- EBC Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DRS Filing

Eastern Bankshares (EBC) DRSDraft registration statement

Filed: 4 May 20, 12:00am

Exhibit 99.3

PRO FORMA VALUATION REPORT STANDARD CONVERSION

Eastern Bankshares, Inc. |Boston, Massachusetts

HOLDING COMPANY FOR:

Eastern Bank | Boston, Massachusetts

Dated as of April 17, 2020

1311-A Dolley Madison Boulevard, Suite 2A

McLean, Virginia 22101

703.528.1700

rpfinancial.com

| April 17, 2020 |

Board of Trustees

Eastern Bank Corporation

Board of Directors

Eastern Bankshares, Inc.

Eastern Bank

265 Franklin Street

Boston, Massachusetts 02110

Members of the Boards of Trustees and Directors:

At your request, we have completed and hereby provide a draft independent appraisal (“Appraisal”) of the estimated pro forma market value of the common stock which is to be issued in connection with themutual-to-stock conversion transaction described below.

This draft Appraisal is subject to revision and will be filed in final form as part of the Applications that will be filed by Eastern Bank Corporation, currently a“no-stock” mutual holding company, in connection with its plan of conversion (the “Plan”), and thus this draft Appraisal will be superseded by the Appraisal filed in final form. Such revisions will reflect any changes in the financial data included in the prospectus, any changes to the pro assumptions, new information learned in conducting ongoing due diligence, updated financial information for the public peer group selected for valuation purposes, more current market pricing data, and discussions with other parties retained by Eastern Bank Corporation to facilitate the Plan. Accordingly, the valuation conclusion set forth in this draft Appraisal may be subject to change.

This Appraisal is furnished pursuant to the requirements stipulated in the Code of Federal Regulations and has been prepared in accordance with the “Guidelines for Appraisal Reports for the Valuation of Savings and Loan Associations Converting from Mutual to Stock Form of Organization” (the “Valuation Guidelines”) of the Office of Thrift Supervision (“OTS”) and accepted by the Federal Reserve Board (“FRB”), the Office of the Comptroller of the Currency (“OCC”), the Federal Deposit Insurance Corporation (“FDIC”), the Massachusetts Commissioner of Banks (the “Commissioner”) and other state banking regulatory agencies, and applicable regulatory interpretations thereof. As described more fully herein, RP Financial formally requested that the FRB and the Commissioner waive the Valuation Guidelines restriction of including only public thrifts in the valuation peer group selection and permit inclusion of public commercial banking companies since there is an insufficient number of public thrifts comparable to Eastern Bank in its asset size class within the region and since Eastern Bank operates a commercial bank charter under the current mutual holding company structure. The FRB and the Commissioner granted this waiver prior to the submission of this draft Appraisal.

Washington Headquarters | ||

| 1311-A Dolley Madison Boulevard | Main: (703)528-1700 | |

| Suite 2A | Fax: (703)528-1788 | |

| McLean, VA 22101 | Toll-Free: (866)723-0594 | |

| www.rpfinancial.com | E-Mail: mail@rpfinancial.com |

Board of Trustees

Board of Directors

April 17, 2020

Page 2

Description of Plan of Conversion

On �� , 2020, the Board of Trustees of Eastern Bank Corporation (the “MHC”) and the Board of Directors of Eastern Bankshares, Inc. (“Eastern Bankshares” or the “Company”) adopted the Plan; whereby, the MHC will convert to stock form. As a result of the conversion, the MHC, which currently owns all of the issued and outstanding common stock of Eastern Bank will be succeeded by Eastern Bankshares, a newly formed Massachusetts stock holding company. Following the conversion, the MHC will no longer exist. For purposes of this document, the existing consolidated entity will hereinafter be referred to as Eastern Bankshares or the Company.

Eastern Bankshares will offer its common stock in a subscription offering to Eligible Account Holders, Supplemental Eligible Account Holders,Tax-Qualified Plans including Eastern Bank’s employee stock ownership plan (the “ESOP”) and Employees, Officers, Directors, Trustees and Corporators of Eastern Bank and the MHC as such terms are defined for purposes of applicable regulatory guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated offering. At least 50% of the net proceeds from the stock offering will be invested in Eastern Bank and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of Eastern Bank, a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, Eastern Bankshares may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

The Plan provides for a contribution to the Eastern Bank Charitable Foundation, an existing charitable foundation previously established by Eastern Bank (the “Foundation”). The Foundation contribution will be funded with 4.0% of the number of shares of common stock that will be outstanding after the offering and that contribution. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Eastern Bank operates, and the contribution will enable those communities to share in the Company’s long-term growth. The Foundation is dedicated completely to community activities and the promotion of charitable causes.

RP® Financial, LC.

RP® Financial, LC. (“RP Financial”) is a financial consulting firm serving the financial services industry nationwide that, among other things, specializes in financial valuations and analyses of business enterprises and securities, including the pro forma valuation for savings institutions converting frommutual-to-stock form. The background and experience of RP Financial is detailed in ExhibitV-1. We believe that, except for the fee we will receive for the Appraisal, we are independent of the Company, Eastern Bank, the MHC and the other parties engaged by Eastern Bank, the Company or the MHC to assist in the stock conversion process.

Board of Trustees

Board of Directors

April 17, 2020

Page 3

Valuation Methodology

In preparing our Appraisal, we have reviewed the regulatory applications of the Company, the Bank and the MHC, including the prospectus that will be filed with the FRB and the Securities and Exchange Commission (“SEC”). We have conducted a financial analysis of the Company, Eastern Bank and the MHC that has included a review of audited financial information for the fiscal years ended December 31, 2015 through December 31, 2019, a review of various unaudited information and internal financial reports through December 31, 2019, and due diligence related discussions with the Company’s management; Ernst & Young LLP, the Company’s independent auditor; Nutter McClennen & Fist LLP, the Company’s counsel for the stock issuance, and Keefe, Bruyette & Woods, Inc. and JPMorgan Securities LLC, the Company’s marketing advisors in connection with the stock offering. All assumptions and conclusions set forth in the Appraisal were reached independently from such discussions. In addition, where appropriate, we have considered information based on other available published sources that we believe are reliable. While we believe the information and data gathered from all these sources are reliable, we cannot guarantee the accuracy and completeness of such information.

We have investigated the competitive environment within which Eastern Bankshares operates and have assessed Eastern Bankshares’ relative strengths and weaknesses. We have kept abreast of the changing regulatory and legislative environment for financial institutions and analyzed the potential impact on Eastern Bankshares and the industry as a whole. We have analyzed the potential effects of the stock offering on Eastern Bankshares’ operating characteristics and financial performance as they relate to the pro forma market value of Eastern Bankshares. We have reviewed the economic and demographic characteristics of the Company’s primary market area. We have compared Eastern Bankshares’ financial performance and condition with selected publicly-traded bank and thrift companies in accordance with the Valuation Guidelines, pursuant to thenon-objection by the FRB and the Commissioner of our request to include publicly-traded commercial banking companies in the Company’s valuation Peer Group as there was an insufficient number of regional public thrifts that could be considered comparable to the Company. We have reviewed the current conditions in the securities markets in general and the market for bank and thrift stocks in particular, including the market for existing bank and thrift issues and initial public offerings by thrifts and thrift holding companies. We have excluded from such analyses banks and thrifts subject to announced or rumored acquisition, and/or institutions that exhibit other unusual characteristics.

The Appraisal is based on Eastern Bankshares’ representation that the information contained in the regulatory applications and additional information furnished to us by Eastern Bankshares and its independent auditor, legal counsel and other authorized agents are truthful, accurate and complete. We did not independently verify the financial statements and other information provided by Eastern Bankshares, or its independent auditor, legal counsel and other authorized agents nor did we independently value the assets or liabilities of Eastern Bankshares. The valuation considers Eastern Bankshares only as a going concern and should not be considered as an indication of Eastern Bankshares’ liquidation value.

Board of Trustees

Board of Directors

April 17, 2020

Page 4

Our appraised value is predicated on a continuation of the current operating environment for Eastern Bankshares and for all banks and thrifts and their holding companies. Changes in the local, state and national economy, the legislative and regulatory environment for financial institutions and mutual holding companies, the stock market, interest rates, and other external forces (such as natural disasters or significant world events) may occur from time to time, often with great unpredictability and may materially impact the value of bank and thrift stocks as a whole or the value of Eastern Bankshares’ stock alone. It is our understanding that there are no current plans for selling control of Eastern Bankshares following completion of the stock offering. To the extent that such factors can be foreseen, they have been factored into our analysis.

