Exhibit 99.2

Investor Presentation Q1 2022

SAFE HARBOR 2 GOED | Q1 2022 Investor Presentation Forward Looking Statements This presentation contains forward - looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward - looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward - looking statements. Forward - looking statements include, but are not limited to, statements about: • the synergies that we expect to experience resulting from the acquisition of Appliances Connection; • our ability to successfully integrate Appliances Connection’s business with our existing business; • our ability to acquire new customers and sustain and/or manage our growth; • the impact of the COVID - 19 pandemic on our operations and financial condition; • the effect of supply chain delays and disruptions on our operations and financial condition; • our goals and strategies; • the identification of material weaknesses in our internal control over financial reporting and disclosure controls and procedures that, if not corrected, could affect the reliability of our consolidated financial statements and have other adverse consequences such as a failure to meet reporting obligations; • our future business development, financial condition and results of operations; • expected changes in our revenue, costs or expenditures; • growth of and competition trends in our industry; • our expectations regarding demand for, and market acceptance of, our products; • our expectations regarding our relationships with investors, institutional funding partners and other parties with whom we collaborate; • fluctuations in general economic and business conditions in the markets in which we operate; and • relevant government policies and regulations relating to our industry. In some cases, you can identify forward - looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward - looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under the heading “Risk Factors” and elsewhere in our Annual Report on Form 10 - K and Quarterly Reports on Form 10 - Q that we have filed with the SEC. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward - looking statements. No forward - looking statement is a guarantee of future performance. In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date on which the statements are made in this presentation, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely upon these statements. The forward - looking statements made in this presentation relate only to events or information as of the date on which the statements are made in this presentation. Although we have ongoing disclosure obligations under United States federal securities laws, we do not intend to update or otherwise revise the forward - looking statements in this presentation, whether as a result of new information, future events or otherwise. Adjusted EBITDA This presentation contains adjusted EBITDA disclosure, which is a non - GAAP financial measure. The Company defines adjusted EBITDA as net income before income taxes, depreciation and amortization, financing costs, interest expense, sales tax accrual and one - time non - operational events. Adjusted EBITDA is not calculated in accordance with GAAP and should not be considered an alternative to any financial measure that was calculated under GAAP. Adjusted EBITDA is used to facilitate a comparison of the ordinary, ongoing and customary course of the operations of the combined company on a consistent basis from period to period and provide an additional understanding of factors and trends affecting the business of the Company. Adjusted EBITDA may not be comparable to similarly titled non - GAAP measures used by other companies as other companies may have calculated the measures differently.

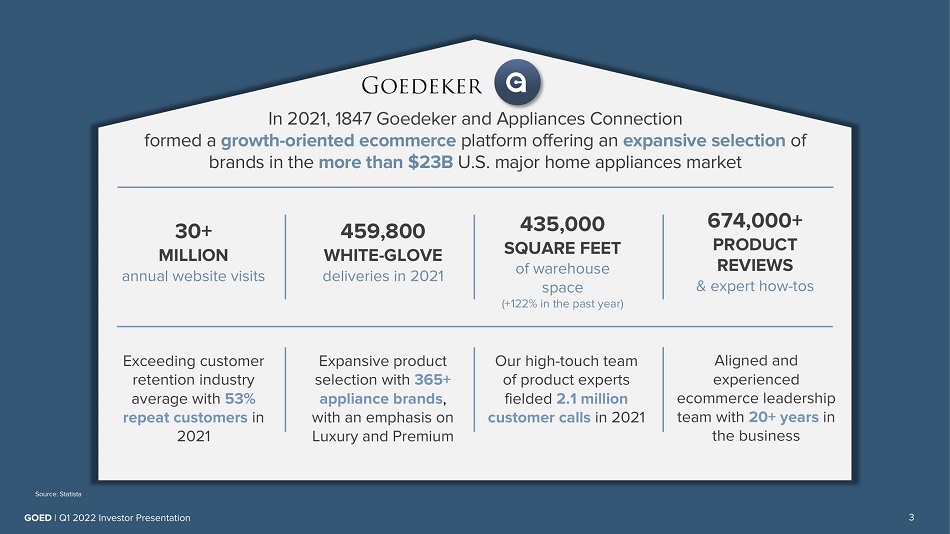

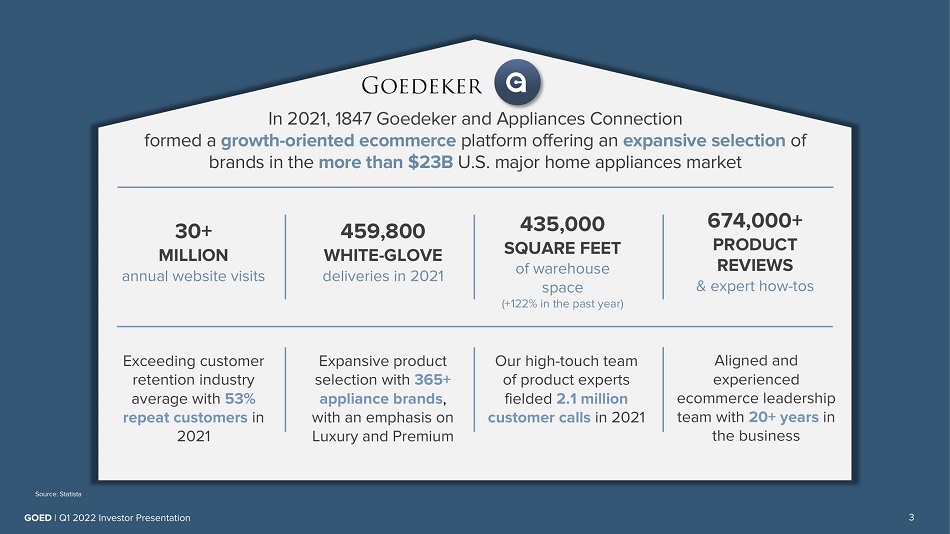

30+ MILLION annual website visits 459,800 WHITE - GLOVE deliveries in 2021 435,000 SQUARE FEET of warehouse space (+122% in the past year) 674 , 000 + PRODUCT REVIEWS & expert how - tos Exceeding customer retention industry average with 53% repeat customers in 2021 Expansive product selection with 365 + appliance brands , with an emphasis on Luxury and Premium Our high - touch team of product experts fielded 2.1 million customer calls in 2021 Aligned and experienced ecommerce leadership team with 20+ years in the business In 2021, 1847 Goedeker and Appliances Connection formed a growth - oriented ecommerce platform offering an expansive selection of brands in the more than $23B U.S. major home appliances market Source: Statista 3 GOED | Q1 2022 Investor Presentation

