Exhibit 99.2 ASTRA INVESTOR UPDATE Q4 2022 First stage engine testing for Rocket 4

DISCLAIMER AND FORWARD-LOOKING STATEMENTS Accordingly, none of Astra nor its respective affiliates and advisors makes any representations Certain statements made in this press release are “forward-looking statements”. Forward-looking as to the accuracy or completeness of this data. Certain amounts related to the statements may be identified by the use of words such as “anticipate”, “believe”, “expect”, “estimate”, transaction described herein have been expressed in U.S. dollars for convenience and, when “plan”, “outlook”, and “project” and other similar expressions that predict or indicate future events or expressed in U.S. dollars in the future, such amounts may be different from those set forth trends or that are not statements of historical matters. These forward-looking statements reflect the herein. current analysis of existing information and are subject to various risks and uncertainties. As a result, caution must be exercised in relying on forward-looking statements. Due to known and unknown Non-GAAP Financial Measures. This Presentation includes non-GAAP financial measures. risks, actual results may differ materially from Astra’s expectations or projections, including the Astra believes that these non-GAAP measures of financial results provide useful information following factors, among others: (i) the failure to meet projected development, delivery and launch to management and investors regarding certain financial and business trends relating to targets, including as a result of the decisions of governmental authorities or other third parties not Astra’s financial condition and results of operations. Astra’s management uses certain of these within our control; (ii) changes in applicable laws or regulations; (iii) the ability of Astra to meet its non-GAAP measures to compare Astra’s performance to that of prior periods for trend analyses financial and strategic goals, due to, among other things, competition and the dedication of our and for budgeting and planning purposes. launch resources to the development of Launch System 2 and its ability to continue operating as a going concern; (iv) the ability of Astra to pursue a growth strategy and manage growth profitability All rights to the trademarks, copyrights, logos and other intellectual property listed herein belong without additional funding; (v) the possibility that Astra may be adversely affected by other economic, to their respective owners and Astra’s use thereof does not imply an affiliation with, or business, and/or competitive factors; (vi) the ability to manage its cash outflows related to its endorsement by the owners of such trademarks, copyrights, logos and other intellectual property. business operations, (vii) the ability of Astra to develop its space services offering as part of its long- term business and growth strategy and (viii) other risks and uncertainties described herein, as well as Solely for convenience, trademarks and trade names referred to in this Presentation may appear those risks and uncertainties discussed from time to time in other reports and other public filings with the ® or ™ symbols, but such references are not intended to indicate, in any way, that such with the Securities and Exchange Commission by Astra. names and logos are trademarks or registered trademarks of Astra. This Presentation accompanies Astra’s earnings call for the fourth quarter and fiscal year 2022, This Presentation contains statistical data, estimates and forecasts that have been provided which was held on March 30, 2023, and is intended to assist in understanding information Astra’s by Astra and/or are based on independent industry publications or other publicly available management discussed in that call. This Presentation should be viewed in conjunction with the information, as well as other information based on Astra’s internal sources. This information March 30, 2023, earnings call, a replay of which is available on Astra’s website at www.astra.com, involves many assumptions and limitations, and you are cautioned not to give undue weight to under Investors. these estimates. We have not independently verified the accuracy or completeness of the data that has been provided by Astra and/or contained in these industry publications and other publicly available information.

