CERTAIN RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

The following is a description of transactions since June 2, 2020 (inception), to which we have been a participant in which the amount involved, exceeded or will exceed $120,000, and in which any of our directors, executive officers or holders of more than 5% of our capital stock, or any members of their immediate family, had or will have a direct or indirect material interest, other than compensation arrangements which are described under “Executive Officer and Director Compensation.”

Initial Public Offering of Holicity

On August 7, 2020, Holicity consummated its initial public offering of 27,500,000 units. Additionally, Holicity granted the underwriters a 45-day option from the date of the final prospectus relating to the initial public offering to purchase up to 4,125,000 additional units to cover over-allotments, if any, at the initial public offering price, less underwriting discounts and commissions. On August 11, 2020, the underwriters purchased 2,500,000 over-allotment units pursuant to the partial exercise of the Over-Allotment Option. The underwriters did not exercise the remaining portion of their Over-Allotment Option.

Each unit consists of one share of Class A common stock and one-third of one redeemable warrant. Each whole warrant entitles the holder thereof to purchase one share of Class A common stock for $11.50 per share, subject to adjustment. The units were sold at an offering price of $10.00 per unit, generating gross proceeds, before expenses, of $300,000,000. On June 4, 2020, Pendrell Corporation (“Pendrell”) purchased an aggregate of 7,187,500 Founder Shares in exchange for payment of certain offering costs of $25,000, or approximately $0.003 per share. Pendrell transferred such shares to the Sponsor on June 9, 2020. In July 2020, the Sponsor transferred 30,000 Founder Shares to the independent director nominees of Holicity, 150,000 shares to Craig O. McCaw, 100,000 shares to Randy Russell, 80,000 shares to R. Gerard Salemme, 40,000 shares to Steve Ednie and 239,000 to other directors, officers, employees and consultants of Pendrell, in each case for approximately the same per-share price initially paid by our sponsor, resulting in the Sponsor holding 6,488,500 Founder Shares. On August 4, 2020, Holicity effectuated a 1.1-for-1 Class B common stock split resulting in an aggregate of 7,906,250 Founder Shares outstanding. As a result, the Initial Stockholders forfeited 406,250 shares, resulting in the Initial Stockholders holding an aggregate of 7,500,000 shares of Class B common stock, of which 6,731,100 are held by the Sponsor. The shares forfeited by the Initial Stockholders were cancelled by Holicity.

Our Sponsor purchased an aggregate of 5,333,333 Private Placement Warrants in connection with Holicity’s Initial Public Offering and the sale of the over-allotment units, at a price of $1.50 per Private Placement Warrant, or $8,000,000 in the aggregate. Each Private Placement Warrant entitles the holder to purchase one share of Class A common stock at $11.50 per share. The Private Placement Warrants (including the Class A common stock issuable upon exercise of the Private Placement Warrants) may not, subject to certain limited exceptions, be transferred, assigned or sold until 30 days after the completion of the Business Combination.

Holicity’s officers and directors were entitled to reimbursement for any out-of-pocket expenses incurred in connection with activities on Holicity’s behalf such as identifying potential target businesses and performing due diligence on suitable business combinations. Holicity’s audit committee reviewed on a quarterly basis all payments that were made to our Sponsor, Holicity’s officers, directors or its or their affiliates.

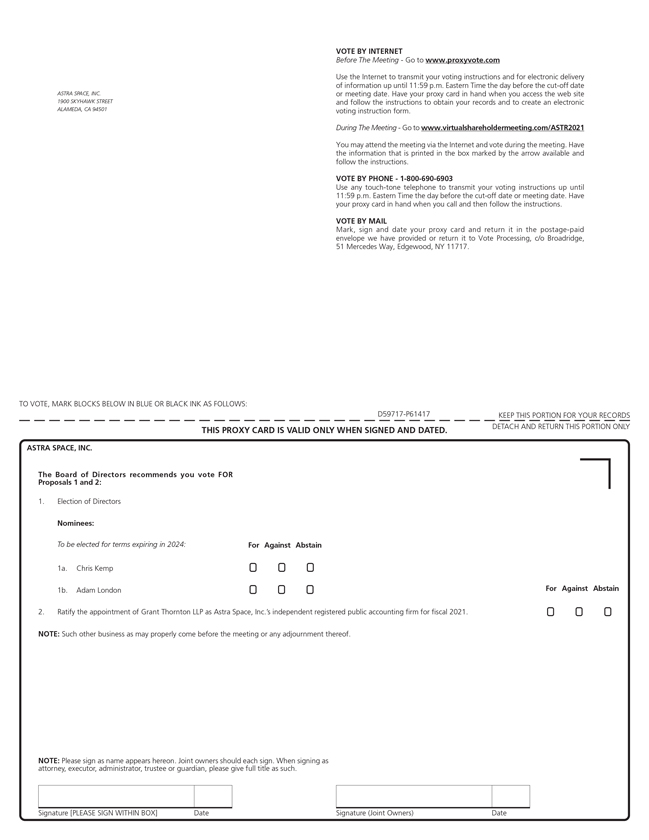

Exchange with Co-Founders and Executive Officers

To facilitate the delivery of Astra Class B common stock by Mr. Kemp and Dr. London, Astra entered into an exchange agreement with Mr. Kemp and Dr. London, effective as of immediately prior to the consummation of the Business Combination, pursuant to which each share of Astra Class A common stock held by Mr. Kemp and Dr. London was automatically exchanged for one share of Astra Class B common stock such that as of immediately following the completion of the Business Combination, Mr. Kemp and Dr. London collectively held approximately 75% of the voting power of the capital stock of the Company on a fully-diluted basis.

26