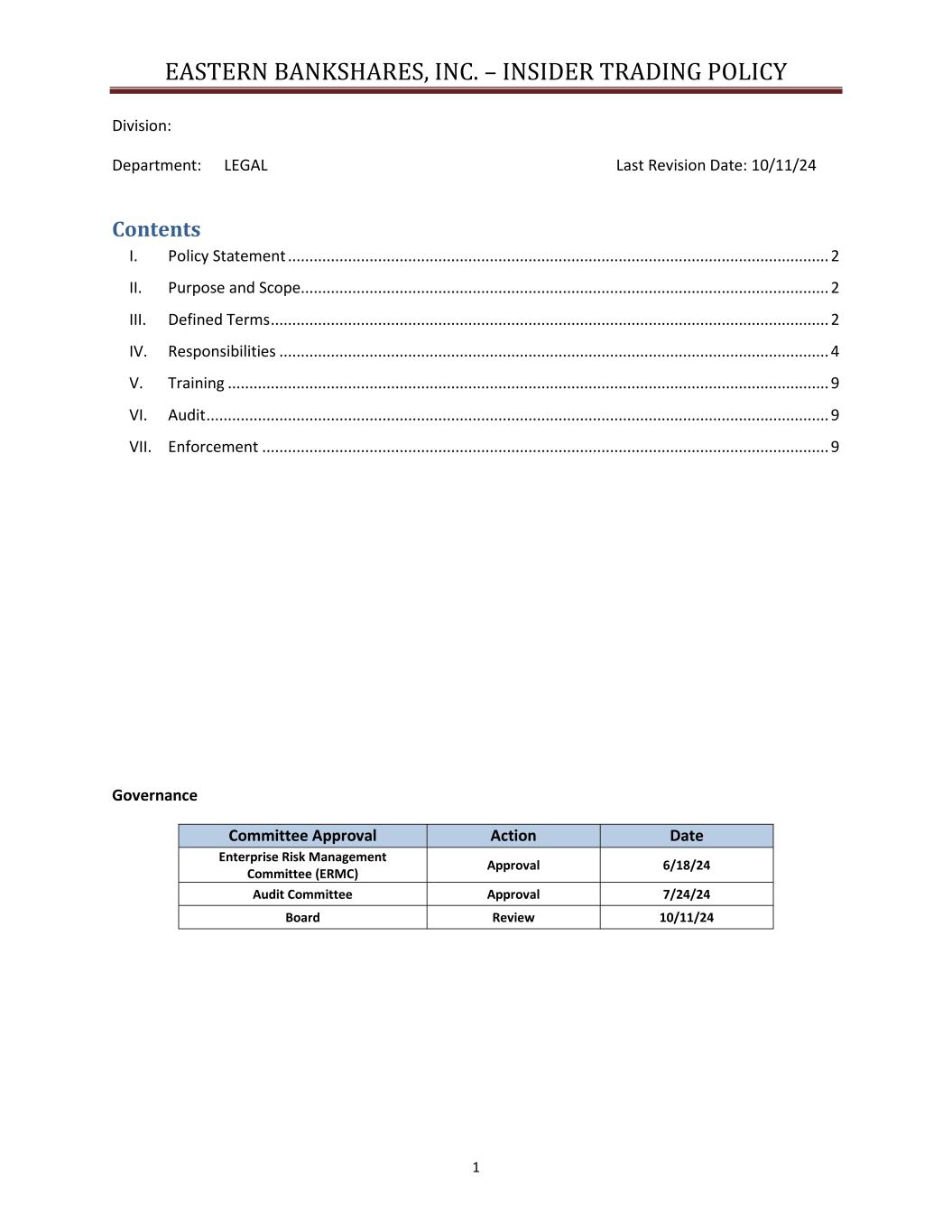

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 1 Division: Department: LEGAL Last Revision Date: 10/11/24 Contents I. Policy Statement .............................................................................................................................. 2 II. Purpose and Scope........................................................................................................................... 2 III. Defined Terms .................................................................................................................................. 2 IV. Responsibilities ................................................................................................................................ 4 V. Training ............................................................................................................................................ 9 VI. Audit ................................................................................................................................................. 9 VII. Enforcement .................................................................................................................................... 9 Governance Committee Approval Action Date Enterprise Risk Management Committee (ERMC) Approval 6/18/24 Audit Committee Approval 7/24/24 Board Review 10/11/24

