Finance. Its sole purpose is to acquire Loans from GFH through the proceeds raised from the sale of Groundfloor Yield Notes as described in this Offering Circular, such Loans to be held for a limited period of time until they are sold to three affiliated companies, Groundfloor Finance, Groundfloor Real Estate 1, LLC and Groundfloor Real Estate 2, LLC, as further described below. Loans typically stay on the balance sheet of GFY for five (5) days, but in any event for no more than thirty (30) days, before being sold to such affiliated companies. As of the date of this Offering Circular, GFY has not commenced full operations. |

| | · | Groundfloor Real Estate 1, LLC (“GRE1”). GRE1 is a single member Georgia limited liability company. It is managed by Groundfloor Finance and Nick Bhargava, Executive Vice President, Secretary, and Acting Chief Financial Officer of Groundfloor Finance. Its purpose is to select and acquire Loans from GFY. Once Loans have been identified for acquisition, GRE1 will sell Limited Recourse Obligations (LROs) to investors which correspond to the identified Loan. It will use these funds to acquire and service the Loan for the duration of the Loan. As of the date of this Offering Circular, GFY has not commenced full operations, and GRE1 has been acquiring Loans directly from GFH. |

| | · | Groundfloor Real Estate 2, LLC (“GRE2”). GRE2 is a single member Georgia limited liability company. It is managed by Groundfloor Finance. Its purpose is to select and acquire Loans from GFY. Once loans have been identified for acquisition, GRE2 will sell securities to institutional purchasers which correspond to the identified Loan. It will use these funds to acquire and service the Loan for the duration of the loan. As of the date of this Offering Circular, GFY has not commenced full operations, and GRE2 has been acquiring Loans directly from GFH. |

| | · | Groundfloor Properties GA, LLC (“GFGA”). GFGA is a single member Georgia limited liability company. It is managed by Groundfloor Finance. Its purpose is to manage distressed assets that have been acquired by affiliated companies in the course of exercising creditor rights. It conducts the majority of foreclosures that may be required by either GRE1 or GRE2. |

GFH does not finance owner-occupied residential projects, nor does it make Loans for any personal, family, or household purpose. All of the loans originated by GFH are commercial in nature. Although GFH only provides Loans to legal entities (i.e., the Developer), due to the nature of the real estate development business and the smaller market segment they service, GFH nevertheless factors into its due diligence and underwriting process the background and experience of the individual(s) who own and operate the borrowing entity (i.e., the “Principal(s)”).

The scope of GFH’s due diligence and underwriting process is not limited only to information about the borrowing entity, which may be very limited in nature. In addition to considering the specific information with respect to the borrower under the Loan, GFH also considers the creditworthiness (through a review of FICO scores) and broader experience of the Principal.

Once GFH has identified the Projects that pass the preliminary assessment and thus meet our basic qualifications and financing requirements, GFH undertakes an assessment of each Project and the proposed terms of the underlying Loan to finalize the pricing terms (interest rate, maturity, repayment schedule, etc.) that it will accept.

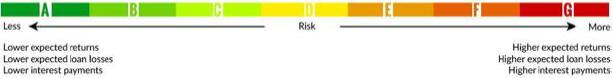

GFH uses a proprietary Grading Algorithm to assign one of seven letter grades, from A to G, to each Project. The letter grade generally reflects the overall risk of the Loan.

The Grading Algorithm, which was developed by the Groundfloor Finance management team in consultation with outside advisors with respect to the general type of residential real estate projects GFH currently finances, involves application of a two-step proprietary mathematical formula. Generally, GFH assigns a scale to each factor. The higher a Project rates with respect to a particular factor, the better the Loan scores. The higher the score, the lower the interest rate GFH will offer on the Loan.

Representing a quantifiable assessment of the risk profile of a given Project, the Grading Algorithm allows GFH to compare the relative risk profiles of various properties through the analysis of specific quantifiable characteristics, including (i) the valuation and strength of a particular Project and (ii) the experience and risk profile of the Developer. GFH uses the Grading Algorithm to determine a proposed base-line interest rate which reflects the given risk profile of a Project when it is underwritten. The lower the risk profile, the lower the interest rate GFH will agree to with respect to a particular Loan.

Groundfloor Yield Notes

Groundfloor Yield Notes, the subject of this Offering Circular, are available to retail investors for purchase through the Mobile App. Funds from the sale of Groundfloor Yield Notes are invested into Loans at the discretion of the Company. Investors in Groundfloor Yield Notes do not directly invest in Loans held by the Company that were acquired from GFH; rather, the Groundfloor Yield Notes are general obligations of the Company, and the proceeds thereof will be used primarily to fund the acquisition by the Company of Loans originated by GFH to continually expand and replenish the portfolio of Loans owned by the Company, which Loans are intended to be subsequently sold to Groundfloor Finance, GRE1 or GRE 2, typically within five (5) business days, but in any event no more than thirty (30) business days, following the acquisition thereof by the Company. The Groundfloor Yield Notes will be secured by a first priority security interest in the assets (and related property and rights) of the Company which will principally consist of commercial real estate loans that the Company has acquired from GFH. Such security interest will rank ahead of any unsecured debt of the Company. Given that the security interest is a blanket lien on the assets of the Company and is not against specifically identified assets of the Company, as of the date of this Offering Circular, there is no unbonded property available for use against the issuance of Groundfloor Yield Notes and the Groundfloor Yield Notes are not being issued against any unbonded property of the Company, the deposit of cash by the Company, or otherwise.

The offering of Groundfloor Yield Notes is being conducted as a continuous offering pursuant to Rule 251(d)(3) of the Securities Act of 1933 (“Securities Act”). Continuous offerings allow for a sale of securities to be made over time, with no specific offering periods or windows in which securities are available. Sales of securities may happen sporadically over the term of the continuous offering, and are not required to be made on any preset cadence. The active acceptance of new investors in Groundfloor Yield Notes, whether via the Mobile App or otherwise, may at times be briefly paused, or the ability to subscribe may be periodically restricted to certain individuals to allow the Company time to effectively and accurately process and settle subscriptions that have been received. The Company may discontinue this offering at any time.

