Filed by ACE Convergence Acquisition Corp. pursuant to

Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: ACE Convergence Acquisition Corp.

Commission File No.: 333-261055

Forward-Looking Statements

This presentation contains certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed business combination (the “Proposed Business Combination”) between Tempo Automation, Inc. (collectively with its subsidiaries and pro forma for its acquisition of Compass AC Holdings, Inc. and Whizz Systems, Inc., “Tempo”), and ACE Convergence Acquisition Corp. (“ACE”), including statements regarding the benefits of the Proposed Business Combination, the anticipated timing of the Proposed Business Combination, the services offered by Tempo and the markets in which it operates, and Tempo’s projected future results. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that could cause the actual results to differ materially from the expected results. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of ACE’s securities, (ii) the risk that the acquisition by Tempo Automation, Inc. of each of Compass AC Holdings, Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed Business Combination may not be completed by ACE’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by ACE, (iv) the failure to satisfy the conditions to the consummation of the Proposed Business Combination, including the receipt of the requisite approvals of ACE’s shareholders and Tempo’s stockholders, respectively, the satisfaction of the minimum trust account amount following redemptions by ACE’s public shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party valuation in determining whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement or pendency of the Proposed Business Combination on Tempo’s business relationships, performance, and business generally, (viii) risks that the Proposed Business Combination disrupts current plans of Tempo and potential difficulties in Tempo employee retention as a result of the Proposed Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Tempo or against ACE related to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to maintain the listing of ACE’s securities on The Nasdaq Stock Market LLC, (xi) the price of ACE’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Tempo plans to operate, variations in performance across competitors, changes in laws and regulations affecting Tempo’s business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination, and identify and realize additional opportunities, (xiii) the risk of downturns in the highly competitive industry in which Tempo operates, (xiv) the impact of the global COVID-19 pandemic, (xv) the enforceability of Tempo’s intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security, (xvi) the ability of Tempo to protect the intellectual property and confidential information of its customers, (xvii) the risk of downturns in the highly competitive additive manufacturing industry, and (xviii) other risks and uncertainties described in ACE’s registration statement on Form S-1 (File No. 333-239716), which was originally filed with the U.S. Securities and Exchange Commission (the “SEC”) on July 6, 2020 (as amended, the “Form S-1”), and Annual Report on Form 10-K for the fiscal year ended December 31, 2020, filed with the SEC on March 17, 2021 and subsequently amended on May 6, 2021, and on December 13, 2021 (the “Form 10-K”), and its subsequent Quarterly Reports on Form 10-Q. The foregoing list of factors is not exhaustive. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by investors as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of the Form S-1, the Form 10-K, Quarterly Reports on Form 10-Q, the Registration Statement (as defined below), the proxy statement/prospectus contained therein, and the other documents filed by ACE from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. These risks and uncertainties may be amplified by the COVID-19 pandemic, which has caused significant economic uncertainty. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Tempo and ACE assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by securities and other applicable laws. Neither Tempo nor ACE gives any assurance that either Tempo or ACE, respectively, will achieve its expectations.

Additional Information and Where to Find It

Additional information about the Proposed Business Combination between Tempo and ACE, including a copy of the merger agreement and investor presentation, was provided in a Current Report on Form 8-K filed by ACE with the U.S. Securities and Exchange Commission (the “SEC”) on October 14, 2021, and is available at www.sec.gov. In connection with the Proposed Business Combination, ACE has filed a registration statement on Form S-4 (as amended or supplemented from time to time, the “Registration Statement”) with the SEC, which includes a preliminary proxy statement to be distributed to holders of ACE’s ordinary shares in connection with ACE’s solicitation of proxies for the vote by ACE’s shareholders with respect to the Proposed Business Combination and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of securities to be issued to Tempo stockholders in connection with the Proposed Business Combination. After the Registration Statement has been declared effective, ACE will mail a definitive proxy statement, when available, to its shareholders. The Registration Statement includes information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to ACE’s shareholders in connection with the Proposed Business Combination. ACE will also file other documents regarding the Proposed Business Combination with the SEC. Before making any voting decision, investors and security holders of ACE and Tempo are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will contain important information about the Proposed Business Combination.

Investors and security holders can obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by ACE through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by ACE may be obtained free of charge from ACE’s website at acev.io or by written request to ACE at ACE Convergence Acquisition Corp., 1013 Centre Road, Suite 403S, Wilmington, DE 19805.

No Offer or Solicitation

This communication is for informational purposes only and does not constitute an offer or invitation for the sale or purchase of securities, assets or the business described herein or a commitment to ACE with respect to any of the foregoing, and this communication shall not form the basis of any contract, nor is it a solicitation of any vote, consent, or approval in any jurisdiction pursuant to or in connection with the Proposed Business Combination or otherwise, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in contravention of applicable law.

Participants in Solicitation

ACE and Tempo, and their respective directors and executive officers, may be deemed participants in the solicitation of proxies of ACE’s shareholders in respect of the Proposed Business Combination. Information about the directors and executive officers of ACE is set forth in ACE’s Form 10-K for the period ended December 31, 2020, as amended. Additional information regarding the identity of all potential participants in the solicitation of proxies to ACE’s shareholders in connection with the Proposed Business Combination and other matters to be voted upon at the special meeting, and their direct and indirect interests, by security holdings or otherwise, is set forth in ACE’s proxy statement. Investors may obtain such information by reading such proxy statement.

Software - Accelerated Electronics Manufacturing TRANSFORMING PRODUCT DEVELOPMENT WITH SOFTWARE AND AI TEMPO AUTOMATION ANALYST DAY MARCH 23, 2022 1

Di s c l aim e r M A R C H 2022 2 This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to a potential business combination between Tempo Automation, Inc. (collectively with its subsidiaries and pro forma for its acquisition of Compass AC Holdings, Inc. and Whizz Systems, Inc., “Tempo”) and ACE Convergence Acquisition Corp. (“ACE”, ”NASDAQ: ACEV”, “NASDAQ: ACEVW”, “NASDAQ: ACEVU”) and related transactions (the “Proposed Business Combination”) and for no other purpose. No representations or warranties, express or implied are given in, or respect of, this Presentation. This Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Tempo or the Proposed Business Combination. Viewers of this Presentation should each make their own evaluation of Tempo and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. By reviewing or reading this Presentation, you will be deemed to have agreed to the obligations and restrictions set out below. Without the express prior written consent of ACE and Tempo, this Presentation and any information contained within it may not be (i) reproduced (in whole or in part), (ii) copied at any time, (iii) used for any purpose other than your evaluation of Tempo or (iv) provided to any other person, except your employees and advisors with a need to know who are advised of the confidentiality of the information. This Presentation supersedes and replaces all previous oral or written communications between the parties hereto relating to the subject matter hereof. Forward - Looking Statements This document contains certain forward - looking statements within the meaning of the federal securities laws with respect to the Proposed Business Combination, including statements regarding the benefits of the Proposed Business Combination, the anticipated timing of the Proposed Business Combination, the services offered by Tempo and the markets in which it operates, and Tempo’s projected future results. These forward - looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward - looking statements in this document, including but not limited to: (i) the risk that the Proposed Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of ACE’s securities, (ii) the risk that the acquisition by Tempo Automation, Inc. of each of Compass AC Holdings, Inc. and Whizz Systems, Inc. may not be completed in a timely manner or at all, (iii) the risk that the Proposed Business Combination may not be completed by ACE’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by ACE, (iv) the failure to satisfy the conditions to the consummation of the Proposed Business Combination, including the receipt of the requisite approvals of ACE’s and Tempo’s stockholders, the satisfaction of the minimum trust account amount following redemptions by ACE’s public shareholders and the receipt of certain governmental and regulatory approvals, (v) the lack of a third party valuation in determining whether or not to pursue the Proposed Business Combination, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the agreement and plan of merger, (vii) the effect of the announcement or pendency of the Proposed Business Combination on Tempo’s business relationships, performance, and business generally, (viii) risks that the Proposed Business Combination disrupts current plans of Tempo and potential difficulties in Tempo employee retention as a result of the Proposed Business Combination, (ix) the outcome of any legal proceedings that may be instituted against Tempo or against ACE related to the agreement and plan of merger or the Proposed Business Combination, (x) the ability to maintain the listing of ACE’s securities on The Nasdaq Stock Market LLC, (xi) the price of ACE’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Tempo plans to operate, variations in performance across competitors, changes in laws and regulations affecting Tempo’s business and changes in the combined capital structure, (xii) the ability to implement business plans, forecasts, and other expectations after the completion of the Proposed Business Combination, and identify and realize additional opportunities, and (xiii) the risk of downturns in the highly competitive additive manufacturing industry. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of ACE’s Annual Report on Form 10 - K, Quarterly Reports on Form 10 - Q, the Registration Statement (as defined below), the proxy statement /prospectus contained therein, and the other documents filed by ACE from time to time with the U.S. Securities and Exchange Commission (the “SEC”). These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements. Forward - looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward - looking statements, and Tempo and ACE assume no obligation and do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise. Neither Tempo nor ACE gives any assurance that either Tempo or ACE, respectively, will achieve its expectations. Additional Information and Where to Find It ACE and Tempo and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of ACE’s shareholders in connection with the Proposed Business Combination. Investors and security holders may obtain more detailed information regarding the names and interests in the Proposed Business Combination of ACE’s directors and officers in ACE’s filings with the SEC, including in the Registration Statement and in ACE’s registration statement on Form S - 1, which was originally filed with the SEC on July 6, 2020 (the “Form S - 1”) and the 2020 10 - K (as defined below). To the extent that holdings of ACE’s securities have changed from the amounts reported in the Registration Statement, the Form S - 1 and the 2020 10 - K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to ACE’s shareholders in connection with the Proposed Business Combination is set forth in the registration statement on Form S - 4 for the Proposed Business Combination, including the proxy statement/prospectus contained therein (as amended from time to time, the “Registration Statement”), which was initially filed by ACE with the SEC on November 12, 2021 and subsequently amended on February 1, 2022 and March 17, 2022. ACE will also file other documents regarding the Proposed Business Combination with the SEC. Before making any voting decision, investors and security holders of ACE and Tempo are urged to read the Registration Statement, the proxy statement/prospectus contained therein, and all other relevant documents filed or that will be filed with the SEC in connection with the Proposed Business Combination as they become available because they will contain important information about the Proposed Business Combination. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by ACE through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by ACE may be obtained free of charge from ACE’s website at www.acev.io or by written request to ACE at ACE Convergence Acquisition Corp., 1013 Centre Road, Suite 403S, Wilmington, DE 19805. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE Participants in Solicitation ACE and Tempo and their respective directors and officers may be deemed to be participants in the solicitation of proxies from ACE’s stockholders in connection with the Proposed Business Combination. Information about ACE’s directors and executive officers and their ownership of ACE’s securities is set forth in ACE’s filings with the SEC, including the Registration Statement and ACE’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2020 that was filed with the SEC on March 17, 2021 and subsequently amended on May 6, 2021 and December 13, 2021 (as amended, the “2020 10 - K”). To the extent that holdings of ACE’s securities have changed since the amounts reported in the Registration Statement, the Form S - 1 and the 2020 10 - K, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Additional information regarding the interests of those persons and other persons who may be deemed participants in the Proposed Business Combination may be obtained by reading the proxy statement/prospectus regarding the Proposed Business Combination. You may obtain free copies of these documents as described in the preceding paragraph. 2