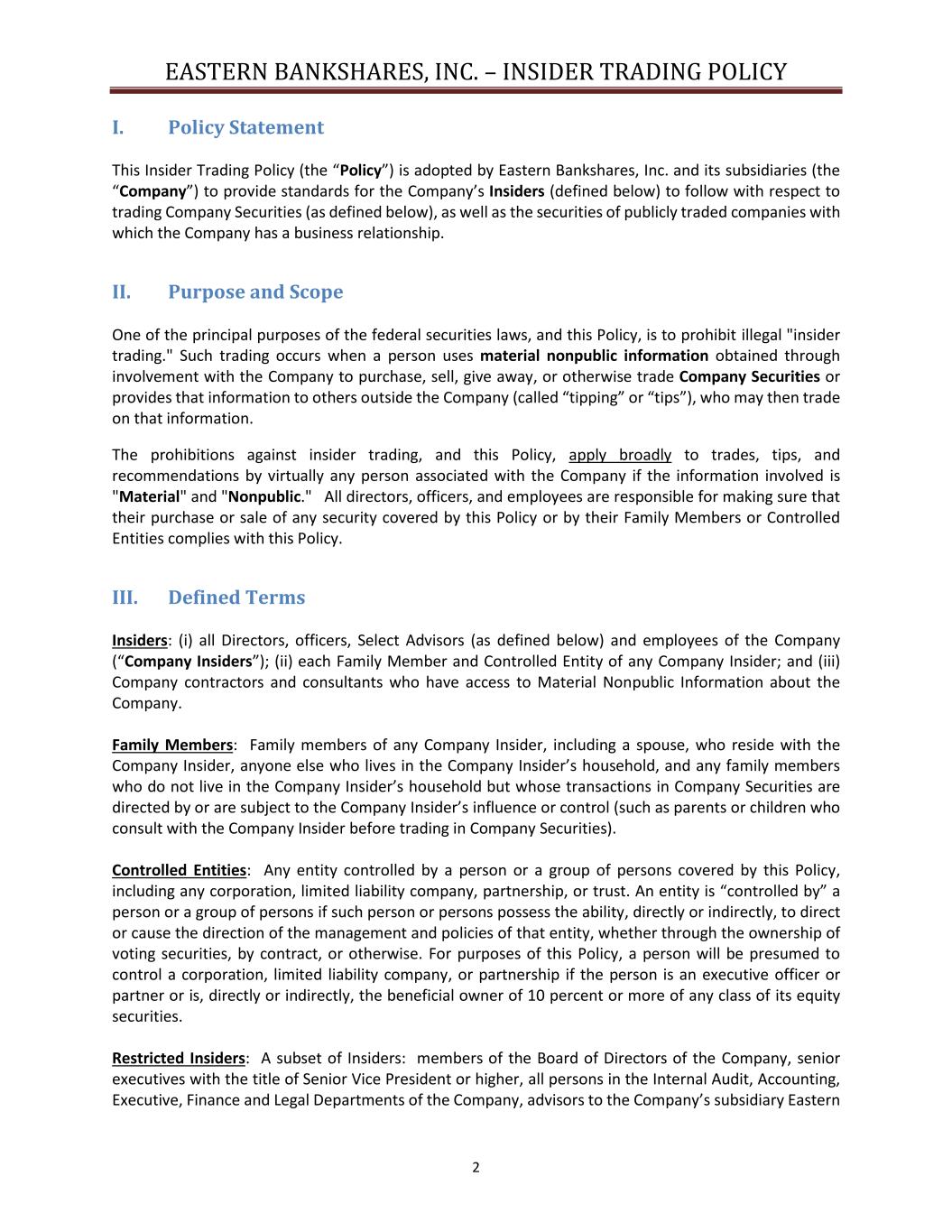

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 2 I. Policy Statement This Insider Trading Policy (the “Policy”) is adopted by Eastern Bankshares, Inc. and its subsidiaries (the “Company”) to provide standards for the Company’s Insiders (defined below) to follow with respect to trading Company Securities (as defined below), as well as the securities of publicly traded companies with which the Company has a business relationship. II. Purpose and Scope One of the principal purposes of the federal securities laws, and this Policy, is to prohibit illegal "insider trading." Such trading occurs when a person uses material nonpublic information obtained through involvement with the Company to purchase, sell, give away, or otherwise trade Company Securities or provides that information to others outside the Company (called “tipping” or “tips”), who may then trade on that information. The prohibitions against insider trading, and this Policy, apply broadly to trades, tips, and recommendations by virtually any person associated with the Company if the information involved is "Material" and "Nonpublic." All directors, officers, and employees are responsible for making sure that their purchase or sale of any security covered by this Policy or by their Family Members or Controlled Entities complies with this Policy. III. Defined Terms Insiders: (i) all Directors, officers, Select Advisors (as defined below) and employees of the Company (“Company Insiders”); (ii) each Family Member and Controlled Entity of any Company Insider; and (iii) Company contractors and consultants who have access to Material Nonpublic Information about the Company. Family Members: Family members of any Company Insider, including a spouse, who reside with the Company Insider, anyone else who lives in the Company Insider’s household, and any family members who do not live in the Company Insider’s household but whose transactions in Company Securities are directed by or are subject to the Company Insider’s influence or control (such as parents or children who consult with the Company Insider before trading in Company Securities). Controlled Entities: Any entity controlled by a person or a group of persons covered by this Policy, including any corporation, limited liability company, partnership, or trust. An entity is “controlled by” a person or a group of persons if such person or persons possess the ability, directly or indirectly, to direct or cause the direction of the management and policies of that entity, whether through the ownership of voting securities, by contract, or otherwise. For purposes of this Policy, a person will be presumed to control a corporation, limited liability company, or partnership if the person is an executive officer or partner or is, directly or indirectly, the beneficial owner of 10 percent or more of any class of its equity securities. Restricted Insiders: A subset of Insiders: members of the Board of Directors of the Company, senior executives with the title of Senior Vice President or higher, all persons in the Internal Audit, Accounting, Executive, Finance and Legal Departments of the Company, advisors to the Company’s subsidiary Eastern