Interest Rate of Groundfloor Yield Notes

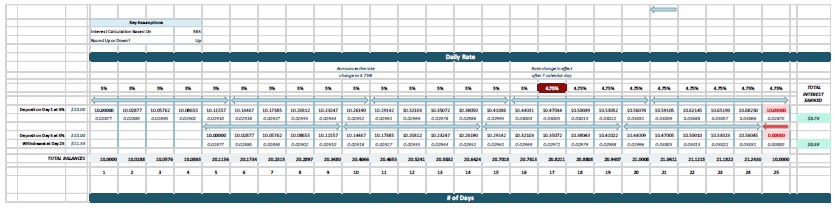

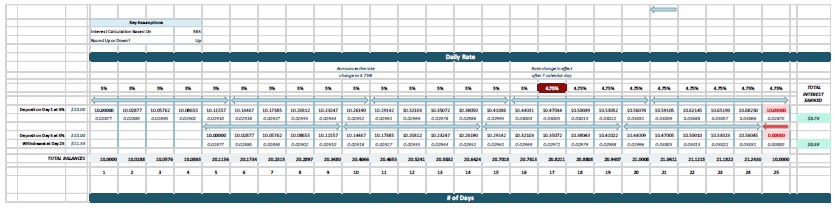

Initially, the Groundfloor Yield Notes will bear interest at a rate of 4.0% per annum, calculated on the basis of a three hundred and sixty (360) day year consisting of twelve thirty (30) day months, as set forth in the applicable Groundfloor Yield Note. The interest payable by the Company in respect of the Groundfloor Yield Notes will be calculated as a summation of the interest payable on each day during the term of the Groundfloor Yield Notes. For reference, an example of the calculation of interest on an investment in Groundfloor Yield Notes follows below.

The Company reserves the right to modify the applicable interest rate on the Groundfloor Yield Notes from time to time in its sole discretion, but not more than twice per month. All such modifications to the interest rate will reflect an interest rate per annum between 2.0% and 6.0% in 0.25% increments. All updates to the applicable interest rate will be communicated to Investors through the Mobile App no later than seven (7) business days prior to the effective date of such updated interest rate, and will also be reflected in an offering circular supplement to be filed with the Securities and Exchange Commission no later than five (5) business days after the effective date of such updated interest rate, which may be obtained from the SEC EDGAR filing website as https://www.sec.gov. All updates to the applicable interest rate shall apply to all outstanding Groundfloor Yield Notes held by such Investor as of the effective date of the interest rate change and the Company will issue an amended and restated Groundfloor Yield Note to all existing holders of Groundfloor Yield Notes that reflect such updated interest rate. Additionally, Investors may elect to purchase additional Notes bearing the updated interest rate through the Groundfloor Yield Mobile App, exercise their put right with respect to their outstanding Groundfloor Yield Notes at any time prior to the applicable maturity date (including at any time prior to the effective date of any interest rate change), or rollover all proceeds of an existing Groundfloor Yield Note on the applicable maturity into a new Groundfloor Yield Note bearing the updated interest rate. No other terms of the Groundfloor Yield Notes will be subject to change in the sole discretion of the Company.

Investor Put Right

From and after the issuance date of the Groundfloor Yield Notes and prior to the applicable maturity date of the Groundfloor Yield Notes, an Investor may require the Company to redeem such Investor’s Groundfloor Yield Note every five (5) business days from the applicable issuance date by exercising such Investor’s put right. The Investor may exercise such Investor’s put right with respect to an outstanding Groundfloor Yield Note by providing notice to the Company through the Mobile App up to and on the applicable Put Date (as defined herein). The Investor may exercise such Investor’s put right with respect to the Groundfloor Yield Notes every five (5) business days from the applicable issuance date of the Groundfloor Yield Notes (each, a “Put Date” and collectively, the “Put Dates”). For example, if a Groundfloor Yield Note is issued on Thursday, January 1, assuming that the Investor provides notice of such Investor’s intention to exercise such Investor’s put right, the Put Date will be the following Thursday, January 8. In the event an Investor exercises such Investor’s put right with respect to a given Groundfloor Yield Note on the Put Date, the Company will remit to the Investor’s GFY Account the accrued and outstanding interest and outstanding principal balance as of the Put Date within five (5) business days of such Put Date. In the event the Investor holds the Groundfloor Yield Note until the applicable maturity date, the Company will remit to the investor’s GFY Account the accrued and outstanding interest and outstanding principal balance as of the maturity date within five (5) business days of such maturity date. Except as described herein, there are no limitations on Investors’ ability to exercise their put rights.

Rollovers of Groundfloor Yield Notes

On the applicable maturity date of the Groundfloor Yield Notes, Investors may elect to roll over all payments received in respect of the outstanding principal balance and all accrued interest into a new Groundfloor Yield Note at the current and effective interest rate as of the issuance date, to be issued by the Company to such Investors on such applicable maturity date (the “Rollover”). If an Investor wishes to elect to rollover such proceeds, such Investor must provide written notice to the Company through the Groundfloor Yield Mobile App no later than on the applicable maturity date of the Groundfloor Yield Note. The Company will treat all rollovers as sales chargeable against the aggregate total of offered securities pursuant to the Offering Statement and to include such sales when calculating the $50 million cap in offering proceeds raised under any qualified offering statement within a 12 month period in accordance with Rule 251(a).

Groundfloor Yield Auto-Invest Program

Investors may elect to participate in the Groundfloor Yield Auto-Invest Program (the “GFY AIP”), which is an optional program that allows an Investor to automatically invest in additional Groundfloor Yield Notes on a recurring basis subject to certain parameters designated by such Investor. In order to affirmatively elect to participate in the GFY AIP, Investors are asked to complete a Groundfloor Yield Auto-Invest Program Election Form (the “GFY AIP Election Form”), which is an exhibit to the form of Note Purchase Agreement. All investors are required to review and complete the Note Purchase Agreement prior to any investments in any Groundfloor Yield Notes issued by the Company. Any investor that does not complete a GFY AIP Election Form shall be deemed to have opted out of participation in the GFY AIP. The GFY AIP Election Form provides investors with the option to select the amount of automatic investment, day of the month for each automatic investment in Groundfloor Yield Notes, along with the frequency of the automatic investment in Groundfloor Yield Notes, which may be on a quarterly basis or a custom schedule (with a minimum of at least two calendar months selected by the investor). If desired, investors may also designate a stop date for automatic investments. Investors may revise or change the elections set forth in the GFY AIP Election Form or cancel their participation in the GFY AIP at any time by submitting a new GFY AIP Election Form to Groundfloor Yield with three (3) business days’ notice in the event of a revision or change in election, or in the event that such investor wishes to cancel its participation in the GFY AIP.

