UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23577

2nd Vote Funds

(Exact name of registrant as specified in charter)

462 Sandcastle Rd.

Franklin, TN 37069

(Address of principal executive offices) (Zip code)

Corporation Service Company

1209 Orange Street

Wilmington, Delaware 19801

(Name and address of agent for service)

(615) 240-7500

Registrant’s telephone number, including area code

Date of fiscal year end: June 30, 2021

Date of reporting period: December 31, 2020

Item 1. Reports to Stockholders.

2nd Vote Funds

Semi-Annual Report

December 31, 2020

2ndVote Life Neutral Plus ETF

Cboe: LYFE

2ndVote Society Defended ETF

Cboe: EGIS

Paper copies of the Funds’ shareholder reports are no longer sent by mail, unless you specifically request them from the Fund or from your financial intermediary, such as a broker-dealer or bank. Shareholder reports are available online. Each time a report is posted on the Fund’s website you will be provided with a link to access the report online, either by mail (hard copy notice) or by email, if you have already signed up for electronic delivery of shareholder reports.

You may elect to receive all future shareholder reports in paper free of charge. If you invest through a financial intermediary, you can contact your financial intermediary to request that you continue to receive paper copies. If you invest directly with the Fund, you can inform the Fund that you wish to continue receiving paper copies by visiting www.2ndvotefunds.com or calling 1-877-223-8699. Your election to receive reports in paper will apply to all funds held with your financial intermediary if you invest through a financial intermediary or all Funds held if you invest directly with the Fund.

Additionally, If you have not yet signed up for electronic delivery of shareholder reports and other Fund communications, you may do so by contacting your financial intermediary or, if you are a direct investor, by visiting www.2ndvotefunds.com or calling 1-877-223-8699.

2nd Vote Funds

Table of Contents

December 31, 2020

i

2nd Vote Funds

December 31, 2020 (Unaudited)

2ndVote Life Neutral Plus ETF Growth of $10,000

The chart illustrates the performance of a hypothetical $10,000 investment made on November 18, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

| Average Annual Returns | Since Inception | Value of $10,000 | ||

| Period Ended December 31, 2020 | (11/18/2020) | (12/31/2020) | ||

| 2ndVote Life Neutral Plus ETF (NAV) | 4.68% | $10,468 | ||

| 2ndVote Life Neutral Plus ETF (Market) | 4.68% | $10,468 | ||

| S&P 500 Total Return Index | 4.26% | $10,426 |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-877-223-6899.

1

2nd Vote Funds

Growth of $10,000 Investment (continued)

December 31, 2020 (Unaudited)

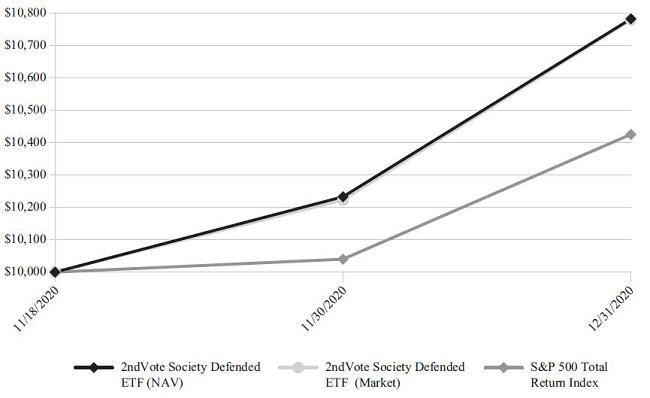

2ndVote Society Defended ETF Growth of $10,000

The chart illustrates the performance of a hypothetical $10,000 investment made on November 18, 2020, and is not intended to imply any future performance. The returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions from the sales of Fund shares. The chart assumes reinvestment of capital gains and dividends. The chart assumes reinvestment of capital gains and dividends, if any. The Index Returns do not reflect fees or expenses and are not available for direct investment.

| Average Annual Returns | Since Inception | Value of $10,000 | ||

| Period Ended December 31, 2020 | (11/18/2020) | (12/31/2020) | ||

| 2ndVote Society Defended ETF (NAV) | 7.83% | $10,783 | ||

| 2ndVote Society Defended ETF (Market) | 7.80% | $10,780 | ||

| S&P 500 Total Return Index | 4.26% | $10,426 |

The S&P 500 Total Return Index is an unmanaged market capitalization-weighted index which is comprised of the largest U.S. domiciled companies and includes the reinvestment of all dividends. Index returns do not reflect the effects of fees or expenses. Investors cannot invest directly in an index or benchmark.

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. All performance is historical and includes reinvestment of dividends and capital gains. Performance data current to the most recent month end may be obtained by calling 1-877-223-6899.

2

2nd Vote Funds

Period Ended December 31, 2020 (Unaudited)

As a shareholder of the Funds you incur two types of costs: (1) transaction costs, including brokerage commissions on purchases and sales of Fund shares, and (2) ongoing costs, including management fees and other Fund expenses. These examples are intended to help you understand your ongoing costs (in dollars) of investing in the Funds and to compare these costs with the ongoing costs of investing in other funds. The examples are based on an investment of $1,000 for the period of time as indicated in the table below.

Actual Expenses

The first line of the table provides information about actual account values based on actual returns and actual expenses. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then, multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second line of the table provides information about hypothetical account values based on a hypothetical return and hypothetical expenses based on the Fund’s actual expense ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions paid on purchases and sales of Fund shares. Therefore, the second line of the table is useful in comparing ongoing costs only and will not help you determine the relative total costs of owning different funds. If these transactional costs were included, your costs would have been higher.

| Annualized | ||||||||

| Beginning | Ending | Expense Ratio | ||||||

| Account Value | Account Value | Expenses | During the Period | |||||

| November 18, | December 31, | Paid During | November 18, 2020 to | |||||

| Fund Name | 2020 | 2020 | the Period^ | December 31, 2020 | ||||

| LYFE | ||||||||

| Actual | 1,000.00 | 1,046.80 | 0.93 | 0.75% | ||||

| Hypothetical (5% annual) | 1,000.00 | 1,005.12 | 0.91 | 0.75% | ||||

| EGIS | ||||||||

| Actual | 1,000.00 | 1,078.30 | 0.94 | 0.75% | ||||

| Hypothetical (5% annual) | 1,000.00 | 1,005.12 | 0.91 | 0.75% |

| ^ | The dollar amounts shown as expenses paid during the period are equal to the annualized six-month expense ratio multiplied by the average account value during the period, multiplied by 44/365 (to reflect the period from November 18, 2020 to December 31, 2020). |

3

2nd Vote Funds

December 31, 2020 (Unaudited)

2ndVote Life Neutral Plus ETF

Top Ten Holdings as of December 31, 2020*

| % of Total | ||||

| Security | Investments | |||

| 1 | ServiceNow, Inc. | 5.18% | ||

| 2 | Chipotle Mexican Grill, Inc. | 5.14% | ||

| 3 | Visa, Inc. – Class A | 4.01% | ||

| 4 | Home Depot, Inc. | 3.72% | ||

| 5 | Fortinet, Inc. | 3.62% | ||

| 6 | Medtronic PLC | 3.56% | ||

| 7 | Regeneron Pharmaceuticals, Inc. | 3.51% | ||

| 8 | FedEx Corp. | 3.46% | ||

| 9 | Lumentum Holdings, Inc. | 3.36% | ||

| 10 | Lincoln National Corp. | 3.21% |

Top Ten Holdings = 38.77% of Total Investments

| * | Current Fund holdings may not be indicative of future Fund holdings. |

4

2nd Vote Funds

Top 10 Holdings (continued)

