Exhibit 99.3 CAMBRIDGE BANCORP AND SUBSIDIARIES UNAUDITED CONSOLIDATED BALANCE SHEETS March 31, 2024 December 31, 2023 (dollars in thousands, except share information) Assets Cash and cash equivalents $ 29,705 $ 33,004 Investment securities Available for sale, at fair value (amortized cost $159,483 and $163,376, respectively) 133,222 137,838 Held to maturity, at amortized cost (fair value $777,383 and $805,428, respectively) 940,618 959,332 Total investment securities 1,073,840 1,097,170 Loans Residential mortgage 1,611,271 1,626,264 Commercial mortgage 1,922,278 1,931,473 Home equity 90,647 95,649 Commercial and industrial 348,549 343,711 Consumer 22,004 24,447 Total loans 3,994,749 4,021,544 Less: allowance for credit losses on loans (39,347) (38,944) Net loans 3,955,402 3,982,600 Federal Home Loan Bank of Boston Stock, at cost 24,291 19,056 Bank owned life insurance 35,471 35,265 Banking premises and equipment, net 20,858 21,753 Right-of-use asset operating leases 21,694 23,233 Deferred income taxes, net 14,359 15,299 Accrued interest receivable 15,226 15,765 Goodwill 64,539 64,539 Merger-related intangibles, net 6,327 6,550 Other assets 112,128 103,432 Total assets $ 5,373,840 $ 5,417,666 Liabilities Deposits Demand- Non Interest bearing $ 965,090 $ 1,032,413 Interest-bearing checking 1,202,713 1,132,518 Money market 934,958 983,480 Savings 507,640 498,386 Certificates of deposit 574,981 674,381 Total deposits 4,185,382 4,321,178 Borrowings 546,405 452,155 Operating lease liabilities 23,914 25,165 Other liabilities 82,543 84,595 Total liabilities 4,838,244 4,883,093 Shareholders’ Equity Common stock, par value $1.00; Authorized: 10,000,000 shares; Outstanding: 7,845,598 shares and 7,845,452 shares, respectively 7,846 7,845 Additional paid-in capital 294,294 293,950 Retained earnings 252,124 250,492 Accumulated other comprehensive loss (18,668) (17,714) Total shareholders’ equity 535,596 534,573 Total liabilities and shareholders’ equity $ 5,373,840 $ 5,417,666 The accompanying notes are an integral part of these unaudited consolidated financial statements.

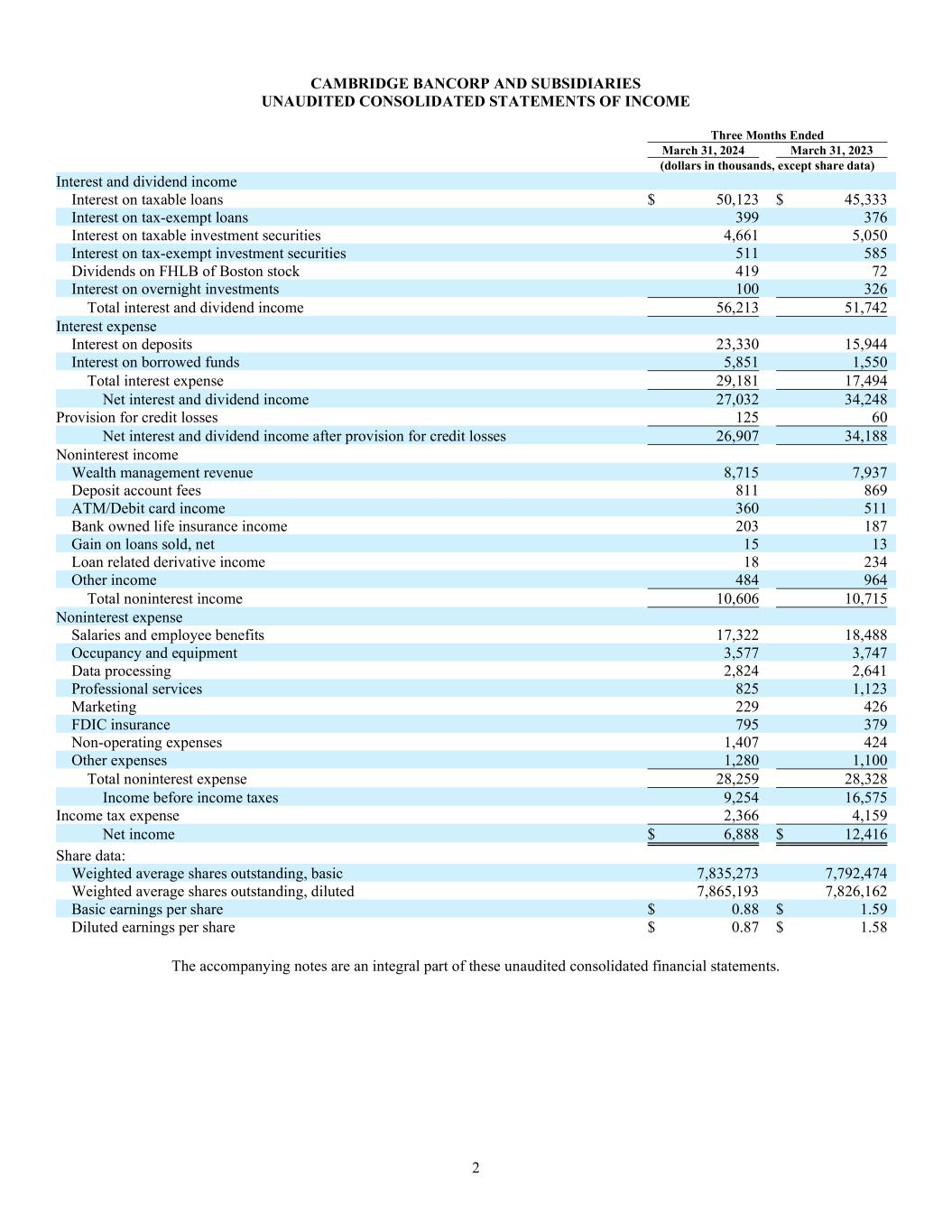

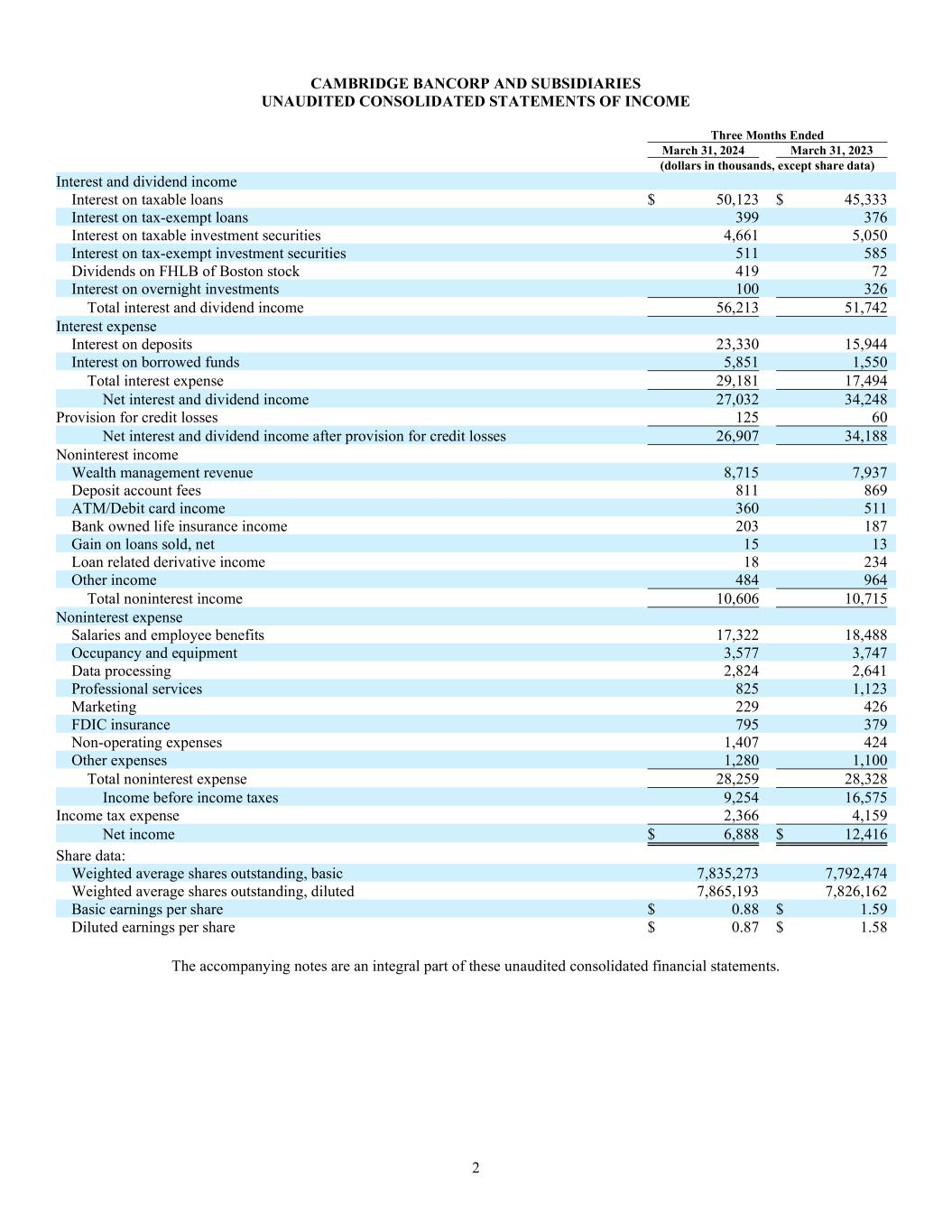

2 CAMBRIDGE BANCORP AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF INCOME Three Months Ended March 31, 2024 March 31, 2023 (dollars in thousands, except share data) Interest and dividend income Interest on taxable loans $ 50,123 $ 45,333 Interest on tax-exempt loans 399 376 Interest on taxable investment securities 4,661 5,050 Interest on tax-exempt investment securities 511 585 Dividends on FHLB of Boston stock 419 72 Interest on overnight investments 100 326 Total interest and dividend income 56,213 51,742 Interest expense Interest on deposits 23,330 15,944 Interest on borrowed funds 5,851 1,550 Total interest expense 29,181 17,494 Net interest and dividend income 27,032 34,248 Provision for credit losses 125 60 Net interest and dividend income after provision for credit losses 26,907 34,188 Noninterest income Wealth management revenue 8,715 7,937 Deposit account fees 811 869 ATM/Debit card income 360 511 Bank owned life insurance income 203 187 Gain on loans sold, net 15 13 Loan related derivative income 18 234 Other income 484 964 Total noninterest income 10,606 10,715 Noninterest expense Salaries and employee benefits 17,322 18,488 Occupancy and equipment 3,577 3,747 Data processing 2,824 2,641 Professional services 825 1,123 Marketing 229 426 FDIC insurance 795 379 Non-operating expenses 1,407 424 Other expenses 1,280 1,100 Total noninterest expense 28,259 28,328 Income before income taxes 9,254 16,575 Income tax expense 2,366 4,159 Net income $ 6,888 $ 12,416 Share data: Weighted average shares outstanding, basic 7,835,273 7,792,474 Weighted average shares outstanding, diluted 7,865,193 7,826,162 Basic earnings per share $ 0.88 $ 1.59 Diluted earnings per share $ 0.87 $ 1.58 The accompanying notes are an integral part of these unaudited consolidated financial statements.

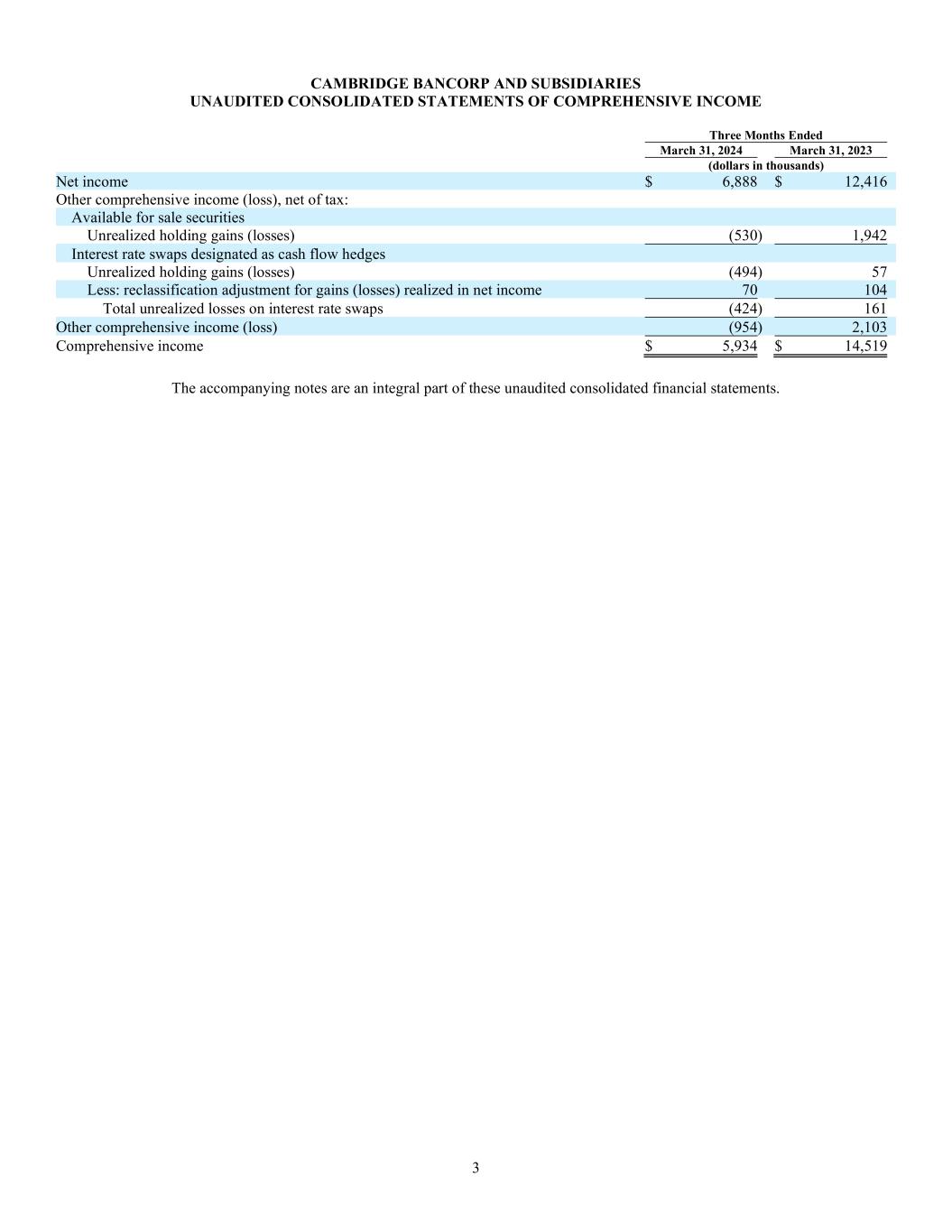

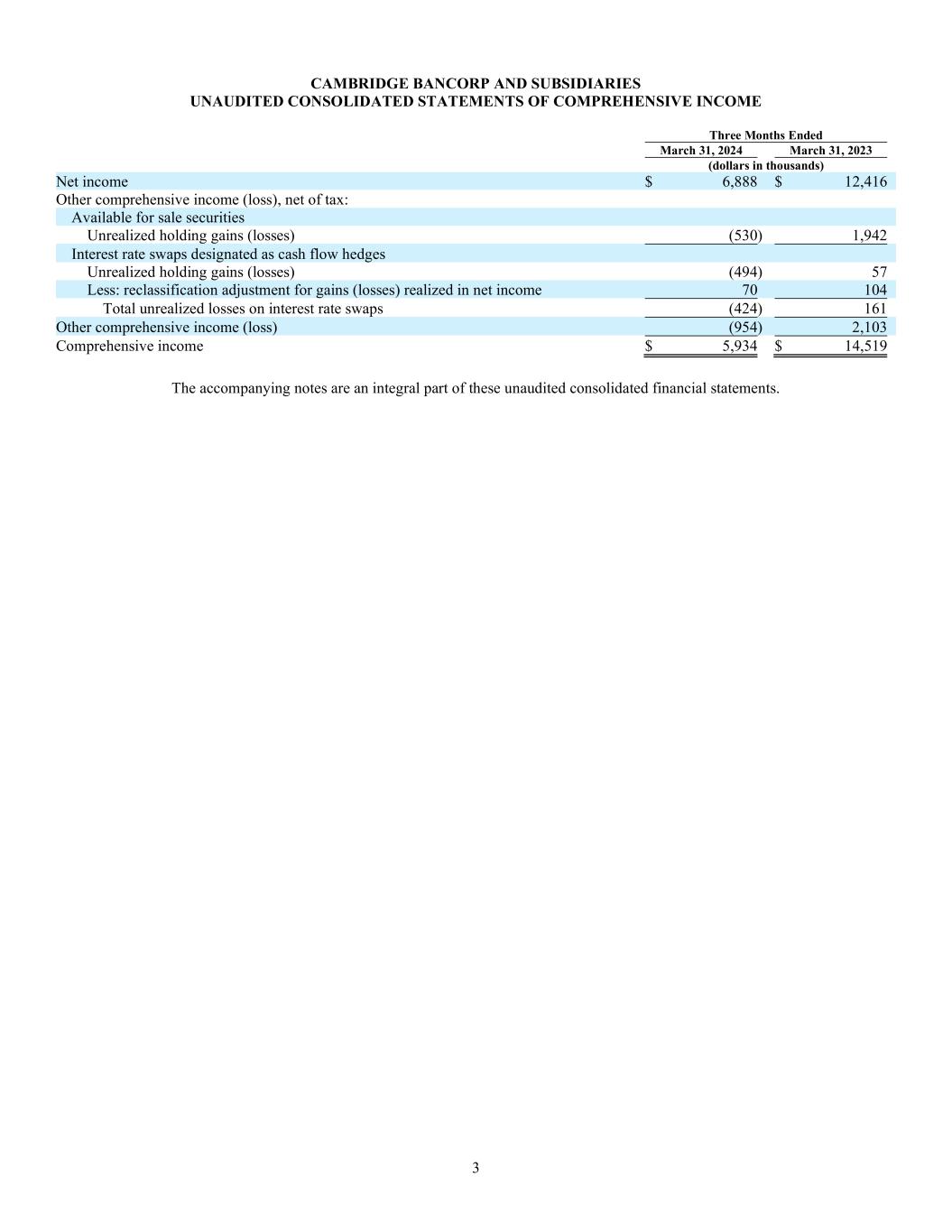

3 CAMBRIDGE BANCORP AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME Three Months Ended March 31, 2024 March 31, 2023 (dollars in thousands) Net income $ 6,888 $ 12,416 Other comprehensive income (loss), net of tax: Available for sale securities Unrealized holding gains (losses) (530) 1,942 Interest rate swaps designated as cash flow hedges Unrealized holding gains (losses) (494) 57 Less: reclassification adjustment for gains (losses) realized in net income 70 104 Total unrealized losses on interest rate swaps (424) 161 Other comprehensive income (loss) (954) 2,103 Comprehensive income $ 5,934 $ 14,519 The accompanying notes are an integral part of these unaudited consolidated financial statements.

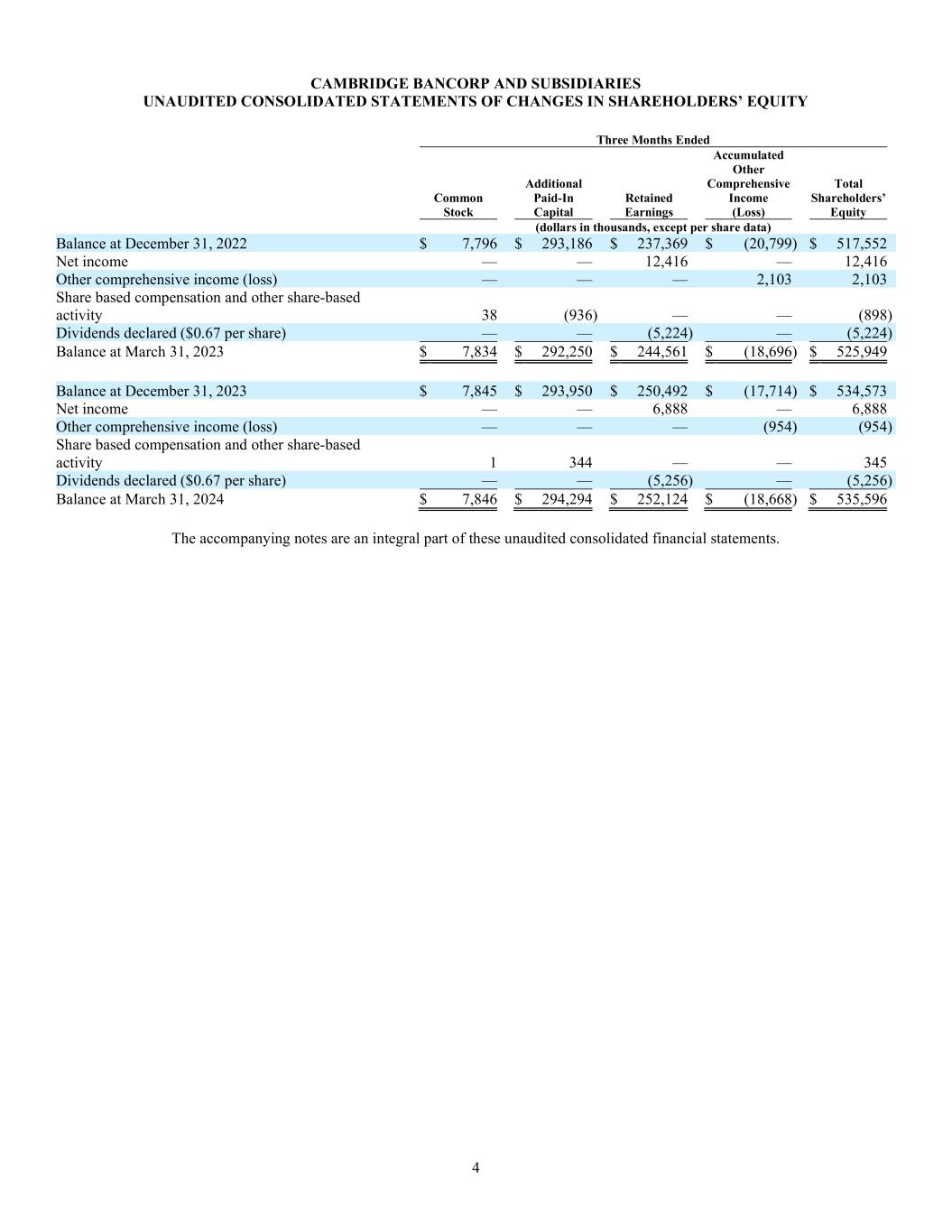

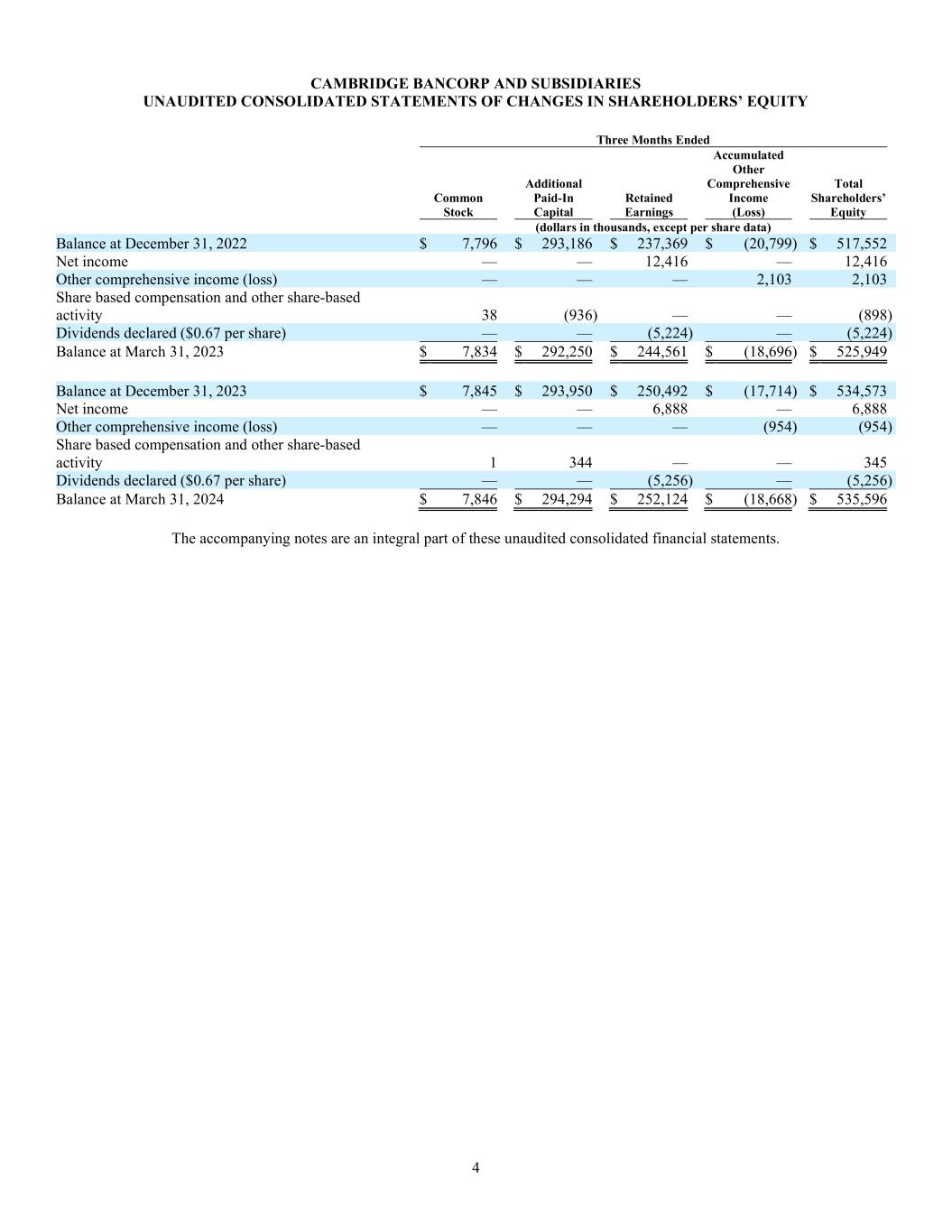

4 CAMBRIDGE BANCORP AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY Three Months Ended Common Stock Additional Paid-In Capital Retained Earnings Accumulated Other Comprehensive Income (Loss) Total Shareholders’ Equity (dollars in thousands, except per share data) Balance at December 31, 2022 $ 7,796 $ 293,186 $ 237,369 $ (20,799) $ 517,552 Net income — — 12,416 — 12,416 Other comprehensive income (loss) — — — 2,103 2,103 Share based compensation and other share-based activity 38 (936) — — (898) Dividends declared ($0.67 per share) — — (5,224) — (5,224) Balance at March 31, 2023 $ 7,834 $ 292,250 $ 244,561 $ (18,696) $ 525,949 Balance at December 31, 2023 $ 7,845 $ 293,950 $ 250,492 $ (17,714) $ 534,573 Net income — — 6,888 — 6,888 Other comprehensive income (loss) — — — (954) (954) Share based compensation and other share-based activity 1 344 — — 345 Dividends declared ($0.67 per share) — — (5,256) — (5,256) Balance at March 31, 2024 $ 7,846 $ 294,294 $ 252,124 $ (18,668) $ 535,596 The accompanying notes are an integral part of these unaudited consolidated financial statements.

5 CAMBRIDGE BANCORP AND SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CASH FLOWS Three Months Ended March 31, 2024 2023 (dollars in thousands) CASH FLOWS FROM OPERATING ACTIVITIES Net income $ 6,888 $ 12,416 Adjustments to reconcile net income to net cash provided by operating activities: Provision for (release of) credit losses 125 60 Amortization (accretion) of deferred charges and fees, net 558 667 Depreciation (accretion), and amortization, net 629 238 Bank owned life insurance income (203) (187) Share-based compensation and other share-based activity 345 (898) Change in accrued interest receivable 539 (11) Deferred income tax expense 1,296 2,659 Change in other assets, net (9,052) 5,440 Change in other liabilities, net 356 (15,830) Net cash provided by operating activities 1,481 4,554 CASH FLOWS FROM INVESTING ACTIVITIES Origination of loans (124,405) (144,601) Proceeds from principal payments of loans 149,477 189,792 Proceeds from calls/maturities of securities available for sale 3,841 3,779 Proceeds from calls/maturities of securities held to maturity 18,476 20,856 (Purchase) redemption of FHLB of Boston stock (5,235) (5,908) Purchase of banking premises and equipment (65) (337) Net cash provided by investing activities 42,089 63,581 CASH FLOWS FROM FINANCING ACTIVITIES Change in demand, interest-bearing, money market and savings accounts (36,396) (324,099) Change in certificates of deposit (99,467) 165,450 Change in borrowings 94,250 135,785 Cash dividends paid on common stock (5,256) (5,224) Net cash used in by financing activities (46,869) (28,088) Net change in cash and cash equivalents (3,299) 40,047 Cash and cash equivalents at beginning of period 33,004 30,719 Cash and cash equivalents at end of period $ 29,705 $ 70,766 SUPPLEMENTAL DISCLOSURES OF CASH FLOW INFORMATION: Cash paid during the period for: Interest $ 31,623 $ 16,935 Income taxes 1,276 2,430 The accompanying notes are an integral part of these unaudited consolidated financial statements.

