Rackspace Technology Lender Presentation January 2024 Exhibit 99.3

Disclaimer 2 Confidentiality Undertaking and Disclaimer This presentation, including the information contained herein and the materials accompanying it, constitutes confidential information and is provided to you on the condition that you will hold it in strict confidence and not reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of Rackspace Technology. This presentation is being provided to the recipient hereof in connection with a review of Rackspace Technology and is not to be used for any other purpose. Acceptance of this presentation constitutes an agreement to be bound by the terms of the foregoing confidentiality and use provisions and the terms and conditions of any confidentiality agreement between Rackspace Technology and the recipient. The recipient understands that this presentation contains material non-public information with respect to Rackspace Technology and its subsidiaries and their respective loans and securities, including for purposes of United States federal and state securities laws. This presentation has been prepared by Rackspace Technology for informational purposes only and not for any other purpose. Nothing contained in this presentation is, or should be construed as, a recommendation, promise or representation by the presenter or Rackspace Technology or any director, employee, agent, or adviser of Rackspace Technology. This presentation does not purport to be all inclusive or to contain all of the information you may desire. Forward-Looking Statements Rackspace Technology has made statements in this presentation and other reports, filings, and other public written and verbal announcements that are forward-looking and therefore subject to risks and uncertainties. All statements, other than statements of historical fact, included in this presentation are, or could be, “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and are made in reliance on the safe harbor protections provided thereunder. These forward-looking statements relate to anticipated financial performance, management’s plans and objectives for future operations, business prospects, outcome of regulatory proceedings, market conditions, and other matters. Any forward-looking statement made in this presentation speaks only as of the date on which it is made. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future developments or otherwise. Forward-looking statements can be identified by various words such as “expects,” “intends,” “will,” “anticipates,” “believes,” “confident,” “continue,” “propose,” “seeks,” “could,” “may,” “should,” “estimates,” “forecasts,” “might,” “goals,” “objectives,” “targets,” “planned,” “projects,” and similar expressions. These forward-looking statements are based on management’s current beliefs and assumptions and on information currently available to management. Rackspace Technology cautions that these statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this presentation, including among others, risk factors that are described in Rackspace Technology, Inc.’s Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and other filings with the Securities and Exchange Commission, including the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained therein.

Disclaimer 3 Preliminary Results The 2023 fiscal year financial information included in this presentation is preliminary, has been prepared by Rackspace Technology’s management, has not been reviewed or audited by our auditors and represents the best estimates of management based on the information available to them as of the date of this presentation. Rackspace Technology’s financial results for the 2023 fiscal year are not yet complete and are subject to revision. Because we have not completed our normal closing and review procedures for the 2023 fiscal year, subsequent events may occur that require adjustments to those results, and it is possible that the actual reported financial results may differ from the estimates included in this presentation. Rackspace Technology cannot provide any assurances to you that when the 2023 fiscal year estimated financial information presented herein is finalized, audited and reported, that such financial information will not be materially different from the information presented herein. Non-GAAP Measures This presentation includes several non-GAAP financial measures such as Owned EBITDA and Owned EBITDA Margin. These non-GAAP financial measures exclude the impact of certain costs, losses and gains that are required to be included in our profit and loss measures under GAAP. Although we believe these measures are useful to investors and analysts for the same reasons they are useful to management, as described in the accompanying presentation, these measures are not a substitute for, or superior to, GAAP financial measures or disclosures. Other companies may calculate similarly-titled non-GAAP measures differently, limiting their usefulness as comparative measures. We have reconciled each of these non-GAAP measures to the applicable most comparable GAAP measure in the accompanying presentation. This presentation shall not constitute an offer to sell or exchange, or a solicitation of an offer to buy or exchange, any securities.

Executive Summary (1 of 2) 4 • Beginning in late 2022, the company embarked on a mission to transform the business to better align to the strengths of the company and build upon the foundation that made Rackspace successful • Starting at the top, Amar Maletira, former CFO, was promoted to CEO and Shashank Samant was added as Lead Director to set a clear top-down vision, strategy and direction, which included: • Operationalizing a two-BU structure and go-to market model consisting of Private Cloud and Public Cloud business units • Refresh of top leadership and talent at the ELT level and down • Right sizing the cost structure • Strengthened the board by adding senior executives with technology and customer experience such as Betsy Atkins (CEO of venture capital firm Baja LLC), Shashank Samant (Former CEO of GlobalLogic Inc), Tony Scott (former CIO for the Obama Administration), and Anthony Roberts (Former Global CIO of Walgreens Boots Alliance)

Executive summary (2 of 2) 5 • 2023 was a year of transformation, separating the company into two BUs and refreshing talent both at a management and sales level • We have begun to see tangible benefits from the shift in strategy…but we are in the early innings: • The strategy to de-emphasize low margin infra resale and shift the focus of Public Cloud to services delivery is being realized in the bookings figures where services account for the majority of bookings…although a more significant absolute quantum of bookings is needed • Private cloud bookings have grown ~20% YoY with much of the growth coming in the key verticals of focus such as Healthcare, BFSI, and Sovereign Cloud • After implementing the structural and organizational changes in the current year, 2024 is a pivotal year where growth in bookings will be the focus and will determine the future trajectory of the company

