- QS Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

QuantumScape (QS) DEF 14ADefinitive proxy

Filed: 4 Aug 22, 4:03pm

Filed by the Registrant ☒ | | | Filed by a party other than the Registrant ☐ |

| Check the appropriate box: | |||

| ☐ | | | Preliminary Proxy Statement |

| ☐ | | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | | | Definitive Proxy Statement |

| ☐ | | | Definitive Additional Materials |

| ☐ | | | Soliciting Material under §240.14a-12 |

| Payment of Filing Fee (Check all boxes that apply): | |||

| ☒ | | | No fee required |

| ☐ | | | Fee paid previously with preliminary materials |

| ☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Notice of 2022 Annual Meeting of Stockholders and Proxy Statement

1730 Technology Drive

San Jose, California, 95110

(408) 452-2000

August 4, 2022

Dear QuantumScape Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of QuantumScape Corporation, to be held on Tuesday, September 20, 2022, at 9:00 a.m., Pacific Time. The annual meeting will be conducted virtually via live audio webcast, which you will be able to attend by visiting www.virtualshareholdermeeting.com/QS2022.

The attached formal meeting notice and proxy statement contain details of the following matters of business to be conducted at the annual meeting:

| ● | To elect 11 directors to serve until the 2023 annual meeting of stockholders; |

| ● | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2022; |

| ● | To approve, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our named executive officers; and |

| ● | To approve, on a non-binding advisory basis, the compensation of the named executive officers. |

Your vote is important. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

We have also included in this proxy statement a brief description of our corporate social responsibility initiatives. As a leader in the development of next-generation solid-state lithium-metal batteries, we focus on environmental, social, and governance (ESG) factors that are connected to our strategic business initiatives, such as product environmental impact, workplace health and safety and employee development.

On behalf of our Board of Directors, we would like to express our appreciation for your continued support of and interest in QuantumScape.

Sincerely,

Jagdeep Singh

President, Chief Executive Officer, Co-Founder and Chairman

QUANTUMSCAPE CORPORATION

1730 Technology Drive

San Jose, California, 95110

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Time and Date | 9:00 a.m., Pacific Time, on Tuesday, September 20, 2022 |

| Virtual Location | The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/QS2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. You will need to have your 16-digit control number included on your proxy card or the instructions that accompanied your Proxy Materials (as defined below) in order to join the annual meeting. |

| Items of Business | Proposal 1: To elect 11 directors to hold office until our next annual meeting of stockholders and until their respective successors are elected and qualified. |

| Board Recommendation: FOR each director nominee |

| Proposal 2: To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. |

| Board Recommendation: FOR |

| Proposal 3: To approve, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our named executive officers. |

| Board Recommendation: ONE YEAR |

| Proposal 4: To approve, on a non-binding advisory basis, the compensation of the named executive officers. |

| Board Recommendation: FOR |

| In addition, we will transaction any other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

| Record Date | July 28, 2022 |

| Only stockholders of record as of the close of business on July 28, 2022, are entitled to notice of and to vote at the annual meeting. A list of the stockholders of record entitled to vote at the annual meeting will be available for examination, for any purpose germane to the annual meeting, during ordinary business hours for ten days prior to the annual meeting online at ir.quantumscape.com. Reasonable accommodations will be made if we cannot make the list available at our principal executive offices. The stockholder list will also be available online during the annual meeting. |

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials containing instructions on how to access our proxy statement, notice of annual meeting, form of proxy and our annual report, is first being sent or given on or about August 4, 2022, to all stockholders entitled to vote at the annual meeting. |

| The Proxy Materials can be accessed as of August 4, 2022, by visiting www.proxyvote.com. |

| Voting | Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. |

| By order of the Board of Directors, | |

|

| Jagdeep Singh |

| President, Chief Executive Officer, Co-Founder and Chairman |

TABLE OF CONTENTS

The proxy materials, which include this proxy statement, proxy card, Notice of Annual Meeting of Stockholders and our 2021 Annual Report on Form 10-K, as amended, are being distributed and made available on or about August 4, 2022. This proxy statement contains important information for you to consider when deciding how to vote on the matters brought before the 2022 Annual Meeting.

This summary does not contain all of the information you should consider. Please read this entire proxy statement carefully before voting.

2022 Annual Meeting of Stockholders

| DATE & TIME | LOCATION | RECORD DATE |

| September 20, 2022 | Virtually by visiting: | July 28, 2022 |

| 9:00 a.m. | ||

| Pacific Time | www.virtualshareholdermeeting.com/QS2022 |

Voting Proposals

| Proposal | Board Recommendation | |||

| 1 | To elect 11 directors to hold office until our next annual meeting of stockholders and until their respective successors are elected and qualified. | FOR each director nominee | ||

| 2 | To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. | FOR | ||

| 3 | To approve, on a non-binding advisory basis, the frequency of future stockholder advisory votes on the compensation of our named executive officers. | ONE YEAR | ||

| 4 | To approve, on a non-binding advisory basis, the compensation of the named executive officers. | FOR |

2022 Proxy Statement | 1

Driven to Revolutionize Energy Storage

QuantumScape is on a mission to revolutionize energy storage by building the world’s best batteries, as measured by energy density, power density (charge time), cycle life, and safety, with the aim of enabling a sustainable future.

We are focusing first on electrifying the automotive powertrain, an application that we believe represents both an important part of the solution to the global greenhouse gas emissions problem as well as an opportunity to create tremendous value for shareholders over the coming decades. After 30 years of gradual improvements in conventional lithium-ion batteries, we believe the market needs a step change in battery technology to make mass-market electric vehicles (EVs) competitive with fossil fuel alternatives.

The proprietary solid-state lithium-metal battery technology that we are developing is a new category of battery designed to meet the requirements for broader market adoption by offering greater energy density, longer life, faster charging, and greater safety when compared to today’s conventional lithium-ion batteries.