The estimated pro forma market value is defined as the price at which Eastern Bankshares’ common stock, immediately upon completion of the stock offering, would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or sell and both having reasonable knowledge of relevant facts.

Valuation Conclusion

It is our opinion that, as of April 17, 2020, the estimated aggregate pro forma market value of the shares to be issued immediately following the conversion, including shares to be issued to the Foundation, equaled $1,588,541,670 at the midpoint, equal to 158,854,167 shares offered at a per share value of $10.00. Pursuant to the conversion guidelines, the 15% valuation range indicates a minimum value of $1,350,260,420 and a maximum value of $1,826,822,920. Based on the $10.00 per share offering price determined by the Board, this valuation range equates to total shares outstanding of 135,026,042 at the minimum and 182,682,292 at the maximum. In the event the appraised value is subject to an increase, the aggregate pro forma market value may be increased up to a super maximum value of $2,100,846,360 without a resolicitation. Based on the $10.00 per share offering price, the super maximum value would result in total shares outstanding of 210,084,636. Based on this valuation range, the offering range is as follows: $1,296,250,000 at the minimum, $1,525,000,000 at the midpoint, $1,753,750,000 at the maximum and $2,016,812,500 at the super maximum. Based on the $10.00 per share offering price, the number of offering shares is as follows: 129,625,000 at the minimum, 152,500,000 at the midpoint, 175,375,000 at the maximum and 201,681,250 at the super maximum.

Limiting Factors and Considerations

The valuation is not intended, and must not be construed, as a recommendation of any kind as to the advisability of purchasing shares of the common stock. Moreover, because such valuation is determined in accordance with applicable regulatory guidelines and is necessarily based upon estimates and projections of a number of matters, all of which are subject to change from time to time, no assurance can be given that persons who purchase shares of common stock in the stock offering will thereafter be able to buy or sell such shares at prices related to the foregoing valuation of the estimated pro forma market value thereof. The appraisal reflects only a valuation range as of this date for the pro forma market value of Eastern Bankshares immediately upon issuance of the stock and does not take into account any trading activity with respect to the purchase and sale of common stock in the secondary market on the date of issuance of such securities or at anytime thereafter following the completion of the stock offering.

Board of Trustees

Board of Directors

April 17, 2020

Page 5

RP Financial’s valuation was based on the financial condition and operations of Eastern Bankshares as of December 31, 2019, the date of the financial data included in the prospectus.

RP Financial is not a seller of securities within the meaning of any federal and state securities laws and any report prepared by RP Financial shall not be used as an offer or solicitation with respect to the purchase or sale of any securities. RP Financial maintains a policy which prohibits RP Financial, its principals or employees from purchasing stock of its client institutions.

This valuation will be updated as provided for in the conversion regulations and the Valuation Guidelines. These updates will consider, among other things, any developments or changes in the financial performance and condition of Eastern Bankshares, management policies, and current conditions in the equity markets for bank and thrift shares, both existing issues and new issues. These updates may also consider changes in other external factors which impact value including, but not limited to: various changes in the legislative and regulatory environment for financial institutions, the stock market and the market for bank and thrift stocks, and interest rates. Should any such new developments or changes be material, in our opinion, to the valuation of the shares, appropriate adjustments to the estimated pro forma market value will be made. The reasons for any such adjustments will be explained in the update at the date of the release of the update. The valuation will also be updated at the completion of Eastern Bankshares’ stock offering.

| Respectfully submitted, |

| RP® FINANCIAL, LC. |

| Ronald S. Riggins |

| President and Managing Director |

| William E. Pommerening |

| CEO and Managing Director |

| Gregory E. Dunn |

| Director |

| RP® Financial, LC. | TABLE OF CONTENTS | |

| i |

TABLE OF CONTENTS

EASTERN BANKSHARES, INC.

EASTERN BANK

Boston, Massachusetts

DESCRIPTION | PAGE NUMBER | |||

CHAPTER ONE OVERVIEW AND FINANCIAL ANALYSIS |

| |||

Introduction | I.1 | |||

Plan of Conversion | I.1 | |||

Strategic Overview | I.2 | |||

Balance Sheet Trends | I.5 | |||

Income and Expense Trends | I.8 | |||

Interest Rate Risk Management | I.12 | |||

Lending Activities and Strategy | I.13 | |||

Asset Quality | I.15 | |||

Funding Composition and Strategy | I.16 | |||

Subsidiary Activities | I.16 | |||

Legal Proceedings | I.17 | |||

CHAPTER TWO MARKET AREA |

| |||

Introduction | II.1 | |||

National Economic Factors | II.1 | |||

Market Area Demographics | II.5 | |||

Regional Economy | II.9 | |||

Unemployment Trends | II.11 | |||

Market Area Deposit Characteristics and Competition | II.12 | |||

CHAPTER THREE PEER GROUP ANALYSIS |

| |||

Peer Group Selection | III.1 | |||

Financial Condition | III.6 | |||

Income and Expense Components | III.8 | |||

Loan Composition | III.11 | |||

Interest Rate Risk | III.11 | |||

Credit Risk | III.14 | |||

Summary | III.14 | |||

| RP® Financial, LC. | TABLE OF CONTENTS | |

| ii |

TABLE OF CONTENTS

EASTERN BANKSHARES, INC.

EASTERN BANK

Boston, Massachusetts

(continued)

DESCRIPTION | PAGE NUMBER | |||

CHAPTER FOUR VALUATION ANALYSIS | ||||

Introduction | IV.1 | |||

Appraisal Guidelines | IV.1 | |||

RP Financial Approach to the Valuation | IV.1 | |||

Valuation Analysis | IV.2 | |||

1. Financial Condition | IV.3 | |||

2. Profitability, Growth and Viability of Earnings | IV.4 | |||

3. Asset Growth | IV.6 | |||

4. Primary Market Area | IV.6 | |||

5. Dividends | IV.8 | |||

6. Liquidity of the Shares | IV.8 | |||

7. Marketing of the Issue | IV.9 | |||

A. The Public Market | IV.9 | |||

B. The New Issue Market | IV.16 | |||

C. The Acquisition Market | IV.16 | |||

8. Management | IV.18 | |||

9. Effect of Government Regulation and Regulatory Reform | IV.19 | |||

Summary of Adjustments | IV.19 | |||

Valuation Approaches 1. Price-to-Earnings (“P/E”) | | IV.19 IV.21 |

| |

2. Price-to-Book (“P/B”) | IV.22 | |||

3. Price-to-Assets (“P/A”) | IV.24 | |||

Comparison to Recent Offerings | IV.24 | |||

Valuation Conclusion | IV.25 | |||

| RP® Financial, LC. | LIST OF TABLES | |

iii |

LIST OF TABLES

EASTERN BANKSHARES, INC.

EASTERN BANK

Boston, Massachusetts

TABLE NUMBER | DESCRIPTION | PAGE | ||||

1.1 | Historical Balance Sheet Data | I.6 | ||||

1.2 | Historical Income Statements | I.9 | ||||

2.1 | Summary Demographic Data | II.6 | ||||

2.2 | Primary Market Area Employment Sectors | II.9 | ||||

2.3 2.4 | Boston MSA and Manchester-Nashua MSA Largest Employers Unemployment Trends | | II.10 II.11 |

| ||

2.5 | Deposit Summary | II.13 | ||||

2.6 | Market Area Deposit Competitors | II.14 | ||||

3.1 | Peer Group of Publicly-Traded Banks and Thrifts | III.3 | ||||

3.2 | Balance Sheet Composition and Growth Rates | III.7 | ||||

3.3 | Income as a Pct. of Avg. Assets and Yields, Costs, Spreads | III.9 | ||||

3.4 | Loan Portfolio Composition and Related Information | III.12 | ||||

3.5 | Interest Rate Risk Measures and Net Interest Income Volatility | III.13 | ||||

