| OFFERING CIRCULAR | AUGUST 10, 2021 |

| | |

United States Securities and Exchange Commission

Washington, D.C. 20549

Part II of Form 1-A,

Regulation A Offering Circular

under the Securities Act of 1933

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

A California Cooperative Corporation

1428 Franklin St,

Oakland, California 94612

(650) 743-6974

https://ebprec.org

Number of securities being sold: 74,000

Price per Share: $1,000.00

This Preliminary Offering Circular relates to the offering (the “Offering”) of Investor Owner Shares (“Shares”) by East Bay Permanent Real Estate Cooperative (the “Cooperative” or “EB PREC”). The Cooperative intends to use these funds to facilitate Black, Indigenous, People of Color, and allied communities in cooperatively organizing, financing, purchasing, occupying, and stewarding properties, taking them permanently off the speculative market, creating community controlled assets, and empowering our communities to cooperatively lead a just transition from an extractive capitalist system into one where communities are ecologically, emotionally, spiritually, culturally, and economically restorative and regenerative.

| | | Price to Public | | | Proceeds to Issuer | | | Proceeds to Other Persons | |

| Price per Share | | $ | 1,000 | | | $ | 1,000 | | | $ | 0 | |

| Total Minimum | | $ | 0 | | | $ | 0 | | | $ | 0 | |

| Total Maximum (1) | | $ | 74,000,000 | | | $ | 74,000,000 | | | $ | 0 | |

(1) Initially, the Cooperative offered for sale $50,000,000 in Investor Owner shares under this Offering, first qualified on September 29, 2020. The Securities and Exchange Commission (the “SEC”) has subsequently raised the cap on Regulation A, Tier 2 Offerings from $50 million to $75 million. As of the date of this Offering Circular, we have sold 578 Shares through this Offering, at a price of $1,000 each, and are continuing to sell Investor Owner Shares under our initial qualified offering statement. Accordingly, the Cooperative seeks to offer a total maximum of $74 million under this Offering Circular.

See the “Securities Being Offered” section starting on page 22 of this Offering Circular for a discussion of the securities offered and the rights of Investor Owners. This Offering was initially qualified by the SEC on September 29, 2020. This is a continuous offering and will likely continue for up to three years from the initial qualification date, unless we terminate the Offering sooner.

These Shares are speculative securities. Investment in the Shares involves significant risk. You should purchase these securities only if you can afford a complete loss of your investment. For example, significant risks arise from the fact that:

| ∙ | EB PREC is not a profit-oriented company; it’s a community-oriented company. |

| ∙ | You can’t sell your Shares to others. You can only redeem them with the Cooperative, and even then only 5 years after your initial purchase. |

| ∙ | When you redeem the Shares, instead of receiving cash, you may receive a promissory note, payable over up to 5 years. |

| ∙ | The Board may reduce the redemption value of the Shares and promissory notes based on the financial health of the company. |

See the “Risk Factors” section starting on page 5 for additional discussion of the many risks of investment.

The United States Securities and Exchange Commission does not pass upon the merits of or give its approval to any securities offered or the terms of the Offering, nor does it pass upon the accuracy or completeness of any offering circular or other solicitation materials. These securities are offered pursuant to an exemption from registration with the Commission; however, the Commission has not made an independent determination that the securities offered are exempt from registration.

An offering statement pursuant to Regulation A relating to these securities has been filed with the Securities and Exchange Commission. Information contained in this Offering Circular is subject to completion or amendment. These securities may not be sold nor may offers to buy be accepted before the offering statement filed with the Commission is qualified. This Offering Circular shall not constitute an offer to sell or the solicitation of an offer to buy nor may there be any sales of these securities in any state in which such offer, solicitation or sale would be unlawful before registration or qualification under the laws of any such state.

We may elect to satisfy our obligation to deliver a Final Offering Circular by sending you a notice within two business days after the completion of our sale to you that contains the URL where the Final Offering Circular or the offering statement in which such Final Offering Circular was filed may be obtained. EB PREC may limit this Offering or offering amounts in certain states where restrictions may apply to the offering of securities in such state, or where EBPREC has limited the Offering in any particular state for any other reason.

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than 10% of the greater of your annual income or net worth. For more information, see the “Limitations On Amount A Non-accredited Investor Can Invest” section starting on page 23.

Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, we encourage you to review Rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, we encourage you to refer to www.investor.gov.

TABLE OF CONTENTS

SUMMARY OF THE OFFERING

This summary highlights information contained elsewhere in this Offering Circular. This summary is not complete and does not contain all of the information that you should consider before investing in the Shares. You should carefully read this entire document, especially the “Risk Factors” section, which discusses risks associated with investing in the Shares.

Key Things to Know About This Offering

FOR WHOM

This Offering is for any person 18 and older, organization, or business in the United States that commits to the Mission and Points of Unity in EB PREC’s Bylaws.

WHAT

The Cooperative is offering the opportunity to purchase Investor Owner Shares at $1,000 per Share.

WHEN

This is a continuous offering that began October 1st, 2020, will likely continue for up to three years, unless we terminate the Offering sooner or renew the Offering.

USE OF FUNDS

Funds raised will be used to acquire, rehabilitate, build, and steward real estate in the East San Francisco Bay Area of California.

MAXIMUM OFFERING

Under this Offering, EB PREC will sell a maximum of $74,000,000 in Shares (74,000 Shares).

MIN. AND MAX. INVESTMENT AMOUNTS

The minimum investment amount per person is one Share ($1,000) and the maximum is dependent on individual factors described later in this document.

REDEMPTION OF SHARES AND DIVIDENDS

When an Investor Owner requests redemption of Shares, EB PREC’s goal is to repay the principal of the investment, along with dividends on Shares accruing and compounding at a target rate of approximately 1.5% per year. EB PREC may also choose to pay dividends prior to redemption.

LIMIT ON REDEMPTION

Investors may not redeem their Shares until after a minimum of five years, unless the Board makes an exception to this rule.

LIMITED TRANSFERABILITY

Investors may not transfer shares to others. They may only be redeemed with the Cooperative.

ONE MEMBER, ONE VOTE

This is a cooperative, meaning that Owners get only one vote each, regardless of their number of Shares.

GOVERNANCE

The Cooperative is overseen by an eight member Board of Directors, with five Directors elected by certain Owners of the Cooperative, and the remaining three appointed by non-profits representing Black, Indigenous, and People of Color stakeholders of the East Bay where the Cooperative focuses its work.

RISK FACTORS

Fluctuation of property values could create challenges.

RISK

EB PREC seeks to decrease volatility and price in the housing market by permanently taking property off the speculative market. However, as EB PREC grows, the speculative markets will continue to conduct business as usual. If property values rise, EB PREC may be priced out of certain areas, or be forced to commit greater financial resources to maintaining or expanding its holdings. Alternatively, EB PREC’s assets could lose value if surrounding property values decrease. Either of these scenarios could limit future leveraging opportunities or dividends.

MITIGATION EFFORTS

EB PREC will mitigate these risks by:

| ● | Diversifying property types and locations within and around the Alameda County, |

| ● | Seeking to negotiate property acquisitions before the properties are put on the open market, and |

| ● | Advocating for public policies that stabilize markets and make real estate more affordable to organizations like EB PREC. |

Loss of key personnel or collaborators could pose challenges for EB PREC.

RISK

The success of EB PREC depends on the skills, experience, and performance of key Staff, Directors, and collaborators. The Cooperative’s success also depends on its ability to recruit, train, and retain qualified staff.

