© 2023 WeWork February 2023 Investor Presentation For all the ways you work, we’re here.

© 2023 WeWork1 Non-GAAP Financial Measures of Foreign Exchange We supplement our GAAP financial results by evaluating our performance excluding the effect of foreign exchange or by assessing our performance using the foreign exchange rates that we used to calculate certain forward-looking financial information, to facilitate period-over-period comparisons. We believe that the disclosure of our financial results on a budgeted foreign exchange basis is a useful supplemental measure of operating performance because it facilitates comparison of our current performance to our guidance provided by excluding the effects of foreign currency volatility. We calculate our budgeted foreign exchange results by translating the current quarter functional currency results at our budgeted foreign exchange rate, which is an estimated forward rate for each of our functional currencies determined during the fourth quarter of the prior fiscal year as part of our annual budgeting process. The presentation of financial results on a budgeted foreign exchange basis should be considered in addition to, but not a substitute for, measures of financial performance reported in accordance with U.S. GAAP. India, China, Israel and Common Desk This presentation includes operating metrics (including number of locations, workstation capacity, and memberships) relating to (A) WeWork's investments and operations in China and India, which are not consolidated, and (B) certain locations in the United States where WeWork's operations are under the "Common Desk" brand and WeWork receives a management fee (and does not recognize other revenue or incur any operating costs) which are also not consolidated (the "Unconsolidated Common Desk Locations"). Therefore, the results of WeWork's operations in China and India as well as the Unconsolidated Common Desk Locations are not reflected in the WeWork financial statements and projections set forth in this presentation on a line-by-line basis, as such operations are not conducted through consolidated subsidiaries or controlling interests of WeWork. In June 2021, WeWork closed a franchise agreement and transferred the building operations and obligations of its Israel locations to the franchisee. Israel results of operations have been included through May 2021, and excluded from subsequent projections. Unless otherwise explicitly specified in this presentation, India, China and Israel related metrics are excluded from all calculations. Trademarks This presentation contains trademarks, service marks, trade names and copyrights of WeWork and other companies, which are the property of their respective owners. Preliminary Financial Information We report our financial results in accordance with U.S. generally accepted accounting principles. All projected financial information and metrics in this press release are preliminary. These estimates are not a comprehensive statement of our financial position and results of operations. There is no assurance that we will achieve our forecasted results within the relevant period or otherwise. As part of the Company's financial statement closing process it is performing its going concern analysis, which will be concluded when the Company's audited financial statements for the year ended December 31, 2022 are finalized. There can be no guarantee as to the accuracy or reliability of such assumptions and you are cautioned not to give undue weight to this information. Further, no representation is made as to the reasonableness of the assumptions made by third parties or the accuracy or completeness of any projections or modeling or any other information contained herein. Any data on past performance of WeWork or modeling contained herein is not an indication as to future performance. WeWork has not independently verified any such third-party information. Similarly, other third-party survey data and research reports commissioned by WeWork, while believed by WeWork to be reliable, are based on limited sample sizes and have not been independently verified by WeWork. In addition, projections, assumptions, estimates, goals, targets, plans and trends of the future performance of the industry in which WeWork operates, and WeWork’s future performance, are necessarily subject to uncertainty and risk due to a variety of factors, including those described above. These and other factors could cause results to differ materially from those expressed in the estimates made by independent parties and by WeWork. Except as may be required by law, WeWork assumes no obligation to update the information in this presentation. Use of Non-GAAP Financial Measures This presentation includes certain financial measures not presented in accordance with generally accepted accounting principles in the United States ("GAAP"): Adjusted EBITDA, Free Cash Flow, Building Margin. and non-GAAP financial measures of foreign exchange (including on a forward looking basis). These financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing our financial results. Therefore, these measures should not be considered in isolation or as an alternative to net loss or other measures of profitability, liquidity or performance under GAAP. You should be aware that our presentation of these measures may not be comparable to similarly titled measures used by other companies, which may be defined and calculated differently. WeWork believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about WeWork. WeWork's management uses forward-looking non-GAAP measures to evaluate WeWork's projected financials and operating performance. Reconciliations of historical non-GAAP measures to their most directly comparable historical GAAP counterparts are included in the Appendix to this presentation. To the extent that forward-looking non-GAAP financial measures are provided, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliations. Forward-Looking Statements Certain statements made in this presentation may be deemed “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended. These forward looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Although WeWork believes the expectations reflected in any forward-looking statement are based on reasonable assumptions, it can give no assurance that its expectations will be attained, and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks, uncertainties and other factors. Such factors include, but are not limited to, WeWork’s ability to refinance, extend, restructure or repay outstanding debt; its outstanding indebtedness; its liquidity needs to operate its business and execute its strategy, and related use of cash; its ability to raise capital through equity issuances, asset sales or the incurrence of debt; WeWork’s expectations regarding its ability to continue as a going concern; WeWork’s preparation of its financial statements for the year ended December 31, 2022; retail and credit market conditions; higher cost of capital and borrowing costs; impairments; its current and projected liquidity needs; changes in general economic conditions, including as a result of the COVID-19 pandemic and the conflict in Ukraine; WeWork’s expectations regarding its exits of underperforming locations, including the timing of any such exits and our ability to retain our members; delays in customers and prospective customers returning to the office and taking occupancy, or changes in the preferences of customers and prospective customers with respect to remote or hybrid working, as a result of the COVID-19 pandemic leading to a parallel delay, or potentially permanent change, in receiving the corresponding revenue; the impact of foreign exchange rates on WeWork’s financial performance; and WeWork's inability to implement its business plan or meet or exceed its financial projections. Forward-looking statements speak only as of the date they are made. WeWork discusses these and other risks and uncertainties in its annual and quarterly periodic reports and other documents filed with the U.S. Securities and Exchange Commission. WeWork undertakes no duty or obligation to update or revise these forward-looking statements, whether as a result of new information, future developments, or otherwise, except as required by law. Use of Data This presentation contains information concerning WeWork's solutions and WeWork's industry, including market size and growth rates of the markets in which WeWork participates, that are based on industry surveys and publications or other publicly available information, other third-party survey data and research reports commissioned by WeWork and its internal sources. This information involves many assumptions and limitations. Disclaimer

© 2023 WeWork2 Our mission is to empower tomorrow’s world at work. Our purpose is to harness the power of community to make a positive impact on people and the environment.

© 2023 WeWork Our Core Values Our Core Constituents Do the right thing. Strive to be better, together. Be entrepreneurial. Give gratitude. Be human, be kind. Colleagues Shareholders Partners Society Members

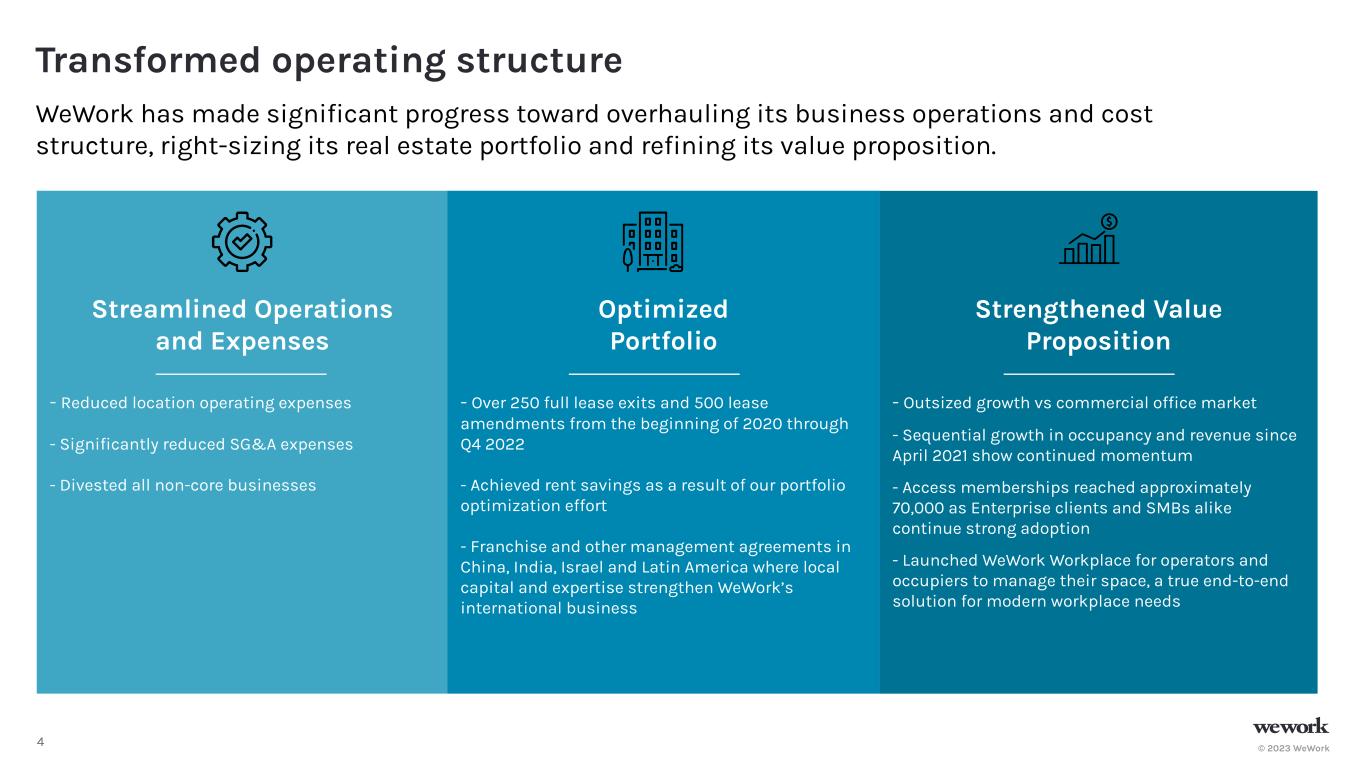

© 2023 WeWork4 Transformed operating structure Strengthened Value Proposition - Outsized growth vs commercial office market - Sequential growth in occupancy and revenue since April 2021 show continued momentum - Access memberships reached approximately 70,000 as Enterprise clients and SMBs alike continue strong adoption - Launched WeWork Workplace for operators and occupiers to manage their space, a true end-to-end solution for modern workplace needs Streamlined Operations and Expenses - Reduced location operating expenses - Significantly reduced SG&A expenses - Divested all non-core businesses Optimized Portfolio - Over 250 full lease exits and 500 lease amendments from the beginning of 2020 through Q4 2022 - Achieved rent savings as a result of our portfolio optimization effort - Franchise and other management agreements in China, India, Israel and Latin America where local capital and expertise strengthen WeWork’s international business WeWork has made significant progress toward overhauling its business operations and cost structure, right-sizing its real estate portfolio and refining its value proposition.

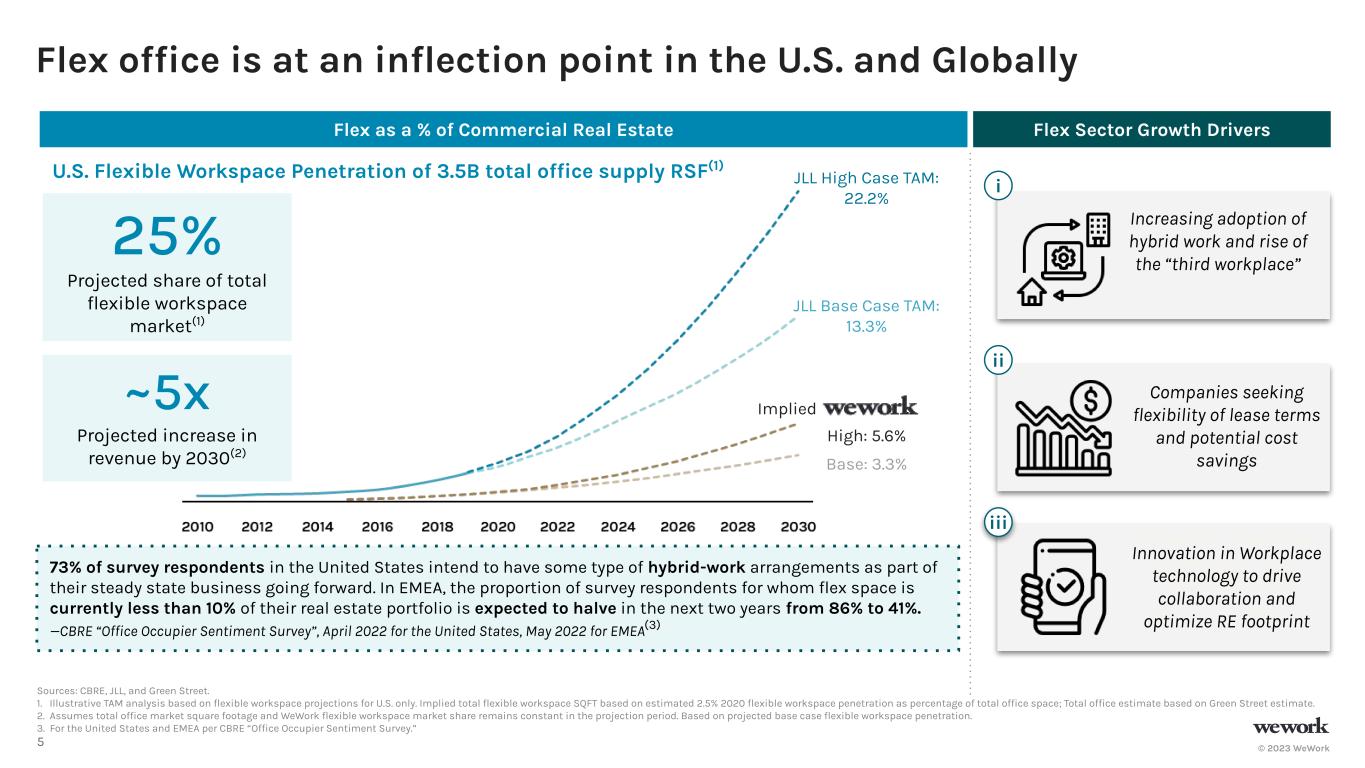

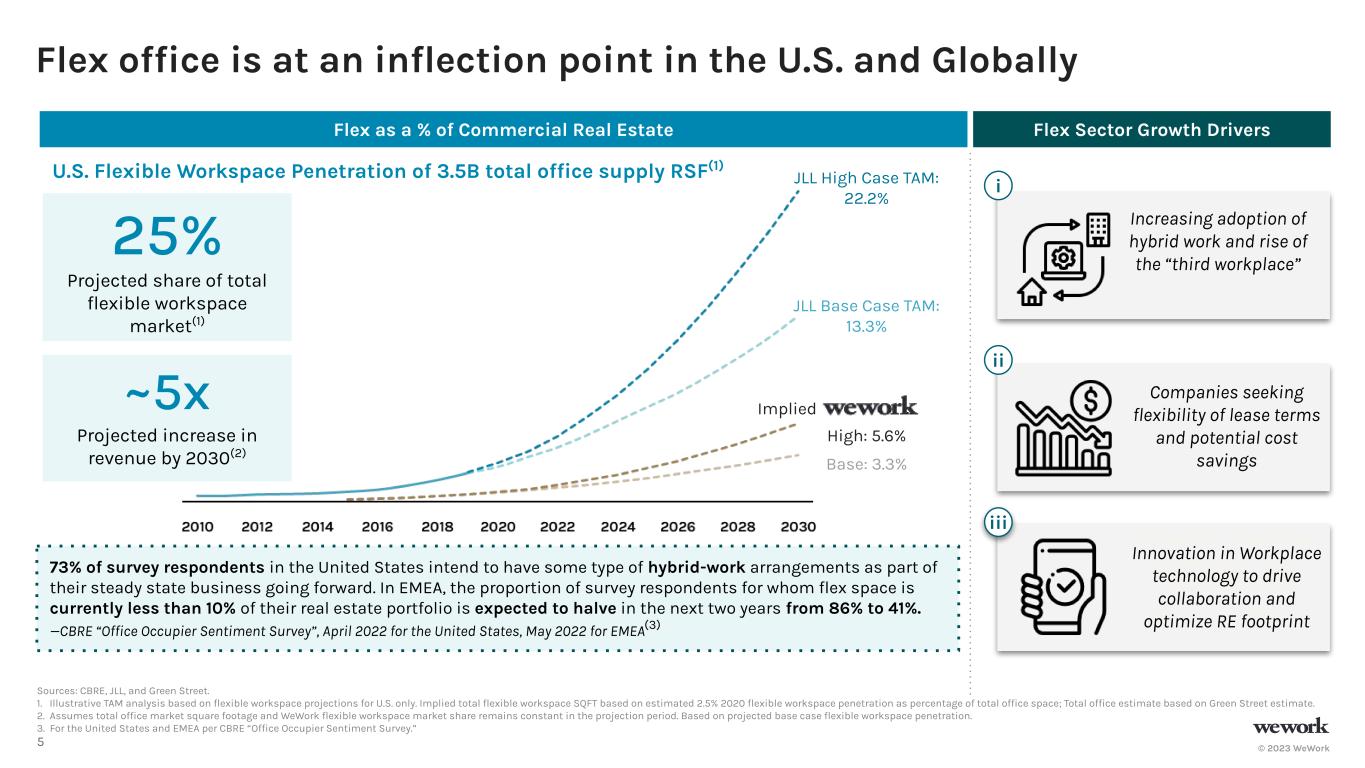

© 2023 WeWork5 Implied : Sources: CBRE, JLL, and Green Street. 1. Illustrative TAM analysis based on flexible workspace projections for U.S. only. Implied total flexible workspace SQFT based on estimated 2.5% 2020 flexible workspace penetration as percentage of total office space; Total office estimate based on Green Street estimate. 2. Assumes total office market square footage and WeWork flexible workspace market share remains constant in the projection period. Based on projected base case flexible workspace penetration. 3. For the United States and EMEA per CBRE “Office Occupier Sentiment Survey.” Flex as a % of Commercial Real Estate Flex Sector Growth Drivers i iii Increasing adoption of hybrid work and rise of the “third workplace” Companies seeking flexibility of lease terms and potential cost savings Innovation in Workplace technology to drive collaboration and optimize RE footprint ii U.S. Flexible Workspace Penetration of 3.5B total office supply RSF(1) 73% of survey respondents in the United States intend to have some type of hybrid-work arrangements as part of their steady state business going forward. In EMEA, the proportion of survey respondents for whom flex space is currently less than 10% of their real estate portfolio is expected to halve in the next two years from 86% to 41%. —CBRE “Office Occupier Sentiment Survey”, April 2022 for the United States, May 2022 for EMEA(3)3} JLL High Case TAM: 22.2% JLL Base Case TAM: 13.3% High: 5.6% Base: 3.3% Innovation in Workplace technology to drive collaboration and optimize RE footprint 25% Projected share of total flexible workspace market(1) ~5x Projected increase in revenue by 2030(2) Flex office is at an inflection point in the U.S. and Globally

© 2023 WeWork6 Product Offerings

© 2023 WeWork7 1. Metrics presented as of December 31, 2022. Consolidated metrics include operations in the United States and Canada, Latin America, Europe, Japan, and Pacific regions. Systemwide metrics include consolidated regions as well as India, China, and Israel, which are not consolidated. 779 LOCATIONS 682k PHYSICAL MEMBERSHIPS 906k WORKSTATION CAPACITY 622 LOCATIONS 547k PHYSICAL MEMBERSHIPS 731k WORKSTATION CAPACITY Consolidated LatAm USC China India EMEA Pacific Japan Israel 71k ALL ACCESS 70k ALL ACCESS Wholly-owned Consolidated JVs Unconsolidated JVs and Franchises Systemwide WeWork’s global footprint(1) Space-as-a-Service

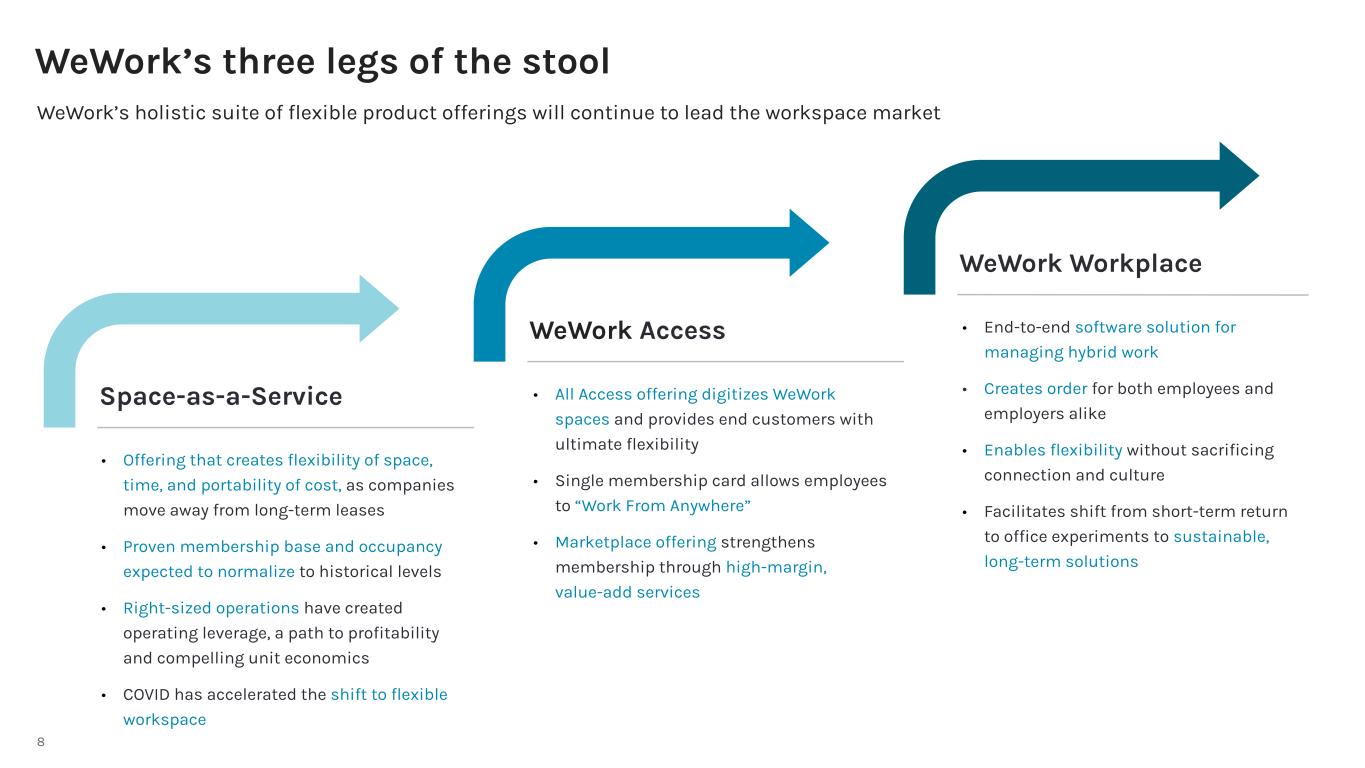

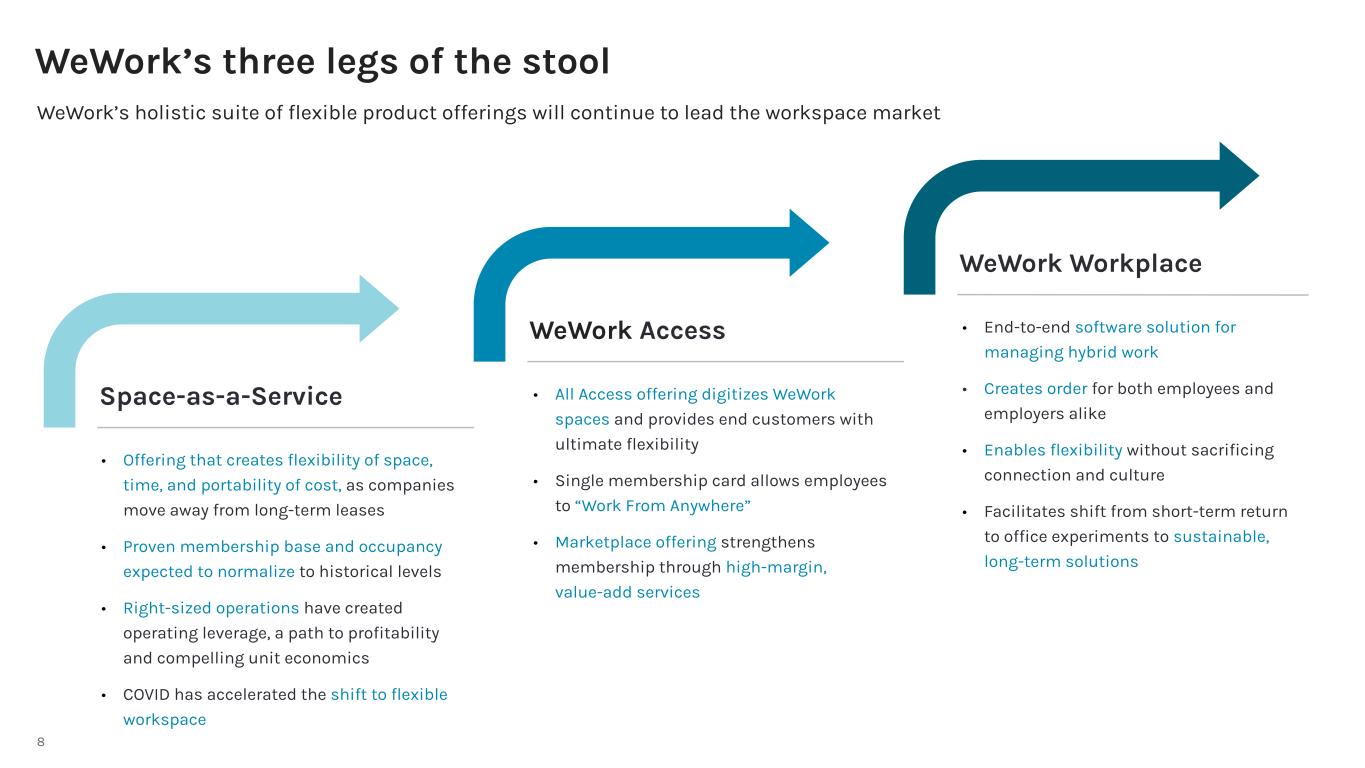

8 WeWork’s holistic suite of flexible product offerings will continue to lead the workspace market Space-as-a-Service • Offering that creates flexibility of space, time, and portability of cost, as companies move away from long-term leases • Proven membership base and occupancy expected to normalize to historical levels • Right-sized operations have created operating leverage, a path to profitability and compelling unit economics • COVID has accelerated the shift to flexible workspace WeWork Access WeWork Workplace • All Access offering digitizes WeWork spaces and provides end customers with ultimate flexibility • Single membership card allows employees to “Work From Anywhere” • Marketplace offering strengthens membership through high-margin, value-add services • End-to-end software solution for managing hybrid work • Creates order for both employees and employers alike • Enables flexibility without sacrificing connection and culture • Facilitates shift from short-term return to office experiments to sustainable, long-term solutions WeWork’s three legs of the stool

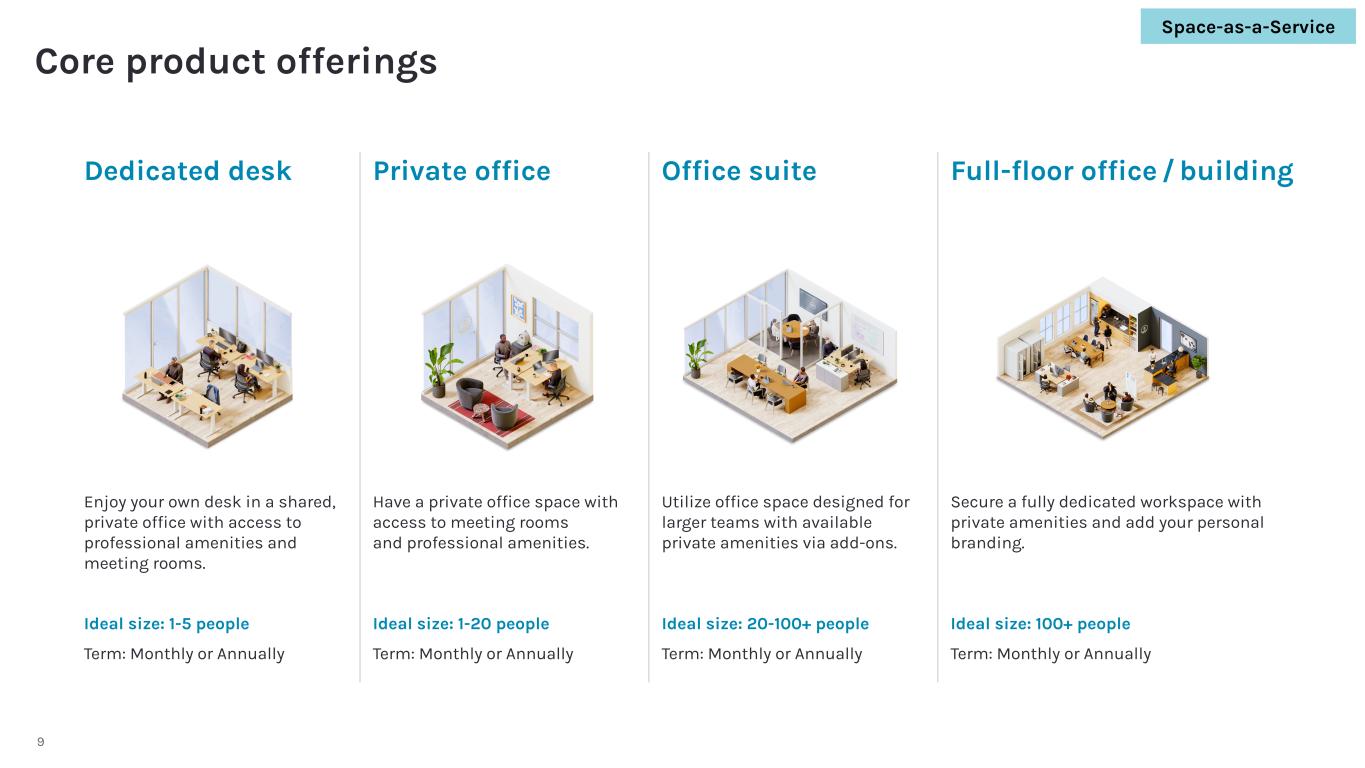

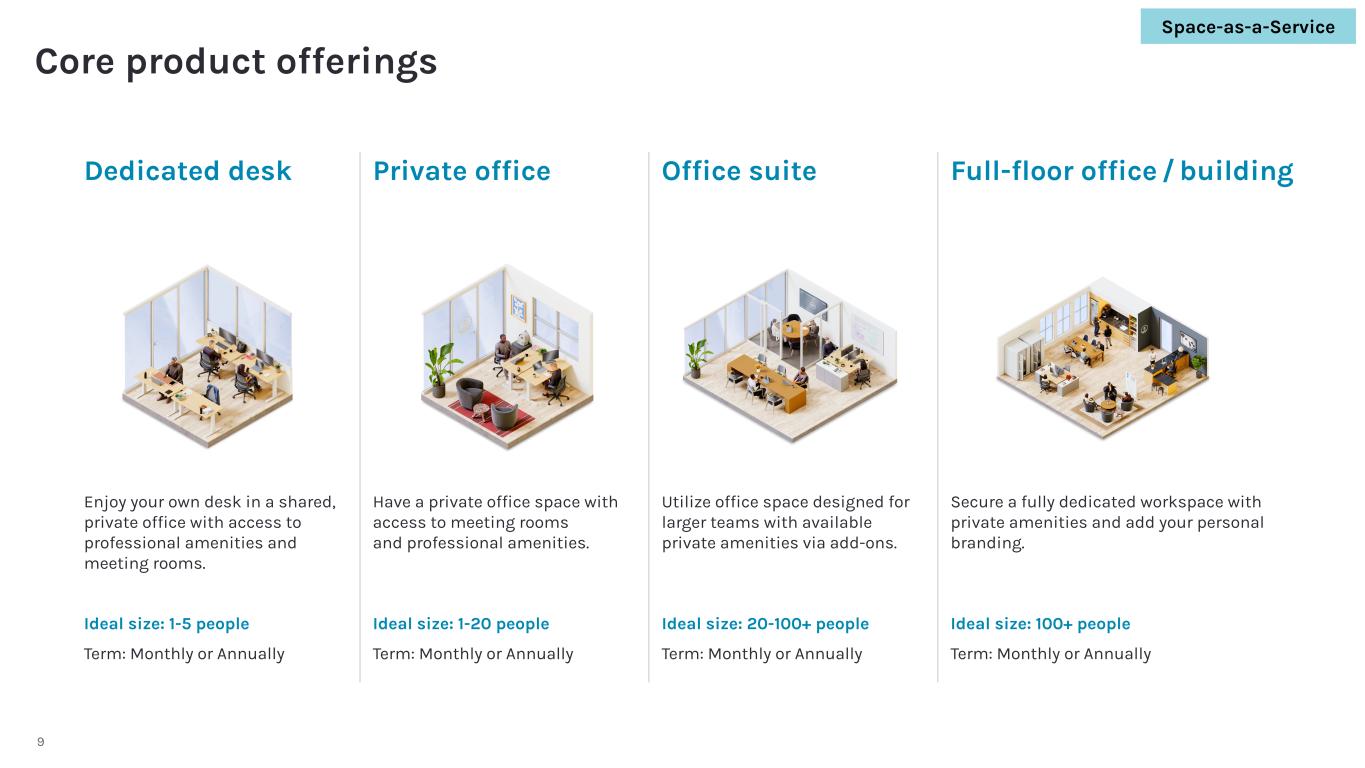

9 Dedicated desk Private office Office suite Full-floor office / building Enjoy your own desk in a shared, private office with access to professional amenities and meeting rooms. Have a private office space with access to meeting rooms and professional amenities. Utilize office space designed for larger teams with available private amenities via add-ons. Secure a fully dedicated workspace with private amenities and add your personal branding. Ideal size: 1-5 people Term: Monthly or Annually Ideal size: 1-20 people Term: Monthly or Annually Ideal size: 20-100+ people Term: Monthly or Annually Ideal size: 100+ people Term: Monthly or Annually Space-as-a-Service Core product offerings