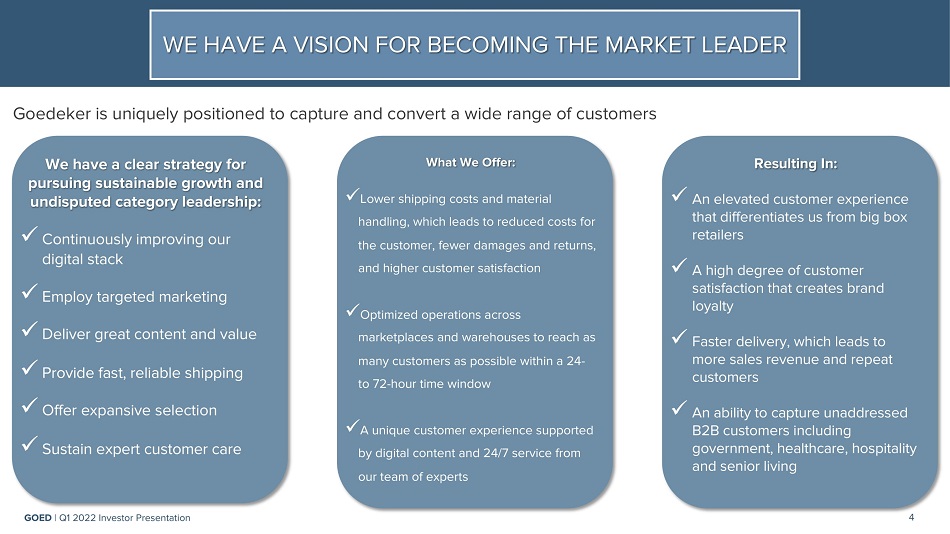

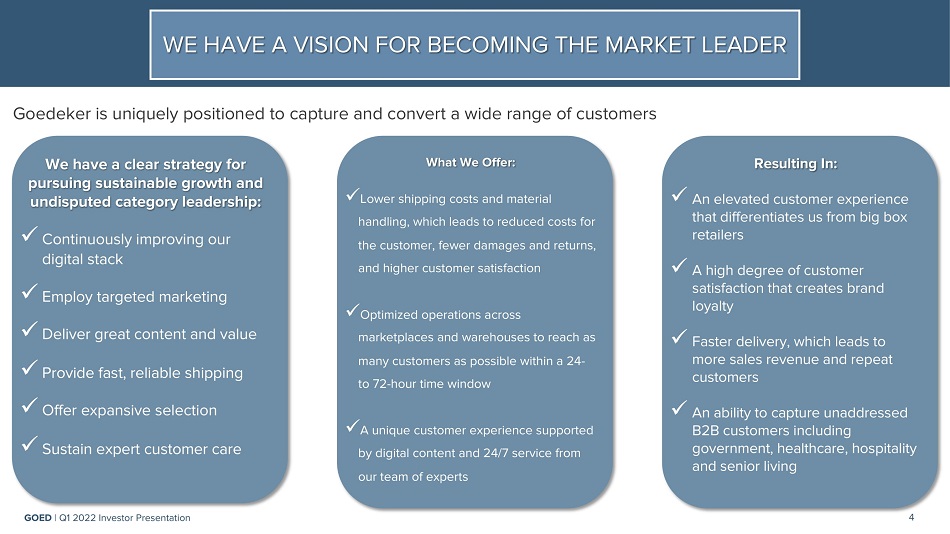

Goedeker is uniquely positioned to capture and convert a wide range of customers We have a clear strategy for pursuing sustainable growth and undisputed category leadership: x Continuously improving our digital stack x Employ targeted marketing x Deliver great content and value x Provide fast, reliable shipping x Offer expansive selection x Sustain expert customer care What We Offer: x Lower shipping costs and material handling, which leads to reduced costs for the customer, fewer damages and returns, and higher customer satisfaction x Optimized operations across marketplaces and warehouses to reach as many customers as possible within a 24 - to 72 - hour time window x A unique customer experience supported by digital content and 24/7 service from our team of experts Resulting In: x An elevated customer experience that differentiates us from big box retailers x A high degree of customer satisfaction that creates brand loyalty x Faster delivery, which leads to more sales revenue and repeat customers x An ability to capture unaddressed B2B customers including government, healthcare, hospitality and senior living 4 GOED | Q1 2022 Investor Presentation WE HAVE A VISION FOR BECOMING THE MARKET LEADER

Financial & Operational Highlights

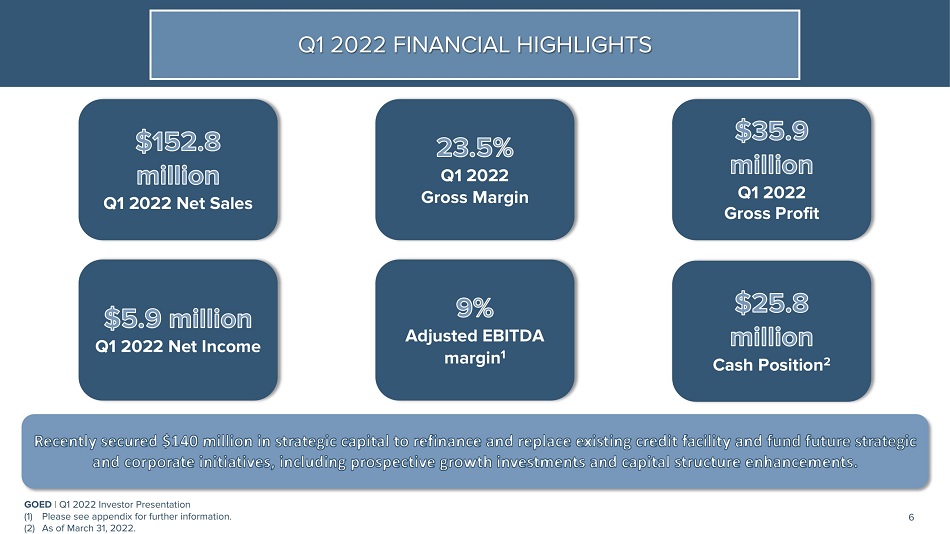

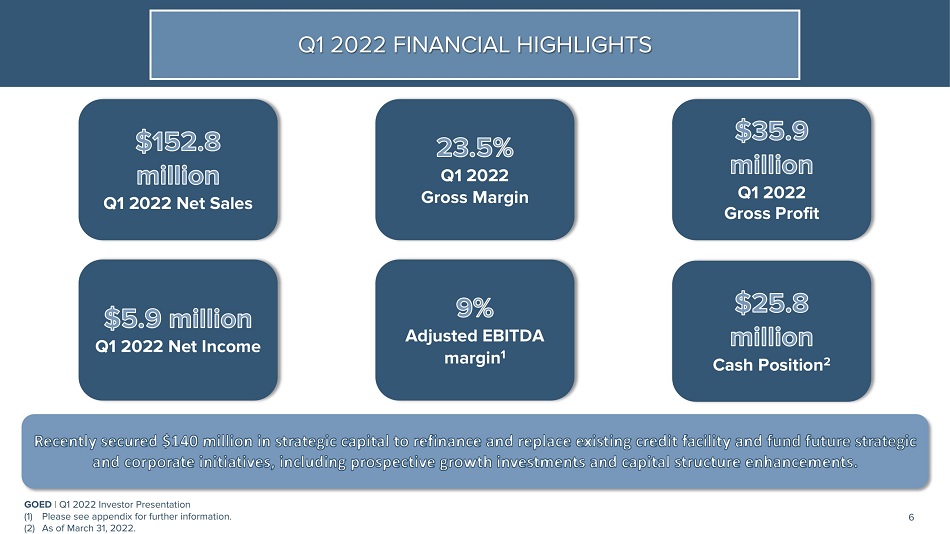

Q1 2022 FINANCIAL HIGHLIGHTS GOED | Q1 2022 Investor Presentation (1) Please see appendix for further information. (2) As of March 31, 2022. 6 Q1 2022 Net Sales Q1 2022 Net Income Q1 2022 Gross Margin Adjusted EBITDA margin 1 Q1 2022 Gross Profit Cash Position 2

We have been laser - focused on building out our leadership team with seasoned supply chain, distribution and logistics, home delivery, merchandising and marketing executives RECRUITING TOP - TIER TALENT Jody Rusnak Chief Merchandising and Brand Officer • Accomplished senior executive with more than three decades of B2C and B2B experience, as well as significant experience growing product assortment and driving growth across categories • Previously the director of Appliances and Electronics at Nebraska Furniture Mart, Inc., which is one of the largest home furnishing stores in North America Mike Barry Director of Home Delivery • Seasoned distribution and logistics executive with more than two decades of experience building and managing best - in - class supply chain, transportation and distribution operations • Recently held senior roles at Pilot Furniture Direct and Last Mile Home, where he was responsible for overseeing appliance delivery operations and specialized in the last mile delivery process Kirstin Currie Head of Marketing 7 GOED | Q1 2022 Investor Presentation • Brings two decades of B2B and B2C marketing leadership experience across several categories, including major and small appliances, consumer electronics and household goods • Spent over a decade at Best Buy, where she held positions such as Senior Director of Category Marketing for Major and Small Appliances

RECRUITING TOP - TIER TALENT (CONT.) Mike Durrick Vice President of Distribution and Logistics • Accomplished supply chain executive with more than two decades of experience across domestic and global operations • Previously held several leadership roles within best - in - class supply chain organizations such as FedEx and DHL, where he focused on returns and reverse logistics, as well as forward and reverse of bulky seasonal items and traditional stocking items Brad Adelsky Director of Financial Planning and Analysis • Seasoned, results - focused Finance Director with over a decade of experience developing the FP&A function in consumer product companies • Recently held FP&A roles at PE - backed companies, leading the budget/forecasting process, developing KPI’s and dashboards, and playing a role in M&A transactions Sami Bazzi Head of Human Resources 8 GOED | Q1 2022 Investor Presentation • Seasoned executive with two decades of experience overseeing and developing human resources and employee relations programs • Previously was HR Director for Face Values, a Bed, Bath & Beyond brand, where she was responsible for devising HR policies and competitive compensation programs, as well as overseeing 3,000 associates at 60+ retail, corporate and warehouse locations across the country We have been laser - focused on building out our leadership team with seasoned supply chain, distribution and logistics, home delivery, merchandising and marketing executives