Americas 2,500+ employees EMEA 900+ employees APJ 2,300+ employees OUR DIFFERENTIATED EXPERTISEOUR GLOBAL REACH 5,700+ Employees globally 20k Customers 120 Countries 168 PB Storage managed 35+ Datacenters 2,600+ Certified technical experts 9,500+ Total technical certifications Rackspace delivering value to customers for 25 years 2002 2005-2007 2012 2020 2023+ Managed Hosting products, services and support Web Hosting OpenStack Public Cloud Multicloud Infra Solution Hybrid - Multicloud+ AI Solutions Provider Infra, Data/AI, Apps, Security Hosted Private Cloud 1998 OUR EVOLUTION- MANY FIRSTS $3B Revenue OUR GLOBAL REACH OUR DIFFERENTIATION Fanatical Customer Experience People + Process + Tools Solution automation Self-healing deployed to customers Open Innovation Innovating with our partner ecosystem 38 NPS Consistently above benchmarks $1B+ Invested 8 Years of unique IP

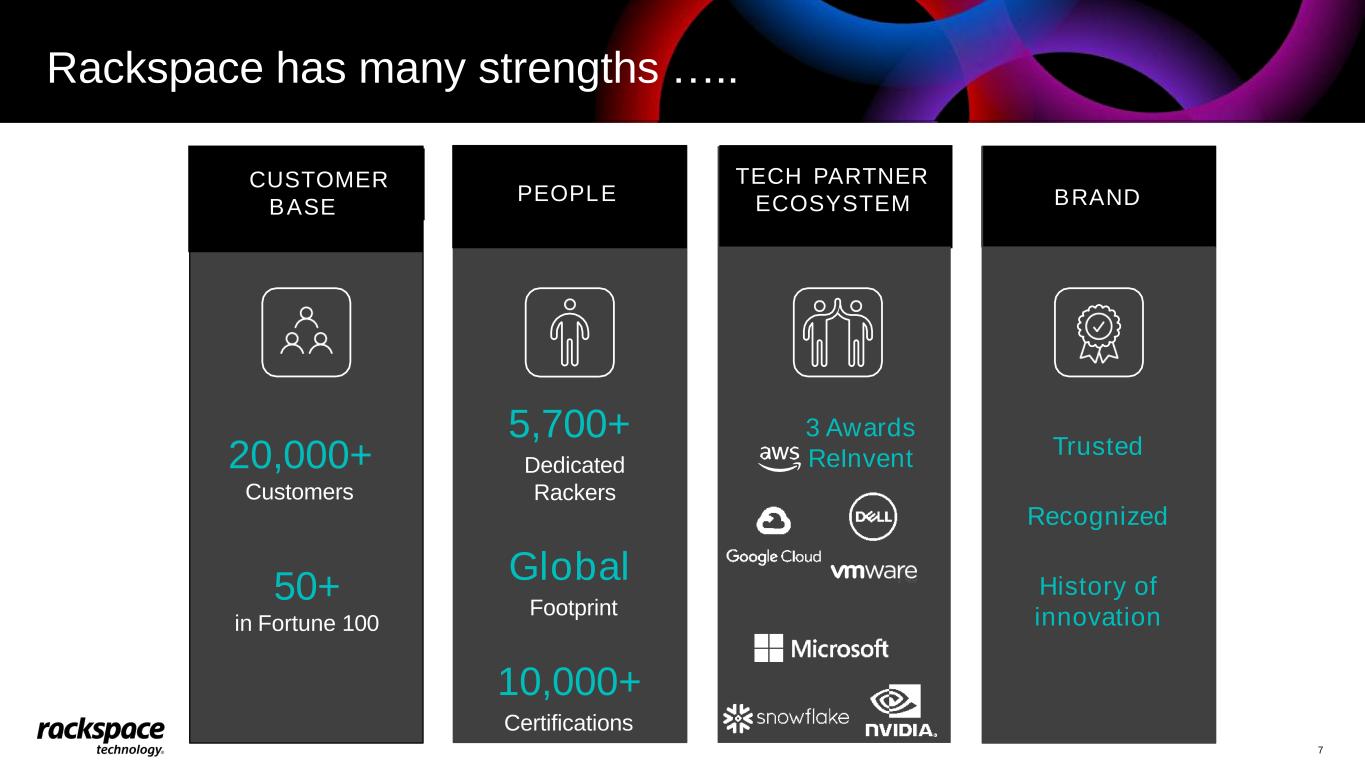

TECH PARTNER ECOSYSTEM Rackspace has many strengths ….. 5,700+ Dedicated Rackers Global Footprint 10,000+ Certifications PEOPLE Trusted Recognized History of innovation BRAND 20,000+ Customers 50+ in Fortune 100 7 3 Awards ReInvent PE PLE CUSTOMER BASE

• Reorganized into two-business unit operating model and strategy – shifting to a more profitable business mix, right sizing our cost structure, and building our product offerings to position Rackspace for long-term success • Making targeted investments to drive future growth in key market vertical including healthcare, BFSI and government • Swift response to the zero-day exploit ransomware attack resulted in the containment of the attack to a small portion of the environment • Built a seasoned executive team to drive our strategy forward and better serve the attractive markets we operate in 8 … But has faced challenges in the recent past • The strategy to move away from high margin private cloud which was the life blood of the company and focus on low margin infrastructure resale has resulted in quarter after quarter degradation in EBITDA • Ransomware attack at the tail-end of 2022 was highly public and resulted in the run-off of ~$30M of high margin revenue • Revolving door of executive leadership has created instability and constant strategy shifts Management is confident that with time and focused effort, Rackspace can return to profitable growth Challenges faced in the past Actions taken to overcome challenges