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 3 Bank (the “Bank”) who serve on key committees of the Bank’s Board of Directors (“Select Advisors”), and other employees designated as Restricted Insiders from time to time by the Company due to routine access to material non-public information as part of their position, responsibilities or information access. Section 16 Filers: Includes members of the Board of Directors and the people designated by the Board of Directors as “officers” as defined by Rule 16a-1(f) promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including members of the Company’s Executive Committee and its principal accounting officer/ controller. Material Nonpublic Information: Information that is both material and not publicly available. Material: Information is material if it could reasonably be expected that an investor would consider it important in deciding whether to buy, hold or sell a security, or if the disclosure of the information could reasonably be expected to alter significantly the total mix of information in the marketplace about the Company. In simple terms, any information that could reasonably be expected to affect the price of the security is material. While it is not possible to identify all information that could be deemed “material,” the following items or types of information should be considered carefully to determine whether they are material: • Projections of future earnings or losses, or other earnings guidance; • Changes in the Company’s prospects; • Changes in the Company’s loan loss provision; • Significant regulatory developments; • Earnings or revenues that are inconsistent with the consensus expectations of the investment community; • Potential restatements of the Company’s financial statements; • A corporate restructuring or reorganization; • A pending or proposed merger, acquisition or tender offer or an acquisition or disposition of significant assets; • A change in the composition of the Executive Committee or the Board of Directors of the Company; • Major events regarding Company Securities, including changes in dividend policy, the declaration of a stock split or the offering of additional securities; • The establishment of a stock repurchase program; • Potential defaults by the Company under a material agreement; • Actual or threatened material litigation or governmental investigations, or major developments in such matters; • A significant cybersecurity, operational or business continuity incident; • New major contracts, customers or finance sources, or the loss thereof; and • Changes in auditors or auditor notification that the Company may no longer rely on an auditor’s audit report. Both positive and negative information can be material. Questions about whether certain information is material should be resolved in favor of materiality and trading should be avoided.

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 4 Nonpublic information: Nonpublic information is information that is not generally known or available to the public. Information is considered to be “available to the public” only when it has been released broadly to the marketplace (such as by press release or an SEC filing) and the investing public has had time to absorb the information fully, generally on the third full trading day after the information is released. For example, if the Company announces its financial results after the close of the trading markets on a Thursday, the first time a Restricted Insider can buy or sell Company Securities is the opening of the market on the following Tuesday. Company Securities: Company Securities include common stock, options and any other securities the Company may issue, such as preferred stock, notes, bonds and convertible securities, as well as derivative securities relating to any of the Company’s securities, whether or not issued by the Company. SEC Compliance Officer: The General Counsel and/or his or her designee shall be the SEC Compliance Officer responsible for assisting with the implementation and enforcement of this Policy and regularly reviewing and updating it as needed. IV. Responsibilities A. RESPONSIBILITIES OF ALL INSIDERS This section applies to all Insiders. 1. Prohibitions on Insider trading and tipping. No Trading on Inside Information Insiders may not purchase or sell, offer to purchase or sell, or gift any Company Securities, directly or through Family Members, Controlled Entities, or through third parties, while in possession of Material Nonpublic Information related to the Company. This prohibition applies to transacting in the Company Securities through the Company’s 401(k) Plan (“Eastern 401(k) Plan”), subject to the exceptions set forth in Section IV(C). Similarly, Insiders may not purchase or sell or offer to purchase or sell the securities of any other issuer of publicly traded securities if they are aware of Material Nonpublic Information about the issuer which was obtained in the course of an Insider’s employment with or role with the Company. No Tipping Insiders who know of Material Nonpublic Information about the Company may not communicate that information (“tip”) to any other person, including friends and family, or otherwise disclose the information without the Company’s authorization. Similarly, Insiders who know of Material Nonpublic Information about any other company, such as a customer or vendor of the Company and those with which the Company may be negotiating a major transaction, may not communicate that information to any other person or otherwise disclose that information without the Company’s authorization. This practice, known as “tipping,” violates the securities laws and can result in the same civil and criminal penalties that apply to insider trading, even if the tipper did not gain any economic benefit from another person’s trading. Company employees should refrain from commenting or responding to inquiries about the Company’s performance in any medium, including LinkedIn or other social media.

