Exhibit 99.4

The Consumer Loan Repayment and Collection Management, Loan Recommendation, and Third - party Payment Services Market Study in China 2020 Prepared for © 2020 Frost & Sullivan. All rights reserved. This document contains highly confidential information and is the sole property of Frost & Sullivan. No part of it may be circulated, quoted, copied or otherwise reproduced without the written approval of Frost & Sullivan. Highly Confidential June 2021

Agenda 2 3 1 Overview of Macro Economy Overview of Consumer Loan Repayment and Collection Management Market in China Introduction 4 Overview of Loan Recommendation Market in China 5 Overview of Third - party Payment Services Market in China 6 Appendix 2

Project Scope Period Scope • Historical year: 2014 - 2019 • Base year: 2019 • Forecast year: 2019E - 2024E • Consumer Loan Repayment and Collection Management • Loan Recommendation • Third - party Payment Services I n d u s t ry Scope • C hina G eo g raphic Scope 3

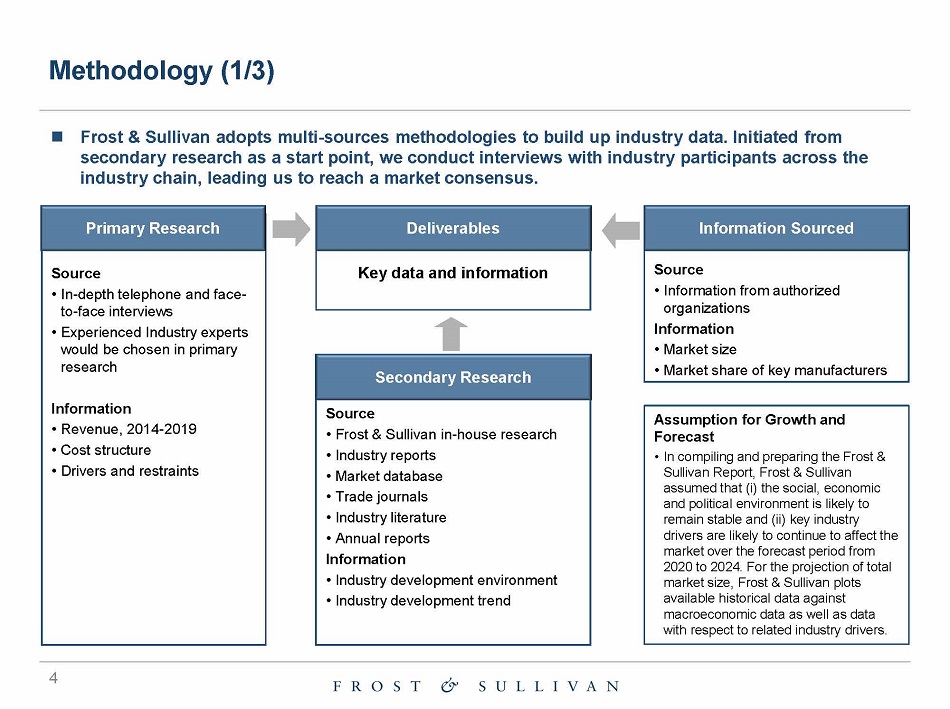

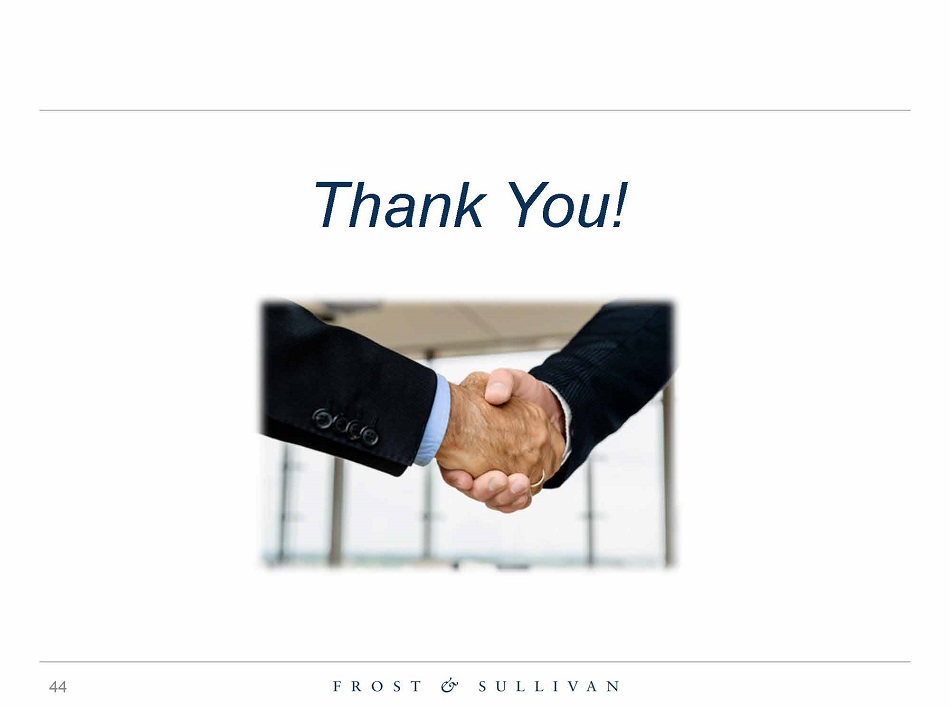

Methodology (1/3) Frost & Sullivan adopts multi - sources methodologies to build up industry data. Initiated from secondary research as a start point, we conduct interviews with industry participants across the industry chain, leading us to reach a market consensus. Key data and information Deliverables Secondary Research Source • Frost & Sullivan in - house research • Industry reports • Market database • Trade journals • Industry literature • Annual reports Information • Industry development environment • Industry development trend Source • Information from authorized organizations Information • Market size • Market share of key manufacturers Information Sourced Source • In - depth telephone and face - to - face interviews • Experienced Industry experts would be chosen in primary research Information • Revenue, 2014 - 2019 • Cost structure • Drivers and restraints Primary Research Assumption for Growth and Forecast • In compiling and preparing the Frost & Sullivan Report, Frost & Sullivan assumed that (i) the social, economic and political environment is likely to remain stable and (ii) key industry drivers are likely to continue to affect the market over the forecast period from 2020 to 2024. For the projection of total market size, Frost & Sullivan plots available historical data against macroeconomic data as well as data with respect to related industry drivers. 4

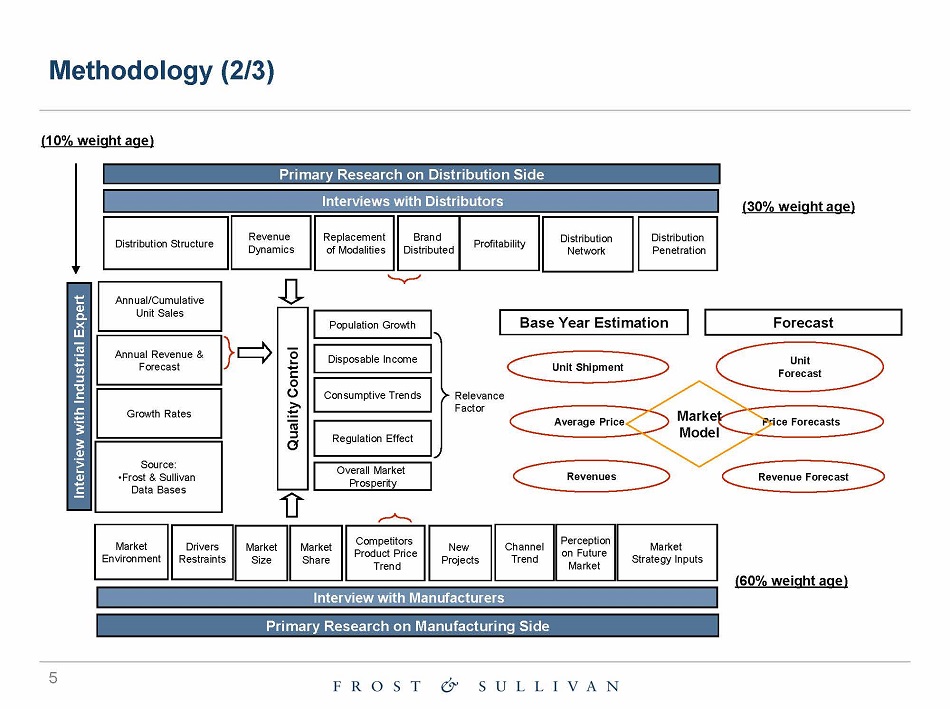

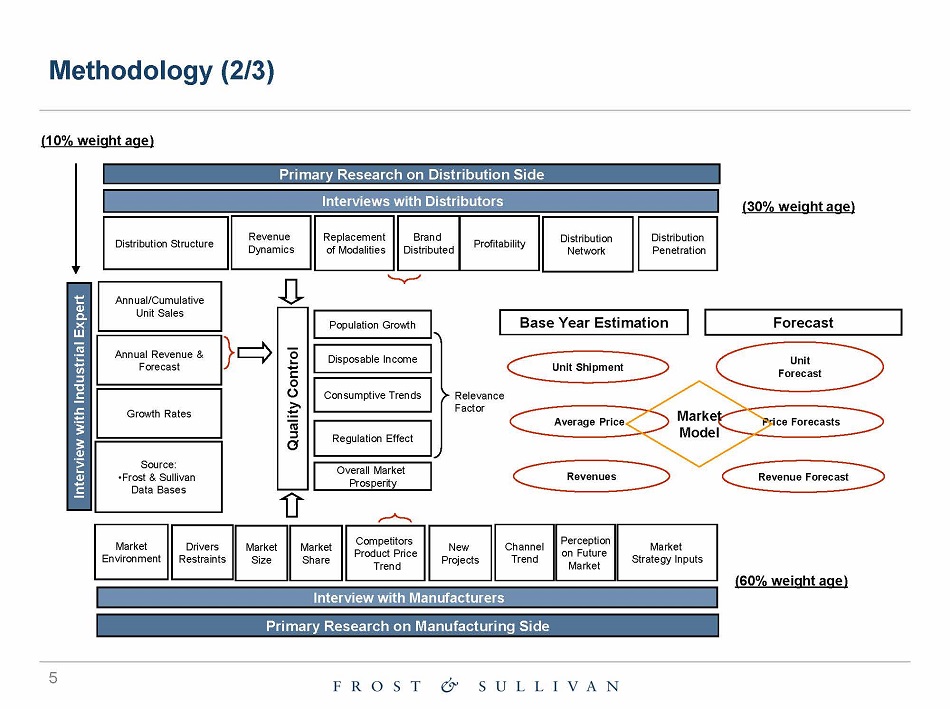

Methodology (2/3) Interviews with Distributors Distribution Structure Revenue Dynamics Rep lac e m en t of Modalities Brand D i s t r ib u t e d Profitability D i s t r ib u tion Network Distribution P ene t ra tion Primary Research on Distribution Side Market E n v ir o n m en t M ar k e t Size New P ro jects Channe l Trend Drivers Re st ra ints Competitors Product Price Trend Interview with Manufacturers Primary Research on Manufacturing Side M ar k e t Share P er c ep tion on Future Market Market Strategy Inputs Interview with Industrial Expert A nnua l/ Cu m u lati v e Unit Sales Annual Revenue & Forecast Growth Rates Source: • Frost & Sullivan Data Bases Base Year Estimation U nit Shipm e nt Average Price Revenues Forecast Unit Fore c as t Price Forecasts Revenue Forecast M arket Model (60% weight age) (30% weight age) (10% weight age) Population Growth Quality Control Disposable Income Consumptive Trends Regulation Effect Overall Market Prosperity Re le v an ce Factor 5

