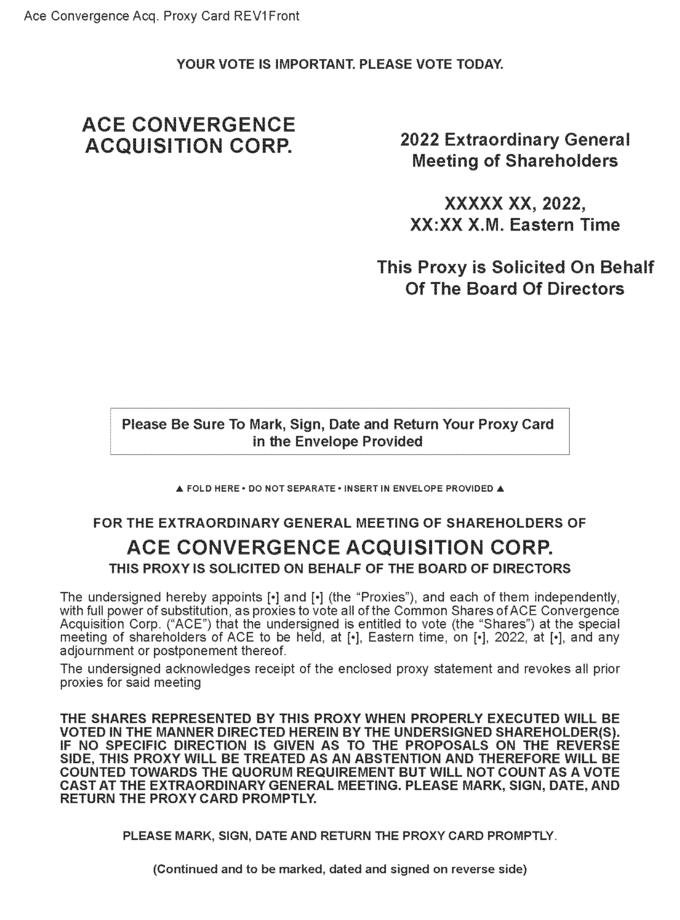

| Ace Convergence Acq. Proxy Card REV1 Back Important Notice Regarding the Availability of Proxy Materials for the Extraordinary General Meeting of Shareholders to be held on [•], 2022. This notice of Special Meeting of Shareholders and accompanying Proxy Statement are available at: [•] PROXY CARD Please mark your votes like this ACE CONVERGENCE ACQUISITION CORP. – THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” ALL PROPOSALS. Proposal No. 1 — The Business Combination Proposal — to consider and vote upon a propos-Proposal No. 6 — Organizational FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN Documents Proposal D — to authorize all oth-al to approve by ordinary resolution and adopt er changes in connection with the replacement the Agreement and Plan of Merger, dated as of October 13, 2021 (as of Cayman Constitutional Documents with the Proposed Certificate of Incorporation and Proposed Bylaws in connection with the consumma-tion of the Business Combination (copies of which are attached to this proxy statement/prospectus as Annex J and Annex K, respectively), including (1) changing the corporate name from “ACE Convergence Acquisition Corp.” to “Tempo Automation Holdings, Inc.,” (2) adopting Delaware as the exclusive forum for certain stockholder litigation, (3) removing certain provisions related to ACE’s status as a blank check company that will no longer be applicable upon consummation of the amended from time to time, the “Merger Agreement”), by and among ACE, ACE Convergence Subsidiary Corp., a Delaware corporation and a direct wholly owned subsidiary of ACE (“Merger Sub”) and Tempo Au-tomation, Inc., a Delaware corporation (“Tempo”), a copy of which is attached to this proxy statement/prospectus as Annex A. The Merger Agreement provides for, among other things, the merger of Merger Sub with and into Tempo (the “Merger”), with Tempo surviving the Merger as a wholly owned subsidiary of ACE, in accordance with the terms and subject to the conditions of the Merger Agreement as more fully de-scribed elsewhere in this proxy statement/prospectus (the “Business Combination Proposal”); Business Combination, all of which ACE’s board of directors believes is necessary to adequately address the needs of New Tempo after the Business Combination, (4) providing that no action shall be taken by stockholders of New Tempo, except at an annual or special meeting of stockholders, (5) removing limitations on the corporate opportunity doctrine, (6) requiring the approval of the holders of 66 2/3% of the then-outstanding capital stock of New Tempo to amend specified pro-visions of the Proposed Certificate of Incorporation, and (7) requiring the approval of the Board or the holders of 66 2/3% of the then-out-standing capital stock of New Tempo to amend the Proposed Bylaws (“Organizational Documents Proposal D”); ProposalNo.2—TheDomestication Proposal —to consider and vote upon a propos-FOR AGAINST ABSTAIN al to approve by special resolution, the change of ACE’s jurisdiction of incorporation by deregistering as an exempted company in the Cayman Islands and continuing and domesticating as a corporation incorporated under the laws of the State of Delaware (the “Domestication” and, together with the Merger, the “Business Combina-tion”) (the “Domestication Proposal”); Organizational Documents Proposals — to consider and vote upon the following four separate proposals (collectively, the “Organizational Documents Proposals”) to approve by special resolution, the following Proposal No. 7 —The Director Election Proposal — to consider and vote upon a propos-FOR AGAINST ABSTAIN al to approve by ordinary resolution, assuming the Business Combination Proposal, the Domestication Proposal and the Organizational Documents Proposals are approved, the election of material differences between ACE’s Amended and Restated Memo-randum and Articles of Association (as may be amended from time to time, the “Cayman Constitutional Documents”) and the proposed new certificate of incorporation (“Proposed Certificate of Incorporation”) and the proposed new bylaws (“Proposed Bylaws”) of ACE Convergence Acquisition Corp. (a corporation incorporated in the State of Delaware, each to be effective upon the Domestication and the filing with and ac-ceptance by the Secretary of State of Delaware