FY 2021 Business Highlights

In fiscal year 2021, our first full year as a public company, we have:

| Successfully achieved technical milestone demonstrating important progress toward our final commercial design, thus unlocking a $100 million investment from Volkswagen |  | Signed customer sampling agreements with two new global auto manufacturers – one a top-10 automaker by global revenues, and the other an established global luxury automaker | |

| Demonstrated 4-layer and 10-layer battery cells cycling capabilities meeting our gold-standard testing conditions, i.e. average charge/discharge rates of 1C or faster, at temperatures of 25 °C, 100% depth of discharge, and externally applied pressure of no more than approximately 3.4 atmospheres, simultaneously |  | Strengthened our financial position by raising $462 million in a follow-on public offering, $100 million from the Volkswagen milestone investment, and $151 million through warrant exercises, bringing our cash balance to approximately $1.5 billion at the end of 2021 | |

| Announced world-first results testing our battery cells under zero externally applied pressure, and battery cells using lithium-iron-phosphate (LFP) cathodes |  | Bolstered our world-class team with additional R&D and manufacturing talent, doubling our headcount to 570 employees | |

| Secured space and began construction on QS-0, our pre-pilot facility, which is a key step in our manufacturing progress |  | Continued to fortify our patent portfolio, with global issued and pending patents increasing from 223 to 284 |

2 | QuantumScape

Corporate Governance Highlights

Director Nominees and Committee Membership

At our 2022 annual meeting, three new director nominees—Jeneanne Hanley, Susan Huppertz, and Dr. Gena Lovett—will stand for election to our board of directors for the first time.

| Name | Age | Role | Director Since(1) | Independent | Committee Memberships(2) | ||

| Audit | Compensation | Nominating | |||||

| & Corporate | |||||||

| Governance | |||||||

| Jagdeep Singh | 55 | President, Chief Executive Officer, Co-Founder and Chairman | May 2010 | No | |||

| Frank Blome | 53 | Director | Sep 2020 | Yes | |||

| Brad Buss | 58 | Lead Independent Director | Aug 2020 | Yes | C | M | |

| Jeneanne Hanley | 49 | Director | Dec 2021 | Yes | M | M | |

| Susan Huppertz | 53 | Director | Feb 2022 | Yes | M | ||

| Prof. Dr. Jürgen Leohold | 68 | Director | May 2015 | Yes | C | M | |

| Dr. Gena Lovett | 59 | Director | Jan 2022 | Yes | M | C | |

| Prof. Dr. Fritz Prinz | 72 | Co-Founder, Director | Dec 2010 | No | |||

| Dipender Saluja | 57 | Director | Aug 2012 | Yes | M | ||

| JB Straubel | 46 | Director | Feb 2020 | Yes | |||

| Jens Wiese | 49 | Director | Jan 2021 | Yes | M | ||

C Chair M Member

| (1) | Includes board service at both QuantumScape Corporation and Legacy QuantumScape. |

| (2) | If director nominees are elected by stockholders, committee composition immediately following the 2022 Annual Meeting will be unchanged. |

|  |

2022 Proxy Statement | 3

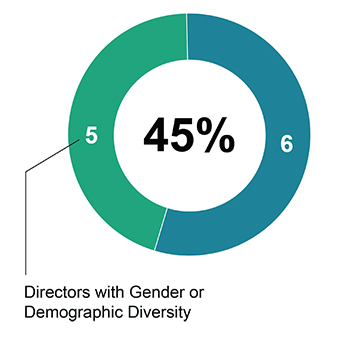

| Board Diversity | ||

| Directors | Female | Male |

| Gender Identity | ||

| Directors | 3 | 8 |

| Race/Ethnicity | ||

| Asian/Pacific Islander | - | 2 |

| Black/African American | 1 | - |

| Caucasian | 2 | 6 |

| Hispanic/Latino | - | - |

| Native American | - | - |

Board Knowledge, Skills and Experience

| 6 | Public company board experience and corporate governance |  | 9 | Automotive industry |  | 9 | Financial |

| 10 | Executive experience |  | 7 | Technology development |  | 10 | Risk management |

| 6 | Battery and energy technology |  | 9 | Manufacturing, scale-up, operations |  | 8 | HR, compensation |

Total number of directors 11

4 | QuantumScape

Executive Compensation Highlights

Compensation Practices

| What we do | |

| Performance-Based Compensation The majority of our executive compensation program is comprised of long-term performance-based compensation, and therefore “at risk,” dependent upon corporate performance and equity-based to align the interests of our executives with our stockholders. |

| Independent Compensation Committee Our compensation committee is comprised solely of independent directors who have established effective means for communicating with each other and with our stockholders, and implementing their executive compensation ideas. |

| Independent Compensation Consultant Our compensation committee engaged its own compensation consultant, Compensia, a national compensation consulting firm, to assist with its compensation review and analysis. |

| Annual Executive Compensation Review Our compensation committee conducts an annual review and approval of our compensation strategy, including a review of our compensation peer group used for comparative purposes. |

| Clawback Arrangements The terms of the awards under our Extraordinary Performance Award Program provide for recovery of such awards recipient’s misconduct. Additionally, our equity and incentive plans permit us to implement compensation recoupment provisions. |

| Stock Ownership Guidelines In April 2022, we adopted stock ownership requirements for our directors and executive officers. |

| What we don’t do | |

| Minimal Perquisites and Special Benefits Our executives are eligible to participate in broad-based Company-sponsored retirement, health and welfare benefits programs on the same basis as our other full-time, salaried employees. At this time, we provide limited perquisites and other personal benefits to our executives and certain senior employees. |

| No “Golden Parachute” Tax Reimbursements We do not provide any tax reimbursement payments on any tax liability that our executives might owe as a result of the application of Sections 280G or 4999 of the Internal Revenue Code. |

| No Hedging and Pledging Our Insider Trading Policy prohibits our employees and the members of our board of directors, from hedging any Company securities, from pledging any Company securities as collateral for any loan or as part of any other pledging transaction, or from holding any Company common stock in margin accounts. |

| No “Single-Trigger” Change-in-Control Arrangements Our executives are not eligible for benefits that are payable solely as a result of a change-in-control in the Company. All change-in-control benefits are based on a “double-trigger” arrangement, requiring both a change-in-control of our Company plus an involuntary termination of employment. |

FY 2021 Compensation Mix for Named Executive Officers

|  |

RSUs and Performance Equity are considered at risk because of stock price volatility; Performance Equity and Incentive Cash are considered at risk because they are earned only upon achievement of performance milestones.

2022 Proxy Statement | 5

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this proxy statement. You should read this entire proxy statement carefully.

What is QuantumScape Corporation’s relationship to Kensington Capital Acquisition Corp.?

The original QuantumScape Corporation, now named QuantumScape Battery, Inc. (“Legacy QuantumScape”) was founded in 2010 with the mission to revolutionize energy storage to enable a sustainable future. On November 25, 2020, Legacy QuantumScape consummated a business combination (the “Business Combination”) with Kensington Capital Acquisition Corp., a special purpose acquisition company (“Kensington”), whereby Legacy QuantumScape became a wholly owned subsidiary of Kensington, and Kensington changed its name to QuantumScape Corporation, a Delaware corporation (the “Company,” “QuantumScape” or “QuantumScape Corporation”).

Why am I receiving these materials?

This proxy statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2022 annual meeting of stockholders of QuantumScape Corporation and any postponements, adjournments or continuations thereof.

