Exhibit 99.1

Q3 FISCAL 2022

LETTER TO SHAREHOLDERS

October 26, 2022

Dear shareholders,

We are pleased to provide an update on our progress during the third quarter.

A-Sample Progress

Our 24-layer A sample is intended to demonstrate our commercially relevant battery cell format and a meaningful increase in layer count relative to previous generations of customer samples. As such, we believe A-sample cell delivery would represent a compelling validation of the core capability of our technology.

As we reported in our Q2 shareholder letter, we encountered a contaminant in our material earlier this year. Over the summer, our team focused on reducing the levels of this contaminant, involving everything from metrology to identify its chemical composition, to working with the supplier to reformulate the incoming material, to remaking separator films with the new material and validating their performance – all on a highly compressed schedule. As a result, we are pleased to report we have dramatically reduced the contaminant in our films. In addition, we rolled in several other process improvements that we believe produce better performing films, and these are now integrated into our baseline process.

This progress has allowed us to freeze the major design parameters of the film and cell, subject to validation, and turn our full focus to building 24-layer test cells. Before we deliver a new generation of battery cells to customers, we run a sample campaign. This campaign involves several successive phases designed to build the necessary confidence in quality to ship cells to customers. The campaign starts by freezing major design parameters for a given sample, allowing us to ramp production and make larger volumes of cells to test and collect data on performance and quality. We then build candidate cells using the data gathered from the test process to help ensure we are sending customers cells that meet their requirements.

We have kicked off our 24-layer A-sample campaign and have frozen major design parameters of the separator film and cell. However, these and other aspects may still change as we learn more from our testing process and address any knock-on effects resulting from changes. Much work remains before the sample campaign can be completed, including validation of all design parameters. We are currently ramping up separator film production and building more 24-layer cells to collect data.

We will not begin shipping cells for customer sampling until we have gathered data that establishes confidence in the performance of finished cells. We plan to provide an update on this front on our next quarterly earnings call.

Cell Architecture Development

Lithium-metal batteries generally experience uniaxial expansion and contraction during charge and discharge, and we believe existing cell formats (i.e., cylindrical, pouch or prismatic formats) are not well equipped to handle this expansion. The cell must also be able to:

•Dissipate excess heat during fast charging

•Function with or without externally applied pressure

•Keep manufacturing and pack integration simple

•Deliver good packaging efficiency, enabling the technology to achieve our cell-level energy density targets

To address these requirements for our A-sample cells, we have been developing a new hybrid cell architecture. There are two fundamental features of this architecture: a frame that wraps around the edge of the cell stack, and a flexible outer layer of metalized polymer, which is similar to conventional pouch material. As the following rendering show, the architecture resembles a cross between a prismatic cell and a pouch cell.

Renderings of the intended QuantumScape cell design in the discharged (left) and charged (right) states

The principle behind the operation of the cell architecture is simple. When fully discharged, the cell is anode free, and the cell stack is in its most contracted position, with the face of the cell sitting around a millimeter below the frame. As the cell charges and the anodes of each cell layer are plated with pure lithium metal, the layers push the faces of the cell out, along with the flexible packaging material. When fully charged, the face of the cell is designed to be more or less flush with the frame.

The architecture development process began last year, when we developed the initial concept and tested a variety of packaging materials, selecting one that we believe is capable of enabling the mechanism of operation. Our current A-sample campaign uses this new architecture, and we expect to continue iterating on the design.