MITIGATION EFFORTS

Policies and practices that mitigate this risk include:

| ● | Under the Bylaws, EB PREC is mandated to spread power among all types of Owners (Bylaws pp. 7-38). The vision is for EB PREC to grow more decentralized over time, allowing EB PREC to rely less and less on central staff and organizers. |

| ● | Similarly, the Bylaws mandate “a non-hierarchical workplace that distributes power to all workers” (Bylaws p. 29). |

| ● | EB PREC gives careful attention to matters of culture, community-building, and conflict engagement, with the goal of meaningfully attracting and engaging people to work with and lead the work of the Cooperative. |

“The activities of the Cooperative will therefore be spread out among small semi-autonomous groups that will be accountable to the whole. [...] We prioritize decentralized governance because it builds people power, creates resiliency, and fosters a strong sense of community ownership, activating people to protect and steward land in the long-term.”

Bylaws p. 7

Control of EB PREC may change over time.

RISK

EB PREC’s success depends on its being controlled by responsible and accountable parties, so a change in control could create problems. The number and type of Owners will vary over time, changing the power of different types of Owners, including Investor Owners.

MITIGATION EFFORTS

The Bylaws are designed to reduce concentration or stagnation of power, undue influence, and mission drift.

| ● | Every Owner gets only one vote, regardless of the number of Shares they hold. This means that power cannot be bought. |

| ● | The Bylaws contain checks and balances, including provisions for oversight of Staff, and removal of Staff, Directors, and Owners. |

| ● | The mission and vision is safeguarded by Vision Protectors (Bylaws p. 38). All Owners must agree to, and act in a manner consistent with, the Mission and Points of Unity in the Bylaws (pp. 5-6). |

WHO CONTROLS THE BOARD?

| ● | 5 Board seats are elected by Owners. Investor Owners are eligible to vote for only 2 of these seats. |

| ● | 3 Board seats are appointed by local organizations, representing Black, Indigenous, and People of Color stakeholders of the East Bay. |

| ● | See the Section of this Offering Circular titled “Directors, Officers, and Significant Employees”, as well as our Bylaws, (pp. 17-21) for more information about our Board of Directors. |

EB PREC will have limited liquidity.

RISK

Real estate is a relatively illiquid asset, meaning it is not easily converted to cash. Further, the Bylaws intentionally create barriers to liquidating Cooperative assets (see Bylaws pp. 56-57). These factors, combined with commitments to maintain affordability, decommodify land, maintain affordability, decommodify land, pay living wages (Bylaws pp. 41-42) and distributee surplus returns (Bylaws pp. 45-47), mean that EB PREC will typically be “cash poor.” This may impact the Cooperative’s ability to distribute dividends and return principal to Investor Owners.

MITIGATION EFFORTS

EB PREC will mitigate this risk by:

| ● | Keeping some reserves in liquid investments, |

| ● | Developing partnerships with financial institutions that facilitate liquidity, |

| ● | Refinancing properties to access cash when needed, and |

| ● | Giving Investor Owners the option to not to receive dividends. |

Tenants’ economic distress could affect the Cooperative’s financial stability.

RISK

EB PREC is creating permanently affordable real estate and working to reduce displacement. When tenants cannot make required payments to EB PREC, EB PREC plans to seek alternatives to eviction, such as by providing grace periods, offering payment plans, and seeking other creative solutions to support tenants. Many of EB PREC’s target residents are already experiencing economic distress due to systemic discrimination and oppression. Therefore, EB PREC may elect to not use conventional credit histories or other traditional metrics in the selection of tenants, which may increase the risk of non-payment by tenants.

The global COVID-19 pandemic also means that many tenants will lose income. In choosing tenants, we do not plan to discriminate based on their sources of income or line of work as it relates to potential to lose income.

MITIGATION EFFORTS

EB PREC is working to mitigate the above by:

| ● | Building community ties among Owners so that they may provide mutual aid and support one another’s financial success, and |

| ● | Partnering with enterprise incubators and technical assistance providers to help ensure the success of commercial tenants. |

Interest rate fluctuation and inflation could affect the financial stability of EB PREC.

RISK

EB PREC will be impacted by general economic and market conditions, such as fluctuating interest rates, availability of credit, inflation rates, economic uncertainty, and changes in laws.

The rate of return applicable to Investor Owner Shares is capped at 5%. Fluctuations in market interest rates will impact the cost of EB PREC’s debt capital especially should the Cooperative enter into a loan agreement with a floating interest rate. Higher than anticipated interest rates on EB PREC’s debt will have an adverse effect on EB PREC’s ability to redeem Shares at the purchase price or at all, or to declare dividends. Should commercial interest or inflation rates rise, the Cooperative is not legally obligated to pay a higher rate or to redeem Shares prior to their maturity.

EB PREC will have increased administrative demands as a result of this Offering.

RISK

The Cooperative will spend more money on administrative capacity as a result of making this Offering. Under federal securities laws, EB PREC will have to file regular reports with the Securities and Exchange Commission and generally work to keep investors informed.

MITIGATION EFFORTS

EB PREC works to mitigate these costs by:

| ● | Avoiding unnecessary “legalese” and irrelevant boilerplate language in documents, so that EB PREC is not overly reliant on high-cost processionals, and |

| ● | Avoiding unnecessary administrative and bureaucratic procedures. |

| ● | Seeking to teach and engage our staff to manage these processes. |

This is a long-term investment and you can’t transfer your shares to others.

RISK

You should consider an investment in the Cooperative only as a long-term investment. The minimum investment period is 5 years, with only some exceptions allowed by the Board (see Bylaws pages 11 and 51).

Further, when you redeem the Shares, EB PREC may not be able to pay you immediately, but may give you a promissory note for amounts due, payable over up to 5 years (see Bylaws page 48).

In addition, you may not transfer your Shares to others. You may only redeem them with the Cooperative (see Bylaws pages 11, 48, and 51).

Federal and state securities laws also limit the transferability of Shares.

EB PREC may never be able to return your investment or pay dividends.

RISK

EB PREC cannot assure that Investor Owners will gain a substantial return on investment, or any return at all, or that an Investor Owner will not lose a substantial portion or all of the investment.

MITIGATION EFFORTS

To reduce the risk of loss for Investor Owners, we aim to pay for our full operational and staffing costs with grants and donations for the next 2-5 years. This means that a significant portion of proceeds from this Offering will be used to purchase capital assets, which will eventually generate a stream of income.

In addition, by bringing in hundreds or thousands of Investor Owners—many from our East Bay community and other like-minded investors from across the country—we are creating a base of support of people who are financially and emotionally invested in the success of EB PREC. We believe this will help ensure we have a community of support if ever we face challenges. Repaying Investor Owners is an important part of our model, because we are passionate about proving that it’s possible to finance real estate using community-sourced financing, rather than conventional mortgages.

EB PREC could face legal compliance problems or lawsuits.

RISK

The Cooperative must comply with local, state, and federal rules and regulations to continue to offer and sell Shares. The Cooperative believes that it complies with the rules and regulations with which it is required to comply. If the Cooperative fails to comply with a rule or regulation, it may be subject to fines, or other penalties, or its permit or licenses may be lost or suspended. Furthermore, the Cooperative may be subject to lawsuits if it operates in breach of the law, or for any number of reasons arising out of the ownership of property, such as environmental, construction, permitting, and zoning matters. The Cooperative may have to stop operating and its Investor Owners may lose their entire investment.

MITIGATION EFFORTS

To mitigate this risk, the Cooperative has engaged a legal team from the Sustainable Economies Law Center (the “Law Center”) and entered into a pro bono legal services agreement that lasts until the end of 2021, and fiscal sponsorship agreement that lasts until the end of 2022. The Law Center has also contracted for additional support from Gundzik Gundzik Heeger LLP, a law firm with experience in Regulation A compliance.

Ownership of real estate comes with inherent risks.

RISK

We are subject to risks generally attributable to the ownership of real property, including for example:

| ● | changes in global, national, regional or local economic, demographic or capital market conditions; |

| ● | changes in supply of or demand for similar properties in a given market, which could result in rising vacancy rates or decreasing market rental rates; and |

| ● | changes in government rules, regulations and fiscal policies, including increases in property taxes, changes in zoning laws, limitations on rental rates, and increasing costs to comply with environmental laws. |

All of these factors are beyond our control. Any negative changes in these factors could affect the Cooperative’s financial performance and our ability to meet our obligations and make distributions to Investor Owners.