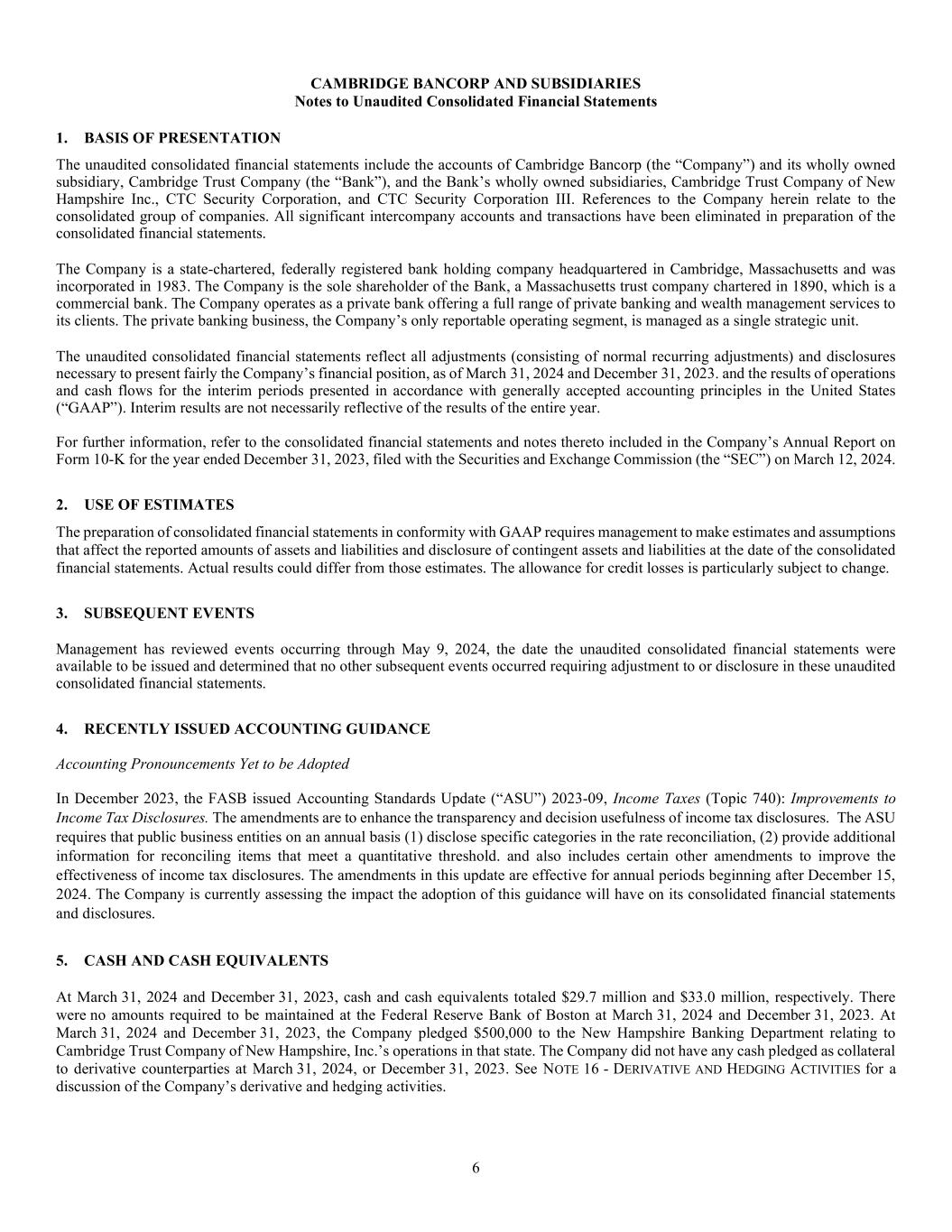

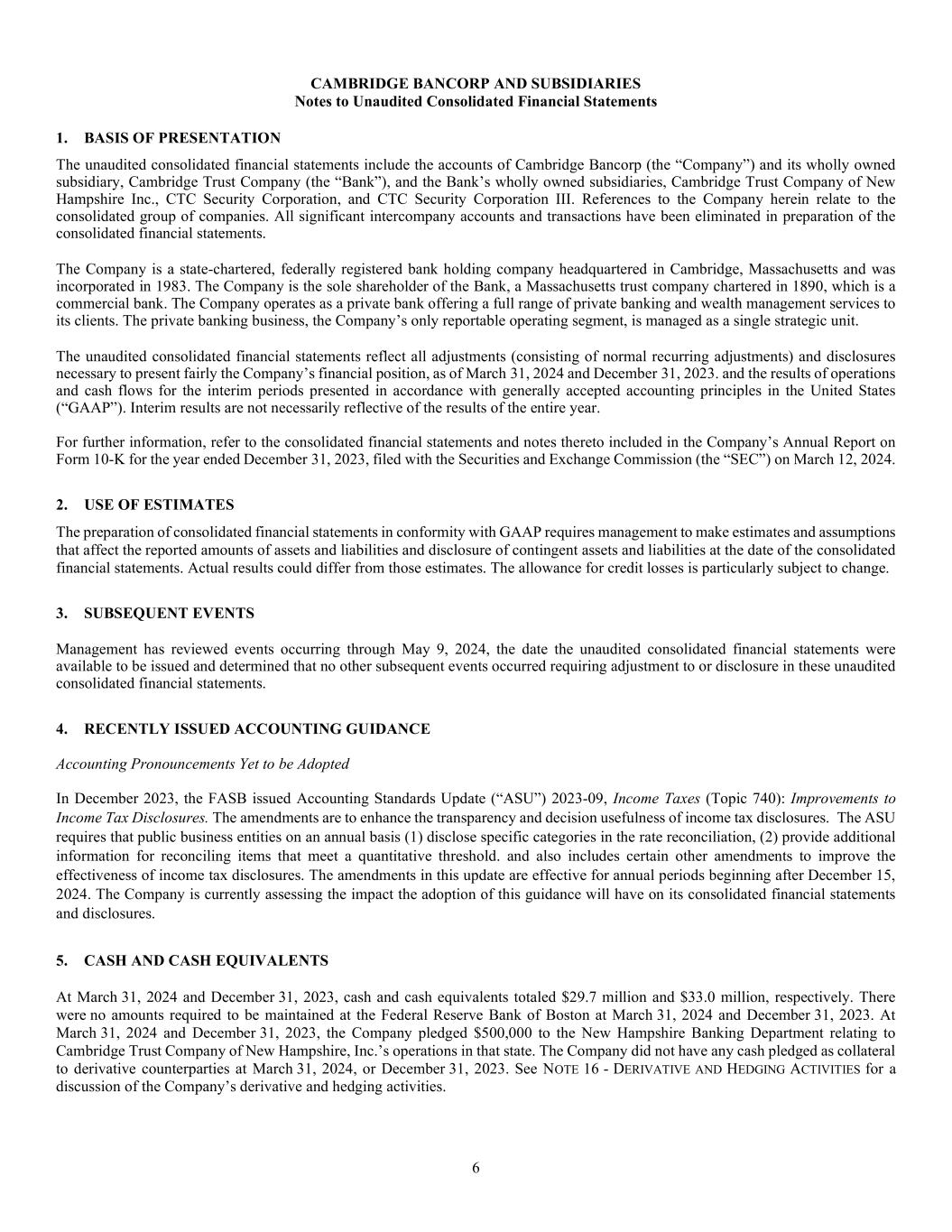

6 CAMBRIDGE BANCORP AND SUBSIDIARIES Notes to Unaudited Consolidated Financial Statements 1. BASIS OF PRESENTATION The unaudited consolidated financial statements include the accounts of Cambridge Bancorp (the “Company”) and its wholly owned subsidiary, Cambridge Trust Company (the “Bank”), and the Bank’s wholly owned subsidiaries, Cambridge Trust Company of New Hampshire Inc., CTC Security Corporation, and CTC Security Corporation III. References to the Company herein relate to the consolidated group of companies. All significant intercompany accounts and transactions have been eliminated in preparation of the consolidated financial statements. The Company is a state-chartered, federally registered bank holding company headquartered in Cambridge, Massachusetts and was incorporated in 1983. The Company is the sole shareholder of the Bank, a Massachusetts trust company chartered in 1890, which is a commercial bank. The Company operates as a private bank offering a full range of private banking and wealth management services to its clients. The private banking business, the Company’s only reportable operating segment, is managed as a single strategic unit. The unaudited consolidated financial statements reflect all adjustments (consisting of normal recurring adjustments) and disclosures necessary to present fairly the Company’s financial position, as of March 31, 2024 and December 31, 2023. and the results of operations and cash flows for the interim periods presented in accordance with generally accepted accounting principles in the United States (“GAAP”). Interim results are not necessarily reflective of the results of the entire year. For further information, refer to the consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission (the “SEC”) on March 12, 2024. 2. USE OF ESTIMATES The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated financial statements. Actual results could differ from those estimates. The allowance for credit losses is particularly subject to change. 3. SUBSEQUENT EVENTS Management has reviewed events occurring through May 9, 2024, the date the unaudited consolidated financial statements were available to be issued and determined that no other subsequent events occurred requiring adjustment to or disclosure in these unaudited consolidated financial statements. 4. RECENTLY ISSUED ACCOUNTING GUIDANCE Accounting Pronouncements Yet to be Adopted In December 2023, the FASB issued Accounting Standards Update (“ASU”) 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures. The amendments are to enhance the transparency and decision usefulness of income tax disclosures. The ASU requires that public business entities on an annual basis (1) disclose specific categories in the rate reconciliation, (2) provide additional information for reconciling items that meet a quantitative threshold. and also includes certain other amendments to improve the effectiveness of income tax disclosures. The amendments in this update are effective for annual periods beginning after December 15, 2024. The Company is currently assessing the impact the adoption of this guidance will have on its consolidated financial statements and disclosures. 5. CASH AND CASH EQUIVALENTS At March 31, 2024 and December 31, 2023, cash and cash equivalents totaled $29.7 million and $33.0 million, respectively. There were no amounts required to be maintained at the Federal Reserve Bank of Boston at March 31, 2024 and December 31, 2023. At March 31, 2024 and December 31, 2023, the Company pledged $500,000 to the New Hampshire Banking Department relating to Cambridge Trust Company of New Hampshire, Inc.’s operations in that state. The Company did not have any cash pledged as collateral to derivative counterparties at March 31, 2024, or December 31, 2023. See NOTE 16 - DERIVATIVE AND HEDGING ACTIVITIES for a discussion of the Company’s derivative and hedging activities.

7 6. INVESTMENT SECURITIES Investment securities have been classified in the unaudited consolidated balance sheets according to management’s intent. The carrying amounts of securities and their approximate fair values were as follows: March 31, 2024 December 31, 2023 Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Fair Value Amortized Cost Gross Unrealized Gains Gross Unrealized Losses Fair Value (dollars in thousands) Available for sale securities U.S. Government Sponsored Enterprise obligations $ 22,999 $ — $ (2,638) $ 20,361 $ 22,998 $ — $ (2,536) $ 20,462 Mortgage-backed securities 136,484 1 (23,624) 112,861 140,378 4 (23,006) 117,376 Total available for sale securities $ 159,483 $ 1 $ (26,262) $ 133,222 $ 163,376 $ 4 $ (25,542) $ 137,838 Held to maturity securities U.S. Treasury Notes $ 3,053 $ — $ (19) $ 3,034 $ 3,039 $ — $ (13) $ 3,026 Mortgage-backed securities 854,043 26 (154,698) 699,371 871,426 17 (146,397) 725,046 Corporate debt securities 250 — — 250 250 — (2) 248 Municipal securities 83,272 5 (8,549) 74,728 84,617 24 (7,533) 77,108 Total held to maturity securities $ 940,618 $ 31 $ (163,266) $ 777,383 $ 959,332 $ 41 $ (153,945) $ 805,428 Total $ 1,100,101 $ 32 $ (189,528) $ 910,605 $ 1,122,708 $ 45 $ (179,487) $ 943,266 All of the Company’s mortgage-backed securities have been issued by, or are collateralized by securities issued by, the Government National Mortgage Association (“Ginnie Mae” or “GNMA”), the Federal National Mortgage Association (“Fannie Mae” or “FNMA”), or the Federal Home Loan Mortgage Corporation (“Freddie Mac” or “FHLMC”). The following tables show the Company’s investment securities with gross unrealized losses for which an allowance for credit losses has not been recorded at March 31, 2024 or at December 31, 2023, aggregated by investment category and length of time that individual investment securities have been in a continuous loss position: March 31, 2024 Less than 12 months 12 months or longer Total Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (dollars in thousands) Available for sale securities U.S. Government Sponsored Enterprise obligations $ — $ — $ 20,361 $ (2,638) $ 20,361 $ (2,638 ) Mortgage-backed securities 68,223 (4) 109,183 (23,620) 177,406 (23,624 ) Total available for sale securities $ 68,223 $ (4) $ 129,544 $ (26,258) $ 197,767 $ (26,262 ) Held to maturity securities U.S. Treasury Notes $ 956 $ (11) $ 2,078 $ (8) $ 3,034 $ (19 ) Mortgage-backed securities — — 696,365 (154,698) 696,365 (154,698 ) Municipal securities 20,373 (209) 51,568 (8,340) 71,941 (8,549 ) Total held to maturity securities $ 21,329 $ (220) $ 750,011 $ (163,046) $ 771,340 $ (163,266 ) Total $ 89,552 $ (224) $ 879,555 $ (189,304) $ 969,107 $ (189,528 )

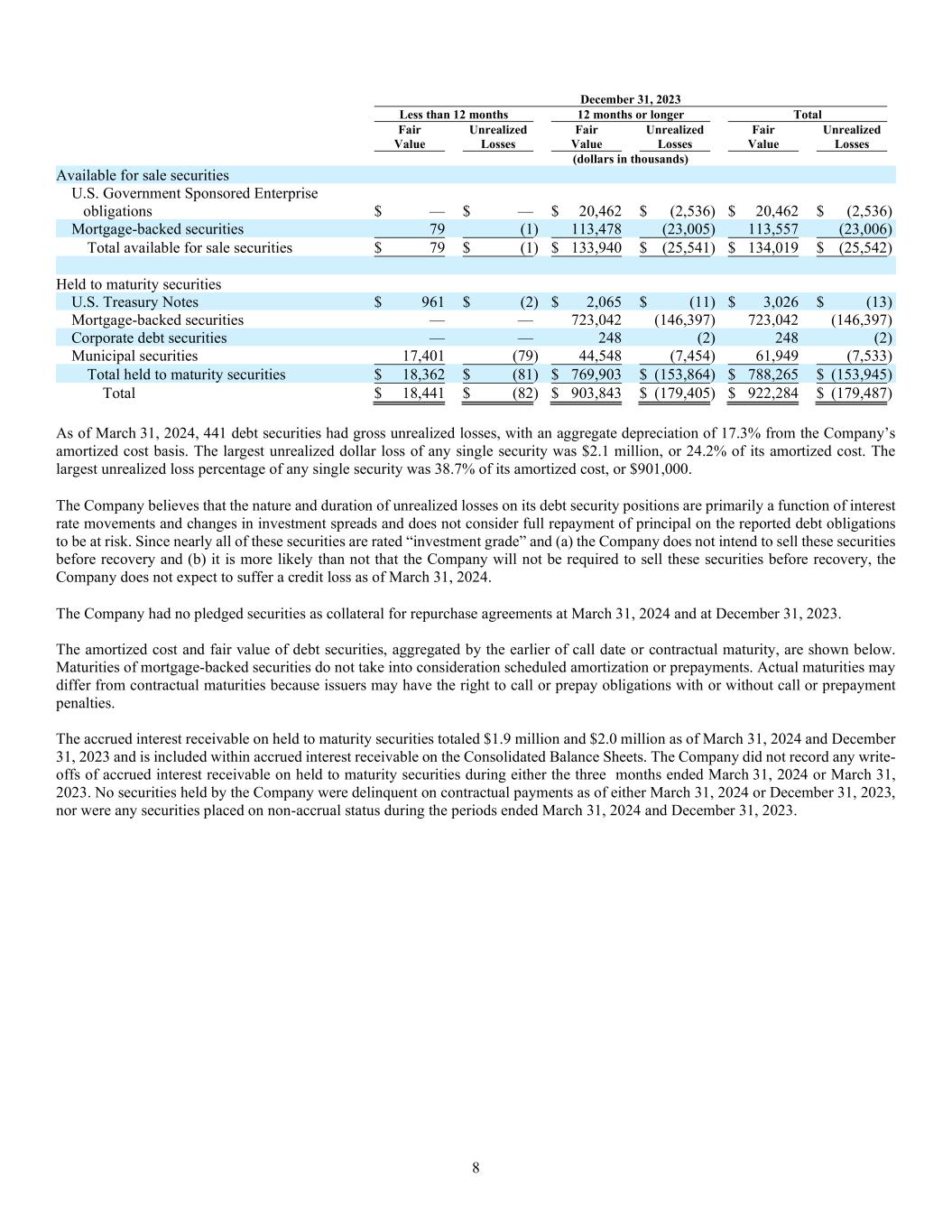

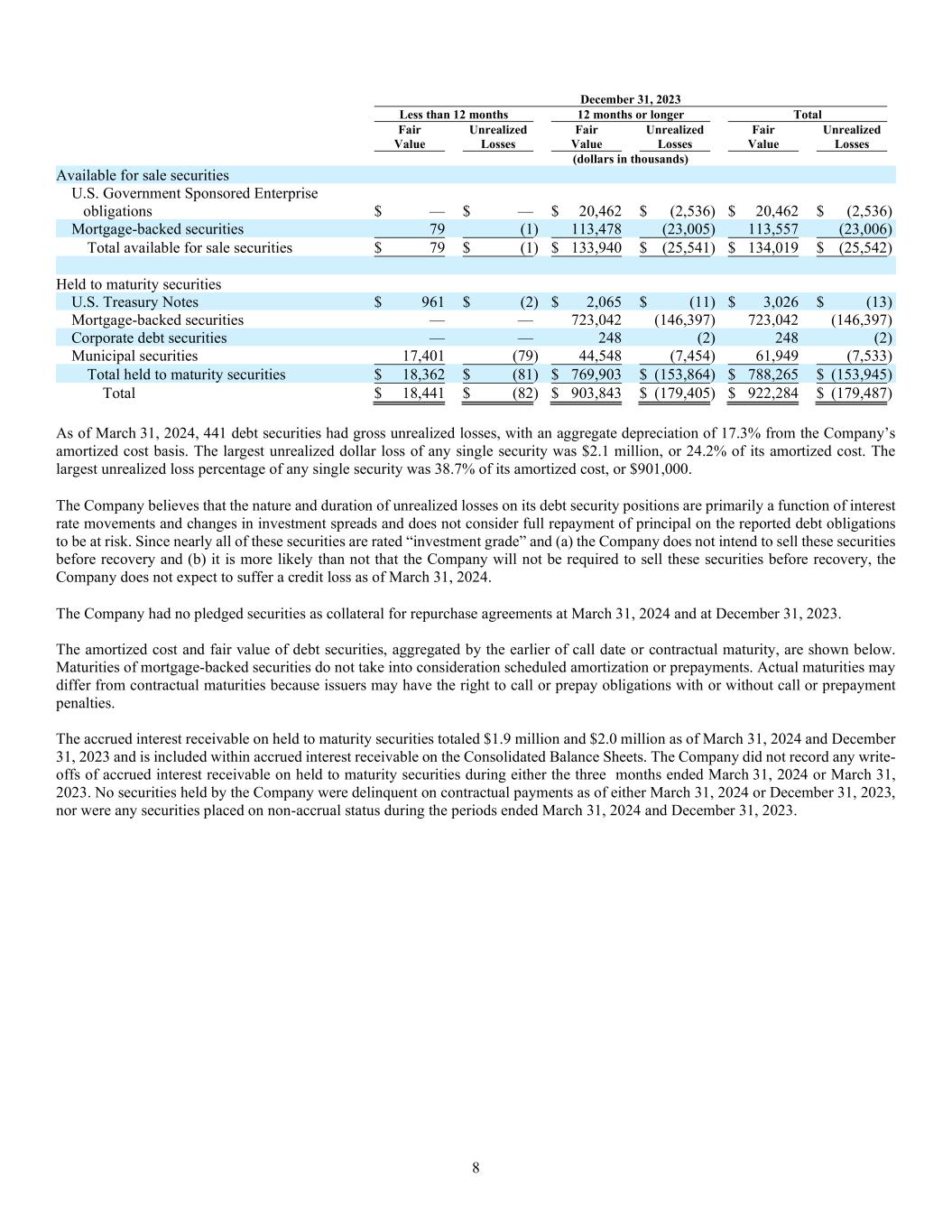

8 December 31, 2023 Less than 12 months 12 months or longer Total Fair Value Unrealized Losses Fair Value Unrealized Losses Fair Value Unrealized Losses (dollars in thousands) Available for sale securities U.S. Government Sponsored Enterprise obligations $ — $ — $ 20,462 $ (2,536) $ 20,462 $ (2,536 ) Mortgage-backed securities 79 (1) 113,478 (23,005) 113,557 (23,006 ) Total available for sale securities $ 79 $ (1) $ 133,940 $ (25,541) $ 134,019 $ (25,542 ) Held to maturity securities U.S. Treasury Notes $ 961 $ (2) $ 2,065 $ (11) $ 3,026 $ (13 ) Mortgage-backed securities — — 723,042 (146,397) 723,042 (146,397 ) Corporate debt securities — — 248 (2) 248 (2 ) Municipal securities 17,401 (79) 44,548 (7,454) 61,949 (7,533 ) Total held to maturity securities $ 18,362 $ (81) $ 769,903 $ (153,864) $ 788,265 $ (153,945 ) Total $ 18,441 $ (82) $ 903,843 $ (179,405) $ 922,284 $ (179,487 ) As of March 31, 2024, 441 debt securities had gross unrealized losses, with an aggregate depreciation of 17.3% from the Company’s amortized cost basis. The largest unrealized dollar loss of any single security was $2.1 million, or 24.2% of its amortized cost. The largest unrealized loss percentage of any single security was 38.7% of its amortized cost, or $901,000. The Company believes that the nature and duration of unrealized losses on its debt security positions are primarily a function of interest rate movements and changes in investment spreads and does not consider full repayment of principal on the reported debt obligations to be at risk. Since nearly all of these securities are rated “investment grade” and (a) the Company does not intend to sell these securities before recovery and (b) it is more likely than not that the Company will not be required to sell these securities before recovery, the Company does not expect to suffer a credit loss as of March 31, 2024. The Company had no pledged securities as collateral for repurchase agreements at March 31, 2024 and at December 31, 2023. The amortized cost and fair value of debt securities, aggregated by the earlier of call date or contractual maturity, are shown below. Maturities of mortgage-backed securities do not take into consideration scheduled amortization or prepayments. Actual maturities may differ from contractual maturities because issuers may have the right to call or prepay obligations with or without call or prepayment penalties. The accrued interest receivable on held to maturity securities totaled $1.9 million and $2.0 million as of March 31, 2024 and December 31, 2023 and is included within accrued interest receivable on the Consolidated Balance Sheets. The Company did not record any write- offs of accrued interest receivable on held to maturity securities during either the three months ended March 31, 2024 or March 31, 2023. No securities held by the Company were delinquent on contractual payments as of either March 31, 2024 or December 31, 2023, nor were any securities placed on non-accrual status during the periods ended March 31, 2024 and December 31, 2023.