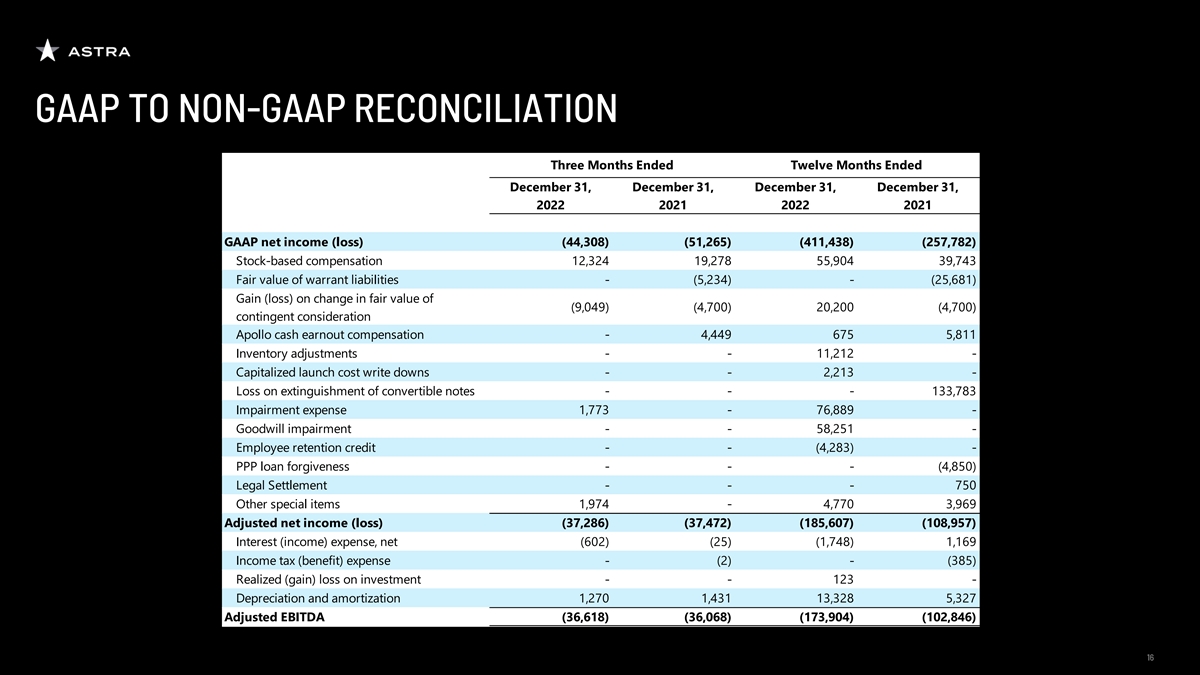

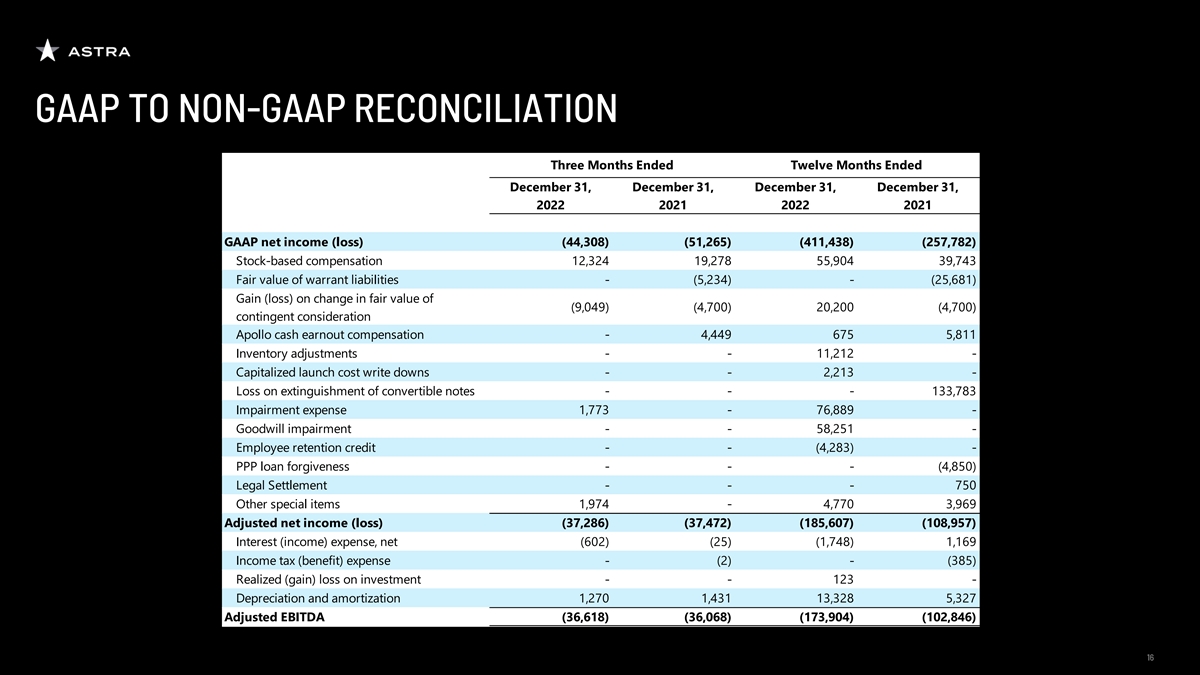

EXPLANATION OF NON-GAAP (OR ADJUSTED) FINANCIAL MEASURES compensation, (b) loss on change in fair value of contingent consideration, (c) cash earnout compensation cost related to the acquisition of Apollo Fusion, (d) inventory write-downs related to This press release includes information about Adjusted Gross Profit (Loss), Adjusted Net Loss and discontinuance of production of Launch System 1, (e) capitalized launch costs write-downs related to Adjusted EBITDA (collectively the “non-GAAP financial measures”), all of which are non-GAAP financial discontinuance of production of Launch System 1 (f) impairment charge, (g) employee retention measures. These non-GAAP financial measures are measurements of financial performance that are credit, (h) PPP loan forgiveness, and (i) other special items, including related to Worker Adjustment not prepared in accordance with U.S. generally accepted accounting principles and computational and Retraining Notification (WARN), employee safety, licensed technology, and a contract methods may differ from those used by other companies. Non-GAAP financial measures are not cancellation. meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with Astra’s condensed consolidated financial statements prepared in accordance with GAAP. Non-GAAP financial measures are reconciled to their most comparable GAAP We define Adjusted EBITDA as Adjusted Net Loss, excluding the following items: (a) interest expense measures in the table set forth in this release. and interest income, (b) income tax expense, (c) loss on marketable securities, and (d) depreciation and amortization. We are unable to predict with reasonable certainty the ultimate outcome of these exclusions without unreasonable effort. We believe that both management and our investors benefit from referring to these non-GAAP financial measures in planning, forecasting and analyzing future periods. Specifically, our management uses these non-GAAP financial measures in planning, monitoring and evaluating our financial and operational decision making and as a means to evaluate period-to-period comparisons. Our management recognizes that the non-GAAP financial measures have inherent limitations because of the excluded items described below. We believe that providing the non-GAAP financial measures, together with the reconciliation to GAAP measures, helps investors make comparisons between Astra and other companies in our industry. In making any comparisons to other companies in our industry, investors need to be aware that companies use different non-GAAP measures to evaluate their financial performance. Investors should pay close attention to the specific definition being used and to the reconciliation between such measure and the corresponding GAAP measure provided by each company under applicable SEC rules. Adjusted Gross Profit (Loss) differs from GAAP Gross Profit (Loss) in that it excludes inventory adjustments related to Rocket 3. Adjusted Net Loss differs from GAAP Net Loss in that it excludes the following items: (a) stock-based

