PART II: ANNUAL REPORT PURSUANT TO REGULATION A

East Bay Permanent Real Estate Cooperative, Inc.

This document contains forward-looking statements and financial projections, and they could be totally wrong.

Financial projections provided in this document and elsewhere are based upon assumptions that the management of the Cooperative believes to be reasonable. However, given all of the risks summarized above and other unpredictable factors impacting the Cooperative, the projections should be viewed merely as financial possibilities and not as a prediction or guarantee of future performance.

Specifically, this document contains forward-looking statements (a term defined in Section 27A of the Securities Act), which tend to include words like “believe,” “may,” “will,” “could,” “would,” “plan,” “expect,” “intend,” “anticipate,” “estimate,” “project,” “hope,” or the negative or plural of these words or similar expressions. With these statements, we aim to project our revenues, income or loss, capital expenditures, business relationships, financing, property acquisitions, and plans for future operations. Such statements are based upon management’s current expectations, beliefs, and assumptions about future events, and therefore involve a number of risks and uncertainties.

You should not rely upon forward-looking statements as predictions of future events. Except as required by law, neither the Cooperative nor any other person assumes responsibility for the accuracy and completeness of the forward-looking statements. The Cooperative undertakes no obligation to update publicly any forward-looking statements for any reason after the date of this Annual Report to conform these statements to actual results or to changes in its expectations.

Details of “Risk Factors” identified by management that can and will affect the accuracy of these forward-looking statements are included in the Cooperative’s Offering Circular dated August 22, 2022, as amended, filed in connection with the Cooperative’s Offering Statement on SEC Form 1-A POS, most recently qualified by the SEC on September 27, 2022. Such Risk Factors may be updated from time to time in the Cooperative’s subsequent filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. You should read this Annual Report, as well as the Offering Circular and all related documents with the understanding that the Cooperative’s actual future results, performance, events, and circumstances may be very different from what the Cooperative expects.

| Item 1. | Description of Business |

East Bay Permanent Real Estate Cooperative, Inc. is a California cooperative corporation. In this document, we also refer to our organization as “East Bay Permanent Real Estate Cooperative” or “EB PREC” and the terms “we,” “us,” “our,” “Cooperative,” “management,” “Company,” or similar terms.

Mission and Background

East Bay Permanent Real Estate Cooperative’s mission is to facilitate Black, Indigenous, People of Color, and allied communities to cooperatively organize, finance, purchase, occupy, and steward properties, taking them permanently off the speculative market, creating community controlled assets, and empowering our communities to cooperatively lead a just transition from an extractive capitalist system into one where communities are ecologically, emotionally, spiritually, culturally, and economically restorative and regenerative.

We were formed in recognition that the Bay Area’s vibrant, diverse communities are rapidly being displaced. In 1980, Black people were by far the largest ethnic group in Oakland, accounting for 46% of Oakland’s population.1 By 2015, the Black population had fallen to 25.4%, now the 3rd largest demographic, following White (26.9%) and Hispanic (26.1%) populations.2 Similar stories are unfolding across the country. We believe the only way to disrupt this pattern is to center communities of color in leading a just transition that conserves cultural assets and permanently protects land from speculative markets.

Approach

1 https://www.sfgate.com/bayarea/article/25-drop-in-African-American-population-in-Oakland-2471925.php

2 http://www2.oaklandnet.com/oakca1/groups/ceda/documents/agenda/oak069022.pdf

We’ve created an approach to stabilizing and preserving the heritage of our community through a participatory model of real estate acquisition and neighborhood development. Our model of real estate development is grassroots-led, rather than top-down. EB PREC’s unique model of development engages community members and local organizations in the visioning and planning process for each property, meaning that each property has a group of people personally “invested” (through participation) in the success of the project.

Primary Activity

EB PREC’s primary business activity is to buy, rehabilitate, steward, and manage real estate. EB PREC’s staff supports and provides technical and financial assistance to groups of community members who coalesce around the acquisition of various types of properties. The group (referred to within EB PREC as an “owner group”) then organizes neighbors and other community members to support the project by becoming Owners of EB PREC. When people purchase Investor Owner Shares, this provides financing to help EB PREC purchase the property. Financing from Investor Owners can be combined with other forms of financing, like loans or “Program Related Investments” from philanthropic foundations, to complete the acquisition.

EB PREC then acquires title, permanently protecting the property from the speculative market, while sharing the governance of the property with democratic groups of residents. EB PREC collaborates with residents to set monthly contributions (a.k.a. rent) not for the purpose of generating profit, but with the goal of sustaining the property financially, while keeping real estate affordable by operating at-cost and allowing residents to build limited equity. The monthly contributions are calculated with the goal of covering the financing, acquisition, operating costs, and any other costs associated with each project. The intention is for surplus income to build limited equity for, and be returned to, residents.

While the real estate market is cyclical and can be unpredictable, EB PREC is uniquely situated to reduce risk in our portfolio over time for various reasons:

| ● | By co-managing our properties with EB PREC’s resident-owners (as defined in our Bylaws), we believe we are likely to have lower resident turnover, better property upkeep, and be able to better anticipate and proactively address problems through active communication and relationship building with residents. |

| ● | The Cooperative is building strong relationships with local community land trusts, affordable housing developers, and housing rights organizations. These partnerships help us access skills, professional expertise, financing, and economies of scale. |

| ● | Our model is designed to allow residents to build equity over time, but we do not tie this equity to market fluctuations, since this would lead to significant financial unpredictability and burdens for the Cooperative when we pay out equity to residents. |

| ● | Investing in the EB PREC brand and cultural capital also helps us to reduce our risk. The value and credibility of our work has grown each year since our founding. With nearly 500 member Owners, dozens of powerful stakeholders (including the City of Oakland and multiple billion-dollar foundations), and national press3, EB PREC’s brand has strengthened our organization and de-risks our work. Additionally, we recently acquired Esther’s Orbit Room, which holds an immense amount of cultural and historical significance in Oakland and across the country. |

Secondary Activities

EB PREC has taken on secondary business activities, most emerging from the deep connections we have built with local government, community members, and organizations, in order to carry out our mission. EB PREC’s secondary activities include:

Education. EB PREC has contracted with and been paid by both Sustainable Economies Law Center (“Law Center”) and Northern California Land Trust (“NCLT”) to develop educational curriculum, classes, and events related to community stewardship of land and housing. For example, NCLT hired EB PREC to develop and host a resident training program for the Co-op 789 real estate project. EB PREC is also a partner in the Transformative Climate Communities (TCC) Grant received by the City of Oakland from the California Strategic Growth Council. As a partner EB PREC is contracted to provide outreach, education, and organizing services to uplift anti-displacement policies, programs, and strategies in East Oakland. This contract should support three full-time staff positions at EB PREC through the end of 2025.

3 https://ebprec.org/press

Community events. EB PREC hosts many community gatherings, discussions, and other events, which may or may not generate income.

Public speaking. EB PREC has received a small stream of earned income in the form of fees and honorariums for speaking engagements, both in person and remote via webinar and panel presentations. EB PREC has presented to the following groups in 2021 and 2022: Bay Area LISC, Justice Funders, Resource Generation Bay Area chapter, Chordata Capital, Natural Investments, East Bay Community Foundation Inclusive Economies Showcase, Grantmakers in the Arts, Transform Finance, San Jose Community Land Trust, Community Vision/CalCORE, Center for Cultural Innovation, Enterprise Community Partners, and many others.

Technical assistance and consulting. Staff of EB PREC provide in-depth technical assistance to local organizations with similar or overlapping goals. Some of these are organizations who might be interested in acquiring a property in partnership with EB PREC, but need technical assistance to reach a point of readiness to acquire property. Other organizations are not interested in acquiring property, but come to us for support on governance, cooperative structures, or financial modeling. Some of the organizations we have supported or are supporting include the East Oakland Grocery Cooperative, the BlacSpace Cooperative, Alena Museum, the Black Cultural Zone, Bay Area LISC, and others. In addition, EB PREC staff have done paid consultations with groups outside of the Bay Area, such as real estate projects in Montreal and Dayton seeking to model themselves off EB PREC.

Coalition-building. EB PREC staff is active in many local and regional housing justice organizations and coalitions, including Right to the City, the People’s Land and Housing Alliance, the Black Cultural Zone Collaborative, the Regional Tenant Organizing Network, the Oakland Property Acquisition Collaborative, and the TCC collaborative. This work allows us to support partners doing mission-aligned work, ask for their support as needed, and contribute to policy work through the power of these coalitions.