MITIGATION EFFORTS.

We conduct extensive due diligence on our prospective acquisitions, with the help of experienced professionals and advisors, in an effort to identify and plan for major issues that may arise. We also seek to get insurance in amounts and on terms commercially reasonable for each property. In addition, by working closely with Resident Owners, we hope to quickly identify and respond to new issues that may arise after we acquire each property.

EB PREC could terminate the Offering early.

RISK

The Cooperative intends to receive investments on a continuous basis, but also has the right to terminate this Offering at any time, regardless of the amount of capital raised. There is no assurance that other people will invest in this Offering, and there is no obligation for EB PREC to refund investments in the event that the Offering ends early. Terminating early will reduce our capital and ability to acquire properties.

MITIGATION EFFORTS

As its name suggests, East Bay Permanent Real Estate Cooperative is designed to become a permanent asset in our communities. By building a base of hundreds of members and supporters, EB PREC seeks to grow from a solid foundation, raising capital continuously and removing hundreds or even thousands of properties from the speculative market over time. Selling Shares to Investor Owners provides EB PREC with low-cost financing which is essential to creating permanently affordable housing. As such, it is unlikely that EB PREC would terminate this Offering early.

EB PREC may not raise sufficient financing.

RISK

The Shares are being offered by the Cooperative on a “Best Efforts” basis. This means that no one has committed to underwrite or otherwise buy any Shares in advance of this Offering. If less than $2 million is raised over the 3 years of this Offering starting in October 2020, the Cooperative’s business plans and prospects for the coming years could be adversely affected or may need to be revised accordingly.

The Cooperative can provide no assurance that this Offering will raise substantial financing. Further, the Cooperative may be unable to secure additional loans or grant funding at the level shown in its projections or at all.

MITIGATION EFFORTS

Our fundraising progress to date has proceeded apace to expectations. We’ve raised over $750,000 dollars through the sale of Shares since the launch of the Cooperative in spite of, among other things, the impact of the COVID-19 pandemic and limited rollout of our marketing efforts. We anticipate reaching $1 million raised by Q1 2022.

As described later in this document, EB PREC is contemplating multiple property acquisitions ranging from low-cost to high-cost, meaning that EB PREC has the flexibility to focus on different acquisitions depending on the amount raised in this Offering. Regardless of the amount raised, it is likely that funds will be deployed for one or more acquisitions, which will eventually generate income for EB PREC.

Our Staff Owners are human.

RISK

Our Staff Owners serve as stewards of the Cooperative, overseen by our Board of Directors. And all of Staff Owners, employees and Directors are committed to our mission. However, we are all human. We will make decisions and seek to guide the Cooperative in a way that we believe will best serve our mission and stakeholders, but it is possible (and expected!) that we will make mistakes from time to time. Management will have significant flexibility in applying the net proceeds of this Offering within the scope of the business of the Cooperative. The failure of management to apply such funds effectively could have a material adverse effect on the Cooperative’s business and financial condition.

MITIGATION

We seek to mitigate this risk through education, mutual support, and accountability. We continue to grow and train our management team, as well hire and seek mentorship from experienced professionals to advise us in areas such as real estate, law, accounting, and environmental matters. Further, our Board continues to guide the Cooperative towards non-hierarchical decision-making: by meaningfully engaging more individuals in Cooperative decisions, we hope to take full advantage of our collective knowledge, perspective, attention, and expertise. Finally, we have instituted a series of checks and balances between and among our Staff Owners, our Board, and our Members, so that we can hold each other accountable in a manner that is transparent, compassionate, and encouraging, rather than punitive.

Investors may have unforeseen tax consequences.

RISK

Shares purchased are investments and not donations. Investors will not receive a charitable tax deduction for purchasing Shares.

Dividends earned on the Shares will likely be taxable to the Investor, regardless of whether they are paid by check or reinvested in the Cooperative.

The Cooperative and its officers, Directors, and any other professional advisors do not provide advice or information about any tax consequences of any investment in the Cooperative. Each prospective Investor Owner should seek tax advice from their own advisors about the tax consequences of an investment in the Cooperative.

This document contains forward-looking statements and financial projections, and they could be totally wrong.

RISK

Financial projections provided in this document and elsewhere are based upon assumptions that the management of the Cooperative believes to be reasonable. However, given all of the risks summarized above and other unpredictable factors impacting the Cooperative, the projections should be viewed merely as financial possibilities and not as a prediction or guarantee of future performance.

Specifically, this document contains forward-looking statements (a term defined in Section 27A of the Securities Act), which tend to include words like “believe,” “may,” “will,” “could,” “would,” “plan,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “hope,” or the negative or plural of these words or similar expressions. With these statements, we aim to project our revenues, income or loss, capital expenditures, business relationships, financing, property acquisitions, and plans for future operations to help you understand our business plan. But such statements are based upon management’s current expectations, beliefs, and assumptions about future events, and therefore involve a number of risks and uncertainties. As a result, you should not rely upon forward-looking statements as predictions of future events.

Except as required by law, neither the Cooperative nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The Cooperative undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this Offering Circular to conform these statements to actual results or to changes in its expectations.

You should read this Offering Circular and all related documents with the understanding that the Cooperative’s actual future results, performance, events, and circumstances may be very different from what the Cooperative expects.

Dilution

When EB PREC sells more Investor Owners shares, or when EB PREC brings in Resident Owners, Community Owners, Staff Owners, or additional Investor Owners, there is likely no immediate impact on the financial rights of each Investor Owner. However, various factors could result in a reduction of financial return for Investor Owners. The number of Investor Owner Shares sold could impact the financial strength or weakness of EB PREC overall, which could either positively or negatively impact the likelihood that an Investor Owner will be able to redeem their shares and receive dividends in full. Further, when EB PREC has any financial obligations to certain creditors or Resident Owners, payments to those creditors and Resident Owners will be prioritized and paid first, before the Cooperative pays its obligations to Investor Owners. Further, the Board of Directors has the discretion to reduce payments on all outstanding Investor Owner Shares and on promissory notes held by former Investor Owners if the Board believes that full payment would threaten the financial health of the Cooperative. (See Bylaws pages 48, 51, and 53.) As such, when an Investor Owner redeems their share, when they exchange a share for a promissory note, or when they receive payments on liquidation of the Cooperative, it is possible that they will receive less money than expected.

ABOUT THE COOPERATIVE: Description of Business and Activities

East Bay Permanent Real Estate Cooperative, Inc. is a California Cooperative Corporation. In this document, we also refer to it as “East Bay Permanent Real Estate Cooperative” or “EB PREC” and the terms “we,” “us,” “our,” “Cooperative,” “management,” or similar terms.

Mission and Background

East Bay Permanent Real Estate Cooperative’s mission is to facilitate Black, Indigenous, People of Color, and allied communities to cooperatively organize, finance, purchase, occupy, and steward properties, taking them permanently off the speculative market, creating community controlled assets, and empowering our communities to cooperatively lead a just transition from an extractive capitalist system into one where communities are ecologically, emotionally, spiritually, culturally, and economically restorative and regenerative.

We were formed in recognition that the Bay Area’s vibrant, diverse communities are rapidly being displaced. In 1980, Black people were by far the largest ethnic group in Oakland, accounting for 46% of Oakland’s population1. By 2015, the Black population had fallen to 25.4%, now the 3rd largest demographic, following White (26.9%) and Hispanic (26.1%).2 Similar stories are unfolding across the country. We believe the only way to disrupt this pattern is to center communities of color in leading a just transition that conserves cultural assets and permanently protects land from speculative markets.

Approach

We’ve created an approach to stabilizing and preserving the heritage of our community through a participatory model of real estate acquisition and neighborhood development. Our model of real estate development is grassroots-led, rather than top-down. EB PREC engages everyday people in organizing, financing, acquiring, and stewarding land and housing.

