Filed Pursuant to Rule (424)(b)(3)

Registration No. 333-257930

PROSPECTUS SUPPLEMENT NO. 5

(to Prospectus dated July 14, 2022)

ASTRA SPACE, INC.

Primary Offering Of

15,333,303 Shares of Class A Common Stock

Secondary Offering of

189,026,575 Shares of Class A Common Stock

This prospectus supplement amends and supplements the prospectus dated July 14, 2022 (as supplemented or amended from time to time, the “Prospectus”), which forms a part of our Registration Statement on Form S-1 (No. 333-257930). This prospectus supplement is being filed to update and supplement the information in the Prospectus with the information contained in our Current Report on Form 8-K, filed with the Securities and Exchange Commission on August 4, 2022 (the “Current Report”). Accordingly, we have attached the Current Report to this prospectus supplement.

The Prospectus and this prospectus supplement also relate to the offer and sale, from time to time, by the selling securityholders named in this prospectus (the “Selling Securityholders”), or any of their permitted transferees, of (i) up to an aggregate of 20,000,000 shares of our Class A common stock that were issued to certain investors (collectively, the “PIPE Investors”) in a private placement in connection with the closing of the Business Combination (as defined herein); (ii) 7,500,000 shares of Class A common stock issued to the Sponsor prior to Holicity’s initial public offering and registered for sale by the Selling Securityholders; (iii) up to an aggregate of 92,277,793 shares of Class A common stock that were issued to certain affiliates of Astra (collectively, the “Astra Affiliates”) pursuant to the Business Combination Agreement (as defined herein); (iv) up to an aggregate 56,239,188 shares of Class A common stock issuable upon conversion (on a one-for-one basis) of shares of our Class B common stock, par value $0.0001 per share (“Class B Common Stock”) held by certain Selling Securityholders and (v) up to an aggregate of 7,676,261 shares of our Class A common stock issued in connection with our acquisition of Apollo Fusion, Inc. (“Apollo Fusion”), which closed on July 1, 2021 comprised of (x) 2,558,744 shares of our Class A common stock (the “Initial Apollo Shares”) issued to certain of the Selling Securityholders on July 1, 2021, in connection with our merger with Apollo Fusion, Inc. (“Apollo Fusion”) and (y) 5,117,517 additional shares of our Class A common stock (the “Additional Apollo Shares”) which may be issued to certain of the Selling Securityholders assuming (a) the achievement of all remaining performance milestones set forth in the Apollo Fusion Merger Agreement (as defined herein), (b) we elect to pay all future milestone consideration in shares of our Class A common stock as required by the terms the Apollo Fusion Merger Agreement, and (c) the per share price used to calculate the number of shares of our Class A common stock to be issued is $11.7243, which is the same per share price used to calculate the number of Initial Shares issued to the Selling Securityholders. The Additional Shares have not been earned and are not currently outstanding. The actual number of Additional Shares issued to the selling stockholders could be materially greater or less than 5,117,517 shares of Class A common stock depending whether and to what extent the future performance milestones are met and/or the actual average closing price of our Class A common stock at the time such milestones are achieved. The Prospectus and this prospectus supplement also cover any additional securities that may become issuable by reason of share splits, share dividends or other similar transactions.

Our Class A common stock is listed on Nasdaq under the symbol “ASTR”. On August 2, 2022, the closing price of our Class A common stock was $1.55 per share.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement.

Investing in our securities involves risks that are described in the “Risk Factors” section beginning on page 13 of the Prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the securities to be issued under the Prospectus or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is August 4, 2022.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 4, 2022

Astra Space, Inc.

(Exact name of Registrant as Specified in Its Charter)

| | | | |

| Delaware | | 001-39426 | | 85-1270303 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| |

1900 Skyhawk Street Alameda, California | | 94501 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (866) 278-7217

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 per share | | ASTR | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 4, 2022, Astra Space, Inc. (the “Company”) issued a press release announcing its financial results for the second quarter ended June 30, 2022.

A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02 of this Current Report, including the accompanying Exhibit 99.1, shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

Also, on August 4, 2022, the Company made a presentation available on our website: www.astra.com. This presentation is intended to accompany our earnings call to be held on August 4, 2022, at 4:30 p.m. eastern time, and to assist in understanding information that the Company will discuss on this call. A copy of this presentation is furnished as Exhibit 99.2 and is incorporated herein by reference.