Customer Engagement

Consumer Electronics

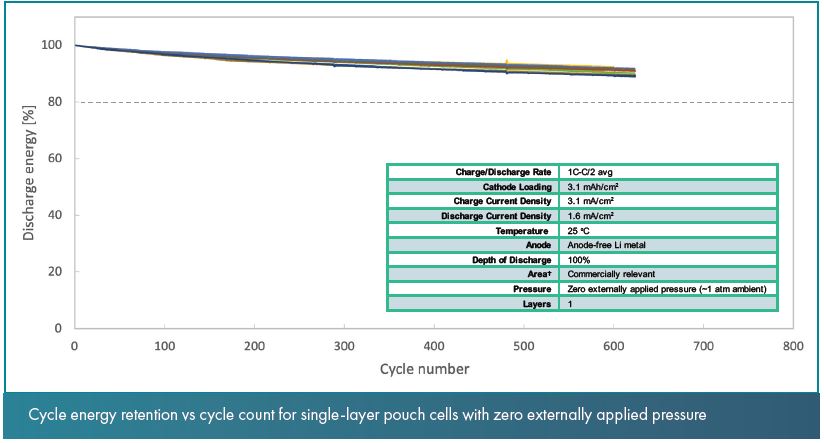

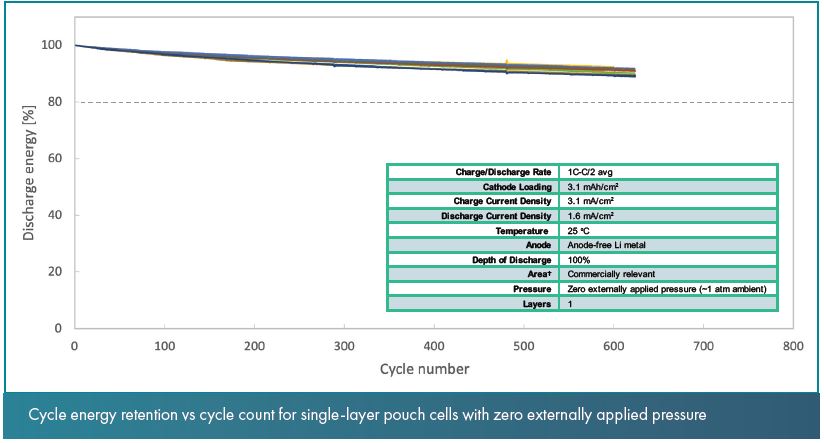

In previous letters, we’ve described potential markets for our technology beyond the automotive sector, including the consumer electronics market, estimated to reach approximately $14B by 2025. We believe a key selling point for this sector is the ability of the battery cells to run with zero externally applied pressure, since volume constraints within consumer devices make it difficult to apply significant pressure. Earlier this year, we shared results demonstrating our technology's ability to operate with zero externally applied pressure, and we believe this enables us to address the consumer electronics market.

We are engaged with some of the leading global consumer electronics companies, and we are pleased to report we have now shipped dozens of zero externally applied pressure single-layer pouch cells for customer testing within this sector. As part of any customer shipment, we build additional cells with the same design, which we refer to as sister cells, and test them in our own labs under conditions intended to replicate those in our customers' labs. The following data shows that leading sister cells from this build have so far achieved over 500 charge-discharge cycles at 1C-C/2 cycling rates1, which we believe represents a key cycle-life threshold for many consumer electronics applications.

Cycle energy retention vs cycle count for single-layer pouch cells with zero externally applied pressure

While we remain focused on the automotive sector to drive our long-term growth, we believe the consumer electronics market represents an attractive opportunity that could potentially provide additional revenue and field validation of our technology.

____________________

1 1C-C/2 cycling means charging in one hour and discharging in two hours. These rates correspond to the test conditions used in ongoing customer testing for consumer electronics applications.

Automotive

In September, we signed a letter agreement with Volkswagen Group, removing the time constraint for site selection of our planned joint venture pilot facility, QS-1, which is currently contemplated to be in either Germany or the United States. We are encouraged that both companies remain committed to bringing vehicles equipped with solid-state lithium-metal battery technology to market as early as practicable.

We expect initial C-sample production to take place at our existing QS-0 facility in San Jose, California. As such, we believe commercialization of our battery technology, defined as making C samples available for customer purchase, is not constrained by the selection of a facility for the joint venture with Volkswagen Group.

With respect to these commercialization plans, we were also encouraged to see battery manufacturing in the U.S. receive a significant boost during the previous quarter, with the passage of the Inflation Reduction Act (IRA). Among other things, the IRA provides significant government investment into domestic clean energy manufacturing and supply chains. This support will potentially benefit our U.S. based operations, both at QS-0 as well as other potential facilities.

Financial Outlook

Third quarter capital expenditures were $54.1M, up from $27.6M spent in the second quarter and in-line with expectations. Cash operating expenses, defined as operating expenses less stock-based compensation and depreciation, were $79.1M.