EB PREC’s staff supports and provides technical and financial assistance to groups of community members who coalesce around the acquisition of properties, including homes, multi-unit buildings, land, cultural spaces, and commercial properties. The group (referred to by EB PREC as an “owner group” or “organizing group”) then organizes neighbors and other community members to support the project by becoming Owners of EB PREC. Financing from the sale of Investor Owner Shares will often be combined with other forms of financing like loans from community banks or credit unions, to enable EB PREC to purchase the property.

EB PREC then acquires title, permanently protecting the property from the speculative market, while over time delegating the governance of the property to small democratic groups of residents. EB PREC collaborates with residents to set rents – not for the purpose of generating profit – but with the goal of keeping real estate affordable by operating at-cost and returning surplus to residents. The rents are calculated with the goal of covering the financing, acquisition, and operational costs of each project. These residents also become resident owners of the Cooperative, giving them the right to vote and other matters on a one member, one vote basis. One Director is elected exclusively by Resident Owners to ensure representation on our Board of Directors.

Primary Activity

EB PREC’s primary business activity is to buy, rehabilitate, steward, and manage real estate, while sustaining EB PREC’s operations with rental income from the properties. EB PREC’s unique model of development engages community members and local organizations in the visioning and planning process for each property, meaning that each property has a group of people personally “invested” in the success of the project.

While the real estate market is cyclical and can be unpredictable, EB PREC is uniquely situated to reduce risk in our portfolio over time for various reasons.

| ● | By co-managing our properties with EB PREC’s resident-owners, we are likely to have lower turnover, better property upkeep, and be able to better anticipate and proactively address problems through active communication and relationship building with residents. |

1 https://www.sfgate.com/bayarea/article/25-drop-in-African-American-population-in-Oakland-2471925.php

2 http://www2.oaklandnet.com/oakca1/groups/ceda/documents/agenda/oak069022.pdf

| ● | The Cooperative is building strong relationships with local community land trusts, affordable housing developers, attorneys, and housing rights organizations. These partnerships will help us access skills, professional expertise, financing, and economies of scale. |

Secondary Activities

EB PREC has taken on secondary business activities, most emerging from the deep connections EB PREC has built with local government, community members, and organizations, in order to carry out its mission. EB PREC’s secondary activities include:

EDUCATION

EB PREC has contracted with and been paid by both Law Center and Northern California Land Trust (NCLT) to develop educational curriculum, classes, and events related to community stewardship of land and housing. For example, NCLT has hired EB PREC to develop and host a resident training program for the Co-op 789 real estate project described elsewhere in this document. The City of Oakland has also hired EB PREC to manage the anti-displacement outreach, education, and organizing portion of the $28,000,000 Transformative Climate Communities (TCC) “Better Neighborhoods, Same Neighbors” grant they received from the Strategic Growth Council.

COMMUNITY EVENTS

EB PREC hosts many community gatherings, discussions, book clubs, and other events (all happening online since the onset of the pandemic). These community events create a small income stream to the Cooperative, because they grow the number of EB PREC’s Community Owners, who, upon joining, make regular financial contributions to EB PREC.

PUBLIC SPEAKING

EB PREC has received a small stream of earned income in the form of fees and honorariums for public speaking events.

TECHNICAL ASSISTANCE AND CONSULTING

Staff of EB PREC are providing or have provided in depth technical assistance to local organizations with similar or overlapping goals, including the East Oakland Grocery Cooperative, Oakland’s Black Cultural Zone, and Alena Museum. In addition, EB PREC staff have done paid consultations with groups throughout the continent, such as a real estate project in Montreal seeking to model itself off EB PREC, a consultation in Jackson Mississippi with New West Jackson Cooperative, and an upcoming consultant role with the Local Initiatives Support Corporation (LISC), a Community Development Financial Institution to organize a West Oakland equitable development advisory committee. EB PREC has also consulted with the City of Oakland as the City develops a program to support low income homeowners to obtain loans and navigate the permit and construction process in order to create more affordable housing stock in Oakland.

COALITION-BUILDING

EB PREC staff is active in many local and regional housing justice organizations and coalitions, including Right to the City, Homes for All CA, the People’s Land and Housing Alliance, and the Oakland Property Acquisition Collaborative. To date, much of this work has been unpaid, and although this requires the time and capacity of our staff and organizers, we continue to believe that it is an important use of these resources. In the future, we may receive compensation for some of this coalition-building work.

Staffing and Support

CURRENT STAFFING AND SUPPORT

As of August 2021 6 individuals worked full time on projects for the Cooperative, and an additional 8 worked part time on EB PREC initiatives. The Cooperative directly employs 5 full-time employees and 1 part-time employee, and regularly engages 1 part-time contractor. In addition, the Law Center employs 6 people who work part-time to support with EB PREC’s development and legal needs, in addition to Noni Session, who is employed full-time to support the work of EB PREC and related education and organizing, under a project fiscally sponsored by the Law Center, called Collective Action and Land Liberation Institute. The details of the Law Center’s commitments to EB PREC are provided in the attached Legal Services Agreement and Incubation and Technical Support Agreement.

HIRING PLANS

EB PREC is in the process of hiring three new staff members to carry out the work of the Transformative Climate Communities (TCC) “Better Neighborhoods, Same Neighbors” grant, and is considering hiring more staff and/or contractors in the second half of 2021, to expand our communications and organizing team, and support upcoming projects like Esther’s Orbit Room.

What is Unique About EB PREC’s Corporate Structure?

EB PREC is a California Cooperative Corporation, which is described in the California Corporations Code sections 12200-12704. According to section 12201 of the Code, “such corporations are democratically controlled and are not organized to make a profit for themselves, as such, or for their members, as such, but primarily for their members as patrons.” As such, Investor Owners should not view the purchase of Investor Owner Shares as an opportunity to profit in the way that investors in conventional stock corporations might. Rather, Investor Owners are providing low-cost capital to support the work EB PREC does for the community, staff, and residents.

Structure and Governance

EB PREC has a unique legal, governance, and financial structure that is best understood by reading our cartoon Bylaws, attached to this document. We have written these Bylaws with the goal that all Owners read, understand, and feel empowered by our structure.

Unlike a conventional housing cooperative, which is formed to provide housing to a defined group of residents, EB PREC could be described as a “movement cooperative,” because it is designed not only to provide housing and affordable real estate, but also to build a large membership base and serve members’ collective goal to transform our neighborhoods and our systems for land ownership.

To this end, EB PREC has 4 categories (or “classes”) of Owners (or “members”), each with different rights, qualifications, responsibilities, and ways of participating in EB PREC:

The securities being sold through this Offering enable people to become Investor Owners. To understand the role of Investor Owners in relation to other Owner categories, please read our Bylaws.

HISTORY AND DEVELOPMENT OF THE COOPERATIVE

The East Bay Permanent Real Estate Cooperative was incorporated in 2017 after nearly one year of meetings and planning by the People of Color Sustainable Housing Network (“POCSHN") and the Sustainable Economies Law Center (the “Law Center”). This section provides a timeline of its development and evolution.

2016: Visioning and Planning

Growth of People of Color Sustainable Housing Network (POCSHN): POCSHN was founded in 2015 and, by early 2016, had grown into a network of more than 1,000 community members who joined a MeetUp group, attended events, and/or subscribed to the group’s newsletter. Among other things, this group sought to learn about models of collective land ownership that could combat displacement of people of color in the East Bay.

Development of the “permanent real estate cooperative” model by the Law Center: The Law Center, founded in 2009, had, by 2016, become frustrated with the practical and legal limitations of current models for development of affordable housing. Law Center staff drafted a concept piece proposing a new model called the “permanent real estate cooperative.”

Joint monthly planning meetings: After POCSHN attended one of the Law Center’s legal clinics, the two organizations began in April 2016 to meet monthly to plan the formation of a permanent real estate cooperative, gathering feedback from POCSHN members and refining the envisioned legal and financial structure.