The information in this Item 7.01 of this Current Report, including the accompanying Exhibit 99.2, shall be deemed “furnished” and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of such section, nor shall it be incorporated by reference in any filing made by the Company pursuant to the Securities Act of 1933, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except to the extent that such filing incorporates by reference any or all of such information by express reference thereto.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | |

Exhibit

No. | | Description |

| |

| 99.1 | | Press release issued by Astra Space, Inc. dated August 4, 2022 |

| |

| 99.2 | | Earnings presentation dated August 4, 2022 |

| |

| 104 | | Cover Page Interactive Data File (embedded with the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | |

| Date: August 4, 2022 | | | | Astra Space, Inc. |

| | | |

| | | | By: | | /s/ Kelyn Brannon |

| | | | Name: | | Kelyn Brannon |

| | | | Title: | | Chief Financial Officer |

Exhibit 99.1

Astra Announces Second Quarter 2022 Financial Results

ALAMEDA, California —August 4, 2022—Astra Space, Inc. (“Astra”) (Nasdaq: ASTR) today announced financial results for its second quarter ended June 30, 2022.

Astra announces that after two of its four Rocket 3.3 flights were successful, the Company will transition to the next version of its launch system and is working with customers to re-manifest all payloads onto the new launch system, designed for higher capacity, reliability, and production rate.

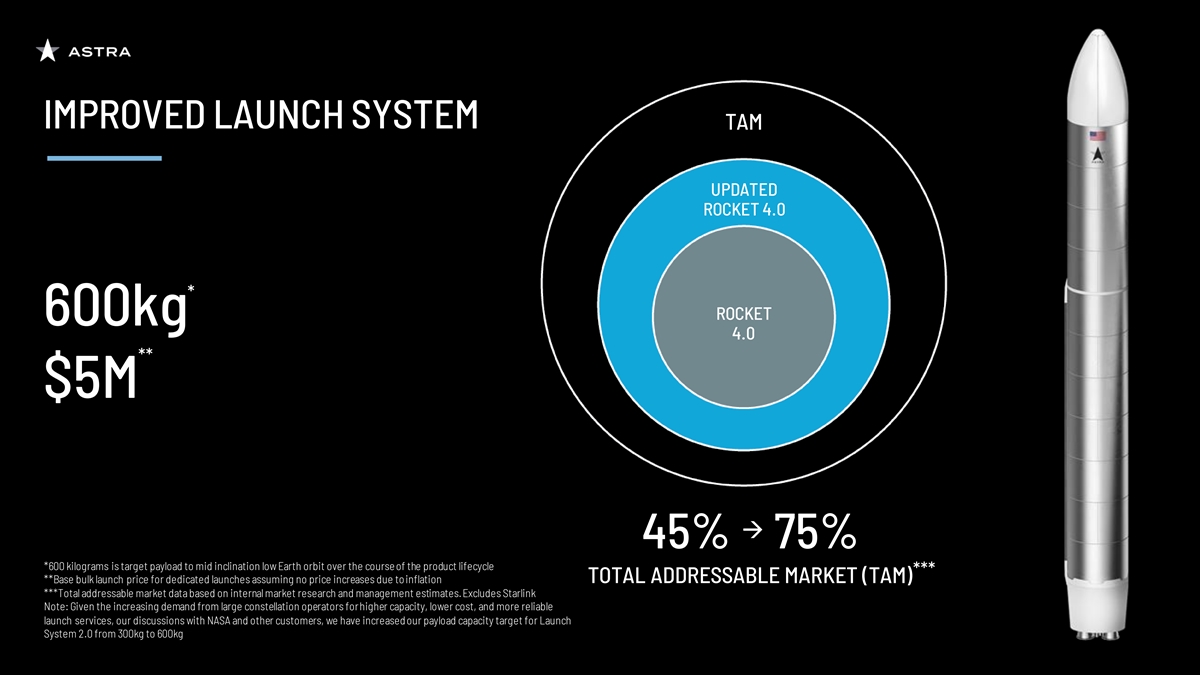

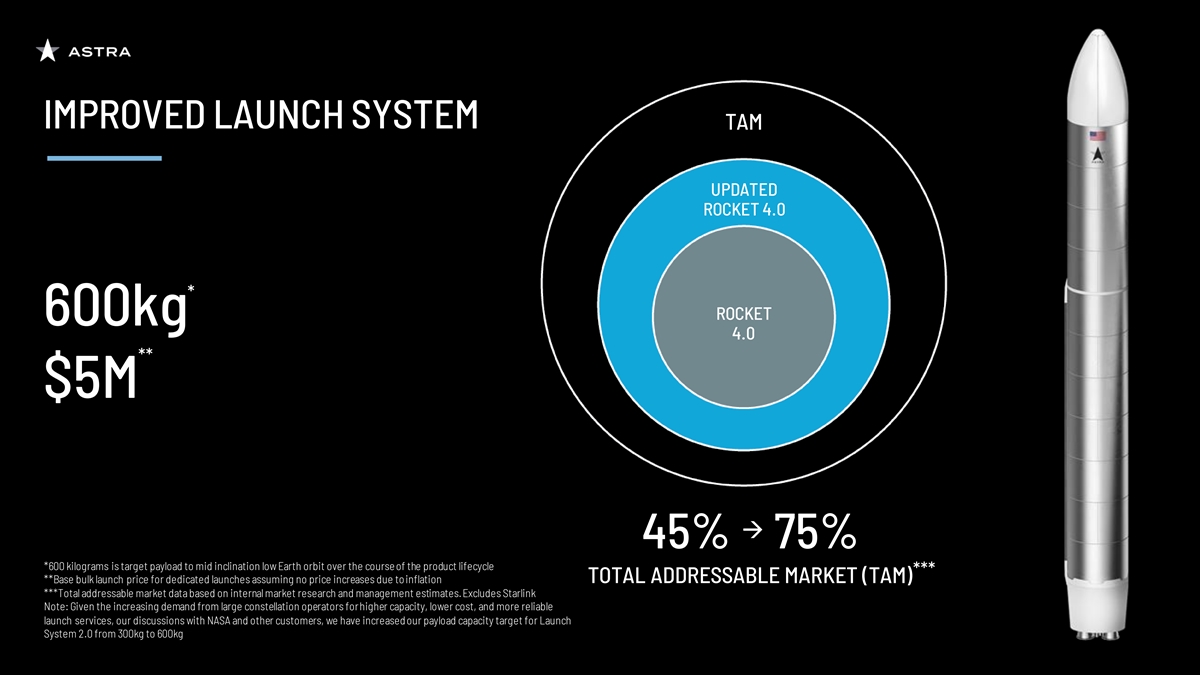

“We have increased the design point of our new launch system to deliver up to 600-kilogram satellites to mid-inclination low Earth orbit over the course of the product lifecycle, which we believe will allow us to service over 75% of the small satellite market, including many of the new mega-constellations,” said Chris Kemp, Astra Co-Founder, Chairman, and CEO.

Astra announced that the base bulk launch price for dedicated launches is expected to remain under five million dollars.

“We have made substantial changes to our operating plan to concentrate and focus our investments on the development and introduction of the upgraded version of our launch system and the increased production of the Astra Spacecraft Engine™,” said CFO, Kelyn Brannon. “Furthermore, the $100 million Committed Equity Facility with B. Riley Principal Capital provides improved financial flexibility as we execute on these objectives.”

Recent Business Highlights

| | • | | Updated, streamlined plan to invest in delivering higher reliability, higher capacity 600kg Launch System 2.0 to market. |

| | • | | Commenced customer deliveries of the Astra Spacecraft Engine™, with total committed orders since July 1, 2021, up 69% over Q1 2022. This includes committed orders for 14 units acquired with the Apollo Fusion acquisition. |

| | • | | Began investing in new production facility to support increased demand for the Astra Spacecraft Engine™. |

| | • | | Held first inaugural Spacetech Day for investors and analysts. |

Second Quarter 2022 Financial Highlights:

For the three months ended June 30, 2022:

