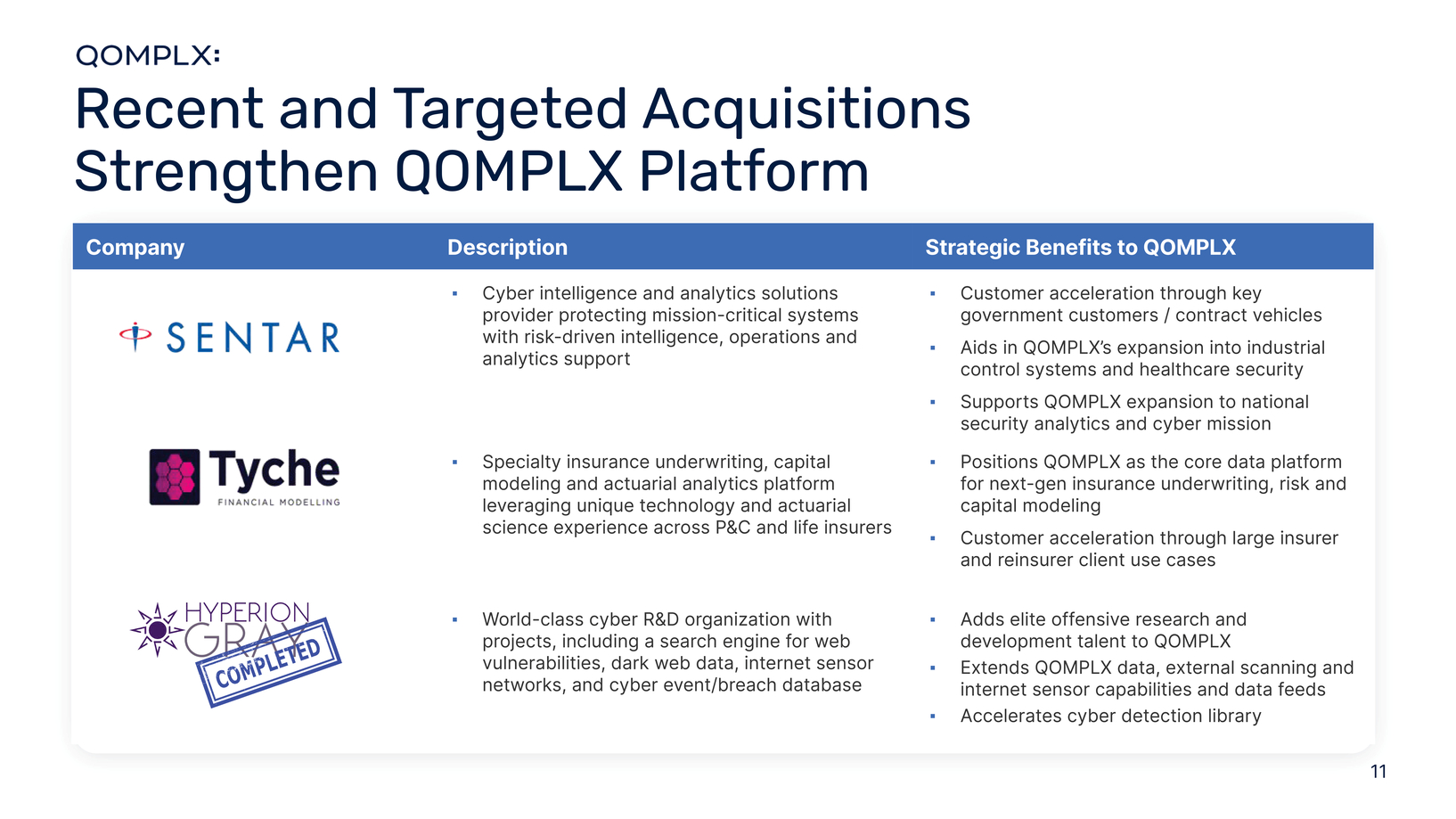

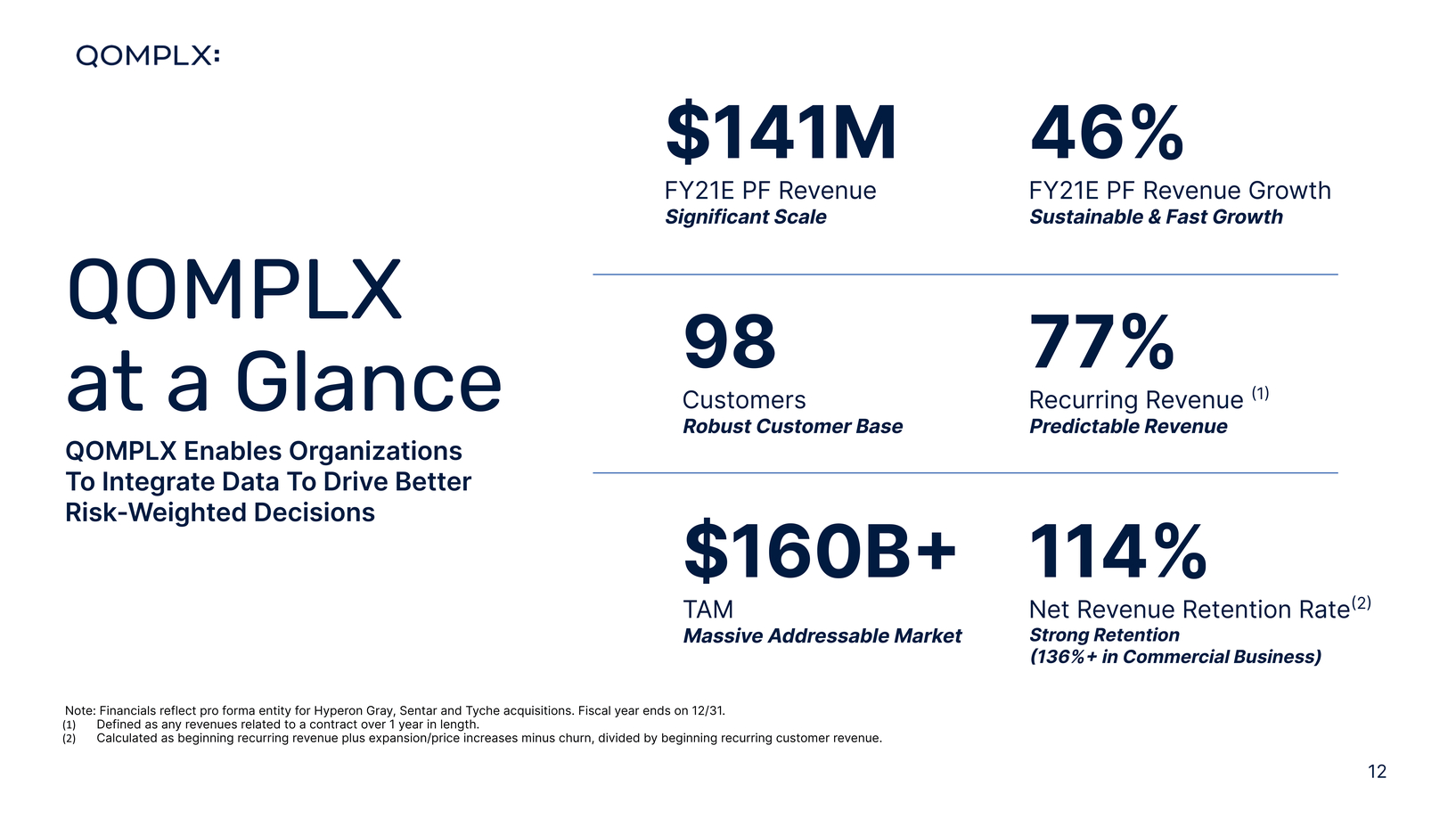

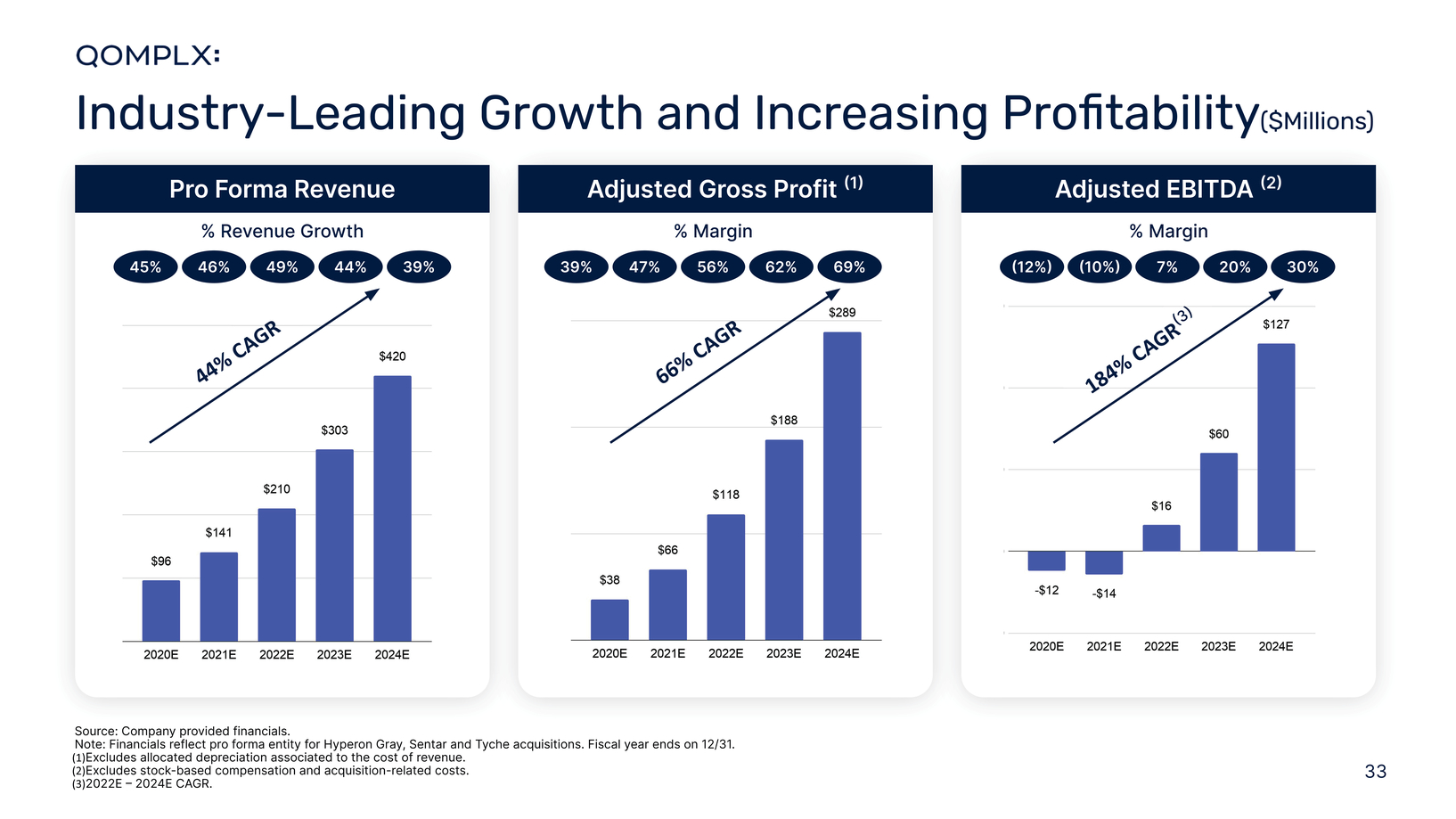

| Disclaimer This investor presentation (this “Presentation”) is for informational purposes only to assist interested parties in making their own evaluation with respect to the proposed business combination (the “Business Combination”) between Tailwind Acquisition Corp. (“Tailwind”) and QOMPLX, Inc. (the “Company”). The information contained herein does not purport to be all-inclusive and none of Tailwind, the Company or their respective affiliates or representatives makes any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. This Presentation does not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination or (ii) an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any security of Tailwind, the Company, or any of their respective affiliates. You should not construe the contents of this Presentation as legal, tax, accounting or investment advice or a recommendation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information contained herein to make any decision. The distribution of this Presentation may also be restricted by law and persons into whose possession this Presentation comes should inform themselves about and observe any such restrictions. The recipient acknowledges that it is (a) aware that the United States securities laws prohibit any person who has material, non-public information concerning a company from purchasing or selling securities of such company or from