3.6 | Credit Risk Measures and Related Information | III.15 | ||||

4.1 | Market Area Unemployment Rates | IV.7 | ||||

4.2 | Pricing Characteristics and After-Market Trends | IV.17 | ||||

4.3 | Market Pricing Versus Peer Group | IV.23 | ||||

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.1 |

I. OVERVIEW AND FINANCIAL ANALYSIS

Introduction

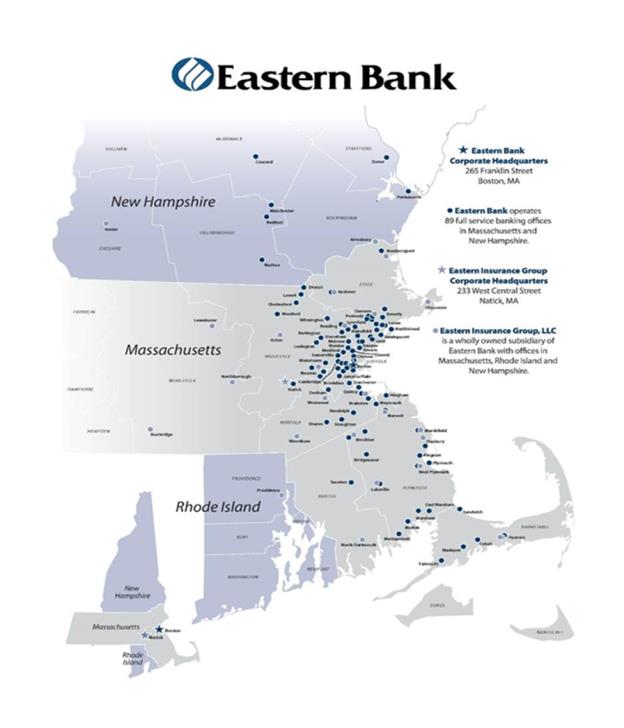

Eastern Bank, established in 1818, is a Massachusetts-chartered commercial bank headquartered in Boston, Massachusetts. Eastern Bank Corporation (the “MHC”) was formed in 1989 as a Massachusetts mutual holding company in connection with the reorganization of Eastern Bank’s mutual saving bank predecessor into the mutual holding company form of organization. To date, the MHC has not engaged in any business activity other than ownership of all the common stock of Eastern Bank. Eastern Bank serves the Boston metropolitan area, southeast New Hampshire and southeastern Massachusetts, including the peninsula of Cape Cod through the headquarters office in Boston and 89 full-service branch offices. The Bank’s financial services are also delivered through 25 insurance offices. A map of Eastern Bank’s branch and insurance office locations is provided in ExhibitI-1. Eastern Bank is a member of the Federal Home Loan Bank (“FHLB”) system and its deposits are insured up to the maximum allowable amount by the Federal Deposit Insurance Corporation (“FDIC”). As of December 31, 2019, Eastern Bank Corporation had total assets of $11.629 billion, total deposits of $9.551 billion and total equity of $1.600 billion equal to 13.76% of total assets. The MHC’s audited financial statements are included by reference as ExhibitI-2.

Plan of Conversion

On ___________________, 2020, the Board of Trustees of the MHC and the Board of Directors of Eastern Bankshares, Inc. (“Eastern Bankshares” or the “Company”) adopted the plan of conversion (the “Plan”); whereby, the MHC will convert to stock form. As a result of the conversion, the MHC, which currently owns all of the issued and outstanding common stock of Eastern Bank will be succeeded by Eastern Bankshares, a newly formed Massachusetts stock holding company. Following the conversion, the MHC will no longer exist. For purposes of this document, the existing consolidated entity will hereinafter be referred to as Eastern Bankshares or the Company.

Eastern Bankshares will offer its common stock in a subscription offering to Eligible Account Holders, Supplemental Eligible Account Holders,Tax-Qualified Plans including Eastern Bank’s employee stock ownership plan (the “ESOP”), and Employees, Officers, Directors, Trustees and Corporators of the Bank or the MHC, as such terms are defined in the Company’s Plan for purposes of applicable regulatory

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.2 |

guidelines governing stock offerings by mutual institutions. To the extent that shares remain available for purchase after satisfaction of all subscriptions received in the subscription offering, the shares may be offered for sale to members of the general public in a community offering and a syndicated offering. At least 50% of the net proceeds from the stock offering will be invested in Eastern Bank and the balance of the net proceeds will be retained by the Company.

At this time, no other activities are contemplated for the Company other than the ownership of the Bank, funding a loan to the newly-formed ESOP and reinvestment of the proceeds that are retained by the Company. In the future, Eastern Bankshares may acquire or organize other operating subsidiaries, diversify into other banking-related activities, pay dividends or repurchase its stock, although there are no specific plans to undertake such activities at the present time.

The Plan provides for a contribution to the Eastern Bank Charitable Foundation, an existing charitable foundation previously established by Eastern Bank (the “Foundation”). The Foundation contribution will be funded with 4.0% of the number of shares of common stock that will be outstanding after the offering and that contribution. The purpose of the Foundation is to provide financial support to charitable organizations in the communities in which Eastern Bank operates, and the contribution will enable those communities to share in the Company’s long-term growth. The Foundation is dedicated completely to community activities and the promotion of charitable causes.

Strategic Overview

The Company offers a full range of financial services to individual, corporate, municipal and institutional customers. The Company’s traditional banking activities include secured and unsecured commercial and consumer lending, originating mortgage loans secured by residential and commercial properties and accepting consumer, commercial and municipal deposits. The Bank’s lending activities are primarily conducted in Massachusetts and New Hampshire. Beyond traditional banking services, Eastern Bankshares’ provides a variety of financial services to address the full range of banking services required of a diverse customer base, including international banking services, municipal banking products and services, capital market investment products and services, and providing financial services to New England based community banks, insurance companies and other financial service companies. Eastern Bank also offers wealth management services, and insurance products and services through its wholly-owned subsidiary, Eastern Insurance Group, LLC (“Eastern Insurance”). For more than 25 years, the Company has pursued a strategy of supplementing organic growth with growth through acquisitions, which have included acquisitions of whole banks, branch offices, insurance agencies and trust departments.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.3 |

Loans constitute the major portion of the Company’s composition of interest-earning assets, with commercial real estate loans and commercial business loans comprising the two largest concentrations of the Company’s loan portfolio. Investments serve as a supplement to the Company’s lending activities and the investment portfolio is considered to be indicative of a low risk investment philosophy, as government-sponsored residential mortgage-backed securities constitute a significant portion of the Company’s investment portfolio.

Deposits have consistently served as the primary funding source for the Company, with supplemental funding provided by utilization of borrowings as an alternative funding source for purposes of managing funding costs and interest rate risk. Core deposits, consisting of transaction and savings account deposits constitute the substantial portion of the Company’s deposit base. Borrowings currently held by the Company consist primarily of federal funds purchased and FHLB advances.

Eastern Bankshares’ earnings base is largely dependent upon net interest income and operating expense levels. The Company’s net interest margin has trended higher in recent years, which is somewhat counter to industrywide trends. The improvement in the Company’s net interest margin has been facilitated by loan growth, particularly with respect to growth of higher yielding types of loans which has translated into an upward trend in the overall yield earned on interest-earning assets. While Eastern Bankshares’ funding costs have also trended higher in recent years, the increase has been less compared to the increase in yield earned on interest-earning assets. A decline in borrowings and maintenance of a high concentration of deposits in relatively low costing core deposits were factors that have served to contain the increase in the Company’s funding costs. Operating expenses have trended higher in recent years, but have been maintained at a relatively stable level as a percent of average assets.

Non-interest operating income is a significant source of revenues for the Company, with insurance commissions providing the largest contribution to the Company’snon-interest operating income. Throughout its history, Eastern Insurance has grown through acquiring relatively small insurance agencies in existing and adjacent markets and is one of the largest insurance agencies headquartered in Massachusetts.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.4 |

The amount of loan loss provisions established has fluctuated in recent periods, giving consideration to credit quality trends, growth of the loan portfolio and economic conditions in the Company’s lending markets.

The post-offering business plan of the Company is expected to continue to focus on implementing strategic initiatives to develop and grow a full service community banking franchise. Accordingly, Eastern Bankshares will continue to be an independent full-service community bank, with a commitment to meeting the retail and commercial banking needs of individuals and businesses in the markets that are served by its network of branches and nearby surrounding markets.