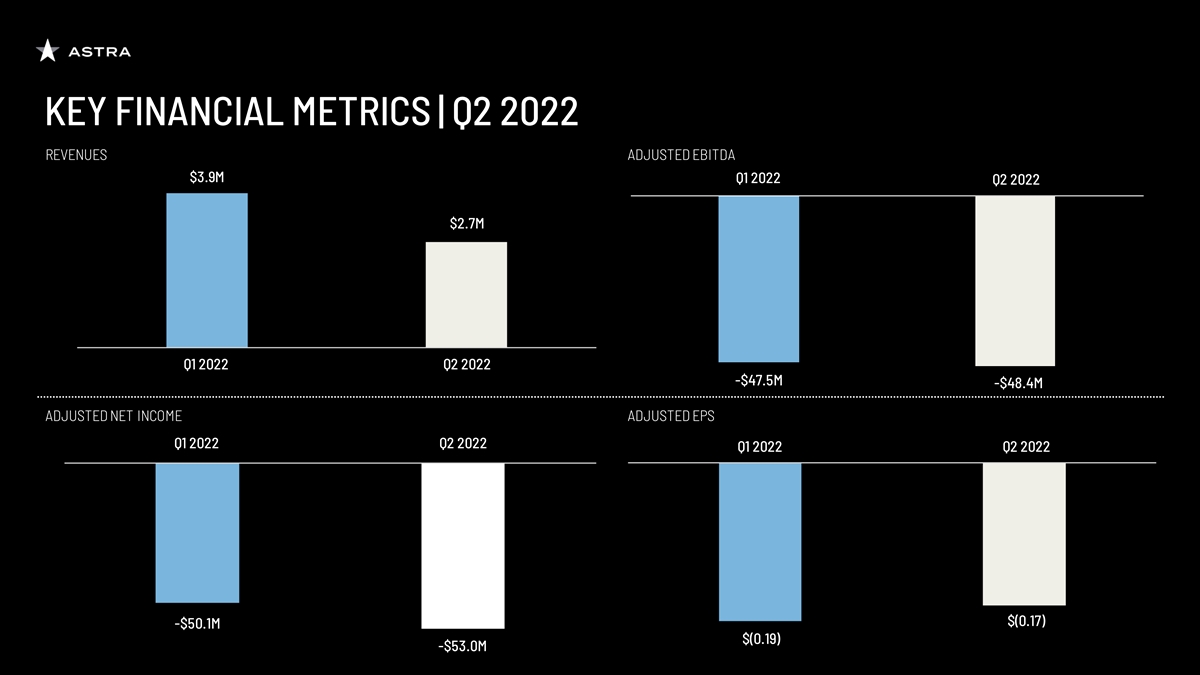

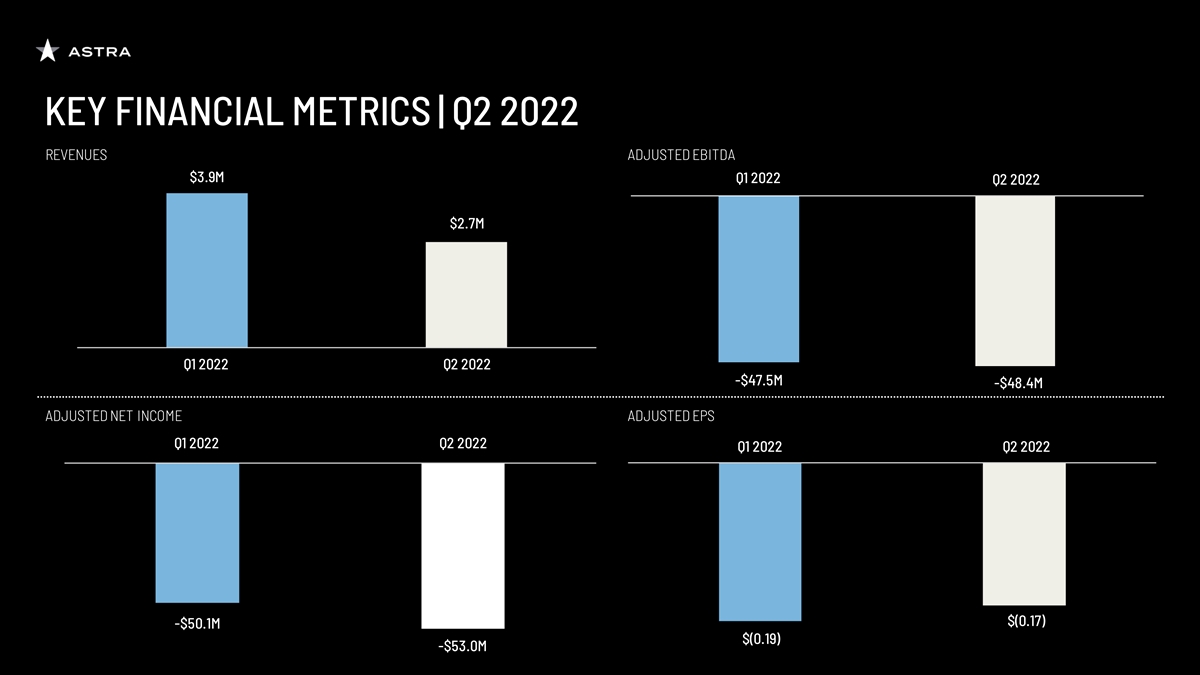

| | • | | GAAP Gross Loss was $14.8 million. |

| | • | | Adjusted Gross Loss* was $2.4 million. |

| | • | | GAAP Net Loss was $82.3 million. |

| | • | | Adjusted Net Loss* was $53.0 million. |

| | • | | Adjusted EBITDA Loss* of $48.4 million. |

| | • | | Capital expenditures during the quarter totaled $12.9 million. |

| | • | | Cash and cash equivalents and marketable securities totaled $200.7 million. |

| * | Denotes Non-GAAP financial measure. Refer to “Explanation of Adjusted (or Non-GAAP) Financial Measures” later in this press release for reconciliation of GAAP to Non-GAAP financial measures. |

Third Quarter 2022 Outlook

As of August 4, 2022, we are providing guidance for the third quarter 2022 based on current market conditions and expectations and given the dedication of our launch resources to the development of Launch System 2.0. We emphasize that the guidance is subject to various important cautionary factors referenced in the section entitled “Forward-Looking Statements” below and our annual report on Form 10-K for the year ended December 31, 2021, including risks and uncertainties associated with the ongoing COVID-19 pandemic as well as the Russia, Ukraine conflict and their potential impact on our business.

For the third quarter ending September 30, 2022, we currently expect:

| | • | | Adjusted EBITDA Loss* between $45.0 million and $51.0 million. |

| | • | | Depreciation and Amortization between $5.5 million and $6.5 million. |

| | • | | Stock-based compensation between $12.0 million and $15.0 million. |

| | • | | Cash income taxes of approximately zero. |

| | • | | Basic shares outstanding between 266.0 million and 270.0 million. |

| | • | | Capital expenditures between $6.0 million and $8.0 million. |

| * | Denotes Non-GAAP financial measure. Refer to “Explanation of Adjusted (or Non-GAAP) Financial Measures” later in this press release for reconciliation of GAAP to Non-GAAP financial measures. |

Conference Call Information

In conjunction with this announcement, Astra will host a conference call for investors at 1:30 p.m. PT (4:30 p.m. ET) today to discuss second quarter results and our outlook for the third quarter ending September 30, 2022. The live webcast and a replay of the webcast will be available on the Investor Relations section of Astra’s website: https://investor.astra.com/news-and-events/events-and-presentations

About Astra Space, Inc.

Astra’s mission is to improve life on Earth from space by creating a healthier and more connected planet. Today, Astra offers one of the lowest cost-per-launch dedicated orbital launch services of any operational launch provider in the world, and one of the industry’s first flight-proven electric propulsion systems for satellites, Astra Spacecraft EngineTM. Astra delivered its first commercial launch to low Earth orbit in 2021, making it the fastest company in history to reach this milestone, just five years after it was founded in 2016. Astra (NASDAQ: ASTR) was the first space launch company to be publicly traded on Nasdaq. Visit astra.com to learn more about Astra.

Forward Looking Statements

Certain statements made in this press release are “forward-looking statements”. Forward-looking statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements reflect the current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from Astra’s expectations or projections, including the following factors, among others: (i) the failure to meet projected development and launch targets, including as a result of the decisions of governmental authorities or other third parties not within our control, weather and other suboptimal conditions that may it difficult to perform a launch attempt, as well as those driven by the

dedication of our launch resources to the development of Launch System 2.0; (ii) changes in applicable laws or regulations; (iii) the ability of Astra to meet its financial and strategic goals, due to, among other things, competition; (iv) the ability of Astra to pursue a growth strategy and manage growth profitability; (v) the possibility that Astra may be adversely affected by other economic, business, and/or competitive factors; (vi) the effect of the COVID-19 pandemic on Astra, (vii) the ability to manage its cash outflows during its business operations and (vii) other risks and uncertainties described herein, as well as those risks and uncertainties discussed from time to time in other reports and other public filings with the Securities and Exchange Commission by Astra.

Explanation of Non-GAAP (or Adjusted) Financial Measures

This press release includes information about Free Cash Flow, Adjusted Gross Loss, Adjusted Net Loss and Adjusted EBITDA (collectively the “non-GAAP financial measures”), all of which are non-GAAP financial measures. These non-GAAP financial measures are measurements of financial performance that are not prepared in accordance with U.S. generally accepted accounting principles and computational methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with Astra’s condensed consolidated financial statements prepared in accordance with GAAP. Non-GAAP financial measures are reconciled to their most comparable GAAP measures in the table set forth in this release.

We believe that both management and our investors benefit from referring to these non-GAAP financial measures in planning, forecasting and analyzing future periods. Specifically, our management uses these non-GAAP financial measures in planning, monitoring and evaluating our financial and operational decision making and as a means to evaluate period-to-period comparisons. Our management recognizes that the non-GAAP financial measures have inherent limitations because of the excluded items described below.

We believe that providing the non-GAAP financial measures, together with the reconciliation to GAAP measures, helps investors make comparisons between Astra and other companies in our industry. In making any comparisons to other companies in our industry, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules.

We define Free Cash Flow as cash used in operating activities including cash used for capital expenditures.

Adjusted Gross Loss differs from GAAP Gross Loss in that it excludes inventory and deferred launch cost write-downs related to discontinuance of production of our current version of launch system.

Adjusted Net Loss differs from GAAP Net Loss in that it excludes the following items: (a) stock-based compensation, (b) loss on change in fair value of contingent consideration, (c) cash earnout compensation cost related to the acquisition of Apollo Fusion, (d) inventory write-downs related to discontinuance of production of our current version of launch system, (e) deferred launch costs write-downs related to discontinuance of production of our current version of launch system, and (f) other special items. During the second quarter, other special items primarily related to amortization of licensed intellectual property and employee COVID-19 testing expenses.

We define Adjusted EBITDA as Adjusted Net Loss, excluding the following items: (a) interest expense and interest income, (b) income tax expense, (c) loss on marketable securities, and (d) depreciation and amortization. We are unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort.

