- RELI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Reliance Global (RELI) S-1IPO registration

Filed: 10 Jan 25, 4:28pm

As filed with the Securities and Exchange Commission on January 10, 2025

Registration No. 333-[__]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Reliance Global Group, Inc.

(Exact name of registrant as specified in its charter)

| Florida | 6411 | 46-3390293 | ||

| (State or Other Jurisdiction of | (Primary Standard Industrial | (I.R.S. Employer | ||

| Incorporation or Organization) | Classification Code Number) | Identification Number) |

300 Blvd. of the Americas, Suite 105 Lakewood, NJ 08701

732- 380-4600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Mr. Ezra Beyman

Chief Executive Officer

300 Blvd. of the Americas, Suite 105 Lakewood, NJ 08701

732-380-4600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony, Linder & Cacomanolis, PLLC 1700 Palm Beach Lakes Blvd, Suite 820 West Palm Beach, Florida 33401 (561) 514-0936 | Ralph V. De Martino, Esq. Marc Rivera, Esq. ArentFox Schiff LLP 1717 K Street NW Washington, DC 20006 (202) 724-6848 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ | Accelerated filer ☐ | |

| Non-Accelerated filer ☒ | Smaller reporting company ☒ | |

| Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the commission, acting pursuant to section 8(a) may determine.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the U.S. Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED JANUARY 10, 2025 |

RELIANCE GLOBAL GROUP, INC.

Up to ______ Units, each consisting of

One Share of Common Stock or One Pre-Funded

Warrant to Purchase One Share of Common Stock and

One Warrant to Purchase One Share of Common Stock

Placement Agent Warrants to Purchase up to _______ Shares of Common Stock

Up to ___________ Shares of Common Stock Underlying the Warrants,

Pre-Funded Warrants, and Placement Agent Warrants

We are offering up to _____ units (“Units”) each Unit consisting of (i) one share of common stock, par value $0.086 per share, and (ii) one warrant with a ___-year term to purchase one share of common stock at an exercise price of $_____ per share (125% of the offering price per Unit) (“Warrant”) on a best-efforts basis. We are offering each Unit at an assumed public offering price of $___ per Unit, equal to the closing price of our common stock on the Nasdaq Capital Market on January __, 2025. Each Warrant will be immediately exercisable for one share of common stock at an assumed exercise price of $_____ per share (not less than 125% of the public offering price of each Unit sold in this offering). The actual public offering price per Unit will be determined between us, Dominari Securities LLC (“Dominari” or the “Placement Agent”) and the investors in the offering, and may be at a discount to the current market price of our common stock. Therefore, the assumed public offering price used throughout this prospectus may not be indicative of the final offering price.

We are also offering to each purchaser of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase Units consisting of one pre-funded warrant to purchase one share of common stock (“Pre-Funded Warrant”) (in lieu of one share of common stock) and one Warrant. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrants if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock. The purchase price of each Unit including a Pre-Funded Warrant will be equal to the price per Unit including one share of common stock, minus $0.001, and the remaining exercise price of each Pre-Funded Warrant will equal $0.001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time until all of the Pre-Funded Warrants are exercised in full. For each Unit including a Pre-Funded Warrant we sell (without regard to any limitation on exercise set forth therein), the number of Units including a share of common stock we are offering will be decreased on a one-for-one basis. The common stock and Pre-Funded Warrants, if any, can each be purchased in this offering only with the accompanying Warrant as part of a Unit, but the components of the Units will immediately separate upon issuance. We are also registering the common stock issuable from time to time upon exercise of the Pre-Funded Warrants and the Warrants included in the Units offered hereby. See “Description of Securities — Description of Securities We Are Offering” in this prospectus for more information.

This offering will terminate on ____________, 2025, unless we decide to terminate the offering (which we may do at any time in our discretion) prior to that date. We will have one closing for all the securities purchased in this offering. The public offering price per Unit will be fixed for the duration of this offering.

Our common stock is listed on the Nasdaq Capital Market (the “Nasdaq”) under the symbol “RELI.” On January 8, 2025, the last reported sale price of our common stock was $2.56 per share, as reported by Nasdaq.

There is no established public trading market for the Units, the Warrants or the Pre-Funded Warrants. We do not intend to list the Units, the Warrants or the Pre-Funded Warrants on any securities exchange or other trading market. We do not expect an active trading market to develop for the Units or Pre-Funded Warrants. Without an active trading market, the liquidity of the Units, the Warrants or the Pre-Funded Warrants will be limited.

We are also seeking to register the issuance of warrants to purchase _____ shares of common stock (the “Placement Agent Warrants”) to Dominari Securities LLC (the “Placement Agent (including the common stock forming part of the Units and the common stock underlying the Warrants and Pre-Funded Warrants forming part of the Units) (assuming the Units are only sold to investors introduced by the Placement Agent), as well as ______ shares of common stock issuable upon exercise by the Placement Agent of the Placement Agent Warrants at an exercise price of $____ per share (115% of public offering price).

There is no minimum number of Units or minimum aggregate amount of proceeds for this offering to close. We expect this offering to be completed not later than two business days following the commencement of this offering.

Investing in our securities is highly speculative and involves a high degree of risk. You should purchase these securities only if you can afford a complete loss of your investment. You should carefully consider the risks and uncertainties described under the heading “Risk Factors” beginning on page 10 of this prospectus before making a decision to purchase our securities.

| Neither the Securities and Exchange Commission | Per Unit consisting of common stock and Warrant | Per Unit consisting of pre-funded warrant and Warrant | Total(5) | |||||||||

| Assumed Public Offering Price (1) (2) | $ | $ | $ | |||||||||

| Placement Agent fees (3) (4) | $ | $ | $ | |||||||||

| Proceeds, before expenses, to us | $ | $ | $ | |||||||||

| (1) | Calculated based on an assumed offering price of $_____, which represents the closing sales price on the Nasdaq Capital Market of the registrant’s common stock on January __, 2025 and assuming no Units with Pre-Funded Warrants are sold in this offering. This amount will decrease by $0.001 for each Unit including a Pre-Funded Warrant sold in this offering. |

| (2) | The public offering price corresponds to (x)(i) a public offering price per share of $ and (ii) a public offering price per Warrant of $0.01, and (y)(i) a public offering price per Pre-Funded Warrant of $ and (ii) a public offering price per Warrant of $0.01. |

| (3) | The Placement Agent fees shall equal (i) eight percent (8%) of the gross proceeds of the securities sold by us in this offering to investors introduced by the Placement Agent or (ii) a fee equal to three percent (3%) of the gross proceeds of the securities sold by us in this offering to investors (friends and family) introduced by us. The calculation above is based on the assumption that all shares sold in this offering were to investors introduced by the Placement Agent. Proceeds to the Company will be higher if any shares sold in this offering were to investors introduced by us. |

| (4) | The Placement Agent will receive compensation in addition to the Placement Agent fees described above. See “Plan of Distribution” for a description of compensation payable to the Placement Agent. | |

| (5) | Assumes that the maximum offering amount is sold. Because there is no minimum number of securities or amount of proceeds required as a condition to closing in this offering, the actual public offering amount, Placement Agent fees, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above. We estimate the total expenses of this offering payable by us, excluding the Placement Agent fees, will be approximately $[_______]. |

We have engaged the Placement Agent as our exclusive Placement Agent to use its reasonable best efforts to solicit offers to purchase our securities in this offering. The Placement Agent has no obligation to purchase any of the securities from us or to arrange for the purchase or sale of any specific number or dollar amount of the securities. Because there is no minimum offering amount required as a condition to closing in this offering the actual public amount, Placement Agent’s fee, and proceeds to us, if any, are not presently determinable and may be substantially less than the total maximum offering amounts set forth above and throughout this prospectus. We have agreed to pay the Placement Agent the Placement Agent fees set forth in the table above and to provide certain other compensation to the Placement Agent. See “Plan of Distribution” beginning on page 36 of this prospectus for more information regarding these arrangements.