The MHC’s Board of Trustees and Eastern Bank’s Board of Directors have elected to complete a public stock offering to sustain growth strategies and facilitate implementation of its strategic plan. Additionally, in the near term, the stock offering will serve to substantially increase regulatory capital and liquidity and, thereby, facilitate building and maintaining loan loss reserves while also providing the Company with greater flexibility to work with borrowers affected by theCOVID-19 induced recession. Over the long term, the capital realized from the stock offering will increase the Company’s operating flexibility and allow for additional growth of the balance sheet. The additional funds realized from the stock offering will provide an alternative funding source to deposits and borrowings in meeting the Company’s future funding needs, which may facilitate a reduction in Eastern Bankshares’ funding costs. Eastern Bankshares’ higherequity-to-assets ratio will also enable the Company to pursue expansion opportunities. Such expansion would most likely occur through the establishment of additional banking offices to gain a market presence in nearby markets that are complementary to the Company’s existing branch network. The Company will also be in a better position to pursue growth through additional acquisitions of other financial service providers following the stock offering, given its strengthened capital position. The projected uses of proceeds are highlighted below.

| • | The Company. The Company is expected to retain not more than 50% of the net offering proceeds. At present, funds at the Company level, net of the loan to the ESOP, are expected to be primarily invested initially into liquid funds held as a deposit at Eastern Bank. Over time, the funds may be utilized for various corporate purposes, possibly including acquisitions, infusing additional equity into Eastern Bank, repurchases of common stock and the payment of cash dividends. |

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.5 |

| • | Eastern Bank. At least 50% of the net conversion proceeds will be infused into Eastern Bank. Cash proceeds (i.e., net proceeds less deposits withdrawn to fund stock purchases) infused into Eastern Bank are anticipated to become part of general operating funds and are expected to be primarily utilized to fund loan growth over time. |

Overall, it is the Company’s objective to pursue controlled growth that will serve to increase returns, while continuing to emphasize management of the overall risk associated with Eastern Bankshares’ operations.

Balance Sheet Trends

Table 1.1 shows the Company’s historical balance sheet data for the past five years. From yearend 2015 through yearend 2019, Eastern Bankshares’ assets increased at a 4.94% annual rate. Asset growth was largely driven by loan growth, which was primarily funded by deposit growth. A summary of Eastern Bankshares’ key operating ratios for the past five years is presented in ExhibitI-3.

Eastern Bankshares’ loans receivable portfolio increased at a 5.92% annual rate from yearend 2015 through yearend 2019, in which the loans receivable balance trended higher throughout the period. Following three years of relatively strong loan growth for the three years ending December 31, 2018, the Company’s loan growth slowed in 2019. The Company’s comparatively stronger loan growth relative to asset growth served to increase theloans-to-assets ratio from 73.72% at yearend 2015 to 76.53% at yearend 2019.

Eastern Bankshares’ emphasis on commercial lending is evidenced by the historical composition of its loan portfolio. Over the past five years, commercial loans have consistently comprised the largest concentration of the Company’s loan portfolio and have been the primary source of loan growth. As of December 31, 2019, the balance of commercial loans totaled $6.223 billion, or 69.24% of total loans, and consisted of $3.536 billion of commercial real estate loans, $1.642 billion of commercial business loans, $771.5 million of business banking loans and $273.6 million of commercial construction loans. Comparatively, commercial loans comprised 62.92% of total loans at yearend 2015. As of December 31, 2019, the balance of the Company’s loan portfolio consisted of $1.429 billion of residential mortgage loans, or 15.90% of total loans, and $1.336 billion of consumer loans, or 14.86% of total loans. Consumer loans held by the Company at December 31, 2019 consisted of $933.1 million of home equity loans and $402.4 million of other consumer loans. Comparatively, at yearend 2015, residential mortgage loans and consumer loans comprised 14.54% and 22.55% of total loans outstanding, respectively. A decline in automobile loans outstanding largely accounted for the lower concentration of consumer loans maintained in the loan portfolio at yearend 2019 compared to yearend 2105, as the Company exited its indirect auto lending program in 2018.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.6 |

Table 1.1

Eastern Bankshares, Inc.

Historical Balance Sheet Data

| At December 31, | 12/31/15- 12/31/19 Annual. Growth Rate Pct | |||||||||||||||||||||||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||||||||||||||||||||||||||

| Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | |||||||||||||||||||||||||||||||||||

| ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | (%) | ||||||||||||||||||||||||||||||||||

Total Amount of: | ||||||||||||||||||||||||||||||||||||||||||||

Assets | $ | 9,588,786 | 100.00 | % | $ | 9,801,109 | 100.00 | % | $ | 10,873,073 | 100.00 | % | $ | 11,378,287 | 100.00 | % | $ | 11,628,775 | 100.00 | % | 4.94 | % | ||||||||||||||||||||||

Cash and cash equivalents | 683,796 | 7.13 | % | 104,750 | 1.07 | % | 311,153 | 2.86 | % | 259,708 | 2.28 | % | 362,602 | 3.12 | % | -14.67 | % | |||||||||||||||||||||||||||

Trading securities | 61,050 | 0.64 | % | 51,663 | 0.53 | % | 46,791 | 0.43 | % | 52,899 | 0.46 | % | 961 | 0.01 | % | -64.58 | % | |||||||||||||||||||||||||||

Investment securities | 979,647 | 10.22 | % | 1,207,596 | 12.32 | % | 1,504,810 | 13.84 | % | 1,455,898 | 12.80 | % | 1,508,236 | 12.97 | % | 11.39 | % | |||||||||||||||||||||||||||

Loans held for sale | 21,998 | 0.23 | % | 2,038 | 0.02 | % | 2,354 | 0.02 | % | 22 | 0.00 | % | 26 | 0.00 | % | -81.46 | % | |||||||||||||||||||||||||||

Loans receivable, net | 7,069,066 | 73.72 | % | 7,635,838 | 77.91 | % | 8,153,986 | 74.99 | % | 8,774,913 | 77.12 | % | 8,899,184 | 76.53 | % | 5.92 | % | |||||||||||||||||||||||||||

FHLB stock | 10,548 | 0.11 | % | 15,342 | 0.16 | % | 24,270 | 0.22 | % | 17,959 | 0.16 | % | 9,027 | 0.08 | % | -3.82 | % | |||||||||||||||||||||||||||

Bank-owned life insurance | 71,931 | 0.75 | % | 75,125 | 0.77 | % | 76,161 | 0.70 | % | 75,434 | 0.66 | % | 77,546 | 0.67 | % | 1.90 | % | |||||||||||||||||||||||||||

Goodwill and other intangibles | 362,762 | 3.78 | % | 362,980 | 3.70 | % | 373,042 | 3.43 | % | 381,276 | 3.35 | % | 377,734 | 3.25 | % | 1.02 | % | |||||||||||||||||||||||||||

Rabbi trust assets | 67,543 | 0.70 | % | 69,757 | 0.71 | % | 70,924 | 0.65 | % | 64,819 | 0.57 | % | 78,012 | 0.67 | % | 3.67 | % | |||||||||||||||||||||||||||

Deposits | $ | 8,133,730 | 84.83 | % | $ | 8,188,950 | 83.55 | % | $ | 8,815,452 | 81.08 | % | $ | 9,399,493 | 82.61 | % | $ | 9,551,392 | 82.14 | % | 4.10 | % | ||||||||||||||||||||||

Borrowings | 53,048 | 0.55 | % | 154,331 | 1.57 | % | 526,505 | 4.84 | % | 334,287 | 2.94 | % | 235,395 | 2.02 | % | 45.14 | % | |||||||||||||||||||||||||||

Equity | $ | 1,205,014 | 12.57 | % | $ | 1,254,927 | 12.80 | % | $ | 1,330,514 | 12.24 | % | $ | 1,433,141 | 12.60 | % | $ | 1,600,153 | 13.76 | % | 7.35 | % | ||||||||||||||||||||||

Tangible equity | $ | 842,252 | 8.78 | % | $ | 891,947 | 9.10 | % | $ | 957,472 | 8.81 | % | $ | 1,051,865 | 9.24 | % | $ | 1,222,419 | 10.51 | % | 9.76 | % | ||||||||||||||||||||||

Loans/Deposits | 86.91 | % | 93.25 | % | 92.50 | % | 93.36 | % | 93.17 | % | ||||||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of ending assets. |

Sources: Eastern Bankshares’ draft prospectus tables, audited and unaudited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.7 |

The intent of the Company’s investment policy is to provide adequate liquidity and to generate a favorable return within the context of supporting Eastern Bankshares’ overall credit and interest rate risk objectives. It is anticipated that proceeds retained at the holding company level will be invested into liquid funds held as a deposit at Eastern Bank. Since yearend 2015, the Company’s level of cash and investment securities (inclusive of FHLB stock) ranged from a low of 14.07% of assets at yearend 2016 to a high of 17.36% of assets at yearend 2017. As of December 31, 2019, cash and investments equaled 16.17% of assets. Mortgage-backed securities totaling $1.168 billion comprised the most significant component of the Company’s investment portfolio at December 31, 2019. Other investments held by the Company at December 31, 2019 consisted of municipal bonds ($283.5 million), U.S. Treasury securities ($50.4 million) and a qualified zone academy bond ($6.3 million). The investment securities portfolio is maintained as available for sale and, as of December 31, 2019, the investment portfolio had a net unrealized gain of $28.0 million. ExhibitI-4 provides historical detail of the Company’s investment portfolio. The Company also maintains a trading securities portfolio, which had declined to a nominal balance as of December 31, 2019. The trading securities portfolio consists of municipal bonds and will be eliminated in 2020. As of December 31, 2019, the Company also held $362.6 million of cash and cash equivalents and $9.0 million of FHLB stock.