Investor Contacts:

Andrew Hsiung, Astra

investors@astra.com

Media Contact:

Kati Dahm, Astra

kati@astra.com

Astra Space, Inc.

Condensed Consolidated Statement of Operations

(Unaudited, in thousands, except per share data)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Revenues | | $ | 2,682 | | | $ | — | | | $ | 6,593 | | | $ | — | |

Cost of revenues | | | 17,445 | | | | — | | | | 28,459 | | | | — | |

| | | | | | | | | | | | | | | | |

Gross Loss | | | (14,763 | ) | | | — | | | | (21,866 | ) | | | — | |

Operating expenses | | | | | | | | | | | | | | | | |

Research and development | | | 40,798 | | | | 10,458 | | | | 78,725 | | | | 22,435 | |

Sales and marketing | | | 4,636 | | | | 1,125 | | | | 9,400 | | | | 1,189 | |

General and administrative | | | 20,608 | | | | 18,318 | | | | 41,594 | | | | 30,931 | |

Loss on change in fair value of contingent consideration | | | 1,800 | | | | — | | | | 17,300 | | | | — | |

| | | | | | | | | | | | | | | | |

Total operating expenses | | | 67,842 | | | | 29,901 | | | | 147,019 | | | | 54,555 | |

| | | | | | | | | | | | | | | | |

Operating loss | | | (82,605 | ) | | | (29,901 | ) | | | (168,885 | ) | | | (54,555 | ) |

Interest income (expense), net | | | 356 | | | | (678 | ) | | | 530 | | | | (1,213 | ) |

Other income (expense), net | | | (54 | ) | | | (718 | ) | | | 339 | | | | (718 | ) |

Loss on extinguishment of convertible notes | | | — | | | | — | | | | — | | | | (133,783 | ) |

| | | | | | | | | | | | | | | | |

Loss before taxes | | | (82,303 | ) | | | (31,297 | ) | | | (168,016 | ) | | | (190,269 | ) |

Income tax (benefit) provision | | | — | | | | — | | | | — | | | | — | |

| | | | | | | | | | | | | | | | |

Net loss | | $ | (82,303 | ) | | $ | (31,297 | ) | | $ | (168,016 | ) | | $ | (190,269 | ) |

| | | | | | | | | | | | | | | | |

Adjustment to redemption value on Convertible Preferred Stock | | | — | | | | — | | | | — | | | | (1,011,726 | ) |

| | | | | | | | | | | | | | | | |

Net loss attributable to common stockholders | | $ | (82,303 | ) | | $ | (31,297 | ) | | $ | (168,016 | ) | | $ | (1,201,995 | ) |

| | | | | | | | | | | | | | | | |

Basic and diluted loss per share | | | | | | | | | | | | | | | | |

Weighted average basic and diluted shares - Class A | | | 209,022 | | | | 20,035 | | | | 208,570 | | | | 18,132 | |

Loss per share | | $ | (0.31 | ) | | $ | (0.47 | ) | | $ | (0.64 | ) | | $ | (18.52 | ) |

Weighted average basic and diluted shares - Class B | | | 55,539 | | | | 46,722 | | | | 55,539 | | | | 46,784 | |

Loss per share | | $ | (0.31 | ) | | $ | (0.47 | ) | | $ | (0.64 | ) | | $ | (18.52 | ) |

Astra Space, Inc.

Condensed Consolidated Balance Sheets

(Unaudited, in thousands)

| | | | | | | | |

| | | June 30,

2022 | | | December 31,

2021 | |

Assets: | | | | | | | | |

Cash and cash equivalents | | $ | 104,315 | | | $ | 325,007 | |

Marketable securities | | | 96,368 | | | | — | |

Trade accounts receivables | | | 3,447 | | | | 1,816 | |

Inventories | | | 3,155 | | | | 7,675 | |

Prepaid and other current assets | | | 3,931 | | | | 12,238 | |

| | | | | | | | |

Total current assets | | | 211,216 | | | | 346,736 | |

Property, plant and equipment, net | | | 88,223 | | | | 66,316 | |

Right-of-use asset | | | 8,601 | | | | 9,079 | |

Goodwill | | | 58,251 | | | | 58,251 | |

Intangible assets, net | | | 16,292 | | | | 17,921 | |

Other non-current assets | | | 3,114 | | | | 721 | |

| | | | | | | | |

Total assets | | $ | 385,697 | | | $ | 499,024 | |

| | | | | | | | |

Liabilities and Stockholders’ Equity: | | | | | | | | |

Accounts payable | | $ | 14,331 | | | $ | 9,122 | |

Operating lease obligation, current portion | | | 1,759 | | | | 1,704 | |

Accrued expenses and other current liabilities | | | 45,182 | | | | 29,899 | |

| | | | | | | | |

Total current liabilities | | | 61,272 | | | | 40,725 | |

Operating lease obligation, net of current portion | | | 6,745 | | | | 7,180 | |

Other non-current liabilities | | | 18,757 | | | | 14,599 | |

| | | | | | | | |

Total liabilities | | | 86,774 | | | | 62,504 | |

Total stockholders’ equity | | | 298,923 | | | | 436,520 | |

| | | | | | | | |

Total liabilities and stockholders’ equity | | $ | 385,697 | | | $ | 499,024 | |

| | | | | | | | |

Astra Space, Inc.