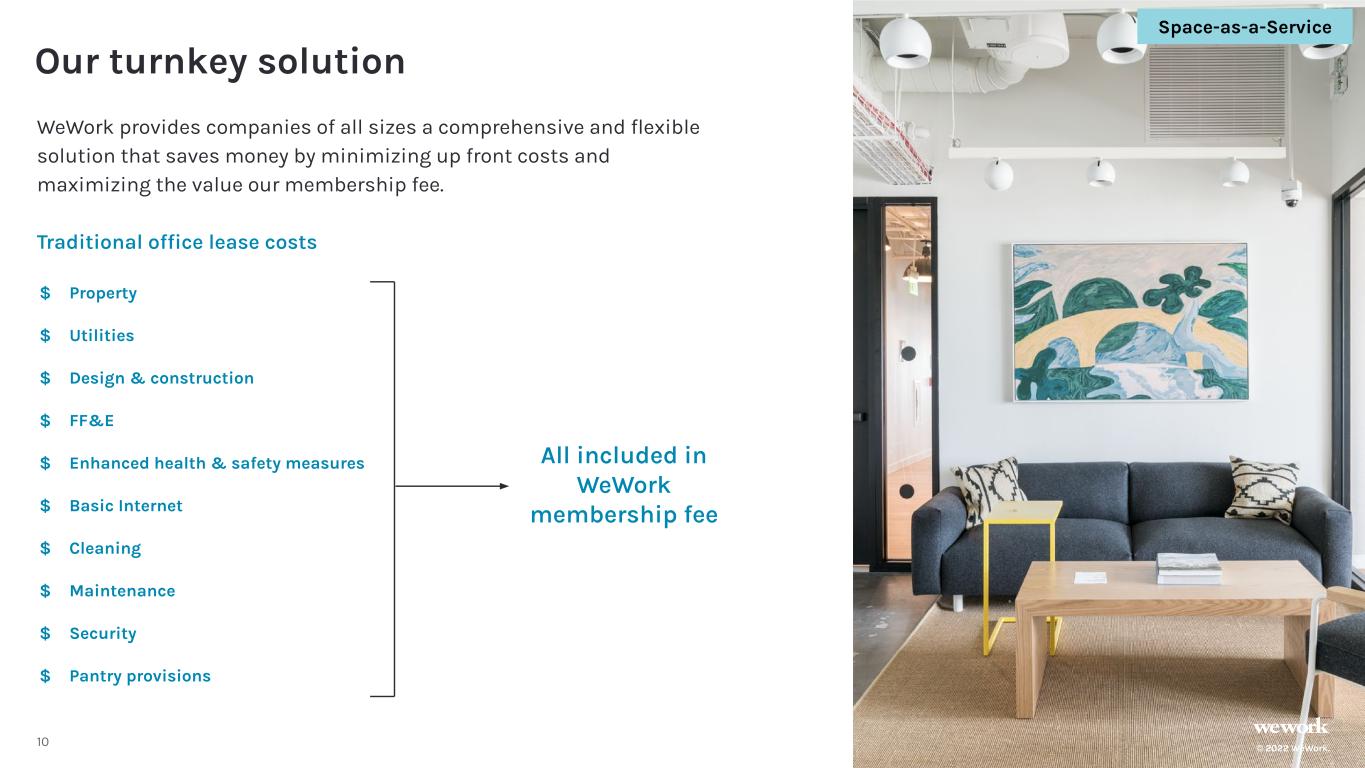

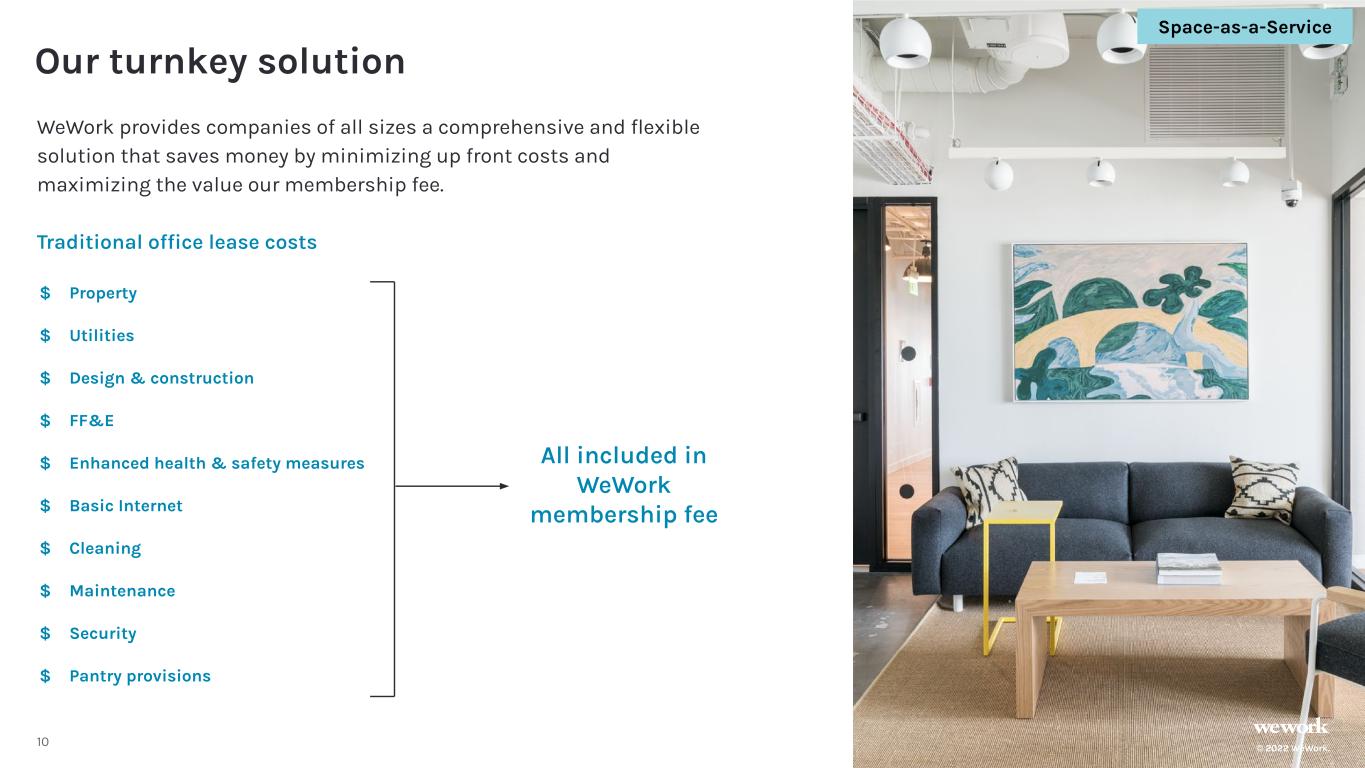

10 Traditional office lease costs WeWork provides companies of all sizes a comprehensive and flexible solution that saves money by minimizing up front costs and maximizing the value our membership fee. $ Property $ Utilities $ Design & construction $ FF&E $ Enhanced health & safety measures $ Basic Internet $ Cleaning $ Maintenance $ Security $ Pantry provisions All included in WeWork membership fee © 2022 WeWork. Space-as-a-Service Our turnkey solution

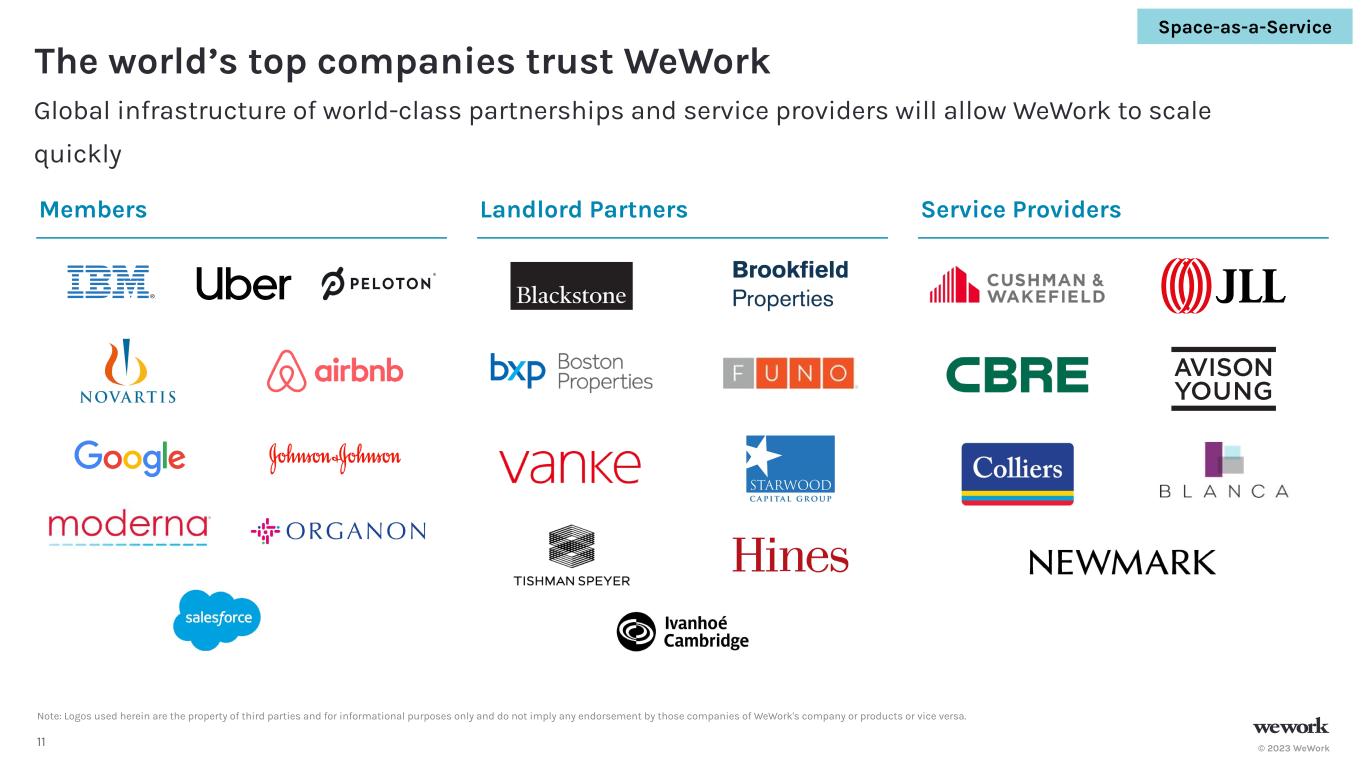

© 2023 WeWork11 The world’s top companies trust WeWork Global infrastructure of world-class partnerships and service providers will allow WeWork to scale quickly Members Landlord Partners Service Providers Note: Logos used herein are the property of third parties and for informational purposes only and do not imply any endorsement by those companies of WeWork's company or products or vice versa. Space-as-a-Service

© 2023 WeWork12 2 All Access MembershipsProducts WeWork On Demand Bookable workspaces around the world by the hour WeWork All Access Monthly membership unlocks 500+ locations worldwide Pay-as-you-go Choose from over 320+ locations in 70+ major cities through the WeWork app. Monthly membership Book workspace through the WeWork app, and unlock access to over 500+ WeWork locations around the world. Global locations: 70+ cities Term: Hourly or daily Global locations: 500+ Term: Monthly Note: See “Terms and Definitions” pages for definition of All Access & Other Legacy Memberships. All Access revenue inclusive of On Demand. All Access memberships shown on a consolidated basis. 32k 45k 20k 15k Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’33 Q4’22 Revenue: $9m $13m $20m $29m $36m $45m $47m $50m 55k 62k 67k WeWork Access Access 70k

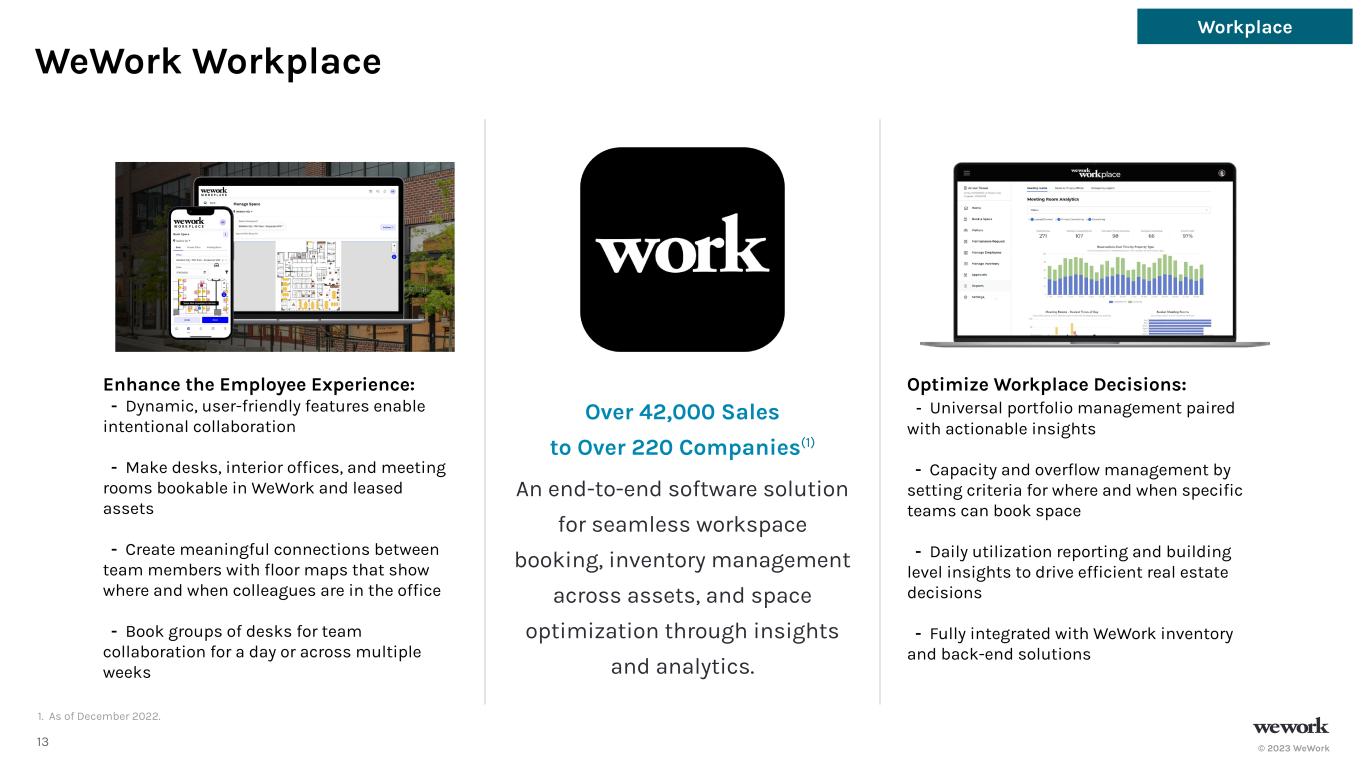

© 2023 WeWork13 Enhance the Employee Experience: - Dynamic, user-friendly features enable intentional collaboration - Make desks, interior offices, and meeting rooms bookable in WeWork and leased assets - Create meaningful connections between team members with floor maps that show where and when colleagues are in the office - Book groups of desks for team collaboration for a day or across multiple weeks Over 42,000 Sales to Over 220 Companies(1) An end-to-end software solution for seamless workspace booking, inventory management across assets, and space optimization through insights and analytics. Optimize Workplace Decisions: - Universal portfolio management paired with actionable insights - Capacity and overflow management by setting criteria for where and when specific teams can book space - Daily utilization reporting and building level insights to drive efficient real estate decisions - Fully integrated with WeWork inventory and back-end solutions WeWork Workplace Workplace 1. As of December 2022.

© 2023 WeWork14 Workplace Signed Deals Workplace 1. As of December 2022. Logos used herein are the property of third parties and for informational purposes only and do not imply any endorsement for those companies of WeWork’s company or products or vise versa. Over 42,000 Sales to Over 220 Companies(1)

© 2023 WeWork15 Quarterly and Annual Results

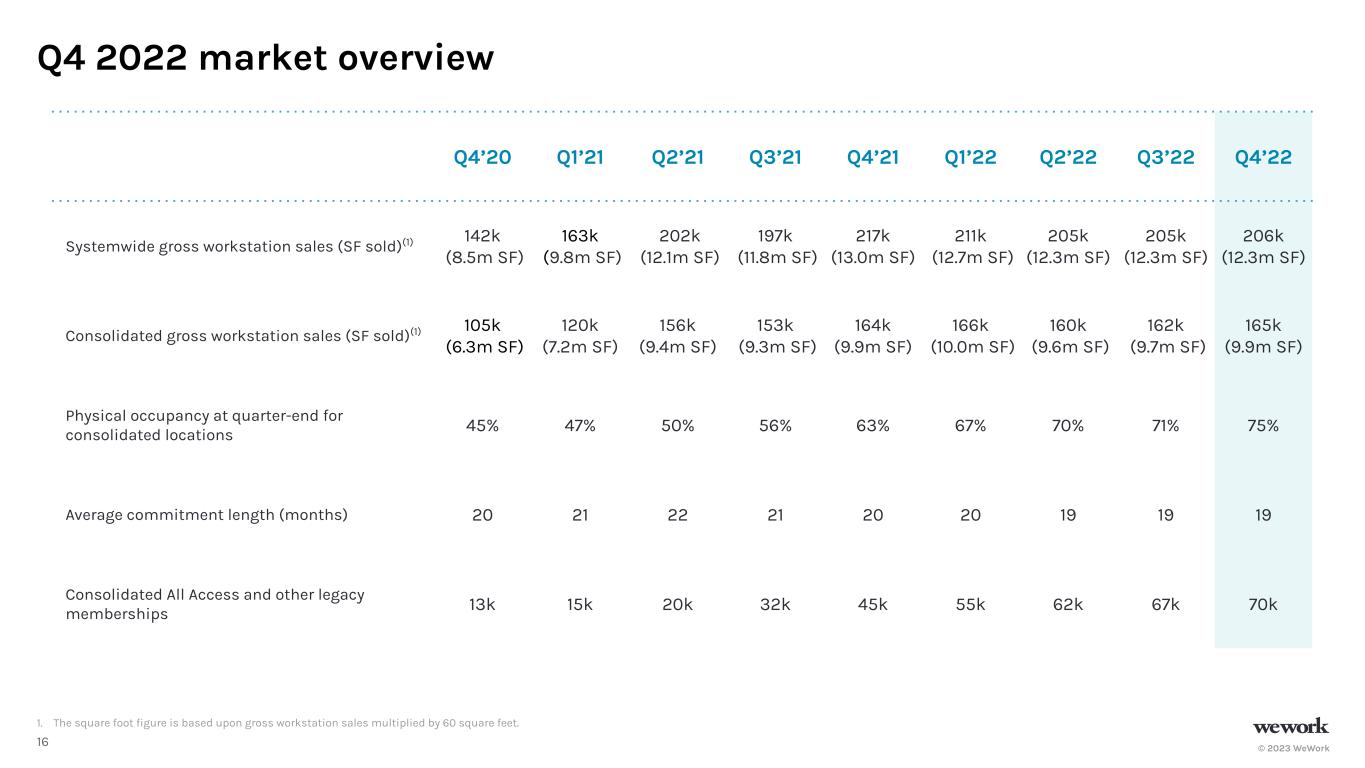

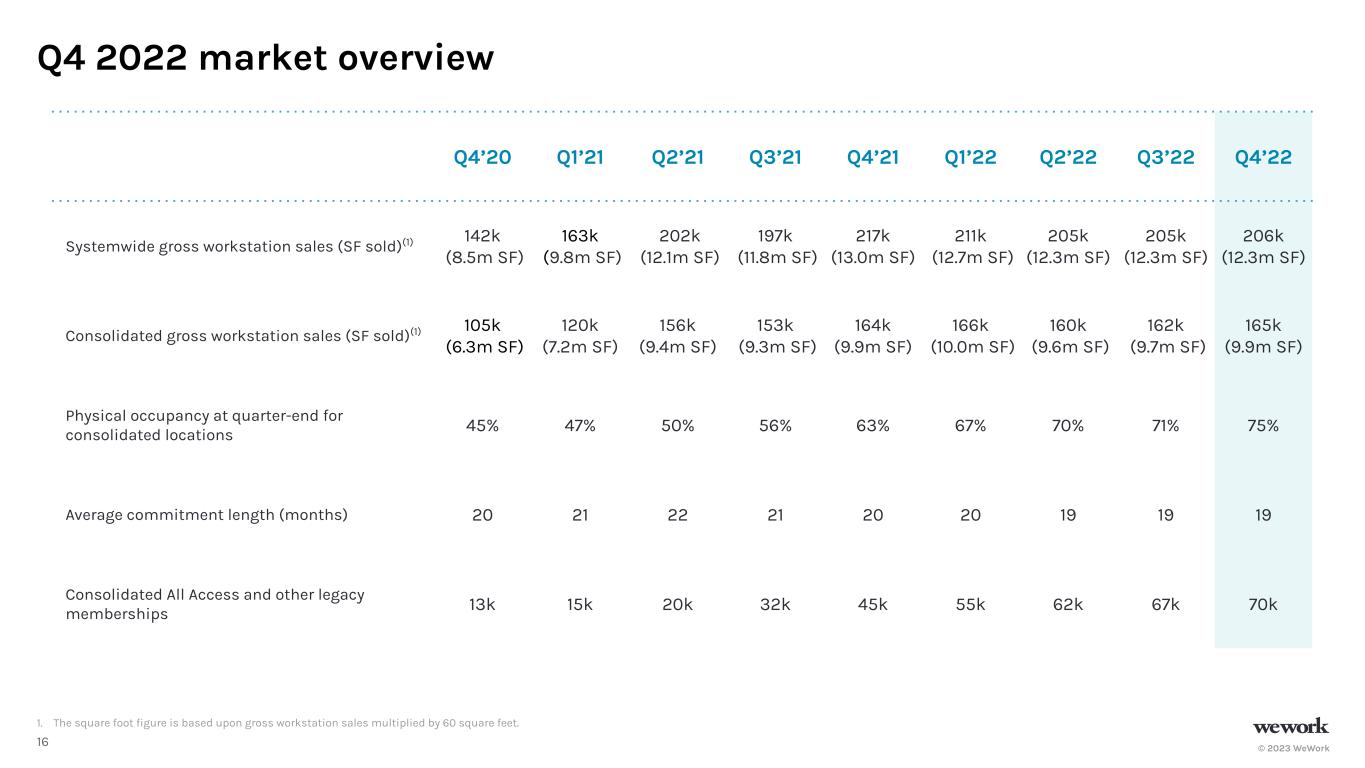

© 2023 WeWork16 Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 Systemwide gross workstation sales (SF sold)(1) 142k (8.5m SF) 163k (9.8m SF) 202k (12.1m SF) 197k (11.8m SF) 217k (13.0m SF) 211k (12.7m SF) 205k (12.3m SF) 205k (12.3m SF) 206k (12.3m SF) Consolidated gross workstation sales (SF sold)(1) 105k (6.3m SF) 120k (7.2m SF) 156k (9.4m SF) 153k (9.3m SF) 164k (9.9m SF) 166k (10.0m SF) 160k (9.6m SF) 162k (9.7m SF) 165k (9.9m SF) Physical occupancy at quarter-end for consolidated locations 45% 47% 50% 56% 63% 67% 70% 71% 75% Average commitment length (months) 20 21 22 21 20 20 19 19 19 Consolidated All Access and other legacy memberships 13k 15k 20k 32k 45k 55k 62k 67k 70k 1. The square foot figure is based upon gross workstation sales multiplied by 60 square feet. Q4 2022 market overview

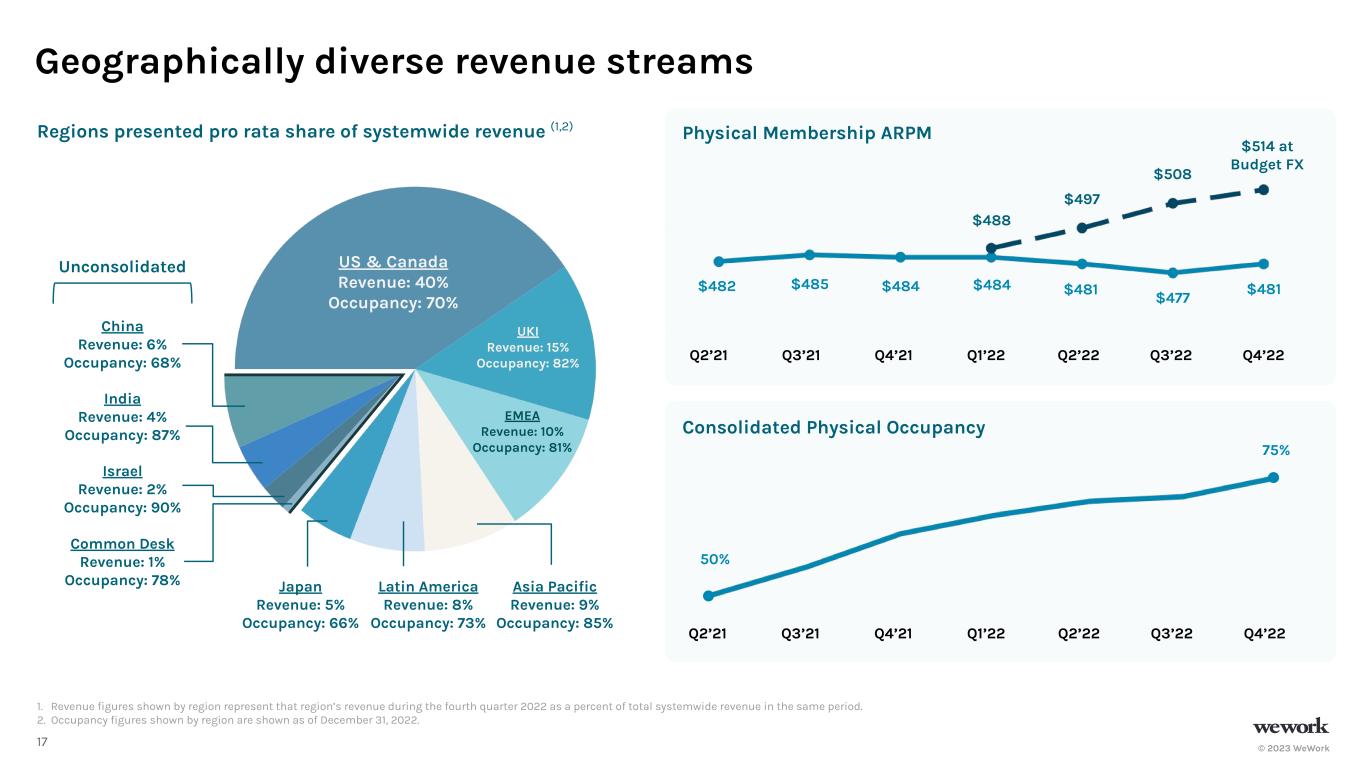

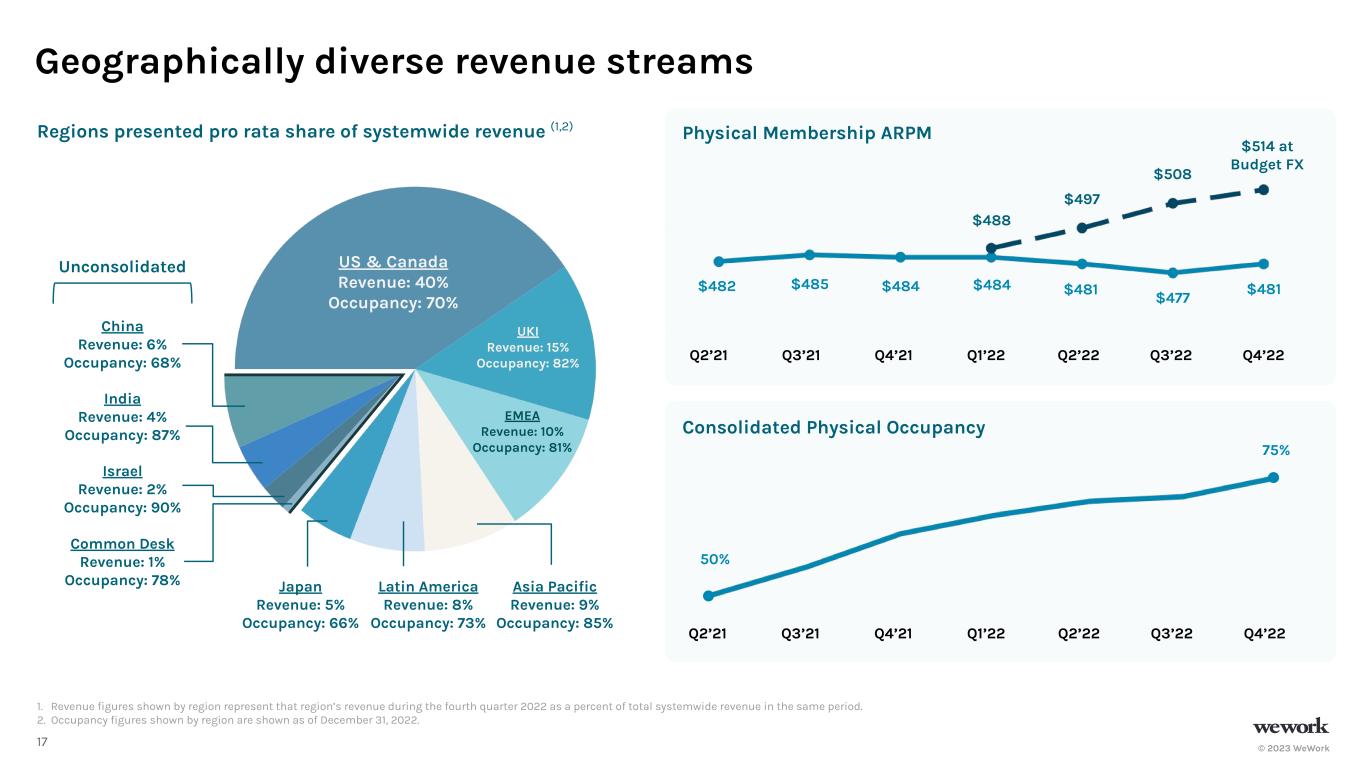

© 2023 WeWork17 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 75% Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 $482 $485 $484 $484 $481 $477 $508 Consolidated Physical Occupancy 50% 1. Revenue figures shown by region represent that region’s revenue during the fourth quarter 2022 as a percent of total systemwide revenue in the same period. 2. Occupancy figures shown by region are shown as of December 31, 2022. $497 $488 $514 at Budget FX $481 US & Canada Revenue: 40% Occupancy: 70% EMEA Revenue: 10% Occupancy: 81% UKI Revenue: 15% Occupancy: 82% Asia Pacific Revenue: 9% Occupancy: 85% Japan Revenue: 5% Occupancy: 66% China Revenue: 6% Occupancy: 68% India Revenue: 4% Occupancy: 87% Israel Revenue: 2% Occupancy: 90% Unconsolidated Latin America Revenue: 8% Occupancy: 73% Common Desk Revenue: 1% Occupancy: 78% Regions presented pro rata share of systemwide revenue (1,2) Physical Membership ARPM Geographically diverse revenue streams

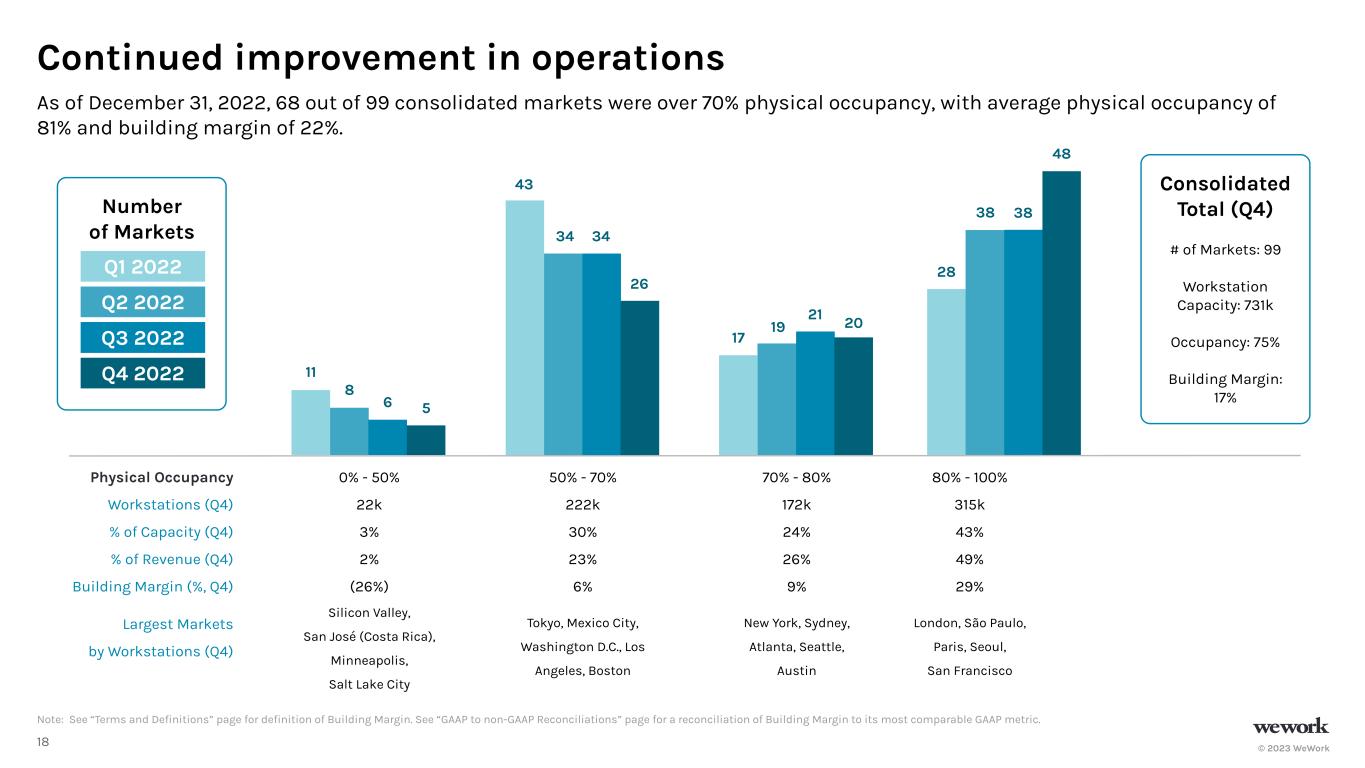

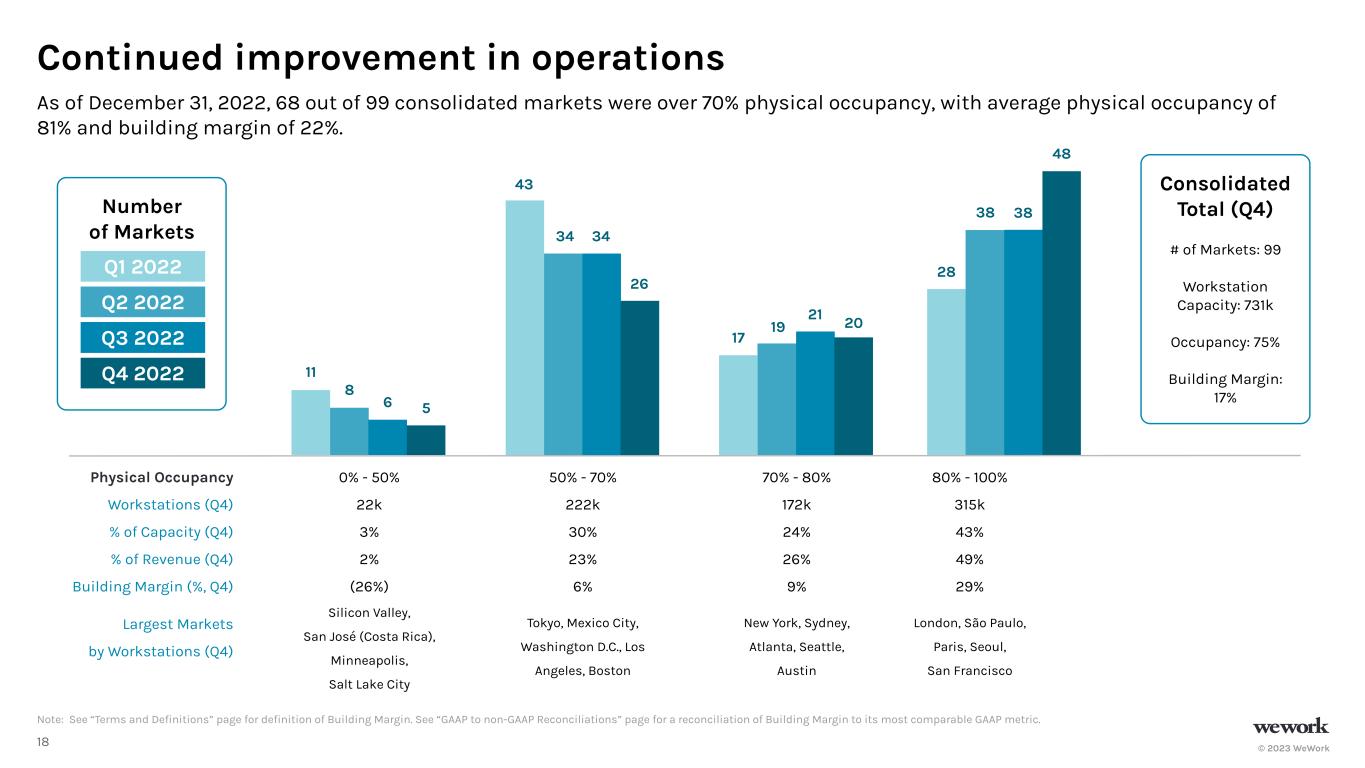

© 2023 WeWork18 Consolidated Total (Q4) # of Markets: 99 Workstation Capacity: 731k Occupancy: 75% Building Margin: 17% Number of Markets As of December 31, 2022, 68 out of 99 consolidated markets were over 70% physical occupancy, with average physical occupancy of 81% and building margin of 22%. Physical Occupancy Workstations (Q4) % of Capacity (Q4) % of Revenue (Q4) Building Margin (%, Q4) Largest Markets by Workstations (Q4) 0% - 50% 22k 3% 2% (26%) Silicon Valley, San José (Costa Rica), Minneapolis, Salt Lake City 50% - 70% 222k 30% 23% 6% Tokyo, Mexico City, Washington D.C., Los Angeles, Boston 70% - 80% 172k 24% 26% 9% New York, Sydney, Atlanta, Seattle, Austin Q1 2022 Q2 2022 Q3 2022 21 19 17 3434 43 11 8 6 Continued improvement in operations 5 26 20 Q4 2022 80% - 100% 315k 43% 49% 29% London, São Paulo, Paris, Seoul, San Francisco 3838 28 48 Note: See “Terms and Definitions” page for definition of Building Margin. See “GAAP to non-GAAP Reconciliations” page for a reconciliation of Building Margin to its most comparable GAAP metric.

