- CMAXQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

CareMax (CMAXQ) 8-KTermination of a Material Definitive Agreement

Filed: 3 Feb 25, 5:21pm

Exhibit 99.1

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 1 of 15

SIDLEY AUSTIN LLP

Thomas R. Califano (24122825)

Juliana L. Hoffman (24106103)

2021 McKinney Avenue, Suite 2000

Dallas, Texas 75201

Telephone:

(214) 981-3300

Facsimile:

(214) 981-3400

Email:

tom.califano@sidley.com

jhoffman@sidley.com

SIDLEY AUSTIN LLP

Stephen Hessler (admitted pro hac vice) Anthony R. Grossi (admitted pro hac vice) Jason L. Hufendick (admitted pro hac vice) 787 Seventh Avenue New York, New York 10019

Telephone: (212) 839-5300

Facsimile: (212) 839-5599

Email: shessler@sidley.com

agrossi@sidley.com

jhufendick@sidley.com

Attorneys for the Debtors and Debtors in Possession

IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS

DALLAS DIVISION

In re: Chapter 11

CAREMAX, INC., et al.1 Case No. 24-80093 (MVL)

Debtors. (Jointly Administered)

GLOBAL NOTES FOR THE

DECEMBER 2024 AMENDED MONTHLY OPERATING REPORTS

On November 17, 2024, (the “Petition Date”) CareMax, Inc. and its affiliated debtors in the above-captioned chapter 11 cases (each a “Debtor” and, collectively, the “Debtors” or the “Company”) commenced voluntary cases (the “Chapter 11 Cases”) under chapter 11 of title 11,

1 A complete list of each of the Debtors in these Chapter 11 Cases may be obtained on the website of the Debtors’ claims and noticing agent at https://cases.stretto.com/CareMax. The Debtors’ mailing address is 1000 NW 57 Court, Suite 400, Miami, Florida 33126.

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 2 of 15

United States Code, §§ 101 et seq. (the “Bankruptcy Code”) in the United States Bankruptcy Court for the Northern District of Texas (the “Court”).

The Debtors continue to operate their business and manage their properties as debtors in possession pursuant to sections 1107(a) and 1108 of the Bankruptcy Code. The Chapter 11 Cases have been consolidated for procedural purposes only and are being jointly administered under case number 24-80093 (MVL).

1. General Methodology: The Debtors are filing this amended monthly operating report (the “MOR”) solely for purposes of complying with the monthly operating requirements of the Debtors’ Chapter 11 Cases. The financial information contained herein is unaudited, limited in scope, and as such, has not been subjected to procedures that would typically be applied to financial statements in accordance with accounting principles generally accepted in the United States of America (“U.S. GAAP”). The MOR should not be relied on by any persons for information relating to current or future financial condition, events, or performance of any of the Debtors or their affiliates, as the results of operations contained herein are not necessarily indicative of results that may be expected from any other period or for the full year and may not necessarily reflect the combined results of operations, financial position, and schedule of receipts and disbursements in the future. There can be no assurance that such information is complete, and the MOR may be subject to revision.

The following notes, statements, and limitations should be referred to and referenced in connection with any review of the MOR.

2. Basis of Presentation: For financial reporting purposes, the Debtors prepare consolidated financial statements, which include information for CareMax, Inc., and its Debtor affiliates.

This MOR only contains financial information of the Debtors. The Debtors are maintaining their books and records in accordance with U.S. GAAP and the information furnished in this MOR uses the Debtors’ normal accrual method of accounting. In preparing the MOR, the Debtors relied on financial data derived from their books and records that was available at the time of preparation. The financial statements presented herein reflect the book values of the Debtor entities of CareMax, Inc., and, as a result, do not reflect the going concern valuation of the Debtors. The Company is not liable for and undertakes no responsibility to indicate variations from securities laws or for any evaluations of the Company based on this financial information or any other information.

3. Reporting Period: Unless otherwise noted herein, the MOR generally reflects the Debtors’ books and records and financial activity occurring during the applicable reporting period.

4. Accuracy: The financial information disclosed herein was not prepared in accordance with federal or state securities laws or other applicable nonbankruptcy law or in lieu of complying with any periodic reporting requirements thereunder. Persons and entities trading in or otherwise purchasing, selling, or transferring the claims against or equity interests in the Debtors should evaluate this financial information in light of the purposes for which it was prepared. The Debtors are not liable for and undertake no responsibility to indicate variations from securities laws or for any evaluations of the Debtors based on this financial information or any other information.

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 3 of 15

5. Payments of Prepetition Claims Pursuant to First Day Orders: Following the Petition

Date, the Court entered certain orders authorizing, but not directing, the Debtors to, among other things, pay certain (a) insurance obligations; (b) employee wages, salaries, additional compensation, contractor obligations, and employee benefit programs; (c) taxes and fees; (d) utilities; (e) service charges and other fees, costs, and expenses charged by the Debtors’ cash management banks; and (f) certain critical vendor payments.

6. Insiders: For purposes of this MOR, the Debtors defined “insiders” pursuant to section 101(31) of the Bankruptcy Code as: (a) directors; (b) officers; (c) persons in control of the Debtors; (d) relatives of the Debtors’ directors, officers, or persons in control of the Debtors; and (e) Debtor and non-Debtor affiliates of the foregoing. Moreover, the Debtors do not take a position with respect to: (a) any insider’s influence over the control of the Debtors; (b) the management responsibilities or functions of any such insider; (c) the decision making or corporate authority of any such insider; or (d) whether the Debtors or any such insider could successfully argue that he or she is not an “insider” under applicable law, with respect to any theories of liability, or for any other purpose.

7. Payments to Insiders: All payments made by the Debtors to “Insiders,” as such term is defined in 11 U.S.C. § 101(31), included wage compensation and benefits in the ordinary course due to those individuals. This information is available upon request.

8. Postpetition Borrowing: Following the Petition Deate, the Court approved debtor-in-possession borrowing as set forth in the Final Order (A) Authorizing the Debtors to

(I) Obtain Postpetition Financing, (II) Use Cash Collateral, (III) Grant Senior Secured Liens and Provide Claims with Superpriority Administrative Expense Status, and (IV) Grant Adequate Protection to the Prepetition Secured Parties, (B) Modifying the Automatic Stay, and (C) Granting Related Relief [Docket No. 245].

9. Estimation of Claims: The amounts of Secured, Unsecured, and Priority Claims reported in the Monthly Operating Reports are estimated based on the Debtors’ available information.

10. Attachments and Exhibits: Bank statements and other supporting documents and exhibits are attached to the MORs as applicable for each Debtor entity. The Debtor entities that do not have bank statements or other supporting documents and exhibits attached to their MORs do not have bank accounts in their name. Any documents, exhibits, or statements attached to the MOR of CareMax, Inc. are incorporated by reference into the MOR for all Debtors.

11. Reservation of Rights: The Debtors reserve all rights to amend or supplement the MOR in all respects, as may be necessary or appropriate, but shall be under no obligation to do so. Nothing contained in this MOR shall constitute a waiver of any of the Debtors’ rights or an admission with respect to their Chapter 11 Cases.