Disclaimer (continued) M A R C H 2022 3 Industry and Market Data This presentation has been prepared by Tempo and ACE and includes market data and other statistical information from sources believed by Tempo and ACE to be reliable, including independent industry publications, governmental publications or other published independent sources. Some data is also based on the good faith estimates of Tempo or ACE, which in each case are derived from its review of internal sources as well as the independent sources described above. Although Tempo and ACE believe these sources are reliable, Tempo and ACE have not independently verified the information and cannot guarantee its accuracy and completeness. Financial Information; Non - GAAP Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the Registration Statement and the proxy statement/prospectus contained therein. Some of the financial information and data contained in this Presentation has not been prepared in accordance with the United States generally accepted accounting principles (“GAAP”). Tempo and ACE believe these non - GAAP measures of financial results provide useful information to management and investors regarding certain financial and business trends relating to Tempo’s financial condition and results of operations. Tempo and ACE believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in comparing Tempo’s financial condition and results of operations with other similar companies, many of which present similar non - GAAP financial measures to investors. Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. You should review Tempo’s audited financial statements, which are included in the Registration Statement. No Offer or Solicitation This Presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. ACE and Tempo reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. Use of Projections This Presentation contains projected financial information with respect to Tempo and ACE. The pro forma numbers and projected financial information of Tempo Automation, Inc. in this presentation are pro forma for the acquisition by Tempo Automation, Inc. of Compass AC Holdings, Inc. and Whizz Systems, Inc., except where stated otherwise. The projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results. The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties. See “Forward - Looking Statements” above. Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts are achieved. Trademarks T h i s P r e s e n t a t i o n co n t a i n s t ra d e m ark s , s e rv i c e m ark s , t ra d e n am e s a n d co p y r i g h t s o f A C E , T e m p o a n d o t h e r co m p a n i e s , w h i c h ar e th e p ro p e r t y o f t h e i r r e s p e c t i v e o w n e r s . T h e u s e o r d i s p l a y o f t h i r d p ar t i e s ’ t r 3 a d e m ark s , s e rv i c e m ark s , t ra d e n am e s o r p ro d u c t s i n t hi s p r es ent a t i o n i s n o t i nt en d ed t o , a nd d o es n o t i m p l y , a r el a t i o ns hi p w i t h A CE o r Tempo, or an endorsement or sponsorship by or of ACE or Tempo. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that ACE or Tempo will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights.

Agenda M A R C H 202 2 4 OVERVIEW MARKET FOR PROTOTYPE & ON - DEMAND ELECTRONICS MANUFACTURING TEMPO PLATFORM FINANCIALS Q&A 4

Our Tempo Presenters Today M A R C H 202 2 5 Joy Weiss PRESIDENT & CEO 5 Ryan Benton CHIEF FINANCIAL OFFICER Jeff Kowalski CHIEF PRODUCT OFFICER

Tempo’s Software - Accelerated Electronics Manufacturing gets Customers to Market Faster 6 M A R C H 202 2 7 TEMPO AI Back - end Manufacturing Software Front - end Customer Portal Software Connected Network of Smart Factories Engineering Design Services Printed Circuit Board Fabrication Printed Circuit Board Assembly: Prototype Production Printed Circuit Board Assembly: On - Demand Production

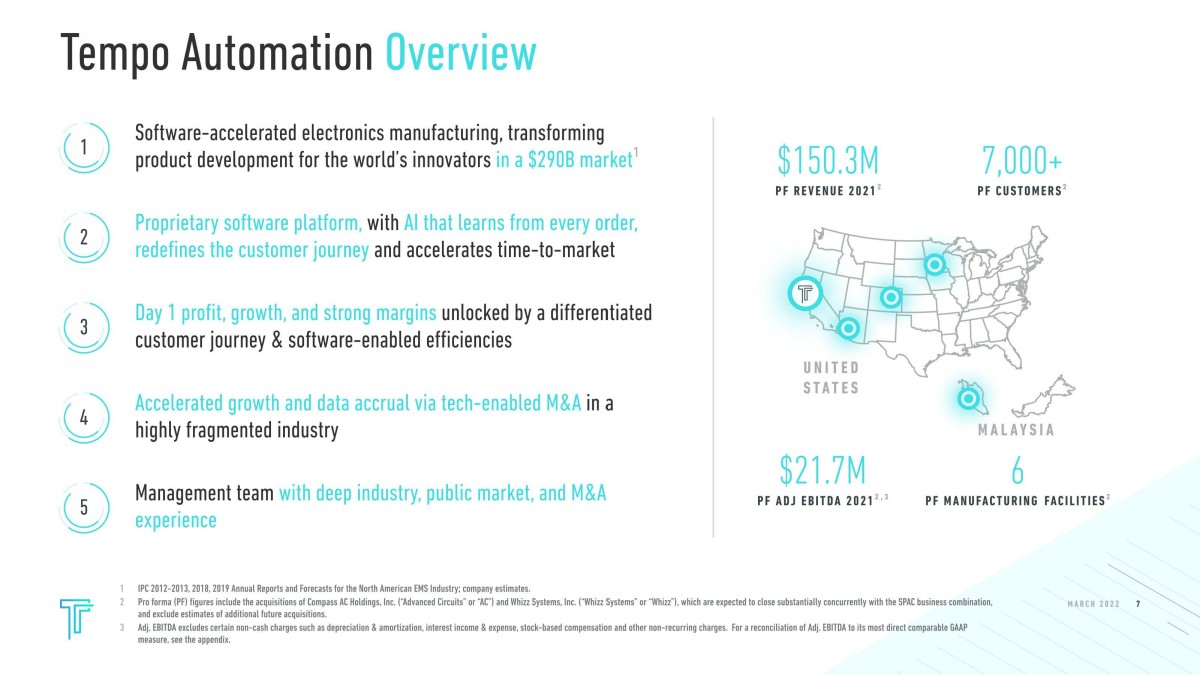

Tempo Automation Overview M A R C H 202 2 8 1 IPC 2012 - 2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates. 2 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. (“Advanced Circuits” or “AC”) and Whizz Systems, Inc. (“Whizz Systems” or “Whizz”), which are expected to close substantially concurrently with the SPAC business combination, and exclude estimates of additional future acquisitions. 3 Adj. EBITDA excludes certain non - cash charges such as depreciation & amortization, interest income & expense, stock - based compensation and other non - recurring charges. For a reconciliation of Adj. EBITDA to its most direct comparable GAAP measure, see the appendix. $150.3M PF REVENUE 2021 2 7,000+ PF CUSTOMERS 2 $21.7M PF ADJ EBITDA 2021 2 ,3 U N I T ED S T A T ES MA L A Y S I A 6 PF MANUFACTURING FACILITIES 2 1 Software - accelerated electronics manufacturing, transforming product development for the world’s innovators in a $290B market 1 2 Proprietary software platform, with AI that learns from every order, redefines the customer journey and accelerates time - to - market 3 Day 1 profit, growth, and strong margins unlocked by a differentiated customer journey & software - enabled efficiencies 4 Accelerated growth and data accrual via tech - enabled M&A in a highly fragmented industry 5 Management team with deep industry, public market, and M&A experience 7

M A R C H 202 2 9 Leadership: Strong Record of Value Creation MANAGEMENT JOY W E I S S PR ES I D EN T & C EO V P D A T A C EN T ER , A N A L O G D EV I C ES C E O , D U S T N E TW O R K S ( A C Q BY L I N E A R TE C H N O L O GY ) R Y A N B E NT ON C H IE F FIN A N C I A L O FFIC E R C F O / C EO , EX A R (AC Q B Y M AX L I N E AR ) 25+ Y E A R S O F M & A J EF F KO W A L S K I C H IE F P RO D U C T O FFIC E R C TO , A U TO D E S K R AL P H R I C HAR T C H IE F TE C H N O L O G Y O FFIC E R P R E SID E N T , C O A ST A L C IR C U IT S ( A CQ B Y A D V A N CE D CI R CU I T S ) M A TTIA S C E D E RG RE N C H IE F M A N U FA C TU R IN G O FFIC E R V P, F L EX D A W N S PR A G UE V I C E PR ES I D EN T O F PEO PL E V P H R , O S ISO F T ( AC Q B Y AV E V A) BOARD OF DIRECTORS (POST DESPAC) B E HR O O Z AB D I , C HAI R M AT T HE W G R AN AD E J A C KI E S C H N EI D ER JOY W E I S S R Y A N B E NT ON M E E N A S R I N AV AS AN A R NOL D B R OW N I I O M ID TA H E RN I A A C E C O N V ER G EN C E, T D K , I N V E NS E NS E , Q U A L C O MM P O I N T 72, DO M I N O DA T A L A B S F I E L D NA T I ON , P R OT OL A B S T EM PO T EM PO GI N GE R L A BS , E S S E N TI A L P R O D U C TS , F I TBI T S C H W AB E , W I LLI AM S O N & W Y AT T , LAT T I C E S E M I C O N D U C T O R , S I BE AM S E R NA I NE T W OR K S , Q U A L C OM M , I K A NO S Strong hardware, software, data, and manufacturing expertise Diverse board Private and public company executive and board experience UNIQUE COMBINATION OF TECHNOLOGY DEVELOPMENT, M&A, AND BUSINESS SCALING EXPERTISE 8

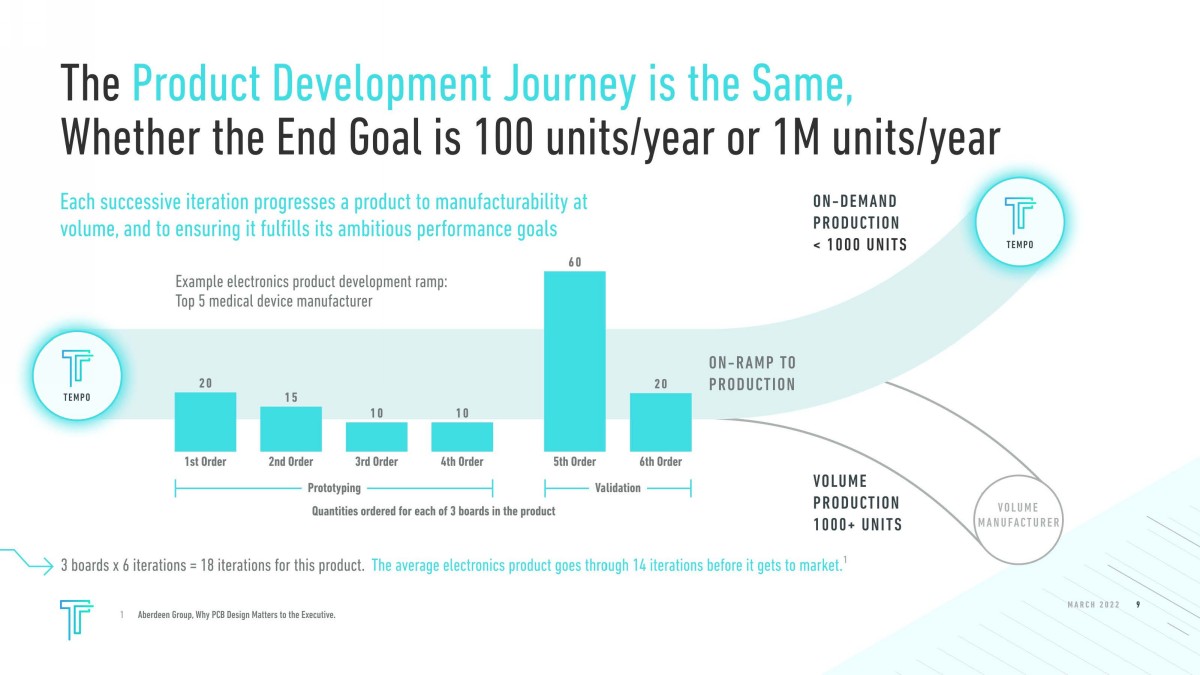

The Product Development Journey is Iterative, Whether the End Goal is 100 units/year or 1M units/year 9 M A R C H 2022 10 1 Aberdeen Group, Why PCB Design Matters to the Executive. ON - DEMAND PRO DU CT IO N < 1000 UNITS VOLUME PRODUCTION 1000+ UNITS The average electronics product goes through 14 iterations before it gets to market. 1 Each iteration progresses the product to manufacturability at volume 1st Order 2nd Order O r de r O r de r O r de r Nth Order Prototyping Validation ON - RAMP TO PRO DU CT IO N T E M PO T E M PO VOLUME M A N U F A C T U RE R