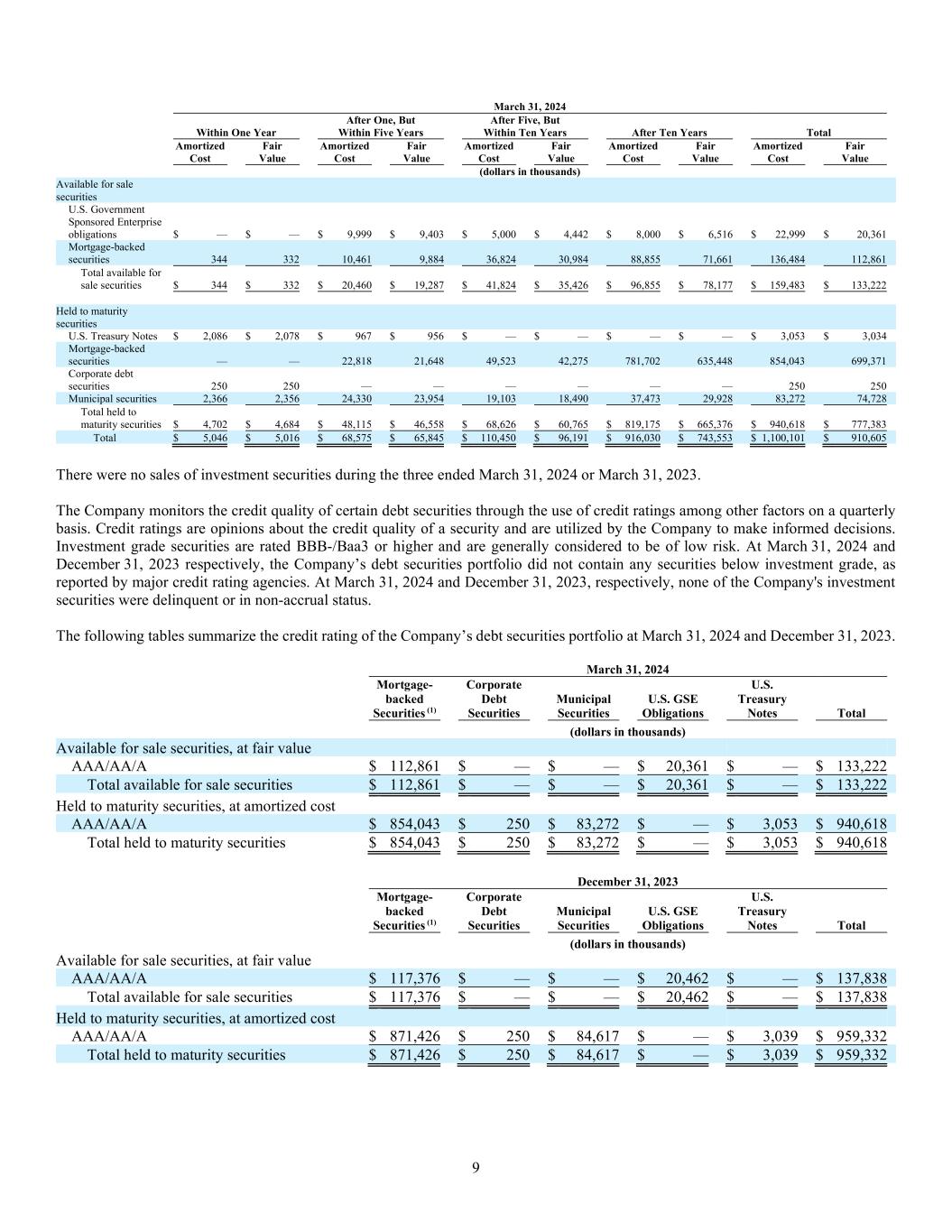

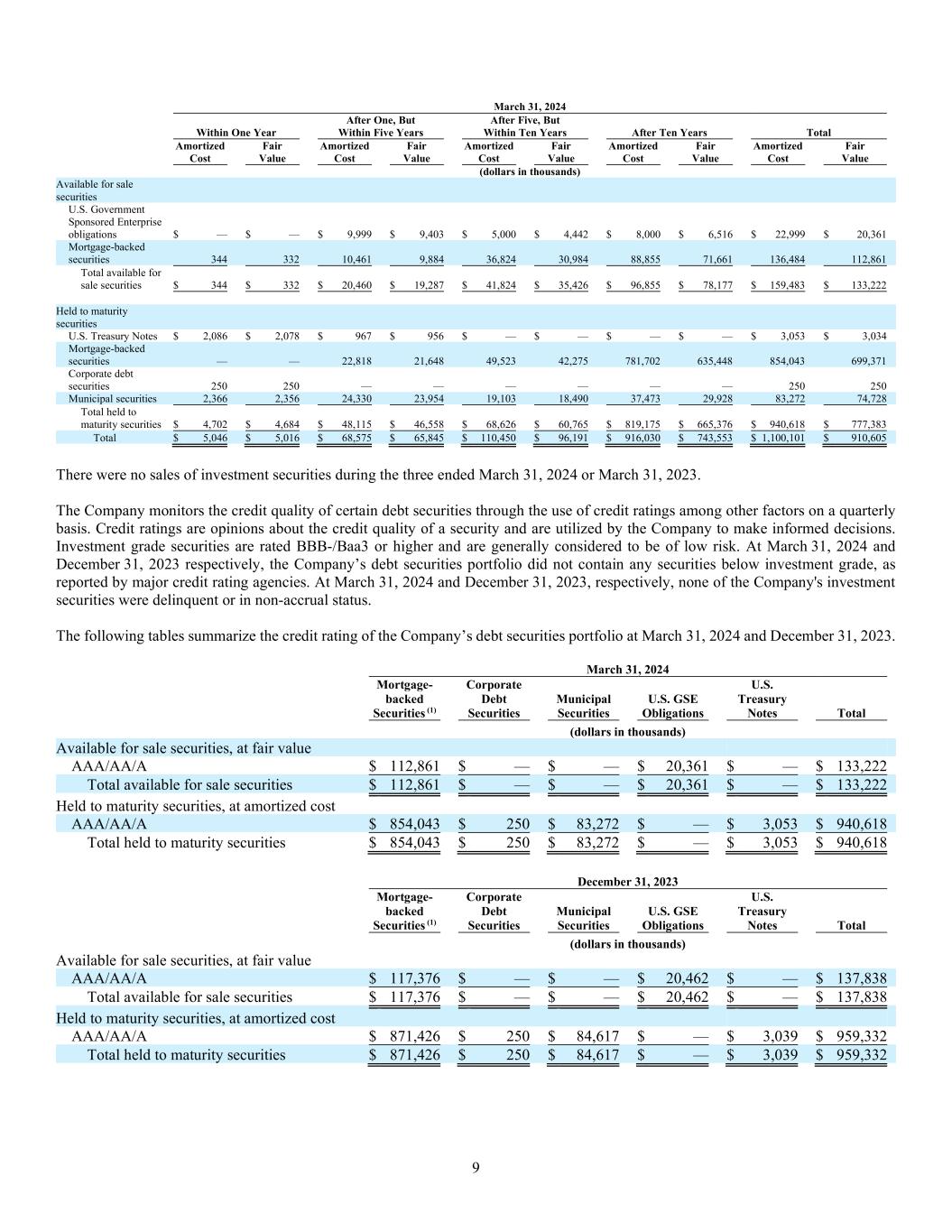

9 March 31, 2024 Within One Year After One, But Within Five Years After Five, But Within Ten Years After Ten Years Total Amortized Cost Fair Value Amortized Cost Fair Value Amortized Cost Fair Value Amortized Cost Fair Value Amortized Cost Fair Value (dollars in thousands) Available for sale securities U.S. Government Sponsored Enterprise obligations $ — $ — $ 9,999 $ 9,403 $ 5,000 $ 4,442 $ 8,000 $ 6,516 $ 22,999 $ 20,361 Mortgage-backed securities 344 332 10,461 9,884 36,824 30,984 88,855 71,661 136,484 112,861 Total available for sale securities $ 344 $ 332 $ 20,460 $ 19,287 $ 41,824 $ 35,426 $ 96,855 $ 78,177 $ 159,483 $ 133,222 Held to maturity securities U.S. Treasury Notes $ 2,086 $ 2,078 $ 967 $ 956 $ — $ — $ — $ — $ 3,053 $ 3,034 Mortgage-backed securities — — 22,818 21,648 49,523 42,275 781,702 635,448 854,043 699,371 Corporate debt securities 250 250 — — — — — — 250 250 Municipal securities 2,366 2,356 24,330 23,954 19,103 18,490 37,473 29,928 83,272 74,728 Total held to maturity securities $ 4,702 $ 4,684 $ 48,115 $ 46,558 $ 68,626 $ 60,765 $ 819,175 $ 665,376 $ 940,618 $ 777,383 Total $ 5,046 $ 5,016 $ 68,575 $ 65,845 $ 110,450 $ 96,191 $ 916,030 $ 743,553 $ 1,100,101 $ 910,605 There were no sales of investment securities during the three ended March 31, 2024 or March 31, 2023. The Company monitors the credit quality of certain debt securities through the use of credit ratings among other factors on a quarterly basis. Credit ratings are opinions about the credit quality of a security and are utilized by the Company to make informed decisions. Investment grade securities are rated BBB-/Baa3 or higher and are generally considered to be of low risk. At March 31, 2024 and December 31, 2023 respectively, the Company’s debt securities portfolio did not contain any securities below investment grade, as reported by major credit rating agencies. At March 31, 2024 and December 31, 2023, respectively, none of the Company's investment securities were delinquent or in non-accrual status. The following tables summarize the credit rating of the Company’s debt securities portfolio at March 31, 2024 and December 31, 2023. March 31, 2024 Mortgage- backed Securities (1) Corporate Debt Securities Municipal Securities U.S. GSE Obligations U.S. Treasury Notes Total (dollars in thousands) Available for sale securities, at fair value AAA/AA/A $ 112,861 $ — $ — $ 20,361 $ — $ 133,222 Total available for sale securities $ 112,861 $ — $ — $ 20,361 $ — $ 133,222 Held to maturity securities, at amortized cost AAA/AA/A $ 854,043 $ 250 $ 83,272 $ — $ 3,053 $ 940,618 Total held to maturity securities $ 854,043 $ 250 $ 83,272 $ — $ 3,053 $ 940,618 December 31, 2023 Mortgage- backed Securities (1) Corporate Debt Securities Municipal Securities U.S. GSE Obligations U.S. Treasury Notes Total (dollars in thousands) Available for sale securities, at fair value AAA/AA/A $ 117,376 $ — $ — $ 20,462 $ — $ 137,838 Total available for sale securities $ 117,376 $ — $ — $ 20,462 $ — $ 137,838 Held to maturity securities, at amortized cost AAA/AA/A $ 871,426 $ 250 $ 84,617 $ — $ 3,039 $ 959,332 Total held to maturity securities $ 871,426 $ 250 $ 84,617 $ — $ 3,039 $ 959,332

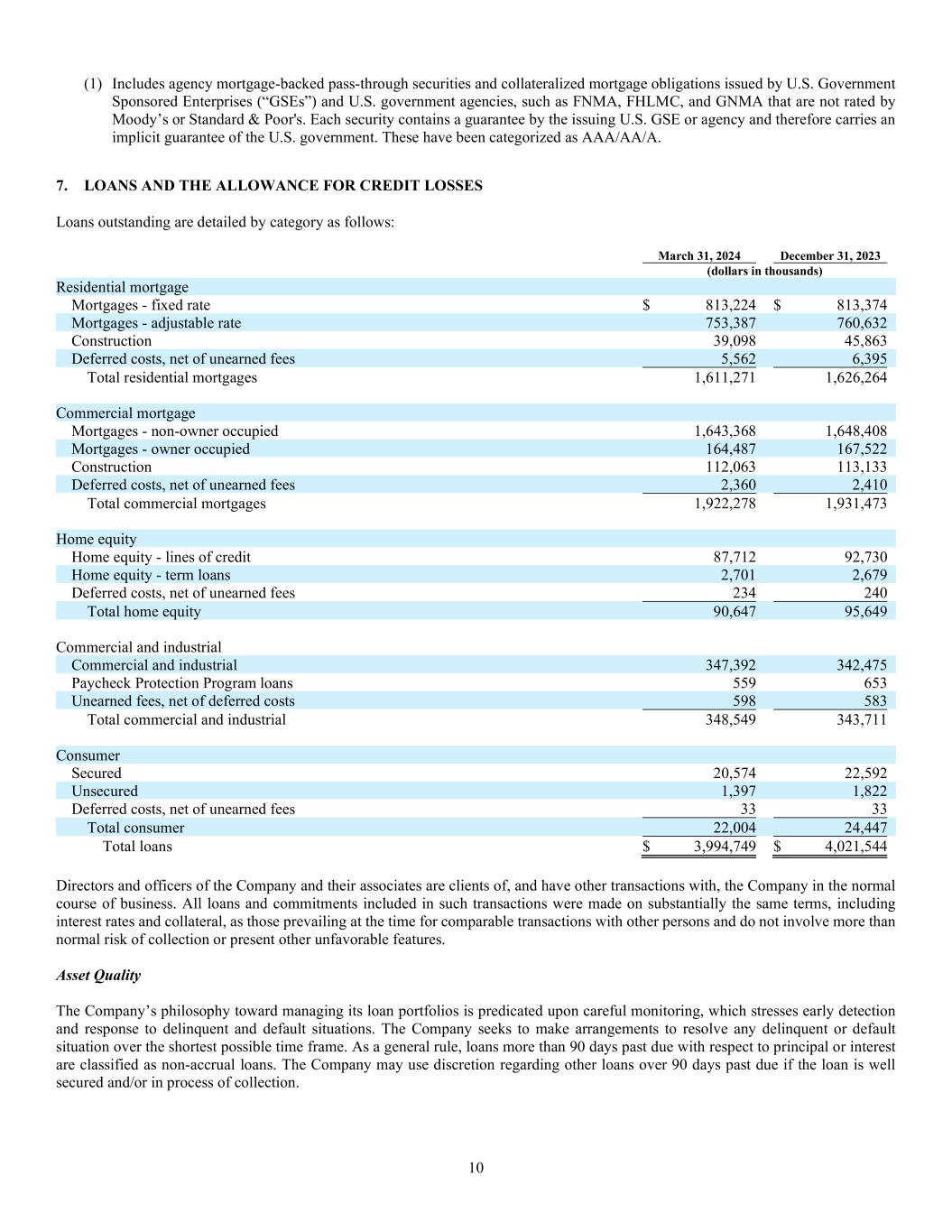

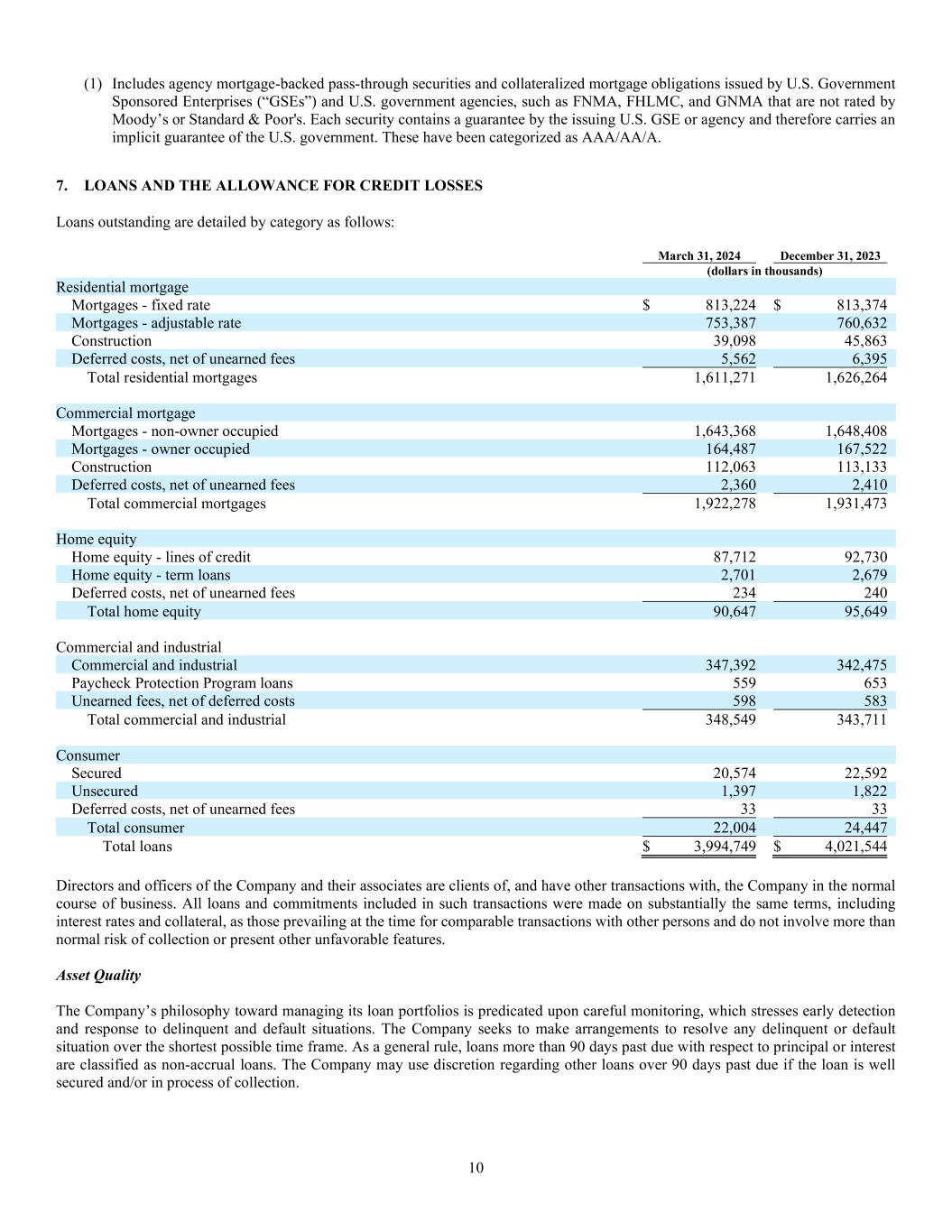

10 (1) Includes agency mortgage-backed pass-through securities and collateralized mortgage obligations issued by U.S. Government Sponsored Enterprises (“GSEs”) and U.S. government agencies, such as FNMA, FHLMC, and GNMA that are not rated by Moody’s or Standard & Poor's. Each security contains a guarantee by the issuing U.S. GSE or agency and therefore carries an implicit guarantee of the U.S. government. These have been categorized as AAA/AA/A. 7. LOANS AND THE ALLOWANCE FOR CREDIT LOSSES Loans outstanding are detailed by category as follows: March 31, 2024 December 31, 2023 (dollars in thousands) Residential mortgage Mortgages - fixed rate $ 813,224 $ 813,374 Mortgages - adjustable rate 753,387 760,632 Construction 39,098 45,863 Deferred costs, net of unearned fees 5,562 6,395 Total residential mortgages 1,611,271 1,626,264 Commercial mortgage Mortgages - non-owner occupied 1,643,368 1,648,408 Mortgages - owner occupied 164,487 167,522 Construction 112,063 113,133 Deferred costs, net of unearned fees 2,360 2,410 Total commercial mortgages 1,922,278 1,931,473 Home equity Home equity - lines of credit 87,712 92,730 Home equity - term loans 2,701 2,679 Deferred costs, net of unearned fees 234 240 Total home equity 90,647 95,649 Commercial and industrial Commercial and industrial 347,392 342,475 Paycheck Protection Program loans 559 653 Unearned fees, net of deferred costs 598 583 Total commercial and industrial 348,549 343,711 Consumer Secured 20,574 22,592 Unsecured 1,397 1,822 Deferred costs, net of unearned fees 33 33 Total consumer 22,004 24,447 Total loans $ 3,994,749 $ 4,021,544 Directors and officers of the Company and their associates are clients of, and have other transactions with, the Company in the normal course of business. All loans and commitments included in such transactions were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and do not involve more than normal risk of collection or present other unfavorable features. Asset Quality The Company’s philosophy toward managing its loan portfolios is predicated upon careful monitoring, which stresses early detection and response to delinquent and default situations. The Company seeks to make arrangements to resolve any delinquent or default situation over the shortest possible time frame. As a general rule, loans more than 90 days past due with respect to principal or interest are classified as non-accrual loans. The Company may use discretion regarding other loans over 90 days past due if the loan is well secured and/or in process of collection.

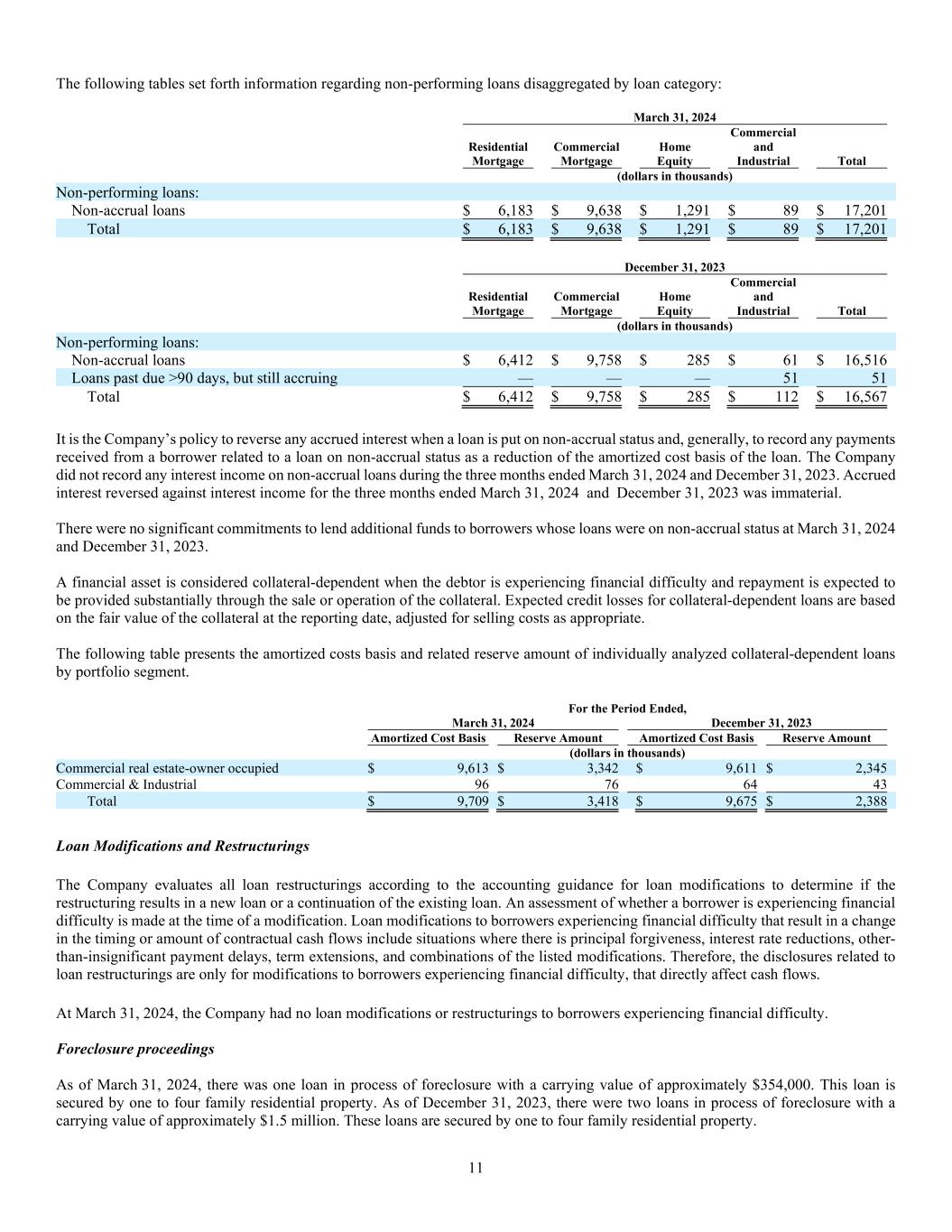

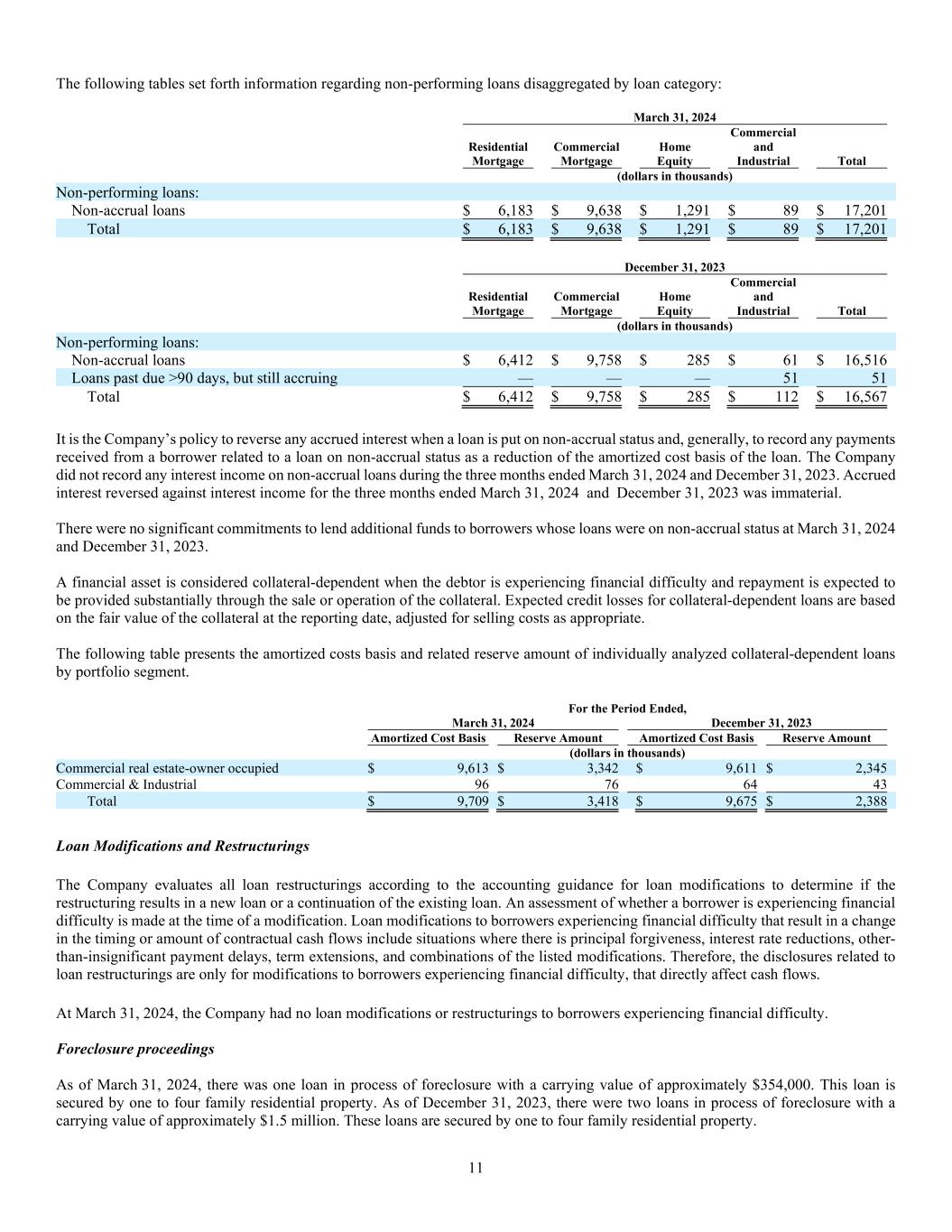

11 The following tables set forth information regarding non-performing loans disaggregated by loan category: March 31, 2024 Residential Mortgage Commercial Mortgage Home Equity Commercial and Industrial Total (dollars in thousands) Non-performing loans: Non-accrual loans $ 6,183 $ 9,638 $ 1,291 $ 89 $ 17,201 Total $ 6,183 $ 9,638 $ 1,291 $ 89 $ 17,201 December 31, 2023 Residential Mortgage Commercial Mortgage Home Equity Commercial and Industrial Total (dollars in thousands) Non-performing loans: Non-accrual loans $ 6,412 $ 9,758 $ 285 $ 61 $ 16,516 Loans past due >90 days, but still accruing — — — 51 51 Total $ 6,412 $ 9,758 $ 285 $ 112 $ 16,567 It is the Company’s policy to reverse any accrued interest when a loan is put on non-accrual status and, generally, to record any payments received from a borrower related to a loan on non-accrual status as a reduction of the amortized cost basis of the loan. The Company did not record any interest income on non-accrual loans during the three months ended March 31, 2024 and December 31, 2023. Accrued interest reversed against interest income for the three months ended March 31, 2024 and December 31, 2023 was immaterial. There were no significant commitments to lend additional funds to borrowers whose loans were on non-accrual status at March 31, 2024 and December 31, 2023. A financial asset is considered collateral-dependent when the debtor is experiencing financial difficulty and repayment is expected to be provided substantially through the sale or operation of the collateral. Expected credit losses for collateral-dependent loans are based on the fair value of the collateral at the reporting date, adjusted for selling costs as appropriate. The following table presents the amortized costs basis and related reserve amount of individually analyzed collateral-dependent loans by portfolio segment. For the Period Ended, March 31, 2024 December 31, 2023 Amortized Cost Basis Reserve Amount Amortized Cost Basis Reserve Amount (dollars in thousands) Commercial real estate-owner occupied $ 9,613 $ 3,342 $ 9,611 $ 2,345 Commercial & Industrial 96 76 64 43 Total $ 9,709 $ 3,418 $ 9,675 $ 2,388 Loan Modifications and Restructurings The Company evaluates all loan restructurings according to the accounting guidance for loan modifications to determine if the restructuring results in a new loan or a continuation of the existing loan. An assessment of whether a borrower is experiencing financial difficulty is made at the time of a modification. Loan modifications to borrowers experiencing financial difficulty that result in a change in the timing or amount of contractual cash flows include situations where there is principal forgiveness, interest rate reductions, other- than-insignificant payment delays, term extensions, and combinations of the listed modifications. Therefore, the disclosures related to loan restructurings are only for modifications to borrowers experiencing financial difficulty, that directly affect cash flows. At March 31, 2024, the Company had no loan modifications or restructurings to borrowers experiencing financial difficulty. Foreclosure proceedings As of March 31, 2024, there was one loan in process of foreclosure with a carrying value of approximately $354,000. This loan is secured by one to four family residential property. As of December 31, 2023, there were two loans in process of foreclosure with a carrying value of approximately $1.5 million. These loans are secured by one to four family residential property.