* * * END OF GLOBAL NOTES * * *

Page 4 of 15

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 4 of 15

UNITED STATES BANKRUPTCY COURT

Northern DISTRICT OF Texas

Dallas

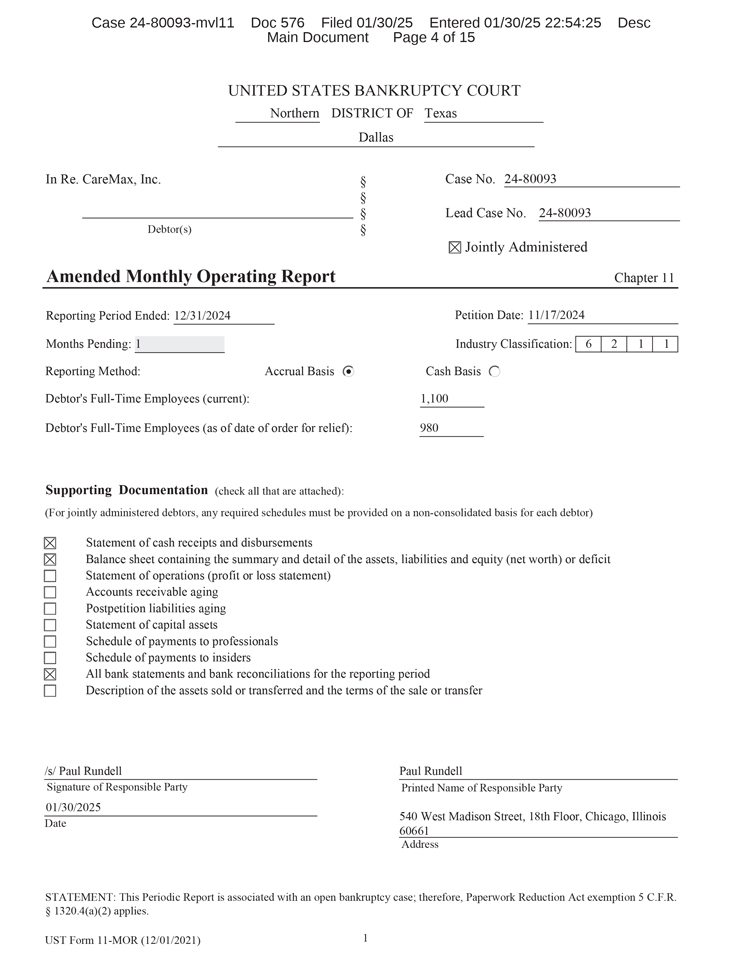

In Re. CareMax, Inc. § Case No. 24-80093

§

§ Lead Case No. 24-80093

Debtor(s) §

Jointly Administered

$PHQGHG_Monthly Operating Report Chapter 11

Reporting Period Ended: 12/31/2024 Petition Date: 11/17/2024

Months Pending: 1 Industry Classification: 6 2 1 1

Reporting Method: Accrual Basis Cash Basis

Debtor’s Full-Time Employees (current): 1,100

Debtor’s Full-Time Employees (as of date of order for relief): 980

Supporting Documentation (check all that are attached):

(For jointly administered debtors, any required schedules must be provided on a non-consolidated basis for each debtor)

Statement of cash receipts and disbursements

Balance sheet containing the summary and detail of the assets, liabilities and equity (net worth) or deficit Statement of operations (profit or loss statement) Accounts receivable aging Postpetition liabilities aging Statement of capital assets Schedule of payments to professionals Schedule of payments to insiders All bank statements and bank reconciliations for the reporting period Description of the assets sold or transferred and the terms of the sale or transfer

/s/ Paul Rundell Paul Rundell

Signature of Responsible Party Printed Name of Responsible Party

01/___2025

Date 540 West Madison Street, 18th Floor, Chicago, Illinois

60661

Address

STATEMENT: This Periodic Report is associated with an open bankruptcy case; therefore, Paperwork Reduction Act exemption 5 C.F.R.

§ 1320.4(a)(2) applies.

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 5 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

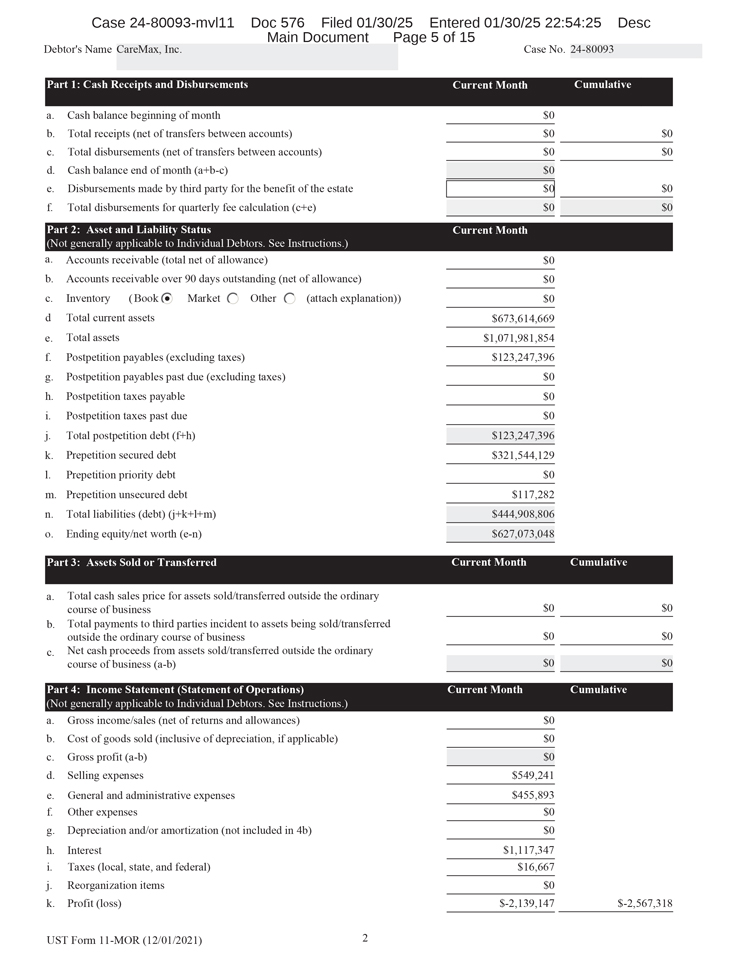

Part 1: Cash Receipts and Disbursements Current Month Cumulative

a. Cash balance beginning of month $0

b. Total receipts (net of transfers between accounts) $0 $0

c. Total disbursements (net of transfers between accounts) $0 $0

d. Cash balance end of month (a+b-c) $0

e. Disbursements made by third party for the benefit of the estate $0 $0

f. Total disbursements for quarterly fee calculation (c+e) $0 $0

Part 2: Asset and Liability Status Current Month

(Not generally applicable to Individual Debtors. See Instructions.)

a. Accounts receivable (total net of allowance) $0

b. Accounts receivable over 90 days outstanding (net of allowance) $0

c. Inventory ( Book Market Other (attach explanation)) $0

d Total current assets $673,614,669

e. Total assets $1,071,981,854

f. Postpetition payables (excluding taxes) $123,247,396

g. Postpetition payables past due (excluding taxes) $0

h. Postpetition taxes payable $0

i. Postpetition taxes past due $0

j. Total postpetition debt (f+h) $123,247,396

k. Prepetition secured debt $321,544,129

l. Prepetition priority debt $0

m. Prepetition unsecured debt $117,282

n. Total liabilities (debt) (j+k+l+m) $444,908,806

o. Ending equity/net worth (e-n) $627,073,048

Part 3: Assets Sold or Transferred Current Month Cumulative

a. Total cash sales price for assets sold/transferred outside the ordinary

course of business $0 $0

b. Total payments to third parties incident to assets being sold/transferred

outside the ordinary course of business $0 $0

c. Net cash proceeds from assets sold/transferred outside the ordinary

course of business (a-b) $0 $0

Part 4: Income Statement (Statement of Operations) Current Month Cumulative

(Not generally applicable to Individual Debtors. See Instructions.)

a. Gross income/sales (net of returns and allowances) $0

b. Cost of goods sold (inclusive of depreciation, if applicable) $0

c. Gross profit (a-b) $0

d. Selling expenses $549,241

e. General and administrative expenses $455,893

f. Other expenses $0

g. Depreciation and/or amortization (not included in 4b) $0

h. Interest $1,117,347

i. Taxes (local, state, and federal) $16,667

j. Reorganization items $0

k. Profit (loss) $-2,139,147 $-2,567,318

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 6 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