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 5 Seek Advance Approval to Trade When in Doubt Determinations of materiality can be difficult and may depend upon an analysis of facts and circumstances. Insiders should never trade, tip or recommend securities (or otherwise cause the purchase or sale of securities) while in possession of information that they think is or may be material and nonpublic unless they first consult with, and obtain the advance approval of, the SEC Compliance Officer or the General Counsel. No Exception for Hardship The existence of a personal financial emergency does not excuse an Insider from compliance with this Policy. 2. Other Prohibited Transactions Company Insiders should not engage in short-term or speculative transactions in Company Securities or in certain transactions in Company Securities that may lead to inadvertent violations of insider trading laws or that could create a conflict of interest for the Insider. Therefore, Company Insiders may not engage in any of the following transactions with respect to Company Securities, whether directly or indirectly through any Family Member or Controlled Entity: • Short Sales. • Buying or selling Company options, including put options or call options or other derivative securities, but excluding the exercise of options granted pursuant to the Company’s long-term equity incentive compensation plans. • Hedging transactions, including through the use of financial instruments such as prepaid variable forwards, equity swaps, collars and exchange funds. • Holding Company Securities in a margin account and or pledging Company Securities as collateral. Securities held in a margin account or pledged as collateral for a loan may be sold without consent by the broker if an Insider were to fail to meet a margin call, or by the lender in foreclosure if the Insider were to default on the loan, including at times when an Insider is aware of Material Nonpublic Information. If an Insider has a managed account (where another person has discretion or authority to trade without the Insider’s prior approval), the Insider should advise the broker or investment plan adviser not to trade in Company Securities in such account at any time other than as part of an Approved Rule 10b5-1 Plan (see Exhibit A). This restriction does not apply to investments in publicly available mutual funds. 3. Standing and Limit Orders. Standing and limit orders create heightened risks for insider trading, as there is no control over the timing of purchases or sales that result from standing instructions. As a result, the trade could occur while the Insider is in possession of Material Nonpublic Information. Insiders are encouraged to minimize the use of standing or limit orders and to maintain such orders for only short durations or pursuant to an Approved Rule 10b5-1 Plan. B. ADDITIONAL RESPONSIBILITIES APPLICABLE TO CERTAIN INSIDERS

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 6 In addition to the responsibilities set forth in Section A above, this section sets forth additional trading restrictions applicable to a smaller group of Insiders, including Restricted Insiders, who, as a result of their position in the Company, are more likely to have regular access to Material Nonpublic Information. 1. Trading Windows Restricted Insiders are only permitted to trade in or gift Company Securities during an open trading window (a “Trading Window”) and upon pre-clearance by the SEC Compliance Officer, or pursuant to an Approved Rule 10b5-1 Trading Plan. The SEC Compliance Officer will determine the commencement date and length of each Trading Window. Generally, Trading Windows will commence at the beginning of the third full trading day following the public release of the Company’s quarterly financial results for the quarter or year-end, as applicable, and end on the third Wednesday of the last month of each calendar quarter. However, even during this Trading Window, a Restricted Insider who is in possession of any Material Nonpublic Information shall not trade in the Company Securities until the beginning of the third full trading day after the information has been made publicly available or the information is no longer material. In addition, the Company may impose a special blackout period on certain individuals due to material information known to the Company and not yet disclosed to the public. During a special blackout period, the Trading Window is closed for those who are subject to the special blackout. The existence of such a special, event-specific trading restriction period will not be announced to all Company Insiders, but only to those aware of that event/material information. The mere fact that the Company has imposed a special blackout period may be material non-public information and should not be shared internally or externally. The SEC Compliance Officer will re-open the Trading Window for those impacted by the special blackout once the special blackout period has ended. 2. Required Pre-Clearance of Securities Transactions by Restricted Insiders Because Restricted Insiders are likely to obtain Material Nonpublic Information on a regular basis, the Company requires all such persons to receive pre-clearance from the SEC Compliance Officer before trading Company Securities, even during a Trading Window. A request for pre-clearance should be made at least one business day in advance of a transaction by submitting a written request to the SEC Compliance Officer at preclearance@easternbank.com. The requestor should (a) summarize the details, such as the amount and nature, of the proposed transaction and (b) confirm that he or she has reviewed this Policy and is not aware of any Material Nonpublic Information concerning the Company. The SEC Compliance Officer records the date each request is received and the date and time each request is approved or disapproved. Unless revoked by the SEC Compliance Officer, a pre-clearance to trade will normally remain valid until the close of trading five (5) business days following the day on which it was granted. If the transaction does not occur during the five-day period, pre-clearance of the transaction must be re-requested. 3. Approved 10b5-1 Trading Plans. The Trading Window and pre-clearance restrictions do not apply to transactions made pursuant to an approved pre-existing written plan, contract, instruction, or arrangement under Rule 10b5-1 of the Exchange Act (an "Approved 10b5-1 Trading Plan"). The Company’s Rule 10b5-1 Trading Plan Guidelines are attached hereto as Exhibit A. The entering into, amending or terminating of 10b5-1 Plans by Restricted Insiders will only be approved by the SEC Compliance Officer during a Trading Window.

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 7 4. Other Publicly Traded Companies. From time to time, Company Insiders may obtain access to Material Nonpublic Information about a publicly traded third party, such as a vendor or counterparty to a Company agreement, through the Insiders’ roles with the Company. An Insider should not trade in the stock of such third parties while aware of Material Nonpublic Information about them. 5. Reporting Obligations and Short Swing Transactions. Section 16 Filers must comply with the reporting obligations and limitations on short-swing transactions set forth in Section 16 of the Exchange Act. The existence of an Approved 10b5-1 Plan does not override the reporting obligations and limitations applicable to Section 16 Filers. 6. Eastern 401(k) Plan. The trading restrictions of this Policy do apply to most activities related to Company stock within the Eastern 401(k) Plan. This includes elections under the Eastern 401(k) Plan to (a) increase or decrease the percentage of contributions to the Company stock fund within the Eastern 401(k) Plan, (b) make an intra- plan transfer of an existing account balance into or out of the Company stock fund, (c) borrow money against an employee’s Eastern 401(k) Plan account if the loan will result in a liquidation of any of the employee’s Company’s stock fund balance, or (d) pre-pay an Eastern 401(k) Plan loan if the pre-payment will result in the allocation of funds to the Company stock fund. However, once an allocation per item (a) above has been preapproved, the trading restrictions do not apply to purchases of Company stock in the 401(k) plan resulting from the ongoing periodic contribution of money to the plan pursuant to a preapproved payroll deduction election. C. EXCEPTIONS TO TRADING RESTRICTIONS Certain Insider transactions do not pose a risk of inadvertent violations of insider trading laws or conflicts of interest for Insiders. Accordingly, all Insiders are permitted to engage in the following transactions, which are not subject to trading restrictions. Stock Option Exercises The restrictions in this Policy do not apply to the exercise of an employee stock option acquired pursuant to the Company’s equity incentive compensation plans, or to the exercise of a tax withholding right pursuant to which a person has elected to have the Company withhold shares subject to an option to satisfy tax withholding requirements. However, this Policy does apply to (i) any sale of shares resulting from the exercise of an employee stock option as part of a cashless exercise of an option (whether net proceeds are received in cash or shares) and (ii) any other sale or exchange of shares to generate the consideration needed to fund the exercise price of an option. Restricted Stock Awards The restrictions in this Policy do not apply to the vesting of restricted stock, restricted stock units or performance stock units (regardless of vesting schedule or performance condition), or the surrender of shares by employees to pay for taxes incident to such vesting. The restrictions in this Policy do apply to any sale of shares upon the vesting of restricted stock, restricted stock units or performance stock units. Eastern 401(k) Plan

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 8 As noted above, the trading restrictions do apply to most actions an employee may take through the Eastern 401(k) Plan if those actions could result in an acquisition or disposition of EBC shares through the Company stock fund within the Eastern 401(k) Plan. However, the trading restrictions do not apply to purchases of Company stock in the 401(k) plan resulting from the ongoing periodic contribution of money to the plan pursuant to a preapproved payroll deduction election. D. POST TERMINATION TRANSACTIONS If an Insider is aware of Material Nonpublic Information when the employment or service relationship terminates, the Insider may not trade in Company Securities until that information has become public or is no longer material. The pre-clearance procedures specified above, however, will cease to apply to transactions in Company Securities at the end of any blackout period or other Company-imposed trading restrictions that were in place at the time of the termination of service. E. PERSONAL RESPONSIBILITY FOR POLICY COMPLIANCE Company Insiders with any questions about this Policy or its application to any proposed transaction should obtain additional guidance from the Company’s Legal Department. The ultimate responsibility for adhering to this Policy and determining whether an individual is in possession of Material Nonpublic Information rests with that individual, and any action or communication by Company, the Legal Department or any other employee, officer, or director pursuant to this Policy (or otherwise) does not in any way constitute legal advice or insulate an Insider from liability under the applicable securities laws. F. VIOLATIONS OF INSIDER TRADING LAWS Legal Penalties. A person who violates insider trading laws by engaging in transactions in a company's securities when he or she has Material Nonpublic Information can be sentenced to a substantial jail term and required to pay a criminal penalty of several times the amount of profits gained, or losses avoided. In addition, a person who tips others may also be liable for transactions by the tippees to whom he or she has disclosed Material Nonpublic Information. Tippers can be subject to the same penalties and sanctions as the tippees and may be subject to large penalties even when the tipper did not profit from the transaction. The SEC can also seek substantial civil penalties from any person who directly or indirectly controls a person who commits an insider trading violation. This could apply to the Company and/or management and supervisory personnel. Even for violations that result in a small or no profit, the SEC can seek penalties from the Company and/or its management and supervisory personnel as control persons. A person who violates insider trading laws, as well as control persons, could be subject to private actions, as well. G. REPORTING POLICY VIOLATIONS Any complaints about insider trading or other violations of this Policy should be promptly submitted to the Company’s Ethics Hotline at www.eastern.ethicspoint.com or at 844-862-7978. The Ethics Hotline is managed by an independent third party. Complaints submitted to the Ethics Hotline can be done on an anonymous basis.

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 9 V. Training All Insiders subject to this Policy shall receive appropriate training on it. Training is delivered on an as needed basis. The General Counsel is responsible for designing training content as (s)he deems appropriate. VI. Audit In accordance with the risk based Internal Audit Plan, the Policy is subject to review by the Company’s Internal Audit Department. The Internal Audit Department provides reasonable assurance to the Company’s Board of Directors that the objectives of this Policy are achieved and are in alignment with state and federal regulations. Reports on this Policy by the Internal Audit Department are issued to the Audit Committee of the Company’s Board of Directors. VII. Enforcement The Company reserves the right to determine, in its discretion and on the basis of information available to it, whether this Policy has been violated. The Company may determine that specific conduct violates this Policy, whether or not the conduct also violates the law. Violation of this policy may result in disciplinary action up to and including dismissal for cause.

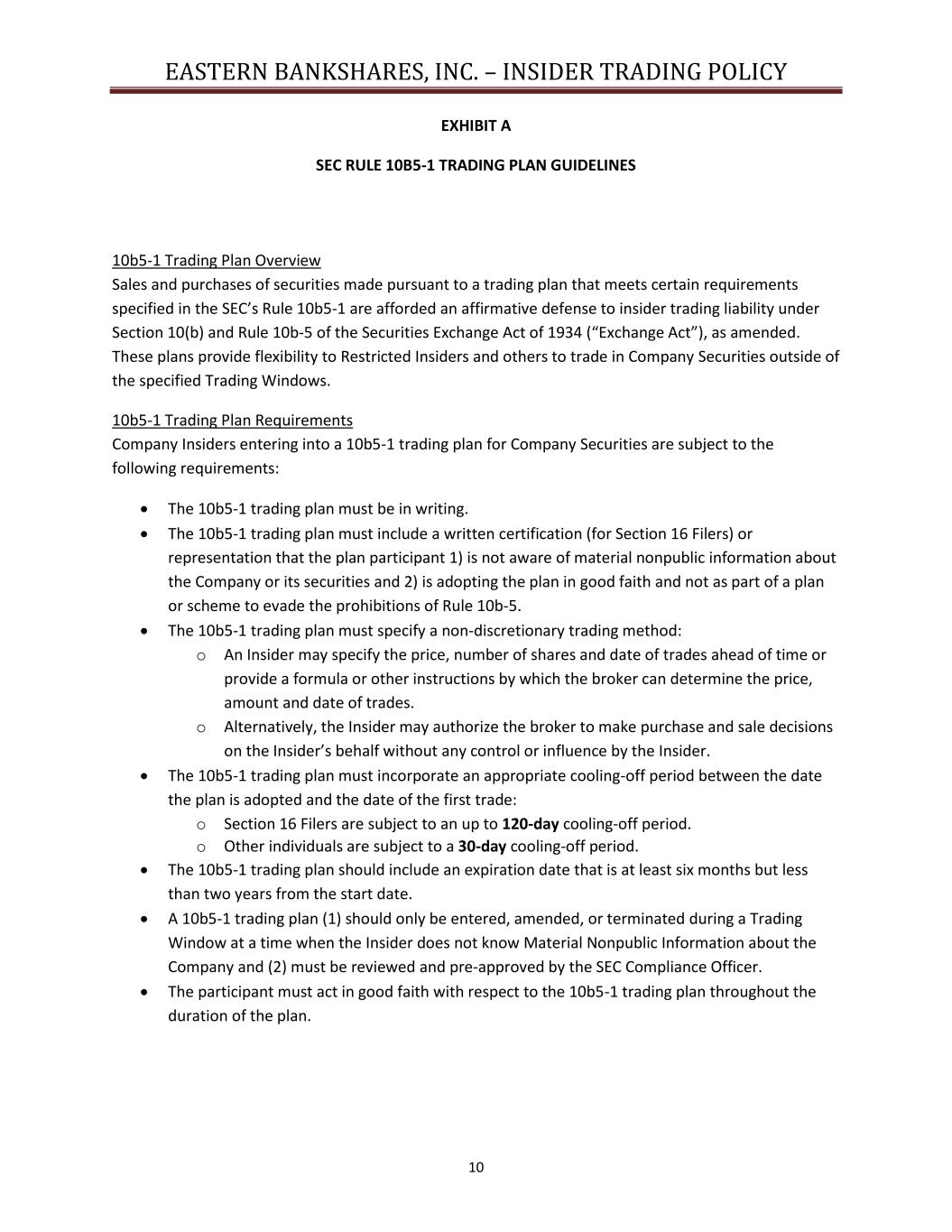

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 10 EXHIBIT A SEC RULE 10B5-1 TRADING PLAN GUIDELINES 10b5-1 Trading Plan Overview Sales and purchases of securities made pursuant to a trading plan that meets certain requirements specified in the SEC’s Rule 10b5-1 are afforded an affirmative defense to insider trading liability under Section 10(b) and Rule 10b-5 of the Securities Exchange Act of 1934 (“Exchange Act”), as amended. These plans provide flexibility to Restricted Insiders and others to trade in Company Securities outside of the specified Trading Windows. 10b5-1 Trading Plan Requirements Company Insiders entering into a 10b5-1 trading plan for Company Securities are subject to the following requirements: • The 10b5-1 trading plan must be in writing. • The 10b5-1 trading plan must include a written certification (for Section 16 Filers) or representation that the plan participant 1) is not aware of material nonpublic information about the Company or its securities and 2) is adopting the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5. • The 10b5-1 trading plan must specify a non-discretionary trading method: o An Insider may specify the price, number of shares and date of trades ahead of time or provide a formula or other instructions by which the broker can determine the price, amount and date of trades. o Alternatively, the Insider may authorize the broker to make purchase and sale decisions on the Insider’s behalf without any control or influence by the Insider. • The 10b5-1 trading plan must incorporate an appropriate cooling-off period between the date the plan is adopted and the date of the first trade: o Section 16 Filers are subject to an up to 120-day cooling-off period. o Other individuals are subject to a 30-day cooling-off period. • The 10b5-1 trading plan should include an expiration date that is at least six months but less than two years from the start date. • A 10b5-1 trading plan (1) should only be entered, amended, or terminated during a Trading Window at a time when the Insider does not know Material Nonpublic Information about the Company and (2) must be reviewed and pre-approved by the SEC Compliance Officer. • The participant must act in good faith with respect to the 10b5-1 trading plan throughout the duration of the plan.