A majority of Q3 capex spend included facility investments supporting the Phase 2 engineering line and QS-0 buildout. Other large payments went toward our Phase 2 engineering line medium-scale continuous kiln, cell assembly and testing equipment, and QS-0 coating equipment.

We continue to emphasize capital efficiency in our ongoing buildout of the QS-0 line. For example, a significant number of tools that will begin production on our Phase 2 engineering line are also suitable for initial low-volume production on the QS-0 line. Including these tools, we continue to believe the majority of equipment needed for this early production on QS-0 will be delivered by the end of the year. Given current macroeconomic trends, we continue to explore additional opportunities to reduce our cash needs.

We reiterate our cash opex guidance of $225M to $275M for FY’22 and expect to be on the lower end of our capital expenditure guidance of $175M to $225M. Based on these projections, we believe we will enter 2023 with more than $1B in liquidity, above previous guidance of over $950 million.

Strategic Outlook

Despite macroeconomics headwinds and geopolitical disruptions, we believe the fundamentals driving the demand for energy storage remain unchanged. In fact, we believe the need for better batteries has never been more urgent.

We have taken important steps forward over the past quarter, and our progress is thanks to the incredible work by all of our employees to overcome challenges, solve new problems, and deliver results as we build momentum toward commercialization.

Our momentum is a product of our motivation, which comes from our mission. QuantumScape was founded as a mission-driven company with a passion for developing technological solutions to some of humanity's most important environmental challenges our planet has ever faced. This quarter, we published our inaugural Environmental, Social and Governance Strategy report. In it, we laid out our commitment to providing a solution to pressing global problems, which we believe will allow us to both deliver on our mission and create exceptional shareholder value at the same time.

Our bold environmental mission has allowed us to attract and retain our incredibly talented team and engage our world-class prospective customers as partners. Our team and customers are passionately committed to realizing the potential benefits of our technology.

We are proud of what we’ve accomplished over the past quarter, and look forward to reporting on our continued progress.

| |

|

|

Jagdeep Singh | Kevin Hettrich |

Founder, CEO & Chairman | CFO |

QuantumScape Corporation

Condensed Consolidated Balance Sheets (Unaudited)

(In Thousands)

| | | | | | | | |

| | September 30, | | | December 31, | |

| | 2022 | | | 2021 | |

Assets | | | | | | |

Current assets | | | | | | |

Cash and cash equivalents ($3,372 and $3,382 as of September 30, 2022 and December 31, 2021, respectively, for joint venture) | | $ | 297,960 | | | $ | 320,700 | |

Marketable securities | | | 857,339 | | | | 1,126,975 | |

Prepaid expenses and other current assets | | | 10,349 | | | | 15,757 | |

Total current assets | | | 1,165,648 | | | | 1,463,432 | |

Property and equipment, net | | | 268,225 | | | | 166,183 | |

Right-of-use assets - finance lease | | | 28,731 | | | | 30,886 | |

Right-of-use assets - operating lease | | | 62,254 | | | | 36,913 | |

Other assets | | | 18,253 | | | | 18,234 | |

Total assets | | $ | 1,543,111 | | | $ | 1,715,648 | |

Liabilities, redeemable non-controlling interest and stockholders’ equity | | | | | | |

Current liabilities | | | | | | |

Accounts payable | | $ | 17,213 | | | $ | 14,182 | |

Accrued liabilities | | | 15,224 | | | | 6,078 | |

Accrued compensation and benefits | | | 9,062 | | | | 9,119 | |

Operating lease liability, short-term | | | 3,394 | | | | 1,209 | |

Finance lease liability, short-term | | | 501 | | | | 19 | |

Total current liabilities | | | 45,394 | | | | 30,607 | |

Operating lease liability, long-term | | | 63,643 | | | | 36,760 | |

Finance lease liability, long-term | | | 38,688 | | | | 39,378 | |

Other liabilities | | | 7,592 | | | | 315 | |

Total liabilities | | | 155,317 | | | | 107,060 | |

Redeemable non-controlling interest | | | 1,691 | | | | 1,693 | |

Total stockholders’ equity | | | 1,386,103 | | | | 1,606,895 | |

Total liabilities, redeemable non-controlling interest and stockholders’ equity | | $ | 1,543,111 | | | $ | 1,715,648 | |