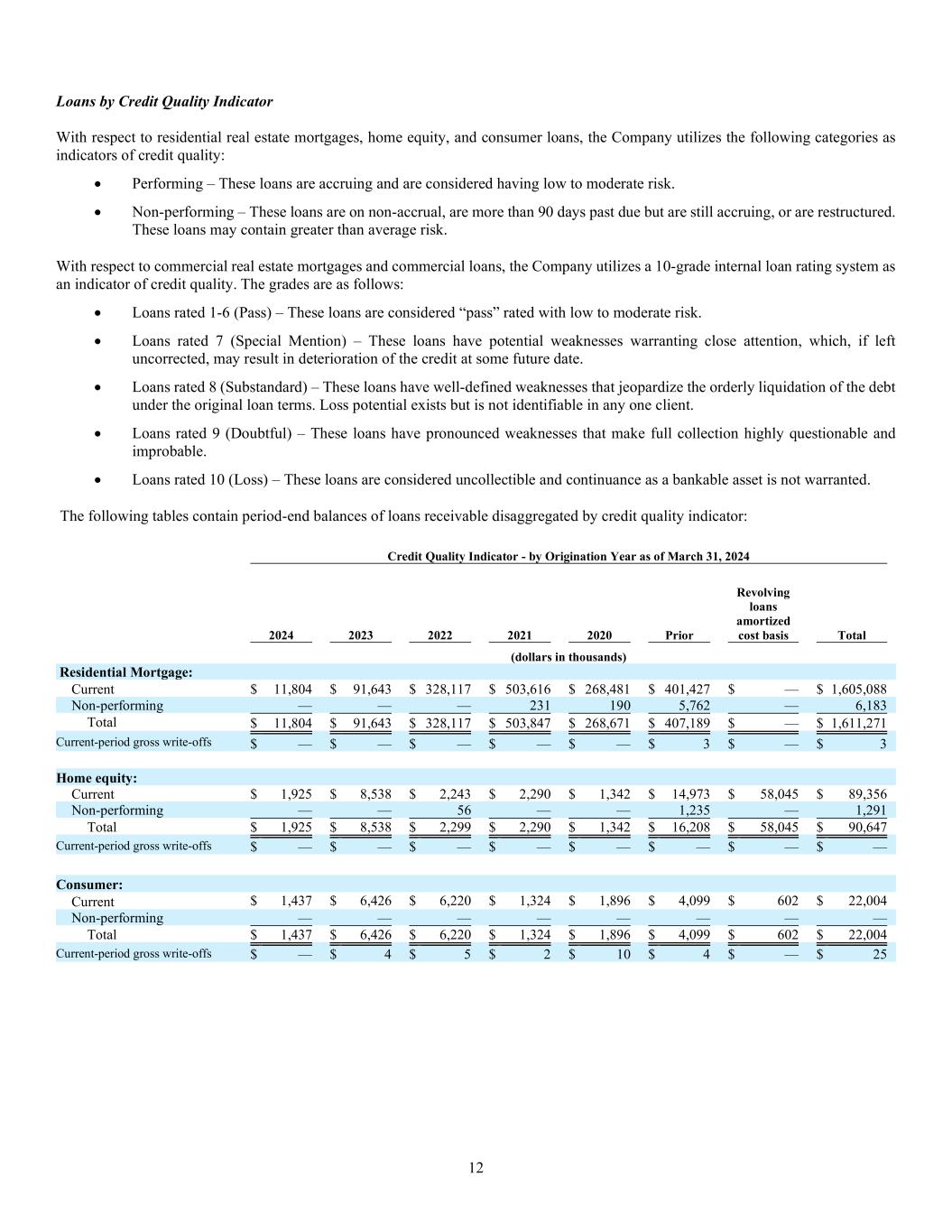

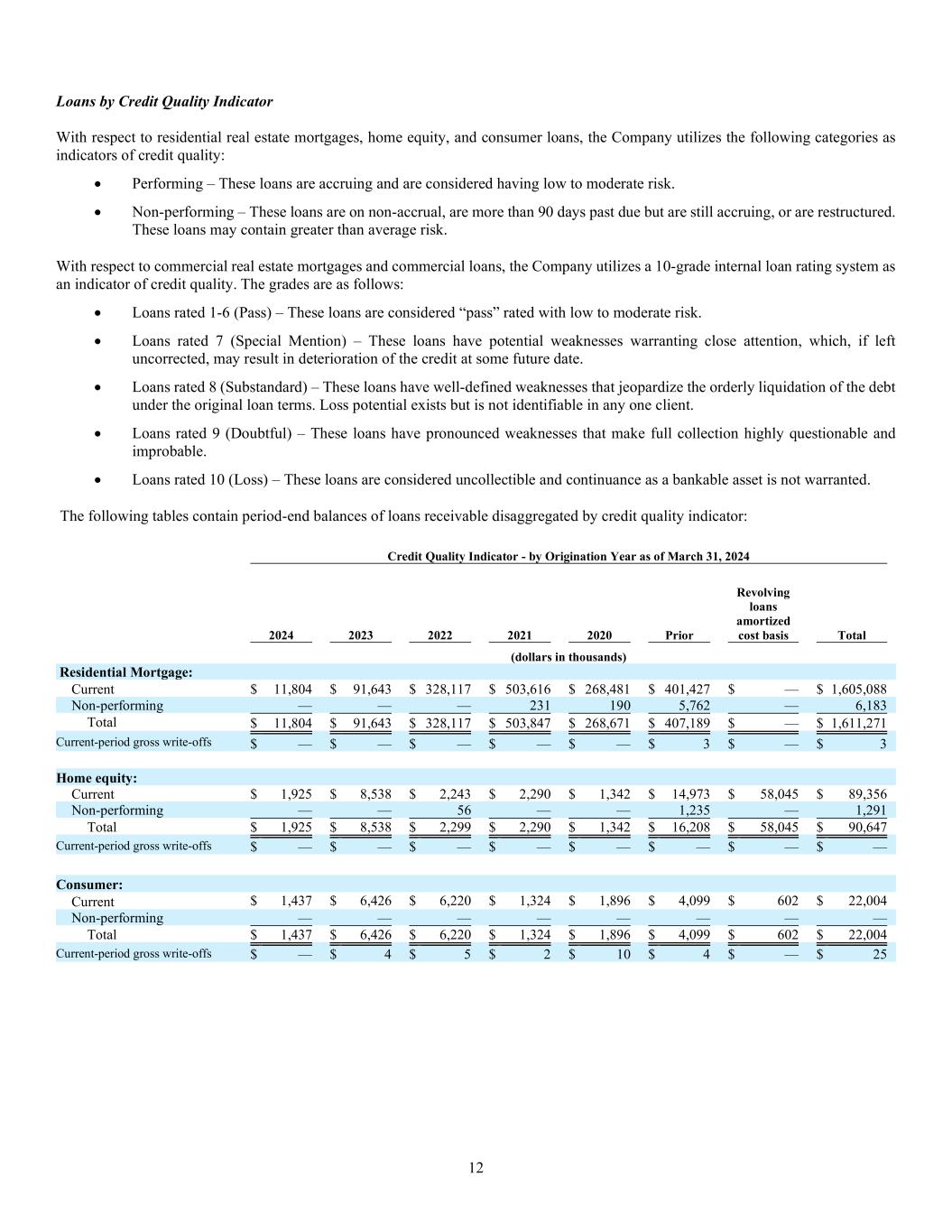

12 Loans by Credit Quality Indicator With respect to residential real estate mortgages, home equity, and consumer loans, the Company utilizes the following categories as indicators of credit quality: Performing – These loans are accruing and are considered having low to moderate risk. Non-performing – These loans are on non-accrual, are more than 90 days past due but are still accruing, or are restructured. These loans may contain greater than average risk. With respect to commercial real estate mortgages and commercial loans, the Company utilizes a 10-grade internal loan rating system as an indicator of credit quality. The grades are as follows: Loans rated 1-6 (Pass) – These loans are considered “pass” rated with low to moderate risk. Loans rated 7 (Special Mention) – These loans have potential weaknesses warranting close attention, which, if left uncorrected, may result in deterioration of the credit at some future date. Loans rated 8 (Substandard) – These loans have well-defined weaknesses that jeopardize the orderly liquidation of the debt under the original loan terms. Loss potential exists but is not identifiable in any one client. Loans rated 9 (Doubtful) – These loans have pronounced weaknesses that make full collection highly questionable and improbable. Loans rated 10 (Loss) – These loans are considered uncollectible and continuance as a bankable asset is not warranted. The following tables contain period-end balances of loans receivable disaggregated by credit quality indicator: Credit Quality Indicator - by Origination Year as of March 31, 2024 2024 2023 2022 2021 2020 Prior Revolving loans amortized cost basis Total (dollars in thousands) Residential Mortgage: Current $ 11,804 $ 91,643 $ 328,117 $ 503,616 $ 268,481 $ 401,427 $ — $ 1,605,088 Non-performing — — — 231 190 5,762 — 6,183 Total $ 11,804 $ 91,643 $ 328,117 $ 503,847 $ 268,671 $ 407,189 $ — $ 1,611,271 Current-period gross write-offs $ — $ — $ — $ — $ — $ 3 $ — $ 3 Home equity: Current $ 1,925 $ 8,538 $ 2,243 $ 2,290 $ 1,342 $ 14,973 $ 58,045 $ 89,356 Non-performing — — 56 — — 1,235 — 1,291 Total $ 1,925 $ 8,538 $ 2,299 $ 2,290 $ 1,342 $ 16,208 $ 58,045 $ 90,647 Current-period gross write-offs $ — $ — $ — $ — $ — $ — $ — $ — Consumer: Current $ 1,437 $ 6,426 $ 6,220 $ 1,324 $ 1,896 $ 4,099 $ 602 $ 22,004 Non-performing — — — — — — — — Total $ 1,437 $ 6,426 $ 6,220 $ 1,324 $ 1,896 $ 4,099 $ 602 $ 22,004 Current-period gross write-offs $ — $ 4 $ 5 $ 2 $ 10 $ 4 $ — $ 25

13 Credit Quality Indicator - by Origination Year as of March 31, 2024 2024 2023 2022 2021 2020 Prior Revolving loans amortized cost basis Total (dollars in thousands) Commercial Mortgage: Credit risk profile by internally assigned grade: 1-6 (Pass) $ 9,224 $ 69,823 $ 468,137 $ 358,601 $ 225,668 $ 697,709 $ — $ 1,829,162 7 (Special Mention) — 1,815 3,521 1,332 1,028 74,582 — 82,278 8 (Substandard) 100 — 1,088 — — 9,650 — 10,838 9 (Doubtful) — — — — — — — — 10 (Loss) — — — — — — — — Total $ 9,324 $ 71,638 $ 472,746 $ 359,933 $ 226,696 $ 781,941 $ — $ 1,922,278 Current-period gross write-offs $ — $ — $ — $ — $ — $ — $ — $ — Commercial and Industrial: Credit risk profile by internally assigned grade: 1-6 (Pass) $ 9,916 $ 46,037 $ 102,279 $ 42,648 $ 49,036 $ 60,135 $ 503 $ 310,554 7 (Special Mention) — 60 25,208 62 9,540 — 10 34,880 8 (Substandard) — — 1,321 — 233 1,561 — 3,115 9 (Doubtful) — — — — — — — — 10 (Loss) — — — — — — — — Total $ 9,916 $ 46,097 $ 128,808 $ 42,710 $ 58,809 $ 61,696 $ 513 $ 348,549 Current-period gross write-offs $ — $ — $ — $ — $ — $ 8 $ — $ 8 Credit Quality Indicator - by Origination Year as of December 31, 2023 2023 2022 2021 2020 2019 Prior Revolving loans amortized cost basis Total (dollars in thousands) Residential Mortgage: Current $ 92,911 $ 331,817 $ 507,677 $ 274,988 $ 111,715 $ 300,744 $ — $ 1,619,852 Non-performing — — — 193 1,490 4,729 — 6,412 Total $ 92,911 $ 331,817 $ 507,677 $ 275,181 $ 113,205 $ 305,473 $ — $ 1,626,264 Current-period gross write-offs $ — $ — $ — $ — $ — $ — $ — $ — Home equity: Current $ 8,085 $ 2,411 $ 2,241 $ 1,399 $ 2,587 $ 14,674 $ 63,967 $ 95,364 Non-performing — 58 — — — 227 — 285 Total $ 8,085 $ 2,469 $ 2,241 $ 1,399 $ 2,587 $ 14,901 $ 63,967 $ 95,649 Current-period gross write-offs $ — $ — $ — $ — $ — $ — $ — $ — Consumer: Current $ 7,281 $ 7,459 $ 1,706 $ 2,841 $ 694 $ 3,842 $ 624 $ 24,447 Non-performing — — — — — — — — Total $ 7,281 $ 7,459 $ 1,706 $ 2,841 $ 694 $ 3,842 $ 624 $ 24,447 Current-period gross write-offs $ — $ — $ — $ — $ — $ 67 $ — $ 67

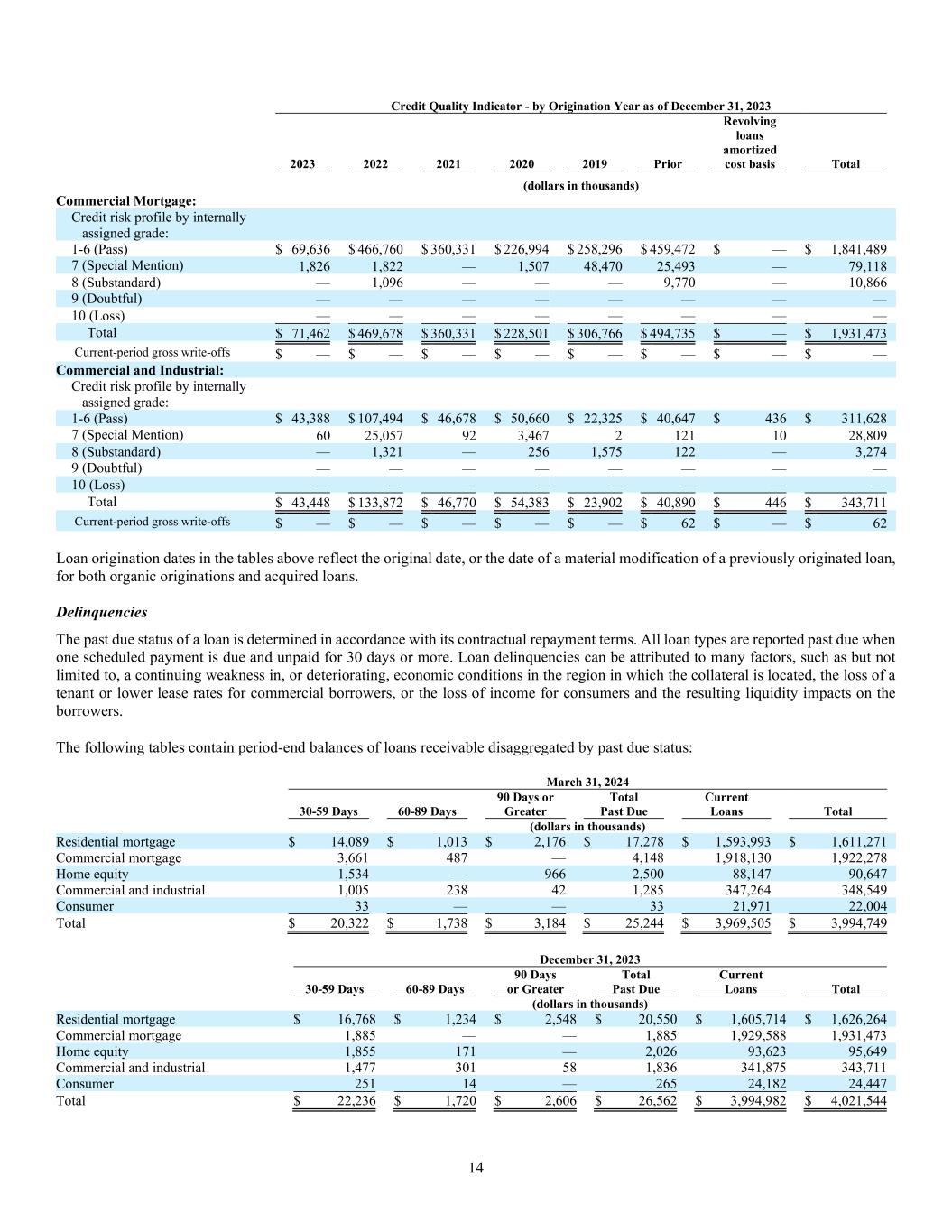

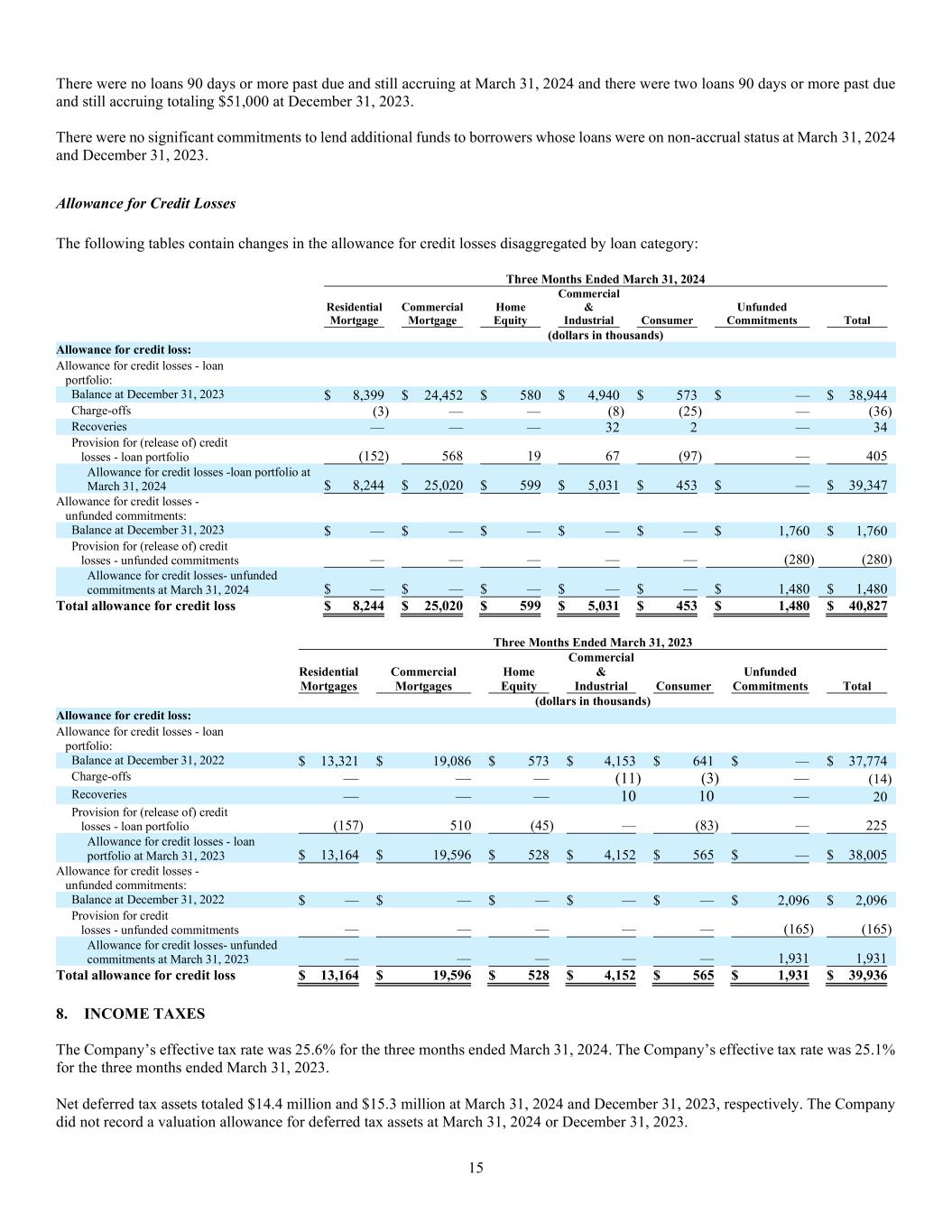

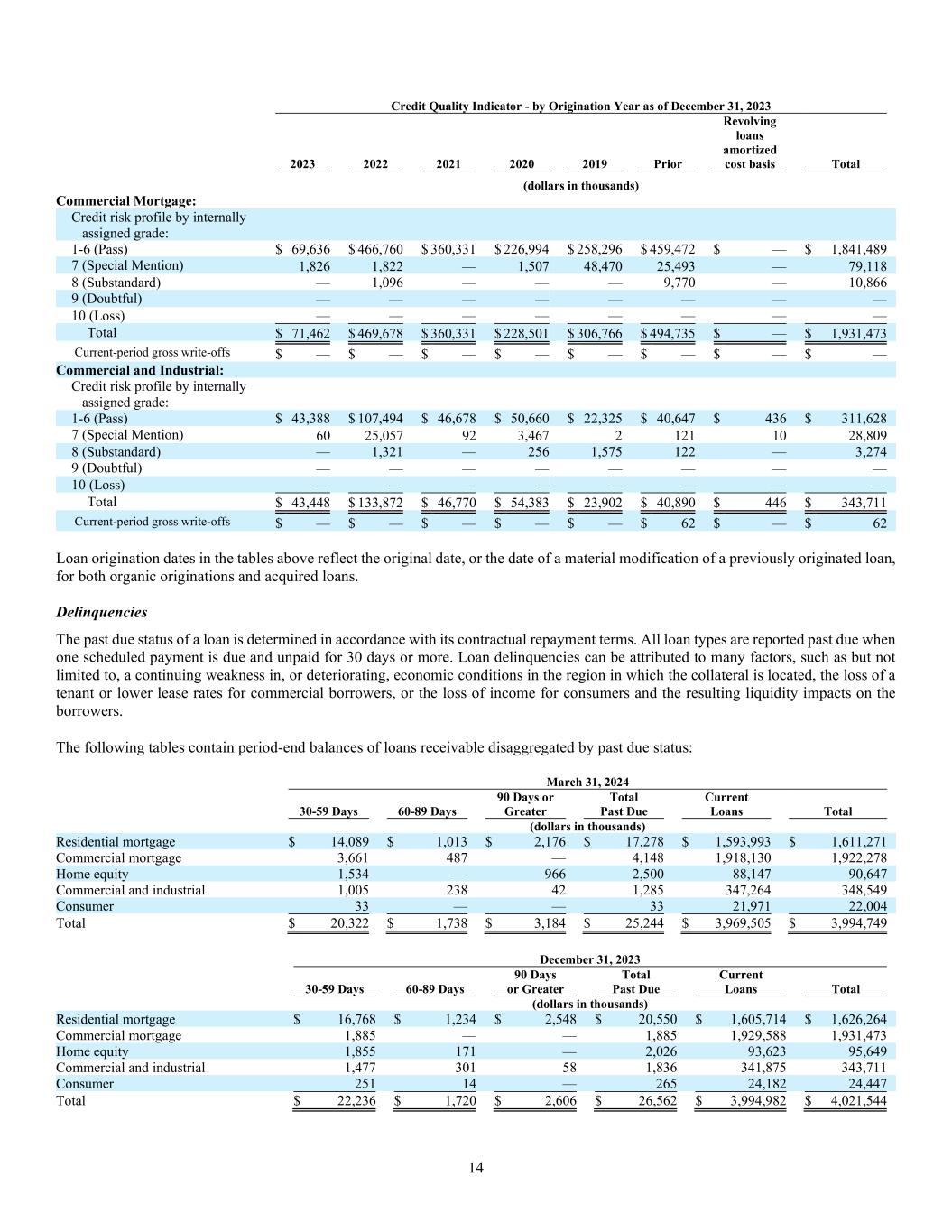

14 Credit Quality Indicator - by Origination Year as of December 31, 2023 2023 2022 2021 2020 2019 Prior Revolving loans amortized cost basis Total (dollars in thousands) Commercial Mortgage: Credit risk profile by internally assigned grade: 1-6 (Pass) $ 69,636 $ 466,760 $ 360,331 $ 226,994 $ 258,296 $ 459,472 $ — $ 1,841,489 7 (Special Mention) 1,826 1,822 — 1,507 48,470 25,493 — 79,118 8 (Substandard) — 1,096 — — — 9,770 — 10,866 9 (Doubtful) — — — — — — — — 10 (Loss) — — — — — — — — Total $ 71,462 $ 469,678 $ 360,331 $ 228,501 $ 306,766 $ 494,735 $ — $ 1,931,473 Current-period gross write-offs $ — $ — $ — $ — $ — $ — $ — $ — Commercial and Industrial: Credit risk profile by internally assigned grade: 1-6 (Pass) $ 43,388 $ 107,494 $ 46,678 $ 50,660 $ 22,325 $ 40,647 $ 436 $ 311,628 7 (Special Mention) 60 25,057 92 3,467 2 121 10 28,809 8 (Substandard) — 1,321 — 256 1,575 122 — 3,274 9 (Doubtful) — — — — — — — — 10 (Loss) — — — — — — — — Total $ 43,448 $ 133,872 $ 46,770 $ 54,383 $ 23,902 $ 40,890 $ 446 $ 343,711 Current-period gross write-offs $ — $ — $ — $ — $ — $ 62 $ — $ 62 Loan origination dates in the tables above reflect the original date, or the date of a material modification of a previously originated loan, for both organic originations and acquired loans. Delinquencies The past due status of a loan is determined in accordance with its contractual repayment terms. All loan types are reported past due when one scheduled payment is due and unpaid for 30 days or more. Loan delinquencies can be attributed to many factors, such as but not limited to, a continuing weakness in, or deteriorating, economic conditions in the region in which the collateral is located, the loss of a tenant or lower lease rates for commercial borrowers, or the loss of income for consumers and the resulting liquidity impacts on the borrowers. The following tables contain period-end balances of loans receivable disaggregated by past due status: March 31, 2024 30-59 Days 60-89 Days 90 Days or Greater Total Past Due Current Loans Total (dollars in thousands) Residential mortgage $ 14,089 $ 1,013 $ 2,176 $ 17,278 $ 1,593,993 $ 1,611,271 Commercial mortgage 3,661 487 — 4,148 1,918,130 1,922,278 Home equity 1,534 — 966 2,500 88,147 90,647 Commercial and industrial 1,005 238 42 1,285 347,264 348,549 Consumer 33 — — 33 21,971 22,004 Total $ 20,322 $ 1,738 $ 3,184 $ 25,244 $ 3,969,505 $ 3,994,749 December 31, 2023 30-59 Days 60-89 Days 90 Days or Greater Total Past Due Current Loans Total (dollars in thousands) Residential mortgage $ 16,768 $ 1,234 $ 2,548 $ 20,550 $ 1,605,714 $ 1,626,264 Commercial mortgage 1,885 — — 1,885 1,929,588 1,931,473 Home equity 1,855 171 — 2,026 93,623 95,649 Commercial and industrial 1,477 301 58 1,836 341,875 343,711 Consumer 251 14 — 265 24,182 24,447 Total $ 22,236 $ 1,720 $ 2,606 $ 26,562 $ 3,994,982 $ 4,021,544

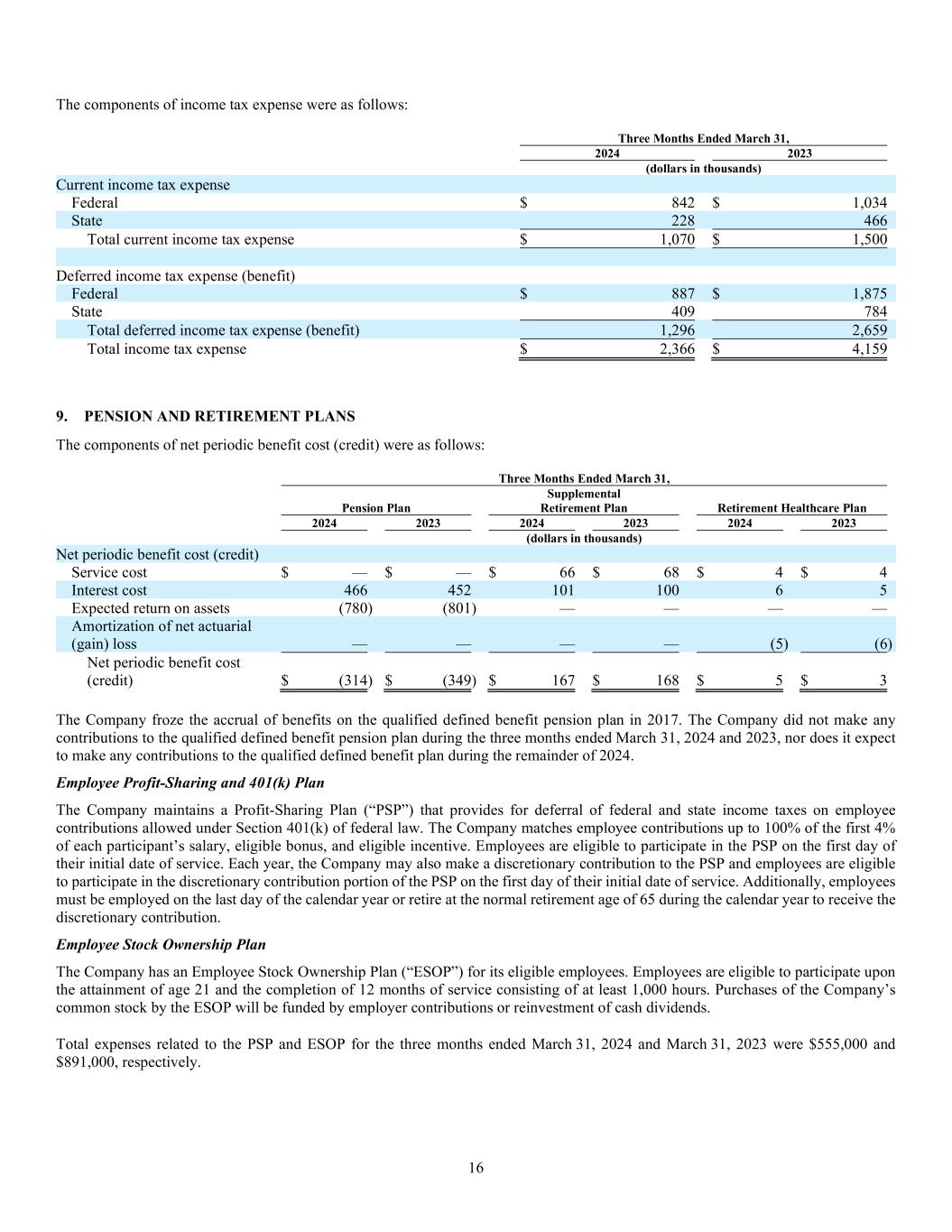

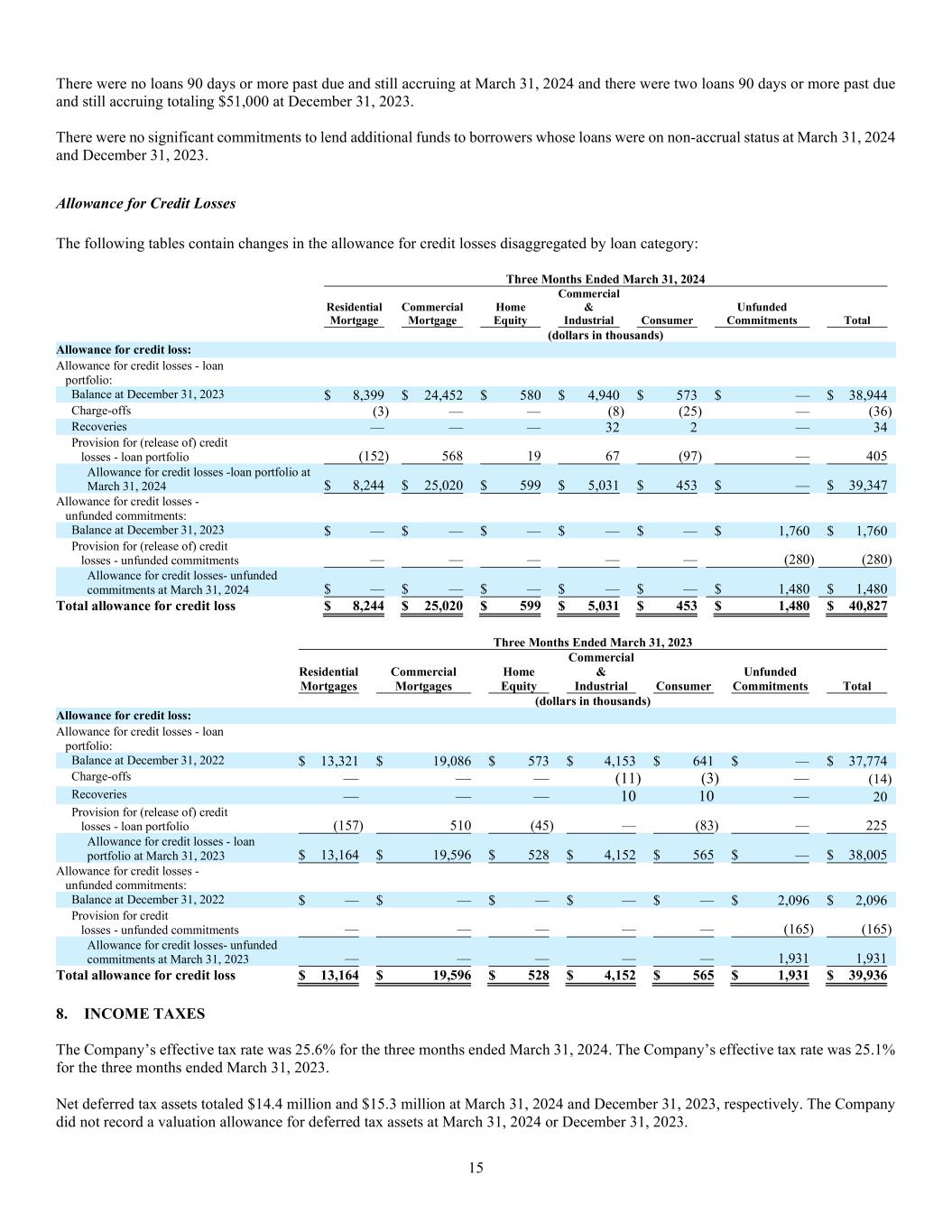

15 There were no loans 90 days or more past due and still accruing at March 31, 2024 and there were two loans 90 days or more past due and still accruing totaling $51,000 at December 31, 2023. There were no significant commitments to lend additional funds to borrowers whose loans were on non-accrual status at March 31, 2024 and December 31, 2023. Allowance for Credit Losses The following tables contain changes in the allowance for credit losses disaggregated by loan category: Three Months Ended March 31, 2024 Residential Mortgage Commercial Mortgage Home Equity Commercial & Industrial Consumer Unfunded Commitments Total (dollars in thousands) Allowance for credit loss: Allowance for credit losses - loan portfolio: Balance at December 31, 2023 $ 8,399 $ 24,452 $ 580 $ 4,940 $ 573 $ — $ 38,944 Charge-offs (3) — — (8 ) (25) — (36) Recoveries — — — 32 2 — 34 Provision for (release of) credit losses - loan portfolio (152) 568 19 67 (97) — 405 Allowance for credit losses -loan portfolio at March 31, 2024 $ 8,244 $ 25,020 $ 599 $ 5,031 $ 453 $ — $ 39,347 Allowance for credit losses - unfunded commitments: Balance at December 31, 2023 $ — $ — $ — $ — $ — $ 1,760 $ 1,760 Provision for (release of) credit losses - unfunded commitments — — — — — (280) (280) Allowance for credit losses- unfunded commitments at March 31, 2024 $ — $ — $ — $ — $ — $ 1,480 $ 1,480 Total allowance for credit loss $ 8,244 $ 25,020 $ 599 $ 5,031 $ 453 $ 1,480 $ 40,827 Three Months Ended March 31, 2023 Residential Mortgages Commercial Mortgages Home Equity Commercial & Industrial Consumer Unfunded Commitments Total (dollars in thousands) Allowance for credit loss: Allowance for credit losses - loan portfolio: Balance at December 31, 2022 $ 13,321 $ 19,086 $ 573 $ 4,153 $ 641 $ — $ 37,774 Charge-offs — — — (11) (3) — (14) Recoveries — — — 10 10 — 20 Provision for (release of) credit losses - loan portfolio (157) 510 (45) — (83) — 225 Allowance for credit losses - loan portfolio at March 31, 2023 $ 13,164 $ 19,596 $ 528 $ 4,152 $ 565 $ — $ 38,005 Allowance for credit losses - unfunded commitments: Balance at December 31, 2022 $ — $ — $ — $ — $ — $ 2,096 $ 2,096 Provision for credit losses - unfunded commitments — — — — — (165) (165) Allowance for credit losses- unfunded commitments at March 31, 2023 — — — — — 1,931 1,931 Total allowance for credit loss $ 13,164 $ 19,596 $ 528 $ 4,152 $ 565 $ 1,931 $ 39,936 8. INCOME TAXES The Company’s effective tax rate was 25.6% for the three months ended March 31, 2024. The Company’s effective tax rate was 25.1% for the three months ended March 31, 2023. Net deferred tax assets totaled $14.4 million and $15.3 million at March 31, 2024 and December 31, 2023, respectively. The Company did not record a valuation allowance for deferred tax assets at March 31, 2024 or December 31, 2023.