We expect to deliver the shares of common stock and Warrants, or Pre-Funded Warrants and Warrants, constituting the Units against payment in New York, New York on or about _______, 2025, subject to customary closing conditions.

Neither the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is _________, 2025.

You should rely only on the information contained in this prospectus or any prospectus supplement or amendment. Neither we, nor the Placement Agent has authorized any other person to provide you with information that is different from, or adds to, that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. Neither we nor the Placement Agent take responsibility for, and we can provide no assurance as to the reliability of, any other information that others may give you. You should assume that the information contained in this prospectus or any free writing prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of our Common Stock. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of any securities in any jurisdiction in which such offer is unlawful.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our Common Stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this public offering and the distribution of this prospectus applicable to that jurisdiction.

The information in this prospectus is accurate only as of the date on the front cover of this prospectus. Our business, financial condition, results of operations and prospects may have changed since those dates.

TABLE OF CONTENTS

| i |

The registration statement of which this prospectus forms a part that we have filed with the Securities and Exchange Commission, or SEC, includes exhibits that provide more detail of the matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC before making your investment decision.

Unless the context otherwise requires, references in this prospectus to “Reliance,” “the Company,” “we,” “us” and “our” refer to Reliance Global Group, Inc. and our subsidiaries. Solely for convenience, trademarks and tradenames referred to in this prospectus may appear without the ® or ™ symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights, or that the applicable owner will not assert its rights, to these trademarks and tradenames.

| ii |

This summary highlights information contained in other parts of this prospectus or information incorporated by reference into this prospectus from our filings with the Securities and Exchange Commission, or SEC, listed in the section of the prospectus entitled “Incorporation of Certain Information by Reference.” Because it is only a summary, it does not contain all of the information that you should consider before purchasing our securities in this offering and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere or incorporated by reference into this prospectus. You should read the entire prospectus, the registration statement of which this prospectus is a part, and the information incorporated by reference herein in their entirety, including the “Risk Factors” and our financial statements and the related notes incorporated by reference into this prospectus, before purchasing our securities in this offering. Unless the context requires otherwise, references in this prospectus to “Reliance,” “Company,” “we,” “us” or “our” refer to Reliance Global Group, Inc., a Florida corporation and its subsidiaries.

Business Overview

Reliance Global Group, Inc. (the “Company”) (formerly known as Ethos Media Network, Inc.) was incorporated in Florida on August 2, 2013. In September 2018, Reliance Global Holdings, LLC, a related party (“Reliance Holdings”), purchased a controlling interest in the Company. Ethos Media Network, Inc. was renamed Reliance Global Group, Inc. on October 18, 2018.

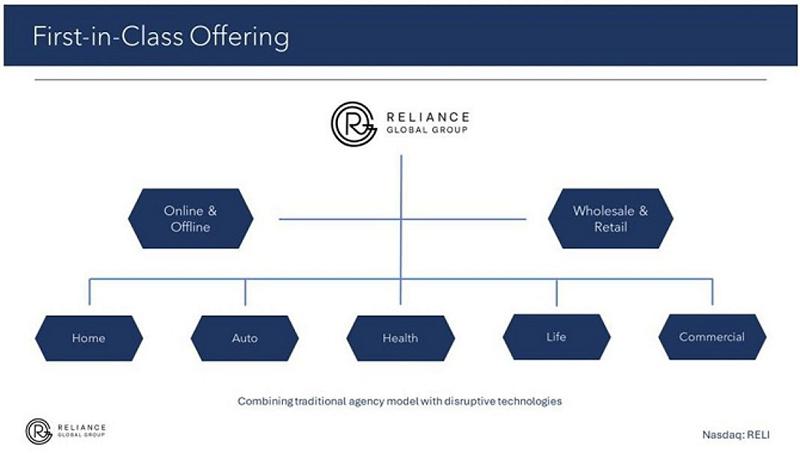

We operate as a company managing assets in the insurance markets, as well as other related sectors under the RELI Exchange umbrella. Our focus is to grow the Company by pursuing an aggressive acquisition strategy, initially and primarily focused upon wholesale and retail insurance agencies. We are led and advised by a management team that offers over 100 years of combined business expertise in insurance, real estate and the financial service industry.

In the insurance sector, our management has extensive experience acquiring and managing insurance portfolios in several states, as well as developing specialized programs targeting niche markets. Our primary strategy is to identify specific risk to reward arbitrage opportunities and develop these on a national platform, thereby increasing revenues and returns, and then identify and acquire undervalued wholesale and retail insurance agencies with operations in growing or underserved segments, expand and optimize their operations, and achieve asset value appreciation while generating interim cash flows.

As part of our growth and acquisition strategy, we remain active in M&A markets and anticipate completing insurance agency/brokerage transactions throughout the course of 2024 and beyond. As of December 31, 2023 we have acquired nine insurance agencies. During 2022, the Company acquired Barra & Associates, LLC., an unaffiliated full-service insurance agency, which we rebranded to RELI Exchange and expanded its footprint nationally. Additionally, we’re implementing our ‘OneFirm’ vision and strategy, which brings together our individual agencies under the single umbrella of the RELI Exchange to operate as one cohesive unit. This initiative is intended to create cross-selling and cross talent sharing opportunities for our agents and agency partners and we believe it will enhance our market presence across the U.S., fortify our relationships with carriers, enabling us to realize more profitable commission and bonus contracts due to expected increases in business volume and offer substantial benefits and efficiencies to both our agents and their clients, our shareholders, and our financial performance.

| 1 |

On May 14, 2024, and as amended on September 6, 2024, the Company entered into a Stock Exchange Agreement (the “Stock Exchange Agreement”) to acquire Spetner Associates, Inc. (“Spetner”). Pursuant to the Stock Exchange Agreement, the Company agreed to: (i) acquire 80% of the issued and outstanding shares of common stock, par value $1.00 per share, of Spetner for $13,714,286 (which amount is to be paid as $5,500,000 in cash, shares of the Company’s Common Stock equal to a beneficial ownership of 9.9% in the Company at the time of issuance, and any remaining balance is to be paid by the Company’s issuance of promissory notes); and (ii) have the sole option to acquire the remaining 20% of Spetner common stock for a predetermined amount based on a multiple of 10 of EBITDA. On October 29, 2024, the Company entered into Amendment No. 1 (the “Amendment”) to the Stock Exchange Agreement. Pursuant to the Amendment, the Company issued to the sellers of Spetner, 140,064 shares of the Company’s common Stock, as a non-refundable deposit and a prepayment of a portion of the First Purchase Price (as defined in the Stock Exchange Agreement), in the approximate amount of $329,431. While the Company intends to further the continued growth of its underlying business with this acquisition which is expected to be the largest acquisition in the Company’s history and is set to be a key inflection point for the Company, there can be no assurance that the Company will be able to close this acquisition, or even if the Company does close the acquisition, there can be no assurance that the Company can successfully implement its strategy for the acquisition of Spetner.