2017: Incorporation and Development

Incorporation and Board: EB PREC was incorporated as a California Cooperative Corporation on February 27, 2017, simple Bylaws were adopted, and a 3-member Board of Directors (Marissa Ashkar, Lina Buffington, and David Jaber) was appointed to steward EB PREC’s development.

Community meetings and working groups: Twice per month from July to December, 2017, EB PREC hosted public meetings to gather feedback from community members on topics such as mission, vision, values, property selection, fundraising, and governance. Small working groups were formed and met separately on topics such as governance, finances, education, and partnerships.

Grants and support staff: Two grants secured by the Law Center (from Full Circle Fund and Christensen Fund) enabled EB PREC to pay stipends to two individuals, Marissa Ashkar and Lina Buffington, to carry out work that included event planning, communications, and administration.

2018: Staffing, Funding, and Launch

Staff Collective: From the working groups formed in 2017, a group of four core leaders emerged (Marissa Ashkar, Noni Session, Ojan Mobedshahi, and Shira Shaham), and in early 2018, the Board formally appointed all four to comprise EB PREC’s first staff collective, along with Gregory Jackson, a staff member of the Law Center.

Loan and donations: In a competitive process, EB PREC was chosen in early 2018 as a recipient of a $100,000 loan accompanied by technical assistance from the Force for Good Fund/LIFT Economy. EB PREC and the Law Center also obtained $11,000 in other donations to support EB PREC’s staffing and operations. The Law Center received a competitive $25,000 Cooperative Innovation Award from Capital Impact Partners for the incubation of the EB PREC. The Law Center paid the full award to EB PREC to support staffing and operations.

Structure: EB PREC staff worked closely with the Law Center and consultants from LIFT Economy to refine EB PREC’s legal, governance, operational, and financial structures, adopting comprehensive graphic governing documents, called our Bylaws, in December of 2018. A copy of our Bylaws, as amended, are attached to this Offering Circular as an Exhibit.

Launch and first 80 members: On December 5, 2018, EB PREC held a launch event and had our first 80 members pledge their commitments to EB PREC. By December 17, 2018, EB PREC accepted payment from both Investor Owners (those purchasing $1,000 Investor Owner Shares) and Community Owners (those making donations of $10 per week, month, or year).

Project planning: In late 2018, EB PREC began meeting and forming partnerships with two local land trusts to plan its first two real estate projects.

2019: Projects and Funding

Real estate projects: Throughout 2019, EB PREC organized with community members to explore more than a dozen potential properties, one of which, Co-op 789, was acquired in partnership with NCLT in May 2019. Significant current and planned real estate projects are described later in this document.

Education, events, and relationships: Throughout 2019, EB PREC staff attended dozens of meetings per week, spoke at conferences, held workshops, discussions, and other events to build community and orient and engage Owners, and deepened relationships with many local residents and organizations.

Membership and financing: By the end of 2019, EB PREC’s membership had grown to 70 Community Owners and 153 Investor Owners, 4 of whom invested a cumulative additional $64,000 (in addition to their initial $1,000 Shares) through a California-only private offering in the fall of 2019. This private offering also included a $25,000 loan from another Owner. Some Investor Owners have set up payment plans to purchase their share in installments, and have not yet purchased their shares in full. In sum, EB PREC raised $200,300 in capital from Owners in 2019.

Grants and donations: EB PREC partnered with the Law Center to secure a handful of grants, including from Solidaire, Chan Zuckerberg Initiative, Chrysalis Fund, Roddenberry Foundation, and Threshold. EB PREC received a direct grant from the Center for Cultural Innovation.

Capacity building: In 2019, EB PREC brought in 3 new staff members and had its first summer intern, and onboarded two Directors appointed by the East Oakland Collective and Sogorea Te Land Trust to ensure Indigenous and Black representation and wisdom on the Board. EB PREC was invited to join various coalitions including Homes 4 All and the People’s Land and Housing Alliance, deepening our roots in the organizing community. EB PREC worked with LIFT Economy and Fortify Community Health to end the year with a strategic planning retreat.

2020: New Projects, Growth, and Collaborations

Completion of first independent property acquisition: In May of 2020, EB PREC received a donation of a 4-bedroom home in Berkeley, which we refer to as the Prince Street Project, described further below.

New real estate projects: Having partnered with other local organizations, EB PREC initiated several new real estate projects, described below in the Description of Properties and Real Estate in Development. One project, not described below, was a majority Black cooperative triplex in Oakland known as “Chateau L’Orange,” for which EB PREC was approved to receive an affordable housing subsidy from the City of Oakland, through Measure KK. While the seller ultimately withdrew from the deal and the project fell through, the process laid significant groundwork for further collaboration with the City of Oakland, as described below.

In January of 2020 EB PREC staff officially took on Esther’s Orbit Room as a “Project”, meaning our staff dedicated substantial time into developing an acquisition and development plan. Despite the COVID-19 pandemic, by December 2020 we had managed two site visits with an architect and City of Oakland allies, were in underwriting for two loans, and in negotiations with the seller.

Work with the City of Oakland on three initiatives:

| ● | Transformative Climate Communities (TCC): EB PREC partnered with the City and various other community groups, including the Black Cultural Zone, Planting Justice, Scraper Bikes, and more, to apply for a $28 million dollar joint grant to support various programs in East Oakland. The grant was awarded to the City of Oakland and includes up to $786,000 over 4 years for EB PREC to do displacement avoidance organizing in East Oakland. |

| ● | ADU Kitchen Table: EB PREC was invited by the City of Oakland to sit on a “Kitchen Table” committee that helped review applicants and selected a contractor who to represent the needs of the community in an City of Oakland RFP process to develop an affordable housing ADU program. |

| ● | Measure KK: EB PREC is making strides toward receiving public funding for our projects. The Cooperative applied for funds under Measure KK, Oakland’s affordable housing bond, in January of 2020. There were challenges since the City is used to working with nonprofits, not cooperatives, but through a series of collaborative conversations with city staff to educate them on EB PREC’s model, the City ensured that EB PREC was and is able to apply for such funding, and has hired the Urban Homesteading Assistance Board to consult with them so that they can better learn to serve housing cooperatives. |

Community engagement and education:

| ● | Online community engagement: When government-mandated Shelter-in-Place began in the Bay Area in response to the COVID-19 pandemic, EB PREC moved its community engagement online. We convened a series of online scenario planning calls with the community to help craft EB PREC’s response to COVID-19, rising unemployment, and a potential recession. These calls opened up direct and regular dialogue with our Owners to help adjust our strategy to meet the needs on the ground, and help build out the vision, strategy, and tactics for our community-led property acquisitions. |

| ● | Building cultural centers: EB PREC continued working with cultural anchors in East and West Oakland, Black Cultural Zone and Alena Museum, respectively. In partnership with these arts anchors, and funding from the Center for Cultural Innovation, EB PREC developed a fellowship program to support each of these organizations both internally with their governance structures and operations, and externally on the pathway to property acquisition with financial modeling and feasibility, site analysis, financing, and more. |

| ● | Resident education: In collaboration with Northern California Land Trust (NCLT), EB PREC led resident education workshops for Co-op 789, a project we are developing with NCLT. Workshops have covered a range of topics, including Intro to Co-ops, Bookkeeping and Accounting for Co-ops, Resident Selection, Community Agreements, and more. This educational series is laying the groundwork for training to be offered to future Resident Owners. |

This Direct Public Offering: On September 29, 2020, the SEC formally qualified this Offering of Investor Owner Shares by EB PREC directly to investors across the United States, pursuant to the terms of Reg A+ Tier 2. In order to maximize our capacity to benefit from this opportunity, EB PREC hired an Investment and Fundraising Director, Annie McShiras, and began planning for a public campaign to bring in funds through this Offering.