Summary of Cash Flow Data

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Cash used in operating activities | | $ | (43,588 | ) | | $ | (20,978 | ) | | $ | (91,862 | ) | | $ | (34,655 | ) |

Capital expenditures | | | (11,122 | ) | | | (8,472 | ) | | | (32,064 | ) | | | (8,796 | ) |

| | | | | | | | | | | | | | | | |

Free cash flow (non-GAAP) | | | (54,710 | ) | | | (29,450 | ) | | | (123,926 | ) | | | (43,451 | ) |

| | | | | | | | | | | | | | | | |

Cash used in investing activities | | | (13,964 | ) | | | (8,472 | ) | | | (129,647 | ) | | | (11,996 | ) |

Cash provided by financing activities | | | 346 | | | | 459,289 | | | | 817 | | | | 488,427 | |

Reconciliation of GAAP Financial Measures to Non-GAAP Financial Measures

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | | Six Months Ended June 30, | |

| | | 2022 | | | 2021 | | | 2022 | | | 2021 | |

Revenues | | $ | 2,682 | | | $ | — | | | $ | 6,593 | | | $ | — | |

GAAP gross loss | | | (14,763 | ) | | | — | | | | (21,866 | ) | | | — | |

GAAP gross margin | | | (550 | )% | | | — | | | | (332 | )% | | | — | |

Inventory write downs | | | 10,200 | | | | — | | | | 10,200 | | | | — | |

Deferred launch costs write downs | | | 2,213 | | | | — | | | | 2,213 | | | | — | |

| | | | | | | | | | | | | | | | |

Adjusted gross loss | | $ | (2,350 | ) | | $ | — | | | $ | (9,453 | ) | | $ | — | |

| | | | | | | | | | | | | | | | |

Adjusted gross margin | | | (88 | )% | | | — | | | | (143 | )% | | | — | |

| | | | | | | | | | | | | | | | |

GAAP net loss | | $ | (82,303 | ) | | $ | (31,297 | ) | | $ | (168,016 | ) | | $ | (190,269 | ) |

Stock-based compensation | | | 12,791 | | | | 7,444 | | | | 29,832 | | | | 17,777 | |

Loss on change in fair value of contingent consideration | | | 1,800 | | | | — | | | | 17,300 | | | | — | |

Apollo cash earnout compensation | | | 1,242 | | | | — | | | | 2,575 | | | | — | |

Inventory write downs | | | 10,200 | | | | — | | | | 10,200 | | | | — | |

Deferred launch costs write downs | | | 2,213 | | | | — | | | | 2,213 | | | | — | |

Loss on extinguishment of convertible notes | | | — | | | | — | | | | — | | | | 133,783 | |

Other special items | | | 1,088 | | | | 750 | | | | 2,781 | | | | 750 | |

| | | | | | | | | | | | | | | | |

Adjusted net loss | | | (52,969 | ) | | | (23,103 | ) | | | (103,115 | ) | | | (37,959 | ) |

Interest (income) expense, net | | | (356 | ) | | | 678 | | | | (530 | ) | | | 1,213 | |

Income tax (benefit) expense | | | — | | | | — | | | | — | | | | — | |

Accretion (amortization) of marketable securities | | | 65 | | | | — | | | | 132 | | | | — | |

Depreciation and amortization | | | 4,858 | | | | 1,030 | | | | 7,633 | | | | 1,918 | |

| | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | (48,402 | ) | | $ | (21,395 | ) | | $ | (95,880 | ) | | $ | (34,828 | ) |