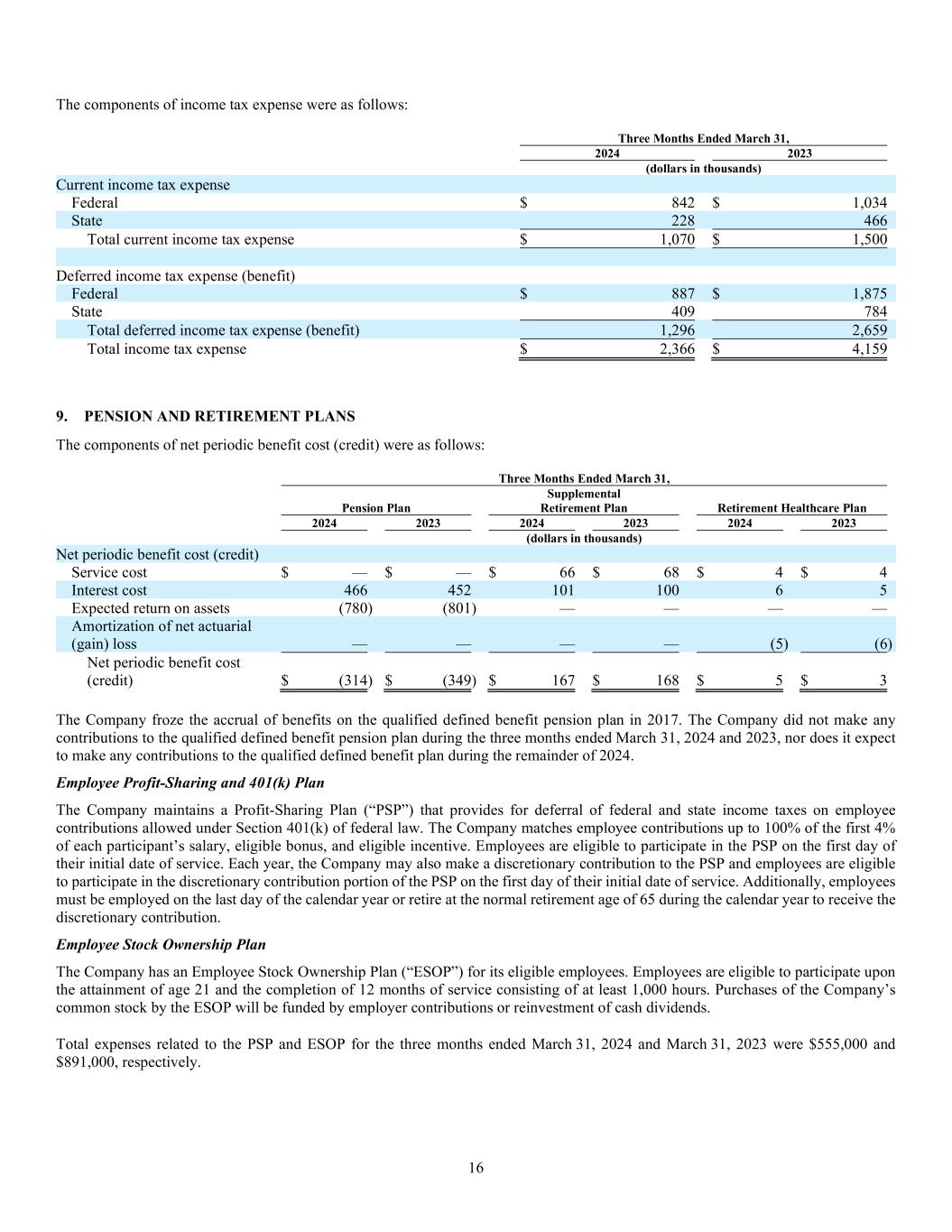

16 The components of income tax expense were as follows: Three Months Ended March 31, 2024 2023 (dollars in thousands) Current income tax expense Federal $ 842 $ 1,034 State 228 466 Total current income tax expense $ 1,070 $ 1,500 Deferred income tax expense (benefit) Federal $ 887 $ 1,875 State 409 784 Total deferred income tax expense (benefit) 1,296 2,659 Total income tax expense $ 2,366 $ 4,159 9. PENSION AND RETIREMENT PLANS The components of net periodic benefit cost (credit) were as follows: Three Months Ended March 31, Pension Plan Supplemental Retirement Plan Retirement Healthcare Plan 2024 2023 2024 2023 2024 2023 (dollars in thousands) Net periodic benefit cost (credit) Service cost $ — $ — $ 66 $ 68 $ 4 $ 4 Interest cost 466 452 101 100 6 5 Expected return on assets (780) (801) — — — — Amortization of net actuarial (gain) loss — — — — (5) (6) Net periodic benefit cost (credit) $ (314) $ (349) $ 167 $ 168 $ 5 $ 3 The Company froze the accrual of benefits on the qualified defined benefit pension plan in 2017. The Company did not make any contributions to the qualified defined benefit pension plan during the three months ended March 31, 2024 and 2023, nor does it expect to make any contributions to the qualified defined benefit plan during the remainder of 2024. Employee Profit-Sharing and 401(k) Plan The Company maintains a Profit-Sharing Plan (“PSP”) that provides for deferral of federal and state income taxes on employee contributions allowed under Section 401(k) of federal law. The Company matches employee contributions up to 100% of the first 4% of each participant’s salary, eligible bonus, and eligible incentive. Employees are eligible to participate in the PSP on the first day of their initial date of service. Each year, the Company may also make a discretionary contribution to the PSP and employees are eligible to participate in the discretionary contribution portion of the PSP on the first day of their initial date of service. Additionally, employees must be employed on the last day of the calendar year or retire at the normal retirement age of 65 during the calendar year to receive the discretionary contribution. Employee Stock Ownership Plan The Company has an Employee Stock Ownership Plan (“ESOP”) for its eligible employees. Employees are eligible to participate upon the attainment of age 21 and the completion of 12 months of service consisting of at least 1,000 hours. Purchases of the Company’s common stock by the ESOP will be funded by employer contributions or reinvestment of cash dividends. Total expenses related to the PSP and ESOP for the three months ended March 31, 2024 and March 31, 2023 were $555,000 and $891,000, respectively.

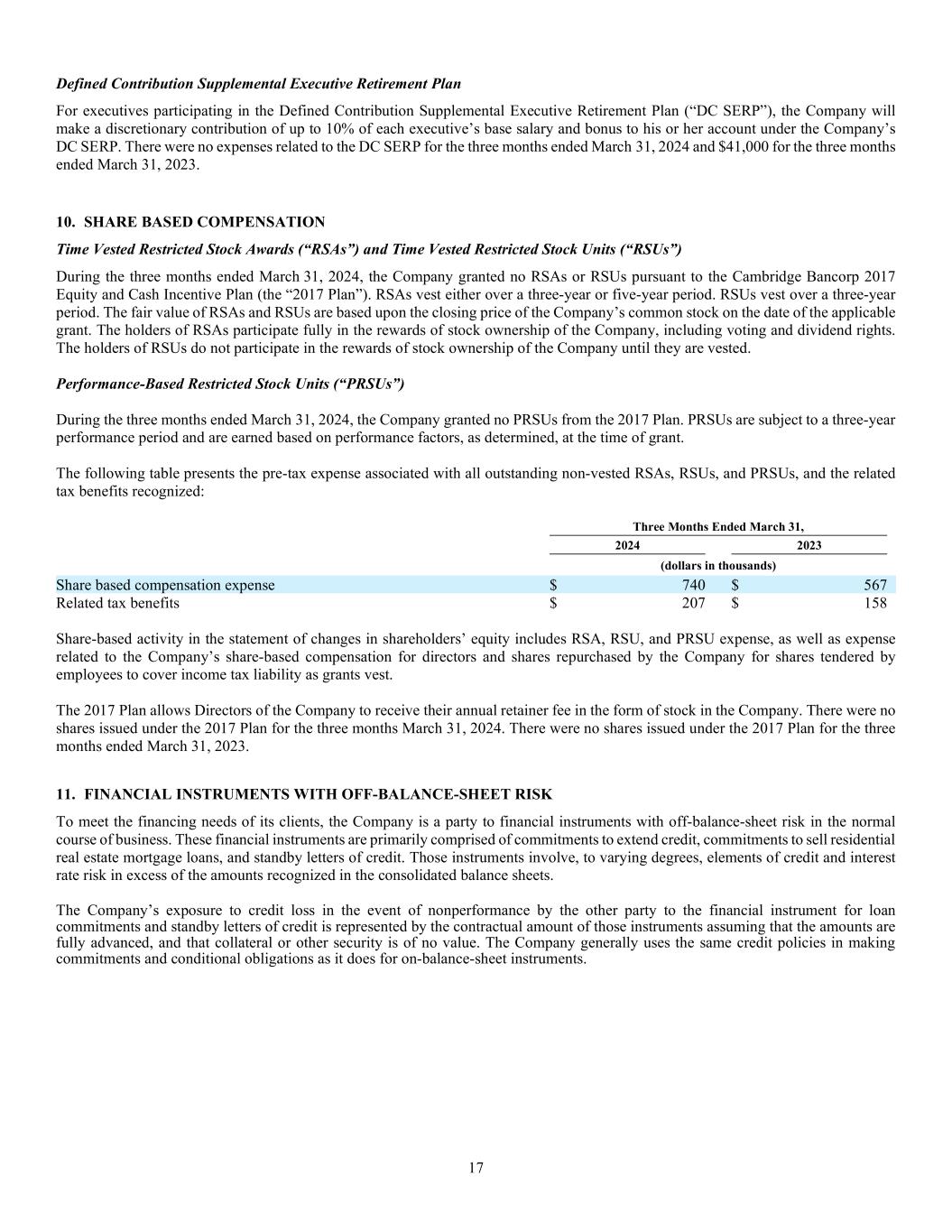

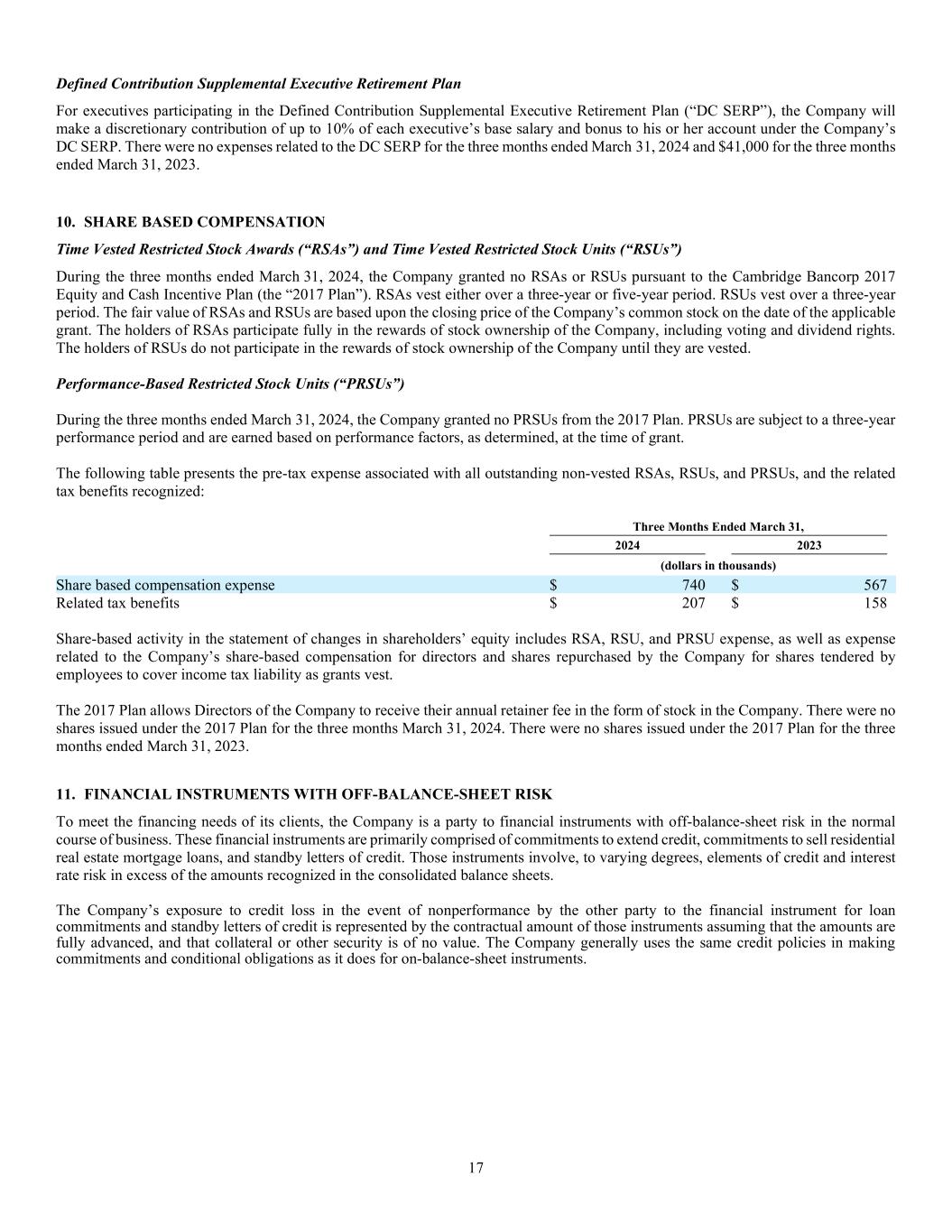

17 Defined Contribution Supplemental Executive Retirement Plan For executives participating in the Defined Contribution Supplemental Executive Retirement Plan (“DC SERP”), the Company will make a discretionary contribution of up to 10% of each executive’s base salary and bonus to his or her account under the Company’s DC SERP. There were no expenses related to the DC SERP for the three months ended March 31, 2024 and $41,000 for the three months ended March 31, 2023. 10. SHARE BASED COMPENSATION Time Vested Restricted Stock Awards (“RSAs”) and Time Vested Restricted Stock Units (“RSUs”) During the three months ended March 31, 2024, the Company granted no RSAs or RSUs pursuant to the Cambridge Bancorp 2017 Equity and Cash Incentive Plan (the “2017 Plan”). RSAs vest either over a three-year or five-year period. RSUs vest over a three-year period. The fair value of RSAs and RSUs are based upon the closing price of the Company’s common stock on the date of the applicable grant. The holders of RSAs participate fully in the rewards of stock ownership of the Company, including voting and dividend rights. The holders of RSUs do not participate in the rewards of stock ownership of the Company until they are vested. Performance-Based Restricted Stock Units (“PRSUs”) During the three months ended March 31, 2024, the Company granted no PRSUs from the 2017 Plan. PRSUs are subject to a three-year performance period and are earned based on performance factors, as determined, at the time of grant. The following table presents the pre-tax expense associated with all outstanding non-vested RSAs, RSUs, and PRSUs, and the related tax benefits recognized: Three Months Ended March 31, 2024 2023 (dollars in thousands) Share based compensation expense $ 740 $ 567 Related tax benefits $ 207 $ 158 Share-based activity in the statement of changes in shareholders’ equity includes RSA, RSU, and PRSU expense, as well as expense related to the Company’s share-based compensation for directors and shares repurchased by the Company for shares tendered by employees to cover income tax liability as grants vest. The 2017 Plan allows Directors of the Company to receive their annual retainer fee in the form of stock in the Company. There were no shares issued under the 2017 Plan for the three months March 31, 2024. There were no shares issued under the 2017 Plan for the three months ended March 31, 2023. 11. FINANCIAL INSTRUMENTS WITH OFF-BALANCE-SHEET RISK To meet the financing needs of its clients, the Company is a party to financial instruments with off-balance-sheet risk in the normal course of business. These financial instruments are primarily comprised of commitments to extend credit, commitments to sell residential real estate mortgage loans, and standby letters of credit. Those instruments involve, to varying degrees, elements of credit and interest rate risk in excess of the amounts recognized in the consolidated balance sheets. The Company’s exposure to credit loss in the event of nonperformance by the other party to the financial instrument for loan commitments and standby letters of credit is represented by the contractual amount of those instruments assuming that the amounts are fully advanced, and that collateral or other security is of no value. The Company generally uses the same credit policies in making commitments and conditional obligations as it does for on-balance-sheet instruments.

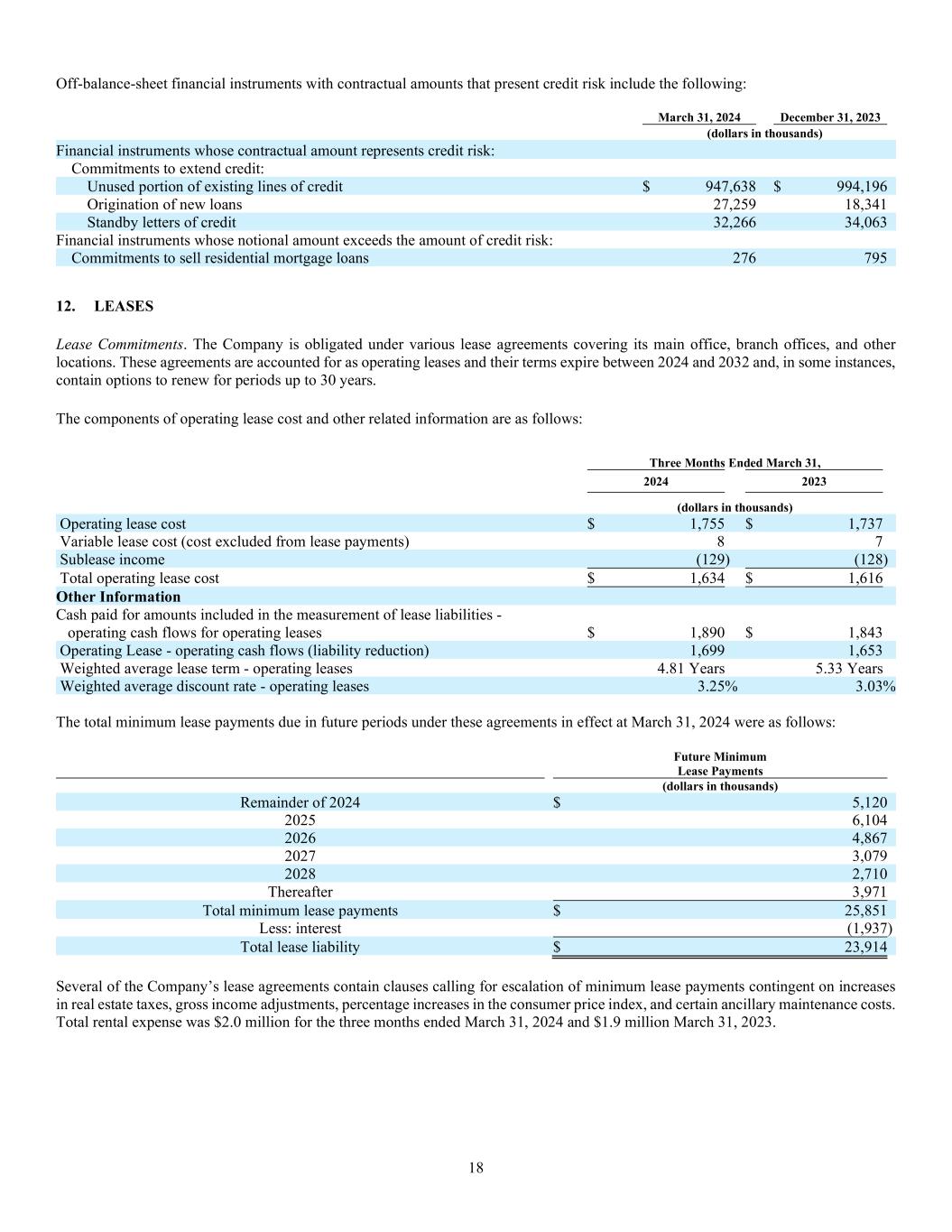

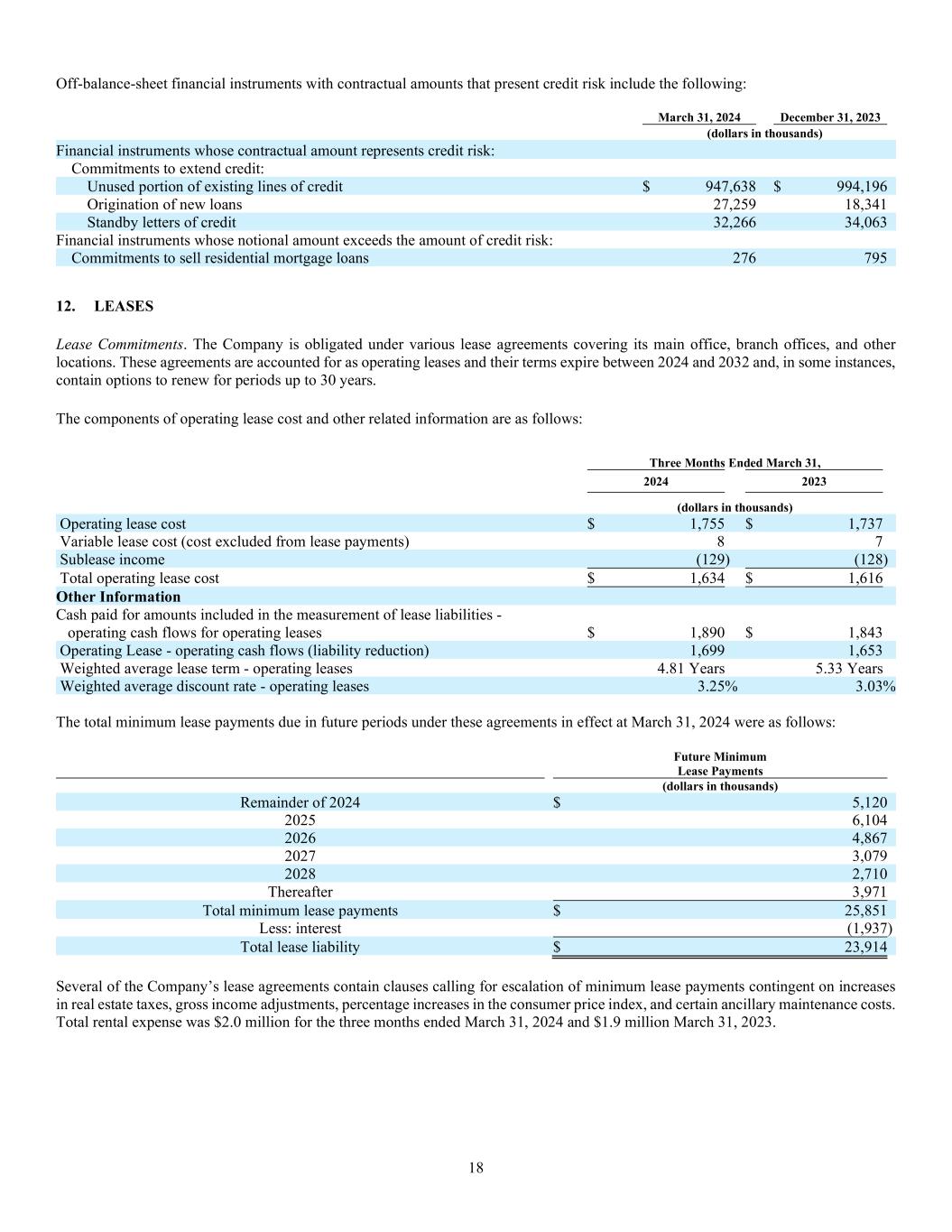

18 Off-balance-sheet financial instruments with contractual amounts that present credit risk include the following: March 31, 2024 December 31, 2023 (dollars in thousands) Financial instruments whose contractual amount represents credit risk: Commitments to extend credit: Unused portion of existing lines of credit $ 947,638 $ 994,196 Origination of new loans 27,259 18,341 Standby letters of credit 32,266 34,063 Financial instruments whose notional amount exceeds the amount of credit risk: Commitments to sell residential mortgage loans 276 795 12. LEASES Lease Commitments. The Company is obligated under various lease agreements covering its main office, branch offices, and other locations. These agreements are accounted for as operating leases and their terms expire between 2024 and 2032 and, in some instances, contain options to renew for periods up to 30 years. The components of operating lease cost and other related information are as follows: Three Months Ended March 31, 2024 2023 (dollars in thousands) Operating lease cost $ 1,755 $ 1,737 Variable lease cost (cost excluded from lease payments) 8 7 Sublease income (129) (128) Total operating lease cost $ 1,634 $ 1,616 Other Information Cash paid for amounts included in the measurement of lease liabilities - operating cash flows for operating leases $ 1,890 $ 1,843 Operating Lease - operating cash flows (liability reduction) 1,699 1,653 Weighted average lease term - operating leases 4.81 Years 5.33 Years Weighted average discount rate - operating leases 3.25% 3.03% The total minimum lease payments due in future periods under these agreements in effect at March 31, 2024 were as follows: Future Minimum Lease Payments (dollars in thousands) Remainder of 2024 $ 5,120 2025 6,104 2026 4,867 2027 3,079 2028 2,710 Thereafter 3,971 Total minimum lease payments $ 25,851 Less: interest (1,937) Total lease liability $ 23,914 Several of the Company’s lease agreements contain clauses calling for escalation of minimum lease payments contingent on increases in real estate taxes, gross income adjustments, percentage increases in the consumer price index, and certain ancillary maintenance costs. Total rental expense was $2.0 million for the three months ended March 31, 2024 and $1.9 million March 31, 2023.

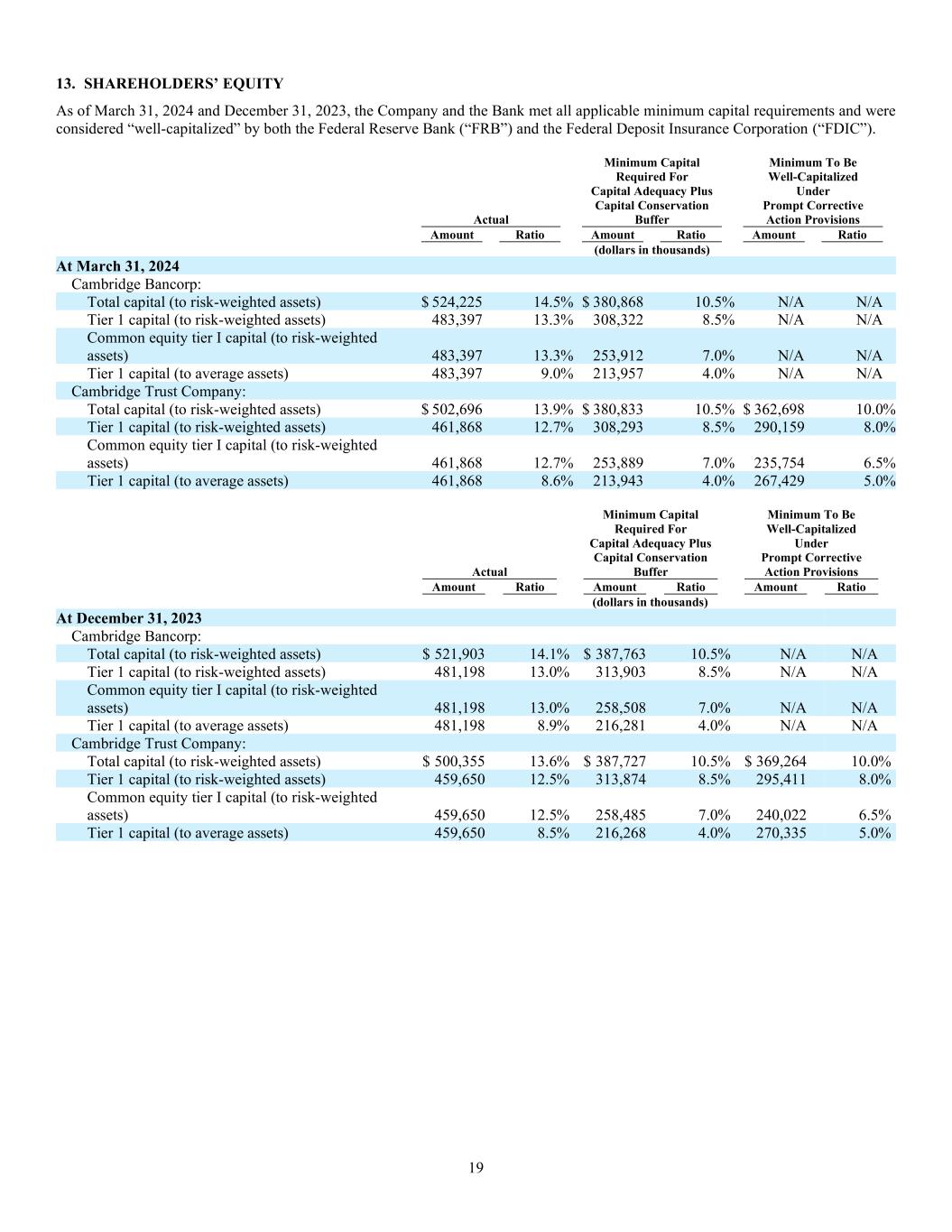

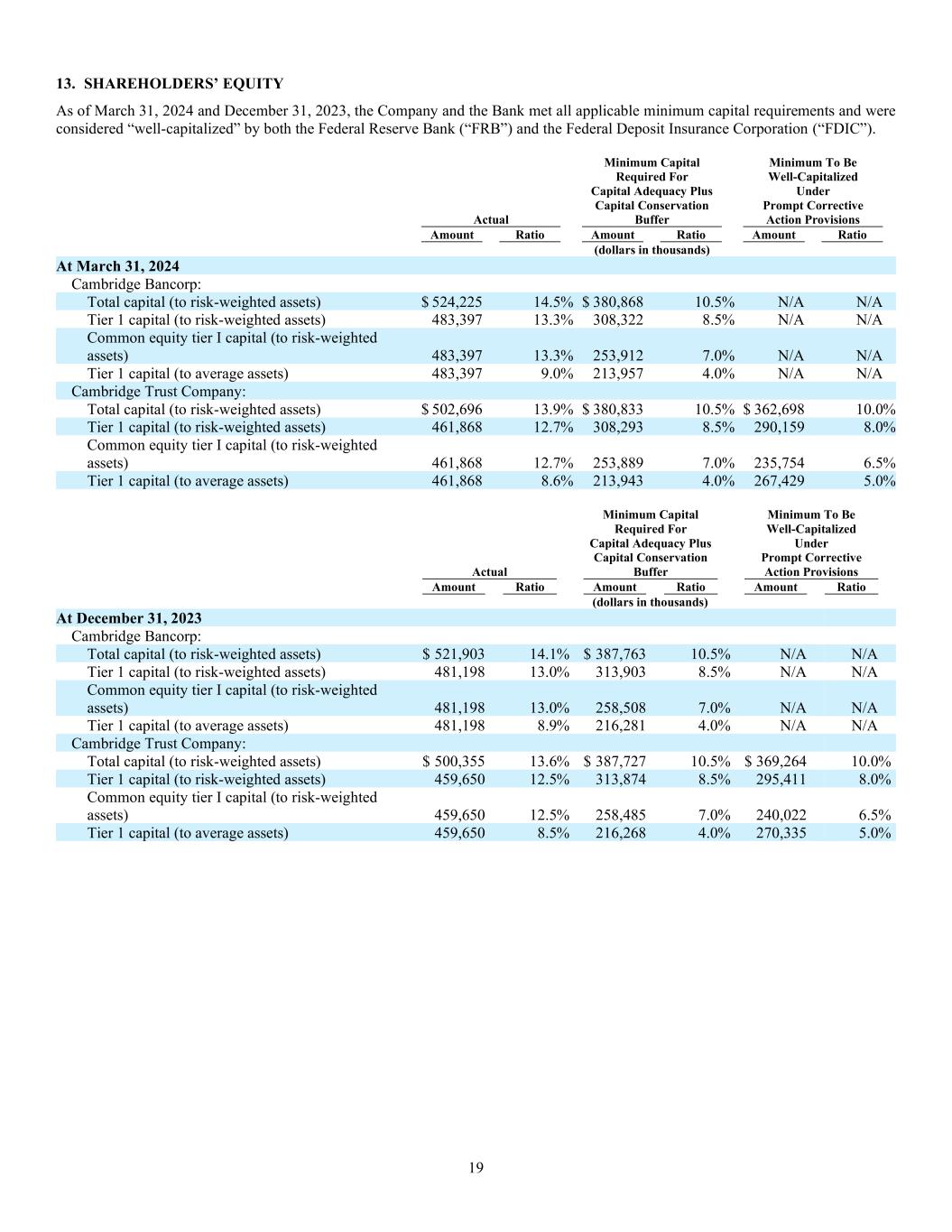

19 13. SHAREHOLDERS’ EQUITY As of March 31, 2024 and December 31, 2023, the Company and the Bank met all applicable minimum capital requirements and were considered “well-capitalized” by both the Federal Reserve Bank (“FRB”) and the Federal Deposit Insurance Corporation (“FDIC”). Actual Minimum Capital Required For Capital Adequacy Plus Capital Conservation Buffer Minimum To Be Well-Capitalized Under Prompt Corrective Action Provisions Amount Ratio Amount Ratio Amount Ratio (dollars in thousands) At March 31, 2024 Cambridge Bancorp: Total capital (to risk-weighted assets) $ 524,225 14.5% $ 380,868 10.5% N/A N/A Tier 1 capital (to risk-weighted assets) 483,397 13.3% 308,322 8.5% N/A N/A Common equity tier I capital (to risk-weighted assets) 483,397 13.3% 253,912 7.0% N/A N/A Tier 1 capital (to average assets) 483,397 9.0% 213,957 4.0% N/A N/A Cambridge Trust Company: Total capital (to risk-weighted assets) $ 502,696 13.9% $ 380,833 10.5% $ 362,698 10.0% Tier 1 capital (to risk-weighted assets) 461,868 12.7% 308,293 8.5% 290,159 8.0% Common equity tier I capital (to risk-weighted assets) 461,868 12.7% 253,889 7.0% 235,754 6.5% Tier 1 capital (to average assets) 461,868 8.6% 213,943 4.0% 267,429 5.0% Actual Minimum Capital Required For Capital Adequacy Plus Capital Conservation Buffer Minimum To Be Well-Capitalized Under Prompt Corrective Action Provisions Amount Ratio Amount Ratio Amount Ratio (dollars in thousands) At December 31, 2023 Cambridge Bancorp: Total capital (to risk-weighted assets) $ 521,903 14.1% $ 387,763 10.5% N/A N/A Tier 1 capital (to risk-weighted assets) 481,198 13.0% 313,903 8.5% N/A N/A Common equity tier I capital (to risk-weighted assets) 481,198 13.0% 258,508 7.0% N/A N/A Tier 1 capital (to average assets) 481,198 8.9% 216,281 4.0% N/A N/A Cambridge Trust Company: Total capital (to risk-weighted assets) $ 500,355 13.6% $ 387,727 10.5% $ 369,264 10.0% Tier 1 capital (to risk-weighted assets) 459,650 12.5% 313,874 8.5% 295,411 8.0% Common equity tier I capital (to risk-weighted assets) 459,650 12.5% 258,485 7.0% 240,022 6.5% Tier 1 capital (to average assets) 459,650 8.5% 216,268 4.0% 270,335 5.0%

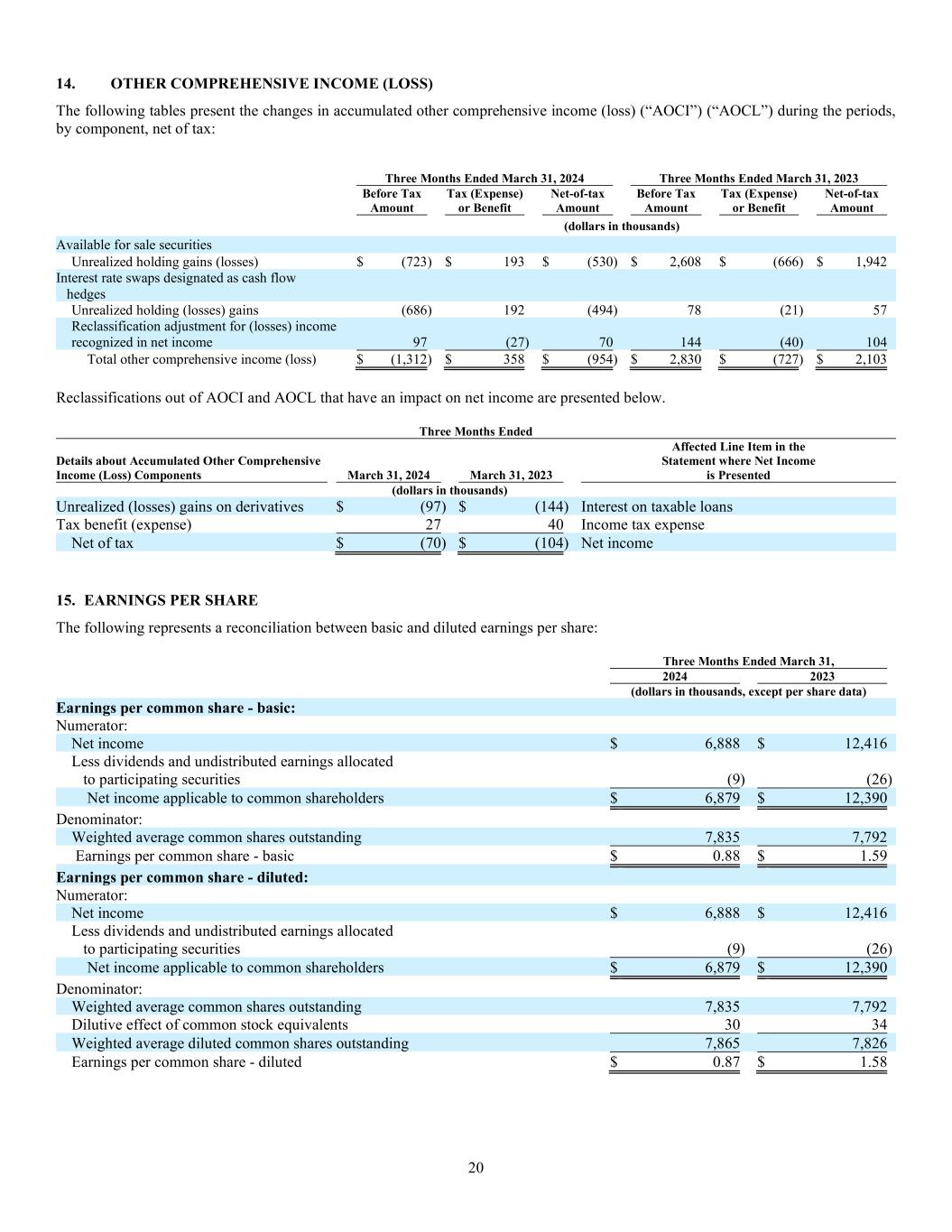

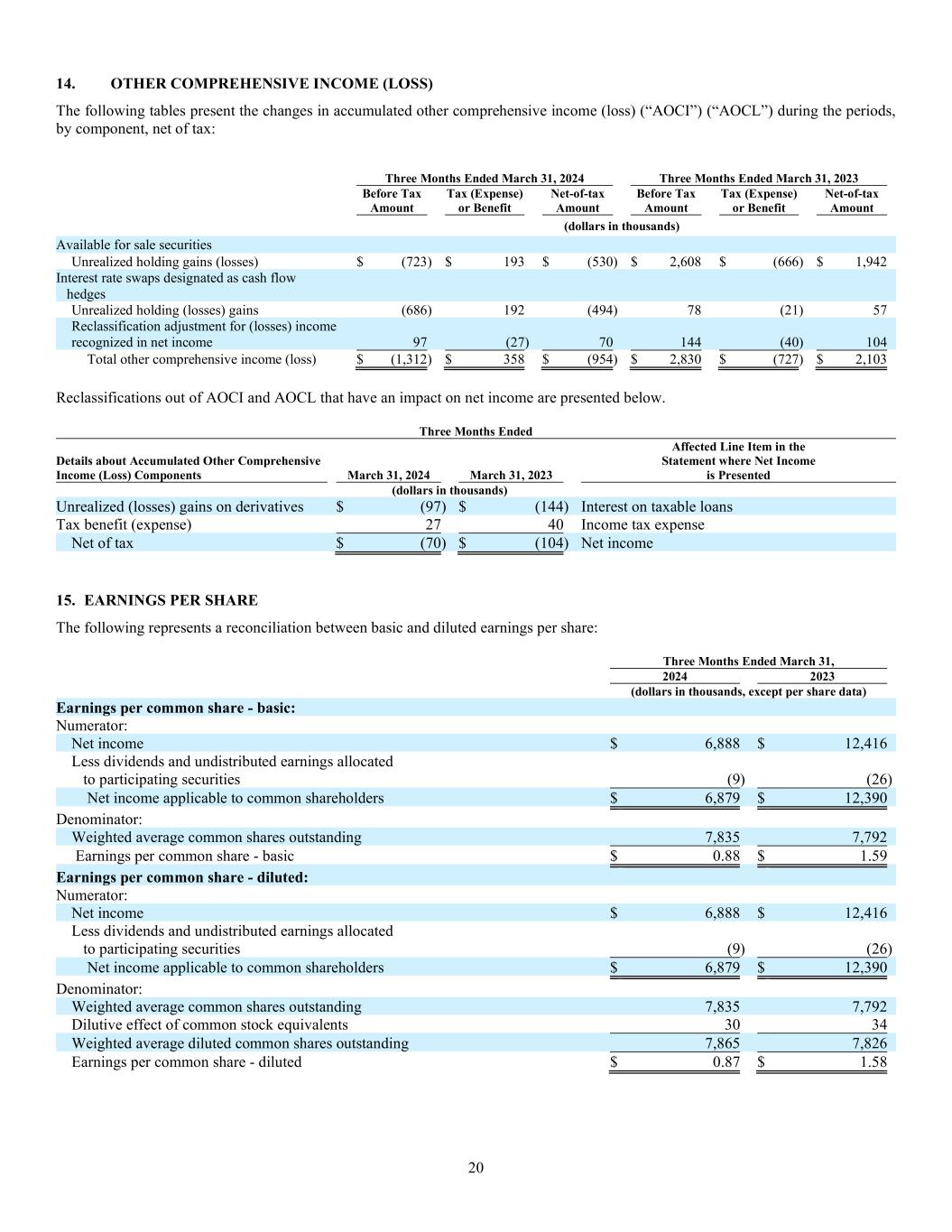

20 14. OTHER COMPREHENSIVE INCOME (LOSS) The following tables present the changes in accumulated other comprehensive income (loss) (“AOCI”) (“AOCL”) during the periods, by component, net of tax: Three Months Ended March 31, 2024 Three Months Ended March 31, 2023 Before Tax Amount Tax (Expense) or Benefit Net-of-tax Amount Before Tax Amount Tax (Expense) or Benefit Net-of-tax Amount (dollars in thousands) Available for sale securities Unrealized holding gains (losses) $ (723 ) $ 193 $ (530) $ 2,608 $ (666) $ 1,942 Interest rate swaps designated as cash flow hedges Unrealized holding (losses) gains (686 ) 192 (494) 78 (21) 57 Reclassification adjustment for (losses) income recognized in net income 97 (27) 70 144 (40) 104 Total other comprehensive income (loss) $ (1,312 ) $ 358 $ (954) $ 2,830 $ (727) $ 2,103 Reclassifications out of AOCI and AOCL that have an impact on net income are presented below. Three Months Ended Details about Accumulated Other Comprehensive Income (Loss) Components March 31, 2024 March 31, 2023 Affected Line Item in the Statement where Net Income is Presented (dollars in thousands) Unrealized (losses) gains on derivatives $ (97) $ (144) Interest on taxable loans Tax benefit (expense) 27 40 Income tax expense Net of tax $ (70) $ (104) Net income 15. EARNINGS PER SHARE The following represents a reconciliation between basic and diluted earnings per share: Three Months Ended March 31, 2024 2023 (dollars in thousands, except per share data) Earnings per common share - basic: Numerator: Net income $ 6,888 $ 12,416 Less dividends and undistributed earnings allocated to participating securities (9) (26) Net income applicable to common shareholders $ 6,879 $ 12,390 Denominator: Weighted average common shares outstanding 7,835 7,792 Earnings per common share - basic $ 0.88 $ 1.59 Earnings per common share - diluted: Numerator: Net income $ 6,888 $ 12,416 Less dividends and undistributed earnings allocated to participating securities (9) (26) Net income applicable to common shareholders $ 6,879 $ 12,390 Denominator: Weighted average common shares outstanding 7,835 7,792 Dilutive effect of common stock equivalents 30 34 Weighted average diluted common shares outstanding 7,865 7,826 Earnings per common share - diluted $ 0.87 $ 1.58

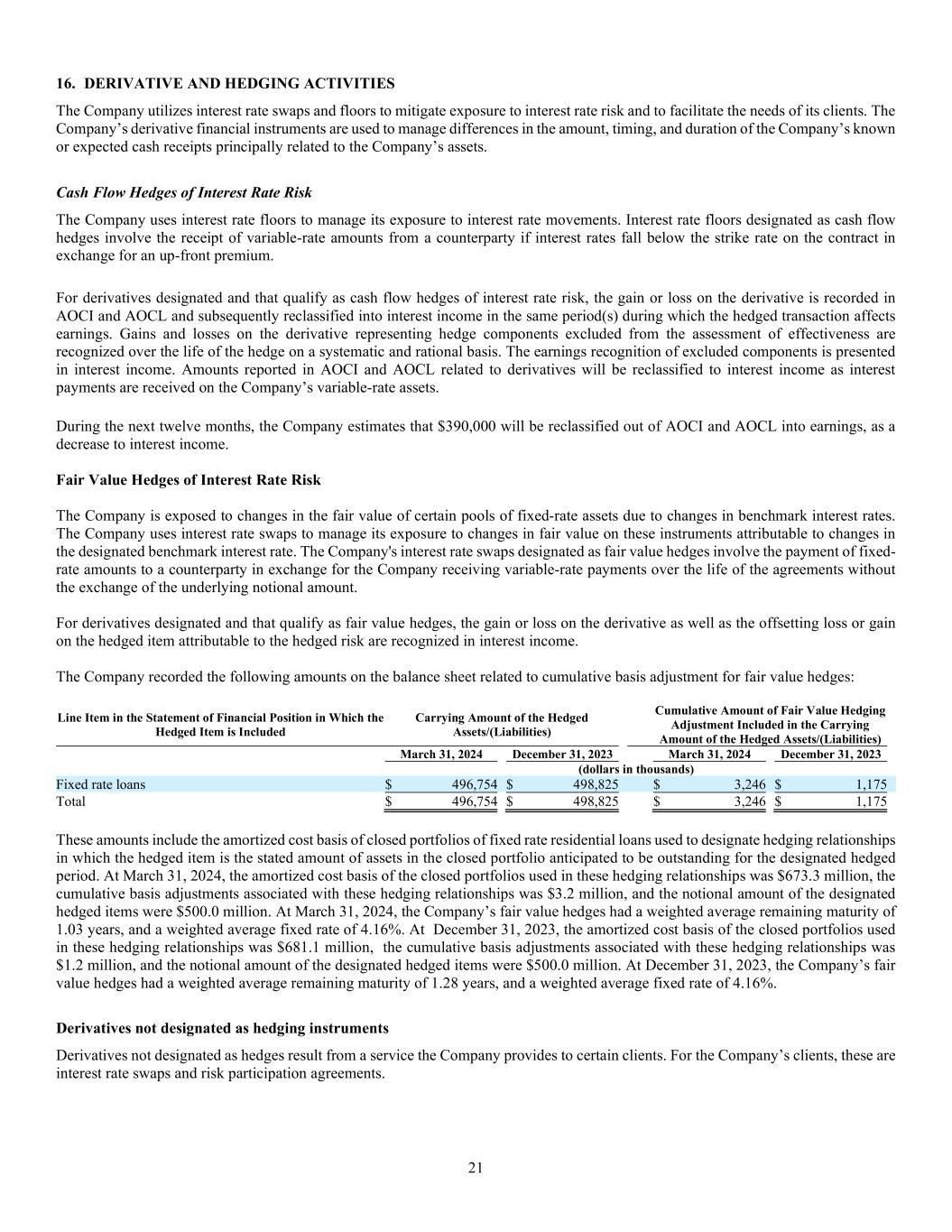

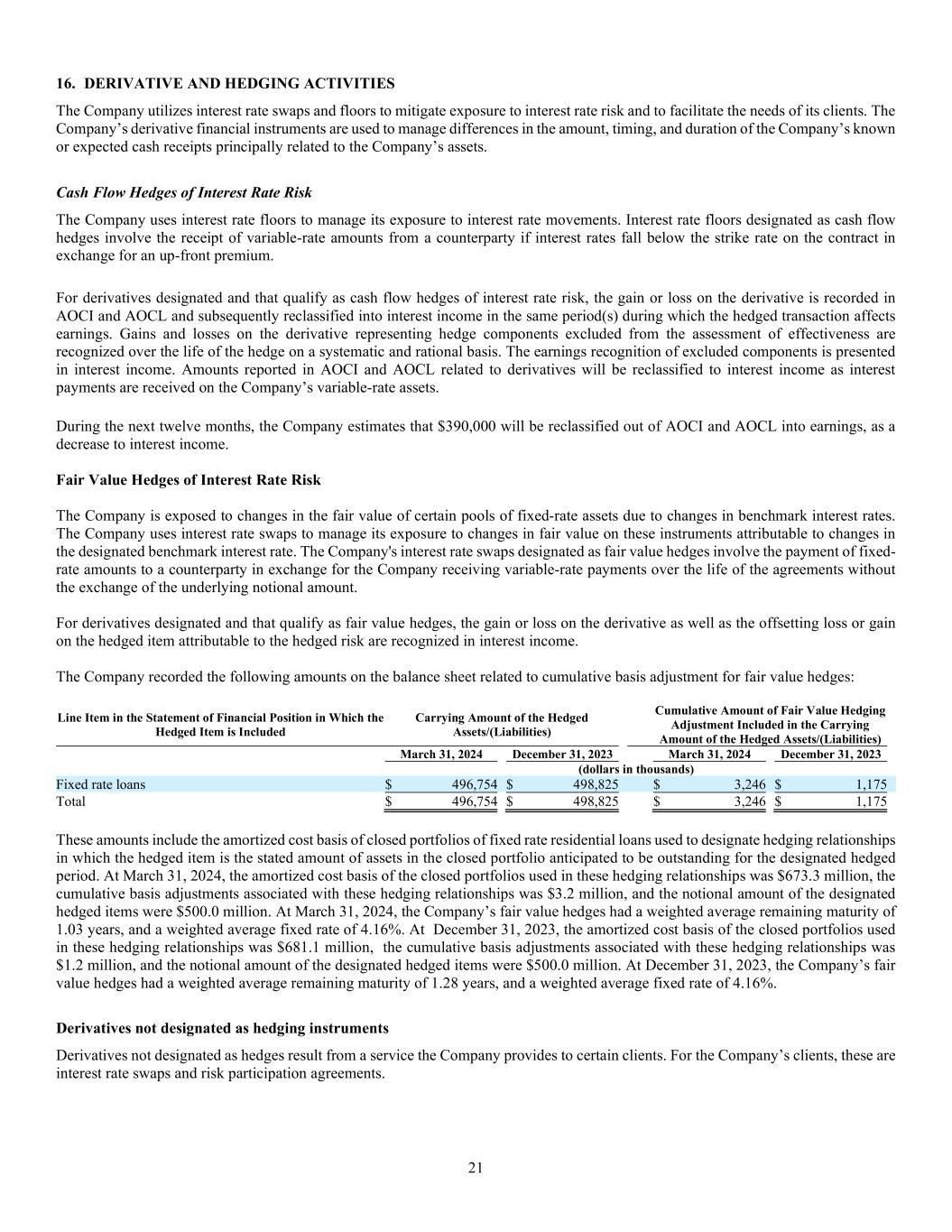

21 16. DERIVATIVE AND HEDGING ACTIVITIES The Company utilizes interest rate swaps and floors to mitigate exposure to interest rate risk and to facilitate the needs of its clients. The Company’s derivative financial instruments are used to manage differences in the amount, timing, and duration of the Company’s known or expected cash receipts principally related to the Company’s assets. Cash Flow Hedges of Interest Rate Risk The Company uses interest rate floors to manage its exposure to interest rate movements. Interest rate floors designated as cash flow hedges involve the receipt of variable-rate amounts from a counterparty if interest rates fall below the strike rate on the contract in exchange for an up-front premium. For derivatives designated and that qualify as cash flow hedges of interest rate risk, the gain or loss on the derivative is recorded in AOCI and AOCL and subsequently reclassified into interest income in the same period(s) during which the hedged transaction affects earnings. Gains and losses on the derivative representing hedge components excluded from the assessment of effectiveness are recognized over the life of the hedge on a systematic and rational basis. The earnings recognition of excluded components is presented in interest income. Amounts reported in AOCI and AOCL related to derivatives will be reclassified to interest income as interest payments are received on the Company’s variable-rate assets. During the next twelve months, the Company estimates that $390,000 will be reclassified out of AOCI and AOCL into earnings, as a decrease to interest income. Fair Value Hedges of Interest Rate Risk The Company is exposed to changes in the fair value of certain pools of fixed-rate assets due to changes in benchmark interest rates. The Company uses interest rate swaps to manage its exposure to changes in fair value on these instruments attributable to changes in the designated benchmark interest rate. The Company's interest rate swaps designated as fair value hedges involve the payment of fixed- rate amounts to a counterparty in exchange for the Company receiving variable-rate payments over the life of the agreements without the exchange of the underlying notional amount. For derivatives designated and that qualify as fair value hedges, the gain or loss on the derivative as well as the offsetting loss or gain on the hedged item attributable to the hedged risk are recognized in interest income. The Company recorded the following amounts on the balance sheet related to cumulative basis adjustment for fair value hedges: Line Item in the Statement of Financial Position in Which the Hedged Item is Included Carrying Amount of the Hedged Assets/(Liabilities) Cumulative Amount of Fair Value Hedging Adjustment Included in the Carrying Amount of the Hedged Assets/(Liabilities) March 31, 2024 December 31, 2023 March 31, 2024 December 31, 2023 (dollars in thousands) Fixed rate loans $ 496,754 $ 498,825 $ 3,246 $ 1,175 Total $ 496,754 $ 498,825 $ 3,246 $ 1,175 These amounts include the amortized cost basis of closed portfolios of fixed rate residential loans used to designate hedging relationships in which the hedged item is the stated amount of assets in the closed portfolio anticipated to be outstanding for the designated hedged period. At March 31, 2024, the amortized cost basis of the closed portfolios used in these hedging relationships was $673.3 million, the cumulative basis adjustments associated with these hedging relationships was $3.2 million, and the notional amount of the designated hedged items were $500.0 million. At March 31, 2024, the Company’s fair value hedges had a weighted average remaining maturity of 1.03 years, and a weighted average fixed rate of 4.16%. At December 31, 2023, the amortized cost basis of the closed portfolios used in these hedging relationships was $681.1 million, the cumulative basis adjustments associated with these hedging relationships was $1.2 million, and the notional amount of the designated hedged items were $500.0 million. At December 31, 2023, the Company’s fair value hedges had a weighted average remaining maturity of 1.28 years, and a weighted average fixed rate of 4.16%. Derivatives not designated as hedging instruments Derivatives not designated as hedges result from a service the Company provides to certain clients. For the Company’s clients, these are interest rate swaps and risk participation agreements.

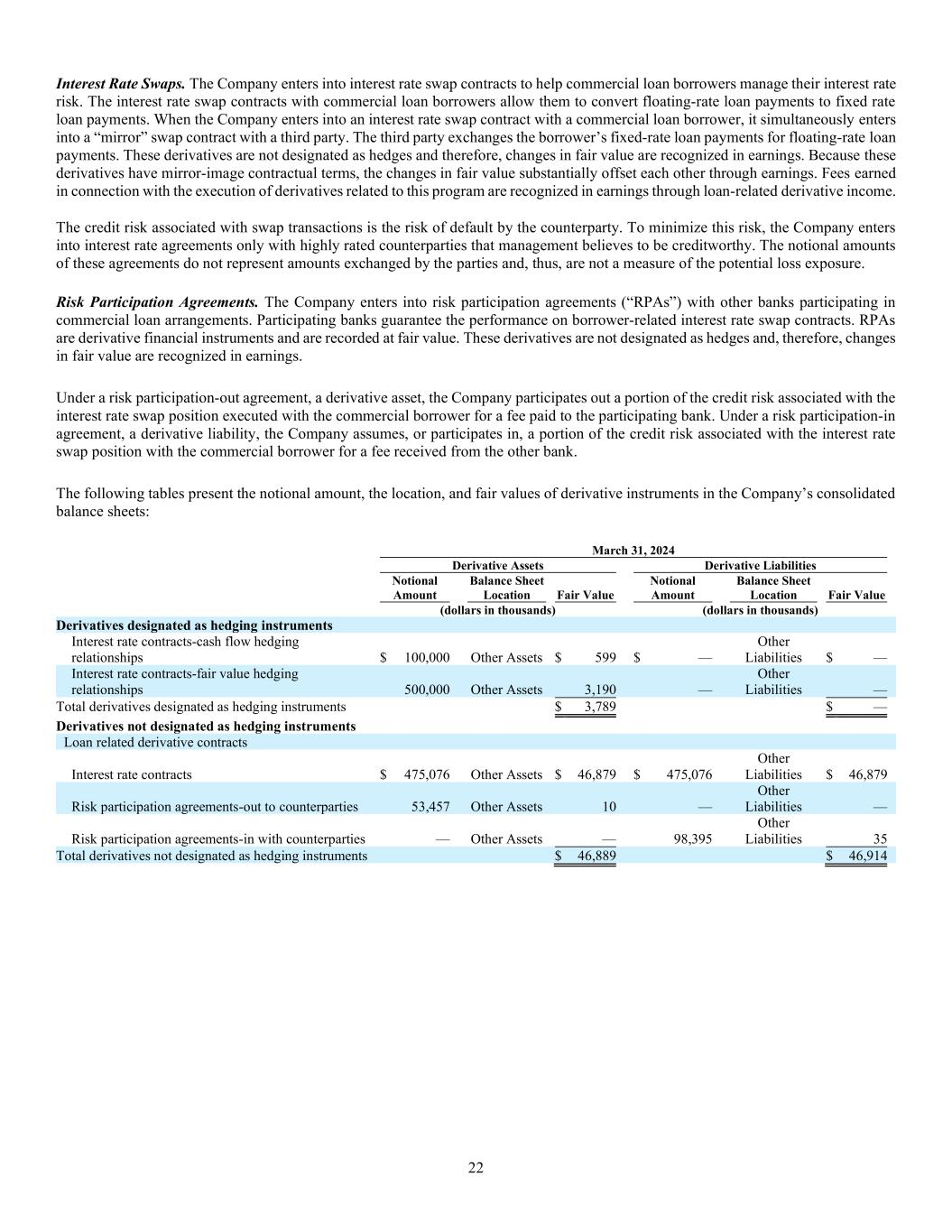

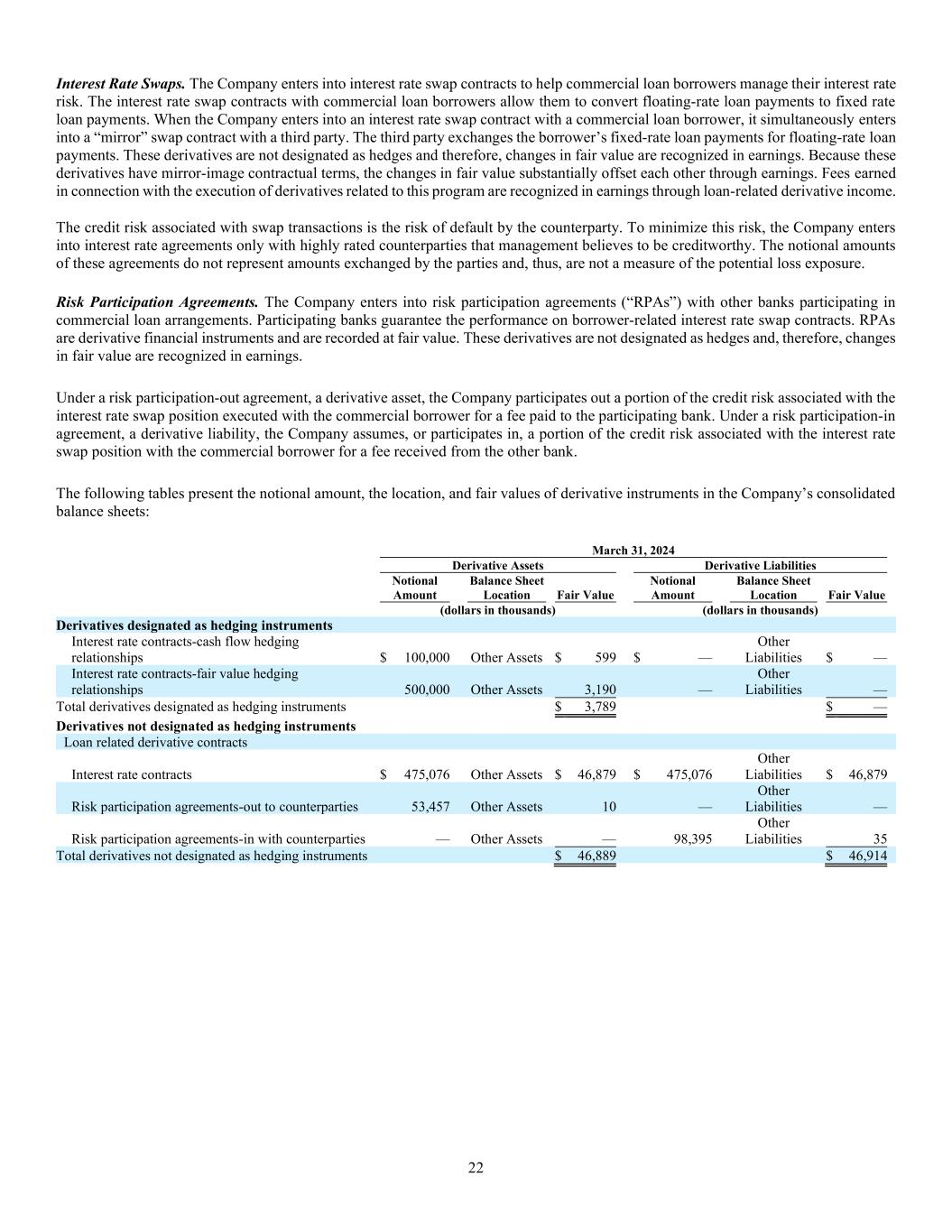

22 Interest Rate Swaps. The Company enters into interest rate swap contracts to help commercial loan borrowers manage their interest rate risk. The interest rate swap contracts with commercial loan borrowers allow them to convert floating-rate loan payments to fixed rate loan payments. When the Company enters into an interest rate swap contract with a commercial loan borrower, it simultaneously enters into a “mirror” swap contract with a third party. The third party exchanges the borrower’s fixed-rate loan payments for floating-rate loan payments. These derivatives are not designated as hedges and therefore, changes in fair value are recognized in earnings. Because these derivatives have mirror-image contractual terms, the changes in fair value substantially offset each other through earnings. Fees earned in connection with the execution of derivatives related to this program are recognized in earnings through loan-related derivative income. The credit risk associated with swap transactions is the risk of default by the counterparty. To minimize this risk, the Company enters into interest rate agreements only with highly rated counterparties that management believes to be creditworthy. The notional amounts of these agreements do not represent amounts exchanged by the parties and, thus, are not a measure of the potential loss exposure. Risk Participation Agreements. The Company enters into risk participation agreements (“RPAs”) with other banks participating in commercial loan arrangements. Participating banks guarantee the performance on borrower-related interest rate swap contracts. RPAs are derivative financial instruments and are recorded at fair value. These derivatives are not designated as hedges and, therefore, changes in fair value are recognized in earnings. Under a risk participation-out agreement, a derivative asset, the Company participates out a portion of the credit risk associated with the interest rate swap position executed with the commercial borrower for a fee paid to the participating bank. Under a risk participation-in agreement, a derivative liability, the Company assumes, or participates in, a portion of the credit risk associated with the interest rate swap position with the commercial borrower for a fee received from the other bank. The following tables present the notional amount, the location, and fair values of derivative instruments in the Company’s consolidated balance sheets: March 31, 2024 Derivative Assets Derivative Liabilities Notional Amount Balance Sheet Location Fair Value Notional Amount Balance Sheet Location Fair Value (dollars in thousands) (dollars in thousands) Derivatives designated as hedging instruments Interest rate contracts-cash flow hedging relationships $ 100,000 Other Assets $ 599 $ — Other Liabilities $ — Interest rate contracts-fair value hedging relationships 500,000 Other Assets 3,190 — Other Liabilities — Total derivatives designated as hedging instruments $ 3,789 $ — Derivatives not designated as hedging instruments Loan related derivative contracts Interest rate contracts $ 475,076 Other Assets $ 46,879 $ 475,076 Other Liabilities $ 46,879 Risk participation agreements-out to counterparties 53,457 Other Assets 10 — Other Liabilities — Risk participation agreements-in with counterparties — Other Assets — 98,395 Other Liabilities 35 Total derivatives not designated as hedging instruments $ 46,889 $ 46,914

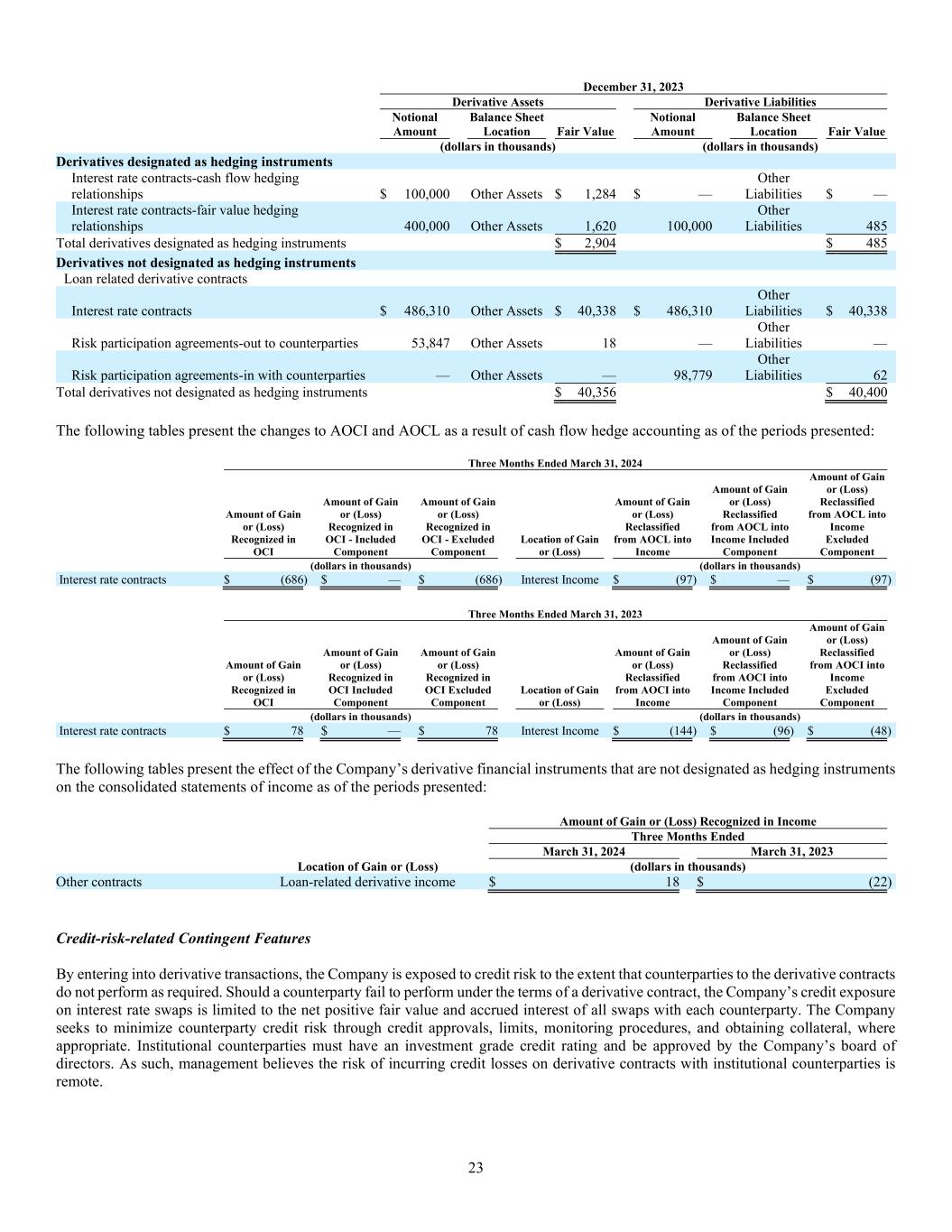

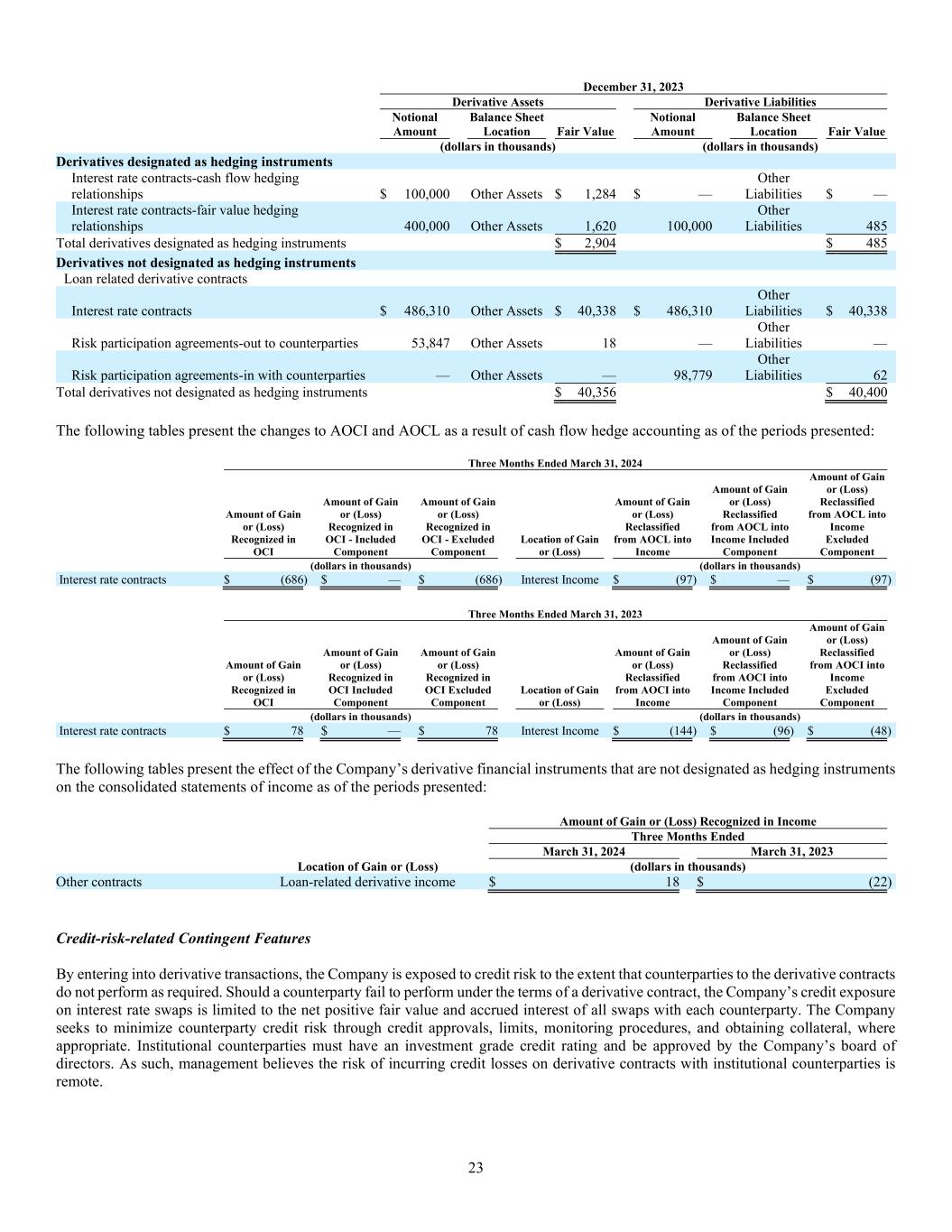

23 December 31, 2023 Derivative Assets Derivative Liabilities Notional Amount Balance Sheet Location Fair Value Notional Amount Balance Sheet Location Fair Value (dollars in thousands) (dollars in thousands) Derivatives designated as hedging instruments Interest rate contracts-cash flow hedging relationships $ 100,000 Other Assets $ 1,284 $ — Other Liabilities $ — Interest rate contracts-fair value hedging relationships 400,000 Other Assets 1,620 100,000 Other Liabilities 485 Total derivatives designated as hedging instruments $ 2,904 $ 485 Derivatives not designated as hedging instruments Loan related derivative contracts Interest rate contracts $ 486,310 Other Assets $ 40,338 $ 486,310 Other Liabilities $ 40,338 Risk participation agreements-out to counterparties 53,847 Other Assets 18 — Other Liabilities — Risk participation agreements-in with counterparties — Other Assets — 98,779 Other Liabilities 62 Total derivatives not designated as hedging instruments $ 40,356 $ 40,400 The following tables present the changes to AOCI and AOCL as a result of cash flow hedge accounting as of the periods presented: Three Months Ended March 31, 2024 Amount of Gain or (Loss) Recognized in OCI Amount of Gain or (Loss) Recognized in OCI - Included Component Amount of Gain or (Loss) Recognized in OCI - Excluded Component Location of Gain or (Loss) Amount of Gain or (Loss) Reclassified from AOCL into Income Amount of Gain or (Loss) Reclassified from AOCL into Income Included Component Amount of Gain or (Loss) Reclassified from AOCL into Income Excluded Component (dollars in thousands) (dollars in thousands) Interest rate contracts $ (686) $ — $ (686) Interest Income $ (97) $ — $ (97) Three Months Ended March 31, 2023 Amount of Gain or (Loss) Recognized in OCI Amount of Gain or (Loss) Recognized in OCI Included Component Amount of Gain or (Loss) Recognized in OCI Excluded Component Location of Gain or (Loss) Amount of Gain or (Loss) Reclassified from AOCI into Income Amount of Gain or (Loss) Reclassified from AOCI into Income Included Component Amount of Gain or (Loss) Reclassified from AOCI into Income Excluded Component (dollars in thousands) (dollars in thousands) Interest rate contracts $ 78 $ — $ 78 Interest Income $ (144) $ (96) $ (48) The following tables present the effect of the Company’s derivative financial instruments that are not designated as hedging instruments on the consolidated statements of income as of the periods presented: Amount of Gain or (Loss) Recognized in Income Three Months Ended March 31, 2024 March 31, 2023 Location of Gain or (Loss) (dollars in thousands) Other contracts Loan-related derivative income $ 18 $ (22) Credit-risk-related Contingent Features By entering into derivative transactions, the Company is exposed to credit risk to the extent that counterparties to the derivative contracts do not perform as required. Should a counterparty fail to perform under the terms of a derivative contract, the Company’s credit exposure on interest rate swaps is limited to the net positive fair value and accrued interest of all swaps with each counterparty. The Company seeks to minimize counterparty credit risk through credit approvals, limits, monitoring procedures, and obtaining collateral, where appropriate. Institutional counterparties must have an investment grade credit rating and be approved by the Company’s board of directors. As such, management believes the risk of incurring credit losses on derivative contracts with institutional counterparties is remote.

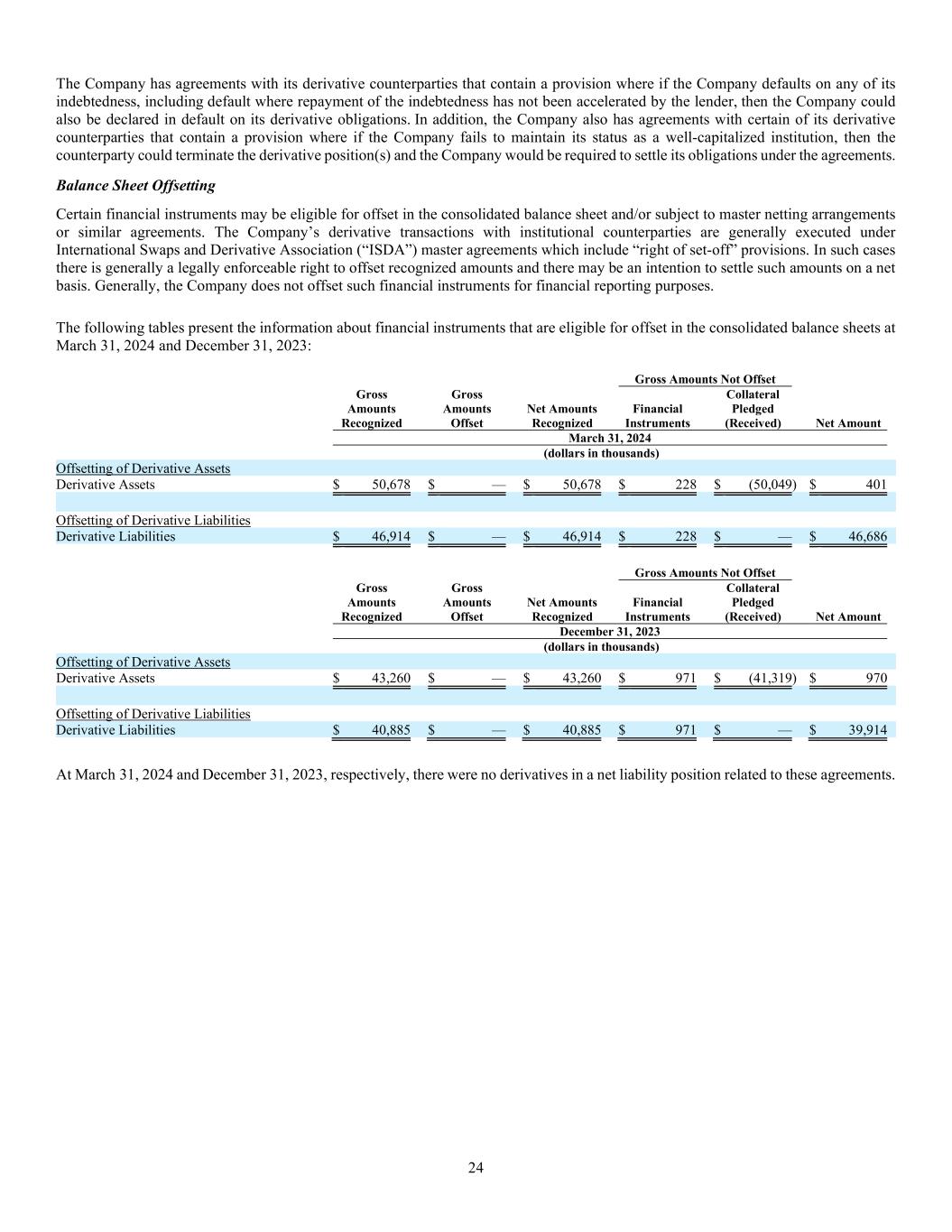

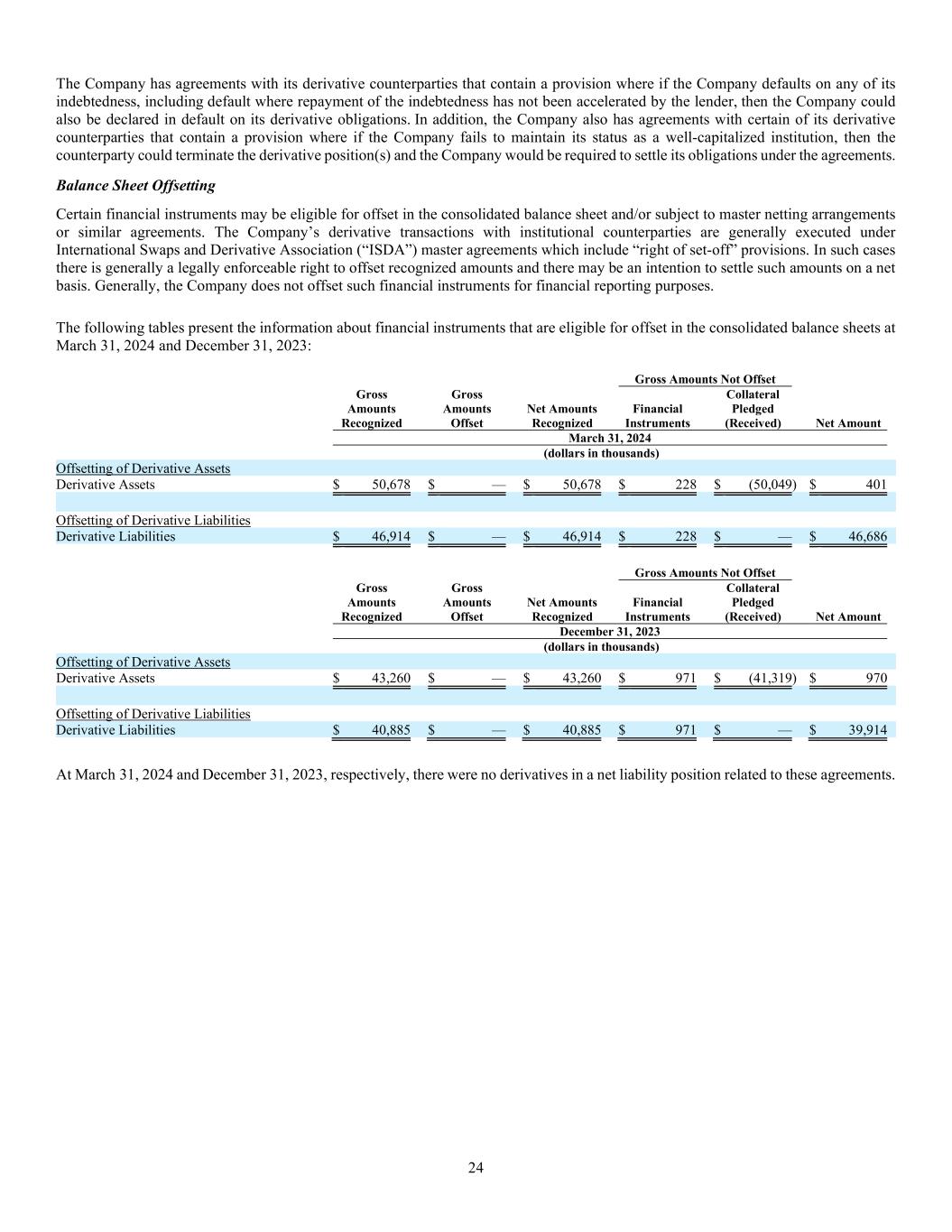

24 The Company has agreements with its derivative counterparties that contain a provision where if the Company defaults on any of its indebtedness, including default where repayment of the indebtedness has not been accelerated by the lender, then the Company could also be declared in default on its derivative obligations. In addition, the Company also has agreements with certain of its derivative counterparties that contain a provision where if the Company fails to maintain its status as a well-capitalized institution, then the counterparty could terminate the derivative position(s) and the Company would be required to settle its obligations under the agreements. Balance Sheet Offsetting Certain financial instruments may be eligible for offset in the consolidated balance sheet and/or subject to master netting arrangements or similar agreements. The Company’s derivative transactions with institutional counterparties are generally executed under International Swaps and Derivative Association (“ISDA”) master agreements which include “right of set-off” provisions. In such cases there is generally a legally enforceable right to offset recognized amounts and there may be an intention to settle such amounts on a net basis. Generally, the Company does not offset such financial instruments for financial reporting purposes. The following tables present the information about financial instruments that are eligible for offset in the consolidated balance sheets at March 31, 2024 and December 31, 2023: Gross Amounts Not Offset Gross Amounts Recognized Gross Amounts Offset Net Amounts Recognized Financial Instruments Collateral Pledged (Received) Net Amount March 31, 2024 (dollars in thousands) Offsetting of Derivative Assets Derivative Assets $ 50,678 $ — $ 50,678 $ 228 $ (50,049) $ 401 Offsetting of Derivative Liabilities Derivative Liabilities $ 46,914 $ — $ 46,914 $ 228 $ — $ 46,686 Gross Amounts Not Offset Gross Amounts Recognized Gross Amounts Offset Net Amounts Recognized Financial Instruments Collateral Pledged (Received) Net Amount December 31, 2023 (dollars in thousands) Offsetting of Derivative Assets Derivative Assets $ 43,260 $ — $ 43,260 $ 971 $ (41,319) $ 970 Offsetting of Derivative Liabilities Derivative Liabilities $ 40,885 $ — $ 40,885 $ 971 $ — $ 39,914 At March 31, 2024 and December 31, 2023, respectively, there were no derivatives in a net liability position related to these agreements.