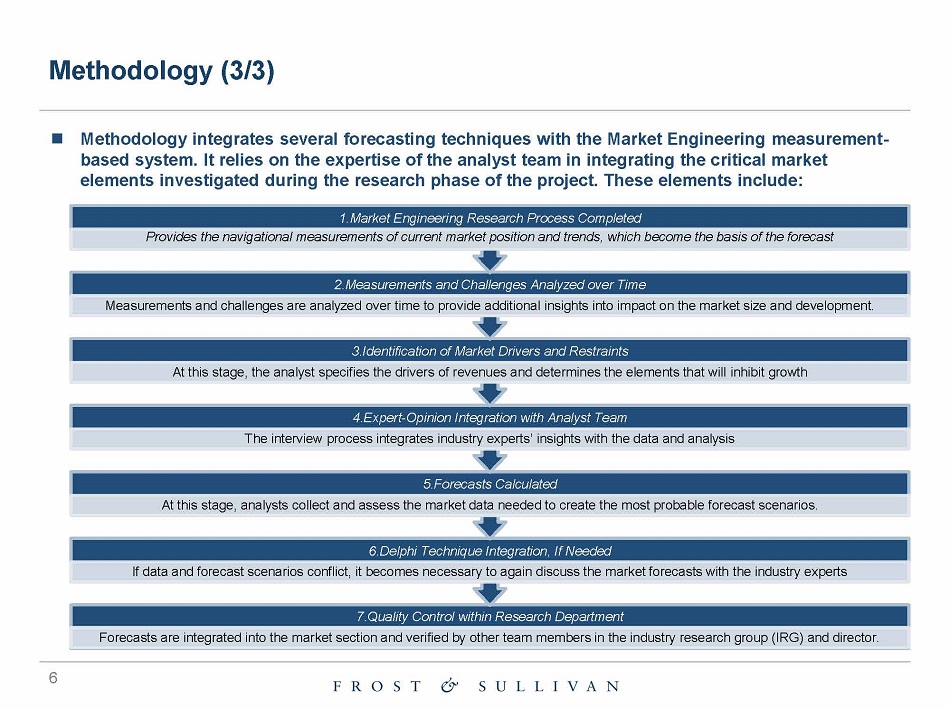

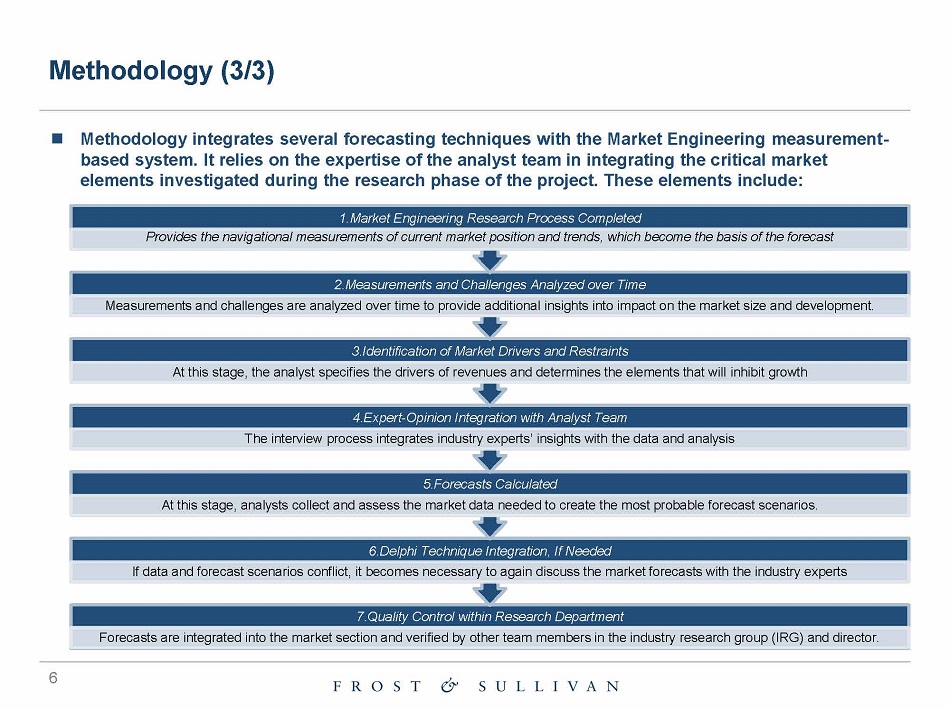

Methodology (3/3) 7.Quality Control within Research Department Forecasts are integrated into the market section and verified by other team members in the industry research group (IRG) and director. 6.Delphi Technique Integration, If Needed If data and forecast scenarios conflict, it becomes necessary to again discuss the market forecasts with the industry experts 5.Forecasts Calculated At this stage, analysts collect and assess the market data needed to create the most probable forecast scenarios. 4.Expert - Opinion Integration with Analyst Team The interview process integrates industry experts’ insights with the data and analysis 3.Identification of Market Drivers and Restraints At this stage, the analyst specifies the drivers of revenues and determines the elements that will inhibit growth 2.Measurements and Challenges Analyzed over Time Measurements and challenges are analyzed over time to provide additional insights into impact on the market size and development. 1.Market Engineering Research Process Completed 6 Provides the navigational measurements of current market position and trends, which become the basis of the forecast Methodology integrates several forecasting techniques with the Market Engineering measurement - based system. It relies on the expertise of the analyst team in integrating the critical market elements investigated during the research phase of the project. These elements include:

Li m itations Industry Expert In t er v iew Market indicators for modeling Official S tatistic al sources Source of Information » Interviews with industry experts and competitors will be conducted on a best - effort basis to collect information for in - depth analysis for this report. » Frost & Sullivan will not be responsible for any information gaps where Interviewees have refused to disclose confidential data or figures. » The study took 2019 as the base year for analysis and 2020 - 2024 for forecast. However, as the point of this study being 2020, some of the figures of 2019 may not be available at the moment from public statistical sources. Frost & Sullivan will use the latest information available (e.g. 2018) or make projections based on historical trends. » Under circumstances where information is not available, Frost & Sullivan in - house analysis will be leveraged using appropriate models and indicators to arrive at an estimate. » Sources of information and data will be clearly stated in the bottom right hand corner on each slide for reference. 7

Agenda 2 3 1 Overview of Macro Economy Overview of Consumer Loan Repayment and Collection Management Market in China Introduction 4 Overview of Loan Recommendation Market in China 5 Overview of Third - party Payment Services Market in China 6 Appendix 8

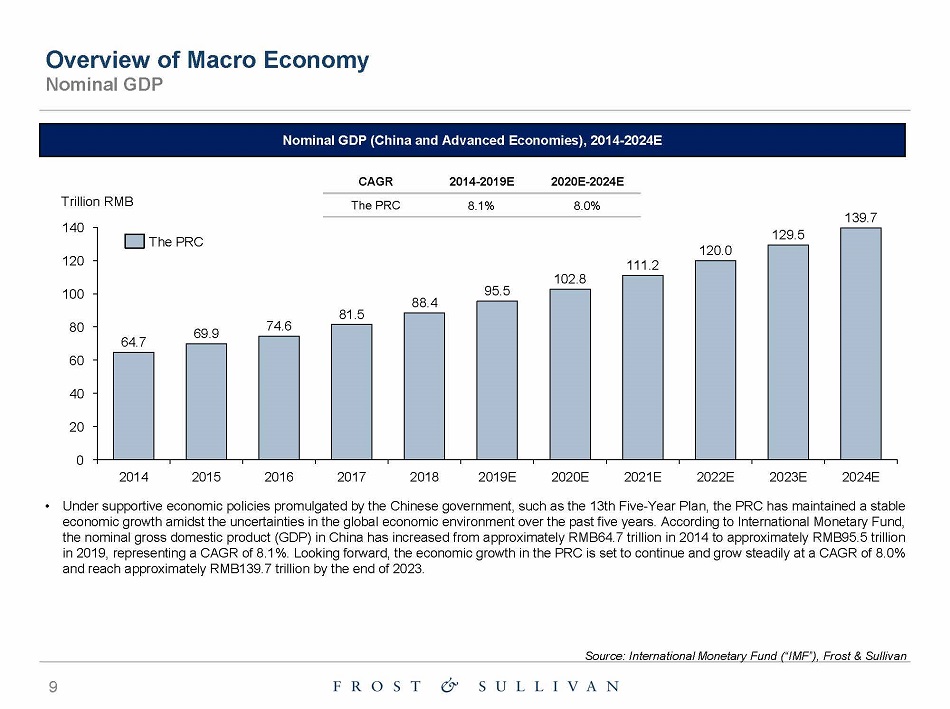

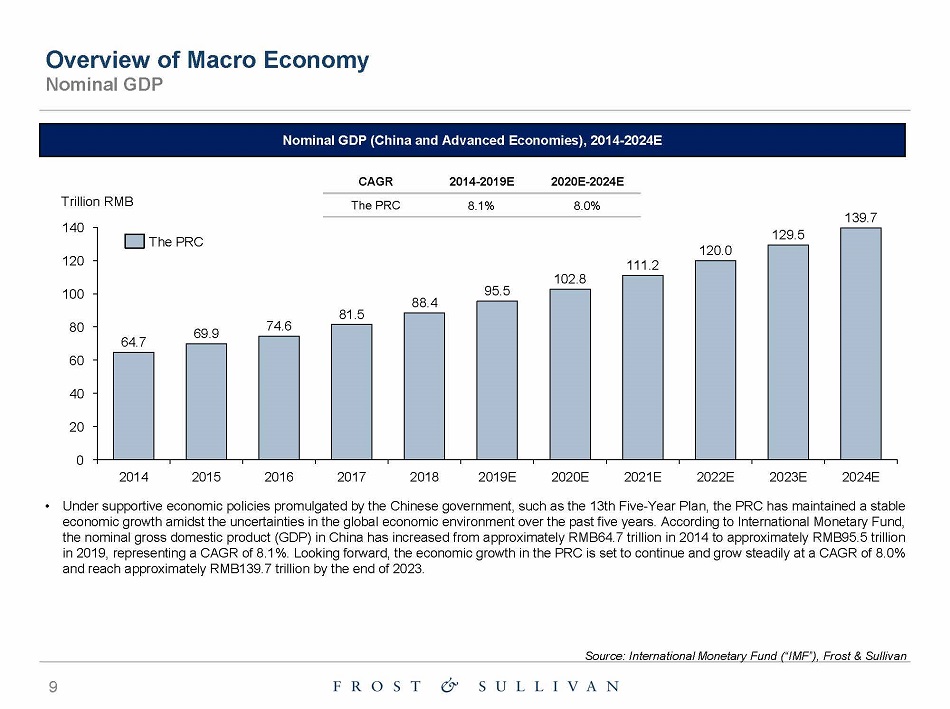

Nominal GDP (China and Advanced Economies), 2014 - 2024E Overview of Macro Economy Nominal GDP CAGR 2014 - 2019E 2020E - 2024E The PRC 8.1% 8.0% 60 40 20 0 2014 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E 2024E • Under supportive economic policies promulgated by the Chinese government, such as the 13 th Five - Year Plan, the PRC has maintained a stable economic growth amidst the uncertainties in the global economic environment over the past five years . According to International Monetary Fund, the nominal gross domestic product (GDP) in China has increased from approximately RMB 64 . 7 trillion in 2014 to approximately RMB 95 . 5 trillion in 2019 , representing a CAGR of 8 . 1 % . Looking forward, the economic growth in the PRC is set to continue and grow steadily at a CAGR of 8 . 0 % and reach approximately RMB 139 . 7 trillion by the end of 2023 . 140 80 100 120 Trillion RMB 81.5 64.7 74.6 69 .9 88.4 111.2 95.5 102.8 120.0 139 .7 129.5 T he P RC Source: International Monetary Fund (“IMF”), Frost & Sullivan 9

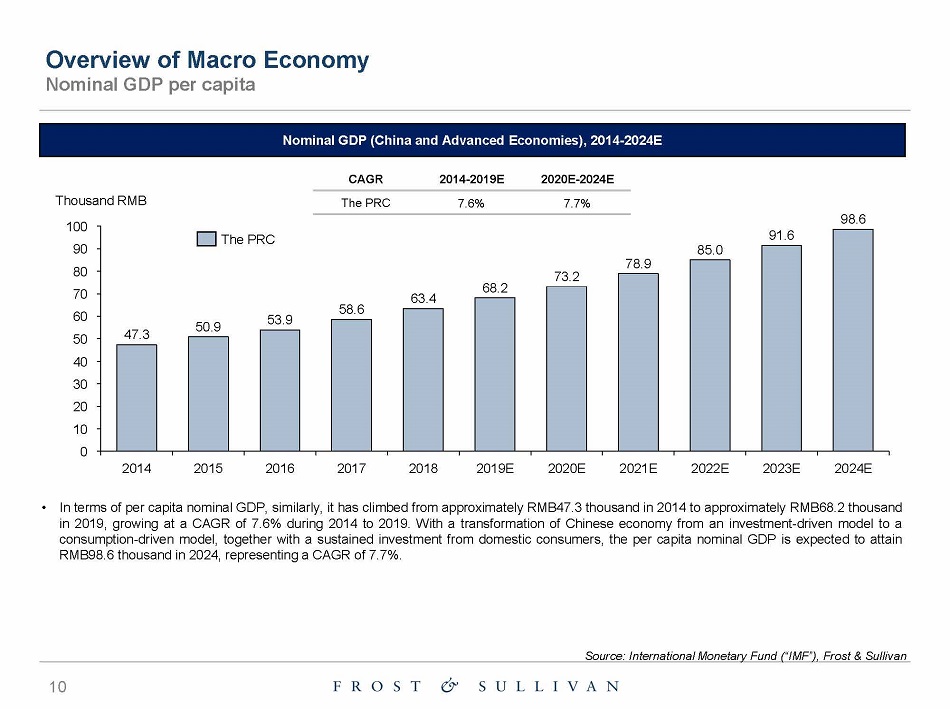

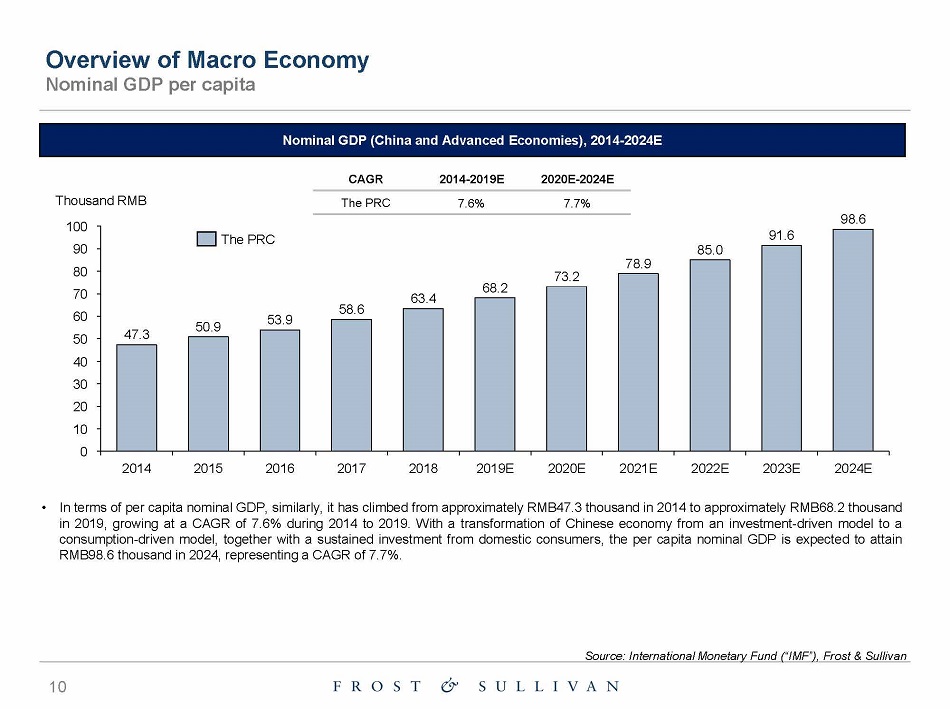

Nominal GDP (China and Advanced Economies), 2014 - 2024E Overview of Macro Economy Nominal GDP per capita CAGR 2014 - 2019E 2020E - 2024E The PRC 7.6% 7.7% 100 90 80 70 60 50 40 30 20 10 0 2014 2015 2016 2017 2018 2019E 2020E 2021E 2022E 2023E 2024E • In terms of per capita nominal GDP, similarly, it has climbed from approximately RMB 47 . 3 thousand in 2014 to approximately RMB 68 . 2 thousand in 2019 , growing at a CAGR of 7 . 6 % during 2014 to 2019 . With a transformation of Chinese economy from an investment - driven model to a consumption - driven model, together with a sustained investment from domestic consumers, the per capita nominal GDP is expected to attain RMB 98 . 6 thousand in 2024 , representing a CAGR of 7 . 7 % . 58 .6 53.9 47.3 68.2 50.9 63.4 73.2 78.9 85.0 91.6 98.6 T hou s an d R M B T he P RC Source: International Monetary Fund (“IMF”), Frost & Sullivan 10