Approved Approved Paid Current Paid

Current Month Cumulative Month Cumulative

a. Debtor’s professional fees & expenses (bankruptcy) Aggregate Total

Itemized Breakdown by Firm

Firm Name Role

i

ii

iii

iv

v

vi

vii

viii

ix

x

xi

xii

xiii

xiv

xv

xvi

xvii

xviii

xix

xx

xxi

xxii

xxiii

xxiv

xxv

xxvi

xxvii

xxviii

xxix

xxx

xxxi

xxxii

xxxiii

xxxiv

xxxv

xxxvi

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 7 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

xxxvii

xxxvii

xxxix

xl

xli

xlii

xliii

xliv

xlv

xlvi

xlvii

xlviii

xlix

l

li

lii

liii

liv

lv

lvi

lvii

lviii

lix

lx

lxi

lxii

lxiii

lxiv

lxv

lxvi

lxvii

lxviii

lxix

lxx

lxxi

lxxii

lxxiii

lxxiv

lxxv

lxxvi

lxxvii

lxxvii

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 8 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

lxxix

lxxx

lxxxi

lxxxii

lxxxii

lxxxiv

lxxxv

lxxxvi

lxxxvi

lxxxvi

lxxxix

xc

xci

xcii

xciii

xciv

xcv

xcvi

xcvii

xcviii

xcix

c

ci

Approved Approved Paid Current Paid

Current Month Cumulative Month Cumulative

b. Debtor’s professional fees & expenses (nonbankruptcy) Aggregate Total

Itemized Breakdown by Firm

Firm Name Role

i

ii

iii

iv

v

vi

vii

viii

ix

x

xi

xii

xiii

xiv

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 9 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

xv

xvi

xvii

xviii

xix

xx

xxi

xxii

xxiii

xxiv

xxv

xxvi

xxvii

xxviii

xxix

xxx

xxxi

xxxii

xxxiii

xxxiv

xxxv

xxxvi

xxxvii

xxxvii

xxxix

xl

xli

xlii

xliii

xliv

xlv

xlvi

xlvii

xlviii

xlix

l

li

lii

liii

liv

lv

lvi

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 10 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

lvii

lviii

lix

lx

lxi

lxii

lxiii

lxiv

lxv

lxvi

lxvii

lxviii

lxix

lxx

lxxi

lxxii

lxxiii

lxxiv

lxxv

lxxvi

lxxvii

lxxvii

lxxix

lxxx

lxxxi

lxxxii

lxxxii

lxxxiv

lxxxv

lxxxvi

lxxxvi

lxxxvi

lxxxix

xc

xci

xcii

xciii

xciv

xcv

xcvi

xcvii

xcviii

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 11 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

xcix

c

c. All professional fees and expenses (debtor & committees) $0 $0 $0 $0

Part 6: Postpetition Taxes Current Month Cumulative

a. Postpetition income taxes accrued (local, state, and federal) $0 $0

b. Postpetition income taxes paid (local, state, and federal) $0 $0

c. Postpetition employer payroll taxes accrued $0 $0

d. Postpetition employer payroll taxes paid $0 $0

e. Postpetition property taxes paid $0 $0

f. Postpetition other taxes accrued (local, state, and federal) $82,698 $82,698

g. Postpetition other taxes paid (local, state, and federal) $0 $0

Part 7: Questionnaire—During this reporting period:

a. Were any payments made on prepetition debt? (if yes, see Instructions) Yes No

b. Were any payments made outside the ordinary course of business Yes No

without court approval? (if yes, see Instructions)

c. Were any payments made to or on behalf of insiders? Yes No

d. Are you current on postpetition tax return filings? Yes No

e. Are you current on postpetition estimated tax payments? Yes No

f. Were all trust fund taxes remitted on a current basis? Yes No

g. Was there any postpetition borrowing, other than trade credit? Yes No

(if yes, see Instructions)

h. Were all payments made to or on behalf of professionals approved by Yes No N/A

the court?

i. Do you have: Worker’s compensation insurance? Yes No

If yes, are your premiums current? Yes No N/A (if no, see Instructions)

Casualty/property insurance? Yes No

If yes, are your premiums current? Yes No N/A (if no, see Instructions)

General liability insurance? Yes No

If yes, are your premiums current? Yes No N/A (if no, see Instructions)

j. Has a plan of reorganization been filed with the court? Yes No

k. Has a disclosure statement been filed with the court? Yes No

l. Are you current with quarterly U.S. Trustee fees as Yes No

set forth under 28 U.S.C. § 1930?

Case 24-80093-mvl11 Doc 576 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Main Document Page 12 of 15

Main Document Page 12 of 15

Debtor’s Name CareMax, Inc. Case No. 24-80093

Part 8: Individual Chapter 11 Debtors (Only)

a. Gross income (receipts) from salary and wages $0

b. Gross income (receipts) from self-employment $0

c. Gross income from all other sources $0

d. Total income in the reporting period (a+b+c) $0

e. Payroll deductions $0

f. Self-employment related expenses $0

g. Living expenses $0

h. All other expenses $0

i. Total expenses in the reporting period (e+f+g+h) $0

j. Difference between total income and total expenses (d-i) $0

k. List the total amount of all postpetition debts that are past due $0

l. Are you required to pay any Domestic Support Obligations as defined by 11 Yes No

U.S.C § 101(14A)?

m. If yes, have you made all Domestic Support Obligation payments? Yes No N/A

Privacy Act Statement

28 U.S.C. § 589b authorizes the collection of this information, and provision of this information is mandatory under 11 U.S.C.

§§ 704, 1106, and 1107. The United States Trustee will use this information to calculate statutory fee assessments under 28 U.S.C. § 1930(a)(6). The United States Trustee will also use this information to evaluate a chapter 11 debtor’s progress through the bankruptcy system, including the likelihood of a plan of reorganization being confirmed and whether the case is being prosecuted in good faith. This information may be disclosed to a bankruptcy trustee or examiner when the information is needed to perform the trustee’s or examiner’s duties or to the appropriate federal, state, local, regulatory, tribal, or foreign law enforcement agency when the information indicates a violation or potential violation of law. Other disclosures may be made for routine purposes. For a discussion of the types of routine disclosures that may be made, you may consult the Executive Office for United States Trustee’s systems of records notice, UST-001, “Bankruptcy Case Files and Associated Records.” See 71 Fed. Reg. 59,818 et seq. (Oct. 11, 2006). A copy of the notice may be obtained at the following link: http:// www.justice.gov/ust/eo/rules_regulations/index.htm. Failure to provide this information could result in the dismissal or conversion of your bankruptcy case or other action by the United States Trustee. 11 U.S.C. § 1112(b)(4)(F).

I declare under penalty of perjury that the foregoing Monthly Operating Report and its supporting documentation are true and correct and that I have been authorized to sign this report on behalf of the estate.

/s/ Paul Rundell Paul Rundell

Signature of Responsible Party Printed Name of Responsible Party

Chief Restructuring Officer 01/__/2025

Title Date

Case 24-80093-mvl11 Doc 576-1 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 1 Page 2 of 2PageFourUST Form 11-MOR (12/01/2021) 12