Market Opportunity & Competitive Positioning

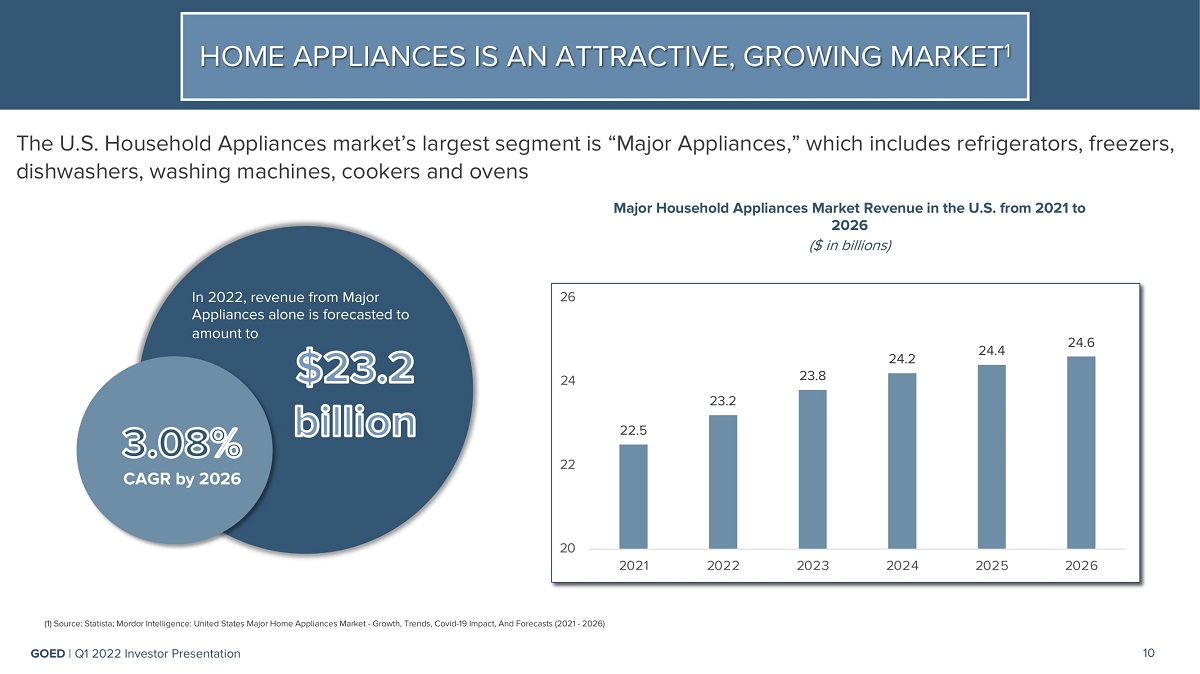

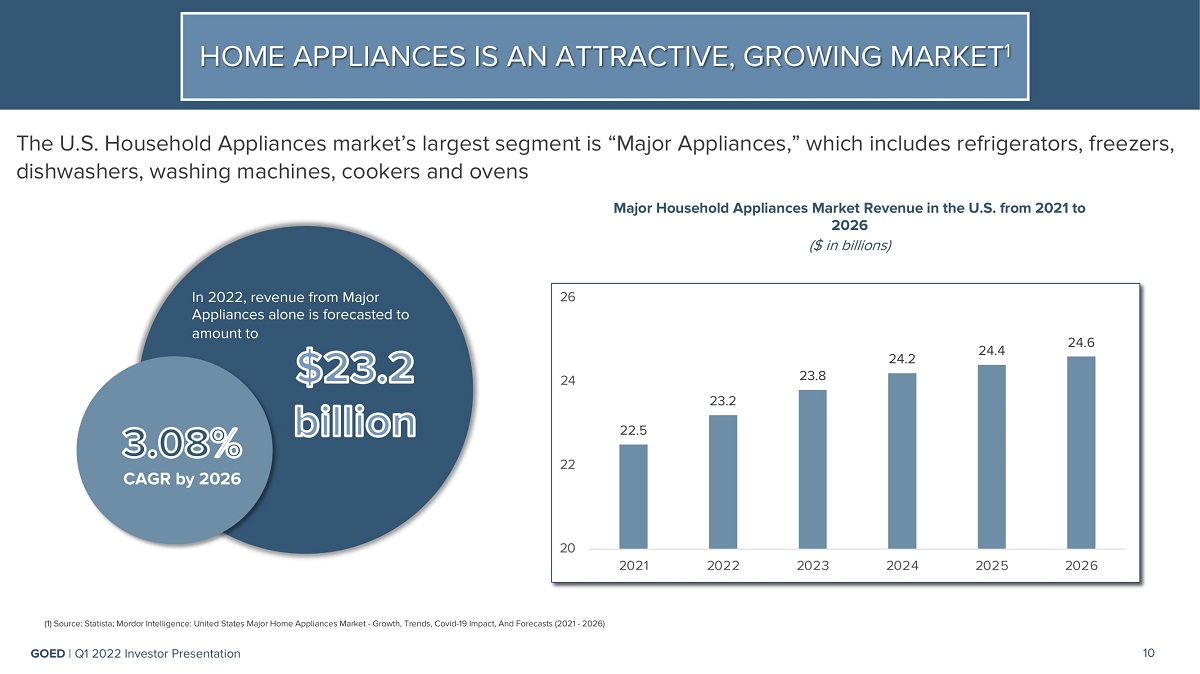

HOME APPLIANCES IS AN ATTRACTIVE, GROWING MARKET 1 In 2022, revenue from Major Appliances alone is forecasted to amount to CAGR by 2026 The U.S. Household Appliances market’s largest segment is “Major Appliances,” which includes refrigerators, freezers, dishwashers, washing machines, cookers and ovens Major Household Appliances Market Revenue in the U.S. from 2021 to 2026 ($ in billions) 23.8 24.2 24.4 24.6 20 23.2 22.5 22 24 26 2021 2022 2023 2024 2025 2026 (1) Source: Statista; Mordor Intelligence: United States Major Home Appliances Market - Growth, Trends, Covid - 19 Impact, And Forecasts (2021 - 2026) 10 GOED | Q1 2022 Investor Presentation

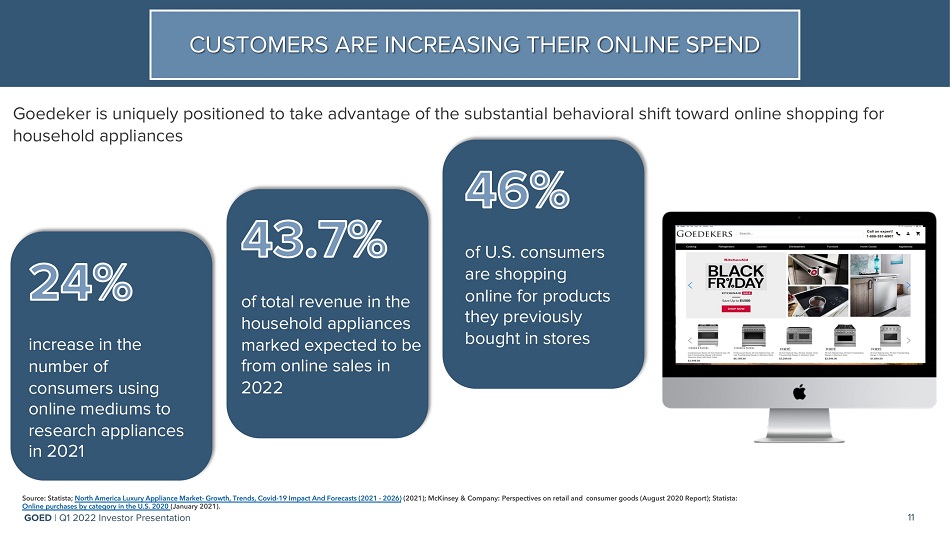

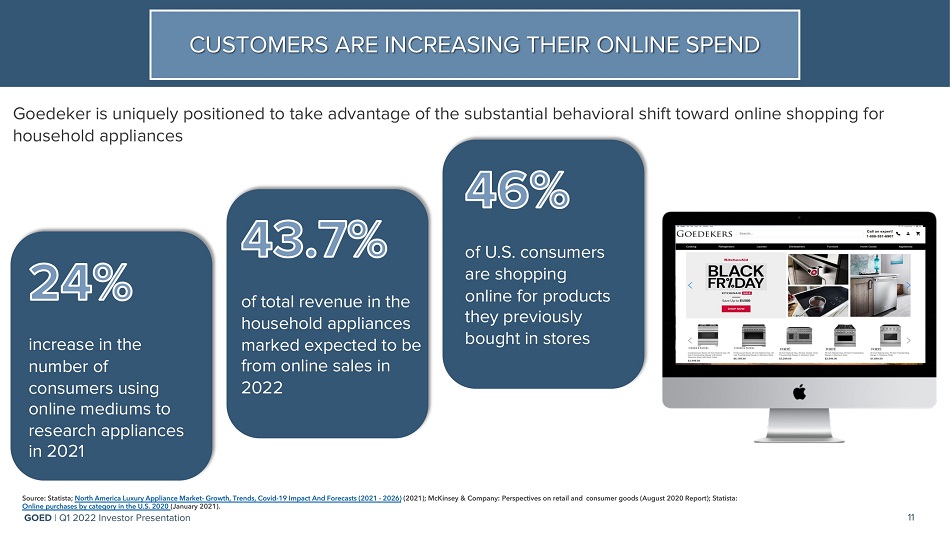

Goedeker is uniquely positioned to take advantage of the substantial behavioral shift toward online shopping for household appliances CUSTOMERS ARE INCREASING THEIR ONLINE SPEND Source: Statista; North America Luxury Appliance Market - Growth, Trends, Covid - 19 Impact And Forecasts (2021 - 2026 ) (2021); McKinsey & Company: Perspectives on retail and consumer goods (August 2020 Report); Statista: Online purchases by category in the U.S. 2020 (January 2021). increase in the number of consumers using online mediums to research appliances in 2021 of total revenue in the household appliances marked expected to be from online sales in 2022 of U.S. consumers are shopping online for products they previously bought in stores 11 GOED | Q1 2022 Investor Presentation

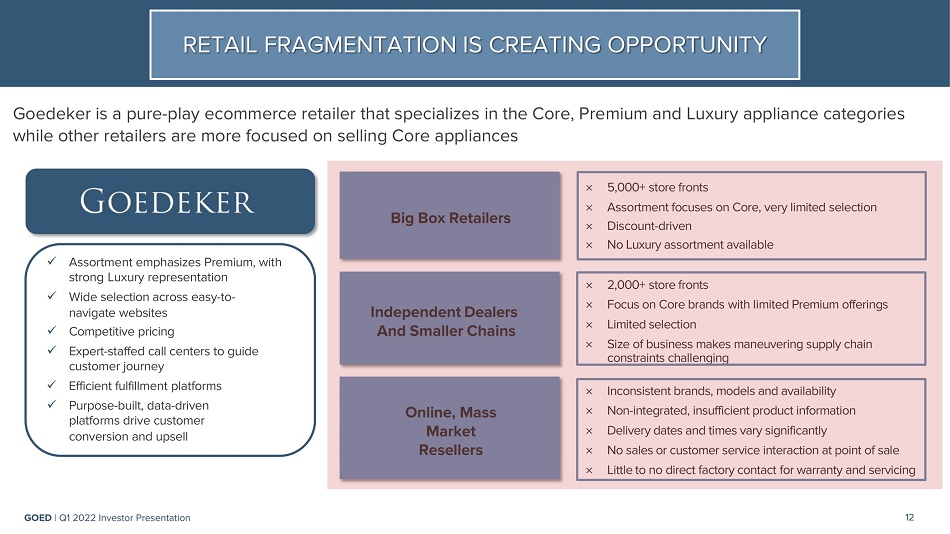

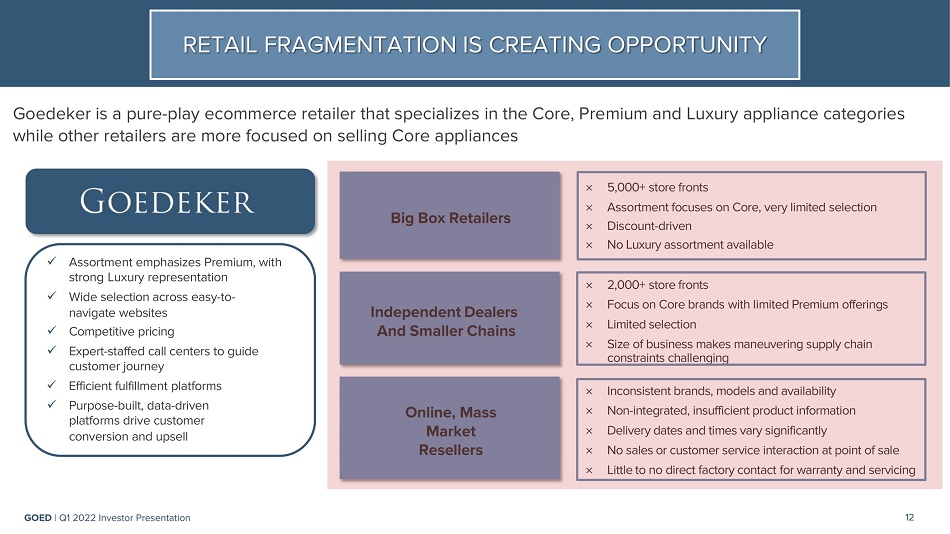

î 5,000+ store fronts î Assortment focuses on Core, very limited selection î Discount - driven î No Luxury assortment available î 2,000+ store fronts î Focus on Core brands with limited Premium offerings î Limited selection î Size of business makes maneuvering supply chain constraints challenging Independent Dealers And Smaller Chains î Inconsistent brands, models and availability î Non - integrated, insufficient product information î Delivery dates and times vary significantly î No sales or customer service interaction at point of sale î Little to no direct factory contact for warranty and servicing Online, Mass Market Resellers Big Box Retailers Goedeker is a pure - play ecommerce retailer that specializes in the Core, Premium and Luxury appliance categories while other retailers are more focused on selling Core appliances RETAIL FRAGMENTATION IS CREATING OPPORTUNITY x Assortment emphasizes Premium, with strong Luxury representation x Wide selection across easy - to - navigate websites x Competitive pricing x Expert - staffed call centers to guide customer journey x Efficient fulfillment platforms x Purpose - built, data - driven platforms drive customer conversion and upsell 12 GOED | Q1 2022 Investor Presentation

We believe Goedeker has clear operating tailwinds that the competitive set does not: WE ARE WELL - POSITIONED TO SEIZE THE WHITE SPACE Distinct ability to offer customers Core, Premium and Luxury appliances brands through one point - and - click experience An existing growth trajectory that we are building upon An aligned leadership team with decades of collective experience in the ecommerce and home appliances verticals Differentiated product expertise that exceeds what other retailers and online marketplaces can provide to consumers and B 2 B customers Proven Leadership Distinct Product Expertise Strong Growth Foundation Vast Product Catalog 13 GOED | Q1 2022 Investor Presentation

WE ARE TAKING STEPS TO BUILD A STRONG FOUNDATION Leveraging Our Increased Scale Continuing to focus on expanding our product catalog, including through private label offerings with strong margins Drawing on our increased scale to access sufficient inventory despite global supply chain constraints Renegotiating agreements with vendors and suppliers to secure the most favorable rates and terms Strengthening Our Brand and Infrastructure Narrowing down a new brand identity and name, which we expect will be rolled out with new ecommerce properties by the end of Q2 2022 Focusing on geographic expansion, including new fulfillment centers in key regions, allowing us to reach more customers and shorten delivery times Integrating leading logistics software and technologies to improve our supply chain 14 GOED | Q1 2022 Investor Presentation

CLEAR PRIORITIES TO CONTINUE DRIVING GROWTH Continue strengthening human capital by adding talent in areas such as analytics, ecommerce and supply chain, while reducing and reconciling positions tied to legacy Goedeker business model Finalize new name and brand to establish a strong identity that will help accelerate our growth and help us realize our vision of becoming a shopping platform that takes customers from inspiration to installation Finalize geographic locations for fulfillment centers in the Southeast and Southwest, where customer demand is growing Sustain inventory flow and gradually expand product catalog, including by adding high - margin private label offerings as well as newer and more environmentally efficient models Begin to build out B2B platform, with an eye toward establishing strategic partnerships that can yield initial entry points with builders and contractors in high - growth markets Continue to strengthen the Board of Directors with the addition of experienced, qualified directors, and explore potential strategies for optimizing the Company’s capital structure 15 GOED | Q1 2022 Investor Presentation

Appendix

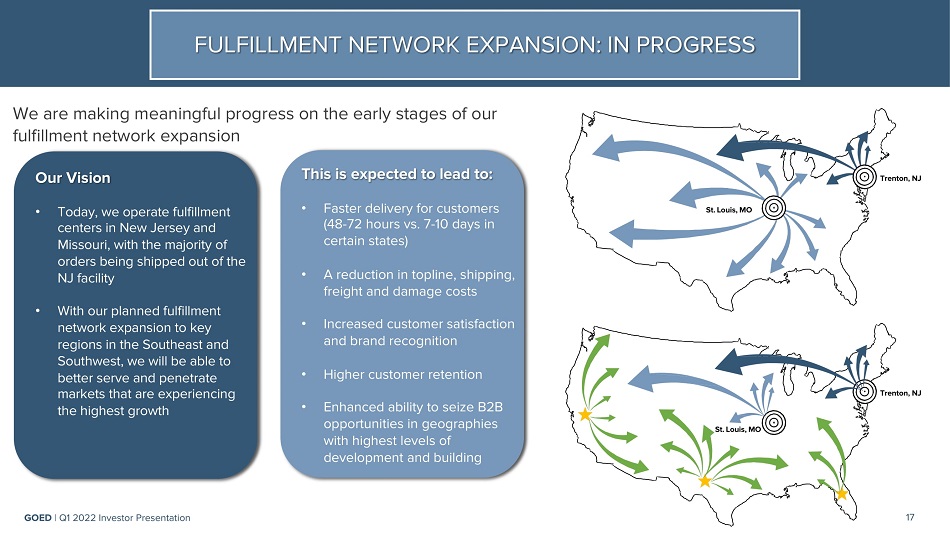

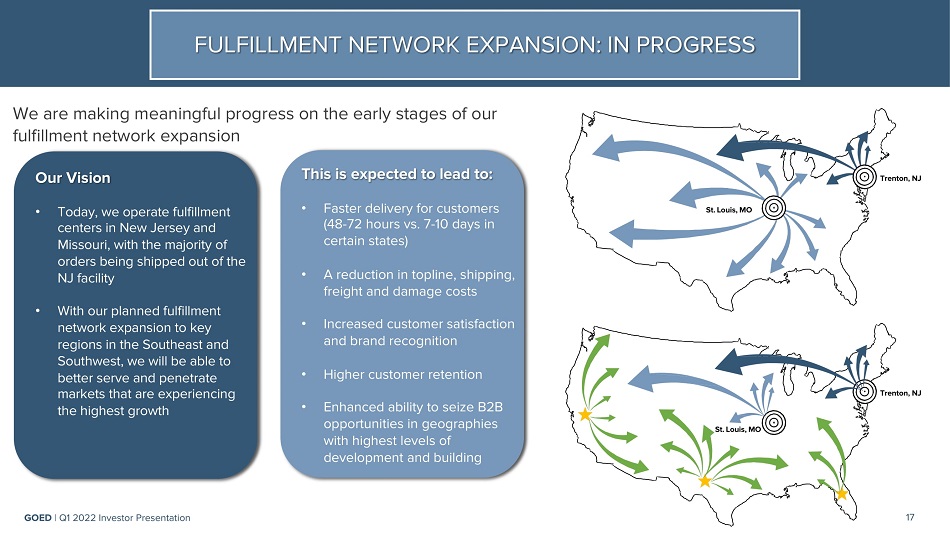

FULFILLMENT NETWORK EXPANSION: IN PROGRESS St. Louis, MO Trenton, NJ St. Louis, MO Trenton, NJ We are making meaningful progress on the early stages of our fulfillment network expansion Our Vision • Today, we operate fulfillment centers in New Jersey and Missouri, with the majority of orders being shipped out of the NJ facility • With our planned fulfillment network expansion to key regions in the Southeast and Southwest, we will be able to better serve and penetrate markets that are experiencing the highest growth This is expected to lead to: 17 GOED | Q1 2022 Investor Presentation • Faster delivery for customers (48 - 72 hours vs. 7 - 10 days in certain states) • A reduction in topline, shipping, freight and damage costs • Increased customer satisfaction and brand recognition • Higher customer retention • Enhanced ability to seize B2B opportunities in geographies with highest levels of development and building