All automatic investments in Groundfloor Yield Notes will earn interest at the then-effective interest rate applicable to all Groundfloor Yield Notes. Upon the consummation of each auto-investment in Groundfloor Yield Notes, the Company will send a confirmatory communication to the investor denoting the amount invested, the interest rate applicable to such Groundfloor Yield Notes, and a Groundfloor Yield Note issued by the Company. Investors who acquire Groundfloor Yield Notes through the GFY AIP (i) will be notified of any pending change in the applicable interest rate thereon in the same manner as described in the section titled Interest Rate of Groundfloor Yield Notes, and (ii) will have a put right with respect to each such Groundfloor Yield Note as described in the section titled Investor Put Right.

The Company has not yet deployed the GFY AIP for Groundfloor Yield Notes and, as a result, 0% of investors in Groundfloor Yield Notes participate in the GFY AIP. The Company anticipates deploying the GFY AIP for Groundfloor Yield Notes within two calendar days after the qualification date of this Offering Circular. The Company will treat sales of Groundfloor Yield Notes under the GFY AIP as sales chargeable against the aggregate total of offered securities pursuant to the Offering Statement and to include such sales when calculating the $50 million cap in offering proceeds raised under any qualified offering statement within a 12 month period in accordance with Rule 251(a).

Proceeds from the sales of Groundfloor Yield Notes may be used for any purpose, including, but not limited to, funding the acquisition of loans originated by GFH, balance sheet support for institutional credit facilities, or used for general corporate purposes. The Company retains final discretion over the use proceeds.

Risks Affecting Us

Our business is subject to numerous risks and uncertainties, including those highlighted in the section titled “Risk Factors” beginning on page 10. These risks include, but are not limited to the following:

| | · | Because real estate development projects are inherently risky, our business may be negatively impacted by changes. |

| | · | We have no operating history and Groundfloor Finance has a limited operating history in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful. |

| | · | We will need to raise substantial additional capital to fund our operations, and if we fail to obtain such funding, we may be unable to grow and remain in business. |

| | · | The Groundfloor entities may not be able to identify and increase the number of Projects that are financed on the Groundfloor Platform. |

| | · | We rely on data centers and outside service providers. |

| | · | Holders of Groundfloor Yield Notes are exposed to the credit risk of the Company. |

| | · | There has been no public market for Groundfloor Yield Notes, and none is expected to develop. |

Our Company

We were formed as a Georgia limited liability company on April 10, 2020 by Groundfloor Finance Inc., our sole member and manager. Our principal offices are located at 600 Peachtree Street, Suite 810, Atlanta, GA 30308. The phone number for these offices is (404) 850-9225. Our mailing address is 600 Peachtree Street, Suite 810, Atlanta, GA 30308.

The Offering

| Securities offered by us | Groundfloor Yield Notes, offered by the Company on a best-efforts basis. |

| | |

| Groundfloor Yield Notes | The Groundfloor Yield Notes will: · Be priced at $0.01 each; · Represent a full and unconditional obligation of the Company; · Bear interest at 4.0% per annum as set forth in the applicable Groundfloor Yield Note, as such interest rate may be modified from time to time, but not more than twice per month, by the Company in its sole discretion, upon seven (7) days prior written notice to Investors; such modifications to reflect an interest rate per annum of 2.0%-6.0% in 0.25% increments; · Have a three (3) year term and will (i) contain a redemption feature that is exercisable by the holder every five (5) business days from the date of issuance; and (ii) be callable, redeemable, and prepayable at any time by the Company; · be secured by a first priority security interest in the assets (and related property and rights) of the Company, which assets will principally consist of commercial real estate loans held by the Company; · Not be payment dependent on any individual underlying real estate loan or loans held by the Company, including without limitation, any loans issued on the Groundfloor Platform; and · Allow investors to participate in the GFY AIP, which allows automatic investment in additional Groundfloor Yield Notes on a regular basis in an amount and preset cadence designated by the investor. |

| | |

| Principal Amount of Groundfloor Yield Notes | We will not issue securities hereby having gross proceeds in excess of $50 million during any 12-month period. The securities we offer hereby will be offered on a continuous basis. |

| | |

| Regulation A Tier | Tier 2 |

| | |

| Groundfloor Yield Notes Purchasers | Accredited investors pursuant to Rule 501 and non-accredited investors. Pursuant to Rule 251(d)(2)(C), non-accredited investors who are natural persons may only invest the greater of 10% of their annual income or net worth. Non-natural non-accredited persons may invest up to 10% of the greater of their net assets or revenues for the most recently completed fiscal year. |

| | |

| Manner of offering | See section titled “Plan of Distribution” beginning on page 33. |

| | |

| How to invest | Directly via the Groundfloor Platform and a smartphone application (the “Mobile App”). |

| | |

| Use of proceeds | If we sell $50 million of gross proceeds from the sale of our securities under this Offering Circular, we estimate our net proceeds, after deducting estimated commissions and expenses, will be approximately $49,889,500, assuming our offering expenses are $110,500. We intend to use the proceeds from this offering to purchase loans originated by GFH and for general corporate purposes of the Company, including the cost of this offering. See "Use of Proceeds". |

| | |

| Risk factors | See the section titled “Risk Factors” beginning on page 10 of this offering statement for a discussion of factors that you should read and consider before investing in our securities. |

RISK FACTORS

Investing in our securities involves a high degree of risk. Before deciding whether to invest, you should consider carefully the risks and uncertainties described below, our consolidated financial statements and related notes and all of the other information in this Offering Circular. If any of the following risks actually occurs, our business, financial condition, results of operations and prospects could be adversely affected. As a result, the value of our securities could decline and you could lose part or all of your investment.