The Company also developed and launched 5MinuteInsure.com (“5MI”), a proprietary direct to consumer InsurTech platform which went live during the summer of 2021. 5MI is a business to consumer website which enables consumers to compare and purchase car and home insurance in a time efficient and effective manner. The platform is currently live in 44 states and offers coverage with more than 30 insurance carriers. As part of the evolution of our InsurTech platform and our efforts to enhance the value proposition of the RELI Exchange platform, we recently launched the proprietary RELI Exchange Client Referral Portal (CRP), designed to help streamline the referral process, increase closure rates among agency partners and establish and strengthen connections with a range of professional service providers, including real estate agents, car dealerships, and mortgage brokers. These professionals frequently interact with clients in need of insurance products. Using this new feature, agency partners are able to generate a unique affiliate link for each referral partner, making the process straightforward for the referral partner’s clients to access and purchase insurance services from a specific RELI Exchange agency partner.

Over the next 12 months, we plan to expand and grow our footprint and market share both through organic growth, and by expansion through additional acquisitions in various insurance markets.

Our competitive advantage includes the ability to:

| ● | Scale to compete at a national level. |

| ● | Capitalize on the consumer shift to ‘online’ with the personal touch of an agent, as the only InsurTech company with this combination. |

| ● | Leverage proprietary agency software and automation to compare carrier prices, for competitive renewal pricing. |

| ● | Employ an empowered and scalable insurance agency model. |

| ● | Leverage technology that facilitates comparing carriers for the best prices. |

The RELI Exchange B2B InsurTech platform and partner network for insurance agents and agencies also:

| ● | Boast being the only white label insurance brokerage agency – New agents can have a multi-million dollar agency look on day one, with a full suite of back office support (licensing, compliance, etc.). |

| ● | Combines the low barriers to entry of an agency network, with state-of-the-art tech. |

| ● | Builds on the artificial intelligence and data mining backbone of 5MinuteInsure.com |

| ● | Is designed to provide instant and competitive insurance quotes from more than thirty insurance carriers nationwide. |

| ● | Reduces back-office burden and expenses by eliminating paperwork. |

| ● | Provides agents more time to focus on selling policies. |

In addition, we have a vast mentorship program behind the scenes, to keep sales teams active. Once people are registered, we enroll them in our mentorship program, and coach them to bring new business.

RELI Exchange is a complete, private label system where agents have more flexibility in how they choose to brand themselves, compared to competitor platforms that require agents to work under the platform’s brand name. In effect, agents have a greater sense of ownership on our platform, and the feeling that comes with a well-financed agency.

| 2 |

Our best-in-class product offerings include the following:

| 1) | An agency partner contract | |

| 2) | An agent / pro contract |

Our value proposition is that we’re giving people a complete, white label business. Agents have a fast and easy website presence, get contracts with carriers they wouldn’t normally access, and they can get paid for referrals.

Recent Developments

Exercise of All Outstanding Series B and Series G Warrants

On June 18, 2024, the holder of the Company’s then remaining Series B Warrants exercised all their remaining 50,980 warrants via cashless exercises, thereby acquiring 39,569 shares of the Company’s common stock. The Series B Warrants effective exercise price per share as of the date of the exercises was $3.91. Accordingly, there are no longer any Series B Warrants outstanding. On June 18, 2024, the holder of the Series G Warrants exercised all of its 247,678 warrants, via cashless exercises, thereby acquiring 192,236 shares of the Company’s common stock. The Series G Warrants effective exercise price per share as of the date of the exercises was $3.96. Accordingly, there are no longer any Series G Warrants outstanding.

Reverse Stock Split

On June 26, 2024, the Company filed a certificate of amendment (the “Certificate of Amendment”) to its Amended and Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), with the Secretary of State of the State of Florida relating to a 1-for-17 reverse stock split (the “Reverse Stock Split”) of the outstanding shares of the Company’s common stock. The Reverse Stock Split became effective at 5:00 p.m. Eastern time, after the close of trading on the Nasdaq Capital Market (“Nasdaq”), on June 28, 2024 and the common stock began trading on Nasdaq on a Reverse Stock Split-adjusted basis on July 1, 2024 at market open.

Pursuant to the Certificate of Amendment, and consistent with Florida law, effective at 5:00 p.m. Eastern time on June 28, 2024, the Company also decreased its authorized shares of common stock by the same proportion as the Reverse Stock Split. Accordingly, stockholder approval of the Reverse Stock Split (and the corresponding reduction in authorized shares) was not required.

As a result of the Reverse Stock Split, the number of outstanding shares of common stock was reduced from approximately 15.7 million shares to approximately 921,000 shares. The par value and other terms of the common stock will not be affected by the Reverse Stock Split. The Company’s post-Reverse Stock Split common stock CUSIP number is 75946W 405.

| 3 |

New Real Estate Division

On July 1, 2024, the Company announced the formation of a new real estate division. Furthermore, Abe Miller, a successful real estate investor and M&A executive, agreed to join the Company to oversee this new division and advise on future real estate transactions. Mr. Miller will receive no fixed salary for his services; rather, he will be compensated entirely on a success-based model. The new division is intended to supplement, and not replace, the Company’s focus on acquiring accretive and cash flow positive insurance agencies.

New AI-powered Quote & Bind InsurTech Solution

On July 30, 2024, the Company announced its new, advanced AI-powered Quote & Bind cutting-edge InsurTech solution for commercial policies, designed to significantly enhance the capabilities of RELI Exchange agency partners. The new Quote & Bind solution, integrated within the RELI Exchange platform, leverages artificial intelligence, enabling agents to provide real-time commercial insurance quotes from multiple carriers and bind policies in real time from the RELI Exchange agent dashboard. These new commercial lines of insurance include workers’ compensation, business owners, general liability, cyber liability, and inland marine, as well as executive lines, such as directors & officers (D&O) insurance and employment practices liability insurance (EPLI). On September 30, 2024, the Company announced the official launch of the beta version of the AI-powered Quote & Bind InsurTech solution for commercial policies.

2024 Annual Meeting

On December 31, 2024, the Company held its annual meeting of stockholders at which the Company’s stockholders voted: (i) to elect Ezra Beyman, Alex Blumenfrucht, Scott Korman, Ben Fruchtzweig, and Sheldon Brickman to the Company’s Board of Directors, each to serve a one-year term expiring at the 2025 Annual Meeting of Stockholders and until such director’s successor is duly elected and qualified; (ii) to approve the Company’s 2024 Omnibus Incentive Plan; (iii) to approve the amendment of the Company’s Articles of Incorporation, as amended, to increase the total number of authorized shares of our common stock from 117,647,058 shares to 2,000,000,000 shares; and (iv) to ratify the appointment of Urish Popeck & Co., LLC as the Company’s independent registered public accounting firm for our fiscal year ending on December 31, 2024.