communicating such information to any other person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities, and (b) familiar with the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder (collectively, the "Exchange Act"), and that the recipient will neither use, nor cause any third party to use, this Presentation or any information contained herein in contravention of the Exchange Act, including, without limitation, Rule 10b-5 thereunder. This Presentation and information contained herein constitutes confidential information and is provided to you on the condition that you agree that you will hold it in strict confidence and not reproduce, disclose, forward or distribute it in whole or in part without the prior written consent of Tailwind and the Company and is intended for the recipient hereof only. Forward-Looking Statements Certain statements in this Presentation may be considered forward-looking statements. Forward-looking statements generally relate to future events or Tailwind’s or the Company’s future financial or operating performance. For example, projections of future Adjusted EBITDA, Adjusted Gross Profit and other metrics are forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expect”, “intend”, “will”, “estimate”, “anticipate”, “believe”, “predict”, “potential” or “continue”, or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by Tailwind and its management, and the Company and its management, as the case may be, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to: (1 the occurrence of any event, change or other circumstances that could give rise to the termination of negotiations and any subsequent definitive agreements with respect to the Business Combination; 2 the outcome of any legal proceedings that may be instituted against Tailwind, the combined company or others following the announcement of the Business Combination and any definitive agreements with respect thereto; 3 the inability to complete the Business Combination due to the failure to obtain approval of the shareholders of Tailwind, to obtain financing to complete the Business Combination or to satisfy other conditions to closing; 4 changes to the proposed structure of the Business Combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the Business Combination; 5 the ability to meet stock exchange listing standards following the consummation of the Business Combination; 6 the risk that the Business Combination disrupts current plans and operations of the Company as a result of the announcement and consummation of the Business Combination; 7 the ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees; 8 costs related to the Business Combination; 9 changes in applicable laws or regulations; 10 the possibility that the Company or the combined company may be adversely affected by other economic, business, and/or competitive factors; 11 the inability of the Company to execute and complete the acquisitions of Sentar and Tyche and realize the expected benefits of those acquisitions within the time periods expected for any reason; 12 inaccuracies for any reason in the estimates of expenses and profitability and projected financial information for the Company, Hyperion Gray, Sentar and Tyche; and 13 other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in Tailwind’s final prospectus relating to its initial public offering dated September 3, 2020. Nothing in this Presentation should be regarded as a representation by any person that the forward-looking statements set forth herein will be achieved or that any of the contemplated results of such forward-looking statements will be achieved. You should not place undue reliance on forward-looking statements, which speak only as of the date they are made. Neither Tailwind nor the Company undertakes any duty to update these forward-looking statements. Non-GAAP Financial Measures This Presentation includes certain financial measures not presented in accordance with generally accepted accounting principles (“GAAP”) including, but not limited to, Adjusted EBITDA and Adjusted Gross Profit. These non-GAAP financial measures are not measures of financial performance in accordance with GAAP and may exclude items that are significant in understanding and assessing the Company’s financial results. Therefore, these measures should not be considered in isolation or as an alternative to net income, cash flows from operations or other measures of profitability, liquidity or performance under GAAP. You should be aware that the Company’s presentation of these measures may not be comparable to similarly-titled measures used by other companies. 1 |