Risks Related to Investing in Groundfloor Yield Notes

Holders of Groundfloor Yield Notes are exposed to the credit risk of the Company.

Groundfloor Yield Notes are the full and unconditional obligations of the Company and are fully recourse to the Company’s assets. You will have a first priority security interest in all assets of the Company. However, the Groundfloor Yield Notes may still be subject to non-payment by the Company in the event of our bankruptcy or insolvency. In an insolvency proceeding, there can be no assurances that you will recover the full amount of your investment in the Groundfloor Yield Notes.

There has been no public market for Groundfloor Yield Notes, and none is expected to develop.

Groundfloor Yield Notes are newly issued securities. Although under Regulation A the securities are not restricted, Groundfloor Yield Notes are still highly illiquid securities. No public market has developed nor is expected to develop for Groundfloor Yield Notes, and we do not intend to list Groundfloor Yield Notes on a national securities exchange or interdealer quotational system. You should be prepared to hold your Groundfloor Yield Notes through their maturity dates as Groundfloor Yield Notes are expected to be highly illiquid investments.

The Company may not be able to generate sufficient cash to service its obligations under the Groundfloor Yield Notes.

The Company’s ability to make payments on the outstanding Groundfloor Yield Notes will depend on the performance of the portfolio of real estate loans that the Company holds, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond the Company’s control. The Company may be unable to maintain a level of cash flows from its portfolio of real estate loans sufficient to permit the Company to pay principal and interest on the Groundfloor Yield Notes. The Groundfloor Yield Notes are secured by solely the assets of the Company and no other party is obligated to make any payments to Investors on the Notes, nor does any party guarantee payments from the real estate loans. Further, the Groundfloor Yield Notes are not insured or guaranteed by the United States or any governmental entity. Payments on any Groundfloor Yield Notes will depend solely on the amount and timing of payments and other collections in respect of the real estate loans owned by the Company. There is no guarantee that such amounts received by the Company are sufficient to make full and timely payments on the Notes. If delinquencies and losses create shortfalls, you may experience delays in payments due under the Notes you hold and you could suffer a loss.

The Groundfloor Yield Note Purchase Agreement limits your rights in some important respects.

When you make an investment through the Groundfloor Platform and Mobile App, you are required to agree to the terms of our standard Groundfloor Yield Note Purchase Agreement, which sets forth your principal rights and obligations as an investor in the Groundfloor Yield Notes we issue, and to agree to the terms of a Groundfloor Yield Note, which sets forth the specific terms of the Groundfloor Yield Notes you are committing to purchase. Under the Groundfloor Yield Note Purchase Agreement, we may require that any claims against us, including without limitation, claims alleging violations of federal securities laws by us or any of our officers or directors and claims other than in connection with this offering, be resolved through binding arbitration rather than in the courts. Notwithstanding the foregoing sentence, you may elect to opt out of the arbitration provision for all purposes by sending an arbitration opt out notice to the Company in accordance with the terms and conditions set forth in Section 24(b) of the Note Purchase Agreement. If you do not opt out of binding arbitration, Section 24(a) of the Note Purchase Agreement, provides, among other things, that (i) arbitration is final and binding on the parties; (ii) the parties are waiving their right to seek remedies in courts, including the right to jury trial; (iii) pre-arbitration discovery is generally more limited and potentially differs in form and scope from court proceedings; (iv) an award by an arbitrator is not required to include factual findings or legal reasoning, and your right to appeal or to seek modification of a ruling by the arbitrator is strictly limited; and (v) the arbitrator (or three arbitrator panel, if applicable) may include a minority of persons engaged in the securities industry. As a result, the arbitration process may be less favorable to investors than court proceedings and may limit your right to engage in discovery proceedings or to appeal an adverse decision. These provisions may have the effect of discouraging lawsuits against us and our directors and officers. Your agreement to the arbitration provisions in the Groundfloor Yield Note Purchase Agreement will not waive the Company’s compliance with the federal securities laws and the rules and regulations promulgated thereunder.

The Company believes that the arbitration provisions in the Agreements are enforceable under federal and state law. The Federal Arbitration Act (“FAA”) is an act of Congress that provides for judicial facilitation of dispute resolution through arbitration and embodies a national policy favoring arbitration, providing that a written contractual provision evidencing a transaction involving interstate commerce to arbitrate a controversy “shall be valid, irrevocable, and enforceable, save upon such grounds as exist at law or in equity for the revocation of any contract.” Further, the United States Supreme Court has interpreted the FAA as creating a uniform body of federal substantive law regulating the enforceability of agreements to arbitrate that applies to all contracts involving interstate commerce in both state and federal court. The arbitration provision in the Groundfloor Yield Note Purchase Agreement specifically states that it is made pursuant to a transaction involving interstate commerce and shall be governed by and enforceable under the FAA.

In the event that enforceability issues arise under state law, the Company maintains its belief that the arbitration clause will be upheld. In AT&T Mobility LLC v. Concepcion, 131 S. Ct. 1740 (2011), the United State Supreme Court recognized that in order to accomplish the general purpose of the FAA to promote efficient streamlined procedures for resolving disputes, federal law has developed a preference for enforcing arbitration agreements according to their terms. Consistent with this preference, the Court has held that state laws discriminating against arbitration are preempted by the FAA because such rules stand as an obstacle to the FAA’s objectives. Further, the FAA is presumed to preempt the state law selected in a general choice-of-law clause unless the contract expressly evidences the parties’ intent that state arbitration law applies in place of or in addition to the FAA. As cited above, the arbitration provision in the Groundfloor Yield Note Purchase Agreement clearly sets forth the parties’ intent that the FAA should apply rather than state law.

You also waive your right to a jury trial under the Groundfloor Yield Note Purchase Agreement. Purchasers of the Groundfloor Yield Notes in any secondary transactions are subject to the terms of the Groundfloor Yield Note Purchase Agreement, and are deemed to have waived their right to a jury trial as well. Accordingly, if you bring a claim against the Company in connection with matters arising under the Groundfloor Yield Note Purchase Agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to such claims, which may have the effect of limiting and discouraging lawsuits against us and our directors and officers. If a lawsuit is brought against us under the Groundfloor Yield Note Purchase Agreement, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in any such action. It is advisable that you consult legal counsel regarding the jury waiver provision before entering into the Groundfloor Yield Note Purchase Agreement.