QuantumScape Corporation

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In Thousands, Except per Share Amounts)

| | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | |

| | 2022 | | | 2021 | | 2022 | | | 2021 | |

Operating expenses: | | | | | | | | | | | |

Research and development | | $ | 87,582 | | | $ | 39,467 | | $ | 214,060 | | | $ | 104,708 | |

General and administrative | | | 33,072 | | | | 14,365 | | | 93,124 | | | | 43,421 | |

Total operating expenses | | | 120,654 | | | | 53,832 | | | 307,184 | | | | 148,129 | |

Loss from operations | | | (120,654 | ) | | | (53,832 | ) | | (307,184 | ) | | | (148,129 | ) |

Other income (loss): | | | | | | | | | | | |

Interest expense | | | (600 | ) | | | (359 | ) | | (1,807 | ) | | | (597 | ) |

Interest income | | | 3,487 | | | | 605 | | | 5,813 | | | | 1,201 | |

Change in fair value of assumed common stock warrant liabilities | | | — | | | | 68,934 | | | — | | | | 168,674 | |

Other income | | | 114 | | | | 3 | | | 335 | | | | 101 | |

Total other income | | | 3,001 | | | | 69,183 | | | 4,341 | | | | 169,379 | |

Net income (loss) | | | (117,653 | ) | | | 15,351 | | | (302,843 | ) | | | 21,250 | |

Less: Net income (loss) attributable to non-controlling interest, net of tax of $0 for the three and nine months ended September 2022 and 2021 | | | 7 | | | | — | | | (2 | ) | | | (10 | ) |

Net income (loss) attributable to common stockholders | | $ | (117,660 | ) | | $ | 15,351 | | $ | (302,841 | ) | | $ | 21,260 | |

Net income (loss) | | $ | (117,653 | ) | | $ | 15,351 | | $ | (302,843 | ) | | $ | 21,250 | |

Other comprehensive income (loss): | | | | | | | | | | | |

Unrealized gain (loss) on marketable securities | | | (2,933 | ) | | | 65 | | | (17,870 | ) | | | (598 | ) |

Total comprehensive income (loss) | | | (120,586 | ) | | | 15,416 | | | (320,713 | ) | | | 20,652 | |

Less: Comprehensive income (loss) attributable to non-controlling interest | | | 7 | | | | — | | | (2 | ) | | | (10 | ) |

Comprehensive income (loss) attributable to common stockholders | | $ | (120,593 | ) | | $ | 15,416 | | $ | (320,711 | ) | | $ | 20,662 | |

| | | | | | | | | | | |

Net income (loss) per share of common stock attributable to common stockholders | | | | | | | | | | | |

Basic | | $ | (0.27 | ) | | $ | 0.04 | | $ | (0.70 | ) | | $ | 0.05 | |

Diluted | | $ | (0.27 | ) | | $ | (0.13 | ) | $ | (0.70 | ) | | $ | (0.36 | ) |

Weighted-average shares used in computing net income (loss) per share of common stock | | | | | | | | | | | |

Basic | | | 434,051 | | | | 417,829 | | | 431,654 | | | | 397,370 | |

Diluted | | | 434,051 | | | | 420,649 | | | 431,654 | | | | 404,369 | |

| | | | | | | | | | | |

QuantumScape Corporation

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In Thousands)

| | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | | Nine Months Ended September 30, | |

| 2022 | | | 2021 | | | 2022 | | | 2021 | |

Operating activities | | | | | | | | | | | |

Net income (loss) | $ | (117,653 | ) | | $ | 15,351 | | | $ | (302,843 | ) | | $ | 21,250 | |

Adjustments to reconcile net income (loss) to net cash used in operating activities: | | | | | | | | | | | |

Depreciation and amortization | | 8,469 | | | | 2,779 | | | | 18,975 | | | | 7,632 | |

Amortization of right-of-use assets and non-cash lease expense | | 1,973 | | | | 1,319 | | | | 5,671 | | | | 2,590 | |

Amortization of premiums and accretion of discounts on marketable securities | | 791 | | | | 3,623 | | | | 4,504 | | | | 9,055 | |

Stock-based compensation expense | | 33,578 | | | | 12,727 | | | | 92,985 | | | | 36,010 | |