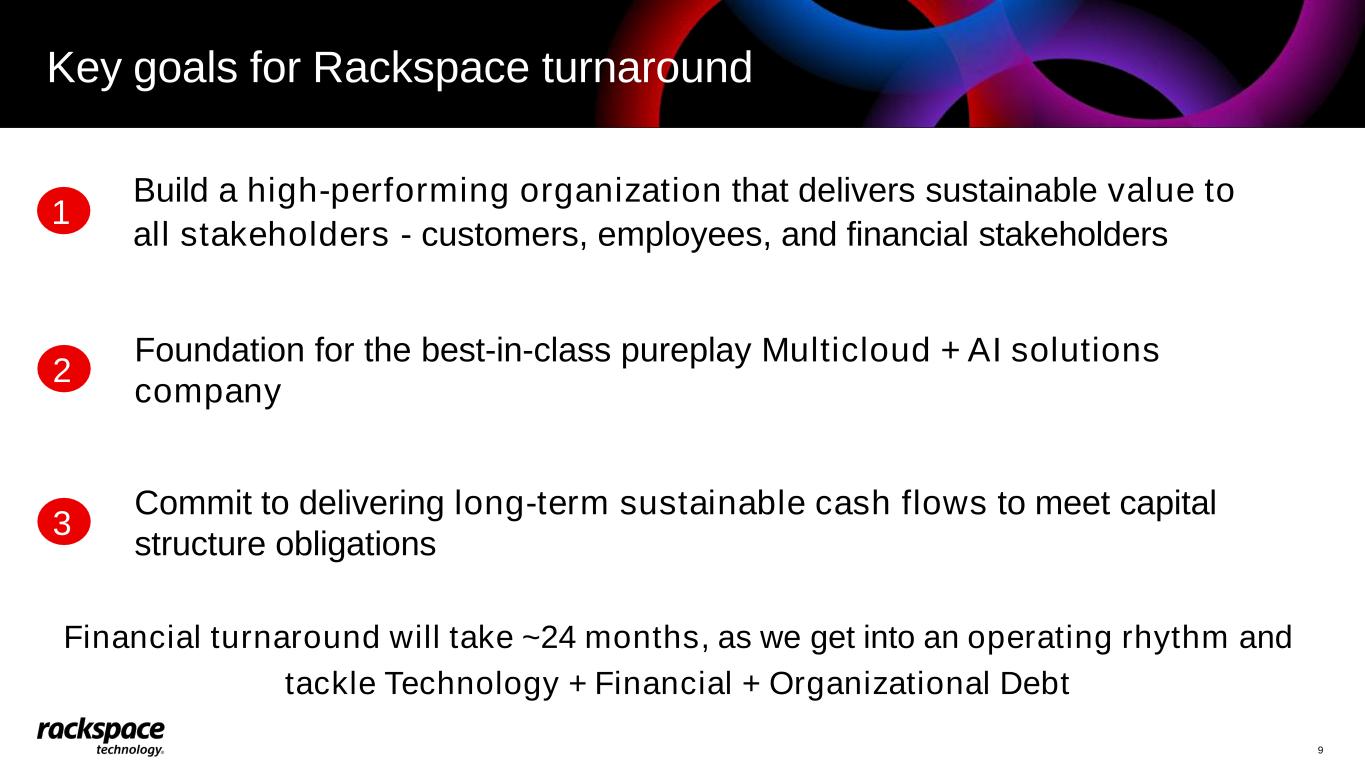

Key goals for Rackspace turnaround Foundation for the best-in-class pureplay Multicloud + AI solutions company Commit to delivering long-term sustainable cash flows to meet capital structure obligations 2 3 9 Financial turnaround will take ~24 months, as we get into an operating rhythm and tackle Technology + Financial + Organizational Debt Build a high-performing organization that delivers sustainable value to all stakeholders - customers, employees, and financial stakeholders 1

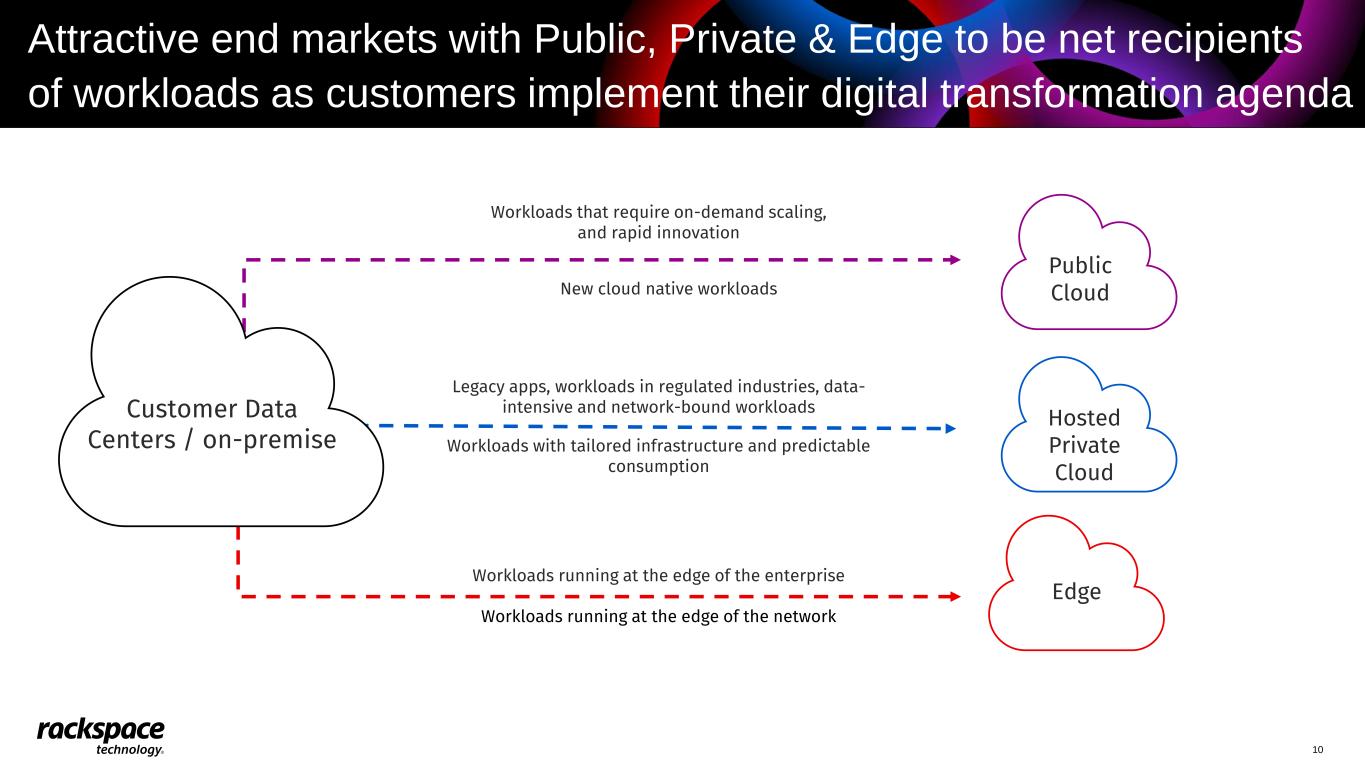

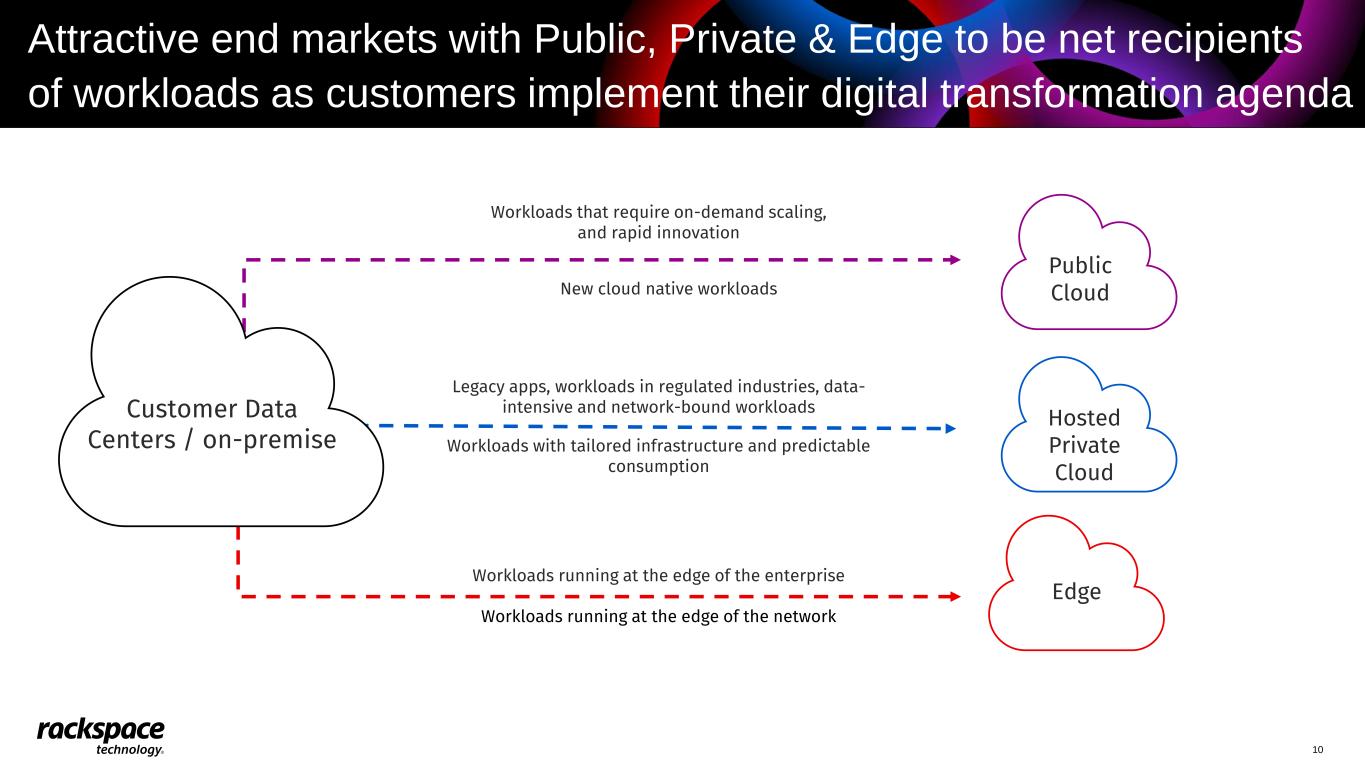

Attractive end markets with Public, Private & Edge to be net recipients of workloads as customers implement their digital transformation agenda 10 Edge Hosted Private Cloud Customer Data Centers / on-premise Public CloudNew cloud native workloads Workloads that require on-demand scaling, and rapid innovation Legacy apps, workloads in regulated industries, data- intensive and network-bound workloads Workloads with tailored infrastructure and predictable consumption Workloads running at the edge of the enterprise Workloads running at the edge of the network

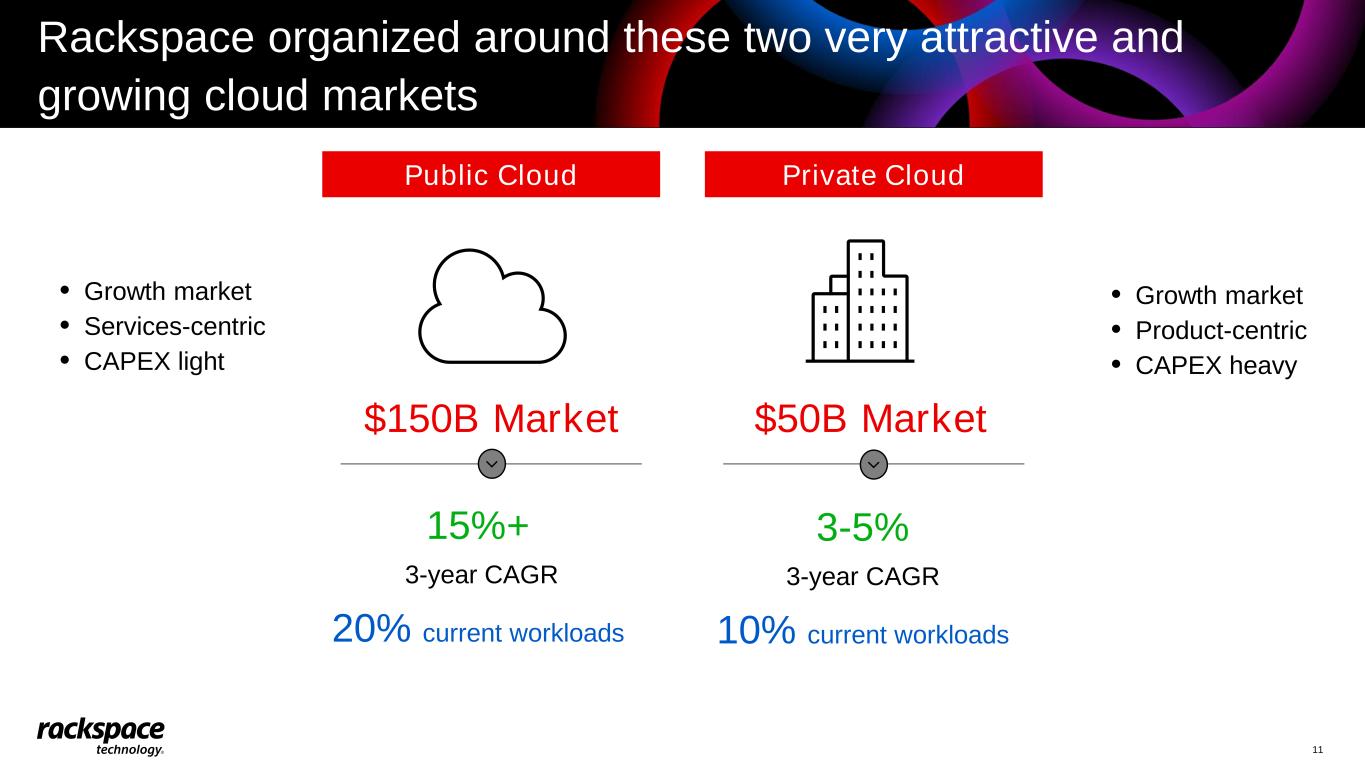

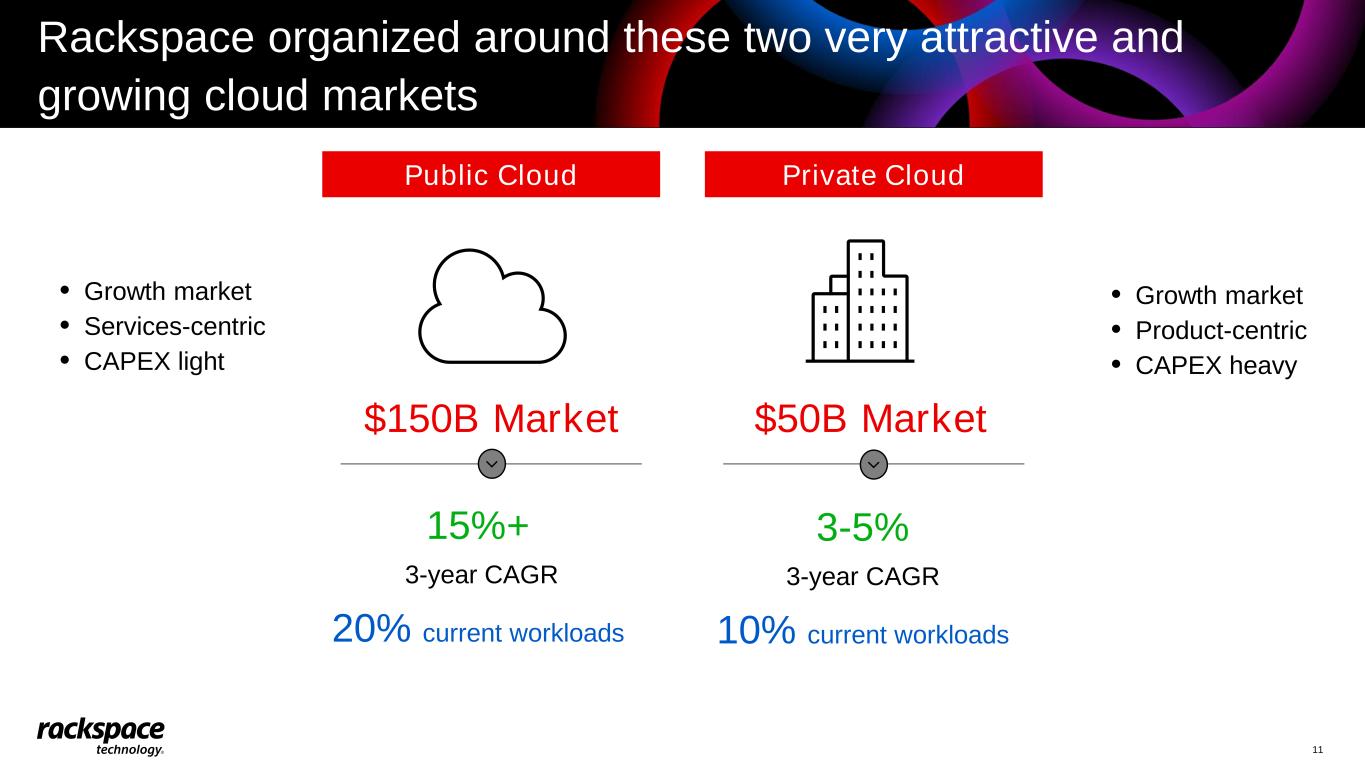

Rackspace organized around these two very attractive and growing cloud markets 11 15%+ 3-year CAGR 20% current workloads 3-5% 3-year CAGR 10% current workloads Public Cloud Private Cloud $150B Market $50B Market Growth market Product-centric CAPEX heavy Growth market Services-centric CAPEX light