The Company also maintains an investment in bank-owned life insurance (“BOLI”) policies and rabbi trust investments. The BOLI investment, which was largely obtained in merger and acquisitions that have been completed by the Company, covers the lives of certain participating executives. The life insurance policies earntax-exempt income through cash value accumulation and death proceeds. Rabbi trust investments consist primarily of cash and cash equivalents, U.S. Government agency obligations, equity securities, mutual funds and other exchange-traded funds. The purpose of the rabbi trust investments is to fund certain executivenon-qualified retirement benefits and deferred compensation. As of December 31, 2019, the cash surrender value of the Company’s BOLI equaled $77.5 million and the rabbi trust investments totaled $78.0 million.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.8 |

Since year end 2015, Eastern Bankshares’ funding needs have been addressed through a combination of deposits, borrowings and internal cash flows. From yearend 2015 through yearend 2019, the Company’s deposits increased at a 4.10% annual rate. Deposits as a percent of assets decreased from 84.83% at yearend 2015 to 82.14% at yearend 2019. Deposits growth was sustained throughout the period covered in Table 1.1. Deposit growth trends in recent years reflect that deposit growth has been largely realized through growth of core deposits, primarily consisting of money market deposits. Core deposits comprised 96.55% of total deposits at December 31, 2019, versus 95.73% of total deposits at December 31, 2017.

Borrowings serve as an alternative funding source for the Company to address funding needs for growth and to support management of deposit costs and interest rate risk. From yearend 2015 through yearend 2019, borrowings ranged from a low of $53.0 million, or 0.55% of assets, at yearend 2015 to a high of $526.5 million, or 4.84% of assets, at yearend 2017. As of December 31, 2019, the Company borrowings totaled $235.4 million, or 2.02% of assets. Borrowings currently held by the Company consist primarily of federal funds purchased and also included FHLB advances and escrow deposits of borrowers.

The Company’s equity increased at a 7.35% annual rate from yearend 2015 through yearend 2019, which was largely related to retention of earnings. A stronger rate of equity growth relative to asset growth since yearend 2015 provided for an increase in the Company’sequity-to-assets ratio from 12.57% at yearend 2015 to 13.76% at yearend 2019. Similarly, the Company’s tangibleequity-to-assets ratio increased from 8.78% at yearend 2015 to 10.51% at yearend 2019. Goodwill and other intangibles, resulting from the numerous acquisitions that have been completed by the Company, totaled $377.7 million, or 3.25% of assets, at December 31, 2019. Eastern Bank maintained capital surpluses relative to all of its regulatory capital requirements at December 31, 2019. The addition of stock proceeds will serve to strengthen the Company’s capital position, as well as support growth opportunities. At the same time, the increase in Eastern Bankshares’ pro forma capital position will initially depress its ROE.

Income and Expense Trends

Table 1.2 shows the Company’s historical income statements for the past five years. The Company’s reported earnings ranged from a low of $62.6 million, or 0.65% of average assets, during 2015 to a high of $135.1 million, or 1.18% of average assets, during 2019. Net interest income and operating expenses represent the primary components of the Company’s recurring earnings, whilenon-interest operating income is also a significant contributor to the Company’s earnings. Loan loss provisions have had a varied impact on the Company’s earnings over the past five years.Non-operating income and losses generally have not been a significant factor in the Company’s earnings over the past five years.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.9 |

Table 1.2

Eastern Bankshares, Inc.

Historical Income Statements

| For the Year Ended December 31, | ||||||||||||||||||||||||||||||||||||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | ||||||||||||||||||||||||||||||||||||

| Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | Amount | Pct(1) | |||||||||||||||||||||||||||||||

| ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | ($000) | (%) | |||||||||||||||||||||||||||||||

Interest income | $ | 280,796 | 2.90 | % | $ | 299,194 | 3.02 | % | $ | 345,406 | 3.32 | % | $ | 415,166 | 3.73 | % | $ | 445,017 | 3.90 | % | ||||||||||||||||||||

Interest expense | (5,819 | ) | -0.06 | % | (5,620 | ) | -0.06 | % | (6,892 | ) | -0.07 | % | (25,122 | ) | -0.23 | % | (33,753 | ) | -0.30 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net interest income | $ | 274,977 | 2.84 | % | $ | 293,574 | 2.96 | % | $ | 338,514 | 3.26 | % | $ | 390,044 | 3.50 | % | $ | 411,264 | 3.61 | % | ||||||||||||||||||||

Provision for loan losses | 325 | 0.00 | % | (7,900 | ) | -0.08 | % | (5,800 | ) | -0.06 | % | (15,100 | ) | -0.14 | % | (6,300 | ) | -0.06 | % | |||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net interest income after provisions | $ | 275,302 | 2.85 | % | $ | 285,674 | 2.88 | % | $ | 332,714 | 3.20 | % | $ | 374,944 | 3.37 | % | $ | 404,964 | 3.55 | % | ||||||||||||||||||||

Non-interest operating income | $ | 150,006 | 1.55 | % | $ | 164,621 | 1.66 | % | $ | 171,474 | 1.65 | % | $ | 177,942 | 1.60 | % | $ | 169,135 | 1.48 | % | ||||||||||||||||||||

Operating expense | (333,695 | ) | -3.45 | % | (367,643 | ) | -3.71 | % | (389,413 | ) | -3.75 | % | (397,928 | ) | -3.57 | % | (412,684 | ) | -3.62 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net operating income | $ | 91,613 | 0.95 | % | $ | 82,652 | 0.83 | % | $ | 114,775 | 1.10 | % | $ | 154,958 | 1.39 | % | $ | 161,415 | 1.42 | % | ||||||||||||||||||||

Non-Operating Income/(Losses) | ||||||||||||||||||||||||||||||||||||||||

Gains (losses) on sales of securities AFS, net | ($ | 62 | ) | 0.00 | % | $ | 261 | 0.00 | % | $ | 11,356 | 0.11 | % | $ | 50 | 0.00 | % | $ | 2,016 | 0.02 | % | |||||||||||||||||||

Trading securities gains, net | 2,365 | 0.02 | % | 2,085 | 0.02 | % | 2,235 | 0.02 | % | 2,156 | 0.02 | % | 1,297 | 0.01 | % | |||||||||||||||||||||||||

Gains (losses) on sales of other assets, net | — | 0.00 | % | — | 0.00 | % | 6,075 | 0.06 | % | 1,989 | 0.02 | % | (15 | ) | 0.00 | % | ||||||||||||||||||||||||

Income from investments held in rabbi trusts | 698 | 0.01 | % | 2,161 | 0.02 | % | 6,587 | 0.06 | % | (1,542 | ) | -0.01 | % | 9,866 | 0.09 | % | ||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Netnon-operating income(loss) | $ | 3,001 | 0.03 | % | $ | 4,507 | 0.05 | % | $ | 26,253 | 0.25 | % | $ | 2,653 | 0.02 | % | $ | 13,164 | 0.12 | % | ||||||||||||||||||||

Net income before tax | $ | 94,614 | 0.98 | % | $ | 87,159 | 0.88 | % | $ | 141,028 | 1.36 | % | $ | 157,611 | 1.42 | % | $ | 174,579 | 1.53 | % | ||||||||||||||||||||

Income tax provision | (32,050 | ) | -0.33 | % | (24,445 | ) | -0.25 | % | (54,331 | ) | -0.52 | % | (34,884 | ) | -0.31 | % | (39,481 | ) | -0.35 | % | ||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Net income (loss) | $ | 62,564 | 0.65 | % | $ | 62,714 | 0.63 | % | $ | 86,697 | 0.83 | % | $ | 122,727 | 1.10 | % | $ | 135,098 | 1.18 | % | ||||||||||||||||||||

Adjusted Earnings | ||||||||||||||||||||||||||||||||||||||||

Net income | $ | 62,564 | 0.65 | % | $ | 62,714 | 0.63 | % | $ | 86,697 | 0.83 | % | $ | 122,727 | 1.10 | % | $ | 135,098 | 1.18 | % | ||||||||||||||||||||