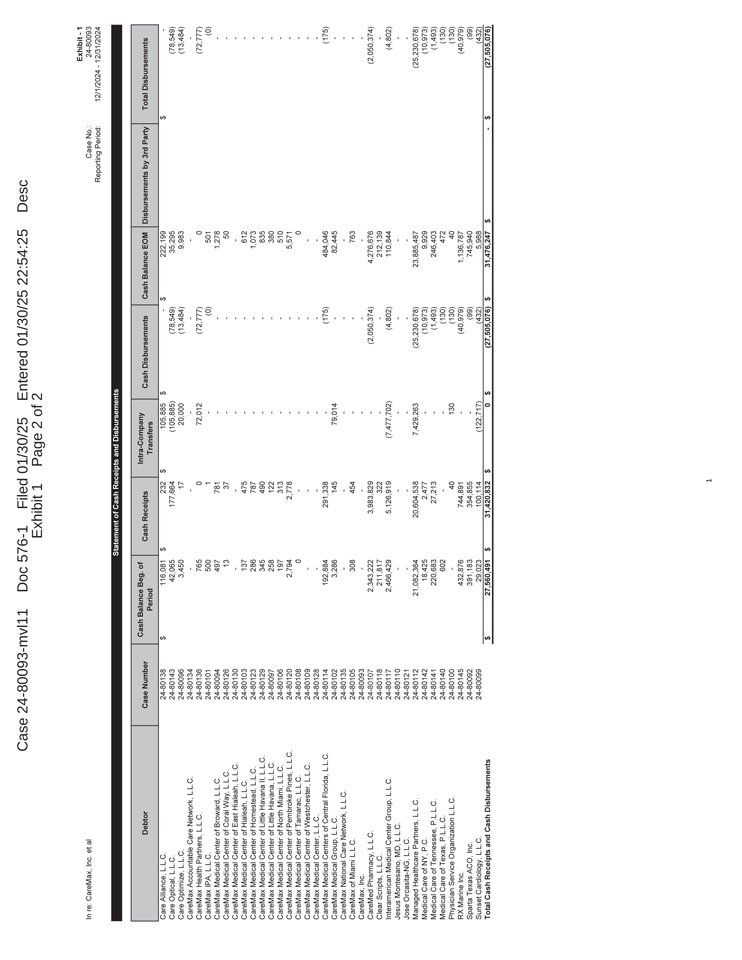

Exhibit 1Statement of Cash Receipts and Disbursements

Exhibit - 1Care Alliance, L.L.C. 24-80138 $ 116,081 $ 232 $ 105,885 $ - $ 222,199 $ -(78,549) 35,295 (78,549) Care Optical, L.L.C. 24-80143 42,065 177,664 (105,885) Care Optimize, L.L.C. 24-80096 3,450 17 20,000 (13,484) 9,983 (13,484) CareMax Accountable Care Network, L.L.C. 24-80134 - - - - - - CareMax Health Partners, L.L.C. 24-80136 765 0 72,012 (72,777) 0 (72,777) CareMax IPA, L.L.C. 24-80101 500 1 - (0) 501 (0) CareMax Medical Center of Broward, L.L.C. 24-80094 497 781 - - 1,278 - CareMax Medical Center of Coral Way, L.L.C. 24-80126 13 37 - - 50 - CareMax Medical Center of East Hialeah, L.L.C. 24-80130 - - - - - - CareMax Medical Center of Hialeah, L.L.C. 24-80103 137 475 - - 612 - CareMax Medical Center of Homestead, L.L.C. 24-80123 286 787 - - 1,073 - CareMax Medical Center of Little Havana II, L.L.C. 24-80129 345 490 - - 835 - CareMax Medical Center of Little Havana, L.L.C. 24-80097 258 122 - - 380 - CareMax Medical Center of North Miami, L.L.C. 24-80106 197 313 - - 510 - CareMax Medical Center of Pembroke Pines, L.L.C. 24-80120 2,794 2,778 - - 5,571 - CareMax Medical Center of Tamarac, L.L.C. 24-80108 0 - - - 0 - CareMax Medical Center of Westchester, L.L.C. 24-80109 - - - - - - CareMax Medical Center, L.L.C. 24-80128 - - - - - - Clear Scripts, L.L.C. 24-80118 211,817 322 - - 212,139 - Medical Care of Texas, P.L.L.C. 24-80140 602 - - (130) 472 (130) Physician Service Organization L.L.C. 24-80100 - 40 130 (130) 40 (130) RX Marine Inc. 24-80145 432,876 744,891 - (40,979) 1,136,787 (40,979) Sparta Texas ACO, Inc. 24-80092 391,183 354,855 - (99) 745,940 (99) Sunset Cardiology, L.L.C. 24-80099 29,023 100,114 (122,717) (432) 5,988 (432)

Case No.: 24-80093

Reporting Period: 12/1/2024 - 12/31/2024

Sunset Cardiology, L.L.C. 24-80099 29,023 100,114 (122,717) (432) 5,988 (432)

Total Cash Receipts and Cash Disbursements $ 27,560,491 $ 31,420,832 $ 0 $ (27,505,076) $ 31,476,247 $ - $ (27,505,076)Case 24-80093-mvl11 Doc 576-1 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 1 Page 1 of 2

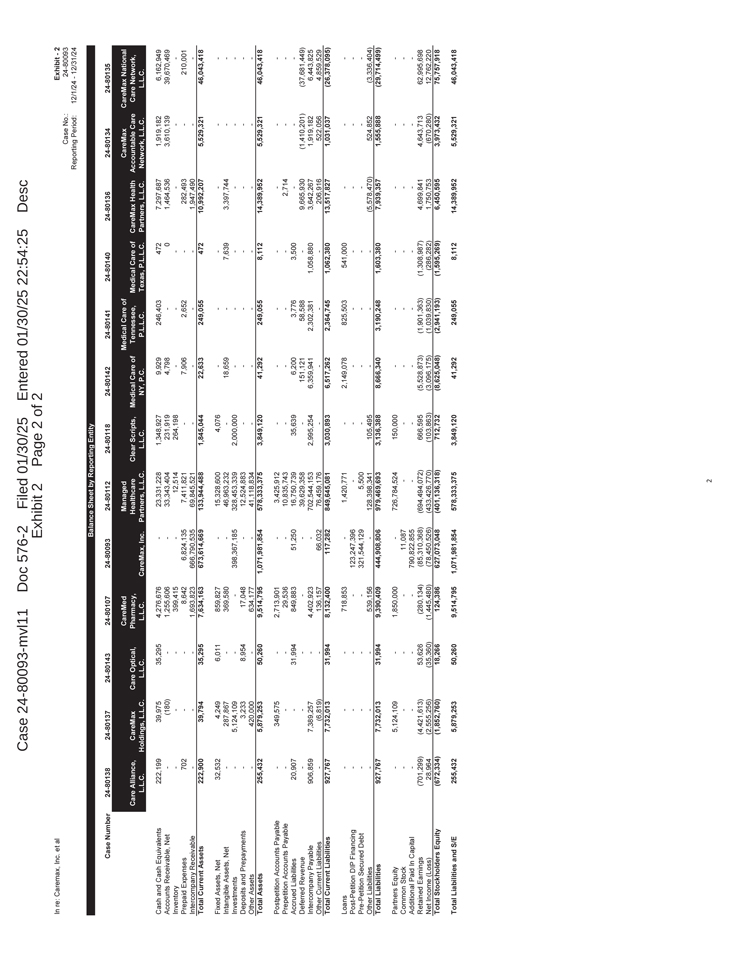

Case 24-80093-mvl11 Doc 576-2 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 2 Page 1 of 2Exhibit 2 Balance sheet by reporting Entity

Exhibit 2 page 2 of 2

Case NExhibit - 1o

Case No.: 24-80093

Reporting Period: 12/1/2024 - 12/31/2024

Cash and Cash Equivalents 222,199 39,975 35,295 4,276,676 - 23,331,228 1,348,927 9,929 246,403 472 7,297,687 1,919,182 6,162,949Accounts Receivable, Net - (180) - 1,255,606 - 33,343,404 231,919 4,798 - 0 1,464,536 3,610,139 39,670,469Inventory - - - 399,415 - 12,514 264,198-- - - - - Prepaid Expenses 702 - - 8,642 6,824,135 7,411,821 - 7,906 2,652 - 282,493 - 210,001Intercompany Receivable - - - 1,693,823 666,790,535 69,845,521 - - - - 1,947,490 - -Total Current Assets 222,900 39,794 35,295 7,634,163 673,614,669 133,944,488 1,845,044 22,633 249,055 472 10,992,207 5,529,321 46,043,418 Fixed Assets, Net 32,532 4,249 6,011 859,827 - 15,328,600 4,076 - - - - - - Intangible Assets, Net - 287,867 - 369,580 - 46,963,232 - 18,659 - 7,639 3,397,744 - - Investments - 5,124,109 - - 398,367,185 328,453,339 2,000,000 - - - - - - Deposits and Prepayments - 3,233 8,954 17,048 - 12,524,883 - - - - - - - Other Assets - 420,000 - 634,177 - 41,118,834 - - - - - - - Total LiabilitiesPartners Equity 927,767 7,732,013 31,994 9,390,409 444,908,806- 5,124,109 - 1,850,000 - 8,666,340 3,190,248 1,603,380726,784,524 150,000 - - - - - - Common StockAdditional Paid In CapitalRetained Earnings - - - - 11,087- - - - 790,822,855 (701,299) (4,421,613) 53,626 (280,134) (85,310,368) - - - - - - - -- - - - - - - -(694,494,072) 666,595 (5,528,873) (1,901,363) (1,308,987) 4,699,841 4,643,713 62,995,698 Net Income (Loss) 28,964 (2,555,256) (35,360) (1,445,480) (78,450,526) (433,426,770) (103,863) (3,096,175) (1,039,830) (286,282) 1,750,753 (670,280) 12,762,220 Total Stockholders Equity (672,334) (1,852,760) 18,266 124,386 627,073,048 (401,136,318) 712,732 (8,625,048) (2,941,193) (1,595,269) 6,450,595 3,973,432 75,757,918 Total Liabilities and S/E 255,432 5,879,253 50,260 9,514,795 1,071,981,854 578,333,375 3,849,120 41,292 249,055 8,112 14,389,952 5,529,321 46,043,418 2Case 24-80093-mvl11 Doc 576-2 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 2 Page 2 of 2