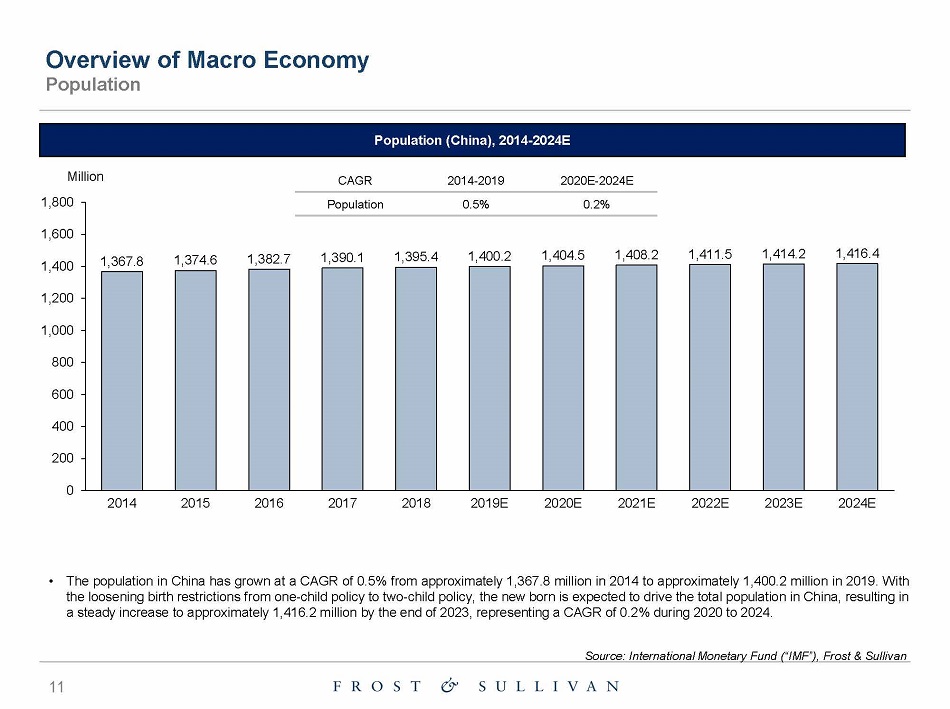

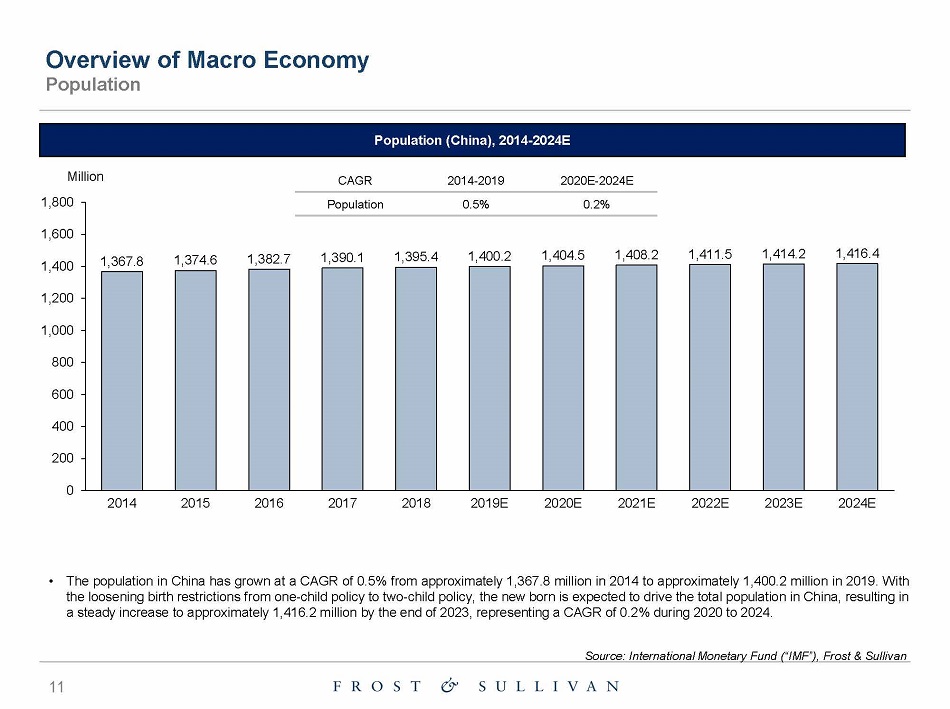

• The population in China has grown at a CAGR of 0 . 5 % from approximately 1 , 367 . 8 million in 2014 to approximately 1 , 400 . 2 million in 2019 . With the loosening birth restrictions from one - child policy to two - child policy, the new born is expected to drive the total population in China, resulting in a steady increase to approximately 1 , 416 . 2 million by the end of 2023 , representing a CAGR of 0 . 2 % during 2020 to 2024 . Population (China), 2014 - 2024E Overview of Macro Economy Population 1,367.8 Source: International Monetary Fund (“IMF”), Frost & Sullivan 11 1,374.6 1,382.7 1,390.1 1,395.4 1,400.2 1,404.5 1,408.2 1,411.5 1,414.2 1 , 416 .4 1 , 2 0 0 1 , 0 0 0 800 600 400 200 0 1 , 4 0 0 Million 1,800 1,600 2019E 2016 2014 2015 2017 2018 2020E 2021E 2022E 2023E 2024E CAGR 2014 - 2019 2020E - 2024E Population 0.5% 0.2%

Agenda 2 3 1 Overview of Macro Economy Overview of Consumer Loan Repayment and Collection Management Market in China Introduction 4 Overview of Loan Recommendation Market in China 5 Overview of Third - party Payment Services Market in China 6 Appendix 12

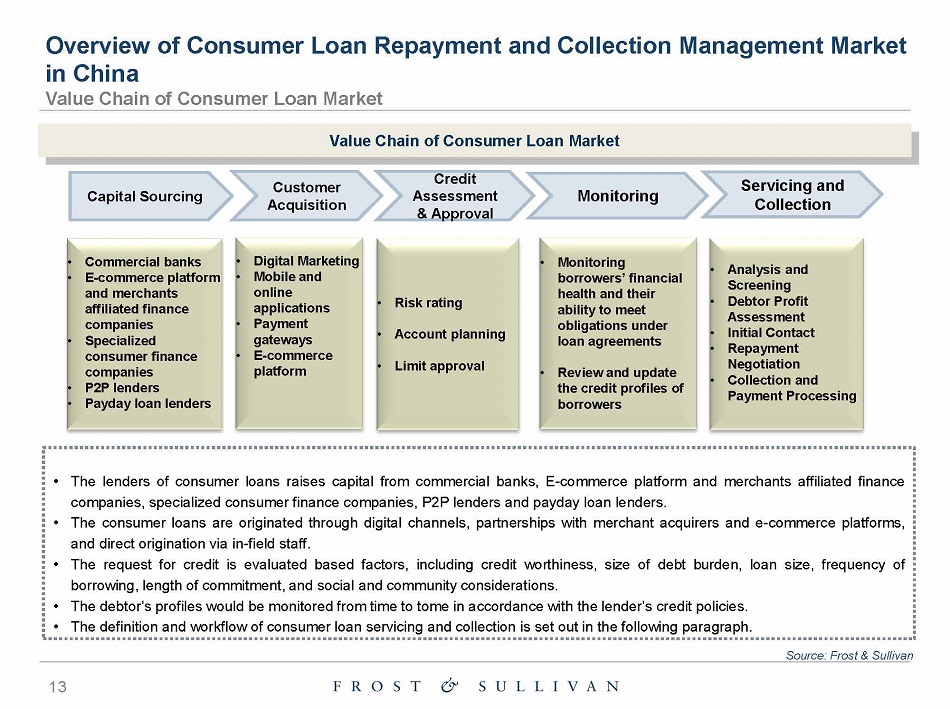

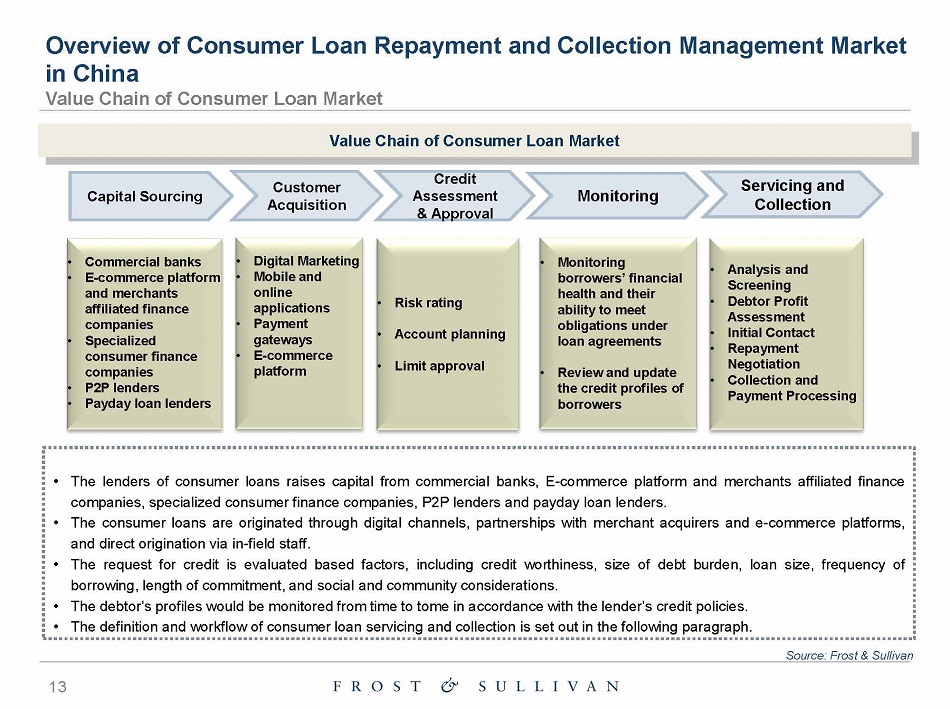

• The lenders of consumer loans raises capital from commercial banks, E - commerce platform and merchants affiliated finance companies, specialized consumer finance companies, P2P lenders and payday loan lenders. • The consumer loans are originated through digital channels, partnerships with merchant acquirers and e - commerce platforms, and direct origination via in - field staff. • The request for credit is evaluated based factors, including credit worthiness, size of debt burden, loan size, frequency of borrowing, length of commitment, and social and community considerations. • The debtor’s profiles would be monitored from time to tome in accordance with the lender’s credit policies. • The definition and workflow of consumer loan servicing and collection is set out in the following paragraph. Source: Frost & Sullivan Value Chain of Consumer Loan Market C a p ital S o u rcing Customer A c q uisition Monitoring • Commercial banks • E - commerce platform and merchants affiliated finance companies • Specialized consumer finance companies • P2P lenders • Payday loan lenders Overview of Consumer Loan Repayment and Collection Management Market in China Value Chain of Consumer Loan Market • Digital Marketing • Mobile and online appli c ations • Payment gate w a y s • E - commerce platform Credit A s s e s sme n t & Approval • Risk rating • Account planning • Limit approval Servicing and Collection • Monitoring bo rr o w e r s ’ finan cia l health and their ability to meet obligations under loan agreements • Review and update the credit profiles of borrowers • Analysis and Screening • Debtor Profit Assessment • Initial Contact • Repayment Neg o tiation • Collection and Payment Processing 13