December 31, 2020 (Unaudited)

2ndVote Society Defended ETF

Top Ten Holdings as of December 31, 2020*

| % of Total | ||||

| Security | Investments | |||

| 1 | ServiceNow, Inc. | 5.03% | ||

| 2 | Twitter, Inc. | 4.61% | ||

| 3 | Goldman Sachs Group, Inc. | 4.33% | ||

| 4 | Lam Research Corp. | 4.03% | ||

| 5 | Chipotle Mexican Grill, Inc. | 3.96% | ||

| 6 | Texas Instruments, Inc. | 3.94% | ||

| 7 | Honeywell International, Inc. | 3.88% | ||

| 8 | Fortinet, Inc. | 3.52% | ||

| 9 | Regeneron Pharmaceuticals, Inc. | 3.41% | ||

| 10 | Discovery, Inc. | 3.25% |

Top Ten Holdings = 39.96% of Total Investments

| * | Current Fund holdings may not be indicative of future Fund holdings. |

5

2ndVote Life Neutral Plus ETF

Schedule of Investments

December 31, 2020 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS — 99.5% | ||||||||

| Ireland — 3.6% | ||||||||

| Health Care Equipment & Supplies — 3.6% | ||||||||

| Medtronic PLC — ADR | 794 | $ | 93,009 | |||||

| United States — 95.9% | ||||||||

| Aerospace & Defense — 1.8% | ||||||||

| L3Harris Technologies, Inc. | 252 | 47,633 | ||||||

| Air Freight & Logistics — 3.5% | ||||||||

| FedEx Corp. | 349 | 90,607 | ||||||

| Airlines — 1.9% | ||||||||

| Southwest Airlines Co. | 1,040 | 48,474 | ||||||

| Biotechnology — 8.2% | ||||||||

| Exelixis, Inc.(a) | 2,585 | 51,881 | ||||||

| Gilead Sciences, Inc. | 1,231 | 71,718 | ||||||

| Regeneron Pharmaceuticals, Inc.(a) | 190 | 91,791 | ||||||

| Total Biotechnology | 215,390 | |||||||

| Capital Markets — 3.1% | ||||||||

| Bank of New York Mellon Corp. | 1,908 | 80,976 | ||||||

| Chemicals — 1.9% | ||||||||

| FMC Corp. | 431 | 49,535 | ||||||

| Communications Equipment — 5.4% | ||||||||

| Arista Networks, Inc.(a) | 182 | 52,884 | ||||||

| Lumentum Holdings, Inc.(a) | 927 | 87,879 | ||||||

| Total Communications Equipment | 140,763 | |||||||

| Consumer Finance — 2.2% | ||||||||

| Discover Financial Services | 645 | 58,392 | ||||||

| Electronic Equipment, Instruments & Components — 6.7% | ||||||||

| Amphenol Corp. — Class A | 396 | 51,785 | ||||||

| II—VI, Inc.(a) | 817 | 62,059 | ||||||

| National Instruments Corp. | 1,414 | 62,131 | ||||||

| Total Electronic Equipment, Instruments & Components | 175,975 | |||||||

| Food & Staples Retailing — 1.6% | ||||||||

| BJ's Wholesale Club Holdings, Inc.(a) | 1,156 | 43,096 | ||||||

| Food Products — 4.5% | ||||||||

| Hormel Foods Corp. | 1,476 | 68,796 | ||||||

| J.M. Smucker Co. | 426 | 49,246 | ||||||

| Total Food Products | 118,042 | |||||||

| Health Care Providers & Services — 4.9% | ||||||||

| CVS Health Corp. | 1,119 | 76,428 | ||||||

| UnitedHealth Group, Inc. | 144 | 50,498 | ||||||

| Total Health Care Providers & Services | 126,926 | |||||||

| Hotels, Restaurants & Leisure — 5.1% | ||||||||

| Chipotle Mexican Grill, Inc.(a) | 97 | 134,511 | ||||||

| Household Durables — 1.9% | ||||||||

| PulteGroup, Inc. | 1,133 | 48,855 | ||||||

| Shares | Value | |||||||

| COMMON STOCKS (continued) | ||||||||

| Household Products — 1.8% | ||||||||

| Kimberly—Clark Corp. | 351 | $ | 47,325 | |||||

| Industrial Conglomerates — 3.0% | ||||||||

| Honeywell International, Inc. | 368 | 78,274 | ||||||

| Insurance — 3.2% | ||||||||

| Lincoln National Corp. | 1,670 | 84,018 | ||||||

| IT Services — 4.0% | ||||||||

| Visa, Inc. — Class A | 479 | 104,772 | ||||||

| Media — 4.0% | ||||||||

| Charter Communications, Inc. — Class A(a) | 77 | 50,939 | ||||||

| Interpublic Group of Cos. | 2,308 | 54,284 | ||||||

| Total Media | 105,223 | |||||||

| Multiline Retail — 2.2% | ||||||||

| Dollar Tree, Inc.(a) | 529 | 57,153 | ||||||

| Oil, Gas & Consumable Fuels — 3.4% | ||||||||

| Diamondback Energy, Inc. | 953 | 46,125 | ||||||

| Phillips 66 | 601 | 42,034 | ||||||

| Total Oil, Gas & Consumable Fuels | 88,159 | |||||||

| Real Estate Investment Trusts (REITs) — 4.1% | ||||||||

| Kimco Realty Corp. | 3,337 | 50,089 | ||||||

| Weyerhaeuser Co. | 1,723 | 57,772 | ||||||

| Total Real Estate Investment Trusts (REITs) | 107,861 | |||||||

| Semiconductors & Semiconductor Equipment — 2.1% | ||||||||

| Lam Research Corp. | 115 | 54,311 | ||||||

| Software — 8.8% | ||||||||

| Fortinet, Inc.(a) | 638 | 94,762 | ||||||

| ServiceNow, Inc.(a) | 246 | 135,406 | ||||||

| Total Software | 230,168 | |||||||

| Specialty Retail — 6.6% | ||||||||

| Home Depot, Inc. | 366 | 97,217 | ||||||

| O'Reilly Automotive, Inc.(a) | 164 | 74,221 | ||||||

| Total Specialty Retail | 171,438 | |||||||

| Total United States | 2,507,877 | |||||||

| TOTAL COMMON STOCKS (Cost $2,487,559) | 2,600,886 | |||||||

See accompanying Notes to Financial Statements.

6

2ndVote Life Neutral Plus ETF

Schedule of Investments (continued)

December 31, 2020 (Unaudited)

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS — 0.5% | ||||||||

| Money Market Funds — 0.5% | ||||||||

| First American Government Obligations Fund — Class X, 0.04%(b) | 14,167 | $ | 14,167 | |||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $14,167) | 14,167 | |||||||

| Total Investments (Cost $2,501,726) — 100.0% | 2,615,053 | |||||||

| Liabilities in Excess of Other Assets — 0.0% | (804 | ) | ||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,614,249 | ||||||

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | The rate quote is the annualized seven-day yield at December 31, 2020. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

See accompanying Notes to Financial Statements.