2021: Esther’s Orbit Room, Capital Campaign, and Organizational Growth

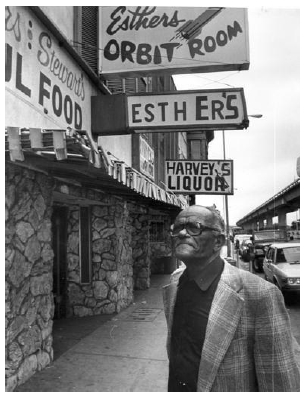

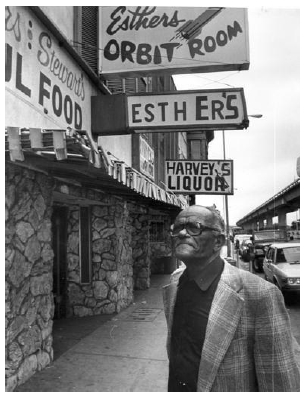

Esther’s Orbit Room: In April of 2021 EB PREC entered into an option agreement giving EB PREC the right to acquire Esther’s Orbit Room and adjacent properties (1720-1724 7th st, and 1715 Goss st, in West Oakland), collectively Esther’s Orbit Room Cultural Revival Project., a 9,000+sq ft mixed-use historic venue, bar, cafe, gallery, and residential units in West Oakland. The option agreement (shown in Exhibit 6.k) provided EB PREC 3 months to acquire the property at the purchase price of $1,500,000, with the right to extend the option for an additional 3 months. EB PREC has exercised the right to extend the option and now has until the end of September 2021 to exercise the option and purchase the property.

The underwriting that we began in the Fall of 2020 led to a $1,400,000 Program Related Investment (PRI) approved in January 2021 by the San Francisco Foundation to help fund project construction costs, in addition to securing a $1,700,000 acquisition loan from the Restorative Economies Fund, via Impact Assets. EB PREC has conducted extensive due diligence on the project since April 2021, including Building Inspections, Phase I and Phase II Environmental Inspections, Seismic Risk Analyses, a Feasibility Study, and more. Our acquisition lender has reviewed and approved of the due diligence we have provided, and is preparing to close escrow on August 31st 2021, at which point EB PREC will wholly own the property. The property needs substantial rehabilitation, but includes a vacant parcel of approximately 2,000 sqft, on which EB PREC will be able to gather with our members and other community members and vision the future of the space together on site. This will be EB PREC’s largest project to date. More information on the project can be found at ebprec.org/esthers.

Capital Campaign: EB PREC staff have worked diligently to plan and launch a capital campaign in connection with this Offering, and raise money for upcoming projects including the acquisition of Esther’s Orbit Room. As of 7/30/2021 EB PREC has raised $242,625 in grants and donations for Esther's Orbit Room, and has cumulatively raised over $750,000 from Investor Owners since the Cooperative’s founding. EB PREC also received a $100,000 recoverable grant from LISC, which we are treating as a loan, because it needs to be paid back if the property is successfully acquired, and we do plan to acquire the property. We invested significant staff time from our Communications team to spread the word about our capital campaign. From May 2021-July 2021, we conducted an 8-week marketing campaign to increase visibility for Esther’s Orbit Room and this Offering. Our marketing efforts for the campaign have since slowed down, but we continue to accept investments, and will likely launch Phase 2 of the campaign after we complete the acquisition of Esther’s Orbit Room.

Resident Owners: EB PREC welcomed its first official Resident Owners into the Cooperative on January 1st, 2021. After doing minor rehabilitation of the Prince Street Project, EB PREC conducted interviews and selected a group of resident owners to move into Prince St. In November and December EB PREC and staff from the Law Center engaged with residents to craft our first Resident Owner Share Agreements (parallel document to a Lease Agreement for our Resident Owners). These provide the basis for cooperation and how residents can meet the needs of the property and one another. Our hope is that by the end of 2021 we will enter “Phase 2” of resident ownership, where we can cooperatively revise the Share Agreements to provide for surplus refunds to resident owners, and increased property management responsibilities. Cooperation and participatory management of properties takes time, and we’re doing our best to move at the pace of community, as we pilot the radical vision of the Cooperative.

Hiring for the TCC “Better Neighborhoods, Same Neighbors” grant: EB PREC has been in a hiring process for most of 2021. We have three positions to fill for this project. As of July 2021we have made offers to two candidates who both accepted, and will be starting in August. This has put us slightly behind schedule, but other project partners have experienced similar challenges with hiring, and we believe we can catch up with the schedule and grant deliverables. We are still in the process of hiring one more community organizer to fill the team.

Juneteenth Celebration/Open Member Meeting: In June 2021 EB PREC held its first in-person event in over a year! This outdoor celebration at Liberation Park (managed by the Black Cultural Zone) was a fun and engaging way to reconnect with members, meet new community, review our history and envision our future together. It was a celebratory land liberation event with delicious food and dancing along with the chance to update our members on the Cooperative’s progress.

More funding for Co-op 789: While Co-op 789 received a $600,000 subsidy from the City of Oakland in 2019, in 2020 the city doubled the funding for which Co-op 789 was eligible under the same program. Thus, in January 2021 NCLT and EB PREC applied again for another $600,000 in funding for the project. This funding was awarded to the project, and NCLT and EB PREC are working with the city and their consultants from UHAB to refine the loan documents so that EB PREC can purchase the property from NCLT in the coming years, while maintaining the subsidies.

Subsidized investor ownership: EB PREC has begun to deploy funds received from two grants from the Center for Cultural Innovation to subsidize investor ownership for BIPOC community members from East and West Oakland. The Shares we are offering are no different from any other Shares, but this grant subsidizes between 50% and 100% of the share price. Prospective Investor Owners must apply for these subsidies, and those who receive Shares supported by subsidies will have all the same rights as other Investor Owners. The $65,000 available for subsidies will be allocated on an ongoing basis until exhausted, or if more funds are acquired for this purpose. Right now community members can apply in person at certain events, or online.

Board Updates: In the spring of 2021 EB PREC held elections and received appointments for certain board seats. Shira Shaham was re-elected by EB PREC’s staff owners as Staff Director and Board secretary, and Ellen Sebastian-Chang was elected by EB PREC’s resident owners as our first Resident Director. Both Pat St. Onge and Candice Elder were reappointed as Directors by the Sogorea Te Land Trust and the East Oakland Collective, respectively. The remaining vacant board seat, the Community Director, is scheduled to be filled next year, and will be chosen by EB PREC’s Community Owners. Biographies of all current Directors are below.

DESCRIPTION OF PROPERTIES AND REAL ESTATE PROJECTS IN DEVELOPMENT

Property Owned by EB PREC: Prince Street Project

| In May of 2020, EB PREC received a donation of a 4-bedroom single family home and dance studio in Berkeley, CA, with an appraised value of $1,175,000. The donor, who is in her 80s, has retained a life lease on one of the home’s bedrooms, allowing EB PREC to lease out the other three bedrooms and make the dance studio available. In 2020 EB PREC performed safety upgrades and remodeled the kitchen, and our first group of official resident owners moved in January 1st, 2021. | |  |

In Development: Co-op 789

| EB PREC organized with tenants and partnered with Northern California Land Trust (NCLT) to have NCLT purchase and co-steward with EB PREC a fully occupied 3,880 sq ft 4-unit residential building in North Oakland, for $1.3 million. The financing includes a $600,000 loan from the City of Oakland for affordable housing from Measure KK. EB PREC, NCLT, and the property residents came together with the shared goal of transferring the property to EB PREC ownership within three years. EB PREC has raised $200,000 to fund necessary rehabilitation, and plans to lend these funds to NCLT, while providing construction management and engaging residents in a co-op training program, eventually purchasing the property from NCLT. Because of COVID-19 and challenges getting the property to positive cash flow, NCLT was unable to get city approval to borrow the funds raised from EB PREC to do the rehab. Instead, EB PREC and NCLT applied and were awarded another round of Measure KK funding, for which the maximum limit had been increased. The loan documents are still in process, but we should soon receive the funding, and determine whether or not NCLT still needs the loan in order to do the rehab, or if EB PREC should repurpose the funds for other projects. The city of Oakland has hired UHAB, a cooperative consulting company from New York, to help them update their loan documents to better work with cooperatives, to eventually facilitate the transfer of the property from NCLT to EB PREC. | |  |

In Development: West Oakland 7th Street Cooperative Cultural Corridor / Uwazi Commons

Through a series of community meetings dubbed “Black Economics Salons,” EB PREC and community members developed the concept of the 7th St. Cooperative Cultural Corridor, aka Uwazi Commons, to ground our work along the historic West Oakland 7th Street. The vision is for Uwazi Commons to be an intergenerational space weaving in Afro diasporic food, retail, arts, and learning. Its mission is to keep Oakland artists & artist-preneurs in Oakland while building quality of life and community strength through shared space, culture, innovation, and economic solidarity.