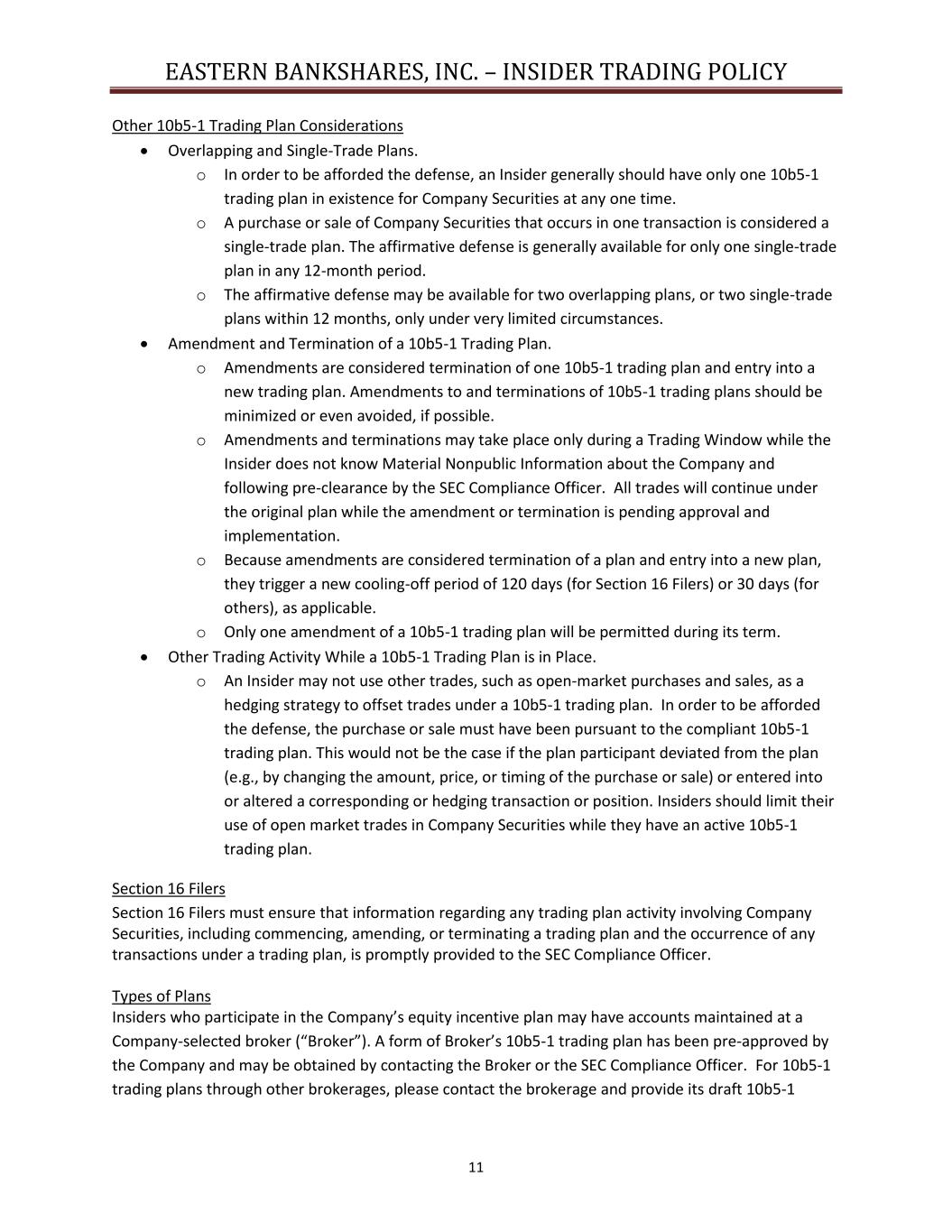

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 11 Other 10b5-1 Trading Plan Considerations • Overlapping and Single-Trade Plans. o In order to be afforded the defense, an Insider generally should have only one 10b5-1 trading plan in existence for Company Securities at any one time. o A purchase or sale of Company Securities that occurs in one transaction is considered a single-trade plan. The affirmative defense is generally available for only one single-trade plan in any 12-month period. o The affirmative defense may be available for two overlapping plans, or two single-trade plans within 12 months, only under very limited circumstances. • Amendment and Termination of a 10b5-1 Trading Plan. o Amendments are considered termination of one 10b5-1 trading plan and entry into a new trading plan. Amendments to and terminations of 10b5-1 trading plans should be minimized or even avoided, if possible. o Amendments and terminations may take place only during a Trading Window while the Insider does not know Material Nonpublic Information about the Company and following pre-clearance by the SEC Compliance Officer. All trades will continue under the original plan while the amendment or termination is pending approval and implementation. o Because amendments are considered termination of a plan and entry into a new plan, they trigger a new cooling-off period of 120 days (for Section 16 Filers) or 30 days (for others), as applicable. o Only one amendment of a 10b5-1 trading plan will be permitted during its term. • Other Trading Activity While a 10b5-1 Trading Plan is in Place. o An Insider may not use other trades, such as open-market purchases and sales, as a hedging strategy to offset trades under a 10b5-1 trading plan. In order to be afforded the defense, the