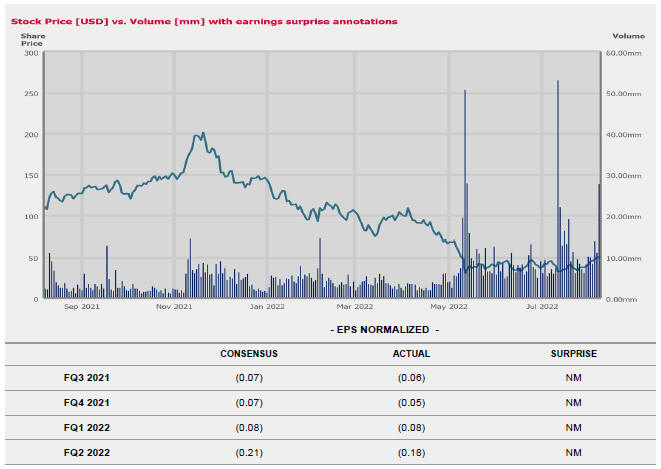

UNITY SOFTWARE INC. FQ2 2022 EARNINGS CALL - PRELIMINARY COPY AUG 09, 2022

Richard Hugh Davis

Vice President Investor Relations & Strategy

And Kash Rangan at Goldman Sachs.

Kasthuri Gopalan Rangan

Goldman Sachs Group, Inc., Research Division

I don’t know if you can see me out there as, but first of all, thanks for all the details, John and Crew and the tremendous progress in the Create side. On the Operate, I’m going to probably boot the question since I’m not an expert in mobile gaming and advertising. But John, you talked about how you have a good handle on data, data versus macro versus competitive impact? I mean how much better informed is the company on all these 3 potential contributors to the issues that caused a shortfall in?

And going forward, what are the — I know you mentioned a little bit about the guardrails that you have in place to ensure that you won’t have this issue. If you don’t mind elaborating on that, that will be great as well.

John S. Riccitiello

CEO, President & Executive Chairman

So again, I’ll tap this and ask everybody to join. The — and by the way, Kash, thanks for the 11-part question. I’ll try to keep it to a reason. So first off, on macro on the Operate side, the majority of our business — the vast majority of our business and Operate within gaming. And as I’ve said a few times before, the only thing that is in larger numbers than games is pundents talking about the game industry and the recession and all the rest of it. .

I’d just start by saying this. The game industry remains a very robust industry and it’s a growth industry. You can look back at the last 5 or 6 recessions, I’ve looked back all the way to the 80s in a prior life. And over almost any 3-year time period, you see double-digit growth, typically averaging out the change or better.

Yes, there’s short-term headwinds that occur from time to time. And in the present period, we’re sort of dealing with extremely high engagement when people stay home for COVID together now that we’re looking into a little bit of a headwind, which is driven macroeconomic factors. And you’ve seen that reported out by a number of game companies where a little bit less revenue from bringing down some forecasts.

We understand there’s a near-term headwind in the game industry relative to that mid-teens growth or better than we’ve seen for so many years. And we expect that we’ll persevere through that, and this is a long-term growth space. So we feel very, very good about that. Now in terms of the issues around our own platform, at a very high level, I can tell you one of the things Ingrid did, and I’m really proud of the work that she had our team have pulled together here.

They pulled together 8 task teams. It literally worked 7-day weeks on everything from resiliency and redundancy to the data side, to the engineering issues we wanted to focus on to the new products and features. It has been a magnificent effort on their part. And what they’ve been able to show me is really strong KPIs around some things that are pre-revenue, but you need accuracy around pinpoint or for the revenue to ultimately grow.

And I’m going to let her expand on that, but it’s tough coming from a period where we’ve had some misses, but it’s great to see the team rebound top of their game and really start to execute, which is what I’m saying from my vantage point. Ingrid, do you want to add to that?

Ingrid Lestiyo

Senior VP & GM of Unity Operate Solutions

Yes. Thank you, John. On our part, just to build on what John said about the task forces, we’ve added significant investment in audience pin pointer. And across the board, One of the things just connecting your macro question to this is that constraint drives focus and the best innovation.

So during this time, we’ve become really disciplined in our resources, we’ve doubled down on those ad products and services that drive the most value to our customers and Unity. And without the luxury of excess spend, this is really an exercise to drive performance with less for our customers such as finding more installs with fewer dollars, right?

| | |

Copyright © 2022 S&P Global Market Intelligence, a division of S&P Global Inc. All Rights reserved. spglobal.com/marketintelligence | | 13 |