The US Outsourced Prototype & On - Demand Production Market is Served Primarily by Small, Owner - Operated Businesses M A R C H 2022 11 1 IPC 2012 - 2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; IPC LinkedIn; company estimates. 2 IPC 2019 Annual Report and Forecast for the North American EMS Industry. 77 % 7 % 16 % US OUTSOURCED ELECTRONIC MANUFACTURER FACILITIES 2 ( $ R EPR ES EN T S A N N U A L R EV EN U E PER EN T ER PR I S E ) COMPANIES WITH $500M+ REVENUE COMPANIES WITH $50M - $500 M REVENUE COMPANIES WITH <$50M REVENUE ~1,100, many of which are owner - operated companies Volume manufacturers often refer out prototyping and on - demand production business 1,000+ UNITS VOLUME PRODUCTION I NTERNATIONAL MARKET SIZE 1 TEMPO’ S MARKET DOMESTIC 1 < 1,000 UNITS PROTOTYPE & ON - DEMAND PRODUCTION $60B $1.3T $375B $290B 10

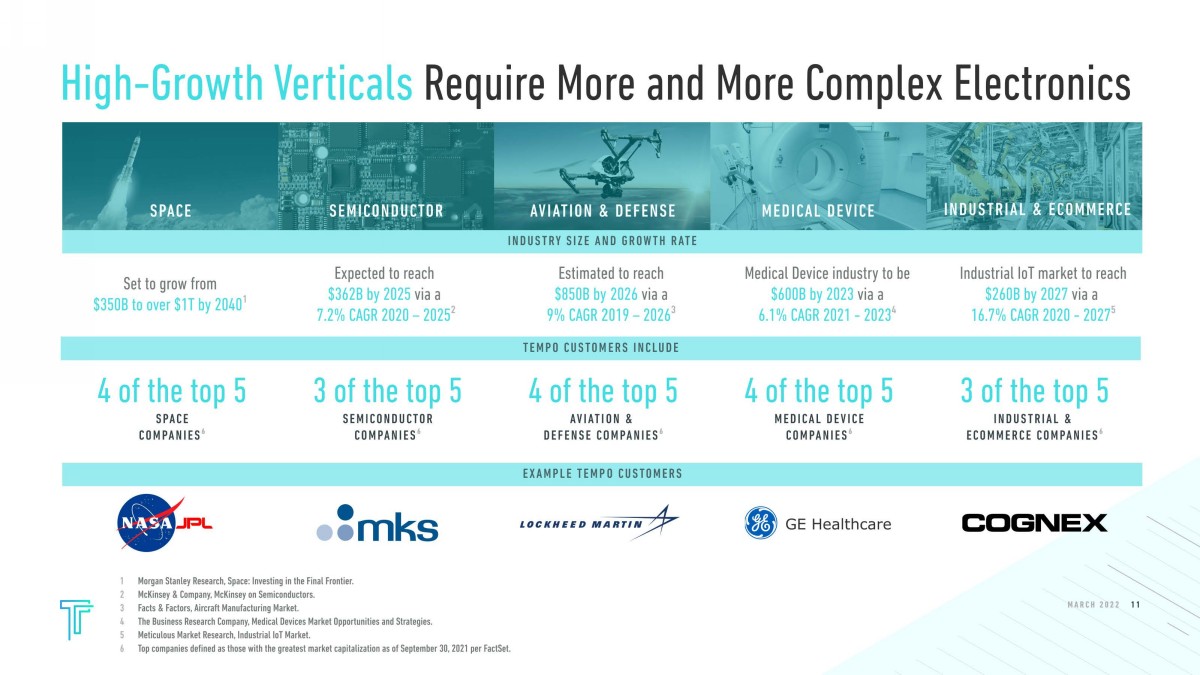

High - Growth Verticals Require More and More Complex Electronics M A R C H 2022 12 1 Morgan Stanley Research, Space: Investing in the Final Frontier. 2 McKinsey & Company, McKinsey on Semiconductors. 3 Facts & Factors, Aircraft Manufacturing Market. 4 The Business Research Company, Medical Devices Market Opportunities and Strategies. 5 Meticulous Market Research, Industrial IoT Market. 6 Top companies defined as those with the greatest market capitalization as of September 30, 2021 per FactSet. SPACE Set to grow from $350B to over $1T by 2040 1 SEMICONDUCTOR Expected to reach $362B by 2025 via a 7.2% CAGR 2020 – 2025 2 Estimated to reach $850B by 2026 via a 9% CAGR 2019 – 2026 3 MEDICAL DEVICE Medical Device industry to be $600B by 2023 via a 6.1% CAGR 2021 - 2023 4 INDUSTRIAL & ECOMMERCE Industrial IoT market to reach $260B by 2027 via a 16.7% CAGR 2020 - 2027 5 AVIATION & DEFENSE I NDUSTRY S IZE AND GROWTH RATE EXAMPLE TEMPO CUSTOMERS TEMPO CUSTOMERS INCLUDE 4 of the top 5 SPACE COMPANIES 6 3 of the top 5 S E M I C ON D U C TO R COMPANIES 6 4 of the top 5 AV I ATION & DEFENSE COMPANIES 6 4 of the top 5 MEDICAL DEVICE COMPANIES 6 3 of the top 5 I NDUSTRIAL & ECOMMERCE COMPANIES 6 11

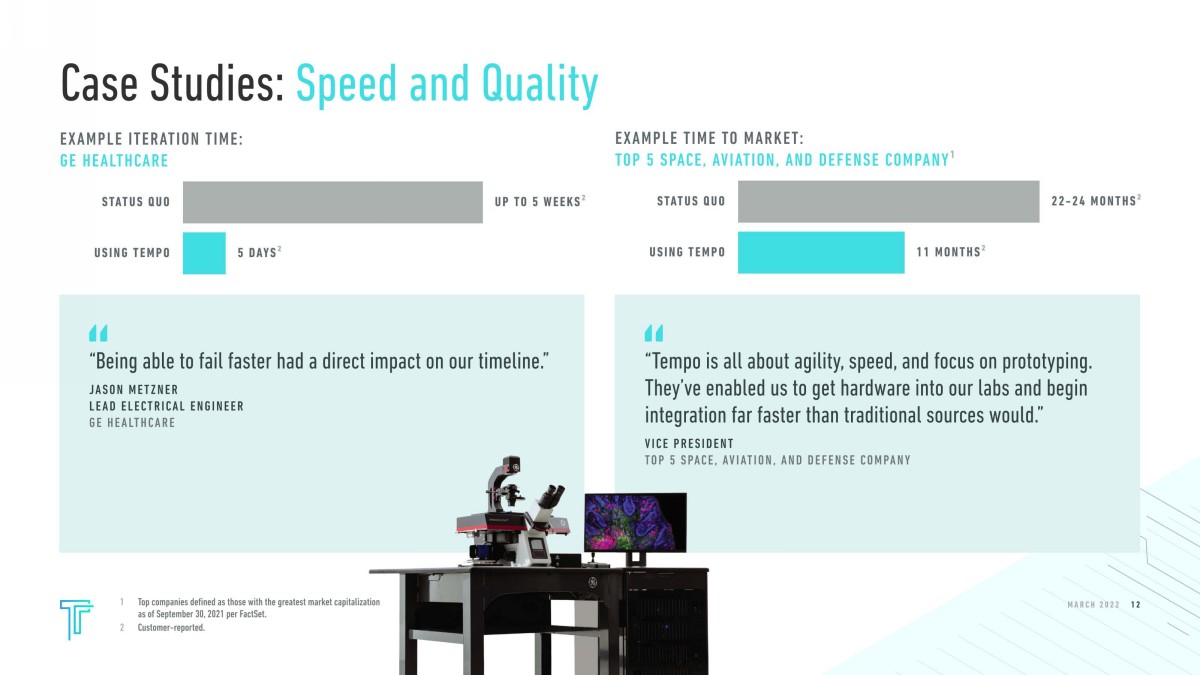

Case Studies: Speed and Quality 12 M A R C H 2022 13 1 Top companies defined as those with the greatest market capitalization as of September 30, 2021 per FactSet. 2 Customer - reported. “Being able to fail faster had a direct impact on our timeline.” JASON METZNER LEAD ELECTRICAL ENGINEER GE HEALTHCARE “Tempo is all about agility, speed, and focus on prototyping . They’ve enabled us to get hardware into our labs and begin integration far faster than traditional sources would . ” V I CE PRESIDENT TOP 5 SPACE, AVIATION, AND DEFENSE COMPANY EXAMPLE TIME TO MARKET: TOP 5 SPACE, AVIATION, AND DEFENSE COMPANY 1 STATUS QUO 22 - 24 MONTHS 2 11 MONTHS 2 USING TEMPO EXAMPLE ITERATION TIME: GE HEALTHCARE STATUS QUO UP TO 5 WEEKS 2 USING TEMPO 5 DAYS 2

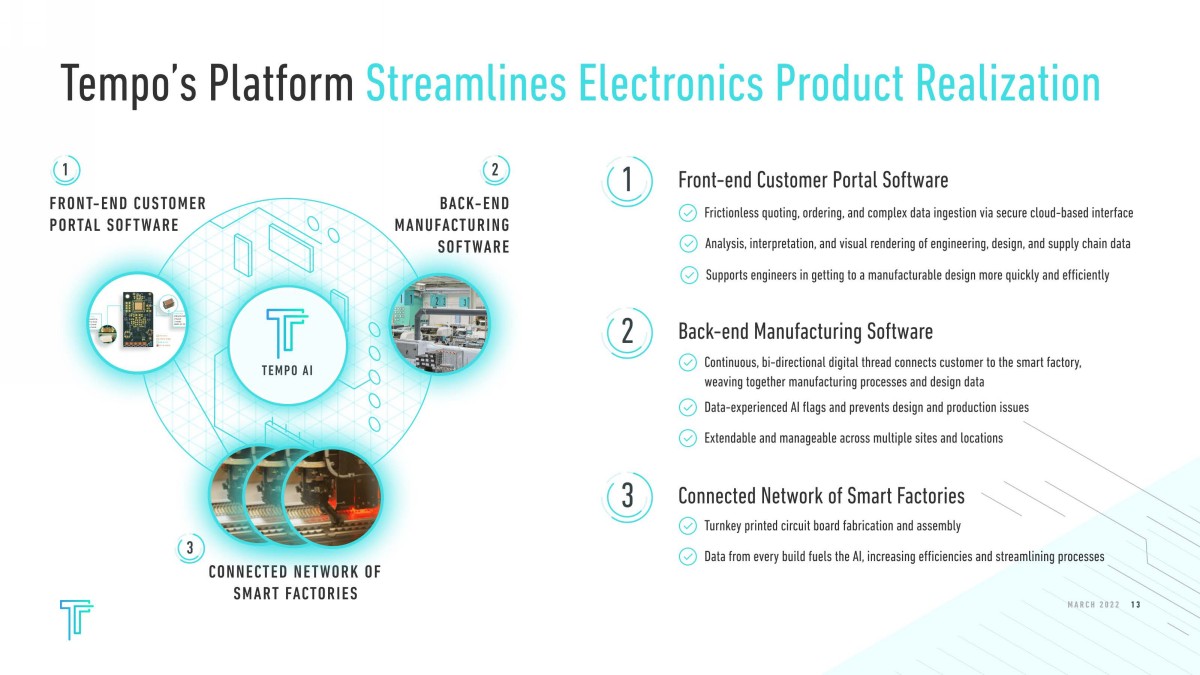

Tempo’s Platform Streamlines Electronics Product Realization 13 M A R C H 2022 14 TEMPO AI 1 FRONT - END CUSTOMER PORTAL SOFTWARE 2 BACK - END M A NU F A C TUR I NG SOFTWARE 3 CONNECTED NETWORK OF SMART FACTORIES 1 2 3 Front - end Customer Portal Software Frictionless quoting, ordering, and complex data ingestion via secure cloud - based interface Analysis, interpretation, and visual rendering of engineering, design, and supply chain data Connected Network of Smart Factories Turnkey printed circuit board fabrication and assembly Supports engineers in getting to a manufacturable design more quickly and efficiently Back - end Manufacturing Software Continuous, bi - directional digital thread connects customer to the smart factory, weaving together manufacturing processes and design data Data - experienced AI flags and prevents design and production issues Extendable and manageable across multiple sites and locations Data from every build fuels the AI, increasing efficiencies and streamlining processes