7

2ndVote Society Defended ETF

Schedule of Investments

December 31, 2020 (Unaudited)

| Shares | Value | |||||||

| COMMON STOCKS — 99.7% | ||||||||

| Ireland — 2.0% | ||||||||

| Health Care Equipment & Supplies — 2.0% | ||||||||

| Medtronic PLC — ADR | 454 | $ | 53,182 | |||||

| Netherlands — 2.0% | ||||||||

| Chemicals — 2.0% | ||||||||

| LyondellBasell Industries NV — Class A ADR | 601 | 55,088 | ||||||

| Switzerland — 1.9% | ||||||||

| Insurance — 1.9% | ||||||||

| Chubb, Ltd. — ADR | 335 | 51,563 | ||||||

| United States — 93.8% | ||||||||

| Aerospace & Defense — 4.5% | ||||||||

| L3Harris Technologies, Inc. | 378 | 71,450 | ||||||

| Raytheon Technologies Corp. | 710 | 50,772 | ||||||

| Total Aerospace & Defense | 122,222 | |||||||

| Biotechnology — 6.4% | ||||||||

| AbbVie, Inc. | 750 | 80,362 | ||||||

| Regeneron Pharmaceuticals, Inc.(a) | 190 | 91,791 | ||||||

| Total Biotechnology | 172,153 | |||||||

| Capital Markets — 9.3% | ||||||||

| Bank of New York Mellon Corp. | 1,272 | 53,983 | ||||||

| BlackRock, Inc. | 111 | 80,091 | ||||||

| Goldman Sachs Group, Inc. | 442 | 116,560 | ||||||

| Total Capital Markets | 250,634 | |||||||

| Electronic Equipment, Instruments & Components — 4.4% | ||||||||

| II—VI, Inc.(a) | 817 | 62,059 | ||||||

| Zebra Technologies Corp. — Class A(a) | 147 | 56,497 | ||||||

| Total Electronic Equipment, Instruments & Components | 118,556 | |||||||

| Food Products — 5.4% | ||||||||

| Hershey Co. | 329 | 50,116 | ||||||

| Hormel Foods Corp. | 984 | 45,864 | ||||||

| J.M. Smucker Co. | 426 | 49,246 | ||||||

| Total Food Products | 145,226 | |||||||

| Health Care Equipment & Supplies — 1.9% | ||||||||

| Stryker Corp. | 215 | 52,684 | ||||||

| Health Care Providers & Services — 3.8% | ||||||||

| CVS Health Corp. | 746 | 50,952 | ||||||

| UnitedHealth Group, Inc. | 144 | 50,498 | ||||||

| Total Health Care Providers & Services | 101,450 | |||||||

| Hotels, Restaurants & Leisure — 4.0% | ||||||||

| Chipotle Mexican Grill, Inc.(a) | 77 | 106,777 | ||||||

| Household Durables — 1.8% | ||||||||

| PulteGroup, Inc. | 1,133 | 48,855 | ||||||

| Household Products — 1.8% | ||||||||

| Kimberly—Clark Corp. | 351 | 47,325 | ||||||

| Shares | Value | |||||||

| COMMON STOCKS (continued) | ||||||||

| Industrial Conglomerates — 3.9% | ||||||||

| Honeywell International, Inc. | 491 | $ | 104,436 | |||||

| Interactive Media & Services — 4.6% | ||||||||

| Twitter, Inc.(a) | 2,291 | 124,058 | ||||||

| Machinery — 1.9% | ||||||||

| Caterpillar, Inc. | 286 | 52,058 | ||||||

| Media — 5.2% | ||||||||

| Discovery, Inc. — Class C(a) | 3,345 | 87,606 | ||||||

| Fox Corp. — Class A | 1,796 | 52,299 | ||||||

| Total Media | 139,905 | |||||||

| Multiline Retail — 2.1% | ||||||||

| Dollar Tree, Inc.(a) | 529 | 57,153 | ||||||

| Oil, Gas & Consumable Fuels — 3.3% | ||||||||

| Diamondback Energy, Inc. | 953 | 46,125 | ||||||

| Phillips 66 | 601 | 42,034 | ||||||

| Total Oil, Gas & Consumable Fuels | 88,159 | |||||||

| Real Estate Investment Trusts (REITs) — 2.0% | ||||||||

| Regency Centers Corp. | 1,180 | 53,796 | ||||||

| Semiconductors & Semiconductor Equipment — 8.0% | ||||||||

| Lam Research Corp. | 230 | 108,622 | ||||||

| Texas Instruments, Inc. | 647 | 106,192 | ||||||

| Total Semiconductors & Semiconductor Equipment | 214,814 | |||||||

| Software — 11.7% | ||||||||

| Fortinet, Inc.(a) | 638 | 94,762 | ||||||

| Oracle Corp. | 1,322 | 85,520 | ||||||

| ServiceNow, Inc.(a) | 246 | 135,406 | ||||||

| Total Software | 315,688 | |||||||

| Specialty Retail — 5.9% | ||||||||

| AutoNation, Inc.(a) | 798 | 55,692 | ||||||

| O'Reilly Automotive, Inc.(a) | 108 | 48,878 | ||||||

| TJX Cos. | 798 | 54,495 | ||||||

| Total Specialty Retail | 159,065 | |||||||

| Trading Companies & Distributors — 1.9% | ||||||||

| Fastenal Co. | 1,039 | 50,734 | ||||||

| Total United States | 2,525,748 | |||||||

| TOTAL COMMON STOCKS (Cost $2,497,336) | 2,685,581 | |||||||

See accompanying Notes to Financial Statements.

8

2ndVote Society Defended ETF

Schedule of Investments (continued)

December 31, 2020 (Unaudited)

| Shares | Value | |||||||

| SHORT-TERM INVESTMENTS — 0.3% | ||||||||

| Money Market Funds — 0.3% | ||||||||

| First American Government Obligations Fund — Class X, 0.04%(b) | 7,825 | $ | 7,825 | |||||

| TOTAL SHORT-TERM INVESTMENTS (Cost $7,825) | 7,825 | |||||||

| Total Investments (Cost $2,505,161) — 100.0% | 2,693,406 | |||||||

| Liabilities in Excess of Other Assets — 0.0% | (153 | ) | ||||||

| TOTAL NET ASSETS — 100.0% | $ | 2,693,253 | ||||||

Percentages are stated as a percent of net assets.

ADR American Depositary Receipt

| (a) | Non-income producing security. |

| (b) | The rate quote is the annualized seven-day yield at December 31, 2020. |

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS is a service mark of MSCI and S&P and has been licensed for use by U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services”).

See accompanying Notes to Financial Statements.

9

2nd Vote Funds

Statements of Assets and Liabilities

As of December 31, 2020 (Unaudited)

| 2ndVote Life Neutral Plus ETF | 2ndVote Society Defended ETF | |||||||

| ASSETS | ||||||||

| Investments in securities, at value* | $ | 2,615,053 | $ | 2,693,406 | ||||

| Receivables: | ||||||||

| Dividends and interest receivable | 1,466 | 2,157 | ||||||

| Total Assets | 2,616,519 | 2,695,563 | ||||||

| LIABILITIES | ||||||||

| Payables: | ||||||||

| Management fees payable | 2,270 | 2,310 | ||||||

| Total Liabilities | 2,270 | 2,310 | ||||||

| Net Assets | $ | 2,614,249 | $ | 2,693,253 | ||||

| NET ASSETS CONSIST OF: | ||||||||

| Paid-in Capital | $ | 2,500,000 | $ | 2,500,000 | ||||

| Total Distributable Earnings | 114,249 | 193,253 | ||||||

| Net Assets | $ | 2,614,249 | $ | 2,693,253 | ||||

| *Identified Cost: | ||||||||

| Investments in securities | $ | 2,501,726 | $ | 2,505,161 | ||||

| Shares Outstanding^ | 100,000 | 100,000 | ||||||

| Net Asset Value, Offering and Redemption Price per Share | $ | 26.14 | $ | 26.93 | ||||

| ^ | No par value, unlimited number of shares authorized |

See accompanying Notes to Financial Statements.

