DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 Q1 Earnings Presentation April 28 | 2022 Exhibit 99.2

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 2 On the call Presenter Topic Bob Rivers Opening Remarks Chief Executive Officer & Chair of the Board Jim Fitzgerald FinancialsChief Administrative Officer, Chief Financial Officer & Treasurer

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 3 Forward-looking statements This presentation contains “forward-looking statements” within the meaning of section 27A of the Securities Act of 1933, as amended, and section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. You can identify these statements from the use of the words “may,” “will,” “should,” “could,” “would,” “plan,” “potential,” “estimate,” “project,” “believe,” “intend,” “anticipate,” “expect,” “target” and similar expressions. Forward-looking statements, by their nature, are subject to risks and uncertainties. There are many factors that could cause actual results to differ materially from expected results described in the forward-looking statements. Certain factors that could cause actual results to differ materially from expected results include developments in the Company’s market relating to the COVID-19 pandemic, including the severity and duration of the associated economic slowdown; adverse developments in the level and direction of loan delinquencies and charge-offs and changes in estimates of the adequacy of the allowance for loan losses; increased competitive pressures; changes in the interest rate environment; risks that revenue or expense synergies or the other expected benefits of the Company’s merger with Century (“Transaction”) may not fully materialize for the Company in the timeframe expected or at all, or may be more costly to achieve; risks that the Company is unable to successfully implement integration strategies for the transaction; reputational risks and the reaction of customers to the Transaction; and diversion of management time on Transaction-related issues; as well as general economic conditions or conditions within the securities markets; and legislative and regulatory changes and related compliance costs that could adversely affect the business in which the Company and its subsidiary Eastern Bank are engaged, including inflation, interest rates, interest rate sensitivity and liquidity, including the effect of, and changes in, monetary and fiscal policies and laws, such as the interest rate policies of the Board of Governors of the Federal Reserve System; market and monetary fluctuations, including fluctuations due to actual or anticipated changes to federal tax laws; credit quality, including adverse developments in local or regional real estate markets that decrease collateral values associated with existing loans; and the failure of the Company to execute all of its planned share repurchases. For further discussion of such factors, please see the Company’s most recent Annual Report on Form 10-K and subsequent filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available on the SEC’s website at www.sec.gov. Further, given the ongoing and dynamic nature of the COVID-19 pandemic, it is difficult to predict what continued effects the COVID-19 pandemic will have on the Company's business and results of operations. The COVID-19 pandemic and the related local and national economic disruption may result in a continued decline in demand for the Company's products and services; increased levels of loan delinquencies, problem assets and foreclosures; an increase in the Company's allowance for loan losses; a decline in the value of loan collateral, including real estate; reduced demand for office space in the Company's markets due to remote and/or hybrid work arrangements; a greater decline in the yield on the Company's interest-earning assets than the decline in the cost of the Company's interest-bearing liabilities; and increased cybersecurity risks, as employees continue to work remotely. Accordingly, you should not place undue reliance on forward-looking statements, which reflect the Company's expectations only as of the date of this presentation. The Company does not undertake any obligation to update forward-looking statements.

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 4 Non-GAAP financial measures used in this presentation are denoted by an asterisk. A non-GAAP financial measure is defined as a numerical measure of the Company’s historical or future financial performance, financial position or cash flows that excludes (or includes) amounts, or is subject to adjustments that have the effect of excluding (or including) amounts that are included in the most directly comparable measure calculated and presented in accordance with accounting principles generally accepted in the United States (“GAAP”) in the Company’s statement of income, balance sheet or statement of cash flows (or equivalent statements). The Company presents non-GAAP financial measures, which management uses to evaluate the Company’s performance, and which exclude the effects of certain transactions that management believes are unrelated to its core business and are therefore not necessarily indicative of its current performance or financial position. Management believes excluding these items facilitates greater visibility for investors into the Company’s core businesses as well as underlying trends that may, to some extent, be obscured by inclusion of such items in the corresponding GAAP financial measures. There are items in the Company’s financial statements that impact its financial results, but which management believes are unrelated to the Company’s core business. Accordingly, the Company presents noninterest income on an operating basis, total operating revenue, noninterest expense on an operating basis, operating net income, operating earnings per share, operating return on average assets, operating return on average shareholders’ equity, the operating efficiency ratio, and the ratio of noninterest income to total revenue on an operating basis. Each of these figures excludes the impact of such applicable items because management believes such exclusion can provide greater visibility into the Company’s core business and underlying trends. Such items that management does not consider to be core to the Company’s business include (i) income and expenses from investments held in rabbi trusts, (ii) gains and losses on sales of securities available for sale, net, (iii) gains and losses on the sale of other assets, (iv) rabbi trust employee benefits, (v) impairment charges on tax credit investments and associated tax credit benefits, (vi) expenses indirectly associated with the Company’s initial public offering (“IPO”), (vii) other real estate owned (“OREO”) gains, (viii) merger and acquisition expenses, (ix) the stock donation to the Eastern Bank Foundation (“EBF”) in connection with the Company’s mutual-to-stock conversion and IPO, and (x) settlement of putative consumer class action litigation matters related to overdraft and non-sufficient funds fees, and associated settlement expenses. The Company does not provide an outlook for its total noninterest income and total noninterest expense because each contains income or expense components, as applicable, such as income associated with rabbi trust accounts and rabbi trust employee benefit expense, which are market-driven, and over which the Company cannot exercise control. Accordingly, reconciliations of the Company’s outlook for its noninterest income on an operating basis and its noninterest expense on an operating basis to an outlook for total noninterest income and total noninterest expense, respectively, cannot be made available without unreasonable effort. Management presents certain asset quality metrics excluding PPP loans which it does not consider to be part of the Company’s core portfolio. These metrics include the ratio of total nonperforming loans to total loans excluding PPP loans, the ratio of the allowance for loan losses to total loans excluding PPP loans, and the ratio of annualized net charge-offs to average total loans excluding PPP loans. The Company does not provide an outlook for its ratio of the allowance for loan losses to total loans because it contains components, such as the volume of PPP loans which is market-driven, over which the Company cannot exercise control. Accordingly, a reconciliation of the Company’s outlook for its ratio of the allowance for loan losses to total loans to an outlook for its ratio of the allowance for loan losses to total loans excluding PPP loans cannot be made available without unreasonable effort. The Company does not provide an outlook for its ratio of annualized net charge-offs to average total loans because it contains components, such as the volume PPP loans which is market-driven, over which the Company cannot exercise control. Accordingly, a reconciliation of the Company’s outlook for its ratio of annualized net charge-offs to average total loans to an outlook for its ratio of annualized net charge-offs to average total loans excluding PPP loans cannot be made available without unreasonable effort. The Company anticipates that the vast majority of its PPP loans outstanding at March 31, 2022 will be forgiven, and to the extent not forgiven, a PPP loan is intended to be 100% guaranteed by the SBA. Management also presents tangible assets, tangible shareholders’ equity, tangible book value per share, and the ratio of tangible shareholders’ equity to tangible assets, each of which excludes the impact of goodwill and other intangible assets, as management believes these financial measures provide investors with the ability to further assess the Company’s performance, identify trends in its core business and provide a comparison of its capital adequacy to other companies. The Company included the tangible ratios because management believes that investors may find it useful to have access to the same analytical tools used by management to assess performance and identify trends. These non-GAAP financial measures presented in this presentation should not be considered an alternative or substitute for financial results or measures determined in accordance with GAAP or as an indication of the Company’s cash flows from operating activities, a measure of its liquidity position or an indication of funds available for its cash needs. An item which management considers to be non-core and excludes when computing these non-GAAP measures can be of substantial importance to the Company’s results for any particular period. In addition, management’s methodology for calculating non-GAAP financial measures may differ from the methodologies employed by other banking companies to calculate the same or similar performance measures, and accordingly, the Company’s reported non-GAAP financial measures may not be comparable to the same or similar performance measures reported by other banking companies. Please refer to Appendices A-E for a reconciliations of the Company's GAAP financial measures to the non- GAAP financial measures in this presentation. Non-GAAP financial measures

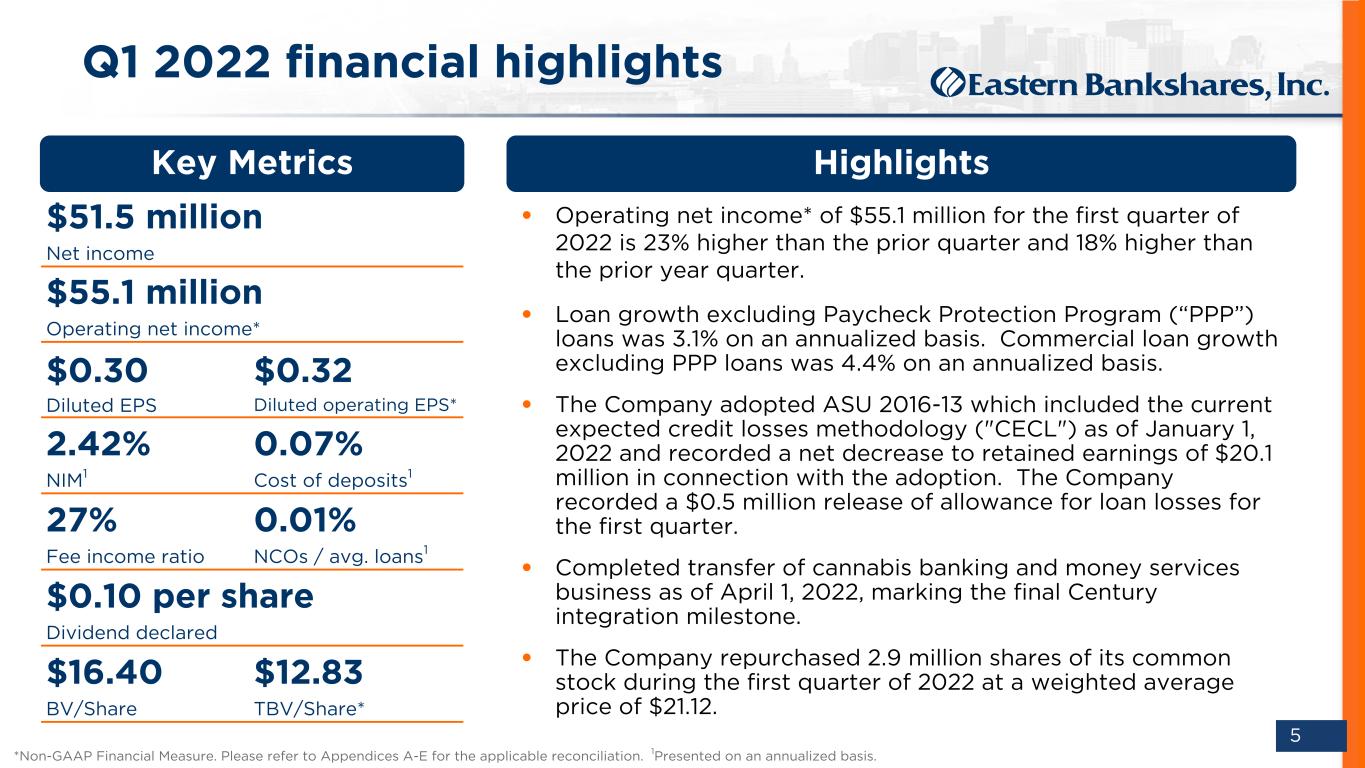

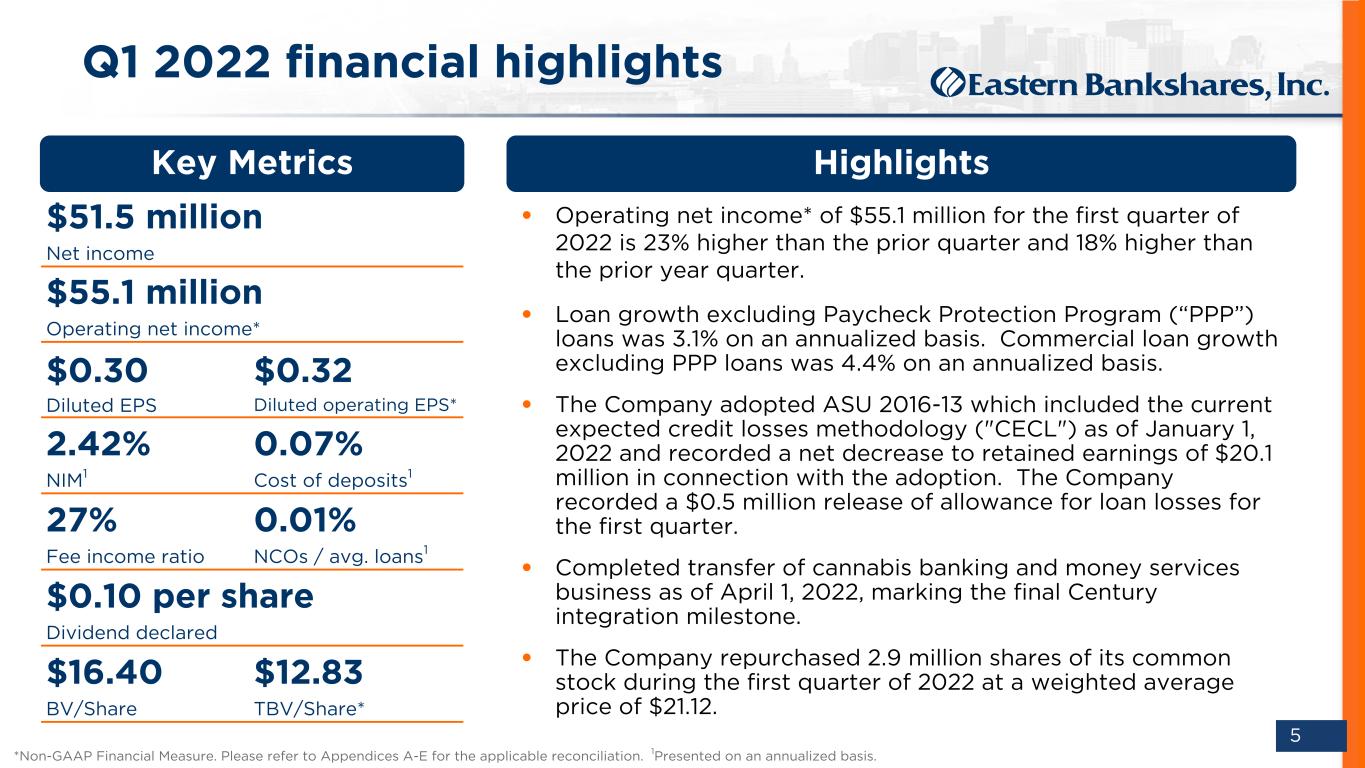

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 5 Q1 2022 financial highlights • Operating net income* of $55.1 million for the first quarter of 2022 is 23% higher than the prior quarter and 18% higher than the prior year quarter. • Loan growth excluding Paycheck Protection Program (“PPP”) loans was 3.1% on an annualized basis. Commercial loan growth excluding PPP loans was 4.4% on an annualized basis. • The Company adopted ASU 2016-13 which included the current expected credit losses methodology ("CECL") as of January 1, 2022 and recorded a net decrease to retained earnings of $20.1 million in connection with the adoption. The Company recorded a $0.5 million release of allowance for loan losses for the first quarter. • Completed transfer of cannabis banking and money services business as of April 1, 2022, marking the final Century integration milestone. • The Company repurchased 2.9 million shares of its common stock during the first quarter of 2022 at a weighted average price of $21.12. *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. 1Presented on an annualized basis. Key Metrics Highlights $0.10 per share Dividend declared $51.5 million Net income $55.1 million Operating net income* $0.30 $0.32 Diluted EPS Diluted operating EPS* $16.40 $12.83 BV/Share TBV/Share* 2.42% 0.07% NIM1 Cost of deposits1 27% 0.01% Fee income ratio NCOs / avg. loans1