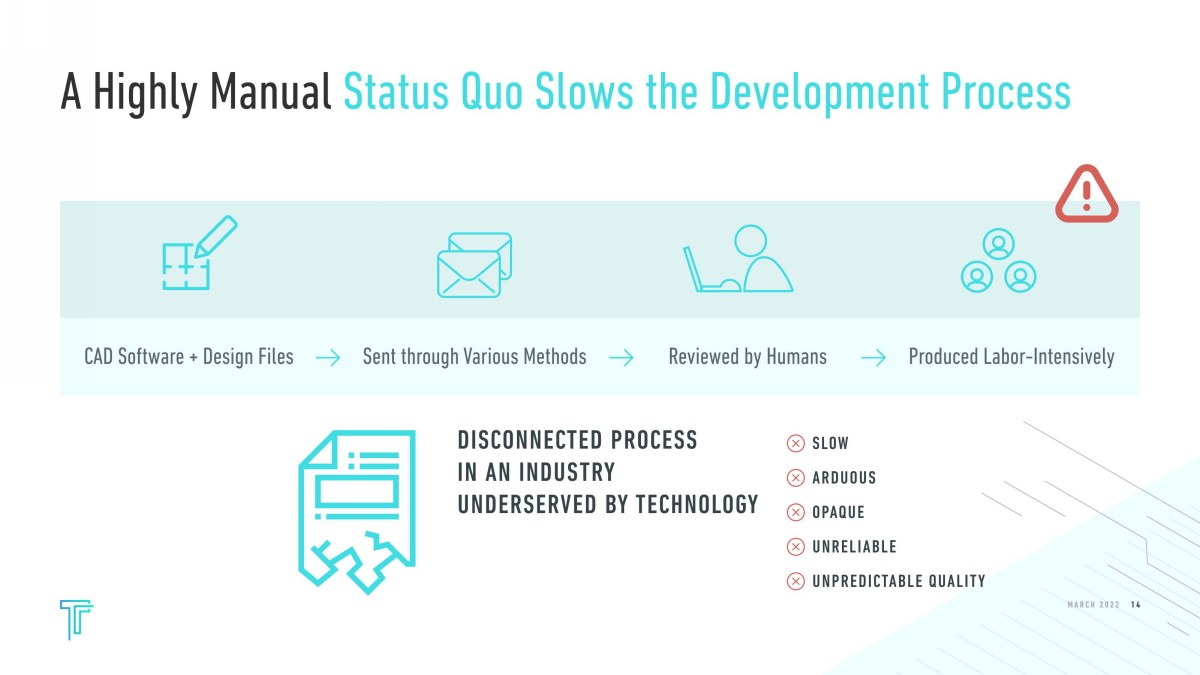

DISCONNECTED PROCESS IN AN INDUSTRY UNDERSERVED BY TECHNOLOGY 14 SLOW A R D UO U S OPAQUE UNRELIABLE UNPREDICTABLE QUALITY M A R C H 2022 15 CAD Software + Design Files Sent through Various Methods Reviewed by Humans Produced Labor - Intensively A Highly Manual Status Quo Slows the Development Process

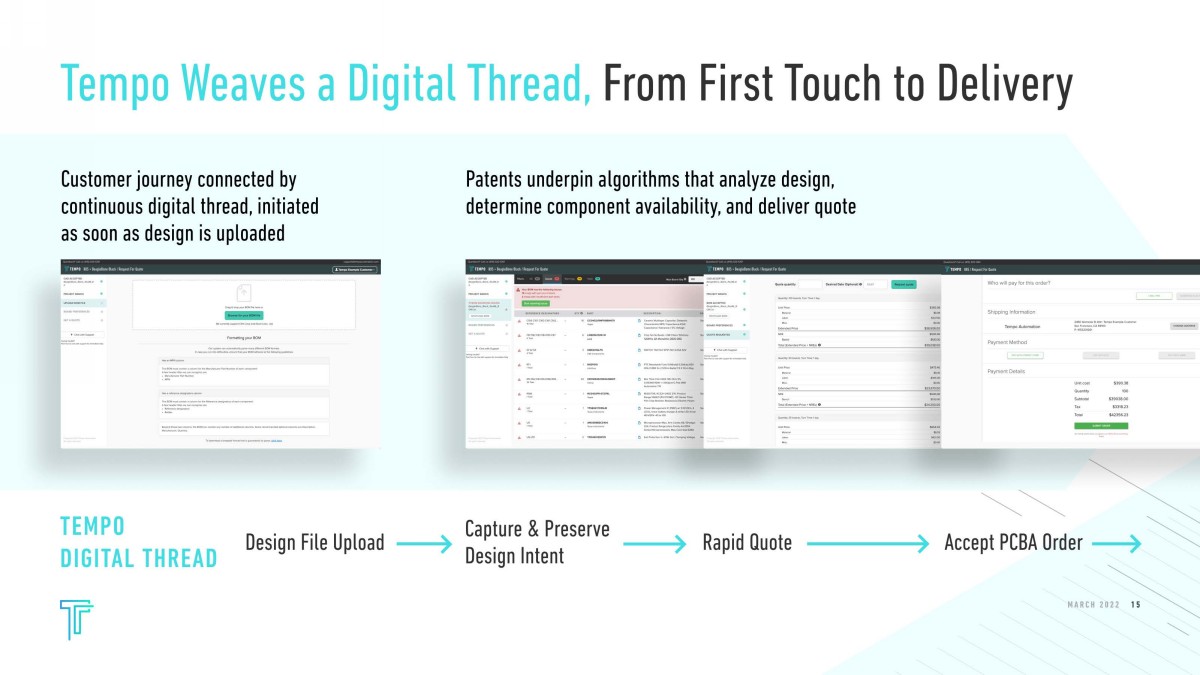

Tempo Weaves a Digital Thread, From First Touch to Delivery M A R C H 2022 15 Customer journey connected by continuous digital thread, initiated as soon as design is uploaded Patents underpin algorithms that analyze design, determine component availability, and deliver quote TEMPO DIGITAL THREAD Design File Upload Capture & Preserve Design Intent Rapid Quote Accept PCBA Order

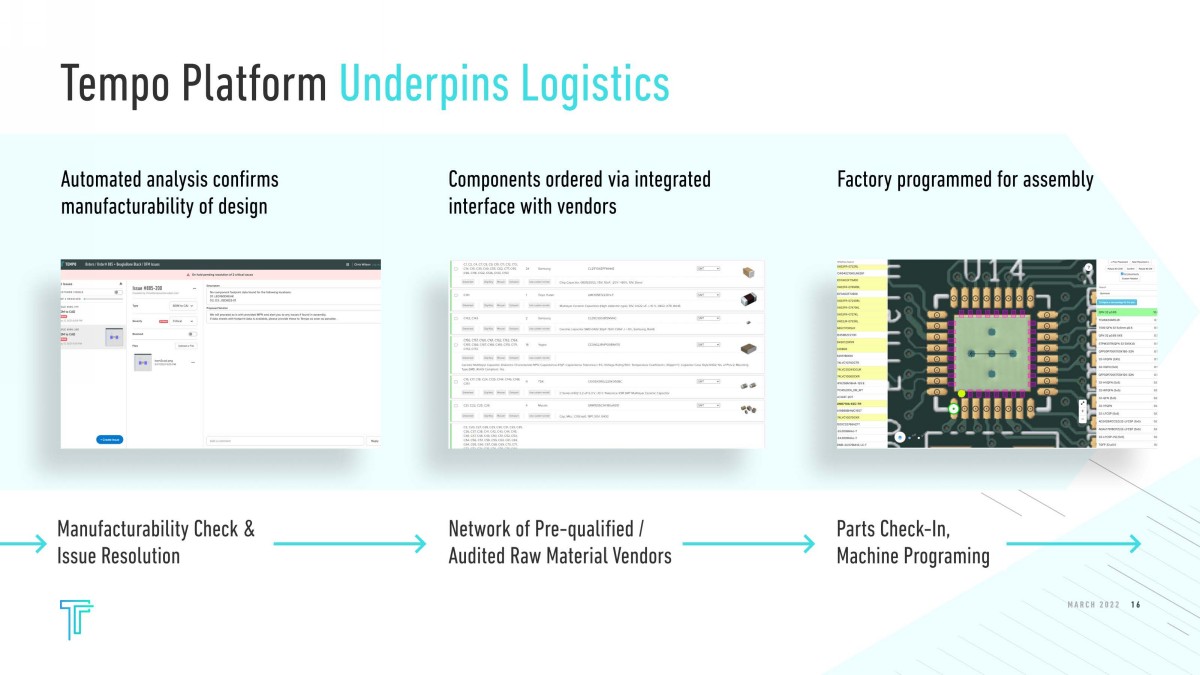

Tempo Platform Underpins Logistics Automated analysis confirms manufacturability of design Components ordered via integrated interface with vendors Factory programmed for assembly Manufacturability Check & Issue Resolution Network of Pre - qualified / Audited Raw Material Vendors Parts Check - In, Machine Programing M A R C H 2022 16