While the Company believes that a contractual pre-dispute jury trial waiver is generally enforceable, the enforceability of the jury trial waiver is not free from doubt. To the Company’s knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by the United States Supreme Court. With respect to enforceability under Georgia state law, the Company acknowledges that the state courts of Georgia, which have jurisdiction over state law matters arising under the Groundfloor Yield Note Purchase Agreement, have upheld the minority position that contractual pre-dispute jury trial waivers are not enforceable. If the Company opposed a jury trial demand based on the waiver, the court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the Groundfloor Yield Note Purchase Agreement.

Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the Groundfloor Yield Note Purchase Agreement with a jury trial if you have not elected to opt out with respect to binding arbitration as set forth in Section 24 of the Groundfloor Yield Note Purchase Agreement. No condition, stipulation or provision of the Groundfloor Yield Note Purchase Agreement or the Groundfloor Yield Note Purchase Agreement serves as a waiver by any Investor of the Company’s compliance with any substantive provision of the U.S. federal securities laws and the rules and regulations promulgated thereunder.

Additionally, by entering into the Groundfloor Yield Note Purchase Agreement, the investor expressly waives and releases, as a condition of and as part of the consideration for the issuance of the Groundfloor Yield Note, any recourse under or upon any obligation, covenant or agreement contained in the Groundfloor Yield Note Purchase Agreement, or because of any obligations evidenced therein, against any incorporator, or against any past, present or future shareholder, officer or director, as such, of the Company, either directly or through the Company, under any rule of law, statute (other than applicable federal securities laws) or constitutional provision or by the enforcement of any assessment or penalty or otherwise. This provision has the effect of limiting the available parties against which an investor may seek recourse in connection with the Company’s obligations under the Groundfloor Yield Note Purchase Agreement.

Pursuant to Section 25 of the Groundfloor Yield Note Purchase Agreement, in connection with your purchase of the Notes, to the extent permitted by law, you waive your right to a jury trial in any litigation relating to the Agreements, including the purchase of the Notes.

When you purchase the Groundfloor Yield Notes, you are required to agree to the terms of the Groundfloor Yield Note Purchase Agreement. Among other things, both agreements provide that you waive your right to a jury trial in any litigation relating to each agreement and your purchase of the Notes, including claims under the federal securities laws. You will have the right to litigate claims, including claims under the federal securities laws through a court before a judge, but you will not have that right if any party elects arbitration pursuant to the terms of the Agreements unless you opt out as provided in Section 24(b) of the Groundfloor Yield Note Purchase Agreement. Neither your waiver of jury trial nor your agreement to the arbitration provision shall be deemed to waive the Company’s compliance with the federal securities laws and the rules and regulations promulgated thereunder. Please refer to the risk factor “The Groundfloor Yield Note Purchase Agreement limits your rights in some important respects” for more information regarding the jury trial waiver provision contained in the Groundfloor Yield Note Purchase Agreement and the Groundfloor Yield Note Purchase Agreement.

Pursuant to Section 2(b) of the Groundfloor Yield Notes, the interest rate payable in respect of the Note may be changed in the sole discretion of the Company.

Upon the initial issuance of Groundfloor Yield Notes in this Offering, the Groundfloor Yield Notes will bear interest at a rate of 4.0% per annum. However, pursuant to Section 2(b) of the Groundfloor Yield Notes, the interest rate applicable to the Groundfloor Yield Notes may be modified from time to time, but not more than twice per month, by the Company in its sole discretion, upon seven (7) days prior written notice to Investors; such modifications to reflect an interest rate per annum of 2.0%-6.0% in 0.25% increments. Investors should be advised that the interest rate applicable to the Groundfloor Yield Notes may be decreased, from the interest rate applicable upon the date of their initial investment, which would reduce the rate of return on the Groundfloor Yield Notes held by such investors. Any modification to the interest rate applicable to the Groundfloor Yield Notes will be applicable to all then-outstanding Groundfloor Yield Notes, and any newly issued Groundfloor Yield Notes will be issued at the then-applicable interest rate. In the event that an Investor does not wish to participate in the Offering at any proposed new interest rate, such Investor may exercise their put right pursuant to Section 3 of the Groundfloor Yield Notes to redeem their Groundfloor Yield Notes prior to the effective date of the interest rate modification.

Risks Related to the Company

We have no operating history, and our parent company has a limited operating history. As companies in the early stages of development, we face increased risks, uncertainties, expenses and difficulties.

Groundfloor Finance (with its affiliates) has a limited operating history and the Company has no operating history. Groundfloor Finance owns and operates the Groundfloor Platform. For our business to be successful, the number of real estate development projects originated by GFH will need to increase, which will require Groundfloor Finance to increase its facilities, personnel and infrastructure to accommodate the greater servicing obligations and demands on the Groundfloor Platform. Groundfloor Finance must constantly update its software and website, expand its customer support services and retain an appropriate number of employees to maintain the operations of the Groundfloor Platform, as well as to satisfy our servicing obligations on the Loans and make payments on the Groundfloor Yield Notes. If Groundfloor Finance is unable to increase the capacity of the Groundfloor Platform and maintain the necessary infrastructure, you may experience delays in receipt of payments on the Groundfloor Yield Notes and periodic downtime of our systems.

If the information provided by customers to GFH is incorrect or fraudulent, those entities may misjudge a customer’s qualification to receive a loan, and our operating results may be harmed.

The lending decisions of GFH are based partly on information provided to them by loan applicants. To the extent that these applicants provide information in a manner that GFH is unable to verify, they may not be able to accurately assess the associated risk. In addition, data provided by third-party sources is a significant component of GFH’s underwriting process, and this data may contain inaccuracies. Inaccurate analysis of credit data that could result from false loan application information could harm the performance of loans originated by GFH, which may harm its reputation, business, and operating results, and in turn, harm the reputation, business, and operating results of the Company which acquires loans originated by GFH.