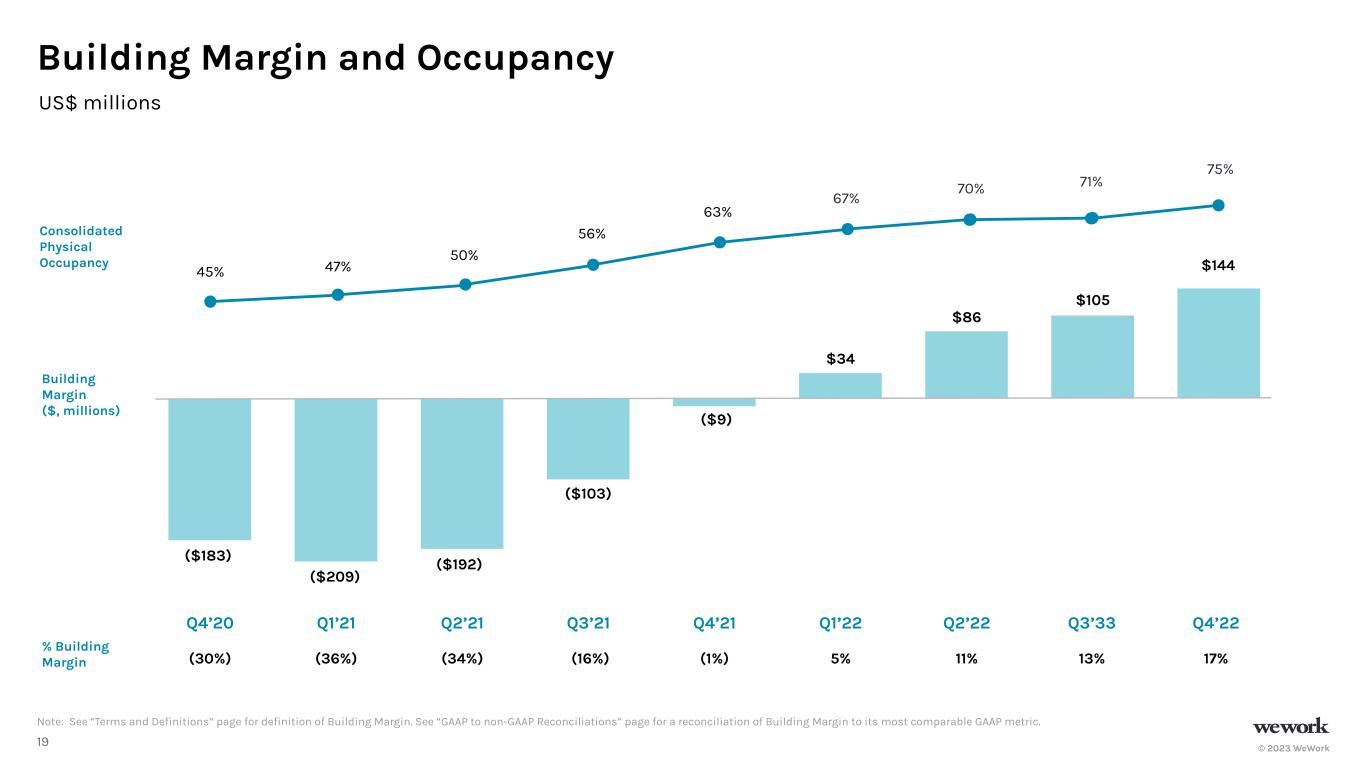

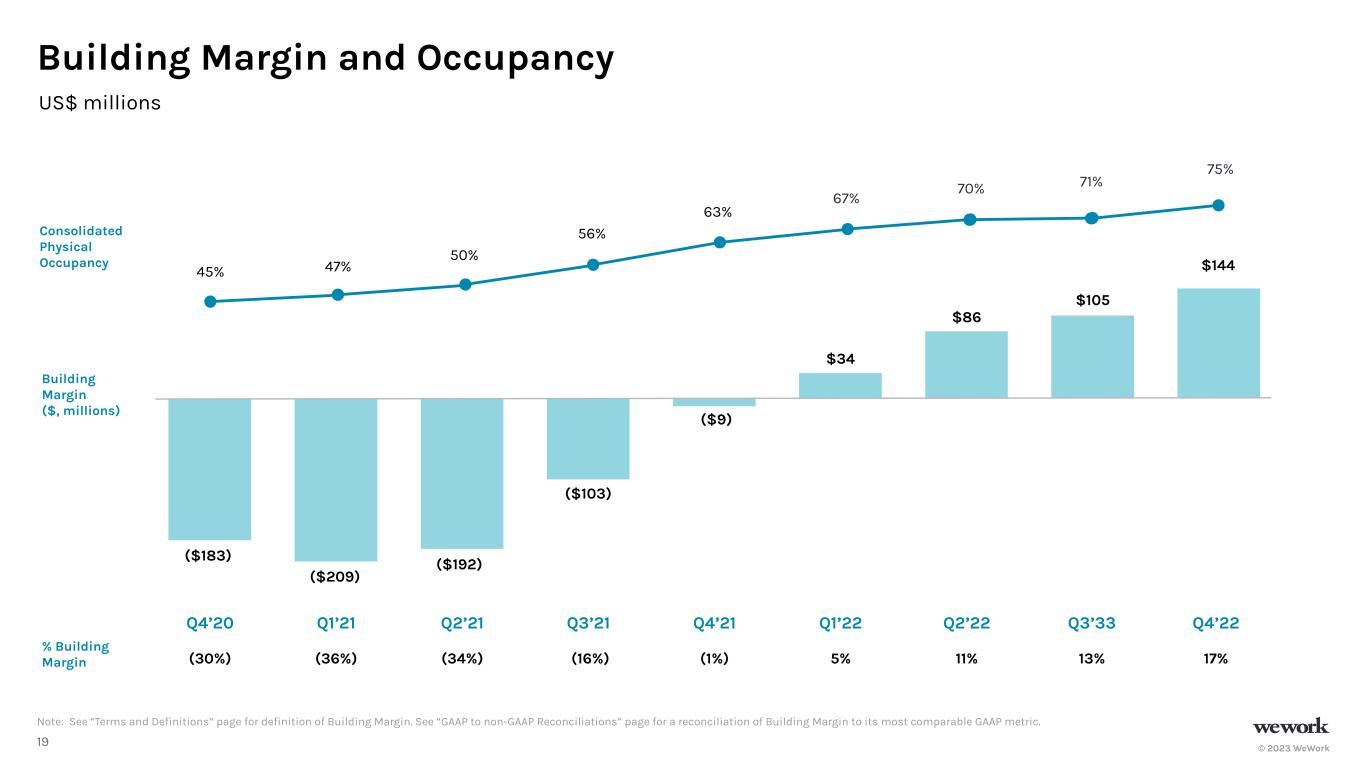

© 2023 WeWork19 ($183) ($209) ($192) ($103) ($9) 45% 47% 50% 56% 63% $34 67% $86 70% Building Margin and Occupancy US$ millions % Building Margin $105 71% $144 75% Note: See “Terms and Definitions” page for definition of Building Margin. See “GAAP to non-GAAP Reconciliations” page for a reconciliation of Building Margin to its most comparable GAAP metric. Q4’20 Q1’21 Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’33 Q4’22 (30%) (36%) (34%) (16%) (1%) 5% 11% 13% 17% Consolidated Physical Occupancy Building Margin ($, millions)

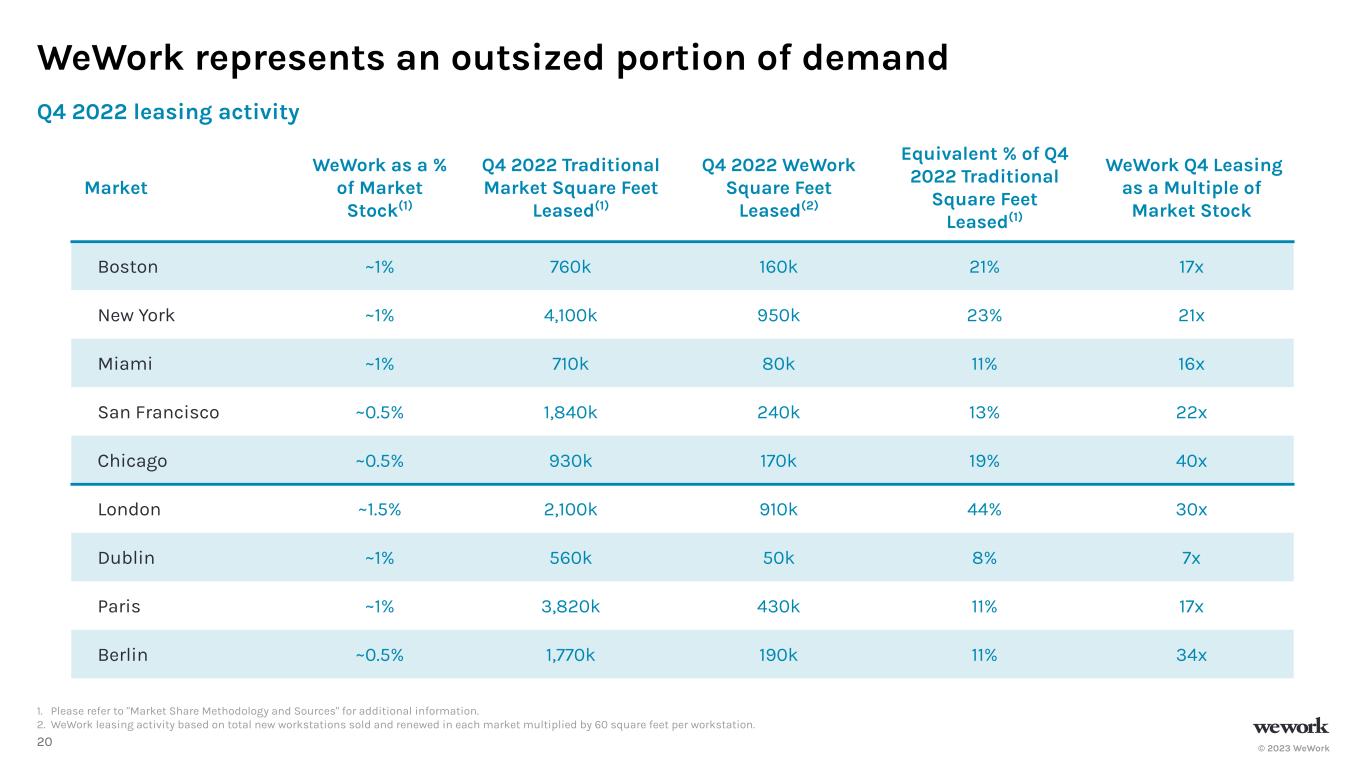

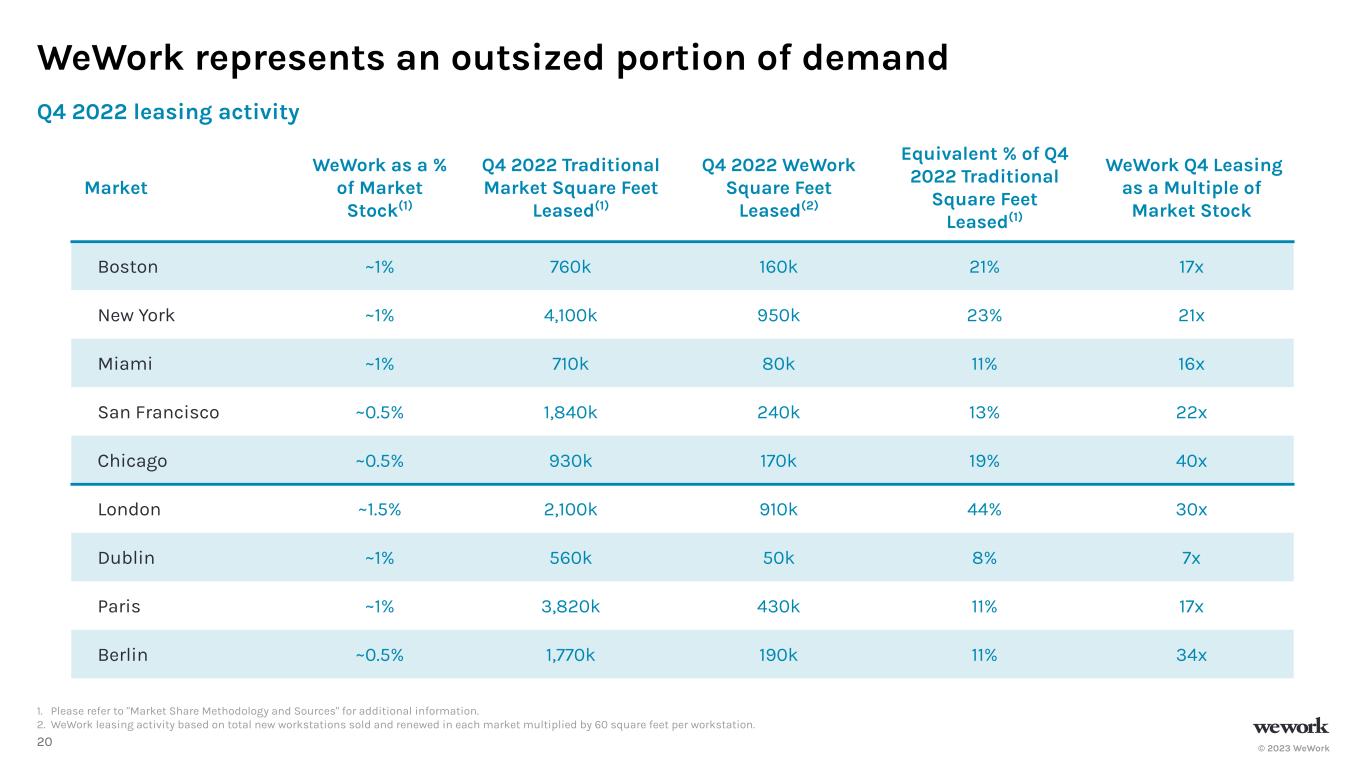

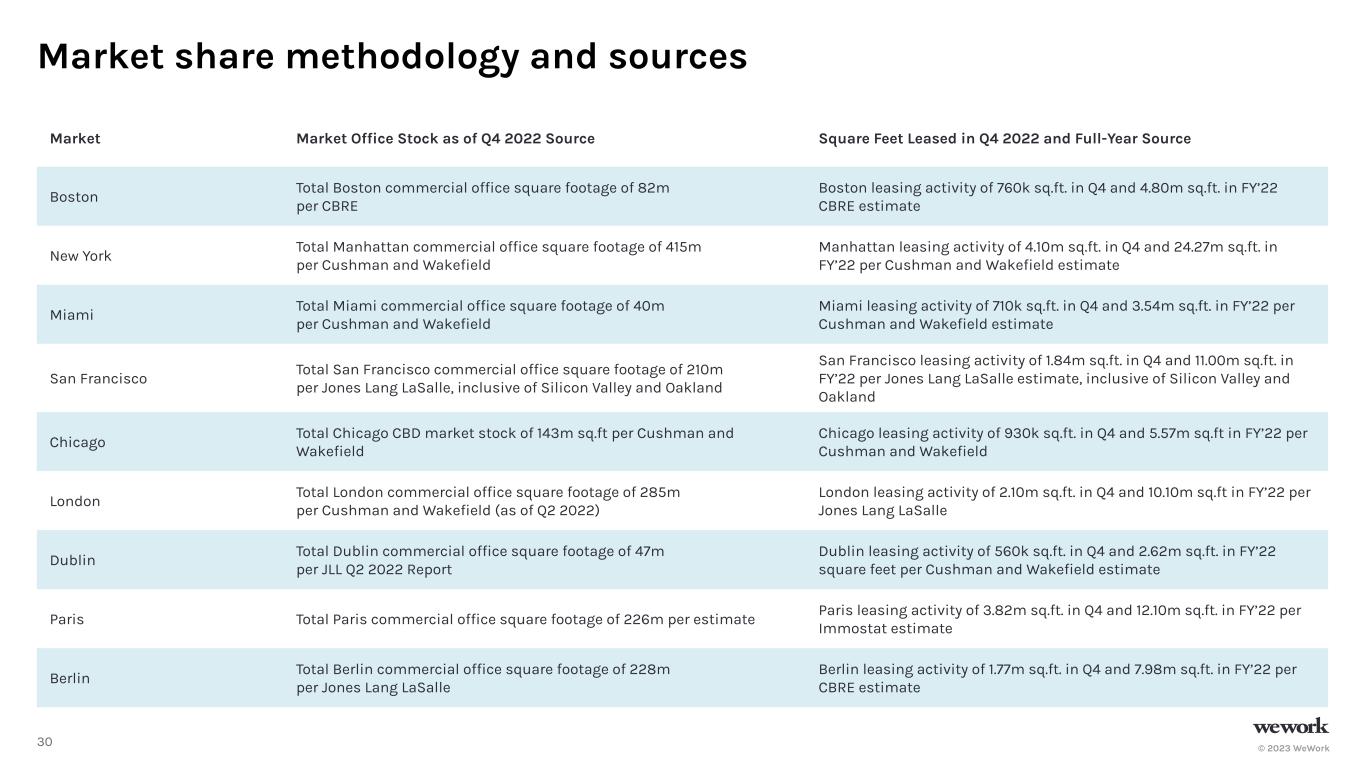

© 2023 WeWork20 Q4 2022 leasing activity 1. Please refer to "Market Share Methodology and Sources" for additional information. 2. WeWork leasing activity based on total new workstations sold and renewed in each market multiplied by 60 square feet per workstation. WeWork represents an outsized portion of demand Market WeWork as a % of Market Stock(1) Q4 2022 Traditional Market Square Feet Leased(1) Q4 2022 WeWork Square Feet Leased(2) Equivalent % of Q4 2022 Traditional Square Feet Leased(1) WeWork Q4 Leasing as a Multiple of Market Stock Boston ~1% 760k 160k 21% 17x New York ~1% 4,100k 950k 23% 21x Miami ~1% 710k 80k 11% 16x San Francisco ~0.5% 1,840k 240k 13% 22x Chicago ~0.5% 930k 170k 19% 40x London ~1.5% 2,100k 910k 44% 30x Dublin ~1% 560k 50k 8% 7x Paris ~1% 3,820k 430k 11% 17x Berlin ~0.5% 1,770k 190k 11% 34x

© 2023 WeWork21 Full-Year 2022 leasing activity Market WeWork as a % of Market Stock(1) 2022 Traditional Market Square Feet Leased(1) 2022 WeWork Square Feet Leased(2) Equivalent % of 2022 Traditional Square Feet Leased(1) WeWork 2022 Leasing as a Multiple of Market Stock Boston ~1% 4,800k 860k 18% 14x New York ~1% 24,270k 4,280k 18% 16x Miami ~1% 3,540k 340k 9% 14x San Francisco ~0.5% 11,000k 1,500k 14% 23x Chicago ~0.5% 5,570k 610k 11% 23x London ~1.5% 10,100k 3,500k 35% 22x Dublin ~1% 2,620k 430k 16% 15x Paris ~1% 12,100k 1,280k 11% 16x Berlin ~0.5% 7,980k 720k 9% 29x 1. Please refer to "Market Share Methodology and Sources" for additional information. 2. WeWork leasing activity based on total new workstations sold and renewed in each market multiplied by 60 square feet per workstation. WeWork represents an outsized portion of demand