Staffing and Support

Current staffing and support. As of December 2022, EB PREC had 10 full time employees making up our staff collective. The Cooperative directly employs 9 full-time employees, and the Law Center employs Noni Session full-time to support the work of EB PREC and related education and organizing, under a project fiscally sponsored by the Law Center, called Collective Action and Land Liberation Institute. The details of the Law Center’s commitments to EB PREC are provided in the attached Legal Services Agreement and Incubation and Technical Support Agreement.

EB PREC also receives additional legal support from Gundzik Gundzik Heeger LLP, and pro bono legal support from Daniel Rollingher.

The Cooperative hired the design/build firm Sabi Design Build, to lead the design, architectural drawings, permitting, and rehabilitation at Esther’s Orbit Room.

Hiring plans. In 2023 EB PREC plans to hire additional staff, including a Communications Manager.

What Is Unique About EB PREC’s Corporate Structure and Governance?

EB PREC is a California cooperative corporation, governed by applicable sections of the California Corporations Code, as well as our Articles of Incorporation and Bylaws (both of which are attached as Exhibits). According to section 12201 of the California Corporations Code, “[Cooperative corporations] are democratically controlled and are not organized to make a profit for themselves, as such, or for their members, as such, but primarily for their members as patrons.”

EB PREC has 4 categories (or “classes”) of these patron Owners (or “members”), each with different rights, qualifications, responsibilities, and ways of participating in EB PREC:

EB PREC’s legal, governance, and financial structure, unique in many ways even from other cooperative corporations, is best understood by reading our Bylaws. We have written and included cartoons in these Bylaws with the goal that all Owners read, understand, and feel empowered by our structure through accessible legal language. We believe EB PREC could be described as a “movement cooperative” because it is designed not only to provide housing and affordable real estate, and empower its staff, but also to build a large membership base and serve members’ collective goal to transform our neighborhoods and our systems for land ownership.

The securities being sold through this Offering are Investor Owner Shares. To understand the role of Investor Owners in relation to other Owner categories, please read our Bylaws, as well as our Offering Circular. Like all of our members, Investor Owners are patrons of the Cooperative, and should not view the purchase of Investor Owner Shares as an opportunity to profit in the way that investors in conventional stock corporations might. Rather, Investor Owners are providing low-cost capital to support the work EB PREC does for the community, staff, and residents.

| Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read this section in conjunction with EB PREC financial statements. See EB PREC Audit Reports for 2021 and 2022 in Item 7 of this document.

The discussion contains forward-looking statements that involve risks, uncertainties, and assumptions. EB PREC’s actual results may differ materially from those anticipated in these forward-looking statements as a result of many factors, including, but not limited to, those set forth under Risk Factors in our Offering Circular.

Esther’s Orbit Room Cultural Revival Project

Our largest project in 2021 and 2022 was the Esther’s Orbit Room Cultural Revival Project. We ran a capital campaign, entered into a 6-month option with the seller, did a lot of due diligence (research and inspections), did a feasibility study, and finally on, September 30th 2021, closed escrow on Esther’s Orbit Room. We spent around $92,000 on due diligence (before closing) and the acquisition itself cost $1,500,000. This acquisition included three separate but connected parcels, with two buildings, including over 9,000 sqft of commercial and residential space, plus a 2,000 sqft “backyard.”

After consulting with our advisors, EB PREC established Orbit Properties LLC as a wholly owned subsidiary to become the legal owner of Esther’s Orbit Room. Because this LLC is wholly owned by EB PREC, its finances are consolidated into the audited financial statements for EB PREC. It is common for companies holding property to set up a separate LLC for each individual property in order to isolate liability risks of that property from the rest of the organization’s assets. Although we do not create a new LLC for every property we acquire—choosing for our residential properties instead to manage risk through insurance, good maintenance and care, careful contracting, and other measures—given the commercial nature of Esther’s Orbit Room and the substantial renovation and construction that will required on the property, that this wholly owned LLC strategy was appropriate.

Orbit Properties LLC received a $1,700,000 zero-interest loan from ImpactAssets (from the Restorative Economies Fund) to acquire and develop Esther’s Orbit Room, as shown in exhibit 6.k. As we navigated the legal framework for this loan, we and the lenders learned about “imputed interest”, which basically means that even if the lender is not charging interest, for the sake of the IRS there is a minimum interest rate that they assume should be assumed for tax purposes4. In our instance, Impact Assets has agreed to do Expenditure Responsibility Reporting, which allows them to give this lack of interest as a “gift” to an organization like ours even though we are not a 501c-3 non-profit. This Expenditure Responsibility Reporting requires an impact report from EB PREC each year to show that our activities align with their charitable purpose. On our side, EB PREC is required to treat the interest we are not paying as income, and thus we must report it as income on our income statement. Because the loan was received in September 2021, for that partial year we received $7,412.93 of this income. In 2022, we reported $29,410 in income relating to imputed interest from this ImpactAssets loan.

4 https://www.investopedia.com/terms/i/imputedinterest.asp

In 2021, EB PREC received a “Recoverable Grant” from LISC for $90,000 (this was before we had established Orbit Properties LLC). “Recoverable Grant” was a confusing concept for our team at first, but eventually we decided it was in our best interest to receive the funds even though it was not a typical grant. Basically, LISC offered to give us $90,000 to do the pre-development work at Esther’s Orbit Room. These $90,000 would be recoverable (meaning we have to pay it back) if we succeed in acquiring the project. If we didn’t succeed in acquiring the project, then the funds would not be recoverable, meaning we would not have to pay them back. This type of recoverable grant is beneficial because it reduces the risk of pre-development. It allowed us to invest $90,000 in the due diligence, research, and feasibility study before we acquired Esther’s, with the safety of knowing that if the project didn’t succeed, we wouldn't have to pay those funds back. However, we did successfully acquire the property in 2021, so according to the conditions of the recoverable grant, we repaid all $90,000 of these funds to LISC in 2022.

EB PREC received an additional loan from the San Francisco Foundation (“SFF”), through their Program Related Investment program and will partially fund the rehabilitation of Esther’s Orbit Room. SFF’s board approved the loan in January of 2021, and we signed final loan documents in 2022. The total loan amount is $1,400,000, with 2% annual interest, and the loan term ending in 2033. The funds will be disbursed by SFF to the project through a series of construction draws, during the construction process, which basically means they will disburse the funds based on our progress and our actual costs of construction, instead of disbursing the funds to EB PREC beforehand. This adds more administrative labor than a typical loan, but on the plus side it means we don’t have to pay interest on any of the funds until they are disbursed. Construction is projected to begin in 2024, and having these construction funds committed puts us in a more comfortable position.

In the beginning of 2022, EB PREC received another recoverable grant from Community Vision and The William and Flora Hewlett Foundation through the Performing Arts Acquisition Fund. This $600,000 grant came directly to Orbit Properties LLC, and required EB PREC to file a document called a CC&R (Covenants, Conditions and Restrictions) with the recorder’s office, which requires us to meet certain conditions placed by the grantor, for 20 years. These conditions require, generally, that the property will be used for local arts and culturally beneficial activities, including, for example, operation of local culturally relevant small businesses. Given that these conditions aligned with our vision and plans for Esther’s Orbit Room, and every year that we comply a portion of the grant is forgiven, we accept these conditions and the grant. For financial reporting purposes, these funds are conditional for 20 years, at which time the entire $600,000 will have been “earned,” so our financial statements will show approximately one twentieth of the total amount as income each year. The income amount for 2022 associated with this grant, $12,500, is a prorated amount based on when we received the funds during the year.

New Property in San Pablo

In December 2022, EB PREC acquired a new property in San Pablo, CA. We made this $469,000 acquisition with all cash, using proceeds from the sale of Investor Owner Shares. Having these funds on hand allowed us to move quickly on a unique opportunity for a naturally affordable acquisition, brought to us by one of our Owner Groups. We spent a few months fixing up the place (using another $45,000 of our available cash), including we fixed the old electrical system, remediated plumbing leaks, re-did some walls, fixed some drainage issues, and even added new circuits to transition the stove and dryer from gas to electric. We managed to keep some costs down by hosting multiple community workdays, where the residents, their community, and EB PREC members were invited to show up and help do some of this work! This was particularly helpful for things like painting and drywall patching, and it was an investment in our community’s skillset, as we all learned and will be better prepared for the next project. Residents moved in on March 1st, 2023, and became official Resident Owners on April 1st, 2023. Their monthly contributions cover all the property’s ongoing costs, with a portion allocated to pay dividends to Investor Owners and eventually redeem Investor Owners shares.

Co-op 789

To revisit an ongoing project, the City of Oakland used funds from Measure KK to fund EB PREC’s first project in partnership with NCLT in 2019: Co-op 789. It was a $1,325,000 acquisition, with $600,000 subsidized by the City of Oakland. However, the project needed more subsidy to remain affordable, so EB PREC and NCLT applied for additional funding through the ACAH in 2021. The City selected the project to be funded, but they had questions about our long term plan to transfer the improvements from NCLT to EB PREC before finalizing the subsidy. EB PREC, NCLT, and our legal representative from the Law Center have been working with the City of Oakland and their staff, lawyers, and consultants, to negotiate the terms of the subsidy and our partnership throughout the course of 2022. We are currently in a series of what the city is calling “Closing Calls” to finalize the terms and hopefully disburse the funding soon.

EB PREC has committed on paper to loan $185,000 to NCLT to support Co-op 789, a project we have been collaborating with NCLT on since 2018. The formal commitment comes as we work with the City of Oakland to finalize a second round of subsidy to support the project. NCLT needed the City’s approval to accept our loan, and the process has finally moved forward to include the commitment letter, and we expect the funds to be deployed in 2023. Though making this loan may be seen as outside of our core business of direct acquisition of real estate, another one of the documents that will be executed simultaneously with this loan is a purchase option, giving EB PREC the right to acquire the building in the coming years.

Investor Owners’ Equity

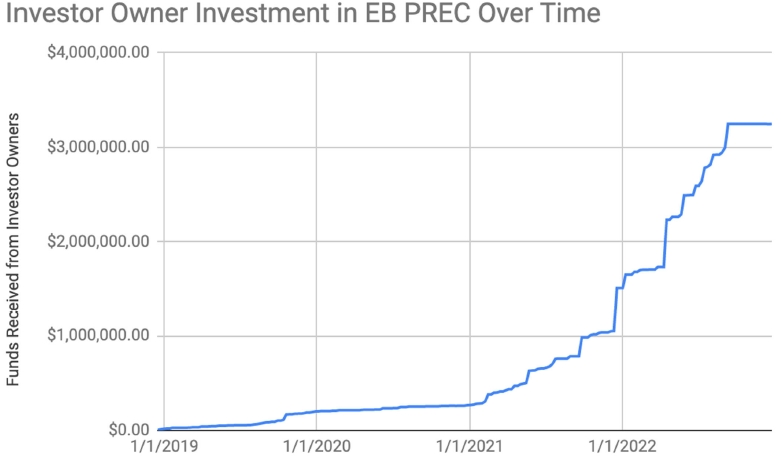

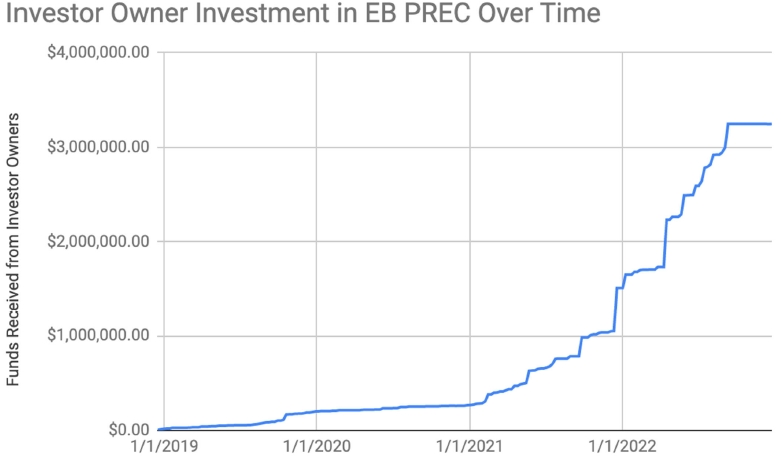

As of April 14th 2023, EB PREC has raised approximately $3,540,000 total through the sale of Investor Owner Shares.

Beginning late 2018, we ran an offering limited to California only, and by the end of 2019, EB PREC had raised over $200,000 from Investor Owners. With the launch of this Offering in September 2020, we were empowered to offer and sell Investor Owner Shares across the U.S. Spurred by our effort to acquire Esther’s Orbit Room in 2021, EB PREC raised $1,240,646 that 2021, ending the year with a total of $1,509,630 raised from Investor Owners.

In 2022 we more than doubled this equity raised, with an additional $1,738,300 raised. While we still had many small investments in 2022, the majority of the funds came from larger investors (including one $500,000 investment, our largest to date) who work through investment advisors. We built many of these investment advisor relationships and completed due diligence with their offices in 2021, making it easier for them to send additional clients our way in 2022.

The following chart shows total investment by Investor Owners in EB PREC over time, through the end of 2022.

Grants Funding EB PREC Operations

Grants have been EB PREC’s primary source of funding for its operations to date. Since its inception, in deep partnership with the Cooperative’s incubating organization, the Law Center, EB PREC has raised over $7,000,000 in received and pledged grant funding for our work.

Not all of this funding appears in EB PREC’s financial statements, because many grants are held and administered by the Law Center for the purpose of incubating EB PREC. The Law Center and EB PREC periodically enter into contracts in which the Law Center agrees to pay EB PREC to carry out work that advances the missions of both organizations.

As of February 28, 2023, the Law Center is planning to distribute $750,000 to EB PREC in 2023, and is holding an additional $3,162,361.83 for the purposes of developing EB PREC, which may be disbursed upon request by EB PREC. See the Exhibits 6.c through 6.h for multiple contracts between the Law Center and EB PREC. These funds support the development of EB PREC in alignment with the charitable mission of the Law Center, including community building, organizing, legal and organizational infrastructure, education, and real estate projects.

Dividends

We declared and paid dividends for the first time in 2022! In previous years, EB PREC’s board has stated their intention to later declare dividends at our 1.5% annual rate but did not actually do so, largely for administrative reasons. In 2022 our board declared dividends at a 1.5% annual rate for all Investor Owners who held shares from the time of our inception, through the end of 2021. These dividends were declared and distributed to our Investor Owners in 2022, totaling approximately $7,261. Roughly 44% of our Investor Owners have opted to waive their right to dividends.

Staffing

Salaries and wages increased from $332,776 in 2021 to $536,971 in 2022, a 61% increase. The Cooperative staffing budget continues to expand as our team grows, now with 9 full time employees on payroll, compared to 6 full time and 1 part time employees as of December 31, 2021. The Law Center employs Noni Session full-time to support the work of EB PREC, so although she is a core member of our team, her salary does not appear on our financial reports.

In addition to increasing our number of employees, in 2022 we increased wages towards our “living wage” target and began providing health insurance to our employees at the start of 2022. At the start of 2023, we also provided 10% salary increases to our employees across the board to account for the high inflation over the past year. A significant drop in real wages for our employees because of inflation is a problem we can’t ignore.

EB PREC expects to hire at least one additional position by the end of 2023, including a Communications Manager.

Liquidity

By the end of 2022, the Cooperative’s assets were over 50% liquid, in the form of cash and CDs. Our cash comes from a combination of grant funding, loans, and proceeds from the sale of Investor Owner Shares. The Cooperative does not intend to use proceeds from the sale of Investor Owner Shares for operating expenses like salaries, but is using and reserving these funds for property acquisitions and rehabilitation. Thus, while EB PREC has high liquidity, we anticipate lower liquidity levels as we continue to purchase more real estate, and as we invest in the rehabilitation of Esther’s Orbit room and other properties.

In 2022, EB PREC invested $1,000,000 into 3 and 6 month CDs, as we were confident we won’t be spending these funds until Esther’s Orbit Room breaks ground. We have continued to turn these over into 6-month CDs. In this way we can ensure to generate a return on those funds that can be passed on to our investors as dividends with low risk, until the funds can be deployed into the project.

Over time, EB PREC expects its core operations to be financially self-sustaining from revenue generated from properties, community owner dues, contracts, consulting, events, and programs. Until then, we are continuing to raise grants and donations to cover our core operational expenses. In the long run we expect grants and donations to continue to expand our capacity to organize, educate, and build a housing justice movement in the East Bay and beyond.

Looking Forward

2021 and 2022 brought incredible changes to EB PREC: We acquired our first mixed use property, Esther’s Orbit Room; we expanded our staff collective to 10, and our Staff Owners to 7, we acquired another residential property and led the rehabilitation ourselves with our community, we built out our presence in Deep East Oakland and on the 7th Street corridor in West Oakland, and so much more.

In December of 2022 EB PREC’s staff collective gathered for a mini-retreat to vision together, and begin strategic planning for 2023 and 2024. The following vision statement was created not with an external audience in mind, but to help guide our staff as we planned our goals and strategies for the year to come:

Develop our Community-led acquisition pipeline by captivating community imagination, cultivating process, relationships, and BIPOC community members, and Activating spaces, Owner Groups, and Funders, in order to seed the next iteration(generation) of cooperative spaces and leaders.

Since that retreat, each circle within our staff has been working to create a few strategic goals that will guide their work over the coming year or two, in alignment with our mission and this shared vision.

While our mission stays true, the market in which we operate continues to be turbulent! One year ago home sales in the Bay Area were just starting to slow down, but prices were still up over the previous year. The California Association of Realtors’ February 2023 report5 shows that Bay Area home prices are actually down 19.2% compared to last year. With interest rates staying high, other buyers are less willing to borrow (and less likely to qualify), and so sellers either have to lower their prices, or decide not to sell. Many sellers are deciding not to sell, with the volume of sales down 32% compared to last year. But enough sellers are putting properties on the market and closing sales so that prices are going down. Given our liquidity position, the decrease in demand and dropping prices could provide good opportunities for EB PREC to purchase properties at more affordable rates, especially if we can continue to access affordable capital from Investor Owners, and through low-interest loans from foundations.

In addition to acquisition costs, we also have to consider construction costs. Supply chain issues, cost inflation, and labor shortages all have the capacity to substantially impact our upcoming construction at Esther’s Orbit Room, either with delays, or rising prices, like the unprecedented high costs of plywood over the past few years. It appears that supply chain issues are not as bad as they were at the height of the pandemic, but we will be watching construction costs over the next year as we prepare to break ground at Esther’s.

Despite continued uncertainty in global capital markets, we have seen a dramatic increase in investment in EB PREC. While this increase is generally aligned with our age as an organization, 2021 brought us our first investments directed to us from investment advisors. The interest we are seeing from investment advisors has the potential to unleash a lot more capital into our work. These investment advisors take the time to perform due diligence on our work in much more detail than most individual investors do, sending us questionnaires and asking for reports, but once they complete their due diligence, they can recommend EB PREC as an investment to their clients who are looking for social impact investing.

The scope of our upcoming acquisitions depends heavily on how much funding we are able to raise through this Offering. Thank you for investing in community.

| Item 3. | Directors and Officers |

DIRECTORS, OFFICERS, AND SIGNIFICANT EMPLOYEES

EB PREC is governed by a Board of Directors and managed by a staff collective. The Board is structured to have eight Directors (a.k.a. Board members). Board members serve two-year terms. Investor Owners only have the right to participate in elections for two Board members. And when Investor Owners do have a right to participate in elections, they do so along with the other three Owner types (Community, Staff, and Resident), with each Owner voting on a one-member, one-vote basis. The majority of our Directors are elected by non-Investor Owners or appointed by Specified Designators, and are intended to represent the stakeholders and values that are integral to EB PREC, as follows:

5 https://www.car.org/marketdata/data/countysalesactivity

Five of the Directors (named the Governance, Financial, Staff, Resident, and Community Directors) are elected, with voting done on a one-member, one-vote basis. All EB PREC Owners (including Staff, Resident, Community, and Investor Owners) are able to vote on just two of these seats: the Governance and Financial Directors. The Staff, Resident, and Community Directors are elected exclusively by the Staff Owners, Resident Owners, and Community Owners respectively.

Three of the Directors (named the POC Housing Justice, Indigenous, and Black East Bay Directors) are designated Board seats appointed by certain Specified Designators, namely, (1) the People of Color Sustainable Housing Network (or, if unavailable, Urban Habitat), (2) Sogorea Te’ Land Trust, and (3) the East Oakland Collective (or, if unavailable, Mandela Grocery Cooperative). These Specified Designators and their respective Board seats anchor EB PREC to its mission and ensure BIPOC community representation on the Board.

Notwithstanding by whom they are appointed or elected, each Director owes fiduciary duties to the Cooperative as a whole under the terms of California law and our charter documents. Taken together, we believe this structure creates important harmony between the various stakeholders in our Cooperative.

For more information about the Board and how it operates, please refer to our Bylaws.

Our current staff and Board members are listed below, with biographies following this table. There are no family relationships among the staff or Board members. We have no part-time employees.

| Name | Position | Age | Start of employment |

| Staff Owners | | | |

| Noni Session | Executive Director | 47 | 3/2018 |

| Ojan Mobedshahi | Finance Director | 32 | 6/2018 |

| Shira Shaham | New Projects Director | 41 | 6/2018 |

| Annie McShiras | Investment & Fundraising Director | 35 | 9/2020 |

| Bee Coleman | Project Manager | 37 | 8/2021 |

| Scott Nanos | Community Organizer | 34 | 8/2021 |

| Christopher Chew | Community Organizer | 29 | 11/2021 |

| Susan Park | Operations Coordinator | 46 | 9/2021 |

| Princess Robinson | Co-ownership and Education Facilitator | 32 | 7/2022 |

| Ace Johnson | Cultural Organizer | 33 | 10/2022 |

| Name | Position | Age | Start of term of office | Appointed/Elected by: |

| Board Members(1) | | | | |

| Candice Elder | Black East Bay Director | 38 | 7/2019 | Specified Designator |

| Hope Williams | Board President & Governance Director | 32 | 5/2022 | All Owners(2) |

| Ellen Sebastian Chang | Resident Director | 65 | 6/2021 | Resident Owners |

| Michele Williams | POC Housing Justice Director | 54 | 7/2022 | Specified Designator |

| Shira Shaham(3) | Board Secretary & Staff Director | 41 | 2/2018 | Staff Owners |

| Toshia Christal | Community Director | 39 | 5/2022 | Community Owners |

Ojan Mobedshahi(3) | Board Treasurer & Finance Director | 33 | 7/2018 | All Owners(2) |

| 1) | There is currently one vacancy on our Board: the Indigenous Director. |

| 2) | Investor Owners, Staff Owners, Resident Owners, and Community Owners, each voting on a one-member, one-vote basis. |

| 3) | Shira and Ojan are Directors and members of the EB PREC Staff. No more than two Directors can also be EB PREC staff members at any one time. |

Staff Owner: Noni Session - Executive Director

Noni is a 3rd generation West Oaklander, Cultural Anthropologist and Grassroots Organizer. After a 2016 run for Oakland City Council in which she garnered more than 43% of the vote, Noni came to believe her community’s clearest pathway to economic justice and to the halt of rapid displacement was a cooperative economy. In the past five years Noni has held many roles, including Assistant Librarian at the West Oakland Public Library; Candidate & Chief Strategist for Oakland City Council Campaign; and Co Founder and Outreach, Media & Strategy lead for State of Black Oakland. Her core competencies include academic research & writing, international development & government agency liaison, volunteer recruitment & management, collections management, and cooperative development.

Staff Owner, Finance Director, and Board Treasurer: Ojan Mobedshahi - Finance Director

Ojan is a 2nd generation Iranian American, born and raised in the Bay Area. He has experience in healthy land use spanning landscape design, restoration and education, real estate brokerage, construction and development, and political organizing. Ojan lives in a tiny house on wheels, and is also a landscape contractor and regenerative permaculture designer. In the past five years Ojan has worked as a Land Analyst at Polaris Pacific, a San Francisco brokerage, and a Development Associate at Ashbury General Contracting and Engineering. Before joining EB PREC, he founded his own business, Happy Planet Land Use Consulting. His previous work includes real estate financial modeling, project management and entitlement in the Bay Area, as well as landscape design, build, and project management.

Staff Owner, Staff Director, and Board Secretary: Shira Shaham - New Projects Director

Shira has over 10 years of experience leading teams and managing custom design projects and businesses. She played a key role in the growth of a food cooperative start-up in New York from the initial meeting of some 20-odd people to a successful business open 6 days/week. Returning to the Bay Area where she was raised, Shira works to give back to the communities that have nurtured her. Shira has worked at Arizmendi Construction Cooperative and Ashbury General Contracting and Engineering, leading teams and managing custom design and construction projects, and has a Bachelors of Architecture from Cal Poly, San Luis Obispo.

Staff Owner: Annie McShiras - Investment & Fundraising Director

With over 10 years of fundraising experience, Annie’s unique skill set has catalyzed the redistribution of over $52 million in service of social and racial justice organizations. She has led capital campaigns large and small for a variety of organizations. She brings a depth of understanding and systemic analysis to the intersections of movements and money.

Annie works to actualize her bold vision of an economy where all people have enough to thrive through her work as a fundraiser, storyteller, and business development strategist. She has worked across fields including student organizing, worker cooperative development, popular education, impact investing, and transforming our financial system.

Staff Owner: Bee Coleman, Project Manager

Bee prefers they/them and is your (sometimes) friendly neighborhood non-binary, queer, magical Black radical, alchemist, anti-capitalist, abolitionist, dream chaser, shape shifter and shift shaper. They are committed to Black liberation and joy, by every means available. A problem-solver and bridge-builder by nature, Bee’s educational and professional journey from Howard University to Patent Examiner to DARPA consultant to dog walker and cooperative developer ultimately taught them, among many truths, that relationships are the most valuable resource on (and for) the planet. From the lineage of the Filipino sex trade and the European slave trade, through a legacy of resistance and resilience, Bee brings their devotion to liberation and talent for manifestation to their greater role as generational curse breaker. In this role with EB PREC, Bee fully intends to see through some of our ancestors’ boldest dreams. You can reach Bee at bee@ebprec.org.

Staff Owner: Scott Ortega-Nanos, Community Organizer

Scott is a queer Pilipinx bookseller and community organizer living on Huichin Ohlone Land. A co-founder of Books for Days, Maji News, Project Kalahati, and Kalahati Books, his work is dedicated to building resources and networks for collective emancipatory action. Scott has given talks at SOMARTS, the San Francisco Public Library, and the Fort Mason Center for Arts & Culture. His projects have been supported by Southern Exposure, the National Endowment for the Arts, and the City of Oakland Cultural Funding Program. You can reach Scott at scott@ebprec.org.

Staff Owner: Christopher Chew, Community Organizer

Chris a second generation North Oaklander & Grassroots Organizer. With economics education and years of direct community engagement within Oakland, Chris is grateful to cultivate even more opportunities for personal and community growth. You can reach Chris at chris@ebprec.org.

Staff Owner: Susan Park, Operations Coordinator

Susan Park is a long-time Oakland resident (Lisjan/Ohlone territory), and a social & environmental justice activist. She spent 10 years working as a project/program coordinator and community organizer for several justice-based grassroots organizations. She spent the prior decade as an office manager in the architecture industry. She once co-founded an anti-gentrification coalition, and has been part of numerous direct action, mutual aid and Indigenous solidarity projects. She has even dabbled in outdoor ecological education with young children. In her non-working life, you can find her entrenched in healing work, gardening and Earth-regenerating practices. Originally from South Korea, she grew up as a low-income immigrant in SoCal.

Employee: Princess Robinson, Co-Ownership and Education Facilitator

Long time Richmond resident, wife, mother of two, and a Los Medanos College Graduate 2019, Princess is a Project Manager and advocate for Cooperation Richmond to develop and launch local worker-owned and community-owned enterprises in Richmond, CA by providing shared learning resources, technical assistance, and access to non extractive financing. Princess’s leadership started 7 years ago as an environmental steward to revitalize natural spaces surrounding her community in North Richmond. Soon after, Princess participated in many community service projects, neighborhood council meetings, community boards, coalitions, and more. Princess also serves in many initiatives throughout the community actively building towards a Just Transition, such as beautification projects, alternative housing solutions, and implementing sustainable practices through climate justice systems. Princess joins the EB PREC team bringing her fierce passion and advocacy for community to facilitate community co-ownership in the Cooperative.

Employee: Ace Johnson, Cultural Project Manager @ Esther’s Orbit Room

Eugene Ace Johnson is an Oakland Native known for his skills as a Visionary Coach and Creative Consultant to Bay Area Entrepreneurs. Over the years, Ace has developed his talent as a public speaker, spoken word activist and lyricist; empowering individuals to find and utilize their creativity to inspire change in the world. In addition to working with Creative Professionals, he teaches Leadership Development and Life Skills through the Creative Arts to youth in underserved communities. His goal is to see Multigenerational Urban Community Development where youth and family can live out their full potentials. Example of this work include Programs like the iVisionary Talent Tour, Cre8ive Genius and The "Better Together" BLOC Party among many others. He's excited to bring his cultural and community work to Esther's Orbit Room.

Board President: Hope Williams, Governance Director

Hope Williams is the Co-Director of the Radical Real Estate Law School and legal apprentice through the Sustainable Economies Law Center. As a black queer woman in the Bay Area she is devoted to housing rights and organizing people-power to fight the oppressive white supermacist regime. She spends most of her time making sure that the law is accessible to the people. Hope is a board member of the San Francisco Community Land Trust and the California Community Land Trust Network. Her background includes managing political campaigns, organizing within the boycott division of UniteHere!, organizing endorsements for Berkeley's Tenant Opportunity to Purchase Act, and coalescing with tenants rights organizations. In her spare time, she secretly trains people on how to organize coordinated acts of civil disobedience.

Board Member: Ellen Sebastian Chang, Resident Director

Ellen Sebastian Chang (she/her), is a storied figure in the performing arts, as a director and arts educator whose career spans 45 years. Her current projects include an ongoing collaboration with AfroFuturist Conjure artist Amara Tabor Smith and the Deep Waters Dance company’s House/Full of BlackWomen, a multi-year site-specific dance theater work that addresses the displacement, sex trafficking, and the creative well-being of Black women and girls in Oakland, California.

She has worked as an arts educator for 42 years: with technical direction/design classes at the Urban School of San Francisco, Magic Theaters Young California Writer’s Program, as an artist in Bay Area Public Schools via Young Audiences of Northern California and for the past 14 years with The World as it Could Be Human Rights Education Arts Program. She is currently teaching with Girl’s Project, a program facilitated with East Side Arts Alliance.

Sebastian Chang was the cofounder and artistic director of Life on the Water, a national and internationally known presenting and producing organization at San Francisco’s Fort Mason Center from 1986 through 1995. In the past five years she has collaborated with the HBO production "Whoopi Goldberg Presents Moms Mabley"; Maya Gurantz "A Hole in Space (Oakland Redux)"; Sunhui Chang and Maya Gurantz "How to Fall in Love in A Brothel; Campo Santo and Ben Fisher’s “Candlestick” and served as the proud co-owner and general manager of FuseBOX Restaurant, created by chef Sunhui Chang in West Oakland, California.

She is a recipient of awards and grants from Creative Capital, MAP Fund, A Blade of Grass Fellowship in Social Engagement, Art Matters, Kenneth Rainin Foundation, NEA, Creative Work Fund, California Arts Council, Mazza Foundation, and Zellerbach Community Arts Fund.

Board Member: Toshia Christal, Community Director

Toshia Christal is an Oakland native born 1983. “Down to earth” and consistent, she is a realist, optimistic in her way of thinking and highly focused on addressing disparities that provide tangible solutions as it specifically pertains to those of the African diaspora. Currently teaching at Laney college, she is a graduate of the Berkeley High School class 2001. Toshia is one who has protested throughout Oakland and Berkeley streets for endless reasons for as long as she can remember and still does. She loves being involved in her community and receives great pleasure from collaborating with likeminded beings and community outreach in general. With over 15 years of entrepreneurship experience she is an artist of many mediums. Toshia is a photographer, jewelry designer, licensed cosmetologist (with an AA in Cosmetology), poet, and spiritual healer to say the least. A minister of “purpose and potential” Toshia recently fulfilled a dream of hers by starting The Church of Universal Conscious Collectives in 2021. Her small brick and motor in Oakland California located at 2911 Fruitvale Avenue has been maintained for 8 years now. She has been featured in numerous art shows, poetry events, radio talks, interviews and articles around the Bay Area. Her most recent works can be found at www.linktr.ee/TChristal , but most importantly Toshia Christal is now the New Community Director for EB PREC and she can’t wait for the awesome connections and opportunities to support each other, sustain each other, grow and to thrive as a whole.

Board Member: Candice Elder, Black East Bay Director

Candice Elder, an East Oakland native who currently resides in City of Oakland District 7, is the Founder and Director of The East Oakland Collective (EOC). Candice went to Oakland public schools and for high school attended The Head Royce School. Candice has a background in law, philanthropy and nonprofit management. Candice was a legal professional for 10 years and has worked in plaintiff class action law firms in employment and antitrust law fields. Candice previously worked as the Executive Coordinator and Membership Manager for the Women's Funding Network, the largest philanthropy network of women's funds and foundations in the country. Candice has a Bachelors of Arts in Political Science and a minor in African-American Studies from the University of California, Berkeley and a Masters of Science in Criminal Justice, with a concentration on reform of the criminal justice, from the University of Cincinnati.

Board Member: Michele Williams, POC Housing Justice Director

Michele is a long time Black queer resident of Chochenyo Ohlone land (aka Oakland) originally from the East Coast. Currently working at the San Francisco Public Library and serving on its Racial Equity Committee, Michele’s background in the nonprofit/public/philanthropic sectors includes 10 years as a Project Manager developing affordable housing. Through The San Francisco Foundation (TSFF)’s

Community Development Program Michele funded projects and advocacy work for affordable housing and economic security and co-funded with the Arts and Culture, Community Health, Social Justice, and Environment Programs. Michele also monitored and evaluated affordable housing projects supported by TSFF’s Program-Related Investments. Michele is an original member of the People of Color Sustainable Housing Network. Michele participates in various liberatory and social justice efforts locally and worldwide. Among Michele’s deep explorations: Black art, music, history, and culture, QTPOC manifestations, disability justice, herbal medicine and growing plants, storytelling, Indigenous spiritual practices and healing technologies, traditional ecological practices. Michele holds a Master in City Planning with a Community Development concentration from the University of California Berkeley.

FINANCIAL INTERESTS AND COMPENSATION OF DIRECTORS, OFFICERS, AND OWNERS

Compensation of Executive Officers

| Name | Capacities in which compensation was received | Cash Compensation | Other Compensation | Total Compensation |

| Ojan Mobedshahi | Finance Director | $79,593.85 | $6,900.00 | $86,493.85 |

| Noni Session* | Executive Director | $75,000.00 | $8,400.00 | $83,400.00 |

| Shira Shaham | New Projects Director | $74,505.00 | $6,900.00 | $81,405.00 |

*Noni Session’s position is fiscally sponsored and funded directly through the Law Center, and therefore is not reflected in East Bay Permanent Real Estate Cooperative’s financial statements.

Compensation of Board Members

Board members currently do not receive compensation for board service but may receive compensation for other work carried out for the Cooperative. The total compensation to the organization’s Directors for this other work (i.e., salaries and wages as officers, employees, or contractors of the Cooperative), in fiscal year 2021 was $90,429.75, which included salaries for our two directors who are also staff members (Shira Shaham and Ojan Mobedshahi), a partial payment of a one-time “founder’s package” policy that the cooperative put together in 2021 to compensate our founding members for substantial time volunteered to the creation of the cooperative in past years, as well as a small honorarium to our Governance Director for running the Joint Elections Committee. In fiscal year 2022, the total compensation to the organization’s Directors was 167,898,85. This increase from 2021 reflects an increase in wages paid to all EB PREC staff (due to increased hourly pay), an increase in total hours worked by these employees, the addition of health benefits to compensation, and the final payment of the “founder’s package”.6

Proposed Future Compensation

Future compensation for staff and directors has not been pre-determined, proposed, or contingent upon the success of this Offering. With the oversight of the Board of Directors, employees of the Cooperative collectively set their compensation, or at minimum adhere to the living wage for 1 adult and 1 child using the MIT Living Wage Index.7 Furthermore, employee compensation is capped at 3 times the median per capita wage for all occupations in the Oakland-Hayward-Berkeley Metropolitan division.

| Item 4. | Security Ownership of Management and Certain Securityholders |

The following table sets forth the beneficial ownership of Investor Owner Shares of the Cooperative’s Executive Officers and Directors as a group, and individually any securityholders who beneficially own more than 10% of the voting power of any of our securities, as of 12/31/2022.

As of the date of this annual report, no Executive Officer, Director, or individual owns more than 10% of the voting power of any class of voting securities. Our voting is done on a one-member, one vote basis irrespective of number of Investor Owner Shares, and we have 364 Investor Owners as of April 14, 2023.

| Title of class | Name and address of beneficial owner | Amount and nature of beneficial ownership | Amount and nature of beneficial ownership acquirable | Percent of class |

Investor Owner | EB PREC Executive Officers and Directors as a group, 1428 Franklin St, Oakland, CA 94612 | 4(1) | 0 | 1.10%(2) |

| (1) | While our Board members and Directors have a total of 4 Investor Owner shares, one of the Board members is investing via a payment plan, and has paid $400 towards their $1,000 investment. If they do not complete their investment as required by our Bylaws, they may lose their right to vote as an Investor Owner. |

| (2) | As our voting is done on a one-member, one vote basis irrespective of number of Investor Owner Shares held, this percentage is based on the total number of Directors and Officers who own shares, divided by the total Investor Owners as of 12/31/2022. If measured by financial contribution, the Directors and Officers would represent only 0.10% of this share class. |

| Item 5. | Interest of Management and Others in Certain Transactions |

In 2021 and 2022 EB PREC contracted with the Law Center to fund Noni Session’s salary (disclosed above) as EB PREC’s Executive Director. The funds used for Noni’s salary were raised collaboratively by EB PREC and the Law Center, but as EB PREC’s fiscal sponsor, the funds were received directly by the Law Center, and paid to Noni as an employee of the Law Center, not passing through EB PREC’s accounts.

No one involved with EB PREC or with the preparation of this Offering Circular and related documents was or is employed or contracted on a contingent basis, meaning that no one will be paid on the basis of how many Shares are sold through this offering.

6 The total amount of the combined founder’s packages was $90,000, and the final $30,000 of this was disbursed in 2022. This is not expected to recur. Of this total, $40,000 was paid to Ojan and Shira, the only directors to receive a portion of the founder’s packages.

7 https://livingwage.mit.edu/counties/06001

| Item 7. | Financial Statements |

FINANCIAL STATEMENTS

December 31, 2022 and 2021

C O N T E N T S

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors

East Bay Permanent Real Estate Cooperative, Inc.

Oakland, California

Opinion

We have audited the financial statements of East Bay Permanent Real Estate Cooperative, Inc., which comprise the consolidated balance sheets as of December 31, 2022 and 2021, and the related consolidated statements of income, owners’ equity, and cash flows for the years then ended, and the related notes to the financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial position of East Bay Permanent Real Estate Cooperative, Inc. as of December 31, 2022 and 2021, and the results of its operations and its cash flows for the years then ended in accordance with accounting principles generally accepted in the United States of America.

Basis for Opinion

We conducted our audits in accordance with auditing standards generally accepted in the United States of America (GAAS). Our responsibilities under those standards are further described in the Auditor’s Responsibilities for the Audit of the Financial Statements section of our report. We are required to be independent of East Bay Permanent Real Estate Cooperative, Inc. and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements relating to our audits. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Responsibilities of Management for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in accordance with accounting principles generally accepted in the United States of America, and for the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement, whether due to fraud or error.

In preparing the financial statements, management is required to evaluate whether there are conditions or events, considered in the aggregate, that raise substantial doubt about East Bay Permanent Real Estate Cooperative, Inc.’s ability to continue as a going concern within one year after the date that the financial statements are available to be issued.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not a guarantee that an audit conducted in accordance with GAAS will always detect a material misstatement when it exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal control. Misstatements are considered material if there is a substantial likelihood that, individually or in the aggregate, they would influence the judgment made by a reasonable user based on the financial statements.

In performing an audit in accordance with GAAS, we:

| · | Exercise professional judgment and maintain professional skepticism throughout the audit. |

| · | Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error, and design and perform audit procedures responsive to those risks. Such procedures include examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. |

| · | Obtain an understanding of internal control relevant to the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of East Bay Permanent Real Estate Cooperative, Inc.’s internal control. Accordingly, no such opinion is expressed. |

| · | Evaluate the appropriateness of accounting policies used and the reasonableness of significant accounting estimates made by management, as well as evaluate the overall presentation of the financial statements. |

| · | Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, that raise substantial doubt about East Bay Permanent Real Estate Cooperative, Inc.’s ability to continue as a going concern for a reasonable period of time. |

We are required to communicate with those charged with governance regarding, among other matters, the planned scope and timing of the audit, significant audit findings, and certain internal control-related matters that we identified during the audit.

Report on Consolidating Information

Our audit was conducted for the purpose of forming an opinion on the financial statements as a whole. The consolidating balance sheet and the consolidating schedule of income are presented for purposes of additional analysis of the consolidated financial statements rather than to present the financial position, results of operations, and cash flows of the individual companies, and it is not a required part of the consolidated financial statements. Such information is the responsibility of management and was derived from and relates directly to the underlying accounting and other records used to prepare the consolidated financial statements. The consolidating information has been subjected to the auditing procedures applied in the audit of the consolidated financial statements and certain additional procedures, including comparing and reconciling such information directly to the underlying accounting and other records used to prepare the consolidated financial statements or to the consolidated financial statements themselves, and other additional procedures in accordance with auditing standards generally accepted in the United States of America. In our opinion, the consolidating information is fairly stated in all material respects in relation to the consolidated financial statements as a whole.

Wegner CPAs, LLP

Madison, Wisconsin

March 31, 2023

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

CONSOLIDATED BALANCE SHEETS

December 31, 2022 and 2021

| | | 2022 | | | 2021 | |

| ASSETS | | | | | | |

| CURRENT ASSETS | | | | | | | | |

| Cash | | $ | 4,097,034 | | | $ | 1,641,065 | |

| Accounts receivable | | | 47,156 | | | | 189,246 | |

| Prepaid income taxes | | | 3,350 | | | | - | |

| | | | | | | | | |

| Total current assets | | | 4,147,540 | | | | 1,830,311 | |

| | | | | | | | | |

| Property and equipment, net | | | 3,493,232 | | | | 2,932,715 | |

| | | | | | | | | |

| OTHER ASSETS | | | | | | | | |

| Deferred taxes | | | 14,000 | | | | 13,000 | |

| | | | | | | | | |

| Total assets | | $ | 7,654,772 | | | $ | 4,776,026 | |

| | | | | | | | | |

| LIABILITIES AND OWNERS' EQUITY | | | | | | | | |

| CURRENT LIABILITIES | | | | | | | | |

| Accounts payable | | $ | 111,500 | | | $ | 3,242 | |

| Accrued payroll and expenses | | | 12,199 | | | | 65,529 | |

| Security deposits | | | 4,211 | | | | - | |

| Deferred revenue | | | 1,205,583 | | | | - | |

| Current portion of long-term debt | | | 21,276 | | | | 109,912 | |

| | | | | | | | | |

| Total current liabilities | | | 1,354,769 | | | | 178,683 | |

| | | | | | | | | |

| Long-term debt, net current portion | | | | | | | | |

| and unamortized debt issuance costs | | | 1,733,110 | | | | 1,754,220 | |

| | | | | | | | | |

| Total liabilities | | | 3,087,879 | | | | 1,932,903 | |

| | | | | | | | | |

| OWNERS' EQUITY | | | | | | | | |

| Investor owner shares | | | 3,247,930 | | | | 1,509,630 | |

| Additional paid in capital | | | 1,350,000 | | | | 1,350,000 | |

| Accumulated deficit | | | (31,037 | ) | | | (16,507 | ) |

| | | | | | | | | |

| Total owners' equity | | | 4,566,893 | | | | 2,843,123 | |

| | | | | | | | | |

| Total liabilities and owners' equity | | $ | 7,654,772 | | | $ | 4,776,026 | |

See accompanying notes.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

CONSOLIDATED STATEMENTS OF INCOME

Years Ended December 31, 2022 and 2021

| | | 2022 | | | 2021 | |

| REVENUE | | | | | | |

| Rental income | | $ | 27,311 | | | $ | - | |

| Membership dues | | | 11,196 | | | | 9,705 | |

| Consulting income | | | 191,649 | | | | - | |

| | | | | | | | | |

| Total revenues | | | 230,156 | | | | 9,705 | |

| | | | | | | | | |

| OPERATING EXPENSES | | | | | | | | |

| Salaries and wages | | | 536,971 | | | | 332,776 | |

| Depreciation | | | 62,407 | | | | 33,775 | |

| Taxes and licenses | | | 53,713 | | | | 16,875 | |

| Professional services | | | 39,177 | | | | 23,215 | |

| Occupancy | | | 28,470 | | | | 17,491 | |

| Insurance | | | 26,019 | | | | 14,538 | |

| Event and conferences | | | 14,238 | | | | 7,991 | |

| Contractors | | | 13,579 | | | | 6,632 | |

| Office supplies | | | 7,860 | | | | 9,452 | |

| Advertising | | | 4,534 | | | | 911 | |

| Bank fees | | | 2,481 | | | | 2,485 | |

| | | | | | | | | |

| Total operating expenses | | | 789,449 | | | | 466,141 | |

| | | | | | | | | |

| Net loss from operations | | | (559,293 | ) | | | (456,436 | ) |

| | | | | | | | | |

| OTHER INCOME (EXPENSES) | | | | | | | | |

| Grant income | | | 650,727 | | | | 375,461 | |

| Donation income | | | 21,190 | | | | 143,462 | |

| Interest income | | | 25,888 | | | | 1,264 | |

| Other income | | | 1,205 | | | | 34,389 | |

| Donation expense | | | (110,000 | ) | | | - | |

| Interest expense | | | (34,955 | ) | | | (13,578 | ) |

| Miscellaneous | | | (9,492 | ) | | | (6,558 | ) |

| | | | | | | | | |

| Total other income (expenses) | | | 544,563 | | | | 534,440 | |

| | | | | | | | | |

| Net income (loss) before income taxes | | | (14,730 | ) | | | 78,004 | |

| | | | | | | | | |

| Provision for income taxes | | | 200 | | | | (26,047 | ) |

| | | | | | | | | |

| Net income (loss) | | $ | (14,530 | ) | | $ | 51,957 | |

See accompanying notes.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

CONSOLIDATED STATEMENTS OF OWNERS' EQUITY

Years Ended December 31, 2022 and 2021

| | | | | | Additional | | | | | | | |

| | | Investor Owner | | | Paid In | | | Accumulated | | | | |

| | | Stock | | | Capital | | | Deficit | | | Total | |

| | | | | | | | | | | | | |

| Balance December 31, 2020 | | $ | 268,984 | | | $ | 1,350,000 | | | $ | (68,464 | ) | | $ | 1,550,520 | |

| | | | | | | | | | | | | | | | | |

| Stock issued | | | 1,240,646 | | | | - | | | | - | | | | 1,240,646 | |

| Net income | | | - | | | | - | | | | 51,957 | | | | 51,957 | |

| | | | | | | | | | | | | | | | | |

| Balance December 31, 2021 | | | 1,509,630 | | | | 1,350,000 | | | | (16,507 | ) | | | 2,843,123 | |

| | | | | | | | | | | | | | | | | |

| Stock issued | | | 1,738,300 | | | | - | | | | - | | | | 1,738,300 | |

| Net loss | | | - | | | | - | | | | (14,530 | ) | | | (14,530 | ) |

| | | | | | | | | | | | | | | | | |

| Balance December 31, 2022 | | $ | 3,247,930 | | | $ | 1,350,000 | | | $ | (31,037 | ) | | $ | 4,566,893 | |