In addition, GFH performs fraud checks and authenticates customer identity by analyzing data provided by external databases. GFH cannot ensure that these checks will catch all fraud, and there is a risk that these checks could fail and fraud may occur. We may not be able to recoup funds in respect of underlying loans acquired by the Company from GFH which were made in connection with inaccurate statements, omissions of fact, or fraud, in which case our revenue, operating results, and profitability will be harmed. Fraudulent activity or significant increases in fraudulent activity could also lead to regulatory intervention, negatively impact our operating results, brand and reputation, and require us to take steps to reduce fraud risk, which could increase our costs.

GFH’s risk management efforts may not be effective.

We could incur substantial losses, and our business operations could be disrupted if (i) GFH is unable to effectively identify, manage, monitor, and mitigate financial risks, such as credit risk, interest rate risk, liquidity risk, and other market-related risk in respect of loans which are subsequently acquired by the Company, or (ii) if we are unable to effectively manage, monitor and mitigate operational risks related to our business, assets, and liabilities. To the extent GFH’s model used to assess the creditworthiness of potential customers does not adequately identify potential risks, the risk profile of such customers could be higher than anticipated. GFH’s risk management policies, procedures, and techniques may not be sufficient to identify all of the risks that the loans it originates are exposed to, mitigate the risks that it has identified, or identify concentrations of risk or additional risks to which the Company may become subject in the future as holder of such loans.

GFH’s businesses may not be able to adequately scale its loan product distribution.

GFH competes against larger companies in marketplace lending, small business divisions of commercial banks, and community banks and credit unions. Their competitors, especially banks, have substantially more resources and spend millions of dollars on marketing. If GFH is unable to attract borrowers, or repeat borrowers, its results of operations will be adversely affected, which may in turn affect the pool of loans available for acquisition by the Company.

GFH originates relatively small-dollar loans which means they need to originate more loans to make as much money as competitors that originate larger-dollar loans.

Presently, GFH is focused on loans up to $500,000. Some of its lending peers who offer larger-dollar loan products need to originate fewer loans than GFH does in order to reach the same amount of dollars lent. GFH’s loan product requires human interaction before it can be approved, which may limit the number of loans they can originate and impact their ability to scale their business. If the GFH’s per-loan origination costs are too high, its results of operations will be adversely impacted, which may in turn affect the pool of loans available for acquisition by the Company.

GFH relies on external capital to grow loan volume and their business.

GFH is in the business of lending money. To demonstrate its commitment to their borrowers and its confidence in its underwriting criteria, GFH funds a portion of most of the loans that it originates. As GFH’s business scales and loan volume increases, it will require increasing amounts of capital to fund its loans as well as build out its operations. GFH has to carefully manage capital as it is not yet profitable. As GFH’s business grows, it will require increasing levels of new capital to fund its lending and operational needs. Similarly, the Company will require increasing amounts of capital to fund its operational needs.

A portion of the funding for GFH (through the acquisition by the Company of loans originated by GFH) and for the Company, including for payments of principal and interest on the Groundfloor Yield Notes and for placing funds in reserve to guard against losses, is anticipated to come from investment in the Groundfloor Yield Notes. This need for capital will require the Company to find additional investors. The Company’s inability to attract sufficient capital at all or on favorable terms will impact our ability and the ability of GFH to grow and remain in business

If we or Groundfloor Finance were to cease operations or enter into bankruptcy proceedings, the servicing of the Groundfloor Yield Notes would be interrupted or may halt altogether.

If we were to become subject to bankruptcy or similar proceedings or if we ceased operations, the Company, or a bankruptcy trustee on our behalf, might be required to find other ways to service the Groundfloor Yield Notes. Such alternatives could result in delays in the disbursement of payments on the Groundfloor Yield Notes or could require payment of significant fees to another company to service the Groundfloor Yield Notes. Since we have not entered into any back-up servicing agreements, if we were to cease operations or otherwise become unable to service the Groundfloor Yield Notes without transferring such Groundfloor Yield Notes to another entity, the operation of the Mobile App and the servicing of the Groundfloor Yield Notes would be interrupted and may halt altogether unless another way to service the Groundfloor Yield Notes on behalf of investors was secured. In the event that we were to cease operations or enter into bankruptcy proceedings, recovery by a holder of a Groundfloor Yield Note may be substantially delayed while back-up servicing is secured, if practicable, or such services halted altogether, and such recovery may be substantially less than the amounts due and to become due on such Groundfloor Yield Note.

Security breaches of investors’ or customers’ confidential information that may harm our or GFH’s reputation and expose us or GFH to liability.

We store our investors’ bank information, credit information, and other sensitive data, and GFH stores its customers’ bank information, credit information, and other sensitive data. Any accidental or willful security breaches or other unauthorized access could cause the theft and criminal use of this data. Security breaches or unauthorized access to confidential information could also expose us or GFH, as applicable, to liability related to the loss of the information, time-consuming and expensive litigation, and negative publicity. If security measures are breached because of employee or third-party error, malfeasance, or otherwise, or if design flaws in the Mobile App or Groundfloor Platform are exposed and exploited, and, as a result, a third party obtains unauthorized access to any of our customers’ data, our relationships with our investors or GFH’s relationships with its customers may be severely damaged, and we or GFH, as applicable could incur significant liability. To the extent that GFH incurs any such liability, its business operations may be adversely affected, which may in turn adversely affect the pool of loans available for acquisition by the Company.

Because techniques used to obtain unauthorized access or to sabotage systems change frequently and generally are not recognized until they are launched against a target, we, the Originating Affiliates and our third-party hosting facilities may be unable to anticipate these techniques or to implement adequate preventative measures. In addition, many states have enacted laws requiring companies to notify individuals of data security breaches involving their personal data. These mandatory disclosures regarding a security breach are costly to implement and often lead to widespread negative publicity, which may cause our investors or GFH’s customers to lose confidence in the effectiveness of our data security measures. Any security breach, whether actual or perceived, could harm our reputation and cause us to lose investors or GFH to lose customers.

The collection, processing, storage, use, and disclosure of personal data could give rise to liabilities as a result of governmental regulation, conflicting legal requirements, or differing views of personal privacy rights.