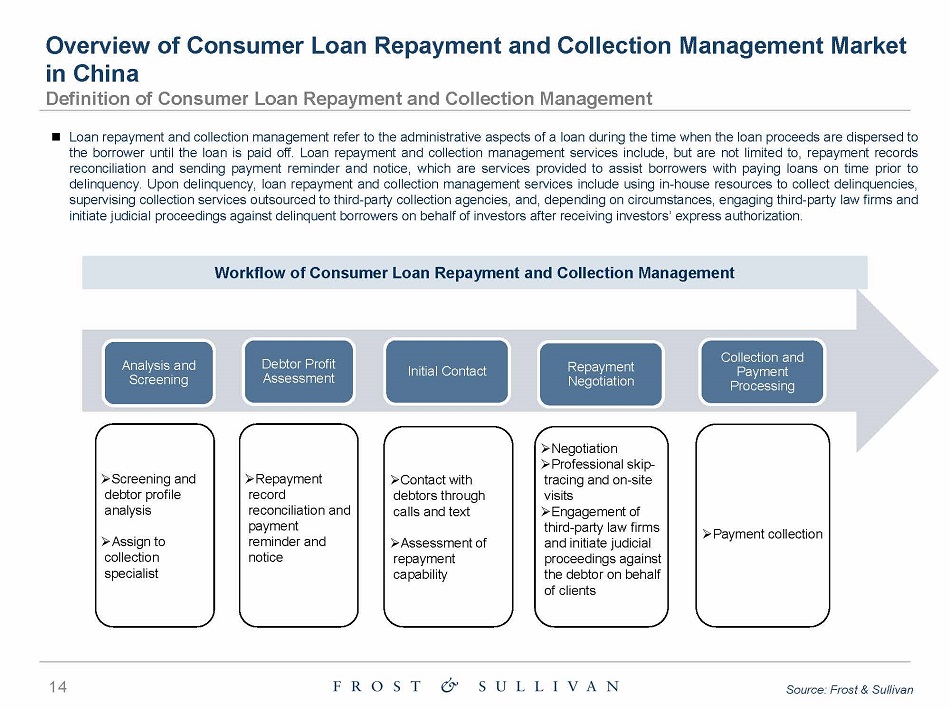

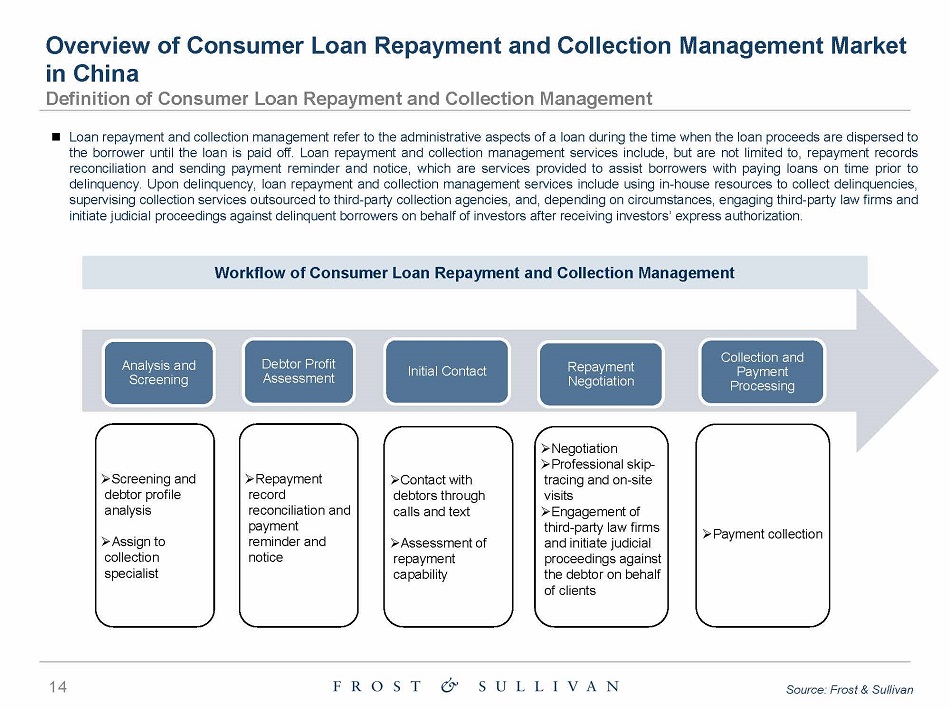

14 Overview of Consumer Loan Repayment and Collection Management Market in China Definition of Consumer Loan Repayment and Collection Management Loan repayment and collection management refer to the administrative aspects of a loan during the time when the loan proceeds are dispersed to the borrower until the loan is paid off . Loan repayment and collection management services include, but are not limited to, repayment records reconciliation and sending payment reminder and notice, which are services provided to assist borrowers with paying loans on time prior to delinquency . Upon delinquency, loan repayment and collection management services include using in - house resources to collect delinquencies, supervising collection services outsourced to third - party collection agencies, and, depending on circumstances, engaging third - party law firms and initiate judicial proceedings against delinquent borrowers on behalf of investors after receiving investors’ express authorization . Source: Frost & Sullivan Workflow of Consumer Loan Repayment and Collection Management Analysis and Screening Debtor Profit A ss es s m e n t Initial Contact Rep a y m e n t Neg o t i at i on » Screening and debtor profile analysis » A ss i gn to collection specialist » Repayment record reco n c ili at i on a n d payment reminder and notice » Contact with d e bt o rs throu g h calls and text » A ss es s m e n t of repayment capability » Negotiation » P ro f es s i o n al s k i p - tracing and on - site visits » Engagement of third - party law firms and initiate judicial pro c e e d i n g s a g a i nst the debtor on behalf of clients Co l l ect i on a n d Payment Processing » Payment collection

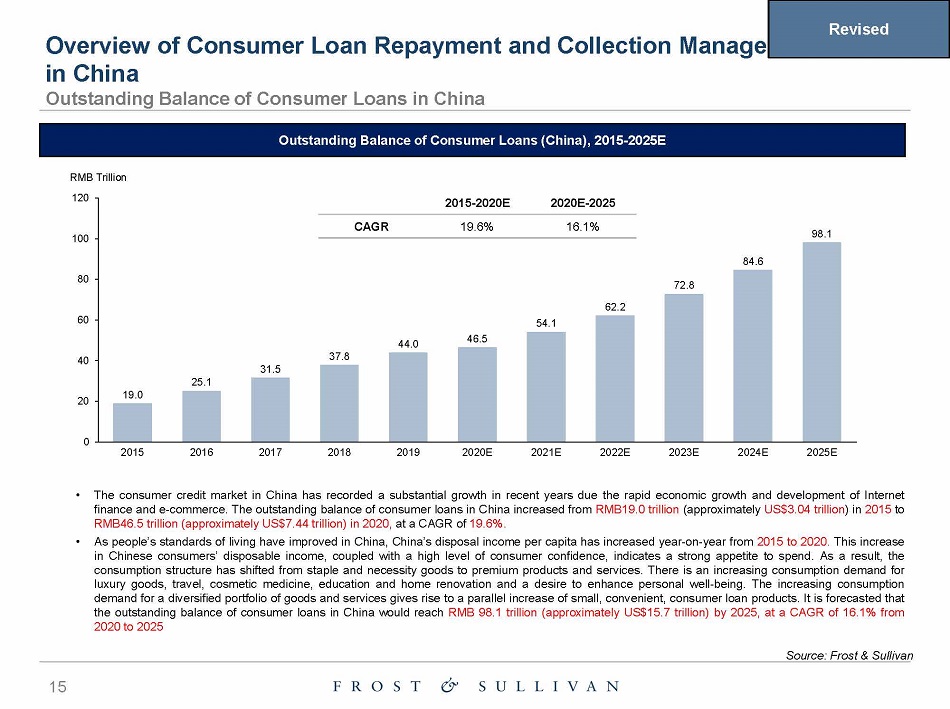

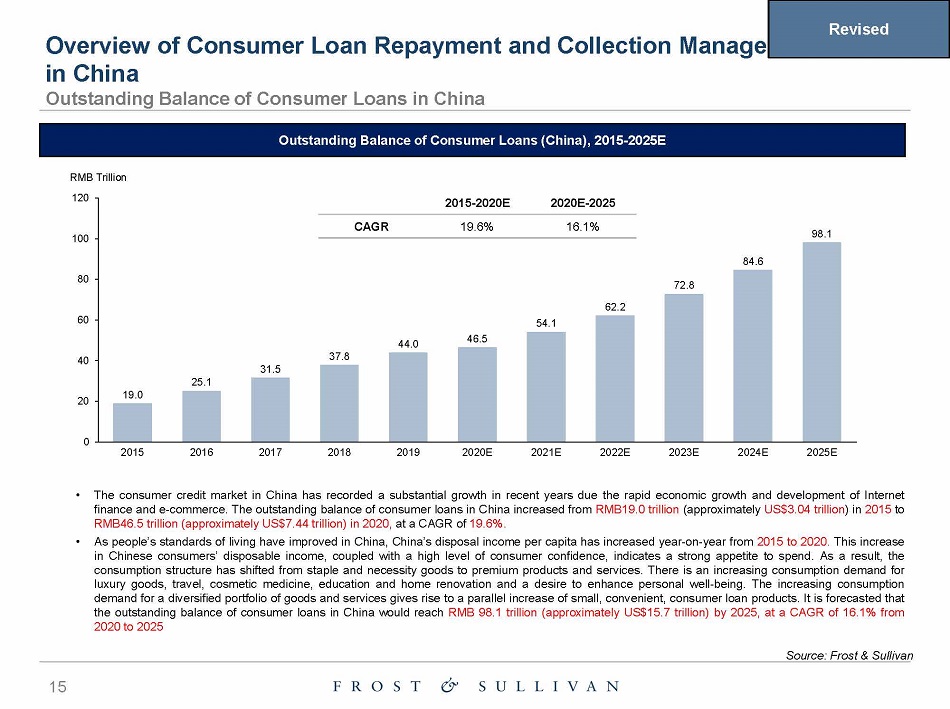

Outstanding Balance of Consumer Loans (China), 2015 - 2025E 19 .0 25 .1 31 .5 37 .8 44 .0 46 .5 54 .1 62 .2 72 .8 84 .6 98 .1 0 20 40 60 80 100 120 R M B T r illi o n 2018 2016 2015 2017 2020E 2019 2021E 2022E 2023E 2024E 2025E • The consumer credit market in China has recorded a substantial growth in recent years due the rapid economic growth and development of Internet finance and e - commerce . The outstanding balance of consumer loans in China increased from RMB 19 . 0 trillion (approximately US $ 3 . 04 trillion ) in 2015 to RMB 46 . 5 trillion (approximately US $ 7 . 44 trillion) in 2020 , at a CAGR of 19 . 6 % . • As people’s standards of living have improved in China, China’s disposal income per capita has increased year - on - year from 2015 to 2020 . This increase in Chinese consumers’ disposable income, coupled with a high level of consumer confidence, indicates a strong appetite to spend . As a result, the consumption structure has shifted from staple and necessity goods to premium products and services . There is an increasing consumption demand for luxury goods, travel, cosmetic medicine, education and home renovation and a desire to enhance personal well - being . The increasing consumption demand for a diversified portfolio of goods and services gives rise to a parallel increase of small, convenient, consumer loan products . It is forecasted that the outstanding balance of consumer loans in China would reach RMB 98 . 1 trillion (approximately US $ 15 . 7 trillion) by 2025 , at a CAGR of 16 . 1 % from 2020 to 2025 2015 - 2020E Source: Frost & Sullivan 15 2020E - 2025 C A GR 19.6% 16.1% ement Market Overview of Consumer Loan Repayment and Collection Manag in China Outstanding Balance of Consumer Loans in China Revised