OUR MISSION: ® IMPROVE LIFE ON EARTH FROM SPACE

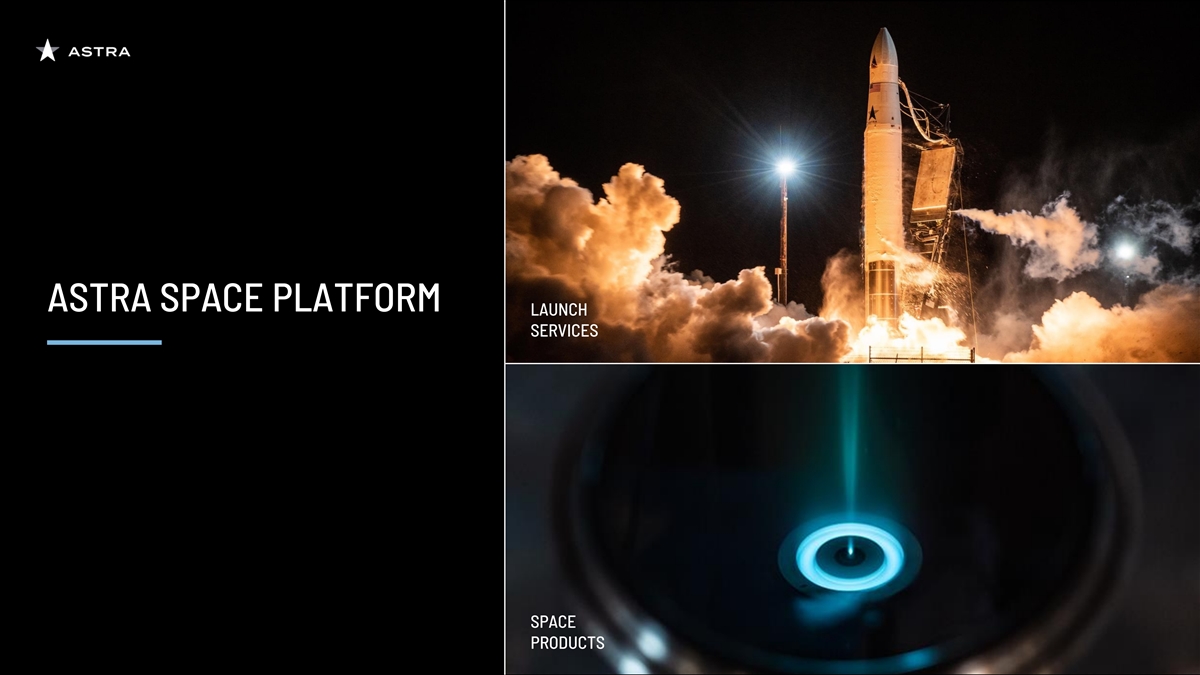

ASTRA SPACE PLATFORM LAUNCH SERVICES SPACE PRODUCTS

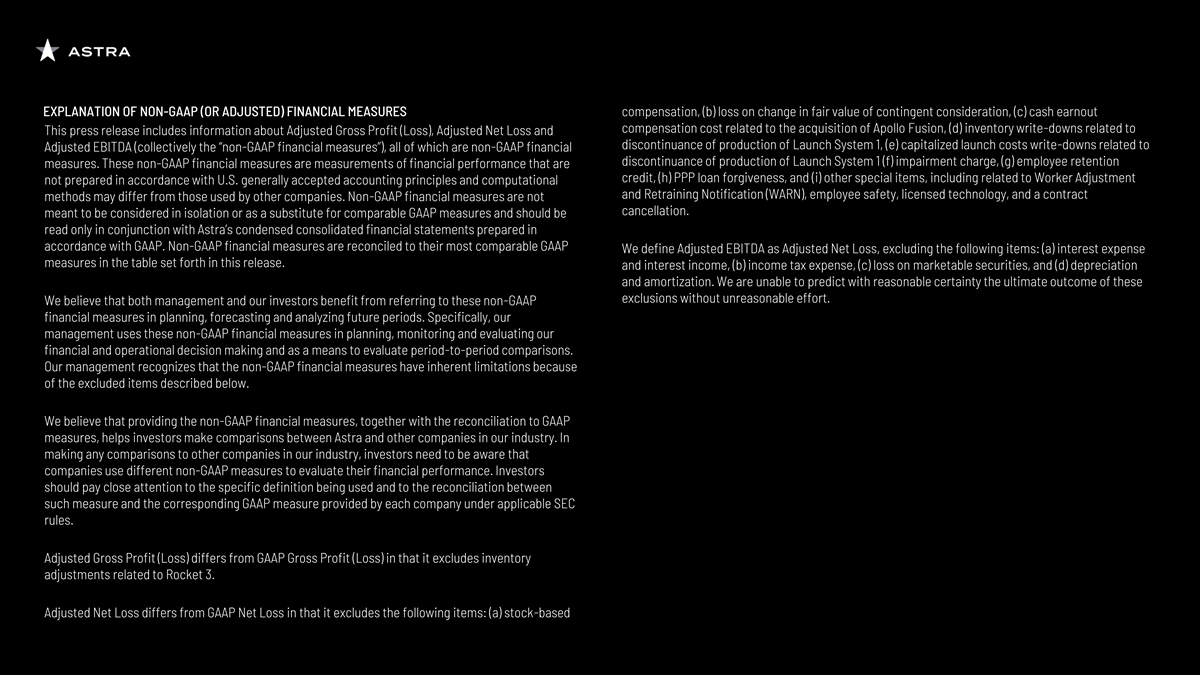

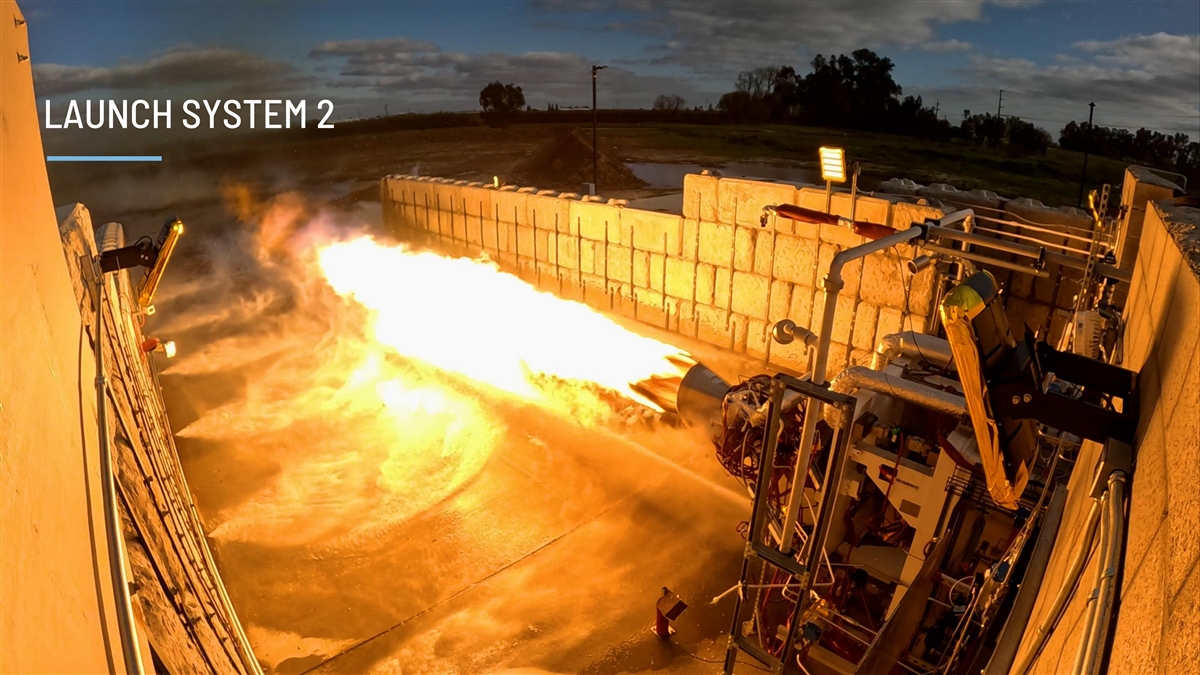

LAUNCH SYSTEM 2

Astra’s headquarters in Alameda, California — 1900 Skyhawk Street

Astra’s headquarters in Alameda, California — 1900 Skyhawk Street

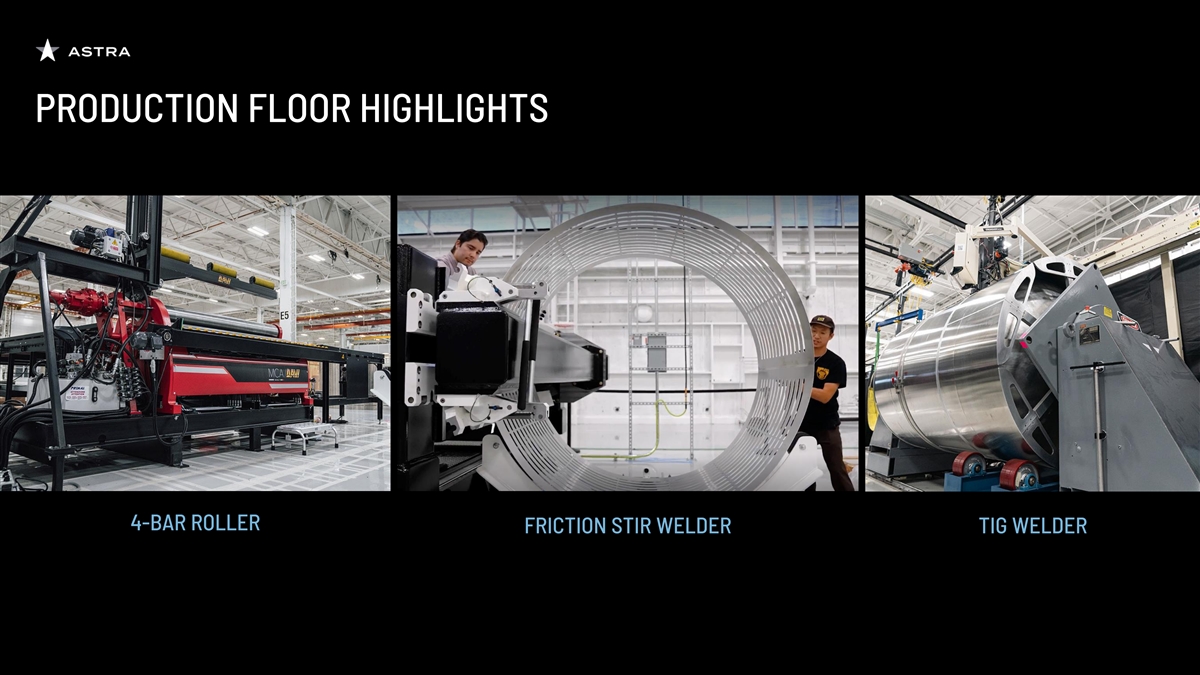

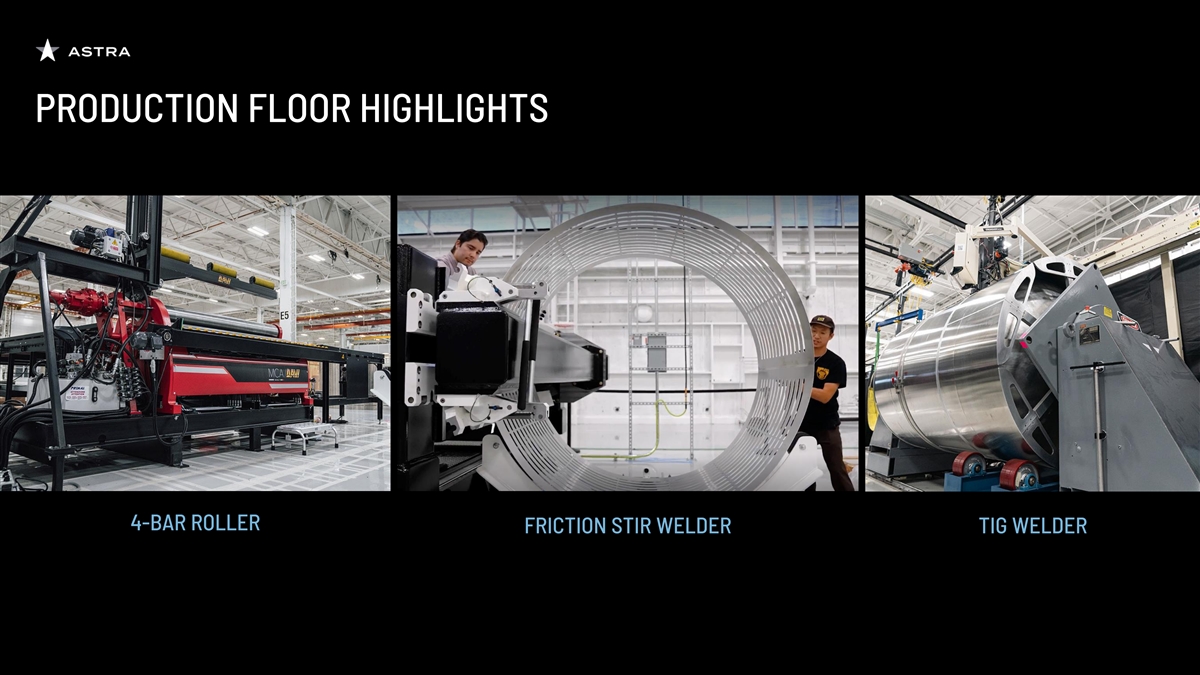

PRODUCTION FLOOR HIGHLIGHTS 4-BAR ROLLER FRICTION STIR WELDER TIG WELDER