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 6 • Net income was $51.5 million in the first quarter. Excluding certain non- recurring items, operating net income* was $55.1 million. • Net interest income was $128.1 million in the first quarter, an increase of $5.7 million, primarily due to increased average earning assets as a result of the Century merger partially offset by lower PPP fee accretion. • Noninterest income was $46.4 million, and $53.3 million on an operating* basis. • Noninterest expense was $108.9 million and $110.9 million on an operating* basis. • Release of allowance for loan losses of $0.5 million for the first quarter. • A tax expense of $14.7 million was recorded in the first quarter, compared to tax benefit of $2.9 million in the prior quarter. $ in millions, except per share amounts Q1 2022 Q4 2021 Q3 2021 Q2 2021 Q1 2021 Net interest income $ 128.1 $ 122.4 $ 102.7 $ 104.6 $ 100.1 Noninterest income 46.4 49.0 43.2 45.7 55.2 Total revenue 174.5 171.4 145.9 150.3 155.3 Noninterest expense 108.9 143.6 99.0 107.3 94.0 Pre-tax, pre-provision income 65.7 27.8 46.9 43.0 61.3 Release of allowance for loan losses (0.5) (4.3) (1.5) (3.3) (0.6) Pre-tax income 66.2 32.2 48.4 46.3 61.8 Income tax expense (benefit) 14.7 (2.9) 11.3 11.5 14.1 Net income $ 51.5 $ 35.1 $ 37.1 $ 34.8 $ 47.7 Operating net income* $ 55.1 $ 44.9 $ 37.4 $ 37.1 $ 46.5 EPS $ 0.30 $ 0.20 $ 0.22 $ 0.20 $ 0.28 Operating EPS* $ 0.32 $ 0.26 $ 0.22 $ 0.22 $ 0.27 ROA1 0.90 % 0.67 % 0.84 % 0.83 % 1.19 % Operating ROA*1 0.96 % 0.86 % 0.86 % 0.89 % 1.15 % Efficiency ratio 62.37 % 83.76 % 67.83 % 71.39 % 60.56 % Operating efficiency ratio* 60.39 % 65.21 % 66.14 % 67.78 % 60.22 % *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. 1Presented on an annualized basis. Income statement

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 7 FTE net interest income and margin*1 Average interest earning assets composition $101,388 $105,877 $104,007 $124,648 $130,385 2.71% 2.69% 2.53% 2.54% 2.42% NII - FTE* NIM - FTE Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 • Net interest income1 increased in the first quarter by $5.7 million, driven primarily by increased average earning assets partially offset by lower PPP fee accretion. • Average interest earning assets increased $2.4 billion reflective of a full quarter as a combined entity with Century. • PPP fees recognized2 were $5.8 million in the first quarter compared to $10.8 million in the prior quarter. • The FTE net interest margin* was 2.42% for the first quarter, representing a 12 basis point decrease from the prior quarter. The prior quarter’s net interest margin benefited from higher PPP fee accretion compared to the first quarter. Net interest margin trends $15,189 $15,759 $16,282 $19,484 $21,855 8,685 8,723 8,879 10,526 11,985 1,132 1,074 649 420 2193,632 4,345 5,250 7,337 8,647 1,741 1,618 1,504 1,201 1,003 Cash & other S.T. investments Investments SBA PPP Loans Net loans, excl. PPP Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 $ in thousands $ in millions *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. 1Presented on a fully tax equivalent (FTE) basis. 2SBA fee accretion, net of deferred cost amortization.

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 8 73% 16% 5% 4%2% Net interest income Insurance commissions Deposit service charges Trust & investment advisory fees Debit card processing fees Noninterest income Noninterest income Fee income provides diverse revenue stream $174.5mm 2022 YTD revenue Noninterest income 27% $55.2 $45.7 $43.2 $49.0 $46.4 $52.2 $41.5 $43.0 $44.5 $53.3 Noninterest income Operating noninterest income* Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 $ in millions *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. $ millions Q1 2022 Q4 2021 Q1 2021 QoQ YoY Insurance commissions 28.7 20.9 28.1 37 % 2 % Deposit service charges 8.5 7.3 5.4 18 % 59 % Trust & investment advisory 6.1 6.5 5.7 (6) % 8 % Debit card processing fees 2.9 3.2 2.7 (7) % 7 % All other 0.1 11.1 13.3 (99) % (99) % Total noninterest income $ 46.4 $ 49.0 $ 55.2 (5) % (16) %

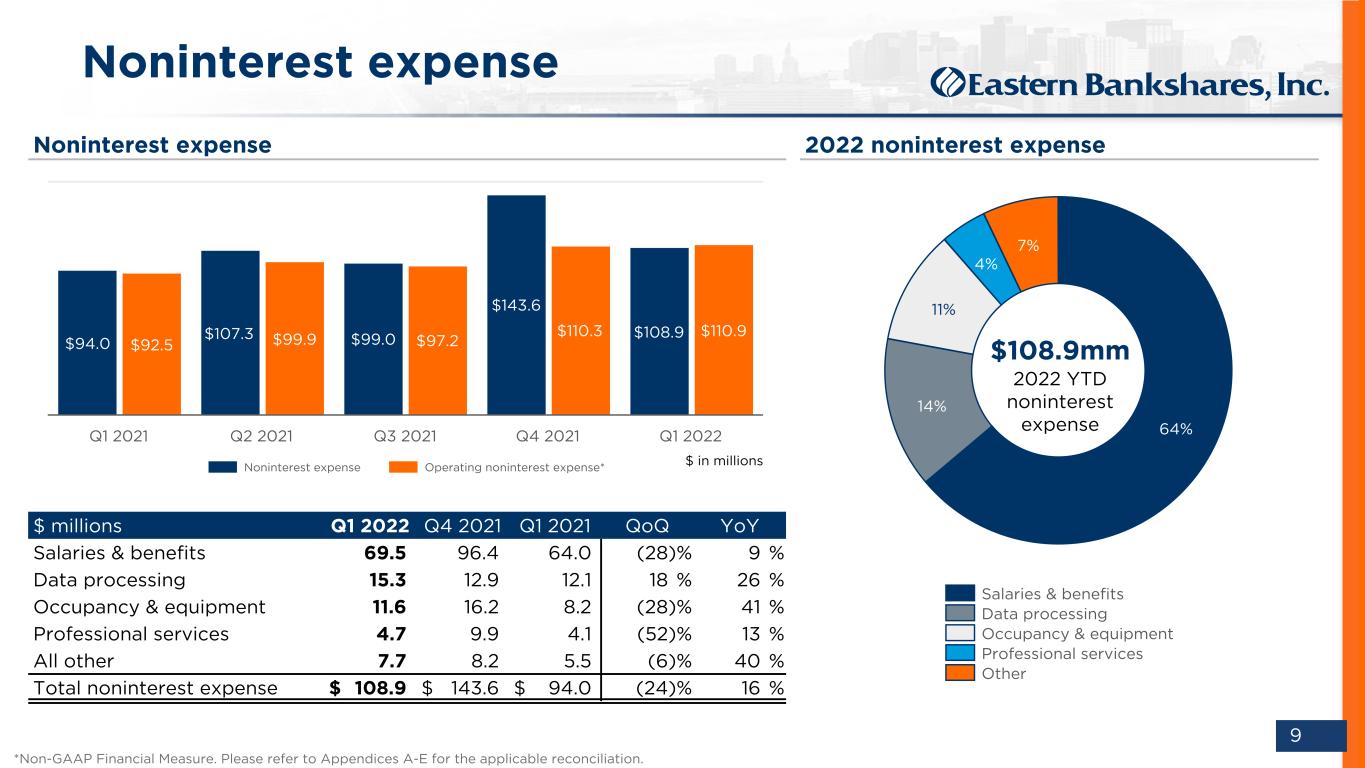

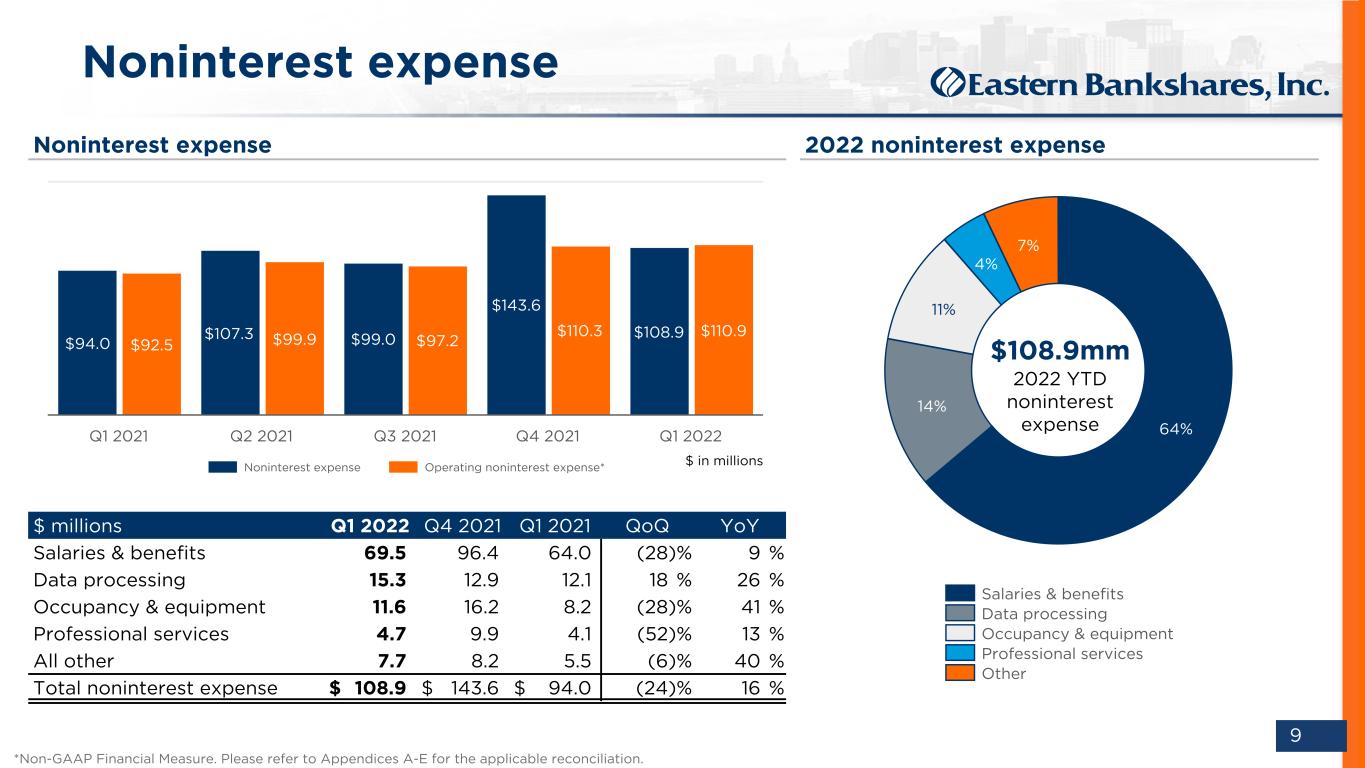

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 9 $94.0 $107.3 $99.0 $143.6 $108.9 $92.5 $99.9 $97.2 $110.3 $110.9 Noninterest expense Operating noninterest expense* Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Noninterest expense Noninterest expense 2022 noninterest expense 64% 14% 11% 4% 7% Salaries & benefits Data processing Occupancy & equipment Professional services Other $108.9mm 2022 YTD noninterest expense *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. $ millions Q1 2022 Q4 2021 Q1 2021 QoQ YoY Salaries & benefits 69.5 96.4 64.0 (28) % 9 % Data processing 15.3 12.9 12.1 18 % 26 % Occupancy & equipment 11.6 16.2 8.2 (28) % 41 % Professional services 4.7 9.9 4.1 (52) % 13 % All other 7.7 8.2 5.5 (6) % 40 % Total noninterest expense $ 108.9 $ 143.6 $ 94.0 (24) % 16 % $ in millions

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 10 Linked Quarter (LQ) Year Over Year (YoY) $ in millions 3/31/2022 12/31/2021 $ % 3/31/2021 $ % Cash and cash equivalents $ 830 $ 1,232 $ (402) (33) % $ 1,860 $ (1,030) (55) % Securities 8,313 8,511 (198) (2) % 3,986 4,327 109 % Loans held for sale 1 1 — — % 2 (1) (50) % Total loans 12,182 12,282 (100) (1) % 9,916 2,266 23 % Allowance for loan losses (124) (98) (26) 27 % (111) (13) 12 % Deferred & unearned (24) (26) 2 (8) % (33) 9 (27) % Net Loans 12,034 12,157 (123) (1) % 9,773 2,261 23 % Goodwill & intangibles 655 650 5 1 % 376 279 74 % Other assets 1,003 961 42 4 % 730 273 37 % Total Assets $ 22,836 $ 23,512 $ (676) (3) % $ 16,727 6,109 37 % Deposits $ 19,393 $ 19,628 $ (235) (1) % $ 12,981 $ 6,412 49 % Borrowings 35 34 1 3 % 29 6 21 % Other liabilities 400 444 (44) (10) % 330 70 21 % Total Liabilities 19,828 20,106 (278) (1) % 13,340 6,488 49 % Shareholders' equity 3,008 3,406 (398) (12) % 3,387 (379) (11) % Total Liabilities & Equity $ 22,836 $ 23,512 $ (676) (3) % $ 16,727 6,109 37 % Equity / assets 13.2 % 14.5 % 20.2 % Tangible equity / tangible assets* 10.6 % 12.1 % 18.4 % • Total assets were $22.8 billion at March 31, 2022 compared to $23.5 billion at end of the prior quarter. • Securities decreased $198 million to $8.3 billion due to lower market values, portfolio sales, and paydowns partially offset by reinvestment. • Total loans decreased $100 million to $12.2 billion. PPP loan paydowns were $190 million and partially offset by loan growth excluding PPP loans of $91 million. • Total deposits decreased $235 million to $19.4 billion due in part to Century repositioning. • Shareholders' equity decreased by $398 million from the prior quarter, reflecting the impact of lower AOCI, share repurchases, and the day 1 CECL adjustment through retained earnings. Balance sheet *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation.