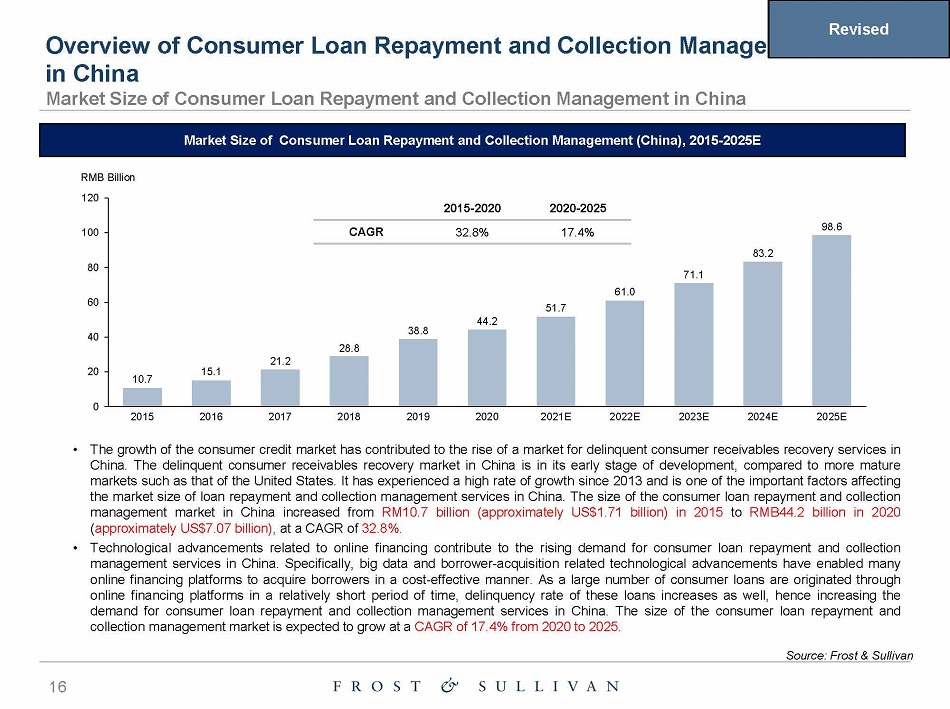

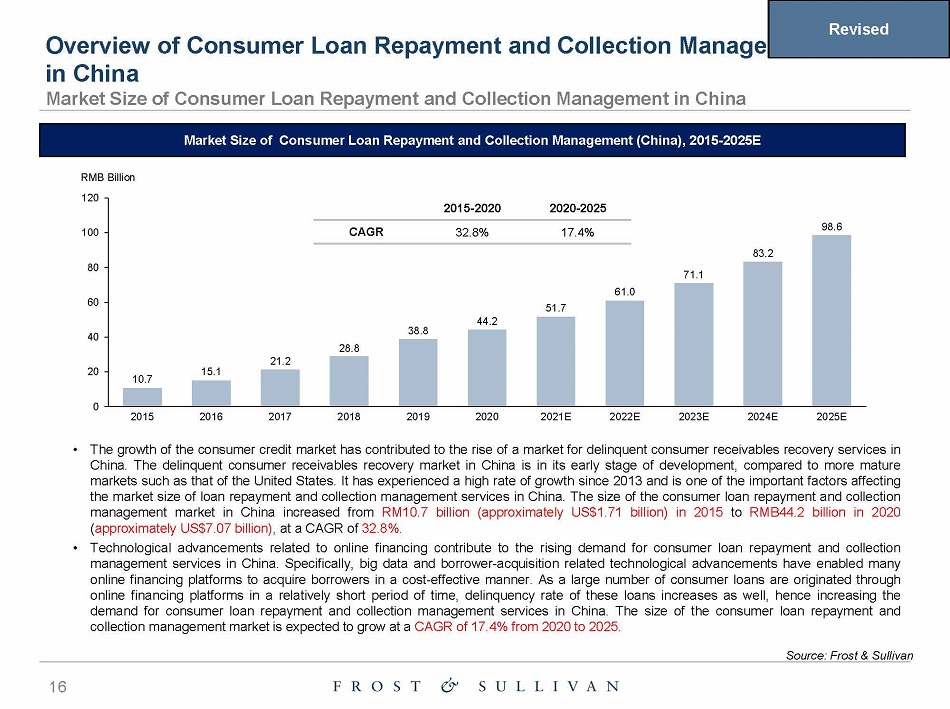

Market Size of Consumer Loan Repayment and Collection Management (China), 2015 - 2025E 10 .7 15 .1 28 .8 21.2 38 .8 44 .2 51 .7 61 .0 71 .1 83 .2 98 .6 20 40 60 80 100 R M B Billi o n 120 0 2015 2016 2017 2018 2019 2020 2021E 2022E 2023E 2024E 2025E • The growth of the consumer credit market has contributed to the rise of a market for delinquent consumer receivables recovery services in China . The delinquent consumer receivables recovery market in China is in its early stage of development, compared to more mature markets such as that of the United States . It has experienced a high rate of growth since 2013 and is one of the important factors affecting the market size of loan repayment and collection management services in China . The size of the consumer loan repayment and collection management market in China increased from RM 10 . 7 billion (approximately US $ 1 . 71 billion) in 2015 to RMB 44 . 2 billion in 2020 ( approximately US $ 7 . 07 billion), at a CAGR of 32 . 8 % . • Technological advancements related to online financing contribute to the rising demand for consumer loan repayment and collection management services in China . Specifically, big data and borrower - acquisition related technological advancements have enabled many online financing platforms to acquire borrowers in a cost - effective manner . As a large number of consumer loans are originated through online financing platforms in a relatively short period of time, delinquency rate of these loans increases as well, hence increasing the demand for consumer loan repayment and collection management services in China . The size of the consumer loan repayment and collection management market is expected to grow at a CAGR of 17 . 4 % from 2020 to 2025 . 2015 - 2020 Source: Frost & Sullivan 16 2020 - 2025 C A GR 32.8% 17.4% ement Market Overview of Consumer Loan Repayment and Collection Manag in China Market Size of Consumer Loan Repayment and Collection Management in China Revised

The Chinese government has supported the development of the consumer finance market by promulgating and implementing policies that promote domestic consumption . In 2016 , the Report on the Work of the Government, released by the State Council of the People's Republic of China, heightened the importance of developing consumer finance services to serve people with low to medium incomes and enable their spending potential to achieve economic growth . In December 2016 , the China Banking Regulatory Commission (“CBRC”) held a press conference, at which CBRC recognized the critical role of consumer - finance service providers in boosting consumption and improving people’s standard of living . Government policies in promot i ng c o n s umer fin a n c e Proliferation of online consumer loans With an ever - faster pace of data generation and comprehensive data gathering through e - commerce, social networks, and other use cases of mobile Internet, financial institutions have invested heavily in data collection, data analytics, and related technologies . Over the past few years, by leveraging their strengthened technology capabilities, financial institutions have facilitated various technological advancements in the consumer finance market, such as workflow automation and borrower/investor profiling based on big data . As a result of these technological advancements, a large number of consumer loans have been originated through online financing platforms in a relatively short period of time, which then resulted in an increased demand for consumer loan repayment and collection management services in China . Shifting of economy Source: Frost & Sullivan 17 towards a consumption - driven model The per capita annual disposable income of urban household increased from RMB 28 . 8 thousand (approximately US $ 4 . 06 thousand) in 2014 to RMB 39 . 3 thousand (approximately US $ 5 . 54 thousand) in 2018 , representing a CAGR of approximately 8 . 1 % . In light of the rising disposable income, China is shifting its economy towards a consumption - driven model, with the total value of consumption increasing from RMB 27 . 2 billion (approximately US $ 3 . 83 billion) in 2014 to RMB 41 . 2 billion (approximately US $ 5 . 81 billion) in 2019 , at a CAGR of 8 . 7 % . Along with growing consumption power, the consumption - driver model will continue to increase the demand for financial services in the personal consumption space in China, including the demand for consumer loan repayment and collection management services . Overview of Consumer Loan Repayment and Collection Management Market in China Market Drivers

CBIRC issued The Guideline On High - quality Development of Banking – Insurance Sectors in 2020 , which aims to diversify the financial structure of the banking and insurance system and broaden the coverage of the system . The guidance encourages the development of foreign banking and insurance institutions . As a result of the supportive government policy, the insurance financing market is expected to grow in the near future . Specifically, insurance financing service providers will be able to issue more consumer loans, which as a result may lead to an increase in the demand for affiliated loan repayment and collection management services in China . Development of in s ura n ce s e ctor Higher growth rate of c o n s umpt i on lo a ns The total volume of consumer loans over the past few years has achieved a high growth rate and is expected to continue to grow rapidly in the foreseeable future . The outstanding balance of consumer loan in China increased from RMB 15 . 4 trillion (approximately US $ 2 . 17 billion) in 2014 to RMB 47 . 2 trillion (approximately US $ 6 . 65 billion) in 2019 , at a CAGR of 25 . 1 % , It is expected to increase at a CAGR of 18 . 3 % from 2019 to 2024 . The steady growth of consumer loans is primarily driven by the rising consumption demand of consumers with diverse financial backgrounds, which brings challenges for consumer finance service providers, including commercial banks, E - commerce platform and merchants affiliated finance companies, specialized consumer finance companies, P 2 P lenders, and payday loan lenders, to accurately evaluate these consumers’ credit profiles in a cost - efficient way . As more loan requests of borrowers with different loan repayment abilities are being approved, more difficulties and uncertainties associated with loan repayment and collection arise, which in return increases the demand for consumer loan repayment and collection management services . Overview of Consumer Loan Repayment and Collection Management Market in China Market Opportunities and Challenges Increased risk resulting Source: Frost & Sullivan 18 from ever - changing business environment As the financial service providers serves various industry sectors, the loan servicing and collection companies face a variety of risks, including operational risk, legal and compliance risks . An effective risk management system is highly required for identifying, managing and mitigating the aforementioned risks . Faced with the ever - changing business environment and uncertainty over the economies, resources and time are required to develop a risk management tailored to the characteristics of each business lines, with a focus on managing the risks through comprehensive loan collection process and independent information review

Overview of Consumer Loan Repayment and Collection Management Market in China Competition Overview The consumer loan repayment and collection management market is highly competitive and fragmented, with competition focusing on industry reputation and expertise in the collection of consumer receivables, technology and IT infrastructure, relationships with clients, quality of collection specialists’ services, and compliance with applicable laws . As estimated, there are approximately 9 , 000 market players in the consumer loan repayment and collection management market in China and the number of market players in Shanghai is approximately 500 . Key entry barriers of consumer loan repayment and collection management market in China include the following : Entry Barrier • Key entry barriers of consumer loan repayment and collection management market in China include the following: 1. Compliance of the repayment and collection management process – Commercial banks and online consumer finance companies have adopted stringent requirements for consumer loan repayment and collection management service providers regarding their technology, facility, compliance, and business scale. These requirements are implemented to ensure the regulatory compliance of the loan repayment and collection management process, since any violation of industry - standard practices and regulations could taint commercial banks and online consumer finance companies’ reputation and increase their regulatory risks. 2. Industry expertise and market know - how – Consumer loan repayment and collection management companies are required to have a solid market know - how to understand industry trends and provide value - added services for clients. In particular, the existing market players typically are equipped with experienced in - house teams to collect past - due loans through means of reminder, negotiation, collaboration with third - party collection agencies, and engagement of third - party law firms. 3. Long established relationships with banks and other financial institutions – Long - established business relationships with banks and other financial institutions constitutes a critical competitive advantage that distinguishes some consumer loan repayment and collection management service providers from their competitors in China. These business relationships enable these service providers to source more deals related to consumer receivables while exploring specific market trends and client needs. Specifically, the long - established business relationships allow consumer loan repayment and collection management service providers to save time and cost in deal negotiation and facilitate more effective communication with business partners during day - to - day operation. Source: Frost & Sullivan 19

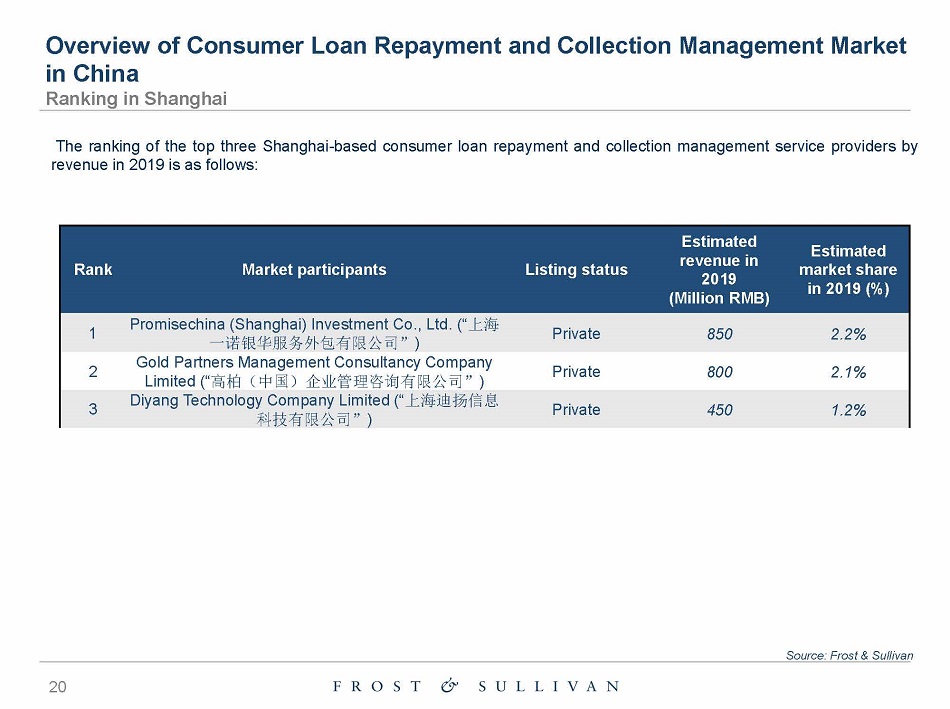

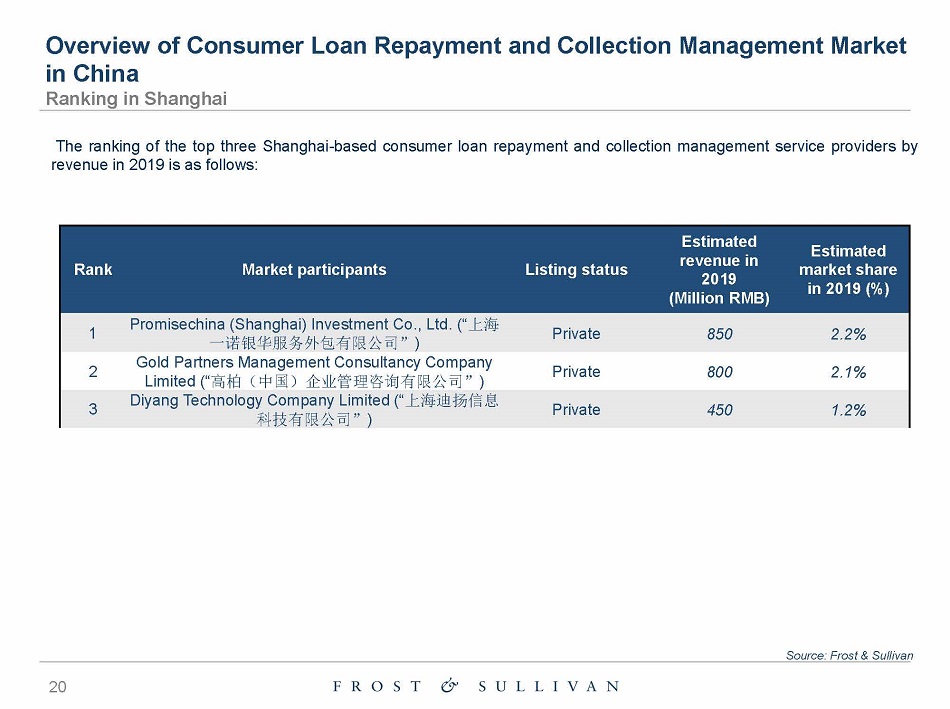

Overview of Consumer Loan Repayment and Collection Management Market in China Ranking in Shanghai Source: Frost & Sullivan 20 The ranking of the top three Shanghai - based consumer loan repayment and collection management service providers by revenue in 2019 is as follows: Rank Market participants Listing status Estimated re v enue in 2019 (Million RMB) Estimated market share in 2019 (%) 1 Promisechina (Shanghai) Investment Co., Ltd. (“ к⎧ а䈪䬦ॾᴽ࣑ཆवᴹ䲀ޜਨ ” ) Private 850 2.2% 2 Gold Partners Management Consultancy Company Limited (“ 儈᷿ ˄ ѝഭ ˅ Աъ㇑⨶䈒ᴹ䲀ޜਨ ” ) Private 800 2.1% 3 Diyang Technology Company Limited (“ к⎧䘚ᢜؑ 、ᢰᴹ䲀ޜਨ ” ) Private 450 1.2%