10

2nd Vote Funds

For the period ended December 31, 2020 (Unaudited)

| 2ndVote Life Neutral Plus ETF1 | 2ndVote Society Defended ETF1 | |||||||

| INVESTMENT INCOME | ||||||||

| Income: | ||||||||

| Dividends from securities (net of foreign withholdings tax of $39 and $0) | $ | 5,178 | $ | 4,925 | ||||

| Total Investment Income | $ | 5,178 | $ | 4,925 | ||||

| Expenses: | ||||||||

| Management fees | 2,270 | 2,310 | ||||||

| Total Expenses | 2,270 | 2,310 | ||||||

| Net Investment Income | 2,908 | 2,615 | ||||||

| REALIZED & UNREALIZED GAIN ON INVESTMENTS | ||||||||

| Net Realized Gain on: | ||||||||

| Unaffiliated Investments | 658 | 4,988 | ||||||

| Net Realized Gain on Investments | 658 | 4,988 | ||||||

| Net Change in Unrealized Appreciation of: | ||||||||

| Unaffiliated Investments | 113,327 | 188,246 | ||||||

| Net Change in Unrealized Appreciation of Investments | 113,327 | 188,246 | ||||||

| Net Realized and Unrealized Gain on Investments | 113,985 | 193,234 | ||||||

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | $ | 116,893 | $ | 195,849 | ||||

| 1 | For the period ended November 18, 2020 to December 31, 2020. |

See accompanying Notes to Financial Statements.

11

2ndVote Life Neutral Plus ETF

Statement of Changes in Net Assets

| Period Ended | ||||||||

| December 31, | ||||||||

| 20201 | ||||||||

| (Unaudited) | ||||||||

| OPERATIONS | ||||||||

| Net investment income | $ | 2,908 | ||||||

| Net realized gain on investments | 658 | |||||||

| Net change in unrealized appreciation of investments and foreign currency | 113,327 | |||||||

| Net increase in net assets resulting from operations | 116,893 | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Net investment income | (2,644 | ) | ||||||

| Total distributions from distributable earnings | (2,644 | ) | ||||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from Shares Sold | 2,500,000 | |||||||

| Net increase in net assets derived from capital share transactions | 2,500,000 | |||||||

| Net increase in net assets | 2,614,249 | |||||||

| NET ASSETS | ||||||||

| Beginning of Period | — | |||||||

| End of Period | $ | 2,614,249 | ||||||

Summary of share transactions is as follows: | ||||||||

| Period Ended December 31, 20201 | ||||||||

| (Unaudited) | ||||||||

| Shares | Amount | |||||||

| Shares Sold | 100,000 | $ | 250,000 | |||||

| Shares Redeemed | — | — | ||||||

| 100,000 | 250,000 | |||||||

| Beginning Shares | — | |||||||

| Ending Shares | 100,000 | |||||||

| 1 | Fund commenced operations on November 18, 2020. The information presented is for the period from November 18, 2020 to December 31, 2020. |

See accompanying Notes to Financial Statements.

12

2ndVote Society Defended ETF

Statement of Changes in Net Assets

| Period Ended | ||||||||

| December 31, | ||||||||

| 20201 | ||||||||

| (Unaudited) | ||||||||

| OPERATIONS | ||||||||

| Net investment income | $ | 2,615 | ||||||

| Net realized gain on investments | 4,988 | |||||||

| Net change in unrealized appreciation of investments and foreign currency | 188,246 | |||||||

| Net increase in net assets resulting from operations | 195,849 | |||||||

| DISTRIBUTIONS TO SHAREHOLDERS | ||||||||

| Net investment income | (2,596 | ) | ||||||

| Total distributions from distributable earnings | (2,596 | ) | ||||||

| CAPITAL SHARE TRANSACTIONS | ||||||||

| Proceeds from Shares Sold | 2,500,000 | |||||||

| Net increase in net assets derived from capital share transactions | 2,500,000 | |||||||

| Net increase in net assets | 2,693,253 | |||||||

| NET ASSETS | ||||||||

| Beginning of Period | — | |||||||

| End of Period | $ | 2,693,253 | ||||||

Summary of share transactions is as follows: | ||||||||

| Period Ended December 31, 20201 | ||||||||

| (Unaudited) | ||||||||

| Shares | Amount | |||||||

| Shares Sold | 100,000 | $ | 250,000 | |||||

| Shares Redeemed | — | — | ||||||

| 100,000 | 250,000 | |||||||

| Beginning Shares | — | |||||||

| Ending Shares | 100,000 | |||||||

| 1 | Fund commenced operations on November 18, 2020. The information presented is for the period from November 18, 2020 to December 31, 2020. |

See accompanying Notes to Financial Statements.

13

2ndVote Life Neutral Plus ETF

For a capital share outstanding throughout the period

| Period Ended | ||||

| December 31, | ||||

| 20201 | ||||

| (Unaudited) | ||||

| Net Asset Value, Beginning of Period | $ | 25.00 | ||

| Income from Investment Operations: | ||||

| Net investment income2 | 0.03 | |||

| Net realized and unrealized gain on investments | 1.14 | |||

| Total from investment operations | 1.17 | |||

| Less Distributions: | ||||

| Distributions from net investment income | (0.03 | ) | ||

| Total Distributions | (0.03 | ) | ||

| Net asset value, end of period | 26.14 | |||

| Total Return | 4.68 | %3 | ||

| Ratios/Supplemental Data: | ||||

| Net assets at end of period (000’s) | $ | 2,614 | ||

| Expenses to Average Net Assets | 0.75 | %4 | ||

| Net Investment Income to Average Net Assets | 0.96 | %4 | ||

| Portfolio Turnover Rate | 5 | %3 | ||

| 1 | Commencement of operations on November 18, 2020. |

| 2 | Calculated based on average shares outstanding during the period. |

| 3 | Not annualized. |

| 4 | Annualized. |

See accompanying Notes to Financial Statements.

14

2ndVote Society Defended ETF

Financial Highlights

For a capital share outstanding throughout the period

| Period Ended | ||||

| December 31, | ||||

| 20201 | ||||

| (Unaudited) | ||||

| Net Asset Value, Beginning of Period | $ | 25.00 | ||

| Income from Investment Operations: | ||||

| Net investment income2 | 0.03 | |||

| Net realized and unrealized gain on investments | 1.93 | |||

| Total from investment operations | 1.96 | |||

| Less Distributions: | ||||

| Distributions from net investment income | (0.03 | ) | ||

| Total Distributions | (0.03 | ) | ||

| Net asset value, end of period | 26.93 | |||

| Total Return | 7.83 | %3 | ||

| Ratios/Supplemental Data: | ||||

| Net assets at end of period (000’s) | $ | 2,693 | ||

| Expenses to Average Net Assets | 0.75 | %4 | ||

| Net Investment Income to Average Net Assets | 0.87 | %4 | ||

| Portfolio Turnover Rate | 5 | %3 | ||

| 1 | Commencement of operations on November 18, 2020. |

| 2 | Calculated based on average shares outstanding during the period. |

| 3 | Not annualized. |

| 4 | Annualized. |

See accompanying Notes to Financial Statements.