In Development: Esther’s Orbit Room Cultural Revival Project

| As our first step in actualizing the 7th Street Cooperative Cultural Corridor, EB PREC is planning to purchase Esther’s Orbit Room, which was one of the great blues and jazz clubs in West Oakland, and neighboring properties (1720-1724 7th st, and 1715 Goss st). Abandoned for almost a decade, this culturally historic property with a music venue, bar, and restaurant, the historic Singer's Arcade and Coffee Shop, three residential units on the second floor, with a total of 7 bedrooms, and an adjacent lot for parking and deliveries, is now ripe for revitalization. By purchasing this property, redesigning and rehabbing the spaces in collaboration with local partners, working with local organizations to incubate artistic enterprises to fill the space, organizing a historic 7th Street Merchants Association, and cooperatively housing and creating permanent affordable ownership for 7-10 local artists, EB PREC will ground a landscape-shifting and sustaining Black arts community business into the rapidly changing landscape of West and Downtown Oakland. Through community-driven development, Esther's Orbit Room will become a cultural and economic resource for Oakland and the Black arts community for generations to come. EB PREC has secured a $1.7MM loan from the Restorative Economies Fund to acquire the property. EB PREC has also secured a $1.4MM loan from the San Francisco Foundation to fund some of the construction, and is raising the remainder of the construction costs through grants and selling Shares. Please see above for our Capital Campaign progress to-date. |

In Development: The DEEP Grocery Cooperative

The DEEP Grocery Cooperative (the “DEEP”) is an emerging cooperative of BIPOC East Oakland residents who are developing a buying club and cooperatively-owned grocery store in the “Deep East” of Oakland, in order to serve the community and build an oasis in what is currently a food desert. The founding cohort of worker owners at the DEEP have prioritized property acquisition as a core component of their work to ensure stability and security for their cooperative and the community. EB PREC is supporting the DEEP as an emerging enterprise with technical assistance in financial planning, business planning, and a property search as the cohort develops their vision for the permanent location. The DEEP is currently online and doing pop-up locations. They are planning to set up a temporary physical store in 2022, with a property acquisition for a permanent “brick and mortar” store in the next few years.

Other Partners and Owner Groups:

EB PREC is always engaging with groups of owners and community partners to investigate “leads” to find projects that EB PREC might be able to support that align with our mission and benefit our community. Many of these projects come and go quickly because they sell quickly, or are not a good fit for EB PREC for various reasons. We do not yet have the capacity to dedicate resources to all the projects that arise, even those that are mission-aligned.

EB PREC also works with mission aligned organizations like The Village, with whom we have been exploring opportunities on and off for months, and the Black Cultural Zone, which is attempting to acquire Liberation Park through the surplus lands act, and EB PREC has signed on as a partner to support with cooperative development at the site.

USE OF FUNDS TO BE RAISED

Intended use of funds: Funds raised through this Offering are intended to be used, regardless of the amount raised, to purchase, develop, build, rehabilitate, manage, and permanently preserve the affordability of real estate. Although we do not plan to use funds raised through this Offering on our secondary activities (as described above) we do not maintain separate bank accounts for these proceeds.

The specific projects to which these funds will be applied will depend on many factors, including the timing of each project’s development and fluctuations in the real estate market. Some of the possible real estate projects are described in the section called Description of Properties and Real Estate Projects In Development, and some of the acquisitions will emerge throughout the course of the coming months and years. The Cooperative will determine what property to purchase on a case-by-case basis. Properties may include:

| ● | Accessory dwelling units (ADUs) |

| ● | Community, cultural, and commercial spaces |

Combination with other financing: The funds will likely be combined with other forms of property acquisition financing, such as loans from foundations, credit unions, community banks, and community development financial institutions; as well as public funding such as municipal bonds or state/federal grants and loans For example, funds raised through this Offering may be used to make a down payment for a property, while the rest of the purchase price may be financed by a credit union loan.

Right to change the use of funds: While the intention is to spend proceeds of this Offering on real estate, as described above, the Cooperative reserves the right to change the use of proceeds as needed in response to unforeseen circumstances, which may include using some of the proceeds to fund operations or to compensate staff, directors, and officers for their labor.

SECURITIES BEING OFFERED

The Cooperative is offering Investor Owner Shares at $1,000 per share. This section describes additional details about what it means to buy Investor Owners Shares.

Dividends

The Cooperative aims to return dividends at a target rate of 1.5% per year, which will likely be accumulated and compounded annually, then paid out every three to five years. Dividends on these Shares are capped at 5% a year. When dividends are declared or distributed, the Cooperative will issue to Investors an IRS Form 1099-DIV, reflecting all dividends earned, provided that the Investor earns $10 or more in annual dividends. EB PREC will also report the dividends to the IRS.

At the time of purchase, Investor Owners will have the option to waive their right to receive dividends, in the interest of further reducing the cost of real estate for our communities.

Since founding, the Cooperative has not yet declared or paid any dividends.

Voting

Being an Investor Owner, regardless of the number of Shares owned, entitles the Investor Owner to only one vote on any matter Investor Owners are eligible to vote on, as laid out in the Bylaws. Investor Owners have the right to participate in member meetings, and in electing the board President and Treasurer, but do not have a say in the election or appointment of the majority of the Directors. Board members serve two-year terms, and terms are staggered, with elections and appointments for certain seats happening each year, as laid out in the Bylaws.

Shares may not be transferred

Investor Owners may not transfer their Shares to others. Shares may only be redeemed with the Cooperative.

Redemption of Investor Owner Share.

Investor Owners must hold their Shares for 5 years before they become eligible for redemption.

Upon redemption, the Cooperative aims to return the full share purchase price ($1,000 per share), plus any dividends that have accrued but have not yet been distributed to the Investor Owners. However, while the intention is to pay all Investor Owners the full share price along with accrued dividends, the Board may decide that the redemption value of Shares to all Investor Owners will be reduced, depending on the financial health of the Cooperative. Investor Owner Shares are a form of equity in the Cooperative; therefore, equity shares are at risk of being lost.

The Cooperative may pay the full amount due immediately, or pay only part of it, converting any unpaid amount to a promissory note payable to the former Owner in installments. After one year, any unpaid amounts shall begin to accrue and annually compound interest at a rate of 1.5% per year. The Cooperative will make reasonable efforts to pay all of these notes within 1 year, but may extend note terms up to 5 years in the event that payment of the note would leave the Cooperative unable to meet its other financial obligations. The term of the promissory note may not exceed 5 years without consent from the Owner. A promissory note to a former Investor Owner shall also provide that if all current Investor Owners receive a reduction in redemption value of their Investor Owner Shares, the Board may choose to apply a proportionate reduction to all outstanding promissory notes of former Investor Owners.

As the Cooperative was only incorporated in 2017, no Investor Owners Shares have yet become eligible for redemption. The Cooperative may choose to adopt additional procedures and processes around the redemption of Shares for administrative purposes and efficiencies.