Our strategy is focused on capturing multicloud market opportunity Private Cloud • Rackspace SDDC • NextGen Private Cloud (containers/ Openstack) • Industry Cloud • Emerging Cloud: Sovereign, AI, Edge DE F E ND AND EXPA N D with new solutions 1 • Defend commercial • Expand into mid-market • Selectively penetrate enterprise Go-to-market ACCE L E RAT E sales motions 3 White spaces TAR G E T for investment • Identify new areas with unmet needs in Cloud • Make smart technology bets to capture market opportunities • Data Freedom, Managed Kubernetes 4 Racker culture AM P LI FY / NURT URE of innovation and Fanatical Customer Experience • Develop a growth mindset • Operate with speed 5 Automation EXPA N D to drive operational effectiveness • Continually identify automation opportunities • Implement quickly to gain efficiency 6 Public Cloud CA P T URE T HE S E CUL AR GR OW T H with solutions that broaden our portfolio • Scaled cloud native solutions on public cloud platforms – AWS, GCP and Azure • Full stack cloud offerings spanning infrastructure, applications, data and security 2 12

Execution starts with a strong and seasoned leadership team Bobby Molu: Chief Financial Officer • Years Experience: 25+ Brian Lillie: President – Private Cloud • Years Experience: 35+ Amar Maletira: Chief Executive Officer • Years Experience: 30+ DK Sinha: President – Public Cloud • Years Experience: 35+ Kellie Teal-Guess: Chief Human Resource Officer • Years Experience: 25+ Srini Koushik: Chief Technology Officer • Years Experience: 30+ 13 Each executive appointed to new role to help facilitate transformation

Experienced leaders driving execution in these dynamic markets Secular growth market Services-centric with deep customer engagement Capital-light Mature / low-growth market Technology-forward Capital-intensive Infrastructure-as-a-service Industry solutions Next-generation solutions: AI cloud, Sovereign cloud, Edge Cloud / digital transformation Services across infrastructure, applications, data and security IP-based service offerings and automation DK Sinha President, Public Cloud 30-year industry leader with broad experience navigating companies through business and technology “S” curves. Strong track-record of scaling businesses and building high-performing teams Brian Lillie President, Private Cloud Product and technology- oriented leader with 30 years of industry experience. Strategic approach with immense focus on execution B. Private Cloud A. Public Cloud BUSINESS DYNAMIC FOCUS AREA BUSINESS DYNAMIC FOCUS AREA Objective: Hypergrowth Objective: Stabilize and grow 14

Private Cloud

Our private cloud strategy supports our vision & goals E X PA N D S O L U T I O N O F F E R I N G S B U I L D G O T O M A R K E T S U C C E S S Bring Compelling Solutions to the Market Radically Improve Sales (IB & New Acq) N U R T U R E G R E E N S H O O T S ; E M E R G I N G B U S I N E S S T R A N S F O R M N E X T - G E N E R AT I O N D E L I V E R Y Improve the Customer Journey Build High-Potential Future Businesses `Our Vision: To be the #1 Private Cloud MSP in the world ▪ Strengthen Platform (‘Horizontal’) capabilities (e.g., Compute, Storage, Security, DR, Virtualization, Containerization)1 ▪ Next Generation Private Cloud (NGPC) built on OpenStack and Platform9 ▪ Launch Industry PVC solutions (Healthcare Provider, TnG, Oil & Gas, BFSI) ▪ Develop new services (e.g., Elastic Eng., Advisory) ▪ Enhance productivity (e.g., ITSM & automation) ▪ Increase op model maturity – shifting center of gravity offshore ▪ Establish E2E Performance Mgmt. to track key metrics & enable corrective actions ▪ Best-in-class CX (e.g., simplified buying / billing), NPS & Retention ▪ Build vertical expertise (aligned with Product Roadmap) ▪ Restart new logo acquisition engine to accelerate progress & leverage targeted partnership plays (e.g., Dell, VMware, BT) ▪ Expand cross-sell / up-sell for IB beyond current play ▪ Improve seller productivity & pipeline generation Build & scale high potential, emerging businesses. ▪ Healthcare ▪ HPC / AI Establish market-leading Partnerships & ensure required support / resourcing provided across Product, GTM, & Delivery 1. Utility Billing, Automation, Self-Provisioning, etc. 16

Key factors driving buyers of private cloud products and services Cost of maintaining on-prem data centers Shortage of infrastructure skills Data sovereignty and compliance $10M to $25M The average yearly cost to operate a large data center.1 1. How Much Does Running A Private Data Center Cost Per Year (streamdatacenters.com) 2. The State of Security 2023 (splunk.com) 3. 2023-data-threat-report-global-edition-usl.pdf (thalesgroup.com) 88% Of organizations say they struggle with talent challenges.2 83% Of organizations are concerned that sovereignty and privacy regulations will affect cloud deployment plans.3 64% Of SOC teams struggle to pivot from one security tool to the next.2 Cloud security and control 17