Add(Deduct):Non-operating income | (3,001 | ) | -0.03 | % | (4,507 | ) | -0.05 | % | (26,253 | ) | -0.25 | % | (2,653 | ) | -0.02 | % | (13,164 | ) | -0.12 | % | ||||||||||||||||||||

Tax effect (2) | 1,200 | 0.01 | % | 1,803 | 0.02 | % | 10,501 | 0.10 | % | 690 | 0.01 | % | 3,423 | 0.03 | % | |||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||||||||||

Adjusted earnings | $ | 60,763 | 0.63 | % | $ | 60,010 | 0.61 | % | $ | 70,945 | 0.68 | % | $ | 120,764 | 1.08 | % | $ | 125,357 | 1.10 | % | ||||||||||||||||||||

Expense Coverage Ratio (3) | 0.82x | 0.80x | 0.87x | 0.98x | 1.00x | |||||||||||||||||||||||||||||||||||

Efficiency Ratio (4) | 78.59 | % | 80.30 | % | 76.37 | % | 70.00 | % | 71.12 | % | ||||||||||||||||||||||||||||||

| (1) | Ratios are as a percent of average assets. |

| (2) | Assumes a 40.0% effective tax rate for 2015-2017 and a 26.0% effective tax rate for 2018 and 2019. |

| (3) | Expense coverage ratio calculated as net interest income before provisions for loan losses divided by operating expenses. |

| (4) | Efficiency ratio calculated as operating expenses divided by the sum of net interest income before provisions for loan losses plusnon-interest operating income. |

Sources: Eastern Bankshares’ draft prospectus tables, audited & unaudited financial statements and RP Financial calculations.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.10 |

During the period covered in Table 1.2, the Company’s net interest income to average assets ratio ranged from a low of 2.84% during 2015 to a high of 3.61% during 2019. The upward trend in the Company’s net interest income ratio since 2015 has been driven by an increase in the interest income ratio. Notably, loan growth and an upward trend in the average yield earned on the loan portfolio provided for a more significant increase in the yield earned on interest-earning assets relative to the increase in the rate paid on interest-bearing liabilities. Higher yields earned on commercial loans accounted for most of the increase in the weighted average yield earned on loans. Overall, during the past five years, the Company’s interest rate spread (fullytax-equivalent basis) increased from a low of 3.13% during 2015 to a high of 3.74% during 2019. The Company’s net interest rate spreads and yields and costs for the past five years are set forth in ExhibitI-3 and ExhibitI-5.

Non-interest operating income has been a significant contributor to the Company’s earnings over the past five years. Throughout the period shown in Table 1.2,non-interest operating income ranged from a low of $150.0 million, or 1.55% of average assets, during 2015 to a high of $177.9 million, or 1.60% of average assets, during 2018. For 2019,non-interest operating income totaled $169.1 million, or 1.48% of average assets. Insurance commissions constitute the largest source ofnon-interest operating income for the Company and accounted for 54% of the Company’snon-interest operating income during 2019, while the Eastern Insurance subsidiary accounted for $9.7 million of the Company’s net income during 2019. Other significant sources ofnon-interest operating income include service charges on deposit accounts, debit card processing fees and trust and investment advisory fees.

Operating expenses represent the other major component of the Company’s earnings, which have been maintained at a relatively high ratio as a percent of average assets. The Company’s relatively high operating expense ratios have been largely attributable to the significance of operational areas that are largelyoff-balance sheet activities, which includes the Company’s insurance business, wealth management services and mortgage banking operations. Notably, as the result of the significance of the Company’soff-balance sheet activities, the Company maintains a relatively low ratio of assets per employee. While operating expenses have trended higher over the past four years, the Company has been effective in leveraging the increase in operating expenses through consistent growth of the balance sheet. Overall, the Company’s operating expenses to average assets ratio ranged from a low of 3.45% during 2015 to a high of 3.75% during 2017. For 2019, operating expenses totaled $412.7 million, or 3.62% of average assets.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.11 |

Overall, during the past five years, the Company’s expense coverage ratios (net interest income divided by operating expenses) ranged from a low of 0.80x during 2016 to a high of 1.00x during 2019. Similarly, the Company’s efficiency ratio (operating expenses as a percent of the sum of net interest income and other operating income) reflected an improving trend in core earnings since 2016, based on high and low efficiency ratios of 80.30% and 70.00% during 2016 and 2018, respectively. For 2019, the Company’s efficiency ratio increased slightly to equal 71.12%.

During the period covered in Table 1.2, the amount of loan loss provisions and recoveries recorded by the Company ranged from a recovery of $325,000, or 0.00% of average assets, during 2015 to loan loss provisions of $15.1 million, or 0.14% of average assets, during 2018. For 2019, the Company reported loan loss provisions of $6.3 million, or 0.06% of average assets. As of December 31, 2019 the Company maintained loan loss allowances of $82.3 million, equal to 0.92% of total loans receivable and 188.00% of non-performing loans. ExhibitI-6 sets forth the Company’s loan loss allowance activity for the past five years.

Non-operating income and losses generally have not been a significant factor in the Company’s earnings over the past five years. Netnon-operating income ranged from a low of $2.7 million, or 0.02% of average assets, during 2018 to a high of $26.3 million, or 0.25% of average assets, during 2017. For 2019, netnon-operating income equaled $13.2 million, or 0.12% of average assets, and consisted of a $2.0 million gain on sale of available for sale securities, $9.9 million of income from investments held in rabbi trusts, $1.3 million of trading securities gains and $15,000 of losses on the sale of other assets.

Over the past five years, the Company’s effective tax rate ranged from a low of 22.13% in 2018 to a high of 38.53% during 2017 and equaled 22.61% during 2019. As set forth in the Company’s prospectus, the Company’s marginal effective tax rate is 26.0%.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.12 |

Interest Rate Risk Management

The Company’s balance sheet is slightly asset sensitive in the short-term (less than one year). While financial institutions in general have been experiencing some interest spread compression during recent periods, the Company has been effective in increasing its interest rate spread through realizing a more significant increase in the overall yield earned on interest-earning assets relative to the increase in the overall rate paid on interest-bearing liabilities. The increase in yield has been primarily realized through earning higher yields on the loan portfolio, particularly with respect to the commercial loan portfolio. As of December 31, 2019, an analysis of the Company’s economic value of equity (“EVE”) and net interest income indicatedthat in the event of an instantaneous parallel 200 basis point increase in the U.S. Treasury yield curve EVE would increase by 1.0% and net interest income would increase by 2.7% in year one, which were within policy limits (see ExhibitI-7).

The Company pursues a number of strategies to manage interest rate risk, particularly with respect to seeking to limit the repricing mismatch between interest rate sensitive assets and liabilities. The Company manages interest rate risk from the asset side of the balance sheet through lending diversification that emphasis origination of adjustable rate or shorter term fixed rate loans, investing in investment securities with short-terms or adjustable interest rates, maintaining the investment portfolio as available for sale and selling originations of longer term1-4 family fixed rate loans. The Company has also entered in interest rate swap agreements to hedge a portion of its floating rate commercial loans portfolio. As of December 31, 2019, of the Company’s total loans due after December 31, 2020, adjustable rate loans comprised 66.7% of total loans receivable (see ExhibitI-8). On the liability side of the balance sheet, the Company’s interest rate risk is primarily managed through maintaining a very high concentration of deposits in lower costing and less interest rate sensitive transaction and savings account deposits. Transaction and savings account deposits comprised 96.55% of the Company’s total deposits at December 31, 2019.

Management of the Company’s interest rate risk is further supported by the Company’s diversification into activities that generate significant sources ofnon-interest operating income, which provide a fairly stable source of revenues throughout various interest rate environments.

The infusion of stock proceeds will serve to further limit the Company’s interest rate risk exposure, as most of the net proceeds will be redeployed into interest-earning assets and the increase in the Company’s capital position will lessen the proportion of interest rate sensitive liabilities funding assets.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.13 |

Lending Activities and Strategy

Pursuant to the Company’s strategic plan, the Company is pursuing a diversified lending strategy emphasizing commercial real estate loans and commercial business loans as the primary areas of targeted loan growth. Other areas of lending for the Company include1-4 family residential mortgage loans, commercial construction loans, home equity loans and other consumer loans. ExhibitI-9 provides historical detail of Eastern Bank’s loan portfolio composition for the past five years and ExhibitI-10 provides the contractual maturity of the Company’s loan portfolio by loan type as of December 31, 2019.

Commercial Real Estate Loans. Commercial real estate loans consist largely of loans originated by the Company, which are generally collateralized by properties in the Company’s regional lending area. On a limited basis, the Company supplements originations of commercial real estate loans with purchased loan participations from local banks. Loan participations are subject to the same underwriting criteria and loan approvals as applied to loans originated by the Company. Eastern Bankshares generally originates commercial real estate loans up to aloan-to-value (“LTV”) ratio of 75% and generally requires a minimum debt-coverage ratio of 1.25 times. Commercial real estate loans are originated with terms and amortization periods up to 30 years. Loan terms offered on commercial real estate loans include fixed rate and adjustable rate loans, which may include a balloon provision. Adjustable rate loans are generally indexed to the30-day LIBOR. Properties securing the commercial real estate loan portfolio include office, industrial, retail, hotel, affordable housing and multi-family. At December 31, 2019, the Company’s ten largest commercial real estate loans had an average balance of $22.7 million, ranging from $19.4 million to $25.8 million. As of December 31, 2019, the Company’s outstanding balance of commercial real estate loans totaled $3.536 billion equal to 39.34% of total loans outstanding.

Commercial Business Loans. The commercial business loan portfolio is generated through extending loans to businesses operating in the local market area. Further expansion of commercial business lending activities is a desired area of loan growth for the Company, pursuant to which the Company is a full-service community bank to its commercial loan customers through offering a full range of commercial loan products that can be packaged with lower cost commercial deposit products. The Company offers a variety of secured and unsecured commercial business loans that include term loans and revolving lines of credit. Substantially all commercial business loans are floating rate loans indexed to LIBOR or the

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.14 |

prime rate as published inThe Wall Street Journal. The commercial business loan portfolio also includes participations in the syndicated loan market and the Shared National Credit (“SNC”) Program. As of December 31, 2019, the SNC portfolio totaled $419.0 million equal to 25.5% of the commercial business loan portfolio. At December 31, 2019, the Company’s ten largest commercial business lending relationships had an average balance of $33.4 million and ranged in size from $28.5 million to $41.6 million. As of Decembe31, 2019, the Company’s outstanding balance of commercial business loans totaled $1.642 billion equal to 18.27% of total loans outstanding.

1-4 Family ResidentialMortgageLoans. Eastern Bankshares offers both fixed rate and adjustable rate1-4 family residential mortgage loans with terms of up to 30 years. Loans are generally underwritten to secondary market guidelines, so as to allow for the sale of such loans if such a strategy is warranted for purposes of interest rate risk management. The Company’s current practice is to generally sell conforming longer term fixed rate loans on a servicing released basis. ARM loans offered by the Company have initial repricing terms of up to ten years and then reprice annually for the balance of the loan term. As of December 31, 2019, the Company’s outstanding balance of1-4 family residential mortgage loans totaled $1.429 billion equal to 15.90% of total loans outstanding.

Business Banking Loans. Business banking loans consist of loans to small businesses with exposures of under $1 million and small investment real estate projects with exposures of under $3 million. The business banking loan portfolio includes loans that are guaranteed by the U.S. Small Business Administration (“SBA”), which are originated through the SBA 7(a) loan program. As of December 31, 2019, the Company’s outstanding balance of business banking loans totaled $771.5 million equal to 8.58% of total loans outstanding and consisted of $229 million of commercial business loans and $542 million of commercial real estate loans.

Home Equity Lines of Credit. The Company’s1-4 family lending activities include home equity lines of credit. Home equity lines of credit are indexed to the prime rate as published inThe Wall Street Journal and are offered for terms of up to a ten year draw period followed by a repayment term of 15 years. The Company will originate home equity lines of credit up to a maximum LTV ratio of 80%, inclusive of other liens on the property. As of December 31, 2019, the Company’s outstanding balance of home equity lines of credit totaled $933.1 million equal to 10.38% of total loans receivable.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.15 |

Commercial Construction Loans. Construction loans originated by the Company consist of loans to finance the construction and development of1-4 family residences and commercial real estate properties. Most of the commercial construction loan portfolio consists of commercial real estate properties. The Company also originates loans on unimproved land for purposes of development. Commercial construction loans are generally originated for terms of up to 36 months and are generally offered up to a maximum LTV ratio of 75% of the appraised market value upon completion of the project. As of December 31, 2019, the Company’s outstanding balance of commercial construction loans totaled $273.6 million equal to 3.04% of total loans outstanding and included $18.5 million of land development loans.

Consumer Loans. Consumer lending other than home equity lines of credit has been somewhat of a limited area of lending diversification for the Company, with such loans consisting primarily of automobile loans originated through the Company’s indirect automobile loan program. The Company exited its indirect auto lending program in 2018. The balance of the consumer loan portfolio consists of other types of installment loans, personal loans and unsecured lines of credit. As of December 31, 2019, the Company held $402.4 million of consumer loans equal to 4.48% of total loans outstanding.

Asset Quality

A healthy regional economy and the Company’s emphasis on lending in local markets have supported maintenance of relatively favorable credit quality measures. Over the past five years, Eastern Bankshares’ balance ofnon-performing assets ranged from a low of $18.5 million, or 0.17% of assets, at yearend 2017 to a high of $43.8 million, or 0.38% of assets, at yearend 2019. As shown in ExhibitI-11,non-performing assets at December 31, 2019 consisted of $42.5 million ofnon-accruing loans and $1.3 million of accruing loans past due 90 days or more. Most of the increase in the balance ofnon-performing loans since yearend 2017 was primarily due to an increase innon-accruing commercial loans, which increased from $10.3 million at yearend 2017 to $34.1 million at yearend 2019. The substantial portion of the increase innon-accruing commercial loans was related to a $16.0 million SNC participation, which became anon-performing loan in 2019.

To track the Company’s asset quality and the adequacy of valuation allowances, the Company has established detailed asset classification policies and procedures which are consistent with regulatory guidelines. Classified assets are reviewed monthly by senior management and the Board. Pursuant to these procedures, when needed, the Company establishes additional valuation allowances to cover anticipated losses in classified ornon-classified assets. As of December 31, 2019, the Company maintained loan loss allowances of $82.3 million equal to 0.92% of total loans receivable and 188.00% ofnon-performing loans.

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.16 |

Funding Composition and Strategy

Deposits have consistently served as the Company’s primary funding source and at December 31, 2019 deposits accounted for 97.59% of Eastern Bankshares’ combined balance of deposits and borrowings. ExhibitI-12 sets forth the Company’s deposit composition for the past three years. Transaction and savings account deposits constituted 96.55% of total deposits at December 31, 2019, as compared to 95.73% of total deposits at December 31, 2017. The slight increase in the concentration of core deposits comprising total deposits since yearend 2017 was realized through growth of core deposits and a decline in CDs. Since yearend 2017, money market account deposits have been the largest source of core deposit growth for the Company and such deposits comprise the largest concentration of the Company’s core deposits. As of December 31, 2019, money market deposits equaled $7.650 billion, or 82.95% of total core deposits.

The balance of the Company’s deposits consists of CDs, which equaled 3.45% of total deposits at December 31, 2019 compared to 4.27% of total deposits at December 31, 2017. Eastern Bankshares’ current CD composition reflects a higher concentration of short-term CDs (maturities of one year or less). ExhibitI-13 sets forth the maturity schedule of the Company’s jumbo CDs (CD accounts with balances of $100,000 or more). As of December 31, 2019, jumbo CDs amounted to $157.6 million, or 47.89% of total CDs.

Borrowings serve as an alternative funding source for the Company to facilitate management of funding costs and interest rate risk Borrowings totaled $235.4 million at December 31, 2019 and consisted of $201.1 million of federal funds purchased, $19.0 million of FHLB advances and $15.3 million of escrow deposits of borrowers.

Subsidiary Activities

Upon completion of the stock offering, the only entity controlled directly by Eastern Bankshares will be Eastern Bank, which will be a wholly-owned subsidiary. Eastern Bank’s subsidiaries are as follows:

| RP® Financial, LC. | OVERVIEW AND FINANCIAL ANALYSIS | |

| I.17 |

Eastern Insurance Group LLCis a full service insurance agency headquartered in Natick, Massachusetts. Eastern Insurance’s business consists of insurance-related activities acting as an independent agent in offering commercial, personal and employee benefits insurance products to individual and commercial clients. Insurance products include commercial property and liability, workers compensation, life, accident and health and automobile insurance. Eastern Insurance also offer a wide range of employee benefits products and services, including professional advice related to health care cost management, employee engagement and retirement and executive services. As an agency business, Eastern Insurance does not assume any underwriting or insurance risk.

Broadway Securities Corporationis engaged in buying, selling, dealing and holding securities.

Market Street Securities Corporation is engaged in buying, selling, dealing and holding securities.

Real Property Services, Inc.provides real estate services.

Shared Value Investments LLCowns BCC Solar III Investment Fund, LLC, which in turn owns BCC NMTC CDE XXII, LLC, a company that invests in a solar community development entity (CDE) that is considered a variable interest entity (VIE). The CDE is considered a VIE because as a group, the holders of the equity investment at risk lack any of the characteristics of a controlling financial interest. BCC NMTC CDE XXII, LLC is considered the primary beneficiary of the CDE as it has the power to direct the activities of a VIE that most significantly impact the VIEs economic performance and the obligation to absorb losses of and the right to receive benefits from the VIE that potentially could be significant to the VIE.

Legal Proceedings

The Company is not currently party to any pending legal proceedings that the Company’s management believes would have a material adverse effect on the Company’s financial condition, results of operations or cash flows.

| RP® Financial, LC. | MARKET AREA | |

| II.1 |

II. MARKET AREA

Introduction

Eastern Bankshares serves the Boston metropolitan area, southeast New Hampshire and southeastern Massachusetts, including the peninsula of Cape Cod through the headquarters office in Boston and 89 full-service branch offices. The Massachusetts branches are located in the counties of Essex (20 offices), Suffolk (10 offices), Middlesex (23 offices), Plymouth (15 offices), Norfolk (9 offices), Barnstable (5 offices) and Bristol (1 office), and the New Hampshire branches are located in the counties of Hillsborough (3 offices), Merrimack (1 office), Rockingham (1 office) and Strafford (1 office). ExhibitII-1 provides information on the Company’s office properties.

With operations in a major metropolitan area, the Company’s competitive environment includes a significant number of thrifts, commercial banks and other financial services companies, some of which have a national presence. The Boston metropolitan area has a highly developed economy, with a relatively high concentration of highly skilled workers who are employed in a number of different industry clusters including healthcare, financial services and technology.

Future growth opportunities for Eastern Bankshares depend in part on the future growth and stability of the national and regional economy, demographic growth trends and the nature and intensity of the competitive environment. These factors have been examined to help determine the growth potential that exists for the Company, the relative economic health of the Company’s market area, and the resultant impact on value.

National Economic Factors

The future success of the Company’s operations is partially dependent upon various national and local economic trends. In assessing national economic trends over the past few quarters, U.S. manufacturing activity for July 2019 declined to an index reading of 51.2, which was its lowest reading in nearly three years. The downward trend in service sector activity also continued in July, based on an index reading of 53.7. Job growth slowed to 164,000 jobs in July, while the July unemployment rate remained at 3.7%. In a sign that lower mortgage rates were starting to spur home buying, existing home sales rose 2.5% in July. However, July new home sales were down 12.8%. Manufacturing activity for August contracted for the first time in three years with an index reading of 49.1. Comparatively, service sector activity for August

| RP® Financial, LC. | MARKET AREA | |

| II.2 |

accelerated to an index reading 56.4. Job growth continued to slow in August, as the U.S. economy added 130,000 jobs in August and the August unemployment rate remained at 3.7%. Existing home sales increased 1.3% in August, which was the strongest pace for home sales in nearly a year and a half. New home sales also rebounded in August, increasing 7.1% compared to July. September manufacturing activity contracted further to an index reading of 47.8, which was the lowest level since June 2009. A slowing U.S. economy also impacted service sector activity in September, as September service sector activity expanded at its slowest pace in three years with an index reading of 52.6. The U.S. economy added 136,000 jobs in September, while the September unemployment rate fell to a 50 year low of 3.5%. Existing and new home sales for September declined by 2.2% and 0.7%, respectively. Third quarter GDP slowed to an annualized rate of 1.9% (subsequently revised to 2.1%).

Manufacturing activity contracted for a third straight month in October 2019 with an index reading of 48.3, which was up slightly from September. Comparatively, October service sector activity accelerated to an index reading of 54.7. U.S. employers added 128,000 jobs in October, while the October unemployment rate ticked up to 3.6%. Retail sales for October increased 0.3%. Existing home sales for October climbed 1.9%, versus a 0.7% decline in October new home sales. November manufacturing activity contracted for a fourth straight month, with an index reading of 48.1. November service sector activity continued to expand, although at a slightly lower rate based on an index reading of 53.9. Job growth for November was stronger than expected, as U.S. employers added 266,000 jobs and the November unemployment rate declined to 3.5%. Retail sales for November increased 0.2%. Home sales for November showed apick-up in both existing and new home sales, based on respective increases of 2.7% and 1.3%. Manufacturing activity declined for the fifth consecutive month in December to an index reading of 47.2, which was the lowest reading since the financial crisis. Comparatively, December service sector activity accelerated to an index reading of 55.0. U.S. employers added 145,000 jobs in December and the December unemployment rate held steady at 3.5%. December retail sales showed a healthy increase of 0.3%. December existing home sales were up 3.6%, while December new home sales slipped 0.4%. Fourth quarter GDP increased at a 2.1% annual rate.

Manufacturing activity for January 2020 expanded for the first time since July 2019, with an index reading of 50.9. January service sector activity also accelerated to an index reading of 55.5, which was its highest reading since August 2019. U.S. employers added 225,000 jobs in January and the unemployment rate for January increased to 3.6%. Low mortgage rates and

| RP® Financial, LC. | MARKET AREA | |

| II.3 |

more housing inventory spurred an 11.8% increase in February existing home sales. February new home sales increased 4.9%, which was an11-month high. Manufacturing activity for February slowed to an index reading of 50.1, while February service sector activity accelerated to a1-year high index reading of 55.5. February’s employment report showed apick-up in hiring, as U.S. employers added 275,000 jobs and the February unemployment rate dropped to 3.5%. Retail sales for February showed a decline of 0.5%. February existing home sales showed a healthy increase of 11.8%, while February new home sales declined 4.4%. The significant impact that theCovid-19 pandemic was having on the U.S. economy was evident in the March data. Manufacturing activity for March fell to an index reading of 49.1, while service sector activity for March slowed to a more than three andone-half year low index reading of 52.5. The U.S. economy shed 701,000 jobs in March and the March unemployment rate jumped to 4.4%. Retail sales for March plunged 8.7%.

In terms of interest rates trends over the past few quarters, the10-year Treasury yield dipped below 2.0% at the start of the third quarter of 2019 and then stabilized at slightly above 2.0% for the balance of July. The Federal Reserve cut its target rate by 0.25% at the end of July, which was its first rate cut since 2008. Treasury yields plummeted to multi-year lows during August, as investor worries that intensifying trade tensions would drag on the economy spurred a flight to safety. Inmid-August, the yield on the10-year Treasury note fell below the yield on the2-year Treasury note for the first time since 2007. A report that manufacturing activity for August shrank for the first time in three years served to push the10-year Treasury yield below 1.50% in early-September. An unexpected increase in producer prices for August contributed to long-term Treasury yields trending higher throughmid-September. The Federal Reserve concluded itsmid-September policy meeting by cutting its target rate by another 0.25%, which was followed by Treasury prices rallying higher through the end of the third quarter.

Growing concerns about the strength of the global economy continued the downward trend in long-term Treasury yields at the beginning of October 2019, which was followed by long-term Treasury yields edging higher into late-October. The favorable employment report for September, along with an improved outlook for the U.S.-China trade talks, were noted factors contributing to the upturn in long-term Treasury yields. Another rate cut by the Federal Reserve and weak manufacturing data pushed Treasury yields lower at the end of October. Treasury yields reversed course and moved higher in the first week of November, as investors gravitated toward more risky investments following the better-than-expected job growth reported for

| RP® Financial, LC. | MARKET AREA | |

| II.4 |

October. Signs of further progress in U.S.-China trade negotiations pushed the10-year Treasury yield above 1.90% going intomid-November, which was its highest yield since July. Long-term Treasury yields drifted lower in the second half of November and the beginning of December, as renewed concerns about the prospect for a U.S.-China trade agreement and manufacturing activity contracting for a fourth straight month in November prompted a flight to safe haven investments. An improving outlook for the U.S. economy pushed the10-year Treasury yield back above 1.90% going into the second half of December, which was followed by a fairly stable interest rate environment in the last two weeks of 2019.