See accompanying notes.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended December 31, 2022 and 2021

| | | 2022 | | | 2021 | |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | | | | | | |

| Net income (loss) | | $ | (14,530 | ) | | $ | 51,957 | |

| Adjustments to reconcile net income (loss) | | | | | | | | |

| to net cash flows from operating activities | | | | | | | | |

| Depreciation | | | 62,407 | | | | 33,775 | |

| Deferred taxes | | | (1,000 | ) | | | 22,000 | |

| (Increase) decrease in assets | | | | | | | | |

| Accounts receivable | | | 142,090 | | | | (189,246 | ) |

| Prepaid income taxes | | | (3,350 | ) | | | 300 | |

| Increase (decrease) in liabilities | | | | | | | | |

| Accounts payable | | | 108,258 | | | | (63 | ) |

| Accrued payroll and expenses | | | (53,330 | ) | | | 51,675 | |

| Security deposits | | | 4,211 | | | | - | |

| Refundable grant advance | | | - | | | | (100,000 | ) |

| Deferred revenue | | | 1,205,583 | | | | - | |

| | | | | | | | | |

| Net cash flows from operating activities | | | 1,450,339 | | | | (129,602 | ) |

| | | | | | | | | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | | | | | | |

| Purchases of property and equipment | | | (622,924 | ) | | | (1,592,287 | ) |

| | | | | | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | | | | | | |

| Proceeds from long-term debt | | | - | | | | 1,790,000 | |

| Payments on long-term debt | | | (111,276 | ) | | | (33,937 | ) |

| Amortization of loan costs | | | 1,530 | | | | 510 | |

| Proceeds from issuance of stock | | | 1,738,300 | | | | 1,240,646 | |

| | | | | | | | | |

| Net cash flows from financing activities | | | 1,628,554 | | | | 2,997,219 | |

| | | | | | | | | |

| Net change in cash | | | 2,455,969 | | | | 1,275,330 | |

| | | | | | | | | |

| Cash at beginning of year | | | 1,641,065 | | | | 365,735 | |

| | | | | | | | | |

| Cash at end of year | | $ | 4,097,034 | | | $ | 1,641,065 | |

| | | | | | | | | |

| SUPPLEMENTAL DISCLOSURES | | | | | | | | |

| Cash paid for interest | | $ | 4,015 | | | $ | 5,655 | |

| Cash paid for income taxes | | | 4,150 | | | | 800 | |

See accompanying notes.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2022 and 2021

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Nature of Business

East Bay Permanent Real Estate Cooperative, Inc. (Cooperative) is a multi-stakeholder cooperative that creates pathways for residents of Oakland, California and surrounding communities to organize, finance, acquire, and co-steward land and housing. The Cooperative seeks to transform the housing system to build collective wealth amongst historically disenfranchised communities, while empowering residents through democratic governance.

Basis of Consolidation

The financial statements include the accounts of East Bay Permanent Real Estate Cooperative, Inc. (EB PREC) and its wholly owned subsidiary, Orbit Properties, LLC. All material intra-entity transactions have been eliminated.

Buildings and Improvements

Purchases of buildings and improvements are recorded at cost. Depreciation is provided using the straight-line over the estimated useful lives of the assets.

Loan costs

Loan costs of $15,300 at December 31, 2022 and 2021 are being amortized over the length of the underlying notes payable. Amortization of loan costs, recorded as interest expense in the consolidated statements of income, was $1,530 and $510 for 2022 and 2021. Accumulated amortization was $13,260 and $510 at December 31, 2022 and 2021.

Revenue Recognition

Membership dues are recognized during the year in which the dues are received. Membership dues are primarily used to fund the operations of the Cooperative and provide little of tangible value to the donors. Consulting income is recognized over time as the relevant services are rendered by the Cooperative. Grant revenue is recognized in the year the performance obligations are fulfilled. Donation income is recognized in the year it is received. Amounts received prior to recognition are recorded as deferred revenue.

Leases

The Cooperative does not recognize short-term leases on the balance sheet. For these leases, the Cooperative recognizes the lease payments in the change in net assets on a straight-line basis over the lease term and variable lease payments in the period in which the obligation for those payments is incurred.

Income Taxes

The Cooperative is taxed on non-patronage earnings and any patronage earnings not paid or allocated to the members. Income taxes are provided for the tax effects of transactions reported in the financial statements and consist of taxes currently due and deferred taxes. Deferred taxes are recognized for differences between basis of assets and liabilities for financial statement and income tax purposes.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2022 and 2021

NOTE 1 – SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (continued)

Estimates

Management uses estimates and assumptions in preparing financial statements. Those estimate and assumptions affect the reported amounts of assets and liabilities, the disclosure of contingent assets and liabilities, and the reported revenue and expenses. Actual results could differ from those estimates.

Date of Management's Review

Management has evaluated subsequent events through March 31, 2023, the date which the financial statements were available to be issued.

NOTE 2 – CONCENTRATION OF CREDIT RISK

The Cooperative maintains cash balances at two financial institutions located in Oakland. The accounts at these institutions are insured by the National Credit Union Administration up to $250,000. At December 31, 2022 and 2021, the Cooperative’s uninsured cash balances totaled approximately $3,238,000 and $1,336,000.

NOTE 3 – PROPERTY AND EQUIPMENT

Property and equipment at December 31, 2022 and 2021 consisted of the following:

| | | 2022 | | | 2021 | |

| | | | | | | |

| Land | | $ | 1,261,312 | | | $ | 1,005,000 | |

| Buildings and improvements | | | 2,216,248 | | | | 1,961,490 | |

| Construction in progress | | | 111,854 | | | | - | |

| | | | | | | | | |

| Property and equipment | | | 3,589,414 | | | | 2,966,490 | |

| Less accumulated depreciation | | | (96,182 | ) | | | (33,775 | ) |

| | | | | | | | | |

| Property and equipment, net | | $ | 3,493,232 | | | $ | 2,932,715 | |

NOTE 4 – CONTRIBUTION OF PROPERTY

In May 2020 a residential property valued at $1,350,000 was contributed to the Cooperative from an owner to be used as cooperative housing. The contribution of this property was recorded as additional paid in capital on the balance sheets.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2022 and 2021

NOTE 5 – LONG-TERM DEBT

Long-term debt at December 31, 2022 and 2021 consisted of the following:

| | | 2022 | | | 2021 | |

| Note payable to Local Initiatives Support | | | | | | | | |

| Corporation. The note carried no interest and | | | | | | | | |

| was paid in May 2022. | | $ | - | | | $ | 90,000 | |

| | | | | | | | | |

| Note payable to Force for Good Fund with interest | | | | | | | | |

| at a fixed rate of 6.85%. Note calls for annual | | | | | | | | |

| payments of $24,291 including principal and interest. | | | | | | | | |

| Matures in December 2024. | | | 42,646 | | | | 63,922 | |

| | | | | | | | | |

| Note payable to a member with interest at a fixed | | | | | | | | |

| rate of 2%. Note calls for annual interest only | | | | | | | | |

| payments until maturity. Matures in March 2025. | | | 25,000 | | | | 25,000 | |

| | | | | | | | | |

| Note payable to ImpactAssets, Inc. Due in full in | | | | | | | | |

| December 2033. The note is noninterest bearing, | | | | | | | | |

| has no prepayment penalty, and is secured by | | | | | | | | |

| certain fixed assets of the Cooperative. Management | | | | | | | | |

| recorded imputed interest expense and grant revenue | | | | | | | | |

| of $29,410 and $7,413 for 2022 and 2021. | | | 1,700,000 | | | | 1,700,000 | |

| | | | | | | | | |

| Long-term debt | | | 1,767,646 | | | | 1,878,922 | |

| | | | | | | | | |

| Unamortized loan costs | | | (13,260 | ) | | | (14,790 | ) |

| Current portion of long-term debt | | | (21,276 | ) | | | (109,912 | ) |

| | | | | | | | | |

| Long-term debt net of current portion | | | | | | | | |

| and unamortized loan costs | | $ | 1,733,110 | | | $ | 1,754,220 | |

Future minimum principal payments consist of the following:

| 2023 | | $ | 21,276 | |

| 2024 | | | 21,370 | |

| 2025 | | | 25,000 | |

| 2026 | | | - | |

| 2027 | | | - | |

| Thereafter | | | 1,700,000 | |

| | | | | |

| Long-term debt | | $ | 1,767,646 | |

NOTE 6 – OPERATING LEASE

The Cooperative leases office space under a month-to-month arrangement requiring monthly payments of $600. Total short-terms lease expense for 2022 and 2021 was $7,200 and $6,600.

EAST BAY PERMANENT REAL ESTATE COOPERATIVE, INC.

NOTES TO FINANCIAL STATEMENTS

December 31, 2022 and 2021

NOTE 7 – OWNERS’ EQUITY

The Cooperative offers a multi-tiered ownership structure. Each category of ownership entitles the owner to difference rights and responsibilities. Owners may become owners through multiple categories of ownership and will bear the rights and responsibilities of each category of ownership. Multiple ownership categories do not entitle an owner to more than a single vote.

An individual who lives in or is rooted in the East Bay area may become a Community Owner. Community owners pay yearly membership dues which are used to fund the Cooperative’s operations. Community Owners do not hold equity in the Cooperative.