Private Cloud business unit long term plan LEVERS Industry Private Cloud offerings (Healthcare, BFSI, Tech, Oil & Gas) Major Product launches each year with agile product lifecycle management Emerging businesses at scale (e.g., Healthcare, HPC/AI) Scaled GTM partnerships (e.g., Dell, BT, VMware, Nvidia, DRT, Palo Alto Networks) 3-4 ~4 4-6 1-2 18

Recent Customer Win Case Study Apria leaves the data center to improve customer experience and increase savings 19 About Apria Apria Healthcare is one of the leading providers of home respiratory services and related medical equipment in the US. Their challenge After being DIY for most of its existence, Apria Healthcare realized that it needed a partner to help manage, modernize and secure an aging and disparate collection of IT and help it remain compliant in a heavily regulated industry. How we helped Colocation, D.C. Discovery & Assessment, Migration, Disaster Recovery, Professional Services for AWS, Rackspace Private Cloud powered by VMware, Managed AWS. What we achieved together With the uncertainty of a global pandemic compressing timelines and affecting work, Apria consolidated and colocated their existing IBM infrastructure and saved 32% in operating costs, strengthened their Disaster Recovery solutions and bolstered their online storefronts with managed hosting during peak buying season, helping them enjoy their largest ecommerce sales day ever. “It almost feels like it’s tailor made for us, which I love. It’s like a white glove service and I’m not paying anything extra. But the value add is there, which, to me, speaks volumes.” Xavier Coto VP of Infrastructure & Operations, Apria Healthcare

Public Cloud

21 Public Cloud revenues have grown 10x in the past 3 years from $15B in 2018 to $150B in 2022 However, 85% of workloads are still on Private Cloud and On-prem Data Centers Most IT leaders (+ 80%) say they have a Multicloud Strategy Fast followers can learn and evolve from early adopters by considering the implications of sustainability, data gravity, sovereignty, cost, and ongoing operations as they look to truly take advantage of all the benefits of Cloud Computing. Early adopters who migrated their workloads to the public cloud focused on cost and speed as a priority and focused on leveraging IaaS and PaaS to help them on their journey. Market Trends In current market, however, every company is seeking to optimize operations and manage costs

22 Capturing our fair share of the market in cloud services Source: Cloud Wars Top 10 Q1 2023 Professional Services Managed Services Elastic Engineering Future TAM of $1 Trillion+ for Cloud Infrastructure $114B$85B $35B Hyperscaler 2023E TAM Cloud Services Annualized 2027 TAM $250B+