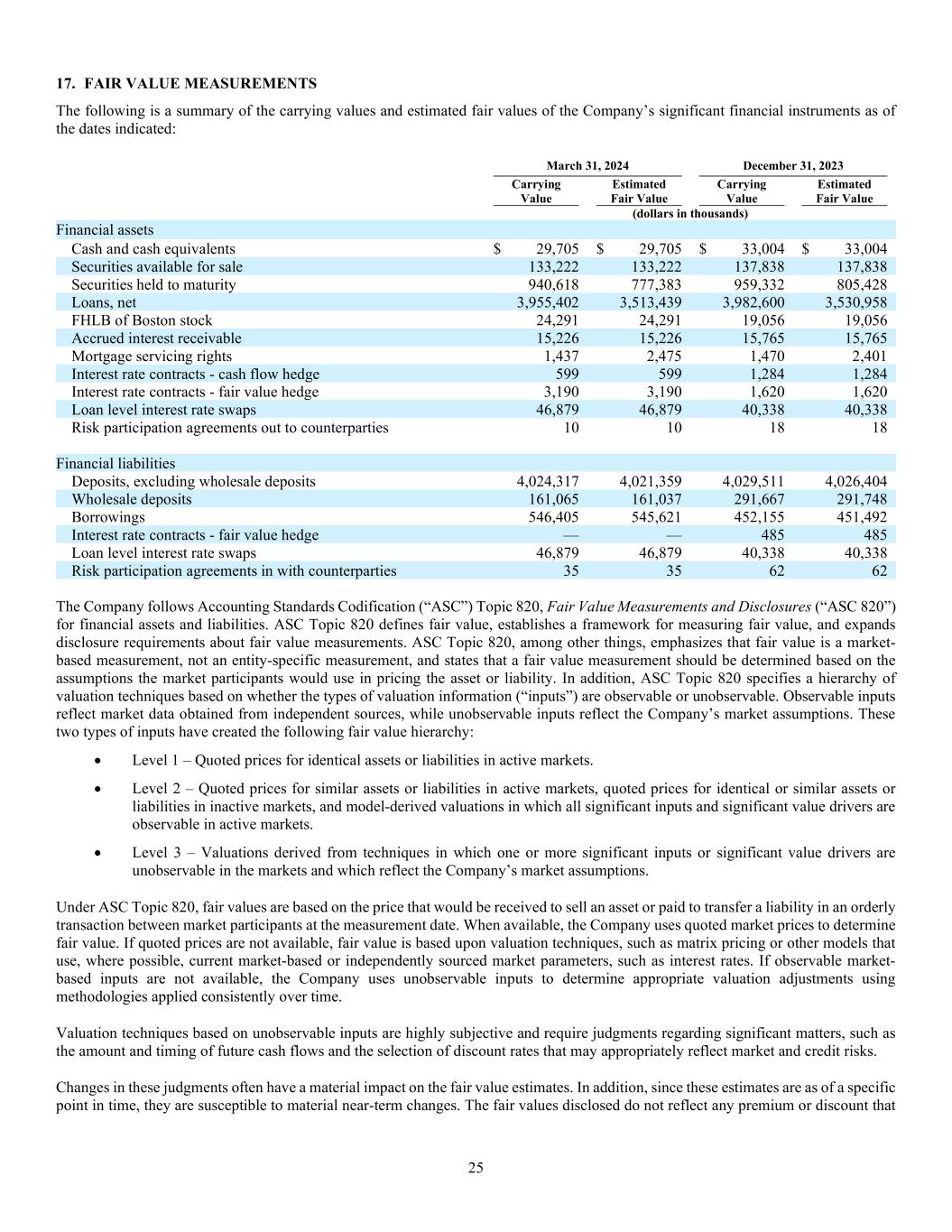

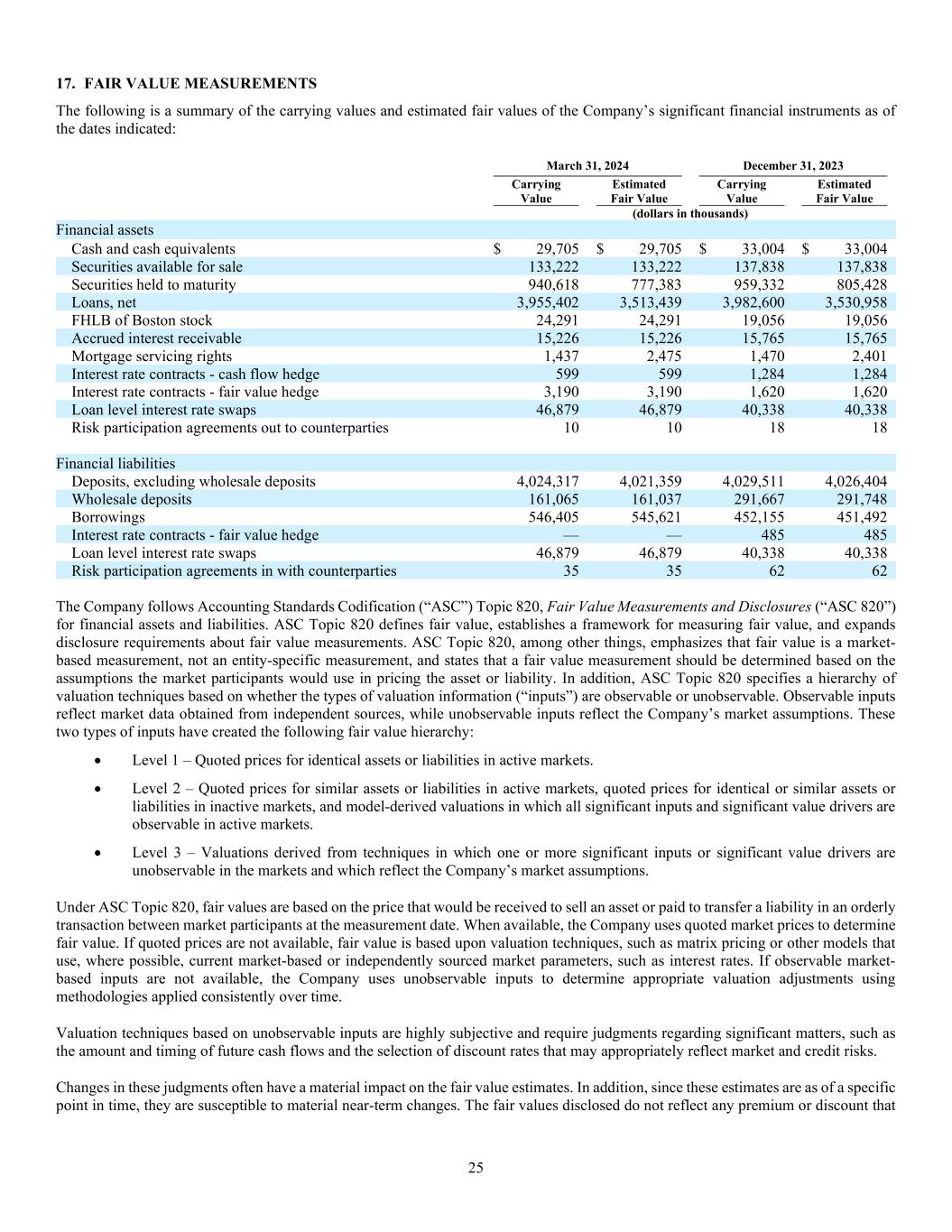

25 17. FAIR VALUE MEASUREMENTS The following is a summary of the carrying values and estimated fair values of the Company’s significant financial instruments as of the dates indicated: March 31, 2024 December 31, 2023 Carrying Value Estimated Fair Value Carrying Value Estimated Fair Value (dollars in thousands) Financial assets Cash and cash equivalents $ 29,705 $ 29,705 $ 33,004 $ 33,004 Securities available for sale 133,222 133,222 137,838 137,838 Securities held to maturity 940,618 777,383 959,332 805,428 Loans, net 3,955,402 3,513,439 3,982,600 3,530,958 FHLB of Boston stock 24,291 24,291 19,056 19,056 Accrued interest receivable 15,226 15,226 15,765 15,765 Mortgage servicing rights 1,437 2,475 1,470 2,401 Interest rate contracts - cash flow hedge 599 599 1,284 1,284 Interest rate contracts - fair value hedge 3,190 3,190 1,620 1,620 Loan level interest rate swaps 46,879 46,879 40,338 40,338 Risk participation agreements out to counterparties 10 10 18 18 Financial liabilities Deposits, excluding wholesale deposits 4,024,317 4,021,359 4,029,511 4,026,404 Wholesale deposits 161,065 161,037 291,667 291,748 Borrowings 546,405 545,621 452,155 451,492 Interest rate contracts - fair value hedge — — 485 485 Loan level interest rate swaps 46,879 46,879 40,338 40,338 Risk participation agreements in with counterparties 35 35 62 62 The Company follows Accounting Standards Codification (“ASC”) Topic 820, Fair Value Measurements and Disclosures (“ASC 820”) for financial assets and liabilities. ASC Topic 820 defines fair value, establishes a framework for measuring fair value, and expands disclosure requirements about fair value measurements. ASC Topic 820, among other things, emphasizes that fair value is a market- based measurement, not an entity-specific measurement, and states that a fair value measurement should be determined based on the assumptions the market participants would use in pricing the asset or liability. In addition, ASC Topic 820 specifies a hierarchy of valuation techniques based on whether the types of valuation information (“inputs”) are observable or unobservable. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s market assumptions. These two types of inputs have created the following fair value hierarchy: Level 1 – Quoted prices for identical assets or liabilities in active markets. Level 2 – Quoted prices for similar assets or liabilities in active markets, quoted prices for identical or similar assets or liabilities in inactive markets, and model-derived valuations in which all significant inputs and significant value drivers are observable in active markets. Level 3 – Valuations derived from techniques in which one or more significant inputs or significant value drivers are unobservable in the markets and which reflect the Company’s market assumptions. Under ASC Topic 820, fair values are based on the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. When available, the Company uses quoted market prices to determine fair value. If quoted prices are not available, fair value is based upon valuation techniques, such as matrix pricing or other models that use, where possible, current market-based or independently sourced market parameters, such as interest rates. If observable market- based inputs are not available, the Company uses unobservable inputs to determine appropriate valuation adjustments using methodologies applied consistently over time. Valuation techniques based on unobservable inputs are highly subjective and require judgments regarding significant matters, such as the amount and timing of future cash flows and the selection of discount rates that may appropriately reflect market and credit risks. Changes in these judgments often have a material impact on the fair value estimates. In addition, since these estimates are as of a specific point in time, they are susceptible to material near-term changes. The fair values disclosed do not reflect any premium or discount that

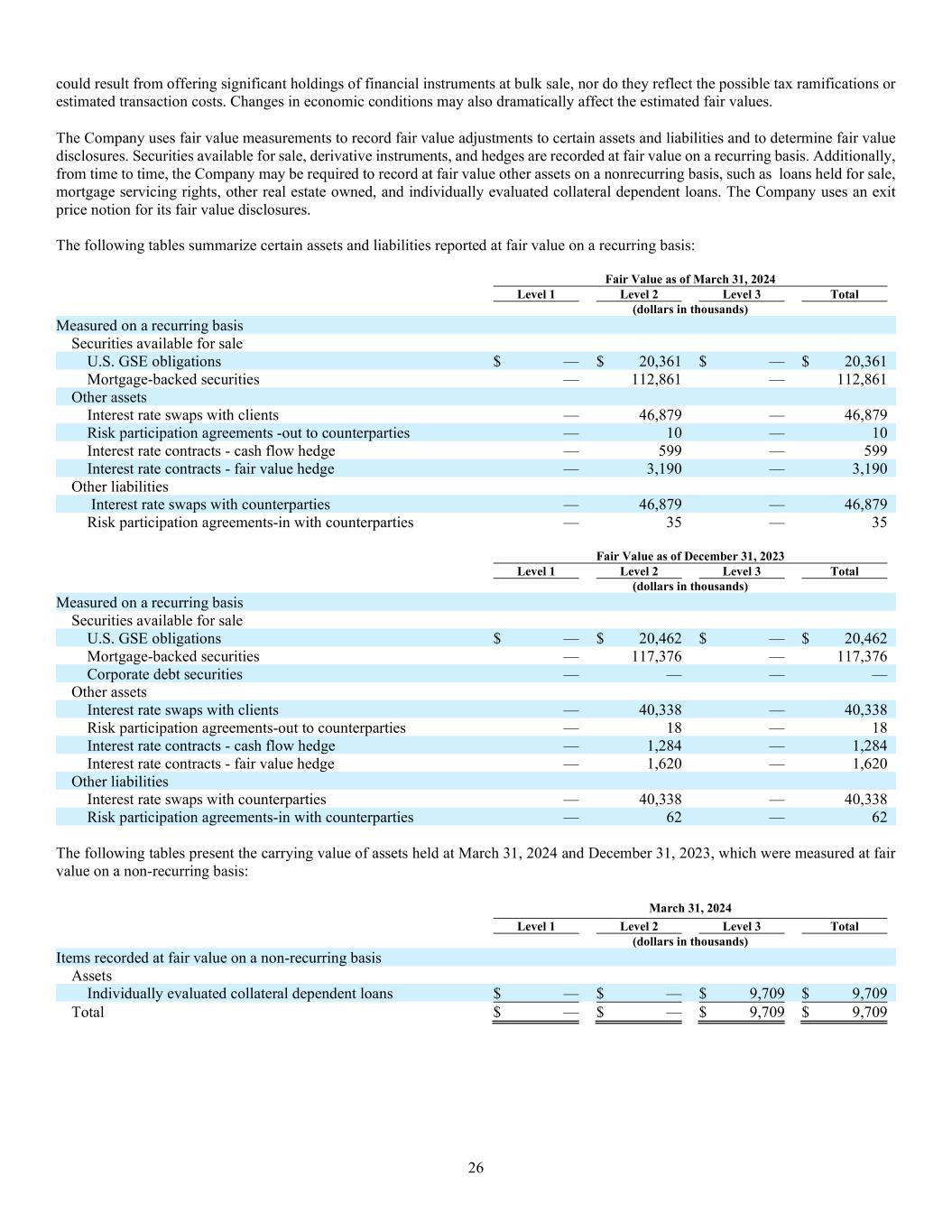

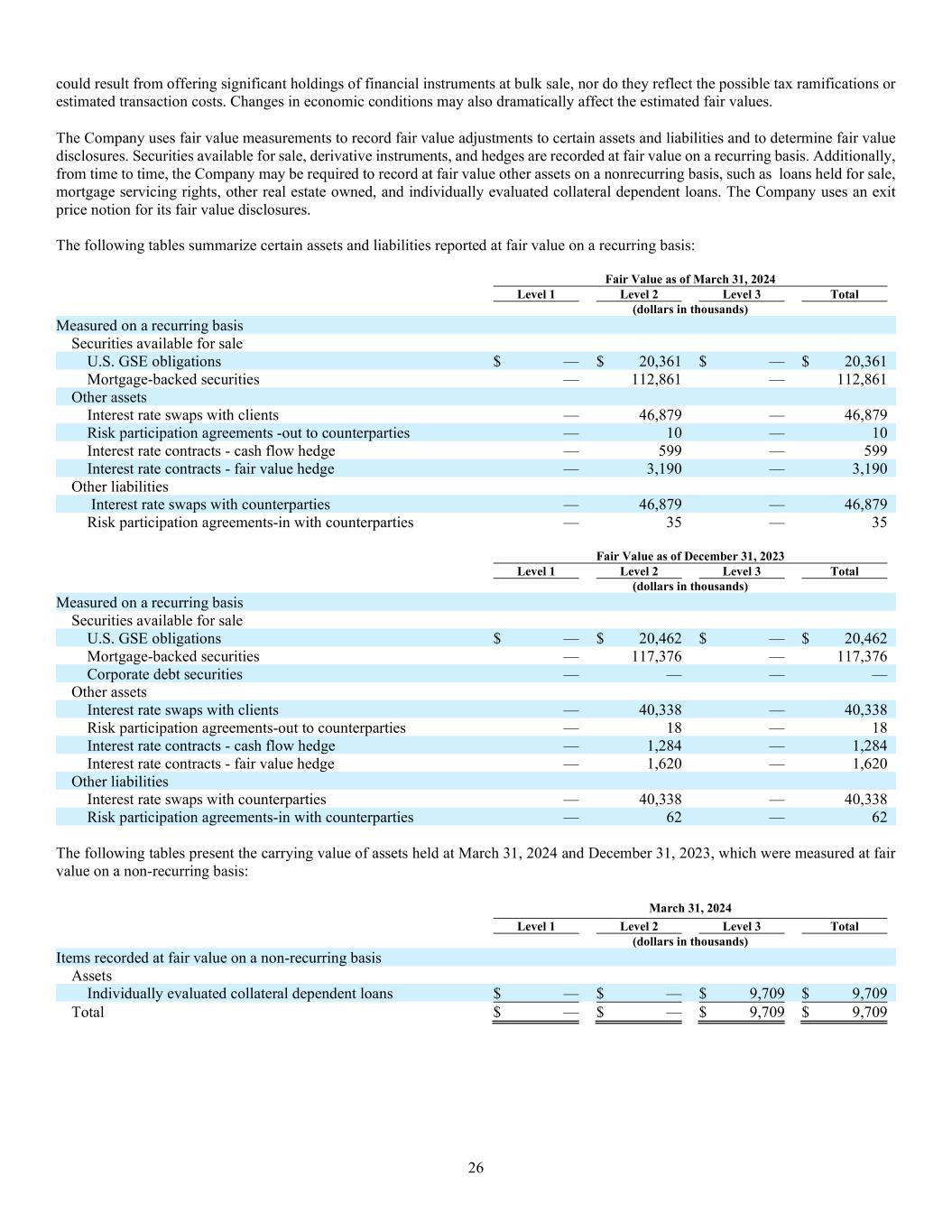

26 could result from offering significant holdings of financial instruments at bulk sale, nor do they reflect the possible tax ramifications or estimated transaction costs. Changes in economic conditions may also dramatically affect the estimated fair values. The Company uses fair value measurements to record fair value adjustments to certain assets and liabilities and to determine fair value disclosures. Securities available for sale, derivative instruments, and hedges are recorded at fair value on a recurring basis. Additionally, from time to time, the Company may be required to record at fair value other assets on a nonrecurring basis, such as loans held for sale, mortgage servicing rights, other real estate owned, and individually evaluated collateral dependent loans. The Company uses an exit price notion for its fair value disclosures. The following tables summarize certain assets and liabilities reported at fair value on a recurring basis: Fair Value as of March 31, 2024 Level 1 Level 2 Level 3 Total (dollars in thousands) Measured on a recurring basis Securities available for sale U.S. GSE obligations $ — $ 20,361 $ — $ 20,361 Mortgage-backed securities — 112,861 — 112,861 Other assets Interest rate swaps with clients — 46,879 — 46,879 Risk participation agreements -out to counterparties — 10 — 10 Interest rate contracts - cash flow hedge — 599 — 599 Interest rate contracts - fair value hedge — 3,190 — 3,190 Other liabilities Interest rate swaps with counterparties — 46,879 — 46,879 Risk participation agreements-in with counterparties — 35 — 35 Fair Value as of December 31, 2023 Level 1 Level 2 Level 3 Total (dollars in thousands) Measured on a recurring basis Securities available for sale U.S. GSE obligations $ — $ 20,462 $ — $ 20,462 Mortgage-backed securities — 117,376 — 117,376 Corporate debt securities — — — — Other assets Interest rate swaps with clients — 40,338 — 40,338 Risk participation agreements-out to counterparties — 18 — 18 Interest rate contracts - cash flow hedge — 1,284 — 1,284 Interest rate contracts - fair value hedge — 1,620 — 1,620 Other liabilities Interest rate swaps with counterparties — 40,338 — 40,338 Risk participation agreements-in with counterparties — 62 — 62 The following tables present the carrying value of assets held at March 31, 2024 and December 31, 2023, which were measured at fair value on a non-recurring basis: March 31, 2024 Level 1 Level 2 Level 3 Total (dollars in thousands) Items recorded at fair value on a non-recurring basis Assets Individually evaluated collateral dependent loans $ — $ — $ 9,709 $ 9,709 Total $ — $ — $ 9,709 $ 9,709

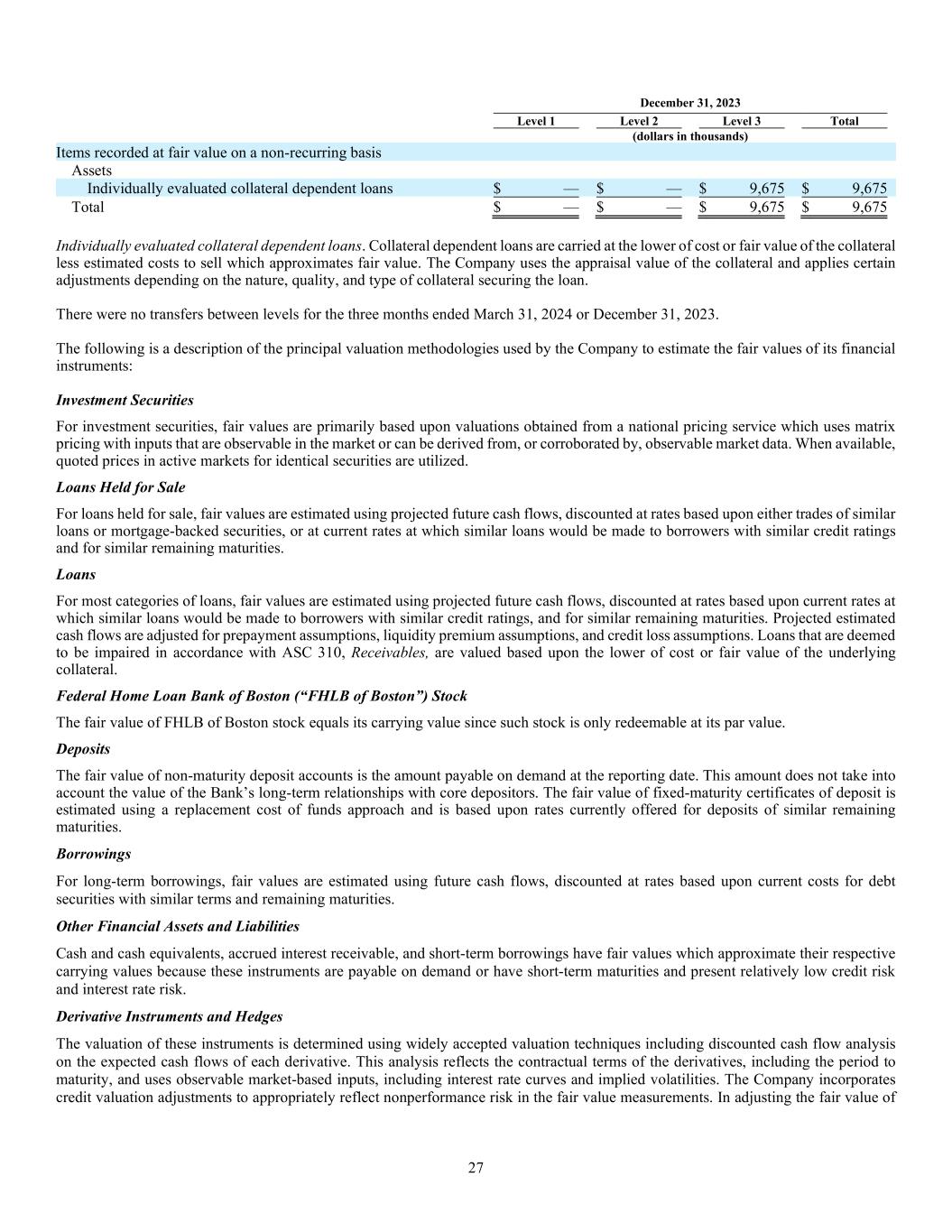

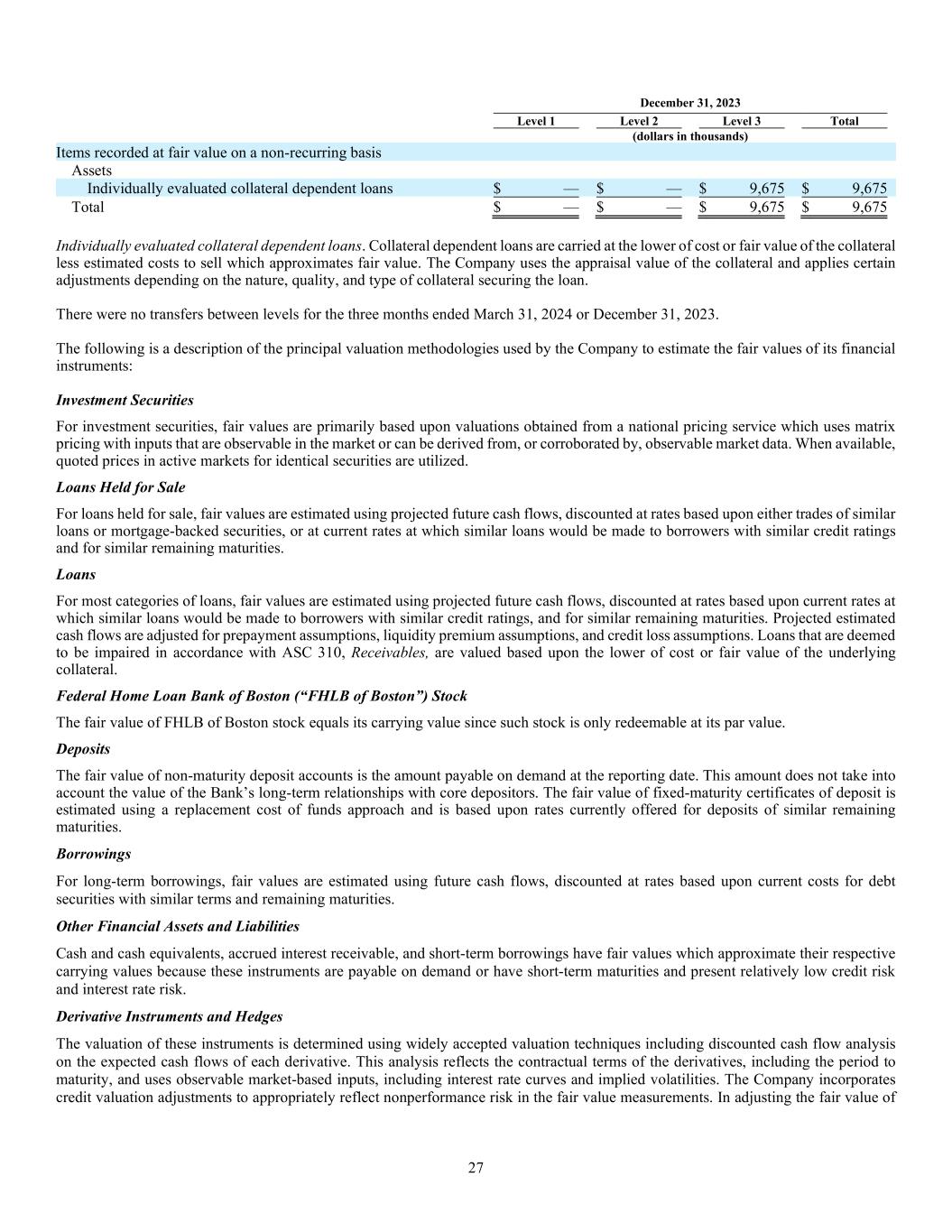

27 December 31, 2023 Level 1 Level 2 Level 3 Total (dollars in thousands) Items recorded at fair value on a non-recurring basis Assets Individually evaluated collateral dependent loans $ — $ — $ 9,675 $ 9,675 Total $ — $ — $ 9,675 $ 9,675 Individually evaluated collateral dependent loans. Collateral dependent loans are carried at the lower of cost or fair value of the collateral less estimated costs to sell which approximates fair value. The Company uses the appraisal value of the collateral and applies certain adjustments depending on the nature, quality, and type of collateral securing the loan. There were no transfers between levels for the three months ended March 31, 2024 or December 31, 2023. The following is a description of the principal valuation methodologies used by the Company to estimate the fair values of its financial instruments: Investment Securities For investment securities, fair values are primarily based upon valuations obtained from a national pricing service which uses matrix pricing with inputs that are observable in the market or can be derived from, or corroborated by, observable market data. When available, quoted prices in active markets for identical securities are utilized. Loans Held for Sale For loans held for sale, fair values are estimated using projected future cash flows, discounted at rates based upon either trades of similar loans or mortgage-backed securities, or at current rates at which similar loans would be made to borrowers with similar credit ratings and for similar remaining maturities. Loans For most categories of loans, fair values are estimated using projected future cash flows, discounted at rates based upon current rates at which similar loans would be made to borrowers with similar credit ratings, and for similar remaining maturities. Projected estimated cash flows are adjusted for prepayment assumptions, liquidity premium assumptions, and credit loss assumptions. Loans that are deemed to be impaired in accordance with ASC 310, Receivables, are valued based upon the lower of cost or fair value of the underlying collateral. Federal Home Loan Bank of Boston (“FHLB of Boston”) Stock The fair value of FHLB of Boston stock equals its carrying value since such stock is only redeemable at its par value. Deposits The fair value of non-maturity deposit accounts is the amount payable on demand at the reporting date. This amount does not take into account the value of the Bank’s long-term relationships with core depositors. The fair value of fixed-maturity certificates of deposit is estimated using a replacement cost of funds approach and is based upon rates currently offered for deposits of similar remaining maturities. Borrowings For long-term borrowings, fair values are estimated using future cash flows, discounted at rates based upon current costs for debt securities with similar terms and remaining maturities. Other Financial Assets and Liabilities Cash and cash equivalents, accrued interest receivable, and short-term borrowings have fair values which approximate their respective carrying values because these instruments are payable on demand or have short-term maturities and present relatively low credit risk and interest rate risk. Derivative Instruments and Hedges The valuation of these instruments is determined using widely accepted valuation techniques including discounted cash flow analysis on the expected cash flows of each derivative. This analysis reflects the contractual terms of the derivatives, including the period to maturity, and uses observable market-based inputs, including interest rate curves and implied volatilities. The Company incorporates credit valuation adjustments to appropriately reflect nonperformance risk in the fair value measurements. In adjusting the fair value of

28 its derivative contracts for the effect of nonperformance risk, the Company has considered the impact of netting and any applicable credit enhancements, such as collateral postings. Off-Balance-Sheet Financial Instruments In the course of originating loans and extending credit, the Company will charge fees in exchange for its commitment. While these commitment fees have value, the Company has not estimated their value due to the short-term nature of the underlying commitments and their immateriality. Values Not Determined In accordance with ASC Topic 820, the Company has not estimated fair values for non-financial assets, such as banking premises and equipment, goodwill, the intangible value of the Company’s portfolio of loans serviced for itself, and the intangible value inherent in the Company’s deposit relationships (i.e., core deposits), among others. Accordingly, the aggregate fair value amounts presented do not represent the underlying value of the Company.