Risks Relating to Our Business

We have been expanding our business by acquiring wholesale and retail insurance agencies in select markets in the U.S. In addition, we operate the RELI Exchange and 5MinuteInsure.com, proprietary internet based platforms we developed as business to business or business to consumer portals enabling agents and consumers to compare quotes from multiple carriers and sell and purchase their auto, home and life insurance coverage in a time efficient and effective manner. Our business and ability to execute our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the risks discussed in detail in the section entitled “Risk Factors” including but not limited to:

| ● | We may experience significant fluctuations in our quarterly and annual results. |

| ● | We have limited resources and there is significant competition for business combination opportunities. Therefore, we may not be able to acquire other assets or businesses. |

| ● | We may be unable to obtain additional financing, if required, to complete an acquisition, or for our operations and growth of existing and target business, which could compel us to restructure a potential business transaction or abandon a particular business combination. |

| ● | Our cash and cash equivalents that we use to meet our working capital and operating expense needs are held in deposit accounts that could be adversely affected if the financial institution holding such funds fail. |

| ● | Our inability to retain or hire qualified employees, as well as the loss of any of our executive officers, could negatively impact our ability to retain existing business and generate new business. |

| ● | Our growth strategy depends, in part, on the acquisition of other insurance intermediaries, which may not be available on acceptable terms in the future or which, if consummated, may not be advantageous to us. |

| ● | A cybersecurity attack, or any other interruption in information technology and/or data security and/or outsourcing relationships, could adversely affect our business, financial condition and reputation. |

| 4 |

| ● | Rapid technological change may require additional resources and time to adequately respond to dynamics, which may adversely affect our business and operating results. |

| ● | Changes in data privacy and protection laws and regulations, or any failure to comply with such laws and regulations, could adversely affect our business and financial results. |

| ● | Because our insurance business is highly concentrated in certain states, adverse economic conditions, natural disasters, or regulatory changes in these states could adversely affect our financial condition. |

| ● | If we fail to comply with the covenants contained in certain of our agreements, our liquidity, results of operations and financial condition may be adversely affected. |

| ● | Certain of our agreements contain various covenants that limit the discretion of our management in operating our business and could prevent us from engaging in certain potentially beneficial activities. |

| ● | We may experience increased competition from insurance companies, technology companies and the financial services industry, as well as the shift away from traditional insurance markets. |

| ● | Risks related to our lack of knowledge in distant geographic markets. |

| ● | We compete in a highly regulated industry, which may result in increased expenses or restrictions on our operations. |

| ● | We are subject to a variety of federal, state and international laws and other obligations regarding data protection. |

| ● | Changes in tax laws could materially affect our financial condition, results of operations and cash flows. |

| ● | Expectations of our company relating to environmental, social and governance factors may impose additional costs and expose us to new risks. |

Corporate Information

We were formed under the name Ethos Media Network, Inc. in Florida on August 2, 2013. In September 2018, Reliance Global Holdings, LLC, a related party, purchased a controlling interest in our company. Ethos Media Network, Inc. changed its name to Reliance Global Group, Inc. on October 18, 2018. Our principal executive offices are located at 300 Blvd. of the Americas, Suite 105, Lakewood, NJ 08701. Our website is located at www.relianceglobalgroup.com and our telephone number is (732) 380-4600. Information found on, or accessible through, our website is not a part of, and is not incorporated into, this prospectus, and you should not consider it part of the prospectus.

| 5 |

| Issuer | Reliance Global Group, Inc. | |

| Securities offered by us | Up to ________ Units on a best-efforts basis. Each Unit consists of (i) one share of common stock and (ii) one Warrant to purchase one share of common stock (together with the common stock underlying the Warrants).

We are also offering to each purchaser, with respect to the purchase of Units that would otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase one Pre-Funded Warrant in lieu of one share of common stock. Subject to limited exceptions, a holder of Pre-Funded Warrants will not have the right to exercise any portion of its Pre-Funded Warrant if the holder, together with its affiliates, would beneficially own in excess of 4.99% (or, at the election of the holder, such limit may be increased to up to 9.99%) of the number of common stock outstanding immediately after giving effect to such exercise. Each Pre-Funded Warrant will be exercisable for one share of common stock. The purchase price per Pre-Funded Warrant will be equal to the price per share of common stock, minus $0.001, and the exercise price of each Pre-Funded Warrant will equal $0.001 per share. The Pre-Funded Warrants will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity until all of the Pre-Funded Warrants are exercised in full.

The Units will not be certificated or issued in stand-alone form. The common stock and/or Pre-Funded Warrants and the Warrants comprising the Units are immediately separable upon issuance and will be issued separately in this offering. | |

| Description of the Warrants and Pre-Funded Warrants | Each Warrant will have an assumed exercise price of $____ per share (not less than 125% of the public offering price of each unit sold in this offering), will be exercisable upon issuance and will expire five years from issuance. Each Pre-Funded Warrant will have an exercise price of $0.001 per share, will be immediately exercisable (subject to the beneficial ownership cap) and may be exercised at any time in perpetuity. Each Warrant and Pre-Funded Warrant is exercisable for one share of common stock, subject to adjustment in the event of stock dividends, stock splits, stock combinations, reclassifications, reorganizations or similar events affecting our common stock as described herein. The terms of the Warrants will be governed by a Warrant Agency Agreement, dated as of the closing date of this offering, that we expect to be entered into between us and VStock Transfer, LLC, or its affiliate (the “Warrant Agent”). This prospectus also relates to the offering of the common stock issuable upon exercise of the Warrants and Pre-Funded Warrants. For more information regarding the Warrants and Pre-Funded Warrants, you should carefully read the section titled “Description of Securities – Description of Securities We are Offering” in this prospectus. | |

| Placement Agent Warrant | The registration statement of which this prospectus is a part also registers for sale warrants to purchase up to ________ shares of our common stock (5% of the shares of common stock forming part of the Units sold to investors introduced by the Placement Agent in this offering and 5% of the shares of common stock underlying the Pre-Funded Warrants and Warrants forming part of the Units sold in this offering) to be issued to the Placement Agent or its designee, as a portion of the Placement Agent compensation payable in connection with this offering. The warrants will be exercisable at any time, and from time to time, in whole or in part, commencing from the closing of the offering and expiring five (5) years from the commencement of sales of the offering, at an exercise price of $_____ (115% of the assumed public offering price of the Units). Please see “Plan of Distribution—Placement Agent Warrants” for a description of these warrants. |

| Size of Offering | $_________ | |

| Assumed Price Per Unit | $______ per Unit including one share of common stock (or $______ per Unit including one Pre-Funded Warrant in lieu of one share of common stock) | |

| Common stock outstanding prior to this offering (1) | 2,250,210 shares | |

| Common stock to be outstanding after this offering (1) | Up to approximately ________ shares (assuming no issuance of Pre-Funded Warrants and no exercise of Common Warrants offered in this offering). |

| 6 |

| Use of proceeds | Assuming the maximum number of Units are sold in this offering at an assumed public offering price of $_____ per Unit, which represents the closing price of our common stock on Nasdaq on January __, 2025, and assuming no issuance of Units including Pre-Funded Warrants in connection with this offering or exercise of the Warrants offered in this offering, we estimate the net proceeds of the offering will be approximately $________, after deducting cash expenses relating to this offering payable by us estimated at approximately $________, including Placement Agent fees (assuming all investors were introduced by the Placement Agent) of approximately $_______ and offering expenses of $________. However, this is a best-efforts offering with no minimum number of securities or amount of proceeds as a condition to closing, and we may not sell all or any of these securities offered pursuant to this prospectus; as a result, we may receive significantly less in net proceeds. We expect to use the net proceeds from this offering for our acquisition of Spetner Associates, Inc., a Missouri corporation and for working capital to grow the Company and general corporate purposes. It is possible that, pending their use, we may invest the net proceeds in a way that does not yield a favorable, or any, return for us. See “Use of Proceeds.” Our management will have broad discretion in the application of the net proceeds, and investors will be relying on our judgment regarding the application of the net proceeds from this offering. See “Risk Factors” for a discussion of certain risks that may affect our intended use of the net proceeds from this offering. | |