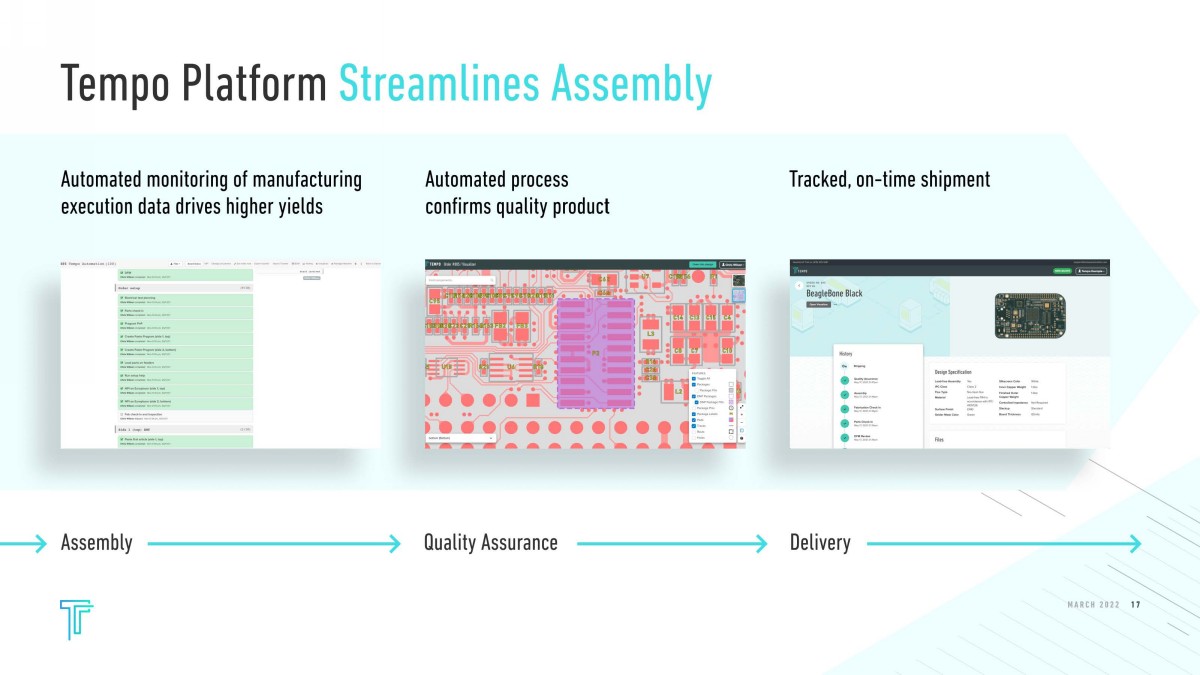

Tempo Platform Streamlines Assembly M A R C H 2022 17 Automated monitoring of manufacturing execution data drives higher yields Automated process confirms quality product Tracked, on - time shipment A sse m b l y Quality Assurance Delivery

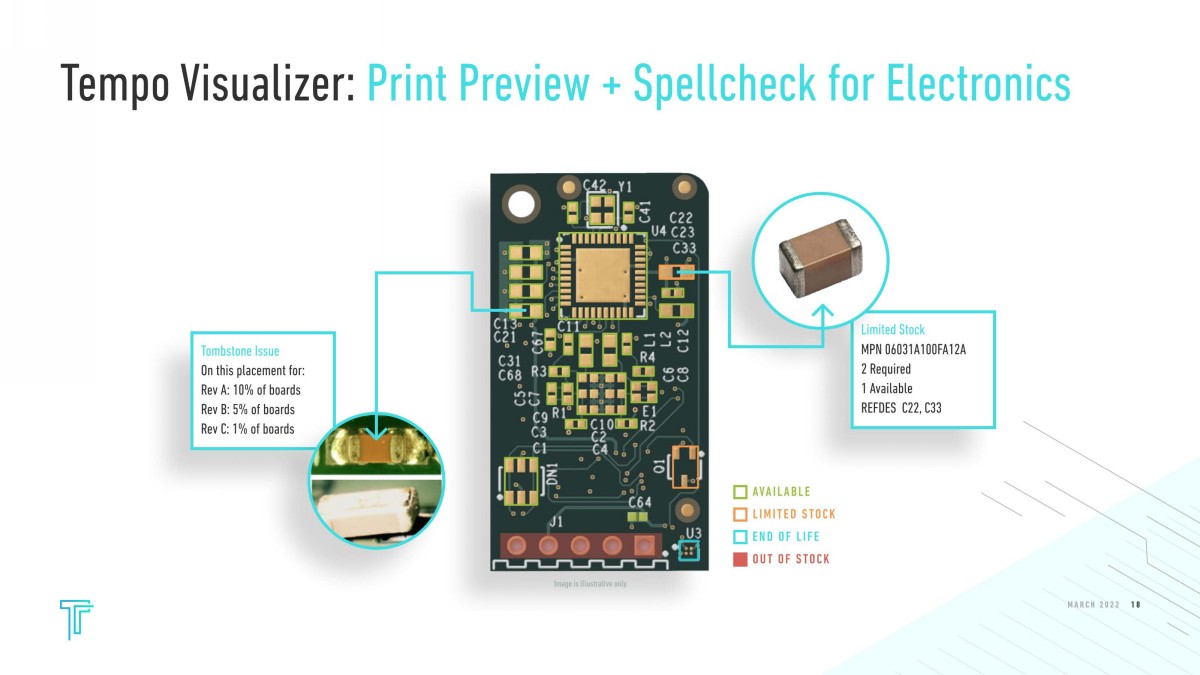

Tempo Visualizer: Print Preview + Spellcheck for Electronics M A R C H 2022 18 Tombstone Issue On this placement for: Rev A: 10% of boards Rev B: 5% of boards Rev C: 1% of boards Limited Stock MPN 06031A100FA12A 2 Required 1 Available REFDES C22, C33 AVAILABLE LIMITED STOCK END OF LIFE OUT OF STOCK Image is illustrative only.

Tempo’s Platform Drives Growth and Profitability 19 M A R C H 2022 20 TOP LINE BENEFITS BOTTOM LINE BENEFITS Customer Portal helps unlock growth in new and existing accounts Increased speed and quality maintain and grow customers Self - service customer interactions reduce the costs associated with executing orders Improved yield and streamlined processes increase margins FRONT - END CUSTOMER PORTAL SOFTWARE BACK - END MANUFACTURING SOFTWARE TEMPO AI

Many Struggle to Navigate the Electronics Supply Chain 20 M A R C H 202 2 7 INVENTORY VISIBILITY SHRINKING FROM YEARS TO DAYS LEAD TIMES SUBSTANTIALLY HIGHER SIGNIFICANT PRICE INCREASES AND VOLATILITY NON - TRADITIONAL DISTRIBUTORS HAVE AVAILABILITY BUT BRING QUALITY, TRACEABILITY, AND COMPLIANCE RISK

Tempo’s Technology Provides Safe Passage 21 M A R C H 202 2 7 PROVIDE EARLY VISIBILITY INTO POTENTIAL SUPPLY CHAIN ISSUES SEARCH AVAILABILITY AND RECOMMEND EQUIVALENT PARTS SUPPORT CUSTOMERS IN RESOLVING ISSUES AGILITY & SPEED TO ADAPT TO CHANGING MARKET CONDITIONS • EARLY ANALYSIS OF PART LIFECYLE RISK • AUTOMATED SOURCING UPDATES • ADVANCED INVENTORY MANAGEMENT

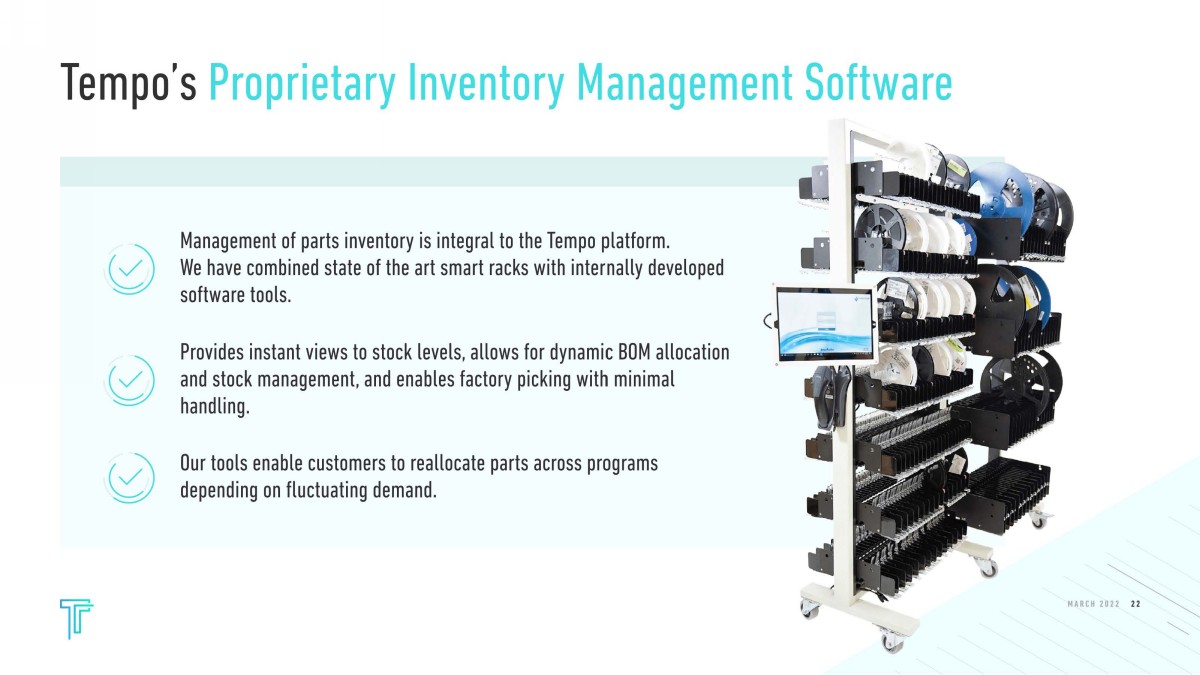

Tempo’s Proprietary Inventory Management Software 22 M A R C H 202 2 7 Management of parts inventory is integral to the Tempo platform . We have combined stat e of the art smart racks with internally developed software tools . Provides instant views to stock levels, allows for dynamic BOM allocation and stock management, and enables factory picking with minimal handling. Our tools enable customers to reallocate parts across programs depending on fluctuating demands.

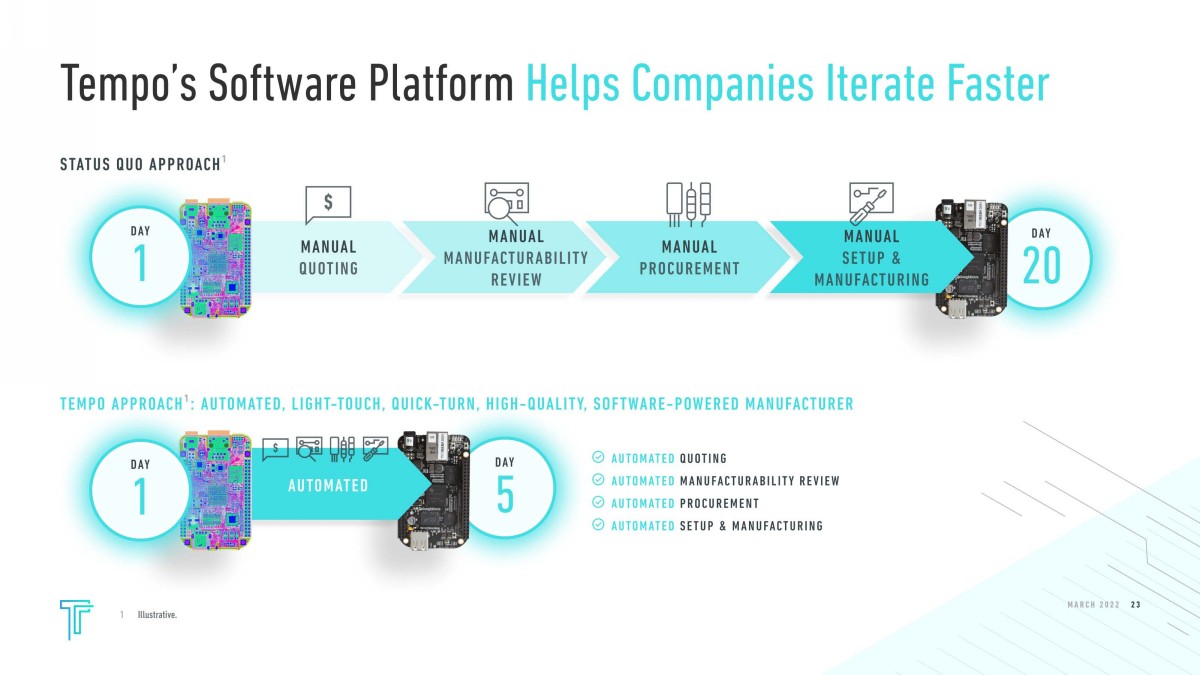

Tempo’s Software Platform Helps Companies Iterate Faster STATUS QUO APPROACH 1 1 Illustrative. TEMPO APPROACH 1 : AUTOMATED, LIGHT - TOUCH, QUICK - TURN, HIGH - QUALITY, SOFTWARE - POWERED MANUFACTURER AUTOMATED QUOTING AUTOMATED MANUFACTURABILITY REVIEW AUTOMATED PROCUREMENT AUTOMATED SETUP & MANUFACTURING M A R C H 2022 23