In re: Caremax, Inc. et al

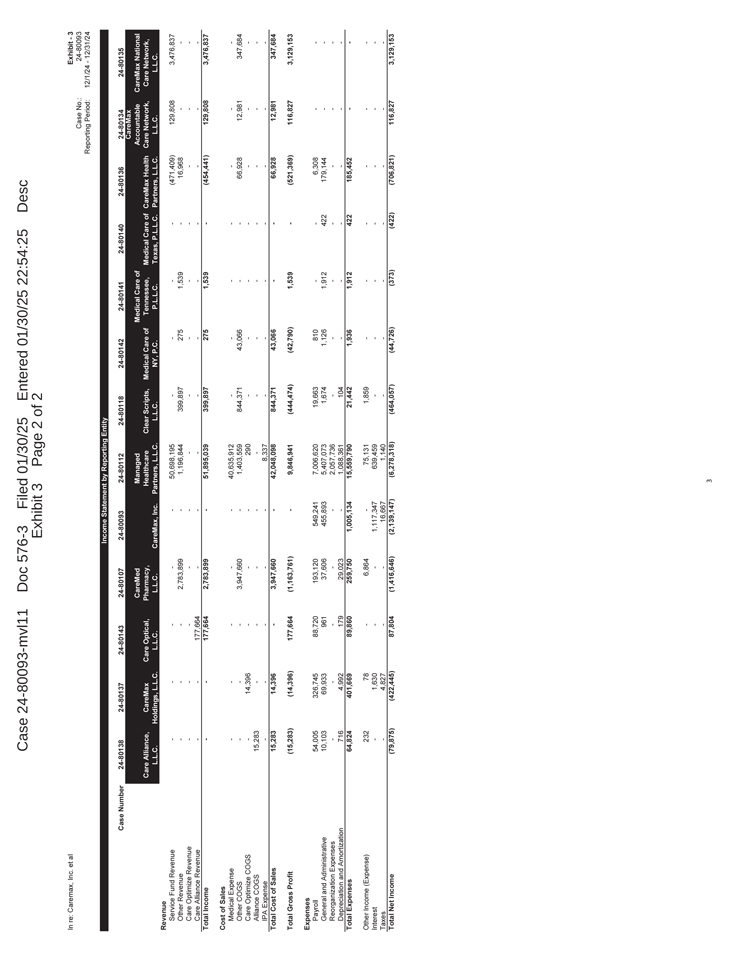

Case 24-80093-mvl11 Doc 576-3 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 3 Page 1 of 2Exhibit 3

Income Statement by Reporting Entity

Exhibit - 3 Case No.: 24-80093 Reporting Period: 12/1/24 - 12/31/24 Service Fund Revenue - - - - - 50,698,195 - - - - (471,409) 129,808 3,476,837 Other Revenue - - - 2,783,899 - 1,196,844 399,897 275 1,539 - 16,968 - -Care Optimize Revenue - - - - - - - - - - - - -Care Alliance Revenue - - 177,664 - - - - - - - - - - Total Income - - 177,664 2,783,899 - 51,895,039 399,897 275 1,539 - (454,441) 129,808 3,476,837 Cost of Sales Medical Expense - - - - - 40,635,912 - - - - - - -Other COGS - - - 3,947,660 - 1,403,559 844,371 43,066 - - 66,928 12,981 347,684 Care Optimize COGS - 14,396 - - - 290 - - - - - - -Alliance COGS 15,283 - - - - - - -

- - - - -IPA Expense - - - - - 8,337 - - - - - - - Total Cost of Sales 15,283 14,396 - 3,947,660 - 42,048,098 844,371 43,066 - - 66,928 12,981 347,684 Total Gross Profit (15,283) (14,396) 177,664 (1,163,761) - 9,846,941 (444,474) (42,790) 1,539 - (521,369) 116,827 3,129,153 Expenses Payroll 54,005 326,745 88,720 193,120 549,241 7,006,620 19,663 810 - - 6,308 - -General and Administrative 10,103 69,933 961 37,606 455,893 5,407,073 1,674 1,126 1,912 422 179,144 - -Reorganization Expenses - - - - - 2,057,736 - - - - - - -Depreciation and Amortization 716 4,992 179 29,023 - 1,088,361 104 - - - - - - Total Expenses 64,824 401,669 89,860 259,750 1,005,134 15,559,790 21,442 1,936 1,912 422 185,452 - - Other Income (Expense) 232 78 - 6,864 - 75,131 1,859 - - - - - -Interest - 1,630 - - 1,117,347 639,459 - - - - - -

-Taxes - 4,827 - - 16,667 1,140 - - - - - - - Total Net Income (79,875) (422,445) 87,804 (1,416,646) (2,139,147) (6,278,318) (464,057) (44,726) (373) (422) (706,821) 116,827 3,129,153 Case Number 24-80138 24-80137 24-80143 24-80107 24-80093 24-80112 24-80118 24-80142 24-80141 24-80140 24-80136 24-80134 24-80135 CareMax CareMed Managed Medical Care of Accountable CareMax National Care Alliance, CareMax Care Optical, Pharmacy, Healthcare Clear Scripts, Medical Care of Tennessee, Medical Care of CareMax Health Care Network, Care Network, L.L.C. Holdings, L.L.C. L.L.C. L.L.C. CareMax, Inc. Partners, L.L.C. L.L.C. NY, P.C. P.L.L.C. Texas, P.L.L.C. Partners, L.L.C. L.L.C. L.L.C.

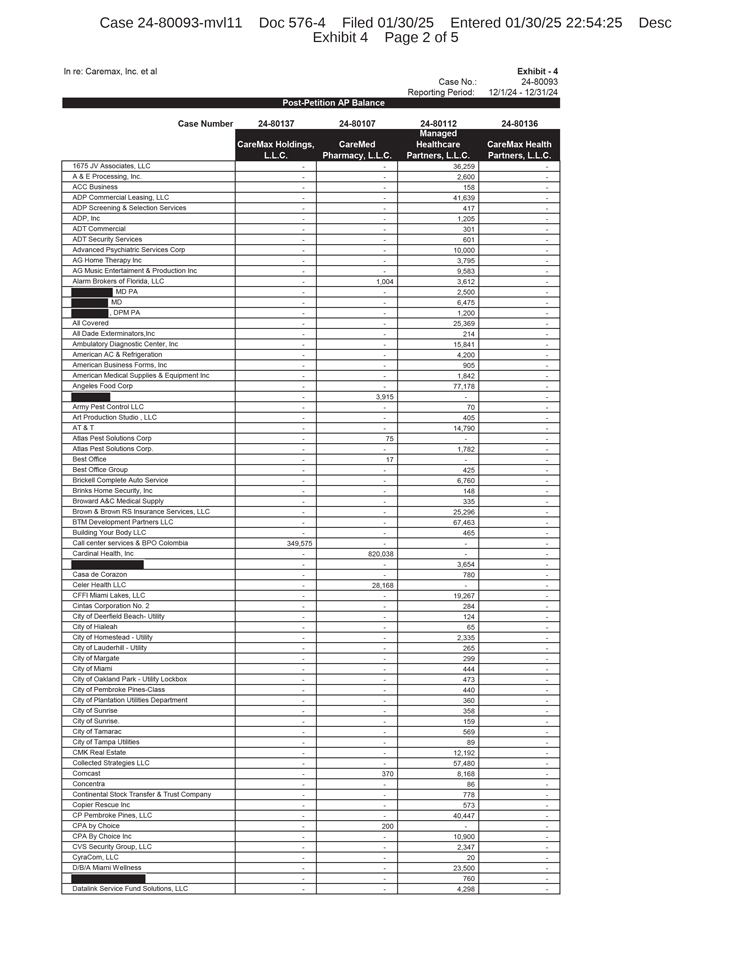

Exhibit 4

Post-Petition Liabilities AgingCase 24-80093-mvl11 Doc 576-4 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 4 Page 1 of 5