The annual meeting will be held on September 20, 2022, at 9:00 a.m., Pacific Time. The annual meeting will be conducted virtually via live audio webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/QS2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting.

The Notice of Internet Availability of Proxy Materials (the “Notice of Internet Availability”), containing instructions on how to access this proxy statement, the accompanying notice of annual meeting and form of proxy, and our annual report (together, the “Proxy Materials”), is first being sent or given on or about August 4, 2022, to all stockholders of record as of July 28, 2022. The Proxy Materials can be accessed as of August 4, 2022, by visiting www.proxyvote.com. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the Proxy Materials in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the Proxy Materials are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

| ● | Proposal 1: the election of 11 directors to hold office until our next annual meeting of stockholders and until their respective successors are elected and qualified; |

| ● | Proposal 2: the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; |

| ● | Proposal 3: the approval, on a non-binding advisory basis, of the frequency of future stockholder advisory votes on the compensation of our named executive officers; and |

| ● | Proposal 4: the approval, on a non-binding advisory basis, of the compensation of the named executive officers. |

As of the date of this proxy statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

6 | QuantumScape

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

| ● | Proposal 1: “FOR” the election of each director nominee named in this proxy statement; |

| ● | Proposal 2: “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; |

| ● | Proposal 3: For “ONE YEAR” as the frequency of future stockholder non-binding advisory votes on the compensation of the Company’s named executive officers; and |

| ● | Proposal 4: “FOR” the approval of the named executive officer compensation pursuant to a non-binding advisory vote. |

Who is entitled to vote at the annual meeting?

Holders of our Class A and Class B common stock as of the close of business on July 28, 2022, the record date for the annual meeting, may vote at the annual meeting. As of the record date, there were 349,707,152 shares of our Class A common stock outstanding and 82,998,187 shares of our Class B common stock outstanding.

How many votes do I have? Each share of Class A common stock is entitled to one vote on each matter properly brought before the annual meeting and each share of Class B common stock is entitled to 10 votes on each matter properly brought before the annual meeting. Our Class A common stock and Class B common stock, collectively referred to in this proxy statement as our common stock, will vote as a single class on all matters described in this proxy statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Continental Stock Transfer & Trust Company, then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability were sent directly to you. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this proxy statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank or other nominee sent to you. Beneficial holders who did not receive a 16-digit control number from their broker, bank or other nominee, who wish to attend the meeting should follow the instructions from their broker, bank or other nominee, including any requirement to obtain a legal proxy. Throughout this proxy statement, we refer to these beneficial holders as “street name stockholders.”

How many votes are needed for approval of each proposal?

| ● | Proposal No. 1: Each director is elected by a plurality of the voting power of the shares present in person (including virtually) or represented by proxy at the annual meeting and entitled to vote on the election of directors. A plurality means that the 11 nominees receiving the highest number of affirmative FOR votes at the annual meeting will be elected as directors. You may (1) vote FOR the election of all of the director nominees named herein, (2) WITHHOLD authority to vote for all such director nominees or (3) vote FOR the election of all such director nominees other than any nominees with respect to whom the vote is specifically WITHHELD by indicating in the space provided on the proxy. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of a WITHHOLD vote or a broker non-vote, will have no effect on the outcome of the election. |

| ● | Proposal No. 2: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022, requires the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the annual meeting and entitled to vote thereon. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal. |

2022 Proxy Statement | 7

| ● | Proposal No. 3: The approval of the frequency of future stockholder advisory votes on the compensation of the Company’s named executive will be considered the advisory vote of our stockholders. You may vote to hold such advisory votes EVERY YEAR, EVERY TWO YEARS or EVERY THREE YEARS or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. Because this vote is advisory only in accordance with applicable laws, it will not be binding on us, our compensation committee or our board of directors. However, we value our stockholders’ input and will take the vote into consideration when determining the frequency of the advisory vote. |

| ● | Proposal No. 4: The approval, on a non-binding advisory basis, of the compensation of our named executive officers requires an affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Broker non-votes will have no effect on the outcome of this proposal. Because this vote is advisory only, it will not be binding on us, our compensation committee or our board of directors. However, we value our stockholders’ input and will take the vote into consideration when evaluating executive compensation decisions. |

Do the Company’s directors and officers have an interest in any of the matters to be acted upon at the annual meeting?

Members of our board of directors have an interest in Proposal 1, the election to the board of directors of the 11 director nominees as set forth herein, as each of the nominees is currently a member of the board of directors. Members of the board of directors and our executive officers do not have any interest in Proposal 2, the ratification of the appointment of our independent registered public accounting firm. Certain of our directors, executive officers and other members of our management team (including our Chief Executive Officer) are named executive officers, and thus may have an interest in Proposal 3 (the approval, on a non-binding advisory basis, of the frequency of future stockholder advisory votes on the compensation of our named executive officers) and Proposal 4 (the approval, on a non-binding advisory basis, of the compensation of our named executive officers).

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our amended and restated bylaws (“Bylaws”) and Delaware law. The presence, in person (including virtually) or by proxy, of holders of a majority of the voting power of our capital stock issued and outstanding and entitled to vote will constitute a quorum to transact business at the annual meeting. Abstentions, withhold votes and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another time or place.

What is the difference between holding shares as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are the “record holder” of those shares. If you are a record holder, the Proxy Materials have been provided directly to you by the Company.

If your shares are held in a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held in “street name.” If your shares are held in street name, the Proxy Materials have been forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the annual meeting. As the beneficial owner, you have the right to instruct this organization on how to vote your shares. Because you are not the stockholder of record, you may not vote your shares electronically during the annual meeting unless you request and obtain a valid proxy issued in your name from the broker, bank or other nominee considered the stockholder of record of the shares.

8 | QuantumScape

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

| ● | by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on September 19, 2022 (have your Notice of Internet Availability or proxy card in hand when you visit the website); |

| ● | by toll-free telephone at 1-800-690-6903, 24 hours a day, 7 days a week, until 11:59 p.m., Eastern Time, on September 19, 2022 (have your Notice of Internet Availability or proxy card in hand when you call); |

| ● | by completing, signing and mailing your proxy card (if you received printed Proxy Materials), which must be received prior to the annual meeting in the prepaid envelope provided; or |

| ● | by attending the annual meeting virtually by visiting www.virtualshareholdermeeting.com/QS2022, where you may vote during the meeting (have your Notice of Internet Availability or proxy card in hand when you visit the website). |

Street Name Stockholders. If you are a street name stockholder and did not receive a 16-digit control number from your broker, bank or other nominee for you to vote your own shares, then you will receive voting instructions from your broker, bank or other nominee. You must follow these instructions, including any requirement to obtain a legal proxy, in order to instruct them on how to vote your shares. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank or other nominee.