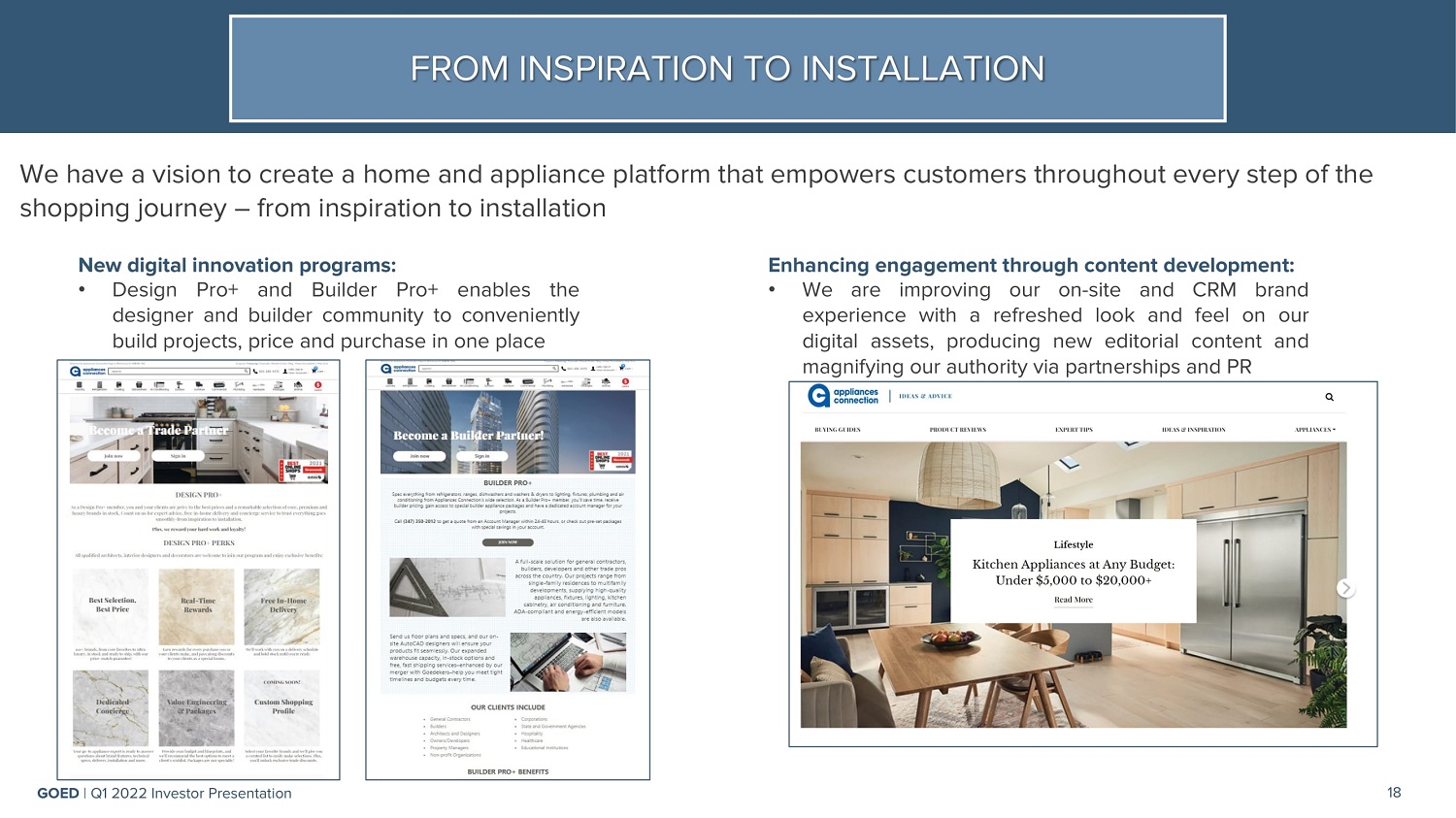

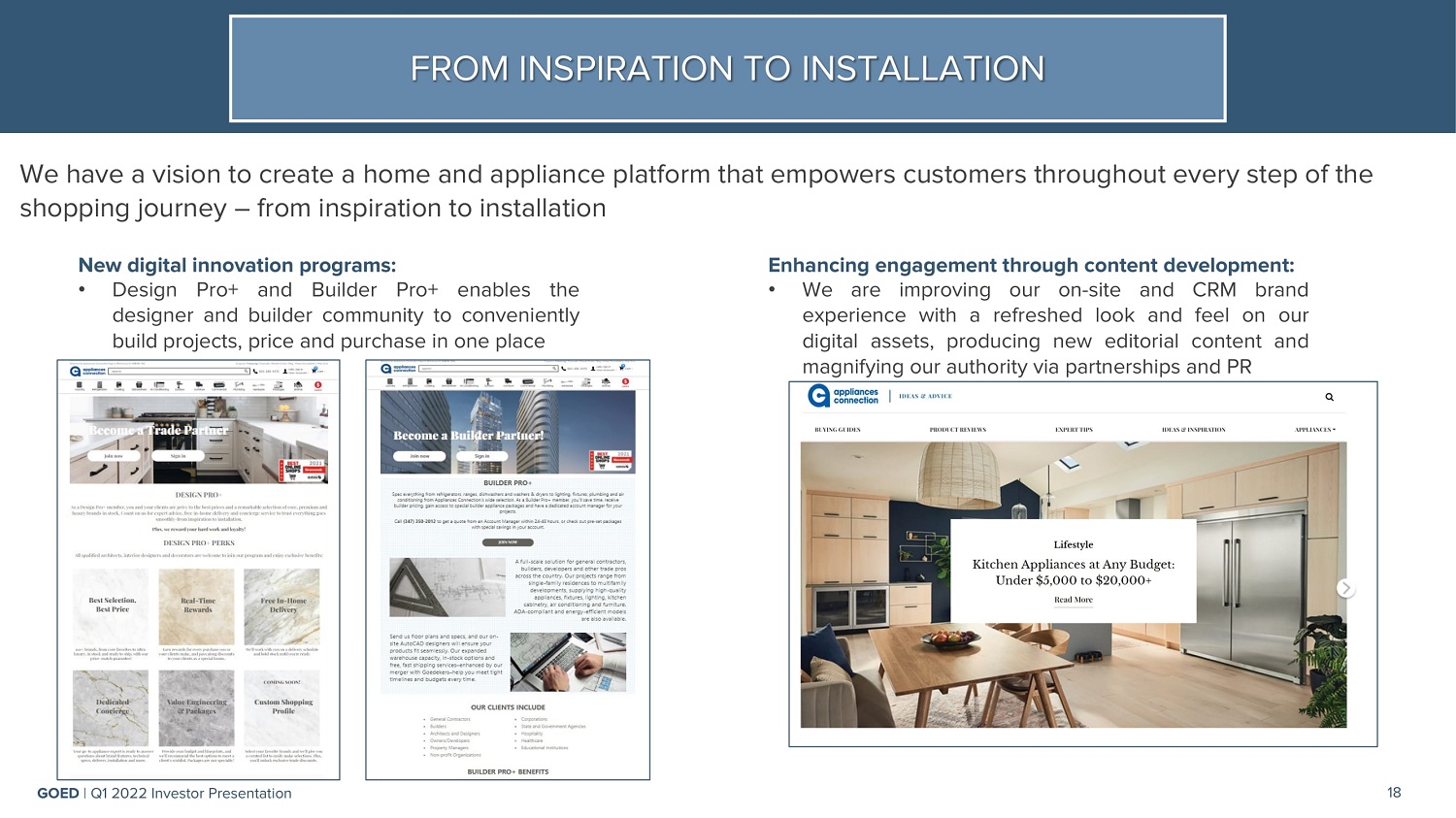

FROM INSPIRATION TO INSTALLATION We have a vision to create a home and appliance platform that empowers customers throughout every step of the shopping journey – from inspiration to installation New digital innovation programs: • Design Pro+ and Builder Pro+ enables the designer and builder community to conveniently build projects, price and purchase in one place Enhancing engagement through content development: • We are improving our on - site and CRM brand experience with a refreshed look and feel on our digital assets, producing new editorial content and magnifying our authority via partnerships and PR 18 GOED | Q1 2022 Investor Presentation

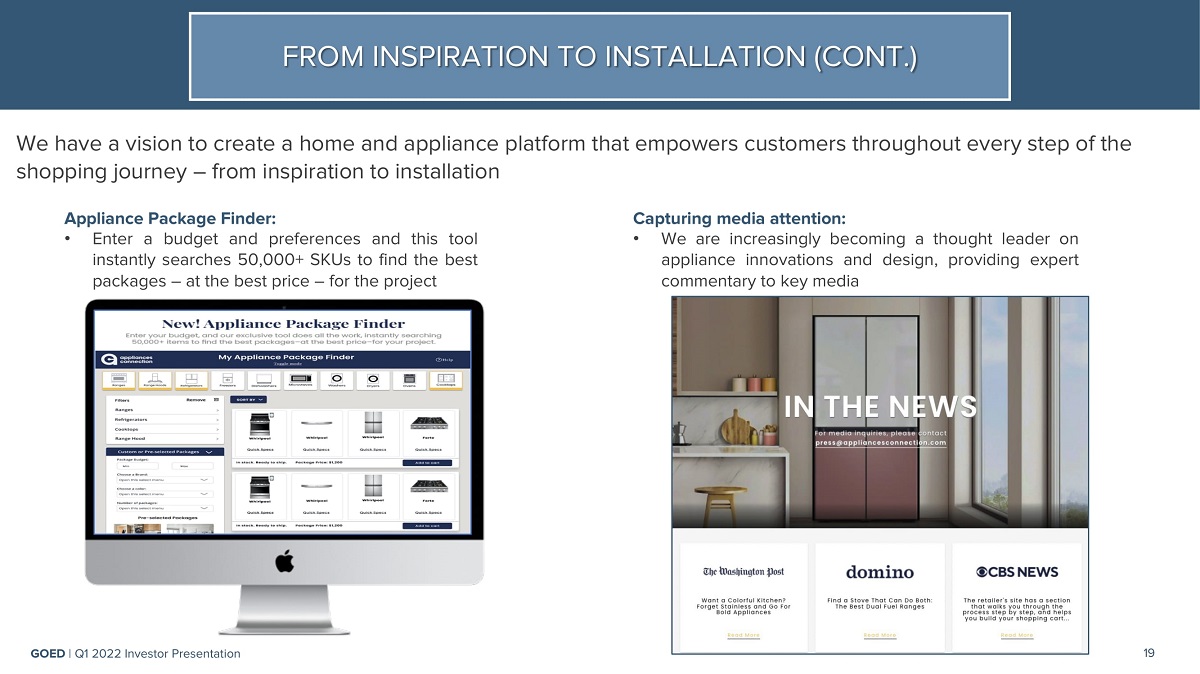

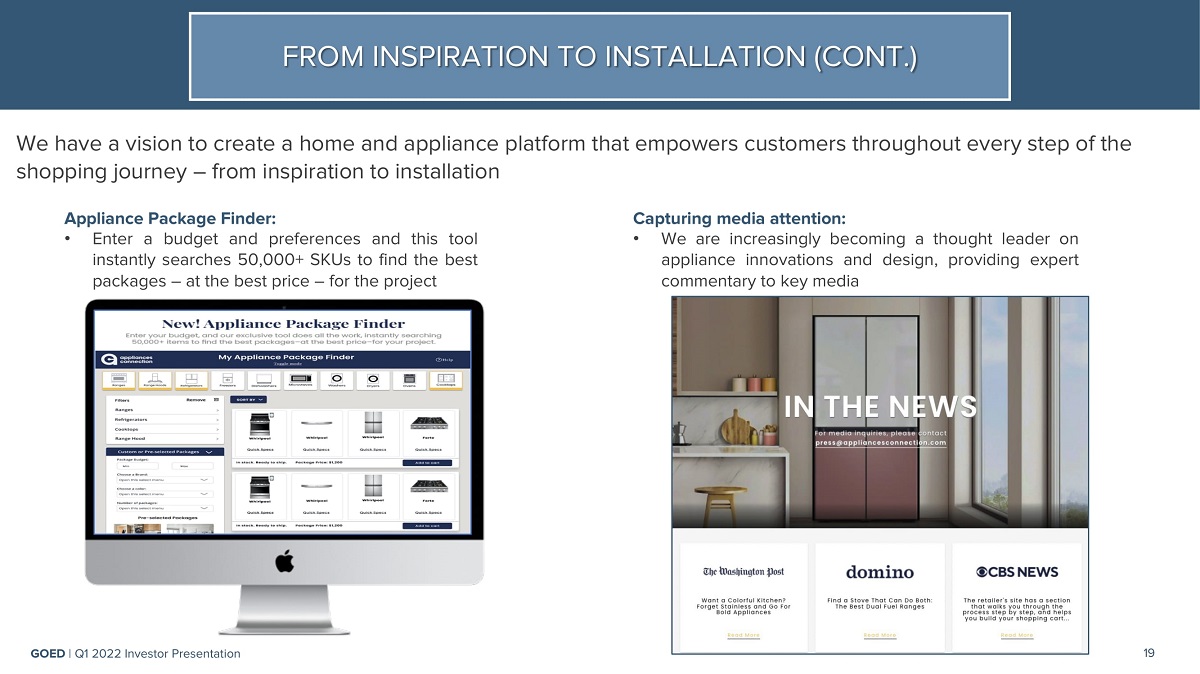

FROM INSPIRATION TO INSTALLATION (CONT.) We have a vision to create a home and appliance platform that empowers customers throughout every step of the shopping journey – from inspiration to installation Appliance Package Finder: • Enter a budget and preferences and this tool instantly searches 50,000+ SKUs to find the best packages – at the best price – for the project Capturing media attention: • We are increasingly becoming a thought leader on appliance innovations and design, providing expert commentary to key media 19 GOED | Q1 2022 Investor Presentation

EXPANDING B2B CONNECTIONS With $20 million in our B2B pipeline as of the first quarter of 2022, we actively are working to build this pipeline, including through creating and maintaining new and existing partnerships 20 GOED | Q1 2022 Investor Presentation

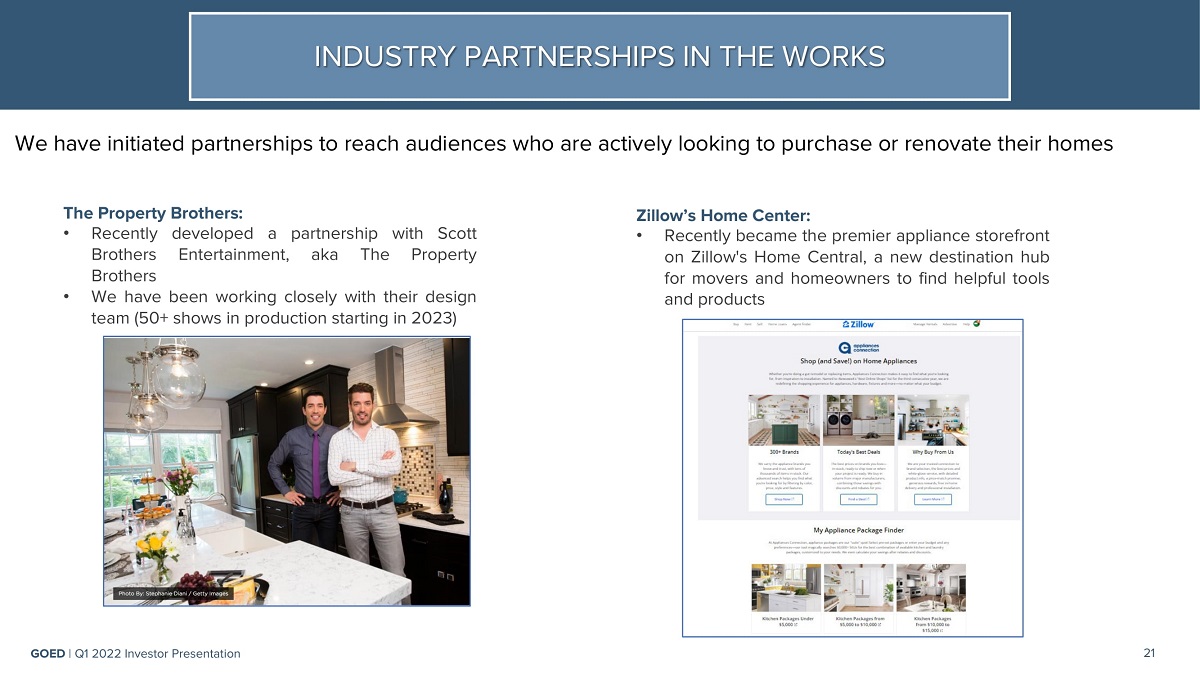

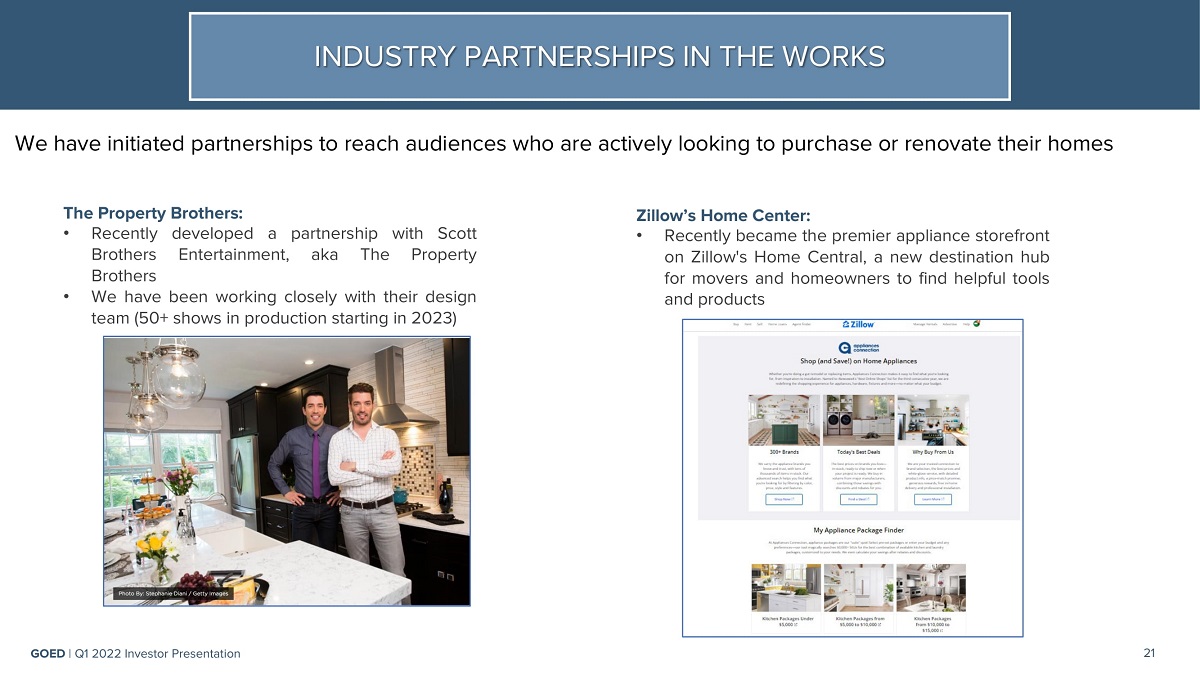

INDUSTRY PARTNERSHIPS IN THE WORKS We have initiated partnerships to reach audiences who are actively looking to purchase or renovate their homes 21 GOED | Q1 2022 Investor Presentation The Property Brothers: • Recently developed a partnership with Scott Brothers Entertainment, aka The Property Brothers • We have been working closely with their design team ( 50 + shows in production starting in 2023 ) Zillow’s Home Center: • Recently became the premier appliance storefront on Zillow's Home Central, a new destination hub for movers and homeowners to find helpful tools and products

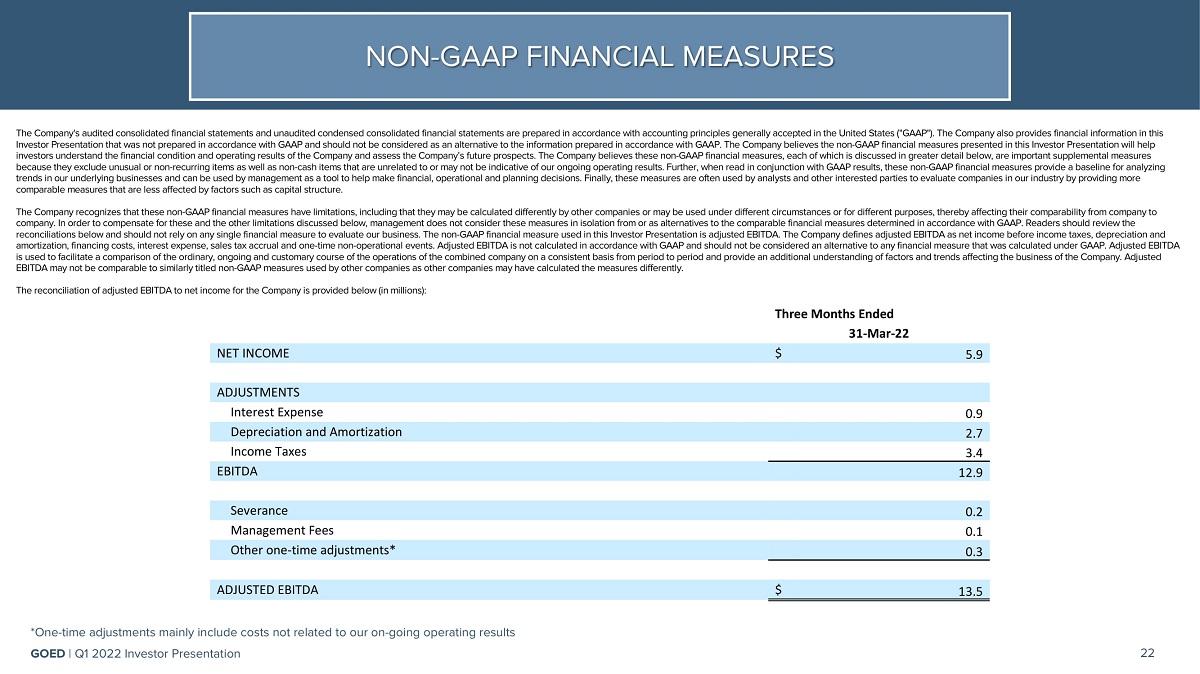

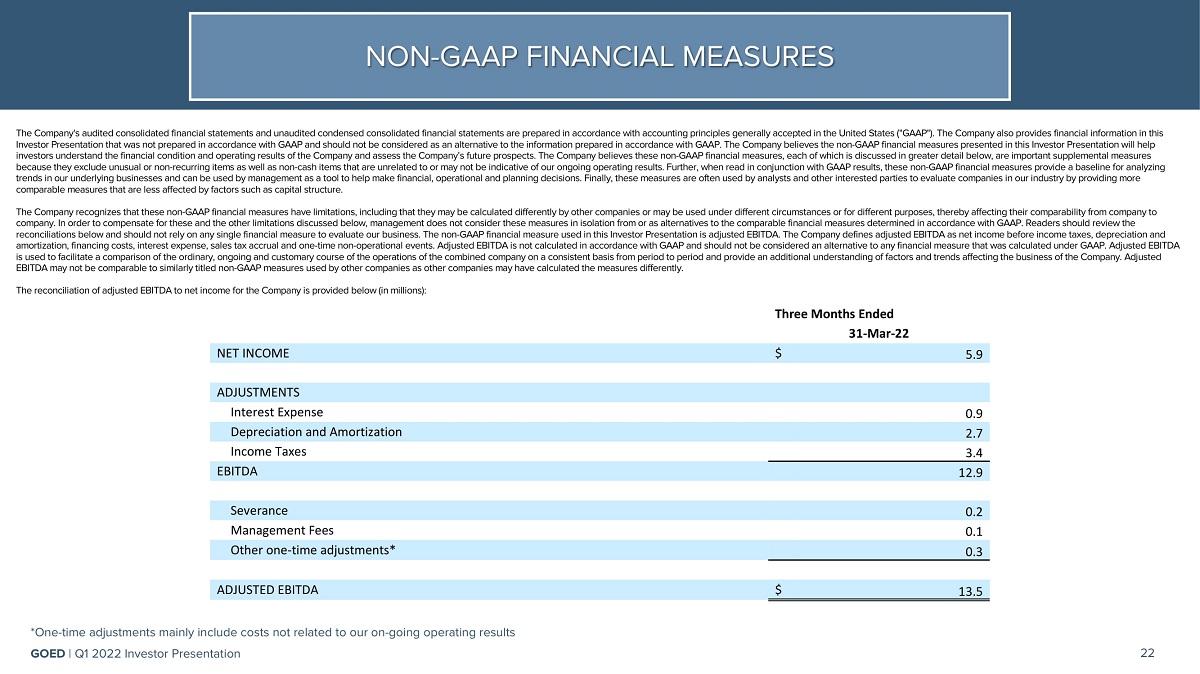

NON - GAAP FINANCIAL MEASURES 22 GOED | Q1 2022 Investor Presentation The Company's audited consolidated financial statements and unaudited condensed consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States ("GAAP"). The Company also provides financial information in this Investor Presentation that was not prepared in accordance with GAAP and should not be considered as an alternative to the information prepared in accordance with GAAP. The Company believes the non - GAAP financial measures presented in this Investor Presentation will help investors understand the financial condition and operating results of the Company and assess the Company’s future prospects. The Company believes these non - GAAP financial measures, each of which is discussed in greater detail below, are important supplemental measures because they exclude unusual or non - recurring items as well as non - cash items that are unrelated to or may not be indicative of our ongoing operating results. Further, when read in conjunction with GAAP results, these non - GAAP financial measures provide a baseline for analyzing trends in our underlying businesses and can be used by management as a tool to help make financial, operational and planning decisions. Finally, these measures are often used by analysts and other interested parties to evaluate companies in our industry by providing more comparable measures that are less affected by factors such as capital structure. The Company recognizes that these non - GAAP financial measures have limitations, including that they may be calculated differently by other companies or may be used under different circumstances or for different purposes, thereby affecting their comparability from company to company. In order to compensate for these and the other limitations discussed below, management does not consider these measures in isolation from or as alternatives to the comparable financial measures determined in accordance with GAAP. Readers should review the reconciliations below and should not rely on any single financial measure to evaluate our business. The non - GAAP financial measure used in this Investor Presentation is adjusted EBITDA. The Company defines adjusted EBITDA as net income before income taxes, depreciation and amortization, financing costs, interest expense, sales tax accrual and one - time non - operational events. Adjusted EBITDA is not calculated in accordance with GAAP and should not be considered an alternative to any financial measure that was calculated under GAAP. Adjusted EBITDA is used to facilitate a comparison of the ordinary, ongoing and customary course of the operations of the combined company on a consistent basis from period to period and provide an additional understanding of factors and trends affecting the business of the Company. Adjusted EBITDA may not be comparable to similarly titled non - GAAP measures used by other companies as other companies may have calculated the measures differently. The reconciliation of adjusted EBITDA to net income for the Company is provided below (in millions): Three Months Ended 31 - Mar - 22 *One - time adjustments mainly include costs not related to our on - going operating results NET INCOME $ 5.9 ADJUSTMENTS Interest Expense 0.9 Depreciation and Amortization 2.7 Severance 0.2 Management Fees 0.1 Other one - time adjustments* 0.3 Income Taxes 3.4 EBITDA 12.9 ADJUSTED EBITDA $ 13.5