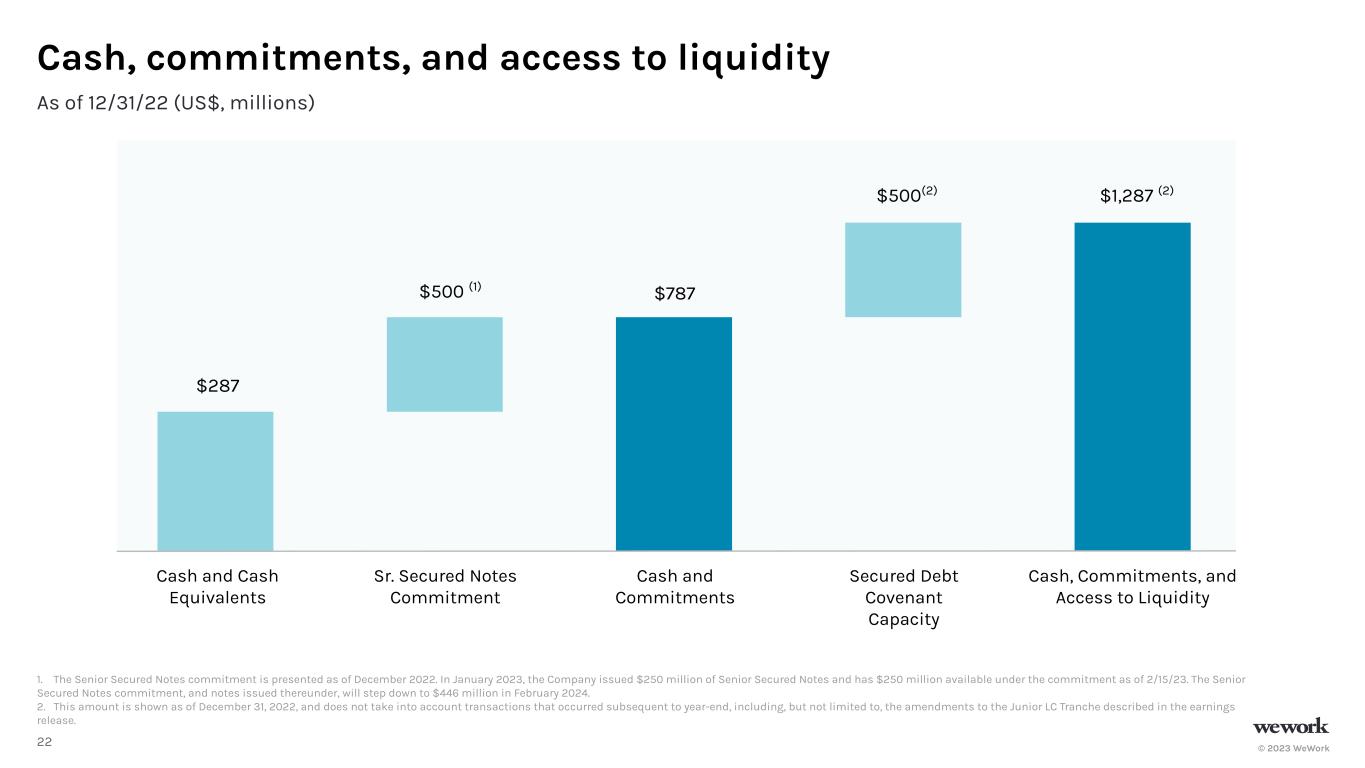

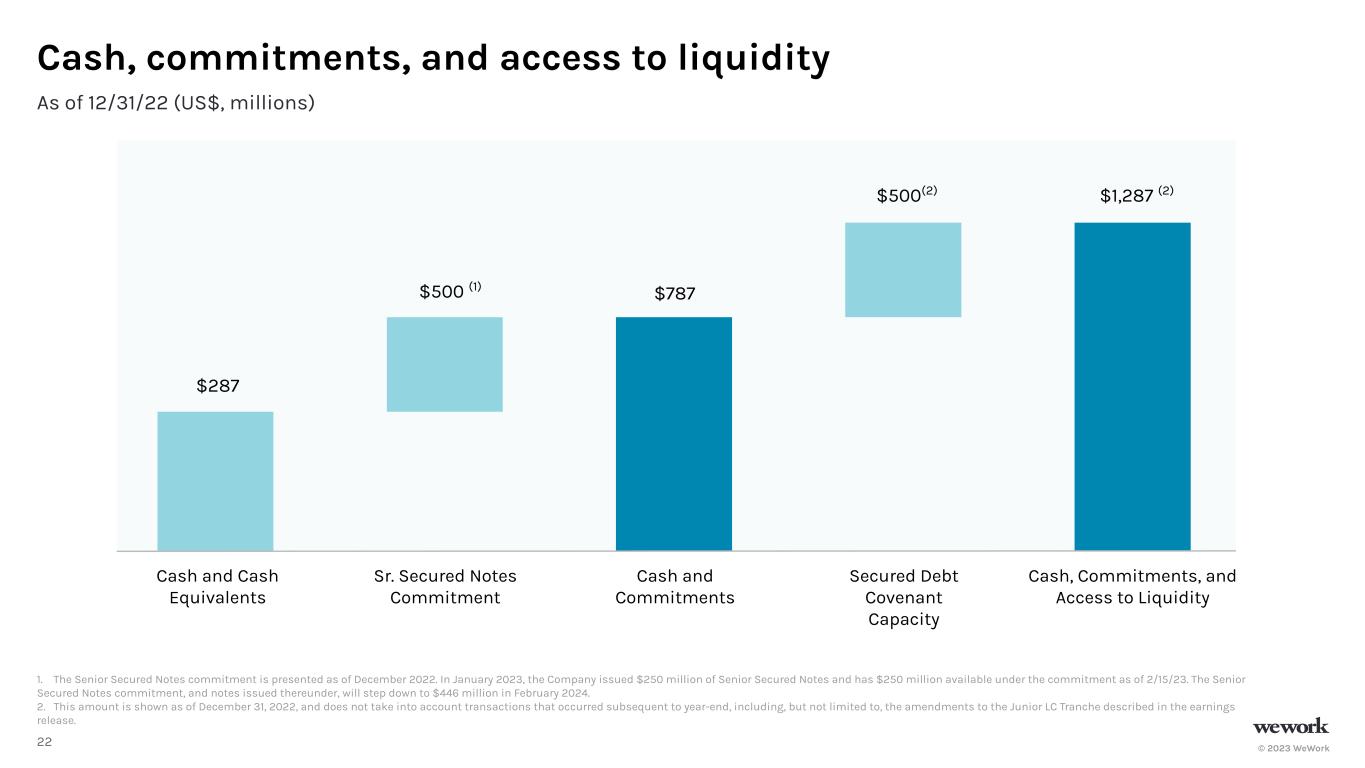

© 2023 WeWork22 Cash, Commitments, and Access to Liquidity Cash and Commitments Cash and Cash Equivalents Sr. Secured Notes Commitment Secured Debt Covenant Capacity $287 $500 (1) $787 $500(2) $1,287 (2) As of 12/31/22 (US$, millions) 1. The Senior Secured Notes commitment is presented as of December 2022. In January 2023, the Company issued $250 million of Senior Secured Notes and has $250 million available under the commitment as of 2/15/23. The Senior Secured Notes commitment, and notes issued thereunder, will step down to $446 million in February 2024. 2. This amount is shown as of December 31, 2022, and does not take into account transactions that occurred subsequent to year-end, including, but not limited to, the amendments to the Junior LC Tranche described in the earnings release. Cash, commitments, and access to liquidity

© 2023 WeWork23 Capitalization table Interest Rate Maturity Amount Cash & cash equivalents $287 $1.1B/$930M Senior LC Tranche (1) 6.125% 3/14/2025 - $350M Junior LC Tranche (2) 9.593% 11/30/2023 $350 $500M Senior Secured Notes Commitment (3) 7.500% / 11.000% PIK 3/15/2025 - JapanCo Debt (4) 2.500% - 3.300% Various $22 Total secured debt $372 Senior Unsecured Notes 7.875% 5/1/2025 $669 Senior Unsecured Notes (Series II) 5.000% 7/10/2025 $550 Senior Unsecured Notes (Series I) 5.000% 7/10/2025 $1,650 Total unsecured debt $2,869 Total outstanding debt $3,241 Net outstanding debt $2,954 1. The Senior LC Tranche commitments stepped down to $930 million on February 10, 2023. On February 15, 2023, the Senior LC Tranche commitments were increased from $930 million to $960 million. 2. In February 2023, the Junior LC Tranche was amended to extend the maturity date from November 2023 to March 2025, increase the tranche from $350 million to $470 million and reset the interest rate from SOFR + 650 basis points to SOFR + 990 basis points. 3. The Senior Secured Notes commitment, and notes issued thereunder, will step down to $446 million in February 2024 and the interest rate will increase to 11.000%, payable in-kind. In January 2023, the Company issued $250 million of Senior Secured Notes. 4. Represents outstanding letters of credit/indebtedness incurred by a joint-venture entity equally owned by the Company and an affiliate of SoftBank Group Corp. As of 12/31/22 (US$, millions)

© 2023 WeWork24 Appendix

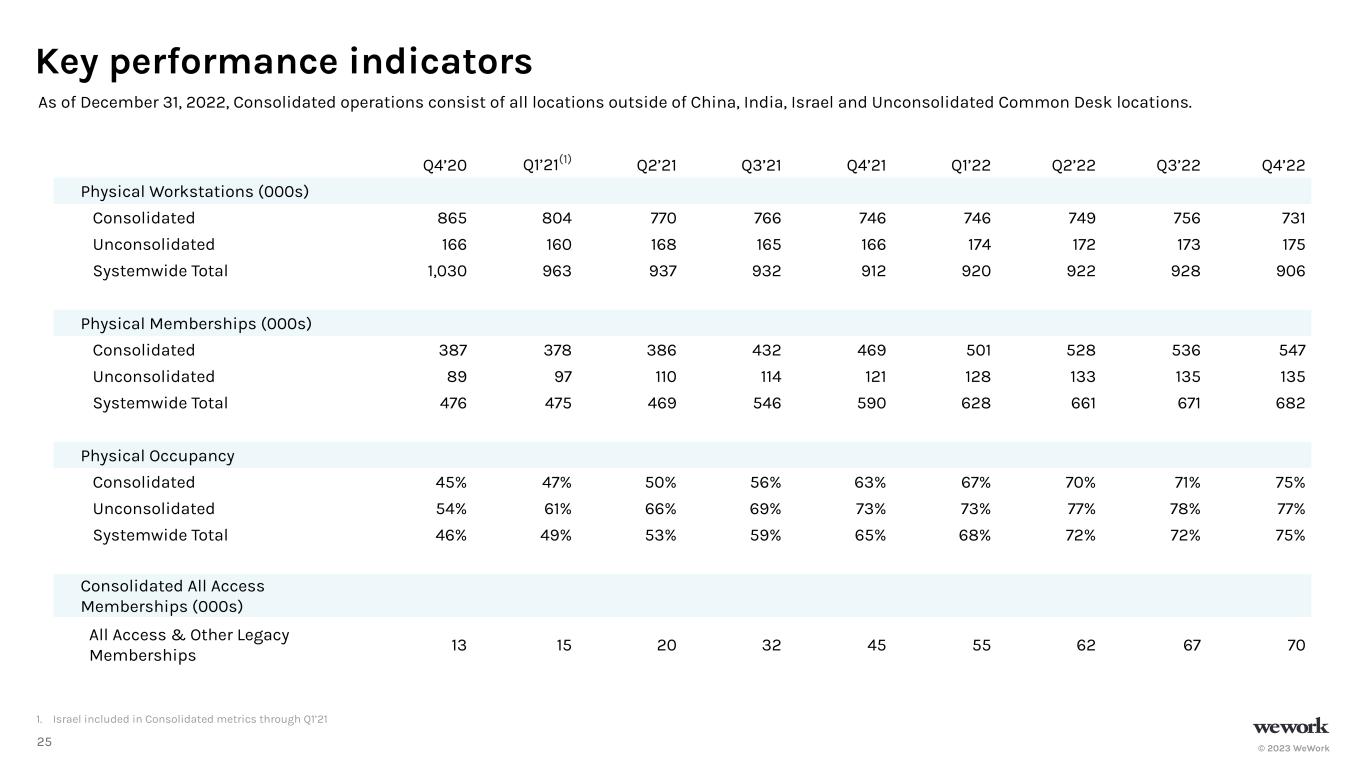

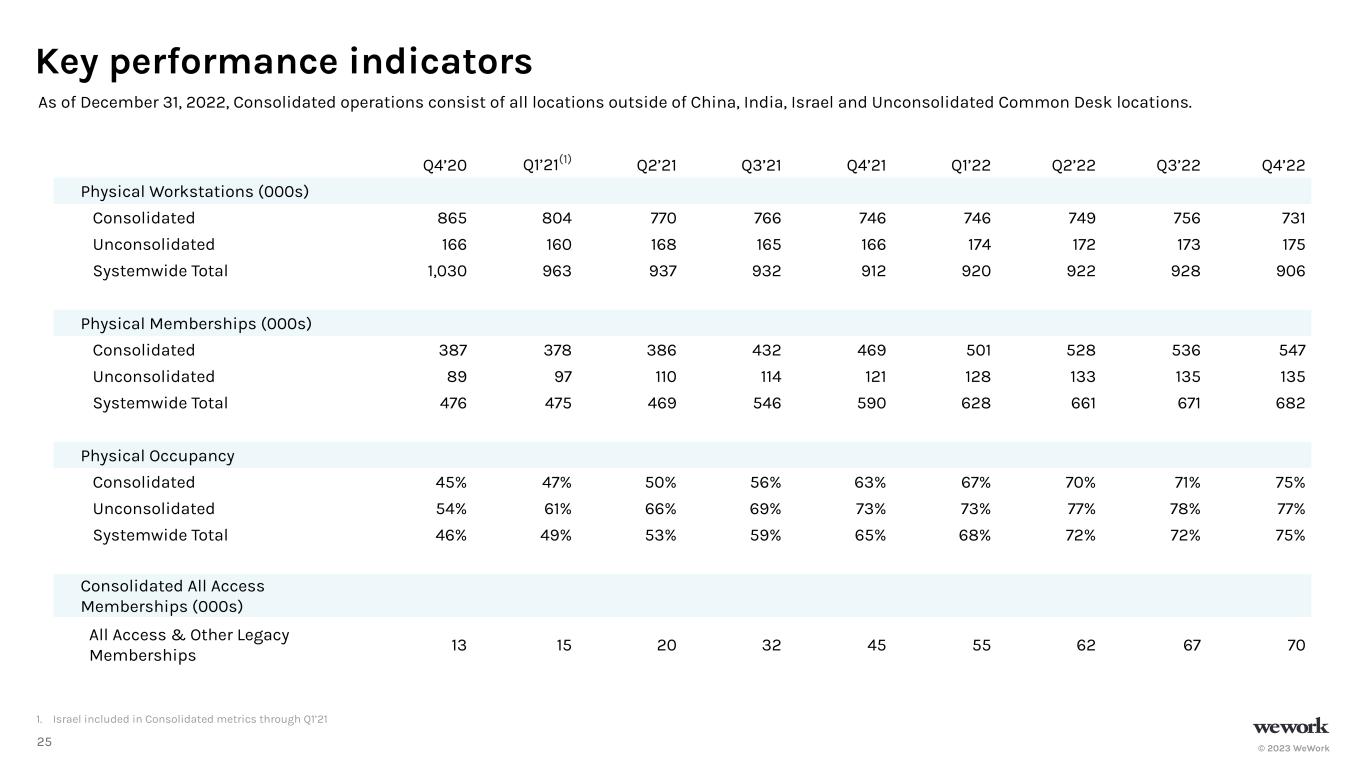

© 2023 WeWork25 Key performance indicators As of December 31, 2022, Consolidated operations consist of all locations outside of China, India, Israel and Unconsolidated Common Desk locations. Q4’20 Q1’21(1) Q2’21 Q3’21 Q4’21 Q1’22 Q2’22 Q3’22 Q4’22 Physical Workstations (000s) Consolidated 865 804 770 766 746 746 749 756 731 Unconsolidated 166 160 168 165 166 174 172 173 175 Systemwide Total 1,030 963 937 932 912 920 922 928 906 Physical Memberships (000s) Consolidated 387 378 386 432 469 501 528 536 547 Unconsolidated 89 97 110 114 121 128 133 135 135 Systemwide Total 476 475 469 546 590 628 661 671 682 Physical Occupancy Consolidated 45% 47% 50% 56% 63% 67% 70% 71% 75% Unconsolidated 54% 61% 66% 69% 73% 73% 77% 78% 77% Systemwide Total 46% 49% 53% 59% 65% 68% 72% 72% 75% Consolidated All Access Memberships (000s) All Access & Other Legacy Memberships 13 15 20 32 45 55 62 67 70 1. Israel included in Consolidated metrics through Q1’21