15

2nd Vote Funds

December 31, 2020 (Unaudited)

NOTE 1 — ORGANIZATION

The 2ndVote Life Neutral Plus ETF and 2ndVote Society Defended ETF (each a “Fund” and together the “Funds”) are each a series of beneficial interest of 2nd Vote Funds (“Trust”), a Delaware statutory trust organized on April 14, 2020. The Trust is registered with the Securities and Exchange Commission (the “SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares (“Shares”) is registered under the Securities Act of 1933, as amended (the “Securities Act”). The Trust currently consists of multiple operational series, of which are covered in this report:

| Commencement of | ||||

| Name | Ticker | Operations | ||

| 2ndVote Life Neutral Plus ETF | LYFE | November 18, 2020 | ||

| 2ndVote Society Defended ETF | EGIS | November 18, 2020 |

The investment objective of each of the Funds is to seek to generate long term total return. The Funds currently offer one class of shares, which has no front end sales load, no deferred sales charges, and no redemption fees. The Funds may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Funds have equal rights and privileges.

Shares of the Funds are listed and traded on Cboe BZX Exchange, Inc. (“Exchange”). Market prices for the Shares may be different from their net asset value (“NAV”). Each Fund issues and redeems Shares on a continuous basis at NAV only in blocks of 25,000 shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified Index. Once created, Shares generally trade in the secondary market at market prices that change throughout the day in quantities less than a Creation Unit. Except when aggregated in Creation Units, Shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem the Shares directly from a Fund. Rather, most retail investors may purchase Shares in the secondary market with the assistance of a broker and may be subject to customary brokerage commissions or fees.

Authorized Participants transacting in Creation Units for cash may pay an additional variable charge to compensate the relevant Fund for certain transaction costs (i.e., brokerage costs) and market impact expenses relating to investing in portfolio securities. Such variable charges, if any, are included in “Transaction Fees” in the Statement of Changes in Net Assets.

NOTE 2 — SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

The Funds follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board Accounting Standard Codification Topic 946 Financial Services — Investment Companies.

16

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (continued)

| A. | Securities listed on a securities exchange, market or automated quotation system for which quotations are readily available, are valued at the last quoted sale price on the primary exchange or market (foreign or domestic) on which they are traded, except for securities listed on Nasdaq Global Market (“Nasdaq”). If, on a particular day, there is no such reported sale, then the most recent quoted bid price will be used. For securities traded on Nasdaq, the Nasdaq Official Closing Price (“NOCP”) will be used. If a Fund holds foreign shares of a security for which there is no reported volume, and there is an actively trading local version of the security, the last quoted sale price of the local security shall be used. Prices denominated in foreign currencies are converted to U.S. dollar equivalents at the current exchange rate. |

Securities for which quotations are not readily available are valued at their respective fair values as determined in good faith by the Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Fund’s Board. The use of fair value pricing by a fund may cause the net asset value of its shares to differ significantly from the net asset value that would be calculated without regard to such considerations.

As described above, the Funds utilize various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

| Level 1 | Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

| Level 2 | Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

| Level 3 | Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Funds’ investments as of December 31, 2020:

LYFE^

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 2,600,886 | $ | — | $ | — | $ | 2,600,886 | ||||||||

| Short Term Investments | 14,167 | — | — | 14,167 | ||||||||||||

| Total Investments in Securities | $ | 2,615,053 | $ | — | $ | — | $ | 2,615,053 | ||||||||

| ^ | For further information regarding security characteristics, see the Schedule of Investments. |

17

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (continued)

EGIS^

| Assets | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Common Stocks | $ | 2,685,581 | $ | — | $ | — | $ | 2,685,581 | ||||||||

| Short Term Investments | 7,825 | — | — | 7,825 | ||||||||||||

| Total Investments in Securities | $ | 2,693,406 | $ | — | $ | — | $ | 2,693,406 | ||||||||

| ^ | For further information regarding security characteristics, see the Schedule of Investments. |

| B. | Federal Income Taxes. The Funds have each elected to be taxed as a “regulated investment company” and intend to distribute substantially all taxable income to their shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have been made. |

To avoid imposition of the excise tax applicable to regulated investment companies, each Fund intends to declare each year as dividends, in each calendar year, at least 98.0% of its net investment income (earned during the calendar year) and 98.2% of its net realized capital gains (earned during the twelve months ended October 31) plus undistributed amounts, if any, from prior years.

Net capital losses incurred after October 31, within the taxable year are deemed to arise on the first business day of each Fund’s next taxable year.

Each Fund recognizes the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination by tax authorities. Each Fund has analyzed its tax position and has concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions expected to be taken in the Funds’ 2020 tax returns. The Funds identify their major tax jurisdictions as U.S. Federal, the State of New Jersey, and the State of Delaware; however the Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next twelve months.

As of December 31, 2020, management has reviewed the tax positions for open periods (for Federal purposes, four years from the date of filing and for state purposes, four years from the date of filing), as applicable to the Funds, and has determined that no provision for income tax is required in the Funds’ financial statements.

Federal Income Taxes. The Funds have each elected to be taxed as a “regulated investment company” and intend to distribute substantially all taxable income to their shareholders and otherwise comply with the provisions of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provisions for federal income taxes or excise taxes have been made.

| C. | Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Discounts/premiums on debt securities purchased are accreted/amortized over the life of the respective securities using the effective interest method. Dividend income is recorded on the ex-dividend date. Interest income is recorded on an accrual basis. Income, including gains, from investments in foreign securities received by the Fund may be subject to income, withholding or other taxes imposed by foreign countries. |

18

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES (continued)

| D. | Foreign Currency Translations and Transactions. The Funds may engage in foreign currency transactions. Foreign currency transactions are translated into U.S. dollars on the following basis: (i) market value of investment securities, assets and liabilities at the daily rates of exchange, and (ii) purchases and sales of investment securities, dividend and interest income and certain expenses at the rates of exchange prevailing on the respective dates of such transactions. For financial reporting purposes, the Funds do not isolate changes in the exchange rate of investment securities from the fluctuations arising from changes in the market prices of securities for unrealized gains and losses. However, for federal income tax purposes, the Funds do isolate and treat as ordinary income the effect of changes in foreign exchange rates on realized gains or losses from the sale of investment securities and payables and receivables arising from trade-date and settlement-date differences. |

| E. | Distributions to Shareholders. Distributions to shareholders from net investment income are declared and paid for the Fund on an annual basis. Net realized gains on securities for the Fund normally are declared and paid on an annual basis. Distributions are recorded on the ex-dividend date. |

| F. | Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates. |

| G. | Share Valuation. The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for the Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the Cboe is closed for trading. For Authorized Participants, the offering and redemption price per share for the Funds are equal to the Funds’ respective net asset value per share. |

| H. | Guarantees and Indemnifications. In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

NOTE 3 — PRINCIPAL INVESTMENT RISKS

Investing in the Funds may involve certain risks, as discussed in the Funds’ prospectus, including, but not limited to, those described below. Any of these risks could cause an investor to lose money.

Scoring and Data Risk. The composition of the Funds’ portfolio is heavily dependent on a proprietary scoring system as well as information and data supplied by third parties (“Scoring and Data”). When Scoring and Data prove to be incorrect or incomplete, any decisions made in reliance thereon may lead to securities being included in or excluded from the Funds’ portfolio that would have been excluded or included had the Scoring and Data been correct and complete. If the composition of the Scoring and Data reflects such errors, the Funds’ portfolio can be expected to reflect the errors, too.

19

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 3 — PRINCIPAL INVESTMENT RISKS (continued)

Social Criteria Risk. Because the Funds evaluate social criteria to assess and exclude certain investments for non-financial reasons, it may forego some market opportunities available to Funds that do not use these factors. The securities of companies that score favorably under 2V scoring methodology may underperform similar companies that do not score as well or may underperform the stock market as a whole. As a result, the Funds may underperform Funds that do not screen or score companies based on social criteria or Funds that use a different social criteria methodology. In addition, the Funds’ assessment of a company, based on the company’s 2V score, may differ from that of other Funds or an investor. As a result, the companies deemed eligible for inclusion in the Fund’s portfolio may not reflect the beliefs or values of any particular investor and may not be deemed to exhibit positive or favorable social criteria characteristics if different metrics were used to evaluate them.