We and GFH receive, collect, process, transmit, store, and use a large volume of personally identifiable information and other sensitive data from customers and potential customers. There are federal, state, and foreign laws regarding privacy, recording telephone calls, and the storing, sharing, use, disclosure, and protection of personally identifiable information and sensitive data. Specifically, personally identifiable information is increasingly subject to legislation and regulations to protect the privacy of personal information that is collected, processed, and transmitted. Any violations of these laws and regulations may require us or GFH to change our business practices or operational structure, address legal claims, and sustain monetary penalties, or other harms to our respective businesses. To the extent that the business operations of GFH are adversely affected, the pool of loans available for acquisition by the Company may in turn be adversely affected as well.

Events beyond our control or the control of GFH may damage our or its ability to maintain adequate records, maintain the Mobile App or the Groundfloor Platform, perform its origination activities or perform our servicing obligations.

If a catastrophic event resulted in an outage of the Mobile App or the Groundfloor Platform or physical data loss, our ability to perform our servicing obligations or the ability of GFH to originate loans, as applicable, would be materially and adversely affected. Similar events impacting third-party service providers that our operations depend on, such as Groundfloor Finance’s hosting provider or payment vendor(s), could materially and adversely affect its (and our) operations. Such events could include, but are not limited to, fires, earthquakes, terrorist attacks, natural disasters, pandemics, computer viruses and telecommunications failures. Groundfloor Finance stores back-up records in offsite facilities located in third-party, off-site locations. If Groundfloor Finance’s electronic data storage and back-up storage system or those of its third-party service providers are affected by such events, we cannot guarantee that you would be able to recoup your investment in the Groundfloor Yield Notes.

Economic, social and other disruptions caused by outbreaks of viruses or other diseases may adversely affect the business and operations of the Company and GFH, which may adversely affect your investment in the Groundfloor Yield Notes.

The business and operations of the Company and GFH could be materially and adversely affected by the outbreak of health epidemics, including the spread of the novel coronavirus COVID-19, particularly if occurring in areas where Developers derive a significant amount of revenue or profit. While the impact of such an outbreak on the global economy is uncertain, such an event could significantly impact the real estate and fintech lending industries and severely disrupt the operations of the Company and GFH. Such event may also have a material adverse effect on the business, financial condition and results of operations of the Company and GFH, which could adversely affect your investment in the Groundfloor Yield Notes.

Risks Related to Compliance and Regulation

The requirements of complying on an ongoing basis with Tier 2 of Regulation A of the Securities Act may strain our resources and divert management’s attention.

Because we are conducting an offering pursuant to Tier 2 of Regulation A of the Securities Act, we will be subject to certain ongoing reporting requirements. Compliance with these rules and regulations will require legal and financial compliance costs, which may impose strain on our operating budget and divert management’s time and attention from operational activities. Moreover, as a result of the disclosure of information in this Offering Circular and in other public filings we make, our business operations, operating results and financial condition will become more visible, including to competitors and other third parties.

GFH’s loan origination activities and our servicing activities are subject to extensive federal, state and local regulation that could adversely impact operations.

Changes in laws or regulations or the regulatory application or judicial interpretation of the laws and regulations applicable to GFH or to us could adversely affect the ability of GFH or our ability to operate in the manner in which it or we currently conduct business or make it more difficult or costly for GFH to originate or otherwise make additional loans, or for us to collect payments on loans by subjecting them or us to additional licensing, registration, and other regulatory requirements in the future or otherwise. A material failure to comply with any such laws or regulations could result in regulatory actions, lawsuits, and damage to their or our reputations, which could have a material adverse effect on their or our businesses and financial conditions, their ability to originate loans, our ability to service loans and our ability to perform our obligations to investors and other constituents.

The initiation of a proceeding relating to one or more allegations or findings of any violation of such laws could result in modifications in GFH’s or our methods of doing business that could impair our ability to collect payments on our loans or to acquire additional loans or could result in the requirement that we pay damages and/or cancel the balance or other amounts owing under loans associated with such violation. We cannot assure you that such claims will not be asserted against us in the future. To the extent it is determined that the loans we make to our customers were not originated in accordance with all applicable laws, we might be obligated to repurchase any portion of the loan we had sold to a third party. We may not have adequate resources to make such repurchases.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Offering Circular contains forward-looking statements that are based on our beliefs and assumptions and on information currently available to us. The forward-looking statements are contained principally in “Offering Circular Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “About the Groundfloor Platform.” Forward-looking statements include information concerning our possible or assumed future results of operations and expenses, business strategies and plans, competitive position, business environment, and potential growth opportunities. Forward-looking statements include all statements that are not historical facts. In some cases, forward-looking statements can be identified by terms such as “anticipates,” “believes,” “could,” “estimates,” “expects,” “intends,” “may,” “plans,” “potential,” “predicts,” “projects,” “seeks,” “should,” “will,” “would,” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Those risks include those described in “Risk Factors” and elsewhere in this Offering Circular. Given these uncertainties, you should not place undue reliance on any forward-looking statements in this Offering Circular. Also, forward-looking statements represent our beliefs and assumptions only as of the date of this Offering Circular. You should read this Offering Circular and the documents that we have filed as exhibits to the Form 1-A of which this Offering Circular is a part, completely and with the understanding that our actual future results may be materially different from what we expect.

Any forward-looking statement made by us in this Offering Circular speaks only as of the date on which it is made. Except as required by law, we disclaim any obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward- looking statements, even if new information becomes available in the future. All forward-looking statements are expressly qualified in their entirety by the foregoing cautionary statements.

USE OF PROCEEDS

If we sell $50,000,000 of gross proceeds from the sale of our securities under this Offering Circular, we estimate our net proceeds, after deducting estimated commissions and expenses, will be approximately $49,889,500, assuming our expenses are $110,500 for such offerings. We currently intend to use the net proceeds of this offering in order to purchase loans originated by GFH, and for general corporate expenses, including the cost of this offering, but we reserve the right to change the use of proceeds as business demands dictate.

Our management team will determine the allocation of proceeds among loan investments and general corporate purposes. Proceeds may be used to fund or supplement investments in loans on our platform by us or by our affiliates.