| Listing | Our common stock currently trades on the Nasdaq Capital Market under the symbol “RELI”. We do not intend to list the Units, Pre-Funded Warrants or Warrants offered hereunder on any stock exchange. | |

| Risk factors | An investment in our securities is highly speculative and involves a significant degree of risk. See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in our securities. | |

| Best Efforts Offering | We have agreed to offer and sell the securities offered hereby to the purchasers through the Placement Agent. The Placement Agent is not required to buy or sell any specific number or dollar amount of the securities offered hereby, but it will use its reasonable best efforts to solicit offers to purchase the securities offered by this prospectus. See “Plan of Distribution” on page 36 of this prospectus. |

| 1 | The number of shares of common stock outstanding before this offering is based on 2,250,210 shares of our common stock outstanding as of January 7, 2025 and assumes no sale of Pre-Funded Warrants in this offering, which, if sold, would reduce the number of common stock that we are offering on a one-for-one basis; and no exercise of the Pre-Funded Warrants or Warrants and excludes the following: |

| ● | 17 shares of our common stock issuable upon the exercise of stock options outstanding as of January 7, 2025, at a weighted-average exercise price of $3,497 per share; | |

| ● | 6,647 shares of common stock issuable upon exercise of warrants to purchase common stock with a weighted-average exercise price of $104.21 per share as of January 7, 2025; | |

| ● | 102 shares of our common stock subject to vested and unvested stock awards as of January 7, 2025; | |

| ● | 2,524 shares of common stock reserved for future issuance under our 2023 and 2019 Equity Incentive Plans as of January 7, 2025; and | |

| ● | ___________ shares of common stock underlying the warrants to be issued to the Placement Agent in connection with this offering. |

Unless otherwise indicated, this prospectus reflects and assumes the following:

| ● | no sale of Pre-Funded Warrants in this offering, which, if sold, would reduce the number of common stock that we are offering on a one-for-one basis; and |

| ● | no exercise of the Warrants issued in this offering. |

| 7 |

CAUTIONARY NOTE CONCERNING FORWARD-LOOKING STATEMENTS

This prospectus and the documents incorporated by reference herein contain “forward-looking statements” within the meaning of the federal securities laws, which statements are subject to considerable risks and uncertainties. These forward-looking statements are intended to qualify for the safe harbor from liability established by the Private Securities Litigation Reform Act of 1995. All statements included or incorporated by reference in this prospectus, other than statements of historical fact, are forward-looking statements. You can identify forward-looking statements by the use of words such as “anticipate,” “believe,” “can,” “continue” “could,” “estimates,” “expect,” “intend,” “may,” “plans,” “potential,” “predicts,” “should,” “will,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to such statements. In particular, forward-looking statements included or incorporated by reference in this prospectus relate to, among other things, our future or assumed financial condition, results of operations, liquidity, business forecasts and plans, strategic plans and objectives, competitive environment and our expected use of the net proceeds from this offering. We caution you that the foregoing list may not include all of the forward-looking statements made in this prospectus.

Our forward-looking statements are based on our management’s current assumptions and expectations about future events and trends, which affect or may affect our business, strategy, operations or financial performance. Although we believe that these forward-looking statements are based upon reasonable assumptions, they are subject to numerous known and unknown risks and uncertainties and are made in light of information currently available to us. Our actual financial condition and results could differ materially from those anticipated in these forward-looking statements as a result of various factors, including those set forth in the section entitled “Risk Factors” beginning on page 10 of this prospectus, as well as in the other reports we file with the SEC. You should read this prospectus with the understanding that our actual future results may be materially different from and worse than what we expect.

Moreover, we operate in an evolving environment. New risk factors and uncertainties emerge from time to time and it is not possible for our management to predict all risk factors and uncertainties, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

Forward-looking statements speak only as of the date they were made, and, except to the extent required by applicable laws or the Nasdaq listing rules, we undertake no obligation to update or review any forward-looking statement because of new information, future events or other factors.

We qualify all of our forward-looking statements by these cautionary statements.

| 8 |

Reverse Stock Split

On June 26, 2024, the Company filed a certificate of amendment (the “Certificate of Amendment”) to its Amended and Restated Articles of Incorporation, as amended (the “Articles of Incorporation”), with the Secretary of State of the State of Florida relating to a 1-for-17 reverse stock split (the “Reverse Stock Split”) of the outstanding shares of the Company’s common stock. The Reverse Stock Split became effective at 5:00 p.m. Eastern time, after the close of trading on the Nasdaq Capital Market (“Nasdaq”), on June 28, 2024 and the common stock began trading on Nasdaq on a Reverse Stock Split-adjusted basis on July 1, 2024 at market open.

Pursuant to the Certificate of Amendment, and consistent with Florida law, effective at 5:00 p.m. Eastern time on June 28, 2024, the Company also decreased its authorized shares of common stock by the same proportion as the Reverse Stock Split. Accordingly, stockholder approval of the Reverse Stock Split (and the corresponding reduction in authorized shares) was not required.

As a result of the Reverse Stock Split, the number of outstanding shares of common stock was reduced from approximately 15.7 million shares to approximately 921,000 shares. The par value and other terms of the common stock will not be affected by the Reverse Stock Split. The Company’s post-Reverse Stock Split common stock CUSIP number is 75946W 405.

The following selected financial data has been derived from our audited financial statements included in our Annual Report on Form 10-K filed with the SEC on April 4, 2024, and our unaudited financial statements included in our Quarterly Report on Form 10-Q filed with the SEC on May 20, 2024, as adjusted to reflect the Reverse Stock Split for all periods presented. Our unaudited financial statements included in our Quarterly Reports on Form 10-Q filed with the SEC on July 25, 2024, and November 7, 2024, were adjusted to reflect the Reverse Stock Split.

Our historical results are not indicative of the results that may be expected in the future, and results of interim periods are not indicative of the results for the entire year.

As Reported

| Years Ended December 31, | ||||||||

| 2023 | 2022 | |||||||

Net (loss) income | $ | (12,009,982 | ) | $ | 6,466,162 | |||

| Net loss per share, basic and diluted | $ | (5.16) | $ | (0.42 | ) | |||

| Weighted-average common shares outstanding, basic | 2,820,275 | 1,094,781 | ||||||

| Weighted-average common shares outstanding, diluted | 2,820,275 | 1,094,989 | ||||||

| Common shares outstanding at year end | 4,761,974 | 1,219,573 | ||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| Net loss | $ | (5,346,663 | ) | $ | (1,788,538 | ) | ||

| Loss per share, basic | $ | (0.81 | ) | $ | (1.15 | ) | ||

| Loss per share, diluted | $ | (0.81 | ) | $ | (2.77 | ) | ||

| Weighted-average common shares outstanding, basic | 6,569,019 | 1,553,953 | ||||||

| Weighted-average common shares outstanding, diluted | 6,569,019 | 2,185,847 | ||||||

| Common shares outstanding at period end | 5,692,387 | 1,566,048 | ||||||

As Adjusted For The Reverse Stock Split

| Years Ended December 31, | ||||||||

| (unaudited, in thousands, except share and per share amounts): | 2023 | 2022 | ||||||