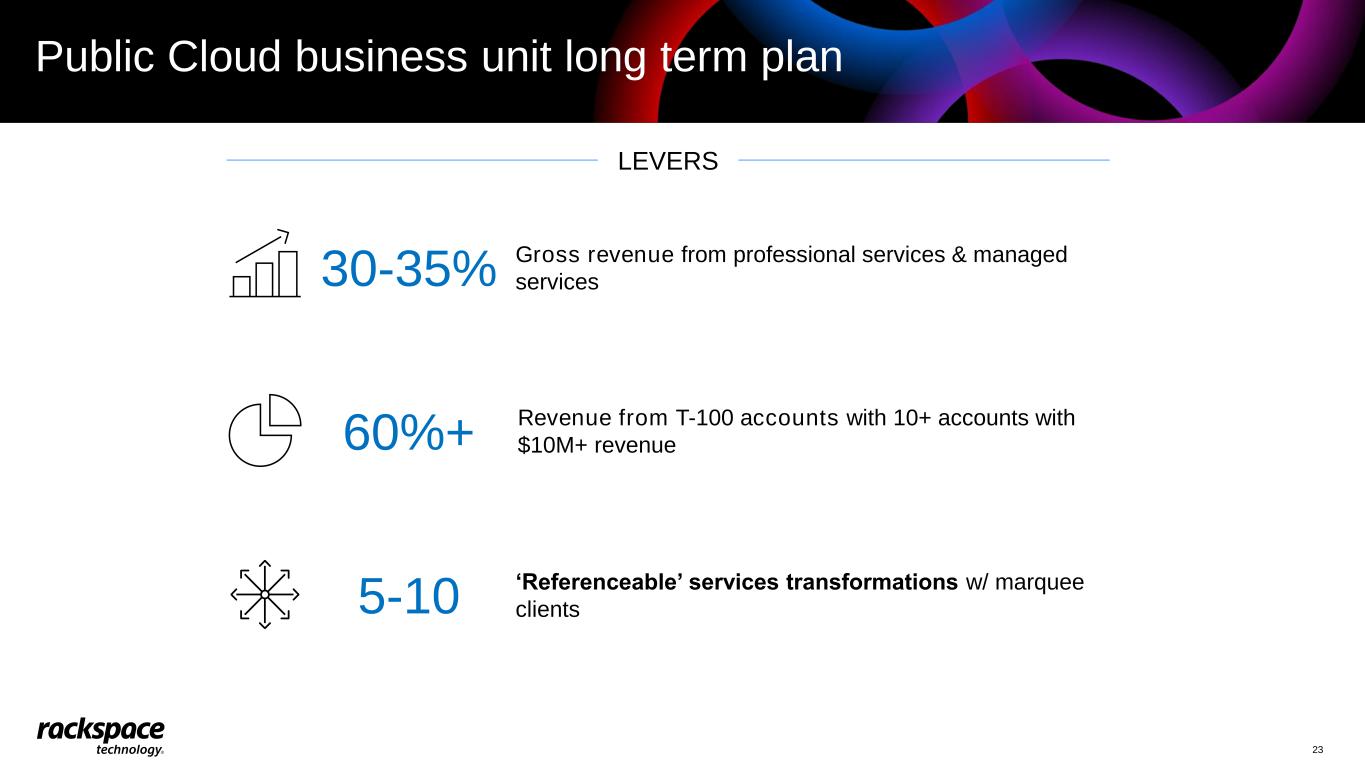

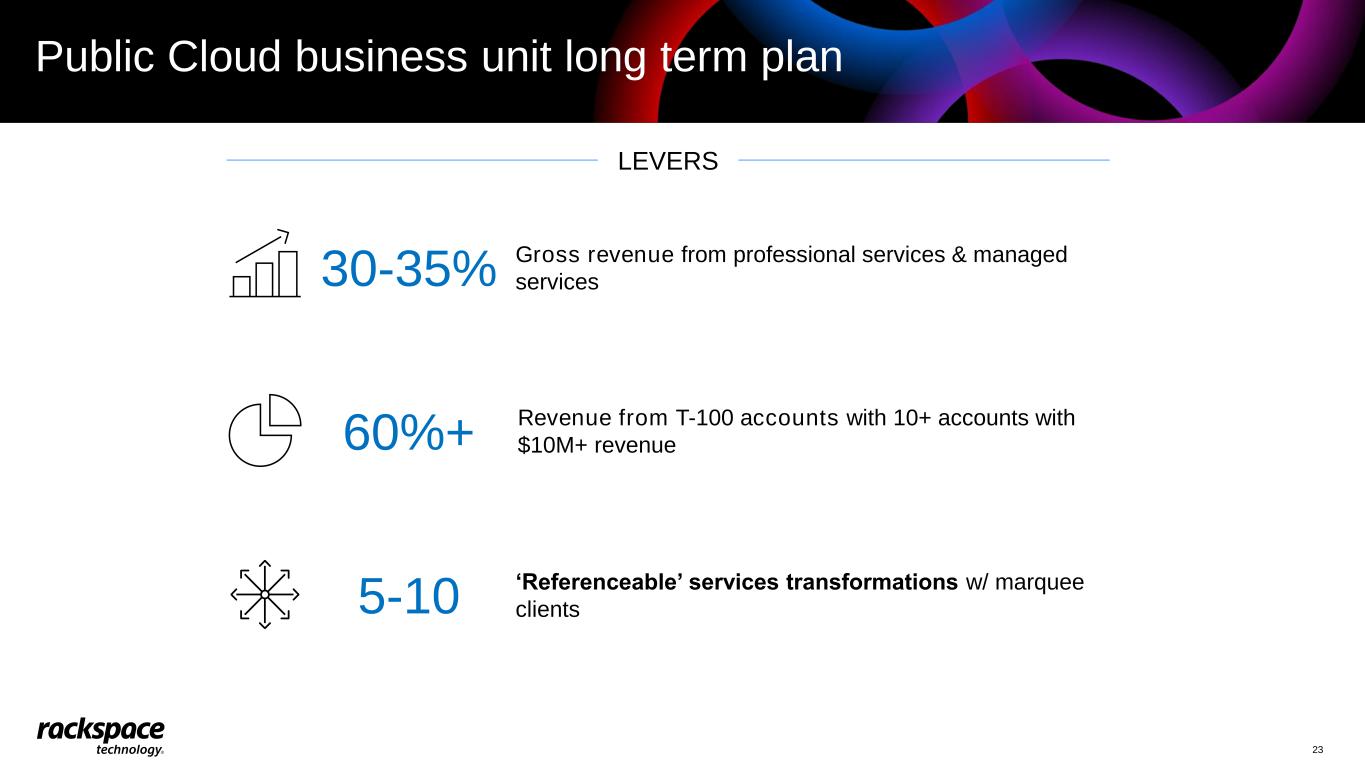

Public Cloud business unit long term plan 23 Gross revenue from professional services & managed services30-35% 60%+ Revenue from T-100 accounts with 10+ accounts with $10M+ revenue ‘Referenceable’ services transformations w/ marquee clients5-10 LEVERS

Consolidated Financial Overview

We are focused on simplifying our business and capital allocation 25 Business simplification • We simplified our business to focus on a two-business unit structure, Public Cloud, and Private Cloud to better leverage the unique competitive advantages of each business Disciplined balance sheet management • Committed to disciplined balance sheet management and reducing leverage over time to a long-term average of 5.5x • No funded corporate maturities until 2028 Rigorous capital allocation decision making • Reinvest in core business with focus on key verticals such as healthcare, private equity and government • Continue to invest in R&D to incubate new offerings to drive organic growth • Focus on bolt-ons to strengthen current technology portfolio and diversify service offerings Managing liquidity position • For latest liquidity details, see Q4 Earnings Release • Executed $300M A/R Securitization Facility to provide additional liquidity • <5.0x first lien covenant (only tested if revolver is >35% drawn) to be tested at FLFO level post-transaction as part of transaction Notes: 1. Cash balance does not include about $3M of restricted cash

Business Plan Overview 26 • After implementing the structural and organizational changes in the FY 2023, 2024 will be a pivotal year where growth in bookings will be the focus and will determine the future trajectory of the company • 2024 bookings will start to be reflected in late-2024/2025 revenues • Public Cloud revenue expected to drive majority of growth going forward, with strategy to de-emphasize low margin infra resale and shift the focus of Public Cloud to services delivery • EBITDA growth will be driven by both segments as the Company continues to focus on higher margin offerings • Capex expected to remain relatively consistent as a percentage of revenue • Continue to finance a larger proportion of capex through hardware vendors as part of cash management strategy • Interest and mandatory debt repayment comprise the majority of cash flow items, with interest including financing lease interest • Interest rate swap matures in February 2026