We may also use the proceeds of the sale of Groundfloor Yield Notes for general corporate purposes. General corporate purposes might be, but are not limited to, the costs of this offering, including our outside legal and accounting expenses, rent and real estate expenses, utilities, computer hardware and software and promotion and marketing. Our management has sole discretion regarding the use of proceeds from the sale of Groundfloor Yield Notes.

ABOUT THE GROUNDFLOOR PLATFORM

Overview and Groundfloor Platform

Groundfloor Finance Inc. (“Groundfloor Finance”) is the sole member of both the Company and Groundfloor Holdings, LLC (“GFH”). GFH is managed by Groundfloor Finance. The Company is managed by Groundfloor Finance and Nick Bhargava, who is also the Co-Founder, Acting Chief Financial Officer, Secretary, and Executive Vice President (Legal and Regulatory) of Groundfloor Finance. The business operations of Groundfloor Finance are managed by a team of executive officers which includes (i) Brian Dally, President and CEO, (ii) Nick Bhargava, in the capacities mentioned above, (iii) Rhonda Hills, Senior Vice President (Marketing and Sales), (iv) Richard Pulido, Senior Vice President (Head of Lending and Risk Management) and (v) Chris Schmitt, Vice President (Software), and by its board of directors, which includes two independent directors.

Groundfloor Finance operates an online investment platform (the “Groundfloor Platform”) designed to source financing for real estate development projects. Through the Groundfloor Platform, investors can choose between multiple real estate development investment opportunities (each, a “Project”) and developers of the Projects (each, a “Developer”) can obtain financing. The Platform focuses on the commercial lending market for developers of residential and small commercial real estate projects that are not owned and occupied by the Developer. Proceeds from the loans are generally applied toward the Project’s acquisition and/or renovation or construction costs. In connection with the issuance of Groundfloor Yield Notes by the Company, the Company owns and operates the Mobile App. The Groundfloor Platform operated by Groundfloor Finance facilitates due diligence and underwriting reviews, coordinates payment to and from investors and developers, manages loan advances, and administers, services and collects on loans originated by GFH which are subsequently acquired by the Company. All intellectual property relating to the Groundfloor Platform and the GFY Mobile App is owned by Groundfloor Finance and the Company, respectively.

Borrower Members and Consideration of the Principal

GFH does not finance owner-occupied residential projects, nor does it make loans for any personal, family, or household purpose. All of its loans are commercial in nature. Although GFH only provides loans to legal entities (i.e., Developers), due to the nature of the real estate development business and the smaller market segment it services, GFH nevertheless factors into its due diligence and underwriting process the background and experience of the individual(s) who own and operate the borrowing entity (i.e., the “Principal(s)”).

The scope of GFH’s due diligence and underwriting process is not limited only to information about the borrowing entity, which may be very limited in nature. In addition to considering the specific information with respect to the borrower under the loan, it also considers the creditworthiness (through a review of FICO scores) and broader experience of the Principal.

Credit Risk and Valuation Assessment

Once GFH has identified Projects that pass the preliminary assessment and thus meet its basic qualifications and financing requirements, it undertakes an assessment of each Project and the proposed terms of the underlying Loan to finalize the pricing terms (interest rate, maturity, repayment schedule, etc.) that it will accept.

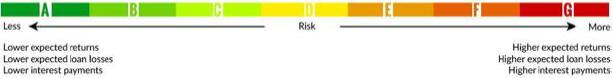

GFH uses its proprietary Grading Algorithm to assign one of seven letter grades, from A to G, to each Project. The letter grade generally reflects the overall risk of the Loan. In general:

The Grading Algorithm, which was developed by Groundfloor Finance’s management team in consultation with outside advisors with respect to the general type of residential real estate projects GFH currently finances, involves application of a two-step proprietary mathematical formula. Generally, GFH assigns a scale to each factor. The higher a Project rates with respect to a particular factor, the better the Loan scores. The higher the score, the lower the interest rate GFH will offer on the Loan.

Representing a quantifiable assessment of the risk profile of a given Project, the Grading Algorithm allows GFH to compare the relative risk profiles of various properties through the analysis of specific quantifiable characteristics, including (i) the valuation and strength of a particular Project and (ii) the experience and risk profile of the Developer. GFH uses the Grading Algorithm to determine a proposed base-line interest rate which reflects the given risk profile of a Project when it is underwritten. The lower the risk profile, the lower the interest rate GFH will agree to with respect to a particular Loan.

Products

(a) Lending Products

Through the Groundfloor Platform, GFH offers commercial loans to real estate developers as described above under “Overview and Groundfloor Platform”. The loans are generally applied toward the Project’s acquisition and/or renovation or construction costs. GFH lends to qualified commercial real estate developers who meet GFH’s business and credit qualifications and are approved through the underwriting platform. GFH utilizes the Grading Algorithm in order to determine the interest rate that it will offer to the prospective commercial borrower.

(b) Investing Products

Groundfloor Yield Notes

General

Groundfloor Yield Notes, the subject of this Offering Circular, are available to retail investors through the Mobile App. Funds from the sale of Groundfloor Yield Notes are used by the Company, at the sole discretion of the Company, to purchase Loans originated by GFH. Investors in Groundfloor Yield Notes do not directly invest in Loans held by the Company that were acquired from GFH; rather, the Groundfloor Yield Notes are general obligations of the Company, and the proceeds thereof will be used primarily to fund the acquisition of Loans originated by GFH to continually expand and replenish the portfolio of Loans owned by the Company, which loans are subsequently sold to Groundfloor Finance, GRE1 or GRE 2, typically within five (5) business days, but in any event no more than thirty (30) business days, following the acquisition thereof by the Company. The Groundfloor Yield Notes will be secured by a first priority security interest in the assets (and related property and rights) of the Company which will principally consist of commercial real estate loans that the Company has acquired from GFH. Such security interest will rank ahead of any unsecured debt of the Company. Given that the security interest is a blanket lien on the assets of the Company and is not against specifically identified assets of the Company, as of the date of this Offering Circular, there is no unbonded property available for use against the issuance of Groundfloor Yield Notes and the Groundfloor Yield Notes are not being issued against any unbonded property of the Company, the deposit of cash by the Company, or otherwise.