| (Unaudited) | ||||||||

| Net (loss) income | $ | (12,009,982 | ) | $ | 6,466,162 | |||

| Net loss per share, basic and diluted | $ | (87.70 | ) | $ | (7.14 | ) | ||

| Weighted-average common shares outstanding, basic | 165,899 | 64,399 | ||||||

| Weighted-average common shares outstanding, diluted | 165,899 | 64,411 | ||||||

| Common shares outstanding at year end | 280,117 | 71,140 | ||||||

| Three Months Ended March 31, | ||||||||

| 2024 | 2023 | |||||||

| (Unaudited) | ||||||||

| Net loss and comprehensive loss | $ | (5,346,663 | ) | $ | (1,788,538 | ) | ||

| Net loss per share, basic | $ | (13.77 | ) | $ | (19.55 | ) | ||

| Net loss per share, diluted | $ | (13.77 | ) | $ | (47.09 | ) | ||

| Weighted-average common shares outstanding, basic | 386,413 | 91,409 | ||||||

| Weighted-average common shares outstanding, diluted | 386,413 | 128,579 | ||||||

| Common shares outstanding at period end | 334,846 | 92,120 | ||||||

| 9 |

Investing in our securities involves a high degree of risk. You should consider carefully the additional risks described below, together with all of the other information included or incorporated by reference in this prospectus, including the risks and uncertainties discussed under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and in our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2024, before deciding whether to purchase our securities in this offering. All of these risk factors are incorporated herein in their entirety. The risks described below and incorporated by reference are material risks currently known, expected or reasonably foreseeable by us. However, the risks described below or that we incorporate by reference are not the only ones that we face. Additional risks not presently known to us or that we currently deem immaterial may also affect our business, operating results, prospects or financial condition. If any of these risks actually materialize, our business, prospects, financial condition, and results of operations could be seriously harmed. This could cause the trading price of our common stock and the value of the warrants to decline, resulting in a loss of all or part of your investment.

Risks Related to Pending Acquisition of Spetner Associates, Inc.

Neither the Company’s board of directors nor any committee thereof obtained a fairness opinion (or any similar report or appraisal) in determining whether or not to pursue the acquisition of Spetner Associates, Inc. Consequently, you have no assurance from an independent source that the price the Company is paying for Spetner Associates, Inc. is fair to the Company — and, by extension, its securityholders — from a financial point of view.

On May 14, 2024, and as amended on September 6, 2024, the Company entered into a Stock Exchange Agreement (the “Stock Exchange Agreement”) to acquire Spetner Associates (“Spetner”). Pursuant to the Stock Exchange Agreement, the Company agreed to: (i) acquire 80% of the issued and outstanding shares of common stock, par value $1.00 per share, of Spetner (the “Spetner Common Stock”) for $13,714,286 (which amount is to be paid as $5,500,000 in cash, shares of the Company’s Common Stock equal to a beneficial ownership of 9.9% in the Company at the time of issuance, and any remaining balance is to be paid by the Company’s issuance of promissory notes); and (ii) have the sole option to acquire the remaining 20% of Spetner common stock for a predetermined amount based on a multiple of 10 of EBITDA. On October 29, 2024, the Company entered into Amendment No. 1 (the “Amendment”) to the Stock Exchange Agreement. Pursuant to the Amendment, the Company issued to the sellers of Spetner, 140,064 shares of the Company’s common stock, as a non-refundable deposit and a prepayment of a portion of the First Purchase Price (as defined in the Stock Exchange Agreement), in the approximate amount of $329,431.

Neither the Company’s board of directors nor any committee thereof is required to obtain an opinion (or any similar report) from an independent investment banking or accounting firm that the price that the Company is paying for Spetner is fair to the Company from a financial point of view, although pursuant to Nasdaq Rule 5630 the Company is required to conduct an appropriate review and oversight of all related party transactions for potential conflict of interest situations on an ongoing basis by the Company’s audit committee or another independent body of the board of directors. In analyzing the acquisition of Spetner, the Company’s board of directors reviewed summaries of due diligence results and financial analyses prepared by management. The Company’s board of directors also consulted with legal counsel and with the Company management and considered a number of factors, uncertainty and risks and concluded that the acquisition of Spetner was in the best interest of the Company’s stockholders. The Company’s board of directors believes that because of the professional experience and background of its directors, it was qualified to conclude that the acquisition of Spetner was fair from a financial perspective to its stockholders. Accordingly, investors will be relying solely on the judgment of the Company’s board of directors in valuing Spetner and the Company’s board of directors may not have properly valued such acquisition. As a result, the terms may not be fair from a financial point of view to the public stockholders of the Company.

The acquisition of Spetner Associates, Inc. will cause dilution to the Company’s stockholders.

Pursuant to the Stock Exchange Agreement with Spetner, the Company agreed to: (i) acquire 80% of the issued and outstanding shares of common stock, par value $1.00 per share, of Spetner (the “Spetner Common Stock”) for $13,714,286 (which amount is to be paid as $5,500,000 in cash, shares of the Company’s Common Stock equal to a beneficial ownership of 9.9% in the Company at the time of issuance, and any remaining balance is to be paid by the Company’s issuance of promissory notes); and (ii) have the sole option to acquire the remaining 20% of Spetner common stock for a predetermined amount based on a multiple of 10 of EBITDA. Pursuant to the Amendment, the Company issued to the sellers of Spetner, 140,064 shares of the Company’s common stock, as a non-refundable deposit and a prepayment of a portion of the First Purchase Price (as defined in the Stock Exchange Agreement), in the approximate amount of $329,431. Of the shares of the Company’s common stock that will be issued and outstanding upon the closing of the Stock Exchange Agreement, the shares issued to Spetner will constitute to 9.9% of the issued and outstanding shares. The issuance of such shares will cause dilution to the Company’s stockholders.

Spetner Associates, Inc. is in a highly competitive industry and there can be no assurance that it will be able to compete with many of its competitors which are larger and have greater financial resources.

Spetner operates in a competitive marketplace where multiple organizations aim to attract and support individuals seeking enrollment in various programs or services. Spetner specializes in simplifying and enhancing the enrollment process, offering solutions tailored to meet the needs of Spetner client companies. Despite this, Spetner face competition from both established companies and new entrants. Spetner’s main competitors include organizations that provide similar enrollment facilitation services. These competitors range from large corporations with significant resources and brand recognition to smaller companies focused on niche markets. Spetner also competes with traditional insurance brokers, direct insurance providers, digital platforms and consulting firms with regard to its business of providing individual life insurance and life settlement. Some of these competitors may already have long-standing relationships with clients or access to advanced technology that enhances their offerings. Additionally, direct service providers, such as educational institutions, insurers, or government agencies, often develop their own in-house enrollment solutions, creating another layer of competition. Spetner aims to distinguish itself through Spetner’s user-friendly BenManage platform, personalized support services, and innovative tools that streamline the enrollment process as well as Spetner’s approach to individual life insurance and life settlement needs. Spetner’s ability to adapt to market trends and integrate feedback from users helps it maintain a competitive edge. However, changes in technology, consumer preferences, or regulatory requirements could affect Spetner’s position relative to competitors. Spetner seeks to, but may not be able to, effectively compete with such competitors.

| 10 |

Spetner Associates, Inc. is subject to intense governmental regulation.