F in a nci a l s M A R C H 2022 2 2 24

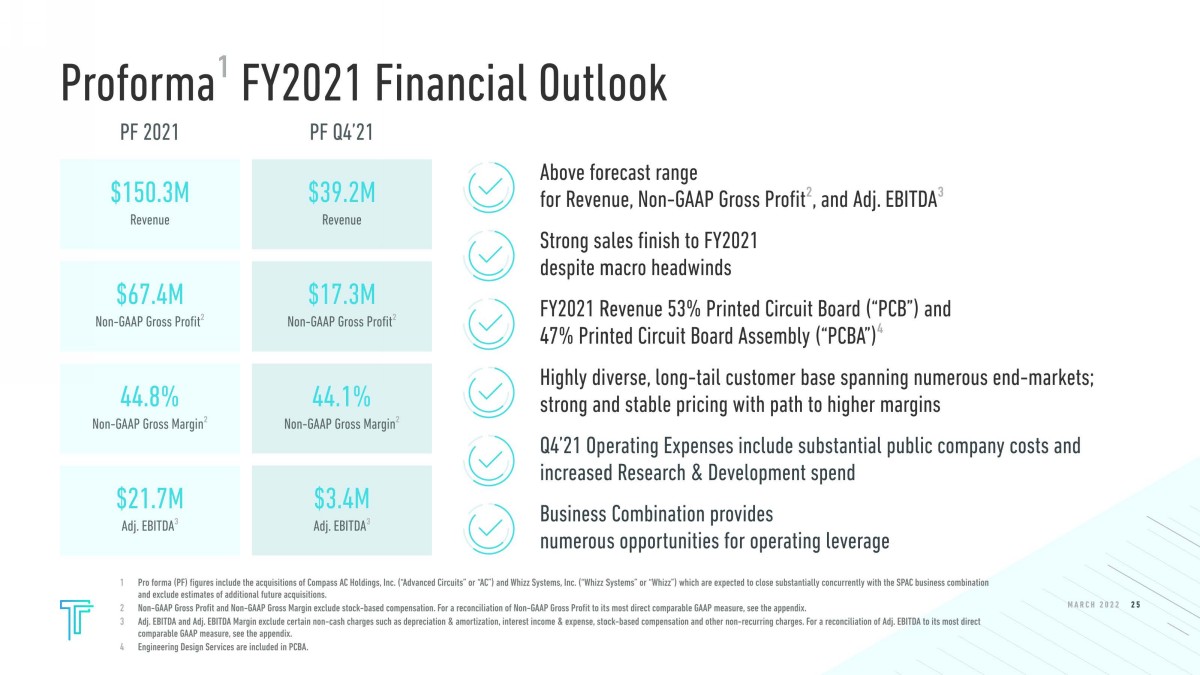

M A R C H 2022 24 P r o f o rm a 1 FY 2021 Financial High l ig h t s PF2021 PFQ4’21 $150.3M Revenue $67.4M Non - GAAP Gross Profit 2 44.8% Non - GAAP Gross Margin 2 $21.7M Adj. EBITDA 3 $39.2M Revenue $17.3M Non - GAAP Gross Profit 2 44.1% Non - GAAP Gross Margin 2 $3.4M Adj. EBITDA 3 25 1 4 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. (“Advanced Circuits” or “AC”) and Whizz Systems, Inc. (“Whizz Systems” or “Whizz”) which are expected to close substantially concurrently with the SPAC business combination and exclude estimates of additional future acquisitions. 2 Non - GAAP Gross Profit and Non - GAAP Gross Margin exclude stock - based compensation. For a reconciliation of Non - GAAP Gross Profit to its most direct comparable GAAP measure, see the appendix. 3 Adj. EBITDA and Adj. EBITDA Margin exclude certain non - cash charges such as depreciation & amortization, interest income & expense, stock - based compensation and other one - time or non - recurring charges. For a reconciliation of Adj. EBITDA to its most direct comparable GAAP measure, see the appendix. Engineering Design Services are included in PCBA. Strong sales finish to FY2021 despite macro headwinds Above forecast range for Revenue, Non - GAAP Gross Profit 2 , and Adj. EBITDA 3 FY2021 Revenue 53% Printed Circuit Board (“PCB”) and 47% Printed Circuit Board Assembly (“PCBA”) 4 Highly diverse, long - tail customer base spanning numerous end - markets. Strong and stable pricing with path to higher margins. Q4’21 Operating expenses include substantial public company costs and increased Research & Development spend. Business Combination provides numerous opportunities for operating leverage

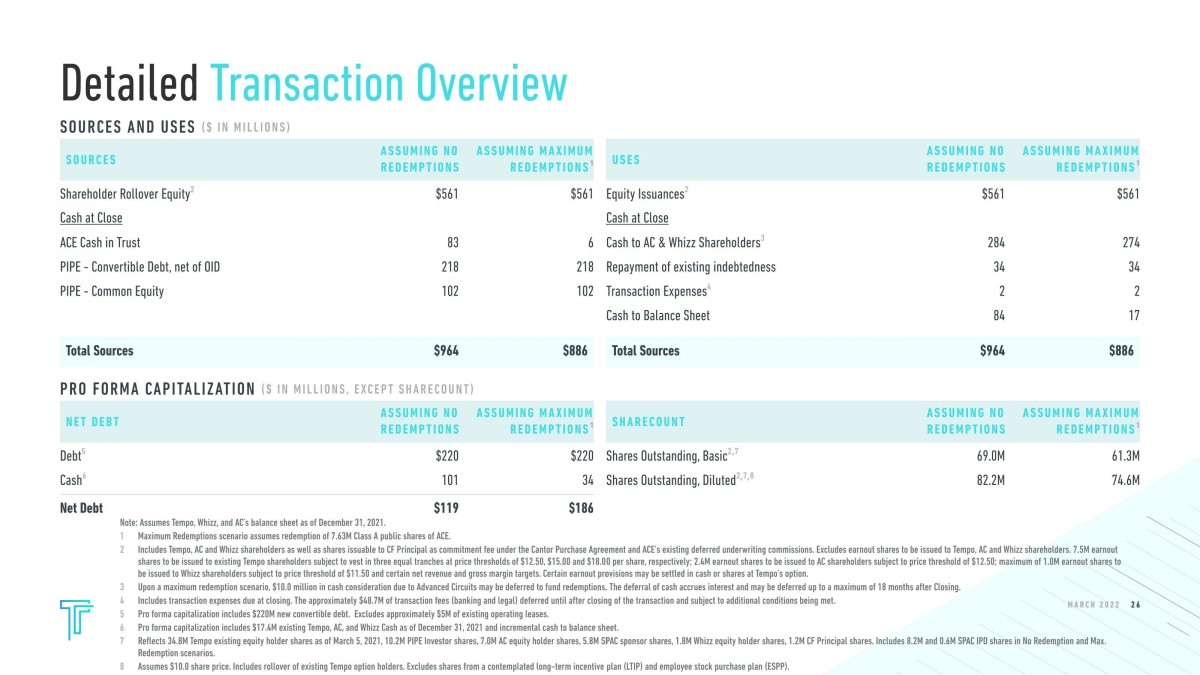

Detailed Transaction Overview M A R C H 2022 25 SOURCES AND USES ( $ IN MILLIONS) , 26 SOURCES Assuming No R e d e m p t i o n s Assuming Maximum Redemptions 1 Uses Assuming No R e d e m p t i o n s Assuming Maximum Redemptions 1 NET DEBT Assuming No R e d e m p t i o n s Assuming Maximum Redemptions 1 SHARECOUNT Assuming No R e d e m p t i o n s Assuming Maximum Redemptions 1 Debt 5 $220 $220 Shares Outstanding, Basic 2,7 69.0M 61.3M Cash 6 101 34 Shares Outstanding, Diluted 2,7,8 82.2M 74.6M Net Debt Note: Assumes Tempo, Whizz, and AC’s balance sheet as of December 31, 2021. $119 $186 1 Maximum Redemptions scenario assumes redemption of 7.63M Class A public shares of ACE 2 Includes Tempo, AC and Whizz shareholders as well as shares issuable to CF Principal as commitment fee under the Cantor Purchase Agreement and ACE’s existing deferred underwriting commissions. Excludes earnout shares to be issued to Tempo, AC and Whizz shareholders. 7.5M earnout shares to be issued to existing Tempo shareholders subject to vest in three equal tranches at price thresholds of $12.50, $15.00 and $18.00 per share, respectively; 2.4M earnout shares to be issued to AC shareholders subject to price threshold of $12.50; maximum of 1.0M earnout shares to be issued to Whizz shareholders subject to price threshold of $11.50 and certain net revenue and gross margin targets. Certain earnout provisions may be settled in cash or shares at Tempo’s option. 3 Upon a maximum redemption scenario, $10.0 million in cash consideration due to Advanced Circuits may be deferred to fund redemptions. The deferral of cash accrues interest and may be deferred up to a maximum of 18 months after Closing. 4 Includes transaction expenses due at closing. The approximately $48.7M of transaction fees (banking and legal) deferred until after closing of the transaction and subject to additional conditions being met. 5 Pro forma capitalization includes $220M new convertible debt. Excludes approximately $5M of existing operating leases. 6 Pro forma capitalization includes $17.4M existing Tempo, AC, and Whizz Cash as of December 31, 2021 and incremental cash to balance sheet. 7 Reflects 34.8M Tempo existing equity holder shares as of March 5, 2021, 10.2M PIPE Investor shares, 7.0M AC equity holder shares, 5.8M SPAC sponsor shares, 1.8M Whizz equity holder shares, 1.2M CF Principal shares. Includes 8.2M and 0.6M SPAC IPO shares in No Redemption and Max. Redemption scenarios. 8 Assumes $10 0 share price Includes rollover of existing Tempo option holders Assumes 2 0M shares for conversion of ACE Convertible Note Excludes shares from a contemplated long - term incentive plan (LTIP) and employee stock purchase plan (ESPP) Shareholder Rollover Equity 2 Cash at Close $561 $561 Equity Issuances 2 Cash at Close $561 $561 ACE Cash in Trust 83 6 Cash to AC & Whizz Shareholders 3 284 274 PIPE – Convertible Debt, net of OID 218 218 Repayment of existing indebtedness 34 34 PIPE – Common Equity 102 102 Transaction Expenses 4 2 2 Cash to Balance Sheet 84 17 Total Sources $964 $886 Total Uses $964 $886 PROFORMA CAPITALIZATION ( $ IN MILLIONS, EXCEPT SHARECOUNT)