As discussed above, if you are a street name stockholder who did not receive a 16-digit control number, then you may not vote your shares at the annual meeting unless you follow the voting instructions from your broker, bank or other nominee and obtain any legal proxy they may require.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy but you do not provide voting instructions, your shares will be voted as recommended by our board of directors:

| ● | Proposal 1: “FOR” the election of each director nominee named in this proxy statement; |

| ● | Proposal 2: “FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; |

| ● | Proposal 3: For “ONE YEAR” as the frequency of future stockholder advisory votes on the compensation of the Company’s named executive officers; and |

| ● | Proposal 4: “FOR” the approval of the named executive officer compensation pursuant to a non-binding advisory vote. |

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

2022 Proxy Statement | 9

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

| ● | entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above); |

| ● | completing and returning a later-dated proxy card, which must be received prior to the annual meeting; |

| ● | delivering a written notice of revocation to our corporate secretary at QuantumScape Corporation, 1730 Technology Drive, San Jose, California, 95110, Attention: Corporate Secretary, which must be received prior to the annual meeting; or |

| ● | attending and voting at the virtual annual meeting (although attendance at the virtual annual meeting will not, by itself, revoke a proxy). |

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

What do I need to do to attend the virtual annual meeting?

This year’s annual meeting will be a completely “virtual” meeting of stockholders. We will be hosting the annual meeting via live audio webcast only. You will be able to attend the annual meeting virtually, submit your questions during the meeting and vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/QS2022. To participate in the annual meeting, you will need the 16-digit control number included on your Notice of Internet Availability. The annual meeting audio webcast will begin promptly at 9:00 a.m., Pacific Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m., Pacific Time, and you should allow ample time for the check-in procedures.

How can I get help if I have trouble checking in or listening to the annual meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please refer to the virtual meeting log-in page at www.virtualshareholdermeeting.com/QS2022.

Will I be able to participate in the virtual annual meeting on the same basis I would be able to participate in a live annual meeting?

The online meeting format for our annual meeting will enable full and equal participation by all our stockholders from any place in the world at little to no cost. We designed the format of our virtual annual meeting to ensure that our stockholders who attend our annual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting and to enhance stockholder access, participation and communication through online tools. We plan to take the following steps to provide for such an experience:

| ● | providing stockholders with the ability to submit appropriate questions up to 15 minutes in advance of the meeting; |

| ● | providing stockholders with the ability to submit appropriate questions real-time via the meeting website, limiting questions to one per stockholder unless time otherwise permits; and |

| ● | answering as many questions submitted in accordance with the meeting rules of conduct as appropriate in the time allotted for the meeting. |

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Michael McCarthy, our Chief Legal Officer and Head of Corporate Development and Kevin Hettrich, our Chief Financial Officer, and each of them, with full power of substitution and re-substitution, have been designated as proxy holders for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If the proxy is dated and signed, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holders will use their own judgment to determine how to vote your shares. If the annual meeting is postponed or adjourned, then the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

10 | QuantumScape

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. or its designee will tabulate the votes and act as inspectors of election.

How can I contact QuantumScape’s transfer agent?

You may contact our transfer agent Continental Stock Transfer & Trust Company, by telephone at 1-800-509-5586 (toll-free) or 1-212-509-4000 (toll and international), or by writing Continental Stock Transfer & Trust Company, at Attention: Customer Service, 1 State Street, 30th Floor, New York, NY 10004-1561. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at www.continentalstock.com.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the Proxy Materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the Proxy Materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We will disclose voting results on a Current Report on Form 8-K that we will file with the U.S. Securities and Exchange Commission (the “SEC”), within four business days after the meeting. If final voting results are not available to us in time to file a Form 8-K, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of Proxy Materials?

In accordance with the rules of the SEC we have elected to furnish our Proxy Materials, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the Proxy Materials. The Notice of Internet Availability contains instructions on how to access our Proxy Materials on the Internet, how to vote on the proposals, how to request printed copies of the Proxy Materials, and how to request to receive all future Proxy Materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the Proxy Materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed Proxy Materials?

If you receive more than one Notice of Internet Availability or more than one set of printed Proxy Materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed Proxy Materials, as applicable, to ensure that all of your shares are voted.

2022 Proxy Statement | 11

I share an address with another stockholder, and we received only one paper copy of the Notice of Internet Availability. How may I obtain an additional copy of the Notice of Internet Availability?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the Proxy Materials, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the Proxy Materials, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of the Proxy Materials, you may contact us as follows:

QuantumScape Corporation

Attention: Investor Relations

1730 Technology Drive,

San Jose, California, 95110

Tel: (408) 452-2000

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

12 | QuantumScape

ELECTION OF DIRECTORS

Our board of directors currently consists of 11 directors. At the annual meeting, 11 directors will be elected for a one-year term and until their respective successors are duly elected and qualified or until their earlier death, resignation or removal.

Nominees

Our nominating and corporate governance committee has recommended, and our board of directors has approved the following 11 individuals as nominees for election as directors at the annual meeting:

| Jagdeep Singh | Dr. Gena Lovett |

| Frank Blome | Prof. Dr. Fritz Prinz |

| Brad Buss | Dipender Saluja |

| Jeneanne Hanley | JB Straubel |

| Susan Huppertz | Jens Wiese |

| Prof. Dr. Jürgen Leohold |

For more information concerning the nominees, please see “Board of Directors and Corporate Governance” starting on page 18.

If elected, each of the foregoing director nominees will serve as a director until the 2023 annual meeting of stockholders and until his or her respective successor is elected and qualified or until his or her earlier death, resignation or removal.

Each of the director nominees have agreed to serve as directors if elected, and management has no reason to believe that they will be unavailable to serve. In the event a nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee designated by the present board of directors to fill the vacancy.

Vote Required

Each director is elected by a plurality of the voting power of the shares present in person (including virtually) or represented by proxy at the meeting and entitled to vote on the election of directors. A plurality means that the eleven nominees receiving the highest number of affirmative FOR votes at the annual meeting will be elected as directors. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of a WITHHOLD vote or a broker non-vote, will have no effect on the outcome of the election.

|

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES NAMED ABOVE.

|

2022 Proxy Statement | 13

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our audit committee has appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2022. Ernst & Young LLP served as our independent registered public accounting firm for the fiscal year ended December 31, 2021.

At the annual meeting, we are asking our stockholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Our audit committee is submitting the appointment of Ernst & Young LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Notwithstanding the appointment of Ernst & Young LLP, and even if our stockholders ratify the appointment, our audit committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our audit committee believes that such a change would be in the best interests of our company and our stockholders. If our stockholders do not ratify the appointment of Ernst & Young LLP, then our audit committee may reconsider the appointment. One or more representatives of Ernst & Young LLP are expected to be present at the annual meeting, and they will have an opportunity to make a statement and are expected to be available to respond to appropriate questions from our stockholders.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees for professional audit services and other services rendered to us by Ernst & Young LLP for our fiscal years ended December 31, 2021 and December 31, 2020 (with dollar amounts below noted in thousands).

| 2021 | 2020 | |||||||

| Audit Fees(1) | $ | 2,106 | $ | 2,559 | ||||

| Audit-Related Fees(2) | - | 17 | ||||||

| Tax Fees(3) | 176 | 23 | ||||||

| Total Fees | $ | 2,282 | $ | 2,599 | ||||

| (1) | “Audit Fees” consist of fees billed for professional services rendered in connection with the audit of our consolidated financial statements, reviews of our quarterly consolidated financial statements and related accounting consultations and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years. This category also includes fees for services incurred in connection with the Business Combination. |

| (2) | “Audit-Related Fees” consist of fees for services for an information security assessment (the Trust Information Security Assessment Exchange, or TISAX). |

| (3) | “Tax Fees” consist of fees for tax compliance services, including assistance with the preparation of income tax returns and general tax planning and consulting. |

Auditor Independence

In each of 2021 and 2020, there were no other professional services provided by Ernst & Young LLP, other than those listed above, that would have required our audit committee to consider their compatibility with maintaining the independence of Ernst & Young LLP.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Effective upon the consummation of the Business Combination, our audit committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our audit committee is required to pre-approve all services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair such accounting firm’s independence. Since the adoption of this policy, all services provided by Ernst & Young LLP for our fiscal years ended December 31, 2021 and December 31, 2020 were pre-approved by our audit committee.

14 | QuantumScape

Vote Required

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the annual meeting and entitled to vote thereon. Abstentions will have the same effect as a vote AGAINST this proposal.

|

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR FISCAL YEAR ENDING DECEMBER 31, 2022.

|

2022 Proxy Statement | 15

NON-BINDING ADVISORY VOTE ON THE FREQUENCY OF THE

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

The Dodd-Frank Act enables our stockholders to indicate, at least once every six years, how frequently we should seek a non-binding vote on the compensation of our named executive officers, as disclosed pursuant to the SEC’s compensation disclosure rules as we have in Proposal No. 4 beginning on page 17 of this proxy statement. By voting on this proposal, stockholders may indicate whether they would prefer a non-binding vote on named executive officer compensation once every one, two, or three years.

After careful consideration, our board of directors has determined that a non-binding vote on executive compensation that occurs annually is the most appropriate alternative for the Company, and therefore recommends that you vote for a one-year interval for non-binding votes on executive compensation.

In formulating its recommendation, our board of directors considered that since compensation decisions are made annually, an annual advisory vote on executive compensation will allow stockholders to provide more frequent and direct input on our compensation philosophy, policies and practices. An annual approach provides regular input by stockholders, while allowing time to evaluate the effects of our compensation program on performance over a longer period. However, we understand that our stockholders may have different views as to what is the best approach for the Company, and we look forward to hearing from our stockholders on this proposal.

You may cast your vote on your preferred voting frequency by choosing the option of one year, two years, three years or abstain from voting when you vote in response to the resolution set forth below:

“RESOLVED, that the option of once every one year, two years, or three years that receives the highest number of votes cast for this resolution will be determined to be the preferred frequency with which the Company is to hold a stockholder vote to approve the compensation of the named executive officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the other related disclosure.”

The option of one year, two years or three years that receives the highest number of votes cast by stockholders will be the frequency for the advisory vote on executive compensation that has been selected by stockholders. However, this vote is advisory and is not binding on the Company, the compensation committee or our board of directors. The board of directors may decide that it is in the best interests of our stockholders and the Company to hold an advisory vote on executive compensation more or less frequently than the option approved by our stockholders.

Vote Required

The approval of the frequency of future stockholder advisory votes on the compensation of the Company’s named executive will be considered the advisory vote of our stockholders. You may vote to hold such advisory votes EVERY YEAR, EVERY TWO YEARS or EVERY THREE YEARS, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions and broker non-votes will have no effect on the outcome of this proposal. Because this vote is advisory only in accordance with applicable laws, it will not be binding on us, our compensation committee or our board of directors. However, we value our stockholders’ input and will take the vote into consideration when determining the frequency of the advisory vote.

|

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE FOR “ONE YEAR” AS THE FREQUENCY OF FUTURE STOCKHOLDER VOTES, ON A NON-BINDING ADVISORY BASIS, ON THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICERS.

|

16 | QuantumScape

NON-BINDING ADVISORY VOTE ON EXECUTIVE COMPENSATION

Pursuant to Schedule 14A of the Exchange Act, we are asking our stockholders to vote to approve, on a non-binding advisory basis, the compensation of our “named executive officers” as disclosed in accordance with the SEC’s rules in the “Executive Compensation” section of this proxy statement beginning on page 36 below. This proposal, commonly known as a “say-on-pay” proposal, is not intended to address any specific item of compensation or any specific named executive officer, but rather the overall compensation of all of our named executive officers and the philosophy, policies and practices described in this proxy statement, as a whole.

The say-on-pay vote is advisory, and therefore not binding on the Company, the compensation committee or the board of directors. The say-on-pay vote will, however, provide information to us regarding investor sentiment about our executive compensation philosophy, policies and practices, which the compensation committee will be able to consider when determining executive compensation for the remainder of the current fiscal year and beyond. The board of directors and the compensation committee value the opinions of our stockholders and to the extent there is any significant vote against our named executive officer compensation as disclosed in this proxy statement, we will consider our stockholders’ concerns and the compensation committee will evaluate whether any additional actions are necessary.

2021 Executive Compensation Program

Our board of directors believes that the detailed information provided above and within the “Executive Compensation” section of this proxy statement demonstrates that our executive compensation program was designed appropriately and is working to ensure management’s interests are aligned with our stockholders’ interests to support long-term value creation.

Proposed Resolution

Accordingly, we ask our stockholders to vote “FOR” the following resolution at the 2022 Annual Meeting:

“RESOLVED, that the Company’s stockholders approve, on a non-binding advisory basis, the compensation of the named executive officers, as disclosed in the Company’s Proxy Statement for the Annual Meeting of Stockholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the Compensation Discussion and Analysis, the compensation tables and the other related disclosure.”

