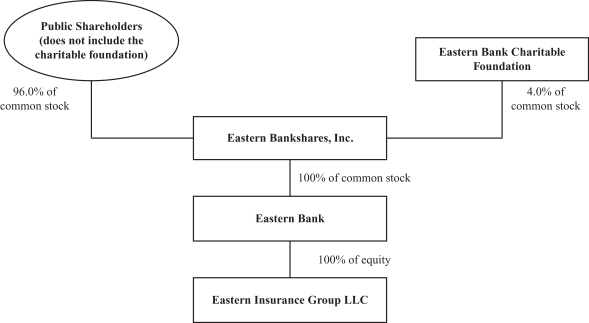

| | (iii) | To our tax-qualified employee benefit plans (including Eastern Bank’s employee stock ownership plan and Eastern Bank’s 401(k) plan which may subscribe for, in the aggregate, up to 10% of the shares of common stock sold in the offering). We expect our employee stock ownership plan to purchase 8% of the shares of our common stock outstanding immediately after the offering (including the shares we donate to the Eastern Bank Charitable Foundation). |

| | (iv) | To employees, officers, directors, trustees and corporators of Eastern Bank, Eastern Bank Corporation or Eastern Insurance Group LLC who are not eligible in the first or second priority. |

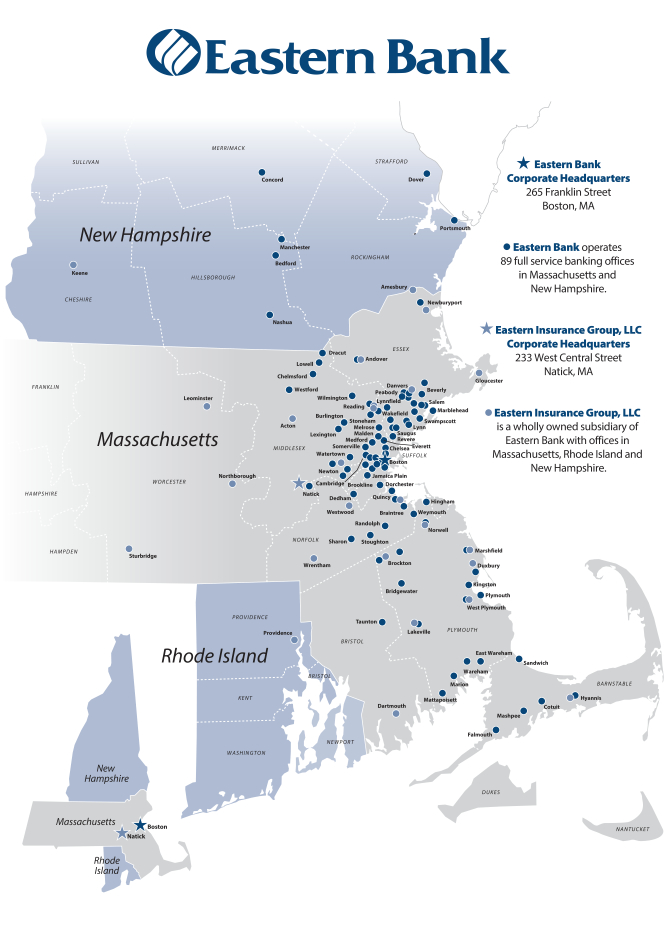

Shares of common stock not purchased in the subscription offering may be offered for sale to the general public in a community offering, with a preference given first to natural persons, and trusts of natural persons, residing in the following cities and towns:

Massachusetts

Abington, Acton, Acushnet, Amesbury, Andover, Arlington, Avon, Barnstable, Bedford, Belmont, Berkley, Beverly, Billerica, Boston, Bourne, Boxford, Braintree, Bridgewater, Brockton, Brookline, Burlington, Cambridge, Canton, Carlisle, Carver, Chelmsford, Chelsea, Cohasset, Danvers, Dedham, Dighton, Dover, Dracut, Dunstable, Duxbury, East Bridgewater, Easton, Essex, Everett, Fairhaven, Falmouth, Foxborough, Framingham, Freetown, Georgetown, Gloucester, Groton, Groveland, Halifax, Hamilton, Hanover, Hanson, Haverhill, Hingham, Holbrook, Hull, Ipswich, Kingston, Lakeville, Lawrence, Lexington, Lincoln, Littleton, Lowell, Lynn, Lynnfield, Malden, Manchester-by-the-Sea, Mansfield, Marblehead, Marion, Marshfield, Mashpee, Mattapoisett, Medford, Melrose, Merrimac, Methuen, Middleborough, Middleton, Milton, Nahant, Natick, Needham, Newbury, Newburyport, Newton, North Andover, North Reading, Norton, Norwell, Norwood, Peabody, Pembroke, Pepperell, Plymouth, Plympton, Quincy, Randolph, Raynham, Reading, Rehoboth, Revere, Rochester, Rockland, Rockport, Rowley, Salem, Salisbury, Sandwich, Saugus, Scituate, Sharon, Sherborn, Somerville, Stoneham, Stoughton, Swampscott, Taunton, Tewksbury, Topsfield, Tyngsborough, Wakefield, Walpole, Waltham, Wareham, Watertown, Wayland, Wellesley, Wenham, West Bridgewater, West Newbury, Westford, Weston, Westwood, Weymouth, Whitman, Wilmington, Winchester, Winthrop, Woburn and Yarmouth.

New Hampshire

Amherst, Atkinson, Auburn, Barrington, Bedford, Boscawen, Bow, Brentwood, Candia, Canterbury, Chester, Chichester, Concord, Danville, Derry, Dover, Durham, East Kingston, Epping, Exeter, Fremont, Goffstown, Hampstead, Hampton, Hampton Falls, Hollis, Hooksett, Hopkinton, Hudson, Kensington, Kingston, Lee, Litchfield, Londonderry, Loudon, Madbury, Manchester, Merrimack, Nashua, New Boston, New Castle, Newfields, Newington, Newmarket, Newton, North Hampton, Pelham, Pembroke, Plaistow, Portsmouth, Raymond, Rochester, Rollinsford, Rye, Salem, Sandown, Seabrook, Somersworth, South Hampton, Stratham, Webster, Warner and Windham.

The community offering may occur either concurrently with or after the subscription offering.

We also may offer for sale shares of common stock not purchased in the subscription offering and the community offering through a syndicated offering. J.P. Morgan Securities LLC and Keefe, Bruyette & Woods, Inc. will act as joint book-running managers for the syndicated offering, if any.

We have the right to accept or reject, in our sole discretion, orders received in the community offering or syndicated offering, and our interpretation of the terms and conditions of the Plan of Conversion will be final. Any determination to accept or reject stock orders in the community offering or syndicated offering will be based on the facts and circumstances available to management at the time of the determination.

If we receive orders for more shares than we are offering, we may not be able to fully or partially fill your order. A detailed description of the subscription offering, the community offering and the syndicated offering, as well as a discussion regarding allocation procedures, can be found in the section of this prospectus titled “The Conversion and Offering.”

Limits on How Much Common Stock You May Purchase

The minimum number of shares of common stock that may be purchased is 25 shares.

Generally, no individual with one or more qualifying accounts or individual exercising subscription rights through a single account held jointly may purchase more than 200,000 shares ($2,000,000) of common stock. If any of the following persons purchase shares of common stock, their purchases, in all categories of the offering, when combined with your purchases, cannot exceed 200,000 shares ($2,000,000) of common stock:

| | • | | most companies, trusts or other entities in which you are a senior officer, partner, trustee or have a substantial beneficial interest; or |