of the certificate of do-mestication in accordance with Section 388 of the Delaware General Corporation Law (the “DGCL”)), which will be renamed “Tempo Automa-tion Holdings, Inc.” in connection with the Business Combination (ACE after the Domestication, including after such change of name, is referred to herein as “New Tempo”): directors who, upon consummation of the Business Combination, will be the directors of New Tempo (the “Director Election Proposal”), to be effective as of the Closing; Proposal No. 8 — The Stock Issuance Proposal — to consider and vote upon a propos-FOR AGAINST ABSTAIN al to approve by ordinary resolution for purposes of complying with the applicable provisions of Nasdaq Listing Rule 5635, the issuance of New Tempo common stock to (a) the PIPE Investors pursuant to the PIPE Investment, (b) the Tempo Stockholders pursuant to the Merger Agreement, (c) the eligible Advanced Circuits equityhold-ers pursuant to the Advanced Circuits Merger Agreement and (d) the eligible Whizz equityholders pursuant to the Whizz Purchase Agreement (the “Stock Issuance Proposal”), to be effective prior to or substantially concurrently with the Closing; Proposal No. 3 — Organizational Documents Proposal A — to authorize the change in the au-FOR AGAINST ABSTAIN thorized capital stock of ACE from 500,000,000 Class A ordinary shares, par value $0.0001 per share (the “ACE Class A ordinary shares”), 50,000,000 Class B ordinary shares, par value $0.0001 per share (the “ACE Class B ordinary shares” and, togeth-er with the ACE Class A ordinary shares, the “ordinary shares”), and Proposal No. 9 — The Incentive Award Plan Proposal — to consider and vote upon a propos-FOR AGAINST ABSTAIN al to approve by ordinary resolution, the Tempo Automation Holdings, Inc. 2022 Incentive Award Plan (the “Incentive Award Plan Proposal”), to be effective prior to the Closing Date; 5,000,000 preference shares, par value $0.0001 per share (the “ACE preferred shares”), to [•] shares of common stock, par value $0.0001 Proposal No. 10 — The ESPP Proposal — to consider and vote upon a proposal to approve FOR AGAINST ABSTAIN per share, of New Tempo (the “New Tempo common stock”) and [•] shares of preferred stock, par value $0.0001 per share, of New Tempo (the “New Tempo preferred stock”) (“Organizational Documents Pro-posal A”); by ordinary resolution, the Tempo Automation Holdings, Inc. 2022 Employee Stock Purchase Plan (the “ESPP Pro-posal”), to be effective prior to the Closing Date; Proposal No. 4 — Organizational Documents Proposal B — to authorize the board of direc-FOR AGAINST ABSTAIN ProposalNo.11—The Adjournment Proposal — to consider and vote upon a propos-FOR AGAINST ABSTAIN tors of New Tempo (the “Board”) to issue any or al to approve by ordinary resolution, the adjourn-all shares of New Tempo preferred stock in one or more classes or se-ries, with such terms and conditions as may be expressly determined by New Tempo’s board of directors and as may be permitted by the DGCL (“Organizational Documents Proposal B”); ment of the extraordinary general meeting to a later date or dates, if nec-essary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the extraordinary general meeting (the “Adjournment Proposal”), to be effective as of the date of the extraordinary general meeting. CONTROL NUMBER Proposal No. 5 — Organizational Documents Proposal C — to provide that New Tempo’s FOR AGAINST ABSTAIN board of directors be divided into three classes with only one class of directors being elected in each year and each class serving a three-year term (“Organizational Documents Proposal C”); and Signature Signature, if held jointly Date , 2022 When Shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by the president or another authorized officer. If a partnership, please sign in partnership name by an authorized person. The Shares represented by the proxy, when properly executed, will be voted in the manner directed herein by the undersigned shareholder(s). If no direction is made, this proxy will be treated as an abstention and therefore will be counted towards the quorum requirement but will not count as a vote cast at the extraordinary general meeting. If any other matters properly come before the meeting, unless such authority is withheld on this proxy card, the Proxies will vote on such matters in their discretion. X |