Equity Securities Risk. Equity securities are subject to changes in value, and their values may be more volatile than those of other asset classes. The Funds’ portfolio is comprised of common stocks, which generally subject their holders to more risks than preferred stocks and debt securities because common stockholders’ claims are subordinated to those of holders of preferred stocks and debt securities upon the bankruptcy of the issuer.

Infectious Illness Risk. An outbreak of an infectious respiratory illness, COVID-19, caused by a novel coronavirus has resulted in travel restrictions, disruption of healthcare systems, prolonged quarantines, cancellations, supply chain disruptions, lower consumer demand, layoffs, defaults and other significant economic impacts. Certain markets have experienced temporary closures, reduced liquidity and increased trading costs. These events will have an impact on the Funds and its investments and could impact the Funds’ ability to purchase or sell securities or cause increased premiums or discounts to the Funds’ NAV. Other infectious illness outbreaks in the future may result in similar impacts.

Market Risk. The Funds could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Local, regional or global events such as war, acts of terrorism, the spread of infectious illness or other public health issue, recessions, or other events could have a significant impact on the Funds and its investments.

ETF Risks. The Funds are ETF’s, and, as a result of an ETF’s structure, it is exposed to the following risks:

Authorized Participants, Market Makers, and Liquidity Providers Concentration Risk. The Funds have a limited number of financial institutions that may act as Authorized Participants (“APs”). In addition, there may be a limited number of market makers and/or liquidity providers in the marketplace. To the extent either of the following events occur, Shares may trade at a material discount to NAV and possibly face trading halts or delisting: (i) APs exit the business or otherwise become unable to process creation and/or redemption orders and no other APs step forward to perform these services, or (ii) market makers and/or liquidity providers exit the business or significantly reduce their business activities and no other entities step forward to perform their functions.

Costs of Buying or Selling Shares. Due to the costs of buying or selling Shares, including brokerage commissions imposed by brokers and bid/ask spreads, frequent trading of Shares may significantly reduce investment results and an investment in Shares may not be advisable for investors who anticipate regularly making small investments.

Flash Crash Risk. Sharp price declines in securities owned by the Funds may trigger trading halts, which may result in the Funds’ shares trading in the market at an increasingly large discount to NAV during part (or all) of a trading day or cause the Funds itself to halt trading. In such market conditions, market or stop-loss orders to sell the ETF shares may be executed at market prices that are significantly below NAV or investors might not even be able to transact in Shares if the Funds halts trading.

20

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 3 — PRINCIPAL INVESTMENT RISKS (continued)

Large Shareholder Risk. From time to time, an Authorized Participant, a third-party investor, the Adviser, the Sub-Adviser, or an affiliate of the Adviser or Sub-Adviser, or a Funds may invest in the Funds and hold its investment for a specific period of time to allow the Funds to achieve size or scale. There can be no assurance that any such entity would not redeem its investment or that the size of the Funds would be maintained at such levels, which could negatively impact the Funds.

Shares May Trade at Prices Other Than NAV. Shares may trade above or below their NAV. Accordingly, investors may pay more than NAV when purchasing Shares or receive less than NAV when selling Shares. Trading. Although Shares are listed for trading on the Exchange and may be traded on U.S. exchanges other than the Exchange, there can be no assurance that Shares will trade with any volume, or at all, on any stock exchange. In stressed market conditions, the liquidity of Shares may begin to mirror the liquidity of the Funds’ underlying portfolio holdings, which can be significantly less liquid than Shares.

Large-Capitalization Companies Risk. Large-capitalization companies may trail the returns of the overall stock market. Large-capitalization stocks tend to go through cycles of doing better — or worse — than the stock market in general. These periods have, in the past, lasted for as long as several years.

Mid-Capitalization Companies Risk. Mid-capitalization companies may have greater price volatility, lower trading volume and less liquidity than large-capitalization companies. In addition, mid-capitalization companies may have smaller revenues, narrower product lines, less management depth and experience, smaller shares of their product or service markets, fewer financial resources and less competitive strength than large-capitalization companies.

New Adviser Risk. The Adviser is a newly registered investment adviser and has not previously managed a mutual Fund. As a result, there is no long-term track record against which an investor may judge the Adviser and it is possible the Adviser may not achieve the Funds’ intended investment objective.

Sector Risk. To the extent the Funds invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors. The Funds may invest a significant portion of its assets in the following sectors and, therefore, the performance of the Funds could be negatively impacted by events affecting each of these sectors.

Consumer Discretionary. Because companies in the consumer discretionary sector manufacture products and provide discretionary services directly to the consumer, the success of these companies is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending. Also, companies in the consumer discretionary sector may be subject to severe competition, which may have an adverse impact on a company’s profitability. Changes in demographics and consumer tastes also can affect the demand for, and success of, consumer discretionary products in the marketplace.

Health Care Sector Risk. Companies in the health care sector are subject to extensive government regulation and their profitability can be significantly affected by restrictions on government reimbursement for medical expenses, rising costs of medical products and services, pricing pressure (including price discounting), limited product lines and an increased emphasis on the delivery of healthcare through outpatient services. Companies in the health care sector are heavily dependent on obtaining and defending patents, which may be time consuming and costly, and the expiration of patents may also adversely affect the profitability of these companies. Health care companies are also subject to extensive litigation based on product liability and similar claims. In addition, their products can become obsolete due to industry innovation, changes in technologies or other market developments. Many new products in the health care sector require significant research and development and may be subject to regulatory approvals, all of which may be time consuming and costly with no guarantee that any product will come to market.

21

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 3 — PRINCIPAL INVESTMENT RISKS (continued)

Information Technology Sector Risk. The Funds are subject to risks faced by companies in the technology industry. Securities of technology companies may be subject to greater volatility than stocks of companies in other market sectors. Technology companies may be affected by intense competition both domestically and internationally, including competition from competitors with lower production costs, obsolescence of existing technology, general economic conditions and government regulation and may have limited product lines, markets, financial resources or personnel. Technology companies may experience dramatic and often unpredictable changes in growth rates and competition for qualified personnel. These companies also are heavily dependent on patent and intellectual property rights, the loss or impairment of which may adversely affect profitability.

NOTE 4 — COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser, the Adviser provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board of Trustees and the officers of the Trust. Under the Advisory Agreement, the Adviser agrees to pay all expenses incurred by the Fund except for the fee paid to the Adviser pursuant to this Agreement, interest charges on any borrowings, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act. For services provided to the Fund, the Fund pays the Advisor 0.75% at an annual rate based on the Fund’s average daily net assets.

Laffer Tengler Investments, Inc. serves as the Sub-Adviser (the “Sub-Adviser”) to the Fund. The Sub-Adviser has overall responsibility for selecting and continuously monitoring the Fund’s investments. The Adviser has overall responsibility for overseeing the investment of the Fund’s assets, managing the Fund’s business affairs and providing certain clerical, bookkeeping and other administrative services for the Trust.

U.S. Bank Global Fund Services, a subsidiary of U.S. Bancorp, serves as the Fund’s Fund accountant, administrator and transfer agent pursuant to certain Fund accounting servicing, Fund administration servicing and transfer agent servicing agreements. U.S. Bank National Association, a subsidiary of U.S. Bancorp, intends to serve as the Fund’s custodian pursuant to a custody agreement.