Spetner is subject to various federal and state regulations designed to ensure consumer protection, financial transparency, and compliance with industry standards. At the federal level, Spetner must comply with laws such as the Employee Retirement Income Security Act (ERISA), which governs the transparency, fiduciary responsibility, and proper management of employee benefit plans. If Spetner handles employees’ health information during the enrollment process, it must also adhere to the Health Insurance Portability and Accountability Act (HIPAA) to protect the privacy and security of that data. Additionally, the Affordable Care Act (ACA) imposes coverage reporting requirements and mandates that any offered plans meet minimum essential coverage standards. For life insurance offerings, Spetner must follow federal guidelines set by organizations like the National Association of Insurance Commissioners (NAIC), which provide model regulations for the insurance industry. On the state level, insurance and employee benefits are heavily regulated, requiring compliance with various state-specific requirements. These include maintaining proper licensing, adhering to life settlement regulations that ensure fair treatment of policyholders, and following consumer protection laws to prevent deceptive practices. Additionally, any voluntary benefits or life insurance products offered often require filing and approval by state insurance departments. Anti-Money Laundering (AML) compliance is also crucial to prevent financial crimes in the sale of life insurance or life settlements. Furthermore, marketing activities must comply with laws like the Telephone Consumer Protection Act (TCPA) and federal or state data privacy regulations such as the California Consumer Privacy Act (CCPA). This regulatory environment is complex, spanning multiple federal and state laws, making it essential to prioritize compliance across all operations to effectively serve clients while mitigating legal and reputational risks. If Spetner is unable to comply with such regulations, it would result in a material adverse effect on Spetner and thereby the Company.

The Company may not successfully implement its strategy for the acquisition of Spetner Associates, Inc.

While the Company intends to further the continued growth of its underlying business with this acquisition which is expected to be the largest acquisition in the Company’s history and is set to be a key inflection point for the Company, there can be no assurance that the Company will be able to successfully implement its strategy for the acquisition of Spetner Associates, Inc. If the Company is unable to do so it will have an adverse impact on the Company’s strategic plans and ability to grow its business.

The Company may not close on its acquisition of Spetner Associates, Inc.

There can be no assurance that the Stock Exchange Agreement will close or that the transactions will take place as planned or at all. If the Stock Purchase Agreement does not close, the Company will not acquire Spetner and will not have the benefit of Spetner as it seeks to expand its business. Additionally, if the Stock Exchange Agreement does not close, it may result in the loss of business opportunities and potential disruption to the Company’s strategic plans.

Risks Related to this Offering and Our Common Stock

The price of our common stock may fluctuate significantly, and this may make it difficult for you to resell shares of common stock owned by you at times or at prices you find attractive.

The trading price of our common stock may fluctuate widely as a result of a number of factors, including the risk factors described above many of which are outside our control. In addition, the stock market is subject to fluctuations in the share prices and trading volumes that affect the market prices of the shares of many companies. These broad market fluctuations have adversely affected and may continue to adversely affect the market price of our common stock. Among the factors that could affect our stock price are:

| ● | General economic and political conditions such as recessions, economic downturns and acts of war or terrorism; | |

| ● | Quarterly variations in our operating results; | |

| ● | Seasonality of our business cycle; | |

| ● | Changes in the market’s expectations about our operating results; |

| ● | Our operating results failing to meet the expectation of securities analysts or investors in a particular period; | |

| ● | Changes in financial estimates and recommendations by securities analysts concerning us or the insurance brokerage or financial services industries in general; | |

| ● | Operating and stock price performance of other companies that investors deem comparable to us; | |

| ● | News reports relating to trends in our markets, including any expectations regarding an upcoming “hard” or “soft” market; | |

| ● | Cyberattacks and other cybersecurity incidents; | |

| ● | Changes in laws and regulations affecting our business; | |

| ● | Material announcements by us or our competitors; | |

| ● | The impact or perceived impact of developments relating to our investments, including the possible perception by securities analysts or investors that such investments divert management attention from our core operations; |

| 11 |

| ● | Market volatility; | |

| ● | A negative market reaction to announced acquisitions; | |

| ● | Competitive pressures in each of our divisions; | |

| ● | General conditions in the insurance brokerage and insurance industries; | |

| ● | Legal proceedings or regulatory investigations; and | |

| ● | Sales of substantial amounts of common shares by our directors, executive officers or significant stockholders or the perception that such sales could occur. |

Stockholder class action lawsuits may be instituted against us following a period of volatility in our stock price. Any such litigation could result in substantial cost and a diversion of management’s attention and resources.

The best-efforts structure of this offering may have an adverse effect on our business plan.

The Placement Agent is offering the securities in this offering on a “best-efforts” basis. The Placement Agent is not required to purchase any securities, but will use its best efforts to sell the securities offered. As a “best-efforts” offering, there can be no assurance that the offering contemplated hereby will ultimately be consummated or will result in any proceeds being made available to us. The success of this offering will impact our ability to use the proceeds to acquire Spetner or to further execute our business plan. We may have insufficient capital to implement our business plans, potentially resulting in greater operating losses unless we are able to raise the required capital from alternative sources. There is no assurance that alternative capital, if needed, would be available on terms acceptable to us, or at all.

Purchasers who purchase our securities in this offering pursuant to a securities purchase agreement may have rights not available to purchasers that purchase without the benefit of a securities purchase agreement.

In addition to rights and remedies available to all purchasers in this offering under federal securities and state law, the purchasers that enter into a securities purchase agreement in this offering will also be able to bring claims of breach of contract against us. The ability to pursue a claim for breach of contract provides those investors with the means to enforce the covenants uniquely available to them under the securities purchase agreement including: (i) timely delivery of shares; (ii) agreement to not enter into variable rate financings for one year from closing, subject certain exceptions; (iii) agreement to not enter into any financings for 90 days from closing, subject to certain exceptions; and (iv) indemnification for breach of contract.

If you purchase our Units (of which common stock forms a part) in this Offering, you will experience immediate and substantial dilution in the net tangible book value of your shares of common stock (if you exercise the Warrants or the Pre-Funded Warrants). In addition, we may issue additional equity or convertible debt securities in the future, which may result in additional dilution to investors.

The price of our common stock in the Unit to be sold in this offering is substantially higher than the net tangible book value per share of our common stock. Therefore, if you purchase Units which include shares of our common stock in this offering, you will pay a price per share that substantially exceeds our net tangible book value per share after this offering. Based on an assumed offering price of $_____ per Unit, and the net tangible book value per share of our common stock of ($______) as of September 30, 2024, if you purchase Units in this offering you will suffer dilution of $_____ per share with respect to the net tangible book value per share of the common stock, which will be ($_____) per share following the offering on a pro forma as adjusted basis (attributing no value to the Warrants). See “Dilution” in this prospectus for more information.

Future sales of our common stock following this offering, which may depress the market price of our common stock.

The Units we are offering include a significant number of shares of our common stock relative to the amount of our common stock currently outstanding. Additionally, a large number of shares of common stock issued as part of the Units in this offering may be sold in the public market following this offering, which may depress the market price of our common stock. If there are more shares of common stock offered for sale than buyers are willing to purchase, then the market price of our common stock may decline to a market price at which buyers are willing to purchase the offered shares of common stock and sellers remain willing to sell the shares of common stock. The common stock issued in the Units in this offering will be freely tradable without restriction or further registration under the Securities Act.