Overview of Consumer Loan Repayment and Collection Management Market in China Major Competitors in China Source: Frost & Sullivan 21 Key market participants in the consumer loan repayment and collection management market in China include China Data Group (Suzhou) Limited, M&Y Global Services, Promisechina (Shanghai) Investment Co . , Ltd and Gold Partners Management Consultancy Company Limited . • China Data Group (Suzhou) Limited . (“ ॾ 䚃ᮠᦞ༴ ⨶ ( 㣿ᐎ ) ᴹ䲀ޜਨ ” ) is a private company based in Suzhou, specializing in loan repayment and collection management, digital marketing, and data management . • M&Y Global Services (“ ेӜॾᤃ䠁㶽ᴽ࣑ཆवᴹ䲀ޜਨ ” ) is a private company based in Beijing and principally engaged in loan repayment and collection management services, user experience management, and digital marketing . • Promisechina (Shanghai) Investment Co . , Ltd . (“ к⎧а 䈪 䬦ॾ ᴽ ࣑ཆवᴹ䲀ޜ ਨ ” ) is a private company based in Shanghai, with focus on loan repayment and collection management services and related financial consultancy services . • Gold Partners Management Consultancy Company Limited (“ 儈᷿ ˄ ѝഭ ˅ Ա ъ ㇑ ⨶ 䈒ᴹ䲀ޜ ਨ ” ) is a private company based in Shanghai, specializing in loan repayment and collection management services, IPO consultancy, and wealth management .

Agenda 2 3 1 Overview of Macro Economy Overview of Consumer Loan Repayment and Collection Management Market in China Introduction 4 Overview of Loan Recommendation Market in China 5 Overview of Third - party Payment Services Market in China 6 Appendix 22

To satisfy borrowers’ financing needs, service providers acting as intermediary agents refer qualified prospective borrowers to institutional funding partners, who in return may directly fund such borrowers . In addition to referral, loan recommendation agents provide other loan - related services, such as loan product consultation, loan application and relevant materials preparation and procession, credit assessment, and real estate appraisal . After loan recommendation agents referred qualified prospective borrowers to institutional funding partners, these funding partners independently conduct their own due diligence to review and assess the credential of the referred prospective borrowers before making a final decision . Throughout the transaction process, institutional funding partners assume full credit risks for issuing loans to borrowers . Loan recommendation agents do not bear any credit risk or provide any guarantee for loans directly issued by the funding partners . Workflow of Loan Recommendation S c re e n i ng » Preliminary credit assessment of the borrower’s background and financing needs » The credit assessment team will either decline or allow the applicant to apply based on available information A p pli c at i on » Preparation of basic in for m a t i on , in c luding but not limited to identification documents and other requested personal information, such as PRC ID card details, a mobile phone number, educational level, information related to employment status, and bank account details Cre di t A ss es s m e n t a n d Risk Management » Comprehensive review process, including information collection, verification, and analysis through various sources, as well as a multidimensional real estate appraisal. » Evaluation of the applicant’s credit history, liquidity, and other criteria to develop a borrower profile that is measured against the internal review guidelines and measures. Referral » Referral of qualified borrowers directly to the institutional funding partners who would make the final credit decisions and directly fund borrowers 23 Source: Frost & Sullivan Overview of Loan Recommendation Market in China Definition of Loan Recommendation

As part of the Company’s strategy to diversify and expand product and service offerings, the Company started providing loan recommendation services in June 2019 . Leveraging its advanced credit assessment and risk management capabilities, the Company carefully evaluate applications and supporting materials submitted by individual borrowers and refer those borrowers it deem qualified to institutional funding partners, who in return directly provide funds to borrowers referred by the Company . For details on the transaction process of the Company’s loan recommendation business, see “Business — Loan Recommendation — Our Business Model and Referral Process . ” In the future, the Company plans to collaborate with seasoned asset management corporations (AMCs) specializing in distressed debt acquisition and management . With AMCs’ commitment to purchasing institutional funding partners’ rights in defaulted loans, the Company believes its collaboration with AMCs will effectively mitigate the impact of a default and expand the scale of loan origination, which in return can better serve borrowers’ financing needs and increase the borrower base for the Company’s loan recommendation business . The Company has the following competitive strengths in the loan recommendation market: » By leveraging its partnerships with referral partners, the Company plays an important role in multiple stages of the mortgage loan facilitation process, including borrower acquisition and credit assessment and risk management . In the future, by collaborating with AMCs, the Company intends to participate in the disposal of the real estate asset underlying the defaulted loan . The Company is also planning on extending its service offering by providing institutional funding partners loan repayment and collection services . The capability to build a comprehensive suite of services and solutions addressing borrowers’ and institutional funding partners’ financial needs across all stages of a loan lifecycle serves as unique asset contributing to the Company’s growth in the loan recommendation market . » Credit assessment and risk management is a major competitive advantage of the Company . The Company has devised and implemented a systematic credit assessment model and an asset - driven, disciplined risk management approach to minimize a borrower’s default risk and mitigate the impact of default . The core value of the Company’s risk management approach lies in its real estate appraisal . The Company requires a current real estate appraisal on all the properties borrowers intend to collateralize . The valuation process is led by in - house appraisers who factor different risks associated with the properties into the appraisal process . Such process enables borrowers to obtain the loan amount that accurately corresponds to the value of their properties and properly reflects the local market liquidity . It also protects institutional funding partners against lending more than they might be able to recover in the case of default . For details, see “Business — Loan Recommendation — Credit Assessment and Risk Management . ” 24 Source: Frost & Sullivan Overview of Loan Recommendation Market in China Business Model of the Group

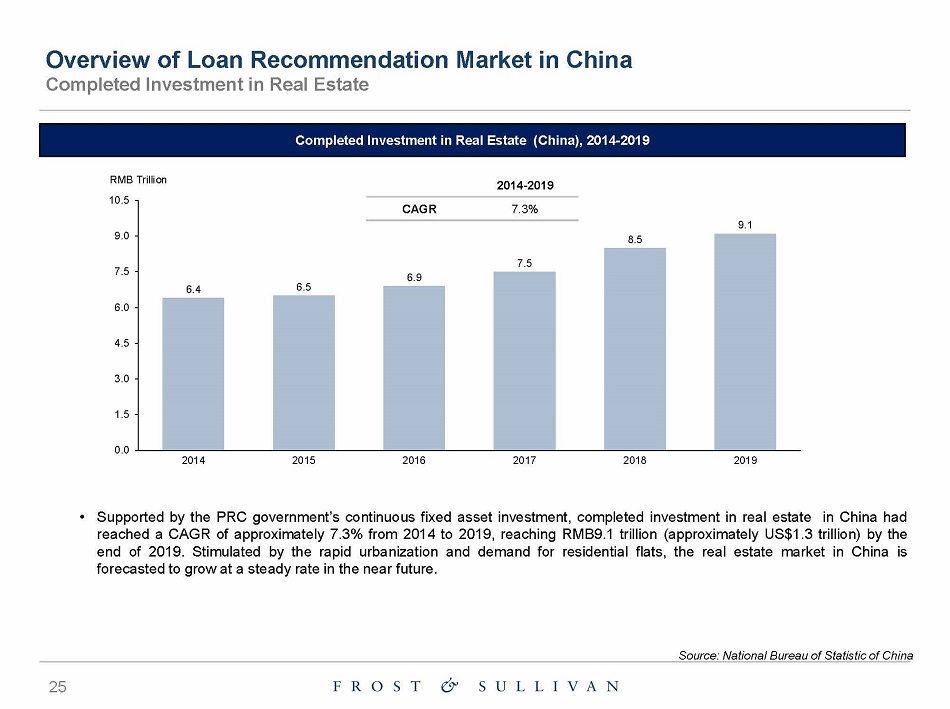

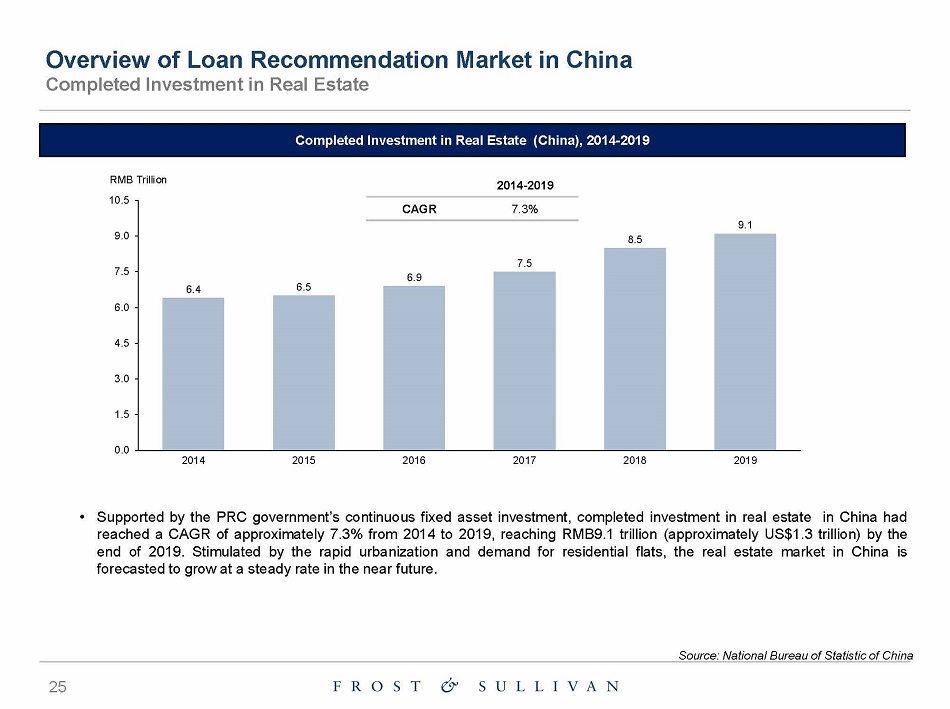

Source: National Bureau of Statistic of China Completed Investment in Real Estate (China), 2014 - 2019 6 .4 6 .5 6 .9 7 .5 8 .5 9 .1 6 .0 4 .5 3 .0 1 .5 0 .0 7 .5 9 .0 10 .5 2015 R M B T r illi o n 2019 2018 2016 2014 2017 • Supported by the PRC government’s continuous fixed asset investment, completed investment in real estate in China had reached a CAGR of approximately 7 . 3 % from 2014 to 2019 , reaching RMB 9 . 1 trillion (approximately US $ 1 . 3 trillion) by the end of 2019 . Stimulated by the rapid urbanization and demand for residential flats, the real estate market in China is forecasted to grow at a steady rate in the near future . 2014 - 2019 25 C A GR 7 .3 % Overview of Loan Recommendation Market in China Completed Investment in Real Estate