Tempo Automation Summary M A R C H 2022 27 1 IPC 2012 - 2013, 2018, 2019 Annual Reports and Forecasts for the North American EMS Industry; company estimates. 2 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. (“Advanced Circuits” or “AC”) and Whizz Systems, Inc. (“Whizz Systems” or “Whizz”), which are expected to close substantially concurrently with the SPAC business combination, and exclude estimates of additional future acquisitions. 3 Adj. EBITDA excludes certain non - cash charges such as depreciation & amortization, interest income & expense, stock - based compensation and other one - time or non - recurring charges. For a reconciliation of Adj. EBITDA to its most direct comparable GAAP measure, see the appendix. $150.3M PF REVENUE 2021A 2 $21.7M PF ADJ EBITDA 2021A 2 ,3 1 Software - accelerated electronics manufacturing, transforming product development for the world’s innovators in a $290B market 1 2 Proprietary software platform, with AI that learns from every order, redefines the customer journey and accelerates time - to - market 3 Day 1 profit, growth, and strong margins unlocked by a differentiated customer journey & software - enabled efficiencies 4 Accelerated growth and data accrual via tech - enabled M&A in a highly fragmented industry 5 Management team with deep industry, public market, and M&A experience 27 7,000+ PF CUSTOMERS 2 TEMPO AI

A pp e n d i x M A R C H 2022 28 28

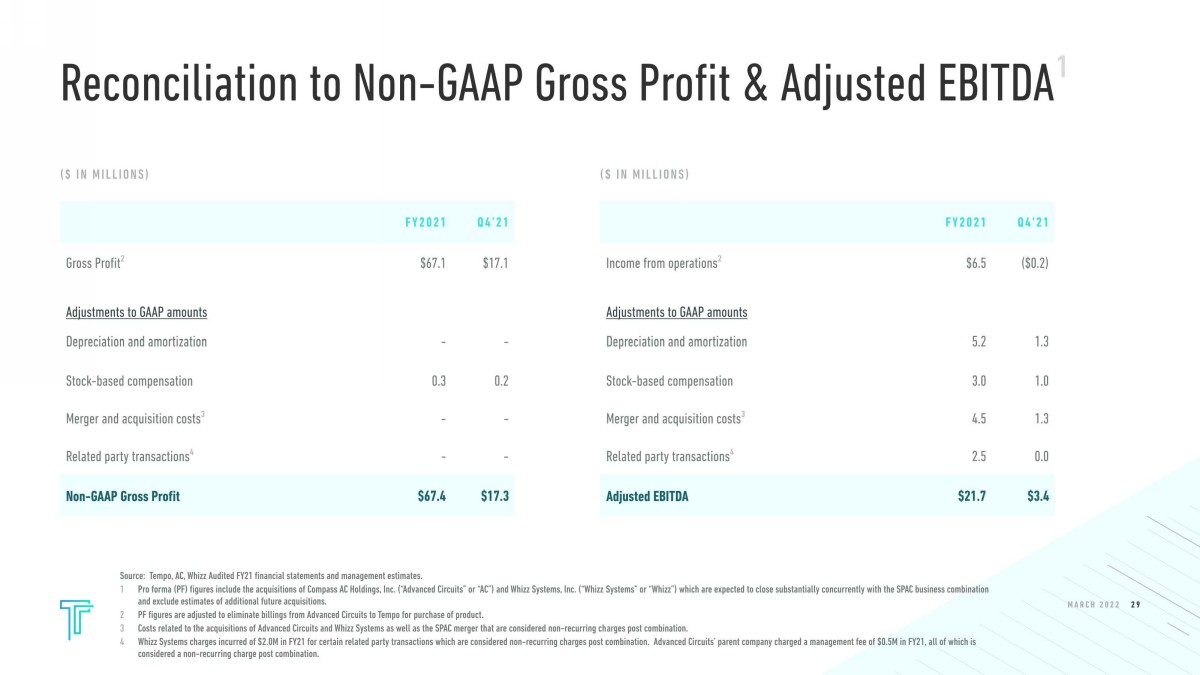

Reconciliation to Adjusted EBITDA 1 M A R C H 2022 29 Source: Tempo, AC, Whizz Audited FY20 and FY21 financial statements and management estimates 29 1 Pro forma (PF) figures include the acquisitions of Compass AC Holdings, Inc. (“Advanced Circuits” or “AC”) and Whizz Systems, Inc. (“Whizz Systems” or “Whizz”) which are expected to close substantially concurrently with the SPAC business combination and exclude estimates of additional future acquisitions. 2 PF figures are adjusted to eliminate billings from Advanced Circuits to Tempo for purchase of product. 3 Costs related to the acquisitions of Advanced Circuits and Whizz Systems as well as the SPAC merger that are considered non - recurring charges post combination. 4 Whizz Systems charges incurred of $2.6M (FY20) and $2.0M in (FY21) for certain related party transactions which are considered non - recurring charges post combination. Advanced Circuits parent company management fee of $0.5M in each of FY20 and FY21, all of which are considered non - recurring charges post combination. ( $ I N MILLIONS) ( $ IN MILLIONS) FY 2021 Q 4’ 21 FY 2021 Q 4’ 21 Gross Profit 2 $67. 1 $17. 1 Income from operations 2 $6. 5 $0. 0 Adjustments to GAAP amounts Depreciation and amortization - - Adjustments to GAAP amounts Depreciation and amortization 5. 2 1. 3 Stock - based compensation 0. 3 0. 2 Stock - based compensation 3. 0 1. 0 Merger and acquisition costs 3 - - Merger and acquisition costs 3 4. 5 1. 4 Related party transactions 4 - - Related party transactions 4 2. 5 0. 0 Non - GAAP Gross Profit $67.4 $17.3 Adjusted EBITDA $21.7 $3.7

Risks Relating to Tempo’s Business and Industry • We are an early - stage company with a history of losses . We have not been profitable historically and may not achieve or maintain profitability in the future . • Our limited operating history and rapid growth makes evaluating our current business and future prospects difficult and may increase the risk of your investment . • The success of our business is dependent on our ability to keep pace with technological changes and competitive conditions in our industry, and our ability to effectively adapt our services as our customers react to technological changes and competitive conditions in their respective industries . We may not timely and effectively scale and adapt our existing technology, processes, and infrastructure to meet the needs of our business . • Our operating results and financial condition may fluctuate from period to period and may fall below expectations in any particular period, which could adversely affect the market price of the combined company’s common stock. • We compete with numerous other diversified manufacturing service providers, electronic manufacturing services and design providers and others, and may face increasing competition, which could cause our operating results to suffer. • We are dependent on a limited number of customers and end markets. A decline in revenue from, or the loss of, any significant customer, could have a material adverse effect on our financial condition and operating results. • Customer relationships with emerging companies may present more risks than with established companies. • We may be adversely affected by supply chain issues, including shortages of required electronic components and raw materials. • Our gross profit and gross margin are dependent on a number of factors, including our services mix, market prices, labor costs and availability, acquisitions we may make and our ability to achieve cost synergies, level of capacity utilization and component, material, and other services prices. • If demand for our services does not grow as expected, or develops more slowly than expected, our revenues may stagnate or decline, and our business may be adversely affected. • Defects in shipped products that give rise to returns or warranty or other claims could result in material expenses, diversion of management time and attention, adversely affect customer relationships and damage to our reputation. • We may be involved in legal proceedings, including intellectual property (“IP”), anti - competition and securities litigation, employee - related claims and regulatory investigations, which could, among other things, divert efforts of management and result in significant expense and loss of our IP rights. • Our operations could suffer if we are unable to attract and retain key management or other key employees. • The effect of COVID - 19 on our operations and the operations of our customers, suppliers and logistics providers has had, and may continue to have, a material and adverse impact on our financial condition and results of operations. M A R C H 2022 30 Risk Factors

Risks Relating to Tempo’s Business and Industry (continued) • Many of our customers and potential customers operate in industries that experience rapid technological change resulting in short product life cycles and as a result, if the product life cycles of our customers slow materially, and research and development expenditures are reduced, our financial condition, business and results of operations will be materially adversely affected. • We purchase a significant amount of the materials and components we use from a limited number of suppliers and if such suppliers become unavailable or inadequate, our customer relationships, results of operations, and financial condition may be adversely affected. • Our facilities, and our suppliers’ and our customers’ facilities, are vulnerable to disruption due to natural or other disasters, public health crises, strikes and other events beyond our control. • If we fail to grow our business as anticipated, our operating results will be adversely affected. If we grow as anticipated but fail to manage our operations and costs accordingly, our business may be harmed and our results of operations may suffer. • As we acquire and invest in companies or technologies, we may not realize expected business, expected cost synergies, technological, or financial benefits. The acquisitions or investments could prove difficult to integrate, disrupt our business, dilute stockholder value and adversely affect our business, results of operations, and financial condition. • We may require additional capital to support business growth, and this capital might not be available on acceptable terms, if at all. • We could be subject to warranty and other claims involving allegedly defective or counterfeit products that we supply. • Compliance or the failure to comply with current and future environmental, health and safety, product stewardship and producer responsibility laws or regulations could cause us significant expense. • An inability to successfully manage the procurement, development, implementation or execution of IT systems, or to adequately maintain these systems and their security, as well as to protect data and other confidential information, may adversely affect our business and reputation. • If we experience a cybersecurity breach or disruption in our information systems, our business could be adversely affected. • We rely on our information technology systems to manage numerous aspects of our business and a disruption of these systems could adversely affect our business. • Our current levels of insurance may not be adequate for our potential liabilities. • Because our industry is rapidly evolving, forecasts of market growth may not be accurate, and even if these markets achieve the forecasted growth, there can be no assurance that our business will grow at similar rates, or at all. • Global economic, political and social conditions and uncertainties in the markets that we serve may adversely impact our business. M A R C H 2022 31 Risk Factors (continued)

Risks Relating to Tempo’s Business and Industry (continued) • Our industry routinely experiences cyclical market patterns and our services are used across different end markets. A significant downturn in the industry or in any of these end markets could cause a meaningful reduction in demand for our services and harm our operating results. • Third - party lawsuits and assertions to which may become subject alleging our infringement of patents, trade secrets or other intellectual property rights may have a significant adverse effect on our business and financial condition. • If we are unable to adequately protect or enforce our intellectual property rights, such information may be used by others to compete against us. • Our internal controls over financial reporting currently do not meet all of the standards contemplated by Section 404 of the Sarbanes - Oxley Act of 2002 (the "Sarbanes - Oxley Act"), and failure to achieve and maintain effective internal controls over financial reporting in accordance with Section 404 of the Sarbanes - Oxley Act could impair our ability to produce timely and accurate financial statements or comply with applicable regulations and have a material adverse effect on our business. • Fluctuations in the cost and availability of raw materials, equipment, labor, and transportation could cause manufacturing delays or increase our costs. • Certain software we use is from open source code sources, which, under certain circumstances could materially adversely affect our business, financial condition, and operating results. • We conduct a portion of our business pursuant to U.S. government contracts, which are subject to unique risks. • The U.S. government may modify, curtail or terminate one or more of our contracts. • Any of the foregoing may adversely affect our margins, cash flow, and our ability to grow our revenue, and may increase the variability of our operating results from period to period. Our failure to meet our customers’ price expectations may adversely affect our business and results of operations. • We have identified material weaknesses in our internal control over financial reporting and may continue to identify additional material weaknesses in the future. If the combined company fails to develop and maintain an effective system of internal control over financial reporting, it may not be able to accurately report its financial results in a timely manner, which may adversely affect investor confidence in the post - combination company. Risks Related to the Business Combination and ACE • Each of ACE Convergence Acquisition Corp. (“ACE”) and Tempo Automation, Inc. (“Tempo”) will incur significant transaction costs in connection with the business combination between ACE and Tempo (the “Business Combination”). • The Sponsor and ACE’s directors, officers and initial shareholders and their permitted transferees have agreed to vote in favor of the Business Combination, regardless of how ACE’s public shareholders vote. M A R C H 2022 32 Risk Factors (continued)