Foreside Financial Services, LLC (“Distributor”), serves as the Fund’s distributor pursuant to a distribution agreement.

Foreside Fund Officers Services, LLC provides the Fund with a Chief Compliance Officer and the Treasurer and Principal Financial Officer.

A Trustee and certain officers of the Trust are also employees/officers of the Adviser or affiliated with the Distributor.

NOTE 5 — DISTRIBUTION PLAN

The Fund has adopted a Plan of Distribution pursuant to Rule 12b-1 under the 1940 Act. Under the Plan, the Funds may pay compensation to the Distributor or any other distributor or financial institution with which the Trust has an agreement with respect to the Funds, with the amount of such compensation not to exceed an annual rate of 0.25% of each Fund’s daily average net assets. For the period ended December 31, 2020, the Funds did not incur any 12b-1 expenses.

22

2nd Vote Funds

Notes to Financial Statements (continued)

December 31, 2020 (Unaudited)

NOTE 6 — PURCHASES AND SALES OF SECURITIES

The costs of purchases and sales of securities, excluding short-term securities and in-kind transactions, for the period ended December 31, 2020:

| Purchases | Sales | |||||||

| LYFE | $ | 2,613,393 | $ | 126,492 | ||||

| EGIS | $ | 2,622,177 | $ | 129,830 | ||||

The costs of purchases and sales of in-kind transactions associated with creations and redemptions for the period ended December 31, 2020:

| Purchases | Sales | |||||||

| In-Kind | In-Kind | |||||||

| LYFE | $ | 0 | $ | 0 | ||||

| EGIS | $ | 0 | $ | 0 | ||||

Purchases in-kind are the aggregate of all in-kind purchases and sales in-kind are the aggregate of all in-kind sales. Net capital gains or losses resulting from in-kind redemptions are excluded from the Funds’ taxable gains and are not distributed to shareholders.

There were no purchases or sales of U.S. Government obligations for the period ended December 31, 2020.

NOTE 7 — NEW ACCOUNTING PRONOUNCEMENTS

In March 2020, FASB issued ASU 2020-04, Reference Rate Reform: Facilitation of the Effects of Reference Rate Reform on Financial Reporting. The main objective of the new guidance is to provide relief to companies that will be impacted by the expected change in benchmark interest rates at the end of 2021, when participating banks will no longer be required to submit London Interbank Offered Rate (“LIBOR”) quotes by the UK Financial Conduct Authority. The new guidance allows companies to, provided the only change to existing contracts are a change to an approved benchmark interest rate, account for modifications as a continuance of the existing contract without additional analysis. In addition, derivative contracts that qualified for hedge accounting prior to modification, will be allowed to continue to receive such treatment, even if critical terms change due to a change in the benchmark interest rate. For new and existing contracts, the Funds may elect to apply the amendments as of March 12, 2020 through December 31, 2022. Management is currently assessing the impact of the ASU’s adoption to the Funds’ financial statements and various filings.

NOTE 8 — SUBSEQUENT EVENTS

In preparing these financial statements, the Funds have evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. This evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments to the Financial statements.

The global outbreak of COVID-19 (commonly referred to as “coronavirus”) has disrupted economic markets and the prolonged economic impact is uncertain. The ultimate economic fallout from the pandemic, and the long-term impact on economies, markets, industries and individual issuers, are not known. The operational and financial performance of the issuers of securities in which each Funds invests depends on future developments, including the duration and spread of the outbreak, and such uncertainty may in turn adversely affect the value and liquidity of each Fund’s investments, impair each Fund’s ability to satisfy redemption requests, and negatively impact each Fund’s performance.

23

2nd Vote Funds

December 31, 2020 (Unaudited)

NOTE 1 – Frequency Distribution of Premiums and Discounts

Information regarding how often shares of the Fund trade on the Exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of the Fund is available on the Fund’s website at www.2ndvotefunds.com.

NOTE 2 — Information About Portfolio Holdings

The Funds file their complete schedule of portfolio holdings for their first and third fiscal quarters with the Securities and Exchange Commission (“SEC”) on Form N-Q or Part F of Form N-PORT. The Funds’ Form N-Q or Part F of Form N-PORT is available on the website of the SEC at www.sec.gov. Each Fund’s portfolio holdings are posted on their website at www.2ndvotefunds.com daily.

NOTE 3 — Information About Proxy Voting

A description of the policies and procedures the Funds use to determine how to vote proxies relating to portfolio securities is provided in the Statement of Additional Information (“SAI”). The SAI is available without charge upon request by calling toll-free at 877-223-8699, by accessing the SEC’s website at www.sec.gov, or by accessing the Funds’ website at www.2ndvotefunds.com.

Information regarding how the Funds voted proxies relating to portfolio securities during the period ending June 30 is available by calling toll-free at 877-223-8699 or by accessing the SEC’s website at www.sec.gov.

Carefully consider the Fund’s investment objectives, risk factors, charges, and expenses before investing. This and additional information can be found in the Fund’s prospectus, which may be obtained by calling 877-223-8699 or by visiting www.2ndvotefunds.com. Read the prospectus carefully before investing.

24

2nd Vote Funds

Approval of Advisory Agreements and Board Consideration

December 31, 2020 (Unaudited)

Investment Advisory Agreement and Investment Sub-Advisory Agreement Approvals 2ndVote Society Defended ETF and the 2ndVote Neutral Plus ETF (“Funds”)

At the October 28, 2020 Board meeting (“October meeting”), the full Board, including the Independent Trustees, met in person and considered the initial approval of the investment advisory agreement between 2nd Vote Advisers, LLC (“Adviser”) and the Trust pertaining to 2ndVote Society Defended ETF (CBOE:EGIS)and the 2ndVote Life Neutral Plus ETF (CBOE:LYFE) (“Investment Management Agreement”) and the Sub-Advisory Agreement between the Adviser and Laffer Tengler Investments, Inc. (“Sub-Adviser” or “Laffer Tengler”) pertaining to 2ndVote Society Defended ETF and the 2ndVote Life Neutral Plus ETF (“Investment Sub-Advisory Agreement”).

In preparation for the October meeting, the Board was presented with a range of information to assist in its deliberations. The Board requested, received and reviewed detailed written responses from the Adviser and the Sub-Adviser to a request letter (“Request Letter”) circulated on the Board’s behalf concerning the personnel, operations, financial condition, performance, and services that would be provided to the two ETFs (“Funds”) by the Adviser and the Sub-Adviser. During its deliberations, the Board received an oral presentation from the Adviser and Sub-Adviser, discussed the materials provided by the Adviser and Sub-Adviser, and input from legal counsel and the Trust’s administrator.

At the October Board meeting, the Board reviewed, among other matters, the topics discussed below.

Investment Management Agreement

Nature, Extent and Quality of Services to be Provided. The Trustees considered the scope of services to be provided under the Investment Management Agreement between the Trust and 2nd Vote noting that 2nd Vote will be providing investment advisory services to the Funds.

In considering the nature, extent and quality of the services to be provided by the Adviser, the Board considered, among other things, the qualifications of the Adviser’s chief compliance officer and the firm’s compliance history. The Board also considered the Adviser’s experience working with exchange-traded funds. The Adviser’s registration form (“Form ADV”) was provided to the Board, as was the response of the Adviser to a detailed series of questions in the Request Letter that included, among other things, information about the background and experience of the portfolio managers primarily responsible for the day-to-day management of the Funds. The Adviser also provided information to the Board about other matters, including: (i) the types of advisory services it offers; (ii) its methods of analysis and strategies it uses in managing assets and supervising the sub-adviser; (iii) other financial industry activities and affiliations of the Adviser and its affiliates; (iv) its supervision of the sub-adviser’s brokerage practices; and (v) its proxy voting policies.