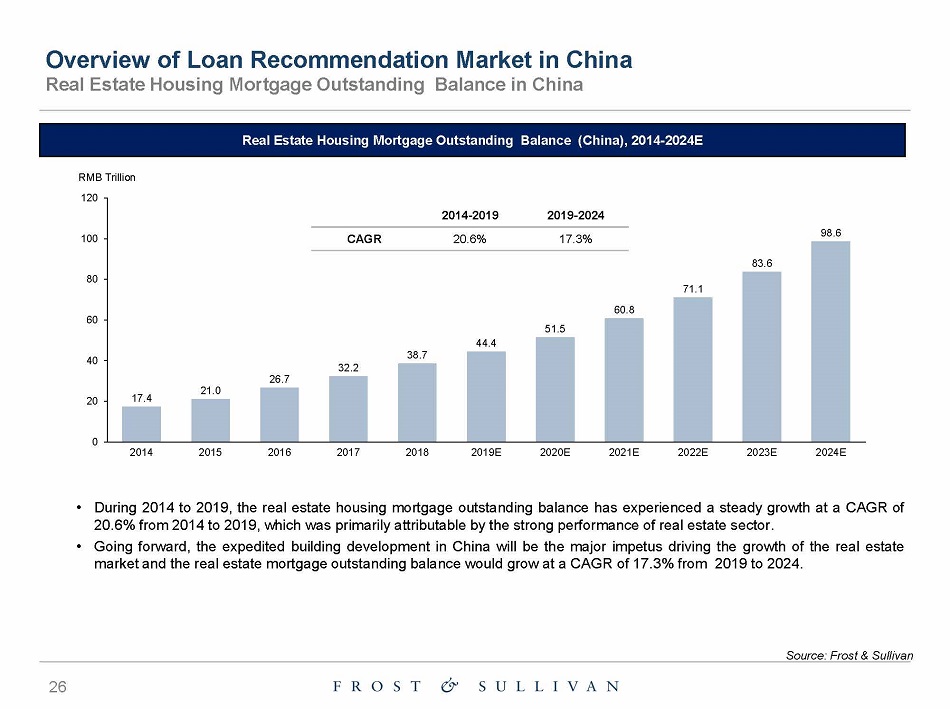

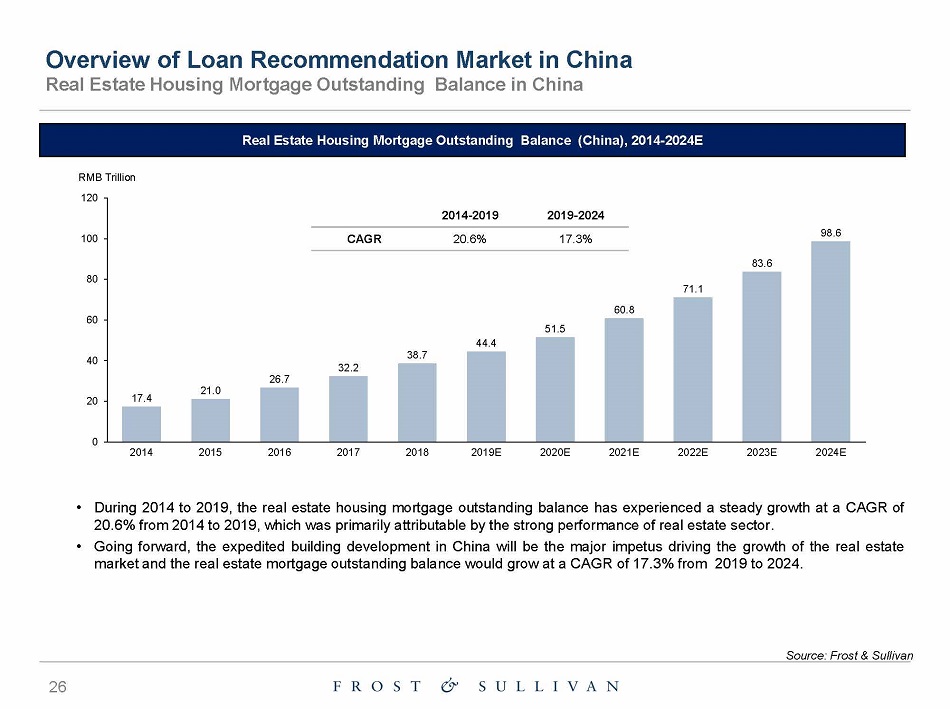

Real Estate Housing Mortgage Outstanding Balance (China), 2014 - 2024E 17 .4 21 .0 26 .7 32 .2 38 .7 44 .4 51 .5 71.1 60.8 83 .6 98 .6 0 20 40 60 80 100 R M B T r illi o n 120 2018 2016 2014 2020E 2015 2017 2019E 2024E 2021E 2022E 2023E • During 2014 to 2019, the real estate housing mortgage outstanding balance has experienced a steady growth at a CAGR of 20.6% from 2014 to 2019, which was primarily attributable by the strong performance of real estate sector. • Going forward, the expedited building development in China will be the major impetus driving the growth of the real estate market and the real estate mortgage outstanding balance would grow at a CAGR of 17.3% from 2019 to 2024. 201 4 - 2019 Source: Frost & Sullivan 26 2019 - 2024 C A GR 20.6% 17.3% Overview of Loan Recommendation Market in China Real Estate Housing Mortgage Outstanding Balance in China

The real estate market in China has been supported by various governmental policies over the past years . The “ 13 th Five - Year Plan for Development of Construction Industry” ( lj ᔪ ㇹ ᾝ Ⲭ ኅ “ ॱ й ӄ ” 㾿ࢳ NJ ) layouts the targeted growth rate of the construction industry in China, which is approximately 7 % from 2016 to 2020 . The Plan for the Development of Regional Integration in the Yangtze River Delta ( 䮧 й䀂 а億ॆ Ⲭ ኅ ), adopted by the State Council of the People's Republic of China in 2019 , promotes the integration of cities in the region, particularly in the area of construction and related business activities . As a result, such policies would contribute to the growth of the regional real estate market and increase the demand for real - estate related financial services, such as loan recommendation services for mortgages . Supportive governmental p o licies Steady Growth of the real Source: Frost & Sullivan 27 e s tate market The growing amount of real estate investment has been a major factor underpinning the rapid development of the real estate market in China . According to the National Bureau of Statistic of China, completed real - estate investment transactions in China reached a CAGR of approximately 7 . 4 % from 2014 to 2018 and achieved RMB 8 . 5 trillion by the end of 2018 and it is forecasted to grow at a CAGR of 5 . 8 % from 2019 to 2024 . In addition to contributing to the development of the real estate market in China, the growing amount of real estate investment will further increase the demand for real - estate related financial services, such as loan recommendation services for mortgages . Overview of Loan Recommendation Market in China Market Drivers

28 Source: Frost & Sullivan The social credit system is a national credit system developed by the Chinese government . Its trial period started in 2009 . In 2014 , the credit system was first used by eight credit scoring firms in China . In 2018 , the People's Bank of China became the agency in charge of managing the credit system . The credit system is designed and implemented to standardize the assessment process of citizens’ and businesses’ economic and social credits . Credit data in the Social Credit System will be accessible to the eight credit scoring firms, which, in return, may provide the public with the data . This mechanism constitutes an efficient, convenient, and accurate method to verify citizens’ and businesses’ data in China . Loan recommendation service providers may conduct preliminary screening on borrowers by accessing data in the Social Credit System through the credit scoring firms . Access to such system strengthens loan recommendation service providers’ credit assessment and risk management capabilities, reduces their operational cost, and improves their operational efficiency . Enhanced credit assessment and risk manag e me nt capabilities Limited sources of f u nding The borrowers are referred to the institutional funding partners for the application of mortgage loans . In order to secure sufficient financing to meet the fast - growing demand from an increasing number of mortgage, it is not uncommon for borrower referral services providers to partner with financial institutions, such as trust companies or fund management companies, to obtain funding from such financial institutions . Increased competition may limit the sources of funding and the growth of borrower referral in China . Overview of Loan Recommendation Market in China Market Opportunities and Challenges

Overview of Loan Recommendation Market in China Competition Overview Entry Barrier • Key entry barriers of loan recommendation market in China include the following: 1. Risk management and credit evaluation system - Companies entering the loan recommendation market must possess strong credit assessment and risk management capabilities and establish a systematic and effective risk management and credit evaluation system to screen prospective borrowers . Loan recommendation service providers with sound credit assessment and risk management capabilities are more likely to achieve higher referral success rates as compared to those who do not possess the capabilities on the same level . 2. Brand reputation - Loan recommendation service providers usually rely on existing clients’ word of mouth to acquire potential clients and establish market presence . As a result of word of mouth, potential clients are more inclined to choose renowned institutions who have already established successful track record in the loan recommendation market . Such feature poses challenges for new market entrants to grow their businesses and build industry credibility . Source: Frost & Sullivan 29 The loan recommendation market in China is highly competitive . It contains a large number of market players . Companies compete on credit assessment and risk management capabilities, reputation, and source of funding partners . As estimated, there are approximately 15 , 000 market players in the mortgage sector of the loan recommendation market in China and the number of market players is estimated to be around 1 , 000 in Shanghai . Key entry barriers of the loan recommendation market in China include the following :

Overview of Loan Recommendation Market in China Major competitor in China Source: Frost & Sullivan 30 Key market participants in the loan recommendation market in China include Guangzhou Yida Mortgage Service Co., Ltd., Hangzhou Kunpeng Real Estate Marketing Planning Co., Ltd., and Ankang Wangjia Real Estate Broker Co., Ltd. Guangzhou Yida Mortgage Service Co . , Ltd . (“ ᒯᐎӯ䗮᤹ᴽ࣑ ᴹ 䲀ޜਨ ” ) is a private company based in Guangdong Province and provides loan recommendation services, mortgage consultation services, and property agency services . Hangzhou Kunpeng Real Estate Marketing Planning Co . , Ltd . (“ ᶝᐎ勢 呿 ᡯൠӗ 㩕 䬰ㆆࡂᴹ䲀ޜ ਨ ” ) is a private company based in Zhejiang Province and specializes in providing loan recommendation services, investment management services, and property agency services . Ankang Wangjia Real Estate Broker Co . , Ltd . (“ ᆹᓧᐲᰪᇦᡯൠӗ 㓿 㓚ᴹ䲀ޜਨ ” ) is a private company based in Shaanxi Province and is principally engaged in providing loan recommendation services, as well as property leasing and property agency services .

Overview of Loan Recommendation Market in China Major competitor in Shanghai Source: Frost & Sullivan 31 Key market participants in the loan recommendation market in Shanghai include Shanghai Qingpu Real Estate Investment Property Co . , Ltd, Shanghai Hongkou Real Estate Service Co . , Ltd . and Shanghai Yangpu Public Housing Asset Management Co . , Ltd . Shanghai Qingpu Real Estate Investment Property Co . , Ltd . (“ к⎧䶂⎖४ᡯൠӗᣅ䍴㖞ъᴹ䲀䍓ԫޜਨ ” ) is a private company based in Shanghai and provides loan recommendation services, property development, financing and loan guarantee services . Shanghai Hongkou Real Estate Service Co . , Ltd . (“ к ⎧㲩 ਓ㖞 ъᴽ࣑ ᴹ 䲀 ޜ ਨ ” ) is a private company based in Shanghai and specializes in providing loan recommendation services and property agency services . Shanghai Yangpu Public Housing Asset Management Co . , Ltd . (“ к⎧ᶘ⎖ޜᡯ䍴ӗ㓿㩕ᴹ䲀ޜਨ ” ) is a private company based in Shanghai and is principally engaged in providing loan recommendation services, property development and loan guarantee services .

Agenda 2 3 1 Overview of Macro Economy Overview of Consumer Loan Repayment and Collection Management Market in China Introduction 4 Overview of Loan Recommendation Market in China 5 Overview of Third - party Payment Services Market in China 6 Appendix 32

Overview of Third - party Payment Services Market in China Introduction Third - party payment service providers act as an intermediary for payment processing and settlement between consumers and merchants . In general, third - party payment services are provided by a non - bank corporation . Third - party payment services are classified as four main types : (i) Point - of - sales (POS) ; (ii) Internet payment ; (iii) Mobile - related payment (including mobile POS and mobile payment) ; and (iv) cross - border payment services . Prepaid payment network services fall under the categories of POS and Internet payment . Third - Party Payment Services POS Internet, mobile and cross - border payment services Source: Frost & Sullivan 33

Overview of Third - party Payment Services Market in China Prepaid card third - party payment services Source: Frost & Sullivan 34 Introduction of Prepaid Payment Network Services Prepaid card issuance and related payment processing is a subcategory of third - party payment services regulated by relevant governmental authorities in China . In order to provide services related to prepaid card issuance and payment processing, a service provider must obtain two separate licenses, namely, prepaid card issuance license and prepaid card payment acceptance license . Alternatively, a service provider must obtain a third - party payment license that allows prepaid card related payment activities . Prepaid cards can be widely used in various commercial settings . They may serve as shopping vouchers and rechargeable consumption cards . Generally, there are two types of prepaid cards, namely, single - purpose prepaid cards (i . e . prepaid cards that can be only used to consume goods and services provided by the card issuer or companies related to the card issuer) and multipurpose prepaid cards (i . e . prepaid cards that can be used to consume goods and services provided by a diverse group of companies across regions and industries) . Issuing single - purpose prepaid cards and processing related payment transactions does not require a service provider to obtain any third - party payment license . In comparison, issuing multipurpose prepaid cards and processing related payment transactions require a service provider to obtain relevant third - party payment licenses .