1675 JV Associates, LLC - - 36,259 - A & E Processing, Inc. - - 2,600 - ACC Business - - 158 - ADP Commercial Leasing, LLC - - 41,639 - ADP Screening & Selection Services - - 417 - ADP, Inc - - 1,205 - ADT Commercial - - 301 - ADT Security Services - - 601 - Advanced Psychiatric Services Corp - - 10,000 - AG Home Therapy Inc - - 3,795 - AG Music Entertaiment & Production Inc - - 9,583 - Alarm Brokers of Florida, LLC - 1,004 3,612 - MD PA - - 2,500 - MD - - 6,475 - , DPM PA - - 1,200 - All Covered - - 25,369 - All Dade Exterminators,Inc - - 214 - Ambulatory Diagnostic Center, Inc - - 15,841 - American AC & Refrigeration - - 4,200 - American Business Forms, Inc - - 905 - American Medical Supplies & Equipment Inc - - 1,842 - Angeles Food Corp - - 77,178 - - 3,915 - - Army Pest Control LLC - - 70 - Art Production Studio , LLC - - 405 - AT & T - - 14,790 - Atlas Pest Solutions Corp - 75 - - Atlas Pest Solutions Corp. - - 1,782 - Best Office - 17 - - Best Office Group - - 425 - Brickell Complete Auto Service - - 6,760 - Brinks Home Security, Inc - - 148 - Broward A&C Medical Supply - - 335 - Brown & Brown RS Insurance Services, LLC - - 25,296 - BTM Development Partners LLC - - 67,463 - Building Your Body LLC - - 465 - Call center services & BPO Colombia 349,575 - - - Cardinal Health, Inc - 820,038 - - - - 3,654 - Casa de Corazon - - 780 - Celer Health LLC - 28,168 - - CFFI Miami Lakes, LLC - - 19,267 - Cintas Corporation No. 2 - - 284 - City of Deerfield Beach- Utility - - 124 - City of Hialeah - - 65 - City of Homestead - Utility - - 2,335 - City of Lauderhill - Utility - - 265 - City of Margate - - 299 - City of Miami - - 444 - City of Oakland Park - Utility Lockbox - - 473 - City of Pembroke Pines-Class - - 440 - City of Plantation Utilities Department - - 360 - City of Sunrise - - 358 - City of Sunrise. - - 159 - City of Tamarac - - 569 - City of Tampa Utilities - - 89 - CMK Real Estate - - 12,192 - Collected Strategies LLC - - 57,480 - Comcast - 370 8,168 - Concentra - - 86 - Continental Stock Transfer & Trust Company - - 778 - Copier Rescue Inc - - 573 - CP Pembroke Pines, LLC - - 40,447 - CPA by Choice - 200 - - CPA By Choice Inc - - 10,900 - CVS Security Group, LLC - - 2,347 - CyraCom, LLC - - 20 - D/B/A Miami Wellness - - 23,500 - - - 760 - Datalink Service Fund Solutions, LLC - - 4,298 -

Exhibit - 4

Case No.: 24-80093

Reporting Period: 12/1/24 - 12/31/24Case 24-80093-mvl11 Doc 576-4 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 4 Page 2 of 5

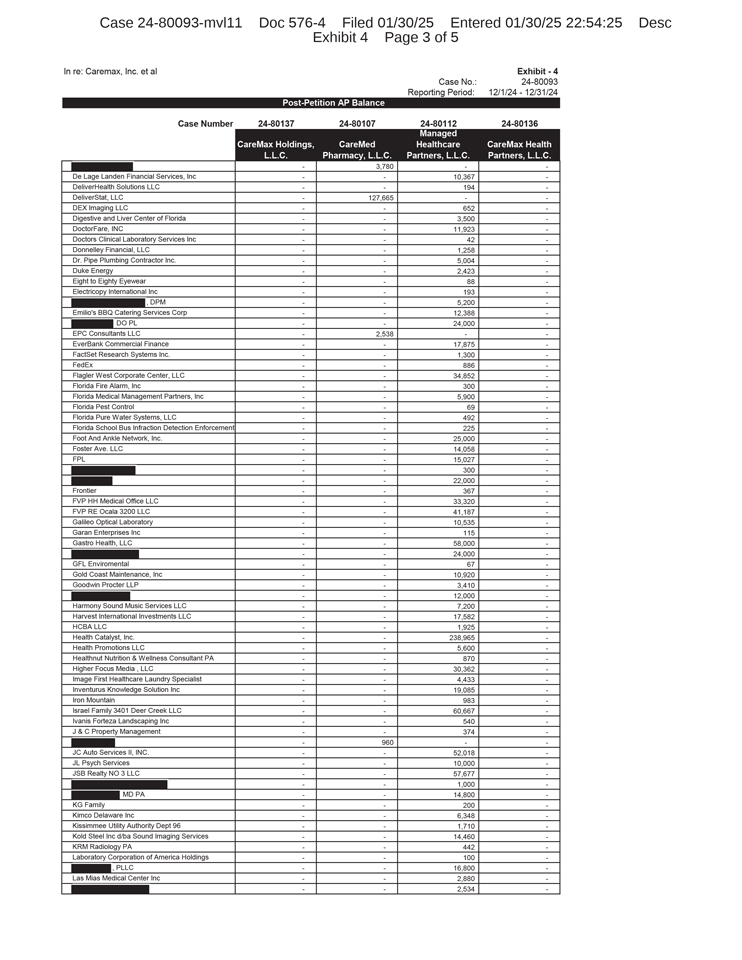

- 3,780 - - De Lage Landen Financial Services, Inc - - 10,367 - DeliverHealth Solutions LLC - - 194 - DeliverStat, LLC - 127,665 - - DEX Imaging LLC - - 652 - Digestive and Liver Center of Florida - - 3,500 - DoctorFare, INC - - 11,923 - Doctors Clinical Laboratory Services Inc - - 42 - Donnelley Financial, LLC - - 1,258 - Dr. Pipe Plumbing Contractor Inc. - - 5,004 - Duke Energy - - 2,423 - Eight to Eighty Eyewear - - 88 - Electricopy International Inc - - 193 - , DPM - - 5,200 - Emilio’s BBQ Catering Services Corp - - 12,388 - DO PL - - 24,000 - EPC Consultants LLC - 2,538 - - EverBank Commercial Finance - - 17,875 - FactSet Research Systems Inc. - - 1,300 - FedEx - - 886 - Flagler West Corporate Center, LLC - - 34,852 - Florida Fire Alarm, Inc - - 300 - Florida Medical Management Partners, Inc - - 5,900 - Florida Pest Control - - 69 - Florida Pure Water Systems, LLC - - 492 - Florida School Bus Infraction Detection Enforcement - - 225 - Foot And Ankle Network, Inc. - - 25,000 - Foster Ave. LLC - - 14,058 - FPL - - 15,027 - - - 300 - - - 22,000 - Frontier - - 367 - FVP HH Medical Office LLC - - 33,320 - FVP RE Ocala 3200 LLC - - 41,187 - Galileo Optical Laboratory - - 10,535 - Garan Enterprises Inc - - 115 - Gastro Health, LLC - - 58,000 - - - 24,000 - GFL Enviromental - - 67 - Gold Coast Maintenance, Inc - - 10,920 - Goodwin Procter LLP - - 3,410 - - - 12,000 - Harmony Sound Music Services LLC - - 7,200 - Harvest International Investments LLC - - 17,582 - HCBA LLC - - 1,925 - Health Catalyst, Inc. - - 238,965 - Health Promotions LLC - - 5,600 - Healthnut Nutrition & Wellness Consultant PA - - 870 - Higher Focus Media , LLC - - 30,362 - Image First Healthcare Laundry Specialist - - 4,433 - Inventurus Knowledge Solution Inc - - 19,085 - Iron Mountain - - 983 - Israel Family 3401 Deer Creek LLC - - 60,667 - Ivanis Forteza Landscaping Inc - - 540 - J & C Property Management - - 374 - - 960 - - JC Auto Services II, INC. - - 52,018 - JL Psych Services - - 10,000 - JSB Realty NO 3 LLC - - 57,677 - - - 1,000 - MD PA - - 14,800 - KG Family - - 200 - Kimco Delaware Inc - - 6,348 - Kissimmee Utility Authority Dept 96 - - 1,710 - Kold Steel Inc d/ba Sound Imaging Services - - 14,460 - KRM Radiology PA - - 442 - Laboratory Corporation of America Holdings - - 100 - , PLLC - - 16,800 - Las Mias Medical Center Inc - - 2,880 - - - 2,534 -Case 24-80093-mvl11 Doc 576-4 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 4 Page 3 of 5