The Board also considered other services to be provided to the Funds by the Adviser, such as monitoring adherence to the Funds’ investment restrictions and monitoring compliance with various Fund policies and procedures and with applicable securities regulations. Based on the factors above, as well as those discussed below, the Board concluded that it was satisfied with the nature, extent and quality of the services to be provided to the Funds by the Adviser.

Cost of Services Provided, Profits to be Realized from Services Rendered, and Comparative Fee and Expense Data. The Board (i) reviewed each Fund’s estimated expense ratio and the unitary fee to be paid by each Fund, (ii) reviewed profits expected to be realized by the Adviser from its services rendered to the Funds, (iii) considered the expense ratios of comparable funds, and (iv) concluded that the unitary fees were reasonable and the result of arm’s length negotiations. Additionally, the Board took into consideration that the unitary fee, along with almost all of each Fund’s other operating fees and expenses, would be paid by the Adviser in exchange for the unitary fee received by the Adviser under the Investment Management Agreement. The Board considered factors such as: (i) the fact that each Fund was newly-organized and, at least initially, would be required to bear fixed expenses across a small asset base; (ii) the fees and expenses of ETFs with similar investment objectives, strategies and tactics as those of each

25

2nd Vote Funds

Approval of Advisory Agreements and Board Consideration (continued)

December 31, 2020 (Unaudited)

Fund; (iii) the competitive landscape for each Fund; and (iv) the knowledge and relevant experience of the Adviser’s personnel that would perform services on behalf of each Fund. The Board also evaluated the compensation and benefits expected to be received by the Adviser from its relationship with the Fund.

Economies of Scale. The Board determined that the Adviser is likely to realize economies of scale in managing each Fund as their assets grow substantially in size. The Board further determined that such economies of scale are currently shared with Fund shareholders through the Adviser’s unitary fee and because the Adviser pays most Fund expenses. The Board members noted that they intend to monitor fees as the Funds grows in size and assess whether fee breakpoints may be warranted.

Based on the Board’s deliberations and its evaluation of the information described above, the Board, including the Independent Trustees, unanimously: (a) concluded that the terms of the Investment Management Agreement are fair and reasonable; (b) concluded that the Adviser’s management fees for each Fund are reasonable in light of the services that the Adviser will provide to the Funds; and (c) agreed to approve the Investment Management Agreement for an initial term of two years.

Investment Sub-Advisory Agreement

Nature, Extent and Quality of Services to be Provided. The Trustees considered the scope of services to be provided under the Investment Sub-Advisory Agreement, noting that Laffer Tengler will be providing investment sub-advisory services to each Fund. The Board noted the responsibilities that the Sub-Adviser has as each Fund’s investment sub-adviser, including: responsibility for the general management of the day-to-day investment and reinvestment of the assets of each Fund; reviewing the daily baskets of deposit securities and cash components; executing portfolio security trades for purchases and redemptions of Fund shares conducted on a cash-in-lieu basis; daily monitoring of tracking error and quarterly reporting to the Board; and implementation of Board directives as they relate to the Fund. The Board also considered the Sub-Adviser’s experience managing accounts with similar investment objectives, strategies and tactics as those of each Fund. The Sub-Adviser’s registration form (“Form ADV”) was provided to the Board, as was the response of the Sub-Adviser to the Request Letter which included, among other things, information about the background and experience of the portfolio managers primarily responsible for the day-to-day investment and reinvestment of the assets of each Fund.

Cost of Services Provided; Profits to be Realized from Services Rendered, Comparative Fee and Expense Data and Economies of Scale. The Board reviewed the unitary fee to be paid by 2nd Vote to Laffer Tengler for its services as Sub-Adviser to the Funds as well as profits expected to be realized by the Sub-Adviser from its services rendered to the Funds. The Board considered that the fees paid to Laffer Tengler would be paid by 2nd Vote from the unitary fee 2nd Vote will receive from the Trust with respect to the Funds and noted that the fee reflected an arms-length negotiation between 2nd Vote and Laffer Tengler. The Board considered factors such as: (i) the fees and expenses of ETFs with similar investment objectives, strategies and tactics as those of each Fund; (ii) the competitive landscape for each Fund; and (iv) the knowledge and relevant experience of the Sub-Adviser’s personnel that would perform services on behalf of each Fund. The Board concluded that the sub-advisory fees were reasonable.

Based on the Board’s deliberations and its evaluation of the information described above, the Board, including the Independent Trustees, unanimously: (a) concluded that the terms of the Investment Sub-Advisory Agreement are fair and reasonable; (b) concluded that the Sub-Adviser’s fees are reasonable in light of the services that the Sub-Adviser will provide to each of the Funds; and (c) agreed to approve the Investment Sub-Advisory Agreement for an initial term of two years.

In approving the Investment Management Agreement and the Investment Sub-Advisory Agreement, the Board did not make its approvals based on any particular factor, but rather based its determination on all of the information provided to the Board.

26

Adviser

2nd Vote Advisers, LLC

462 Sandcastle Rd.

Franklin, Tennessee 37069

Sub-Adviser

Laffer Tengler Investments, Inc

103 Murphy Court

Nashville, Tennessee 37203

Distributor

Foreside Financial Services, LLC

3 Canal Plaza, Suite 100,

Portland, Maine 04101

Custodian

U.S. Bank National Association

Custody Operations

1555 North River Center Drive, Suite 302, Milwaukee, Wisconsin 53212

Transfer Agent

U.S. Bancorp Fund Services, LLC doing business as U.S. Bank Global Fund Services

615 East Michigan Street, Milwaukee, Wisconsin 53202

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1350 Euclid Avenue, Suite 800

Cleveland, OH 44115

Legal Counsel

Practus, LLP

11300 Tomahawk Creek Parkway, Ste. 310

Leawood, KS 66211

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable to registrants who are not listed issuers (as defined in Rule 10A-3 under the Securities Exchange Act of 1934).

Item 6. Investments.

| (a) | Schedule of Investments is included as part of the report to shareholders filed under Item 1 of this Form. |

| (b) | Not Applicable. |

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders.

The registrant has not adopted any procedure by which shareholders may recommend nominees to the registrant’s board of directors.

Item 11. Controls and Procedures.

| (a) | The registrant’s principal executive officer and principal financial officer have concluded, based on an evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended) as of a date within 90 days prior to the filing date of this Form N-CSR, that the disclosure controls and procedures are effectively designed to ensure that information required to be disclosed by the registrant in this Form N-CSR is recorded, processed, summarized and reported by the filing date, including ensuring that information required to be disclosed in this Form N-CSR is accumulated and communicated to the registrant’s management, including the registrant’s principal executive officer and principal financial officer, as appropriate, to allow timely decisions regarding required disclosure. |

| (b) | There were no significant changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940, as amended) that occurred during the second fiscal quarter covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting. |

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. |

(3) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(4) Change in the registrant’s independent public accountant. There was no change in the registrant’s independent public accountant for the period covered by this report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | 2nd Vote Funds | ||

| By (Signature and Title)* | /s/ Daniel Grant | ||

| Daniel Grant, President | |||

| Date: February 25, 2021 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Daniel Grant | ||

| Daniel Grant, President | |||

| Date: February 25, 2021 | |||

| By (Signature and Title)* | /s/ Troy Statczar | ||

| Troy Statczar, Treasurer and Principal Financial Officer | |||

| Date: February 25, 2021 |

* Print the name and title of each signing officer under his or her signature.