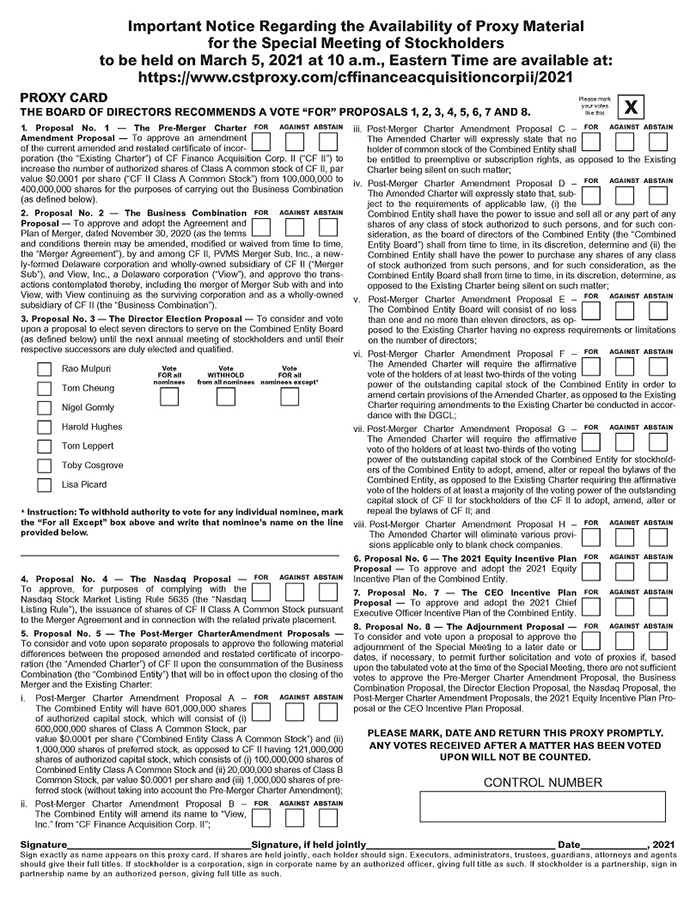

Important Notice Regarding the Availability of Proxy Material for the Special Meeting of Stockholders to be held on March 5, 2021 at 10 a.m., Eastern Time are available at: https://www.cstproxy.com/cffinanceacquisitioncorpii/2021 PROXY CARD THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4, 5, 6, 7 AND 8. Please mark your votes like this X 1. Proposal No. 1 — The Pre-Merger Charter FOR AGAINST ABSTAIN Amendment Proposal — To approve an amendment of the current amended and restated certificate of incorporation (the “Existing Charter”) of CF Finance Acquisition Corp. II (“CF II”) to increase the number of authorized shares of Class A common stock of CF II, par value $0.0001 per share (“CF II Class A Common Stock”) from 100,000,000 to 400,000,000 shares for the purposes of carrying out the Business Combination (as defined below). 2. Proposal No. 2 — The Business Combination FOR AGAINST ABSTAIN Proposal — To approve and adopt the Agreement and Plan of Merger, dated November 30, 2020 (as the terms and conditions therein may be amended, modified or waived from time to time, the “Merger Agreement”), by and among CF II, PVMS Merger Sub, Inc., a newly-formed Delaware corporation and wholly-owned subsidiary of CF II (“Merger Sub”), and View, Inc., a Delaware corporation (“View”), and approve the transactions contemplated thereby, including the merger of Merger Sub with and into View, with View continuing as the surviving corporation and as a wholly-owned subsidiary of CF II (the “Business Combination”). 3. Proposal No. 3 — The Director Election Proposal — To consider and vote upon a proposal to elect seven directors to serve on the Combined Entity Board (as defined below) until the next annual meeting of stockholders and until their respective successors are duly elected and qualified. Rao Mulpuri FOR Vote all WITHHOLD Vote FOR Vote all nominees from all nominees nominees except* Tom Cheung Nigel Gormly Harold Hughes Tom Leppert Toby Cosgrove Lisa Picard * Instruction: To withhold authority to vote for any individual nominee, mark the “For all Except” box above and write that nominee’s name on the line provided below. 4. Proposal No. 4 — The Nasdaq Proposal — FOR AGAINST ABSTAIN To approve, for purposes of complying with the Nasdaq Stock Market Listing Rule 5635 (the “Nasdaq Listing Rule”), the issuance of shares of CF II Class A Common Stock pursuant to the Merger Agreement and in connection with the related private placement. 5. Proposal No. 5 — The Post-Merger CharterAmendment Proposals — To consider and vote upon separate proposals to approve the following material differences between the proposed amended and restated certificate of incorporation (the “Amended Charter”) of CF II upon the consummation of the Business Combination (the “Combined Entity”) that will be in effect upon the closing of the Merger and the Existing Charter: i. Post-Merger Charter Amendment Proposal A — FOR AGAINST ABSTAIN The Combined Entity will have 601,000,000 shares of authorized capital stock, which will consist of (i) 600,000,000 shares of Class A Common Stock, par value $0.0001 per share (“Combined Entity Class A Common Stock”) and (ii) 1,000,000 shares of preferred stock, as opposed to CF II having 121,000,000 shares of authorized capital stock, which consists of (i) 100,000,000 shares of Combined Entity Class A Common Stock and (ii) 20,000,000 shares of Class B Common Stock, par value $0.0001 per share and (iii) 1,000,000 shares of preferred stock (without taking into account the Pre-Merger Charter Amendment); ii. Post-Merger Charter Amendment Proposal B — FOR AGAINST ABSTAIN The Combined Entity will amend its name to “View, Inc.” from “CF Finance Acquisition Corp. II”; iii. Post-Merger Charter Amendment Proposal C — FOR AGAINST ABSTAIN The Amended Charter will expressly state that no