In re: Caremax, Inc. et al Exhibit - 4 Case No.: 24-80093 Reporting Period: 12/1/24 - 12/31/24

Leading Fitness LLC - - 740 - LEAF - - 815 - Leaseflorida FT.Pierce, LLC - - 25,796 - Liberty Software Inc. - 14,900 4,277 - Lower Extremity Care LLC - - 1,820 - Loza Pest Solutions - - 569 - - - 2,692 - LYFT, Inc - - 13,220 - MD PA - - 18,750 - - - 2,577 - - - 3,692 - Matheson Tri-Gas Inc. - - 763 - - - 3,080 - MB Mobile Repair - - 21,843 - McKesson Corporation - 1,706,369 1,637 - McKesson Medical Surgical - - 5,218 - MDFlow Systems - - 3,500 - Medallion - - 8 - Medical Electronics Inc - - 1,190 - Medical Health Services of South Florida - - 5,000 - Medical Waste Management - 90 3,345 - Memorial Healthcare System - - 8,519 - Mercedez-Benz Financial Serivces - - 992 - MetLife - - 1,706 - MetLife. - - 80,104 - Metropolitan Fire Equipment Inc - - 187 - Metropolitan Telecommunications- Mettel - - 145 - Miami Dade Water & Sewer Dept - - 449 - Miami-Dade Clerk of the Court - - 277 - Miami-Dade Fire Rescue Department - - 588 - - - 110 - - - 6,273 - - - 500 - myMDcareers - - 22,000 - Navitas Credit Corp - - 2,498 - Newclear Medical Service Inc - - 1,040 - nexAir,LLC - - 2,740 - NextGen Healthcare Inc - - 10,877 - - - 2,615 - - - 2,848 - Nova Healthcare Management - - 13,750 - Olymbec USA LLC - - 6,275 - OpusCare of South Florida - - 6,650 - Oracle Elevator Holdco Inc - - 81 - Original Impressions LLC - - 3,112 - ORKIN, LLC - - 124 - Orlando Utilities Commission - - 6,823 - Osha Medical Training, Inc - - 1,500 - Outpatient Psy Care, Inc - - 11,050 - Philips Medical Capital - - 1,424 - Pitney Bowes Bank Inc- Purchase Power - - 1,311 - Pitney Bowes Purchase Power - - 129 - Professional Parking Management Corp. - - 115 - Psych Me Health Services INC - - 13,600 - Pulmonary Physician of South Florida, LLC - - 24,600 - Quality Managed Health Care Inc - - 13,798 - Quench USA, Inc - - 113 - Quest Diagnostics - - 48 - Radiation Detection Company, Inc - - 762 - Radphysics Consultants Inc - - 400 - Ramswel, Inc - 639 20,123 - Republic Service #696 - - 384 - Rico Foods Company - - 320 - RingCentral Inc - - 147,847 - Roberto & Silvio Lawn Services Inc - - 1,248 - Roberts Oxygen Company Inc - - 97 - - - 4,890 - Ropes & Gray LLP - - 38,833 - - - 195 - Ross + Ross LLC - - 59,754 -Case 24-80093-mvl11 Doc 576-4 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 4 Page 4 of 5

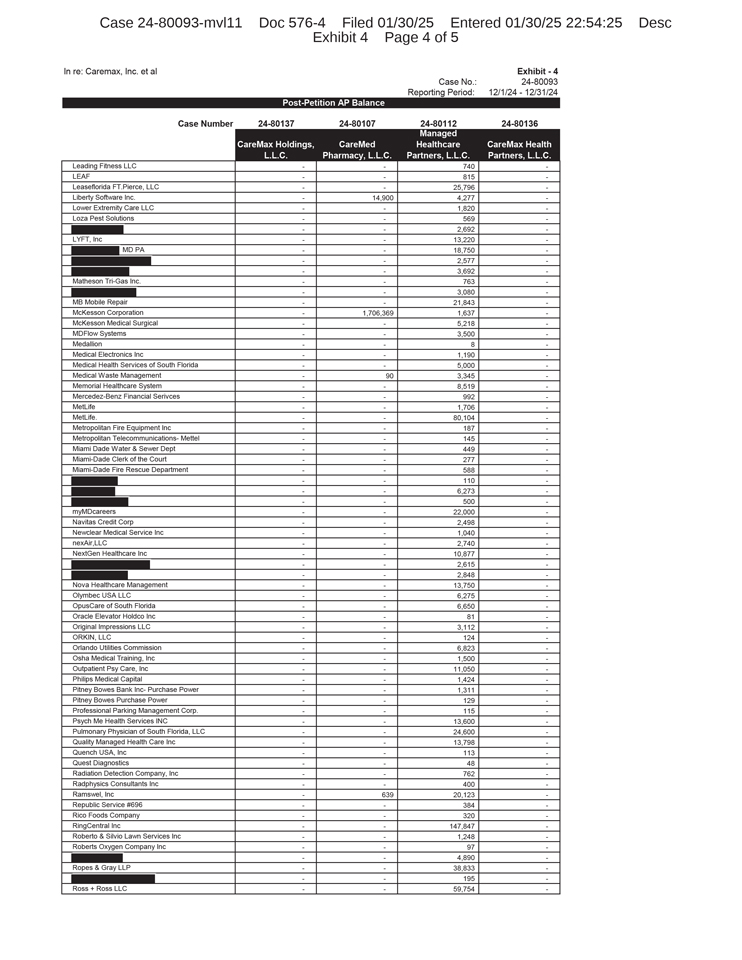

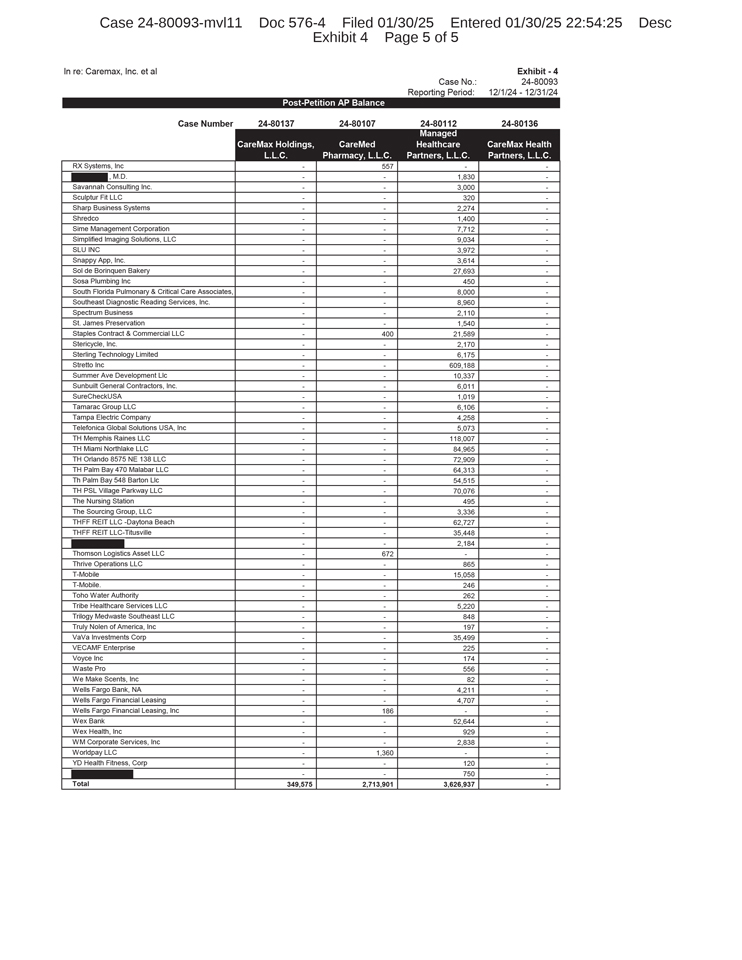

In re: Caremax, Inc. et al Exhibit - 4 Case No.: 24-80093 Reporting Period: 12/1/24 - 12/31/24