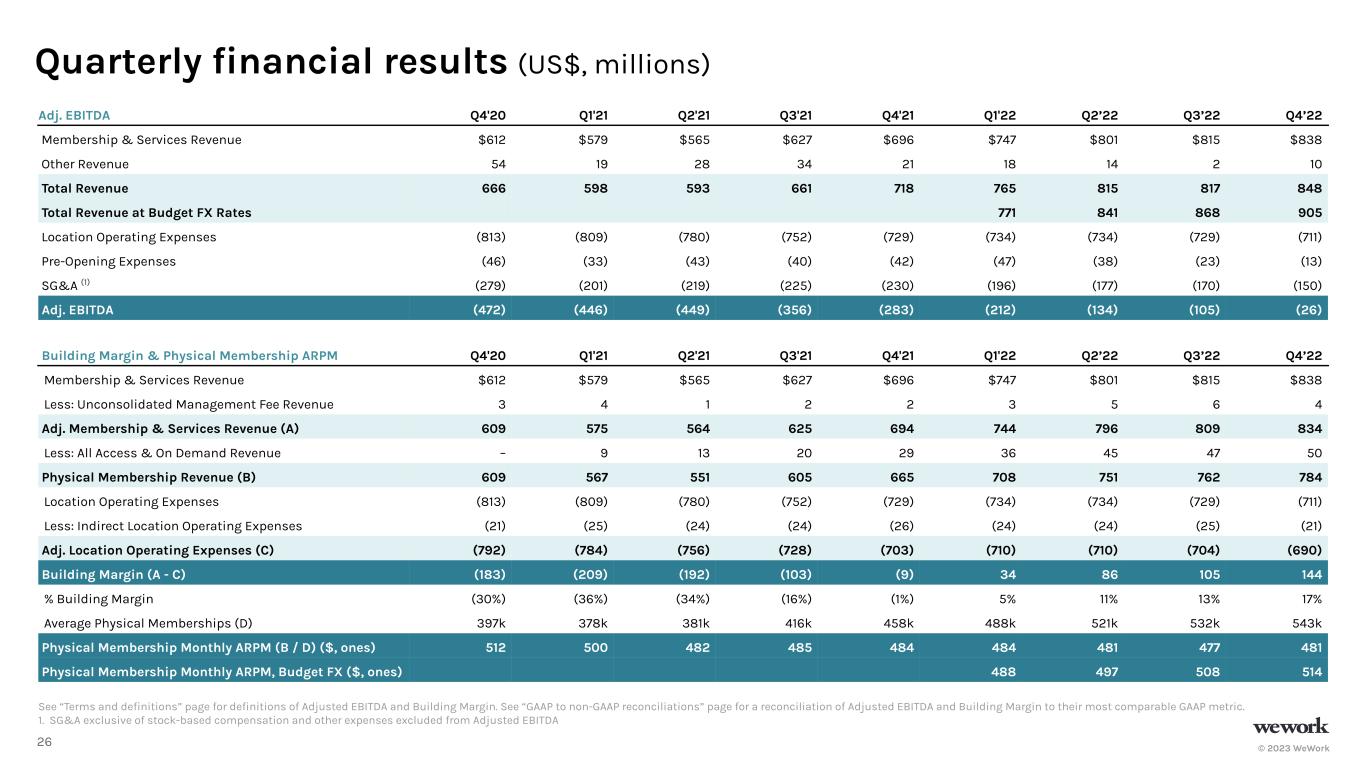

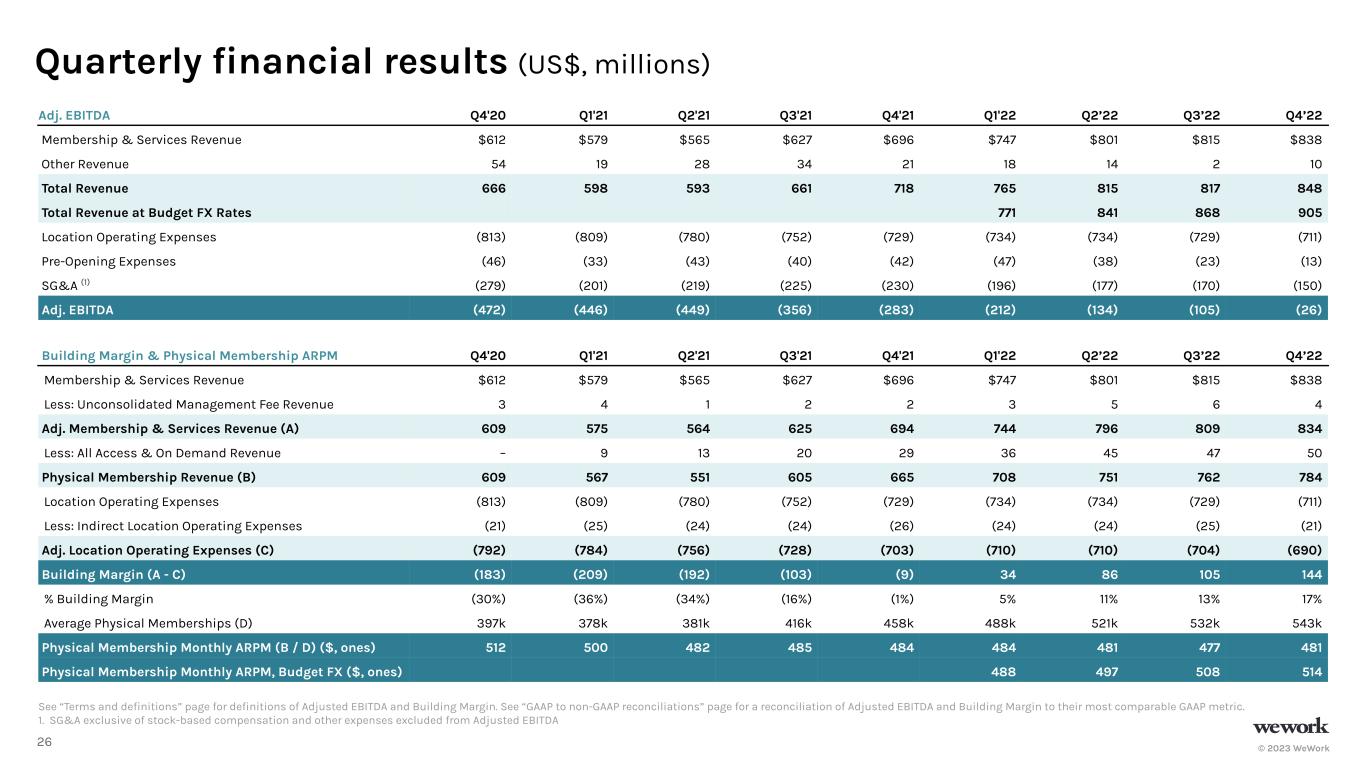

© 2023 WeWork26 Quarterly financial results (US$, millions) Adj. EBITDA Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2’22 Q3’22 Q4’22 Membership & Services Revenue $612 $579 $565 $627 $696 $747 $801 $815 $838 Other Revenue 54 19 28 34 21 18 14 2 10 Total Revenue 666 598 593 661 718 765 815 817 848 Total Revenue at Budget FX Rates 771 841 868 905 Location Operating Expenses (813) (809) (780) (752) (729) (734) (734) (729) (711) Pre-Opening Expenses (46) (33) (43) (40) (42) (47) (38) (23) (13) SG&A (1) (279) (201) (219) (225) (230) (196) (177) (170) (150) Adj. EBITDA (472) (446) (449) (356) (283) (212) (134) (105) (26) Building Margin & Physical Membership ARPM Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2’22 Q3’22 Q4’22 Membership & Services Revenue $612 $579 $565 $627 $696 $747 $801 $815 $838 Less: Unconsolidated Management Fee Revenue 3 4 1 2 2 3 5 6 4 Adj. Membership & Services Revenue (A) 609 575 564 625 694 744 796 809 834 Less: All Access & On Demand Revenue – 9 13 20 29 36 45 47 50 Physical Membership Revenue (B) 609 567 551 605 665 708 751 762 784 Location Operating Expenses (813) (809) (780) (752) (729) (734) (734) (729) (711) Less: Indirect Location Operating Expenses (21) (25) (24) (24) (26) (24) (24) (25) (21) Adj. Location Operating Expenses (C) (792) (784) (756) (728) (703) (710) (710) (704) (690) Building Margin (A - C) (183) (209) (192) (103) (9) 34 86 105 144 % Building Margin (30%) (36%) (34%) (16%) (1%) 5% 11% 13% 17% Average Physical Memberships (D) 397k 378k 381k 416k 458k 488k 521k 532k 543k Physical Membership Monthly ARPM (B / D) ($, ones) 512 500 482 485 484 484 481 477 481 Physical Membership Monthly ARPM, Budget FX ($, ones) 488 497 508 514 See “Terms and definitions” page for definitions of Adjusted EBITDA and Building Margin. See “GAAP to non-GAAP reconciliations” page for a reconciliation of Adjusted EBITDA and Building Margin to their most comparable GAAP metric. 1. SG&A exclusive of stock-based compensation and other expenses excluded from Adjusted EBITDA

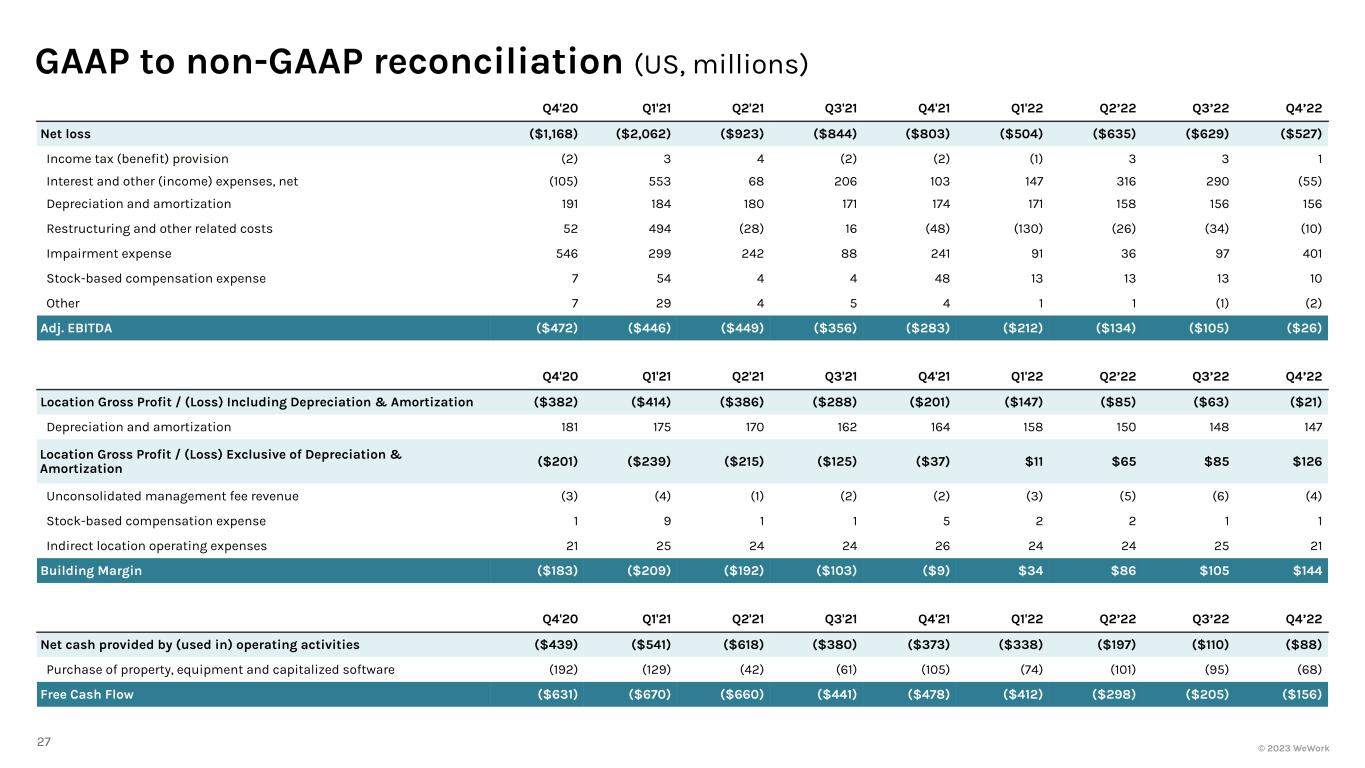

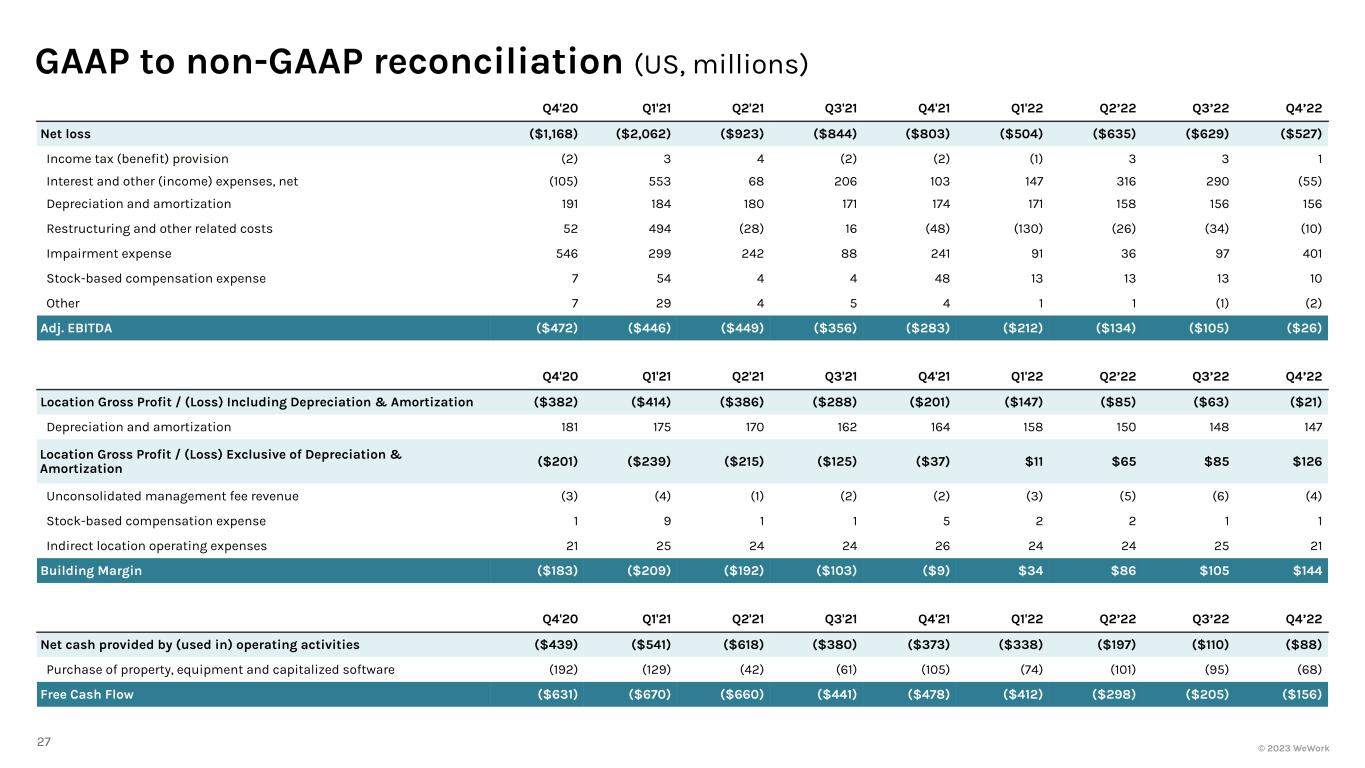

© 2023 WeWork27 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2’22 Q3’22 Q4’22 Net loss ($1,168) ($2,062) ($923) ($844) ($803) ($504) ($635) ($629) ($527) Income tax (benefit) provision (2) 3 4 (2) (2) (1) 3 3 1 Interest and other (income) expenses, net (105) 553 68 206 103 147 316 290 (55) Depreciation and amortization 191 184 180 171 174 171 158 156 156 Restructuring and other related costs 52 494 (28) 16 (48) (130) (26) (34) (10) Impairment expense 546 299 242 88 241 91 36 97 401 Stock-based compensation expense 7 54 4 4 48 13 13 13 10 Other 7 29 4 5 4 1 1 (1) (2) Adj. EBITDA ($472) ($446) ($449) ($356) ($283) ($212) ($134) ($105) ($26) Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2’22 Q3’22 Q4’22 Location Gross Profit / (Loss) Including Depreciation & Amortization ($382) ($414) ($386) ($288) ($201) ($147) ($85) ($63) ($21) Depreciation and amortization 181 175 170 162 164 158 150 148 147 Location Gross Profit / (Loss) Exclusive of Depreciation & Amortization ($201) ($239) ($215) ($125) ($37) $11 $65 $85 $126 Unconsolidated management fee revenue (3) (4) (1) (2) (2) (3) (5) (6) (4) Stock-based compensation expense 1 9 1 1 5 2 2 1 1 Indirect location operating expenses 21 25 24 24 26 24 24 25 21 Building Margin ($183) ($209) ($192) ($103) ($9) $34 $86 $105 $144 Q4'20 Q1'21 Q2'21 Q3'21 Q4'21 Q1'22 Q2’22 Q3’22 Q4’22 Net cash provided by (used in) operating activities ($439) ($541) ($618) ($380) ($373) ($338) ($197) ($110) ($88) Purchase of property, equipment and capitalized software (192) (129) (42) (61) (105) (74) (101) (95) (68) Free Cash Flow ($631) ($670) ($660) ($441) ($478) ($412) ($298) ($205) ($156) GAAP to non-GAAP reconciliation (US, millions)