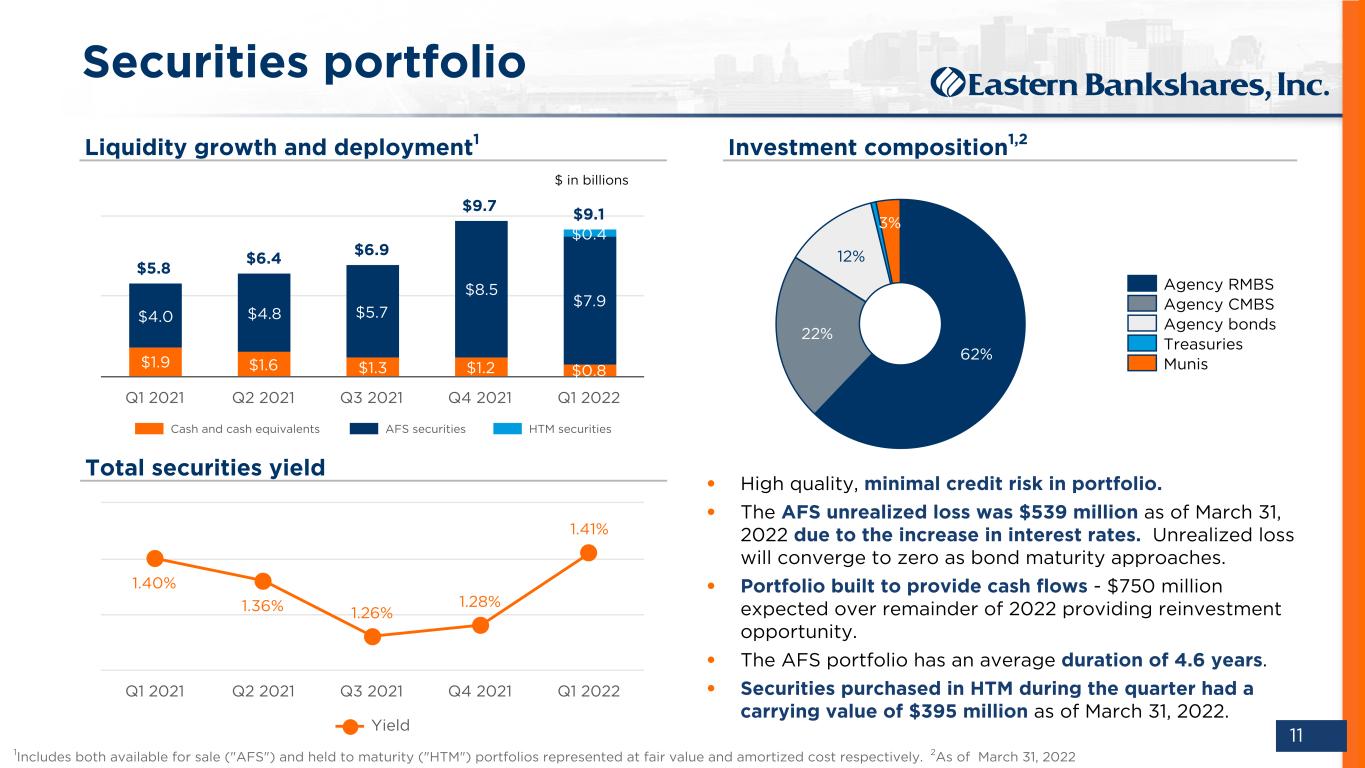

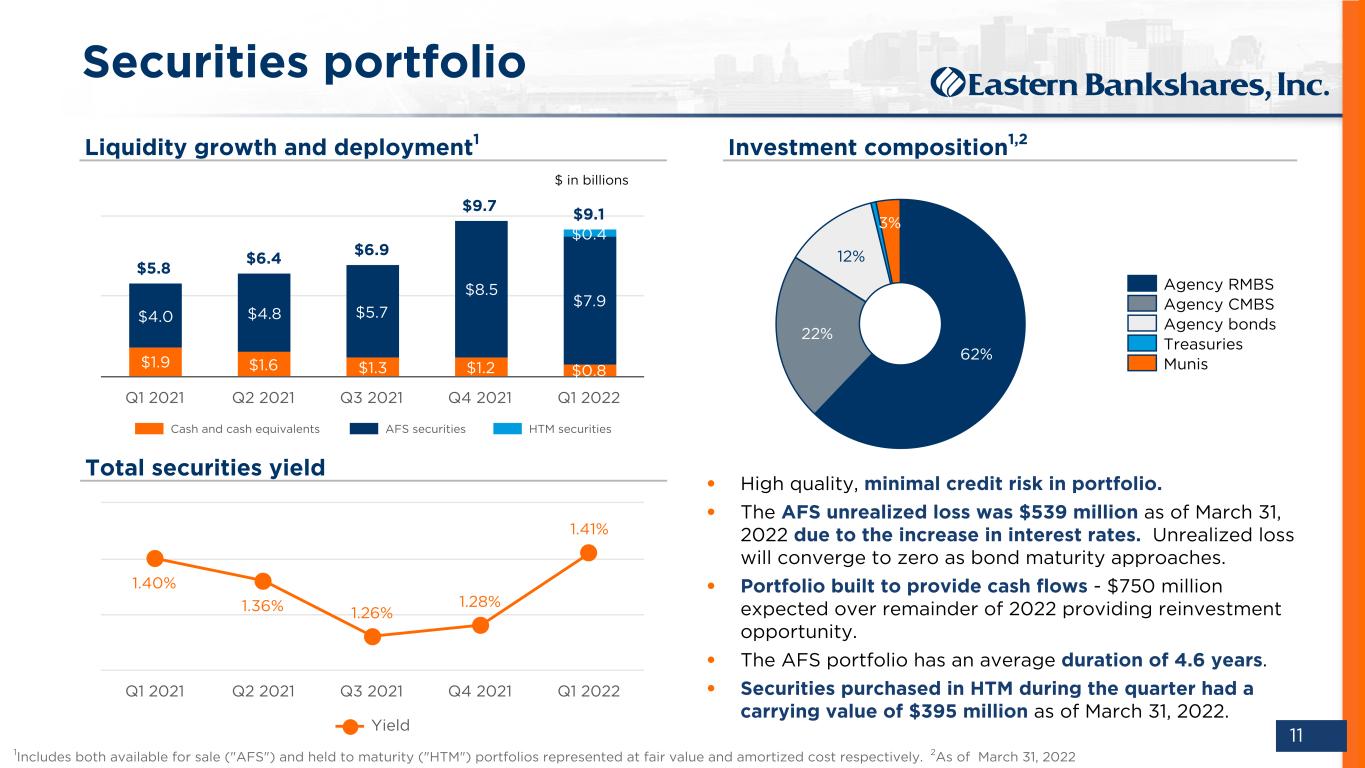

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 11 Securities portfolio Investment composition1,2 $ in billions Liquidity growth and deployment1 Total securities yield • High quality, minimal credit risk in portfolio. • The AFS unrealized loss was $539 million as of March 31, 2022 due to the increase in interest rates. Unrealized loss will converge to zero as bond maturity approaches. • Portfolio built to provide cash flows - $750 million expected over remainder of 2022 providing reinvestment opportunity. • The AFS portfolio has an average duration of 4.6 years. • Securities purchased in HTM during the quarter had a carrying value of $395 million as of March 31, 2022. 62% 22% 12% 3% 0% Agency RMBS Agency CMBS Agency bonds Treasuries Munis 1.40% 1.36% 1.26% 1.28% 1.41% Yield Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 1Includes both available for sale ("AFS") and held to maturity ("HTM") portfolios represented at fair value and amortized cost respectively. 2As of March 31, 2022 $5.8 $6.4 $6.9 $9.7 $9.1 $1.9 $1.6 $1.3 $1.2 $0.8 $4.0 $4.8 $5.7 $8.5 $7.9 $0.4 Cash and cash equivalents AFS securities HTM securities Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022

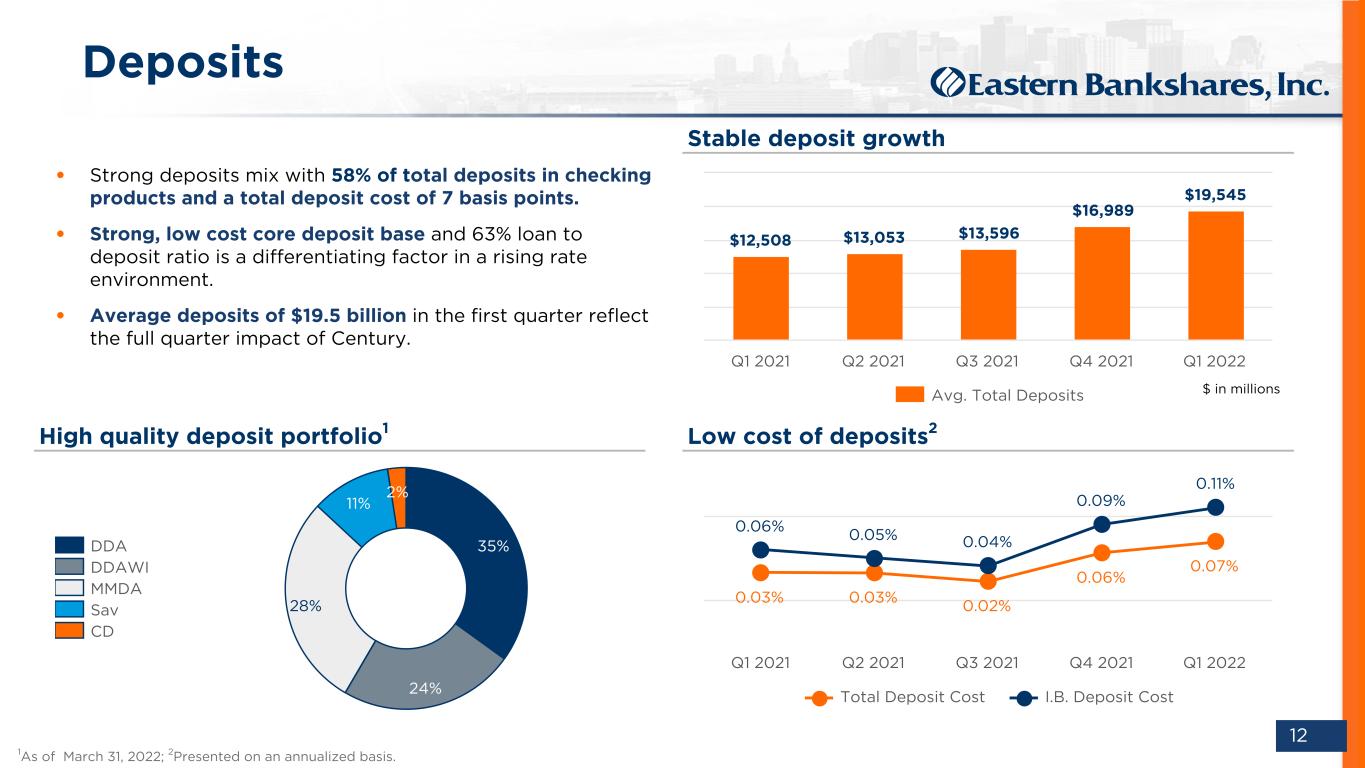

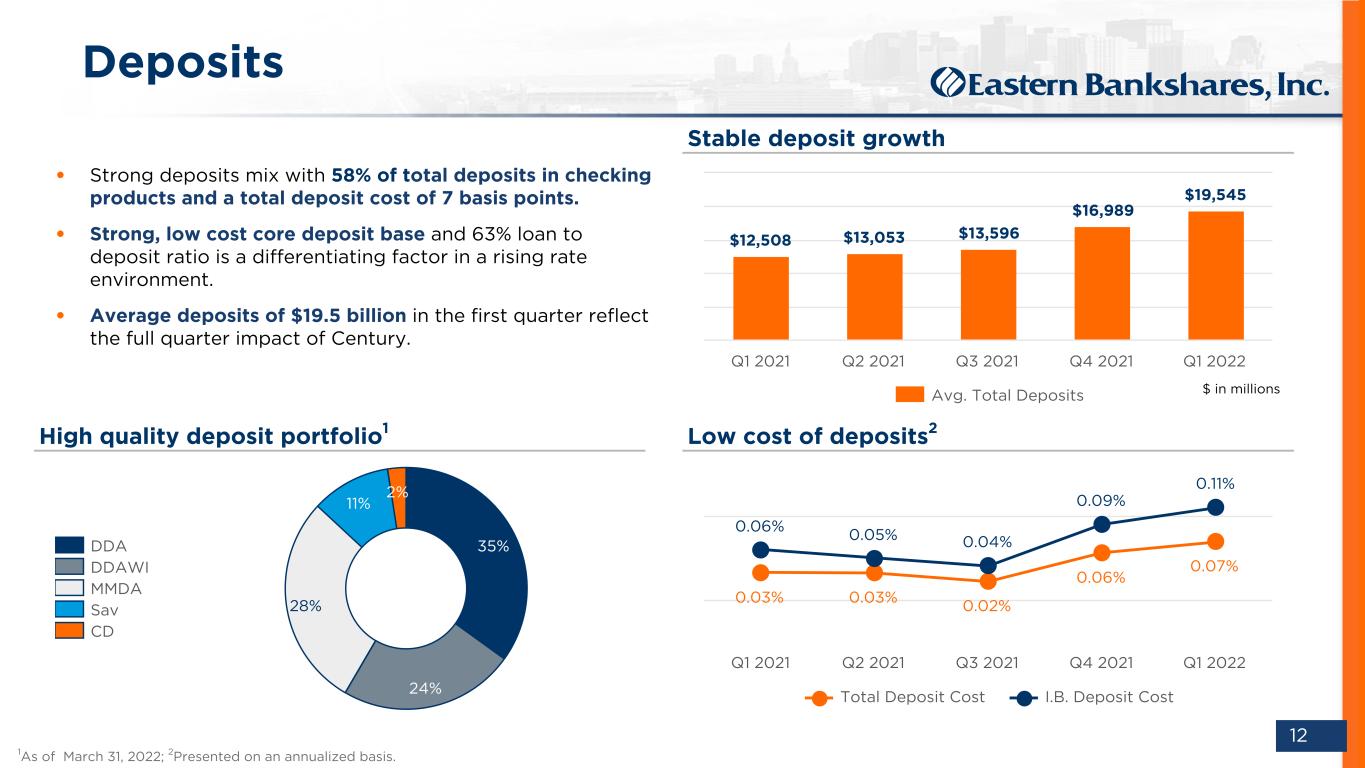

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 12 • Strong deposits mix with 58% of total deposits in checking products and a total deposit cost of 7 basis points. • Strong, low cost core deposit base and 63% loan to deposit ratio is a differentiating factor in a rising rate environment. • Average deposits of $19.5 billion in the first quarter reflect the full quarter impact of Century. Stable deposit growth Low cost of deposits2High quality deposit portfolio1 35% 24% 28% 11% 2% DDA DDAWI MMDA Sav CD $12,508 $13,053 $13,596 $16,989 $19,545 Avg. Total Deposits Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 0.03% 0.03% 0.02% 0.06% 0.07% 0.06% 0.05% 0.04% 0.09% 0.11% Total Deposit Cost I.B. Deposit Cost Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Deposits $ in millions 1As of March 31, 2022; 2Presented on an annualized basis.

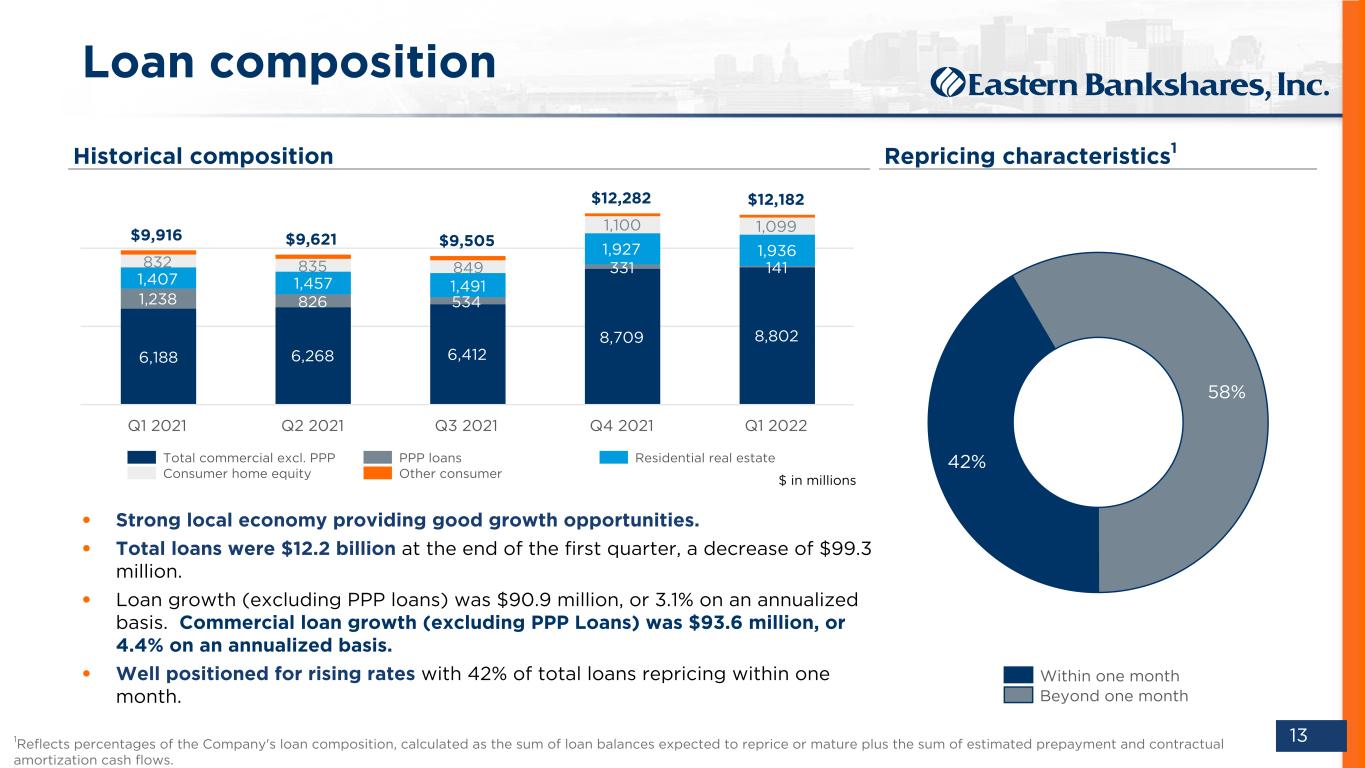

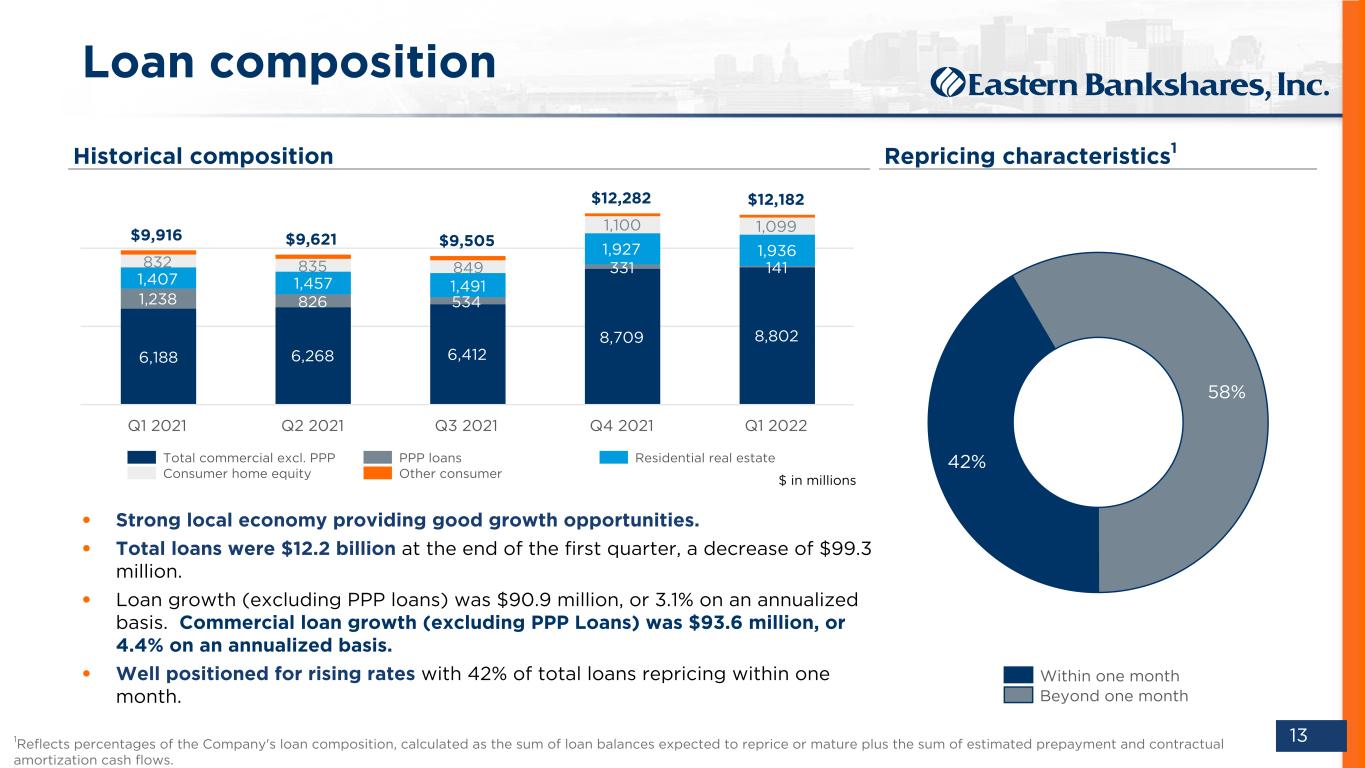

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 13 42% 58% Within one month Beyond one month • Strong local economy providing good growth opportunities. • Total loans were $12.2 billion at the end of the first quarter, a decrease of $99.3 million. • Loan growth (excluding PPP loans) was $90.9 million, or 3.1% on an annualized basis. Commercial loan growth (excluding PPP Loans) was $93.6 million, or 4.4% on an annualized basis. • Well positioned for rising rates with 42% of total loans repricing within one month. Loan composition Repricing characteristics1 $9,916 $9,621 $9,505 $12,282 $12,182 6,188 6,268 6,412 8,709 8,802 1,238 826 534 331 141 1,407 1,457 1,491 1,927 1,936 832 835 849 1,100 1,099 Total commercial excl. PPP PPP loans Residential real estate Consumer home equity Other consumer Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Historical composition $ in millions 1Reflects percentages of the Company's loan composition, calculated as the sum of loan balances expected to reprice or mature plus the sum of estimated prepayment and contractual amortization cash flows.

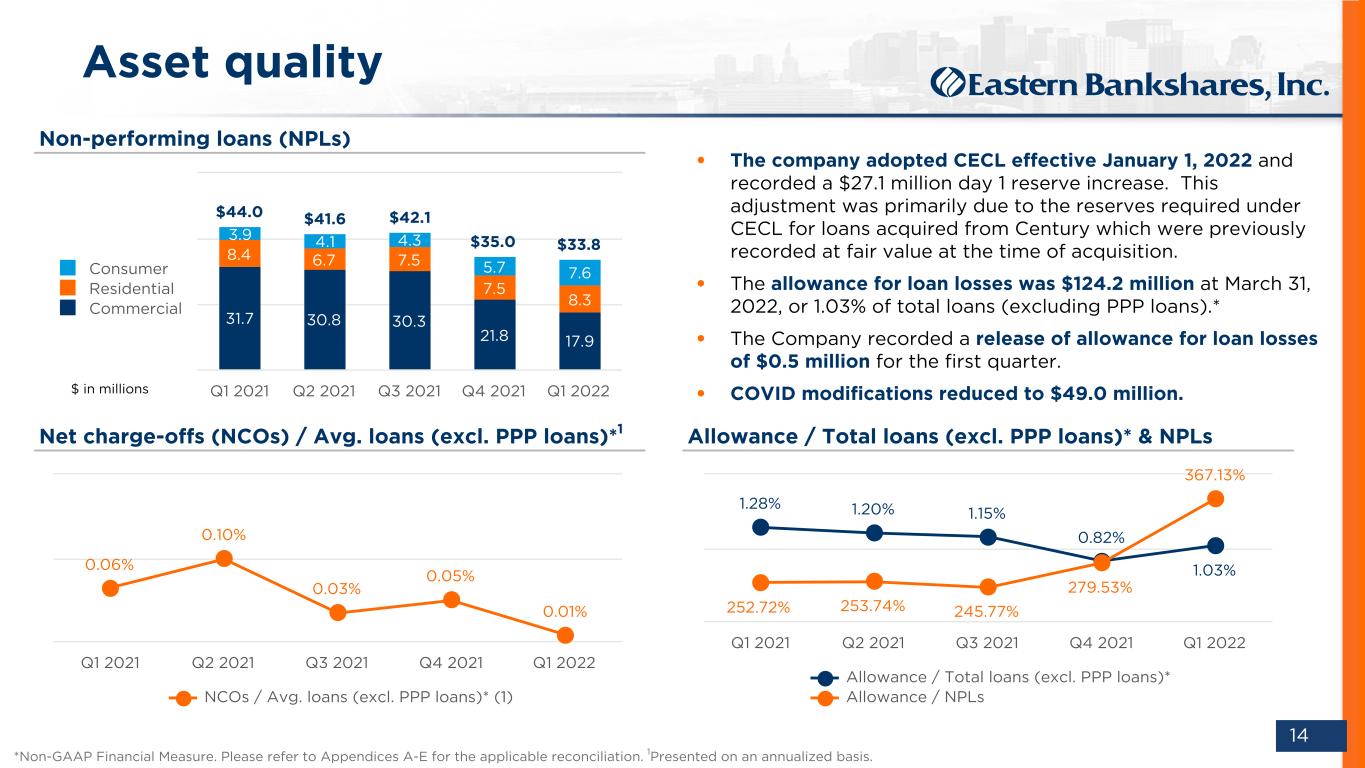

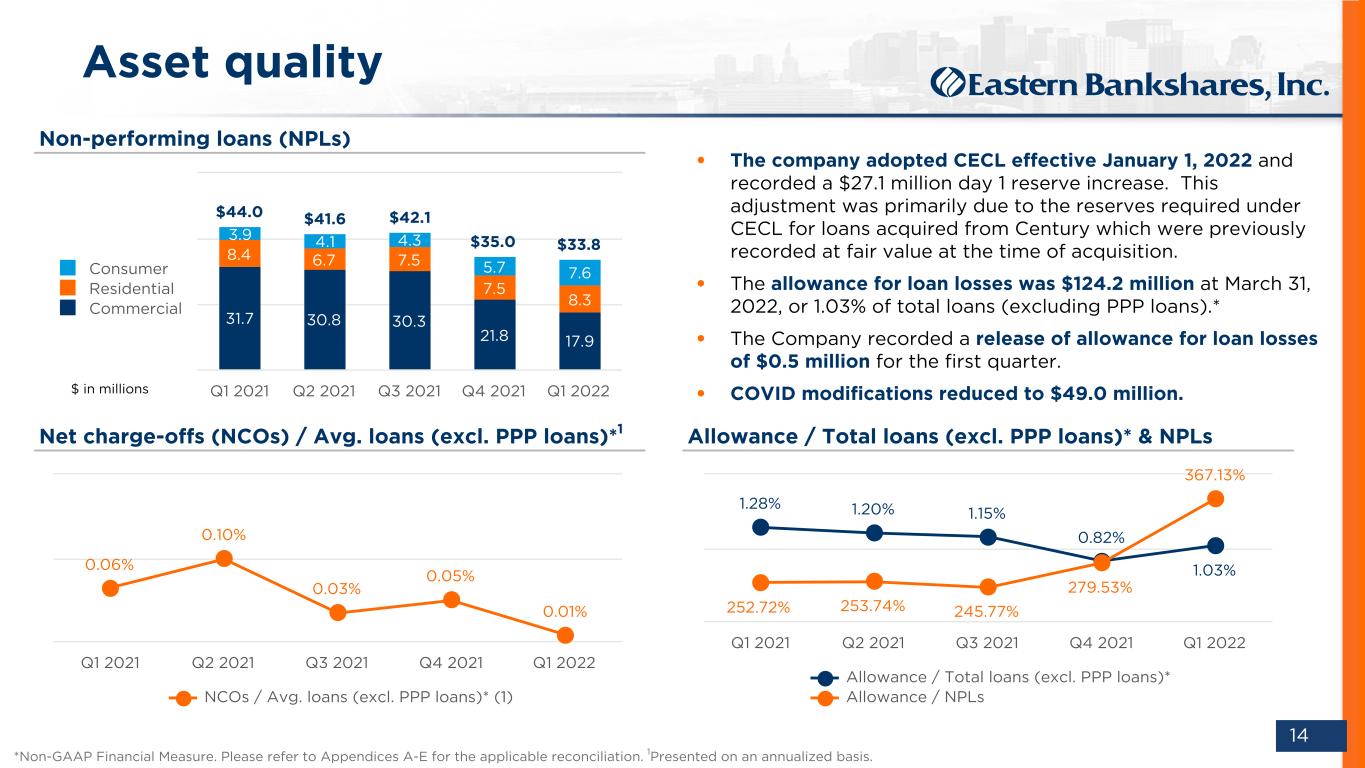

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 14 Net charge-offs (NCOs) / Avg. loans (excl. PPP loans)*1 Non-performing loans (NPLs) Allowance / Total loans (excl. PPP loans)* & NPLs 0.06% 0.10% 0.03% 0.05% 0.01% NCOs / Avg. loans (excl. PPP loans)* (1) Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 1.28% 1.20% 1.15% 0.82% 1.03% 252.72% 253.74% 245.77% 279.53% 367.13% Allowance / Total loans (excl. PPP loans)* Allowance / NPLs Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 $44.0 $41.6 $42.1 $35.0 $33.8 31.7 30.8 30.3 21.8 17.9 8.4 6.7 7.5 7.5 8.3 3.9 4.1 4.3 5.7 7.6Consumer Residential Commercial Q1 2021 Q2 2021 Q3 2021 Q4 2021 Q1 2022 • The company adopted CECL effective January 1, 2022 and recorded a $27.1 million day 1 reserve increase. This adjustment was primarily due to the reserves required under CECL for loans acquired from Century which were previously recorded at fair value at the time of acquisition. • The allowance for loan losses was $124.2 million at March 31, 2022, or 1.03% of total loans (excluding PPP loans).* • The Company recorded a release of allowance for loan losses of $0.5 million for the first quarter. • COVID modifications reduced to $49.0 million. Asset quality *Non-GAAP Financial Measure. Please refer to Appendices A-E for the applicable reconciliation. 1Presented on an annualized basis. $ in millions

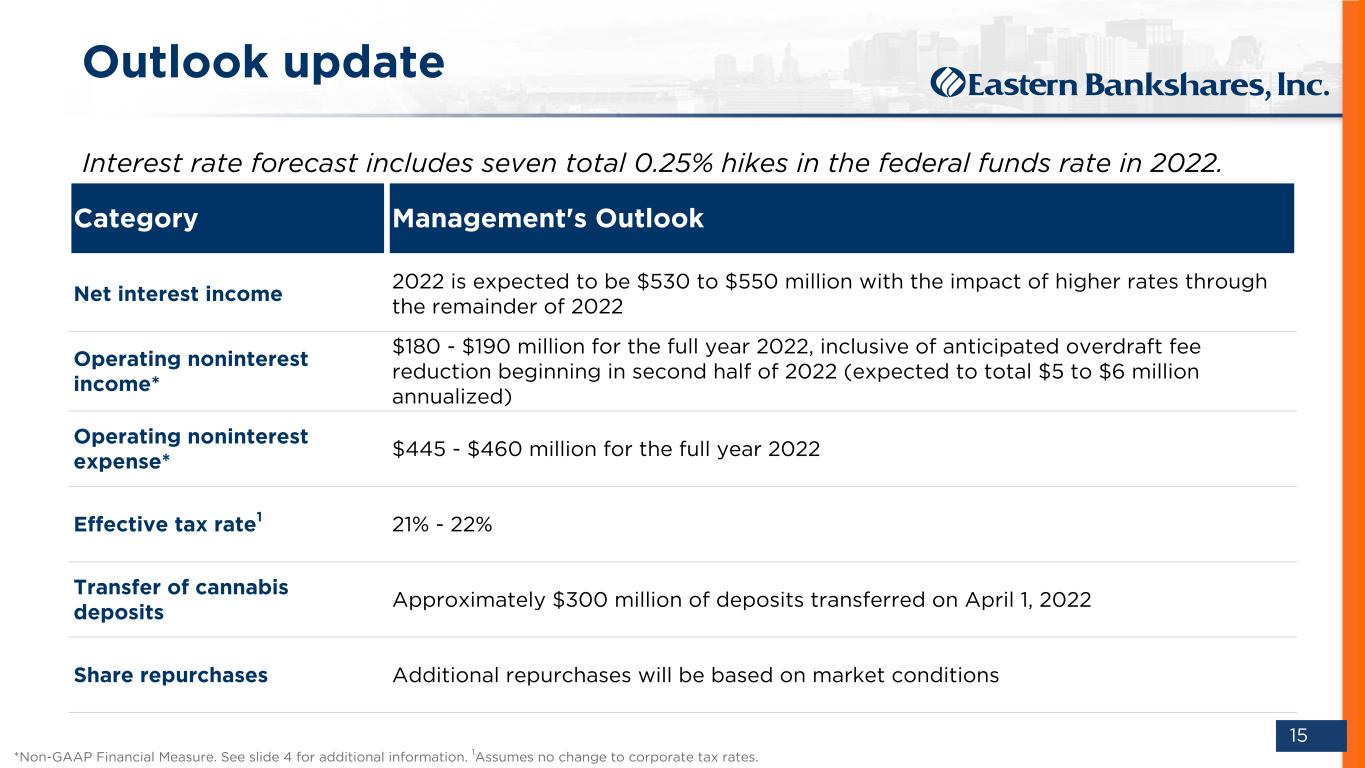

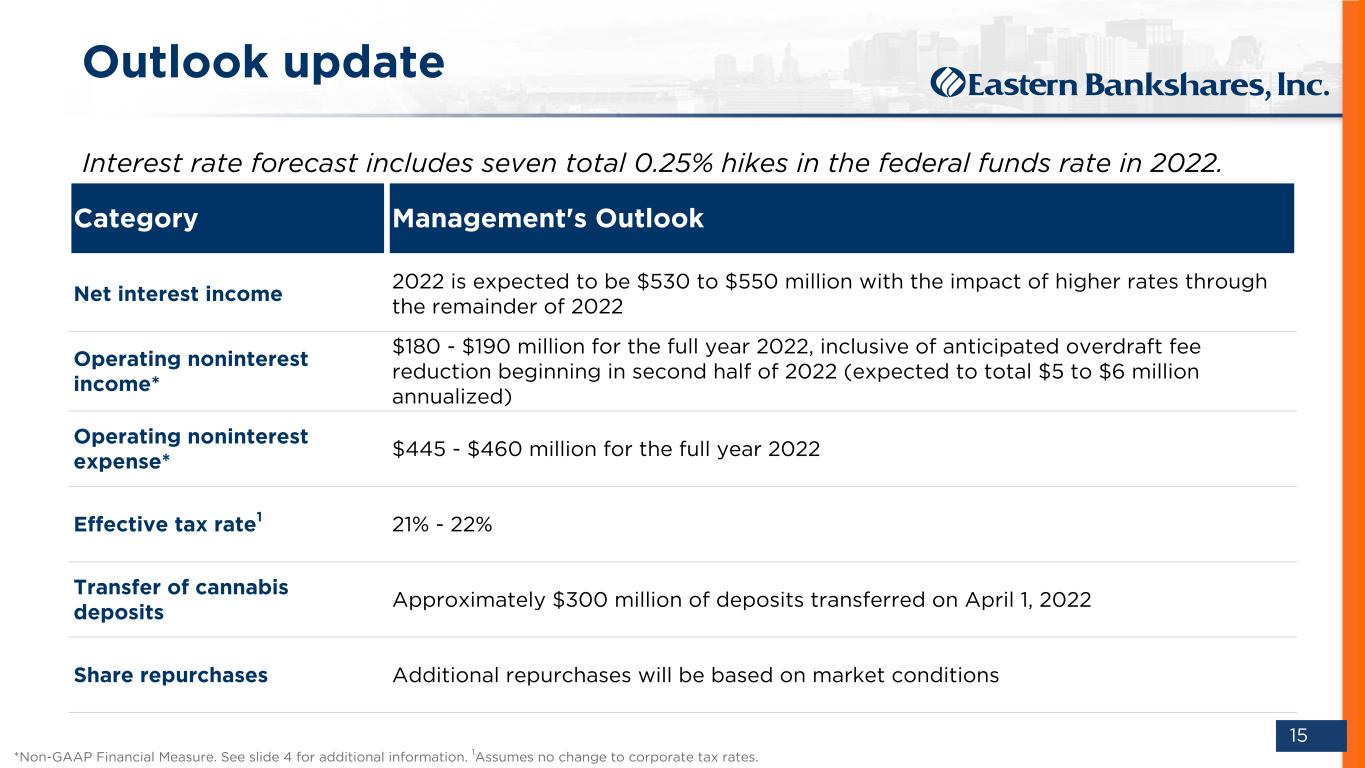

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 15 Outlook update Interest rate forecast includes seven total 0.25% hikes in the federal funds rate in 2022. *Non-GAAP Financial Measure. See slide 4 for additional information. 1Assumes no change to corporate tax rates. Category Management's Outlook Net interest income 2022 is expected to be $530 to $550 million with the impact of higher rates through the remainder of 2022 Operating noninterest income* $180 - $190 million for the full year 2022, inclusive of anticipated overdraft fee reduction beginning in second half of 2022 (expected to total $5 to $6 million annualized) Operating noninterest expense* $445 - $460 million for the full year 2022 Effective tax rate1 21% - 22% Transfer of cannabis deposits Approximately $300 million of deposits transferred on April 1, 2022 Share repurchases Additional repurchases will be based on market conditions

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 Appendix

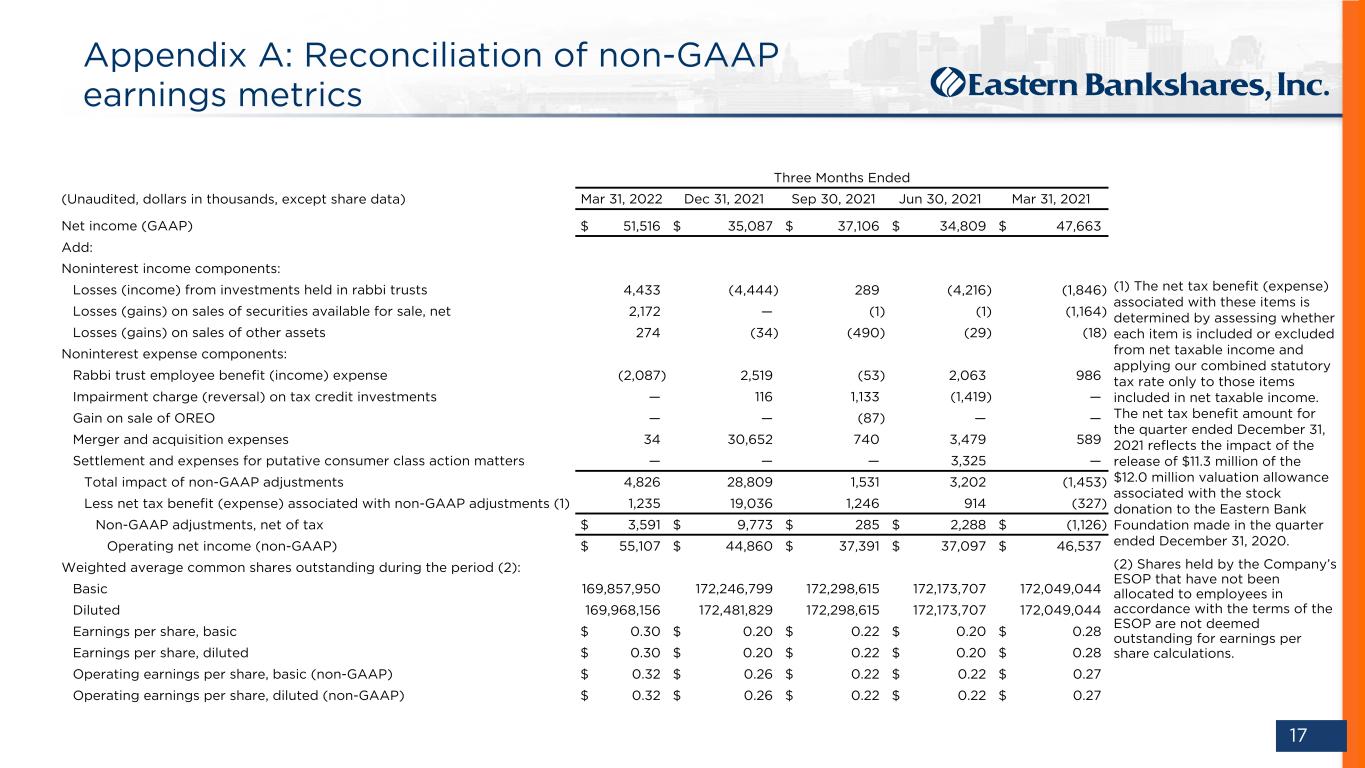

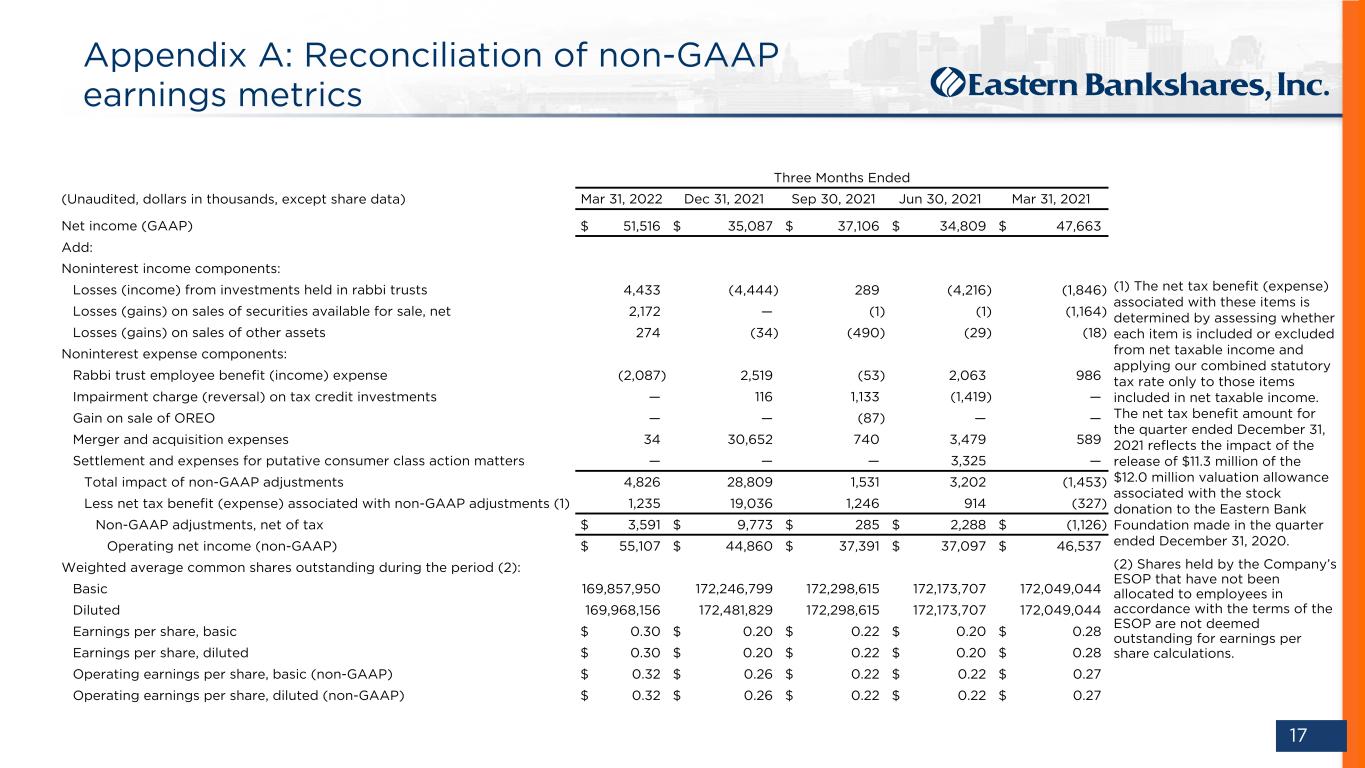

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 17 Appendix A: Reconciliation of non-GAAP earnings metrics (1) The net tax benefit (expense) associated with these items is determined by assessing whether each item is included or excluded from net taxable income and applying our combined statutory tax rate only to those items included in net taxable income. The net tax benefit amount for the quarter ended December 31, 2021 reflects the impact of the release of $11.3 million of the $12.0 million valuation allowance associated with the stock donation to the Eastern Bank Foundation made in the quarter ended December 31, 2020. (2) Shares held by the Company’s ESOP that have not been allocated to employees in accordance with the terms of the ESOP are not deemed outstanding for earnings per share calculations. Three Months Ended (Unaudited, dollars in thousands, except share data) Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 Net income (GAAP) $ 51,516 $ 35,087 $ 37,106 $ 34,809 $ 47,663 Add: Noninterest income components: Losses (income) from investments held in rabbi trusts 4,433 (4,444) 289 (4,216) (1,846) Losses (gains) on sales of securities available for sale, net 2,172 — (1) (1) (1,164) Losses (gains) on sales of other assets 274 (34) (490) (29) (18) Noninterest expense components: Rabbi trust employee benefit (income) expense (2,087) 2,519 (53) 2,063 986 Impairment charge (reversal) on tax credit investments — 116 1,133 (1,419) — Gain on sale of OREO — — (87) — — Merger and acquisition expenses 34 30,652 740 3,479 589 Settlement and expenses for putative consumer class action matters — — — 3,325 — Total impact of non-GAAP adjustments 4,826 28,809 1,531 3,202 (1,453) Less net tax benefit (expense) associated with non-GAAP adjustments (1) 1,235 19,036 1,246 914 (327) Non-GAAP adjustments, net of tax $ 3,591 $ 9,773 $ 285 $ 2,288 $ (1,126) Operating net income (non-GAAP) $ 55,107 $ 44,860 $ 37,391 $ 37,097 $ 46,537 Weighted average common shares outstanding during the period (2): Basic 169,857,950 172,246,799 172,298,615 172,173,707 172,049,044 Diluted 169,968,156 172,481,829 172,298,615 172,173,707 172,049,044 Earnings per share, basic $ 0.30 $ 0.20 $ 0.22 $ 0.20 $ 0.28 Earnings per share, diluted $ 0.30 $ 0.20 $ 0.22 $ 0.20 $ 0.28 Operating earnings per share, basic (non-GAAP) $ 0.32 $ 0.26 $ 0.22 $ 0.22 $ 0.27 Operating earnings per share, diluted (non-GAAP) $ 0.32 $ 0.26 $ 0.22 $ 0.22 $ 0.27

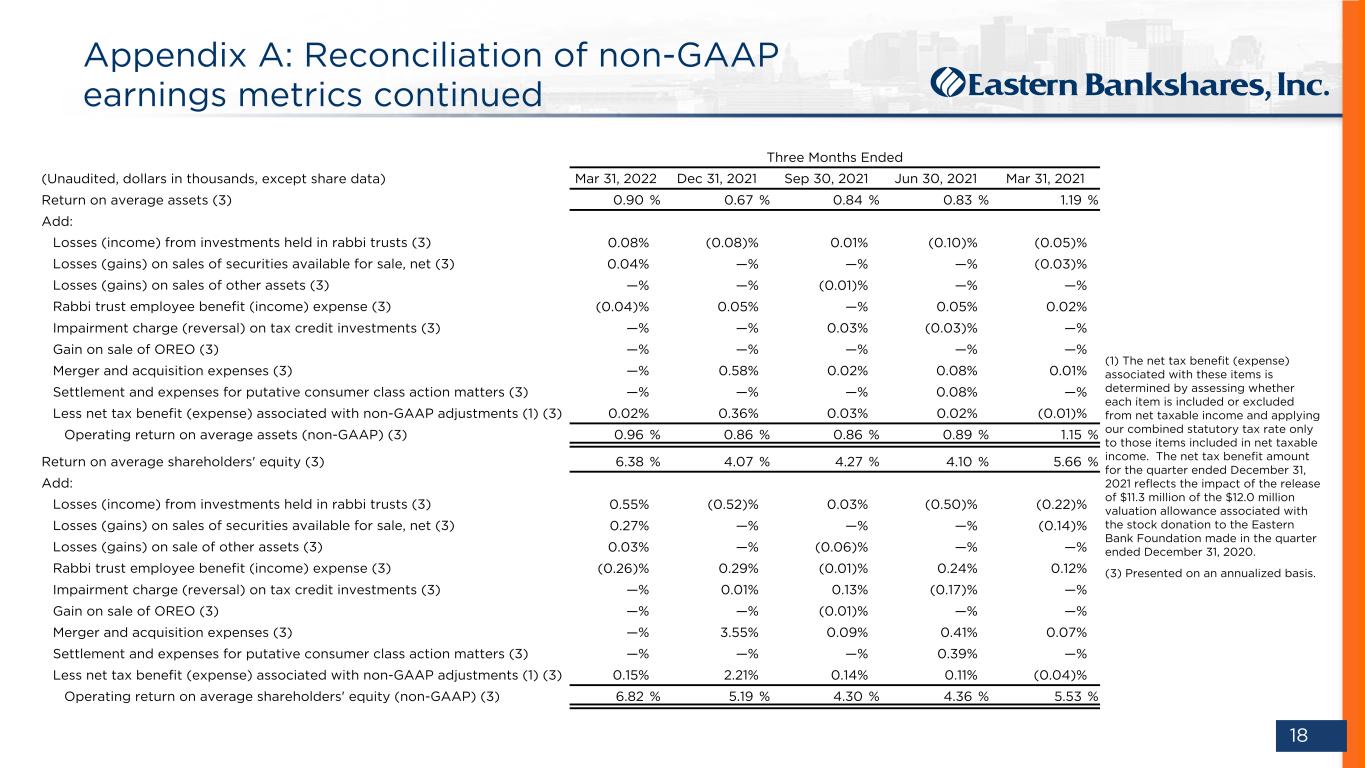

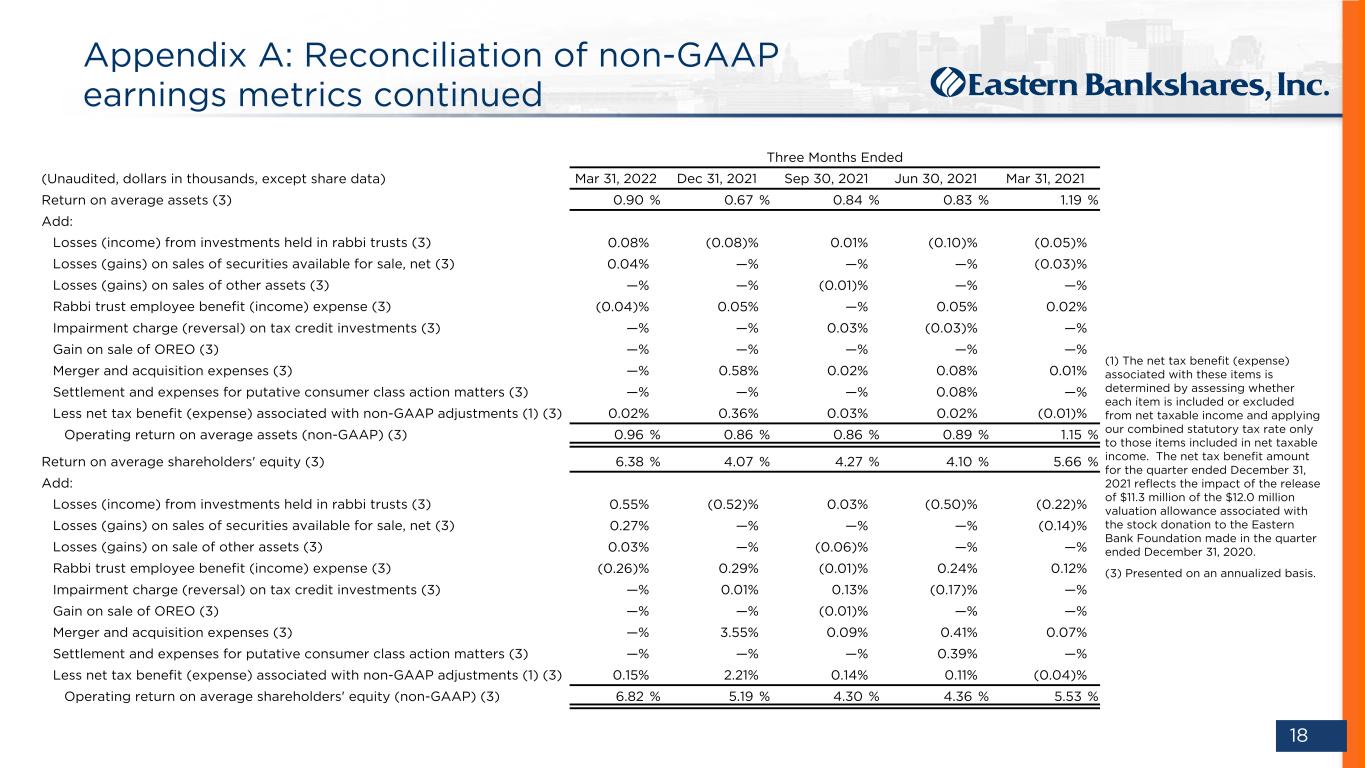

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 18 Appendix A: Reconciliation of non-GAAP earnings metrics continued Three Months Ended (Unaudited, dollars in thousands, except share data) Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 Return on average assets (3) 0.90 % 0.67 % 0.84 % 0.83 % 1.19 % Add: Losses (income) from investments held in rabbi trusts (3) 0.08 % (0.08) % 0.01 % (0.10) % (0.05) % Losses (gains) on sales of securities available for sale, net (3) 0.04 % — % — % — % (0.03) % Losses (gains) on sales of other assets (3) — % — % (0.01) % — % — % Rabbi trust employee benefit (income) expense (3) (0.04) % 0.05 % — % 0.05 % 0.02 % Impairment charge (reversal) on tax credit investments (3) — % — % 0.03 % (0.03) % — % Gain on sale of OREO (3) — % — % — % — % — % Merger and acquisition expenses (3) — % 0.58 % 0.02 % 0.08 % 0.01 % Settlement and expenses for putative consumer class action matters (3) — % — % — % 0.08 % — % Less net tax benefit (expense) associated with non-GAAP adjustments (1) (3) 0.02 % 0.36 % 0.03 % 0.02 % (0.01) % Operating return on average assets (non-GAAP) (3) 0.96 % 0.86 % 0.86 % 0.89 % 1.15 % Return on average shareholders' equity (3) 6.38 % 4.07 % 4.27 % 4.10 % 5.66 % Add: Losses (income) from investments held in rabbi trusts (3) 0.55 % (0.52) % 0.03 % (0.50) % (0.22) % Losses (gains) on sales of securities available for sale, net (3) 0.27 % — % — % — % (0.14) % Losses (gains) on sale of other assets (3) 0.03 % — % (0.06) % — % — % Rabbi trust employee benefit (income) expense (3) (0.26) % 0.29 % (0.01) % 0.24 % 0.12 % Impairment charge (reversal) on tax credit investments (3) — % 0.01 % 0.13 % (0.17) % — % Gain on sale of OREO (3) — % — % (0.01) % — % — % Merger and acquisition expenses (3) — % 3.55 % 0.09 % 0.41 % 0.07 % Settlement and expenses for putative consumer class action matters (3) — % — % — % 0.39 % — % Less net tax benefit (expense) associated with non-GAAP adjustments (1) (3) 0.15 % 2.21 % 0.14 % 0.11 % (0.04) % Operating return on average shareholders' equity (non-GAAP) (3) 6.82 % 5.19 % 4.30 % 4.36 % 5.53 % (1) The net tax benefit (expense) associated with these items is determined by assessing whether each item is included or excluded from net taxable income and applying our combined statutory tax rate only to those items included in net taxable income. The net tax benefit amount for the quarter ended December 31, 2021 reflects the impact of the release of $11.3 million of the $12.0 million valuation allowance associated with the stock donation to the Eastern Bank Foundation made in the quarter ended December 31, 2020. (3) Presented on an annualized basis.

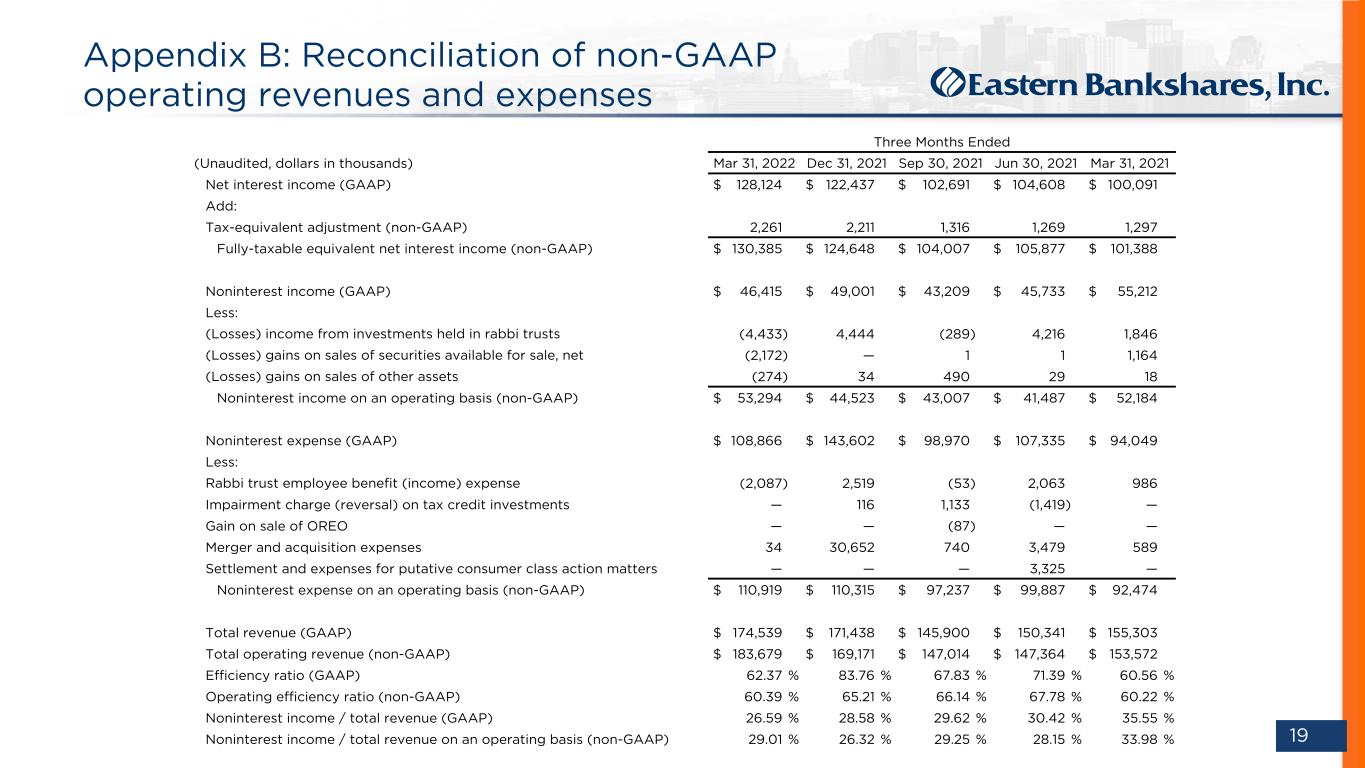

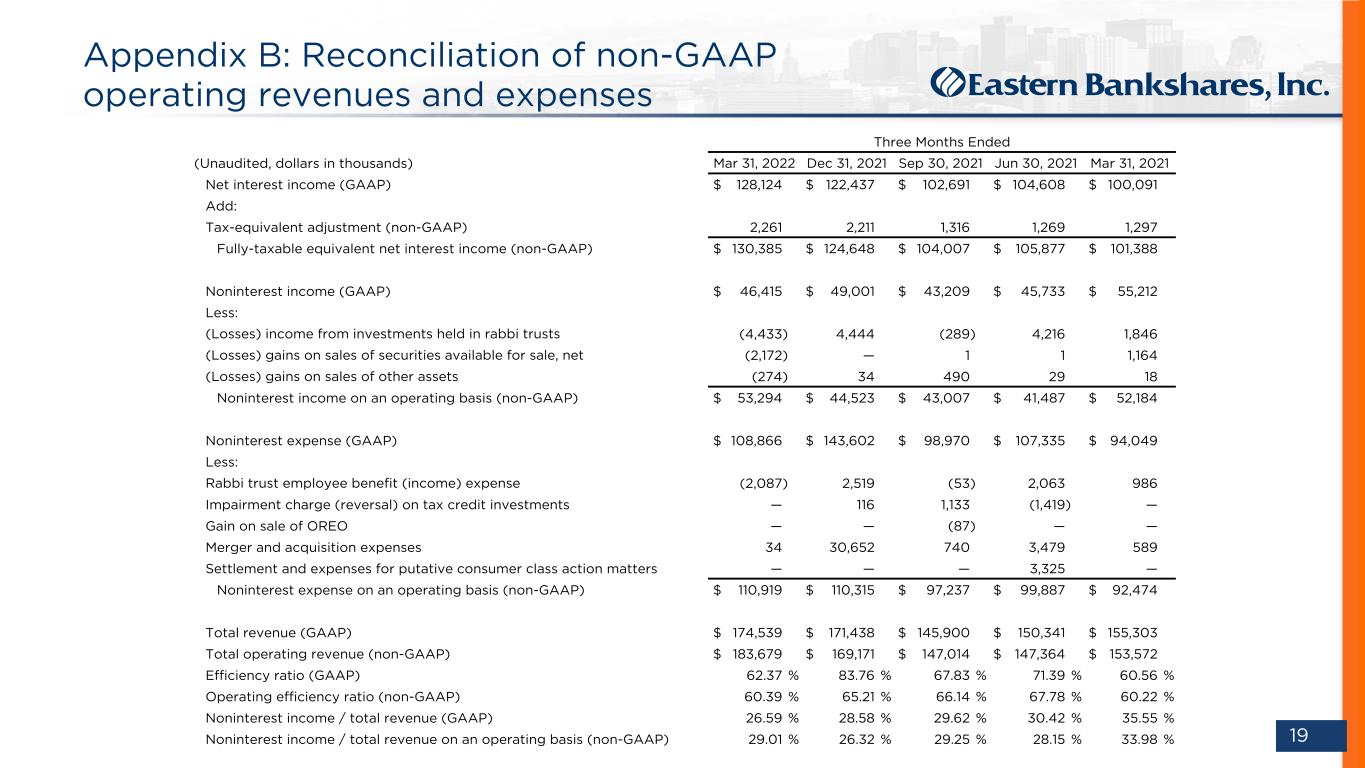

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 19 Appendix B: Reconciliation of non-GAAP operating revenues and expenses Three Months Ended (Unaudited, dollars in thousands) Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 Net interest income (GAAP) $ 128,124 $ 122,437 $ 102,691 $ 104,608 $ 100,091 Add: Tax-equivalent adjustment (non-GAAP) 2,261 2,211 1,316 1,269 1,297 Fully-taxable equivalent net interest income (non-GAAP) $ 130,385 $ 124,648 $ 104,007 $ 105,877 $ 101,388 Noninterest income (GAAP) $ 46,415 $ 49,001 $ 43,209 $ 45,733 $ 55,212 Less: (Losses) income from investments held in rabbi trusts (4,433) 4,444 (289) 4,216 1,846 (Losses) gains on sales of securities available for sale, net (2,172) — 1 1 1,164 (Losses) gains on sales of other assets (274) 34 490 29 18 Noninterest income on an operating basis (non-GAAP) $ 53,294 $ 44,523 $ 43,007 $ 41,487 $ 52,184 Noninterest expense (GAAP) $ 108,866 $ 143,602 $ 98,970 $ 107,335 $ 94,049 Less: Rabbi trust employee benefit (income) expense (2,087) 2,519 (53) 2,063 986 Impairment charge (reversal) on tax credit investments — 116 1,133 (1,419) — Gain on sale of OREO — — (87) — — Merger and acquisition expenses 34 30,652 740 3,479 589 Settlement and expenses for putative consumer class action matters — — — 3,325 — Noninterest expense on an operating basis (non-GAAP) $ 110,919 $ 110,315 $ 97,237 $ 99,887 $ 92,474 Total revenue (GAAP) $ 174,539 $ 171,438 $ 145,900 $ 150,341 $ 155,303 Total operating revenue (non-GAAP) $ 183,679 $ 169,171 $ 147,014 $ 147,364 $ 153,572 Efficiency ratio (GAAP) 62.37 % 83.76 % 67.83 % 71.39 % 60.56 % Operating efficiency ratio (non-GAAP) 60.39 % 65.21 % 66.14 % 67.78 % 60.22 % Noninterest income / total revenue (GAAP) 26.59 % 28.58 % 29.62 % 30.42 % 35.55 % Noninterest income / total revenue on an operating basis (non-GAAP) 29.01 % 26.32 % 29.25 % 28.15 % 33.98 %

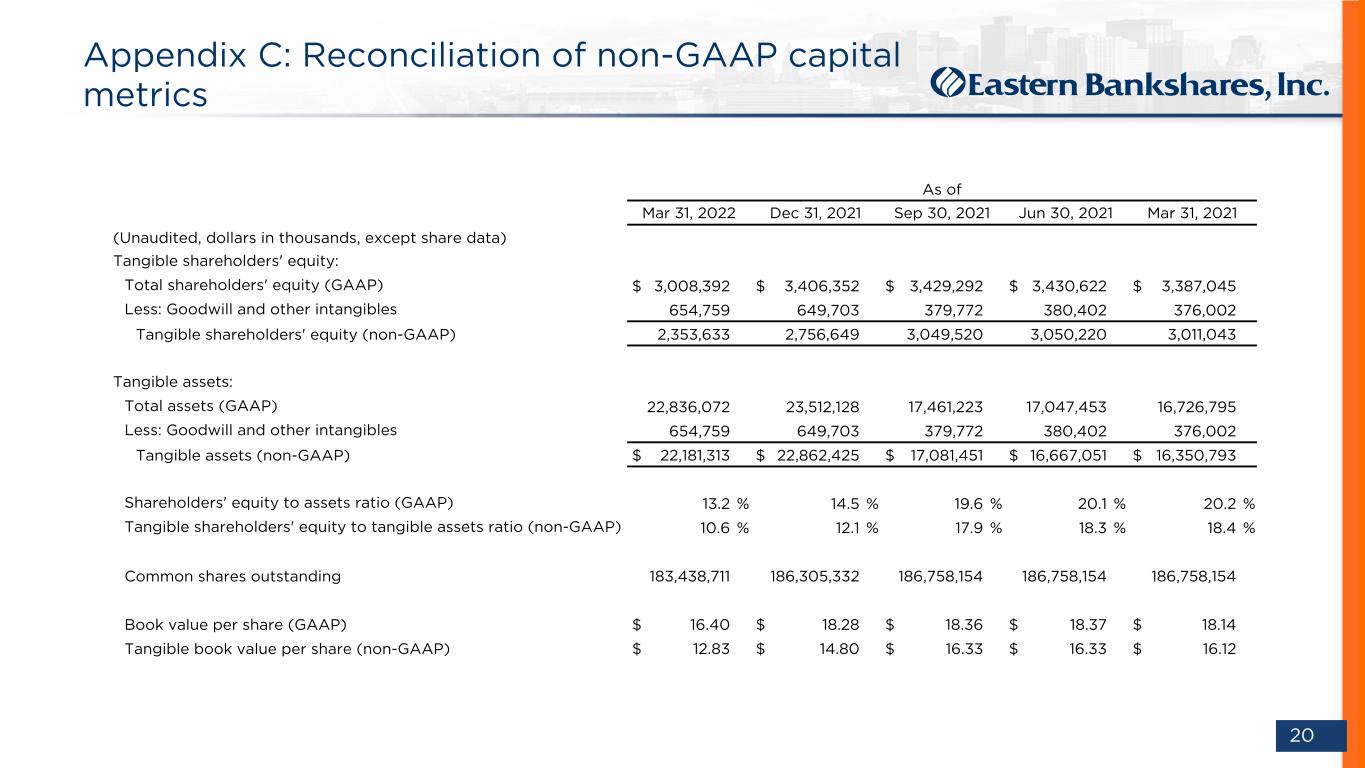

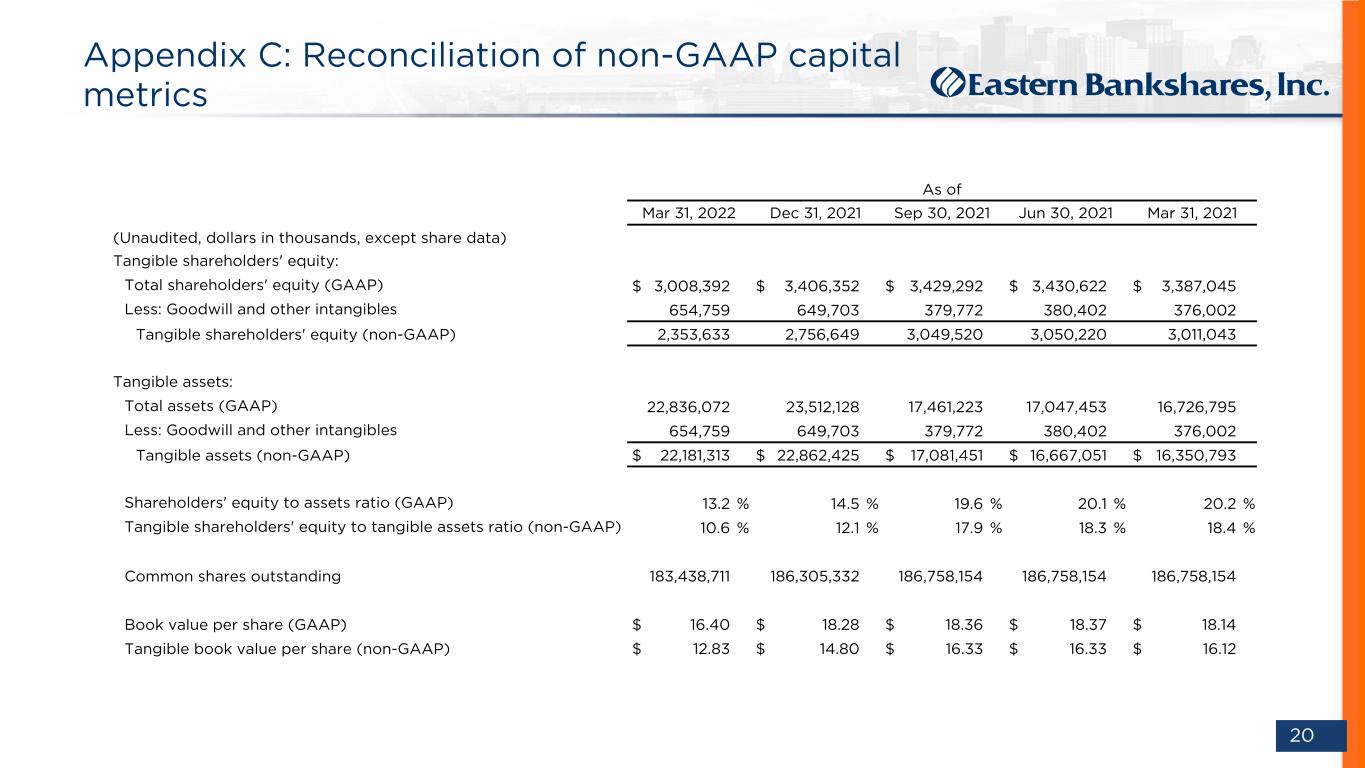

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 20 Appendix C: Reconciliation of non-GAAP capital metrics As of Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 (Unaudited, dollars in thousands, except share data) Tangible shareholders' equity: Total shareholders' equity (GAAP) $ 3,008,392 $ 3,406,352 $ 3,429,292 $ 3,430,622 $ 3,387,045 Less: Goodwill and other intangibles 654,759 649,703 379,772 380,402 376,002 Tangible shareholders' equity (non-GAAP) 2,353,633 2,756,649 3,049,520 3,050,220 3,011,043 Tangible assets: Total assets (GAAP) 22,836,072 23,512,128 17,461,223 17,047,453 16,726,795 Less: Goodwill and other intangibles 654,759 649,703 379,772 380,402 376,002 Tangible assets (non-GAAP) $ 22,181,313 $ 22,862,425 $ 17,081,451 $ 16,667,051 $ 16,350,793 Shareholders' equity to assets ratio (GAAP) 13.2 % 14.5 % 19.6 % 20.1 % 20.2 % Tangible shareholders' equity to tangible assets ratio (non-GAAP) 10.6 % 12.1 % 17.9 % 18.3 % 18.4 % Common shares outstanding 183,438,711 186,305,332 186,758,154 186,758,154 186,758,154 Book value per share (GAAP) $ 16.40 $ 18.28 $ 18.36 $ 18.37 $ 18.14 Tangible book value per share (non-GAAP) $ 12.83 $ 14.80 $ 16.33 $ 16.33 $ 16.12

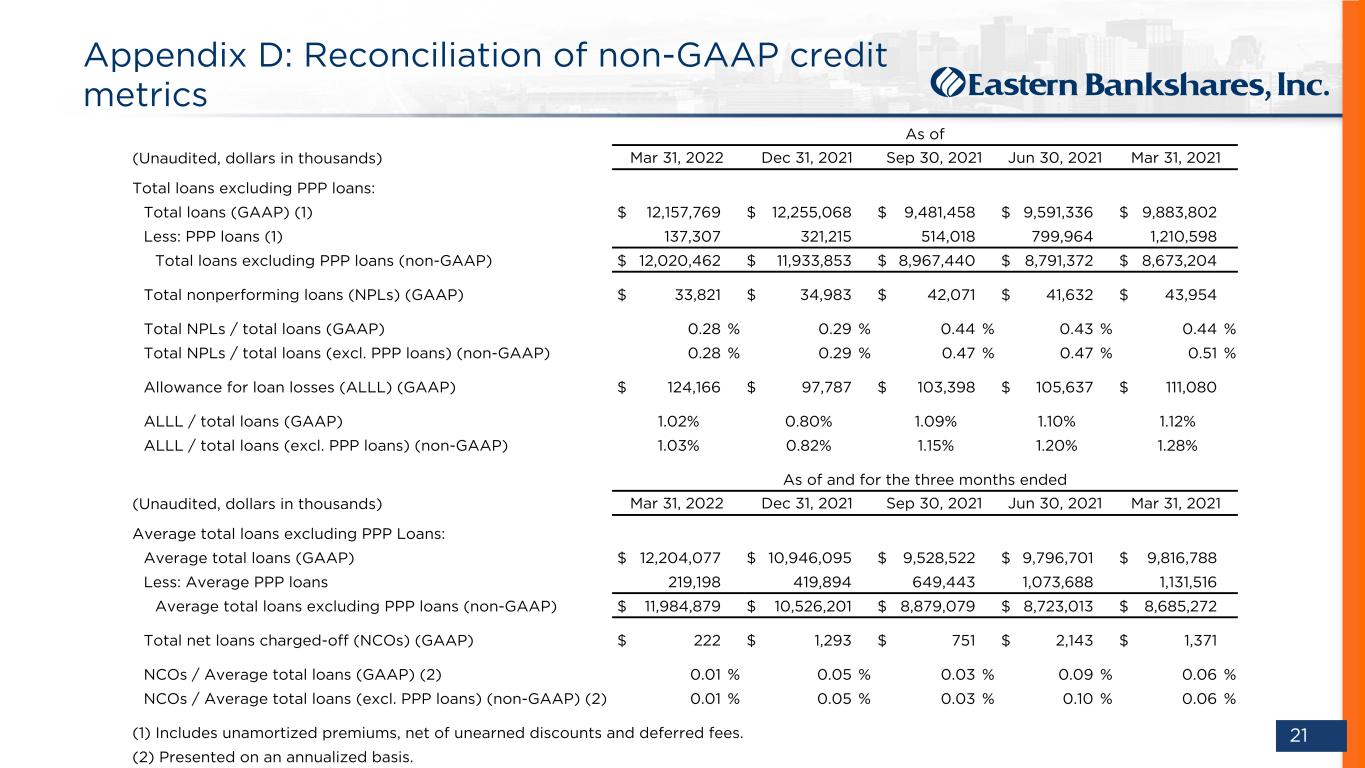

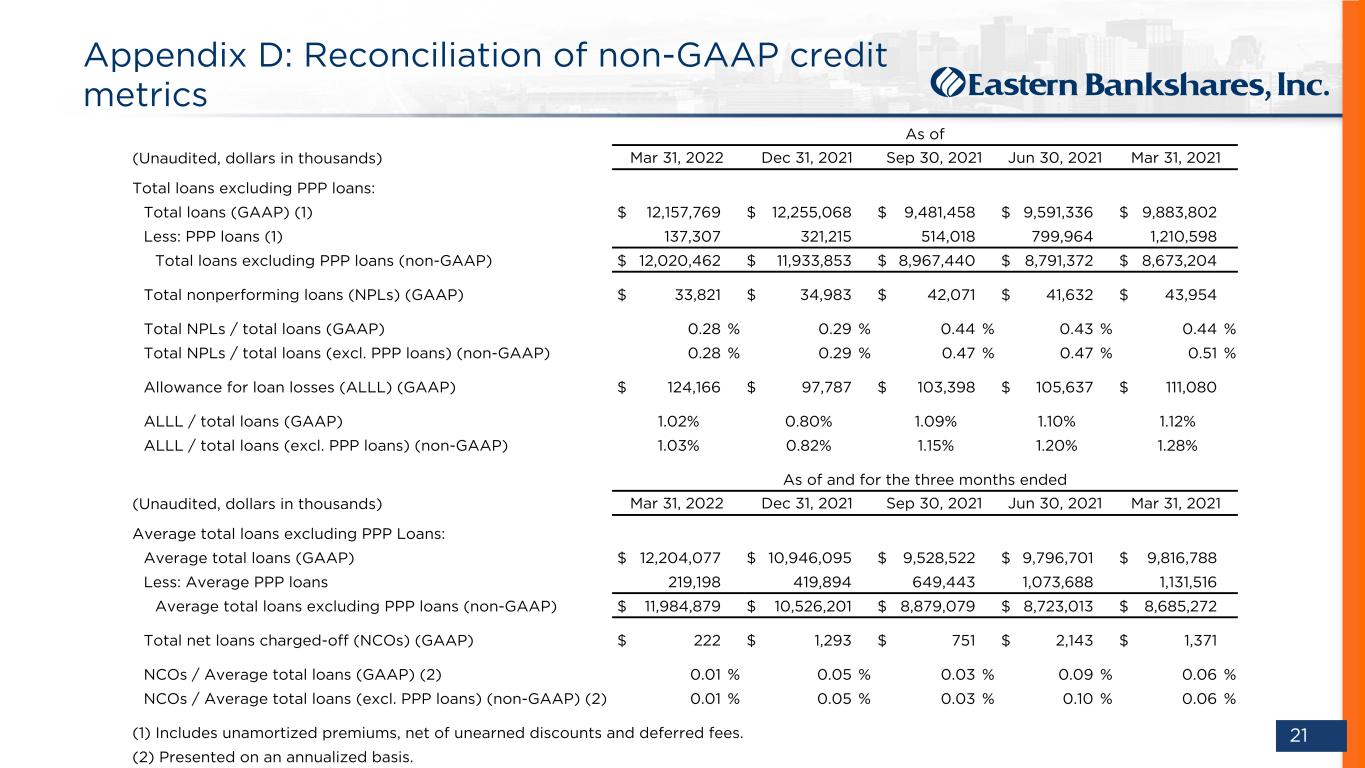

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 21 Appendix D: Reconciliation of non-GAAP credit metrics As of (Unaudited, dollars in thousands) Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 Total loans excluding PPP loans: Total loans (GAAP) (1) $ 12,157,769 $ 12,255,068 $ 9,481,458 $ 9,591,336 $ 9,883,802 Less: PPP loans (1) 137,307 321,215 514,018 799,964 1,210,598 Total loans excluding PPP loans (non-GAAP) $ 12,020,462 $ 11,933,853 $ 8,967,440 $ 8,791,372 $ 8,673,204 Total nonperforming loans (NPLs) (GAAP) $ 33,821 $ 34,983 $ 42,071 $ 41,632 $ 43,954 Total NPLs / total loans (GAAP) 0.28 % 0.29 % 0.44 % 0.43 % 0.44 % Total NPLs / total loans (excl. PPP loans) (non-GAAP) 0.28 % 0.29 % 0.47 % 0.47 % 0.51 % Allowance for loan losses (ALLL) (GAAP) $ 124,166 $ 97,787 $ 103,398 $ 105,637 $ 111,080 ALLL / total loans (GAAP) 1.02% 0.80% 1.09% 1.10% 1.12% ALLL / total loans (excl. PPP loans) (non-GAAP) 1.03% 0.82% 1.15% 1.20% 1.28% As of and for the three months ended (Unaudited, dollars in thousands) Mar 31, 2022 Dec 31, 2021 Sep 30, 2021 Jun 30, 2021 Mar 31, 2021 Average total loans excluding PPP Loans: Average total loans (GAAP) $ 12,204,077 $ 10,946,095 $ 9,528,522 $ 9,796,701 $ 9,816,788 Less: Average PPP loans 219,198 419,894 649,443 1,073,688 1,131,516 Average total loans excluding PPP loans (non-GAAP) $ 11,984,879 $ 10,526,201 $ 8,879,079 $ 8,723,013 $ 8,685,272 Total net loans charged-off (NCOs) (GAAP) $ 222 $ 1,293 $ 751 $ 2,143 $ 1,371 NCOs / Average total loans (GAAP) (2) 0.01 % 0.05 % 0.03 % 0.09 % 0.06 % NCOs / Average total loans (excl. PPP loans) (non-GAAP) (2) 0.01 % 0.05 % 0.03 % 0.10 % 0.06 % (1) Includes unamortized premiums, net of unearned discounts and deferred fees. (2) Presented on an annualized basis.

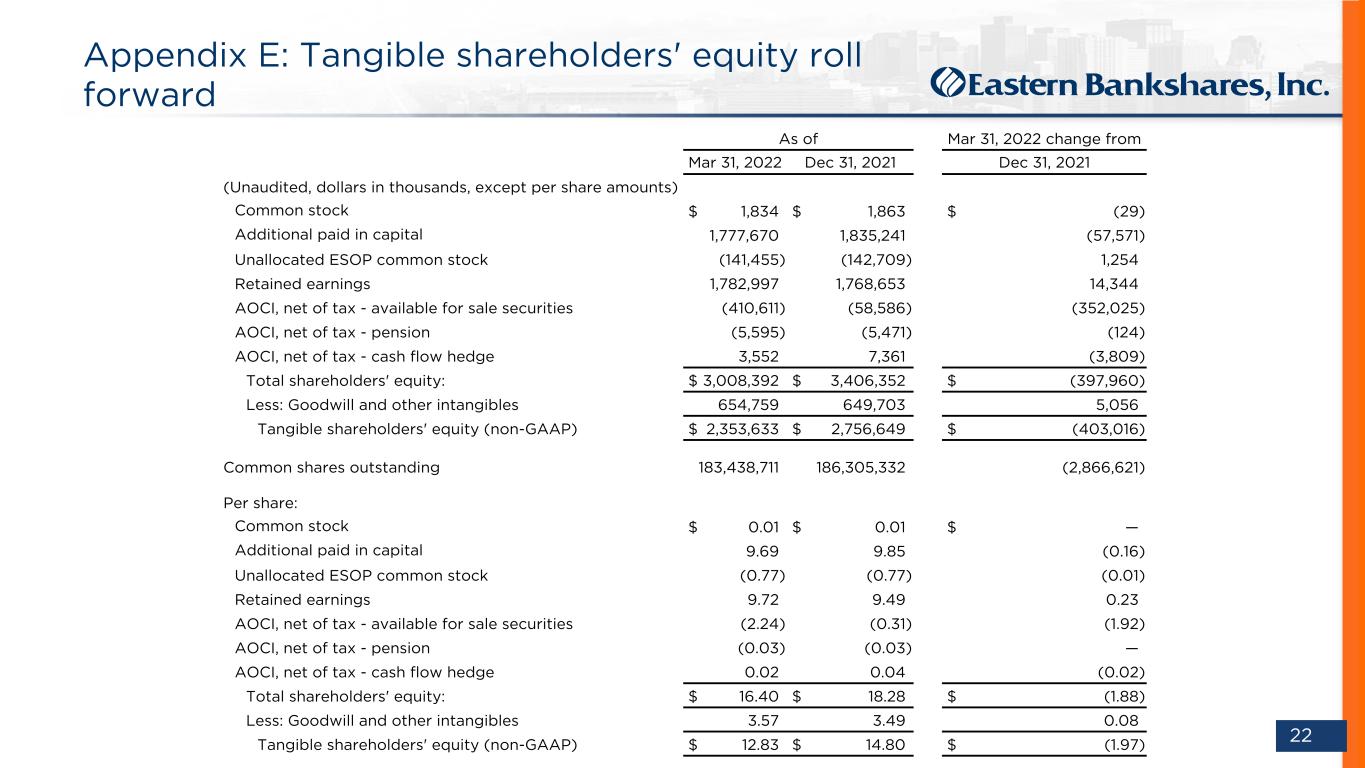

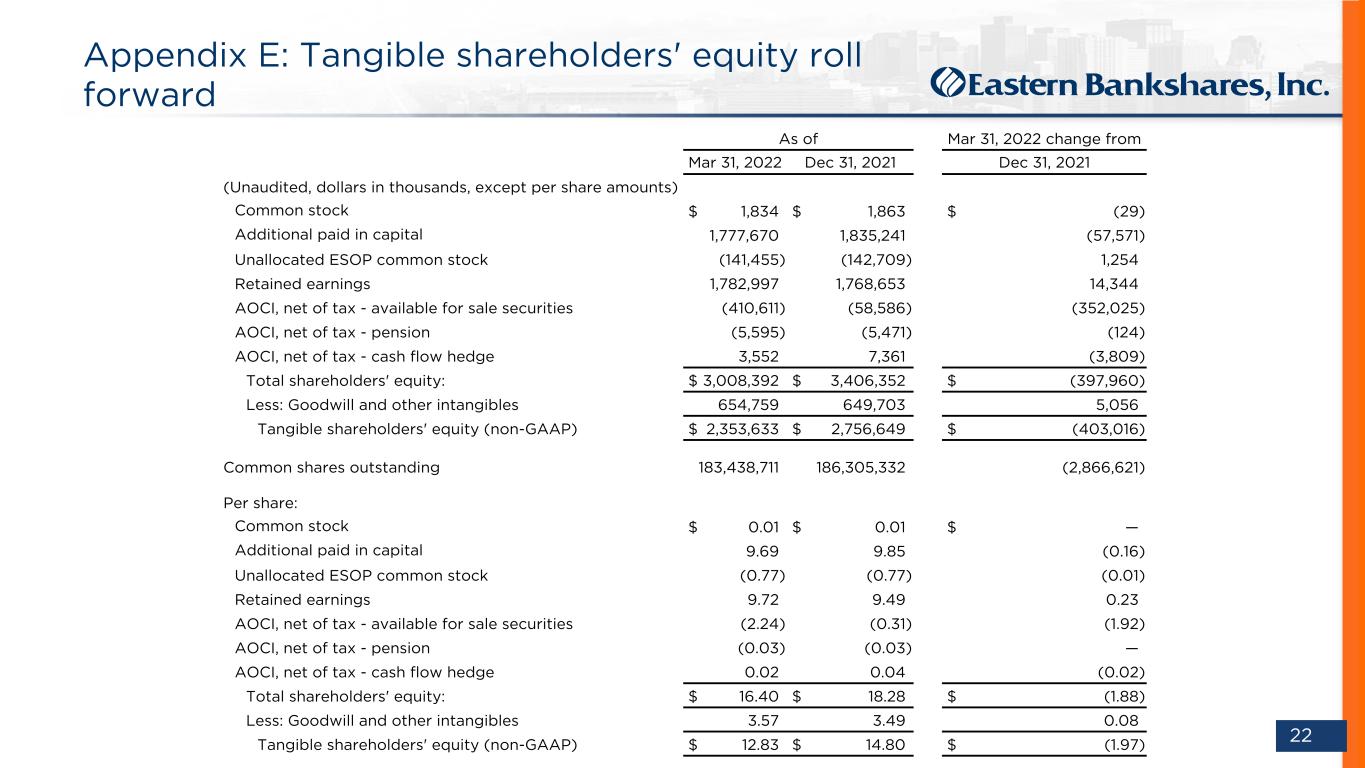

DO NOT REFRESH Color PaletteComplementary 000 / 000 / 051 Body text 074 / 075 / 076 030 / 152 / 213 185 / 197 / 212 023 / 061 / 110 119 / 139 / 154 255 / 107 / 000109 / 110 / 112 237 / 237 / 238 000 / 139 / 151 137 / 139 / 141 197 / 064 / 044 166 / 168 / 171 103 / 086 / 164 208 / 210 / 211 238 / 184 / 028 22 Appendix E: Tangible shareholders' equity roll forward As of Mar 31, 2022 change from Mar 31, 2022 Dec 31, 2021 Dec 31, 2021 (Unaudited, dollars in thousands, except per share amounts) Common stock $ 1,834 $ 1,863 $ (29) Additional paid in capital 1,777,670 1,835,241 (57,571) Unallocated ESOP common stock (141,455) (142,709) 1,254 Retained earnings 1,782,997 1,768,653 14,344 AOCI, net of tax - available for sale securities (410,611) (58,586) (352,025) AOCI, net of tax - pension (5,595) (5,471) (124) AOCI, net of tax - cash flow hedge 3,552 7,361 (3,809) Total shareholders' equity: $ 3,008,392 $ 3,406,352 $ (397,960) Less: Goodwill and other intangibles 654,759 649,703 5,056 Tangible shareholders' equity (non-GAAP) $ 2,353,633 $ 2,756,649 $ (403,016) Common shares outstanding 183,438,711 186,305,332 (2,866,621) Per share: Common stock $ 0.01 $ 0.01 $ — Additional paid in capital 9.69 9.85 (0.16) Unallocated ESOP common stock (0.77) (0.77) (0.01) Retained earnings 9.72 9.49 0.23 AOCI, net of tax - available for sale securities (2.24) (0.31) (1.92) AOCI, net of tax - pension (0.03) (0.03) — AOCI, net of tax - cash flow hedge 0.02 0.04 (0.02) Total shareholders' equity: $ 16.40 $ 18.28 $ (1.88) Less: Goodwill and other intangibles 3.57 3.49 0.08 Tangible shareholders' equity (non-GAAP) $ 12.83 $ 14.80 $ (1.97)