Future sales or other dilution of our equity could adversely affect the market price of our common stock.

We grow our business organically as well as through acquisitions. One method of acquiring companies or otherwise raising capital is through the issuance of additional equity securities. The issuance of any additional shares of common or of preferred stock or convertible securities could be substantially dilutive to holders of our common stock. Moreover, to the extent that we issue restricted stock units, performance stock units, options or warrants to purchase shares of our common stock in the future and those options or warrants are exercised or as the restricted stock units or performance stock units vest, our stockholders may experience further dilution. Holders of our common stock have no preemptive rights that entitle holders to purchase their pro rata share of any offering of shares of any class or series and, therefore, such sales or offerings could result in increased dilution to our stockholders. The market price of our common stock could decline as a result of sales of shares of our common stock or the perception that such sales could occur.

| 12 |

Possible issuance of additional securities.

Our Articles of Incorporation, as amended, authorize the issuance of 2,000,000,000 shares of common stock, par value $0.086 per share. As of September 30, 2024, we had 1,452,249 shares issued and outstanding; 51 shares of our common stock issuable upon the exercise of stock options outstanding as of September 30, 2024, at a weighted-average exercise price of $5,024 per share; 6,647 shares of our common stock issuable upon the exercise of warrants outstanding as of September 30, 2024, at a weighted-average exercise price of $104.21 per share; 2,568 shares of common stock available for future issuance under the Reliance Global Group Inc. 2023 and 2019 Equity Incentive Plans as of September 30, 2024; and _______ Warrants and ____ Pre-Funded Warrants issued in the Units in this offering to purchase shares of common stock at an exercise price of $____ per share and $0.01 per share, respectively. All warrants, Pre-Funded Warrants and stock options are convertible, or exercisable into, one share of common stock. The issuance of shares of our common stock upon the exercise of outstanding convertible securities could result in substantial dilution to our shareholders, which may have a negative effect on the price of our common stock. In addition, we may be expected to issue additional shares in connection with raising capital, our pursuit of new business opportunities and new business operations. To the extent that additional shares of common stock are issued, our shareholders would experience dilution of their respective ownership interests. If we issue shares of common stock in connection with our intent to pursue new business opportunities, a change in control of the Company may be expected to occur. The issuance of additional shares of common stock may adversely affect the market price of our common stock, in the event that an active trading market commences.

Obligations under credit agreements.

Under our credit agreements with Oak Street, the Company has agreed that at all times that the loans are outstanding: (i) Ezra Beyman, our chief executive officer, Debra Beyman, Mr. Beyman’s wife, or Yaakov Beyman, son of Mr. and Ms. Beyman, or someone else approved by Oak Street, as applicable, will be the manager of the current subsidiaries of the Company, (ii) Mr. Ezra Beyman will be President and Chairperson of the Board of the Company, and (iii) Reliance Global Holdings will continue to remain a shareholder of the Company’s equity and Ezra and Debra will be the sole owners of Reliance Global Holdings as tenants in entirety. The loans by Oak Street immediately mature and become due and payable if the Company fails to comply with these provisions, subject to certain notice and/or cure periods.

Our management will have broad discretion in the use of the net proceeds from this offering and may not use them effectively.

Any person who invests in the Company’s securities will do so without an opportunity to evaluate the specific merits or risks of any prospective acquisition. As a result, investors will be entirely dependent on the broad discretion and judgment of management in connection with the selection of acquisitions. There can be no assurance that determinations made by the Company’s management will permit us to achieve the Company’s business objectives.

Our management will have broad discretion in the application of the net proceeds from this offering, and our stockholders will not have the opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. The failure by our management to apply these funds effectively could harm our business. See “Use of Proceeds” on page 16 for a description of our proposed use of proceeds from this offering.

Dividends unlikely.

The Company does not expect to pay dividends for the foreseeable future. The payment of dividends will be contingent upon the Company’s future revenues and earnings, if any, capital requirements and overall financial conditions. The payment of any future dividends will be within the discretion of the Company’s board of directors as then constituted. It is the Company’s expectation that future management following a business combination will determine to retain any earnings for use in its business operations and accordingly, the Company does not anticipate declaring any dividends in the foreseeable future.

| 13 |

Our failure to meet the continued listing requirements of The Nasdaq Capital Market could result in a delisting of our common stock.

Our shares of common stock are currently listed on Nasdaq. If we fail to satisfy the continued listing requirements of The Nasdaq Capital Market, such as the corporate governance requirements, minimum bid price requirement or the minimum stockholders’ equity requirement, Nasdaq may take steps to delist our common stock. Any delisting would likely have a negative effect on the price of our common stock and would impair stockholders’ ability to sell or purchase their common stock when they wish to do so.

As previously disclosed in the Current Report on Form 8-K we filed on September 29, 2022, on September 27, 2022, the Company received written notice from Nasdaq’s Listing Qualifications Department notifying the Company that for the preceding 30 consecutive business days (August 15, 2022 through September 26, 2022), the Company’s common stock did not maintain a minimum closing bid price of $1.00 per share as required by Nasdaq Listing Rule 5550(a)(2). The notice had no immediate effect on the listing or trading of the Company’s common stock and the common stock continued to trade on Nasdaq under the symbol “RELI.” In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company had a compliance period of 180 calendar days, or until March 27, 2023, to regain compliance with Nasdaq Listing Rule 5550(a)(2).

On March 9, 2023, Nasdaq’s Listing Qualifications Department notified the Company that it had regained compliance with Nasdaq Listing Rule 5550(a)(2).

As previously disclosed in the Current Report on Form 8-K filed on January 16, 2024 by the Company on January 12, 2024, the Company received written notice from Nasdaq’s Listing Qualifications Department notifying the Company that for the preceding 30 consecutive business days (November 29, 2023 to January 11, 2024), the Company’s common stock did not maintain a minimum closing bid price of $1.00 per share as required by Nasdaq Listing Rule 5550(a)(2). The notice has no immediate effect on the listing or trading of the Company’s common stock and the common stock continued to trade on Nasdaq under the symbol “RELI.” In accordance with Nasdaq Listing Rule 5810(c)(3)(A), the Company had a compliance period of 180 calendar days, or until July 10, 2024, to regain compliance with Nasdaq Listing Rule 5550(a)(2). The Company received notice from The Nasdaq Stock Market on July 16, 2024, indicating that the Company had regained compliance with the minimum bid price requirement under Nasdaq Rule 5550(a)(2).

| 14 |

There can be no assurance that the Company will be able to maintain compliance with the bid price requirement, even if it maintains compliance with the other listing requirements.

In addition, we cannot assure you our securities will meet the continued listing requirements to be listed on Nasdaq in the future. If Nasdaq delists our common stock from trading on its exchange, we could face significant material adverse consequences including:

| ● | a limited availability of market quotations for our securities; | |

| ● | a determination that our common stock is a “penny stock” which will require brokers trading in our common stock to adhere to more stringent rules and possibly resulting in a reduced level of trading activity in the secondary trading market for our common stock; | |

| ● | a limited amount of news and analyst coverage for our company; and | |

| ● | a decreased ability to issue additional securities or obtain additional financing in the future. |

If we fail to maintain compliance with all applicable continued listing requirements for the Nasdaq Capital Market and Nasdaq determines to delist our common stock, the delisting could adversely affect the market liquidity of our common stock, our ability to obtain financing to repay debt and fund our operations