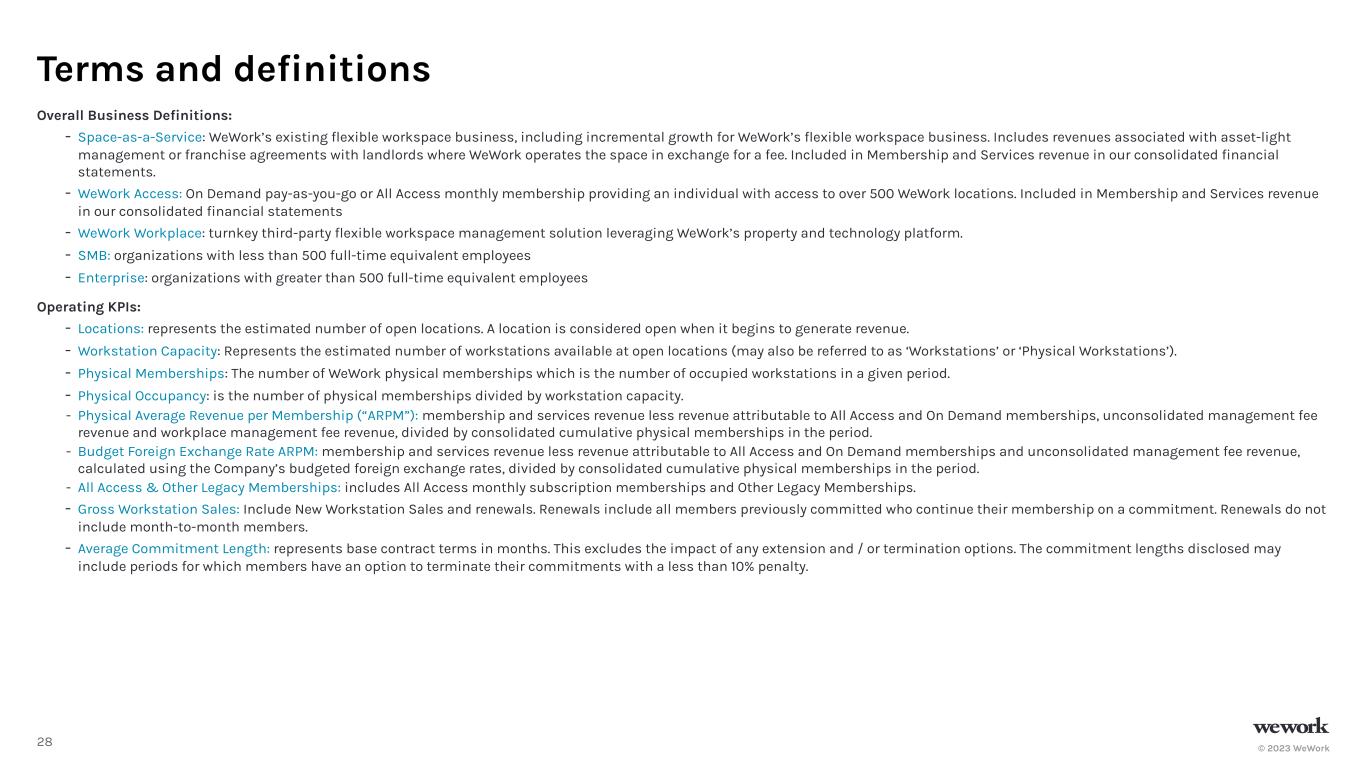

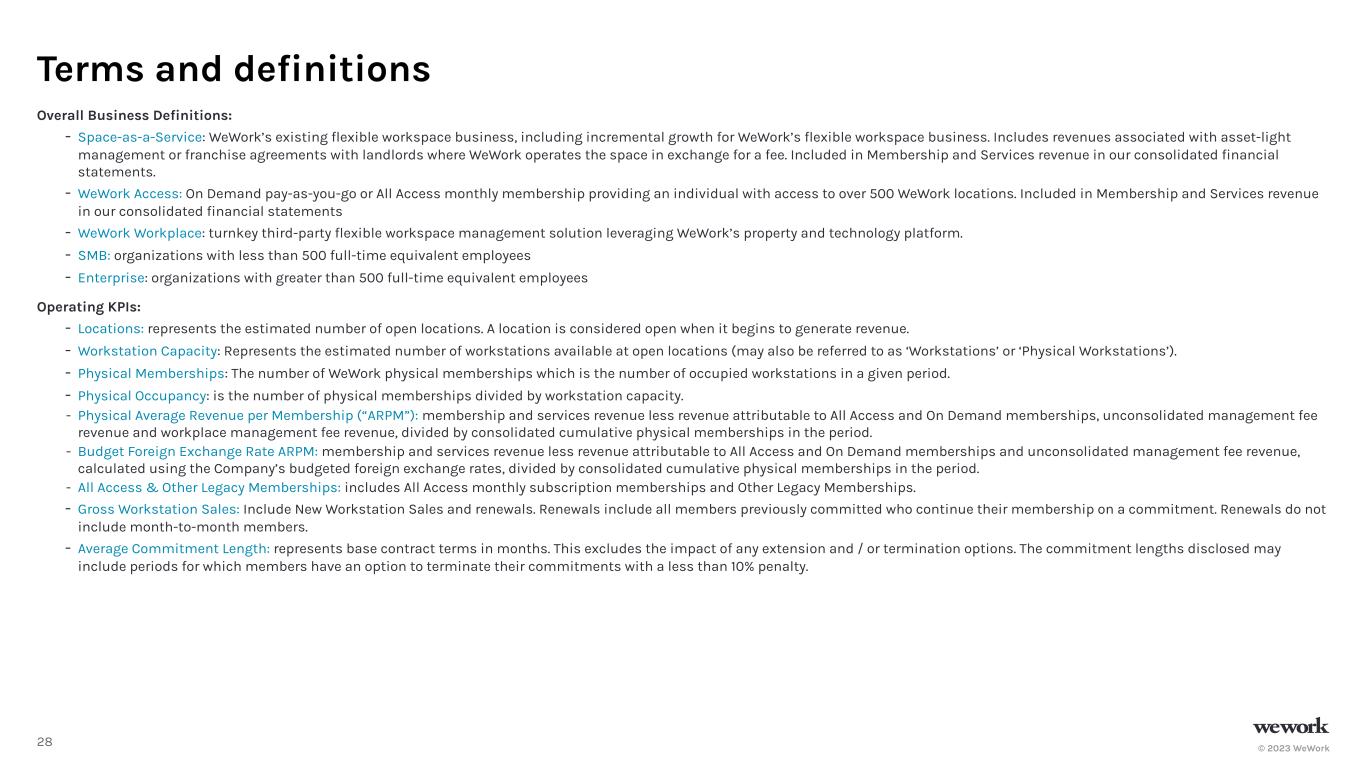

© 2023 WeWork28 Overall Business Definitions: - Space-as-a-Service: WeWork’s existing flexible workspace business, including incremental growth for WeWork’s flexible workspace business. Includes revenues associated with asset-light management or franchise agreements with landlords where WeWork operates the space in exchange for a fee. Included in Membership and Services revenue in our consolidated financial statements. - WeWork Access: On Demand pay-as-you-go or All Access monthly membership providing an individual with access to over 500 WeWork locations. Included in Membership and Services revenue in our consolidated financial statements - WeWork Workplace: turnkey third-party flexible workspace management solution leveraging WeWork’s property and technology platform. - SMB: organizations with less than 500 full-time equivalent employees - Enterprise: organizations with greater than 500 full-time equivalent employees Operating KPIs: - Locations: represents the estimated number of open locations. A location is considered open when it begins to generate revenue. - Workstation Capacity: Represents the estimated number of workstations available at open locations (may also be referred to as ‘Workstations’ or ‘Physical Workstations’). - Physical Memberships: The number of WeWork physical memberships which is the number of occupied workstations in a given period. - Physical Occupancy: is the number of physical memberships divided by workstation capacity. - Physical Average Revenue per Membership (“ARPM”): membership and services revenue less revenue attributable to All Access and On Demand memberships, unconsolidated management fee revenue and workplace management fee revenue, divided by consolidated cumulative physical memberships in the period. - Budget Foreign Exchange Rate ARPM: membership and services revenue less revenue attributable to All Access and On Demand memberships and unconsolidated management fee revenue, calculated using the Company’s budgeted foreign exchange rates, divided by consolidated cumulative physical memberships in the period. - All Access & Other Legacy Memberships: includes All Access monthly subscription memberships and Other Legacy Memberships. - Gross Workstation Sales: Include New Workstation Sales and renewals. Renewals include all members previously committed who continue their membership on a commitment. Renewals do not include month-to-month members. - Average Commitment Length: represents base contract terms in months. This excludes the impact of any extension and / or termination options. The commitment lengths disclosed may include periods for which members have an option to terminate their commitments with a less than 10% penalty. Terms and definitions

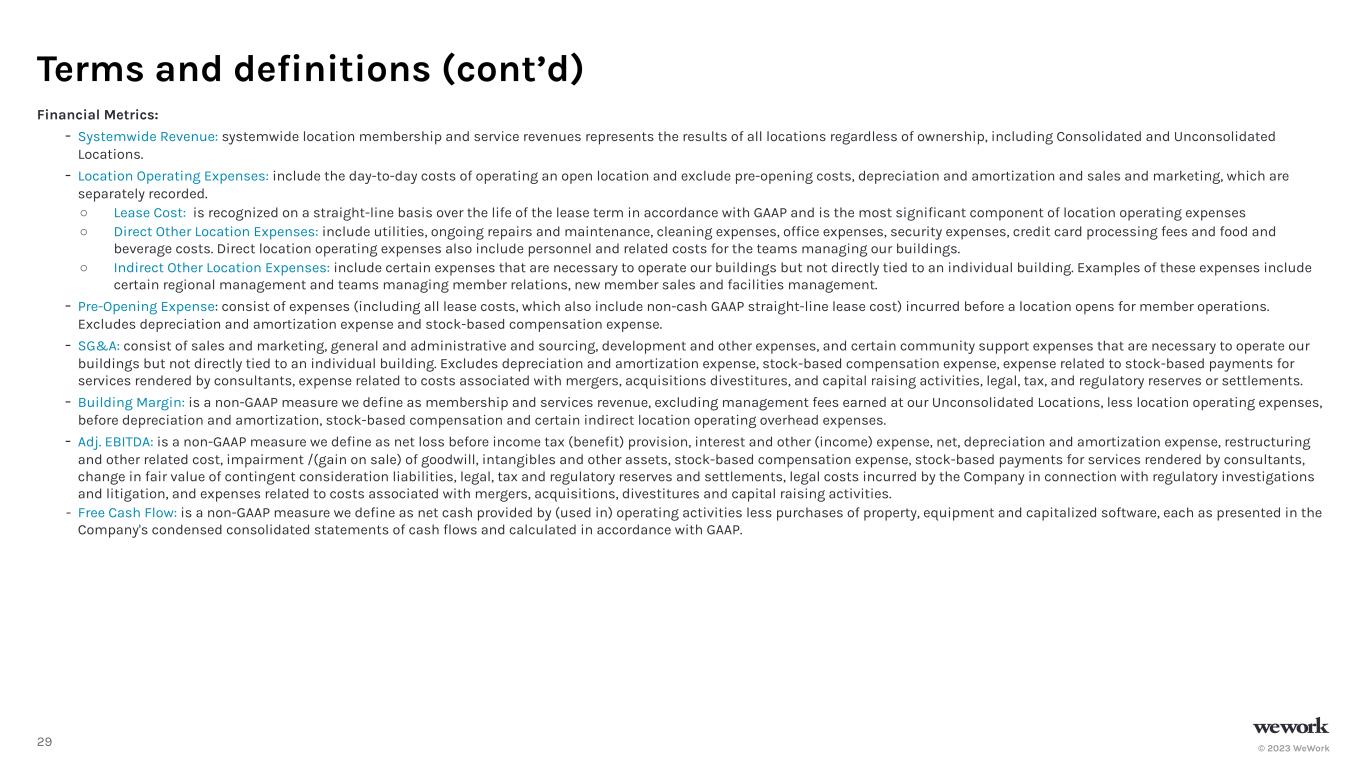

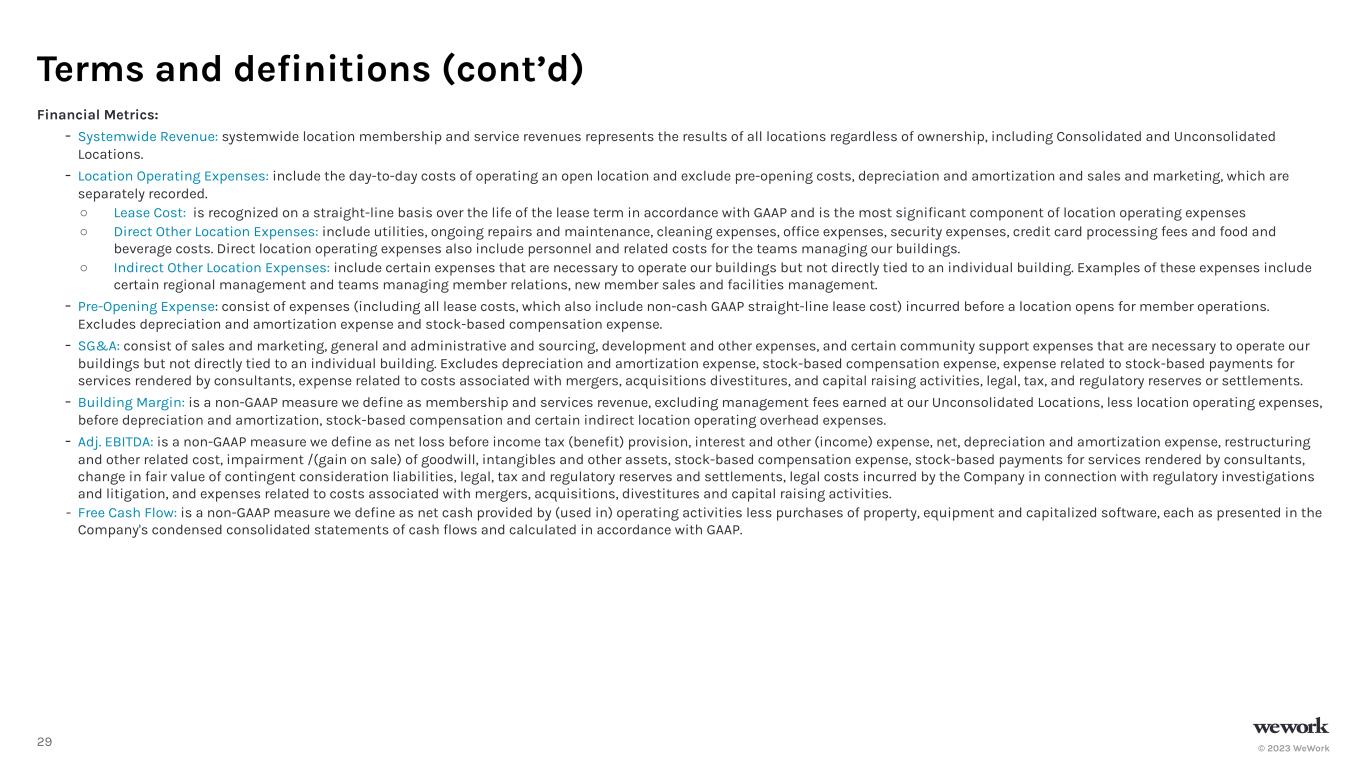

© 2023 WeWork29 Terms and definitions (cont’d) Financial Metrics: - Systemwide Revenue: systemwide location membership and service revenues represents the results of all locations regardless of ownership, including Consolidated and Unconsolidated Locations. - Location Operating Expenses: include the day-to-day costs of operating an open location and exclude pre-opening costs, depreciation and amortization and sales and marketing, which are separately recorded. ○ Lease Cost: is recognized on a straight-line basis over the life of the lease term in accordance with GAAP and is the most significant component of location operating expenses ○ Direct Other Location Expenses: include utilities, ongoing repairs and maintenance, cleaning expenses, office expenses, security expenses, credit card processing fees and food and beverage costs. Direct location operating expenses also include personnel and related costs for the teams managing our buildings. ○ Indirect Other Location Expenses: include certain expenses that are necessary to operate our buildings but not directly tied to an individual building. Examples of these expenses include certain regional management and teams managing member relations, new member sales and facilities management. - Pre-Opening Expense: consist of expenses (including all lease costs, which also include non-cash GAAP straight-line lease cost) incurred before a location opens for member operations. Excludes depreciation and amortization expense and stock-based compensation expense. - SG&A: consist of sales and marketing, general and administrative and sourcing, development and other expenses, and certain community support expenses that are necessary to operate our buildings but not directly tied to an individual building. Excludes depreciation and amortization expense, stock-based compensation expense, expense related to stock-based payments for services rendered by consultants, expense related to costs associated with mergers, acquisitions divestitures, and capital raising activities, legal, tax, and regulatory reserves or settlements. - Building Margin: is a non-GAAP measure we define as membership and services revenue, excluding management fees earned at our Unconsolidated Locations, less location operating expenses, before depreciation and amortization, stock-based compensation and certain indirect location operating overhead expenses. - Adj. EBITDA: is a non-GAAP measure we define as net loss before income tax (benefit) provision, interest and other (income) expense, net, depreciation and amortization expense, restructuring and other related cost, impairment /(gain on sale) of goodwill, intangibles and other assets, stock-based compensation expense, stock-based payments for services rendered by consultants, change in fair value of contingent consideration liabilities, legal, tax and regulatory reserves and settlements, legal costs incurred by the Company in connection with regulatory investigations and litigation, and expenses related to costs associated with mergers, acquisitions, divestitures and capital raising activities. - Free Cash Flow: is a non-GAAP measure we define as net cash provided by (used in) operating activities less purchases of property, equipment and capitalized software, each as presented in the Company's condensed consolidated statements of cash flows and calculated in accordance with GAAP.

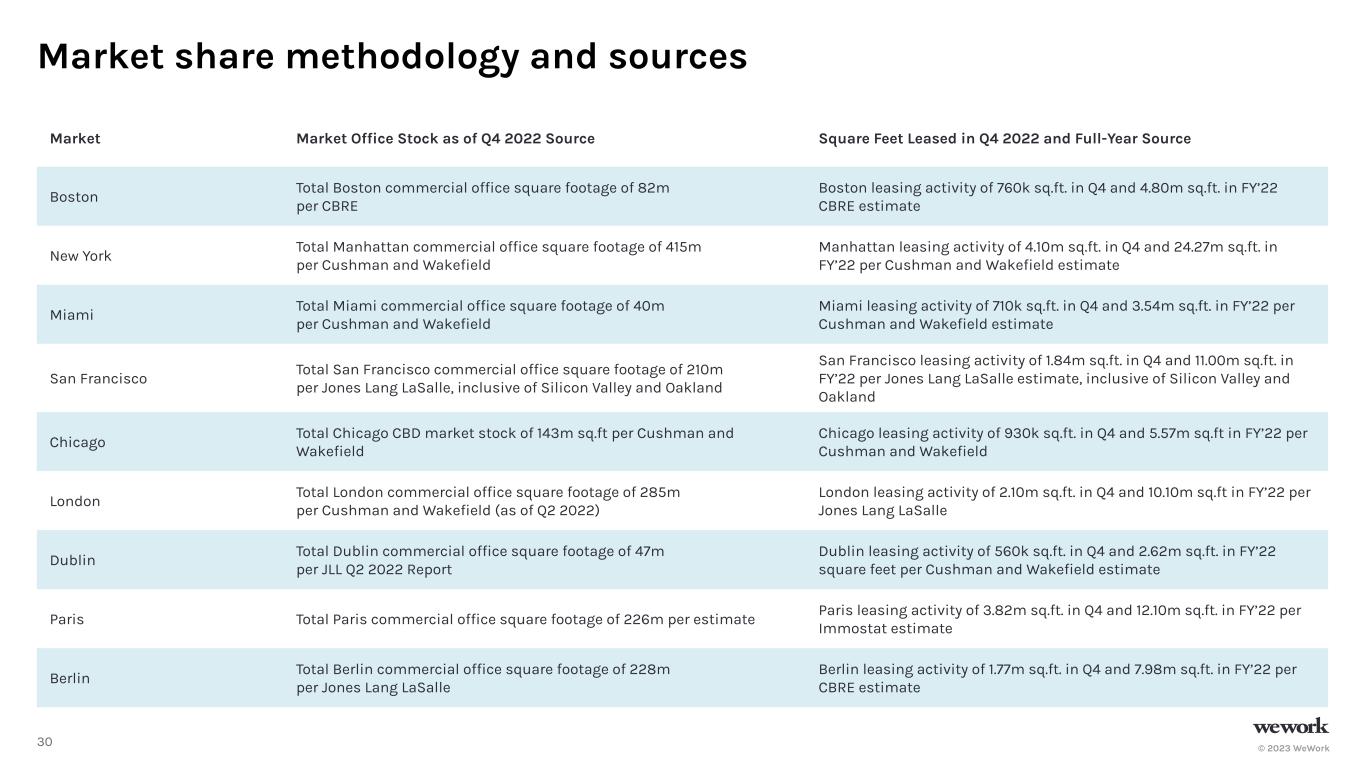

© 2023 WeWork30 Market share methodology and sources Market Market Office Stock as of Q4 2022 Source Square Feet Leased in Q4 2022 and Full-Year Source Boston Total Boston commercial office square footage of 82m per CBRE Boston leasing activity of 760k sq.ft. in Q4 and 4.80m sq.ft. in FY’22 CBRE estimate New York Total Manhattan commercial office square footage of 415m per Cushman and Wakefield Manhattan leasing activity of 4.10m sq.ft. in Q4 and 24.27m sq.ft. in FY’22 per Cushman and Wakefield estimate Miami Total Miami commercial office square footage of 40m per Cushman and Wakefield Miami leasing activity of 710k sq.ft. in Q4 and 3.54m sq.ft. in FY’22 per Cushman and Wakefield estimate San Francisco Total San Francisco commercial office square footage of 210m per Jones Lang LaSalle, inclusive of Silicon Valley and Oakland San Francisco leasing activity of 1.84m sq.ft. in Q4 and 11.00m sq.ft. in FY’22 per Jones Lang LaSalle estimate, inclusive of Silicon Valley and Oakland Chicago Total Chicago CBD market stock of 143m sq.ft per Cushman and Wakefield Chicago leasing activity of 930k sq.ft. in Q4 and 5.57m sq.ft in FY’22 per Cushman and Wakefield London Total London commercial office square footage of 285m per Cushman and Wakefield (as of Q2 2022) London leasing activity of 2.10m sq.ft. in Q4 and 10.10m sq.ft in FY’22 per Jones Lang LaSalle Dublin Total Dublin commercial office square footage of 47m per JLL Q2 2022 Report Dublin leasing activity of 560k sq.ft. in Q4 and 2.62m sq.ft. in FY’22 square feet per Cushman and Wakefield estimate Paris Total Paris commercial office square footage of 226m per estimate Paris leasing activity of 3.82m sq.ft. in Q4 and 12.10m sq.ft. in FY’22 per Immostat estimate Berlin Total Berlin commercial office square footage of 228m per Jones Lang LaSalle Berlin leasing activity of 1.77m sq.ft. in Q4 and 7.98m sq.ft. in FY’22 per CBRE estimate