| | | | | | | | | | | | | | | | |

Exhibit 99.2 ASTRA INVESTOR UPDATE Q2 2022 View from LV0009 in low Earth orbit

DISCLAIMER AND FORWARD-LOOKING STATEMENTS Certain statements made in this presentation are “forward-looking statements”. Forward-looking Accordingly, none of Astra nor its respective affiliates and advisors makes any representations statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, as to the accuracy or completeness of these data. Certain amounts related to the “estimate”, “plan”, “outlook”, and “project” and other similar expressions that predict or indicate transaction described herein have been expressed in U.S. dollars for convenience and, when future events or trends or that are not statements of historical matters. These forward-looking expressed in U.S. dollars in the future, such amounts may be different from those set forth statements reflect the current analysis of existing information and are subject to various risks herein. and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown risks, actual results may differ materially from Astra’s Non-GAAP Financial Measures. This Presentation includes non-GAAP financial measures. expectations or projections, including the following factors, among others: (i) the failure to meet Astra believes that these non-GAAP measures of financial results provide useful information projected development and launch targets, including as a result of the decisions of governmental to management and investors regarding certain financial and business trends relating to authorities or other third parties not within our control, weather and other suboptimal conditions Astra’s financial condition and results of operations. Astra’s management uses certain of these that may it difficult to perform a launch attempt, as well as those driven by the dedication of our non-GAAP measures to compare Astra’s performance to that of prior periods for trend analyses launch resources to the development of Launch System 2.0; (ii) changes in applicable laws or and for budgeting and planning purposes. regulations; (iii) the ability of Astra to meet its financial and strategic goals, due to, among other things, competition; (iv) the ability of Astra to pursue a growth strategy and manage growth All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong profitability; (v) the possibility that Astra may be adversely affected by other economic, business, to their respective owners and Astra’s use thereof does not imply an affiliation with, or and/or competitive factors; (vi) the effect of the COVID-19 pandemic on Astra, (vii) the ability to endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. manage its cash outflows during its business operations and (vii) other risks and uncertainties Solely for convenience, trademarks and trade names referred to in this Presentation may appear described herein, as well as those risks and uncertainties discussed from time to time in other with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such reports and other public filings with the Securities and Exchange Commission by Astra. names and logos are trademarks or registered trademarks of Astra. This Presentation contains statistical data, estimates and forecasts that have been provided This Presentation accompanies Astra’s earnings call for the second quarter 2022, which was held by Astra and/or are based on independent industry publications or other publicly available on August 4, 2022, and is intended to assist in understanding information Astra’s management information, as well as other information based on Astra’s internal sources. This information discussed in that call. This Presentation should be viewed in conjunction with the August 4, 2022, involves many assumptions and limitations, and you are cautioned not to give undue weight to earnings call, a replay of which is available on Astra’s website at www.astra.com, under Investors. these estimates. We have not independently verified the accuracy or completeness of the data that has been provided by Astra and/or contained in these industry publications and other publicly available information.

OUR MISSION Improve Life On Earth From Space

ASTRA SPACE PLATFORM SPACE SPACE LAUNCH SERVICES SERVICES PRODUCTS NOVEMBER 2021

TROPICS-1 Investigation Continues View from LV0010 upper stage

IMPROVED LAUNCH SYSTEM TAM UPDATED ROCKET 4.0 * ROCKET 600kg 4.0 ** $5M → 45% 75% *600 kilograms is target payload to mid inclination low Earth orbit over the course of the product lifecycle *** **Base bulk launch price for dedicated launches assuming no price increases due to inflation TOTAL ADDRESSABLE MARKET (TAM) ***Total addressable market data based on internal market research and management estimates. Excludes Starlink Note: Given the increasing demand from large constellation operators for higher capacity, lower cost, and more reliable launch services, our discussions with NASA and other customers, we have increased our payload capacity target for Launch System 2.0 from 300kg to 600kg

$100MM COMMITTED EQUITY FACILITY

TM ASTRA SPACECRAFT ENGINE * 103 committed orders through Q2 *From July 1, 2021 through June 30, 2022, including 14 units sold, but not delivered, before Astra acquired Apollo Fusion.

ASTRA SPACECRAFT ENGINE Flight-Proven Electric Propulsion Systems SCALING TO SERVE CONSTELLATIONS CURRENTLY AT WORK ON ORBIT 300+ ON ORBIT BURNS 9

KEY FINANCIAL METRICS | Q2 2022 REVENUES ADJUSTED EBITDA $3.9M Q Q11 2 20 02 22 2 Q2 2022 Q2 2022 $2.7M Q1 2022 Q2 2022 -$47.5M -$47.5M -$48.4M -$48.4M ADJUSTED NET INCOME ADJUSTED EPS Q1 2022 Q2 2022 Q1 2022 Q2 2022 $(0.17) -$50.1M $(0.19) -$53.0M

KEY FINANCIAL METRICS (CONT'D) | Q2 2022 NON-GAAP OPERATING EXPENSES CASH, CASH EQUIVALENTS & SHORT-TERM INVESTMENTS $48.4M $44.2M $255.2M $200.7M Q1 2022 Q2 2022 Q1 2022 Q2 2022 (1) (2) FREE CASH FLOW CAPITAL EXPENDITURES Q1 2022 Q2 2022 $15.1M $12.9M -$54.7M Q1 2022 Q2 2022 -$69.2M (1) Operating cash provided by operations less Capital expenditures (2) Includes Property, Plant & Equipment and investments in leasehold improvements