Investor Owner Rights if the Cooperative Liquidates

In the event that the Cooperative liquidates, Investor Owner Shares will be redeemed only after the Cooperative first pays off its debts and liabilities and its Resident Owner account balances, and redeems its Resident Owner Shares. Remaining funds, if any, will be used to redeem Investor Owner Shares. If funds are not available for full redemption of all Investor Owner Shares, then payments shall be reduced proportionally for each Investor Owner Share. If there are any other account balances held by Investor Owners (which are not debts, liabilities, or Shares) any remaining funds will be used to redeem those account balances, along with Community Owner account balances, with any lack of funds leading to a proportional reduction in payment for each Owner.

To better understand how EB PREC’s finances work, and particularly to understand the rights of different categories of Owners, please read our attached Bylaws.

Amending Investor Owner Rights

Generally, rights of Investor Owners, as outlined in the Bylaws, may be changed by a 2/3 vote of all EB PREC Owners (not only Investor Owners). Every Owner gets only one vote. Certain items require an even higher voting or approval threshold, as outlined in Bylaws page 37.

Other Information about the Securities Being Offered

Purchasing one share using a payment plan: Investors who cannot make a one-time payment of $1,000 may set up regular payments. In this case, they may buy a Share with a minimum first payment of $100 and a good faith commitment to pay the remaining $900 within 5 years, with payments made at least annually.

Subsidized Investor Ownership: EB PREC has begun to deploy funds received from two grants from the Center for Cultural Innovation to subsidize investor ownership for BIPOC community members from East and West Oakland. The Shares we are offering are no different from any other Shares, but this grant subsidizes between 50% and 100% of the share price. Prospective Investor Owners must apply for these subsidies, and those who receive these Shares supported by subsidies will have all the same rights as other Investor Owners. The funds available for subsidies will be allocated on an ongoing basis until exhausted, or if more funds are acquired for this purpose. Right now community members can apply in person at certain events, or online.

Access to information: Investor Owners have access to Board meeting agendas and minutes, certain Cooperative Policies, and Financial Statements, as laid out in slide 28 of the Bylaws.

Other financial provisions:

Investors have no preemptive or conversion rights, and there is no sinking fund provision.

Investors have no liability to further calls or assessments by the Cooperative (i.e. the issuer of the Investor Owner Shares) .

There is no provision discriminating against existing or prospective holders of securities as a result of shareholders owning a substantial amount of securities.

PLAN OF DISTRIBUTION:

Our Plan and Procedures for Selling the Shares

Eligibility to Participate

Generally, any person, organization, or business may become an Investor Owner. Individual Investors must be 18 years of age or older to invest.

All Investors must align and agree with EB PREC’s Mission and Points of Unity, as laid out in the Cooperative’s Bylaws which are attached in the exhibits to this Offering Circular.

In case of confusion as to whether you can invest, please contact the Cooperative at info@ebprec.org.

Where Shares Will Be Offered

This Offering is not available in all states, provinces, or countries. EB PREC may limit this Offering or offering amounts in certain states where restrictions may apply to the offering of securities in each such state, or where EB PREC has limited the Offering in any particular state for any other reason.

An updated list of all states in which shares are offered will be maintained on EB PREC’s website: https://ebprec.org/investor-owner. As of the date of this Offering, EB PREC currently offers Investor Owner shares in 13 states as well as Washington, D.C. We continue to expand the states where we offer our Shares through this Offering on an ongoing basis, taking care to comply with the legal requirements before doing so in each state.

How to Participate

Go to ebprec.org and click on the “Invest Now” or “Invest” button, and follow the procedures as described.

Upon a prospective Investor’s completion of an Investor Owner Agreement, the Cooperative will send a copy of the Agreement to the Investor by email. A copy of this Agreement is attached. Then, the Cooperative will invoice the prospective Investor for the Share(s) to be purchased. Upon acceptance of payment for the Share(s), the prospective Investor becomes an Investor Owner, and the Cooperative will send a confirmation email. After this point, the Investor Owner may not revoke or change the investment or request the return of investment funds, except as a redemption, as detailed in the Cooperative’s Bylaws and described in this Offering Circular.

No Revocation By Investor

Once a person has executed an Investor Owner Agreement and submitted funds for the purchase of the Shares, such investment may not be revoked without the consent of the Cooperative.

The Investor, not the Cooperative, bears the risk of delivery for the Investor Owner Agreement, payment, and all other documents that the Investor must deliver to participate in the investment program. The Cooperative prefers that all documents be executed electronically, and all payments be made by Automated Clearing House (“ACH”) or by Check.

Discretion to Accept, Reject, or Modify Investments

A few important things for prospective Investors to know:

| ∙ | This Offering is made subject to withdrawal, cancellation, or modification by the Cooperative without notice. |

| ∙ | The Cooperative reserves the right to reject an investment for any reason. |

| ∙ | The Cooperative need not accept investments in the order received. |

| ∙ | The Cooperative reserves the right to allot to any prospective Investor less than the amount of the Securities such Investor desires to purchase. |

| ∙ | The Cooperative reserves the right to accept an investment even if the investment is defective in some way. The Cooperative will either work with Investors to cure any defects, or will return all monies from rejected investments immediately to those Investors, generally without interest and without deduction. |

Advertising, Sales, and other Promotional Materials

The Cooperative is Offering these Shares directly to the public at the following website: https://ebprec.org/investor-owner

The Cooperative will be offering the Shares to the public directly, not using any underwriters, brokers/dealers, or other intermediaries who might receive commissions for sharing information about the Offering.

In addition to this Offering Circular, subject to limitations imposed by applicable securities laws, the Cooperative expects to use additional advertising, sales, and other promotional materials in connection with this Offering. These materials may include public advertisements and audio-visual materials, in each case only as authorized by the Cooperative. Although these materials will not contain information in conflict with the information provided by this Offering Circular and will be prepared with a view to presenting a balanced discussion of risk and reward with respect to the Securities, these materials will not give a complete understanding of this Offering, the Cooperative, or the investment opportunity and are not to be considered part of this Offering Circular. This Offering is made only by means of this Offering Circular, and prospective Investor Owners must read and rely on the information provided in this Offering Circular in connection with their decision to invest.

The Cooperative may work with partner websites to share information about the Offering. No partners will be acting as underwriters or registered broker/dealers.

Limitations on Amounts Investors Can Invest

If one is not an “accredited investor,” as further defined below, the amount one can invest is limited by law.

In order to purchase Shares, and prior to the acceptance of any funds from an Investor, each Investor will be required, in the Owner Agreement, to certify and represent to the Cooperative’s satisfaction that s/he is either 1) an accredited investor or 2) is in compliance with investment limitations applicable to non-accredited investors in this Offering.

The next two sections summarize rules for accredited and non-accredited investors.

Accredited Investors

The term “accredited investor” is defined by the SEC in regulation 17 CFR §230.501. Some of the more common examples of accredited investors from that definition include:

| ∙ | A natural person who has individual net worth, or joint net worth with the person’s spouse, that exceeds $1 million at the time of the purchase, excluding the value of the primary residence of such person; |

| ∙ | A natural person with income exceeding $200,000 in each of the two most recent years or joint income with a spouse exceeding $300,000 for those years and a reasonable expectation of the same income level in the current year; |

| ∙ | A business in which all the equity owners are accredited investors; |

| ∙ | An employee benefit plan, within the meaning of the Employee Retirement Income Security Act, if a bank, insurance company, or registered investment adviser makes the investment decisions, or if the plan has total assets in excess of $5 million; |

| ∙ | A bank, insurance company, registered investment company, business development company, or small business investment company; |

| ∙ | A charitable organization, corporation, or partnership, not formed for the specific purpose of acquiring the Securities offered, with total assets exceeding $5 million; and |

| ∙ | A director, executive officer, or general partner of the company selling the Securities, or any director, executive officer, or general partner of a general partner of that issuer. |

If an Investor falls within any of those categories of accredited investor, or another as defined by the SEC, then that Investor may invest as much as they want, subject to other terms of this Offering.