purchase or sale must have been pursuant to the compliant 10b5-1 trading plan. This would not be the case if the plan participant deviated from the plan (e.g., by changing the amount, price, or timing of the purchase or sale) or entered into or altered a corresponding or hedging transaction or position. Insiders should limit their use of open market trades in Company Securities while they have an active 10b5-1 trading plan. Section 16 Filers Section 16 Filers must ensure that information regarding any trading plan activity involving Company Securities, including commencing, amending, or terminating a trading plan and the occurrence of any transactions under a trading plan, is promptly provided to the SEC Compliance Officer. Types of Plans Insiders who participate in the Company’s equity incentive plan may have accounts maintained at a Company-selected broker (“Broker”). A form of Broker’s 10b5-1 trading plan has been pre-approved by the Company and may be obtained by contacting the Broker or the SEC Compliance Officer. For 10b5-1 trading plans through other brokerages, please contact the brokerage and provide its draft 10b5-1

EASTERN BANKSHARES, INC. – INSIDER TRADING POLICY 12 trading plan to the SEC Compliance Officer for review prior to commencing the plan. The Company may require edits to such plans. Compliance The Company may update these Guidelines or impose additional or different restrictions or requirements from time to time. Please note that each Insider is responsible for compliance with the Company’s Insider Trading Policy, these Guidelines, and applicable securities laws and regulations. Any action or communication by Company, the Company’s Legal Department, or employees or officers does not constitute legal advice or insulate Insiders from potential liability under applicable securities laws.