RX Systems, Inc - 557 - - , M.D. - - 1,830 - Savannah Consulting Inc. - - 3,000 - Sculptur Fit LLC - - 320 - Sharp Business Systems - - 2,274 - Shredco - - 1,400 - Sime Management Corporation - - 7,712 - Simplified Imaging Solutions, LLC - - 9,034 - SLU INC - - 3,972 - Snappy App, Inc. - - 3,614 - Sol de Borinquen Bakery - - 27,693 - Sosa Plumbing Inc - - 450 - South Florida Pulmonary & Critical Care Associates, - - 8,000 - Southeast Diagnostic Reading Services, Inc. - - 8,960 - Spectrum Business - - 2,110 - St. James Preservation - - 1,540 - Staples Contract & Commercial LLC - 400 21,589 - Stericycle, Inc. - - 2,170 - Sterling Technology Limited - - 6,175 - Stretto Inc - - 609,188 - Summer Ave Development Llc - - 10,337 - Sunbuilt General Contractors, Inc. - - 6,011 - SureCheckUSA - - 1,019 - Tamarac Group LLC - - 6,106 - Tampa Electric Company - - 4,258 - Telefonica Global Solutions USA, Inc - - 5,073 - TH Memphis Raines LLC - - 118,007 - TH Miami Northlake LLC - - 84,965 - TH Orlando 8575 NE 138 LLC - - 72,909 - TH Palm Bay 470 Malabar LLC - - 64,313 - Th Palm Bay 548 Barton Llc - - 54,515 - TH PSL Village Parkway LLC - - 70,076 - The Nursing Station - - 495 - The Sourcing Group, LLC - - 3,336 - THFF REIT LLC -Daytona Beach - - 62,727 - THFF REIT LLC-Titusville - - 35,448 - - - 2,184 - Thomson Logistics Asset LLC - 672 - - Thrive Operations LLC - - 865 - T-Mobile - - 15,058 - T-Mobile. - - 246 - Toho Water Authority - - 262 - Tribe Healthcare Services LLC - - 5,220 - Trilogy Medwaste Southeast LLC - - 848 - Truly Nolen of America, Inc - - 197 - VaVa Investments Corp - - 35,499 - VECAMF Enterprise - - 225 - Voyce Inc - - 174 - Waste Pro - - 556 - We Make Scents, Inc - - 82 - Wells Fargo Bank, NA - - 4,211 - Wells Fargo Financial Leasing - - 4,707 - Wells Fargo Financial Leasing, Inc - 186 - - Wex Bank - - 52,644 - Wex Health, Inc - - 929 - WM Corporate Services, Inc - - 2,838 - Worldpay LLC - 1,360 - - YD Health Fitness, Corp - - 120 - - - 750 - Total 349,575 2,713,901 3,626,937 -Case 24-80093-mvl11 Doc 576-4 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 4 Page 5 of 5

In re: Caremax, Inc. et al Exhibit - 4 Case No.: 24-80093 Reporting Period: 12/1/24 - 12/31/24

Post-Petition AP Balance

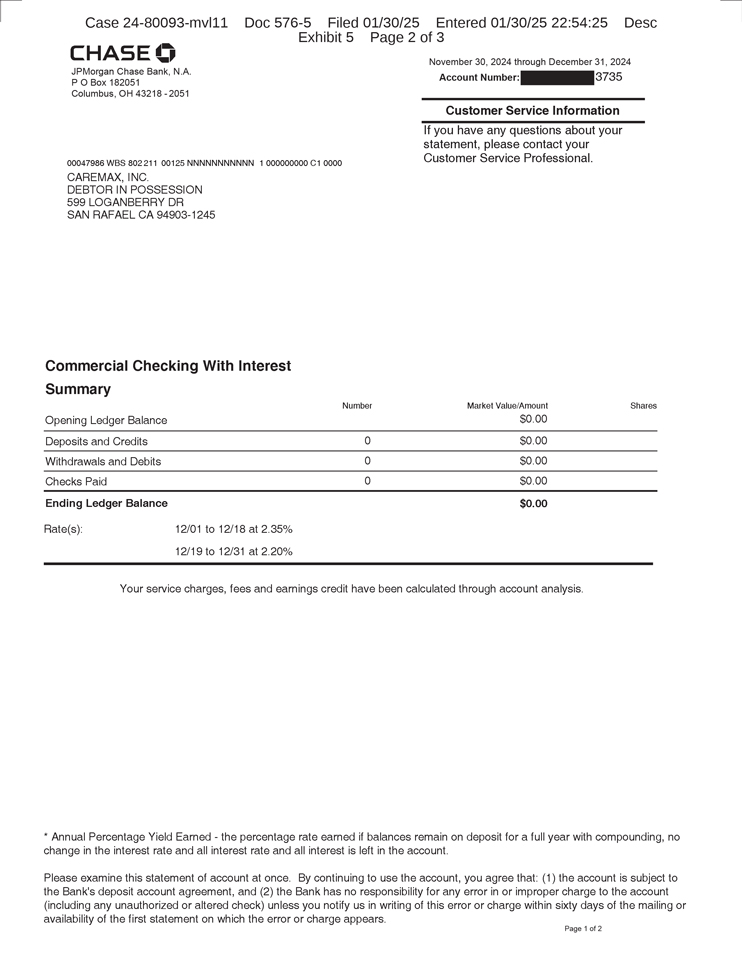

Case 24-80093-mvl11 Doc 576-5 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc Exhibit 5 Page 1 of 3

Exhibit _5 Bank statements

Case 24-80093-mvl11 Doc 576-5 Filed 01/30/25 Entered 01/30/25 22:54:25 Desc

Exhibit 5 Page 2 of 3

CHASE O

JPMorgan Chase Bank, N.A.

PO Box 182061

Columbus, OH 43218-2051

November 30, 2024 through December 31, 2004

Account Number:

3735

0004790G WIS 00221100125 WN!00000000000000

CAREMAX, INC

DEBTOR IN POSSESSION

599 LOGANBERRY DR

SAN RAFAEL CA 94903-1245

Customer Service Information

if you have any questions about your

statement, please contact your

Customer Service Professional

Commercial Checking With Interest

Summary

Opening Ledger Balance

Deposts and Credits

Withdrawals and Debits

Chocks Paid

Ending Ledger Balance

Rate(s)

12/01 to 12/18 at 2.36%

12/19 to 12/31 at 2.20%

Numb

MVA

$0.00

50 00

$0.00

50.00

50.00

Your service charges, fees and earnings credit have been calculated through account analysis

Share

*Annual Percentage YieldEaned the percentage rate caned balances remain on deposit for a full year with compounding, no

change in the interest rate and all interest rate and all interest is left in the account

Please examine this statement of account at once By continuing to use the account, you agree that (1) the account is subject to

the Bank’s deposit accourt agreement, and (2) the Bank has no responsibility for any error in or improper charge to the account

(including any unauthorized or atered check) unless you not by us in witing of this or or charge within sixty days of the mailingor

availability of the first statement on which the enor or charge appears

Page 12

Case 24-80093-mvl11 Doc 576-5 Filed 01/30/25Entered 01/30/25 22:54:25DescExhibit 5 Page 3 of 3Th s Page Intent ona y Left B ankPage 2 of 2