Change in fair value of assumed common stock warrant liabilities | | — | | | | (68,934 | ) | | | — | | | | (168,674 | ) |

Impairment of fixed assets | | 7,806 | | | | — | | | | 7,806 | | | | — | |

Other | | (134 | ) | | | 336 | | | | 474 | | | | 223 | |

Changes in operating assets and liabilities: | | | | | | | | | | | |

Prepaid expenses and other assets | | 155 | | | | 1,951 | | | | 5,393 | | | | 2,419 | |

Accounts payable, accrued liabilities and accrued compensation | | 8,815 | | | | 2,345 | | | | 9,516 | | | | 7,361 | |

Other long-term liabilities | | — | | | | — | | | | 2,100 | | | | — | |

Operating lease liability | | (175 | ) | | | (364 | ) | | | 311 | | | | (1,168 | ) |

Net cash used in operating activities | | (56,375 | ) | | | (28,867 | ) | | | (155,108 | ) | | | (83,302 | ) |

Investing activities | | | | | | | | | | | |

Purchases of property and equipment | | (54,079 | ) | | | (38,741 | ) | | | (121,004 | ) | | | (82,396 | ) |

Proceeds from maturities of marketable securities | | 215,150 | | | | 200,005 | | | | 634,390 | | | | 611,005 | |

Proceeds from sales of marketable securities | | — | | | | 50,838 | | | | 15,105 | | | | 172,293 | |

Purchases of marketable securities | | (151,460 | ) | | | (286,828 | ) | | | (402,247 | ) | | | (1,106,167 | ) |

Net cash (used in) provided by investing activities | | 9,611 | | | | (74,726 | ) | | | 126,244 | | | | (405,265 | ) |

Financing activities | | | | | | | | | | | |

Proceeds from exercise of stock options and employee stock purchase plan | | 1,967 | | | | 1,880 | | | | 6,934 | | | | 11,332 | |

Proceeds from exercise of warrants | | — | | | | 39,113 | | | | — | | | | 151,431 | |

Payment of Business Combination share issuance costs | | — | | | | — | | | | — | | | | (1,016 | ) |

Proceeds from issuance of common stock, net of issuance costs paid | | — | | | | — | | | | — | | | | 462,926 | |

Proceeds from issuance of Class A Common Stock pursuant to Legacy QuantumScape Series F Preferred Stock Purchase Agreement, net of issuance costs | | — | | | | — | | | | — | | | | 99,930 | |

Principal payment for finance lease, net of credit | | (610 | ) | | | 5,172 | | | | (809 | ) | | | 5,210 | |

Net cash provided by financing activities | | 1,357 | | | | 46,165 | | | | 6,125 | | | | 729,813 | |

Net increase (decrease) in cash, cash equivalents and restricted cash | | (45,407 | ) | | | (57,428 | ) | | | (22,739 | ) | | | 241,246 | |

Cash, cash equivalents and restricted cash at beginning of period | | 360,891 | | | | 414,084 | | | | 338,223 | | | | 115,410 | |

Cash, cash equivalents and restricted cash at end of period | $ | 315,484 | | | $ | 356,656 | | | $ | 315,484 | | | $ | 356,656 | |

Supplemental disclosure of cash flow information | | | | | | | | | | | |

Cash paid for interest | $ | 600 | | | $ | — | | | $ | 1,207 | | | $ | 238 | |

Purchases of property and equipment, not yet paid | $ | 13,828 | | | $ | 21,724 | | | $ | 13,828 | | | $ | 21,724 | |

Fair value of assumed common stock warrants exercised | $ | — | | | $ | 79,521 | | | $ | — | | | $ | 521,025 | |

Net Loss to Adjusted EBITDA

Adjusted EBITDA is a non-GAAP supplemental measure of operating performance that does not represent and should not be considered an alternative to operating loss or cash flow from operations, as determined by GAAP. Adjusted EBITDA is defined as net income (loss) before interest expense, non-controlling interest, revaluations, stock-based compensation and depreciation and amortization expense. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted EBITDA may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations. A reconciliation of Adjusted EBITDA to net loss is as follows:

| | | | | | | | | | | | | | | | |

($ in Thousands) | | Three Months Ended

September 30, | | | Nine Months Ended

September 30, | |

| | 2022 | | | 2021 | | | 2022 | | | 2021 | |

GAAP net income (loss) attributable to Common Stockholders | | $ | (117,660 | ) | | $ | 15,351 | | | $ | (302,841 | ) | | $ | 21,260 | |