Vote Required

The approval, on a non-binding advisory basis, of the compensation of our named executive officers requires an affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the Annual Meeting and entitled to vote thereon to be approved. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Broker non-votes will have no effect on the outcome of this proposal. Because this vote is advisory only, it will not be binding on us, our compensation committee or our board of directors. However, we value our stockholders’ input and will take the vote into consideration when evaluating executive compensation decisions.

|

Recommendation of our Board of Directors

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE NAMED EXECUTIVE OFFICER COMPENSATION PURSUANT TO A NON-BINDING ADVISORY VOTE.

|

2022 Proxy Statement | 17

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of our Board of Directors

Our business and affairs are organized under the direction of our board of directors, which currently consists of 11 directors, 9 of whom are independent under the listing standards of the New York Stock Exchange (the “NYSE”). Jagdeep Singh serves as Chairman of our board of directors and Brad Buss serves as our Lead Independent Director. The primary responsibilities of our board of directors are to provide oversight, strategic guidance, counseling and direction to our management. Our board of directors meets on a regular basis and additionally as required. At each annual meeting of stockholders, directors will be elected for a term expiring at our next annual meeting of stockholders and until their successors are duly elected and qualified. Each of the nominees has been recommended for nomination by the nominating and corporate governance committee and each of them is currently serving as a director.

The following table sets forth the names, ages as of July 1, 2022, and certain other information for each of our director nominees:

Nominees for Directors

| Name | Age | Position(s) | Director Since | Independent |

| Jagdeep Singh | 55 | President, Chief Executive Officer, Co-Founder and Chairman | May 2010 (1) | No |

| Frank Blome | 53 | Director | September 2020 (1) | Yes |

| Brad Buss(2)(3) | 58 | Lead Independent Director | August 2020 (1) | Yes |

| Jeneanne Hanley(2)(3) | 49 | Director | December 2021 | Yes |

| Susan Huppertz(2) | 53 | Director | February 2022 | Yes |

| Prof. Dr. Jürgen Leohold(3)(4) | 68 | Director | May 2015 (1) | Yes |

| Dr. Gena Lovett(2)(4) | 59 | Director | January 2022 | Yes |

| Prof. Dr. Fritz Prinz | 72 | Co-Founder, Director | December 2010 (1) | No |

| Dipender Saluja(4) | 57 | Director | August 2012 (1) | Yes |

| JB Straubel | 46 | Director | February 2020 (1) | Yes |

| Jens Wiese(3) | 49 | Director | January 2021 | Yes |

| (1) | Includes board service at Legacy QuantumScape |

| (2) | Member of audit committee |

| (3) | Member of compensation committee |

| (4) | Member of nominating and corporate governance committee |

Board of Directors Diversity Matrix

The nominating and corporate governance committee of our board of directors identifies, reviews and makes recommendations of candidates to serve on our board of directors, and considers director qualifications that include, without limitation, diversity factors such as race, ethnicity, gender, differences in professional background, education, age and geography, as well as other individual qualities and attributes that contribute to the total mix of viewpoints and experience represented on our board.

The following matrix highlights key skills, experiences and attributes possessed by our directors which our board of directors believes are important to our business and industry. If a director is not listed under a particular skill, experience or attribute, that does not mean that such director does not possess it or is unable to contribute to the decision-making process in that area.

18 | QuantumScape

| Singh | Blome | Buss | Hanley | Huppertz | Leohold | Lovett | Prinz | Saluja | Straubel | Wiese | |

| Knowledge, Skills and Experience | |||||||||||

| Public company board experience and corporate governance | ● | ● | ● | ● | ● | ● | |||||

| Executive experience | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| Battery and energy technology | ● | ● | ● | ● | ● | ● | |||||

| Automotive industry | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Technology development | ● | ● | ● | ● | ● | ● | ● | ||||

| Manufacturing, scale-up, operations | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Financial | ● | ● | ● | ● | ● | ● | ● | ● | ● | ||

| Risk management | ● | ● | ● | ● | ● | ● | ● | ● | ● | ● | |

| HR, compensation | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Demographics | |||||||||||

| Race/Ethnicity | |||||||||||

| Asian/Pacific Islander | ● | ● | |||||||||

| Black/African American | ● | ||||||||||

| Caucasian | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Hispanic/Latino | |||||||||||

| Native American | |||||||||||

| Gender | |||||||||||

| Male | ● | ● | ● | ● | ● | ● | ● | ● | |||

| Female | ● | ● | ● | ||||||||

| Company Board Tenure | |||||||||||

| Years* | 13 | 2 | 2 | <1 | <1 | 7 | <1 | 12 | 10 | 2 | 1 |

* Includes board service on both QuantumScape Corporation and Legacy QuantumScape, rounded to the nearest whole year, as of July 1, 2022.

Letter Agreements on Board and Committee Representation

On September 2, 2020, we entered into a letter agreement (the “Original Letter Agreement”) with Legacy QuantumScape, and Volkswagen Group of America Investments, LLC (“VGA”) pursuant to which we would nominate one designee of VGA for election to our board of directors, and from and after the First Closing (as defined under the Series F Preferred Stock Purchase Agreement between Legacy QuantumScape and VGA, dated May 14, 2020), a second designee of VGA. On December 7, 2020, the parties amended and restated the Original Letter Agreement to provide (subject to VGA satisfying certain specified stock ownership thresholds) that (i) in connection with any annual or special meeting of stockholders at which directors will be elected, we will nominate for election to our board of directors two designees of VGA (each, a “VW Director”), and (ii) we shall cause one VW Director to be appointed to the nominating and corporate governance committee of our board of directors, provided that such VW Director fulfills the independence requirements under applicable NYSE rules (as amended, the “VW Director Agreement”). Messrs. Blome and Wiese are the two current VW Directors pursuant to the VW Director Agreement.

2022 Proxy Statement | 19

Nominees for Director

Jagdeep Singh has served as our President, Chief Executive Officer and the Chairman of our board of directors since November 2020. Mr. Singh co-founded Legacy QuantumScape and has served as its President and Chief Executive Officer and on Legacy QuantumScape’s board of directors since its incorporation in May 2010. Prior to joining Legacy QuantumScape, he was the founder and Chief Executive Officer at Infinera Corporation (NASDAQ: INFN), a telecommunications company, from 2001 to 2009. Mr. Singh served on the boards of Khosla Ventures Acquisition Co. (NASDAQ: KVSA) (“KVSA”), a blank check company, from February 2021 to February 2022, and of Slam Corp. (NASDAQ: SLAM), a blank check company, from March 2021 to February 2022. Mr. Singh served as the Chair of the Corporate Governance and Nominating Committee and a member of the Audit Committee of KVSA, and as Chair of the Compensation Committee and member of the Audit Committee of Slam Corp. Mr. Singh holds a B.S. in Computer Science from the University of Maryland College Park, an M.B.A. from the University of California, Berkeley, Haas School of Business, and a M.S. in Computer Science from Stanford University.

We believe Mr. Singh is qualified to serve on our board of directors because of the perspective and experience he brings as Legacy QuantumScape’s President and Chief Executive Officer, leadership experience in the energy storage industry, educational background and strong scientific knowledge.

Frank Blome has served on our board of directors since November 2020, and on Legacy QuantumScape’s board of directors from September 2020 until January 2021. Mr. Blome has also served on the board of QSV Operations LLC since September 2020. Mr. Blome has 25 years of professional experience in the automotive industry, with a particular focus on alternative powertrain technologies and battery cell technology. Since January 2018, Mr. Blome has served as the Head of the Battery Center of Excellence of Volkswagen AG. Prior to this, Mr. Blome served from May 2016 to June 2016 as Chief Executive Officer at Mercedes-Benz Energy GmbH, a subsidiary of the Daimler Group active in the EV battery storage space. From July 2013 to June 2017, Mr. Blome served as Chief Executive Officer of LiTec Battery GmbH, a battery cell manufacturing company started as a joint venture between Daimler Group and Evonik Industries AG, a specialty chemicals company. In addition to these roles, Mr. Blome served from June 2009 to June 2017 as the Chief Executive Officer of Deutsche Accumotive GmbH & Co KG, a subsidiary of Daimler Group, producing batteries for hybrid and electric vehicles, after which Mr. Blome undertook a sabbatical until January 2018 when he started in his current position at Volkswagen AG. Mr. Blome holds a diploma in electrical engineering from the University of Applied Sciences Bielefeld.

We believe Mr. Blome is qualified to serve on our board of directors due to his vast experience in the automotive and alternative powertrain industries.

Brad Buss has served on our board of directors since November 2020, on Legacy QuantumScape’s board of directors from August 2020 until January 2021, and as our lead independent director since April 2022. From August 2014 until his retirement in February 2016, Mr. Buss served as the Executive Vice President and Chief Financial Officer of SolarCity Corporation, a solar energy company acquired by Tesla, Inc. (NASDAQ: TSLA), a high-performance electric vehicle company (“Tesla”). Mr. Buss also served as the Executive, Vice President and Chief Financial Officer of Cypress Semiconductor Corporation (NASDAQ: CY), a semiconductor design and manufacturing company, from August 2005 to June 2014. Mr. Buss has served on the boards of Marvell Technology Group Ltd. (NASDAQ: MRVL) (“Marvell”), a semiconductor company, since July 2018, AECOM (NYSE: ACM), an engineering firm, since August 2020, and TuSimple Holdings Inc., an autonomous driving technology company (NASDAQ: TSP) (“TSP”), since December 2020. Mr. Buss serves as Chair of the Nominating and Governance Committee and as a member of the Audit Committee of Marvell, as Chair of the Nominating and Governance Committee and as a member of the Compensation and Organization Committee of AECOM, as Chair of the Audit Committee of TSP, as a member of the Nominating and Corporate Governance Committee of TSP, and as lead independent director of TSP. Mr. Buss previously served on the boards of Tesla from November 2009 to June 2019, Cavium, Inc., a semiconductor company, from July 2016 until its acquisition by Marvell in July 2018, CafePress Inc., an e-commerce company, from October 2007 to July 2016, and Advance Auto Parts, Inc. (NYSE: AAP), an automotive parts and accessories provider, from March 2016 until May 2021. He served on the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee, and Disclosure Committee of Tesla, the Audit Committee and Compensation Committee of Cavium, Inc., the Audit Committee and Compensation Committee of CafePress Inc., and as Chair of the Audit Committee of Advance. Mr. Buss holds a B.A. in Economics from McMaster University and a Honors Business Administration degree from University of Windsor.

20 | QuantumScape

We believe Mr. Buss is qualified to serve on our board of directors because of his vast leadership expertise, financial expertise and experience on the boards of major automotive companies.

Jeneanne Hanley has served on our board of directors since December 2021. Ms. Hanley has held various positions at Lear Corporation, a designer and manufacturer of automotive seating systems and electrical distribution systems and related components, from 1994 until January 2019, most recently serving as Senior Vice President and President of the E-Systems Division. Other positions at Lear Corporation she has held include Corporate Vice President, Global Surface Materials, Corporate Vice President, Americas Seating Business Unit and Vice President, Global Strategy and Business Development. Ms. Hanley earned her bachelor’s degree in mechanical engineering in 1994 and her master’s degree in business administration in 2000 from the University of Michigan.

Ms. Hanley is standing for election to our board or directors for the first time and came to our attention through a global executive search firm. We believe Ms. Hanley is qualified to serve on our board of directors due to her past service as an operational executive of significant business units and divisions serving the global automotive industry.

Susan Huppertz has served on our board of directors since February 2022. Ms. Huppertz has been serving as Chief Supply Chain Officer at Johnson Controls (NYSE: JCI), a designer and manufacturer of building automation and control technologies, since March 2022. Prior to that, Ms. Huppertz served as Chief Manufacturing and Supply Chain Officer at Hubbell Incorporated (NYSE: HUBB), an electronic products designer and manufacturer, from January 2018 to March 2022. She also served as Vice President, Global Operations at TE Connectivity Ltd (NYSE: TEL), a connectivity and sensor solutions provider, from May 2014 until November 2017, and in a variety of roles over 20 years at Siemens AG, an industrial manufacturing conglomerate, including as Senior Vice President Global Manufacturing and Supply Chain Manager of its Water Technologies Business Unit from August 2011 to January 2014, and as Vice President Regional Manufacturing Manager for Europe, Latin America and Middle East for its OSRAM Professional Lighting Business Unit from January 2008 to August 2011. Ms. Huppertz holds a B.A. in Computer Science and Economics from Cornell University and dual M.B.A. degrees from the Kellogg Graduate School of Management at Northwestern University and Wissenschaftliche Hochschule für Unternehmensführung.

Ms. Huppertz is standing for election to our board or directors for the first time and came to our attention through a global executive search firm. We believe Ms. Huppertz is qualified to serve on our board of directors due to her past leadership experience and her expertise in manufacturing and supply chains.