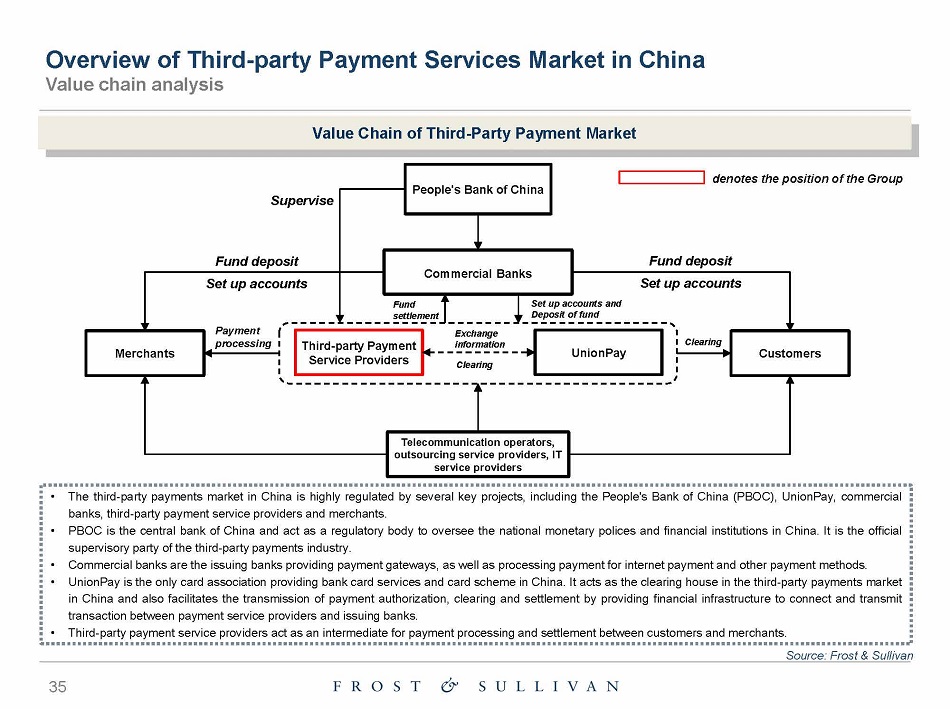

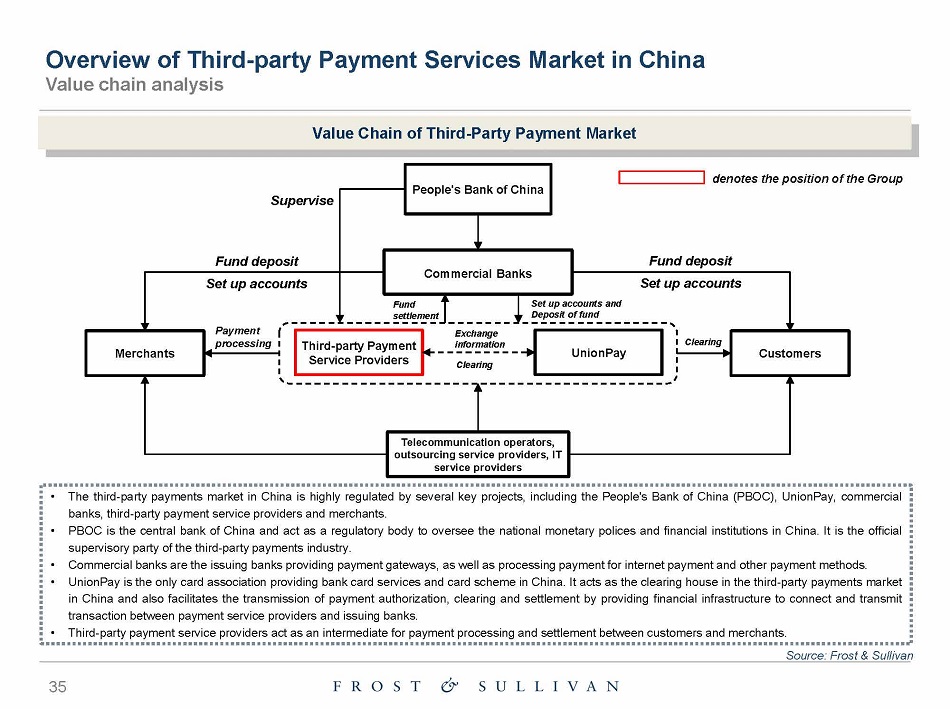

Overview of Third - party Payment Services Market in China Value chain analysis • The third - party payments market in China is highly regulated by several key projects, including the People's Bank of China (PBOC), UnionPay, commercial banks, third - party payment service providers and merchants . • PBOC is the central bank of China and act as a regulatory body to oversee the national monetary polices and financial institutions in China . It is the official supervisory party of the third - party payments industry . • Commercial banks are the issuing banks providing payment gateways, as well as processing payment for internet payment and other payment methods . • UnionPay is the only card association providing bank card services and card scheme in China . It acts as the clearing house in the third - party payments market in China and also facilitates the transmission of payment authorization, clearing and settlement by providing financial infrastructure to connect and transmit transaction between payment service providers and issuing banks . • Third - party payment service providers act as an intermediate for payment processing and settlement between customers and merchants . Value Chain of Third - Party Payment Market denotes the position of the Group People's Bank of China Commercial Banks Merchants Customers Third - party Payment Service Providers UnionPay Telecommunication operators, outsourcing service providers, IT service providers S upe r vi s e Fund deposit Set up accounts Fund deposit Set up accounts Fund sett l e m e n t Set up accounts and Deposit of fund Payment proc e ss ing Exchange i n f o rm at i o n Source: Frost & Sullivan 35 Cl ea ri n g Cl ea ri n g

38 .9 97 .6 190 .5 220 .8 187 .7 208 .7 234 .0 264 .6 300 .1 327 .1 19 .0 35 .6 41 .2 46 .9 52.5 58 .1 63 .7 69 .4 14 .2 29.6 36 .1 43 .0 37 .4 41 .2 45.8 51 .0 56 .4 61 .4 0 1 0 0 2 0 0 3 0 0 4 0 0 5 0 0 373 .7 2023E 2024E 37 .2 332 .3 152 .9 255 .7 299 .4 266 .3 296 .8 420 .2 457 .9 80.0 22 .1 Un it 2025E Revised Market Size of Third - party Payment Market by Segment (China), 2015 - 2025E 2015 2016 POS Services 2017 2018 Inte rne t Pa y m en t 2019 2020 2021E 2022E Mobile POS and Mobile Payments Source: Frost & Sullivan 36 CAGR 2015 - 2020 POS Services 21.4% Internet P a y m en t 28.4% Mobile POS an d Mobile Payment 75.7% Total 48.2% • The size of the third - party payment services market in China has rapidly grown over the years, which is mainly attributable to the general economic growth and the booming of e - commerce market in China . In particular, the mobile POS and mobile payment segment has experienced the greatest growth among the other two third - party payment services market segments . POS services and Internet payment had increased with CAGRs of 21 . 4 % and 28 . 4 % , respectively, during the same period . • Due to the outbreak of COVID - 19 , China’s economy is expected to slow down in 2020 . The closure of a large amount of retail stores will adversely impact the demand for POS services and mobile - related payment services . Meanwhile, the demand for Internet payment services will remain strong as the e - commerce market in China is not expected to be much affected by the outbreak of COVID - 19 . From 2020 onward, the third - party payment services market is expected to rebound and restore its steady growth . The market size is expected to reach RMB 457 . 9 trillion by 2025 , with a CAGR of 11 . 4 % from 2020 to 2025 . Overview of Third - party Payment Services Market in China Market Size of Third - party Payment Market by Segment

Overview of Third - party Payment Services Market in China Market drivers The rapid development of e - commerce in China has completely changed consuming behaviors in China, as well as consumers’ payment preferences . According to the Ministry of Commerce of the PRC, the total e - commerce transaction volume in 2018 reached RMB 31 . 6 trillion, representing a CAGR of 17 . 8 % from 2014 to 2018 . As a result, the demand for mobile and digital payment solutions has been rising, which has expanded the third - party payment services market in China . In addition, Chinese citizens’ improved standard of living has contributed to the growth of the retail industry in China, which subsequently creates more demands for third - party payment services . Changing consumers’ consumption patterns Increase in awareness and convenience of pre p aid c a rds The ease of access to prepaid cards and the booming e - commerce industry, has been one of the critical factors driving the growth of third - party payment services market in China . Prepaid cards are widely used across various industry verticals such as corporate institutions, retailers, governments and financial institutions primarily driven by the surge in the number of internet users, increase in awareness and convenience of prepaid cards . Prepaid cards have become an integral part of the third - party payment services market in China and can be used to pay for almost everything . Growth in unbanked and underbanked population and emergence of new applications are expected to translate into growth opportunities for prepaid cards and third - party payment services market in the future . Demand underpinned by Source: Frost & Sullivan 37 the rising number of micro and small mercha n ts The rising number of micro and small merchants in China translates into growth opportunities for the third - party payment services market . Due to these merchants’ small business sizes and limited resources, third - party payment solutions that are convenient, efficient and affordable meet merchants’ increasing payment processing needs . In addition, as mobile payments become universally acceptable among consumers in China, there are more micro and small merchants who need payment solutions that enable them to accept both bank cards and other digital payment methods in a cost - effective way .

Overview of Third - party Payment Services Market in China Competition Overview Entry Barrier • Key entry barriers of third - party payment services market in China include the following: 1. Licensed market – In order to regulate access to the third - party payment services market and tighten regulations over the market, PBOC has only issued 271 Payment Business Permits since 2011 . With 31 retracted licenses, the total number of licensed third - party payment service providers amounts to 240 in China in 2019 . New market entrants must meet the stringent financial and compliance requirements determined by PBOC and other relevant regulatory bodies in order to acquire a Payment Business Permit, whose market price is approximately RMB 25 million (approximately US $ 3 . 54 million) . 2. Established business relationship – Existing market players, particularly the leading players, have already established stable relationships with different stakeholders in the third - party payment services market, including, but not limited to channels partners, including commercial banks and SaaS providers, NetsUnion, UnionPay, and relevant regulatory authorities . To reduce their operational risks and cost, merchants as potential clients are more inclined to use services provided by payment solution service providers who have established stable business relationships with various stakeholders . Therefore, if new market entrants cannot establish and maintain such connections with these stakeholders in a cost - effective manner, they may not be able to grow their businesses and survive in the market . Source: Frost & Sullivan 38 The third - party payment services market is highly regulated in China . In 2019 , the total number of licensed third - party payment service providers amounts to 240 in China . Third - party payment service providers primarily compete on the basis of the scope of service offerings and service fees . Key entry barriers to the third - party payment services market in China include the following :

Overview of Third - party Payment Services Market in China Major Competitor in China Source: Frost & Sullivan 39 Key market participants in the third - party payment services market in China include 51 Credit Card, Lakala Payment Co. Ltd, and Huifu Payment Limited. 51 Credit Card (“51 ؑ ⭘ ” ) is a Hong Kong Listed company specializing in issuing credit cards and providing payment processing personal services and 2B third - party payment services. Lakala Payment Co. Ltd. (“ ” ) is a Shanghai Stock Exchange listing company providing third - party payment service for small and middle - sized enterprises. Huifu Payment Limited (“ ≷Ԉཙл ” ) is a Hong Kong Listed company focusing on providing third - party merchant payment services and fintech enabling services.

Overview of Third - party Payment Services Market in China Major Competitor in Shandong province Source: Frost & Sullivan 40 Key market participants in the third - party payment services market in Shandong province include Shandong Chenglian Card Payment Co., Ltd., Qingdao Baisentong Payment Co., Ltd. and Shandong Feiyin Intelligent Technology Co., Ltd.. Shandong Chenglian Card Payment Co., Ltd. (“ ኡь㚄а 䙊 ᭟Ԉᴹ䲀䍓ԫ ޜ ਨ ” ) is a private company based in Shandong Province specializing in prepaid card issuance and acceptance in Shandong province. Qingdao Baisentong Payment Co., Ltd. (“ 䶂 ዋⲮ䙊᭟Ԉᴹ䲀ޜਨ ” ) is a private company based in Shandong Province with focus on prepaid card issuance and acceptance in Qingdao city, and wholesale business. Shandong Feiyin Intelligent Technology Co., Ltd. (“ ኡь伎䬦Ც㜭、ᢰᴹ䲀ޜ ਨ ” ) is a private company based in Shandong Province and is principally engaged in prepaid card issuance and acceptance in Shandong province.

Appendix Competitive Strengths Source: Frost & Sullivan 41 We believe the following competitive strengths will contribute to our success and differentiate us from our competitors: • Local Market leading position – Through its wholly - owned subsidiary, Qingdao Buytop Payment Services, Co . , Ltd . , the Company is a leading third - party payment service provider in Qingdao City*, Shandong Province, China . It owns the largest market share in the multipurpose prepaid cards segment with a focus on large shopping malls . • Reliable, Robust Technology Infrastructure – With the support of reliable, robust technology infrastructure, the Company has been able to organically scale its prepaid payment network services business . Leveraging such technology infrastructure, the Company has developed technology systems that allow it to process a large volume of transactions, achieve high level of stability, promote workflow automation, and build an easily scalable business model . • Forefront at the industry – The Company is one of the 237 third - party payment service providers authorized by CSRC to offer payment and settlement services as at April 2020 . In particular, the Company is one of the third - party payment service providers authorized to offer payment services specifically related to prepaid card issuance and acceptance . • Experienced management team – The Company’s management team has demonstrated extensive expertise and track record in both technology and financial services industries, which are critical to the Company’s growth in the third - party payment services market . Note : * According to the National Statistics Bureau of China, Qingdao City is the eleventh largest city in terms of GDP in the PRC in 2018 with the population of over 9 million . In terms of GDP, the comparable cities in the U . S . include St . Louis and Portland .

• Value and percentage figures in this report are all rounded. Figures may not add up to the respective totals owing to rounding. • The base year is 2019. The historic period is from 2014 to 2018. The forecast period is from 2020 to 2024. 42 Note to Numeric Calculations Limitations in Source of Information • Interviews with end - users and vendors are conducted to collect information for this report, based on a best - efforts basis. • Frost & Sullivan will not be responsible for any information gaps where interviewees have refused to divulge confidential data or figures. • In instances where information is not available, figures based on similar indicators combined with Frost & Sullivan in - house analysis will be deployed to arrive at an estimate. • Frost & Sullivan will state the information sources at the bottom right - hand corner of each slide for easy reference. Appendix Limitation

▪ Frost & Sullivan is an independent global consulting firm, which was founded in 1961 in New York . It offers industry research and market strategies and provides growth consulting and corporate training . Its industry coverage in China and Hong Kong includes automotive and transportation, chemicals, materials and food, commercial aviation, consumer products, energy and power systems, environment and building technologies, healthcare, industrial automation and electronics, industrial and machinery, and technology, media and telecom . ▪ The Frost & Sullivan’s report includes information on Global and the China’s macro economy, consumer loan servicing and collection, borrower referral, and third - party payment services market in China . ▪ The market research process for this study has been undertaken through detailed primary research which involves discussing the status of the industry with leading industry participants and industry experts . Secondary research involved reviewing company reports, independent research reports and data based on Frost & Sullivan’s own research database . ▪ Projected total market size was obtained from historical data analysis plotted against macroeconomic data as well as specific related industry drivers . ▪ Frost & Sullivan’s report was compiled based on the below assumptions : – China’s economy is likely to maintain steady growth in the next decade ; – China’s social, economic, and political environment is likely to remain stable in the forecast period ; ▪ The report was completed in March, 2020 . ▪ All the data and information regarding the Group is provided by the Group . 43 Appendix Methodologies

Thank You! 44