holder of common stock of the Combined Entity shall be entitled to preemptive or subscription rights, as opposed to the Existing Charter being silent on such matter; iv. Post-Merger Charter Amendment Proposal D — FOR AGAINST ABSTAIN The Amended Charter will expressly state that, subject to the requirements of applicable law, (i) the Combined Entity shall have the power to issue and sell all or any part of any shares of any class of stock authorized to such persons, and for such consideration, as the board of directors of the Combined Entity (the “Combined Entity Board”) shall from time to time, in its discretion, determine and (ii) the Combined Entity shall have the power to purchase any shares of any class of stock authorized from such persons, and for such consideration, as the Combined Entity Board shall from time to time, in its discretion, determine, as opposed to the Existing Charter being silent on such matter; v. Post-Merger Charter Amendment Proposal E — FOR AGAINST ABSTAIN The Combined Entity Board will consist of no less than one and no more than eleven directors, as opposed to the Existing Charter having no express requirements or limitations on the number of directors; vi. Post-Merger Charter Amendment Proposal F — FOR AGAINST ABSTAIN The Amended Charter will require the affirmative vote of the holders of at least two-thirds of the voting power of the outstanding capital stock of the Combined Entity in order to amend certain provisions of the Amended Charter, as opposed to the Existing Charter requiring amendments to the Existing Charter be conducted in accordance with the DGCL; vii. Post-Merger Charter Amendment Proposal G — FOR AGAINST ABSTAIN The Amended Charter will require the affirmative vote of the holders of at least two-thirds of the voting power of the outstanding capital stock of the Combined Entity for stockholders of the Combined Entity to adopt, amend, alter or repeal the bylaws of the Combined Entity, as opposed to the Existing Charter requiring the affirmative vote of the holders of at least a majority of the voting power of the outstanding capital stock of CF II for stockholders of the CF II to adopt, amend, alter or repeal the bylaws of CF II; and viii. Post-Merger Charter Amendment Proposal H — FOR AGAINST ABSTAIN The Amended Charter will eliminate various provisions applicable only to blank check companies. 6. Proposal No. 6 — The 2021 Equity Incentive Plan FOR AGAINST ABSTAIN Proposal — To approve and adopt the 2021 Equity Incentive Plan of the Combined Entity. 7. Proposal No. 7 — The CEO Incentive Plan FOR AGAINST ABSTAIN Proposal — To approve and adopt the 2021 Chief Executive Officer Incentive Plan of the Combined Entity. 8. Proposal No. 8 — The Adjournment Proposal — FOR AGAINST ABSTAIN To consider and vote upon a proposal to approve the adjournment of the Special Meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies if, based upon the tabulated vote at the time of the Special Meeting, there are not sufficient votes to approve the Pre-Merger Charter Amendment Proposal, the Business Combination Proposal, the Director Election Proposal, the Nasdaq Proposal, the Post-Merger Charter Amendment Proposals, the 2021 Equity Incentive Plan Proposal or the CEO Incentive Plan Proposal. PLEASE MARK, DATE AND RETURN THIS PROXY PROMPTLY. ANY VOTES RECEIVED AFTER A MATTER HAS BEEN VOTED UPON WILL NOT BE COUNTED. CONTROL NUMBER Signature Signature, if held jointly Date , 2021 Sign exactly as name appears on this proxy card. If shares are held jointly, each holder should sign. Executors, administrators, trustees, guardians, attorneys and agents should give their full titles. If stockholder is a corporation, sign in corporate name by an authorized officer, giving full title as such. If stockholder is a partnership, sign in partnership name by an authorized person, giving full title as such.