Prof. Dr. Jürgen Leohold has served on our board of directors since November 2020, and on Legacy QuantumScape’s board of directors from May 2015 until January 2021. From October 2012 to December 2017, Prof. Dr. Leohold served as the Head of the Volkswagen AutoUni, an advanced training and research institution for Volkswagen AG, a German automobile manufacturer. He continued to serve as a consultant for Volkswagen AG’s research and development group from January 2018 until retiring in May 2019. He also served as the Executive Director of Group Research at Volkswagen AG from April 2006 to July 2016. Prof. Dr. Leohold holds a degree in Electrical Engineering from the University of Hannover, a M.S. in Electrical Engineering from the Georgia Institute of Technology and a doctoral degree from the University of Hannover.

We believe Prof. Dr. Leohold is qualified to serve on our board of directors because of his leadership experience and his expertise in the energy technology and automotive fields.

Dr. Gena Lovett has served on our board of directors since January 2022. Dr. Lovett has most recently served as Vice President, Operations, Defense, Space and Security, of The Boeing Company (NYSE:BA), an aerospace manufacturer, from July 2015 until June 2019. She also served as Global Chief Diversity Officer from January 2012 until June 2015, and as Director, Manufacturing, Forging, from July 2007 until January 2012, of Alcoa Corporation (NYSE: AA), an aluminum manufacturer. Prior to that, Dr. Lovett served in a number of engineering and managing roles over 15 years at Ford Motor Company (NYSE: F), an automotive manufacturer, including as Plant Manager for New Model Programs from 2006 to 2007, and as an Assistant Plant Manager for the Atlanta Assembly from 2005 to 2006. In addition, Dr. Lovett has served as a member of the board of directors of AdvanSix Inc. (NYSE: ASIX), a fully integrated manufacturer of nylon 6 resin, chemical intermediates, and ammonium sulfate fertilizer, since September 2021, and as a member of the board of directors of Trex Company, Inc. (NYSE: TREX), a manufacturer of wood-alternative composite decking and railing materials, since March 2021. She further serves on the Nominating and Governance Committee, and Health, Safety, Environmental and Sustainability Committee of ASIX, and on the Audit Committee and the Nominating/Corporate Governance Committee of TREX. Dr. Lovett also served on the board of directors of Shiloh Industries (NASDAQ: SHLO) from August 2019 to December 2020. Dr. Lovett holds a B.A. in Criminal Justice from The Ohio State University, an M.B.A. from Baker College, an M.Sc. in Values Driven Leadership from Benedictine University, and a Ph.D. in Values Driven Leadership from Benedictine University.

2022 Proxy Statement | 21

Dr. Lovett is standing for election to our board of directors for the first time and came to our attention through a global executive search firm. We believe Dr. Lovett is qualified to serve on our board of directors because of her operational leadership experience and extensive operational and manufacturing experience in automotive, heavy forging, and aerospace.

Prof. Dr. Fritz Prinz co-founded Legacy QuantumScape and has served on our board of directors since November 2020, and on Legacy QuantumScape’s board of directors from December 2010 until January 2021. Prof. Dr. Prinz also provides consulting and advisory services to the Company apart from his board service. He has served as Professor of Materials Science and Engineering, Professor of Mechanical Engineering, and Senior Fellow at the Precourt Institute for Energy since September 2010. He has also served as the Leonardo Professor at the School of Engineering at Stanford University since September 1994. Prof. Dr. Prinz holds a Ph.D. in Physics and Mathematics from the University of Vienna, Austria.

We believe Prof. Dr. Prinz is qualified to serve on our board of directors because of his in-depth educational expertise and his broad insight and research into energy conservation.

Dipender Saluja has served on our board of directors since November 2020, and on Legacy QuantumScape’s board of directors from August 2012 until January 2021. Mr. Saluja has served as Managing Director of Capricorn Investment Group, an investment firm, since 2006. Prior to Capricorn Investment Group, he served in various positions from 1990 to 2006 at Cadence Design Systems, an electronic design company. Mr. Saluja has served on the board of Joby Aviation, Inc. (NYSE: JOBY) and as a member of its Nominating and Corporate Governance Committee since August 2021, and on the board of Navitas Semiconductor, Inc. (NASDAQ: NVTS) and as a member of its Nominating and Corporate Governance Committee since October 2021. Mr. Saluja also currently serves on the boards of several private companies.

We believe Mr. Saluja is qualified to serve on our board of directors because of his extensive investment experience in the technology industry and extensive expertise and skills in strategy, finance and management.

JB Straubel has served on our board of directors since November 2020, and on Legacy QuantumScape’s board of directors from December 2019 until January 2021. Mr. Straubel is the Founder and Chief Executive Officer of Redwood Materials Inc., a Nevada-based company working to drive down the costs and environmental footprint of lithium-ion batteries by offering large-scale sources of domestic anode and cathode materials produced from recycled batteries. Prior to joining Legacy QuantumScape, Mr. Straubel also co-founded and served as the Chief Technology Officer of Tesla from May 2005 to July 2019. Mr. Straubel previously served on the board of SolarCity Corporation and as a member of its Nominating and Corporate Governance Committee from August 2006 until its acquisition by Tesla in November 2016. Mr. Straubel holds a B.S. in Energy Systems Engineering and a M.S. in Engineering, with an emphasis on energy conversion, from Stanford University.

We believe Mr. Straubel is qualified to serve on our board of directors because of his technical and manufacturing expertise along with his leadership experience in energy technology companies.

22 | QuantumScape

Jens Wiese has served on our board of directors since January 2021. Mr. Wiese has also served as Chairman of the board of QSV Operations LLC since its inception in September 2018. Mr. Wiese has 23 years of professional experience in the automotive industry, including more than 15 years as a top management consultant, advising clients from the automotive industry in strategic and financial turnaround matters. Mr. Wiese has served in multiple roles at Volkswagen AG, most recently as Head of Volkswagen Group M&A, Investment Advisory, and Partnerships since January 2020, Head of Industrial Cooperations and Partnerships from June 2018 to December 2019, Head of Group Battery Strategy from June 2016 to December 2019, and Corporate Strategy/Head of Performance Improvement from March 2016 to May 2018. Prior to his service at Volkswagen AG, Mr. Wiese served as Senior Director and Member of the German Management Team at Alix Partners GmbH, a consulting firm, from March 2007 to February 2016. Prior to that, Mr. Wiese served as a Principal and Member of the Automotive Leadership team at Roland Berger Strategy Consultants GmbH, a consulting firm, from April 1999 to March 2007. Mr. Wiese holds a Master’s degree in Business Administration from the Ludwig Maximilian University of Munich.

We believe Mr. Wiese is qualified to serve on our board of directors because of his broad investment advisory and strategic experience, along with his long-term experience in the automotive industry.

Director Independence