Interest income, net | | | (2,887 | ) | | | (246 | ) | | | (4,006 | ) | | | (604 | ) |

Other income, net | | | (114 | ) | | | (3 | ) | | | (335 | ) | | | (101 | ) |

Change in fair value of assumed common stock warrant liabilities | | | — | | | | (68,934 | ) | | | — | | | | (168,674 | ) |

Net income (loss) attributable to non-controlling interests | | | 7 | | | | — | | | | (2 | ) | | | (10 | ) |

Stock-based compensation | | | 33,578 | | | | 12,727 | | | | 92,985 | | | | 36,010 | |

Impairment of fixed assets and purchase cancellation charges | | | 11,254 | | | | — | | | | 11,254 | | | | — | |

Non-GAAP operating loss | | $ | (75,822 | ) | | $ | (41,105 | ) | | $ | (202,945 | ) | | $ | (112,119 | ) |

Depreciation and amortization expense | | | 8,469 | | | | 2,779 | | | | 18,975 | | | | 7,632 | |

Adjusted EBITDA | | $ | (67,353 | ) | | $ | (38,326 | ) | | $ | (183,970 | ) | | $ | (104,487 | ) |

Management’s Use of Non-GAAP Financial Measures

This letter includes certain non-GAAP financial measures as defined by SEC rules. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in this letter, and not to rely on any single financial measure to evaluate our business.

Forward-Looking Statements

This current report contains forward-looking statements within the meaning of the federal securities laws and information based on management’s current expectations as of the date of this current report. All statements other than statements of historical fact contained in this current report, including statements regarding the future development of the Company’s battery technology, the anticipated benefits of the Company’s technologies and the performance of its batteries, plans and objectives for future operations, forecasted cash usage, including spending and investment, are forward-looking statements. When used in this current report, the words “may,” “will,” “estimate,” “pro forma,” “expect,” “plan,” “believe,” “potential,” “predict,” “target,” “should,” “would,” “could,” “continue,” “believe,” “project,” “intend,” “anticipates,” “seek,” “working toward,” “embarking” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions, and strategies regarding future events and are based on currently available information as to the outcome and timing of future events.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Many of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include, but are not limited to ones listed here. The Company faces significant barriers in its attempts to produce a solid-state battery cell and may not be able to successfully develop its solid-state battery cell. Building high volumes of multilayer cells in commercially relevant area and with higher layer count requires substantial development effort. The Company could encounter significant delays and/or technical challenges in replicating the performance seen in its single-layer and early multilayer cells, in achieving the high quality, consistency and throughput required for commercial production and sale (e.g., unanticipated contamination issues), and in developing a cell architecture that meets all the technical requirements and be produced at low cost. The Company has encountered delays and other obstacles in acquiring, installing and operating new manufacturing equipment for automated and/or continuous-flow processes, including vendor delays (which we have already experienced) and other supply chain disruptions and challenges optimizing complex manufacturing processes. The Company may encounter delays in hiring the engineers it needs to expand its development and production efforts, delays in building out QS-0, and delays caused by the COVID-19 pandemic. Delays in increasing production of engineering samples have slowed the Company’s development efforts. These or other sources of delay could delay our delivery of A-samples and B-samples. Delays or difficulties in meeting technical milestones could cause prospective customers and JV partners not to purchase cells from our pre-production line or not to proceed with a manufacturing joint venture. The Company may be unable to adequately control the costs associated with its operations and the components necessary to build its solid-state battery cells at competitive prices. The Company’s spending may be higher than currently anticipated. The Company may not be successful in competing in the battery market industry or establishing and maintaining confidence in its long-term business prospectus among current and future partners and customers. The Company is at an early stage of testing its battery technology for use in consumer electronics applications, and we may discover technical or other hurdles that impede our ability to serve that market. The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that could materially affect the Company’s actual results can be found in the Company’s periodic filings with the SEC. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov.