kind whatsoever; (c) any subdivision or authority of any of the foregoing; (d) any quasi-governmental or private body or public body exercising any regulatory, administrative, expropriation or taxing authority under or for the account of the foregoing; and (e) any stock or securities exchange;

“Liens” means any mortgage, charge, pledge, hypothec, security interest, prior claim, encroachments, option, right of first refusal or first offer, occupancy right, covenant, assignment, lien (statutory or otherwise), defect of title, or restriction or adverse right or claim, or other third party interest or encumbrance of any kind, in each case, whether contingent or absolute;

“Interim Order” means the order made after application to the Court pursuant to section 291 of the BCBCA after being informed of the intention to rely upon the Section 3(a)(10) Exemption, providing for, among other things, the calling and holding of the Meeting, as such order may be amended, supplemented or varied by the Court;

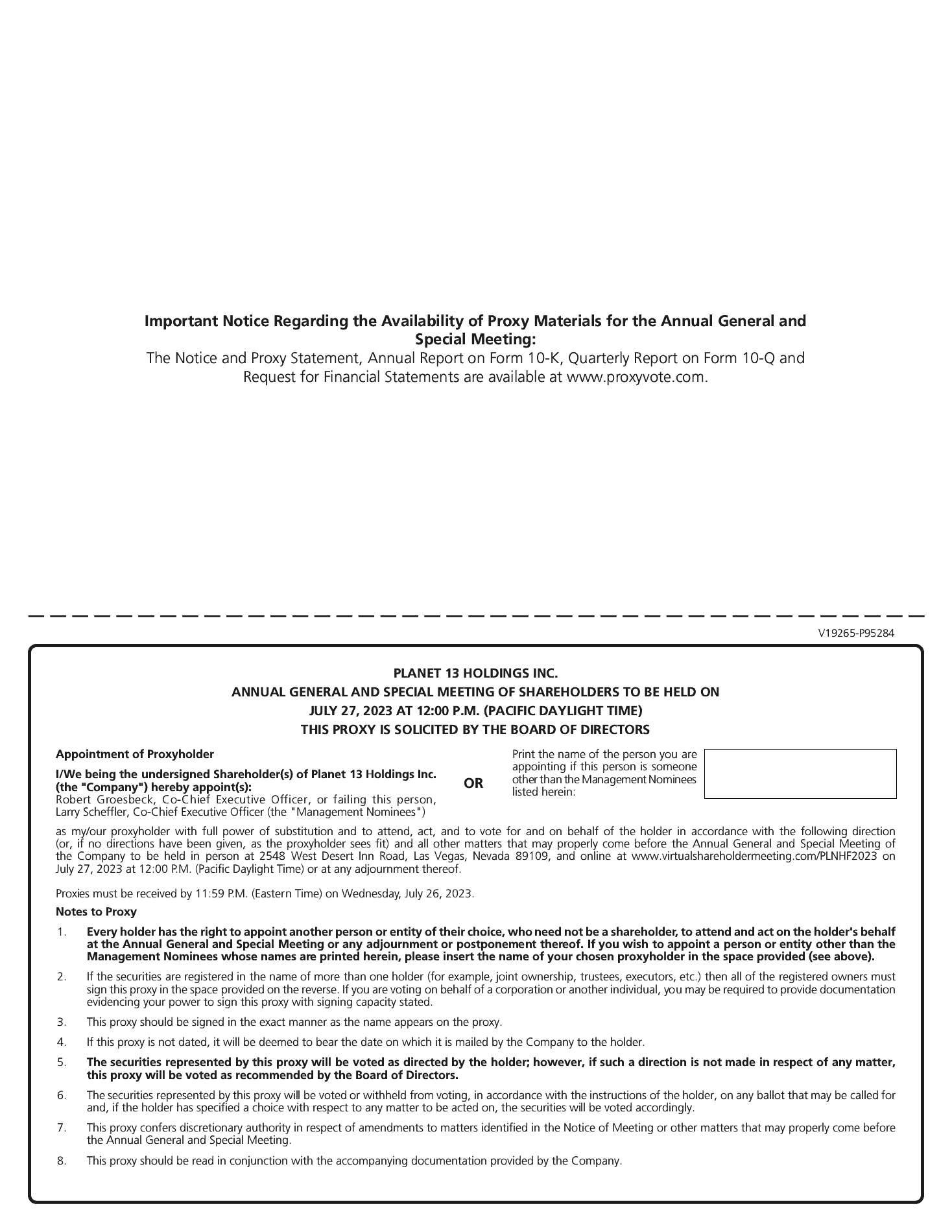

“Meeting” means the special meeting of the Shareholders to be held to consider and vote on this Plan of Arrangement, and any adjournment thereof;

“Nevada Secretary of State” means the Secretary of State for the State of Nevada;

“NRS” means the Nevada Revised Statutes;

“Planet 13 Nevada” means the Company upon and following the Continuance under the NRS;

“Proxy Statement” means the proxy statement to be prepared by the Company and forwarded as part of the proxy solicitation materials to Shareholders in respect of the Meeting;

“Section 3(a)(10) Exemption” means the exemption from registration requirements of the U.S. Securities Act provided by Section 3(a)(10) thereof;

“Shareholders” means the holders from time to time of Common Shares;

“Taxes” means all taxes, surtaxes, duties, levies, imposts, fees, assessments, reassessments, withholdings, dues and other charges of any nature, imposed or collected by any Governmental Authority, whether disputed or not, including federal, provincial, territorial, state, municipal and local, foreign and other income, franchise, capital, real property, personal property, withholding, payroll, health, transfer, value added, alternative, or add on minimum tax including GST/HST, sales, use, consumption, excise, customs, anti-dumping, countervail, net worth, stamp, registration, franchise, payroll, employment, education, business, school, local improvement, development and occupation taxes, duties, levies, imposts, fees, assessments and withholdings and Canada Pension Plan and Québec Pension Plan contributions, employment insurance premiums and all other taxes and similar governmental charges, levies or assessments of any kind whatsoever imposed by any Governmental Authority including any installment payments, interest, penalties or other additions associated therewith, whether or not disputed; and

“U.S. Securities Act” means the United States Securities Act of 1933, as amended.

The division of this Plan of Arrangement into sections and the insertion of headings are for reference purposes only and shall not affect the interpretation of this Plan of Arrangement. Unless otherwise indicated, any reference in this Plan of Arrangement to a section refers to the specified section of this Plan of Arrangement.

1.3

| Number, Gender and Persons |

In this Plan of Arrangement, unless the context otherwise requires, words importing the singular number include the plural and vice versa, words importing any gender include all genders and words importing persons include individuals, bodies corporate, partnerships, associations, trusts, unincorporated organizations, governmental bodies and other legal or business entities of any kind.

In the event that any date on or by which any action is required or permitted to be taken hereunder is not a business day, such action shall be required or permitted to be taken on or by the next succeeding day which is a business day.