Risks Related to the Business Combination and ACE (continued) • The announcement of the proposed Business Combination could disrupt Tempo’s relationships with its customers, suppliers, business partners and others, as well as its operating results and business generally. • Compliance obligations under the Sarbanes - Oxley Act may make it more difficult to effectuate the Business Combination, require substantial financial and management resources and increase the time and costs of completing a business combination. • Subsequent to consummation of the Business Combination, ACE may be exposed to unknown or contingent liabilities and may be required to subsequently take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on ACE’s financial condition, results of operations and share price, which could cause a loss of some or all of one’s investment. • The historical financial results of Tempo and unaudited pro forma financial information included in the Registration Statement may not be indicative of what Tempo’s actual financial position or results of operations would have been. • Neither the ACE board of directors nor any committee thereof obtained a third party valuation in determining whether or not to pursue the Business Combination. • ACE may be forced to close the Business Combination even if they determined it is no longer in ACE’s shareholders’ best interest. • Since the Sponsor and ACE’s directors and executive officers have interests that are different, or in addition to (and which may conflict with), the interests of ACE’s shareholders, a conflict of interest may have existed in determining whether the Business Combination with Tempo is appropriate as ACE’s initial business combination. Such interests include that Sponsor will lose its entire investment in ACE if ACE’s business combination is not completed. • The exercise of ACE’s directors’ and executive officers’ discretion in agreeing to changes or waivers in the terms of the Business Combination may result in a conflict of interest when determining whether such changes to the terms of the Business Combination or waivers of conditions are appropriate and in ACE’s shareholders’ best interest. • Deferred underwriting fees in connection with the IPO and payable at the consummation of the Business Combination will not be adjusted to account for redemptions by the public stockholders; if the public stockholders exercise their redemption rights, the amount of effective total underwriting commissions as a percentage of the aggregate proceeds from the IPO will increase. • Future resales of common stock after the consummation of the Business Combination may cause the market price of the combined company’s securities to drop significantly, even if its business is doing well. M A R C H 2022 33 Risk Factors (continued)

Risks Related to the Business Combination and ACE (continued) • The public stockholders of ACE will experience immediate dilution as a consequence of the issuance of common stock as consideration in the Business Combination and the PIPE Investment and due to future issuances pursuant to the combined company’s equity plan(s). Having a minority share position may reduce the influence that current stockholders have on the management of the combined company. • Even if the Business Combination is consummated, the public warrants may never be in the money, and they may expire worthless and the terms of the warrants may be amended in a manner adverse to a holder if holders of at least 65% of the then outstanding public warrants approve of such amendment. • ACE may redeem unexpired warrants prior to their exercise at a time that is disadvantageous to an investor, thereby making those warrants worthless. • ACE’s and Tempo’s ability to consummate the Business Combination, and the operations of the combined company following the Business Combination, may be materially adversely affected by the COVID - 19 pandemic. • Following the consummation of the Business Combination, ACE’s only significant asset will be ACE’s ownership interest in the combined company and such ownership may not be sufficient to pay dividends or make distributions or loans to enable ACE to pay any dividends on the combined company’s common stock or satisfy ACE’s other financial conditions. • ACE has a specified maximum redemption threshold. This redemption threshold may make it more difficult for ACE to complete the Business Combination as contemplated. • The Sponsor may elect to purchase shares or warrants from public shareholders prior to the consummation of the Business Combination, which may influence the vote on the Business Combination and reduce the public “float” of ACE’s securities. • There are risks to ACE shareholders who are not affiliates of the Sponsor associated with becoming stockholders of the combined company through the Business Combination rather than acquiring securities of Tempo directly in an underwritten public offering, including no independent due diligence review by an underwriter and conflicts of interest of the Sponsor. • ACE is not registering the shares of the combined company common stock issuable upon exercise of the warrants under the Securities Act or any state securities laws at this time, and such registration may not be in place when an investor decides to exercise warrants, thus precluding such investor from being able to exercise its warrants and causing such warrants to expire worthless. • If third parties bring claims against ACE, the proceeds held in the trust account could be reduced and the per share redemption amount received by shareholders may be less than $10.00 per share (which was the offering price per unit in its initial public offering). M A R C H 2022 34 Risk Factors (continued)

Risks Related to the Business Combination and ACE (continued) • If, after ACE distributes the proceeds in the trust account to its public shareholders, ACE files a winding - up or bankruptcy petition or an involuntary winding - up or bankruptcy petition is filed against it that is not dismissed, a bankruptcy court may seek to recover such proceeds, and we and our board of directors may be exposed to claims of punitive damages. • If, before ACE distributes the proceeds in the trust account to its public shareholders, ACE files a winding - up or bankruptcy petition or an involuntary winding - up or bankruptcy petition is filed against it that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of ACE’s shareholders and the per share amount that would otherwise be received by ACE’s shareholders in connection with the liquidation may be reduced. • ACE’s shareholders may be held liable for claims by third parties against ACE to the extent of distributions received by them upon redemption of their shares. • Warrants will become exercisable for combined company common stock, which would increase the number of shares eligible for future resale in the public market and result in dilution to ACE stockholders. • Nasdaq may not list the combined company’s securities on its exchange, and the combined company may not be able to comply with the continued listing standards of Nasdaq, which could limit investors’ ability to make transactions in its securities and subject it to additional trading restrictions. Risks Related to the Convertible Notes • Our convertible notes to be issued and outstanding after the consummation of the Business Combination may impact our financial results, result in dilution to our stockholders, create downward pressure on the price of our common stock, and restrict our ability to raise additional capital or take advantage of future opportunities. • We may not have the ability to raise the funds necessary to settle conversions of the convertible notes, repurchase the convertible notes upon a fundamental change or repay the convertible notes in cash at their maturity, and our future debt may contain limitations on our ability to pay cash upon conversion, redemption or repurchase of the convertible notes. • We may still incur substantially more debt or take other actions that would diminish our ability to make payments on the convertible notes when due. • The Indenture will contain restrictions and limitations that could significantly impact our ability to operate our business. M A R C H 2022 35 Risk Factors (continued)

Risks Related to the Combined Company • Concentration of ownership among the combined company’s executive officers, directors and their affiliates may prevent new investors from influencing significant corporate decisions. • If the Business Combination’s benefits do not meet the expectations of investors or securities analysis, the market price of ACE’s securities or, following the Closing, the combined company’s securities, may decline. • Our disclosure controls and procedures may not prevent or detect all errors or acts of fraud. Additional Risks Related to Ownership of the Combined Company Stock Following the Business Combination and the Combined Company operating as a Public Company • The price of the combined company’s stock and warrants may be volatile. • We do not intend to pay cash dividends for the foreseeable future. • Future resales of common stock after the consummation of the Business Combination may cause the market of the combined company’s securities to drop significantly, even if its business is doing well. • We will incur increased costs as a result of operating as a public company, and the combined company’s management will be required to devote substantial time to new compliance and investor relations initiatives. • If we fail to maintain proper and effective internal controls over financial reporting, our ability to produce accurate and timely financial statements could be impaired, investors may lose confidence in our financial reporting and the trading price of the combined company’s common stock may decline. • Changes in accounting rules and regulations, or interpretations thereof, could result in unfavorable accounting changes or require us to change our compensation policies. M A R C H 2022 36 Risk Factors (continued)

Additional Risks Related to Ownership of the Combined Company Stock Following the Business Combination and the Combined Company operating as a Public Company (continued) • While we anticipate losing our emerging growth company status by the end of 2022 , we are currently an emerging growth company and a smaller reporting company within the meaning of the Securities Act, and to the extent we have taken advantage of certain exemptions from disclosure requirements available to emerging growth companies or smaller reporting companies, this could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies . • The combined company’s proposed certificate of incorporation will provide that the Court of Chancery of the State of Delaware will be the exclusive forum for substantially all disputes between the combined company and its stockholders and that the federal district courts shall be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the U.S. Securities Act of 1933, as amended, which could limit the combined company’s stockholders’ ability to obtain a favorable judicial forum for disputes with the combined company or its directors, officers or employees. Risks Related to the Consummation of the Domestication of ACE (“the Domestication”) • The Domestication may result in adverse tax consequences for holders of ACE Class A ordinary shares and warrants. • Upon consummation of the Business Combination, the rights of holders of the combined company common stock arising under the DGCL as well as the proposed organizational documents will differ from and may be less favorable to the rights of holders of ACE Class A ordinary shares arising under the Cayman Islands Companies Act as well as ACE’s current amended and restated memorandum and articles of association. • Delaware law and the combined company’s proposed organizational documents contain certain provisions, including anti - takeover provisions that limit the ability of stockholders to take certain actions and could delay or discourage takeover attempts that stockholders may consider favorable. Risks if the Adjournment Proposal (as defined in the Registration Statement) is not approved • If the Adjournment Proposal is not approved, and an insufficient number of votes have been obtained to authorize the consummation of the Business Combination, our board of directors will not have the ability to adjourn the extraordinary general meeting to a later date in order to solicit further votes, and, therefore, the Business Combination will not be approved, and, therefore, the Business Combination may not be consummated . M A R C H 2022 37 Risk Factors (continued)

Risks if the Domestication and the Business Combination are not Consummated • If we are not able to complete the Business Combination by July 13, 2022, and if ACE is not able to complete another business combination by then, in each case as may be further extended pursuant to the Cayman Constitutional Documents, ACE would cease all operations except for the purpose of winding up and ACE would redeem its Class A ordinary shares and liquidate the trust account, in which case ACE’s public shareholders may only receive approximately $10.00 per share and ACE’s warrants will expire worthless. • You will not have any rights or interests in funds from the trust account, except under certain limited circumstances. To liquidate your investment, therefore, you may be forced to sell your public shares and/or public warrants, potentially at a loss. • If ACE has not completed its initial business combination or validly extended beyond the combination deadline, its public shareholders may be forced to wait until after July 13, 2022 before redemption from the trust account. • If the net proceeds of ACE’s initial public offering not being held in the trust account are insufficient to allow ACE to operate through to July 13, 2022 (or if such date is further extended at a duly called extraordinary general meeting, such later date) and ACE is unable to obtain additional capital, it may be unable to complete its initial business combination, in which case its public shareholders may only receive $10.00 per share, and its warrants will expire worthless. General Risk Factors • The combined company may be subject to securities litigation, which is expensive and could divert management attention. • If analysts do not publish research about our business or if they publish inaccurate or unfavorable research, the combined company’s stock price and trading volume could decline. • ACE’s warrants are accounted for as liabilities and the changes in value of its warrants could have a material effect on its financial results. • ACE identified a material weakness in its internal controls over financial reporting as of December 31, 2020. If ACE is unable to develop and maintain an effective system of internal control over financial reporting, it may not be able to accurately report its financial results in a timely manner, which may adversely affect investor confidence in ACE and materially and adversely affect its business and operating results. • ACE may face litigation and other risks as a result of the material weakness in its internal control over financial reporting. • ACE faces risks and uncertainties related to litigation, regulatory actions and government investigations and inquiries. M A R C H 2022 38 Risk Factors (continued)

M A R C H 2022 39 WWW. TEMPOAUTOMATION. COM 39