QUALITY CONTROL LAB

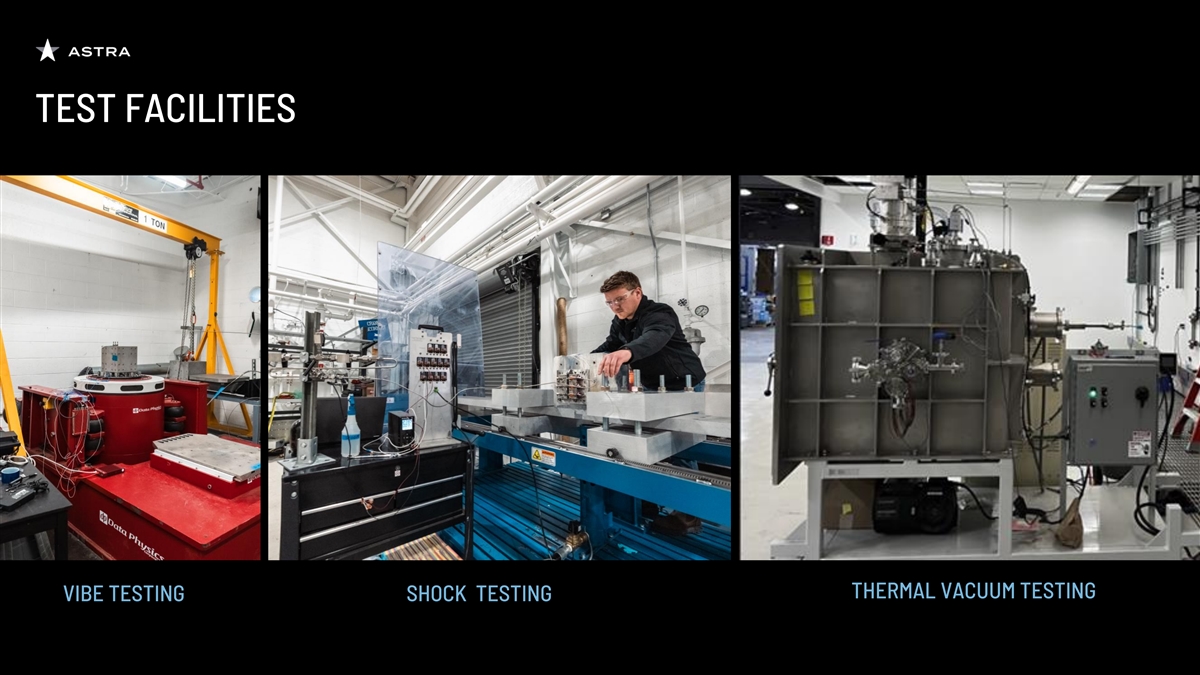

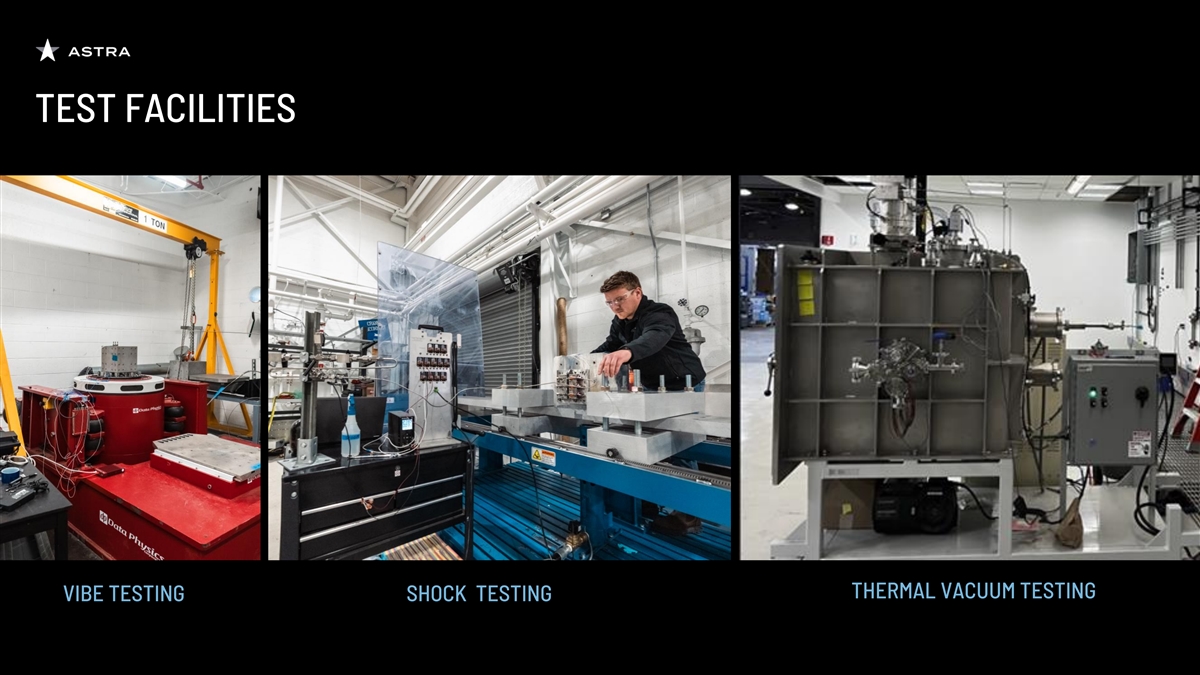

TEST FACILITIES In-house environmental testing allows Astra to perform rapid test, design and manufacture cycles. THERMAL VACUUM TESTING VIBE TESTING SHOCK TESTING

TM ASTRA SPACECRAFT ENGINE 278 CUMULATIVE COMMITTED ORDERS* 600+ ON-ORBIT BURNS *Consisting of 264 new orders obtained between July 1, 2021 through March 30, 2023, in addition to 14 existing orders from the Apollo Fusion acquisition that closed on July 1, 2021.

Astra Spacecraft Engine™ 3-Station Test Chamber

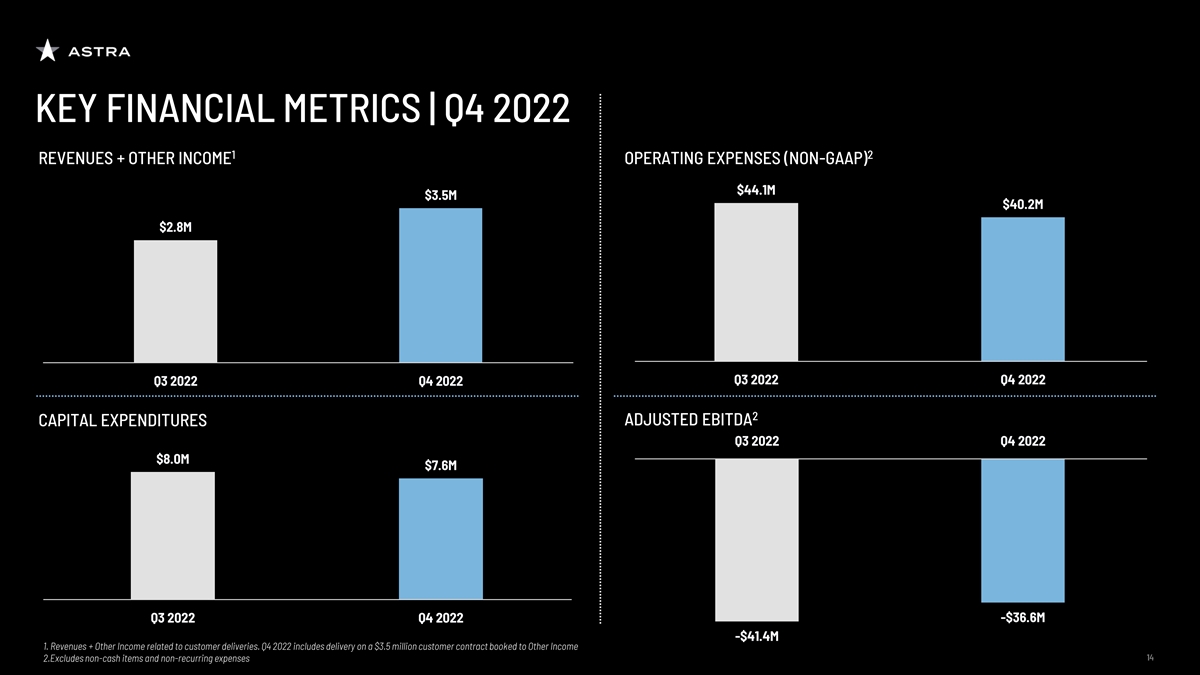

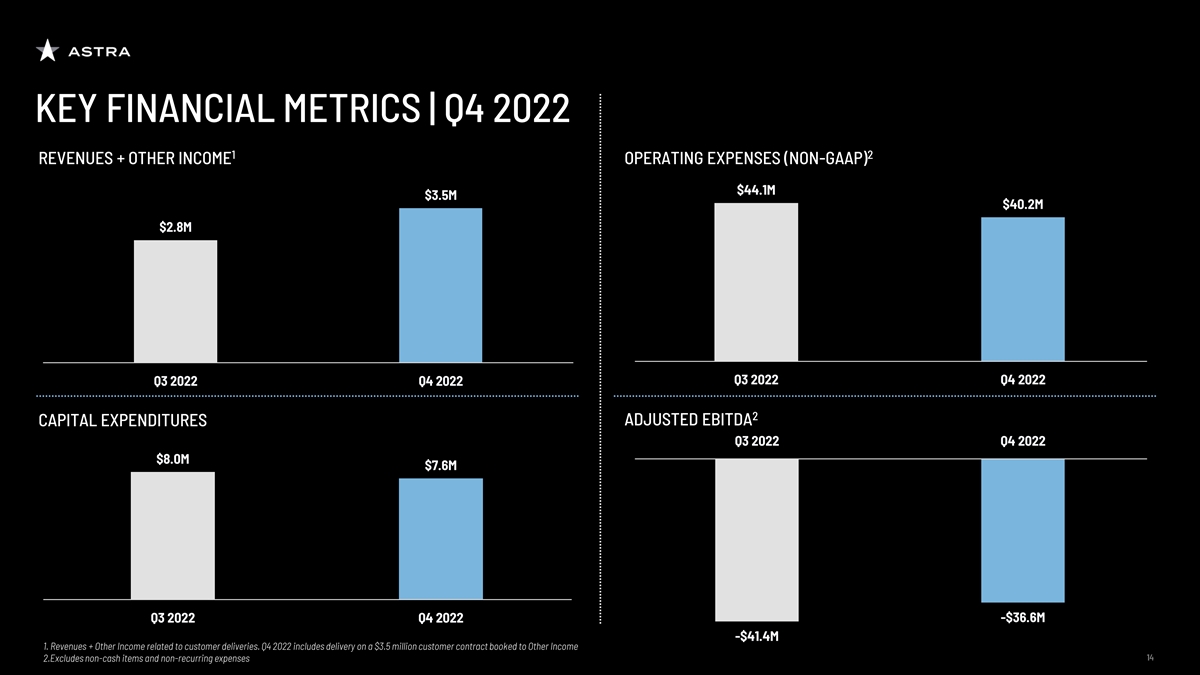

KEY FINANCIAL METRICS | Q4 2022 1 2 REVENUES + OTHER INCOME OPERATING EXPENSES (NON-GAAP) $44.1M $3.5M $40.2M $2.8M Q3 2022 Q4 2022 Q3 2022 Q4 2022 2 CAPITAL EXPENDITURES ADJUSTED EBITDA Q3 2022 Q4 2022 $8.0M $7.6M Q3 2022 Q4 2022 -$36.6M -$41.4M 1. Revenues + Other Income related to customer deliveries. Q4 2022 includes delivery on a $3.5 million customer contract booked to Other Income 14 14 2.Excludes non-cash items and non-recurring expenses

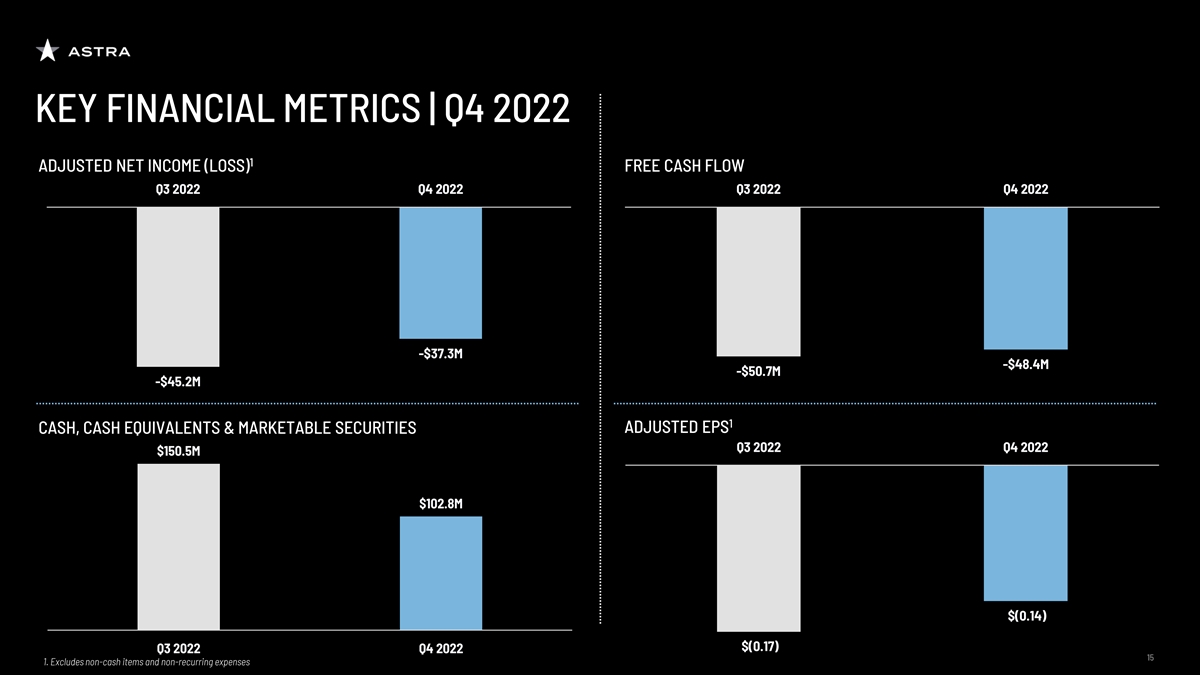

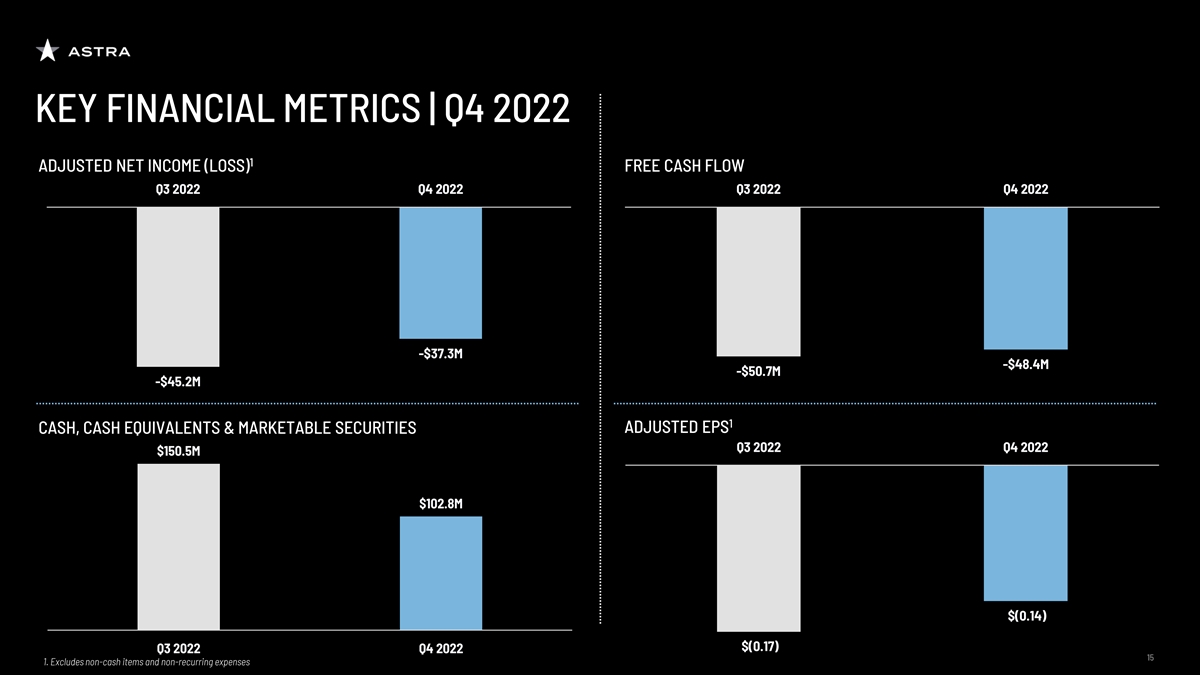

KEY FINANCIAL METRICS | Q4 2022 1 ADJUSTED NET INCOME (LOSS) FREE CASH FLOW Q3 2022 Q4 2022 Q3 2022 Q4 2022 -$37.3M -$48.4M -$50.7M -$45.2M 1 CASH, CASH EQUIVALENTS & MARKETABLE SECURITIES ADJUSTED EPS Q3 2022 Q4 2022 $150.5M $102.8M $(0.14) $(0.17) Q3 2022 Q4 2022 15 15 1. Excludes non-cash items and non-recurring expenses

GAAP TO NON-GAAP RECONCILIATION Three Months Ended Twelve Months Ended December 31, December 31, December 31, December 31, 2022 2021 2022 2021 GAAP net income (loss) (44,308) (51,265) (411,438) (257,782) Stock-based compensation 12,324 19,278 55,904 39,743 Fair value of warrant liabilities - (5,234) - (25,681) Gain (loss) on change in fair value of (9,049) (4,700) 20,200 (4,700) contingent consideration Apollo cash earnout compensation - 4,449 675 5,811 Inventory adjustments - - 11,212 - Capitalized launch cost write downs - - 2,213 - Loss on extinguishment of convertible notes - - - 133,783 Impairment expense 1,773 - 76,889 - Goodwill impairment - - 58,251 - Employee retention credit - - (4,283) - PPP loan forgiveness - - - (4,850) Legal Settlement - - - 750 Other special items 1,974 - 4,770 3,969 Adjusted net income (loss) (37,286) (37,472) (185,607) (108,957) Interest (income) expense, net (602) (25) (1,748) 1,169 Income tax (benefit) expense - (2) - (385) Realized (gain) loss on investment - - 123 - Depreciation and amortization 1,270 1,431 13,328 5,327 Adjusted EBITDA (36,618) (36,068) (173,904) (102,846) 16 16

ASTRA.COM/LAUNCH-SERVICES Download the Rocket 4 Payload User’s Guide

astra.com/livestream